Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Diffusion Pharmaceuticals Inc. | ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Diffusion Pharmaceuticals Inc. | ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Diffusion Pharmaceuticals Inc. | ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Diffusion Pharmaceuticals Inc. | ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2015

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ______________.

Commission file number: 000-24477

RESTORGENEX CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

30-0645032 |

|

(State of other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

2150 E. Lake Cook Road, Suite 750

Buffalo Grove, Illinois 60089

(Address of principal executive offices, including zip code)

(847) 777-8092

(Registrant’s telephone number including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller reporting company ☒ |

|

|

|

(Do not check if a smaller reporting company) |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The number of shares of common stock outstanding at November 10, 2015 was 18,614,968 shares.

RESTORGENEX CORPORATION

form 10-q

SEPTEMBER 30, 2015

INDEX

|

Page | |||

|

PART I – FINANCIAL INFORMATION |

1 | ||

|

ITEM 1. |

FINANCIAL STATEMENTS |

1 | |

|

ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

15 | |

|

ITEM 3. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

27 | |

|

ITEM 4. |

CONTROLS AND PROCEDURES |

27 | |

|

PART II – OTHER INFORMATION |

29 | ||

|

ITEM 1. |

LEGAL PROCEEDINGS |

29 | |

|

ITEM 1A. |

RISK FACTORS |

29 | |

|

ITEM 2. |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

29 | |

|

ITEM 3. |

DEFAULTS UPON SENIOR SECURITIES |

30 | |

|

ITEM 4. |

MINE SAFETY DISCLOSURES |

30 | |

|

ITEM 5. |

OTHER INFORMATION |

30 | |

|

ITEM 6. |

EXHIBITS |

30 | |

___________________________

As used in this report, the terms “RestorGenex,” the “Company,” “we,” “us,” “our” and similar references refer to RestorGenex Corporation and our consolidated subsidiaries, and the term “common stock” refers to our common stock, par value $0.001 per share.

This report contains the following trademarks, trade names and service marks of ours: RestorGenex. This report also contains trademarks, trade names and service marks that are owned by other persons or entities.

This quarterly report on Form 10-Q contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by those sections. For more information, see “Part I. Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Special Note Regarding Forward-Looking Statements.”

PART I – FINANCIAL INFORMATION

|

ITEM 1. |

FINANCIAL STATEMENTS |

|

RESTORGENEX CORPORATION |

|

Condensed Consolidated Balance Sheets |

|

September 30, 2015 and December 31, 2014 |

|

(Unaudited) |

|

September 30, |

December 31, |

|||||||

|

2015 |

2014 |

|||||||

|

ASSETS |

||||||||

|

CURRENT ASSETS |

||||||||

|

Cash and cash equivalents |

$ | 14,580,596 | $ | 21,883,887 | ||||

|

Prepaid expenses, deposits and other assets |

1,049,254 | 2,286,930 | ||||||

| 15,629,850 | 24,170,817 | |||||||

|

PROPERTY AND EQUIPMENT, NET |

63,389 | 102,315 | ||||||

|

OTHER ASSETS |

||||||||

|

Intangible assets, net |

6,449,628 | 6,449,628 | ||||||

|

Goodwill |

985,000 | 12,055,991 | ||||||

|

Investment in Or-Genix |

250,000 | - | ||||||

|

TOTAL ASSETS |

$ | 23,377,867 | $ | 42,778,751 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

||||||||

|

CURRENT LIABILITIES |

||||||||

|

Accounts payable |

$ | 240,381 | $ | 417,307 | ||||

|

Other accrued liabilities |

1,794,230 | 1,921,293 | ||||||

| 2,034,611 | 2,338,600 | |||||||

|

DEFERRED TAXES |

2,274,526 | 2,274,526 | ||||||

|

TOTAL LIABILITIES |

4,309,137 | 4,613,126 | ||||||

|

COMMITMENTS AND CONTINGENCIES |

||||||||

|

STOCKHOLDERS' EQUITY |

||||||||

|

Common stock: |

||||||||

|

Issued and outstanding; $0.001 par value; 1,000,000,000 shares authorized; 2015 - 18,614,968; 2014 - 18,614,968 |

18,615 | 18,615 | ||||||

|

Additional paid-in-capital |

115,050,722 | 113,437,384 | ||||||

|

Accumulated deficit |

(96,000,607 | ) | (75,290,374 | ) | ||||

|

Total stockholders' equity |

19,068,730 | 38,165,625 | ||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

$ | 23,377,867 | $ | 42,778,751 | ||||

See accompanying notes to the condensed consolidated financial statements.

|

RESTORGENEX CORPORATION |

|

Condensed Consolidated Statements of Operations |

|

Three and nine months ended September 30, 2015 and 2014 |

|

(Unaudited) |

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2015 |

2014 |

2015 |

2014 |

|||||||||||||

|

REVENUES |

$ | - | $ | - | $ | - | $ | - | ||||||||

|

TOTAL REVENUES |

- | - | - | - | ||||||||||||

|

EXPENSES |

||||||||||||||||

|

Research and development |

692,709 | 1,273,186 | 3,360,057 | 1,709,424 | ||||||||||||

|

General and administrative |

1,456,567 | 1,869,840 | 5,298,945 | 4,091,530 | ||||||||||||

|

Impairment of goodwill |

11,070,991 | - | 11,070,991 | - | ||||||||||||

|

Depreciation and amortization |

5,393 | 368,924 | 17,875 | 883,995 | ||||||||||||

|

Former employee severance expense |

- | - | 967,683 | - | ||||||||||||

|

TOTAL EXPENSES |

13,225,660 | 3,511,950 | 20,715,551 | 6,684,949 | ||||||||||||

|

LOSS FROM OPERATIONS |

(13,225,660 | ) | (3,511,950 | ) | (20,715,551 | ) | (6,684,949 | ) | ||||||||

|

OTHER (INCOME)/EXPENSES |

||||||||||||||||

|

Loss on settlement of notes payable - related parties |

- | - | - | 1,829,562 | ||||||||||||

|

Loss on settlement of notes payable |

- | - | - | 876,543 | ||||||||||||

|

Other (income) expenses |

(1,165 | ) | (3,151 | ) | (5,318 | ) | (3,597 | ) | ||||||||

|

Interest expense |

- | 86,670 | - | 281,548 | ||||||||||||

|

TOTAL OTHER (INCOME)/EXPENSES |

(1,165 | ) | 83,519 | (5,318 | ) | 2,984,056 | ||||||||||

|

LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES |

(13,224,495 | ) | (3,595,469 | ) | (20,710,233 | ) | (9,669,005 | ) | ||||||||

|

Benefit from income taxes |

- | 145,999 | - | 384,128 | ||||||||||||

|

NET LOSS |

(13,224,495 | ) | (3,449,470 | ) | (20,710,233 | ) | (9,284,877 | ) | ||||||||

|

TOTAL BASIC AND DILUTED NET LOSS PER SHARE |

$ | (0.71 | ) | $ | (0.18 | ) | $ | (1.11 | ) | $ | (0.76 | ) | ||||

|

BASIC WEIGHTED AVERAGE SHARES OUTSTANDING |

18,614,968 | 18,671,121 | 18,614,968 | 12,155,041 | ||||||||||||

|

FULLY-DILUTED WEIGHTED AVERAGE SHARES OUTSTANDING |

18,614,968 | 18,671,121 | 18,614,968 | 12,155,041 | ||||||||||||

See accompanying notes to the condensed consolidated financial statements.

|

RESTORGENEX CORPORATION |

|

Condensed Consolidated Statements of Cash Flows |

|

Nine months ended September 30, 2015 and 2014 |

|

(Unaudited) |

|

Nine Months Ended September 30, |

||||||||

|

2015 |

2014 |

|||||||

|

CASH FLOWS (USED IN) OPERATING ACTIVITIES |

||||||||

|

Net loss |

$ | (20,710,233 | ) | $ | (9,284,877 | ) | ||

|

Adjustments to reconcile net loss to net cash (used in) operating activities |

||||||||

|

Depreciation and amortization |

17,875 | 883,995 | ||||||

|

Loss on disposal of fixed assets |

49,278 | 6,056 | ||||||

|

Employee and director stock-based compensation - non-cash |

1,613,854 | 1,075,131 | ||||||

|

Stock warrant expense - non-cash |

499,003 | - | ||||||

|

Deferred income taxes |

- | (384,128 | ) | |||||

|

Impairment of goodwill |

11,070,991 | - | ||||||

|

Loss on settlement of note payable - related parties |

- | 1,829,562 | ||||||

|

Loss on settlement of note payable |

- | 876,543 | ||||||

|

Changes in other assets and liabilities affecting cash flows used in operating activities |

||||||||

|

Prepaid expenses, deposits and other assets |

738,157 | 540,069 | ||||||

|

Accounts payable and accrued liabilities |

(303,989 | ) | (2,642,272 | ) | ||||

|

Net cash (used in) operating activities |

(7,025,064 | ) | (7,099,921 | ) | ||||

|

CASH FLOWS (USED IN) INVESTING ACTIVITIES |

||||||||

|

Investment in Or-Genix |

(250,000 | ) | - | |||||

|

Purchase of fixed assets |

(28,227 | ) | - | |||||

|

Net cash (used in) investing activities |

(278,227 | ) | - | |||||

|

CASH FLOWS PROVIDED BY FINANCING ACTIVITIES |

||||||||

|

Proceeds on notes payable |

- | 400,000 | ||||||

|

Payment of notes payable |

(1,540,000 | ) | ||||||

|

Proceeds from issuance of common stock |

- | 31,773,293 | ||||||

|

Net cash provided by financing activities |

- | 30,633,293 | ||||||

|

NET (DECREASE) INCREASE CASH AND CASH EQUIVALENTS |

(7,303,291 | ) | 23,533,372 | |||||

|

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD |

21,883,887 | 254,964 | ||||||

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD |

$ | 14,580,596 | $ | 23,788,336 | ||||

|

NON-CASH INVESTING AND FINANCING ACTIVITIES |

||||||||

|

Acquisition of business in exchange for common stock |

$ | - | $ | 6,800,000 | ||||

|

Conversion of accounts payable to notes payable related to Company's outside law firm |

$ | - | $ | 407,998 | ||||

|

Issuance of shares of common stock and stock warrants as payment of notes payable - related parties |

$ | - | $ | 1,105,475 | ||||

|

Issuance of shares of common stock and stock warrants as payment of notes payable |

$ | - | $ | 517,945 | ||||

|

Issuance of shares of common stock and stock warrants as payment of accounts payable and accrued liabilities |

$ | - | $ | 1,361,404 | ||||

See accompanying notes to the condensed consolidated financial statements.

RESTORGENEX CORPORATION

form 10-q

SEPTEMBER 30, 2015

NOTES TO condensed CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

|

|

|

1. |

Description of Business |

RestorGenex Corporation (“Company”) is a specialty biopharmaceutical company focused on developing products for oncology, ophthalmology and dermatology. The Company’s lead product is a novel PI3K/Akt/mTOR pathway inhibitor which has completed two Phase I clinical trials for age-related macular degeneration and is in pre-clinical development in oncology, specifically glioblastoma multiforme. The Company’s current pipeline also includes a “soft” anti-androgen compound for the treatment of acne vulgaris. The Company’s novel inhibition of the PI3K/Akt/mTOR pathway and unique targeting of the androgen receptor show promise in a number of additional diseases, which the Company is evaluating for the purpose of creating innovative therapies that are safe and effective treatments to satisfy unmet medical needs. In addition, as a part of the Company’s corporate strategy, it continues to seek, consider, and if appropriate, implement strategic alternatives with respect to its products and the Company, including licenses, business collaborations and other business combinations or transactions with other pharmaceutical and biotechnology companies.

|

2. |

Basis of Presentation and Significant Accounting Policies |

Basis of Presentation

The unaudited financial statements presented in this report represent the consolidation of RestorGenex Corporation and its consolidated subsidiaries.

The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) applicable to interim financial statements. Accordingly, certain information related to significant accounting policies and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) have been condensed or omitted. These unaudited condensed consolidated financial statements reflect, in the opinion of management, all material adjustments (which include only normally recurring adjustments) necessary to fairly state, in all material respects, the Company’s financial position, results of operations and cash flows for the periods presented.

Operating results for interim periods are not necessarily indicative of the results that can be expected for any subsequent interim period or for a full year. These interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto included in its annual report on Form 10-K for the year ended December 31, 2014.

On June 18, 2015, the Company changed its state of incorporation from the State of Nevada to the State of Delaware.

Correction of Prior Period Misstatements

In the fourth quarter of 2014, the Company recorded certain adjustments for misstatements related to prior 2014 interim and prior annual periods that had been deemed immaterial. See Note 2 to the Company’s consolidated financial statements for the year ended December 31, 2014, included in the Company’s annual report on Form 10-K for the year ended December 31, 2014, for further information as to the nature of the adjustments recorded in the fourth quarter of 2014.

For the nine months ended September 30, 2014 consolidated statements of operations, the current period presentation of $1,829,562 of “loss on settlement of notes payable – related parties” and $876,543 of “loss on settlement of notes payable” were moved to other expenses from operating expenses reflecting the correction of an immaterial prior period misstatement related to the classification of losses on settlement of notes payable.

$145,999 and $384,128 of income tax benefit recognized in the three and nine months ended September 30, 2014 was reclassified to benefit from income taxes in the current period condensed consolidated statements of operations from other (income) expense in the prior year presentation, representing the correction of a prior period immaterial misstatement related to the presentation of income tax benefit.

Reclassifications

Certain 2014 amounts were reclassified to conform to the manner of presentation in the current period. These reclassifications included:

$286,774 and $860,322 of amortization expense recognized in the three and nine months ended September 30, 2014 condensed consolidated statements of operations from amortizing the prepaid expense asset for general financial advisory and investment banking services described in Note 4 to these condensed consolidated financial statements was reclassified to “general and administrative” expense in the current period condensed consolidated statements of operations presentation from “depreciation and amortization” expense where it was presented in the prior period. In the condensed consolidated statements of cash flows, the same amount was reclassified within the “cash flows used in operating activities” section from “depreciation and amortization” in the prior period presentation to “prepaid expenses, deposits and other assets” in the current period presentation.

$783,932 and $1,075,131 of expense recognized in the three and nine months ended September 30, 2014 condensed consolidated statements of operations presentation from stock-based compensation and warrant expense described in Notes 9 and 10 to these condensed consolidated financial statements was reclassified to “general and administrative” ($440,935 and $699,310 for the three and nine months ended September 30, 2014) and “research and development” ($342,997 and $375,821 for the three and nine months ended September 30, 2014) in the current period condensed consolidated statements of operations presentation from “warrants, options and stock compensation” expense in the prior period presentation. In the condensed consolidated statements of cash flows, the same amount was reclassified within the “cash flows used in operating activities” section from “warrants, options and stock compensation” in the prior period presentation to “employee and director stock-based compensation – non-cash” in the amount of $1,075,131 in the current period presentation.

$294,390 and $810,680 of legal and professional services expense recognized in the three and nine months ended September 30, 2014 condensed consolidated statements of operations was reclassified to “general and administrative” expense in the current period condensed consolidated statements of operations presentation from “legal and professional services” expense in the prior period presentation.

$408,953 of “loss on settlement of accounts payable and accrued liabilities” recognized in the nine months ended September 30, 2014 condensed consolidated statements of operations was reclassified to “general and administrative” expense in the current period condensed consolidated statements of operations presentation from “loss on settlement of accounts payable and accrued liabilities” in the prior period presentation.

In the condensed consolidated statements of cash flows within net cash (used in) operating activities, $408,953 from loss on settlement of issuing shares for liabilities and $73,420 from noncash interest expense on notes payable in the prior period presentation was reclassified to accounts payable and accrued liabilities in the amount of $482,373 in the current period presentation.

Use of Estimates

The preparation of the Company’s condensed consolidated financial statements in accordance with U.S. GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and the disclosure of contingent assets and liabilities in the Company’s condensed consolidated financial statements and accompanying notes. Although these estimates are based on the Company’s knowledge of current events and actions that the Company may undertake in the future, actual results may differ from such estimates and assumptions.

Income Taxes

The Company has no current tax provision due to its current and accumulated losses, which result in net operating loss carryforwards. The Company’s deferred tax liability relates to indefinite lived intangible assets. See Note 18 to the Company’s consolidated financial statements for the year ended December 31, 2014 included in the Company’s annual report on Form 10-K for the year ended December 31, 2014.

Comprehensive Income (Loss)

The Company does not have items of other comprehensive income (loss) for the three and nine months ended September 30, 2015 or September 30, 2014; and therefore, comprehensive loss equals net loss for those periods.

Recently Issued Accounting Pronouncements

In April 2014, the Financial Accounting Standards Board (the “FASB”) issued guidance that changes the criteria for determining which disposals can be presented as discontinued operations and modifies related disclosure requirements. Under the new guidance, a discontinued operation is defined as a component or group of components that is disposed of or is classified as held for sale and represents a strategic shift that has or will have a major effect on an entity’s operations and financial results. The change is effective for fiscal years, and interim reporting periods within those years, beginning on or after December 15, 2014, which means the Company’s first quarter of 2015, with early adoption permitted. The guidance applies prospectively to new disposals and new classifications of disposal groups as held for sale after the effective date. The adoption of this new guidance did not affect the Company’s consolidated financial position, results of operations or cash flows.

In May 2014, the FASB issued Accounting Standards Update (“ASU”) 2014-09, “Revenue from Contracts with Customers (Accounting Standards Codification (“ASC”) Topic 606).” In July 2015, the FASB deferred the effective date of ASU 2014-09 by one year. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve that core principle, an entity should apply the following steps:

Step 1: Identify the contract(s) with a customer.

Step 2: Identify the performance obligation in the contract.

Step 3: Determine the transaction price.

Step 4: Allocate the transaction price to the performance obligations in the contract.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation.

For public entities, ASU 2014-09 is now effective for fiscal years, and interim periods within those years, beginning after December 15, 2017. Early adoption is permitted as of January 1, 2017. Entities have the option of applying either a full retrospective approach or a modified approach to adopt the guidance in ASU 2014-09. The Company is evaluating the potential impact of adoption of this ASU on its consolidated financial statements.

In August 2014, the FASB issued ASU 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (“ASU 2014-15”). This pronouncement provides additional guidance surrounding the disclosure of going concern uncertainties in the financial statements and implementing requirements for management to perform interim and annual assessments of an entity’s ability to continue as a going concern within one year of the date the financial statements are issued. The Company will adopt this guidance as of January 1, 2016. The Company does not anticipate that the adoption of this guidance will result in additional disclosures; however, management will begin performing the periodic assessments required by ASU 2014-15 on its effective date.

|

3. |

Acquisitions |

Paloma and VasculoMedics Acquisitions

On March 3, 2014, the Company entered into an agreement and plan of merger with Paloma Acquisition, Inc., Paloma Pharmaceuticals, Inc. (“Paloma”) and David Sherris, Ph.D., as founding stockholder and holder representative, pursuant to which the Company agreed to acquire by virtue of a merger all of the outstanding capital stock of Paloma, with Paloma becoming a wholly owned subsidiary of the Company. On March 28, 2014, the merger with Paloma was effected and the Company issued an aggregate of 2,500,000 shares of common stock to the holders of Paloma’s common stock and its derivative securities, which included the assumption of promissory notes of Paloma in the aggregate amount (including both principal amount and accrued interest) of approximately $1,151,725, to be paid on the first anniversary of the closing date of the Paloma merger. On August 5, 2014, the Company repaid in full the then-outstanding balance, including accrued interest, of the Paloma assumed promissory notes, totaling $1,331,007. The notes were terminated upon their prepayment and there were no early termination fees.

Also on March 3, 2014, the Company entered into an agreement and plan of merger with VasculoMedics Acquisition, Inc., VasculoMedics, Inc. (“VasculoMedics”) and David Sherris, Ph.D. pursuant to which the Company agreed to acquire by virtue of a merger all of the outstanding capital stock of VasculoMedics, with VasculoMedics becoming a wholly owned subsidiary of the Company. The VasculoMedics merger was concurrently closed with and as a condition to the closing of the Paloma merger on March 28, 2014 and the Company issued an aggregate of 220,000 shares of common stock to the VasculoMedics stockholders.

The acquisitions of Paloma and VasculoMedics were additional steps in the implementation of the Company’s plan to position itself as a specialty biopharmaceutical company. The total purchase consideration for the Paloma and VasculoMedics acquisitions was $6,800,000.

The transaction has been accounted for using the acquisition method of accounting which requires that assets acquired and liabilities assumed be recognized at their fair values as of the acquisition date. The valuation technique utilized to value the intangible assets was the cost approach. The following table summarizes the assets acquired and liabilities assumed as of the acquisition date:

|

March 3, 2014 |

||||

|

Intangible assets |

$ | 6,449,628 | ||

|

Prepaid expenses and other current assets |

23,642 | |||

|

Property, plant and equipment |

58,123 | |||

|

Goodwill |

3,829,858 | |||

|

Accrued liabilities |

(135,000 | ) | ||

|

Notes payable and accrued interest |

(1,151,725 | ) | ||

|

Deferred tax liability |

(2,274,526 | ) | ||

|

Net assets acquired |

$ | 6,800,000 | ||

Pro Forma Financial Information (Unaudited)

The following pro forma financial information reflects the consolidated results of operations of the Company as if the acquisitions of Paloma and VasculoMedics had taken place on January 1, 2013. The pro forma information includes acquisition and integration expenses. The pro forma financial information is not necessarily indicative of the results of operations as they would have been had the transactions been effected on the assumed date.

|

Nine Months Ended September 30, 2014 |

||||

|

Net revenues |

$ | 0 | ||

|

Net loss |

(9,591,971 | ) | ||

|

Basic and diluted loss per share |

$ | (0.70 | ) | |

|

4. |

Prepaid Expenses, Deposits and Other Assets |

In July 2013, the Company entered into an agreement with Maxim Group LLC (“Maxim”) to provide general financial advisory and investment banking services to the Company for three years on a non-exclusive basis. Under this agreement, the Company issued Maxim 210,250 shares of the Company’s common stock. These shares were valued at $15.00 per share, which was the closing price of the common stock on the date of the agreement, for a total expense of $3,153,750. This expense is being recognized ratably over the life of the three-year term of the agreement at $262,813 per quarter. As of September 30, 2015, $788,436 remained in prepaid expenses, deposits and other assets related to the Maxim agreement on the condensed consolidated balance sheets.

|

5. |

Property and Equipment, Net |

Property and equipment were as follows:

|

September 30, 2015 |

December 31, 2014 |

|||||||

|

Computing equipment and office machines |

$ | 38,786 | $ | 16,072 | ||||

|

Furniture and fixtures |

35,196 | 32,945 | ||||||

|

Leasehold improvements |

5,157 | 60,017 | ||||||

| 79,139 | 109,034 | |||||||

|

Less accumulated depreciation |

(15,750 | ) | (6,719 | ) | ||||

|

Property and equipment, net |

$ | 63,389 | $ | 102,315 | ||||

For the three and nine months ended September 30, 2015, depreciation was $5,393 and $17,875, respectively. For the three and nine months ended September 30, 2014, depreciation was $1,905 and $8,971, respectively. During the nine months ended September 30, 2015 and 2014, the Company disposed of certain property and equipment, resulting in a loss on disposal of $49,278 and $6,056, respectively, which is included within general and administrative expenses on the condensed consolidated statements of operations.

|

6. |

Intangible Assets, Net |

Intangible assets were as follows:

|

September 30, 2015 |

December 31, 2014 |

|||||||||||||||||||||||

|

Gross Carrying Amount |

Accumulated Amortization |

Intangible Assets, net |

Gross Carrying Amount |

Accumulated Amortization |

Intangible Assets, net |

|||||||||||||||||||

|

In-process research and development costs (IPR&D) |

$ | 6,449,628 | $ | 0 | $ | 6,449,628 | $ | 6,449,628 | $ | 0 | $ | 6,449,628 | ||||||||||||

For the three months and nine months ended September 30, 2014, the Company recorded amortization expense on finite lived intangible assets of $367,019 and $875,024 within depreciation and amortization on the condensed consolidated statements of operations. Such amortization expense related to intangible assets acquired in the Company’s acquisition of Canterbury Laboratories LLC and Hygeia Therapeutics, Inc., which the Company abandoned and wrote-off in the fourth quarter of 2014. See Note 6 to the Company’s consolidated financial statements for the year ended December 31, 2014 included in the Company’s annual report on Form 10-K for the year ended December 31, 2014.

During the second quarter of 2015, the Company performed its annual review for impairment of its in-process research and development (“IPR&D”) intangible asset as prescribed in ASC 350 and also following guidance from “AICPA’s Accounting & Valuation Guide: Assets Acquired to Be Used in R&D Activities,” and determined that there had been no impairment to this asset. In connection with an impairment of the Company’s goodwill as discussed in Note 7 below, the Company re-assessed the IPR&D asset for impairment as of September 30, 2015 and concluded there continues to be no impairment to this asset.

7. Goodwill

Goodwill is the excess of the cost of an acquired entity over the net amounts assigned to tangible and intangible assets acquired and liabilities assumed. The Company applies ASC 350 “Goodwill and Other Intangible Assets,” which requires testing goodwill for impairment on an annual basis. The Company assesses goodwill for impairment as part of its annual reporting process in the fourth quarter. In between valuations, the Company conducts additional tests if circumstances indicate a need for testing. The Company evaluates goodwill on a consolidated basis as the Company is organized as a single reporting unit.

An annual impairment review was most recently completed on December 31, 2014. As of the December 31, 2014 impairment review, there was no impairment loss associated with recorded goodwill as the estimated fair value exceeded the carrying amount. The fair value of the reporting unit as of December 31, 2014, for the purpose of assessing the impairment of goodwill, was determined based on a primary analysis method, which provided a market capitalization of $66.1 million as of December 31, 2014. The Company determined that the fair value of its businesses for accounting purposes was equal to its market capitalization of approximately $66.1 million, which the Company then compared to its stockholders’ equity of $38.2 million, noting that fair value exceeded the carrying value, and therefore, indicated no impairment of goodwill.

The Company considers certain triggering events when evaluating whether an interim goodwill impairment analysis is warranted. Among these would be a significant long-term decrease in the market capitalization of the Company based on events specific to the Company’s operations. The Company’s market capitalization has decreased significantly during the past several months as the Company’s per share price has declined from $2.80 as of April 30, 2015 to $0.90 as of September 30, 2015. As of September 30, 2015, the Company’s market capitalization was approximately $16.7 million, falling to an amount significantly less than the Company’s stockholders’ equity. In September 2015, management concluded that given the significant and sustained decrease in the Company’s share price to a level below its stockholders’ equity, combined with information on the Company’s fair value derived from strategic discussions with third parties during the third quarter of 2015, a triggering event requiring an interim assessment of goodwill impairment had occurred during the third quarter of 2015. Management performed the goodwill impairment assessment using a market approach to estimating the fair value of the Company, using multiple inputs, some weighted heavier than others. The inputs included the Company’s market capitalization, which, based on the inactive trading activity in the Company’s stock, is a lower level input on the fair value measurement hierarchy, and other more heavily weighted unobservable inputs as to the Company’s fair value derived from strategic discussions with third parties. The initial step one assessment indicated that it was likely the Company’s goodwill was impaired, and the Company proceeded to perform step two of its goodwill impairment assessment. As a result of that assessment, the Company concluded that a goodwill impairment loss of $11,070,991 was necessary. Following the recording of the goodwill impairment loss, the Company’s goodwill as of September 30, 2015 was $985,000. The Company will perform its next annual goodwill impairment review during the fourth quarter of 2015.

|

|

|

8. |

Other Accrued Liabilities |

Other accrued liabilities consisted of the following:

|

September 30, 2015 |

December 31, 2014 |

|||||||

|

Payroll related |

$ | 579,009 | $ | 741,032 | ||||

|

Former employee severance |

453,504 | 0 | ||||||

|

Professional fees |

108,580 | 217,663 | ||||||

|

Board fees |

55,938 | 55,000 | ||||||

|

Rent liability for facilities no longer occupied |

424,155 | 808,418 | ||||||

|

Other |

173,044 | 99,180 | ||||||

| $ | 1,794,230 | $ | 1,921,293 | |||||

|

9. |

Stockholder’s Equity |

Common Stock

During the three and nine months ended September 30, 2015, the Company did not issue, purchase or retire any shares of its common stock.

Warrants

During the three months and nine months ended September 30, 2015, the Company did not grant any warrants to purchase shares of its common stock and no warrants were exercised. During the three and nine months ended September 30, 2015, warrants to purchase an aggregate of 20,700 and 35,700 shares of common stock expired unexercised, respectively.

In December 2014, the Company issued to its investor relations firm a warrant to purchase 250,000 shares of common stock at an exercise price of $3.75 in consideration for investor relations services for one year, commencing December 15, 2014 and ending December 14, 2015. The warrants were immediately vested and exercisable as of the date of grant and have a five-year term from the date of grant, resulting in a Black-Scholes warrant value of $517,576. The Company ended its relationship with the investor relations firm in September 2015 resulting in the Company expensing the remaining Black-Sholes warrant value during the three months ended September 30, 2015. Of the total Black-Scholes warrant value of $517,576, $237,433 and $496,010 were expensed in general and administrative expenses during the three months and nine months ended September 30, 2015, respectively.

Warrants to purchase an aggregate of 4,788,066 shares of the Company’s common stock were outstanding and exercisable as of September 30, 2015, with per share exercise prices ranging from $2.00 to $200.00 and a weighted average exercise price of $8.22 per share.

|

10. |

Stock-Based Compensation |

During the three and nine months ended September 30, 2015, the Company granted options to purchase 0 and 6,650 shares of its common stock, respectively, and no options were exercised. During the three and nine months ended September 30, 2015, options to purchase an aggregate of 68,268 and 624,892 shares of common stock were cancelled or expired unexercised. Options to purchase an aggregate of 3,030,005 shares of common stock were outstanding as of September 30, 2015, and options to purchase an aggregate of 1,648,520 shares of common stock were exercisable as of September 30, 2015. The options outstanding as of September 30, 2015 had per share exercise prices ranging from $1.90 to $54.00 and a weighted average exercise price of $4.27 per share

During the nine months ended September 30, 2015, the Company amended certain options to extend the vesting and the post-termination exercise period, resulting in additional stock-based compensation expense of $45,953 in the three and nine months ended September 30, 2015.

On March 5, 2015, the Company’s Board of Directors approved the RestorGenex Corporation 2015 Equity Incentive Plan (the “2015 Equity Plan”), and on June 17, 2015, the Company’s stockholders approved the 2015 Equity Plan. The 2015 Equity Plan allows for the issuance of up to a maximum of 2,500,000 shares of common stock in connection with the grant of stock-based awards, including stock options, restricted stock, restricted stock units, stock appreciation rights and other types of awards as deemed appropriate. As of September 30, 2015, options to purchase 6,650 shares of common stock were outstanding and 2,493,350 shares of common stock remained available for grant under the 2015 Equity Plan.

Options are granted with per share exercise prices equal to the per share fair value of the common stock on the date of grant. The Company recognizes the fair value of stock-based awards granted in exchange for employee and non-employee services as a cost of those services. The Company recognizes stock-based compensation expense for option awards on a straight-line basis over the vesting period.

The following table summarizes the stock-based compensation expense for employees and non-employees recognized in the Company’s condensed consolidated statements of operations for the periods indicated:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2015 |

2014 |

2015 |

2014 |

|||||||||||||

|

Research and development |

$ | 106,692 | $ | 342,997 | $ | 490,862 | $ | 375,821 | ||||||||

|

General and administrative |

374,545 | 440,935 | 1,122,992 | 699,310 | ||||||||||||

|

Total stock-based compensation expense |

$ | 481,237 | $ | 783,932 | $ | 1,613,854 | $ | 1,075,131 | ||||||||

As of September 30, 2015, the Company had $3,156,902 of total unrecognized compensation cost related to unvested stock-based compensation arrangements granted to employees. That cost is expected to be recognized over a weighted-average service period of 1.66 years.

|

11. |

Basic and Diluted Net Loss Per Share |

Basic net loss per share is computed by dividing the net loss by the weighted average number of shares of common stock outstanding for the period. Diluted net loss per share is computed similar to basic net loss per share except that the denominator is increased to include the number of additional shares of common stock that would have been outstanding if all of the Company’s potential shares, warrants and stock options had been issued and if the additional shares are dilutive.

Because of their anti-dilutive effect, all stock options and warrants for the three and nine months ended September 30, 2015 and 2014, respectively, have been excluded from the calculation of diluted net loss per share.

|

Three Months Ended |

Nine Months Ended |

|||||||||||||||

|

2015 |

2014 |

2015 |

2014 |

|||||||||||||

|

Basic and dilutive numerator: |

||||||||||||||||

|

Net loss, as reported |

$ | (13,224,495 | ) | $ | (3,449,470 | ) | $ | (20,710,233 | ) | $ | (9,284,877 | ) | ||||

|

Denominator: |

||||||||||||||||

|

Weighted-average shares outstanding |

18,614,968 | 18,671,121 | 18,614,968 | 12,155,041 | ||||||||||||

|

Net loss per share - basic and diluted |

$ | (0.71 | ) | $ | (0.18 | ) | $ | (1.11 | ) | $ | (0.76 | ) | ||||

|

|

|

12. |

Commitments and Contingencies |

Office Space Rental

On September 4, 2014, the Company entered into a lease agreement for office space totaling approximately 2,900 square feet in Buffalo Grove, Illinois and relocated its corporate headquarters to this facility in the third quarter of 2014. The term of the lease commenced on September 15, 2014 and will continue through February 28, 2018. The Company has an option to renew the lease for one renewal term of three years. Under the lease agreement, the first five months were rent free and then the base rent is approximately $6,000 per month through February 28, 2016 for a total of approximately $72,000 per year. The base rent will increase to approximately $6,100 per month for the first year thereafter and $6,200 per month for the second year thereafter.

The Company’s contractual obligations with respect to rental commitments as of September 30, 2015 were as follows:

|

Rental Commitments |

||||

|

Payments due by period: |

||||

|

One year |

$ | 72,561 | ||

|

Two years |

73,996 | |||

|

Three years |

31,081 | |||

|

Thereafter |

— | |||

|

Total |

$ | 177,638 | ||

Purchase Obligations

As of September 30, 2015, the Company had future purchase obligation commitments for $528,009 in regards to the preclinical development of RES-529 and RES-440.

Litigation

From time to time, the Company is subject to various pending or threatened legal actions and proceedings, including those that arise in the ordinary course of its business, which may include employment matters, breach of contract disputes and stockholder litigation. Such actions and proceedings are subject to many uncertainties and to outcomes that are not predictable with assurance and that may not be known for extended periods of time. The Company records a liability in its condensed consolidated financial statements for costs related to claims, including future legal costs, settlements and judgments, where the Company has assessed that a loss is probable and an amount can be reasonably estimated. If the reasonable estimate of a probable loss is a range, the Company records the most probable estimate of the loss or the minimum amount when no amount within the range is a better estimate than any other amount. The Company discloses a contingent liability even if the liability is not probable or the amount is not estimable, or both, if there is a reasonable possibility that a material loss may have been incurred. In the opinion of management, as of September 30, 2015, the amount of liability, if any, with respect to these matters, individually or in the aggregate, will not materially affect the Company’s consolidated results of operations, financial position or cash flows.

On August 7, 2014, a complaint was filed in the Superior Court of Los Angeles County, California by Paul Feller, the Company’s former Chief Executive Officer under the caption Paul Feller v. RestorGenex Corporation, Pro Sports & Entertainment, Inc., ProElite, Inc. and Stratus Media Group, GmbH (Case No. BC553996). The complaint asserts various causes of action, including, among other things, promissory fraud, negligent misrepresentation, breach of contract, breach of employment agreement, breach of the covenant of good faith and fair dealing, violations of the California Labor Code and common counts. The plaintiff is seeking, among other things, compensatory damages in an undetermined amount, punitive damages, accrued interest and an award of attorneys’ fees and costs. On December 30, 2014, the Company filed a petition to compel arbitration and a motion to stay the action. On April 1, 2015, the plaintiff filed a petition in opposition to the Company’s petition to compel arbitration and a motion to stay the action. After a hearing for the petition and motion on April 14, 2015, the Court granted the Company’s petition to compel arbitration and a motion to stay the action. A status conference is scheduled for January 14, 2016. The Company believes this action is without merit and intends to defend the action vigorously. Because this lawsuit is in an early stage, the Company does not believe a loss is probable, and is unable to predict the outcome of the lawsuit and the possible loss or range of loss, if any, associated with its resolution or any potential effect the lawsuit may have on the Company’s financial position, results of operations or cash flows. Depending on the outcome or resolution of this lawsuit, it could have a material effect on the Company’s financial position, results of operations or cash flows.

|

13. |

Investment in Or-Genix |

In April 2015, the Company entered into several agreements with Or-Genix Therapeutics, Inc. (“Or-Genix”), pursuant to which the Company transferred certain of its non-focus technology rights to Or-Genix in exchange for a 19.9% ownership interest in Or-Genix, representing 2,484,395 shares of the common stock of Or-Genix, and purchased $250,000 in perpetual non-redeemable preferred stock which is included in other assets as of September 30, 2015. The rights the Company transferred include exclusive rights to a compound formerly known as “RES-102,” which is a “soft” estrogen potentially to be developed for the treatment of aging skin fragility/thinning and vulvo-vaginal atrophy, and exclusive rights to a compound formerly known as “RES-214,” a non-prescription cosmeceutical product under development by a sublicensee. The Company previously licensed these rights from Yale University and as part of this transaction assigned those license agreements to Or-Genix. The Company also assigned its rights under a sublicense agreement with Ferndale Pharma Group, Inc. for the formulation, manufacture, sale and marketing of RES-214. As the rights exchanged for the common stock investment had a recorded value of zero as of the transaction date, and as the common stock transaction was a non-monetary exchange, no value was assigned to the common stock portion of the Company’s Or-Genix investment and no gain or loss was recognized as a result of the transaction. Or-Genix is founded and owned primarily by Yael Schwartz, Ph.D., a former member of the Company’s Board of Directors and former Executive Vice President, Preclinical Development. The transfer of these technology rights to Or-Genix was executed since the Company is focusing its development efforts and resources on its other technologies. The Company does not control nor exercise significant influence over Or-Genix.

|

14. |

Former Employee Severance Expense |

On April 30, 2015, the Company entered into resignation agreements with the Company’s former Executive Vice President, Preclinical Development and former Vice President of Pharmaceutical Sciences. As part of these resignation agreements, the Company modified their stock option agreements to provide for continued vesting until June 30, 2015 and to extend the post-termination exercise period from 90 days to one year, resulting in a minimal amount of additional stock-based compensation expense. On June 19, 2015, the Company entered into a resignation agreement with the Company’s former Chief Scientific Officer. Costs associated with the resignation agreements, consisting primarily of severance-related charges, are reflected in the former employee severance expense section in the condensed consolidated statement of operations for the three months and nine months ended September 30, 2015. $453,504 related to these charges was included in other accrued liabilities as of September 30, 2015.

|

ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

You should read the following discussion of our financial condition and results of operations together with the unaudited condensed consolidated financial statements and the notes thereto included elsewhere in this report and other financial information included in this report. The following discussion may contain predictions, estimates and other forward looking statements that involve a number of risks and uncertainties, including those discussed under “Part I — Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Special Note Regarding Forward Looking Statements” in this report and under “Part I — Item 1A. Risk Factors” in our annual report on Form10-K for the fiscal year ended December 31, 2014. These risks could cause our actual results to differ materially from any future performance suggested below.

Business Overview

We are a specialty biopharmaceutical company focused on developing products for oncology, ophthalmology, and dermatology. Our lead product is a novel PI3K/Akt/mTOR pathway inhibitor which has completed two Phase I clinical trials for age-related macular degeneration and is in preclinical development in oncology, specifically glioblastoma multiforme. Our current pipeline also includes a “soft” anti-androgen compound for the treatment of acne vulgaris. Our novel inhibition of the PI3K/Akt/mTOR pathway and unique targeting of the androgen receptor show promise in a number of additional diseases, which we are evaluating for the purpose of creating innovative therapies that are safe and effective treatments to satisfy unmet medical needs. In addition, as a part of our corporate strategy, we continue to seek, consider, and if appropriate, implement strategic alternatives with respect to our products and our company, including licenses, business collaborations and other business combinations or transactions with other pharmaceutical and biotechnology companies.

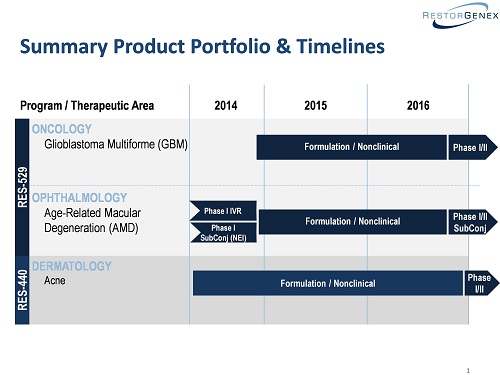

Our portfolio of product candidates is summarized in the following table:

Oncology

Our novel PI3K/Akt/mTOR pathway inhibitor, RES-529, is in preclinical development for oncology. Through a series of in vitro and in vivo animal models, RES-529 has been shown to have activity in several cancer types due to its ability to target and inhibit the PI3K/Akt/mTOR signal transduction pathway. RES-529 is a first-in-class inhibitor of both TORC1 and TORC2 that is mechanistically differentiated from other PI3K/Akt/mTOR pathway inhibitors currently in development. Signaling components of the PI3K/Akt/mTOR pathway are central regulators of cell proliferation, growth, differentiation, survival and angiogenesis. Up to 80 percent of tumor types have been shown to have an aberrant up-regulation of the PI3K pathway. Activation of this pathway has been observed in glioblastoma patients and is being pursued aggressively as a target for therapeutic intervention. We have shown activity in both in vitro and in vivo glioblastoma animal models and have demonstrated that RES-529 is orally bioavailable and can cross the blood brain barrier.

We believe the glioblastoma market represents substantial financial upside given the significant unmet medical need due to limited and modestly effective therapies. We plan to complete necessary work to start a Phase I/II glioblastoma human clinical trial in 2016. We also plan to initiate Phase II studies in other tumor types once the RES-529 maximum tolerated dose is determined in the initial portion of the glioblastoma study. We intend to focus in areas where preclinical evidence of activity has been demonstrated, specifically breast, prostate and/or lung cancers. In January 2015, the U.S. Food and Drug Administration (“FDA”) granted Orphan Drug Designation for RES-529 for the treatment of glioblastoma multiforme.

Ophthalmology

The specific focus of our prescription ophthalmology business is on pathologies showing an aberrant up-regulation of the PI3K/Akt/mTOR pathway in the area of ophthalmology. Two human Phase I clinical studies with one of our palomids known as “RES-529” have been completed for wet age-related macular degeneration (“AMD”), both studies of which showed preliminary evidence of biologic activity and no serious toxicity. One of the two completed studies was sponsored by Paloma Pharmaceuticals, Inc., a company we acquired in March 2014, using intravitreal administration and was completed in December 2011. The second study was sponsored and conducted by The National Eye Institute using subconjunctival administration and was completed in July 2012. We currently are planning Phase I/II studies with RES-529 for wet age-related macular degeneration that we plan to begin in 2016 after we finalize CMC (chemistry, manufacturing and control) work for subconjunctival administration and complete necessary preclinical studies.

Dermatology

Our prescription dermatology business is based primarily upon a “soft” anti-androgen, known as “RES-440,” which is under development for the treatment of acne vulgaris. RES-440 has completed in vitro and in vivo proof-of-concept studies in tissue and animal models. We currently are working on CMC and necessary pre-clinical studies and are planning Phase I/Phase II studies in 2016 for the treatment of acne.

Other Indications/Products/Strategies

We have rights to and own technologies and potential products beyond just those described above. It is our strategy to focus at the current time on oncology, ophthalmology and dermatology, specifically gliobastoma, wet AMD and acne, as described in this report. Beyond the potential products described in this report, we intend to continue to review our technologies and potential products on a regular basis and consider internal development in the future and the potential to out-license portions of our technology and potential products to other biopharmaceutical companies with greater focus and resources than ours or potentially in-license additional technologies and products for development. In addition, we intend to consider the acquisition of other technologies, products and companies that may be synergistic with ours to build our portfolio of potential products as a part of our corporate strategy. These activities may include but are not limited to licenses, business collaborations and other business combinations or transactions with other pharmaceutical and biotechnology companies. Therefore, as a matter of course, from time to time, we may engage in discussions with third parties regarding the licensure, sale or acquisition of our products and technologies or a merger or sale of our company, with the goal of maximizing stockholder value.

In furtherance of this strategy, during second quarter of 2015, we transferred certain of our non-focus technology rights to Or-Genix Therapeutics, Inc. (“Or-Genix”) in exchange for a 19.9% ownership interest in Or-Genix, representing 2,484,395 shares of the common stock of Or-Genix, and we purchased $250,000 in perpetual non-redeemable preferred stock. The rights we transferred include exclusive rights to a compound formerly known as “RES-102,” which is a “soft” estrogen potentially to be developed for the treatment of aging skin fragility/thinning and vulvo-vaginal atrophy, and exclusive rights to a compound formerly known as “RES-214,” a non-prescription cosmeceutical product under development by a sublicensee. We previously licensed these rights from Yale University and as part of this transaction assigned those license agreements to Or-Genix. We also assigned our rights under a sublicense agreement with Ferndale Pharma Group, Inc. for the formulation, manufacture, sale and marketing of RES-214. Or-Genix is founded and owned primarily by Yael Schwartz, Ph.D., a former member of our Board of Directors and former Executive Vice President, Preclinical Development. The transfer of these technology rights to Or-Genix was executed since we are focusing our development efforts and resources on our other technologies.

Financial Summary

Our working capital totaled $13,595,239, including $14,580,596 in cash and cash equivalents, as of September 30, 2015, compared to total working capital of $21,832,217, including $21,883,887 in cash and cash equivalents, as of December 31, 2014.

We recognized no revenues and our operating expenses were $13,225,660 and $20,715,551 during the three and nine months ended September 30, 2015, respectively. The primary reason for the increase in our 2015 operating expenses over the respective prior year periods was an $11,070,991 non-cash impairment of goodwill during the three and nine months ended September 30, 2015.

Our research and development expense decreased 46% to $692,709 during the three months ended September 30, 2015 and increased 97% to $3,360,057 during the nine months ended September 30, 2015, in each case compared to the respective prior year period. The decrease in research and development expenses for the three month comparison was primarily a result of a reduction in internal research and development personnel, and the increase in research and development expenses for the nine month period comparison was a result of the research and development of our technologies and product candidates, with a concentration on RES-529 for oncology and ophthalmology uses and RES-440 for acne. Our general and administrative expenses decreased 22% to $1,456,567 during the three months ended September 30, 2015 and increased 30% to $5,298,945 during the nine months ended September 30, 2015, in each case compared to the respective prior year period. The decrease in general and administrative expenses for the three month comparison was primarily the result of slightly lower salary expense and the reduction of a liability associated with rent obligations, and the increase in general and administrative expenses for the nine month comparison was primarily the result of employee and director non-cash stock-based compensation expenses. We recognized a net loss of $13,224,495 and $20,710,233 for the three and nine months ended September 30, 2015, respectively, or $0.71 and $1.11 per share, compared to net loss of $3,449,470, and $9,284,877, or $0.18 and $0.76 per share, for the three and nine months ended September 30, 2014, respectively. We expect to continue to recognize net losses for the foreseeable future.

We intend to use our existing cash and cash equivalents for working capital and to fund the research and development of our technologies and product candidates. We believe our cash and cash equivalents as of September 30, 2015 will be sufficient to fund our planned operations at least into the second half of 2016.

Results of Operations for Three and Nine Months Ended September 30, 2015 Compared to Three and Nine Months Ended September 30, 2014

For a complete understanding of our results of operations for the three and nine months ended September 30, 2015 compared to the same periods ended September 30, 2014, we reference those certain adjustments for prior period misstatements recorded in the fourth quarter of 2014 related to prior 2014 interim and prior annual periods which were deemed immaterial. See Note 2 to our consolidated financial statements for the year ended December 31, 2014, included in our annual report on Form 10-K for the year ended December 31, 2014, for further information as to the nature of the adjustments recorded in the fourth quarter of 2014.

The following table sets forth our results of operations for the three months ended September 30, 2015 and 2014.

|

Three Months Ended September 30, |

||||||||||||||||

|

2015 |

2014 |

$ Change |

% Change |

|||||||||||||

|

Revenue |

$ | 0 | $ | 0 | $ | 0 | 0 | % | ||||||||

|

Expenses |

||||||||||||||||

|

Research and development |

692,709 | 1,273,186 | (580,477 | ) | (45.6 | ) | ||||||||||

|

General and administrative |

1,456,567 | 1,869,840 | (413,273 | ) | (22.1 | ) | ||||||||||

|

Impairment of goodwill |

11,070,991 | 0 | 11,070,991 | N/A | ||||||||||||

|

Depreciation and amortization |

5,393 | 368,924 | (363,531 | ) | (98.5 | ) | ||||||||||

|

Other (income) expenses |

(1,165 | ) | (3,151 | ) | (1,986 | ) | (63.0 | ) | ||||||||

|

Interest expense |

0 | 86,670 | (86,670 | ) | (100.0 | ) | ||||||||||

|

Benefit from income taxes |

0 | 145,999 | (145,999 | ) | (100.0 | ) | ||||||||||

|

Net loss |

$ | (13,224,495 | ) | $ | (3,449,470 | ) | $ | (9,629,026 | ) | 279.1 | ||||||

|

Basic and diluted net loss per share |

$ | (0.71 | ) | $ | (0.18 | ) | $ | (0.53 | ) | 294.4 | ||||||

|

Weighted average number of shares and equivalent shares outstanding |

18,614,968 | 18,671,121 | (56,153 | ) | (0.3 | ) | ||||||||||

The following table sets forth our results of operations for the nine months ended September 30, 2015 and 2014.

|

Nine Months Ended September 30, |

||||||||||||||||

|

2015 |

2014 |

$ Change |

% Change |

|||||||||||||

|

Revenue |

$ | 0 | $ | 0 | $ | 0 | 0 | % | ||||||||

|

Expenses |

||||||||||||||||

|

Research and development |

3,360,057 | 1,709,424 | 1,650,633 | 96.6 | ||||||||||||

|

General and administrative |

5,298,945 | 4,091,530 | 1,207,415 | 29.5 | ||||||||||||

|

Impairment of goodwill |

11,070,991 | 0 | 11,070,991 | N/A | ||||||||||||

|

Depreciation and amortization |

17,875 | 883,995 | (866,120 | ) | (98.0 | ) | ||||||||||

|

Former employee severance expense |

967,683 | 0 | 967,683 | N/A | ||||||||||||

|

Loss on settlement of notes payable – related party |

0 | 1,829,562 | (1,829,562 | ) | (100.0 | ) | ||||||||||

|

Loss on settlement of notes payable |

0 | 876,543 | (876,543 | ) | (100.0 | ) | ||||||||||

|

Other (income) expenses |

(5,318 | ) | (3,597 | ) | 1,721 | 47.8 | ||||||||||

|

Interest expense |

0 | 281,548 | (281,548 | ) | (100.0 | ) | ||||||||||

|

Benefit from income taxes |

0 | 384,128 | (384,128 | ) | (100.0 | ) | ||||||||||

|

Net loss |

$ | (20,710,233 | ) | $ | (9,284,877 | ) | $ | (11,425,356 | ) | 123.1 | ||||||

|

Basic and diluted net loss per share |

$ | (1.11 | ) | $ | (0.76 | ) | $ | (0.35 | ) | 46.1 | ||||||

|

Weighted average number of shares and equivalent shares outstanding |

18,614,968 | 12,155,041 | 6,459,927 | 53.1 | ||||||||||||

Revenues

We recognized no revenues during the three and nine months ended September 30, 2015 or 2014.

Operating Expenses

Operating expenses were $13,225,660 during the three months ended September 30, 2015, representing an increase of 277%, compared to $3,511,950 during the three months ended September 30, 2014. Operating expenses were $20,715,551 during the nine months ended September 30, 2015, representing an increase of 210%, compared to $6,684,949 during the nine months ended September 30, 2014. These increases were due primarily to a non-cash $11,070,991 goodwill impairment. In addition, for the nine month comparison, the increase was also due to an increase in research and development expenses as a result of the research and development of our technologies and product candidates, an increase in general and administrative expenses as a result of employee and director non-cash stock-based compensation expenses, and the recognition of former employee severance expense.

We recognized $692,709 and $3,360,057 in research and development expenses during the three and nine months ended September 30, 2015, respectively, compared to $1,273,186 and $1,709,424 in research and development expenses during the three and nine months ended September 30, 2014, respectively. The increase in research and development expenses for the nine month period comparison was a result of the research and development of our technologies and product candidates, while the decrease in research and development expenses for the three month comparison was primarily a result of a reduction in research and development personnel.

General and administrative expenses were $1,456,567 during the three months ended September 30, 2015, representing a decrease of 22% from $1,869,840 during the three months ended September 30, 2014. General and administrative expenses were $5,298,945 during the nine months ended September 30, 2015, representing an increase of 30% from $4,091,530 during the nine months ended September 30, 2014. The decrease in general and administrative expenses for the three month comparison was primarily the result of slightly lower salary expense and the reduction of a liability associated with rent liability for facilities no longer occupied, and the increase in general and administrative expenses for the nine month comparison was primarily a result of employee and director non-cash stock-based compensation expenses.

Stock-based compensation expense, which is included in research and development expenses and general and administrative expenses, was $481,237 during the three months ended September 30, 2015, representing a decrease of 39%, over $783,932 during the three months ended September 30, 2014. Stock-based compensation expense was $1,613,854 during the nine months ended September 30, 2015, representing an increase of 50%, over $1,075,131 during the nine months ended September 30, 2014.

We recognized a non-cash goodwill impairment of $11,070,991 for the three and nine months ended September 30, 2015. We consider certain triggering events when evaluating whether an interim goodwill impairment analysis is warranted. Among these would be a significant long-term decrease in our market capitalization based on events specific to our operations. Our market capitalization has decreased significantly during the past several months as our per share price has declined from $2.80 as of April 30, 2015 to $0.90 as of September 30, 2015. As of September 30, 2015, our market capitalization was approximately $16.7 million, falling to an amount significantly less than our stockholders’ equity. In September 2015, management concluded that given the significant and sustained decrease in our share price to a level below our stockholders’ equity, combined with information on our fair value derived from strategic discussions with third parties during the third quarter of 2015, a triggering event requiring an interim assessment of goodwill impairment had occurred during the third quarter of 2015. Management performed the interim goodwill impairment assessment using a market approach to estimating the fair value of our company, using multiple inputs, some weighted heavier than others. The inputs included our market capitalization and other more heavily weighted unobservable inputs as to our fair value derived from our strategic discussions with third parties. The initial step one assessment indicated that it was likely our goodwill was impaired, and we proceeded to perform step two of our goodwill impairment assessment resulting in the conclusion that an impairment loss had occurred. Our goodwill as of September 30, 2015 was $985,000.

Depreciation and amortization was $5,393 and $17,875 during the three and nine months ended September 30, 2015, respectively, compared to $368,924 and $883,995 during the three and nine months ended September 30, 2014, respectively. These decreases were primarily related to a decrease in amortization expense attributable to intangible assets acquired in our acquisition of Canterbury Laboratories LLC and Hygeia Therapeutics, Inc. due to our abandonment and write-off of such intangible assets during the fourth quarter of 2014.

Former employee severance expense was $0 and $967,683 for the three and nine months ended September 30, 2015, respectively. This expense consisted of severance related charges following the resignation of our former Executive Vice President, Preclinical Development and former Vice President of Pharmaceutical Sciences in April 2015 and the resignation of our former Chief Scientific Officer in June 2015.

Loss on Settlement of Notes Payable

Loss on settlement of notes payable – related parties was $0 and $1,829,562 for the three and nine months ended September 30, 2014, respectively. During the second quarter of 2014, we issued shares of common stock and warrants to purchase shares of common stock to a member of our Board of Directors in exchange for notes payable in the aggregate principal amount of $1,050,000. There was no loss on settlement of notes payable – related parties incurred in the three and nine months ended September 30, 2015.

Loss on settlement of notes payable was $0 and $876,543 for the three and nine months ended September 30, 2014, respectively. During the second quarter of 2014, we issued shares of common stock to a creditor upon conversion of a promissory note in the principal amount of $500,000. There was no loss on settlement of notes payable incurred in the three and nine months ended September 30, 2015.

Other (Income) Expenses

Other income was $1,165 and $5,318 during the three and nine months ended September 30, 2015, respectively, compared to other income of $3,151 and $3,597 during the three and nine months ended September 30, 2014, respectively. Other income for the three and nine months ended September 30, 2015 related primarily to the recognition of interest income.

Interest Expense

Interest expense was zero during the three and nine months ended September 30, 2015 compared to $86,670 and $281,548 during the three and nine months ended September 30, 2014. These decreases were due to a reduction in our total indebtedness during the last three quarterly periods of 2014, which eliminated all of our debt as of December 31, 2014.

Benefit From Income Taxes

Benefit from income taxes was zero during the three and nine months ended September 30, 2015 compared to $145,999 and $384,128 for the three and nine months ended September 30, 2014 related primarily to a reduction in deferred taxes related to the amortization of intangible assets.

Net Loss

We recognized a net loss of $13,224,495 for the three months ended September 30, 2015, or $0.71 per share, compared to net loss of $3,449,470, or $0.18 per share, for the three months ended September 30, 2014. We recognized a net loss of $20,710,233 for the nine months ended September 30, 2015, or $1.11 per share, compared to net loss of $9,284,877, or $0.76 per share, for the nine months ended September 30, 2014. We recognized an $11,070,991 non-cash impairment of goodwill during the three and nine months ended September 30, 2015, which represents the primary reason for the increase in our operating expenses over the respective prior year periods. We expect to incur net losses in future periods for the foreseeable future as we plan to continue our efforts to develop our technologies and product candidates.

Liquidity and Capital Resources

Working Capital

Our working capital totaled $13,595,239, including $14,580,596 in cash and cash equivalents, as of September 30, 2015, compared to working capital of $21,832,217, including $21,883,887 in cash and cash equivalents, as of December 31, 2014.

The following table summarizes our working capital as of September 30, 2015 and December 31, 2014:

|

September 30, 2015 |

December 31, 2014 |

|||||||

|

Cash and cash equivalents |

$ | 14,580,596 | $ | 21,883,887 | ||||

|

Prepaid expenses, deposits and other assets |

1,049,254 | 2,286,930 | ||||||

|

Total current liabilities |

(2,034,611 | ) | (2,338,600 | ) | ||||

|

Working capital |

$ | 13,595,239 | $ | 21,832,217 | ||||

We expect to continue to incur net losses for the foreseeable future. We intend to use our existing cash and cash equivalents for working capital and to fund the research and development of our technologies and product candidates.

Cash Flows

The following table sets forth our cash flows for the nine months ended September 30, 2015 and 2014:

|

Nine Months Ended September 30, |

||||||||

|

2015 |

2014 |

|||||||

|

Operating activities |

$ | (7,025,064 | ) | $ | (7,099,921 | ) | ||

|

Investing activities |

(278,227 | ) | — | |||||

|

Financing activities |

— | 30,633,293 | ||||||

|

Net (decrease) increase in cash and cash equivalents |

$ | (7,303,291 | ) | $ | 23,533,372 | |||

Operating Activities

Cash used in operating activities was primarily unchanged during the nine months ended September 30, 2015 and 2014. The $7,025,064 in cash used in operating activities expended on research and development and general and administrative activities during the nine months ended September 30, 2015 approximated the $7,099,921 in cash used in operating activities during the nine months ended September 30, 2014 primarily due to the payment of pre-2014 liabilities during the nine months ended September 30, 2014.

Investing Activities

Net cash used in investing activities was $278,227 during the nine months ended September 30, 2015 compared to $0 during the nine months ended September 30, 2014. The investment in Or-Genix accounted for $250,000 and the purchase of fixed assets accounted for $28,227 of cash used in investing activities during the nine months ended September 30, 2015.

Financing Activities

Net cash provided by financing activities was $0 during the nine months ended September 30, 2015 compared to $30,633,293 during the nine months ended September 30, 2014. Net cash provided by financing activities during the prior year period resulted primarily from proceeds from our 2014 private placement.

Capital Requirements

We expect to incur substantial expenses and generate significant operating losses as we continue to execute our business strategy, including:

|

|

● |

synthesis and formulation of our product candidates; |

|

● |

conducting preclinical and clinical trials to pursue our product development initiatives; |

|

● |

hiring additional personnel for managerial, research and development, operations and other functions; |

|

● |

implementing our business and corporate development strategies, including the potential for licenses, business collaborations and other business combinations or transactions with other pharmaceutical and biotechnology companies; and |

|

● |

implementing improved operational, financial and management systems. |

To date, we have used primarily equity and debt financings to fund our ongoing business operations and short-term liquidity needs, and we expect to continue this practice for the foreseeable future. During 2014, we completed a private placement pursuant to which we raised approximately $35.6 million in gross proceeds and $31.9 million in net proceeds, after paying placement agent fees and commission and offering expenses. In the private placement, we issued an aggregate of 8,895,685 shares of our common stock and warrants to purchase an aggregate of 2,668,706 shares of common stock. Investors received warrants to purchase 0.3 share of common stock for each share of common stock that investors purchased in the private placement. The purchase price of each common stock/warrant unit was $4.00. Each warrant is exercisable into one share of common stock at an initial exercise price of $4.80 per share.