Attached files

| file | filename |

|---|---|

| EX-32 - PetLife Pharmaceuticals, Inc. | ex32.htm |

| EX-31 - PetLife Pharmaceuticals, Inc. | ex31.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended August 31, 2017

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-52445

PETLIFE PHARMACEUTICALS, INC,

(Name of registrant as specified in its charter)

| Nevada | 33-1133537 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

38 West Main Street Hancock, MD |

21750 | |

| (Address of principal executive offices) | (Zip Code) |

(844) 473-8543

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

On December 31, 2016, the last business day of the registrant’s most recently completed second quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $4,595,945, based upon the closing price on that date of the common stock of the registrant on the OTC Bulletin Board system of $0.13. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its Common Stock are deemed affiliates of the registrant.

As of December 14, 2017, the registrant had 73,966,195 shares of its common stock, $0.001 par value, issued, issuable, and outstanding.

TABLE OF CONTENTS

| 2 |

The document (including information incorporated herein by reference) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which involve a degree of risk and uncertainty due to various factors affecting PetLife Pharmaceuticals, Inc.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements, including, without limitation, in the sections captioned “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Result of Operations,” and elsewhere. Any and all statements contained in this Current Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Annual Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”), (iv) our beliefs regarding potential clinical and other health benefits of our PetLife products, and (v) the assumptions underlying or relating to any statement described in points (i), (ii), (iii) or (iv) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time and resources associated with the development of our products and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of our business and the healthcare industry, the results of clinical studies or trials, lack of product diversification, volatility in the price of our raw materials, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Annual Report appears in the section captioned “Risk Factors” and elsewhere in this Annual Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Annual Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Annual Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Annual Report, and other documents which we may file from time to time with the SEC.

All references in this Form 10-K that refer to the “Company,” “PetLife Pharmaceuticals, Inc.,” “Registrant,” “we,” “us,” or “our” are to PetLife Pharmaceuticals, Inc., a Nevada formed corporation.

| 3 |

Historical Company Information

PetLife Pharmaceuticals, Inc. (“PetLife”) were incorporated on April 5, 2002 under the laws of the State of Nevada as “Aztek Ventures Inc.” Effective November 13, 2007, we filed a Certificate of Amendment to our Articles of Incorporation to change our name from “Aztek Ventures Inc.” to “Genesis Uranium Corp.” Effective April 21, 2008, we amended our Articles of Incorporation to change our name from “Genesis Uranium Corp.” to “Vault Technology Inc.” to reflect the change in our business focus beyond solely that of uranium exploration. Effective July 10, 2009, we filed a Certificate of Amendment to our Articles of Incorporation to change our name from “Vault Technology, Inc.” to “Modern Renewable Technologies, Inc.” (“Modern”). On May 27, 2011, Modern, merged with Eco Ventures Group, Inc., and the name of the Company was changed to Eco Ventures Group, Inc. On July 18, 2013, the Company declared a 15-for-1 reverse stock split for all of its common and preferred stock. On June 26, 2014, Eco Ventures Group, Inc. entered into an Agreement and Plan of Merger with its subsidiary, PetLife Pharmaceuticals, Inc., a Nevada Corporation, with PetLife Pharmaceuticals, Inc. being the surviving entity. As part of that merger, the name of the Company was changed to PetLife Pharmaceuticals, Inc. and each 20 shares of our common stock were exchanged for one share in the surviving company. Effective August 12, 2014 we completed the closing of the Share Exchange Agreement and the acquisition of PetLife and changed our name to PetLife Pharmaceuticals, Inc. Effective July 19, 2016, we agreed to complete a subsidiary merger in which we effectively complete a 1 for 5 reduction in our outstanding shares. All references herein to the number of shares outstanding and per-share amounts have been retroactively restated to reflect both the reverse stock split on July 18, 2013, the exchange ratio in the merger with PetLife Pharmaceuticals, Inc., and the reduction in September 2016.

Business of PetLife Pharmaceuticals, Inc.

Summary

We have developed and are launching a new generation of high potency veterinary cancer medications and nutraceuticals.

PetLife’s main product, Vitalzul™ inhibits blood vessels formation in solid tumors. Chlorotoxin blocks trans-membrane fluxes of chlorine and regulates the adjusting of cell growth, cell division, metastasis and induces apoptosis (dose dependent) that leads to tumor cells death. The regulating of activity of the potassium (K+) 3-4 kDa, sodium (N+) 6-8 kDa and chloride (CL+) voltgate ionic channels of the tumor cells leads to growth arrest and causes cell death (apoptosis); additionally, calcium dependent potassium channels inhibit growth of other cancer cells.

The National Cancer Institute reported that in the United States alone, nearly 6 million dogs and 6.5 million cats are diagnosed with cancer annually with dogs being 35 times and cats 40 times more likely to suffer from cancer than humans. Sixty percent of dogs and cats over six years of age will be diagnosed with cancer.

| 4 |

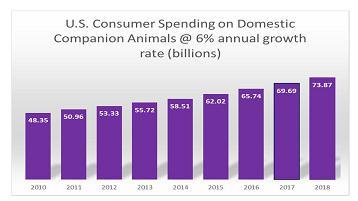

In the United States over 92 million households own a dog or cat, representing 83.3 million dogs and 95.6 million cats. Consumer spending on domestic companion animals in the United States alone is expected to reach over $60.28 billion in 2015, with over $13 billion being spent on over the counter medications. Demand for domestic pet health products is expected to grow approximately 4 - 6% annually through 2018

PetLife plans to apply to the FDA in the first quarter of 2018 to begin a New Animal Drug Application for prescription strength version of VitalzulTM. Although there can be no assurance the FDA will work this quickly, the Company anticipates FDA approval of its prescription strength products in the second half of 2019, and intends to roll out those products shortly thereafter.

The Company has a developed a sophisticated, multi-channel marketing strategy, to be implemented in the second half of 2017, that includes direct sales, retail, veterinarian vertical market, affiliate sales and infomercials for its nutraceutical formulation.

As part of our mission to bring health and well-being to our companion animals, PetLife has acquired “Healthy Life Pets “a natural based pet food company founded by renowned veterinarian, Dr. Geoffrey Broderick. The Company plans to market a new brand “Dr. Geoff’s by PetLife” as a premium product and will seek to provide evidence of the benefit of the food on cancer prevention and general pet health.

Corporate Overview

PetLife Pharmaceuticals, Inc. is a registered U.S. Veterinary Pharmaceutical company whose mission is to bring its scientifically proven, potentiated bioactive medication and nutraceuticals — “Vitalzul™” — to the world of veterinary oncology. The Company specializes in the research, development, sales and support of advanced drugs and nutraceuticals for pet cancer and autoimmune related diseases such as arthritis.

Since the histology (cellular biology) of human, dogs and cats is quite similar at the molecular level, it is notable that PetLife, upon the completion of our veterinary trials, PetLife can continue to develop Vitalzul™, for human use or out license the technology as deemed appropriate by management and our medical team.

Business Strategy

| ● | Initially, enter the market with an oral nutraceutical version of Vitalzul™ with a focus on the oncology needs of dogs and cats. | |

| ● | Raise capital through traditional means, including through this private placement of securities, additional private placements, public offerings and/or bank financings. | |

| ● | Apply for FDA approval of the Caribbean Blue Scorpion animal pharmaceutical drug, VitalzulTM for cancer treatment, a prescription strength oral pharmaceutical as well as a concentrated intravenous and injectable version for direct administration to a tumor. | |

| ● | Concurrently develop edible dog and cat treats that are infused with Vitalzul™’s active ingredients that deliver preventative benefits for both dogs and cats. |

FDA Process, Cost and Time Line

The Company plan outlines the necessary studies and regulatory actions required to move Vitalzul TM thought the Food and Drug Administration (“FDA”) and Center for Veterinary Medicine (“CVM”) approval process.

The lead for our FDA approval of the pharmaceutical version of VitalzulTM is Dr. Vivek Ramana, our Chief Medical Officer, who has greater than 20 years of experience in the pharmaceutical industry and has worked on more than 25 drugs that have been approved by the FDA. Dr. Ramana has more than four years’ experience working with Scorpion venom and has successfully secured approval of a scorpion-based Chlorotoxin Oncology drug for humans in India. His combined professional experience and personal knowledge of Vitalzul™ gives PetLife great confidence in his ability to manage the process, adhere to the timelines and maintain the project budget.

Dr. Ramana has provided PetLife with a time line of approximately 24 months to successfully complete the required clinical studies and register the pharmaceutical version of Vitalzul TM with the FDA/CVM. We will also push to fast track the drug and can potentially have it approved as a compassionate use drug for pets in as little as nine months.

Prior to our discussions with the FDA, the Company, under the direction of Dr. Ramana, has completed a preliminary dosing and toxicology study. The third study required prior to our FDA discussion is a cell line study, which should be completed within the next several months.

During the initial stage of our proposed FDA trial, the drug will be analyzed to establish its structure, stability and toxicity. This stage will establish the ability to produce a stable, replicable drug product supply for the subsequent clinical studies in animals. This stage is estimated to take 3-9 months to complete at a cost of approximately $700,000.

The second stage is pre-clinical development. In this stage, InnoVision Therapeutics will perform the studies necessary to establish the safety of the product. These studies include toxicology and dosing studies as well as establish the pharmokinetics and pharmodynamics of the drug. Essentially, we want to learn what the drug does to the body and what the body does to the drug. This stage is estimated to take between 9 and 24 months. Many of these studies can be performed during the initial stage of the project if funding is available. The estimated cost of this stage is approximately $2,200,000.

In the third stage will include standard FDA phase I, II and III studies on dogs. These studies will establish safety and efficacy of the drug in a canine model and allow for the determination of appropriate dosing. Some of these studies can be run concurrently with earlier stages. The estimated to take between 12-24 months at accost of $3,600,000.

| 5 |

Based on the information provided in our Development Plan, assuming immediate full funding allowing concurrent studies, we expect to complete our FDA submission within 24 months.

The FDA/CVM registration is only necessary for the pharmaceutical version products PetLife wishes to sell globally. The nutraceutical version, pet food, treats and other products do require FDA/CVM approval under the Nutraceutical Division. Having this stamp of approval and completing these necessary tests will allow PetLife to make the necessary claims on the product label and in its advertising programs. This will move PetLife from a company with lots of anecdotal evidence and a few clinical trials to one with certified studies and evidence meeting all the necessary requirements by the FDA/CVM.

The Company’s Vitalzul TM Product

PetLife will initially develop dedicated cancer preventative products, such as animal treats. These products are designed to prolong pets’ lives when taken consistently. The Company anticipates this will drive sales for PetLife as clients adopt these types of products as part of their pet’s normal daily diets. Part of PetLife’s sales and marketing framework is to not only sell the products to animal’s post cancer diagnosis, but to educate owners on cancer and autoimmune prevention. PetLife’s preventative animal treats, for example, are an excellent way for pet owners to promote lasting health and viability for their companions.

PetLife anticipates developing the following products for the cancer preventative products:

| ● | Vitalzul™ Preventative – a natural pet treat preventative | |

| ● | Vitalzul™ Tabs – a natural daily pet preventative tablet | |

| ● | Vitalzul™ Pet Foods – natural preventative foods |

VitalzulTM has demonstrated an effect on several different cancer types. With inexpensive modifications, PetLife may be able to create cancer specific products that may increase sales. The following are the top veterinary cancer types that PetLife intends to target:

| ● | Lymphoma or Lymph sarcoma | |

| ● | Hemangiosarcoma | |

| ● | Osteosarcoma | |

| ● | Mast Cell Tumor | |

| ● | Melanoma | |

| ● | Squamous Cell Carcinoma | |

| ● | Mammary Carcinoma | |

| ● | Apocrine Gland Carcinoma (Anal Sac) | |

| ● | Transitional Cell Carcinoma | |

| ● | Soft Tissue Sarcoma | |

| ● | Lymphoma | |

| ● | Squamous carcinoma | |

| ● | Fibrosarcoma | |

| ● | Lung tumors | |

| ● | Brain tumors | |

| ● | Nasal tumors | |

| ● | Liver tumors |

PetLife plans to design three products for differentiated intake protocols for home and veterinary usage.

| ● | Oral / Rectal - Home oral and rectal administration of the VitalzulTM liquid makes the animal easy to treat. The solution is colorless and odorless and can be administered through a droplet or enema. This is an effective tool which clients can use in the convenience of their home. |

| 6 |

| ● | Injectable/Intravenous - The injectable/intravenous version can be used by veterinarians to directly inject the product into the tumor for effective, targeted high dose treatments. This will increase sales with vets who will have an effective in clinic, targeted product will require clients to bring their pets into the vet clinic for treatment. |

PetLife, through the work of its analytical scientists, has identified a diversity of diseases that it believes will respond positively from treatments with the Vitalzul™ nutraceuticals and drugs. The diseases below illustrate those areas of potential expansion beyond the current focus on veterinary oncology related illnesses. The expansion of the application of PetLife’s products and technical knowledge into other health related areas will require the addition of skilled research scientists and pharmacological experts. PetLife will expand its market reach and increase its revenue by treating other diseases.

PetLife intends to also develop products for pets in the following areas:

| ● | Arthritis: Arthritis (or osteoarthritis) is a slowly progressive, degenerative disease of the joints for which there is no cure. However, Vitalzul TM may be able to help to prevent, delay, and manage arthritis in dogs or cats. Arthritis affects 1 in 5 dogs over the age of 7 and over 90% of geriatric cats have arthritis; currently 12 million cats have arthritis. | |

| ● | Hepatitis: As with humans, Hepatitis in dogs and cats affects the liver. This contagious disease includes symptoms such as fever, vomiting and diarrhea accompanied by abdominal pain. Furthermore, Hepatitis may lead to kidney damage. Approximately, 12% of dogs and 40% of cats get Hepatitis. |

| ● | Lyme disease: Lyme disease is a dangerous bacterial disease that can cause irreversible damage to a companion animal’s health. About 5% of dogs contract Lyme disease while the statistics for cats is nominal. |

Global Market for Vitalzul TM and the Company’s Products

The global veterinary pharmaceutical industry is composed of various veterinary health products including biological, veterinary pharmaceuticals and medicated food additives. Over the past few years, the range of animal health products has diversified, currently encompassing metabolic drugs, reproductive aids, anti-infectives, feed additives, imaging diagnostics, vaccines, parasite control, and topical solutions. Veterinary products have emerged for treating chronic diseases such as cancer, osteoarthritis and cardiovascular disease. Pet owners, more than ever before, are spending a larger proportion of their income to take care of their pets’ health.

In the future, the global market for pet health products is expected to grow by an average of 4 - 6% annually and become more specialized. The major drivers will be: (1) the continued strengthening of the bond between owners and their animal companions, (2) increasing companion animal owner awareness and willingness to pay for care, (3) increasing occurrence of cancer in dogs and cats than people while only a fraction are treated because of prohibitive costs, (4) offering an FDA drug at competitive prices, and potentially more effective, as an incentive for more pet owners to treat their pets and extend their duration and quality of life. Companion animals have come to play an important part in the lives of many people. Unsurprisingly the bond between companion animals and people continues to strengthen in parallel to the market for products that contribute significantly to the health and well-being of these animals, such as the products offered by PetLife.

The current focus of the Company’s market is veterinary oncology, a branch of veterinary medicine whose emphasis is dealing with cancer diagnosis and treatment in animals, especially companion animals. Over the years, the number of animals dying of cancer has increased. For example, approximately 45% of dogs aged ten years and above die of cancer. Part of PetLife’s product expansion will include an injectable version that will focus on decreasing and eliminating tumors that are accessible to direct injection

PetLife realizes the parallels between animals and their owners regarding certain conditions, such as poor diet, and its consequences. Overall, the companion animal segment is considered to be the health segment that parallels the human pharmaceutical sector. Many of the innovations in human medicine, at least in terms of new medications, are subsequently adapted and tailored to suit companion animals, like Vitalzul™.

The global animal health market is consolidated with the top ten players controlling the majority share of the market. For many years the largest players in the companion animal market have been Merial and Zoetis. However, the market has seen considerable consolidation mainly through acquisitions and mergers. Proposed mergers and acquisitions are monitored very carefully by governments around the world (such as the Directorate General for Economic and Financial Affairs in the European Union and the United States Federal Trade Commission) to protect the consumer from reduced competition, price increases, and reduced innovation.

Medication and treatments for veterinary cancer are limited and largely ineffective - mainly aimed at temporarily delaying disease progression rather than effective treatments. The veterinary health market for companion animals has grown slowly but steadily by 4% - 6% annually while companion animal expenditures has grown to more than 6.9% compound annual growth rate.

While the U.S. represents the biggest regional market for animal medication, Asia-Pacific region represents the fastest growing market for pet medication with annual dollar sales in the region growing at an annual average of 10.5%. This can be attributed to factors such as increasing income, improvement in per capita consumption per animal, improved living standards, as well as increased pet populations in various regions all over the world. About half of Brazilian households have a dog, more than any other country, according to data tracker Euromonitor, and pet food sales there rose 10 percent to $5.6 billion last year, trailing only the U.S. and U.K. in the $71 billion worldwide market.

| 7 |

Despite remaining challenges in the overall economy, the pet industry has remained unshaken and has been less affected by the recent global recession than other retail sectors. Over the past years, the United States and the United Kingdom have been the leaders in the pet industry. However, today there are a number of other countries that are coming out as players in the global pet industry. The trend in world pet industry has increased tremendously, which is a clear indication of the growing market for veterinary oncology services.

Market in the United States

The veterinary oncology market in the United States is expected to grow mainly due to an increase in the pet population in the United States. People’s attitude towards companion animals has changed, as most pet owners now treat their pets as family members. In a report by Global Industry Analysts, Animal Medication: A Global Strategic Business Report, the authors indicate that animal care often mirrors the trends in human health care. Diagnosis and disease monitoring in veterinary medicine, particularly for companion animals, has also followed trends in human medicine. Diagnostic imaging techniques, such as ultrasonography, computed tomography (CT), and magnetic resonance imaging (MRI), have become commonplace and many veterinary practices have in-house analyzers for clinical chemistry and hematology, as well as rapid patient-side tests, e.g., for infectious agents.

The National Cancer Institute reported that nearly six million dogs in the United States alone are diagnosed with cancer annually, with dogs being 35 times more likely to suffer from cancer than humans. Over six years of age, sixty percent of America’s 83.3 million dogs and 95.6 million cats will be diagnosed with cancer. Unfortunately, only an estimated 10% of those diagnosed receive treatment. PetLife understands that 90% of dogs and cats with cancer go untreated because of unrealistically high costs associated with treatments as well as the dramatic suffering typical of treating pets with toxic, conventional chemotherapy

Marketing Plan

PetLife will deliver its nutraceutical and prescription strength medicines to the enormous population of untreated animals by making the product affordable and convenient in both the home and veterinary setting. PetLife will also capitalize on the increased willingness of pet owners to spend more on their animals’ preventative health, and of veterinarians to meet that demand as key drivers of this market. PetLife will also dedicate their marketing efforts to include educating the public as to the risk their companion animal has at developing cancer. The Company will emphasize the importance on pet owners being proactive and taking the necessary steps to protect their animal. The Company will offer VitalzulTM as the preventative solution.

Currently, apart from surgery which carries its own risks for older pets, the preponderance of treatment for dogs and cats with cancer is simply the same, drastically expensive (most pets do not have medical insurance), toxic chemotherapy drugs developed for humans — scaled down in dosage by the pet’s weight — with many of the same side effects such as nausea, diarrhea, lost appetite, cachexia (“wasting” loss of muscle and fat tissues) headache, hair loss, liver and kidney toxicity and susceptibility to opportune infections.

Direct Sales

PetLife has lined up key team members to execute a traditional, multichannel marketing campaign. This campaign, composed of the traditional five “P” marketing mix will include:

| ● | Product – PetLife will capitalize on the proprietary nature of their primary product offering, Vitalzul™. PetLife will sell Vitalzul™ to veterinarians using multiple respected veterinarian centers of influence to promote the product. PetLife will also sell directly to pet owners through online and brick and mortar establishments; this will be achieved using a well-connected sales force to market to both distributors and direct to retail outlets. | |

| ● | Physical attributes – a newly redesigned bottle has been approved. | |

| ● | Place or distribution – the Company will configure its corporate structure to accommodate the most efficient global supply chain, production and distribution through regional sales centers. PetLife representatives will manage the supply chain, local final production (as required) and distribution. |

| 8 |

| ● | Promotion – direct to vet, direct to consumer, direct to wholesaler; there will also be trade shows, direct vet outreach and online webinars. PetLife will also implement an aggressive online marketing campaign to drive sales in the United States and key international markets using: |

| (i) | DOSEP Campaign: DOSEP (Direct Organic Search Engine Optimization) is a groundbreaking online awareness campaign and technology that will push PetLife’s web presence to the top of Google organic search results for targeted search keywords determined by PetLife management. | |

| (ii) | Multi-Touch Facebook Campaign: The retained Marketing Company will execute a targeted multi-touch Facebook advertising campaign that will generate major social awareness (and resulting online sales) of Vet Oncology products. The marketing messages will appear directly in the Facebook newsfeeds of specific demographic groups who additionally have expressed personal or professional interest in cancer treatment, based on research and targeting of the specific interests contained in their Facebook profiles. | |

| (iii) | Scientifically-Optimized Banner Ad Campaign: The Marketing Company will conduct research for optimal placement, and perform continuous split testing of ads to quickly determine “winners” and then further refine campaigns to determine the optimal combination of performance metrics to justify increasing ad budget spend for top-performing banner campaigns. |

| ● | Media – the Company will engage a top-notch boutique public relations firm to generate media coverage for its products in general news, family, pet and veterinarian publications, e-zines, videos and the blogosphere to communicate Vitalzul™ features and benefits to consumers. |

The online strategic marketing campaigns will repeatedly “local-launch” PetLife into specific metro markets while concurrently building PetLife’s overall brand and marketing presence globally. Repeating the online marketing campaign in each additional targeted metro market will not only localize and establish the PetLife’s brand and products, each event will also increase PetLife’s local and nationwide Google search rankings via DOSEP, Multi-Touch Facebook and Scientifically-Optimized Banner Ads, producing both short- and long-term online sales growth, and firmly establish PetLife as a market leader.

Direct Response: Infomercials

This year an estimated $150 billion dollars in product sales will be generated by infomercials. Specifically, over $1.5 billion will be spent on pet-related purchases through infomercials. Research has shown that retail sales driven by infomercials all range from two to 15 times the infomercial sales. More and more major brands are integrating infomercials into their marketing mix. Infomercials share the product story and benefits with millions of additional prospects at a cost per lead or cost per order that usually matches or beats other direct marketing channels such as direct mail or print ads.

PetLife anticipates the infomercial will:

| ● | Reach millions of new customers and present a complete product story. | |

| ● | Enhance, support, and fill in where other advertising avenues, particularly spot television, leaves off. | |

| ● | Generate qualified leads. | |

| ● | Reduce advertising costs per order and avoid print and mailing costs. | |

| ● | Rapidly and cost-effectively introduce a new product or revive an under-marketed but potentially profitable product. |

PetLife intends to capitalize on the lucrative channels of distribution available to an infomercial marketer. Only one out of every 100 consumers watching an infomercial actively calls an 800 number and purchases the product immediately. Therefore, the retail channel provides a means for the other 99 individuals - who may have been primed by the infomercial - to buy the product.

One-step infomercials are commonly utilized for products previously unable to get retail shelf space in order to gain retailers attention and establish instant distribution. For example, PetLife can inform a retailer that more than a million consumers ordered their product directly from their television ads and thousands of others called for more information. These kinds of figures are meant to grab the attention of brick and mortar retailers, who then purchase and showcase infomercial products realizing that “as seen on TV” are big sellers at retail.

Competition

For most of the products the Company offers there are a number of competitors, several of which are publicly-traded where they not only manufacture and produce their own products but also have established distribution and sales networks and participate in large group purchasing organizations within the medical industry. As mature companies, they also have extensive legacy systems and expensive administrative and sales commission cost structures. In addition, there are independent distributorships of pet medications primarily focused on limited geographic markets and products located across the United States.

| 9 |

Key among the Company’s competitors are:

| Paccal Vet: Paccal Vet®-CA1 has been granted conditional approval by the FDA for the treatment of: non-resectable stage III, IV or V mammary carcinoma in dogs that have not received previous chemotherapy, or radiotherapy and resectable and non-resectable squamous cell carcinoma in dogs that have not received previous chemotherapy, or radiotherapy. | ||

| Palladia: The only drug fully approved by the FDA for the treatment of cancer in canines is Palladia. Palladia is a prescription-only therapy is used to treat grade II or III recurrent cutaneous mast cell tumors with or without regional lymph node involvement. It works by blocking the activity of key receptors important in the development of blood vessels that supply tumors, as well as receptors vital for tumor survival | ||

| Zoetis, Inc.: the world’s largest producer medicine and vaccinations for pets and livestock. Zoetis is engaged in the discovery, development, manufacture and commercialization of animal health medicines and vaccines, with a focus on both livestock and companion animals. It offers a diversified product portfolio, including vaccines, parasiticides, anti-infectives, medicated feed additives and other pharmaceuticals, for both livestock and companion animal customers. | ||

| Merial, Inc.: Sanofi Pasteur is a worldwide leader in the vaccine industry. Its net sales amounted to €3,716 million in 2013, with leading vaccines in five areas: pediatric vaccines, influenza vaccines, adult and adolescent booster vaccines, meningitis vaccines, and travel and endemic vaccines. The company’s Animal Health activity is carried out through Merial, one of the world’s leading animal healthcare companies, dedicated to the research, development, manufacture and delivery of innovative pharmaceuticals and vaccines used by veterinarians, farmers and pet owners and providing a comprehensive line of products to enhance the health, well-being and performance of a wide range of production and companion animals. | ||

| Virbac SA: Virbac SA develops, manufactures, and sells vaccines and medicines to prevent and treat pathologies for companion and food-producing animals in France, the rest of Europe, North America, Latin America, Africa, the Middle East, Asia, and the Pacific region. The company’s products are comprised of a multitude of products in the animal health sector. | ||

Dechra Pharmaceuticals PLC: Dechra Pharmaceuticals PLC is engaged in the development, manufacture, distribution, sale, and marketing of veterinary pharmaceuticals worldwide. It markets and sells licensed branded pharmaceuticals and specialist pet foods to the veterinary professionals in Europe, as well as manufactures products for third party customers. The company also markets and sells a range of endocrine, ophthalmic, dermatological, and equine products in North America. In addition, it develops and licenses its branded veterinary product portfolio of novel and generic pharmaceuticals, and specialist pet diets.

Preveceutical, Inc.: Preveceutical and partner, Uniquest, are currently screening peptides isolated from Caribbean Blue Scorpion venom across some of the most aggressive diseases where there exists unmet clinical need, such as cancer. |

In addition to drug companies, PetLife competes with animal supplements companies. That segment is fragmented, and is dominated by small firms. However, it is witnessing tremendous growth due to the following trends;

● Pet owners view supplements as natural ways to promote health and wellness

● Veterinarians have come to view supplements as reasonable alternatives to animal drugs and are more willing to recommend them as adjuvant or even replacement therapy

● Well formulated supplements with functional ingredients that target specific physiological—and psychological—needs of today’s pets are enticing a whole population of pet parents committed to optimizing the quality of their animals’ lives

● The marketing of recognizable label claims and ingredients found in human diets, such as chicken fillets or fresh salmon, glucosamine, omega 3 fatty acids, probiotics and antioxidants attract shoppers who want to provide the “best” for their pets.

Intellectual Property

PetLife has developed its own patent-pending formulation of Chlorotoxin (the primary active of Blue Scorpion venom) and other naturally occurring plant-based nutrients with known cancer fighting properties. Additionally, PetLife has acquired the formulations of Healthy Life Pets, which is the basis of our “Dr. Geoff’s by PetLife” food line.

Regulatory Issues

There are worldwide, national, state and local rules, regulations and statutes that may impact the Company’s ability to fully implement our strategic plan. The sale of animal health products is governed by the laws and regulations specific to each country in which we sell our products. To maintain compliance with these regulatory requirements, we have established processes, systems and dedicated resources with involvement from product concept to launch and maintenance in the market. In the majority of our markets, the relevant animal health authority is separate from those governing human medicinal products.

| 10 |

United States

The regulatory body that is responsible for the regulation of animal health pharmaceuticals in the United States is the Center for Veterinary Medicine (CVM), housed within the United States Food and Drug Administration (FDA). All manufacturers of animal health pharmaceuticals must show their products to be safe, effective and produced by a consistent method of manufacture as defined under the Federal Food, Drug and Cosmetic Act. Post-approval monitoring of products is required by law, with reports being provided to the CVM’s Surveillance and Compliance group. Reports of product quality defects, adverse events or unexpected results are produced in accordance with the law. Additionally, we are required to submit all new information for a product, regardless of the source.

The regulatory body in the United States for veterinary vaccines is the United States Department of Agriculture (USDA). The USDA’s Center for Veterinary Biologics is responsible for the regulation of animal health vaccines, including immunotherapeutics. All manufacturers of animal health biologicals must show their products to be pure, safe, effective and produced by a consistent method of manufacture as defined under the Virus Serum Toxin Act. Post-approval monitoring of products is required. Reports of product quality defects, adverse events or unexpected results are produced in accordance with the agency requirements.

Outside of the United States

Country-specific regulatory laws have provisions that include requirements for certain labeling, safety, efficacy and manufacturers’ quality control procedures (to assure the consistency of the products), as well as company records and reports. With the exception of the European Union, most other countries’ regulatory agencies will generally refer to the FDA, USDA, EU and other international animal health entities, including the World Organization for Animal Health, Codex Alimentarius, in establishing standards and regulations for veterinary pharmaceuticals and vaccines.

Employees

Currently, we have one employee, which is an executive officer. We have good relationships with our employees and do not anticipate issues relative to our employees.

Properties

We presently lease our principal executive offices, located at 38 West Main Street, Hancock, MD 20715. We believe that our present business property is adequate and suitable to meet our needs.

The PetLife Scorpion Ranch is located in Haiti just a few hours from the capital of Port Au Prince. The ranch will also be the location of our expanded laboratory for the collection and initial processing of scorpion venom. The Company has yet to lease the ranch which is independently owned by unrelated parties.

Legal Proceedings

We are not currently a party in any legal proceeding or governmental regulatory proceeding nor are we currently aware of any pending or potential legal proceeding or governmental regulatory proceeding proposed to be initiated against us.

Our business and an investment in our securities are subject to a variety of risks. The following risk factors describe some of the most significant events, facts or circumstances that could have a material adverse effect upon our business, financial condition, results of operations, ability to implement our business plan and the market price for our securities. Many of these events are outside of our control. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment.

Risks Related to our Business

We were formed on December 12, 2012 and have a limited operating history and accordingly may not be able to effectively operate our business.

We are still in the early stages of company development and accordingly, there is only a limited basis upon which to evaluate our prospects for achieving our intended business objectives. There can be no assurance that we will ever achieve positive cash flow or profitability, or that if either is achieved, that it will be at the levels estimated by management.

We have not yet generated any revenue to date. Our failure to generate significant revenues would seriously harm our business. Even if we are able to access capital, we anticipate that we will experience operating losses and incur significant and increasing losses in the future due to growth, expansion, development and marketing. In the event that we are able to raise adequate capital, we expect to significantly increase our sales and marketing and general and administrative expenses. As a result of these additional expenses, we would need to generate substantial revenues to become profitable. We expect to incur significant operating losses for at least the next several years.

| 11 |

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

The report of our independent auditors on our consolidated financial statements for the year ended August 31, 2017 included an explanatory paragraph indicating that there is substantial doubt about our ability to continue as a going concern. Our auditors’ doubts are based on our incurring significant losses from operations and our working capital deficit position. Our ability to continue as a going concern will be determined by our ability to obtain additional funding in the short term to enable us to realize the commercialization of our planned business operations. Our consolidated financial statements do not include any adjustments that might result from the outcome of this uncertain.

Our Vitalzul ™ product has not been approved by the FDA.

U.S. pet owners may be hesitant to consider Vitalzul™ for treating cancer without FDA approval. Alternative cancer treatments are not well-accepted in the U.S. The Company will need to educate and change the mindset of those who normally would not seek medicinal alternatives for themselves or for their pets for us to be successful. Obtaining approval for our products will be a lengthy and very costly process, the success of which cannot be assured.

Our brand is not well known in the United States.

Marketing Vitalzul™ products will require the Company to establish branding reputation of credibility. U.S. pet owners and veterinarians must become familiar with the products. Due to lack of brand recognition, significant advertising budgets will be required to market and promote products in the U.S. Additional costs are required for a team of experts to seek approval of the PetLife products in foreign markets. The brand initially may not be able to position itself on price, within the natural remedies markets. While the product is less costly than chemotherapy treatments, it may still not be reasonably priced for entry in some markets.

We will require approval for the products in numerous countries.

If Vitalzul™ is not approved in the countries selected to market and promote the products, PetLife will need to consider secondary markets, which may have limited sales potential. In addition, many chemotherapy drugs used by veterinarians today are used as “off label” treatments with no FDA approval for veterinary use, regardless of successful use in treating humans. Veterinarians who have had success with these drugs may be hesitant to try something new or more natural in treating pet cancers.

We are highly dependent on the continued availability of our scorpion farm facilities and would be harmed if they were unavailable for any prolonged period of time.

Any failure in the physical infrastructure of our scorpion ranch facilities or services could lead to significant costs and disruptions that could reduce our revenues and harm our business reputation and financial results. We are highly reliant on our Haiti facilities. Any natural or man-made event that impacts our ability to utilize these facilities could have a significant impact on our operating results, reputation and ability to continue operations. Our ability to rebuild facilities would take a considerable amount of time and expense and may cause a significant disruption in service to our customers. The Company has the ability to store venom offsite which will help mitigate this risk.

We are not currently profitable and we will need to raise additional funds in the future; however, additional funds may not be available on acceptable terms, or at all.

We have substantial operating expenses associated with the sales and marketing of our products. The sales and marketing expenses are anticipated to be funded from operating cash flow and from potential financing transactions. There can be no assurance that we will have sufficient access to liquidity or cash flow to meet our operating expenses and other obligations. If we do not increase our revenue or reduce our expenses, we will need to raise additional capital, which would result in dilution to our stockholders, or seek additional loans. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could result in our inability to pay our expenses as they come due, limit our ability to expand our business operations, and harm our overall business prospects.

We may not be able to raise capital or, if we can, it may not be on favorable terms. We may seek to raise additional capital through public or private equity financings, partnerships, joint ventures, dispositions of assets, debt financings or restructurings, bank borrowings or other sources. To obtain additional funding, we may need to enter into arrangements that require us to relinquish rights to certain technologies, products and/or potential markets. If adequate funds are not otherwise available, we would be forced to curtail operations significantly, including reducing our sales and marketing expenses which could negatively impact product sales and we could even be forced to cease operations, liquidate our assets and possibly even seek bankruptcy protection.

We operate in a highly regulated environment, and any legal or regulatory action could be time-consuming and costly.

If we fail to comply with all applicable laws, standards and regulations, action by the FDA or other regulatory agencies could result in significant restrictions, including restrictions on the marketing or use of our products or the withdrawal of products from the market. Any such restrictions or withdrawals could materially affect our business and operations. In addition, governmental authorities could impose fines, seize our inventory of products, or force us to recall any product already in the market if we fail to comply with governmental regulations.

| 12 |

Competitive products exist and more will be developed, and we may not be able to successfully compete because we are smaller and have fewer financial resources.

Our business is in a very competitive and evolving field. Rapid new developments in this field have occurred over the past few years, and are expected to continue to occur. Other companies already have competing products available or may develop products to compete with ours. Many of these products have short regulatory timeframes and our competitors, many with more substantial development resources, may be able to develop competing products that are equal to or better than ours. This may make our products obsolete or undesirable by comparison and reduce our revenue. Our success will depend, in large part, on our ability to maintain a competitive position concerning our intellectual property, and to develop new technologies and new applications for our technologies. Many of our competitors have substantially greater financial and technical resources, as well as greater production and marketing capabilities, and our ability to compete remains uncertain.

We will need to continue to innovate and develop new products to be desirable to our customers.

The markets for our products and services are characterized by rapid technological change, frequent new introductions, changes in customers’ demands and evolving industry standards. Accordingly, we will need to continue to innovate and develop additional products. These efforts can be costly, subject to long development and regulatory delays and may not result in products approved for sale. These costs may hurt operating results and may require additional capital. If additional capital is not available, we may be forced to curtail development activities. In addition, any failure on our behalf to react to changing market conditions could create an opportunity for other market participants to capture a critical share of the market within a short period of time.

Our success will depend on our ability to engage and retain qualified technical personnel who are difficult to attract.

Our success will depend on our ability to attract and retain qualified technical personnel to assist in research and development, testing, product implementation, low-scale production and technical support. The demand for such personnel is high and the supply of qualified technical personnel is limited. A significant increase in the wages paid by competing employers could result in a reduction of our technical work force and increases in the wage rates that we must pay or both. If either of these events were to occur, our cost structure could increase, and our growth potential could be impaired.

Loss of key members of our management who we need to succeed could adversely affect our business.

We are highly dependent on the services of key members of our management team, and the loss of any of their services could have an adverse effect on our future operations. We do not currently maintain key-man life insurance policies insuring the life of any member of our management team.

We will be required to invest in facilities and equipment on a continuing basis, which will put pressure on us to finance these investments.

We have invested, and intend to continue to invest, in facilities and state-of-the-art equipment in order to increase, expand or update our capabilities and facilities. Changes in technology or sales growth beyond currently established production capabilities, which we anticipate, will require further investment. However, there can be no assurance that we will generate sufficient funds from operations to maintain our existing facilities and equipment or to finance any required capital investments or that other sources of funding will be available. Additionally, there can be no guarantee that any future expansion will not negatively affect earnings.

Future revenue will depend on our ability to increase sales.

We intend to sell our products through numerous means, including direct sales by our employees, through infomercials and through a multi-level marketing program. We have and will continue to incur increased sales and marketing expenses in building and expanding our sales force, and there can be no assurance that we will generate increased sales as a result of this effort.

Our operating results will be harmed if we are unable to effectively manage and sustain our future growth.

We might not be able to manage our future growth efficiently or profitably. Our business is unproven on a large scale and actual revenue and operating margins, or revenue and margin growth, may be less than expected. If we are unable to scale our production capabilities efficiently, we may fail to achieve expected operating margins, which would have a material and adverse effect on our operating results. Growth may also stress our ability to adequately manage our operations, quality of products, safety and regulatory compliance. In order to grow, we may be required to obtain additional financing, which may increase our indebtedness or result in dilution to our stockholders. Further, there can be no assurance that we would be able to obtain any additional financing.

Our success depends on our ability to avoid infringing on the intellectual property rights of third parties which could expose us to litigation or commercially unfavorable licensing arrangements.

Our commercial success depends in part on our ability to avoid infringing patents and proprietary rights of third parties. Third parties may accuse us of employing their proprietary technology in our products, or in the materials or processes used to research or develop our products, without authorization. Any legal action against us claiming damages and/or seeking to stop our commercial activities relating to the affected products, materials and processes could, in addition to subjecting us to potential liability for damages, require us to obtain a license to continue to utilize the affected materials or processes or to manufacture or market the affected products. We cannot predict whether we would prevail in any of these actions or whether any license required under any of these patents would be made available on commercially reasonable terms, if at all. If we are unable to obtain such a license, we may be unable to continue to utilize the affected materials or processes or manufacture or market the affected products or we may be obligated by a court to pay substantial royalties and/or other damages to the patent holder. Even if we are able to obtain such a license, the terms of such a license could substantially reduce the commercial value of the affected product or products and impair our prospects for profitability. Accordingly, we cannot predict whether or to what extent the commercial value of the affected product or products or our prospects for profitability may be harmed as a result of any of the liabilities discussed above. Furthermore, infringement and other intellectual property claims, with or without merit, can be expensive and time-consuming to litigate and can divert management’s attention from our core business. We may be unable to obtain and enforce intellectual property rights to adequately protect our products and related intellectual property.

| 13 |

Our business will become subject to continuing regulatory compliance by the FDA and other authorities which is costly and could result in delays in the commercialization of our products.

Upon completion of the FDA process for our approved drug Vitalzul™ product, we will become subject to extensive regulation by the FDA and potentially other federal governmental agencies and, in some jurisdictions, by state and foreign governmental authorities. These regulations govern the introduction of new pharmaceuticals even for pets, the observance of certain standards with respect to the design, manufacture, testing, labeling, promotion and sales of the pharmaceuticals, the maintenance of certain records, the ability to track devices, the reporting of potential problems, and other matters.

Future revenue will depend on our ability to develop new sales channels and there can be no assurance that these efforts will result in significant revenues.

We are heavily dependent on developing sales channels for our products but there can be no assurance that these channels can be developed or that we will continue to be successful in selling our products. We are engaging in a major initiative to build and further expand our direct sales force, as well as develop infomercial and multi-level marketing sales. This effort will have significant costs that will be incurred prior to the generation of revenue sufficient to cover these costs. The costs incurred for these efforts may impact our operating results and there can be no assurance of their effectiveness. Many of our competitors have well-developed sales channels and it may be difficult for us to break through these competitors to take market share. If we are unable to develop these sales channels, we may not be able to grow revenue or maintain our current level of revenue generation.

Risks Related to our Stock

There may be fluctuations in our operating results, which will impact our stock price.

Significant annual and quarterly fluctuations in our results of operations may be caused by, among other factors, our volume of revenues, the timing of new product or service announcements, releases by us and our competitors in the marketplace of new products or services, seasonality and general economic conditions. There can be no assurance that the level of revenues achieved by us in any particular fiscal period will not be significantly lower than in other comparable fiscal periods. Our expense levels are based, in part, on our expectations as to future revenues. As a result, if future revenues are below expectations, net income or loss may be disproportionately affected by a reduction in revenues, as any corresponding reduction in expenses may not be proportionate to the reduction in revenues.

Because we became public through a reverse merger, we may not be able to attract the attention of major brokerage firms or certain investors.

There are coverage risks associated with our becoming public through a reverse merger, including, among other things, security analysts of major brokerage firms may not provide coverage of us since there is no incentive to brokerage firms to recommend the purchase of our common stock. In addition, we may not attract the attention of major brokerage firms and certain investors due to the possibility of a low stock price. We cannot assure you that brokerage firms would want to conduct any public offerings on our behalf in the future.

The market price of our common stock is extremely volatile, which may affect our ability to raise capital in the future and may subject the value of your investment to sudden decreases.

The market price for securities of biotechnology companies, including ours, historically has been highly volatile, and the market from time to time has experienced significant price and volume fluctuations that are unrelated to the operating performance of such companies. Fluctuations in the trading price or liquidity of our common stock may harm the value of your investment in our common stock.

Our stockholders may experience significant dilution if future equity offerings are used to fund operations or acquire complementary businesses.

If our future operations or acquisitions are financed through the issuance of equity securities, our stockholders could experience significant dilution. In addition, securities issued in connection with future financing activities or potential acquisitions may have rights and preferences senior to the rights and preferences of our common stock.

We do not anticipate paying dividends in the foreseeable future; you should not buy our stock if you expect dividends.

We currently intend to retain our future earnings to support operations and to finance expansion and, therefore, we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

| 14 |

Our current management can exert significant influence over us and make decisions that are not in the best interests of all stockholders.

As of August 31, 2017, our executive officers and directors beneficially owned as a group approximately 32.6% of our outstanding shares of common stock. These officers continue to own a controlling interest in the stock. As a result, these stockholders will be able to assert significant influence over all matters requiring stockholder approval, including the election and removal of directors and any change in control. In particular, this concentration of ownership of our outstanding shares of common stock could have the effect of delaying or preventing a change in control, or otherwise discouraging or preventing a potential acquirer from attempting to obtain control. This, in turn, could have a negative effect on the market price of our common stock. It could also prevent our stockholders from realizing a premium over the market prices for their shares of common stock. Moreover, the interests of the owners of this concentration of ownership may not always coincide with our interests or the interests of other stockholders and, accordingly, could cause us to enter into transactions or agreements that we would not otherwise consider.

Our common stock is considered “penny stock” and may be difficult to sell.

The SEC has adopted Rule 3a51-1, which establishes the definition of a “penny stock” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. The market price of our common stock is less than $5.00 per share and therefore may be designated as a “penny stock” according to SEC rules. For any transaction involving a penny stock, unless exempt, Rule 15g-9 requires:

● that a broker or dealer approve a person’s account for transactions in penny stocks; and

● that the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

● obtain financial information and investment experience objectives of the person; and

● make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form:

● sets forth the basis on which the broker or dealer made the suitability determination; and

● that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our Common Stock and cause a decline in the market value of our stock. In addition, since the Common Stock is currently traded on the OTC Bulletin Board, investors may find it difficult to obtain accurate quotations of the Common Stock and may experience a lack of buyers to purchase such stock or a lack of market makers to support the stock price.

We could issue “blank check” preferred stock without stockholder approval with the effect of diluting then current stockholder interests and impairing their voting rights, and provisions in our charter documents and under Nevada law could discourage a takeover that stockholders may consider favorable.

Our certificate of incorporation provides for the authorization to issue up to 50,000,000 shares of “blank check” preferred stock with designations, rights and preferences as may be determined from time to time by our board of directors. Our board of directors is empowered, without stockholder approval, to issue one or more series of preferred stock with dividend, liquidation, conversion, voting or other rights which could dilute the interest of, or impair the voting power of, our common stockholders. The issuance of a series of preferred stock could be used as a method of discouraging, delaying or preventing a change in control. For example, it would be possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of our company.

Item 1B. Unresolved Staff Comments

Not applicable

| 15 |

Properties

We presently lease our principal executive offices, located at 38 West Main Street, Hancock, MD 21750. We believe that our present business property is adequate and suitable to meet our needs.

The PetLife Scorpion Ranch is located in Haiti just a few hours from the capital of Port Au Prince. The ranch will also be the location of our expanded laboratory for the collection and initial processing of scorpion venom. The Company has yet to lease the ranch which is independently owned by unrelated parties.

We are not currently a party in any legal proceeding or governmental regulatory proceeding nor are we currently aware of any pending or potential legal proceeding or governmental regulatory proceeding proposed to be initiated against us.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market for Common Equity

Marketing Information

The Company’s common stock is quoted on OTC Markets Group, Inc.’s OTCQB under the symbol “PTLF.” As of August 31, 2017, the Company’s common stock was held by 327 shareholders of record, which does not include shareholders whose shares are held in street or nominee name.

Below is a table indicating the range of high and low closing price information for the common stock as reported by the OTC Markets Group for the periods listed. These prices do not necessarily reflect actual transactions.

| For the Years Ended August 31, | ||||||||||||||||

| 2017 | 2016 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter | $ | 0.99 | $ | 0.45 | $ | 0.35 | $ | 0.075 | ||||||||

| Second Quarter | $ | 0.55 | $ | 0.159 | $ | 0.253 | $ | 0.03 | ||||||||

| Third Quarter | $ | 0.5055 | $ | 0.19 | $ | 0.3111 | $ | 0.02 | ||||||||

| Fourth Quarter | $ | 0.2896 | $ | 0.125 | $ | 1.00 | $ | 0.0202 | ||||||||

Source: OTC Markets

Transfer Agent

Our current transfer agent and registrar for our common stock is Empire Stock Transfer, 1859 Whitney Mesa Drive, Henderson, NV 89014.

Dividend Distributions

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock for the foreseeable future. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy may be modified from time to time by our board of directors.

Securities authorized for issuance under equity compensation plans

The Company established a stock option plan on June 9, 2016. The Board of Directors approved the 2016 Stock Option Plan which reserved 20,000,000 shares of common stock.

Penny Stock

Our common stock is considered “penny stock” under the rules the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market System, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that:

| 16 |

| ● | contains a description of the nature and level of risks in the market for penny stocks in both public offerings and secondary trading; |

| ● | contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities’ laws; contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| ● | contains a toll-free telephone number for inquiries on disciplinary actions; |

| ● | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| ● | contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation. |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with:

| ● | bid and offer quotations for the penny stock; |

| ● | the compensation of the broker-dealer and its salesperson in the transaction; |

| ● | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the marker for such stock; and |

| ● | monthly account statements showing the market value of each penny stock held in the customer’s account. |

In addition, the penny stock rules that require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgement of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

Related Stockholder Matters

None.

Purchase of Equity Securities

None.

Item 6. Selected Financial Data.

As the Company is a “smaller reporting company,” this item is inapplicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Rule 175 of the Securities Act of 1933, as amended, and Rule 3b-6 of the Securities Act of 1934, as amended, that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as “anticipate,” “expects,” “intends,” “plans,” “believes,” “seeks” and “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Form 10-K. Investors should carefully consider all of such risks before making an investment decision with respect to the Company’s stock. The following discussion and analysis should be read in conjunction with our consolidated financial statements and summary of selected financial data for PetLife Pharmaceuticals, Inc. Such discussion represents only the best present assessment from our Management.

DESCRIPTION OF COMPANY

PetLife is launching a new generation of non-toxic veterinary cancer medications and nutraceuticals, based on the venom of the Blue Scorpion. This treatment is based on the same patented formula and production processes used in the human formulation. PetLife is developing, packaging, and marketing a new product line, “Vitalzul for Pets™.” The Company’s mission is to bring several non-invasive treatments to market with the goal of improving the quality of life in our companion animals. The anticipated registration of a U.S. Food and Drug Administration (“FDA”) approved drug, “Vitalzul For Pets™,” for the treatment of cancer in animals, as well as the introduction of nutraceuticals, food, and pet treats, are all in the works today. This product has not been approved by the FDA or the Center for Veterinary Medicine for the treatment, cure or prevention of cancer or any other disease in animals. Currently, Vitalzul™ is a nutraceutical product and falls under the category of a Dietary Supplement.

| 17 |

PetLife’s primary goal is to bring its products to the world of veterinary oncology, with the ultimate goal of extending the life of pets with cancer and improving their quality of life. In the process of achieving these objectives, PetLife will transition into a world renowned, professionally respected veterinary pharmaceutical company that will create new industry standards as well as being profitable and innovative.