Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NOVAVAX INC | tv482885_8k.htm |

Exhibit 99.1

` J.P. Morgan Healthcare Conference January 2018

2 Certain information, particularly information relating to future performance and other business matters, including expectations regarding clinical development, market opportunities and anticipated milestones constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act . Forward - looking statements may generally contain words such as “believe,” “may,” “could,” “will,” “possible,” “can,” “estimate,” “continue,” “ongoing,” “consider,” “intend,” “plan,” “project,” “expect,” “should,” “would,” or “assume” or variations of such words or other words with similar meanings . Novavax cautions that these forward - looking statements are subject to numerous assumptions, risks and uncertainties that change over time and may cause actual results to differ materially from the results discussed in the forward - looking statements . Uncertainties include but are not limited to clinical trial results, dependence on third party contractors, competition for clinical resources and patient enrollment and risks that we may lack the financial resources to fund ongoing operations . Additional information on Risk Factors are contained in Novavax’ filings with the U . S . Securities and Exchange Commission, including our Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, and Current Reports on Form 8 - K, which are all available at http : //www . sec . gov . Forward - looking statements are based on current expectations and assumptions and currently available data and are neither predictions nor guarantees of future events or performance . Current results may not be predictive of future results . You should not place undue reliance on forward - looking statements which speak only as of the date hereof . The Company does not undertake to update or revise any forward - looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law . Safe harbor statement

3 RSV Vaccine for Infants Via Maternal Immunization (IVM) x RSV remains a major unmet medical need for newborns in their first 6 months of life x Novavax has the only RSV vaccine in Phase 3 clinical trial x Informational analysis of Phase 3 successful; indicates vaccine is efficacious x Interim efficacy analysis in 4Q 2018/1Q 2019 x Novavax RSV F Vaccine for IVM is a ~$1.5 billion revenue opportunity Influenza ( Flu ) Vaccine for Older Adults (OA) x Efficacy of seasonal flu vaccines is inconsistent; usually less than 50% 1 x Annual flu vaccination is universally recommended due to large burden of disease x Flu vaccine market in 2015 was approximately $ 3.1B 2 in 7 major markets 3 x Novavax is developing a better, differentiated flu vaccine to capture significant market share Novavax Priority Targets: RSV for IVM; Flu for OA 1 http://www.cdc.gov/flu/professionals/vaccination/effectiveness - studies.htm 2 PharmaPoint Seasonal Influenza Vaccines Global Drug Forecast and Market Analysis to 2025, October 2016 3 7 major markets: USA, Japan, Italy, Spain, UK , Germany and France

Status of Phase 3 RSV IVM Clinical Trial 4

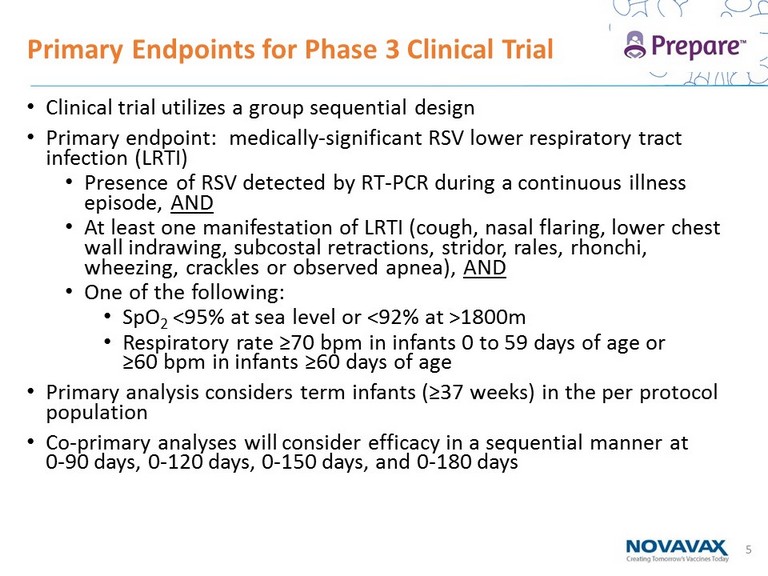

5 • Clinical trial utilizes a group sequential design • Primary endpoint: medically - significant RSV lower respiratory tract infection (LRTI) • Presence of RSV detected by RT - PCR during a continuous illness episode, AND • At least one manifestation of LRTI (cough, nasal flaring, lower chest wall indrawing , subcostal retractions, stridor, rales, rhonchi, wheezing, crackles or observed apnea), AND • One of the following: • SpO 2 <95% at sea level or < 92% at >1800m • Respiratory rate ≥70 bpm in infants 0 to 59 days of age or ≥60 bpm in infants ≥60 days of age • Primary analysis considers term infants (≥37 weeks) in the per protocol population • Co - primary analyses will consider efficacy in a sequential manner at 0 - 90 days, 0 - 120 days, 0 - 150 days, and 0 - 180 days Primary Endpoints for Phase 3 Clinical Trial

6 • Currently completing enrollment in Global Year 3 and beginning enrollment in Global Year 4 • ~ 80 sites in 11 countries • United States, United Kingdom, Spain, South Africa, Australia, New Zealand, Argentina, Mexico, India, Philippines, Bangladesh Phase 3 IVM Clinical Trial Is Ongoing Worldwide • >3,000 enrolled to date • Project ~4,600 by Q2 18

Review of Phase 3 Informational Analysis 7

8 • Novavax performed an informational analysis in Q4 2017 • In a multi - year Phase 3 trial, Novavax wanted to ensure that the ongoing investment in the program was justified based on a high probability of a commercially - viable determination of efficacy • Targeted an efficacy threshold against the primary endpoint at day 90 of > 40% • Medically significant secondary endpoints would likely exceed the vaccine efficacy (VE) for primary endpoint ( e.g. , hospitalizations and more severe disease) • Large unmet need, no alternative vaccine on the horizon Rationale for Informational Analysis

9 • December 2017: Data Safety Monitoring Board statistician performed this unblinded analysis and communicated that RSV F Vaccine successfully met this criteria • Received yes/no answer, Novavax remains blinded Informational Analysis

Phase 3 Outcome De - risked by Successful Informational Analysis 100% 0% Vaccine Efficacy (VE) Against Primary Endpoint Informational Analysis Result 1,307 Enrollees A ssumes 2:1 randomization Data from the informational analysis indicate an observed vaccine efficacy in the range of 42 - 100% 40 %

11 Based on the positive informational analysis, we are focusing on: • Continuing enhanced enrollment efforts to drive to interim analysis • Designing clinical lot consistency trial • Completing preparation for PPQ campaigns • Extending two - year drug product stability in vials; one - year in PFS • Initiating marketing application preparation ( e.g. BLA, MAA) • Continuing collaboration with CDC’s RSV working group Next Steps after Informational Analysis

Plan for Upcoming Interim Analysis 12

13 ~4,600 mothers treated by 2Q 2018 • Exact number dependent on actual randomization • 2:1 randomization • FDA requires ≥ 3,000 active vaccinees for safety and efficacy 3,000+ active infants born Interim analysis completed by 4Q 2018/1Q 2019 • Conducted by DSMB; NVAX remains blinded BLA filing by 4Q 2019/1Q 2020 Overview of Interim Analysis • An interim efficacy analysis will be performed with ~4,600 enrollees • Interim analysis projected to be complete by 4Q 2018/1Q 2019

Commercial Opportunity for Maternal RSV Vaccine 14

4 6 8 0 2 1 3 5 7 9 Taiwan Total 0.5 0.6 RSV incidence in 9 key markets in newborns from birth to 6 months of age (2014) Millions of addressable patients U.S. UK 0.4 0.5 0.7 Germany France Italy 1.0 Spain Japan South Korea 3.7 0.8 0.2 8.4 RSV has a large addressable population, with ~8.4M incident newborn RSV cases in 9 high - value markets and ~55M more cases in the rest of the world Source: CDC, Index Mundi, World Population Statistics, World Bank, UK Office of National Statistics, National Institute of Statistics a nd Economic Studies, L.E.K. interviews and analysis There may be an additional ~55M incident cases of RSV in newborns in the rest of the world

The annual direct burden of infant RSV exceeds ~$1.8B in select geographies, driven largely by hospitalization and inpatient costs for acute care 0 1 2 3 4 5 6 Total Infant RSV disease burden by country (2014) Billions of USD SK TW U.S. JP 2.7 2.1 0.5 0.2 0.0 5.6 Direct burden Indirect burden ● The direct and indirect cost burden of infant RSV have been stable over the past year Measurements considered Direct burden Hospitalization Office visits Pharmaceutical products Etc. Indirect burden Value of statistical life Present value of lost earnings Source: L.E.K. interviews, research, and analysis

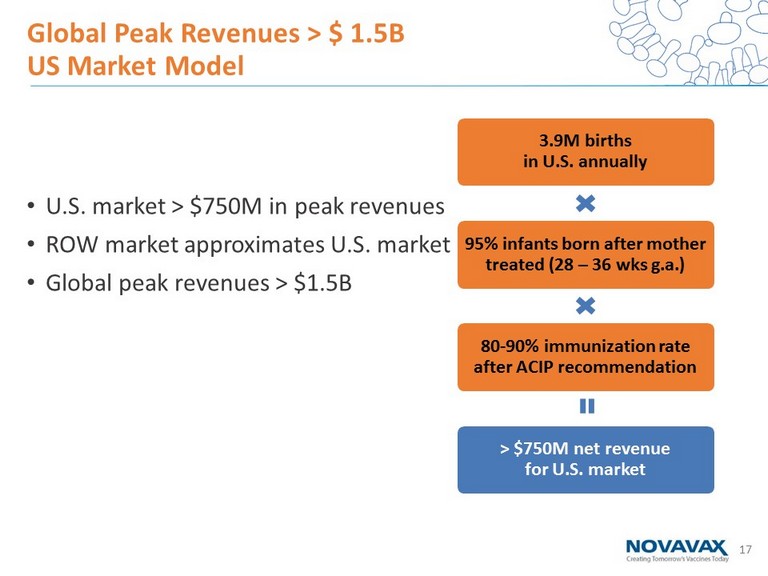

17 • U.S. market > $750M in peak revenues • ROW market approximates U.S. market • Global peak revenues > $1.5B Global Peak Revenues > $ 1.5B US Market Model 3.9M births in U.S. annually 95% infants born after mother treated (28 – 36 wks g.a .) 80 - 90% immunization rate after ACIP recommendation > $750M net revenue for U.S. market

Maternal Immunization: Building on a Proven Strategy 18 Building on Proven Strategy • Growing acceptance of maternal vaccination for flu and pertussis among HCPs and mothers • American College of Obstetrics and Gynecology conducts CME - accredited webinar: “Respiratory Syncytial Virus: The Need for a Maternal Immunization Strategy” Vaccine Injury Compensation Program (VICP) • Amendment in 21st Century Cures Act: As of December 13, 2016, program covers “both a woman who received a covered vaccine while pregnant and any child who was in utero” under government no - fault insurance program ACIP RSV Working Group • CDC Advisory Committee on Immunization Practices (ACIP) established RSV Working Group, May 2016 • First step towards ACIP consideration for recommendation RESCEU ( REspiratory Syncytial virus Consortium in EUrope ) • EU consortium of global leaders in RSV research (academia, public policy, industry) • Epidemiology, surveillance and economic burden research

Summary 19

20 • Informational analysis indicates RSV F Vaccine is efficacious • First positive Phase 3 efficacy indication for an RSV vaccine • Phase 3 enrollment to yield pivotal efficacy data by 4Q 2018/1Q 2019 • Expected to be first licensed RSV vaccine • Global peak revenue estimated to be >$ 1.5B Summary

Nanoparticle Influenza V accine with Matrix - M™ (NanoFlu) 21

22 Influenza (Flu ) market snapshot x Efficacy of seasonal flu vaccines is inconsistent and usually less than 50% x Older adults vaccine efficacy is lower than healthy younger adults x Sanofi HD, based on published data, has not sufficiently improved the outcomes x Annual flu vaccination is universally recommended due to large burden of disease x More people in the US are vaccinated today than in the past – more than 150 million annually x Awareness for the importance of influenza vaccine is very high x Flu vaccine market in 2015 was approximately $3.1B in 7 major markets x Novavax is developing a better, differentiated flu vaccine to capture significant market share x Non - egg based matched to the circulating wild type virus x Adjuvanted with Novavax Matrix adjuvant technology for improved efficacy in the older adult population Nanoparticle Influenza Vaccine ( NanoFlu )

23 A significant p ercentage of older a dults are vaccinated for influenza Source: CDC, L.E.K . and Company research and analysis • Current older adult influenza immunization rates in U.S. and Canada: • CDC aims to have at least 90% of adults aged 65 or older receive an annual flu shot by 2020 -20 0 20 40 60 80 100 2007-8 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 All Ages Percent Effectiveness Effectiveness of Licensed Flu Vaccines * * * Vaccination rate Year USA (U.S. CDC) 66.7% 2014/15 Canada (Statistics Canada) 64.1% 2014 Total (pop. wt. avg.) 66.4%

The need for new and better influenza vaccines

25 • A November 29, 2017 editorial in the New England Journal of Medicine detailed public health concerns related to the poor efficacy of existing seasonal influenza vaccines that is due, in part, to changes or drift in genes that encode the HA protein, leading to low vaccine efficacy • Based on projections from the Southern Hemisphere, the effectiveness of the seasonal influenza vaccine for the 2017 - 2018 Northern Hemisphere season is projected to be approximately 10 % New and growing awareness about the shortcomings of egg - based flu vaccines

26 Flu program d ata p ublished in Vaccine Full publication is available on Novavax website and at : http://www.sciencedirect.com/science/article/pii/S0264410X17310885

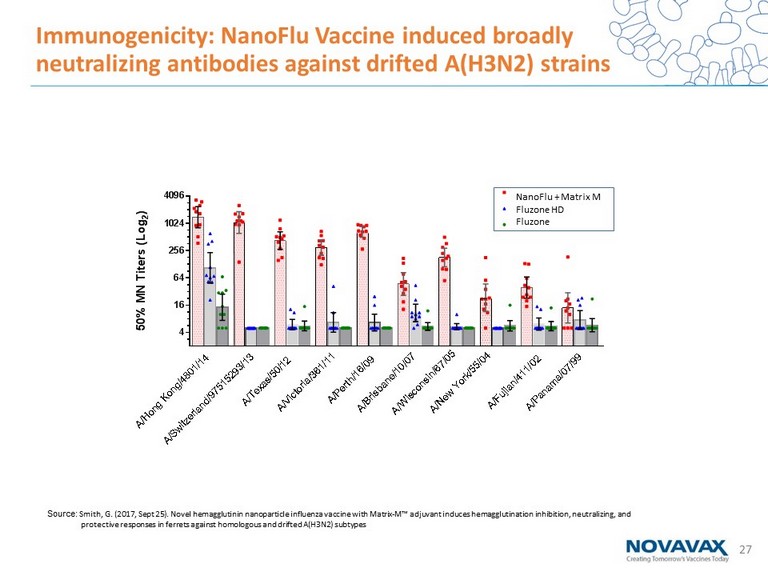

27 4 16 64 256 1024 4096 5 0 % M N T i t e r s ( L o g 2 ) NIV + Matrix M Fluzone HD Fluzone QIV A / H o n g K o n g / 4 8 0 1 / 1 4 A / S w i t z e r l a n d / 9 7 5 1 5 2 9 3 / 1 3 A / T e x a s / 5 0 / 1 2 A / V i c t o r i a / 3 6 1 / 1 1 A / P e r t h / 1 6 / 0 9 A / B r i s b a n e / 1 0 / 0 7 A / N e w Y o r k / 5 5 / 0 4 A / F u j i a n / 4 1 1 / 0 2 A / P a n a m a / 0 7 / 9 9 A / W i s c o n s i n / 6 7 / 0 5 Immunogenicity: NanoFlu Vaccine induced broadly neutralizing antibodies against drifted A(H3N2) strains NanoFlu + Matrix M Fluzone HD Fluzone Source: Smith, G. (2017, Sept 25). Novel hemagglutinin nanoparticle influenza vaccine with Matrix - M™ adjuvant induces hemagglutination inhibition, neutralizing, and protective responses in ferrets against homologous and drifted A(H3N2) subtypes

• Primary objective: assess safety and immunogenicity of two concentrations (15 µg or 60 µg) of NanoFlu compared to licensed vaccine ( Fluzone ® High - Dose) • 330 healthy older adults; 110 per group • Evaluate immune response by microneutralization assays • Contrast immune response to egg based versus egg based vaccine • Requires both wild type and egg based reagents to be developed • Compare ability of each vaccine to neutralize drifted strains due to: • Egg adaptation • Natural drift • Data expected in February 2018 Phase 1/2 trial of NanoFlu Vaccine initiated in Older Adults 28

29 RSV Vaccine for Infants Via Maternal Immunization (IVM) x RSV remains a major unmet medical need for newborns in their first 6 months of life x Novavax has the only RSV vaccine in Phase 3 clinical trial x Informational analysis of Phase 3 successful; indicates vaccine is efficacious x Interim efficacy analysis in 4Q 2018/1Q 2019 x Novavax RSV F Vaccine for IVM is a ~$1.5 billion revenue opportunity Influenza ( Flu ) Vaccine for Older Adults (OA) x Efficacy of seasonal flu vaccines is inconsistent; usually less than 50% 1 x Annual flu vaccination is universally recommended due to large burden of disease x Flu vaccine market in 2015 approximately $ 3.1B 2 in 7 major markets 3 x Novavax is developing a better, differentiated flu vaccine to capture significant market share Novavax Priority Targets: RSV for IVM; Flu for OA 1 http://www.cdc.gov/flu/professionals/vaccination/effectiveness - studies.htm 2 PharmaPoint Seasonal Influenza Vaccines Global Drug Forecast and Market Analysis to 2025, October 2016 3 7 major markets: USA, Japan, Italy, Spain, UK , Germany and France

Discussion 30