Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEWPARK RESOURCES INC | a2017q38kirpresentation.htm |

N E W P A R K R E S O U R C E S P R E S E N TAT I O N

D E C E M B E R 2 0 1 7

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act that are

based on management's current expectations, estimates and projections. All statements that address expectations or projections

about the future, including Newpark's strategy for growth, product development, market position, expected expenditures and

future financial results are forward-looking statements. Words such as “will”, “may”, “could”, “would”, “anticipates”, “believes”,

“estimates”, “expects”, “plans”, “intends”, and similar expressions are intended to identify these forward-looking statements but

are not the exclusive means of identifying them. These forward-looking statements reflect the current views of our management;

however, various risks, uncertainties, contingencies and other factors, some of which are beyond our control, are difficult to

predict and could cause our actual results, performance or achievements to differ materially from those expressed in, or implied

by, these statements, including the success or failure of our efforts to implement our business strategy. We assume no obligation

to update, amend or clarify publicly any forward-looking statements, whether as a result of new information, future events or

otherwise, except as required by securities laws. Many factors, including those discussed more fully elsewhere in this presentation

and in documents filed with the Securities and Exchange Commission by Newpark, particularly its Annual Report on Form 10-K for

the year ended December 31, 2016, as well as others, could cause results to differ materially from those expressed in, or implied

by, these statements. These risk factors include, but are not limited to, risks related to the worldwide oil and natural gas industry,

our customer concentration and reliance on the U.S. exploration and production market, risks related to our international

operations, the cost and continued availability of borrowed funds including noncompliance with debt covenants, operating

hazards present in the oil and natural gas industry, our ability to execute our business strategy and make successful business

acquisitions and capital investments, the availability of raw materials and skilled personnel, our market competition, compliance

with legal and regulatory matters, including environmental regulations, the availability of insurance and the risks and limitations of

our insurance coverage, potential impairments of long-lived intangible assets, technological developments in our industry, risks

related to severe weather, particularly in the U.S. Gulf Coast, cybersecurity breaches or business system disruptions and risks

related to the fluctuations in the market value of our common stock. Newpark’s filings with the Securities and Exchange

Commission can be obtained at no charge at www.sec.gov, as well as through its website at www.newpark.com.

F O R W A R D L O O K I N G S TAT E M E N T S

2

This presentation includes references to financial measurements that are supplemental to the Company’s financial performance

as calculated in accordance with generally accepted accounting principles (“GAAP”). These non-GAAP financial measures include

earnings before interest, taxes, depreciation and amortization (“EBITDA”), EBITDA Margin, Net Debt and the Ratio of Net Debt to

Capital. Management believes that these non-GAAP financial measures are frequently used by investors, securities analysts and

other parties in the evaluation of our performance and/or that of other companies in our industry. In addition, management uses

these measures to evaluate operating performance, and our incentive compensation plan measures performance based on our

consolidated EBITDA, along with other factors. The methods we use to produce these non-GAAP financial measures may differ

from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial

measures prepared in accordance with GAAP.

N O N - G A A P F I N A N C I A L M E A S U R E S

3

$984

$1,042

$1,118

$677

$471 $543

$334

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2012 2013 2014 2015 2016 2017

83%

17%

Two Operating Segments:

Fluids Systems

Oil and Gas exploration

Mats and Integrated Services

Oil and Gas exploration

Electrical transmission and

distribution

Pipeline

Petrochemical

Construction

Key geographic markets:

North America

EMEA

Latin America

Asia Pacific

R

e

ve

n

u

e

s

($

m

ill

io

n

s)

Consolidated Revenues

Fluids Systems

Mats and Integrated Services

C O M P A N Y O V E R V I E W

4

Full Year

First Nine Months

48%

52%

First Nine Months – Breakdown by Segment

Revenue EBITDA*

** EBITDA is a non-GAAP financial measure. See reconciliation to the most comparable GAAP measure in the Appendix to this presentation. EBITDA

contribution % based on Segment EBITDA and excludes Corporate Office expenses.

Revenue by Region

G L O B A L S T R E N G T H

5

67%

57%

45%

61%

7%

8%

7%

8%

8%

7%

9%

5%

18%

28%

39%

26%

2014 2015 2016 First Nine

Months

U.S. Canada

Latin America EMEA/APAC

S T R E N G T H E N E D B Y O U R I N V E S T M E N T S

Elevated capital campaign completed

Infrastructure investments open new

markets and significantly enhance our

competitiveness

Reflects our commitment to be the global

leader in fluids and mats technology

6

Fluids: Manufacturing Facility &

Distribution Center Completed 2016 Fluids: Gulf of Mexico Deepwater Shorebase

Completed 2017

Mats: Completed Manufacturing 2015

and Technology Center 2016

55%

9%

30%

6%

U.S. Canada EMEA/APAC Latin America

Largest independent drilling

fluids provider

3rd largest drilling fluids

company worldwide*

Seek to capitalize on strong

market position and extend

Fluids’ product offerings to

completions and other

applications

Expanding global market share,

leveraging IOC/NOC

relationships

$862

$926 $965

$581

$395

$284

$453

$0

$200

$400

$600

$800

$1,000

$1,200

2012 2013 2014 2015 2016 2017

Re

ve

n

u

e

s

($

m

il

lio

n

s)

Total Segment Revenues

First Nine Months 2017 - Revenue by Region

F L U I D S S Y S T E M S - O V E R V I E W

7

Full Year

First Nine Months

* Source: Kimberlite International Oilfield Research, June 2017

F L U I D S S Y S T E M S - T E C H N O L O G Y

8

Proven drilling fluid systems designed to

enhance wellsite performance

Evolution® high-performance, water-based

technology for global applications

Fusion™ brine fluid system creates a

unique enhancement for shale basins

Kronos™ deepwater drilling fluid systems

offers operators a consistent fluid across a

wide temperature and pressure spectrum

Fluids Development

Driving continued advancements in

technology, bringing new chemistries to

enhance drilling efficiencies in challenging

environments

2,283

2,114

2,241

1,170

639

1,068

10%

11%

12%

13%

14%

15%

16%

-

500

1,000

1,500

2,000

2,500

2012 2013 2014 2015 2016 First Nine

Months

NAM Rig Count Market Share

$615

$654

$687

$352

$183

$123

$292

$0

$100

$200

$300

$400

$500

$600

$700

$800

2012 2013 2014 2015 2016 2017

Revenues impacted by lower

drilling activity levels which

remain >50% below pre-

downturn levels

Service quality, operational focus

and organizational alignment

driving share gains in the market

Currently hold #2 market share

position in U.S. land*

Focused on expanding presence

in GOM

Shorebase facility fully

operational

(1) Source: BHI and company data

Re

ve

n

u

e

(

$

m

il

lio

n

s)

North American Revenues

NAM Rig Count & Market Share(1)

F L U I D S S Y S T E M S – N O R T H A M E R I C A

9

Full Year

First Nine Months

*Source: Kimberlite International Oilfield Research, June 2017

$246

$272

$278

$229 $212

$161

$161

$0

$50

$100

$150

$200

$250

$300

$350

2012 2013 2014 2015 2016 2017

$117 $137

$166 $164 $167

$87

$99

$84

$47 $40

$42

$36 $28

$18

$5

2012 2013 2014 2015 2016

EMEA LATAM APAC

International presence remains key to

our strategy

More stable than NAM, through the

industry cycles

Longer term contracts

Largely IOC’s/NOC’s

Fewer competitors

Key contract awards have driven growth

Kuwait (KOC)

Algeria (Sonatrach)

Republic of Congo (ENI)

Uruguay ultra-deepwater (Total)

Albania (Shell)

Chile (ENAP)

Two recent awards provide future

growth

India (Cairn)

Offshore Australia (partnering with

Baker Hughes)

International Revenues

International Revenues by Region

F L U I D S S Y S T E M S – I N T E R N AT I O N A L

10

Full Year

First Nine Months

$122

$116

$153

$96

$76

$51

$90

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

2012 2013 2014 2015 2016 2017

Leading provider of engineered worksite

solutions

Established core rental business in NAM

exploration market, where mats reduce

operator’s costs and improve environmental

protection during drilling and completion

phase

Capitalizing on strong market position to

expand into non-exploration end markets

Patented technology, service capability and

size of composite mat rental fleet provide

competitive advantage

Recent completion of R&D Center is critical to

drive innovation and expansion of product

offering

Revenues include rentals/service and sale of

composite mats

Total Segment Revenues

R

e

ve

n

u

e

s

($

m

ill

io

n

s)

M AT S & I N T E G R AT E D S E R V I C E S - O V E R V I E W

11

Full Year

First Nine Months

M AT S - C O M P E T I T I V E A D V A N TA G E S A C R O S S I N D U S T R I E S

12

Superior

Quality

Enhanced EH&S

Attributes

Scale &

Responsiveness

DO WE HAVE

PHOTOS OF

ACTUAL INSTALL?

PHOTO

FROM PG 3

OF

BROCHURE?

Transportation, Install &

Remediation Efficiency

Diversifying beyond the wellsite

Accelerate penetration of non-

exploration markets, both domestically

and internationally

Larger addressable market

Similar value drivers as exploration

market

Innovate and commercialize

differentiated system enhancements,

including EPZ Grounding System™ for

the utility industry

M AT S – A C C E L E R AT I N G D I V E R S I F I C AT I O N

13

M AT S – W E L L S E R V I C E G R O U P / U T I L I T Y A C C E S S S O L U T I O N

A C Q U I S I T I O N

14

Completed November 2017

Total consideration included

$45m cash and $32m equity

WSG served as strategic logistics and

installation service partner since

2012

Expands complementary service

offering, creating natural bundles

with matting systems

Enhances mats geographical

presence throughout Northeast,

Midwest, Rockies and West Texas

Provides expanded capabilities to

support growth efforts across end-

user markets

M AT S – D I V E R S I F I C AT I O N I S K E Y T O E A R N I N G S S TA B I L I T Y

15

$122 $116

$153

$96

$76

0%

10%

20%

30%

40%

50%

60%

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

$200

2012 2013 2014 2015 2016

R

e

ve

n

u

e

($

m

il)

EB

IT

D

A

M

ar

gi

n

*

* EBITDA and EBITDA margin are non-GAAP financial measures. See reconciliation to the most

comparable GAAP measure in the Appendix to this presentation.

30% 58%

12%

O & G - Exploration NAM Non-Exploration Int'l Non-Exploration

First Nine Months 2017 Revenues by Market

Following historic collapse of O&G

activity in 2015, expansion of business

outside of NAM exploration accelerated

Geographic and end-user market

diversification was key to maintaining

profitability through the cycle

Majority of revenue now derived from

non-exploration markets, providing

stability during E&P market volatility

Significant opportunity for expansion

remains

Capitalize on NAM exploration

recovery

Build upon position in utilities and

pipeline, where a high volume of

infrastructure projects are planned

for upcoming years

Segment Revenue and EBITDA Margin

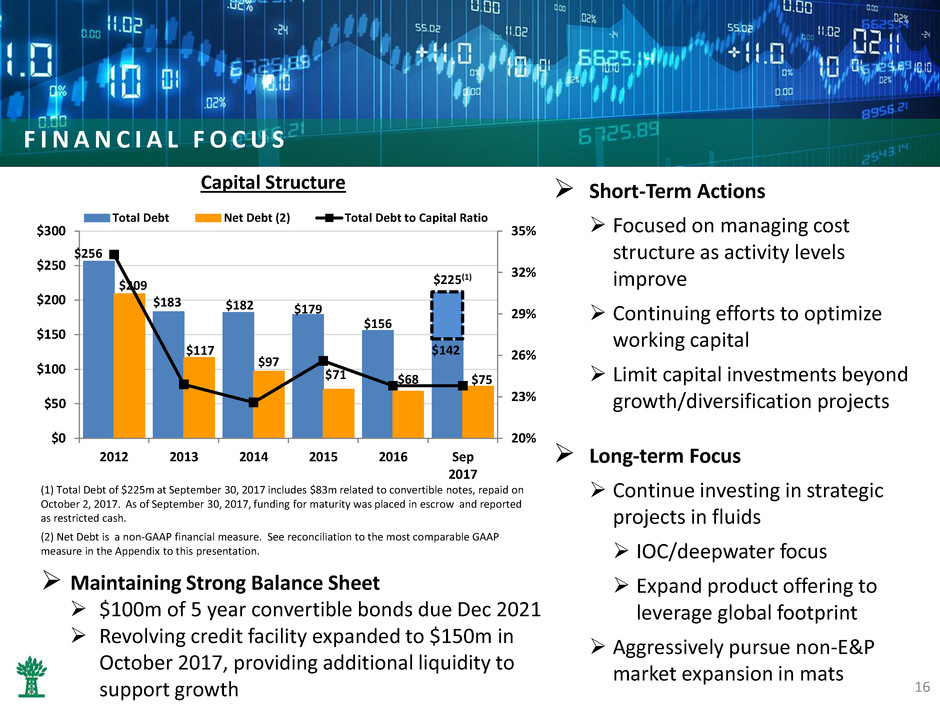

F I N A N C I A L F O C U S

Short-Term Actions

Focused on managing cost

structure as activity levels

improve

Continuing efforts to optimize

working capital

Limit capital investments beyond

growth/diversification projects

Long-term Focus

Continue investing in strategic

projects in fluids

IOC/deepwater focus

Expand product offering to

leverage global footprint

Aggressively pursue non-E&P

market expansion in mats

$256

$183 $182 $179

$156

$209

$117

$97

$71 $68 $75

20%

23%

26%

29%

32%

35%

$0

$50

$100

$150

$200

$250

$300

2012 2013 2014 2015 2016 Sep

2017

Total Debt Net Debt (2) Total Debt to Capital Ratio

$225(1)

Capital Structure

Maintaining Strong Balance Sheet

$100m of 5 year convertible bonds due Dec 2021

Revolving credit facility expanded to $150m in

October 2017, providing additional liquidity to

support growth 16

(2) Net Debt is a non-GAAP financial measure. See reconciliation to the most comparable GAAP

measure in the Appendix to this presentation.

(1) Total Debt of $225m at September 30, 2017 includes $83m related to convertible notes, repaid on

October 2, 2017. As of September 30, 2017, funding for maturity was placed in escrow and reported

as restricted cash.

$142

A P P E N D I X

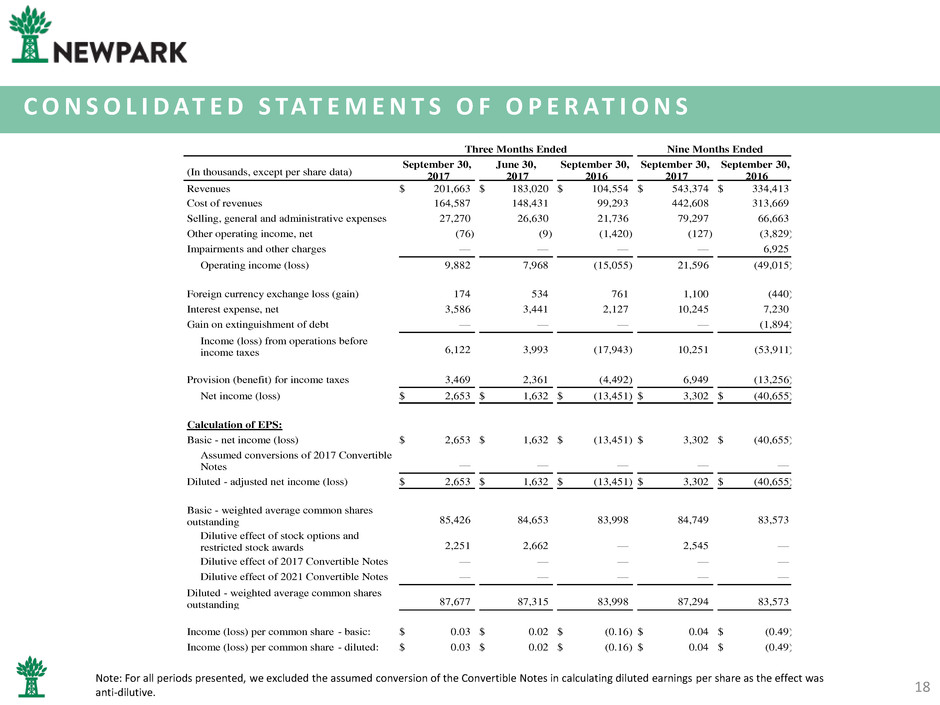

C O N S O L I D AT E D S TAT E M E N T S O F O P E R AT I O N S

18

Note: For all periods presented, we excluded the assumed conversion of the Convertible Notes in calculating diluted earnings per share as the effect was

anti-dilutive.

Three Months Ended Nine Months Ended

(In thousands, except per share data)

September 30,

2017

June 30,

2017

September 30,

2016

September 30,

2017

September 30,

2016

Revenues $ 201,663 $ 183,020 $ 104,554 $ 543,374 $ 334,413

Cost of revenues 164,587 148,431 99,293 442,608 313,669

Selling, general and administrative expenses 27,270 26,630 21,736 79,297 66,663

Other operating income, net (76 ) (9 ) (1,420 ) (127 ) (3,829 )

Impairments and other charges — — — — 6,925

Operating income (loss) 9,882 7,968 (15,055 ) 21,596 (49,015 )

Foreign currency exchange loss (gain) 174 534 761 1,100 (440 )

Interest expense, net 3,586 3,441 2,127 10,245 7,230

Gain on extinguishment of debt — — — — (1,894 )

Income (loss) from operations before

income taxes 6,122

3,993

(17,943 ) 10,251

(53,911 )

Provision (benefit) for income taxes 3,469 2,361 (4,492 ) 6,949 (13,256 )

Net income (loss) $ 2,653 $ 1,632 $ (13,451 ) $ 3,302 $ (40,655 )

Calculation of EPS:

Basic - net income (loss) $ 2,653 $ 1,632 $ (13,451 ) $ 3,302 $ (40,655 )

Assumed conversions of 2017 Convertible

Notes —

—

—

—

—

Diluted - adjusted net income (loss) $ 2,653 $ 1,632 $ (13,451 ) $ 3,302 $ (40,655 )

Basic - weighted average common shares

outstanding 85,426

84,653

83,998

84,749

83,573

Dilutive effect of stock options and

restricted stock awards 2,251

2,662

—

2,545

—

Dilutive effect of 2017 Convertible Notes — — — — —

Dilutive effect of 2021 Convertible Notes — — — — —

Diluted - weighted average common shares

outstanding 87,677

87,315

83,998

87,294

83,573

Income (loss) per common share - basic: $ 0.03 $ 0.02 $ (0.16 ) $ 0.04 $ (0.49 )

Income (loss) per common share - diluted: $ 0.03 $ 0.02 $ (0.16 ) $ 0.04 $ (0.49 )

O P E R AT I N G S E G M E N T R E S U LT S

19

(1) Operating results for the third quarter and first nine months of 2016 included $2.6 million of charges associated with asset demobilization and wind-

down of our operations in Uruguay following the customer decision to discontinue offshore exploration efforts in the country. Operating results for the first

nine months of 2016 also included $7.6 million of charges associated with asset impairments primarily in the Asia Pacific region and $4.1 million of charges

associated with workforce reductions.

Three Months Ended Nine Months Ended

(In thousands)

September 30,

2017

June 30,

2017

September 30,

2016

September 30,

2017

September 30,

2016

Revenues

Fluids systems $ 166,726 $ 150,623 $ 89,097 $ 453,399 $ 283,901

Mats and integrated services 34,937 32,397 15,457 89,975 50,512

Total revenues $ 201,663 $ 183,020 $ 104,554 $ 543,374 $ 334,413

Operating income (loss)

Fluids systems (1) $ 7,930 $ 5,863 $ (8,995 ) $ 20,145 $ (36,126 )

Mats and integrated services 10,941 11,419 882 28,762 8,607

Corporate office (8,989 ) (9,314 ) (6,942 ) (27,311 ) (21,496 )

Operating income (loss) $ 9,882 $ 7,968 $ (15,055 ) $ 21,596 $ (49,015 )

Segment operating margin

Fluids systems (1) 4.8 % 3.9 % (10.1 )% 4.4 % (12.7 )%

Mats and integrated services 31.3 % 35.2 % 5.7 % 32.0 % 17.0 %

C O N S O L I D AT E D B A L A N C E S H E E T S

20

(In thousands, except share data)

September 30,

2017

December 31,

2016

ASSETS

Cash and cash equivalents $ 64,741 $ 87,878

Receivables, net 262,105 214,307

Inventories 164,384 143,612

Prepaid expenses and other current assets 104,703 17,143

Total current assets 595,933 462,940

Property, plant and equipment, net 298,663 303,654

Goodwill 20,415 19,995

Other intangible assets, net 4,312 6,067

Deferred tax assets 3,379 1,747

Other assets 3,221 3,780

Total assets $ 925,923 $ 798,183

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current debt $ 85,119 $ 83,368

Accounts payable 85,049 65,281

Accrued liabilities 50,138 31,152

Total current liabilities 220,306 179,801

Long-term debt, less current portion 139,721 72,900

Deferred tax liabilities 36,559 38,743

Other noncurrent liabilities 7,577 6,196

Total liabilities 404,163 297,640

Common stock, $0.01 par value, 200,000,000 shares authorized and 101,150,629 and

99,843,094 shares issued, respectively 1,012

998

Paid-in capital 568,743 558,966

Accumulated other comprehensive loss (53,727 ) (63,208 )

Retained earnings 132,825 129,873

Treasury stock, at cost; 15,316,359 and 15,162,050 shares, respectively (127,093 ) (126,086 )

Total stockholders’ equity 521,760 500,543

Total liabilities and stockholders' equity $ 925,923 $ 798,183

C O N S O L I D AT E D S TAT E M E N T S O F C A S H F L O W

21

Nine Months Ended September 30,

(In thousands) 2017 2016

Cash flows from operating activities:

Net income (loss) $ 3,302 $ (40,655 )

Adjustments to reconcile net income (loss) to net cash provided by operations:

Impairments and other non-cash charges — 9,493

Depreciation and amortization 28,998 28,421

Stock-based compensation expense 8,458 8,865

Provision for deferred income taxes (3,489 ) (3,205 )

Net provision for doubtful accounts 1,386 2,032

Gain on sale of assets (4,896 ) (2,331 )

Gain on extinguishment of debt — (1,894 )

Amortization of original issue discount and debt issuance costs 4,068 1,150

Change in assets and liabilities:

(Increase) decrease in receivables (73,512 ) 31,360

(Increase) decrease in inventories (17,348 ) 25,368

Increase in other assets (1,621 ) (568 )

Increase (decrease) in accounts payable 17,996 (24,241 )

Increase (decrease) in accrued liabilities and other 52,421 (3,860 )

Net cash provided by operating activities 15,763 29,935

Cash flows from investing activities:

Capital expenditures (21,888 ) (33,390 )

Increase in restricted cash (85,680 ) (578 )

Proceeds from sale of property, plant and equipment 2,233 3,317

Business acquisitions, net of cash acquired — (3,761 )

Net cash used in investing activities (105,335 ) (34,412 )

Cash flows from financing activities:

Borrowings on lines of credit 84,900 6,056

Payments on lines of credit (21,400 ) (7,210 )

Purchase of 2017 Convertible Notes — (9,206 )

Debt issuance costs (342 ) (2,143 )

Other financing activities 1,487 1,452

Proceeds from employee stock plans 2,107 508

Purchases of treasury stock (2,761 ) (1,236 )

Net cash provided by (used in) financing activities 63,991 (11,779 )

Effect of exchange rate changes on cash 2,444 982

Net decrease in cash and cash equivalents (23,137 ) (15,274 )

Cash and cash equivalents at beginning of year 87,878 107,138

Cash and cash equivalents at end of period $ 64,741 $ 91,864

N O N - G A A P F I N A N C I A L M E A S U R E S

22

To help understand the Company’s financial performance, the Company has supplemented its financial results that it provides in

accordance with generally accepted accounting principles (“GAAP”) with non-GAAP financial measures. Such financial measures include

earnings before interest, taxes, depreciation and amortization (“EBITDA”), EBITDA Margin, Net Debt and the Ratio of Net Debt to Capital.

We believe these non-GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of

our performance and/or that of other companies in our industry. In addition, management uses these measures to evaluate operating

performance, and our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors.

The methods we use to produce these non-GAAP financial measures may differ from methods used by other companies. These measures

should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP.

(1) 2015 net loss and EBITDA included $88.7 million of pre-tax charges associated with goodwill and other asset impairments, workforce

reductions and estimated resolution of wage and hour litigation. 2016 net loss and EBITDA included $13.8 million of net pre-tax charges

associated with asset impairments and workforce reductions partially offset by gains for extinguishment of debt and adjustment for

settlement of wage and hour litigation.

Consolid te Nine Months Ended

(In thousands) 2012 2013 2014 2015 2016 September 30, 2017

Net income (loss) from continuing operations (GAAP) (1) 50,453$ 52,622$ 79,009$ (90,828)$ (40,712)$ 3,302$

Interest expense, net 9,727 11,279 10,431 9,111 9,866 10,245

Provision (benefit) for income taxes 31,346 28,725 41,048 (21,398) (24,042) 6,949

Depreciation and amortization 28,946 39,764 41,175 43,917 37,955 28,998

EBITDA (non-GAAP) (1) 120,472$ 132,390$ 171,663$ (59,198)$ (16,933)$ 49,494$

Twelve Months Ended December 31,

N O N - G A A P F I N A N C I A L M E A S U R E S

23

(2) 2015 Fluids Systems operating results and EBITDA included $82.7 million of pre-tax charges associated with goodwill and other asset

impairments and workforce reductions. 2016 Fluids Systems operating results and EBITDA included $15.6 million of pre-tax charges

associated with asset impairments and workforce reductions.

(3) 2015 Mats and Integrated Services operating results and EBITDA included $0.7 million of pre-tax charges associated with workforce

reductions. 2016 Mats and Integrated Services operating results and EBITDA included $0.3 million of pre-tax charges associated with

workforce reductions.

Fluids Systems Nine Months Ended

(In thousands) 2012 2013 2014 2015 2016 September 30, 2017

Operating income (loss) (GAAP) (2) 59,987$ 72,604$ 95,600$ (86,770)$ (43,631)$ 20,145$

Depreciation and amortization 18,419 26,679 22,934 22,108 20,746 16,221

EBITDA (non-GAAP) (2) 78,406$ 99,283$ 118,534$ (64,662)$ (22,885)$ 36,366$

Revenues 861,670$ 926,392$ 965,049$ 581,136$ 395,461$ 453,399$

Operating Margin (GAAP) 7.0% 7.8% 9.9% -14.9% -11.0% 4.4%

EBITDA Margin (non-GAAP) 9.1% 10.7% 12.3% -11.1% -5.8% 8.0%

Mats and Integrated Services Nine Months Ended

(In thousands) 2012 2013 2014 2015 2016 September 30, 2017

Operating income (loss) (GAAP) (3) 54,251$ 49,394$ 70,526$ 24,949$ 14,741$ 28,762$

Depreciation and amortization 7,952 10,501 15,507 18,869 14,227 10,414

EBITDA (non-GAAP) (3) 62,203$ 59,895$ 86,033$ 43,818$ 28,968$ 39,176$

Revenues 122,283$ 115,964$ 153,367$ 95,729$ 76,035$ 89,975$

Operating Margin (GAAP) 44.4% 42.6% 46.0% 26.1% 19.4% 32.0%

EBITDA Margin (non-GAAP) 50.9% 51.6% 56.1% 45.8% 38.1% 43.5%

Twelve Months Ended December 31,

Twelve Months Ended December 31,

N O N - G A A P F I N A N C I A L M E A S U R E S

24

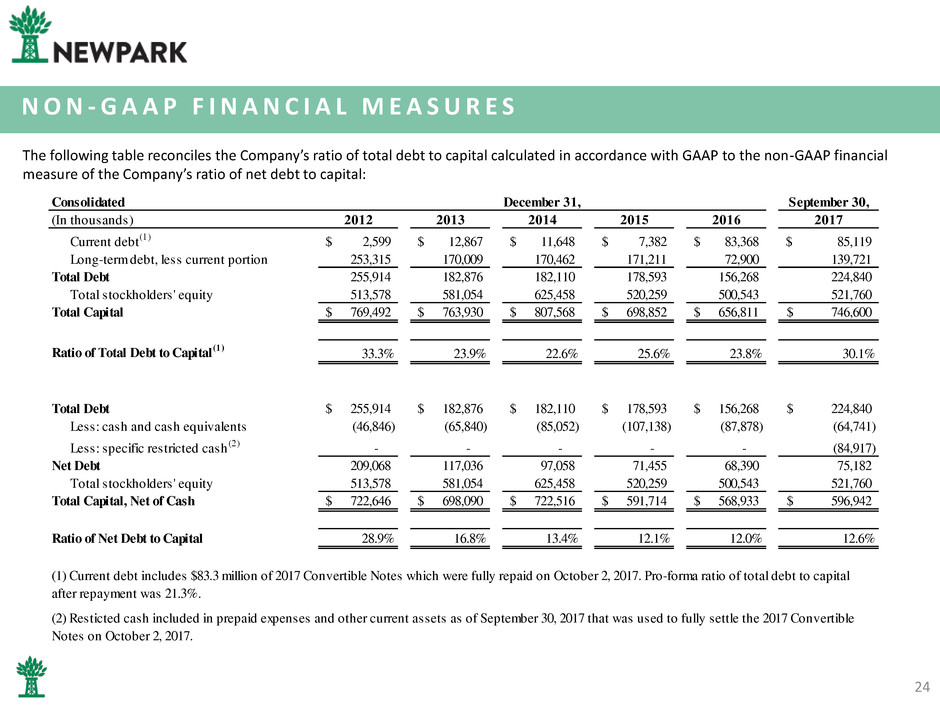

The following table reconciles the Company’s ratio of total debt to capital calculated in accordance with GAAP to the non-GAAP financial

measure of the Company’s ratio of net debt to capital:

Consolidated September 30,

(In thousands) 2012 2013 2014 2015 2016 2017

Current debt(1) 2,599$ 12,867$ 11,648$ 7,382$ 83,368$ 85,119$

Long-term debt, less current portion 253,315 170,009 170,462 171,211 72,900 139,721

Total Debt 255,914 182,876 182,110 178,593 156,268 224,840

Total stockholders' equity 513,578 581,054 625,458 520,259 500,543 521,760

Total Capital 769,492$ 763,930$ 807,568$ 698,852$ 656,811$ 746,600$

Ratio of Total Debt to Capital(1) 33.3% 23.9% 22.6% 25.6% 23.8% 30.1%

Total Debt 255,914$ 182,876$ 182,110$ 178,593$ 156,268$ 224,840$

Less: cash and cash equivalents (46,846) (65,840) (85,052) (107,138) (87,878) (64,741)

Less: specific restricted cash (2) - - - - - (84,917)

Net Debt 209,068 117,036 97,058 71,455 68,390 75,182

Total stockholders' equity 513,578 581,054 625,458 520,259 500,543 521,760

Total Capital, Net of Cash 722,646$ 698,090$ 722,516$ 591,714$ 568,933$ 596,942$

Ra io f Net Debt to Capital 28.9% 16.8% 13.4% 12.1% 12.0% 12.6%

December 31,

(1) Current debt includes $83.3 million of 2017 Convertible Notes which were fully repaid on October 2, 2017. Pro-forma ratio of total debt to capital

after repayment was 21.3%.

(2) Resticted cash included in prepaid expenses and other current assets as of September 30, 2017 that was used to fully settle the 2017 Convertible

Notes on October 2, 2017.

E X P E R I E N C E D L E A D E R S H I P

• Paul Howes President & CEO

• Gregg Piontek Vice President & CFO

• Mark Airola SVP, GC & Admin Officer

• Phil Vollands President

Fluids Systems

• Bruce Smith Chief Technology Officer

Fluids Systems

• Matthew Lanigan President

Mats & Integrated Services

• Ida Ashley Vice President, Human Resources

25

M A N A G E M E N T B I O G R A P H I E S

Paul L. Howes, President & CEO: Paul L. Howes joined our Board of Directors and was appointed as our Chief Executive Officer in

March 2006. In June 2006, Mr. Howes was also appointed as our President. Mr. Howes’ career has included experience in the defense

industry, chemicals and plastics manufacturing, and the packaging industry. Following the sale of his former company in October 2005

until he joined our Board of Directors in March 2006, Mr. Howes was working privately as an inventor and engaging in consulting and

private investing activities. From 2002 until October 2005, he served as President and Chief Executive Officer of Astaris LLC, a primary

chemicals company headquartered in St. Louis, Missouri, with operations in North America, Europe and South America. Prior to this,

from 1997 until 2002, he served as Vice President and General Manager, Packaging Division, for Flint Ink Corporation, a global ink

company headquartered in Ann Arbor, Michigan with operations in North America, Europe, Asia Pacific and Latin America.

Mr. Howes is also actively engaged in energy industry trade associations. He currently holds the Chairman position on the General

Membership Committee for the American Petroleum Institute (API); and, is a contributing member to the API Board of Directors and

Executive Committee. Additionally, he is a member of the Board of Directors of the National Ocean Industries Association (NOIA).

Gregg S. Piontek, VP & CFO: Gregg joined Newpark in April 2007 and served as Vice President, Controller and Chief Accounting

Officer from April 2007 to October 2011. Prior to joining Newpark, Mr. Piontek was Vice President and Chief Accounting Officer of

Stewart & Stevenson LLC from 2006 to 2007. From 2001 to 2006, Mr. Piontek held the positions of Assistant Corporate Controller and

Division Controller for Stewart & Stevenson Services, Inc. Prior to that, Mr. Piontek served in various financials roles at General

Electric and CNH Global N.V., after beginning his career as an auditor for Deloitte & Touche LLP. Mr. Piontek is a Certified Public

Accountant and holds a bachelor degree in Accountancy from Arizona State University and a Master of Business Administration

degree from Marquette University.

Mark J. Airola, Sr. VP, GC & Admin Officer: Mark joined Newpark in October 2006 as its Vice President, General Counsel and Chief

Administrative Officer. Mr. Airola was named Senior Vice President in February of 2011. Prior to joining Newpark, Mr. Airola was

Assistant General Counsel and Chief Compliance Officer for BJ Services Company, a leading provider of pressure pumping and other

oilfield services to the petroleum industry, serving as an executive officer since 2003. From 1988 to 1995, he held the position of

Senior Litigation Counsel at Cooper Industries, Inc., a global manufacturer of electrical products and tools, with initial responsibility

for managing environmental regulatory matters and litigation and subsequently managing the company’s commercial litigation.

26

Phillip T. Vollands, President, Fluids Systems: Phil joined Newpark in October 2013 as President, North America Fluids Systems and

became President, Western Hemisphere in 2016. Prior to Newpark, he was Vice President, Tubular Running Services for

Weatherford International from 2010 to 2013. Previously, from 1997 to 2010, he served in a variety of sales and operational roles of

increasing responsibility for National Oilwell Varco including VP Power Generation Division and VP Global Strategic Accounts. Phil

started his oilfield career as a wireline logging engineer working primarily in the North Sea. He brings over 25 years of global oilfield

service experience that span multiple disciplines with a strong track record in driving profitable growth across the globe. Phil holds

a BA in Engineering Science from Oxford University and MA (Oxon).

Bruce C. Smith, Chief Technology Officer, Fluids Systems: Bruce has been in the drilling fluids industry since 1973 and has held

many technical, operational and leadership positions during this 35 year period. Bruce joined Newpark in April 1998 as Vice

President International and served as President of Newpark Drilling Fluids from October 2000 – June 2017. Prior to joining Newpark,

Mr. Smith was the Managing Director of the UK operations of M-I SWACO.

Matthew Lanigan, President Mats and Integrated Services: Matthew joined Newpark in April 2016, as President of Newpark Mats

& Integrated Services. Matthew began his professional career at ExxonMobil in Australia working on rigs as a Drilling & Completions

Engineer, progressing from there to Offshore Production Engineer and as a Marketer for Crude & LPG. While pursuing his MBA, he

accepted a position with GE in the Plastics division where he rose to the role of Chief Marketing Officer before transferring to the

Capital division of GE, based in the UK. His first opportunity to work in the United States came with the Enterprise Client Group of

GE's Capital division, where he worked in leadership roles in Sales & Marketing. In 2011, he was appointed as the Director of

Commercial Excellence for Asia Pacific, based in Australia. In addition to growing revenue and market share, key responsibilities for

this role included developing cross-organizational synergies and market entry strategies.

Ida Ashley, VP, Human Resources: Ida joined Newpark in March 2015 as Vice President, Human Resources. Ida has over 20 years of

experience in Human Resources, 17 of which were specific to Oilfield Services where she specialized in Employee Relations, Mergers

& Acquisitions and International HR programs. Ida has worked in a variety of HR leadership roles in Smith International, M-I SWACO

and Schlumberger. Her role prior to joining Newpark was VP of HR, North America in Schlumberger. Originating from Smith

International, she had the unique opportunity to lead the HR integration project team during the Schlumberger/Smith merger from

August 2010 – December 2012. Ida earned her Masters of Science in Human Resources from Houston Baptist University in 2000 and

her Bachelors of Arts in Modern Languages from Texas A&M in 1991.

M A N A G E M E N T B I O G R A P H I E S

27

Our Board members represent a desirable mix of diverse backgrounds, skills and experiences and we believe they

all share the personal attributes of effective directors. They each hold themselves to the highest standards of

integrity and are committed to the long-term interests of our stockholders.

B O A R D O F D I R E C T O R S

28

DAVID C. ANDERSON Chief Executive Officer, Anderson Partners

Chairman of the Board Former President and Chief Operating Officer, Heidrick & Struggles

ANTHONY J. BEST Retired Chief Executive Officer, SM Energy Company

G. STEPHEN FINLEY Retired Senior V.P. and Chief Financial Officer, Baker Hughes Incorporated

PAUL L. HOWES President and Chief Executive Officer, Newpark Resources

RODERICK A. LARSON President and Chief Executive Officer, Oceaneering International, Inc.

JOHN C. MINGE Chairman and President, BP America

GARY L. WARREN Retired Senior Vice President, Weatherford

Please visit our website for full biographies of our Board.

F O CU S E D ON C U S TOME R ’ S N E E D S