Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Protalix BioTherapeutics, Inc. | tv482763_8k.htm |

Exhibit 99.1

Protalix BioTherapeutics Corporate Update January 2018

This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amende d, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward - looking statements including, among others, statemen ts regarding expectations as to regulatory approvals, market opportunity for, and potential sales of, the Company’s product and pr oduct candidates, goals as to product candidate development and timing of the Company’s clinical trials, are based on the Company’ s current intent, belief and expectations. These statements are not guarantees of future performance and are subject to certain risks and uncer tai nties that are difficult to predict. Factors that might cause material differences include, among others: failure or delay in the commenceme nt or completion of the Company’s preclinical and clinical trials which may be caused by several factors, including: slower than expected rates of patient recruitment; unforeseen safety issues; determination of dosing issues; lack of effectiveness during clinical trials; inabilit y t o monitor patients adequately during or after treatment; inability or unwillingness of medical investigators and institutional review boards to fol low the Company’s clinical protocols; and lack of sufficient funding to finance clinical trials; the risk that the results of the clinical tria ls of the Company’s product candidates will not support the Company’s claims of safety or efficacy, that the Company’s product candidates will not have the desired effects or will be associated with undesirable side effects or other unexpected characteristics; the Company’s dependence on performance by third party providers of services and supplies, including without limitation, clinical trial services; delays in the Company’s preparation and filing of applications for regulatory approval; delays in the approval or potential rejection of any applications we file with the FDA or other health regulatory authorities, and other risks relating to the review process; the inherent risks and uncertainties in developing dr ug platforms and products of the type we are developing; the impact of development of competing therapies and/or technologies by other compani es and institutions; potential product liability risks, and risks of securing adequate levels of product liability and other necessa ry insurance coverage; and other factors described in the Company’s filings with the U.S. Securities and Exchange Commission. Existing and prospective investors are cautioned not to place undue reliance on these forward - looking statements, which speak only as of today’s date. The Company undertakes no obligation to update or revise the information contained in this presentation whether as a result of new information, futu re events or circumstances or otherwise. Note Regarding Forward - Looking Statements ;

Company Highlights 3 FDA approved ProCellEx ® plant cell - based expression system being utilized to develop clinically differentiated and improved recombinant therapeutic proteins. FDA multi - product and EMA approved manufacturing facility in Carmiel , Israel. Pegunigalsidase alfa in Phase III for Fabry disease >$ 1.2B growing market; potential to be best - in - class with a superiority claim: • Ex US exclusive license to Chiesi Farmaceutici S.p.A. – $50M in payments prior to results • Orphan Drug Designation (ODD) granted in EU Two Phase II candidates with business development opportunities • Inhaled alidornase alfa for Cystic Fibrosis targeting an ~ $700M market with growth potential • Oral anti - TNF alpha for inflammatory bowel diseases targeting >$5B market Elelyso® (alfataliglucerase) approved and commercialized for Gaucher disease – Protalix retains rights in Brazil; $24M order secured

Corporate Strategy 4 Execution of Phase III Fabry clinical trial program and key data read - outs and potential global approvals Focus on additional partnering opportunities for assets in development Generate revenue through sales of alfataliglucerase in Brazil Advancement of early pipeline products into clinical development

Pipeline Overview 5 (PRX 102) Fabry Disease alidornase alfa (PRX 110) Cystic Fibrosis Oral anti - TNF (OPRX - 106) – Ulcerative Colitis/ Inflammatory diseases Preclinical Phase I Phase II Phase III

for Fabry Disease

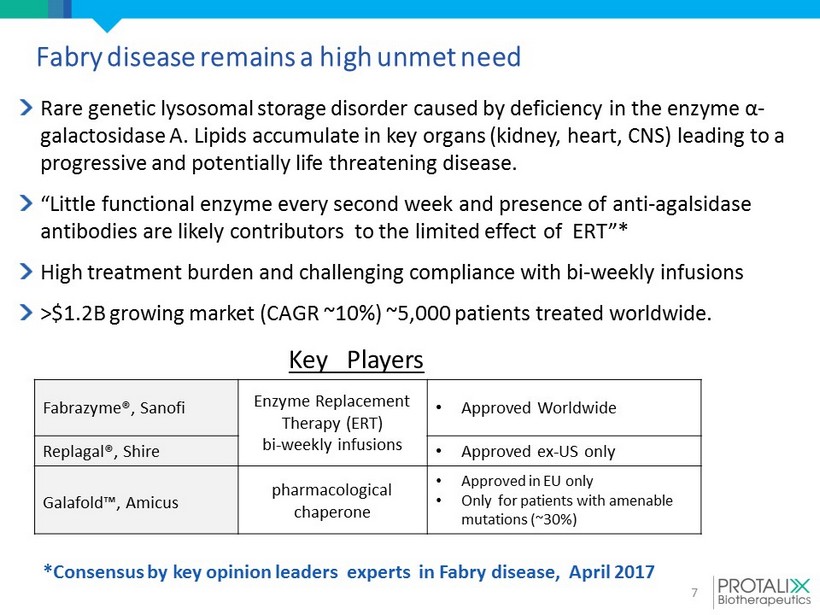

Fabry disease remains a high unmet need 7 Rare genetic lysosomal storage disorder caused by deficiency in the enzyme α - galactosidase A. Lipids accumulate in key organs (kidney, heart, CNS) leading to a progressive and potentially life threatening disease . “Little functional enzyme every second week and presence of anti - agalsidase antibodies are likely contributors to the limited effect of ERT”* High treatment burden and challenging compliance with bi - weekly infusions >$ 1.2B growing market (CAGR ~10 %) ~5,000 patients treated worldwide. Fabrazyme® , Sanofi Enzyme Replacement Therapy (ERT) bi - weekly infusions • Approved Worldwide Replagal® , Shire • Approved ex - US only Galafold ™ , Amicus pharmacological chaperone • Approved in EU only • Only for patients with amenable mutations (~30%) Key Players *Consensus by key opinion leaders experts in Fabry disease, April 2017

8 Unique proposition for addressing significant unmet needs A chemically modified plant cell derived PEGylated enzyme. Designed to be superior to the currently approved ERTs Two dosing regimens: potential for better efficacy and lower treatment burden x Treatment flexibility for patients x Two independent paths for product superio rity 1mg/kg/2weeks 2mg/kg/4weeks Superior ERT for patients with progressing impaired renal function Better quality of life by maintaining clinical stability with 50% less infusions

; Pegunigalsidase alfa ≥ 14 Days of active enzyme Fabrazyme® time frame* Concentration (ng/mL) 1 10 100 1000 10000 100000 0.0 50.0 100.0 150.0 200.0 250.0 300.0 350.0 Time (hours ) PRX-102 1mg/Kg Fabrazyme 1mg/Kg pegunigalsidase alfa 1mg/kg 14 Days * * Fabrazyme ® ( agalsidase beta) – USPI Higher levels of pegunigalsidase alfa in the blood at day 14 than Fabrazyme® at day 1 Half life 40 times greater than Fabrazyme® ® 78.9 2 0 20 40 60 80 100 pegunigalsidase alfa (1mg/Kg) Fabrazyme®(1mg/Kg) T½ (hours) Higher levels of active available enzyme ; potentially more efficacious Substantially greater enzyme exposure than current ERTs

10 PK modeling shows greater AUC in a single infusion of 2 mg/kg pegunigalsidase alfa vs. two bi - weekly infusions of Fabrazyme® over a 4 week time frame First in class once monthly administration Greater AUC ; potential for clinical stability with half the infusions

11 Phase I/II – 24 month data Positive impact on kidney function Pegunigalsidase alfa (eGFR BL 82.4 - 156.3 ) Fabrazyme® (eGFR BL 49 - 170) 2 eGFR slope 1 - 2.2* - 3.8 Excellent safety and tolerability profile • Favorable safety and tolerability observed throughout ~35 patient years • 19% formation of anti - drug antibodies (ADAs ) in pegunigalsidase alfa vs. 74% with Fabrazyme® • All ADA positive patients turned negative in the second year following treatment, leaving 0% of present anti - drug antibodies • Any ADA positivity with pegunigalsidase alfa had no observed impact on safety and efficacy * N=7 classic Fabry patients 1. Measured as Annualized Rate of Estimated GFR Change (mL/min/1.73 m 2 /year) – 24 months 2. Germain et al 2015

Continuous reductions observed over 24 months 0 2 4 6 8 10 12 14 0 10 20 30 40 50 60 70 80 90 100 0 5 10 15 20 25 Treatment Duration - Months Gb3 ( ug /mL) Lyso - Gb 3 (ng/mL) Lyso Gb3 Gb3 Gastrointestinal symptoms Mean Score 0.00 0.50 1.00 1.50 2.00 2.50 3.00 BL Month 12 Month 24 SEVERITY OF ABDOMINAL PAIN FREQUENCY OF ABDOMINAL PAIN FREQUENCY OF DIARRHEA Plasma Gb3 and Lyso - Gb3 n=11 n= 11

Continuous clinical stability observed over 24 months Stable Renal Function n=11 n=11 0 20 40 60 80 100 120 140 160 0 5 10 15 20 25 eGFR (mL/ min/ 1.73m 2 ) Treatment duration (Months) Individual eGFR CKD - EPI trend - lines 0.0 20.0 40.0 60.0 80.0 100.0 120.0 BL 12M 24M BL 12M 24M BL 12M 24M EF (%) LV_MASS (gr) LVMi (gr/m^2) Stable Cardiac Parameters (by MRI) Mean LVM, LVMI and EF

Clinical advantage recognized with granting of EU Orphan Drug Designation (ODD ) Although other therapies for Fabry Disease are approved for use in the EU, the European Commission granted Orphan Drug Designation (ODD) for pegunigalsidase alfa for the treatment of Fabry disease based on: Pegunigalsidase alfa demonstrated clinically relevant advantages over authorized therapies: » Reduced peripheral neuropathy » Reduced immunogenicity In addition to these advantages pegunigalsidase alfa has demonstrated significant benefit : » Reduced accumulation of toxic metabolites in relevant tissues » Clinical data demonstrating the stabilization of kidney function

15 Chiesi , an international privately - held company, strong presence outside US, with focus on the development and commercialization of innovative medicines In exchange for ex - US commercialization rights for pegunigalsidase alfa: • Upfront payment of $25 million and additional payments of up to $25 million in development costs • Eligibility for an aggregate of $320 million in regulatory and commercial milestones as well as tiered royalties ranging from 15% to 35% Protalix remains the manufacturer for clinical development and commercial product. Ex US exclusive collaboration with Chiesi Farmaceutici S.p.A. • Validates Protalix’s Fabry program • Secures funding for clinical program • A focused and effective commercialization partner • Protalix maintains US rights

16 1 mg/kg 2 weeks Head to Head vs. Fabrazyme® in Switch Patients 2mg/kg 4weeks Switch - over from Fabrazyme® and Replagal ® 1mg/kg 2 weeks Switch - over from Replagal® FDA 24 mos Superiority 12 mos Safety and efficacy 12 mos Supportive EMA Rest of World 12 mos Comparability (potential for superiority) 12 mos Safety and efficacy 12 mos Safety and efficacy Number of patients 78 (52+26) 30 22 Robust Phase III pivotal clinical program

17 Potential to be gold standard therapy Peak Sales Potential over $ 1 B Annually ( > 50 % market share) » 1 mg/kg /2 weeks Potential superiority in efficacy Fabrazyme® pegunigalsidase alfa eGFR slope - 3.8 - 2.2* Half life 2 hours ~80 hours Active enzyme ½ day >14 days Antibody presence 74% 0%** *N=7 classic Fabry patients , 24 months **19% formation of anti - drug antibodies (ADAs)/ All ADAs turned negative in the second year following treatment, leaving 0% of present anti - drug antibodies » Once monthly 2 mg/kg 50% less infusions • One month of active enzyme • Clinical efficacy maintained • Enhanced quality of life • Lower treatment burden

alidornase alfa (PRX - 110) for Cystic Fibrosis

19 Cystic Fibrosis (CF) is a rare genetic disease characterized by a highly viscous mucus most prominently leading to severe lung damage and loss of respiratory function. Over 70,000 CF patients world - wide Leading product, Pulmozyme®, DNase enzyme, ~$700M annual sales with significant growth potential Alidornase alfa (PRX 110) was designed as a recombinant DNase resistant to actin inhibition to enhance enzyme activity In human sputa samples, alidornase alfa exhibits superior activity compared to Pulmozyme® in breaking down extracellular DNA and lowering sputum viscosity which translates to potentially improving lung function Can potentially lower incidence of respiratory tract infections More effective mucus clearance for Cystic Fibrosis patients alidornase alfa (PRX 110)

20 Mean absolute change in ppFEV1 * N=16 Phase II trial demonstrates clinically meaningful lung function improvement alidornase alfa (PRX 110 )

21 Clinically meaningful lung function improvement as a result of effective mucociliary clearance Extraordinary reduction of the presence of Pseudomonas aeruginosa (P.sa) infections as a result of alidornase alfa treatment - All P.sa positive patients showed an >75% reduction of which 60% experienced total eradication. • potential for lowering respiratory tract infections • potential for reduction in CF exacerbations Safe, tolerable and shorter inhalation time Cystic Fibrosis Foundation approves letter of application enabling Protalix to apply for grant funding Based on the positive results in phase II, a medical advisory board has been assembled consisting of 12 leading KOLs across the globe to determine upcoming development plan Advances the treatment of Cystic Fibrosis alidornase alfa (PRX 110)

Oral anti - TNF OPRX - 106 for Ulcerative Colitis

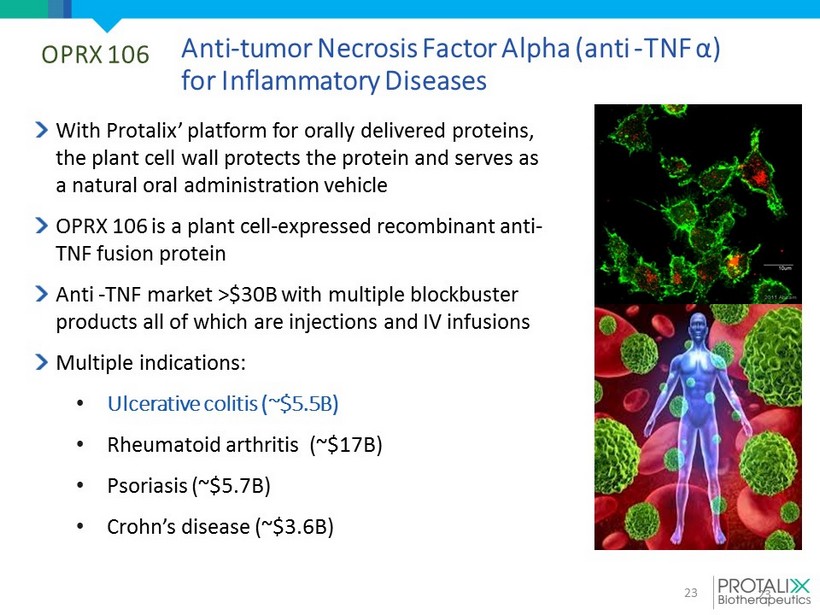

With Protalix’ platform for orally delivered proteins, the plant cell wall protects the protein and serves as a natural oral administration vehicle OPRX 106 is a plant cell - expressed recombinant anti - TNF fusion protein Anti - TNF market >$30B with multiple blockbuster products all of which are injections and IV infusions Multiple indications: • Ulcerative colitis (~$5.5B) • Rheumatoid a rthritis ( ~ $ 1 7 B ) • Psoriasis ( ~ $5.7B ) • Crohn’s d isease ( ~ $ 3 .6 B ) 23 23 Anti - tumor Necrosis Factor Alpha ( anti - TNF α ) for Inflammatory Diseases OPRX 106

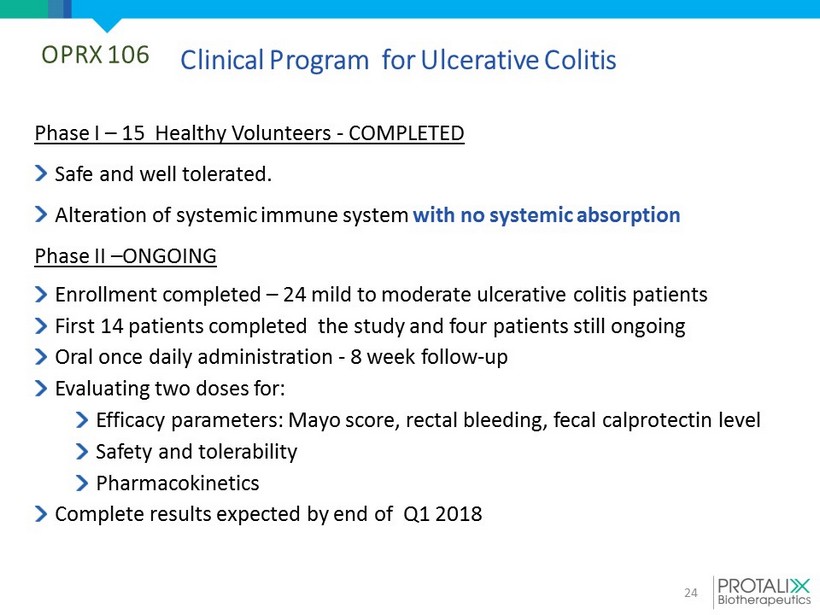

24 Phase I – 15 Healthy Volunteers - COMPLETED Safe and well tolerated. Alteration of systemic immune system with no systemic absorption Phase II – ONGOING Enrollment completed – 24 mild to moderate ulcerative colitis patients First 14 patients completed the study and four patients still ongoing Oral once daily administration - 8 week follow - up Evaluating two doses for : Efficacy parameters: Mayo score, rectal bleeding, fecal calprotectin level Safety and tolerability Pharmacokinetics Complete results expected by end of Q1 2018 Clinical Program for Ulcerative Colitis OPRX 106

Positive interim results of 14 patients: Improvement for majority of patients OPRX 106 Parameter Number of patients Clinical Response 1 8/14 57% Clinical Remission 2 5/14 36% Improved rectal bleeding score 3 11/14 79% Fecal calprotectin 12/14 86% Geboes score 9/14 64% OPRX 106 was safe and well - tolerated. Adverse events (AEs) were mild to moderate and transient with headaches the most common adverse event No immunosuppression was evident 1. Clinical response: Reduced Mayo score >3 points and decrease in the rectal bleeding sub - score of >1 point from baseline, or a rectal bleeding sub - score of 0 or 1 2. Clinical remission: Mayo score of ≤ 2 with no sub - score reaching >1 point 3. Rectal bleeding sub - score = 0 or 1 point

Financial Overview 26 • ~144M shares outstanding, as of December 31, 2017 • Dual listed on NYSE MKT and TASE • Cash position: ~$50.5M as of December 31, 2017 • Cash level currently projected to fund operations into 2020 • $5.9M convertible note due by September 2018, ~$59M convertible note due by November 2021 • 10 years of 0% tax after using up NOL (currently ~$150M)

Protalix has an exciting road ahead… 27 x Two year data for pegunigalsidase alfa x Promising results for alidornase alfa and OPRX 106 x Clinical development pipeline targeting markets ~$7B x R&D focus to advance early pipeline with attractive opportunities for proteins designed for superior clinical profiles and multiple near term catalysts in the next 12 months 1. Report final results from Phase II for oral anti - TNF (OPRX - 106) 2. Finalize enrollment in Phase III pegunigalsidase alfa studies 3. Continue partnership transactions 4. Introduce new pipeline ( currently in preclinical )

Moshe Manor President and CEO Protalix BioTherapeutics moshe.manor@protalix.com