UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2018

Rapid7, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-37496 | 35-2423994 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 100 Summer Street, Boston, Massachusetts | 02110 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (617) 247-1717

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

| Item 2.02 | Results of Operations and Financial Condition |

In connection with a proposed registered offing of common stock, Rapid7, Inc. has announced certain preliminary financial data as set forth below.

All references below to “Rapid7,” the “Company,” “we,” “us,” “our” and similar references refer to Rapid7, Inc., except where the context otherwise requires or as otherwise indicated.

Recent Developments

This recent developments section includes forward-looking statements. All statements contained herein other than statements of historical facts, including, without limitation, statements regarding our expectations regarding our financial and operating results for the year and three months ended December 31, 2017 and our future financial and business performance, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “will” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements are subject to a number of risks and uncertainties, including, without limitation, risks related to our rapid growth and ability to sustain our revenue growth rate, risk related to the timing of our recognition of deferred revenue, the ability of our products and professional services to correctly detect vulnerabilities, competition in the markets in which we operate, market growth, our ability to innovate and manage our growth.

Preliminary Financial Results

The following preliminary financial information for the three months and the year ended December 31, 2017 is based upon our estimates and subject to completion of our financial closing procedures. Moreover, these data have been prepared solely on the basis of currently available information by, and are the responsibility of, Rapid7. Our independent registered public accounting firm, KPMG LLP, has not audited or reviewed, and does not express an opinion with respect to, these data. This summary is not a comprehensive statement of our financial results for this period, and our actual results may differ materially from these estimates due to the completion of our financial closing procedures, final adjustments, completion of the audit of our financial statements and other developments that may arise between now and the time the audit of our financial statements is completed. Our actual results for the three months and the year ended December 31, 2017 will not be available until after the proposed public offering is completed. There can be no assurance that these estimates will be realized, and estimates are subject to risks and uncertainties, many of which are not within our control.

We have prepared estimates of the following preliminary financial data for the three months and the year ended December 31, 2017.

| Year ended December 31, 2017 |

% Change (year-over-year) |

Three months ended December 31, 2017 |

% Change (year-over-year) |

|||||||||||||||||||||||||||||

| Range | Range | |||||||||||||||||||||||||||||||

| Low | High | Low | High | Low | High | Low | High | |||||||||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||||||||||||||

| GAAP Data |

||||||||||||||||||||||||||||||||

| Revenue |

$ | 200.4 | $ | 200.7 | 27 | % | 27 | % | $ | 57.2 | $ | 57.5 | 27 | % | 28 | % | ||||||||||||||||

| Loss from operations |

$ | (49.3 | ) | $ | (49.0 | ) | $ | (13.9 | ) | $ | (13.6 | ) | ||||||||||||||||||||

| Net loss |

$ | (46.5 | ) | $ | (45.8 | ) | $ | (14.0 | ) | $ | (13.3 | ) | ||||||||||||||||||||

| Cash flows from operating activities |

$ | 12.5 | $ | 13.0 | ||||||||||||||||||||||||||||

| Other Data |

||||||||||||||||||||||||||||||||

| Calculated billings(1) |

$ | 254.8 | $ | 255.8 | 30 | % | 30 | % | $ | 92.0 | $ | 93.0 | 42 | % | 43 | % | ||||||||||||||||

| Annualized recurring revenue(2) |

$ | 163.0 | $ | 164.0 | 34 | % | 35 | % | $ | 163.0 | $ | 164.0 | 34 | % | 35 | % | ||||||||||||||||

| Non-GAAP loss from operations(3) |

$ | (26.5 | ) | $ | (26.3 | ) | $ | (7.9 | ) | $ | (7.7 | ) | ||||||||||||||||||||

| (1) | Calculated billings is a non-GAAP measure that we define as total revenue recognized in accordance with generally accepted accounting principles, or GAAP, plus the change in deferred revenue from the beginning to the end of the period. We consider calculated billings to be a useful metric for management and investors, as a supplement to the corresponding GAAP measure of total revenue, because billings drive deferred revenue, which is an important indicator of the health and visibility of trends in our business, and represents a significant percentage of future |

| revenue. We regularly monitor calculated billings because we believe the measure offers information regarding the performance of our business. With the expansion of our subscription, cloud-based product offerings (InsightVM, InsightIDR, InsightAppSec, and InsightOps) on the Insight platform, we may realize a shortening of our average contract duration, which should be taken into consideration when evaluating calculated billings. Our use of calculated billings has limitations as an analytical tool and should not be considered in isolation or as a substitute for revenue recognition or revenue measurement, or an analysis of our results as reported under GAAP. Also, it is important to note that other companies, including companies in our industry, may not use calculated billings, may compute billings differently, may have different billing frequencies, or may use other financial measures to evaluate their performance, all of which could reduce the usefulness of calculated billings as a comparative measure. The following table presents a reconciliation of calculated billings to revenue, the most directly comparable GAAP measure, for each of the periods indicated: |

| Year ended December 31, 2017 |

Three months ended December 31, 2017 |

|||||||||||||||

| Range | Range | |||||||||||||||

| Low | High | Low | High | |||||||||||||

| (in millions) | ||||||||||||||||

| Revenue |

$ | 200.4 | $ | 200.7 | $ | 57.2 | $ | 57.5 | ||||||||

| Deferred revenue, end of period |

223.4 | 224.1 | 223.4 | 224.1 | ||||||||||||

| Deferred revenue, beginning of period |

169.1 | 169.1 | 188.6 | 188.6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Calculated billings |

$ | 254.8 | $ | 255.8 | $ | 92.0 | $ | 93.0 | ||||||||

| (2) | Annualized recurring revenue is defined as the annual value of all recurring revenue related to contracts in place at the end of the period. |

| (3) | Non-GAAP loss from operations is a non-GAAP measure that we define as loss from operations calculated in accordance with GAAP plus stock-based compensation expense, amortization of acquired intangible assets and acquisition-related expense. We consider non-GAAP loss from operations to be a useful metric for management and investors, as a supplement to the corresponding GAAP measure of loss from operations, because non-GAAP loss from operations excludes non-cash charges that we do not believe to be indicative of our core operating results. We regularly monitor non-GAAP loss from operations because we believe the measure offers valuable information regarding the performance of our business and will help investors better understand our operating performance on a period-to-period basis. Our use of non-GAAP loss from operations has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of our results as reported under GAAP. Also, it is important to note that other companies, including companies in our industry, may not use non-GAAP loss from operations, may compute non-GAAP loss from operations differently or may use other financial measures to evaluate their performance, all of which could reduce the usefulness of non-GAAP loss from operations as a comparative measure. The following table presents a reconciliation of non-GAAP loss from operations to loss from operations calculated in accordance with GAAP, the most directly comparable GAAP measure, for each of the periods indicated: |

| Year ended December 31, 2017 |

Three months ended December 31, 2017 |

|||||||||||||||

| Range | Range | |||||||||||||||

| Low | High | Low | High | |||||||||||||

| (in millions) | ||||||||||||||||

| Loss from operations (GAAP) |

$ | (49.3 | ) | $ | (49.0 | ) | $ | (13.9 | ) | $ | (13.6 | ) | ||||

| Stock-based compensation expense |

19.7 | 19.6 | 5.0 | 4.9 | ||||||||||||

| Amortization of acquired intangible assets |

2.9 | 2.9 | 1.0 | 1.0 | ||||||||||||

| Acquisition-related expense |

0.2 | 0.2 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-GAAP loss from operations |

$ | (26.5 | ) | $ | (26.3 | ) | $ | (7.9 | ) | $ | (7.7 | ) | ||||

Below we have provided information regarding comparisons to prior year and quarters for context.

Revenue

The increase in revenue for the year and three months ended December 31, 2017 was driven by increased adoption across our solutions globally.

GAAP and non-GAAP loss from operations

Our loss from operations on both a GAAP and non-GAAP basis for the year ended December 31, 2017 reflected our revenue growth, partially offset by increased costs of goods sold and increased sales and marketing expense. Our loss from operations on both a GAAP and non-GAAP basis for the three months ended December 31, 2017, reflected our revenue growth, partially offset by increased costs of goods sold and increased commissions as a result of our increased calculated billings.

Net loss

Our net loss for the year ended December 31, 2017 reflected our revenue growth, partially offset by increased costs of goods sold and increased sales and marketing expense. Our net loss for the three months ended December 31, 2017, reflected our revenue growth, partially offset by increased costs of goods sold and increased commissions as a result of our increased calculated billings.

Cash flow from operating activities

Our increased cash flow from operating activities for the year ended December 31, 2017 was driven by increased collections as a result of our increased calculated billings, partially offset by higher cost of goods sold and higher sales and marketing expense.

Calculated billings

The increase in calculated billings for the year and three months ended December 31, 2017 was driven by strong adoption across our solutions globally.

Annualized recurring revenue

The increase in annualized recurring revenue for the year ended December 31, 2017 was driven by strong adoption across our solutions globally, as evidenced by our calculated billings growth, and the increased shift of our customers to a subscription pricing model.

Preliminary Guidance

Based on available information, we anticipate the following results for the year ending December 31, 2018 calculated in accordance with Accounting Standards Codification 605 and without giving effect to the impact of the adoption of Accounting Standards Codification 606:

| • | year-over-year annualized recurring revenue growth of at least 30% compared to the year ended December 31, 2017; |

| • | calculated billings slightly up relative to the year ended December 31, 2017 due to shorter anticipated contract lengths and the impact of the anticipated continued shift from perpetual to subscription licenses; going forward, we believe that calculated billings may be less useful as a measure of the growth of our business; |

| • | year-over-year revenue growth of approximately 20% compared to the year ended December 31, 2017 driven by the anticipated continued transition to subscription licenses with respect to our vulnerability management product line; |

| • | slightly improved non-GAAP loss from operations compared to the year ended December 31, 2017; and |

| • | cash flows from operating activities consistent with those for the year ended December 31, 2017. |

Non-GAAP guidance excludes estimates for stock-based compensation expense, amortization of acquired intangible assets and acquisition-related expenses. Rapid7 has provided a reconciliation of historical non-GAAP financial measures to the most comparable GAAP measures above. A reconciliation of non-GAAP guidance measures to the most comparable GAAP measures is not available on a forward-looking basis as a result of the uncertainty regarding, and the potential variability of, many of the costs and expenses that we may incur in the future.

The information included in Item 2.02 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

| Item 8.01 | Other Events |

Updated Business Description and Risk Factors

In connection with a proposed registered offing of common stock, the Company is providing an updated business decription and the new and/or revised risk factors set forth below.

All references below to “Rapid7,” the “Company,” “we,” “us,” “our” and similar references refer to Rapid7, Inc., except where the context otherwise requires or as otherwise indicated.

Description of Business

Business Overview

Organizations of all sizes are faced with a more sophisticated and motivated set of cyber attackers. Coupled with an increasingly complex IT environment and expanding attack surface, driven by mobility and a shift to the cloud, security and IT teams are struggling to maintain adequate levels of cyber security, provide visibility to their management teams, and meet increasing regulatory requirements. At the same time, they must navigate a shortage of capable cyber security professionals. Out of these challenges, the concept of Security Operations, or SecOps, is emerging. SecOps is a movement that recognizes that Security and IT Operations must work together to deliver better security and more nimbly adapt to emerging threats, without adding significant resources. SecOps requires solutions that provide visibility, analytics and automation that enable IT, Security and DevOps to work together to achieve significantly higher levels of productivity and success.

Rapid7 is a leading provider of security and IT analytics and automation solutions for SecOps, and is trusted by professionals around the world to provide visibility, analytics and automation to help manage risk, simplify IT complexity and drive innovation. Our solutions, which include vulnerability management, incident detection and response, security information and event management, or SIEM, application security testing, log analytics, and security orchestration and automation all focus on the critical needs of enterprises for greater visibility into their environments, analytics that provide context to complex data, and automation that enables SecOps teams to scale and more efficiently to address critical security and IT tasks.

We combine our extensive experience in collecting data from an ever-expanding IT environment, our deep insight into attacker behaviors and techniques, and our powerful and proprietary analytics to provide solutions that can quickly and efficiently identify and prioritize risks and active threats in an enterprise’s IT environment. Our broad data collection capabilities encompass endpoints, servers, applications, users, cloud-based assets, client devices, network activity, log data and information from third-party applications. We also provide workflows and automations that can enable and accelerate remediation of these risks and active threats. We have designed our solutions to be easy to deploy and use for security and IT teams of all sizes.

We offer analytic solutions across three core areas. Our Vulnerability Management offerings include our industry-leading vulnerability management, web application security testing and attack simulation products. These solutions provide enterprises with comprehensive, yet prioritized, visibility into potential cyber risks across their IT environment. We have also added remediation workflows to help ensure that these risks can be easily mitigated. Our Incident Detection and Response solutions are designed to enable organizations to rapidly detect and respond to cyber security incidents and breaches across physical, virtual and cloud assets, including those posed by the behaviors of their users. These solutions combine the collection of massive amounts of data with our core analytics and machine-learning-driven user behavioral analytics to simplify the task of identifying and responding to potential breaches. Our IT Analytics and Automation solutions are designed to allow operations teams to quickly gain visibility into their IT environment and facilitate automated workflows to eliminate repetitive, manual and labor-intensive tasks. Finally, to complement our SecOps products, we offer a range of services, including managed services based on our software solutions, incident response services, security advisory services, and deployment and training.

As of December 31, 2017, we had more than 7,000 customers, including 52% of the Fortune 100. We have experienced strong revenue growth, with revenue increasing from $46.0 million in 2012 to $157.4 million in 2016, representing a 36% compound annual growth rate. In the third quarter of 2017, 71% of our revenues were recurring revenues. We incurred net losses of $49.9 million, $49.0 million and $32.5 million in 2015, 2016 and the nine months ended September 30, 2017, respectively, as we continued to invest for long-term growth.

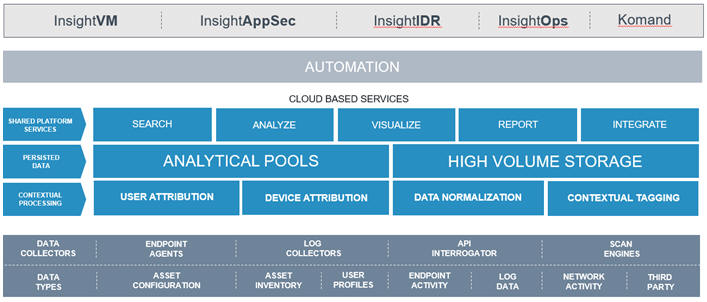

Our Analytics and Automation Cloud

The Rapid7 Insight Platform is at the core of our security and IT analytics product offerings. The platform was built in the cloud using our extensive experience in collecting and analyzing data to enable our customers to create and manage active, analytics-driven cyber security and IT operations management programs. Our robust data collection architecture supports gathering a wide swath of organizational and environmental data from endpoints to the cloud, including key data about user-specific behavior. By utilizing our powerful, proprietary analytics to assess and understand the context and relationships around users, IT assets and cyber threats within a customer’s environment, our solutions can provide our customers with specific, actionable insights critical for their SecOps approach. We designed the Rapid7 Insight Platform to allow customers to collect their data once and leverage that same data across multiple solutions, providing shared visibility across teams, improved and automated workflows, and reducing time to value for additional solutions. The design and development of our Insight Platform includes the following key features and benefits:

Holistic Dataset for Managing IT Operations and Cyber Security. Our Insight Platform collects information from across an organization’s environment into a unified dataset. Our platform also applies context to events, including user and asset level details. We overlay this against our comprehensive and continuously expanding set of known vulnerabilities, exploits and threat intelligence, providing SecOps professionals a holistic view of their IT environment.

Agentless and Agent-Based Architecture. We developed our platform with flexible processing technologies that employ both agentless data collection and our own internally-developed endpoint agent technology, which enables rapid and seamless integration of our products into our customers’ IT environments and provides IT professionals with instant visibility into their dynamic and rapidly-expanding IT ecosystem. This means it is much easier to deploy our Insight agent, potentially increasing the time to value for not just one of our products, but many of them.

Fast Search. Our search technology enables IT and security professionals to search across their entire IT environment including endpoints and, unlike other machine search solutions, provides live access without having to wait for lengthy indexing processes. These capabilities, along with real time and easily accessible search across raw logs and endpoints for known patterns with intuitive search queries, can enable IT security professionals to access their data for operational purposes.

User Behavior Analytics. Our Insight Platform creates a behavior profile for each user in a customer’s IT environment and correlates every event with a user, asset or application. User behavior profiles can then be automatically analyzed to identify suspicious user behavior and compromised user credentials. Our ability to provide rapid context around users and assets involved in an incident can significantly reduce investigation time, enabling organizations to more quickly respond to, contain and mitigate breaches.

Live Dashboards, Remediation Workflows and Automation. Our Insight Platform includes live dashboards which provide customers real-time, dynamic visibility into their risks, potential threats and progress to remediation all based on a shared reporting and visualization service. Remediation workflows enable customers to initiate, manage, prioritize and monitor the progress of vulnerability remediation. We also provide the ability to create automated workflows that can accelerate incident detection, response, and resolution.

Robust Platform and Customer Data Security. Our Insight Platform was designed to provide a secure environment for both our data and that of our customers. We deploy a variety of technologies and industry-leading practices such as physical and logical customer data segregation, network segmentation, audited and monitored access level controls, data anonymization, encryption and separated development-staging-production environments to help ensure that the data collected from a customer’s environment remains proprietary and secure. We have achieved Service Organization Control, or SOC, II Type 2 certification for the foundation of our platform and are continuing to expand the specific compliance regimes for which we are audited.

Enterprise-Grade Scalability. Our Insight Platform provides a high level of horizontal scalability. We leverage on-premise deployment models and Amazon Web Services, or AWS, to achieve a high degree of redundancy, fault tolerance and cost-effective operations. Our automated deployment technologies enable us to add new AWS instances or additional services rapidly. Our infrastructure architecture is designed to process large amounts of data and easily incorporate new data sources, including on premise, cloud and mobile. Our platform is designed to support customers with large numbers of users or with geographically dispersed environments, and we have scaled to meet the needs of customers with over 2.5 million active assets and 700,000 active users as of December 31, 2017.

Extensible Modern Platform. Our Insight Platform provides a rich set of application program interfaces, or APIs, and services that enable customers, partners and developers to import and export data and utilize our analytics capabilities. This allows us to easily integrate with other security tools in the customer’s environment and also enables customers to build bespoke applications and analysis on top of the data that we gather.

Our Market Opportunity

Our estimate, based on International Data Corporation, or IDC, data, is that the overall market for IT and security analytics and automation solutions was a $6.9 billion opportunity in 2017. Included in our estimates are all or a portion of the markets for Vulnerability Assessment, Policy and Compliance, Security Information and Event Management, Forensics and Incident Management, IT Operations Analytics-Public Cloud, IT Automation and Configuration Management Software and IT Operations Management Software. As our solutions expand to address more of the SecOps opportunity, we believe we may be able to address portions of the broader IT Operations Management Software market, as well as the IT Automation and Configuration Management Software market, which would expand our estimated overall market opportunity in 2017 to $22.2 billion, based on IDC data.

Risk Factors

Risks Related to Our Business and Industry

We are a rapidly growing company, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

We are a rapidly growing company. Our ability to forecast our future operating results is subject to a number of uncertainties, including our ability to plan for and model future growth. We have encountered and will continue to encounter risks and uncertainties frequently experienced by growing companies in rapidly evolving industries. If our assumptions regarding these uncertainties, which we use to plan our business, are incorrect or change in reaction to changes in our markets, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations, our business could suffer and the trading price of our common stock may decline.

If we are unable to sustain our revenue growth rate, we may not achieve or maintain profitability in the future.

From the year ended December 31, 2012 to the year ended December 31, 2016, our revenue grew from $46.0 million to $157.4 million, which represents a compounded annual growth rate of approximately 36%. Although we have experienced rapid growth historically and currently have high renewal rates, we expect that we may not continue to grow as rapidly in the future and our renewal rates may decline. Any success that we may experience in the future will depend, in large part, on our ability to, among other things:

| • | maintain and expand our customer base; |

| • | successfully manage the transition to a more subscription-based business model; |

| • | increase revenues from existing customers through increased or broader use of our products and services within their organizations; |

| • | improve the performance and capabilities of our products through research and development; |

| • | continue to develop our cloud-based solutions; |

| • | maintain the rate at which customers purchase our content subscriptions, maintenance and support and managed services; |

| • | continue to successfully expand our business domestically and internationally; and |

| • | successfully compete with other companies. |

If we are unable to maintain consistent revenue or revenue growth, our stock price could be volatile, and it may be difficult to achieve and maintain profitability. You should not rely on our revenue for any prior quarterly or annual periods as any indication of our future revenue or revenue growth.

We have not been profitable historically and may not achieve or maintain profitability in the future.

We have posted a net loss in each year since inception, including net losses of $49.0 million, $49.9 million, $32.6 million, $32.5 million and $39.2 million in the years ended December 31, 2016, 2015 and 2014 and the nine months ended September 30, 2017 and 2016, respectively. As of September 30, 2017, we had an accumulated deficit of $421.9 million. While we have experienced significant revenue growth in recent periods, we are not certain whether or when we will obtain a high enough volume of sales of our products and services to sustain or increase our growth or achieve or maintain profitability in the future. We also expect our costs to increase in future periods, which could negatively affect our future operating results if our revenue does not increase. In particular, we expect to continue to expend financial and other resources on:

| • | research and development related to our offerings, including investments in our research and development team; |

| • | sales and marketing, including a significant expansion of our sales organization, both domestically and internationally; |

| • | continued international expansion of our business; |

| • | expansion of our services organization; and |

| • | general and administrative expenses as we continue to implement and enhance our administrative, financial and operational systems, procedures and controls. |

These investments may not result in increased revenue or growth in our business. If we are unable to increase our revenue at a rate sufficient to offset the expected increase in our costs, our business, financial position and results of operations will be harmed, and we may not be able to achieve or maintain profitability over the long term. Additionally, we may encounter unforeseen operating expenses, difficulties, complications, delays and other unknown factors that may result in losses in future periods. If our revenue growth does not meet our expectations in future periods, our financial performance may be harmed, and we may not achieve or maintain profitability in the future.

If our products or services fail to detect vulnerabilities or incorrectly detect vulnerabilities, or if our products contain undetected errors or defects, our brand and reputation could be harmed, which could have an adverse effect on our business and results of operations.

If our products or services fail to detect vulnerabilities in our customers’ cyber security infrastructure, or if our products or services fail to identify and respond to new and increasingly complex methods of cyber attacks, our business and reputation may suffer. There is no guarantee that our products or services will detect all vulnerabilities, especially in light of the rapidly changing security landscape to which we must respond. Additionally, our products may falsely detect vulnerabilities or threats that do not actually exist. For example, our Metasploit offering relies on information provided by an active community of security researchers who contribute new exploits, attacks and vulnerabilities. If the information from these third parties is inaccurate, the potential for false indications of security vulnerabilities increases. These false positives, while typical in the industry, may impair the perceived reliability of our offerings and may therefore adversely impact market acceptance of our products and services and could result in negative publicity, loss of customers and sales and increased costs to remedy any problem.

Our products may also contain undetected errors or defects when first introduced or as new versions are released. We have experienced these errors or defects in the past in connection with new products and product upgrades and we expect that these errors or defects will be found from time to time in the future in new or enhanced products after commercial release. Defects may cause our products to be vulnerable to attacks, cause them to fail to detect vulnerabilities, or

temporarily interrupt customers’ networking traffic. Any errors, defects, disruptions in service or other performance problems with our products may damage our customers’ business and could hurt our reputation. If our products or services fail to detect vulnerabilities for any reason, we may incur significant costs, the attention of our key personnel could be diverted, our customers may delay or withhold payment to us or elect not to renew or other significant customer relations problems may arise. We may also be subject to liability claims for damages related to errors or defects in our products. A material liability claim or other occurrence that harms our reputation or decreases market acceptance of our products may harm our business and operating results.

An actual or perceived security breach or theft of the sensitive data of one of our customers, regardless of whether the breach is attributable to the failure of our products or services, could adversely affect the market’s perception of our offerings and subject us to legal claims.

The market for Security Operations is new and unproven and may not grow.

We believe our future success will depend in large part on the growth, if any, in the market for Security Operations, or SecOps. This market is nascent, and as such, it is difficult to predict important market trends, including the potential growth, if any. To date, the majority of enterprise spend on cyber security has been on threat protection products, such as network, endpoint and web security that are designed to stop threats from penetrating corporate networks. Organizations that use these security products may believe that their existing security solutions sufficiently protect access to their sensitive business data. Therefore, they may continue allocating their cyber security budgets to these products and may not adopt our products and services in addition to, or in lieu of, such traditional products. Further, sophisticated cyber attackers are skilled at adapting to new technologies and developing new methods of gaining access to organizations’ sensitive business data, and changes in the nature of advanced cyber threats could result in a shift in IT budgets away from products and services such as ours. In addition, while recent high visibility attacks on prominent enterprises and governments have increased market awareness of the problem of cyber attacks, if cyber attacks were to decline, or enterprises or governments perceived that the general level of cyber attacks have declined, our ability to attract new customers and expand our sale to existing customers could be materially and adversely affected. If products and services such as ours are not viewed by organizations as necessary, or if customers do not recognize the benefit of our offerings as a critical layer of an effective cyber security strategy, our revenue may not grow as quickly as expected, or may decline, and the trading price of our stock could suffer. It is therefore difficult to predict how large the market will be for our solutions.

In addition, it is difficult to predict customer adoption and renewal rates, customer demand for our products and services, the size and growth rate of the market for SecOps, the entry of competitive products or the success of existing competitive products. Any expansion in our market depends on a number of factors, including the cost, performance and perceived value associated with our offerings and those of our competitors. If these offerings do not achieve

widespread adoption or there is a reduction in demand for solutions in our market caused by a lack of customer acceptance, technological challenges, competing technologies and products, decreases in corporate spending, weakening economic conditions, or otherwise, it could result in reduced customer orders, early terminations, reduced renewal rates or decreased revenue, any of which would adversely affect our business operations and financial results. You should consider our business and prospects in light of the risks and difficulties we face in this new and unproven market.

If we are unable to successfully hire, train, manage and retain qualified personnel, especially those in sales and marketing and research and development, our business may suffer.

We continue to be substantially dependent on our sales force to obtain new customers and increase sales with existing customers. Our ability to successfully pursue our growth strategy will also depend on our ability to attract, motivate and retain our personnel, especially those in sales, marketing and research and development. We face intense competition for these employees from numerous technology, software and other companies, especially in certain geographic areas in which we operate, and we cannot ensure that we will be able to attract, motivate and/or retain sufficient qualified employees in the future. If we are unable to attract new employees and retain our current employees, we may not be able to adequately develop and maintain new products or services or market our existing products or services at the same levels as our competitors and we may, therefore, lose customers and market share. Our failure to attract and retain personnel, especially those in sales and marketing and research and development positions for which we have historically had a high turnover rate, could have an adverse effect on our ability to execute our business objectives and, as a result, our ability to compete could decrease, our operating results could suffer and our revenue could decrease. Even if we are able to identify and recruit a sufficient number of new hires, these new hires will require significant training before they achieve full productivity and they may not become productive as quickly as we would like or at all.

We believe that our corporate culture has been a critical component to our success. We have invested substantial time and resources in building our team. As we grow and mature as a public company, we may find it difficult to maintain our corporate culture. Any failure to preserve our culture could negatively affect our future success, including our ability to attract, motivate and retain personnel and effectively focus on and pursue our business strategy.

Our sales cycle may be unpredictable.

The timing of sales of our offerings is difficult to forecast because of the length and unpredictability of our sales cycle, particularly with large enterprises and with respect to certain of our products. We sell our products primarily to IT departments that are managing a growing set of user and compliance demands, which has increased the complexity of customer

requirements to be met and confirmed during the sales cycle and prolonged our sales cycle. Further, the length of time that potential customers devote to their testing and evaluation, contract negotiation and budgeting processes varies significantly, depending on the size of the organization and nature of the product or service under consideration. In addition, we might devote substantial time and effort to a particular unsuccessful sales effort, and as a result, we could lose other sales opportunities or incur expenses that are not offset by an increase in revenue, which could harm our business.

Organizations may be reluctant to purchase SecOps offerings that are cloud-based due to the actual or perceived vulnerability of cloud solutions.

Some organizations have been reluctant to use cloud solutions for cyber security, such as our InsightIDR, InsightVM, InsightAppSec, InsightOps and Logentries products, because they have concerns regarding the risks associated with the reliability or security of the technology delivery model associated with this solution. If we or other cloud service providers experience security incidents, breaches of customer data, disruptions in service delivery or other problems, the market for cloud solutions may be negatively impacted, which could harm our business.

Our quarterly operating results may vary from period to period, which could result in our failure to meet expectations with respect to operating results and cause the trading price of our stock to decline.

Our operating results, including the levels of our revenue, billings, cash flow, deferred revenue and gross margins, have historically varied from period to period, and we expect that they will continue to do so as a result of a number of factors, many of which are outside of our control, including:

| • | the level of demand for our products and services; |

| • | customer renewal rates and ability to attract new customers; |

| • | the extent to which customers purchase additional products, including content subscriptions and maintenance and support related to our Nexpose, Metasploit and AppSpider products, or services; |

| • | the ability to successfully grow our sales of InsightOps, InsightIDR, InsightVM and InsightAppSec; |

| • | the level of perceived threats to organizations’ cyber security; |

| • | network outages, security breaches, technical difficulties or interruptions with our products; |

| • | changes in the growth rate of the markets in which we compete; |

| • | variations in our billings and sales of our products and services due to seasonality and customer demand; |

| • | the announcement or adoption of new regulations and policy mandates or changes to existing regulations and policy mandates; |

| • | the timing and success of new product or service introductions by us or our competitors or any other changes in the competitive landscape of our industry, including consolidation among our competitors; |

| • | the introduction or adoption of new technologies that compete with our offerings; |

| • | the mix of our products and services sold during a period; |

| • | decisions by potential customers to purchase cyber security products or services from other vendors; |

| • | the amount and timing of operating costs and capital expenditures related to the operations and expansion of our business; |

| • | the timing of sales commissions relative to the recognition of revenue and the timing of revenue recognition generally; |

| • | price competition; |

| • | our ability to successfully manage and integrate any future acquisitions of businesses, including without limitation the amount and timing of expenses and potential future charges for impairment of goodwill from acquired companies; |

| • | our ability to increase, retain and incentivize the channel partners that market and sell our products and services; |

| • | our continued international expansion and associated exposure to changes in foreign currency exchange rates, including any fluctuations caused by uncertainties relating to Brexit; |

| • | the amount and timing of operating expenses related to the maintenance and expansion of our business, operations and infrastructure; |

| • | unforeseen litigation and intellectual property infringement; |

| • | the announcement or adoption of new regulations and policy mandates or changes to existing regulations and policy mandates; |

| • | the strength of regional, national and global economies; |

| • | the impact of natural disasters or manmade problems such as terrorism or war; and |

| • | future accounting pronouncements or changes in our accounting policies. |

Each factor above or discussed elsewhere herein or the cumulative effect of some of these factors may result in fluctuations in our operating results. This variability and unpredictability could result in our failure to meet expectations with respect to operating results, or those of securities analysts or investors, for a particular period. If we fail to meet or exceed expectations for our operating results for these or any other reasons, the market price of our stock could fall and we could face costly lawsuits, including securities class action suits.

If we do not continue to innovate and offer products and services that address the dynamic threat landscape, we may not remain competitive, and our revenue and operating results could suffer.

The SecOps market is characterized by rapid technological advances, changes in customer requirements, frequent new product introductions and enhancements and evolving industry standards. Our success also depends, in part, upon our ability to anticipate industry evolution and introduce or acquire new products and services to keep pace with technological developments and market requirements both within our industry and in related industries. While we continue to invest significant resources in research and development in order to ensure that our products continue to address the cyber security risks that our customers face, the introduction of products and services embodying new technologies could render our existing products or services obsolete or less attractive to customers. In addition, developing new products and product enhancements is expensive and time consuming, and there is no assurance that such activities will result in significant cost savings, revenue or other expected benefits. If we spend significant time and effort on research and development and are unable to generate an adequate return on our investment, our business and results of operations may be materially and adversely affected. Further, we may not be able to successfully anticipate or adapt to changing technology or customer requirements or the dynamic threat landscape on a timely basis, in a way that sufficiently differentiates us from competing solutions such that customers choose to purchase our solutions. If any of our competitors implement new technologies before we are able to implement them or better anticipate the innovation opportunities in related industries, those competitors may be able to provide more effective or more cost-effective solutions than ours. In addition, we may experience technical problems and additional costs as we introduce new products and product enhancements, deploy future iterations of our products and integrate new products with existing customer systems. If any of these problems were to arise, our business, financial condition and results of operations could be adversely affected.

To date, we have derived a substantial majority of our revenue from customers using our vulnerability management offerings. If we are unable to renew or increase sales of our vulnerability management offerings, or if we are unable to increase sales of our other offerings, our business and operating results could be adversely affected.

Although we continue to introduce and acquire new products and services, we derive and expect to continue to derive a substantial majority of our revenue from customers using certain of our vulnerability management offerings, Nexpose and Metasploit. Greater than half of our revenue was attributable to Nexpose in each of our last three fiscal years. As a result, our operating results could suffer due to:

| • | any decline in demand for our vulnerability management offerings; |

| • | failure of our vulnerability management offerings to detect vulnerabilities in our customers’ IT environments; |

| • | the introduction of products and technologies that serve as a replacement or substitute for, or represent an improvement over, our vulnerability management offerings; |

| • | technological innovations or new standards that our vulnerability management offerings do not address; |

| • | sensitivity to current or future prices offered by us or competing solutions; and |

| • | our inability to release enhanced versions of our vulnerability management offerings on a timely basis in response to the dynamic threat landscape. |

Our inability to renew or increase sales of our vulnerability management offerings, including content subscriptions, maintenance and support and managed services, or a decline in prices of our vulnerability management offerings would harm our business and operating results more seriously than if we derived significant revenues from a variety of offerings. In addition, we have introduced several cloud-based subscription products, including InsightOps, InsightIDR, InsightVM and InsightAppSec products. These products are relatively new, and it is uncertain whether they will gain market acceptance. We are also investing in the expansion of our security advisory services offerings, which we believe will help drive demand for our other products in addition to being a stand-alone service. Any factor adversely affecting sales of our products or services, including release cycles, market acceptance, competition, performance and reliability, reputation and economic and market conditions, could adversely affect our business and operating results.

Our business and growth depend substantially on customers renewing their content subscriptions and maintenance and support agreements with us. Any decline in our customer renewals could adversely affect our future operating results.

Our maintenance and support agreements are sold on a term basis. In addition, we also enter into content subscription agreements for our offerings. In order for us to improve our operating results, it is important that our existing customers renew their content subscription agreements, if applicable, and maintenance and support agreements when the initial contract term expires. Our customers have no obligation to renew their content subscription or maintenance and support agreements with us after the initial terms have expired. Our customers’ renewal rates may

decline or fluctuate as a result of a number of factors, including their satisfaction or dissatisfaction with our new or current product offerings, our pricing, the effects of economic conditions, competitive offerings or alterations or reductions in our customers’ spending levels. If our customers do not renew their agreements with us or renew on terms less favorable to us, our revenues and results of operations may be adversely impacted.

If we fail to successfully manage the transition to a more subscription-based business model, our results of operations could be negatively impacted.

We offer our solutions through a combination of perpetual and term software licenses, cloud-based subscriptions and managed services offerings. Historically, a substantial majority of our customers have purchased our vulnerability management offerings through a perpetual license. We are currently transitioning to a more subscription-based business model. The subscription pricing model allows customers to use our solutions at a lower initial cost of software acquisition when compared to the more traditional perpetual license sale. It is uncertain whether this transition will prove successful or whether we will be able to successfully transition our sales approach to drive subscription revenue. This transition may have negative revenue implications and our business could be harmed.

This subscription strategy may give rise to a number of risks, including the following:

| • | our revenue growth may decline more than anticipated over the short-term; |

| • | if new or current customers desire only perpetual licenses, our subscription sales may lag behind our expectations or those of market or industry analysts; |

| • | the shift to a more subscription-based strategy may raise concerns among our customer base, including concerns regarding changes to pricing over time and access to files once a subscription has expired; |

| • | we may be unsuccessful in maintaining our target pricing, product adoption and projected renewal rates, or we may select a target price that is not optimal and could negatively affect our sales or earnings; |

| • | our shift to a more subscription-based model may result in confusion among new or existing customers (which could slow adoption rates), partners and investors; |

| • | our shift to a more subscription-based model may result in lower-than-expected sales performance; |

| • | if our customers do not renew their subscriptions, our revenue may decline over the long-term and our business may suffer; |

| • | our relationships with existing channel partners that resell perpetual licenses may be damaged; and |

| • | we may incur sales compensation costs at a higher than forecasted rate if the pace of our subscription transition is faster than anticipated. |

If Metasploit were to be used by attackers to exploit vulnerabilities in the cyber security infrastructures of third parties, our reputation and business could be harmed.

Although Metasploit is a penetration testing tool that is intended to allow organizations to test the effectiveness of their cyber security programs, Metasploit has in the past and may in the future be used to exploit vulnerabilities in the cyber security infrastructures of third parties. While we have incorporated certain features into Metasploit to deter misuse, there is no guarantee that these controls will not be circumvented or that Metasploit will only be used defensively or for research purposes. Any actual or perceived security breach, malicious intrusion or theft of sensitive data in which Metasploit is believed to have been used could adversely affect perception of, and demand for, our offerings. Further, the identification of new exploits and vulnerabilities by the Metasploit community may enhance the knowledge base of cyber attackers or enable them to undertake new forms of attacks. If any of the foregoing were to occur, we could suffer negative publicity and loss of customers and sales, as well as possible legal claims.

We face intense competition in our market.

The market for SecOps solutions is highly fragmented, intensely competitive and constantly evolving. We compete with an array of established and emerging security software and services vendors. With the introduction of new technologies and market entrants, we expect the competitive environment to remain intense going forward. Our competitors include: vulnerability management and assessment vendors, including Qualys and Tenable Network Security; diversified security software and services vendors, including IBM and HPE; legacy compliance and monitoring solutions such as SIEM, provided by vendors including LogRhythm, Alienvault and Sumo Logic; machine data analysis tools such as those provided by Splunk; security services specialists, including Mandiant (a subsidiary of FireEye); and providers of point solutions that compete with some of the features present in our solutions.

Some of our actual and potential competitors have advantages over us, such as longer operating histories, significantly greater financial, technical, marketing or other resources, stronger brand and business user recognition, larger and more mature intellectual property portfolios and broader global distribution and presence. In addition, our industry is evolving rapidly and is

becoming increasingly competitive. Larger and more established companies may focus on security operations and could directly compete with us. Smaller companies could also launch new products and services that we do not offer and that could gain market acceptance quickly.

Our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. With the introduction of new technologies, the evolution of our offerings and new market entrants, we expect competition to intensify in the future. In addition, some of our larger competitors have substantially broader product offerings and can bundle competing products and services with other software offerings. As a result, customers may choose a bundled product offering from our competitors, even if individual products have more limited functionality than our solutions. These competitors may also offer their products at a lower price as part of this larger sale, which could increase pricing pressure on our offerings and cause the average sales price for our offerings to decline. These larger competitors are also often in a better position to withstand any significant reduction in capital spending, and will therefore not be as susceptible to economic downturns.

Furthermore, our current and potential competitors may establish cooperative relationships among themselves or with third parties that may further enhance their resources and product and services offerings in the markets we address. In addition, current or potential competitors may be acquired by third parties with greater available resources. As a result of such relationships and acquisitions, our current or potential competitors might be able to adapt more quickly to new technologies and customer needs, devote greater resources to the promotion or sale of their products and services, initiate or withstand substantial price competition, take advantage of other opportunities more readily or develop and expand their product and service offerings more quickly than we do. For all of these reasons, we may not be able to compete successfully against our current or future competitors, or we may be required to expend significant resources in order to remain competitive. If our competitors are more successful than we are in developing new product and service offerings or in attracting and retaining customers, our business, financial condition and results of operations could be adversely affected.

A component of our growth strategy is dependent on our continued international expansion, which adds complexity to our operations.

We market and sell our products and services throughout the world and have personnel in many parts of the world. For the nine months ended September 30, 2017 and 2016, operations located outside of North America generated 15% and 13% of our revenue, respectively. Our growth strategy is dependent, in part, on our continued international expansion. We expect to conduct a significant amount of our business with organizations that are located outside the United States, particularly in Europe and Asia. We cannot assure you that our expansion efforts into international markets will be successful in creating further demand for our products and services or in effectively selling our products and services in the international markets that we enter. Our current international operations and future initiatives will involve a variety of risks, including:

| • | increased management, infrastructure and legal costs associated with having international operations; |

| • | reliance on channel partners; |

| • | trade and foreign exchange restrictions; |

| • | economic or political instability or uncertainty in foreign markets and around the world, such as related to the United Kingdom’s referendum in June 2016 in which voters approved an exit from the European Union, commonly referred to as “Brexit”; |

| • | foreign currency exchange rate fluctuations; |

| • | greater difficulty in enforcing contracts, accounts receivable collection and longer collection periods; |

| • | changes in regulatory requirements, including, but not limited to data privacy, data protection and data security regulations; |

| • | difficulties and costs of staffing and managing foreign operations; |

| • | the uncertainty and limitation of protection for intellectual property rights in some countries; |

| • | costs of compliance with foreign laws and regulations and the risks and costs of non-compliance with such laws and regulations; |

| • | costs of compliance with U.S. laws and regulations for foreign operations, including the U.S. Foreign Corrupt Practices Act, import and export control laws, tariffs, trade barriers, economic sanctions and other regulatory or contractual limitations on our ability to sell or provide our solutions in certain foreign markets, and the risks and costs of non-compliance; |

| • | heightened risks of unfair or corrupt business practices in certain geographies and of improper or fraudulent sales arrangements that may impact financial results and result in restatements of, and irregularities in, financial statements; |

| • | the potential for political unrest, acts of terrorism, hostilities or war; |

| • | management communication and integration problems resulting from cultural differences and geographic dispersion; |

| • | costs associated with language localization of our products; and |

| • | costs of compliance with multiple and possibly overlapping tax structures. |

Our business, including the sales of our products and services by us and our channel partners, may be subject to foreign governmental regulations, which vary substantially from country to country and change from time to time. Our failure, or the failure by our channel partners, to comply with these regulations could adversely affect our business. Further, in many foreign countries it is common for others to engage in business practices that are prohibited by our internal policies and procedures or U.S. regulations applicable to us. Although we have implemented policies and procedures designed to comply with these laws and policies, there can be no assurance that our employees, contractors, channel partners and agents have complied, or will comply, with these laws and policies. Violations of laws or key control policies by our employees, contractors, channel partners or agents could result in delays in revenue recognition, financial reporting misstatements, fines, penalties or the prohibition of the importation or exportation of our products and could have a material adverse effect on our business and results of operations. If we are unable to successfully manage the challenges of international expansion and operations, our business and operating results could be adversely affected.

We are also monitoring developments related to Brexit, which could have significant implications for our business. Brexit could lead to economic and legal uncertainty, including significant volatility in global stock markets and currency exchange rates, and differing laws and regulations as the United Kingdom determines which European Union laws to replace or replicate. Any of these effects of Brexit, among others, could adversely affect our operations in the United Kingdom and our financial results.

As a cyber security provider, we are a target of cyber attacks that could adversely impact our reputation and operating results.

We sell cyber security and data analytics products. As a result, we have been and will be a target of cyber attacks designed to impede the performance of our products, penetrate our network security or the security of our cloud platform or our internal systems, or that of our customers, misappropriate proprietary information and/or cause interruptions to our services. For example, because Metasploit serves as an introduction to hacking for many individuals, a successful cyber attack on us may be perceived as a victory for the cyber attacker, thereby increasing the likelihood that we may be a target of cyber attacks, even absent financial motives. Further, if our systems are breached, attackers could learn critical information about how our products operate to help protect our customers’ IT infrastructures from cyber risk, thereby making our customers more vulnerable to cyber attacks. In addition, if actual or perceived breaches of our network security occur, they could adversely affect the market perception of our products, negatively affecting our reputation, and may expose us to the loss of our proprietary information or information belonging to our customers, investigations or litigation and possible liability, including injunctive relief and monetary damages. Such security breaches could also divert the efforts of our technical and management personnel. In addition, such security breaches could impair our ability to operate our business and provide products to our customers. If this happens, our reputation could be harmed, our revenue could decline and our business could suffer.

We are dependent on the continued services and performance of our senior management and other key employees, the loss of any of whom could adversely affect our business, operating results and financial condition.

Our future performance depends on the continued services and contributions of our senior management, particularly Corey Thomas, our President and Chief Executive Officer, and other key employees to execute on our business plan and to identify and pursue new opportunities and product innovations. From time to time, there may be changes in our senior management team resulting from the termination or departure of our executive officers and key employees. Our senior management and key employees are generally employed on an at-will basis, which means that they could terminate their employment with us at any time. The loss of the services of our senior management, particularly Mr. Thomas, or other key employees for any reason could significantly delay or prevent our development or the achievement of our strategic objectives and harm our business, financial condition and results of operations.

Our business and operations are experiencing rapid growth, and if we do not appropriately manage our future growth, or are unable to scale our systems and processes, our operating results may be negatively affected.

We are a rapidly growing company. To manage future growth effectively we will need to continue to improve and expand our internal information technology systems, financial infrastructure, and operating and administrative systems and controls, which we may not be able to do efficiently, in a timely manner or at all. Any future growth would add complexity to our organization and require effective coordination across our organization. Failure to manage any future growth effectively could result in increased costs, harm our results of operations and lead to customers or investors losing confidence in our internal systems and processes, which could harm our results of operations and stock price.

We recognize substantially all of our revenue ratably over the term of our agreements with customers and, as a result, downturns or upturns in sales may not be immediately reflected in our operating results.

We recognize substantially all of our revenue ratably over the terms of our agreements with customers, which generally occurs over a one to three-year period. As a result, a substantial portion of the revenue that we report in each period will be derived from the recognition of deferred revenue relating to agreements entered into during previous periods. Consequently, a decline in new sales or renewals in any one period may not be immediately reflected in our revenue results for that period. This decline, however, will negatively affect our revenue in future periods. Accordingly, the effect of significant downturns in sales and market acceptance of our products and potential changes in our rate of renewals may not be fully reflected in our results of operations until future periods. Our model also makes it difficult for us to rapidly increase our revenue through additional sales in any period, as revenue from new customers generally will be recognized over the term of the applicable agreement.

We also intend to increase our investment in research and development, sales and marketing, and general and administrative functions and other areas to grow our business. We are likely to recognize the costs associated with these increased investments earlier than some of the anticipated benefits and the return on these investments may be lower, or may develop more slowly, than we expect, which could adversely affect our operating results.

We may be unable to rapidly and efficiently adjust our cost structure in response to significant revenue declines, which could adversely affect our operating results.

Our brand, reputation and ability to attract, retain and serve our customers are dependent in part upon the reliable performance of our products and network infrastructure.

Our brand, reputation and ability to attract, retain and serve our customers are dependent in part upon the reliable performance of our products and network infrastructure. We have experienced, and may in the future experience, disruptions, outages and other performance problems due to a variety of factors, including infrastructure changes, human or software errors, capacity constraints and fraud or security attacks. In some instances, we may not be able to identify the cause or causes of these performance problems within an acceptable period of time.

We utilize third-party data centers located in Boston, Massachusetts, in addition to operating and maintaining certain elements of our own network infrastructure. We also utilize Amazon Web Services for our Insight platform infrastructure. Some elements of this complex system are operated by third parties that we do not control and that could require significant time to replace. We expect this dependence on third parties to continue. More specifically, certain of our products, in particular our Managed Vulnerability Management (Nexpose), InsightIDR, InsightVM, InsightAppSec, InsightOps and Logentries products, are hosted on Amazon Web Services, which provides us with computing and storage capacity. Interruptions in our systems or the third-party systems on which we rely, whether due to system failures, computer viruses, physical or electronic break-ins, or other factors, could affect the security or availability of our products, network infrastructure and website.

Prolonged delays or unforeseen difficulties in connection with adding capacity or upgrading our network architecture when required may cause our service quality to suffer. Problems with the reliability or security of our systems could harm our reputation. Damage to our reputation and the cost of remedying these problems could negatively affect our business, financial condition, and operating results.

Additionally, our existing data center facilities and third-party hosting providers have no obligations to renew their agreements with us on commercially reasonable terms or at all, and certain of the agreements governing these relationships may be terminated by either party at any time. If we are unable to maintain or renew our agreements with these providers on commercially reasonable terms or if in the future we add additional data center facilities or third-party hosting providers, we may experience costs or downtime as we transition our operations.

Any disruptions or other performance problems with our products could harm our reputation and business and may damage our customers’ businesses. Interruptions in our service delivery might reduce our revenue, cause us to issue credits to customers, subject us to potential liability and cause customers to not renew their purchases or our products.

If we fail to manage our operations infrastructure, our customers may experience service outages and/or delays.

Our future growth is dependent upon our ability to continue to meet the expanding needs of our customers and to attract new customers. As existing customers gain more experience with our products, they may broaden their reliance on our products, which will require that we expand our operations infrastructure. We also seek to maintain excess capacity in our operations infrastructure to facilitate the rapid provision of new customer deployments. In addition, we need to properly manage our technological operations infrastructure in order to support changes in hardware and software parameters and the evolution of our products, all of which require significant lead time. If we do not accurately predict our infrastructure requirements, our existing customers may experience service outages that may subject us to financial penalties, financial liabilities and customer losses. If our operations infrastructure fails to keep pace with increased sales, customers may experience delays as we seek to obtain additional capacity, which could adversely affect our reputation and our revenue.

If our products fail to help our customers achieve and maintain compliance with regulations and/or industry standards, our revenue and operating results could be harmed.

We generate a portion of our revenue from our vulnerability management offerings that help organizations achieve and maintain compliance with regulations and industry standards both domestically and internationally. For example, many of our customers subscribe to our vulnerability management offerings to help them comply with the security standards developed and maintained by the Payment Card Industry Security Standards Council, or the PCI Council, which apply to companies that process, transmit or store cardholder data. In addition, our vulnerability management offerings are used by customers in the health care industry to help them comply with numerous federal and state laws and regulations related to patient privacy. In particular, the Health Insurance Portability and Accountability Act of 1996, or HIPAA, and the 2009 Health Information Technology for Economic and Clinical Health Act include privacy standards that protect individual privacy by limiting the uses and disclosures of individually identifiable health information and implementing data security standards. The foregoing and other state, federal and international legal and regulatory regimes may affect our customers’

requirements for, and demand for, our products and services. Governments and industry organizations, such as the PCI Council, may also adopt new laws, regulations or requirements, or make changes to existing laws or regulations, that could impact the demand for, or value of, our products. If we are unable to adapt our products to changing legal and regulatory standards or other requirements in a timely manner, or if our products fail to assist with, or expedite, our customers’ cyber security defense and compliance efforts, our customers may lose confidence in our products and could switch to products offered by our competitors, or threaten or bring legal actions against us. In addition, if laws, regulations or standards related to data security, vulnerability management and other IT security and compliance requirements are relaxed or the penalties for non-compliance are changed in a manner that makes them less onerous, our customers may view government and industry regulatory compliance as less critical to their businesses, and our customers may be less willing to purchase our products. In any of these cases, our revenue and operating results could be harmed.

In addition, government and other customers may require our products to comply with certain privacy, security or other certifications and standards. If our products are late in achieving or fail to achieve or maintain compliance with these certifications and standards, or our competitors achieve compliance with these certifications and standards, we may be disqualified from selling our products to such customers, or may otherwise be at a competitive disadvantage, either of which would harm our business, results of operations, and financial condition.

If our customers are unable to implement our products successfully, customer perceptions of our offerings may be impaired or our reputation and brand may suffer.

Our products are deployed in a wide variety of IT environments, including large-scale, complex infrastructures. Some of our customers have experienced difficulties implementing our products in the past and may experience implementation difficulties in the future. If our customers are unable to implement our products successfully, customer perceptions of our offerings may be impaired or our reputation and brand may suffer.

In addition, in order for our products to achieve their functional potential, our products must effectively integrate into our customers’ IT infrastructures, which have different specifications, utilize varied protocol standards, deploy products from multiple different vendors and contain multiple layers of products that have been added over time. Our customers’ IT infrastructures are also dynamic, with a myriad of devices and endpoints entering and exiting the customers’ IT systems on a regular basis, and our products must be able to effectively adapt to and track these changes.

Any failure by our customers to appropriately implement our products or any failure of our products to effectively integrate and operate within our customers’ IT infrastructures could result in customer dissatisfaction, impact the perceived reliability of our products, result in negative press coverage, negatively affect our reputation and harm our financial results.

Future acquisitions could disrupt our business and harm our financial condition and operating results.

In order to remain competitive, we have in the past and may in the future seek to acquire additional businesses, products or technologies. The environment for acquisitions in our industry is very competitive and acquisition candidate purchase prices will likely exceed what we would prefer to pay. We also may not find suitable acquisition candidates, and acquisitions we complete may be unsuccessful.