Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TOTAL SYSTEM SERVICES INC | d465361dex991.htm |

| 8-K - 8-K - TOTAL SYSTEM SERVICES INC | d465361d8k.htm |

TSYS to Acquire Cayan Solidifying TSYS’ Leadership Position in Technology-Led SMB Merchant Services December 18, 2017 ©2017 Total System Services, Inc.® Proprietary. All rights reserved worldwide. Exhibit 99.2

Forward Looking Statements This slide presentation and comments made by management contain forward-looking statements including, among others, statements regarding the expected benefits of the proposed acquisition of Cayan (including the expected impact of the acquisition on TSYS’ net revenue growth and adjusted diluted EPS), and the expected timing for closing the acquisition. These statements are based on management’s current expectations and assumptions and are subject to risks, uncertainties and changes in circumstances. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “potential,” “estimate” or similar expressions. Actual results may differ materially from those set forth in the forward-looking statements due to a variety of factors, including our ability to achieve expected synergies and successfully complete the integration of Cayan, the level of expenses and other charges related to the acquisition, and the other risks and uncertainties discussed in TSYS’ filings with the Securities and Exchange Commission, including its 2016 Annual Report on Form 10-K. There can be no assurances that the acquisition will be completed, or if it is completed, that the expected benefits of the transaction will be realized. TSYS disclaims any obligation to update any forward-looking statements as a result of new information, future developments or otherwise except as required by law. ©2017 Total System Services, Inc.® Proprietary. All rights reserved worldwide.

©2017 Total System Services, Inc.® Proprietary. All rights reserved worldwide. + Driven to help our merchants and partners grow through best in class service and solutions

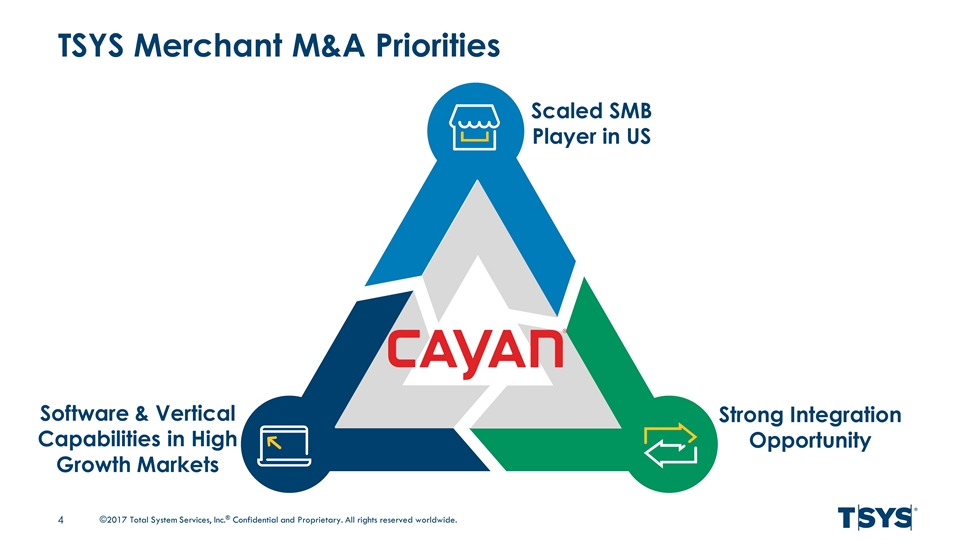

©2017 Total System Services, Inc.® Confidential and Proprietary. All rights reserved worldwide. Strong Integration Opportunity Software & Vertical Capabilities in High Growth Markets Scaled SMB Player in US TSYS Merchant M&A Priorities

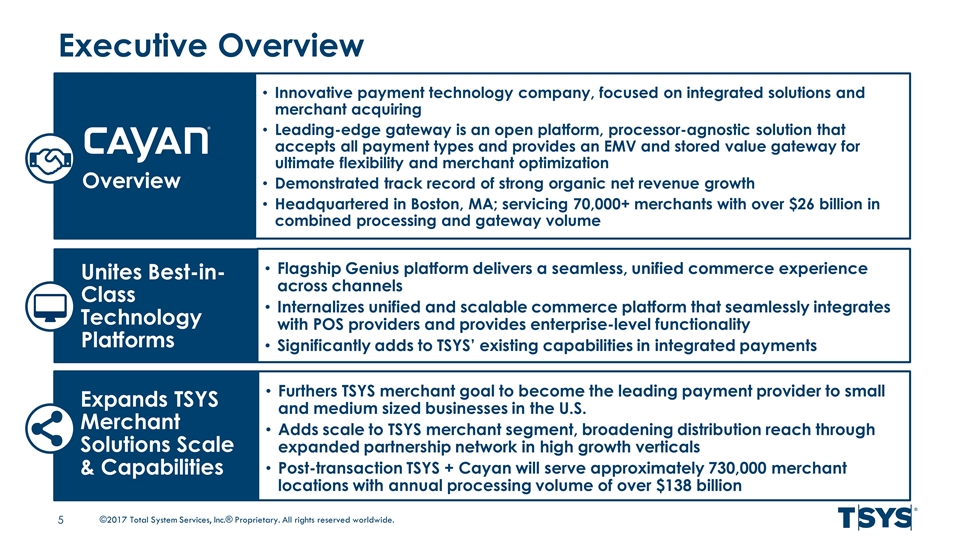

Executive Overview ©2017 Total System Services, Inc.® Proprietary. All rights reserved worldwide. Innovative payment technology company, focused on integrated solutions and merchant acquiring Leading-edge gateway is an open platform, processor-agnostic solution that accepts all payment types and provides an EMV and stored value gateway for ultimate flexibility and merchant optimization Demonstrated track record of strong organic net revenue growth Headquartered in Boston, MA; servicing 70,000+ merchants with over $26 billion in combined processing and gateway volume Overview Flagship Genius platform delivers a seamless, unified commerce experience across channels Internalizes unified and scalable commerce platform that seamlessly integrates with POS providers and provides enterprise-level functionality Significantly adds to TSYS’ existing capabilities in integrated payments Unites Best-in-Class Technology Platforms Furthers TSYS merchant goal to become the leading payment provider to small and medium sized businesses in the U.S. Adds scale to TSYS merchant segment, broadening distribution reach through expanded partnership network in high growth verticals Post-transaction TSYS + Cayan will serve approximately 730,000 merchant locations with annual processing volume of over $138 billion Expands TSYS Merchant Solutions Scale & Capabilities

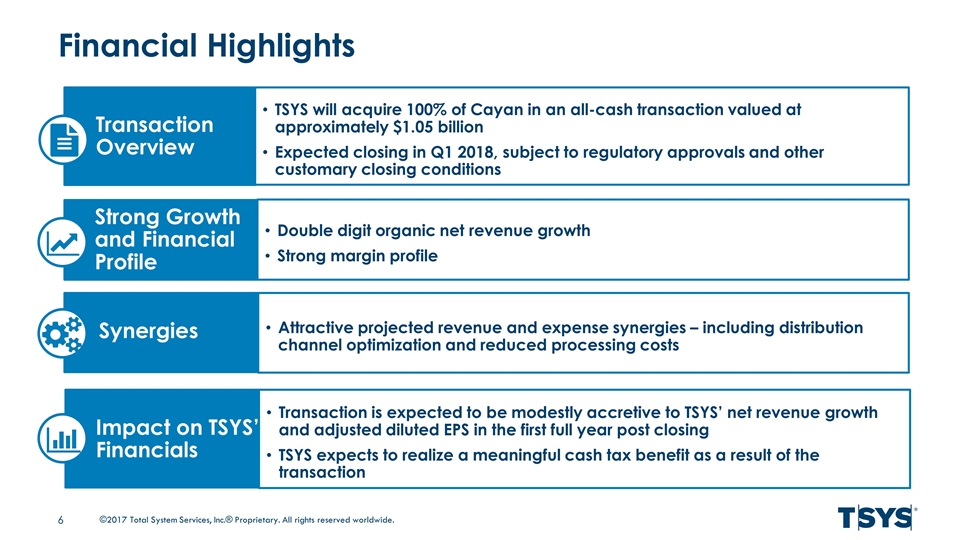

Financial Highlights ©2017 Total System Services, Inc.® Proprietary. All rights reserved worldwide. TSYS will acquire 100% of Cayan in an all-cash transaction valued at approximately $1.05 billion Expected closing in Q1 2018, subject to regulatory approvals and other customary closing conditions Transaction Overview Double digit organic net revenue growth Strong margin profile Strong Growth and Financial Profile Attractive projected revenue and expense synergies – including distribution channel optimization and reduced processing costs Synergies Transaction is expected to be modestly accretive to TSYS’ net revenue growth and adjusted diluted EPS in the first full year post closing TSYS expects to realize a meaningful cash tax benefit as a result of the transaction Impact on TSYS’ Financials

Conclusion Leading-edge gateway significantly expands TSYS’ existing capabilities in integrated payments Extends sales and distribution reach through expanded partnership network in high growth verticals Adds material scale to TSYS’ merchant segment, advancing our goal to become the leading payment provider to small and medium sized businesses in the U.S. Attractive financial profile, accelerating TSYS’ growth and accretive to adjusted diluted earnings per share in 2018 ©2017 Total System Services, Inc.® Proprietary. All rights reserved worldwide.

Thank You ©2017 Total System Services, Inc.® Proprietary. All rights reserved worldwide.