Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Diffusion Pharmaceuticals Inc. | ex_102300.htm |

| EX-3.3 - EXHIBIT 3.3 - Diffusion Pharmaceuticals Inc. | ex_102323.htm |

As filed with the Securities and Exchange Commission on December 20, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

DIFFUSION PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

2834 |

|

30-0645032 |

|

(State or other jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

1317 Carlton Avenue, Suite 200

Charlottesville, VA 22902

(434) 220-0718

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David G. Kalergis

Chief Executive Officer

1317 Carlton Avenue, Suite 200

Charlottesville, VA 22902

(434) 220-0718

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

|

David S. Rosenthal, Esq. |

Robert F. Charron, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, New York 10105 (212) 370-1300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.☐

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered |

Proposed maximum |

Amount of |

||||||

|

Common Stock, $0.001 par value per share (2)(3) |

$ | 14,950,000 | $ | 1,861.28 | ||||

|

(1) |

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act. Includes the offering price of any additional securities that the underwriter has the option to purchase. |

|

(2) |

Includes $1,950,000 of shares of common stock, as well as shares of common stock under any underwriter’s option to purchase additional shares. |

|

(3) |

Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated December 20, 2017

PRELIMINARY PROSPECTUS

Shares of Common Stock

We are offering shares of our common stock. Our common stock is listed on the Nasdaq Capital Market under the symbol “DFFN.” On , 2017, the last reported sale price of our common stock on the Nasdaq Capital Market was $ per share. The public offering price per share will be determined between us and the underwriter at the time of pricing, and may be at a discount to the current market price.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 4 of this prospectus and in the documents incorporated by reference into this prospectus for a discussion of risks that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

|

|

Per Share |

|

Total |

|

|

Public offering price |

|

$ |

|

$ |

|

|

Underwriting discounts and commissions(1) |

|

$ |

|

$ |

|

|

Proceeds, before expenses, to us (2) |

|

$ |

|

$ |

|

_________

|

(1) |

In addition, we have agreed to reimburse the underwriter for certain expenses and to issue common stock purchase warrants to the underwriter. See “Underwriting” for additional information. |

|

(2) |

We estimate the total expenses of this offering payable by us, excluding the underwriting discounts and commissions, will be approximately $ . |

The offering is being underwritten on a firm commitment basis. We have granted the underwriter an option for a period of 30 days from the date of this prospectus to purchase up to an amount of additional shares of our common stock equal to 15% of the number of shares issued in this offering at a price per share equal to the public offering price, less the underwriting discounts and commissions.

The underwriter expects to deliver the shares of common stock to purchasers on or about , 2017.

Sole Book-Running Manager

H.C. Wainwright & Co.

The date of this prospectus is , 2017

TABLE OF CONTENTS

|

|

|

Page |

||

|

Prospectus Summary |

|

|

6 |

|

|

The Offering |

9 |

|||

|

Risk Factors |

|

|

10 |

|

|

Special Note Regarding Forward-Looking Statements |

|

|

13 |

|

|

Use of Proceeds |

|

|

15 |

|

|

Capitalization |

16 |

|||

|

Dilution |

18 |

|||

|

Description of Capital Stock |

|

|

20 |

|

|

Market Price of our Common Stock |

23 |

|||

|

Underwriting |

|

|

25 |

|

|

Legal Matters |

|

|

28 |

|

|

Experts |

|

|

28 |

|

|

Where You Can Find Additional Information |

|

|

28 |

|

|

Incorporation of Certain Information by Reference |

|

|

28 |

|

ABOUT THIS PROSPECTUS

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. You should not assume that the information in this prospectus is accurate at any date other than the date indicated on the cover page of this prospectus or the filing date of any document incorporated by reference, regardless of its time of delivery. We are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

For investors outside the United States: neither we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of this prospectus or incorporated by reference into this prospectus from our filings with the Securities and Exchange Commission (the “SEC”). As it is only a summary, it does not contain all of the information that you should consider before purchasing our securities in this offering and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere or incorporated by reference into this prospectus. You should read the entire prospectus, the registration statement of which this prospectus is a part, and the information incorporated by reference herein in their entirety, including the “Risk Factors” and our financial statements and the related notes contained in and incorporated by reference into this prospectus, before purchasing our securities in this offering. Unless otherwise mentioned or unless the context requires otherwise, all references in this prospectus to “Diffusion,” “we,” “our,” “us” or similar references mean Diffusion Pharmaceuticals Inc.

Diffusion Pharmaceuticals Inc.

Business Overview

We are a clinical stage biotechnology company focused on extending the life expectancy of cancer patients by improving the effectiveness of current standard-of-care treatments, including radiation therapy and chemotherapy. We are developing our lead product candidate, transcrocetinate sodium, also known as trans sodium crocetinate (“TSC”), for use in the many cancer types in which tumor oxygen deprivation (“hypoxia”) is known to diminish the effectiveness of current treatments. TSC is designed to target the cancer’s hypoxic micro-environment, re-oxygenate treatment-resistant tissue and make the cancer cells more susceptible to the therapeutic effects of standard-of-care radiation therapy and chemotherapy.

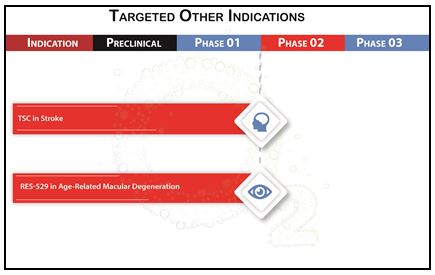

Our lead development programs target TSC against cancers known to be inherently treatment-resistant, with a focus on brain cancers. A Phase 2 clinical program, completed in the fourth quarter of 2015, evaluated 59 patients with newly diagnosed glioblastoma multiforme (“GBM”), a particularly deadly form of primary brain cancer. This open label, historically controlled study demonstrated a favorable safety and efficacy profile for TSC combined with standard of care, including a 36% improvement in overall survival over the control group at two years. A strong efficacy signal was seen in the inoperable patients, where survival of TSC-treated patients at two years was increased by almost four-fold over the controls. The U.S. Food and Drug Administration, or FDA, has provided Diffusion with final protocol guidance for a Phase 3 trial of TSC in this newly diagnosed inoperable GBM patient population. The Company has responded to all outstanding points raised by the FDA and plans to begin the trial under the protocol permitted by the FDA by the end of 2017. The trial will enroll 236 patients in total, 118 in each arm. Due to its novel mechanism of action, TSC has safely re-oxygenated a range of tumor types in our preclinical and clinical studies. Diffusion believes its therapeutic potential is not limited to one specific tumor type, thereby making it potentially useful to improve standard-of-care treatments of other life-threatening cancers. Given TSC's safety profile and animal data, we can, with appropriate funding, move directly into Phase 2 studies in other cancers. We also believe that TSC has potential application in other indications involving hypoxia, such as neurodegenerative diseases and emergency medicine. For example, a stroke program is now under discussion with doctors from UCLA and the University of Virginia, with whom we have established a joint team dedicated to developing a program to test TSC in the treatment of stroke, with an in-ambulance trial of TSC in stroke under consideration. Planning for such a trial is on-going.

In addition to the TSC programs, we are exploring alternatives regarding how best to capitalize upon our product candidate RES-529, which may include possible out-licensing and other options. RES-529 is a novel PI3K/Akt/mTOR pathway inhibitor which has completed two Phase 1 clinical trials for age-related macular degeneration and is in preclinical development in oncology, specifically GBM. RES-529 has shown activity in both in vitro and in vivo glioblastoma animal models and has been demonstrated to be orally bioavailable and can cross the blood-brain barrier.

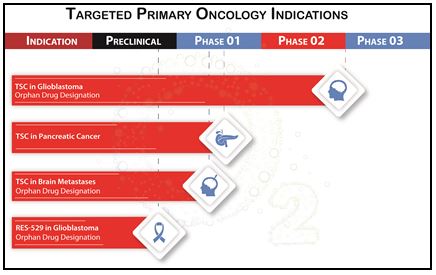

Summary of Current Product Candidate Pipeline

The following tables, as of September 30, 2017, summarizes the targeted clinical indications for Diffusion’s lead molecule, TSC:

TSC eligible for Phase 2 studies based on preclinical and clinical data from prior Phase 1 and Phase 2 clinical trials, including GBM and Peripheral Artery Disease.

Potential Conversion of Series A Preferred Stock

If we sell at least $10 million in gross proceeds of securities in this offering, substantially concurrently with the completion of this offering, our Series A Preferred Stock will automatically convert into the applicable number of shares of our common stock pursuant to the terms set forth in our Certificate of Incorporation, as amended. Unless otherwise indicated, all information contained in this prospectus assumes the automatic conversion of all outstanding shares of Series A Preferred Stock into shares (the “Conversion Shares”) of common stock (including accrued dividends paid in kind and the “make-whole” adjustment feature thereof) pursuant to the terms thereof, which will occur substantially concurrently with the consummation of this offering provided that we sell at least $10 million in gross proceeds of securities in this offering. See “Description of Capital Stock.”

For purposes of calculating an assumed number of Conversion Shares we have assumed a public offering price of $ per share (the last reported sale price of our common stock on the Nasdaq Capital Market on , 2017) and that this offering is completed on , 2017.

There is no assurance that we will sell $10 million of securities in this offering, in which case the Series A Preferred Stock would not automatically convert into shares of common stock. See “Risk Factors -- If we do not sell at least $10 million of securities in this offering, the Series A Preferred Stock will remain outstanding.”

Corporate Information

We are a Delaware corporation that was incorporated in June 2015. Prior to June 2015, we were a Nevada corporation. We maintain our principal executive offices at 1317 Carlton Avenue, Suite 200, Charlottesville, VA 22902. Our telephone number there is (434) 220-0718. The address of our website is www.diffusionpharma.com. The information set forth on, or connected to, our website is expressly not incorporated by reference into, and does not constitute a part of, this prospectus.

We are a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies in this prospectus as well as our filings under the Exchange Act.

THE OFFERING

| Common stock offered by us in this offering | shares. |

|

Common stock to be outstanding after this offering |

shares. |

| Option to purchase additional shares | The underwriter has a 30-day option to purchase up to an amount of additional shares of our common stock equal to 15% of the number of shares issued in this offering at a price per share equal to the public offering price, less the underwriting discounts and commissions. |

| Use of proceeds | We intend to use the net proceeds from this offering to fund research and development of our lead product candidate, TSC, including clinical trial activities, and for general corporate purposes. See “Use of Proceeds.” |

| Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of certain of the factors to consider carefully before deciding to purchase any shares of our common stock in this offering. |

| National Securities Exchange Listing | Our common stock is listed on the Nasdaq Capital Market under the symbol “DFFN.” |

The number of shares of our common stock to be outstanding after this offering is based on 14,503,976 shares of common stock outstanding as of September 30, 2017 and excludes as of that date:

|

• |

213,879 shares issuable upon conversion of convertible promissory notes in an aggregate principal amount of $0.6 million; |

|

• |

2,545,989 shares of common stock issuable upon the exercise of outstanding stock options under the Diffusion Pharmaceuticals Inc. 2015 Equity Incentive Plan, as amended (the “2015 Equity Plan”), at a weighted-average exercise price of $7.34 per share; |

|

• |

13,555,887 shares of common stock issuable upon the exercise of outstanding warrants issued in connection with the Series A Preferred Stock private placement, at a weighted-average exercise price of $2.22 per share; |

|

• |

447,721 shares of common stock issuable upon the exercise of other outstanding warrants, at a weighted-average exercise price of $44.52 per share; and |

|

• |

114,291 shares of common stock reserved for future issuance under the 2015 Equity Plan. |

Unless otherwise indicated, all information contained in this prospectus assumes (i) no exercise by the underwriter of its option to purchase additional shares of common stock and (ii) the automatic conversion of all outstanding Series A Preferred Stock (including accrued dividends paid in kind and the “make-whole” adjustment feature thereof), which will occur substantially concurrently with the consummation of this offering provided that we sell at least $10 million of securities in this offering. See “Description of Capital Stock.”

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with the other information contained in this prospectus, including our financial statements and the related notes appearing at the end of this prospectus, before making your decision to invest in shares of our common stock. We cannot assure you that any of the events discussed in the risk factors below will not occur. These risks could have a material and adverse impact on our business, results of operations, financial condition and cash flows, and our future prospects would likely be materially and adversely affected. If that were to happen, the trading price of our common stock could decline, and you could lose all or part of your investment. In addition, you should also carefully consider the other risks described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016 and our Quarterly Reports on Form 10-Q for the periods ended March 31, 2017, June 30, 2017 and September 30, 2017, which are incorporated herein by reference.

Risks Related to this Offering

We have significant discretion over the use of the net proceeds from this offering.

Our net proceeds from this offering are expected to be approximately $ . We intend to use the net proceeds of this offering to fund research and development of our lead product candidate, TSC, including clinical trial activities, and for general corporate purposes. Accordingly, our management will have broad discretion as to the application of such proceeds. The proceeds shall be used to carry out our business plan, pay salaries to our employees, and satisfy all our expenses, foreseeable and unforeseeable. As is the case with any business, it should be expected that certain expenses unforeseeable to management at this juncture will arise in the future. There can be no assurance that management’s use of proceeds generated through this offering will prove optimal or translate into revenue or profitability for the Company. Investors are urged to consult with their attorneys, accountants and personal investment advisors prior to making any decision to invest in the Company.

Even if this offering is successful, we will need to raise additional capital in the future to continue operations, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

To date, we have not sold, or received approval to sell, any pharmaceutical products. We do not expect to sell any pharmaceutical products for at least the next several years, if at all. Our net losses were approximately $18.0 million, and $6.7 million for the years ended December 31, 2016 and 2015, respectively. As of September 30, 2017 and December 31, 2016, we had incurred cumulative net losses totaling approximately $63.3 million and $60.2 million, respectively. Moreover, we expect that our net losses will continue and may increase for the foreseeable future. We may not be able to achieve projected results if we generate lower revenues (if any) or receive lower investment income than expected, or we incur greater expenses than expected, or all of the above. We may never generate sufficient product revenue (if any) to become profitable. We also expect to have quarter-to-quarter fluctuations in revenues, expenses, and losses, some of which could be significant.

We estimate that we will receive net proceeds of approximately $ million from the sale of the securities offered by us in this offering, based on the assumed public offering price of $ per share (the last reported sale price of our common stock on the NASDAQ Capital Market on , 2017), and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. In the event of a decrease in the net proceeds to us from this offering as a result of a decrease in the assumed public offering price or the number of shares offered by us, we may need to raise additional capital sooner than we anticipate or may need to scale back or eliminate certain of our development programs.

We will need to raise more money to complete our planned clinical trials, continue the research and development necessary to bring our products to market and to establish marketing and additional manufacturing capabilities. We may seek additional funds through public and private stock offerings, government contracts and grants, arrangements with corporate collaborators, borrowings under lines of credit or other sources. However, we may not be able to raise additional funds on favorable terms, or at all. Conditions in the credit markets and the financial services industry may make equity and debt financing more difficult to obtain, and may negatively impact our ability to complete financing transactions. To the extent that we raise additional funds by issuing equity securities, our stockholders may experience significant dilution. Any debt financing, if available, may involve restrictive covenants, such as limitations on our ability to incur additional indebtedness and other operating restrictions that could adversely impact our ability to conduct our business.

If we are unable to obtain additional funds, we may have to scale back our development of new products, reduce our workforce, license to others products or technologies that we otherwise would seek to commercialize ourselves or, ultimately, cease operations. The amount of money we may need would depend on many factors, including:

|

• |

The costs and progress of our research and development programs; |

|

• |

The scope and results of our preclinical studies and clinical trials; |

|

• |

The amount of our legal expenses and any settlement or damages payments associated with litigation; and |

|

• |

The time and costs involved in: obtaining necessary regulatory approvals; filing, prosecuting and enforcing patent claims; scaling up our manufacturing capabilities; and the commercial arrangements we may establish. |

An investment in our securities is speculative and there can be no assurance of any return on any such investment.

An investment in our securities is speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

If you purchase our common stock in this offering, you will incur immediate and substantial dilution in the book value of your shares, including as a result of the “make-whole” feature of the Series A Preferred Stock.

The public offering price in this offering is substantially higher than the net tangible book value per share of our common stock. Investors purchasing common stock in this offering will pay a price per share that substantially exceeds the book value of our tangible assets after subtracting our liabilities. As a result, investors purchasing common stock in this offering will incur immediate dilution of $ per share, based on the assumed public offering price of $ per share. This dilution also reflects the reclassification of $16.3 million common stock warrant liability to stockholders’ equity as a result of the amendment of our certificate of incorporation on November 1, 2017 with respect to the dividend feature of the Series A Preferred Stock and the issuance of additional shares to the holders of our Series A Preferred Stock pursuant to the “make-whole” feature thereof (assuming the public offering price is less than $2.02 per share). See “Description of Capital Stock.”

As a result of the dilution to investors purchasing shares in this offering, investors may receive significantly less than the purchase price paid in this offering, if anything, in the event of our liquidation. For a further description of the dilution that you will incur as a result of purchasing shares in this offering, see "Dilution."

There may be future sales of our securities or other dilution of our equity, which may adversely affect the market price of our common stock.

We are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable for, or that represent the right to receive, common stock. The market price of our common stock could decline as a result of sales of common stock or securities that are convertible into or exchangeable for, or that represent the right to receive, common stock after this offering or the perception that such sales could occur.

If we cannot continue to satisfy the Nasdaq Capital Market continued listing standards and other Nasdaq rules, our common stock could be delisted, which would harm our business, the trading price of our common stock, our ability to raise additional capital and the liquidity of the market for our common stock.

Our common stock is currently listed on the Nasdaq Capital Market. To maintain the listing of our common stock on the Nasdaq Capital Market, we are required to meet certain listing requirements, including, among others, either: (i) a minimum closing bid price of $1.00 per share, a market value of publicly held shares (excluding shares held by our executive officers, directors and 10% or more stockholders) of at least $1 million and stockholders’ equity of at least $2.5 million; or (ii) a minimum closing bid price of $1.00 per share, a market value of publicly held shares (excluding shares held by our executive officers, directors and 10% or more stockholders) of at least $1 million and a total market value of listed securities of at least $35 million.

There is no assurance that we will continue to meet the minimum closing price requirement and other listing requirements. In the event that our common stock is delisted from Nasdaq and is not eligible for quotation or listing on another market or exchange, trading of our common stock could be conducted only in the over-the-counter market or on an electronic bulletin board established for unlisted securities such as the Pink Sheets or the OTC Bulletin Board. In such event, it could become more difficult to dispose of, or obtain accurate price quotations for, our common stock, and there would likely also be a reduction in our coverage by securities analysts and the news media, which could cause the price of our common stock to decline further.

If we do not sell at least $10 million of securities in this offering, the Series A Preferred Stock will remain outstanding.

If we sell at least $10 million of securities in this offering, substantially concurrently with the completion of this offering, the Series A Preferred Stock will automatically convert into the applicable number of shares of our common stock pursuant to the terms set forth in our Certificate of Incorporation, as amended (“Certificate of Incorporation”). See “Description of Capital Stock.” However, if at least $10 million of securities are not sold in this offering, and the Series A Preferred Stock will not automatically convert into shares of our common stock and the outstanding shares of Series A Preferred Stock will rank senior to the shares of common stock in the event of a liquidation, dissolution or winding up of the Company. In the event of a Liquidation Event (as defined in the Certificate of Incorporation), the holders of the Series A Preferred Stock shall be entitled to receive, out of the assets of the Company or proceeds thereof legally available therefor, an amount in cash equal to 100% of the stated value of the Series A Preferred Stock before any payment or distribution of the assets of the Company is made or set apart for the holders of the common stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the other information and documents incorporated by reference herein include forward-looking statements. We may, in some cases, use terms such as “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Forward-looking statements appear in and are incorporated by reference into a number of places throughout this prospectus and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ongoing and planned preclinical development and clinical trials, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for our product candidates, our intellectual property position, the degree of clinical utility of our products, particularly in specific patient populations, our ability to develop commercial functions, expectations regarding clinical trial data, our results of operations, cash needs, financial condition, liquidity, prospects, growth and strategies, the industry in which we operate and the trends that may affect the industry or us.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics and industry change, and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each forward-looking statement contained in or incorporated by reference into this prospectus, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in and incorporated by reference into this prospectus. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in and incorporated by reference into this prospectus, they may not be predictive of results or developments in future periods.

Actual results could differ materially from our forward-looking statements due to a number of factors, including risks related to:

|

• |

our ability to obtain additional financing, including the overhang and restrictive provisions of the Series A convertible preferred stock and related warrants; |

|

• |

our estimates regarding expenses, future revenues, capital requirements and needs for additional financing; |

|

• |

our ability to continue as a going concern; |

|

• |

obtaining and maintaining intellectual property protection for our product candidates and our proprietary technology; |

|

• |

the success and timing of our preclinical studies and clinical trials; |

|

• |

the difficulties in obtaining and maintaining regulatory approval of our products and product candidates, and the labeling under any approval we may obtain; |

|

• |

our failure to recruit or retain key scientific or management personnel or to retain our executive officers; |

|

• |

the accuracy of our estimates of the size and characteristics of the potential markets for our product candidates and our ability to serve those markets; |

|

• |

regulatory developments in the United States and foreign countries; |

|

• |

our ability to operate our business without infringing the intellectual property rights of others; |

|

• |

recently enacted and future legislation regarding the healthcare system; |

|

• |

our ability to satisfy the continued listing requirements of the Nasdaq Capital Market or any other exchange that our securities may trade on in the future; |

|

• |

our plans and ability to develop and commercialize our product candidates; |

|

• |

the rate and degree of market acceptance of any of our product candidates; |

|

• |

the success of competing products that are or may become available; and |

|

• |

the performance of third parties, including contract research organizations and manufacturers. |

You should also read carefully the factors described in the “Risk Factors” section contained in this prospectus and incorporated by reference herein from our Annual Report on Form 10-K filed with the SEC on March 31, 2017, as amended, our Quarterly Reports on Form 10-Q and our other public filings to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements contained in or incorporated by reference into this prospectus will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

Any forward-looking statements that we make in or incorporate by reference into this prospectus speak only as of the date of such statement, and, except as required by applicable law, we undertake no obligation to update such statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

USE OF PROCEEDS

We estimate that we will receive net proceeds of approximately $ million (or approximately $ million if the underwriter’s option to purchase additional shares is exercised in full) from the sale of the securities offered by us in this offering, based on the assumed public offering price of $ per share (the last reported sale price of our common stock on the Nasdaq Capital Market on , 2017), and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

A $0.10 increase (decrease) in the assumed public offering price of $ per share would increase (decrease) the net proceeds to us from this offering by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

Similarly, a one million share increase (decrease) in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) the net proceeds to us by approximately $ million, assuming the assumed public offering price of $ per share remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We currently intend to use the net proceeds from this offering to fund research and development of our lead product candidate, TSC, including clinical trial activities, and for general corporate purposes. See “Risk Factors” for a discussion of certain risks that may affect our intended use of the net proceeds from this offering, including that we will need to raise additional capital in the future to complete the development of TSC and our other product candidates.

Our expected use of net proceeds from this offering represents our current intentions based upon our present plans and business condition. As of the date of this prospectus, we cannot currently allocate specific percentages of the net proceeds that we may use for the purposes specified above, and we cannot predict with certainty all of the particular uses for the net proceeds to be received upon the completion of this offering, or the amounts that we will actually spend on the uses set forth above. The amounts and timing of our actual use of the net proceeds will vary depending on numerous factors, including our ability to obtain additional financing, the progress, cost and results of our preclinical and clinical development programs, and whether we are able to enter into future licensing or collaboration arrangements. We may find it necessary or advisable to use the net proceeds for other purposes, and our management will have broad discretion in the application of the net proceeds, and investors will be relying on our judgment regarding the application of the net proceeds from this offering.

Pending the use of the net proceeds from this offering, we intend to invest the net proceeds in short-term, investment-grade, interest-bearing securities or certificates of deposit.

CAPITALIZATION

The following table sets forth cash and capitalization as of September 30, 2017:

|

● |

on an actual historical basis for Diffusion; |

|

● |

on a pro forma basis to give effect to the reclassification of $16.3 million common stock warrant liability to stockholders’ equity as a result of the amendment of our certificate of incorporation on November 1, 2017 with respect to the dividend feature of the Series A Preferred Stock and resulting accounting adjustments; |

|

● |

on a pro forma, as adjusted basis to give effect to: |

|

o |

the assumed issuance and sale of shares of common stock in this offering at the assumed public offering price of $ per share (the last reported sale price of our common stock on the Nasdaq Capital Market on , 2017), after deducting estimated placement agent fees and commissions, and estimated offering expenses payable by us; and |

|

o |

the automatic conversion of all outstanding shares of Series A Preferred Stock into shares (the “Conversion Shares”) of common stock (including accrued dividends paid in kind and the “make-whole” adjustment feature thereof) pursuant to the terms thereof, which will occur substantially concurrently with the consummation of this offering, assuming a public offering price of $ per share (the last reported sale price of our common stock on the Nasdaq Capital Market on , 2017) and that this offering is completed on , 2017. |

|

|

Pro Forma |

Pro Forma |

||||||||||

|

Cash, cash equivalents and certificate of deposit |

$ | 11,236,164 | $ | 11,236,164 | $ | |||||||

|

Common Stock warrant liability |

$ | 16,316,054 | $ | — | $ | — | ||||||

|

Convertible debt |

$ | 550,000 | $ | 550,000 | $ | |||||||

|

Series A - 13,750,000 shares authorized, 8,324,032 issued and outstanding, actual; 13,750,000 shares authorized, no shares issued or outstanding, as adjusted |

— | — | ||||||||||

| Stockholders' equity: | ||||||||||||

|

Common stock, par value $0.001 per share; 1,000,000,000 authorized, 14,503,976 shares issued and outstanding actual; 1,000,000,000 shares authorized, [______] shares issued and outstanding pro forma as adjusted |

14,504 | 14,504 | ||||||||||

|

Additional paid-in capital |

$ | 69,686,744 | $ | 82,840,268 | $ | |||||||

|

Accumulated deficit |

$ | (63,344,552 | ) | $ | (60,182,022 | ) | $ | |||||

|

Total stockholders' equity |

$ | 6,356,696 | $ | 22,672,750 | $ | |||||||

|

Total capitalization |

$ | 23,222,750 | $ | 23,222,750 | $ | |||||||

The number of shares of common stock outstanding in the table excludes the following, outstanding as of September 30, 2017:

|

o |

213,879 shares issuable upon conversion of convertible promissory notes in an aggregate principal amount of $0.6 million; |

|

o |

2,545,989 shares of common stock issuable upon the exercise of outstanding stock options under the 2015 Equity Plan, at a weighted-average exercise price of $7.34 per share; |

|

o |

13,555,887 shares of common stock issuable upon the exercise of outstanding warrants issued in connection with the Series A private placement, at a weighted-average exercise price of $2.22 per share; |

|

o |

447,721 shares of common stock issuable upon the exercise of other outstanding warrants, at a weighted-average exercise price of $44.52 per share; and |

|

o |

114,291 shares of common stock reserved for future issuance under the 2015 Equity Plan. |

The amounts set forth in the table above also assume no exercise by the underwriter of its option to purchase additional shares.

DILUTION

If you invest in our common stock in this offering, your interest will be diluted to the extent of the difference between the public offering price per share of our common stock and the net tangible book value per share of our common stock upon consummation of this offering. Dilution results from the fact that the public offering price is substantially in excess of the book value per share attributable to the existing stockholders for the presently outstanding stock.

The historical net tangible book value (deficit) of our common stock as of September 30, 2017 was approximately $(9.2) million, or approximately $(0.64) per share of common stock. Historical net tangible book value (deficit) per share is determined by dividing the number of outstanding shares of common stock into its total tangible assets (total assets less intangible assets) less total liabilities and preferred shares.

On a pro forma basis, after giving effect to the reclassification of our $16.3 million common stock warrant liability to stockholders’ equity as a result of the amendment of our certificate of incorporation on November 1, 2017 with respect to the dividend feature of the Series A Preferred Stock and resulting accounting adjustments, pro forma net tangible book value (deficit) of our common stock as of September 30, 2017 was approximately $7.1 million, or approximately $0.48 per share of common stock. This represents an immediate increase in pro forma net tangible book value of $1.12 per share.

In addition, assuming the aggregate gross proceeds of this offering are at least $10 million, all of the outstanding shares of our Series A Preferred Stock will automatically convert into shares of common stock on a one-for-one basis. Further, each holder of Series A Preferred Stock will also receive additional shares of common stock representing (i) paid-in-kind dividends accrued through the date of conversion and (ii) assuming that the public offering price in this offering is less than $2.02 per share, payment in respect of the “make-whole” feature of the Series A Preferred Stock. For purposes of calculating an assumed number of Conversion Shares, we have assumed a public offering price of $ per share (the last reported sale price of our common stock on the Nasdaq Capital Market on , 2017) and that this offering is completed on , 2017, which would result in the issuance of, in the aggregate, shares of common stock in respect of the conversion of our Series A Preferred Stock.

On a pro forma as adjusted basis, after giving effect to the conversion of the outstanding shares of Series A Preferred Stock, assuming the public offering price in this offering is $ per share, the closing price of our common stock on the Nasdaq Capital Market on [______], 2017, and assuming that this offering is closed on , 2017, our net tangible book value at September 30, 2017 would have been approximately $ million, or approximately $ per share of common stock.

Investors purchasing securities in this offering will incur immediate and substantial dilution. After giving effect to the sale of common stock offered in this offering assuming a public offering price of $ per share, the closing price of our common stock on the Nasdaq Capital Market on , 2017, and after deducting the estimated underwriting discounts and commissions and estimated offering costs payable by us, our as adjusted net tangible book value as of September 30, 2017 would have been approximately $ million, or approximately $ per share of common stock. This represents an immediate increase in pro forma as adjusted net tangible book value of $ per share to existing stockholders, and an immediate dilution in the pro forma as adjusted net tangible book value of $ per share to investors purchasing shares of our common stock in this offering.

The following table illustrates this per share dilution:

|

Assumed public offering price per share |

||||

|

Historical net tangible book value (deficit) per share |

(0.64 | ) | ||

|

Increase per share attributable to pro forma adjustments |

1.12 | |||

|

Pro forma net tangible book value (deficit) per share at September 30, 2017 |

0.48 | |||

|

Increase in net tangible book value per share attributable to this offering and automatic conversion of Series A preferred stock |

||||

|

Pro forma as adjusted net tangible book value after this offering |

||||

|

Dilution per share to investors |

The dilution information discussed above is illustrative only and will change based on the actual public offering price and other terms of this offering determined at pricing. A $1.00 increase or decrease in the assumed public offering price of $ per share would increase or decrease the as adjusted net tangible book value per share by $ million, or approximately $ per share, and the dilution per share to investors participating in this offering by approximately $ per share, assuming the number of shares of common stock offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

The discussion and table above assume no exercise of the underwriter’s option to purchase additional shares of common stock. If the underwriter fully exercises its option to purchase additional shares of common stock in the offering, our as adjusted net tangible book value after this offering, calculated in the manner set forth above, would be approximately $ million, our as adjusted net tangible book value per share after this offering would be $ per share, the increase in our as adjusted net tangible book value per share attributable to investors participating in this offering would be $ per share and the as adjusted dilution per share to new investors in this offering would be $ per share.

DESCRIPTION OF CAPITAL STOCK

Company Capitalization

Our authorized capital stock consists of 1,000,000,000 shares of common stock and 30,000,000 shares of preferred stock, $0.001 par value, 13,750,000 of which have been designated as Series A Preferred Stock and the remainder of which remain undesignated. The following summary is qualified in its entirety by reference to our Certificate of Incorporation, as amended, a copy of which is filed as an exhibit to our previous filings with the SEC and incorporated herein by reference.

Common Stock

Authorized. We are authorized to issue 1,000,000,000 shares of common stock, of which 14,503,976 shares were issued and outstanding as of September 30, 2017. We may amend from time to time our Certificate of Incorporation to increase the number of authorized shares of common stock. Any such amendment would require the approval of the holders of a majority of the voting power of the shares entitled to vote thereon.

Voting Rights. For all matters submitted to a vote of stockholders, each holder of common stock is entitled to one vote for each share registered in the holder’s name on our books. Our common stock does not have cumulative voting rights. At all meetings of the stockholders, except where otherwise provided by law, the Certificate of Incorporation or Bylaws, the presence, in person or by proxy duly authorized, of the holders of a majority of the outstanding shares of common stock entitled to vote constitutes a quorum for the transaction of business. Except as otherwise provided by law or by the Certificate of Incorporation or Bylaws, in all matters other than the election of directors, the affirmative vote of the majority of shares of common stock present in person or represented by proxy at the meeting and entitled to vote generally on the subject matter shall be the act of the stockholders. Except as otherwise provided by law, the Certificate of Incorporation or Bylaws, directors are elected by a plurality of the votes of the shares of common stock present in person or represented by proxy at the meeting and entitled to vote generally on the election of directors.

Dividends. Subject to limitations under Delaware law and any preferences that may be applicable to any then outstanding preferred stock, holders of common stock are entitled to receive ratably those dividends, if any, as may be declared by our Board out of legally available funds.

Liquidation. Upon our liquidation, dissolution or winding up, the holders of common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities of our company, subject to any prior rights of any preferred stock then outstanding.

Fully Paid and Non-assessable. All shares of our outstanding common stock are fully paid and non-assessable and any additional shares of common stock that we issue will be fully paid and non-assessable.

Other Rights and Restrictions. Holders of common stock do not have preemptive or subscription rights, and they have no right to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to common stock. The rights, preferences and privileges of common stockholders are subject to the rights of the stockholders of any series of preferred stock which we may designate in the future. Our Certificate of Incorporation and Bylaws do not restrict the ability of a holder of common stock to transfer the holder’s shares of common stock.

Listing. Our common stock is quoted on the Nasdaq Capital Market under the symbol “DFFN.”

Transfer Agent and Registrar. The transfer agent and registrar for common stock is Computershare Investor Services, LLC, 250 Royall Street, Canton, Massachusetts, telephone number: 1-800-942-5909.

Series A Convertible Preferred Stock

As of September 30, 2017, there were 8,324,032 shares of the Series A Preferred Stock issued and outstanding. The following is a summary of the rights, privileges and preferences of the Series A Preferred Stock, which such summary is qualified in its entirety by the Certificate of Designation of Preferences, Rights and Limitations of the Series A Convertible Preferred Stock (the “Series A Certificate of Designation”).

Voting. The holders of the Series A Preferred Stock are entitled to vote with the holders of common stock (and any other class or series that may similarly be entitled to vote with the holders of common stock as the Board may authorize and issue) and not as a separate class, at any annual or special meeting of stockholders of the Company, and may act by written consent in the same manner as the holders of common stock. In the event of any such vote or action by written consent, each holder of shares of Series A Preferred Stock is entitled to that number of votes equal to the whole number of shares of common stock into which the aggregate number of shares of Series A Preferred Stock held of record by such Holder are convertible as of the close of business on the record date fixed for such vote or such written consent based on a conversion price, solely for such purpose, equal to the closing price of our common stock on the date such Series A Preferred Stock was issued. In addition, for as long as 50% of the shares of Series A Preferred Stock outstanding immediately after the final closing remain outstanding, without the consent of holders of at least a majority of the then outstanding shares of Series A Preferred Stock, the Company may not (a) amend the Certificate of Incorporation or Bylaws so as to materially and adversely affect any rights of the holders of the Series A Preferred Stock, (b) increase or decrease (other than by conversion of the Series A Preferred Stock) the authorized number of Series A Preferred Stock to be in excess of the number of shares required to satisfy the Maximum Offering Amount, (c) amend the Series A Certificate of Designation, (d) repay, repurchase or offer to repay, repurchase or otherwise acquire more than a de minimis number of shares of common stock or common stock equivalents or (e) enter into any agreement or understanding with respect to (a) through (d).

Dividends. The Series A Preferred Stock are entitled to an 8.0% cumulative preferred dividend payable semi-annually in shares of common stock or cash (in the Company’s sole discretion) that began accruing on the issue date of the Series A Preferred Stock. The dividend will begin to accrue and be cumulative on the first day of each applicable dividend period and shall remain accumulated dividends with respect to such Series A Preferred Stock until paid; provided, that the first dividend payable with respect to any share of Series A Preferred Stock shall not begin to accrue until the date of original issuance of such share of Series A Preferred Stock. Dividends shall accrue whether or not there are profits, surplus or other funds of the Company legally available for the payment of dividends but shall not be payable until legally permissible, as applicable.

Liquidation. The Series A Preferred Stock ranks senior to the common stock and will rank senior to each other class of capital stock of the Company or series of preferred stock of the Company authorized by the Board in the future that does not expressly provide that such class or series ranks senior to, or on parity with, the Series A Preferred Stock (“Series A Junior Securities”). In the event of a Liquidation Event (as defined in the Series A Certificate of Designation), the holders of the Series A Preferred Stock are entitled to receive, out of the assets of the Company or proceeds thereof legally available therefor, an amount in cash equal to 100% of the stated value of the Series A Preferred Stock before any payment or distribution of the assets of the Company is made or set apart for the holders of Series A Junior Securities. In addition, prior to such Liquidation Event, the holders of Series A Preferred Stock are entitled to notice so that they may exercise their conversion rights prior to such event. If, upon the occurrence of any Liquidation Event, the assets of the Company, or proceeds thereof, distributable after payment in full of the Company’s creditors and any securities senior to the Series A Preferred Stock are insufficient to pay in full the aggregate amount of 100% of the stated value to the holders of the Series A Preferred Stock, the assets of the Company, or the proceeds thereof, shall be distributed ratably among the holders of any Series A Preferred Stock and the holders of any security ranked equally with the Series A Preferred Stock.

Conversion Rate: Each share of Series A Preferred Stock is convertible into a share of common stock at a conversion price equal to the Purchase Price, subject to adjustment as provided in the Certificate of Designation and summarized herein (the “Series A Conversion Price”), at any time after the final closing date at the holder’s sole and absolute discretion. Holders may immediately convert their Series A Preferred Stock prior to the occurrence of certain Liquidation Events. Each share of Series A Preferred Stock will automatically convert, initially, into a share of common stock (a) on any date that is more than thirty (30) trading days after the original issued date of such share Series A Preferred Stock that the 30 day moving average of the closing price of the common stock on the Nasdaq Capital Market (or any other exchange where the common stock is traded) exceeds $8.00 per share (subject to adjustment in the event of a stock dividend or split), (b) upon a financing of at least $10 million or (c) upon the majority vote of the voting power of the then outstanding shares of Series A Preferred Stock. The Company is not required to issue any fractional shares of Series A Preferred Stock or common stock in connection with the conversion of Series A Preferred Stock and may, in each case, at the Company’s discretion, pay the holder such amount in cash or deliver an additional whole share in lieu thereof. If the Company sells at least $10 million of securities in this offering, the Series A Preferred Stock will automatically convert into the applicable number of shares of our common stock.

Limitations of Conversion: The number of shares of common stock issuable upon a conversion of the Series A Preferred Stock that may be acquired by a holder shall be limited to the extent necessary to ensure that, following such conversion (or other issuance), the total number of shares of common stock then beneficially owned by such holder and its affiliates and any other persons whose beneficial ownership of common stock would be aggregated with the Holder's for purposes of Section 13(d) of the Securities and the Exchange Act, does not exceed 4.99% of the total number of issued and outstanding shares of common stock (including for such purpose the shares of common stock issuable upon such conversion). However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% of the total number of shares of common stock then issued and outstanding provided that such increase in percentage shall not be effective until sixty-one (61) days after notice to the Company.

Dilution Protection. In the event the Company, at any time after the first date of issue of the Series A Preferred Stock and while at least one share of Series A Preferred Stock is outstanding: (a) pays a dividend or otherwise make a distribution or distributions on shares of its common stock or any other equity or equity equivalent securities payable in shares of common stock (which, for avoidance of doubt, shall not include any shares of common stock issued by the Company upon conversion of the Series A Preferred Stock or any debt securities), (b) subdivides outstanding shares of common stock into a larger number of shares, (c) combines (including by way of reverse stock split) outstanding shares of common stock into a smaller number of shares or (d) issues by reclassification of shares of common stock any shares of capital stock of the Company, then in each case the Series A Conversion Price shall be multiplied by a fraction of which (x) the numerator shall be the number of shares of common stock (excluding treasury shares, if any) outstanding immediately before such event and (y) the denominator shall be the number of shares of common stock outstanding immediately after such event. Any adjustment made pursuant to this section shall become effective immediately after the effective date of the applicable event described in subsections (a) through (d) above.

Make-Whole Adjustment. In the event the Company, during the three years immediately following the Initial Closing, subject to certain exceptions, issues in an offering at least $10 million of common stock or securities convertible into or exercisable for common stock at a per share price less than $2.02 per share (the “Make-Whole Price”), the Company will be required to issue to the holders of Series A Preferred Stock a number of shares of common stock equal to the additional number of shares of common stock that such shares of Series A Preferred Stock would be convertible into if the Series A Conversion Price of the Series A Preferred Stock was equal to 105% of the Make-Whole Price (the “Make-Whole Adjustment”). The Company will only be obligated to issue shares with respect to a Make-Whole Adjustment in the first such subsequent offering, if any, following the final closing of the Series A Preferred Stock.

Warrants and Stock Options Issued and Outstanding

In connection with the Series A Preferred Stock private placement, we issued 5-year warrants to purchase 12,376,329 shares of common stock at an exercise price equal to $2.22 per share to the holders of the Series A Preferred stock and we issued 5-year warrants to purchase of 1,179,558 shares of common stock at an exercise price equal to $2.22 per share, with such warrants containing a cashless exercise provision to our placement agent in the Series A private placement. As of September 30, 2017, all 13,555,887 warrants issued in connection with the Series A private placement were outstanding and exercisable.

In addition, as of September 30, 2017, other warrants to purchase an aggregate of 447,721 shares of common stock were outstanding and exercisable with per share exercise prices ranging from $20.00 to $750.00 per share, a weighted average exercise price of $44.52 and expiration dates ranging from March 27, 2018 to December 8, 2019.

Market Price for our Common Stock

Our common stock trades publicly on the Nasdaq Capital Market under the symbol “DFFN.” Prior to November 9, 2016, our common stock traded on the OTCQX over-the-counter bulletin board. The following table sets forth the high and low daily sale prices for our common stock, as reported or quoted by the Nasdaq Capital Market or the OTCQX, as applicable, for each calendar quarter during 2017, 2016 and 2015, after giving effect to the 1-for-10 reverse stock split of our common stock on August 17, 2016. The over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

For the year ended December 31, 2017 |

High |

Low |

|

Fourth Quarter (through [December 18], 2017) |

$[2.97] |

$[1.27] |

|

Third Quarter |

$3.04 |

$1.34 |

|

Second Quarter |

$4.73 |

$2.26 |

|

First Quarter |

$15.50 |

$2.01 |

|

For the year ended December 31, 2016 |

High |

Low |

|

Fourth Quarter |

$7.00 |

$1.94 |

|

Third Quarter |

9.25 |

5.27 |

|

Second Quarter |

11.50 |

8.00 |

|

First Quarter |

17.00 |

8.50 |

|

For the year ended December 31, 2015 |

High |

Low |

|

Fourth Quarter |

$26.00 |

$4.00 |

|

Third Quarter |

17.50 |

8.00 |

|

Second Quarter |

30.50 |

16.50 |

|

First Quarter |

37.50 |

23.50 |

Anti-Takeover Provisions

Delaware Anti-Takeover Law

We are subject to Section 203 of the DGCL. Section 203 generally prohibits a public Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder, unless:

|

• |

prior to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder; |

|

• |

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding (a) shares owned by persons who are directors and also officers of the corporation and (b) shares issued under employee stock plans under which employee participants do not have the right to determine whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

|

• |

on or subsequent to the date of the transaction, the business combination is approved by the board and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2⁄3% of the outstanding voting stock that is not owned by the interested stockholder. |

Section 203 defines a business combination to include:

|

• |

any merger or consolidation involving the corporation and the interested stockholder; |

|

• |

any sale, transfer, pledge or other disposition involving the interested stockholder of 10% or more of the assets of the corporation; |

|

• |

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; |

|

• |

any transaction involving the corporation that has the effect of increasing the proportionate share of its stock owned by the interested stockholder; or |

|

• |

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation. |

In general, Section 203 defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by the entity or person.

UNDERWRITING

We have entered into an underwriting agreement dated , 2017, with H.C. Wainwright & Co., LLC as the sole book-running manager of this offering. Subject to the terms and conditions of the underwriting agreement, we have agreed to sell to the underwriter and the underwriter has agreed to purchase from us, at the public offering price less the underwriting discounts and commissions set forth on the cover page of this prospectus, shares of common stock.

A copy of the underwriting agreement has been filed as an exhibit to the registration statement of which this prospectus is a part. The shares we are offering are being offered by the underwriter subject to certain conditions specified in the underwriting agreement.

We have been advised by the underwriter that it proposes to offer the shares directly to the public at the public offering price set forth on the cover page of this prospectus. Any shares sold by the underwriter to securities dealers will be sold at the public offering price less a selling concession not in excess of $ per share.

The underwriting agreement provides that the underwriter's obligation to purchase the shares we are offering is subject to conditions contained in the underwriting agreement. The underwriter is obligated to purchase and pay for all of the shares offered by this prospectus.

None of the shares included in this offering may be offered or sold, directly or indirectly, nor may this prospectus or any other offering material or advertisements in connection with the offer and sales of any of the shares be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons who receive this prospectus are advised to inform themselves about and to observe any restrictions relating to this offering of the shares and the distribution of this prospectus. This prospectus is neither an offer to sell nor a solicitation of any offer to buy the shares in any jurisdiction where that would not be permitted or legal.

The underwriter has advised us that it does not intend to confirm sales to any accounts over which it exercises discretionary authority.

Underwriting Discounts, Commissions and Expenses

We have agreed to pay an underwriter discount equal to 8% of the aggregate gross proceeds raised in this offering.

The following table shows the public offering price, underwriting discounts and commissions and proceeds, before expenses to us. These amounts are shown assuming both no exercise and full exercise of the underwriter's option to purchase additional shares.

|

Total |

||||||||||||

|

Per Share |

Without |

With |

||||||||||

|

Public offering price |

||||||||||||

|

Underwriting discounts and commissions |

||||||||||||

|

Proceeds, before expenses, to us |

||||||||||||

We estimate the total expenses payable by us for this offering to be approximately $ million, which amount includes (i) an underwriting discount of $ million ($ million if the underwriter's option to purchase additional shares is exercised in full), (ii) a management fee equal to 1% of the aggregate gross proceeds raised in this offering, (iii) a $35,000 non-accountable expense allowance payable to the underwriter, (iv) reimbursement of the accountable expenses of the underwriter equal to $100,000 including the legal fees of the underwriter being paid by us (none of which has been paid in advance), and (v) other estimated expenses of approximately $ which include legal, accounting, printing costs and various fees associated with the registration and listing of our shares.

Option to Purchase Additional Securities

We have granted the underwriter the option to purchase up to additional shares of common stock (15% of the shares issued in the offering) at the public offering price per share, less the underwriting discounts and commissions. The underwriter may exercise its option at any time, and from time to time, within 30 days from the date of this prospectus. If any additional shares are purchased pursuant to the option to purchase additional shares of common stock, the underwriter will purchase these shares on the same terms as those on which the shares are being offered hereby.

Underwriter Warrants

We have agreed to issue to the underwriter warrants to shares of our common stock which represent 5% of the aggregate number of shares of common stock sold in this offering. The underwriter warrants will have a term of five years from the effective date of this prospectus and an exercise price per share equal to $ per share, which represents 125% of the public offering price for the shares sold in this offering. Pursuant to FINRA Rule 5110(g), the underwriter warrants and any shares issued upon exercise of the underwriter warrants shall not be sold, transferred, assigned, pledged, or hypothecated, or be the subject of any hedging, short sale, derivative, put or call transaction that would result in the effective economic disposition of the securities by any person for a period of 180 days immediately following the date of effectiveness or commencement of sales of this offering, except the transfer of any security: (i) by operation of law or by reason of our reorganization; (ii) to any FINRA member firm participating in the offering and the officers or partners thereof, if all securities so transferred remain subject to the lock-up restriction set forth above for the remainder of the time period; (iii) if the aggregate amount of our securities held by the underwriter or related persons do not exceed 1% of the securities being offered; (iv) that is beneficially owned on a pro rata basis by all equity owners of an investment fund, provided that no participating member manages or otherwise directs investments by the fund and the participating members in the aggregate do not own more than 10% of the equity in the fund; or (v) the exercise or conversion of any security, if all securities remain subject to the lock-up restriction set forth above for the remainder of the time period.

Right of First Refusal

We have also granted the underwriter, for a period of 12 months from the closing date of this offering, a right of first refusal to act as sole book-running manager for a public offering of equity or debt securities using an underwriter by us or any of our successors or subsidiaries. We have also agreed to a tail fee equal to the cash and warrant compensation in this offering if any investor to which the underwriter introduced us with respect to this offering during the term of its engagement provides us with further capital in a public or private offering or capital raising transaction during the 12-month period following termination of our engagement of the underwriter.

Nasdaq Capital Market Listing

Our stock is currently traded on the Nasdaq Capital Market under the symbol "DFFN." On , 2017, the last reported sale price of our common stock was $ per share.

Lock-up Agreements

Our officers and directors have agreed with the underwriter to be subject to a lock-up period of 90 days following the date of this prospectus. This means that, during the applicable lock-up period, such persons may not offer for sale, contract to sell, sell, distribute, grant any option, right or warrant to purchase, pledge, hypothecate or otherwise dispose of, directly or indirectly, any shares of our common stock or any securities convertible into, or exercisable or exchangeable for, shares of our common stock. We have also agreed in the underwriting agreement, subject to certain exceptions, to similar lock-up restrictions on the issuance and sale of our securities for 90 days following the closing of this offering. The underwriter may, in its sole discretion and without notice, waive the terms of any of these lock-up agreements.

Stabilization, Short Positions and Penalty Bids

The underwriter may engage in syndicate covering transactions, stabilizing transactions and penalty bids or purchases for the purpose of pegging, fixing or maintaining the price of our common stock:

|

● |

Syndicate covering transactions involve purchases of shares in the open market after the distribution has been completed in order to cover syndicate short positions. Such a naked short position would be closed out by buying shares in the open market. A naked short position is more likely to be created if the underwriter is concerned that there could be downward pressure on the price of the shares in the open market after pricing that could adversely affect investors who purchase in the offering. |

|

● |

Stabilizing transactions permit bids to purchase the shares so long as the stabilizing bids do not exceed a specific maximum. |

|

● |