Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Customers Bancorp, Inc. | a4q17pressrelease.htm |

| 8-K - 8-K - Customers Bancorp, Inc. | a8k123117.htm |

Highly Focused, Above Average Growth

Bank Holding Company

Investor Presentation

January, 2018

NYSE: CUBI

Member FDIC

2

Forward-Looking Statements

This presentation, as well as other written or oral communications made from time to time by us, contains forward-looking information within the meaning of the

safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to future events or future predictions, including events

or predictions relating to future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believe,” “expect,” “may,”

“will,” “should,” “plan,” “intend,” or “anticipate” or the negative thereof or comparable terminology. Forward- looking statements in this presentation include,

among other matters, guidance for our financial performance, and our financial performance targets. Forward-looking statements reflect numerous assumptions,

estimates and forecasts as to future events. No assurance can be given that the assumptions, estimates and forecasts underlying such forward-looking statements

will accurately reflect future conditions, or that any guidance, goals, targets or projected results will be realized. The assumptions, estimates and forecasts

underlying such forward-looking statements involve judgments with respect to, among other things, future economic, competitive, regulatory and financial market

conditions and future business decisions, which may not be realized and which are inherently subject to significant business, economic, competitive and regulatory

uncertainties and known and unknown risks, including the risks described under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31,

2016 and subsequent Quarterly Reports on Form 10-Q, as such factors may be updated from time to time in our filings with the SEC. Our actual results may differ

materially from those reflected in the forward-looking statements.

In addition to the risks described under “Risk Factors” in our filings with the SEC, important factors to consider and evaluate with respect to our forward-looking

statements include:

• changes in external competitive market factors that might impact our results of operations;

• changes in laws and regulations, including without limitation changes in capital requirements under Basel III;

• changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;

• our ability to identify potential candidates for, and consummate, acquisition or investment transactions;

• the timing of acquisition, investment or disposition transactions;

• constraints on our ability to consummate an attractive acquisition or investment transaction because of significant competition for these opportunities;

• local, regional and national economic conditions and events and the impact they may have on us and our customers;

• costs and effects of regulatory and legal developments, including the results of regulatory examinations and the outcome of regulatory or other governmental

inquiries and proceedings, such as fines or restrictions on our business activities;

• our ability to attract deposits and other sources of liquidity;

• changes in the financial performance and/or condition of our borrowers;

• changes in the level of non-performing and classified assets and charge-offs;

• changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements;

• inflation, interest rate, securities market and monetary fluctuations;

3

Forward-Looking Statements

• timely development and acceptance of new banking products and services and perceived overall value of these products and services by users, including the

products and services being developed and introduced to the market by the BankMobile division of Customers Bank;

• changes in consumer spending, borrowing and saving habits;

• technological changes;

• our ability to increase market share and control expenses;

• continued volatility in the credit and equity markets and its effect on the general economy;

• effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight

Board, the Financial Accounting Standards Board and other accounting standard setters;

• the businesses of Customers Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being more

difficult, time-consuming or costly than expected;

• material differences in the actual financial results of merger and acquisition activities compared with our expectations, such as with respect to the full realization

of anticipated cost savings and revenue enhancements within the expected time frame;

• our ability to successfully implement our growth strategy, control expenses and maintain liquidity;

• Customers Bank's ability to pay dividends to Customers Bancorp;

• risks related to our proposed spin-off of BankMobile and merger of BankMobile into Flagship Bank, including:

• our ability to successfully complete the transactions and the timing of completion;

• the ability of Customers and Flagship Bank to meet all of the conditions to completion of the proposed transactions;

• the impact of an announcement of the proposed spin-off and merger on the value of our securities, our business and our relationship with

employees and customers;

• risks relating to BankMobile, including:

• material variances in the adoption rate of BankMobile's services by new students

• the usage rate of BankMobile's services by current student customers compared to our expectations;

4

Forward-Looking Statements

• the levels of usage of other BankMobile student customers following graduation of additional product and service offerings of BankMobile or

Customers Bank, including mortgages and consumer loans, and the mix of products and services used;

• our ability to implement changes to BankMobile's product and service offerings under current and future regulations and governmental policies;

• our ability to effectively manage revenue and expense fluctuations that may occur with respect to BankMobile's student-oriented business

activities, which result from seasonal factors related to the higher-education academic year;

• our ability to implement our strategy regarding BankMobile, including with respect to our intent to spin-off and merge or otherwise dispose of the

BankMobile business in the future, depending upon market conditions and opportunities; and

• BankMobile's ability to successfully implement its growth strategy and control expenses.

You are cautioned not to place undue reliance on any forward-looking statements we make, which speak only as of the date they are made. We do not undertake

any obligation to release publicly or otherwise provide any revisions to any forward-looking statements we may make, including any forward-looking financial

information, to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events, except as may be required

under applicable law.

This presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any

sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction.

5

Investment Proposition

Highly Focused, Innovative, Relationship Banking Based Commercial Bank Providing;

Business bank with a unique private banking service model; $10 billion in assets and growing

Strong Organic Growth, Well Capitalized, Branch Lite Bank in Attractive Markets

Highly skilled teams targeting privately held businesses and high net worth families

Robust risk management driven business strategy

Target market from Boston to Washington DC along Interstate 95, and Chicago

Strong Profitability, Growth & Efficient Operations

Operating efficiencies offset tighter margins and generate sustainable profitability

Community Business Banking segment operating efficiency ratio in the 40’s

Target above average ROAA (~1.1%) and ROTCE (>12%)

Strong Credit Quality & Low Interest Rate Risk

Unwavering underwriting standards

Loan portfolio performance consistently better than industry and peers

Attractive Valuation

January 19, 2018 share price of $30.38, 11.0x street estimated 2018 EPS of $2.75 and

1.39x tangible book value(1)

December 31, 2017 tangible book value(1) of $21.90, up 67% since December 2012 with a CAGR of 11%

(1) Non-GAAP measure calculated as GAAP total shareholders equity less preferred stock, less goodwill and other intangibles divided by common shares outstanding.

6

Top Strategic Priorities

• Strengthen Capital

• At December 31, 2017, Customers substantially achieved all capital targets

• Targets: 7.0% TCE, 9.0% Tier 1 Leverage, 9.0% CET1, 11% Tier 1 Risk Based, and 13% Total Risk Based

• Grow and Successfully Divest BankMobile in 2018

• Announced on October 19, 2017 plans to spin-off BankMobile to shareholders and then merge BankMobile into

Flagship Community Bank in Mid-2018

• Customers expects Flagship to file an application with the FDIC for its acquisition of BankMobile’s deposits

shortly. Once approvals of the transaction and documents are received from the FDIC and SEC as appropriate,

Customers will announce the record date for the distribution of BankMobile Technologies, Inc. shares.

• CUBI shareholders will receive a majority ownership interest in newly issued, publicly traded, common equity in

Flagship. The distribution is expected to be tax-free to Customers and its shareholders.

• Improve financial performance

• We target: an ROAA of ~1.1%; ROTCE >12%, FTE NIM of 2.80% to 3.00%, 15% CAGR in EPS, and bank

segment efficiency in the low 40%s

• Priorities include strong risk management, core deposit growth, a wider NIM, positive operating leverage, and

carefully managed credit risk.

7

2018 Outlook

Community Business Banking: targeting diluted EPS of $2.75 to $3.00

• This is our core franchise which will remain after the spin-off and merger of BankMobile

is complete in mid-2018

• 12% to 15% growth in total assets

• FTE net interest margin between 2.70% to 2.80%

• Efficiency ratio in the mid to high 40%s

• Fee income of approximately $35 million to $40 million

• Effective tax rate of approximately 24%

• Q1 earnings are seasonally impacted by lower average balances in the mortgage

warehouse business, a shorter day count, and an increase in compensation expense

BankMobile:

• Divestiture of BankMobile on schedule, expected to be completed in mid-2018

• BankMobile’s business is seasonal, and the full year earnings impact of BankMobile on

Customers‘ results of operations will depend on the exact time of divestiture

• BankMobile's segment results will likely range between a slight profit and a $4.5 million

loss per quarter until its divestiture (assumes approximately a 2.5% spread earned on

BankMobile’s low cost deposits)

8

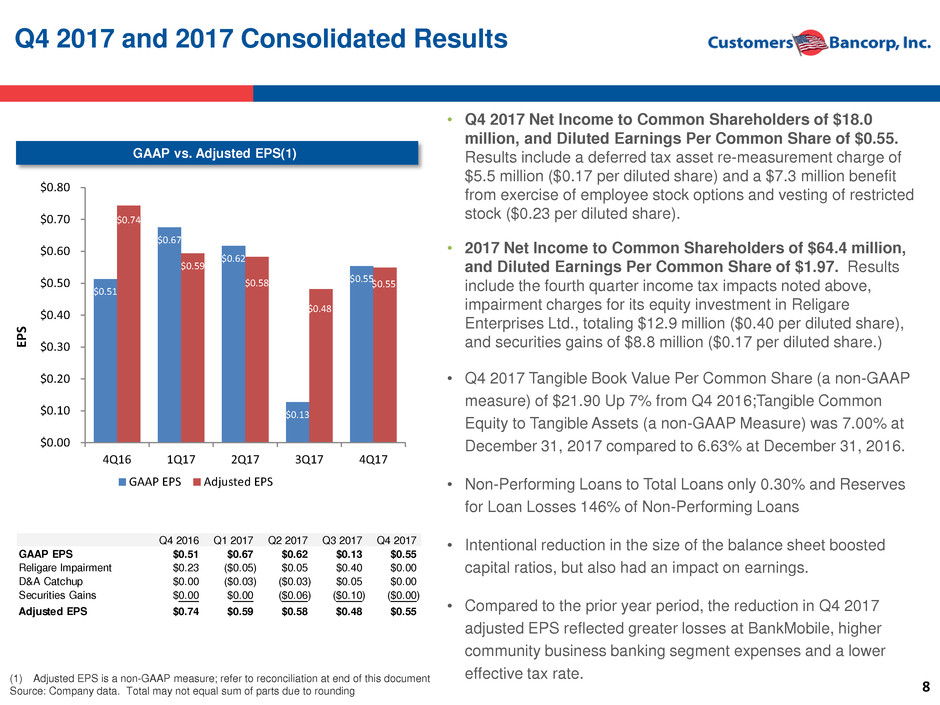

Q4 2017 and 2017 Consolidated Results

• Q4 2017 Net Income to Common Shareholders of $18.0

million, and Diluted Earnings Per Common Share of $0.55.

Results include a deferred tax asset re-measurement charge of

$5.5 million ($0.17 per diluted share) and a $7.3 million benefit

from exercise of employee stock options and vesting of restricted

stock ($0.23 per diluted share).

• 2017 Net Income to Common Shareholders of $64.4 million,

and Diluted Earnings Per Common Share of $1.97. Results

include the fourth quarter income tax impacts noted above,

impairment charges for its equity investment in Religare

Enterprises Ltd., totaling $12.9 million ($0.40 per diluted share),

and securities gains of $8.8 million ($0.17 per diluted share.)

• Q4 2017 Tangible Book Value Per Common Share (a non-GAAP

measure) of $21.90 Up 7% from Q4 2016;Tangible Common

Equity to Tangible Assets (a non-GAAP Measure) was 7.00% at

December 31, 2017 compared to 6.63% at December 31, 2016.

• Non-Performing Loans to Total Loans only 0.30% and Reserves

for Loan Losses 146% of Non-Performing Loans

• Intentional reduction in the size of the balance sheet boosted

capital ratios, but also had an impact on earnings.

• Compared to the prior year period, the reduction in Q4 2017

adjusted EPS reflected greater losses at BankMobile, higher

community business banking segment expenses and a lower

effective tax rate.

(1) Adjusted EPS is a non-GAAP measure; refer to reconciliation at end of this document

Source: Company data. Total may not equal sum of parts due to rounding

GAAP vs. Adjusted EPS(1)

$0.51

$0.67

$0.62

$0.13

$0.55

$0.74

$0.59

$0.58

$0.48

$0.55

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

4Q16 1Q17 2Q17 3Q17 4Q17

EP

S

GAAP EPS Adjusted EPS

Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

GAAP EPS $0.51 $0.67 $0.62 $0.13 $0.55

Religare Impairment $0.23 ($0.05) $0.05 $0.40 $0.00

D&A Catchup $0.00 ($0.03) ($0.03) $0.05 $0.00

Securities Gains $0.00 $0.00 ($0.06) ($0.10) ($0.00)

Adjusted EPS $0.74 $0.59 $0.58 $0.48 $0.55

9

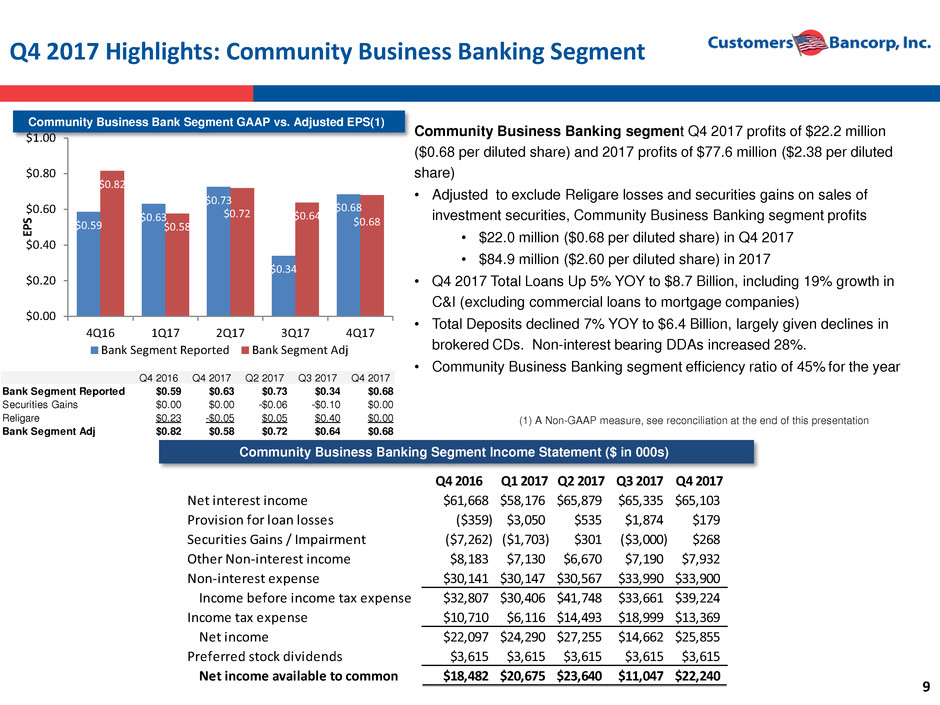

Q4 2017 Highlights: Community Business Banking Segment

Community Business Banking segment Q4 2017 profits of $22.2 million

($0.68 per diluted share) and 2017 profits of $77.6 million ($2.38 per diluted

share)

• Adjusted to exclude Religare losses and securities gains on sales of

investment securities, Community Business Banking segment profits

• $22.0 million ($0.68 per diluted share) in Q4 2017

• $84.9 million ($2.60 per diluted share) in 2017

• Q4 2017 Total Loans Up 5% YOY to $8.7 Billion, including 19% growth in

C&I (excluding commercial loans to mortgage companies)

• Total Deposits declined 7% YOY to $6.4 Billion, largely given declines in

brokered CDs. Non-interest bearing DDAs increased 28%.

• Community Business Banking segment efficiency ratio of 45% for the year

Community Business Bank Segment GAAP vs. Adjusted EPS(1)

Community Business Banking Segment Income Statement ($ in 000s)

(1) A Non-GAAP measure, see reconciliation at the end of this presentation

$0.59

$0.63

$0.73

$0.34

$0.68

$0.82

$0.58

$0.72 $0.64 $0.68

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

4Q16 1Q17 2Q17 3Q17 4Q17

EP

S

Bank Segment Reported Bank Segment Adj

Q4 2016 Q4 2017 Q2 2017 Q3 2017 Q4 2017

Bank Segment Reported $0.59 $0.63 $0.73 $0.34 $0.68

Securities Gains $0.00 $0.00 -$0.06 -$0.10 $0.00

Religare $0.23 -$0.05 $0.05 $0.40 $0.00

Bank Segment Adj $0.82 $0.58 $0.72 $0.64 $0.68

Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

Net interest income $61,668 $58,176 $65,879 $65,335 $65,103

Provision for loan losses ($359) $3,050 $535 $1,874 $179

Securities Gains / Impairment ($7,262) ($1,703) $301 ($3,000) $268

Other Non-interest income $8,183 $7,130 $6,670 $7,190 $7,932

Non-interest expense $30,141 $30,147 $30,567 $33,990 $33,900

Income before income tax expense $32,807 $30,406 $41,748 $33,661 $39,224

Income tax expense $10,710 $6,116 $14,493 $18,999 $13,369

Net income $22,097 $24,290 $27,255 $14,662 $25,855

Preferred stock dividends $3,615 $3,615 $3,615 $3,615 $3,615

Net income available to common $18,482 $20,675 $23,640 $11,047 $22,240

10

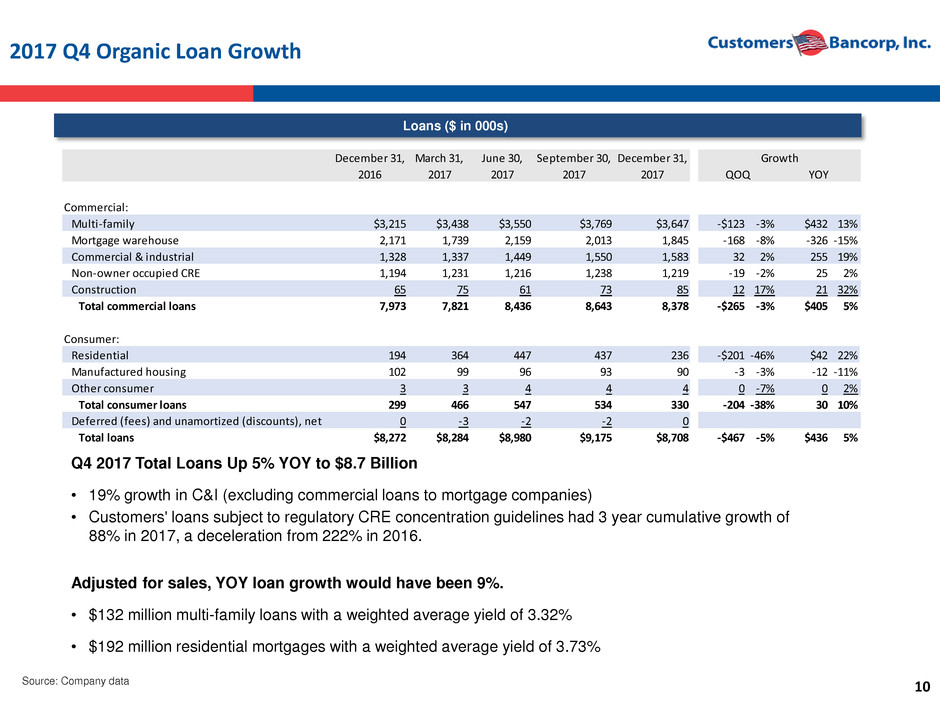

2017 Q4 Organic Loan Growth

Q4 2017 Total Loans Up 5% YOY to $8.7 Billion

• 19% growth in C&I (excluding commercial loans to mortgage companies)

• Customers' loans subject to regulatory CRE concentration guidelines had 3 year cumulative growth of

88% in 2017, a deceleration from 222% in 2016.

Adjusted for sales, YOY loan growth would have been 9%.

• $132 million multi-family loans with a weighted average yield of 3.32%

• $192 million residential mortgages with a weighted average yield of 3.73%

Source: Company data

Loans ($ in 000s)

December 31, March 31, June 30, September 30, December 31,

2016 2017 2017 2017 2017

Commercial:

Multi-family $3,215 $3,438 $3,550 $3,769 $3,647 -$123 -3% $432 13%

Mortgage warehouse 2,171 1,739 2,159 2,013 1,845 -168 -8% -326 -15%

Commercial & industrial 1,328 1,337 1,449 1,550 1,583 32 2% 255 19%

Non-owner occupied CRE 1,194 1,231 1,216 1,238 1,219 -19 -2% 25 2%

Construction 65 75 61 73 85 12 17% 21 32%

Total commercial loans 7,973 7,821 8,436 8,643 8,378 -$265 -3% $405 5%

Consumer:

Residential 194 364 447 437 236 -$201 -46% $42 22%

Manufactured housing 102 99 96 93 90 -3 -3% -12 -11%

Other consumer 3 3 4 4 4 0 -7% 0 2%

Total consumer loans 299 466 547 534 330 -204 -38% 30 10%

Deferred (fees) and unamortized (discounts), net 0 -3 -2 -2 0

Total loans $8,272 $8,284 $8,980 $9,175 $8,708 -$467 -5% $436 5%

Growth

QOQ YOY

11

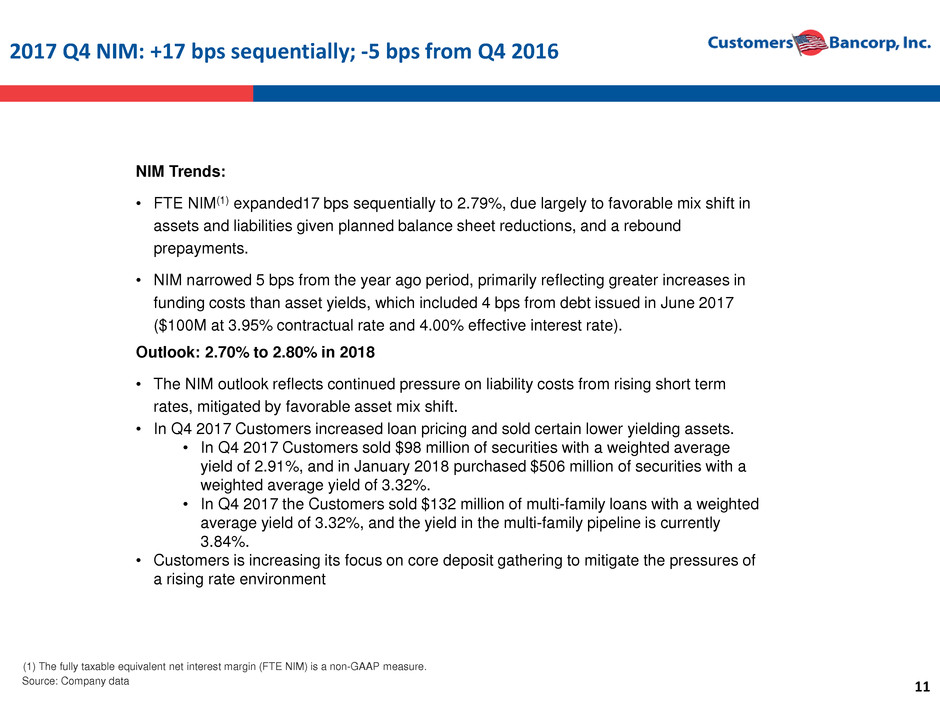

2017 Q4 NIM: +17 bps sequentially; -5 bps from Q4 2016

NIM Trends:

• FTE NIM(1) expanded17 bps sequentially to 2.79%, due largely to favorable mix shift in

assets and liabilities given planned balance sheet reductions, and a rebound

prepayments.

• NIM narrowed 5 bps from the year ago period, primarily reflecting greater increases in

funding costs than asset yields, which included 4 bps from debt issued in June 2017

($100M at 3.95% contractual rate and 4.00% effective interest rate).

Source: Company data

Outlook: 2.70% to 2.80% in 2018

• The NIM outlook reflects continued pressure on liability costs from rising short term

rates, mitigated by favorable asset mix shift.

• In Q4 2017 Customers increased loan pricing and sold certain lower yielding assets.

• In Q4 2017 Customers sold $98 million of securities with a weighted average

yield of 2.91%, and in January 2018 purchased $506 million of securities with a

weighted average yield of 3.32%.

• In Q4 2017 the Customers sold $132 million of multi-family loans with a weighted

average yield of 3.32%, and the yield in the multi-family pipeline is currently

3.84%.

• Customers is increasing its focus on core deposit gathering to mitigate the pressures of

a rising rate environment

(1) The fully taxable equivalent net interest margin (FTE NIM) is a non-GAAP measure.

12

Q4 2017 Highlights: BankMobile Segment

Source: Company data

BankMobile segment loss of $4.2 million (-$0.13 per diluted

share) in Q4 2017

• BankMobile processed over $9.5 billion of student loan

disbursements in 2017.

• BankMobile deposits averaged $558 million in Q4 2017, a 2%

increase over Q4 2016 levels.

• Operating expenses only increased 6% over the prior year,

despite significant investment in technology to support expected

White Label partnerships.

• A new unsecured consumer loan product was recently launched,

which is the first of five new consumer credit products that will

be made available to BankMobile customers this year in an effort

to deepen relationships and create “customers for life.”

Bank Mobile Segment GAAP vs. Adjusted EPS(1)

BankMobile Segment Income Statement ($ in 000s)

-$0.07

$0.04

-$0.11

-$0.21

-$0.13

-$0.07

$0.02

-$0.14

-$0.16

-$0.13

-$0.25

-$0.20

-$0.15

-$0.10

-$0.05

$0.00

$0.05

$0.10

4Q16 1Q17 2Q17 3Q17 4Q17

EP

S

BankMobile Reported BankMobile Adjusted

$(0.0

Q4 2016 Q4 2017 Q2 2017 Q3 2017 Q4 2017

BankMobile Reported -$0.07 $0.04 -$0.11 -$0.21 -$0.13

D&A Catchup $0.00 -$0.03 -$0.03 $0.05 $0.00

BankMobile Adjusted -$0.07 $0.02 -$0.14 -$0.16 -$0.13

Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

Net interest income $2,460 $4,242 $2,727 $2,684 $3,197

Provision for loan losses $546 $0 $0 $478 $652

Non-interest income $14,210 $17,327 $11,419 $13,836 $11,540

Non-interest expense $19,783 $19,219 $19,845 $27,050 $20,888

Income before income tax expense ($3,659) $2,350 ($5,699) ($11,008) ($6,803)

Income tax expense $1,390 $893 ($2,166) ($4,100) ($2,563)

Net income available to common ($2,269) $1,457 ($3,533) ($6,908) ($4,240)

(1) A Non-GAAP measure, see reconciliation at the end of this presentation

13

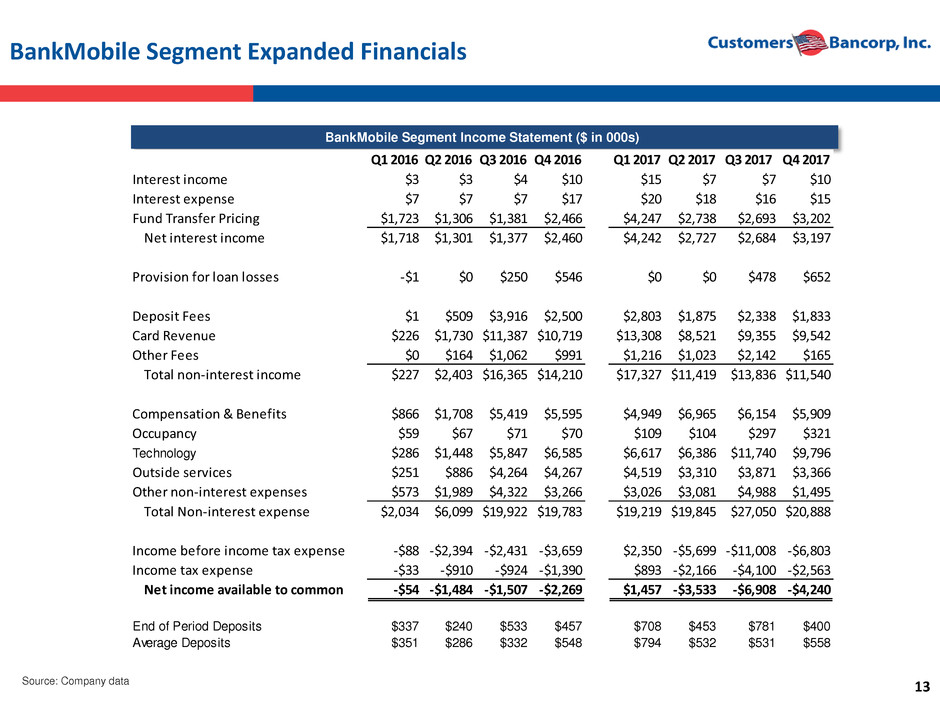

BankMobile Segment Expanded Financials

Source: Company data

BankMobile Segment Income Statement ($ in 000s)

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

Interest income $3 $3 $4 $10 $15 $7 $7 $10

Interest expense $7 $7 $7 $17 $20 $18 $16 $15

Fund Transfer Pricing $1,723 $1,306 $1,381 $2,466 $4,247 $2,738 $2,693 $3,202

Net interest income $1,718 $1,301 $1,377 $2,460 $4,242 $2,727 $2,684 $3,197

Provision for loan losses -$1 $0 $250 $546 $0 $0 $478 $652

Deposit Fees $1 $509 $3,916 $2,500 $2,803 $1,875 $2,338 $1,833

Card Revenue $226 $1,730 $11,387 $10,719 $13,308 $8,521 $9,355 $9,542

Other Fees $0 $164 $1,062 $991 $1,216 $1,023 $2,142 $165

Total non-interest income $227 $2,403 $16,365 $14,210 $17,327 $11,419 $13,836 $11,540

Compensation & Benefits $866 $1,708 $5,419 $5,595 $4,949 $6,965 $6,154 $5,909

Occupancy $59 $67 $71 $70 $109 $104 $297 $321

Technology $286 $1,448 $5,847 $6,585 $6,617 $6,386 $11,740 $9,796

Outside services $251 $886 $4,264 $4,267 $4,519 $3,310 $3,871 $3,366

Other non-interest expenses $573 $1,989 $4,322 $3,266 $3,026 $3,081 $4,988 $1,495

Total Non-interest expense $2,034 $6,099 $19,922 $19,783 $19,219 $19,845 $27,050 $20,888

Income before income tax expense -$88 -$2,394 -$2,431 -$3,659 $2,350 -$5,699 -$11,008 -$6,803

Income tax expense -$33 -$910 -$924 -$1,390 $893 -$2,166 -$4,100 -$2,563

Net income available to common -$54 -$1,484 -$1,507 -$2,269 $1,457 -$3,533 -$6,908 -$4,240

End of Period Deposits $337 $240 $533 $457 $708 $453 $781 $400

Average Deposits $351 $286 $332 $548 $794 $532 $531 $558

14

BankMobile Spin-off / Merger

Key Steps

CUBI

Shareholders

CUBI

Customers Bank

BankMobile

Technologies

(BMT)

1

4

32

Flagship

Shareholders New Investors

Flagship

Flagship Raises

Equity

Event Target Date

Customers announced spin-off of BankMobile and merger of BankMobile into Flagship Community Bank 2017 Q4

Flagship files application with FDIC January 2018

Customers files with SEC for spin-off of BankMobile Technologies (BMT) – after 2017 financials audit March 2018

Flagship files registration statement for capital raise through an IPO – after 2017 financials audit March / April 2018

Customers announces record date – after appropriate regulatory approvals 2018 Q2

Flagship completes IPO Mid-2018, just prior to close

1) BMT is spun-out to Customers’ shareholders, 2) BMT merges into Flagship Community Bank in a tax-

free exchange for newly issued shares of Flagship common stock, 3) Deposits and associated earning

assets are transferred from Customers Bank to Flagship, 4) Flagship changes name to BankMobile and

lists on a national exchange

Mid-2018 / Closing Date

Key Steps in Spin-off / Merger

15

Capital Plan: Internal Targets are Within Sight

The Q4 2017 reduction in balance sheet size boosted capital ratios at least 50 bps

Ratio Regulatory

Capital

Requirement(1)

Internal

Target

Consolidated

Bancorp

2017 Q4 (Est.)

Customers

Bank Sub

2017 Q4 (Est.)

Tier 1 Leverage >=5.00% >=9.00% 8.94% 9.74%

Tier 1 Risk Based >=8.50% >=11.00% 11.67% 12.30%

Total Risk Based >=10.50% >=13.00% 13.20% 14.12%

CET1 >=7.00% >=9.00% 8.87% 12.30%

TCE/TA (2) NA >=7.00% 7.00% NA

Source: Company data

(1) Regulatory capital requirement is equal to the greater of the fully phased in Basel III levels required to avoid limitations on certain elective distributions, or Prompt Corrective Action

“well capitalized” floors.

(2) A Non-GAAP measure, see reconciliation at the end of this presentation

16

Customers Bank

Executing On Our Unique High Performing

Banking Model

17

Unique Single

Point of

Contact Model

Customer

Centric

Experienced

Leadership

Branch Lite

Private

Banking

Source

Model

High Tech /

High Touch

Excellence in

Service

Strong Asset

Quality

Superior Risk

Management

Customers Business Model

Approach to Winning Model

Relationship driven but never deviate from following critical success factors

• Only focus on very strong credit quality niches

• Very strong risk management culture

• Operate at lower efficiency ratio than peers to deliver sustainable strong profitability and growth

• Always attract and retain top quality talent

• Culture of innovation and continuous improvement

18

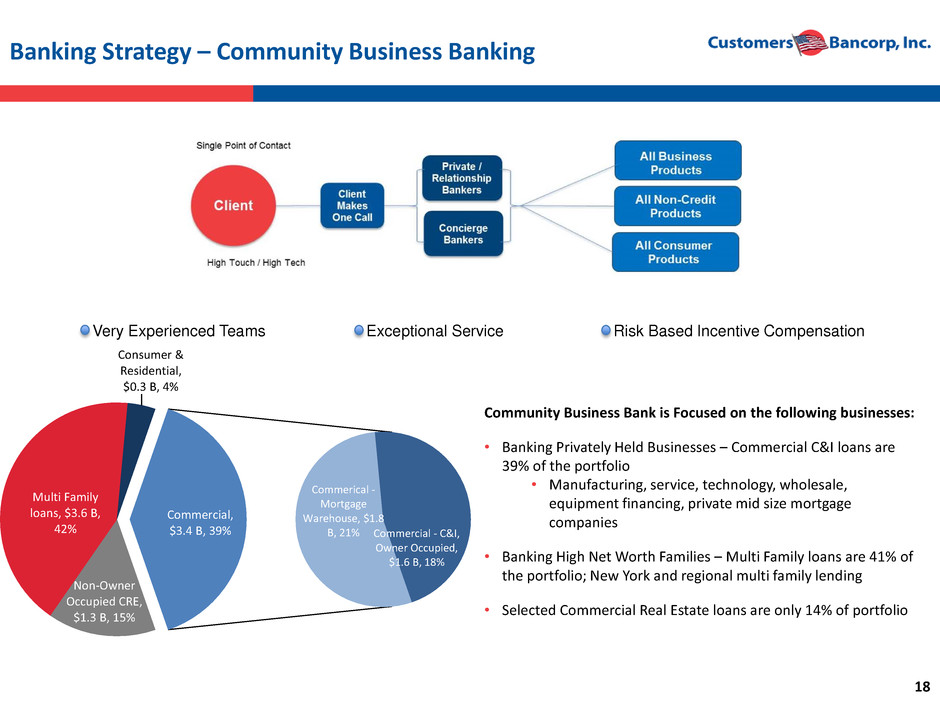

Very Experienced Teams Exceptional Service Risk Based Incentive Compensation

Banking Strategy – Community Business Banking

Community Business Bank is Focused on the following businesses:

• Banking Privately Held Businesses – Commercial C&I loans are

39% of the portfolio

• Manufacturing, service, technology, wholesale,

equipment financing, private mid size mortgage

companies

• Banking High Net Worth Families – Multi Family loans are 41% of

the portfolio; New York and regional multi family lending

• Selected Commercial Real Estate loans are only 14% of portfolio

Non-Owner

Occupied CRE,

$1.3 B, 15%

Commerical -

Mortgage

Warehouse, $1.8

B, 21% Commercial - C&I,

Owner Occupied,

$1.6 B, 18%

Multi Family

loans, $3.6 B,

42%

Consumer &

Residential,

$0.3 B, 4%

Commercial,

$3.4 B, 39%

19

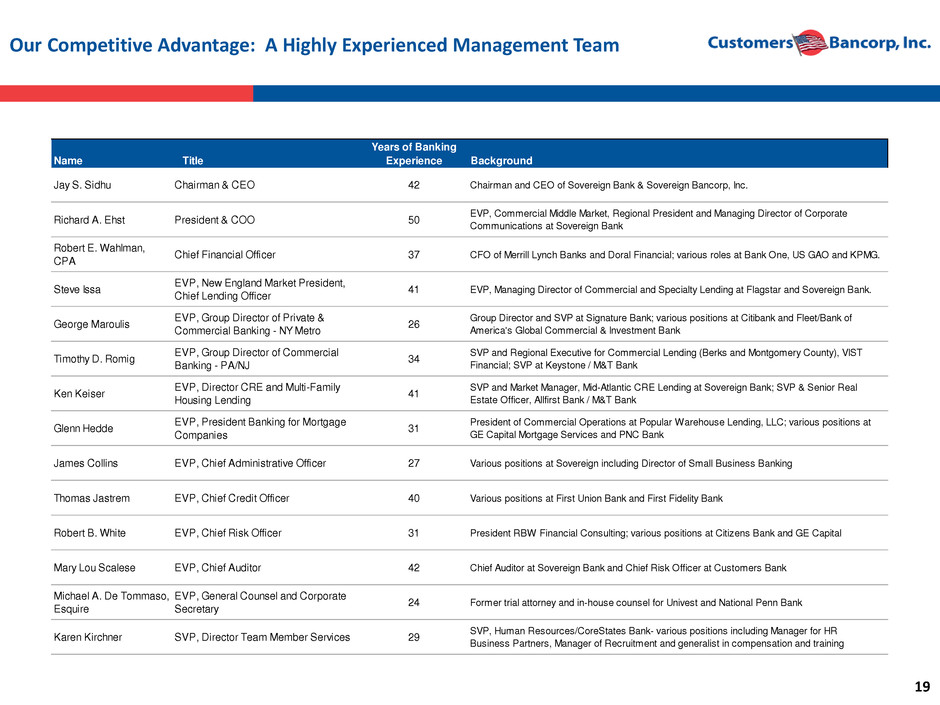

Our Competitive Advantage: A Highly Experienced Management Team

Name Title

Years of Banking

Experience Background

Jay S. Sidhu Chairman & CEO 42 Chairman and CEO of Sovereign Bank & Sovereign Bancorp, Inc.

Richard A. Ehst President & COO 50

EVP, Commercial Middle Market, Regional President and Managing Director of Corporate

Communications at Sovereign Bank

Robert E. Wahlman,

CPA

Chief Financial Officer 37 CFO of Merrill Lynch Banks and Doral Financial; various roles at Bank One, US GAO and KPMG.

Steve Issa

EVP, New England Market President,

Chief Lending Officer

41 EVP, Managing Director of Commercial and Specialty Lending at Flagstar and Sovereign Bank.

George Maroulis

EVP, Group Director of Private &

Commercial Banking - NY Metro

26

Group Director and SVP at Signature Bank; various positions at Citibank and Fleet/Bank of

America's Global Commercial & Investment Bank

Timothy D. Romig

EVP, Group Director of Commercial

Banking - PA/NJ

34

SVP and Regional Executive for Commercial Lending (Berks and Montgomery County), VIST

Financial; SVP at Keystone / M&T Bank

Ken Keiser

EVP, Director CRE and Multi-Family

Housing Lending

41

SVP and Market Manager, Mid-Atlantic CRE Lending at Sovereign Bank; SVP & Senior Real

Estate Officer, Allfirst Bank / M&T Bank

Glenn Hedde

EVP, President Banking for Mortgage

Companies

31

President of Commercial Operations at Popular Warehouse Lending, LLC; various positions at

GE Capital Mortgage Services and PNC Bank

James Collins EVP, Chief Administrative Officer 27 Various positions at Sovereign including Director of Small Business Banking

Thomas Jastrem EVP, Chief Credit Officer 40 Various positions at First Union Bank and First Fidelity Bank

Robert B. White EVP, Chief Risk Officer 31 President RBW Financial Consulting; various positions at Citizens Bank and GE Capital

Mary Lou Scalese EVP, Chief Auditor 42 Chief Auditor at Sovereign Bank and Chief Risk Officer at Customers Bank

Michael A. De Tommaso,

Esquire

EVP, General Counsel and Corporate

Secretary

24 Former trial attorney and in-house counsel for Univest and National Penn Bank

Karen Kirchner SVP, Director Team Member Services 29

SVP, Human Resources/CoreStates Bank- various positions including Manager for HR

Business Partners, Manager of Recruitment and generalist in compensation and training

20

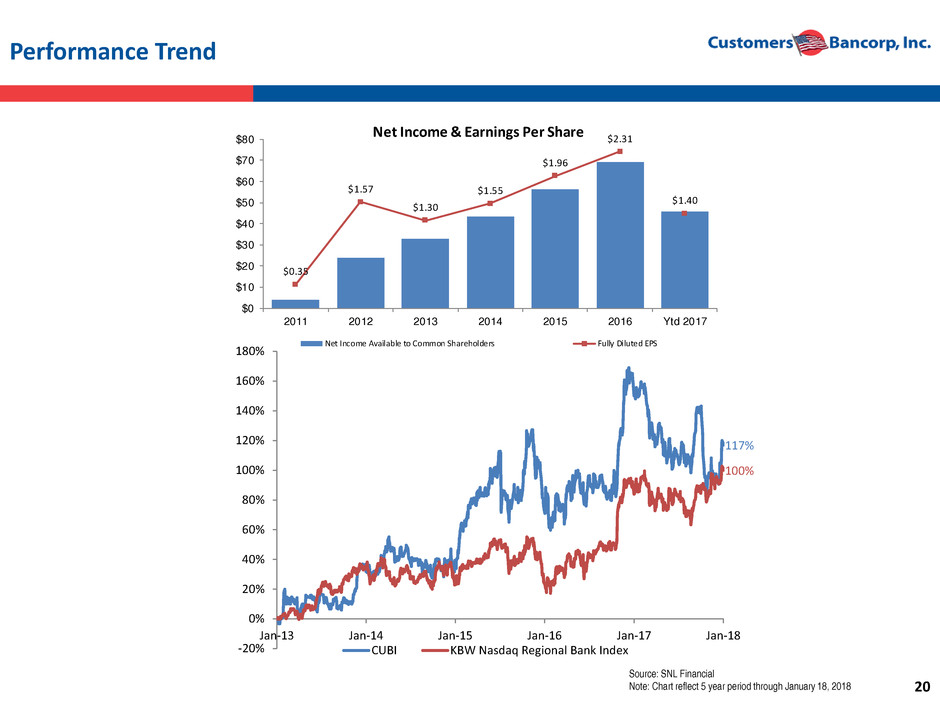

Performance Trend

Source: SNL Financial

Note: Chart reflect 5 year period through January 18, 2018

$0.35

$1.57

$1.30

$1.55

$1.96

$2.31

$1.40

$0

$10

$20

$30

$40

$50

$60

$70

$80

2011 2012 2013 2014 2015 2016 Ytd 2017

Net Income & Earnings Per Share

Net Income Available to Common Shareholders Fully Diluted EPS

117%

100%

-20%

0%

20%

40%

60%

80%

100%

120%

140%

160%

180%

Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18

CUBI KBW Nasdaq Regional Bank Index

21

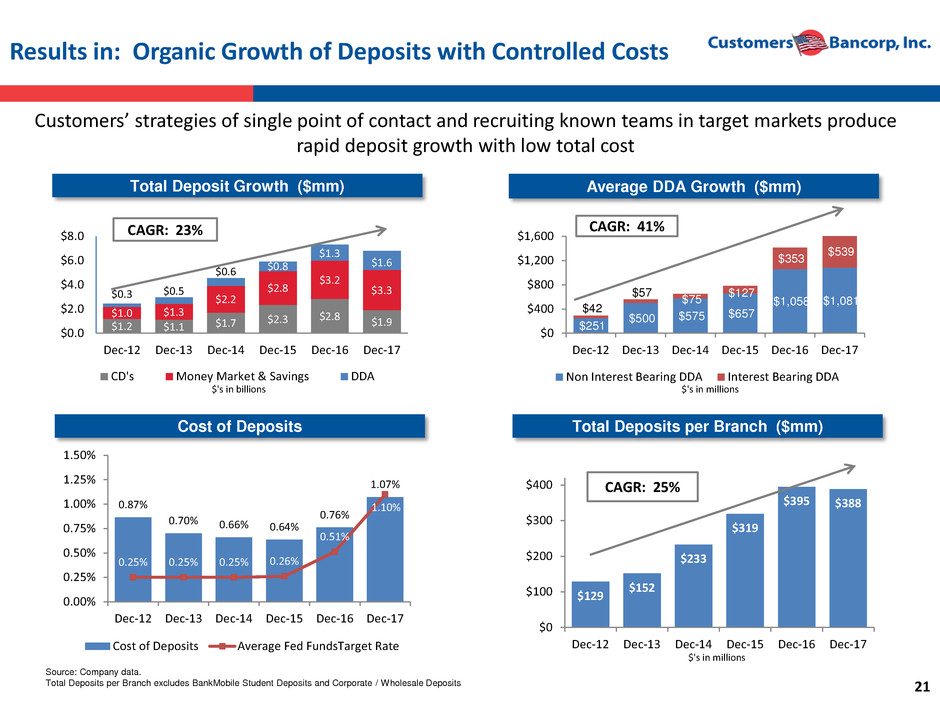

Results in: Organic Growth of Deposits with Controlled Costs

Source: Company data.

Total Deposits per Branch excludes BankMobile Student Deposits and Corporate / Wholesale Deposits

Total Deposit Growth ($mm) Average DDA Growth ($mm)

Cost of Deposits Total Deposits per Branch ($mm)

Customers’ strategies of single point of contact and recruiting known teams in target markets produce

rapid deposit growth with low total cost

$1.2 $1.1 $1.7

$2.3 $2.8 $1.9

$1.0 $1.3

$2.2

$2.8

$3.2

$3.3 $0.3 $0.5

$0.6 $0.8

$1.3

$1.6

$0.0

$2.0

$4.0

$6.0

$8.0

Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17

$'s in billions

CD's Money Market & Savings DDA

CAGR: 23%

$251

$500 $575 $657

$1,058 $1,081 $42

$57 $75 $127

$353 $539

$0

$400

$800

$1,200

$1,600

Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17

$'s in millions

Non Interest Bearing DDA Interest Bearing DDA

CAGR: 41%

0.87%

0.70% 0.66% 0.64%

0.76%

1.07%

0.25% 0.25% 0.25% 0.26%

0.51%

1.10%

0.00%

0.25%

0.50%

0.75%

1.00%

1.25%

1.50%

Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17

Cost of Deposits Average Fed FundsTarget Rate

$129

$152

$233

$319

$395 $388

$0

$100

$200

$300

$400

Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17

$'s in millions

CAGR: 25%

22

Lending Strategy

High Growth with Strong Credit Quality

Continuous recruitment and retention of high quality teams

Centralized credit committee approval for all loans

Loans are stress tested for higher rates and a slower economy

Insignificant delinquencies on loans originated since new management team took over

Creation of solid foundation for future earnings

Source: Company data. Includes deferred costs and fees.

Loan Growth

$0.6 $0.9 $1.0 $1.3

$1.3 $0.4

$1.1

$2.3 $2.9

$3.2 $3.6

$1.6

$1.3

$2.1

$2.9

$3.5 $3.4

$0.3

$0.3

$0.4

$0.4

$0.3

$0.3

$0

$2

$4

$6

$8

$10

Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17

Non-Owner Occupied CRE Multi Family loans Commercial Consumer & Residential

CAGR: 26%

$'

s

in

B

ill

io

ns

23

NPL

Source: SNL Financial, Company data. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with comparable size in assets and loan portfolios (excluding banks with large

residential mortgage loan portfolios). Industry data includes all commercial and savings banks. Peer and Industry data as of Sept 30, 2017.

Build an Outstanding Loan Quality Portfolio

Charge Offs

3.33%

2.64%

2.06%

1.70% 1.70%

1.42%

1.83%

1.44%

1.09% 0.91% 0.89% 0.88%0.72% 0.60%

0.20% 0.15% 0.22% 0.32%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2012 2013 2014 2015 2016 Q3 2017

Industry Peer Customers Bancorp, Inc.

1.09%

0.68%

0.48% 0.42% 0.45% 0.45%0.48%

0.28%

0.15%

0.12% 0.12%

0.07%

0.29% 0.22% 0.07%

0.19%

0.02% 0.03%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

2012 2013 2014 2015 2016 Q3 2017

Industry Peer Customers Bancorp, Inc.

Asset Quality Indicators Continue to be Strong

Note: Customers 2015 charge-offs includes 12 bps for a $9 million

fraudulent loan

24

C&I & Owner Occupied CRE Banking Strategy

Private & Commercial Banking

Target companies with up to $100 million annual

revenues

Single point of contact

NE, NY, PA & NJ markets

SBA loans originated by small business relationship

managers

Banking Mortgage Companies

Private banking focused on privately held mortgage

companies generally with equity of $5 to $10 million

Very strong credit quality relationship business with good

fee income and deposits

~75 strong mortgage companies as clients

All outstanding loans are variable rate and classified as

held for sale

Target non-interest bearing DDA’s at 10% of outstanding

loans

Banking Privately Held Business

Commercial Loan and Deposit Growth ($mm)

Source: Company data

$1.6

$1.3

$2.1

$2.9

$3.5 $3.4

$0.4 $0.5

$1.6

$2.8

$4.0 $4.0

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

$4.5

2012 2013 2014 2015 2016 2017

$'s in billions Loans Deposits

LOAN CAGR: 17%

25

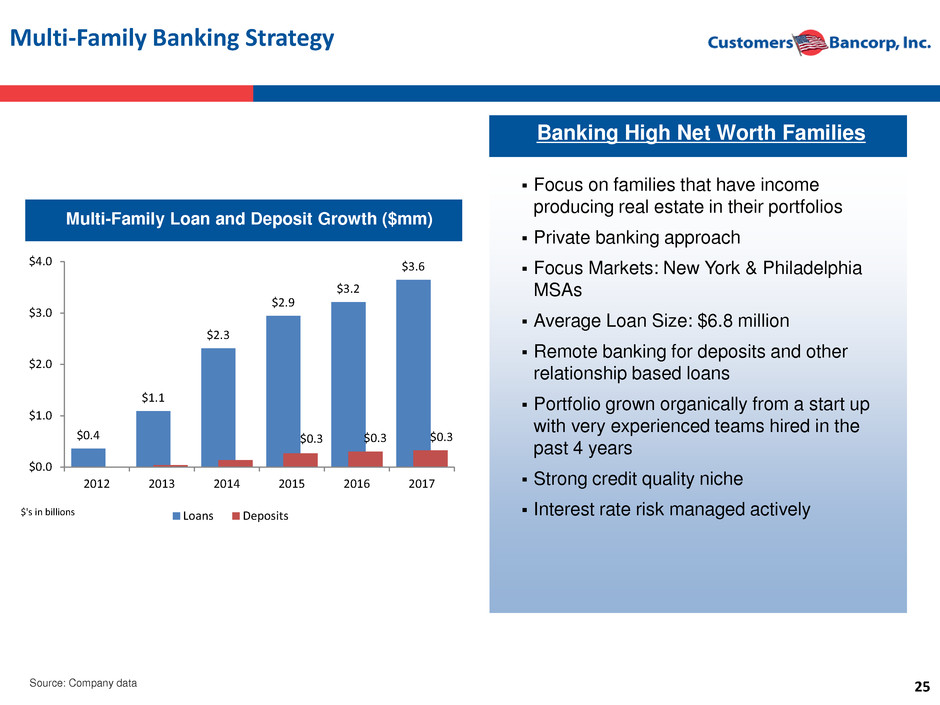

Multi-Family Banking Strategy

Banking High Net Worth Families

Multi-Family Loan and Deposit Growth ($mm)

Focus on families that have income

producing real estate in their portfolios

Private banking approach

Focus Markets: New York & Philadelphia

MSAs

Average Loan Size: $6.8 million

Remote banking for deposits and other

relationship based loans

Portfolio grown organically from a start up

with very experienced teams hired in the

past 4 years

Strong credit quality niche

Interest rate risk managed actively

Source: Company data

$0.4

$1.1

$2.3

$2.9

$3.2

$3.6

$0.3 $0.3 $0.3

$0.0

$1.0

$2.0

$3.0

$4.0

2012 2013 2014 2015 2016 2017

$'s in billions Loans Deposits

26

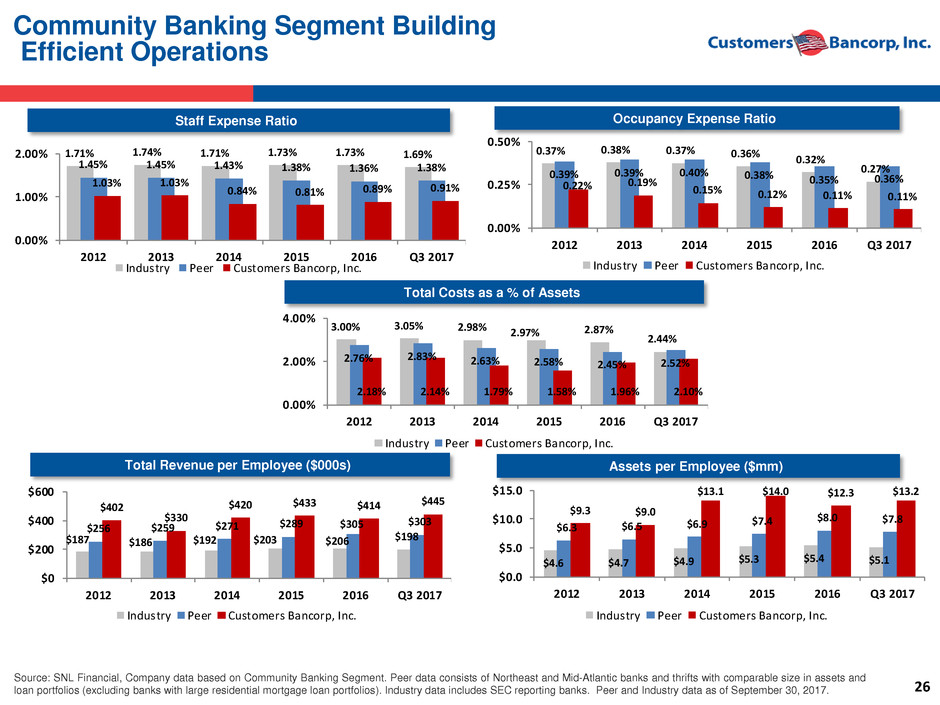

Staff Expense Ratio

Community Banking Segment Building

Efficient Operations

Source: SNL Financial, Company data based on Community Banking Segment. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with comparable size in assets and

loan portfolios (excluding banks with large residential mortgage loan portfolios). Industry data includes SEC reporting banks. Peer and Industry data as of September 30, 2017.

Occupancy Expense Ratio

Total Costs as a % of Assets

Total Revenue per Employee ($000s) Assets per Employee ($mm)

0.37% 0.38% 0.37% 0.36% 0.32%

0.27%0.39% 0.39% 0.40% 0.38% 0.35% 0.36%0.22% 0.19% 0.15% 0.12% 0.11% 0.11%

0.00%

0.25%

0.50%

2012 2013 2014 2015 2016 Q3 2017

Industry Peer Customers Bancorp, Inc.

$4.6 $4.7 $4.9 $5.3 $5.4 $5.1

$6.3 $6.5 $6.9

$7.4 $8.0 $7.8

$9.3 $9.0

$13.1 $14.0 $12.3 $13.2

$0.0

$5.0

$10.0

$15.0

2012 2013 2014 2015 2016 Q3 2017

Industry Peer Customers Bancorp, Inc.

1.71% 1.74% 1.71% 1.73% 1.73% 1.69%

1.45% 1.45% 1.43% 1.38% 1.36% 1.38%

1.03% 1.03%

0.84% 0.81% 0.89% 0.91%

0.00%

1.00%

2.00%

2012 2013 2014 2015 2016 Q3 2017

Industry Peer Customers Bancorp, Inc.

3.00% 3.05% 2.98% 2.97% 2.87% 2.44%

2.76% 2.83% 2.63% 2.58% 2.45% 2.52%

2.18% 2.14% 1.79% 1.58% 1.96% 2.10%

0.00%

2.00%

4.00%

2012 2013 2014 2015 2016 Q3 2017

Industry Peer Customers Bancorp, Inc.

$187 $186 $192 $203 $206 $198

$256 $259 $271 $289 $305

$303

$402

$330

$420 $433 $414 $445

$0

$200

$400

$600

2012 2013 2014 2015 2016 Q3 2017

Industry Peer Customers Bancorp, Inc.

27

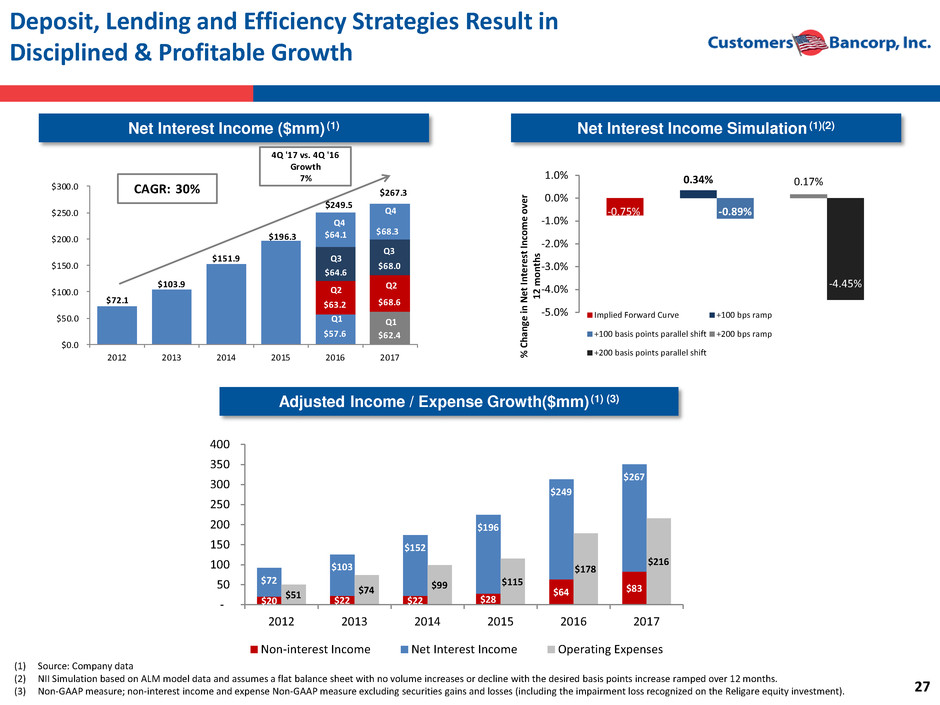

Deposit, Lending and Efficiency Strategies Result in

Disciplined & Profitable Growth

Net Interest Income ($mm) (1)

(1) Source: Company data

(2) NII Simulation based on ALM model data and assumes a flat balance sheet with no volume increases or decline with the desired basis points increase ramped over 12 months.

(3) Non-GAAP measure; non-interest income and expense Non-GAAP measure excluding securities gains and losses (including the impairment loss recognized on the Religare equity investment).

Net Interest Income Simulation (1)(2)

Adjusted Income / Expense Growth($mm) (1) (3)

$72.1

$103.9

$151.9

$196.3

$57.6 $62.4

$63.2 $68.6

$64.6

$68.0

$64.1 $68.3

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

2012 2013 2014 2015 2016 2017

CAGR: 30%

Q3

Q1

Q2

Q1

4Q '17 vs. 4Q '16

Growth

7%

Q2

Q4

$249.5

Q3

$267.3

Q4

$20 $22 $22 $28

$64 $83

$72

$103

$152

$196

$249

$267

$51 $74

$99 $115

$178

$216

2012 2013 2014 2015 2016 2017

-

50

100

150

200

250

300

350

400

4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21

Non-interest Income Net Interest Income Operating Expenses

-0.75%

0.00%

0.34%

-0.89%

0.17%

-4.45%

-5.0%

-4.0%

-3.0%

-2.0%

-1.0%

0.0%

1.0%

%

C

ha

ng

e

in

N

et

In

te

re

st

In

co

m

e

ov

er

12

m

on

th

s

Implied Forward Curve +100 bps ramp

+100 basis points parallel shift +200 bps ramp

+200 basis points parallel shift

28

Deposit, Lending and Efficiency Strategies Result in

Disciplined & Profitable Growth

• Strategy execution has produced superior growth in revenues and earnings

Efficiency Ratio(1)

(1) Source: Company data

(2) Non-GAAP measure calculated as GAAP net income available to common shareholders excluding securities gains and losses (including the impairment loss recognized on the Religare equity

investment), and reversal of previously deferred tax benefits associated with Religare Impairment.

Adjusted Community Banking Segment Net Income

Available to Common Shareholders ($mm)(1)(2) Total Revenue ($mm)

(1)

55%

59% 57%

51%

57%

62%

0%

10%

20%

30%

40%

50%

60%

70%

2012 2013 2014 2015 2016 2017

$101.0

$126.6

$177.0

$224.0

$63.1 $85.2

$71.4

$87.0

$92.1

$86.0

$79.3

$88.0

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

$400.0

2012 2013 2014 2015 2016 YTD 2017

CAGR: 28%

Q4

Q2

Q1 Q1

Q3

$305.9

Q2

$346.3

Q3

Q4

$18.0

$32.1

$39.8

$56.6

$18.9

$23.4

$20.6

$22.1

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

2012 2013 2014 2015 2016 2017

CAGR: 36%

Q1

$81.7

Q2

$85.0

Q4

Q3

29

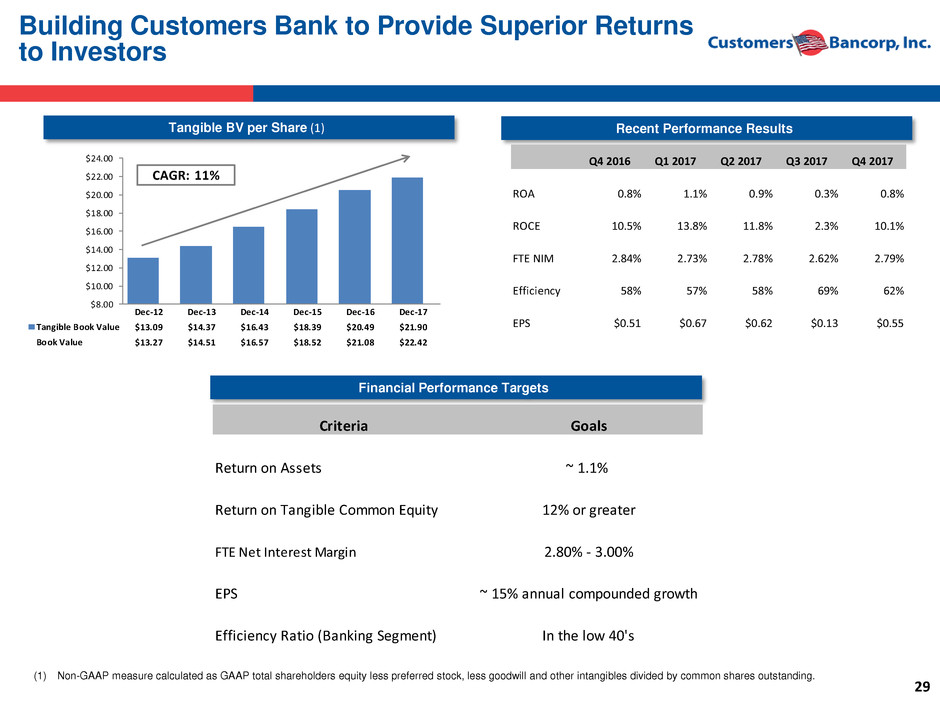

Tangible BV per Share (1)

Building Customers Bank to Provide Superior Returns

to Investors

Recent Performance Results

Financial Performance Targets

(1) Non-GAAP measure calculated as GAAP total shareholders equity less preferred stock, less goodwill and other intangibles divided by common shares outstanding.

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

$20.00

$22.00

$24.00

Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17

Tangible Book Value $13.09 $14.37 $16.43 $18.39 $20.49 $21.90

Book Value $13.27 $14.51 $16.57 $18.52 $21.08 $22.42

CAGR: 11%

Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

ROA 0.8% 1.1% 0.9% 0.3% 0.8%

ROCE 10.5% 13.8% 11.8% 2.3% 10.1%

FTE NIM 2.84% 2.73% 2.78% 2.62% 2.79%

Efficiency 58% 57% 58% 69% 62%

EPS $0.51 $0.67 $0.62 $0.13 $0.55

Criteria Goals

Return on Assets ~ 1.1%

Return on Tangible Common Equity 12% or greater

FTE Net Interest Margin 2.80% - 3.00%

EPS ~ 15% annual compounded growth

Efficiency Ratio (Banking Segment) In the low 40's

30

Contacts

Company:

Robert Wahlman, CFO

Tel: 610-743-8074

rwahlman@customersbank.com

Jay Sidhu

Chairman & CEO

Tel: 610-301-6476

jsidhu@customersbank.com

Bob Ramsey

Director of IR and Strategic Planning

Tel: 484-926-7118

rramsey@customersbank.com

Customers believes that the non-GAAP measurements disclosed within this

document are useful for investors, regulators, management and others to evaluate

our results of operations and financial condition relative to other financial

institutions. These non-GAAP financial measures exclude from corresponding

GAAP measures the impact of certain elements that we do not believe are

representative of our financial results, which we believe enhance an overall

understanding of our performance. Investors should consider our performance and

financial condition as reported under GAAP and all other relevant information

when assessing our performance or financial condition. Although non-GAAP

financial measures are frequently used in the evaluation of a company, they have

limitations as analytical tools and should not be considered in isolation or as a

substitute for analysis of our results of operations or financial condition as reported

under GAAP.

The following tables present reconciliations of GAAP to Non-GAAP measures

disclosed within this document.

31

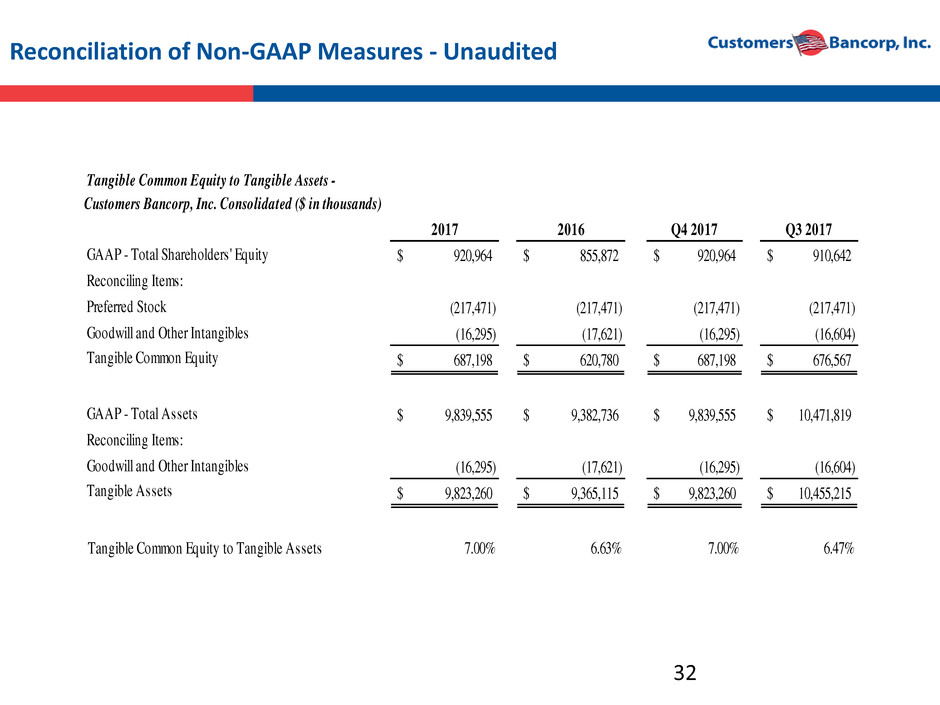

Reconciliation of Non-GAAP Measures - Unaudited

32

Tangible Common Equity to Tangible Assets -

Customers Bancorp, Inc. Consolidated ($ in thousands)

2017 2016 Q4 2017 Q3 2017

GAAP - Total Shareholders' Equity 920,964$ 855,872$ 920,964$ 910,642$

Reconciling Items:

Preferred Stock (217,471) (217,471) (217,471) (217,471)

Goodwill and Other Intangibles (16,295) (17,621) (16,295) (16,604)

Tangible Common Equity 687,198$ 620,780$ 687,198$ 676,567$

GAAP - Total Assets 9,839,555$ 9,382,736$ 9,839,555$ 10,471,819$

Reconciling Items:

Goodwill and Other Intangibles (16,295) (17,621) (16,295) (16,604)

Tangible Assets 9,823,260$ 9,365,115$ 9,823,260$ 10,455,215$

Tangible Common Equity to Tangible Assets 7.00% 6.63% 7.00% 6.47%

Reconciliation of Non-GAAP Measures - Unaudited

33

Tangible Book Value per Common Share - Customers

Bancorp, Inc. Consolidated ($ in thousands, except per

share data)

2017 2016 2015 2014 2013 2012

GAAP -Total Shareholders' Equity 920,964$ 855,872$ 553,902$ 443,145$ 386,623$ 269,475$

Reconciling Items:

Preferred Stock (217,471) (217,471) (55,569) - - -

Goodwill and Other Intangibles (16,295) (17,621) (3,651) (3,664) (3,676) (3,689)

Tangible Common Equity 687,198$ 620,780$ 494,682$ 439,481$ 382,947$ 265,786$

Common shares outstanding 31,382,503 30,289,917 26,901,801 26,745,529 26,646,566 20,305,452

Tangible Book Value per Common Share 21.90$ 20.49$ 18.39$ 16.43$ 14.37$ 13.09$

Book Value per Common Share 22.42$ 21.08$ 18.52$ 16.57$ 14.51$ 13.27$

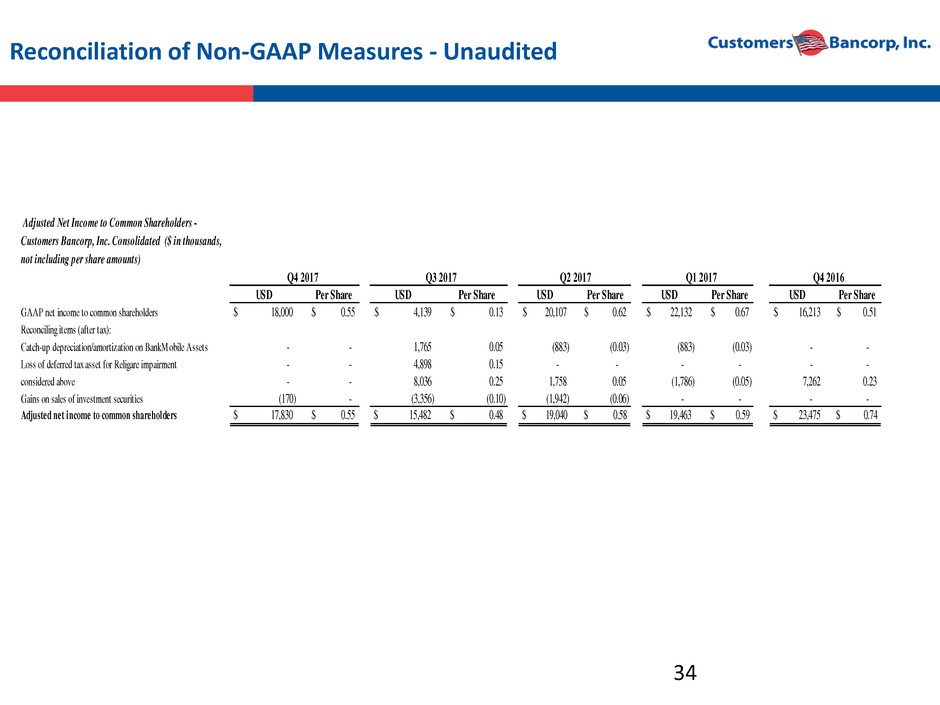

Reconciliation of Non-GAAP Measures - Unaudited

34

Adjusted Net Income to Common Shareholders -

Customers Bancorp, Inc. Consolidated ($ in thousands,

not including per share amounts)

Q4 2017 Q3 2017 Q2 2017 Q1 2017 Q4 2016

USD Per Share USD Per Share USD Per Share USD Per Share USD Per Share

GAAP net income to common shareholders $ 18,000 $ 0.55 4,139$ 0.13$ 20,107$ 0.62$ 22,132$ 0.67$ 16,213$ 0.51$

Reconciling items (after tax):

Catch-up depreciation/amortization on BankMobile Assets - - 1,765 0.05 (883) (0.03) (883) (0.03) - -

Loss of deferred tax asset for Religare impairment - - 4,898 0.15 - - - - - - g p g

considered above - - 8,036 0.25 1,758 0.05 (1,786) (0.05) 7,262 0.23

Gains on sales of investment securities (170) - (3,356) (0.10) (1,942) (0.06) - - - -

Adjusted net income to common shareholders $ 17,830 $ 0.55 $ 15,482 $ 0.48 $ 19,040 $ 0.58 $ 19,463 $ 0.59 $ 23,475 $ 0.74

Reconciliation of Non-GAAP Measures - Unaudited

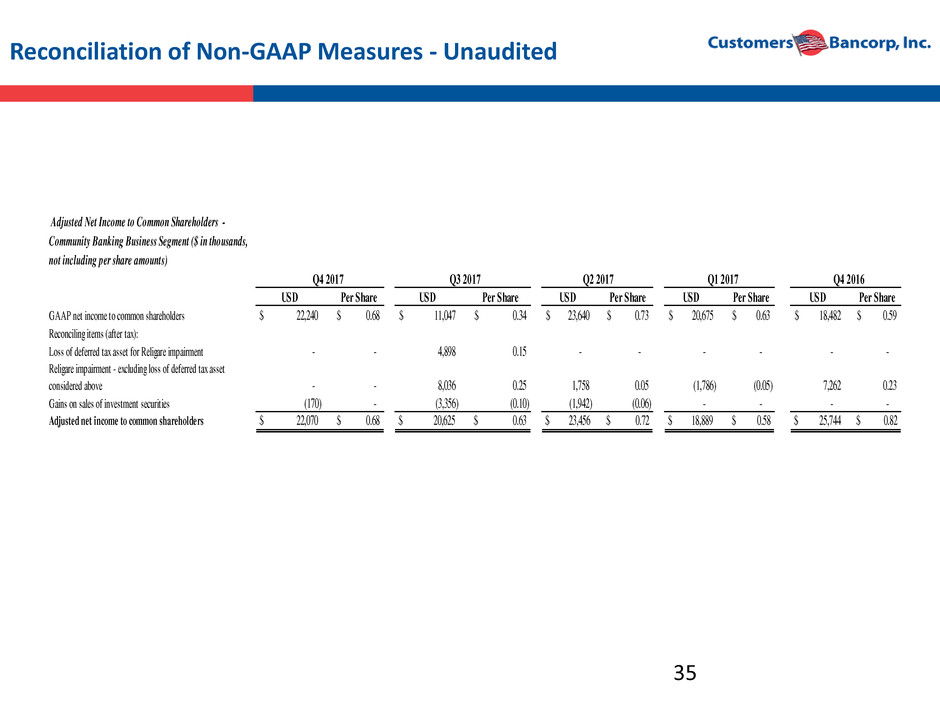

35

Adjusted Net Income to Common Shareholders -

Community Banking Business Segment ($ in thousands,

not including per share amounts)

Q4 2017 Q3 2017 Q2 2017 Q1 2017 Q4 2016

USD Per Share USD Per Share USD Per Share USD Per Share USD Per Share

GAAP net income to common shareholders $ 22,240 $ 0.68 11,047$ 0.34$ 23,640$ 0.73$ 20,675$ 0.63$ 18,482$ 0.59$

Reconciling items (after tax):

Loss of deferred tax asset for Religare impairment - - 4,898 0.15 - - - - - -

Religare impairment - excluding loss of deferred tax asset

considered above - - 8,036 0.25 1,758 0.05 (1,786) (0.05) 7,262 0.23

Gains on sales of investment securities (170) - (3,356) (0.10) (1,942) (0.06) - - - -

Adjusted net income to common shareholders $ 22,070 $ 0.68 $ 20,625 $ 0.63 $ 23,456 $ 0.72 $ 18,889 $ 0.58 $ 25,744 $ 0.82

Reconciliation of Non-GAAP Measures - Unaudited

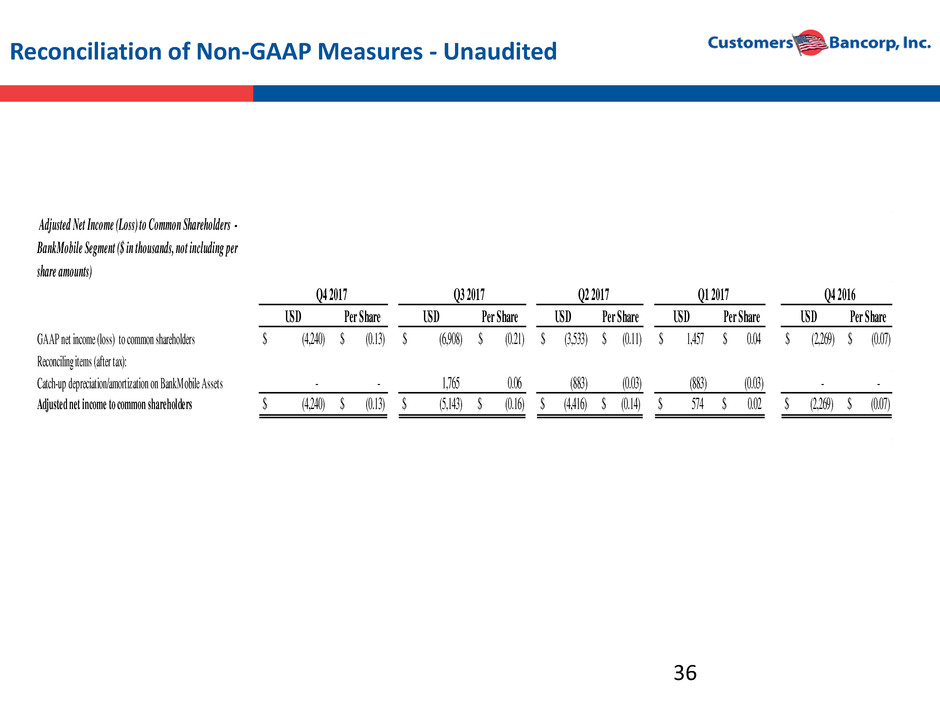

Adjusted Net Income (Loss) to Common Shareholders -

BankMobile Segment ($ in thousands, not including per

share amounts)

Q4 2017 Q3 2017 Q2 2017 Q1 2017 Q4 2016

USD Per Share USD Per Share USD Per Share USD Per Share USD Per Share

GAAP net income (loss) to common shareholders $ (4,240) $ (0.13) (6,908)$ (0.21)$ (3,533)$ (0.11)$ 1,457$ 0.04$ (2,269)$ (0.07)$

Reconciling items (after tax):

Catch-up depreciation/amortization on BankMobile Assets - - 1,765 0.06 (883) (0.03) (883) (0.03) - -

Adjusted net income to common shareholders $ (4,240) $ (0.13) $ (5,143) $ (0.16) $ (4,416) $ (0.14) $ 574 $ 0.02 $ (2,269) $ (0.07)

36

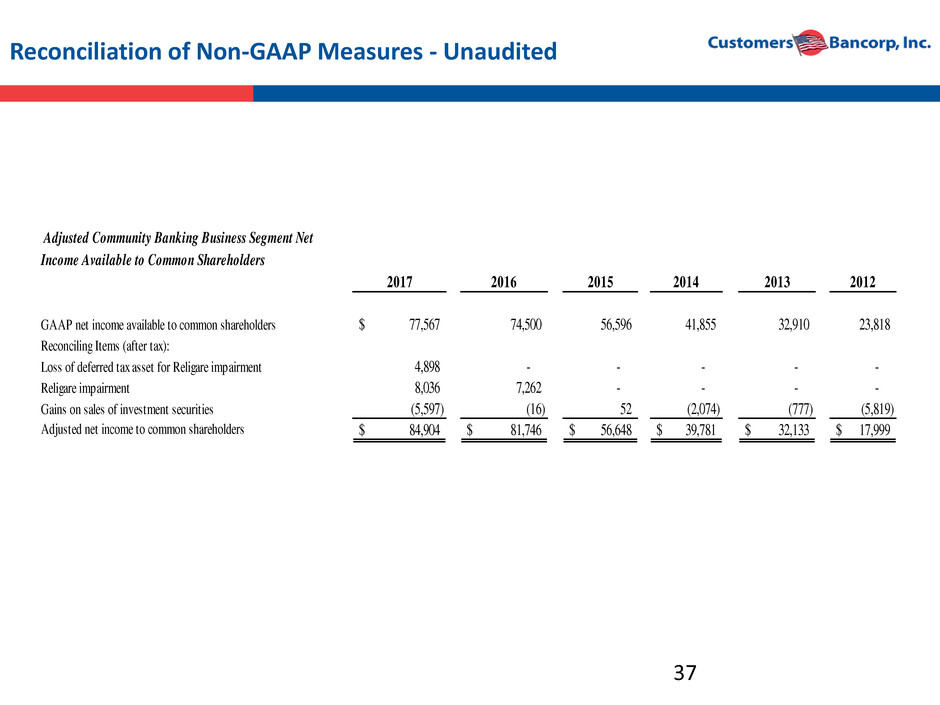

Reconciliation of Non-GAAP Measures - Unaudited

37

Adjusted Community Banking Business Segment Net

Income Available to Common Shareholders

2017 2016 2015 2014 2013 2012

GAAP net income available to common shareholders 77,567$ 74,500 56,596 41,855 32,910 23,818

Reconciling Items (after tax):

Loss of deferred tax asset for Religare impairment 4,898 - - - - -

Religare impairment 8,036 7,262 - - - -

Gains on sales of investment securities (5,597) (16) 52 (2,074) (777) (5,819)

Adjusted net income to common shareholders 84,904$ 81,746$ 56,648$ 39,781$ 32,133$ 17,999$

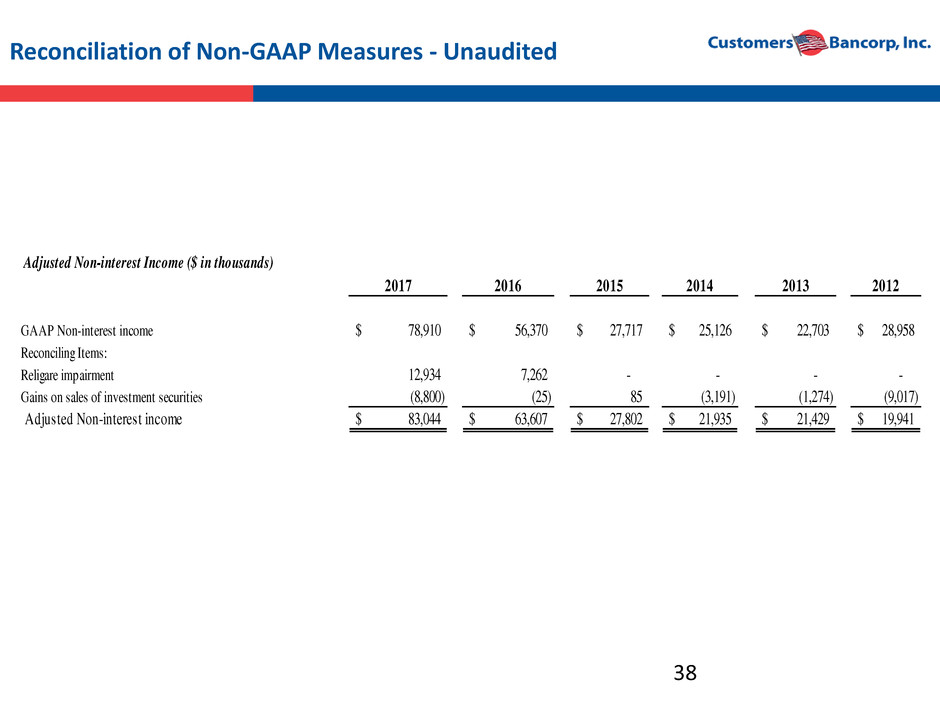

Reconciliation of Non-GAAP Measures - Unaudited

38

Adjusted Non-interest Income ($ in thousands)

2017 2016 2015 2014 2013 2012

GAAP Non-interest income 78,910$ 56,370$ 27,717$ 25,126$ 22,703$ 28,958$

Reconciling Items:

Religare impairment 12,934 7,262 - - - -

Gains on sales of investment securities (8,800) (25) 85 (3,191) (1,274) (9,017)

Adjusted Non-interest income 83,044$ 63,607$ 27,802$ 21,935$ 21,429$ 19,941$

Reconciliation of Non-GAAP Measures - Unaudited

39

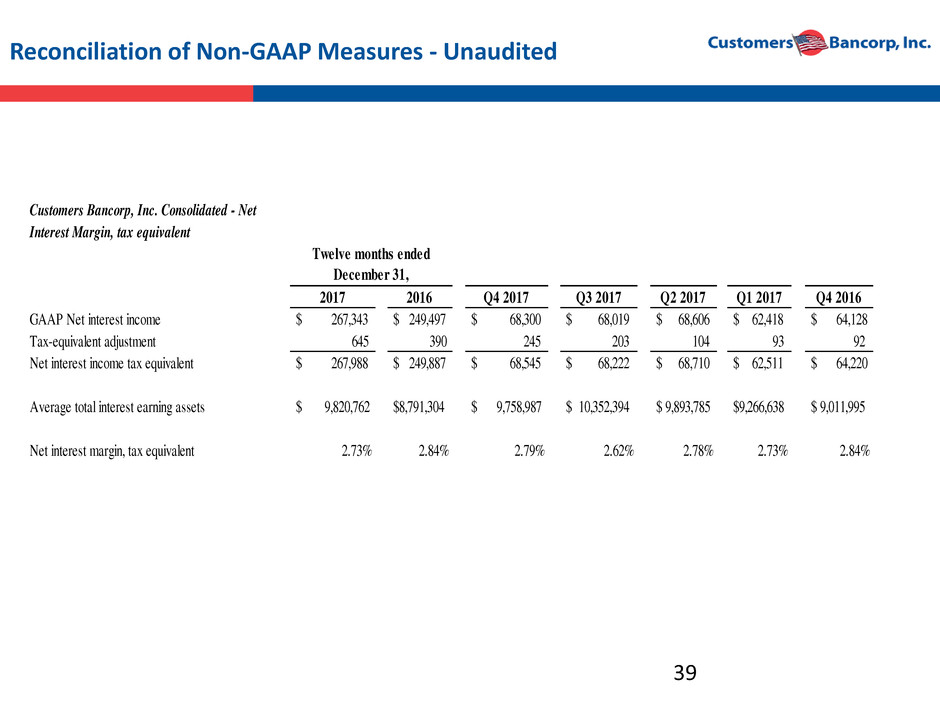

Customers Bancorp, Inc. Consolidated - Net

Interest Margin, tax equivalent

2017 2016 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Q4 2016

GAAP Net interest income $ 267,343 $ 249,497 $ 68,300 $ 68,019 $ 68,606 $ 62,418 $ 64,128

Tax-equivalent adjustment 645 390 245 203 104 93 92

Net interest income tax equivalent $ 267,988 $ 249,887 $ 68,545 $ 68,222 $ 68,710 $ 62,511 $ 64,220

Average total interest earning assets $ 9,820,762 $8,791,304 $ 9,758,987 $ 10,352,394 $ 9,893,785 $9,266,638 $ 9,011,995

Net interest margin, tax equivalent 2.73% 2.84% 2.79% 2.62% 2.78% 2.73% 2.84%

Twelve months ended

December 31,

Reconciliation of Non-GAAP Measures - Unaudited