Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CAMBER ENERGY, INC. | cei-8k_011018.htm |

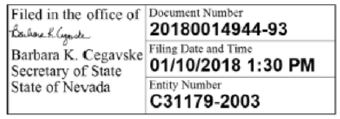

Exhibit 3.1

| |

| *090204* |

|

BARBARA

K. CEGAVSKE Secretary of State 202 North Carson Street Carson City, Nevada 89701-4201 (775) 684-5708 Website: www.nvsos.gov |

|

| Certificate of Amendment | |

| (PURSUANT TO NRS 78.385 AND 78.390) | |

| USE BLACK INK ONLY - DO NOT HIGHLIGHT | ABOVE SPACE IS FOR OFFICE USE ONLY |

Certificate

of Amendment to Articles of Incorporation

For Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock)

| 1. Name of corporation: |

| Camber Energy, Inc. [C31179-2003] |

| 2. The articles have been amended as follows: (provide article numbers, if available) |

| Article Four Capital Stock is deleted and replaced in its entirety with Article Four set forth on the attachment hereto (which shall have no effect on any previously designated series of preferred stock) |

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is: 53

| 4. Effective date and time of filing: (optional) | Date: | Time: | |||

| (must not be later than 90 days after the certificate is filed) | |||||

5. Signature: (required)

*lf any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected.

| This form must be accompanied by appropriate fees. | Nevada Secretary of

State Amend Profit-After Revised: 1-5-15 |

ARTICLE FOUR. CAPITAL STOCK

| A. | General Authorization. |

The Corporation has the authority to issue Five Hundred Ten Million (510,000,000) shares of stock consisting of:

| (1) | Common Stock. Five Hundred Million (500,000,000) shares of common stock, having a par value of $0.001 per share (the “Common Stock”); and | |

| (2) | Preferred Stock. Ten Million (10,000,000) shares of Preferred Stock having a par value of $0.001 per share (the “Preferred Stock”). |

All capital stock when issued shall be fully paid and nonassessable. No holder of shares of stock of this Corporation is entitled as such to any pre-emptive or preferential rights to subscribe to any unissued stock or any other securities which the Corporation may now or hereafter issue.

| B. | Common Stock. |

| (1) | Number of Shares. The Common Stock shall consist of Five Hundred Million (500,000,000) shares. | |

| (2) | Voting. Except as provided in these Articles of Incorporation or by applicable law, each holder of Common Stock is entitled to one vote for each share of Common Stock held of record on all matters as to which Common Stockholders are entitled to vote, which voting rights shall not be cumulative in any election of Directors. | |

| (3) | Other Rights. Each share of Common Stock issued and outstanding shall be identical in all respects with each other such share, and no dividends shall be paid on any shares of Common Stock unless the same dividend is paid on all shares of Common Stock outstanding at the time of such payment. Except for and subject to those rights expressly granted to the holders of Preferred Stock and except as may be provided by the laws of the State of Nevada, the Common Stockholders shall have all other rights of stockholders. |

| C. | Preferred Stock. |

Subject to the terms contained in any designation of a series of Preferred Stock, the Board of Directors is expressly authorized, at any time and from time to time, to fix, by resolution or resolutions, the following provisions for shares of any class or classes of Preferred Stock of the Corporation:

| (1) | The designation of such class or series, the number of shares to constitute such class or series which may be increased (but not below the number of shares of that class or series then outstanding) by a resolution of the Board of Directors; | |

| (2) | Whether the shares of such class or series shall have voting rights, in addition to any voting rights provided by law, and if so, the terms of such voting rights; | |

| (3) | The dividends, if any, payable on such class or series, whether any such dividends shall be cumulative, and, if so, from what dates, the conditions and dates upon which such dividends shall be payable, and the preference or relation which such dividends shall bear to the dividends payable on any share of stock of any other class or any other shares of the same class; | |

| (4) | Whether the shares of such class or series shall be subject to redemption by the Corporation, and, if so, the times, prices and other conditions of such redemption or a formula to determine the times, prices and such other conditions; | |

| (5) | The amount or amounts payable upon shares of such series upon, and the rights of the holders of such class or series in, the voluntary or involuntary liquidation, dissolution or winding up, or upon any distribution of the assets, of the Corporation; | |

| (6) | Whether the shares of such class or series shall be subject to the operation of a retirement or sinking fund, and, if so, the extent to and manner in which any such retirement or sinking fund shall be applied to the purchase or redemption of the shares of such class or series for retirement or other corporate purposes and the terms and provisions relative to the operation thereof; |

| (7) | Whether the shares of such class or series shall be convertible into, or exchangeable for, shares of stock of any other class or any other series of the same class or any other securities and, if so, the price or prices or the rate or rates of conversion or exchange and the method, if any, of adjusting the same, and any other terms and conditions of conversion or exchanges; | |

| (8) | The limitations and restrictions, if any, to be effective while any shares of such class or series are outstanding upon the payment of dividends or the making of other distributions on, and upon the purchase, redemption or other acquisition by the Corporation of the Common Stock or shares of stock of any other class or any other series of the same class; | |

| (9) | The conditions or restrictions, if any, upon the creation of indebtedness of the Corporation or upon the issuance of any additional stock, including additional shares of such class or series or of any other series of the same class or of any other class; | |

| (10) | The ranking (be it pari passu, junior or senior) of each class or series vis-à-vis any other class or series of any class of Preferred Stock as to the payment of dividends, the distribution of assets and all other matters; | |

| (11) | Facts or events to be ascertained outside the articles of incorporation of the Corporation, or the resolution establishing the class or series of stock, upon which any rate, condition or time for payment of distributions on any class or series of stock is dependent and the manner by which the fact or event operates upon the rate, condition or time of payment; | |

| (12) | Any other powers, preferences and relative, participating, optional and other special rights, and any qualifications, limitations and restrictions thereof, insofar as they are not inconsistent with the provisions of the Articles of Incorporation of this Corporation, to the full extent permitted by the laws of the State of Nevada. |

The powers, preferences and relative, participating, optional and other special rights of each class or series of Preferred Stock, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series at any time outstanding.