Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED INSURANCE HOLDINGS CORP. | form8-kq32017investorprese.htm |

United Insurance Holdings Corp.

NASDAQ: UIHC

Company Presentation

December 2017

2DECEMBER 2017 INVESTOR PRESENTATION

Cautionary Statements

This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward

looking statements include expectations regarding our diversification, growth opportunities, retention rates, liquidity, investment returns and our

ability to meet our investment objectives and to manage and mitigate market risk with respect to our investments. These statements are based on

current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions.

Without limiting the generality of the foregoing, words such as "may," "will," "expect," "endeavor," "project," "believe," "anticipate," "intend," "could,"

"would," "estimate," or "continue" or the negative variations thereof, or comparable terminology, are intended to identify forward-looking statements.

Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could

cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation:

the regulatory, economic and weather conditions in the states in which we operate; the impact of new federal or state regulations that affect the

property and casualty insurance market; the cost, variability and availability of reinsurance; assessments charged by various governmental agencies;

pricing competition and other initiatives by competitors; our ability to attract and retain the services of senior management; the outcome of litigation

pending against us, including the terms of any settlements; dependence on investment income and the composition of our investment portfolio and

related market risks; our exposure to catastrophic events and severe weather conditions; downgrades in our financial strength ratings; risks and

uncertainties relating to our acquisitions including our ability to successfully integrate the acquired companies; and other risks and uncertainties

described in the section entitled "Risk Factors" and elsewhere in our filings with the Securities and Exchange Commission (the "SEC"), including our

Annual Report on Form 10-K for the year ended December 31, 2016. We caution you not to place undue reliance on these forward looking statements,

which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any

forward-looking statements to reflect new information, the occurrence of unanticipated events, or otherwise.

This presentation contains certain non-GAAP financial measures. See the Appendix section of this presentation for further information regarding these

non-GAAP financial measures.

The Company has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the Securities Exchange

Commission ("SEC"). This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities. Any offering of

securities in the future will be made only by means of the prospectus in that registration statement and a related prospectus supplement, which will

be filed with the SEC. Before you invest in any potential offering, you should read the prospectus, the related prospectus supplement and other

documents the Company has filed with the SEC for more complete information about the Company and the potential offering. When available,

you may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company will arrange to send you

the prospectus and the related prospectus supplement after filing if you request it.

The information in this presentation is confidential. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and

any forwarding of a copy of this presentation or any portion of this presentation to any person is prohibited.

3DECEMBER 2017 INVESTOR PRESENTATION

Management Overview

John Forney has served as our Chief Executive Officer and a member of our

Board since June 14, 2012. He assumed the additional role of President in July

2013. From 2002 until he joined UIHC, Mr. Forney served in a number of

different capacities at Raymond James (NYSE: RJF), a financial services

holding company based in St. Petersburg, Florida. He last served there as

managing director in Raymond James' public finance department, where he

managed the department and led the firm's investment banking efforts in

catastrophe insurance financing. Mr. Forney received a B.A. in Economics from

Princeton University and an M.B.A. in Finance from the Wharton School at the

University of Pennsylvania. He also holds the Chartered Financial Analyst

designation.

B. Bradford Martz has served as our Chief Financial Officer since October 1,

2012. Prior to joining UIHC, Mr. Martz served as Chief Financial Officer and

Board Member of Bankers Financial Corporation, a Florida-based diversified

holding company system with operations in the property and casualty insurance,

life/annuity insurance, warranty, insurance agency, insurance business process

outsourcing and real estate markets. Mr. Martz obtained a B.S. in Finance from

the University of Colorado at Boulder and an M.B.A. from Northeastern

University. Mr. Martz is a Certified Public Accountant actively licensed in Florida

and also holds the Global Certified Management Accountant designation from

the American Institute of Certified Public Accountants.

4DECEMBER 2017 INVESTOR PRESENTATION

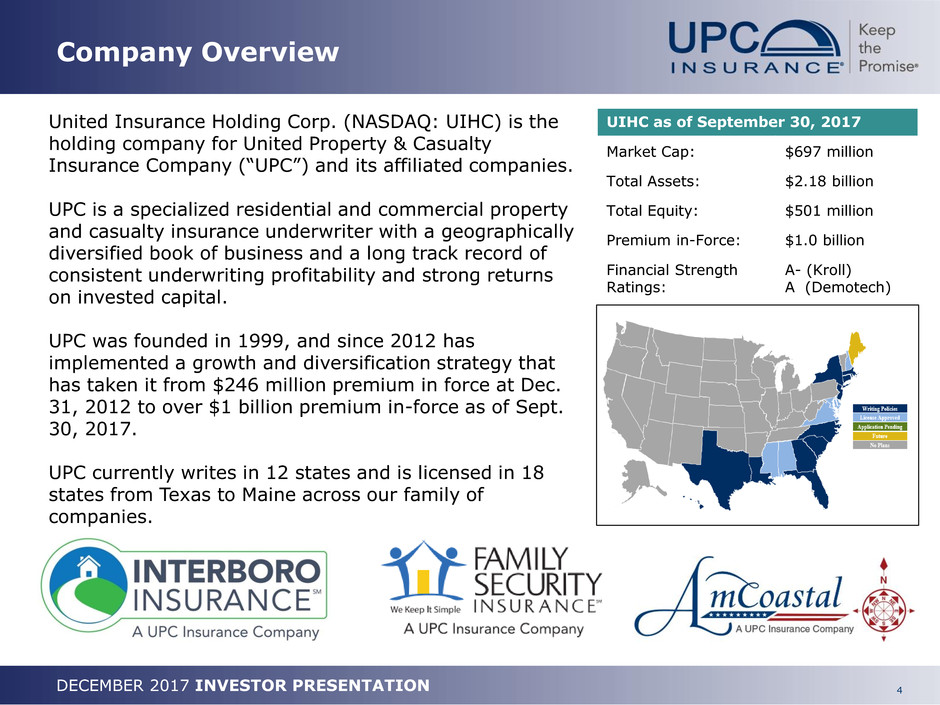

United Insurance Holding Corp. (NASDAQ: UIHC) is the

holding company for United Property & Casualty

Insurance Company (“UPC”) and its affiliated companies.

UPC is a specialized residential and commercial property

and casualty insurance underwriter with a geographically

diversified book of business and a long track record of

consistent underwriting profitability and strong returns

on invested capital.

UPC was founded in 1999, and since 2012 has

implemented a growth and diversification strategy that

has taken it from $246 million premium in force at Dec.

31, 2012 to over $1 billion premium in-force as of Sept.

30, 2017.

UPC currently writes in 12 states and is licensed in 18

states from Texas to Maine across our family of

companies.

Company Overview

UIHC as of September 30, 2017

Market Cap: $697 million

Total Assets: $2.18 billion

Total Equity: $501 million

Premium in-Force: $1.0 billion

Financial Strength

Ratings:

A- (Kroll)

A (Demotech)

5DECEMBER 2017 INVESTOR PRESENTATION

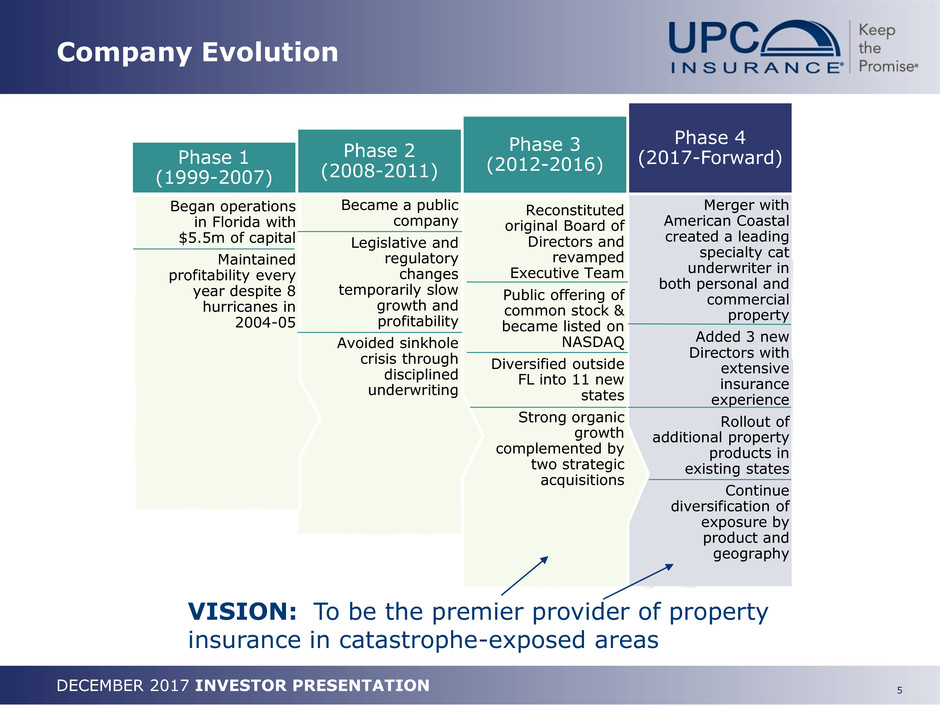

Company Evolution

Merger with

American Coastal

created a leading

specialty cat

underwriter in

both personal and

commercial

property

Added 3 new

Directors with

extensive

insurance

experience

Rollout of

additional property

products in

existing states

Continue

diversification of

exposure by

product and

geography

Phase 4

(2017-Forward)

Reconstituted

original Board of

Directors and

revamped

Executive Team

Public offering of

common stock &

became listed on

NASDAQ

Diversified outside

FL into 11 new

states

Strong organic

growth

complemented by

two strategic

acquisitions

Phase 3

(2012-2016)

Became a public

company

Legislative and

regulatory

changes

temporarily slow

growth and

profitability

Avoided sinkhole

crisis through

disciplined

underwriting

Phase 2

(2008-2011)

Began operations

in Florida with

$5.5m of capital

Maintained

profitability every

year despite 8

hurricanes in

2004-05

Phase 1

(1999-2007)

VISION: To be the premier provider of property

insurance in catastrophe-exposed areas

6DECEMBER 2017 INVESTOR PRESENTATION

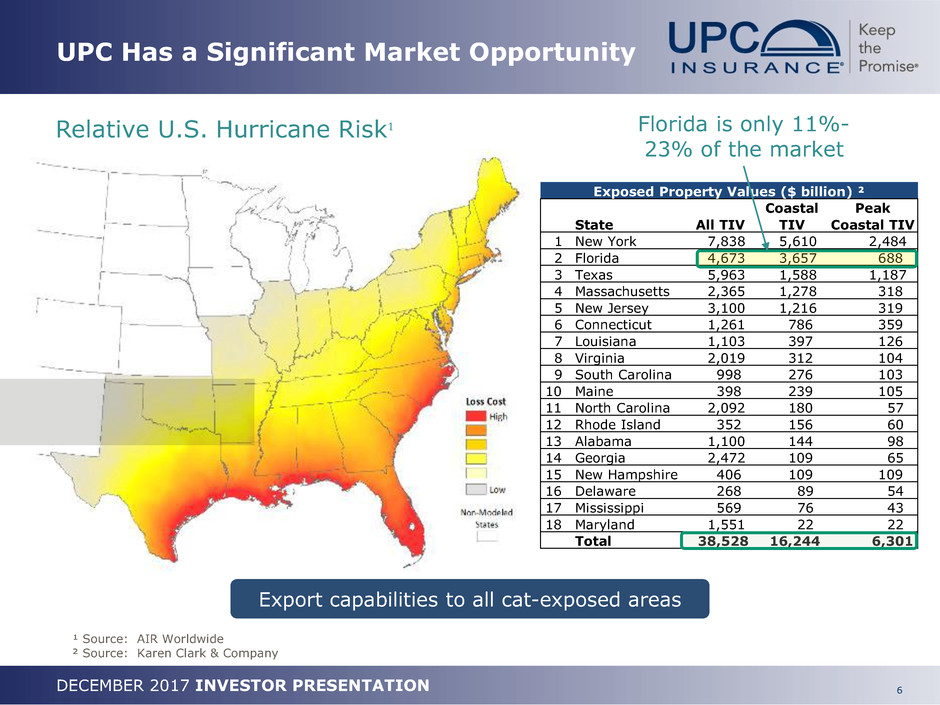

UPC Has a Significant Market Opportunity

Relative U.S. Hurricane Risk¹

¹ Source: AIR Worldwide

² Source: Karen Clark & Company

Export capabilities to all cat-exposed areas

Exposed Property Values ($ billion) ²

Coastal Peak

State All TIV TIV Coastal TIV

1 New York 7,838 5,610 2,484

2 Florida 4,673 3,657 688

3 Texas 5,963 1,588 1,187

4 Massachusetts 2,365 1,278 318

5 New Jersey 3,100 1,216 319

6 Connecticut 1,261 786 359

7 Louisiana 1,103 397 126

8 Virginia 2,019 312 104

9 South Carolina 998 276 103

10 Maine 398 239 105

11 North Carolina 2,092 180 57

12 Rhode Island 352 156 60

13 Alabama 1,100 144 98

14 Georgia 2,472 109 65

15 New Hampshire 406 109 109

16 Delaware 268 89 54

17 Mississippi 569 76 43

18 Maryland 1,551 22 22

Total 38,528 16,244 6,301

Florida is only 11%-

23% of the market

7DECEMBER 2017 INVESTOR PRESENTATION

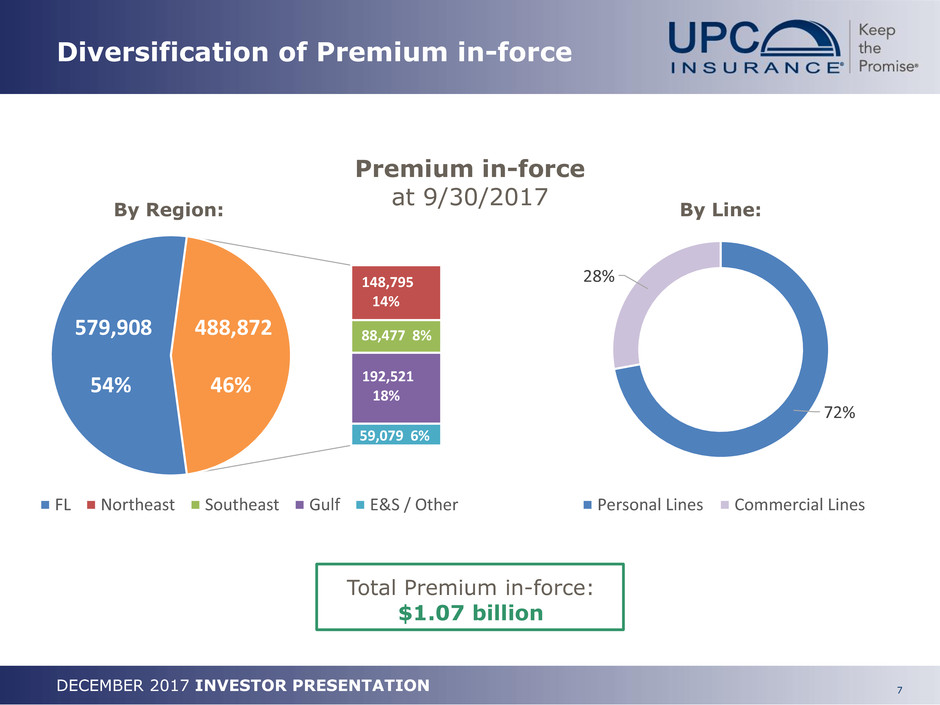

Diversification of Premium in-force

Premium in-force

at 9/30/2017

Total Premium in-force:

$1.07 billion

579,908

54%

148,795

14%

88,477 8%

192,521

18%

59,079 6%

488,872

46%

FL Northeast Southeast Gulf E&S / Other

72%

28%

Personal Lines Commercial Lines

By Region: By Line:

8DECEMBER 2017 INVESTOR PRESENTATION

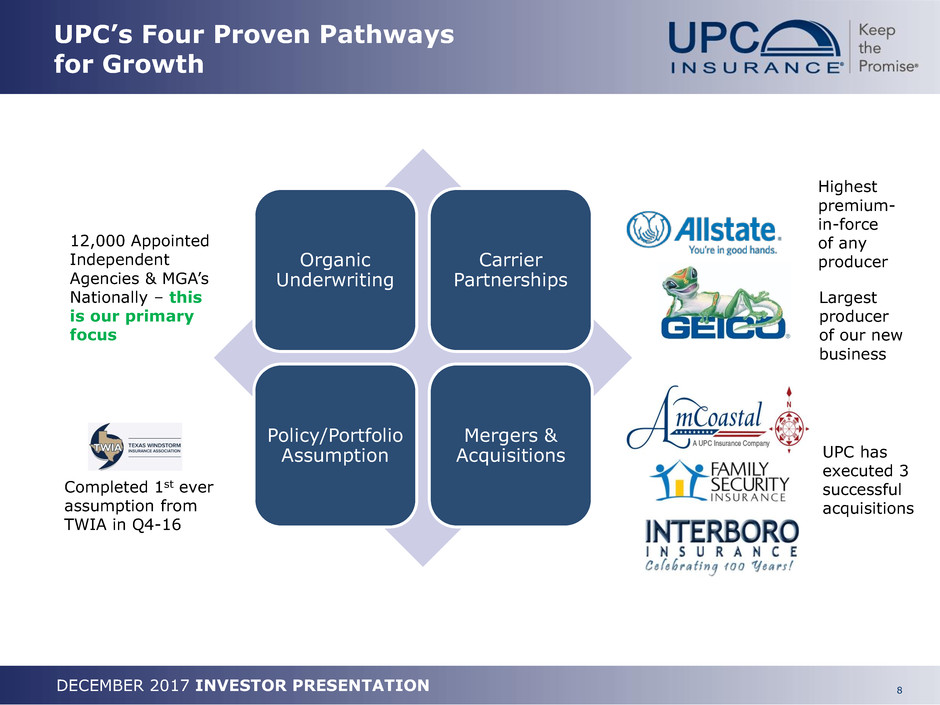

UPC’s Four Proven Pathways

for Growth

Organic

Underwriting

Carrier

Partnerships

Policy/Portfolio

Assumption

Mergers &

Acquisitions

12,000 Appointed

Independent

Agencies & MGA’s

Nationally – this

is our primary

focus

Highest

premium-

in-force

of any

producer

Largest

producer

of our new

business

UPC has

executed 3

successful

acquisitions

Completed 1st ever

assumption from

TWIA in Q4-16

9DECEMBER 2017 INVESTOR PRESENTATION

Strong Underwriting Performance

Underlying annual combined

ratio consistently below 90%

1 Catastrophe losses (CAT) include all events in excess of $1 million of incurred losses from 2 or more claims.

2 Underlying combined ratio, a measure that is not based on U.S. GAAP, is reconciled above to the combined ratio, the most directly comparable GAAP measure. Additional information

regarding non-GAAP measures can be found in the Appendix of this presentation

Loss ratio, net 54.5 % 65.3 % 70.0 %

Expense ratio, net 39.5 % 39.6 % 48.4 %

Combined ratio (CR) 94.0 % 104.9 % 118.4 %

Effect of current year catastrophe

losses on CR ¹

8.5 % 12.2 % 27.4 %

Effect of prior year (favorable)

development on CR

(0.7) % 3.7 % (0.7) %

Effect of ceding commission income

on CR

1.0 % 1.5 % 7.2 %

Underlying combined ratio ² 85.2 % 87.5 % 84.5 %

2015 2016 YTD 9/30/17

10DECEMBER 2017 INVESTOR PRESENTATION

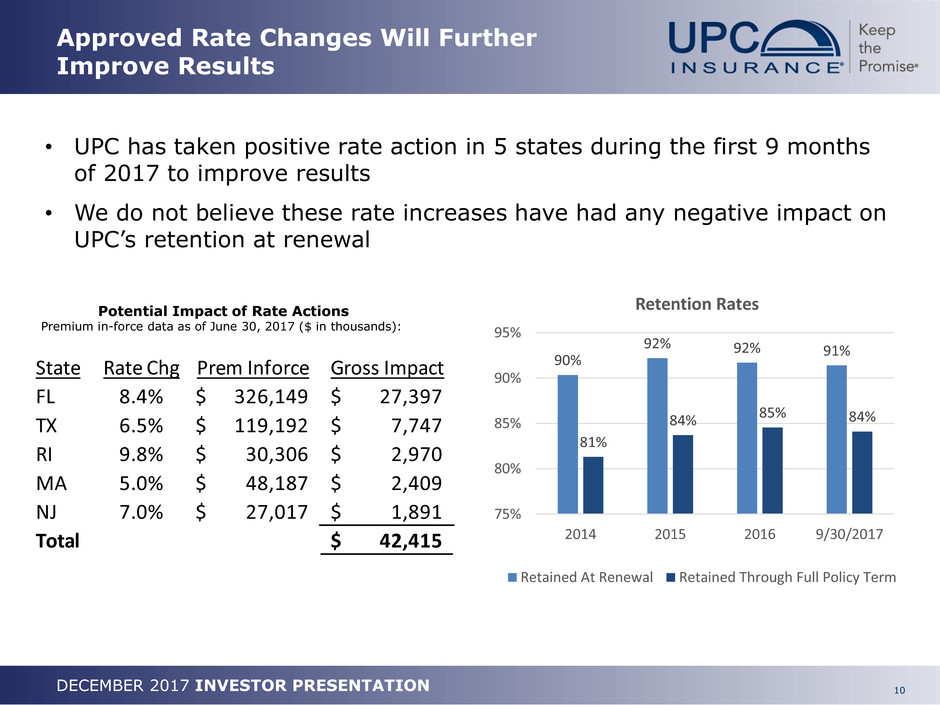

Approved Rate Changes Will Further

Improve Results

State Rate Chg Prem Inforce Gross Impact

FL 8.4% 326,149$ 27,397$

TX 6.5% 119,192$ 7,747$

RI 9.8% 30,306$ 2,970$

MA 5.0% 48,187$ 2,409$

NJ 7.0% 27,017$ 1,891$

Total 42,415$

• UPC has taken positive rate action in 5 states during the first 9 months

of 2017 to improve results

• We do not believe these rate increases have had any negative impact on

UPC’s retention at renewal

90%

92% 92% 91%

81%

84% 85% 84%

75%

80%

85%

90%

95%

2014 2015 2016 9/30/2017

Retention Rates

Retained At Renewal Retained Through Full Policy Term

Potential Impact of Rate Actions

Premium in-force data as of June 30, 2017 ($ in thousands):

11DECEMBER 2017 INVESTOR PRESENTATION

Q3 & YTD 2017 Results

Improvements Y/Y excluding CAT

Consolidated GAAP ($000) YTD as of September 30,

Q3-17 Q3-16 % Chg 2017 2016 % Chg

Revenue

Gross Earned 268,001$ 173,520$ 54.4% 711,650$ 484,607$ 46.9%

Ceded Earned (115,507) (53,299) 116.7% (292,355) (148,837) 96.4%

Net Earned 152,494 120,221 26.8% 419,295 335,770 24.9%

Investment Income 4,901 2,663 84.0% 12,489 7,786 60.3%

Realized gain(loss) (71) 106 -167.0% (554) 478 215.9%

Other revenue 13,804 4,212 227.7% 40,604 11,650 248.5%

Total Revenue 171,128 127,202 34.5% 471,834 355,684 32.7%

Expenses

Loss & LAE - NonCAT 60,512 67,637 -10.5% 178,373 175,730 1.5%

Loss & LAE - CAT 82,615 5,109 1517.0% 115,025 23,885 381.6%

Policy Acquisition 46,546 31,333 48.6% 125,302 84,086 48.8%

Operating & Admin 26,207 17,887 46.5% 77,845 47,085 65.3%

Interest Expense 771 206 274.3% 2,282 397 474.8%

Total Expense 216,651 122,172 77.3% 498,827 331,183 50.6%

Operating Income (45,523) 5,030 -1005.1% (26,993) 24,501 -210.1%

Other Inc (Exp) 36 11 94 80 100.0%

Income Tax (17,475) 1,618 -1180.0% (10,043) 8,366 -220.0%

Net Income (28,012) 3,423 -918.5% (16,856) 16,215 -204.0%

Combined Ratio (CR) 141.6% 101.4% 40.2% 118.4% 98.5% 19.9%

Underlying CR 81.5% 91.4% -9.9% 84.5% 87.7% -3.2%

Solid revenue

growth and

underlying

combined

ratios (CR)

impacted by

unusually high

catastrophe

(CAT) losses

during 2017

1 Underlying combined ratio, a measure that is not based on U.S. GAAP, removes the impact of catastrophe losses, prior year reserve development and ceding commission income on the combined ratio, which is the

most directly comparable GAAP measure. Additional information regarding non-GAAP financial measures can be found in Appendix of this presentation.

1

12DECEMBER 2017 INVESTOR PRESENTATION

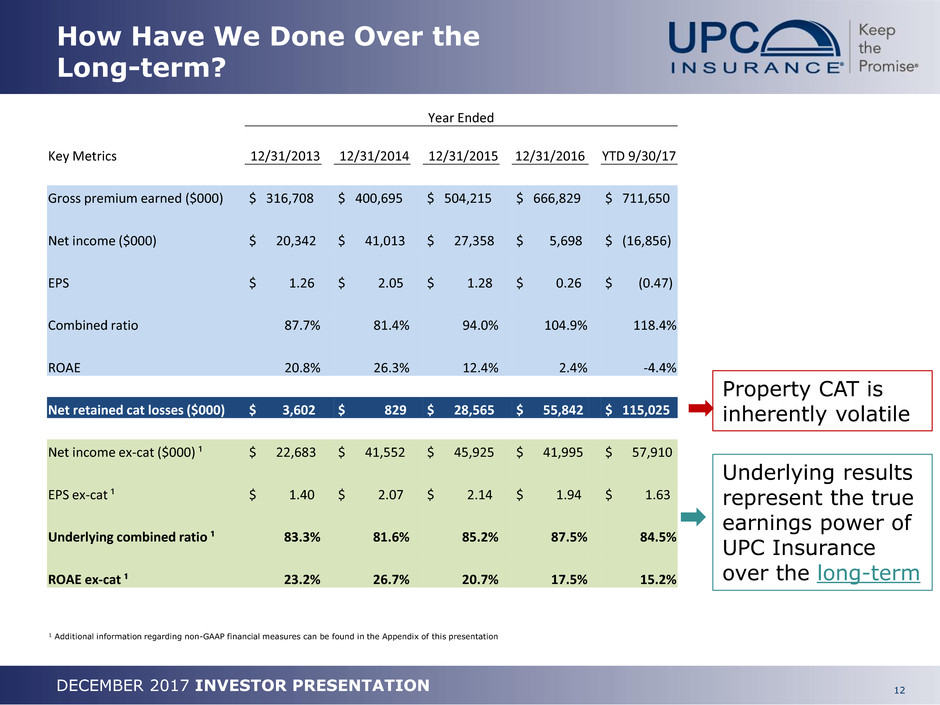

How Have We Done Over the

Long-term?

Underlying results

represent the true

earnings power of

UPC Insurance

over the long-term

Property CAT is

inherently volatile

Year Ended

Key Metrics 12/31/2013 12/31/2014 12/31/2015 12/31/2016 YTD 9/30/17

Gross premium earned ($000) $ 316,708 $ 400,695 $ 504,215 $ 666,829 $ 711,650

Net income ($000) $ 20,342 $ 41,013 $ 27,358 $ 5,698 $ (16,856)

EPS $ 1.26 $ 2.05 $ 1.28 $ 0.26 $ (0.47)

Combined ratio 87.7% 81.4% 94.0% 104.9% 118.4%

ROAE 20.8% 26.3% 12.4% 2.4% -4.4%

Net retained cat losses ($000) $ 3,602 $ 829 $ 28,565 $ 55,842 $ 115,025

Net income ex-cat ($000) ¹ $ 22,683 $ 41,552 $ 45,925 $ 41,995 $ 57,910

EPS ex-cat ¹ $ 1.40 $ 2.07 $ 2.14 $ 1.94 $ 1.63

Underlying combined ratio ¹ 83.3% 81.6% 85.2% 87.5% 84.5%

ROAE ex-cat ¹ 23.2% 26.7% 20.7% 17.5% 15.2%

1 Additional information regarding non-GAAP financial measures can be found in the Appendix of this presentation

13DECEMBER 2017 INVESTOR PRESENTATION

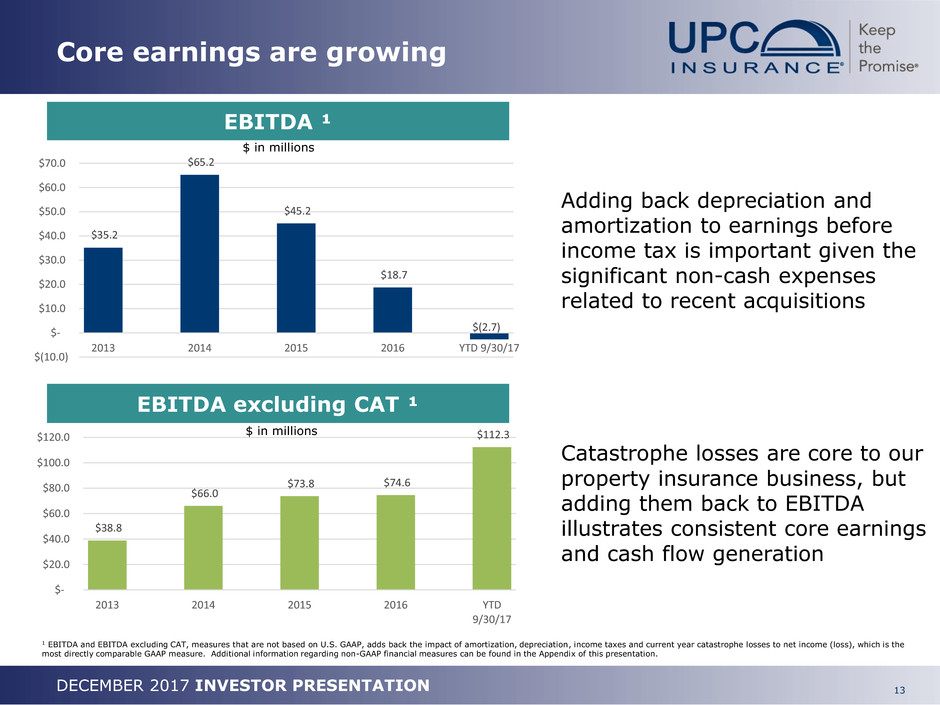

Core earnings are growing

EBITDA ¹

EBITDA excluding CAT ¹

Adding back depreciation and

amortization to earnings before

income tax is important given the

significant non-cash expenses

related to recent acquisitions

Catastrophe losses are core to our

property insurance business, but

adding them back to EBITDA

illustrates consistent core earnings

and cash flow generation

$35.2

$65.2

$45.2

$18.7

$(2.7)

$(10.0)

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

2013 2014 2015 2016 YTD 9/30/17

$ in millions

$ in millions

1 EBITDA and EBITDA excluding CAT, measures that are not based on U.S. GAAP, adds back the impact of amortization, depreciation, income taxes and current year catastrophe losses to net income (loss), which is the

most directly comparable GAAP measure. Additional information regarding non-GAAP financial measures can be found in the Appendix of this presentation.

$38.8

$66.0

$73.8 $74.6

$112.3

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

2013 2014 2015 2016 YTD

9/30/17

14DECEMBER 2017 INVESTOR PRESENTATION

Strong Liquidity & Cash Generation

Holding Co. Liquidity

Debt-to-Capital Ratio

Cash Flow from Operations

$110

$69

$98

$66

$112

$-

$20

$40

$60

$80

$100

$120

2013 2014 2015 2016 Annualized Q3-17

12.0%

6.2%

4.9%

18.3%

9.6%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

2013 2014 2015 2016 Q3-

2017

• Strong dividend capacity from

insurance subsidiaries

• Consistent cash generation including

significant contribution from

unregulated sources, such as our

wholly-owned Mananging General

Agency (MGA)

• Conservative financial leverage profile

$ in millions $ in millions

$28.5

$52.3

$75.1

$36.5

$69.4

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

2013 2014 2015 2016 Q3-2017

Dividend capacity of subsidiaries Unrestricted liquidity on hand

15DECEMBER 2017 INVESTOR PRESENTATION

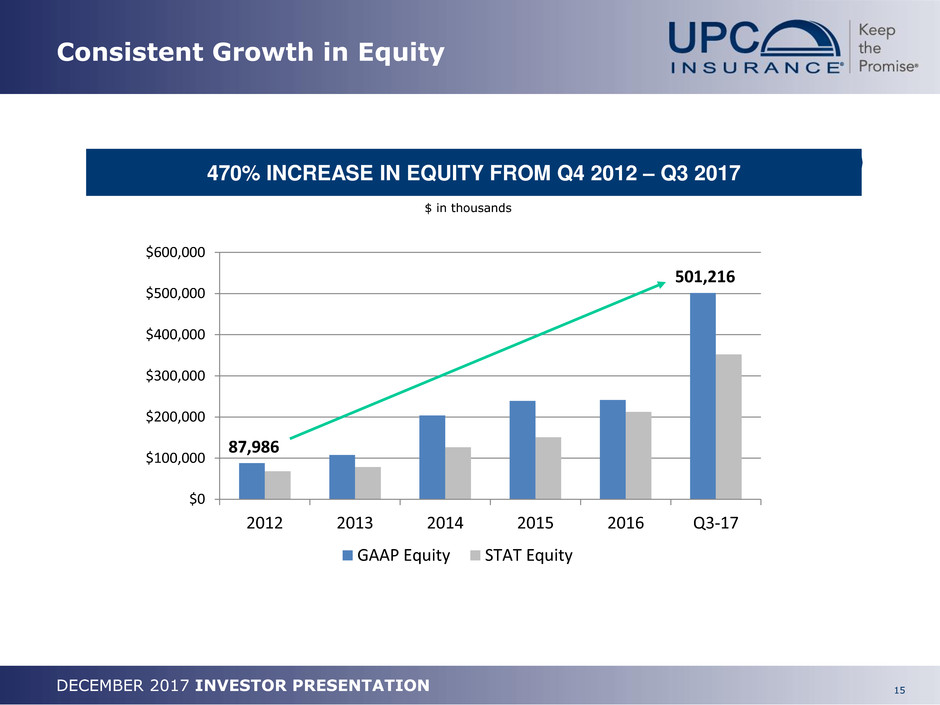

Consistent Growth in Equity

87,986

501,216

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

2012 2013 2014 2015 2016 Q3-17

GAAP Equity STAT Equity

470% INCREASE IN EQUITY FROM Q4 2012 – Q3 2017

$ in thousands

16DECEMBER 2017 INVESTOR PRESENTATION

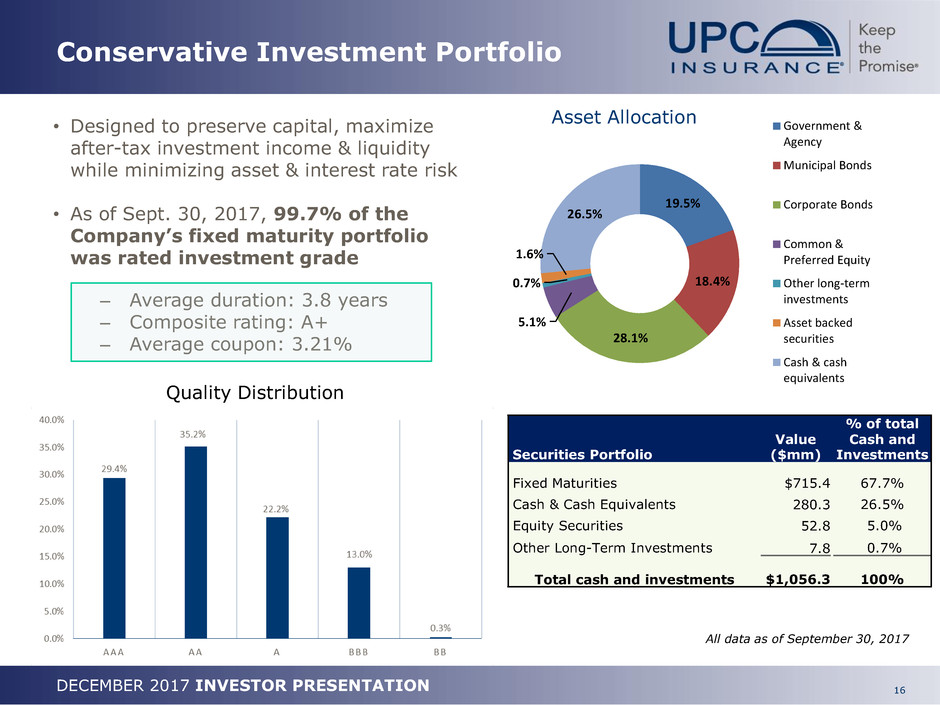

Conservative Investment Portfolio

• Designed to preserve capital, maximize

after-tax investment income & liquidity

while minimizing asset & interest rate risk

• As of Sept. 30, 2017, 99.7% of the

Company’s fixed maturity portfolio

was rated investment grade

– Average duration: 3.8 years

– Composite rating: A+

– Average coupon: 3.21%

All data as of September 30, 2017

Securities Portfolio

Value

($mm)

% of total

Cash and

Investments

Fixed Maturities $715.4 67.7%

Cash & Cash Equivalents 280.3 26.5%

Equity Securities 52.8 5.0%

Other Long-Term Investments 7.8 0.7%

Total cash and investments $1,056.3 100%

Quality Distribution

Asset Allocation

19.5%

18.4%

28.1%

5.1%

0.7%

1.6%

26.5%

Government &

Agency

Municipal Bonds

Corporate Bonds

Common &

Preferred Equity

Other long-term

investments

Asset backed

securities

Cash & cash

equivalents

17DECEMBER 2017 INVESTOR PRESENTATION

Reinsurance Philosophy

Reinsurance mitigates risk and our track

record shows catastrophe losses are

earnings events, not capital events

We try to

balance

protection

against

frequency

& severity

of loss

with risk

retained

as well as

the total

cost of

premiums

ceded to

reinsurers

Consistent risk transfer is an integral part of

our capital strategy

View reinsurers as long-term partners, not

short-term capital providers

Net retained losses are limited as a % of

total capital for each occurrence

18DECEMBER 2017 INVESTOR PRESENTATION

2017-18 Reinsurance Program

Layer 1

$200M xs $25M

NIL

$50M Retention

$56M

$256M

$570M

Layer 3

$400M xs

$25M

NIL

Public FHCF

45% of

$1.73B xs

$535M

NIL

$539M

$2.3B

$2.8B

100 YR$1.629B

$1.3B

Layer 4

$450M xs $25M

NIL

$2.1B

Layer 5

$578M xs $25M

NIL

Layer 2

$300M xs $25M

NIL

20% $6M

QS

¹ Return times and expected losses based on 9/30/17 projected

exposures using AIR v3.1 LT

$21M Retention

$25M

Public FHCF

45% of

$664M xs

$535M

NIL

Layer 4

$267M xs $25M

NIL

$539M

$1.140B

50 YR

$1.2B

Layer 5

$578M xs $25M

NIL

$292M

20% $4M

QS

1st Event: 100 YR ($1.629B FL

Only)

TOTAL RECOVERY: $1.629BM

NET RETAINED: $50.0M

REMAINING 2nd EVENT LIMIT: $1.148B

2nd Event: 50 YR ($1.14B FL

Only)

TOTAL RECOVERY: $1.115B

NET RETAINED: $21.0M

REMAINING LIMIT: $28.8M

The Loss Scenarios Depicted Assume Losses of $1.629B (100

YR) 1st Event, followed by a loss of $1.14B (50 YR) in a 2nd Event.

Should a Loss Be Less Than the Full 2nd Event Limit, Any

Remaining Limit Would Be Available For a 3rd Event. ²

Andrew$447M

2005 Season

(7 events)

$888M

² Excludes Blueline which has a

separate reinsurance program and a

$5 million retention for each event

400 YR

RT ¹

19DECEMBER 2017 INVESTOR PRESENTATION

Conclusion

EXTENSIVE MARKET OPPORTUNITY

• Permanent dislocation/lack of capacity in windstorm exposed markets

• Small market share needed to generate significant premium growth and strong returns

• UPC was the 21st largest homeowners insurer in U.S. for 2016 with production in only 12 states

• Approximately 85% of new business is being written outside Florida

• Seven member executive team has deep experience growing national platforms

LONG TRACK RECORD OF SUCCESS

• Cumulative written premiums nearly $4 billion; cumulative claims paid over $1.5 billion since inception

• Anti-fragility demonstrated during more than 50 different catastrophe events since 1999

• Business model has produced strong returns on invested capital through the cycle

CONSERVATIVELY CAPITALIZED

• Strong balance sheet with ample equity and liquidity – minimal financial leverage and investment risk

• Shareholders’ equity of $501 million augmented by over $2.2 billion of reinsurance remaining at Q3-17

• Conservative reserving philosophy with short tail exposure resulting in low reserve risk

• Low financial leverage and strong cash flow from both regulated and unregulated sources

MAJOR INVESTMENTS IN THE PLATFORM

• Merger with Florida’s largest commercial property writer – American Coastal

• New claims and policy processing systems provide premier functionality and scalability

• Insourcing of key insurance functions gives UPC control over customer experience

20DECEMBER 2017 INVESTOR PRESENTATION

APPENDIX

21DECEMBER 2017 INVESTOR PRESENTATION

Definition & Reconciliation of

Underlying Combined Ratio

We believe that investors’ understanding of UPC Insurance’s performance is enhanced by our disclosure

of the following non-GAAP measures. Our methods for calculating these measures may differ from

those used by other companies and therefore comparability may be limited.

Combined ratio excluding the effects of current year catastrophe losses, prior year

development and ceding commission income (underlying combined ratio) is a non-GAAP ratio,

which is computed as the GAAP combined ratio less (plus) the effect of current year catastrophe losses,

prior year development and ceding commission income on the combined ratio. We believe that this

ratio is useful to investors and it is used by management to reveal the trends in our business that may

be obscured by current year catastrophe losses and prior year development. Current year catastrophe

losses cause our loss trends to vary significantly between periods as a result of their incidence of

occurrence and magnitude, and can have a significant impact on the combined ratio. Prior year

development is unexpected loss development on historical reserves. We believe it is useful for investors

to evaluate these components separately and in the aggregate when reviewing our performance. The

most direct comparable GAAP measure is the combined ratio. The underlying combined ratio should not

be considered as a substitute for the combined ratio and does not reflect the overall profitability of our

business.

2013 2014 2015 2016 YTD 9/30/17 YTD 9/30/16 Q3-17 Q3-16

Combined ratio (CR) 87.7 % 81.4 % 94.0 % 104.9 % 118.4 % 98.5 % 141.6 % 101.4 %

Effect of current year catastrophe

losses on CR

1.8 % 0.3 % 8.5 % 12.2 % 27.4 % 7.1 % 54.2 % 4.2 %

Effect of prior year (favorable)

development on CR

2.1 % (1.5) % (0.7) % 3.7 % (0.7) % 2.9 % (0.7) % 4.9 %

Effect of ceding commission income

on CR

0.5 % 1.0 % 1.0 % 1.5 % 7.2 % 0.8 % 6.6 % 0.9 %

Underlying combined ratio 83.3 % 81.6 % 85.2 % 87.5 % 84.5 % 87.7 % 81.5 % 91.4 %

22DECEMBER 2017 INVESTOR PRESENTATION

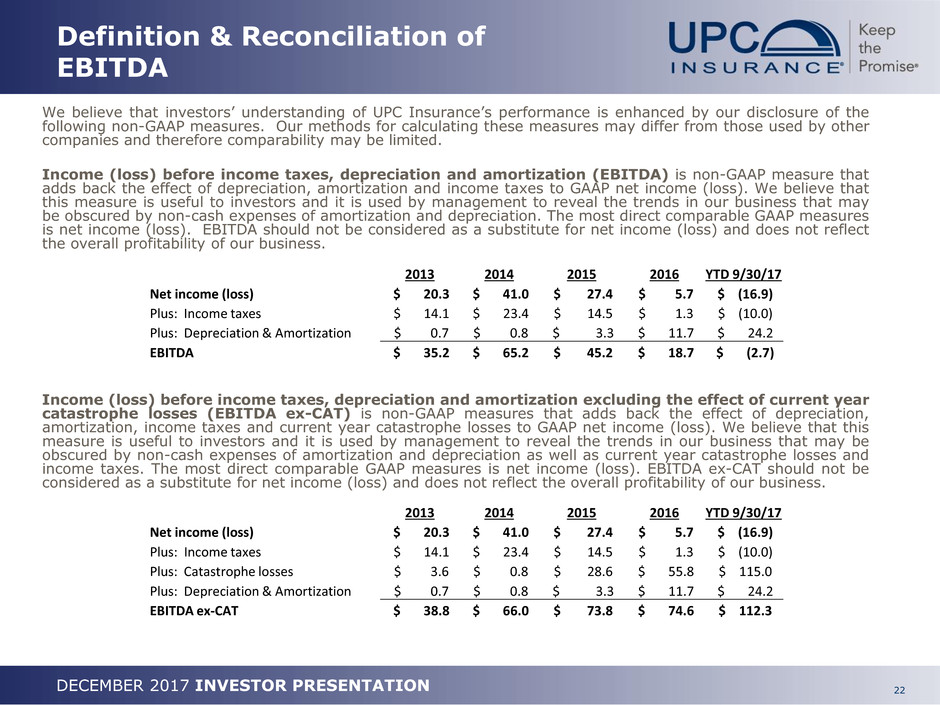

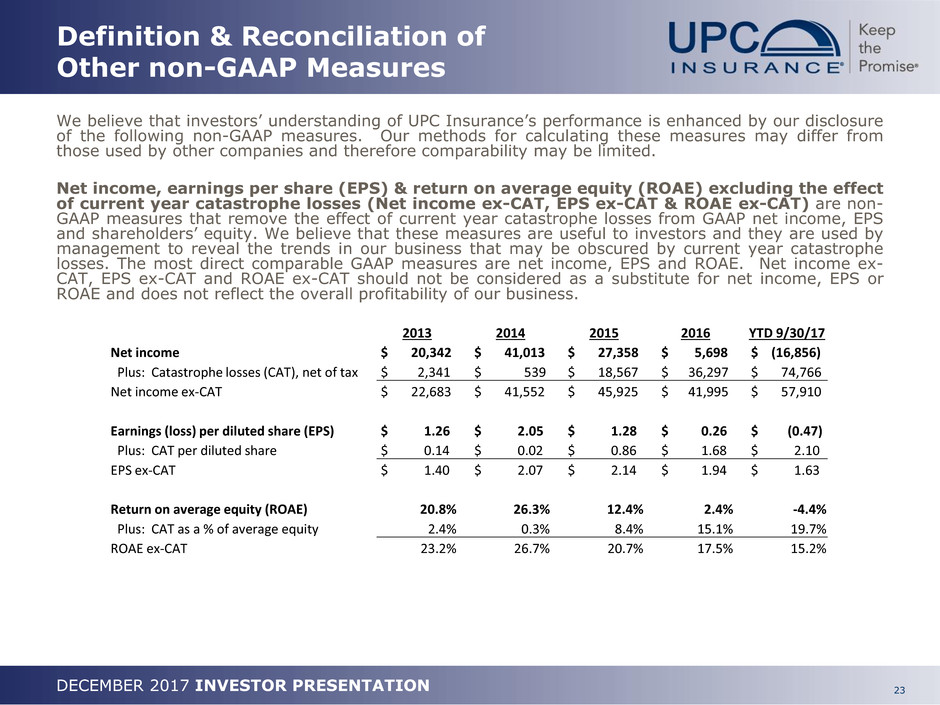

We believe that investors’ understanding of UPC Insurance’s performance is enhanced by our disclosure of the

following non-GAAP measures. Our methods for calculating these measures may differ from those used by other

companies and therefore comparability may be limited.

Income (loss) before income taxes, depreciation and amortization (EBITDA) is non-GAAP measure that

adds back the effect of depreciation, amortization and income taxes to GAAP net income (loss). We believe that

this measure is useful to investors and it is used by management to reveal the trends in our business that may

be obscured by non-cash expenses of amortization and depreciation. The most direct comparable GAAP measures

is net income (loss). EBITDA should not be considered as a substitute for net income (loss) and does not reflect

the overall profitability of our business.

Income (loss) before income taxes, depreciation and amortization excluding the effect of current year

catastrophe losses (EBITDA ex-CAT) is non-GAAP measures that adds back the effect of depreciation,

amortization, income taxes and current year catastrophe losses to GAAP net income (loss). We believe that this

measure is useful to investors and it is used by management to reveal the trends in our business that may be

obscured by non-cash expenses of amortization and depreciation as well as current year catastrophe losses and

income taxes. The most direct comparable GAAP measures is net income (loss). EBITDA ex-CAT should not be

considered as a substitute for net income (loss) and does not reflect the overall profitability of our business.

Definition & Reconciliation of

EBITDA

2013 2014 2015 2016 YTD 9/30/17

Net income (loss) $ 20.3 $ 41.0 $ 27.4 $ 5.7 $ (16.9)

Plus: Income taxes $ 14.1 $ 23.4 $ 14.5 $ 1.3 $ (10.0)

Plus: Depreciation & Amortization $ 0.7 $ 0.8 $ 3.3 $ 11.7 $ 24.2

EBITDA $ 35.2 $ 65.2 $ 45.2 $ 18.7 $ (2.7)

2013 2014 2015 2016 YTD 9/30/17

Net income (loss) $ 20.3 $ 41.0 $ 27.4 $ 5.7 $ (16.9)

Plus: Income taxes $ 14.1 $ 23.4 $ 14.5 $ 1.3 $ (10.0)

Plus: Catastrophe losses $ 3.6 $ 0.8 $ 28.6 $ 55.8 $ 115.0

Plus: Depreciation & Amortization $ 0.7 $ 0.8 $ 3.3 $ 11.7 $ 24.2

EBITDA ex-CAT $ 38.8 $ 66.0 $ 73.8 $ 74.6 $ 112.3

23DECEMBER 2017 INVESTOR PRESENTATION

Definition & Reconciliation of

Other non-GAAP Measures

We believe that investors’ understanding of UPC Insurance’s performance is enhanced by our disclosure

of the following non-GAAP measures. Our methods for calculating these measures may differ from

those used by other companies and therefore comparability may be limited.

Net income, earnings per share (EPS) & return on average equity (ROAE) excluding the effect

of current year catastrophe losses (Net income ex-CAT, EPS ex-CAT & ROAE ex-CAT) are non-

GAAP measures that remove the effect of current year catastrophe losses from GAAP net income, EPS

and shareholders’ equity. We believe that these measures are useful to investors and they are used by

management to reveal the trends in our business that may be obscured by current year catastrophe

losses. The most direct comparable GAAP measures are net income, EPS and ROAE. Net income ex-

CAT, EPS ex-CAT and ROAE ex-CAT should not be considered as a substitute for net income, EPS or

ROAE and does not reflect the overall profitability of our business.

2013 2014 2015 2016 YTD 9/30/17

Net income $ 20,342 $ 41,013 $ 27,358 $ 5,698 $ (16,856)

Plus: Catastrophe losses (CAT), net of tax $ 2,341 $ 539 $ 18,567 $ 36,297 $ 74,766

Net income ex-CAT $ 22,683 $ 41,552 $ 45,925 $ 41,995 $ 57,910

Earnings (loss) per diluted share (EPS) $ 1.26 $ 2.05 $ 1.28 $ 0.26 $ (0.47)

Plus: CAT per diluted share $ 0.14 $ 0.02 $ 0.86 $ 1.68 $ 2.10

EPS ex-CAT $ 1.40 $ 2.07 $ 2.14 $ 1.94 $ 1.63

Return on average equity (ROAE) 20.8% 26.3% 12.4% 2.4% -4.4%

Plus: CAT as a % of average equity 2.4% 0.3% 8.4% 15.1% 19.7%

ROAE ex-CAT 23.2% 26.7% 20.7% 17.5% 15.2%