Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Teligent, Inc. | form8k.htm |

JP Morgan Healthcare Conference

January 10, 2018

Jason Grenfell-Gardner │CEO

Nasdaq Global Select: TLGT

Safe Harbor

1

Except for historical facts, the statements in this presentation, as well as oral statements

or other written statements made or to be made by Teligent, Inc., are forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995 and

involve risks and uncertainties. For example, without limitation, statements about the

Company’s anticipated growth and future operations, the current or expected market size

for its products, the success of current or future product offerings and the research and

development efforts and the Company’s ability to file for and obtain U.S. Food and Drug

Administration (FDA) approvals for future products, are forward-looking statements.

Forward-looking statements are merely the Company’s current predictions of future

events. The statements are inherently uncertain, and actual results could differ materially

from the statements made herein. There is no assurance that the Company will achieve

the sales levels that will make its operations profitable or that FDA filings and approvals

will be completed and obtained as anticipated. For a description of additional risks and

uncertainties, please refer to the Company’s filings with the Securities and Exchange

Commission, including its latest Annual Report on Form 10–K and its latest Quarterly

Report on Form 10-Q. The Company assumes no obligation to update its forward-looking

statements to reflect new information and developments.

Key Investment Highlights

Teligent is a “market disruptor” in alternative dosage form generics

Focused on Topical, Injectable, Complex and Ophthalmic (TICO) markets

Led by a proven and dynamic management team

Significant investment in R&D has resulted in a high-value pipeline

State of the art topical and injectable manufacturing infrastructure

Strong historical sales growth

Solid foundation to support sustainable, profitable growth

1

2

3

4

5

6

7

2

Teligent at-a-glance

3

Teligent is a high-growth generics company that develops and markets a diversified

product portfolio focused on alternative dosage forms

Diversified Product

Portfolio

• 58 products sold

throughout North

America

− 28 injectables and

topicals in US

− 30 injectables in

Canada

Deep Development

Pipeline

• 32 ANDAs pending at

FDA representing

~$2B IMS opportunity

• >40 products in active

development

State of the Art

Manufacturing

• ~$55M invested in

facility expansion

and upgrade

−High-speed topical

filling

−New sterile

injectable capability

Skilled and Dedicated

Employees

• 200+ employees

worldwide

• Presence in New

Jersey, Toronto, and

Estonia

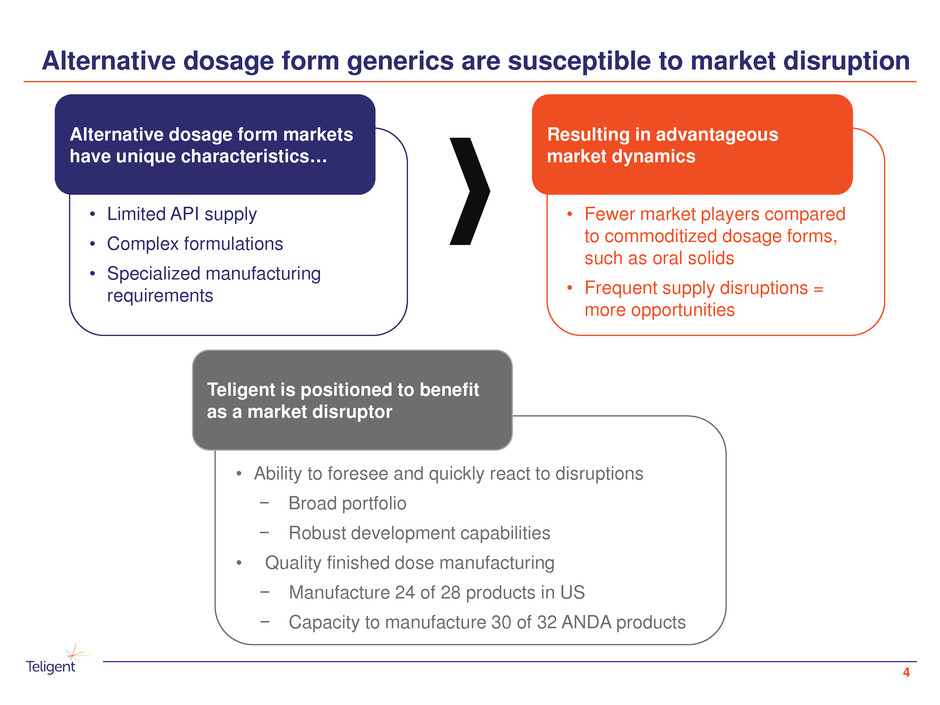

• Limited API supply

• Complex formulations

• Specialized manufacturing

requirements

• Fewer market players compared

to commoditized dosage forms,

such as oral solids

• Frequent supply disruptions =

more opportunities

• Ability to foresee and quickly react to disruptions

− Broad portfolio

− Robust development capabilities

• Quality finished dose manufacturing

− Manufacture 24 of 28 products in US

− Capacity to manufacture 30 of 32 ANDA products

Alternative dosage form generics are susceptible to market disruption

4

Alternative dosage form markets

have unique characteristics…

Resulting in advantageous

market dynamics

Teligent is positioned to benefit

as a market disruptor

Teligent is focused on Topical, Injectable, Complex and Ophthalmic

(TICO) markets

5

Dosage Form Description Current Teligent Strength

Topical • Core strength

• Established development and manufacturing capabilities

• 24 commercial products; 30 filed ANDAs

Injectable • Investing in manufacturing – first commercial product out of

new facility in 2019

• Expanded development capabilities

• 34 products commercialized in the US and Canada

Complex • Leverages existing development and commercial know-

how

• First product, representing >$200M IMS market

opportunity, filed in 2017

Ophthalmic • Leverages sterile injectable expertise and retail commercial

channel presence

• First ophthalmic filed in 2017, and three additional products

under active development with CMO

Led by a proven and dynamic executive leadership team

6

Jason Grenfell-Gardner

President & Chief Executive Officer

Jenniffer Collins

Chief Financial Officer

Steve Richardson

Chief Scientific Officer

Martin Wilson

General Counsel

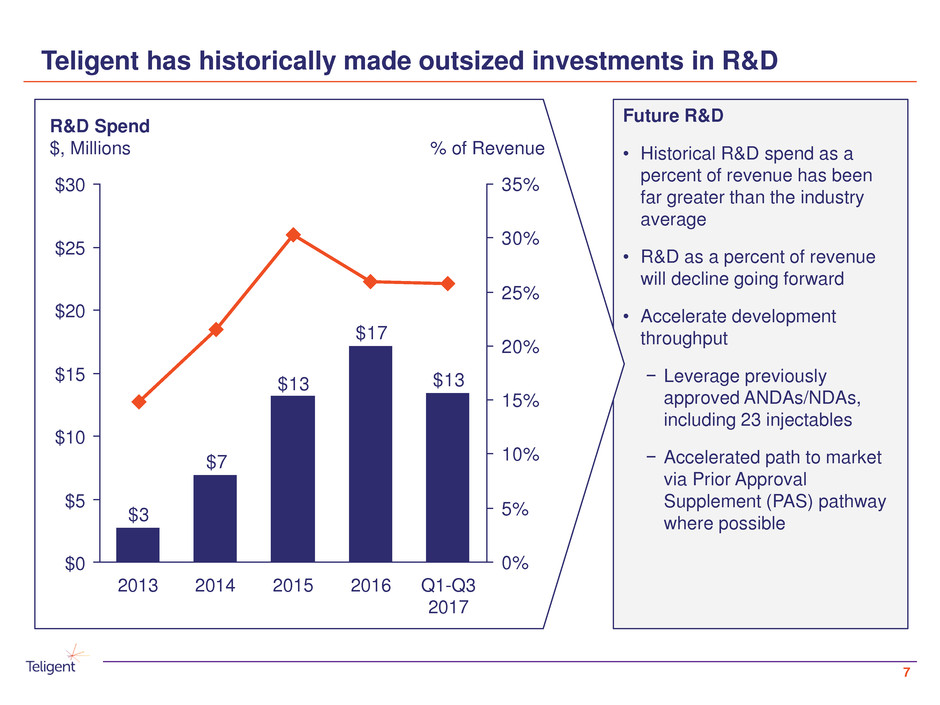

Future R&D

• Historical R&D spend as a

percent of revenue has been

far greater than the industry

average

• R&D as a percent of revenue

will decline going forward

• Accelerate development

throughput

− Leverage previously

approved ANDAs/NDAs,

including 23 injectables

− Accelerated path to market

via Prior Approval

Supplement (PAS) pathway

where possible

Teligent has historically made outsized investments in R&D

7

$13

$17

$13

$7

$3

0%

5%

10%

15%

20%

25%

30%

35%$30

$0

$10

$20

$15

$5

$25

% of Revenue

R&D Spend

$, Millions

2014 20162013 2015 Q1-Q3

2017

R&D investment has resulted in a deep, high-value pipeline

8

Cumulative US ANDA

Submissions and Approvals

As of December 31, 2017

8

13

19

31

36

32

1911

2012 2013 20172016

2

2014

1

2015

Pending ANDAsApproved ANDAs

% Total Addressable Market of

US Submissions

100% = ~$2.0 billion*

GDUFA Year 3-5

10%

Pre-GDUFA Year 3

90%

* IQVIA TAM as of November 2017

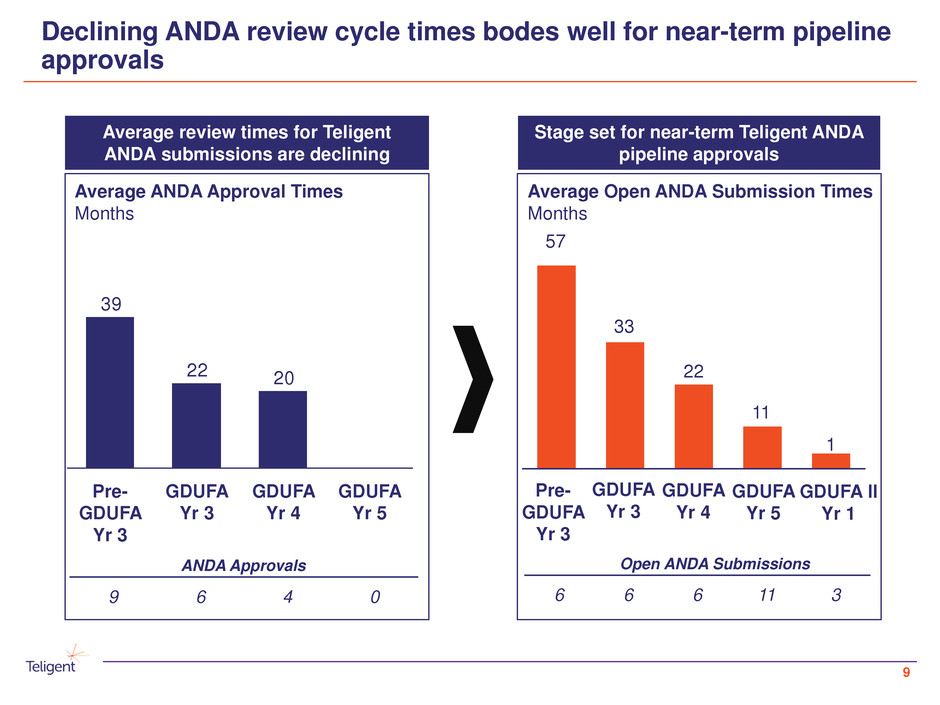

Declining ANDA review cycle times bodes well for near-term pipeline

approvals

9

2022

39

GDUFA

Yr 5

GDUFA

Yr 3

GDUFA

Yr 4

Pre-

GDUFA

Yr 3

57

33

22

11

1

GDUFA

Yr 5

Pre-

GDUFA

Yr 3

GDUFA

Yr 3

GDUFA

Yr 4

Average ANDA Approval Times

Months

Average Open ANDA Submission Times

Months

Average review times for Teligent

ANDA submissions are declining

Stage set for near-term Teligent ANDA

pipeline approvals

ANDA Approvals

9 6 4 0

Open ANDA Submissions

6 6 6 11 3

GDUFA II

Yr 1

Robust topical and injectable manufacturing infrastructure

10

Investing

~$55M

in the facility

expansion

Background

• Located in Buena, New Jersey

• Currently manufacture 24 Teligent-

label topical products

• Facility expansion >3x original plant

− Now almost 110,000 square feet

− Increased topical capacity

− New sterile injectable capability

Expansion Milestones

2016 – Commenced construction

2017 – Construction completed

Mid-2018 – File first injectable product

2H2018 – FDA prior approval inspection

2019 – Launch first injectable product

~4-8M

initial injectable unit

capacity with

increase to

~40M

with addition of

high-speed line

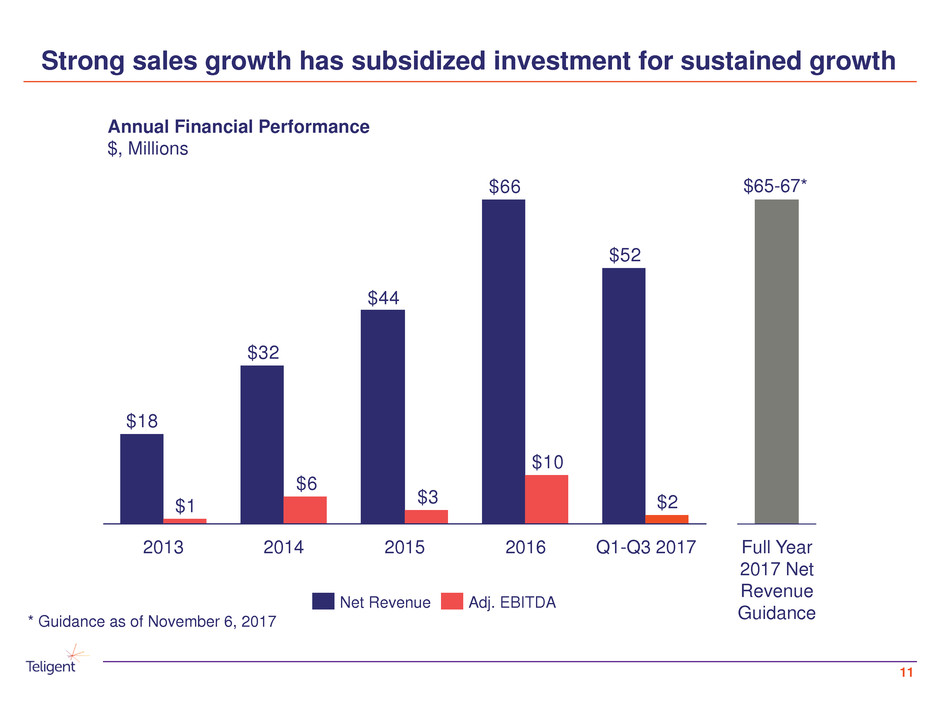

Strong sales growth has subsidized investment for sustained growth

11

$52

$66

$44

$32

$18

$2

$10

$3

$6

$1

2013 20152014 Q1-Q3 20172016

Annual Financial Performance

$, Millions

Adj. EBITDANet Revenue

Full Year

2017 Net

Revenue

Guidance

$65-67*

* Guidance as of November 6, 2017

Teligent-label product sales have exhibited strong growth

12

49

32

20

7

2014 20152013 2016

CAGR +88%

Annual Teligent-Label Product Net Sales

$, Millions

Key Growth Drivers:

• 19 Teligent-label products launched in

US since 2012

− Launched first Teligent-label product

in December 2012

• Acquired econazole nitrate cream in

2013

• Launched TICO strategy in 2014

• Acquired 3 injectable products (Fortaz®,

Zantac® and Zinacef®) in 2015

• Acquired Alveda Pharmaceuticals,

which was generating ~$16M CAD in

net sales, in 2015

Solid foundation to support sustainable, profitable growth

Focus on Investment

2012 - 2017

Focus on Profitability

2018 and beyond

• Invested >$150M* over the past 5

years

• Transitioned from contract services to

Teligent-label products

• Strengthened development

capabilities and grew product pipeline

• Expanded manufacturing capabilities

beyond topicals into injectables

• Harvest pipeline and accelerate new

product launches

• Strengthen commercial capabilities

and improve margins

• Focus on lean operations and

enhancing profitability

• Accelerate product development by

leveraging R&D and enhanced

manufacturing capabilities

* Investment defined as R&D, CapEx and M&A

Key 2018 Objectives

14

• Enhance profitability

− Disciplined cost control

• Increase development throughput

− Leverage previously launched ANDAs/NDAs

• Accelerate ANDA approvals

− 11 ANDAs with GDUFA goal dates in 1Q and 2Q

• Strengthen commercial presence

− Expand commercial team – enhance retail and

build institutional presence

• Operationalize new injectable facility

− First injectable filing, triggering PAI