Attached files

| file | filename |

|---|---|

| EX-95.1 - EXHIBIT 95.1 - NEWPARK RESOURCES INC | nr10-kexhibit951.htm |

| EX-32.2 - EXHIBIT 32.2 - NEWPARK RESOURCES INC | nr10-kexhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - NEWPARK RESOURCES INC | nr10-kexhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - NEWPARK RESOURCES INC | nr10-kexhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - NEWPARK RESOURCES INC | nr10-kexhibit311.htm |

| EX-23.1 - EXHIBIT 23.1 - NEWPARK RESOURCES INC | nr10-kexhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - NEWPARK RESOURCES INC | nr10-kexhibit211.htm |

| EX-10.66 - EXHIBIT 10.66 - NEWPARK RESOURCES INC | nr10-kexhibit1066.htm |

| EX-10.22 - EXHIBIT 10.22 - NEWPARK RESOURCES INC | nr10-kexhibit1022.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From to

Commission File Number 001-2960

Newpark Resources, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 72-1123385 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

9320 Lakeside Blvd., Suite 100 | |

The Woodlands, Texas | 77381 |

(Address of principal executive office | (Zip Code) |

Registrant’s telephone number, including area code (281) 362-6800

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ___ No √

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ___ No √

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes √ No ___

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes √ No ___

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ___

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ___ | Accelerated filer √ |

Non-accelerated filer ___ (Do not check if a smaller reporting company) | Smaller Reporting Company ___ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes ___ No √

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, computed by reference to the price at which the common equity was last sold as of June 30, 2016, was $476.0 million. The aggregate market value has been computed by reference to the closing sales price on such date, as reported by The New York Stock Exchange.

As of February 21, 2017, a total of 84,746,098 shares of Common Stock, $0.01 par value per share, were outstanding.

Documents Incorporated by Reference

Pursuant to General Instruction G(3) to this Form 10-K, the information required by Items 10, 11, 12, 13 and 14 of Part III hereof is incorporated by reference from the registrant’s definitive Proxy Statement for its 2017 Annual Meeting of Stockholders.

NEWPARK RESOURCES, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2016

1

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. We also may provide oral or written forward-looking information in other materials we release to the public. Words such as “will”, “may”, “could”, “would”, “anticipates”, “believes”, “estimates”, “expects”, “plans”, “intends”, and similar expressions are intended to identify these forward-looking statements but are not the exclusive means of identifying them. These forward-looking statements reflect the current views of our management; however, various risks, uncertainties, contingencies and other factors, some of which are beyond our control, are difficult to predict and could cause our actual results, performance or achievements to differ materially from those expressed in, or implied by, these statements, including the success or failure of our efforts to implement our business strategy.

We assume no obligation to update, amend or clarify publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities laws. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Annual Report might not occur.

For further information regarding these and other factors, risks and uncertainties affecting us, we refer you to the risk factors set forth in Item 1A of this Annual Report on Form 10-K.

2

PART I

ITEM 1. Business

General

Newpark Resources, Inc. was organized in 1932 as a Nevada corporation. In 1991, we changed our state of incorporation to Delaware. We are a geographically diversified supplier providing products and services primarily to the oil and gas exploration and production (“E&P”) industry. We operate our business through two reportable segments: Fluids Systems and Mats and Integrated Services. Our Fluids Systems segment provides drilling fluids products and technical services to customers in the North America, Europe, the Middle East and Africa (“EMEA”), Latin America and Asia Pacific regions. Our Mats and Integrated Services segment provides composite mat rentals as well as location construction and related site services to customers at well, production, transportation and refinery locations in the United States (“U.S.”). In addition, mat rental and services activity is expanding into applications in other markets, including electrical transmission & distribution, pipeline, solar, petrochemical and construction industries across the U.S., Canada and United Kingdom. We also manufacture and sell composite mats to customers outside of the U.S., and to domestic customers outside of the oil and gas exploration market. In March 2014, we completed the sale of our Environmental Services business, which was historically reported as a third operating segment. For a detailed discussion of this matter, see “Note 14 - Discontinued Operations” in our Notes to Consolidated Financial Statements.

Our principal executive offices are located at 9320 Lakeside Blvd., Suite 100, The Woodlands, Texas 77381. Our telephone number is (281) 362-6800. You can find more information about us at our website located at www.newpark.com. Our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K and any amendments to those reports are available free of charge through our website. These reports are available as soon as reasonably practicable after we electronically file these materials with, or furnish them to, the Securities and Exchange Commission (“SEC”). Our Code of Ethics, our Corporate Governance Guidelines, our Audit Committee Charter, our Compensation Committee Charter and our Nominating and Corporate Governance Committee Charter are also posted to the corporate governance section of our website. We make our website content available for informational purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference in this Form 10-K. Information filed with the SEC may be read or copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C., 20549. Information on operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

When referring to “Newpark” and using phrases such as “we”, “us” and “our”, our intent is to refer to Newpark Resources, Inc. and its subsidiaries as a whole or on a segment basis, depending on the context in which the statements are made.

Industry Fundamentals

Historically, several factors have driven demand for our products and services, including the supply, demand and pricing of oil and gas commodities, which drive E&P drilling and development activity. Demand for most of our Fluids Systems’ products and services is also driven, in part, by the level, type, depth and complexity of oil and gas drilling. Historically, drilling activity levels in North America have been volatile, primarily driven by the price of oil and natural gas. Beginning in the fourth quarter of 2014 and continuing throughout 2015 and into early 2016, the price of oil declined dramatically from the price levels in recent years. As a result, E&P drilling activity significantly declined in North America and many global markets over this period. While oil prices have since improved from the lows reached in the first quarter of 2016, price levels remain lower than in recent years. The most widely accepted measure of activity for our North American operations is the Baker Hughes Rotary Rig Count. The average North America rig count was 639 in 2016, compared to 1,170 in 2015, and 2,241 in 2014. The North America rig count continually declined in 2015 and early 2016, reaching a low point of 447 in May 2016, and has since recovered to 1,082 as of February 17, 2017. With the improvement in rig counts from the lows reached in May 2016, average activity levels are expected to improve in 2017 compared to 2016 but remain below 2015 levels.

The lower E&P drilling activity levels in 2015 and 2016 reduced the demand for our services, negatively impacted customer pricing and resulted in elevated costs associated with workforce reductions, all of which negatively impacted our profitability. Further, due to the fact that our business contains substantial levels of fixed costs, including significant facility and personnel expenses, North American operating margins in both operating segments have been negatively impacted by the lower customer demand.

Outside of North America, drilling activity is generally more stable, as drilling activity in many countries is based upon longer term economic projections and multiple year drilling programs, which tend to reduce the impact of short term changes in commodity prices on overall drilling activity. While drilling activity in certain of our international markets, including Brazil and Australia, has declined dramatically following the decline in oil prices, our activities in the EMEA region have continued to grow in recent years, driven by expansion into new geographic markets, as well as market share gains in existing markets.

3

Reportable Segments

Fluids Systems

Our Fluids Systems business provides drilling fluids products and technical services to customers in the North America, EMEA, Latin America, and Asia Pacific regions. We offer customized solutions for highly technical drilling projects involving complex subsurface conditions such as horizontal, directional, geologically deep or deep water drilling. These projects require increased monitoring and critical engineering support of the fluids system during the drilling process.

We also have industrial mineral grinding operations for barite, a critical raw material in drilling fluids products, which serve to support our activity in the North American drilling fluids market. We grind barite and other industrial minerals at four facilities, including locations in Texas, Louisiana and Tennessee. We use the resulting products in our drilling fluids business, and also sell them to third party users, including other drilling fluids companies. We also sell a variety of other minerals, principally to third party industrial (non-oil and gas) markets.

Raw Materials — We believe that our sources of supply for materials and equipment used in our drilling fluids business are adequate for our needs, however, we have experienced periods of short-term scarcity of barite ore, which have resulted in significant cost increases. Our specialty milling operation is our primary supplier of barite used in our North American drilling fluids business. Our mills obtain raw barite ore under supply agreements from foreign sources, primarily China and India. We obtain other materials used in the drilling fluids business from various third party suppliers. We have encountered no serious shortages or delays in obtaining these raw materials.

Technology — Proprietary technology and systems are an important aspect of our business strategy. We seek patents and licenses on new developments whenever we believe it creates a competitive advantage in the marketplace. We own patent rights in a family of high-performance water-based fluids systems, which we market as Evolution®, DeepDrill®, and FlexDrill™ systems, which are designed to enhance drilling performance and provide environmental benefits. We also rely on a variety of unpatented proprietary technologies and know-how in many of our applications. We believe that our reputation in the industry, the range of services we offer, ongoing technical development and know-how, responsiveness to customers and understanding of regulatory requirements are of equal or greater competitive significance than our existing proprietary rights.

Competition — We face competition from larger companies, including Halliburton, Schlumberger and Baker Hughes, which compete vigorously on fluids performance and/or price. In addition, these companies have broad product and service offerings in addition to their drilling fluids. We also have smaller regional competitors competing with us mainly on price and local relationships. We believe that the principal competitive factors in our businesses include a combination of technical proficiency, reputation, price, reliability, quality, breadth of services offered and experience. We believe that our competitive position is enhanced by our proprietary products and services.

Customers — Our customers are principally major integrated and independent oil and gas E&P companies operating in the markets that we serve. During 2016, approximately 60% of segment revenues were derived from the 20 largest segment customers, and 38% of segment revenues were generated domestically. For the year ended December 31, 2016, revenue from Sonatrach, our primary customer in Algeria, was approximately 17% of our segment revenues and 14% of our consolidated revenues. Typically, we perform services either under short-term standard contracts or under “master” service agreements. As most agreements with our customers can be terminated upon short notice, our backlog is not significant. We do not derive a significant portion of our revenues from government contracts. See “Note 12 - Segment and Related Information” in our Consolidated Financial Statements for additional information on financial and geographic data.

Mats and Integrated Services

We manufacture our DURA-BASE® Advanced Composite Mats for use in our rental operations as well as for third-party sales. Our mats provide environmental protection and ensure all-weather access to sites with unstable soil conditions. We provide mat rentals to customers in the E&P, electrical transmission & distribution, pipeline, solar, petrochemical and construction industries across the U.S., Canada and United Kingdom. We also offer location construction and related services to customers, primarily in the U.S. Gulf Coast region. We continue to expand our product offerings, which now include the EPZ Grounding System™ for enhanced safety and efficiency for contractors working on power line maintenance and construction projects and the Defender™ spill containment system to provide customers with an alternative to the use of plastic liners for spill containment.

We also sell composite mats direct to customers in areas around the world. Historically, our marketing efforts for the sale of composite mats focused on oil and gas exploration markets outside the U.S., as well as markets outside the E&P sector in the U.S. and Europe. We believe these mats have worldwide applications outside our traditional oilfield market, primarily in infrastructure construction, maintenance and upgrades of pipelines and electric utility transmission lines, and as temporary roads for movement of oversized or unusually heavy loads. In order to support our efforts to expand our markets globally, we completed an expansion of our mats manufacturing facility in 2015 which nearly doubled our manufacturing capacity and significantly expanded our research and development capabilities.

4

Raw Materials — We believe that our sources of supply for materials used in our business are adequate for our needs. We are not dependent upon any one supplier and we have encountered no serious shortages or delays in obtaining any raw materials. The resins, chemicals and other materials used to manufacture composite mats are widely available. Resin is the largest material component in the manufacturing of our composite mat products.

Technology — We have obtained patents related to the design and manufacturing of our DURA-BASE mats and several of the components, as well as other products and systems related to these mats (including the the EPZ Grounding System™ and the Defender™ spill containment system). Using proprietary technology and systems is an important aspect of our business strategy. We believe that these products provide us with a distinct advantage over our competition. We believe that our reputation in the industry, the range of services we offer, ongoing technical development and know-how, responsiveness to customers and understanding of regulatory requirements also have competitive significance in the markets we serve.

Competition — Our market is fragmented and competitive, with many competitors providing various forms of site preparation products and services. The mat sales component of our business is not as fragmented as the rental and services segment with only a few competitors providing various alternatives to our DURA-BASE mat products, such as Signature Systems Group and Checkers Group. This is due to many factors, including large capital start-up costs and proprietary technology associated with this product. We believe that the principal competitive factors in our businesses include product capabilities, price, reputation, and reliability. We also believe that our competitive position is enhanced by our proprietary products, services and experience.

Customers — Our customers are principally infrastructure construction and oil and gas E&P companies operating in the markets that we serve. Approximately 56% of our segment revenues in 2016 were derived from the 20 largest segment customers, of which, the largest customer represented 11% of our segment revenues. As a result of our recent efforts to expand beyond our traditional oilfield customer base, revenues from non E&P customers continued to increase in 2016 and represented approximately 70% of segment revenues in 2016. Typically, we perform services either under short-term contracts or rental service agreements. As most agreements with our customers are cancelable upon short notice, our backlog is not significant. We do not derive a significant portion of our revenues from government contracts. See “Note 12 - Segment and Related Information” in our Consolidated Financial Statements for additional information on financial and geographic data.

Sale of Environmental Services Segment

In March 2014, we completed the sale of our Environmental Services business, which was historically reported as a third operating segment. For further discussion of this matter, see “Note 14 - Discontinued Operations” in our Consolidated Financial Statements.

The Environmental Services business processed and disposed of waste generated by our oil and gas customers that was treated as exempt under the Resource Conservation and Recovery Act (“RCRA”). The Environmental Services business also processed E&P waste contaminated with naturally occurring radioactive material. In addition, the business received and disposed of non-hazardous industrial waste, principally from generators of such waste in the U.S. Gulf Coast market, which produced waste that was not regulated under RCRA.

Employees

At January 31, 2017, we employed approximately 1,800 full and part-time personnel none of which are represented by unions. We consider our relations with our employees to be satisfactory.

Environmental Regulation

We seek to comply with all applicable legal requirements concerning environmental matters. Our business is affected by governmental regulations relating to the oil and gas industry in general, as well as environmental, health and safety regulations that have specific application to our business. Our activities are impacted by various federal and state regulatory agencies, and provincial pollution control, health and safety programs that are administered and enforced by regulatory agencies.

Additionally, our business exposes us to environmental risks. We have implemented various procedures designed to ensure compliance with applicable regulations and reduce the risk of damage or loss. These include specified handling procedures and guidelines for waste, ongoing employee training, and monitoring and maintaining insurance coverage.

We also employ a corporate-wide web-based health, safety and environmental management system (“HSEMS”), which is ISO 14001:2004 compliant. The HSEMS is designed to capture information related to the planning, decision-making, and general operations of environmental regulatory activities within our operations. We also use the HSEMS to capture the information generated by regularly scheduled independent audits that are done to validate the findings of our internal monitoring and auditing procedures.

5

ITEM 1A. Risk Factors

The following summarizes the most significant risk factors to our business. Our success will depend, in part, on our ability to anticipate and effectively manage these and other risks. Any of these risk factors, either individually or in combination, could have significant adverse impacts to our results of operations and financial condition, or prevent us from meeting our profitability or growth objectives.

Risks Related to the Worldwide Oil and Natural Gas Industry

We derive a significant portion of our revenues from customers in the worldwide oil and natural gas industry; therefore, our risk factors include those factors that impact the demand for oil and natural gas. Spending by our customers for exploration, development and production of oil and natural gas is based on a number of factors, including expectations of future hydrocarbon demand, energy prices, the risks associated with developing reserves, our customer’s ability to finance exploration and development of reserves, regulatory developments and the future value of the reserves. Reductions in customer spending levels adversely affect the demand for our services and consequently, our revenue and operating results; and the presence of these market conditions negatively affects our revenue and operating results. The key risk factors that we believe influence the worldwide oil and natural gas markets are discussed below.

Demand for oil and natural gas is subject to factors beyond our control

Demand for oil and natural gas, as well as the demand for our services, is highly correlated with global economic growth and in particular by the economic growth of countries such as the U.S., India, China, and developing countries in Asia and the Middle East. Weakness in global economic activity could reduce demand for oil and natural gas and result in lower oil and natural gas prices. In addition, demand for oil and natural gas could be impacted by environmental regulation, including cap and trade legislation, regulation of hydraulic fracturing, and carbon taxes. Weakness or deterioration of the global economy could reduce our customers’ spending levels and reduce our revenue and operating results.

Supply of oil and natural gas is subject to factors beyond our control

The ability to produce oil and natural gas can be affected by the number and productivity of new wells drilled and completed, as well as the rate of production and resulting depletion of existing wells. Productive capacity in excess of demand is also an important factor influencing energy prices and spending by oil and natural gas exploration companies. Oil and natural gas storage inventory levels are indicators of the relative balance between supply and demand. Supply can also be impacted by the degree to which individual Organization of Petroleum Exporting Countries (“OPEC”) nations and other large oil and natural gas producing countries are willing and able to control production and exports of hydrocarbons, to decrease or increase supply and to support their targeted oil price or meet market share objectives. Any of these factors could affect the supply of oil and natural gas and could have a material effect on our results of operations.

Volatility of oil and natural gas prices can adversely affect demand for our products and services

Volatility in oil and natural gas prices can also impact our customers’ activity levels and spending for our products and services. The level of energy prices is important to the cash flow for our customers and their ability to fund exploration and development activities. Compared to 2011 to 2014 levels, oil prices have declined significantly due in large part to increasing supplies, weakening demand growth and the decision by OPEC countries to maintain production levels throughout 2015 and most of 2016. Expectations about future commodity prices and price volatility are important for determining future spending levels. Our customers also take into account the volatility of energy prices and other risk factors by requiring higher returns for individual projects if there is higher perceived risk.

Our customers’ activity levels, spending for our products and services and ability to pay amounts owed us could be impacted by the ability of our customers to access equity or credit markets

Our customers’ access to capital is dependent on their ability to access the funds necessary to develop oil and gas prospects. Limited access to external sources of funding has and may continue to cause customers to reduce their capital spending plans. In addition, a reduction of cash flow to our customers resulting from declines in commodity prices or the lack of available debt or equity financing may impact the ability of our customers to pay amounts owed to us.

Risks Related to our Customer Concentration and reliance on the U.S. Exploration and Production Market

In 2016, approximately 53% of our consolidated revenues were derived from our 20 largest customers, which includes 14% from Sonatrach, our primary customer in Algeria. In addition, approximately 45% of our consolidated revenues were derived from our U.S. operations.

6

Beginning in late 2014 and continuing throughout 2015 and into early 2016, the price of oil declined dramatically from the price levels in recent years. While oil prices have since improved from the lows reached in the first quarter of 2016, price levels remain lower than in recent years and there are no assurances that the price for oil will not further decline. Following this decline, North American drilling activity has decreased significantly, which has reduced the demand for our services and negatively impacted customer pricing in our North American operations. Due to these changes, our quarterly and annual operating results have been negatively impacted and may continue to fluctuate in future periods. Because our business has substantial fixed costs, including significant facility and personnel expenses, downtime or low productivity due to reduced demand can have a significant adverse impact on our profitability.

Risks Related to International Operations

We have significant operations outside of the United States, including certain areas of Canada, EMEA, Latin America, and Asia Pacific. In 2016, these international operations generated approximately 55% of our consolidated revenues. Algeria represents our largest international market with our total Algerian operations representing 17% of our consolidated revenues in 2016 and 8% of our total assets at December 31, 2016.

In addition, we may seek to expand to other areas outside the United States in the future. International operations are subject to a number of risks and uncertainties, including:

▪ | difficulties and cost associated with complying with a wide variety of complex foreign laws, treaties and regulations; |

▪ | uncertainties in or unexpected changes in regulatory environments or tax laws; |

▪ | legal uncertainties, timing delays and expenses associated with tariffs, export licenses and other trade barriers; |

▪ | difficulties enforcing agreements and collecting receivables through foreign legal systems; |

▪ | risks associated with failing to comply with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act, export laws, and other similar laws applicable to our operations in international markets; |

▪ | exchange controls or other limitations on international currency movements; |

▪ | sanctions imposed by the U.S. government that prevent us from engaging in business in certain countries or with certain counter-parties; |

▪ | inability to obtain or preserve certain intellectual property rights in the foreign countries in which we operate; |

▪ | our inexperience in certain international markets; |

▪ | fluctuations in foreign currency exchange rates; |

▪ | political and economic instability; and |

▪ | acts of terrorism. |

In addition, several North African markets in which we operate, including Tunisia, Egypt, Libya, and Algeria have experienced social and political unrest in past years, which negatively impacted our operating results, including the temporary suspension of our operations. More recently in Brazil, a widely-publicized corruption investigation, along with general social unrest, has led to disruptions in Petrobras’ operations.

Risks Related to the Cost and Continued Availability of Borrowed Funds, including Risks of Noncompliance with Debt Covenants

We employ borrowed funds as an integral part of our long-term capital structure and our future success is dependent upon continued access to borrowed funds to support our operations. The availability of borrowed funds on reasonable terms is dependent on the condition of credit markets and financial institutions from which these funds are obtained. Adverse events in the financial markets may significantly reduce the availability of funds, which may have an adverse effect on our cost of borrowings and our ability to fund our business strategy. Our ability to meet our debt service requirements and the continued availability of funds under our existing or future loan agreements is dependent upon our ability to generate operating income and remain in compliance with the covenants in our debt agreements. This, in turn, is subject to the volatile nature of the oil and natural gas industry, and to competitive, economic, financial and other factors that are beyond our control.

In May 2016, we entered into a new asset-based revolving credit agreement, as amended in February 2017, (the “ABL Facility”). Borrowing availability under the ABL Facility is calculated based on eligible accounts receivable, inventory, and, subject to satisfaction of certain financial covenants as described below, composite mats included in the rental fleet, net of reserves and limits on such assets included in the borrowing base calculation. To the extent pledged by us, the borrowing base calculation shall also include the amount of eligible pledged cash. The lender may establish reserves, in part based on appraisals of the asset base, and other limits at its discretion which could reduce the amounts otherwise available under the ABL Facility. Availability associated with eligible rental mats will also be subject to maintaining a minimum consolidated fixed charge coverage ratio and a minimum level of operating income for the Mats and Integrated Services segment. The availability under the ABL Facility is expected to fluctuate directionally with changes in our domestic accounts receivable, inventory, and composite mat rental fleet.

7

The ABL Facility terminates on March 6, 2020; however, the ABL Facility has a springing maturity date that will accelerate the maturity of the credit facility to June 30, 2017 if, prior to such date, the convertible notes due 2017 (“Convertible Notes due 2017”) have not either been repurchased, redeemed, converted or we have not provided sufficient funds to repay the Convertible Notes due 2017 in full on their maturity date. For this purpose, funds may be provided in cash to an escrow agent or a combination of cash to an escrow agent and the assignment of a portion of availability under the ABL Facility. The ABL Facility requires compliance with a minimum fixed charge coverage ratio and minimum unused availability of $25.0 million to utilize borrowings or assignment of availability under the ABL Facility towards funding the repayment of the 2017 Convertible Notes. We intend to use available cash on-hand, cash generated by operations, including U.S. income tax refunds, and estimated availability under our ABL Facility to repay the remaining Convertible Notes due 2017. If the timing of the U.S. income tax refunds are delayed and the other sources described above are not sufficient to repay the remaining Convertible Notes due 2017, we could seek other financing alternatives to satisfy the funding requirement for the Convertible Notes due 2017. If we are unable to satisfy the funding requirement for the Convertible Notes due 2017, this could have a material adverse effect on our business and financial condition.

We are subject to compliance with a fixed charge coverage ratio covenant if our borrowing availability falls below $25.0 million. If we are unable to make required payments under the ABL Facility or other indebtedness of more than $25.0 million, or if we fail to comply with the various covenants and other requirements of the ABL Facility, including the June 30, 2017 funding requirement for the Convertible Notes due 2017, we would be in default thereunder, which would permit the holders of the indebtedness to accelerate the maturity thereof, unless we are able to obtain, on a timely basis, a necessary waiver or amendment. Any waiver or amendment may require us to revise the terms of our agreements which could increase the cost of our borrowings, require the payment of additional fees, and adversely impact the results of our operations. Upon the occurrence of any event of default that is not waived, the lenders could elect to exercise any of their available remedies, which include the right to not lend any additional amounts or, in the event we have outstanding indebtedness under the ABL Facility, to declare any outstanding indebtedness, together with any accrued interest and other fees, to be immediately due and payable. If we are unable to repay the outstanding indebtedness, if any, under the ABL Facility when due, the lenders would be permitted to proceed against their collateral. In the event any outstanding indebtedness in excess of $25.0 million is accelerated, this could also cause an event of default under our Convertible Notes due 2017 and our convertible notes due 2021 (“Convertible Notes due 2021”). The acceleration of any of our indebtedness and the election to exercise any such remedies could have a material adverse effect on our business and financial condition.

Risks Related to Operating Hazards Present in the Oil and Natural Gas Industry

Our operations are subject to hazards present in the oil and natural gas industry, such as fire, explosion, blowouts, oil spills and leaks or spills of hazardous materials (both onshore and offshore). These incidents as well as accidents or problems in normal operations can cause personal injury or death and damage to property or the environment. The customer’s operations can also be interrupted and it is possible that such incidents can interrupt our ongoing operations and the ability to provide our services. From time to time, customers seek recovery for damage to their equipment or property that occurred during the course of our service obligations. Damage to the customer’s property and any related spills of hazardous materials could be extensive if a major problem occurred. We purchase insurance which may provide coverage for incidents such as those described above, however, the policies may not provide coverage or a sufficient amount of coverage for all types of damage claims that could be asserted against us. See the section entitled “Risks Related to the Inherent Limitations of Insurance Coverage” for additional information.

Risks Related to Business Acquisitions and Capital Investments

Our ability to successfully execute our business strategy will depend, among other things, on our ability to make capital investments and acquisitions which provide us with financial benefits. In 2017, our capital expenditures are expected to range between $15.0 million to $20.0 million (exclusive of any acquisitions), including expenditures for the completion of the facility upgrade and expansion of our Fourchon, Louisiana facility serving the Gulf of Mexico deepwater market in the Fluids Systems segment. These investments are subject to a number of risks and uncertainties, including:

▪ | incorrect assumptions regarding business activity levels or results from our capital investments, acquired operations or assets; |

▪ | failure to complete a planned acquisition transaction or to successfully integrate the operations or management of any acquired businesses or assets in a timely manner; |

▪ | diversion of management's attention from existing operations or other priorities; |

▪ | unanticipated disruptions to our business associated with the implementation of our enterprise-wide operational and financial system; and |

▪ | delays in completion and cost overruns associated with large construction projects, including the projects mentioned above. |

Any of the factors above could have an adverse effect on our business, financial condition or results of operations.

8

Risks Related to the Availability of Raw Materials and Skilled Personnel

Our ability to provide products and services to our customers is dependent upon our ability to obtain the raw materials and qualified personnel necessary to operate our business.

Barite is a naturally occurring mineral that constitutes a significant portion of our drilling fluids systems. We currently secure the majority of our barite ore from foreign sources, primarily China and India. The availability and cost of barite ore is dependent on factors beyond our control including transportation, political priorities and government imposed export fees in the exporting countries, as well as the impact of weather and natural disasters. The future supply of barite ore from existing sources could be inadequate to meet the market demand, particularly during periods of increasing world-wide demand, which could ultimately restrict industry activity or our ability to meet customer’s needs.

Our mats business is highly dependent on the availability of high-density polyethylene (“HDPE”), which is the primary raw material used in the manufacture of our DURA-BASE mats. The cost of HDPE can vary significantly based on the energy costs of the producers of HDPE, demand for this material, and the capacity/operations of the plants used to make HDPE. Should our cost of HDPE increase, we may not be able to increase our customer pricing to cover our costs, which may result in a reduction in future profitability.

All of our businesses are also highly dependent on our ability to attract and retain highly-skilled engineers, technical sales and service personnel. The market for these employees is competitive, and if we cannot attract and retain quality personnel, our ability to compete effectively and to grow our business will be severely limited. Also, a significant increase in the wages paid by competing employers could result in a reduction in our skilled labor force or an increase in our operating costs.

Risk Related to our Market Competition

We face competition in the Fluids Systems business from larger companies, which compete vigorously on fluids performance and/or price. In addition, these companies have broad product and service offerings in addition to their drilling fluids. At times, these larger companies attempt to compete by offering discounts to customers to use multiple products and services from our competitor, some of which we do not offer. We also have smaller regional competitors competing with us mainly on price and local relationships. Our competition in the Mats and Integrated Services business is fragmented, with many competitors providing various forms of mat products and services. More recently, several competitors have begun marketing composite products to compete with our DURA-BASE mat system. While we believe the design and manufacture of our mat products provide a differentiated value to our customers, many of our competitors seek to compete on pricing. Further, the weakness in North American drilling activity in recent years has resulted in significant reductions in pricing from many of our competitors, in both the Fluids Systems and Mats and Integrated Services segments.

Risks Related to Legal and Regulatory Matters, Including Environmental Regulations

We are responsible for complying with numerous federal, state, local and foreign laws, regulations and policies that govern environmental protection, zoning and other matters applicable to our current and past business activities, including the activities of our former subsidiaries. Failure to remain compliant with these laws, regulations and policies may result in, among other things, fines, penalties, costs of cleanup of contaminated sites and site closure obligations, or other expenditures. Further, any changes in the current legal and regulatory environment could impact industry activity and the demands for our products and services, the scope of products and services that we provide, or our cost structure required to provide our products and services, or the costs incurred by our customers.

The markets for our products and services are dependent on the continued exploration for and production of fossil fuels (predominantly oil and natural gas). Climate change is receiving increased attention worldwide. Many scientists, legislators and others attribute climate change to increased levels of greenhouse gases, including carbon dioxide, which has led to significant legislative and regulatory efforts to limit greenhouse gas emissions. The Environmental Protection Agency (the “EPA”) and other domestic and foreign regulatory agencies have adopted regulations that potentially limit greenhouse gas emissions and impose reporting obligations on large greenhouse gas emission sources. In addition, the EPA has adopted rules that could require the reduction of certain air emissions during exploration and production of oil and gas. To the extent that laws and regulations enacted as part of climate change legislation increase the costs of drilling for or producing such fossil fuels, limit or restrict oil and natural gas exploration and production, or reduce the demand for fossil fuels, such legislation could have a material adverse impact on our operations and profitability.

9

Hydraulic fracturing is an increasingly common practice used by E&P operators to stimulate production of hydrocarbons, particularly from shale oil and gas formations in the United States. The process of hydraulic fracturing, which involves the injection of sand (or other forms of proppants) laden fluids into oil and gas bearing zones, has come under increasing scrutiny from a variety of regulatory agencies, including the EPA and various state authorities. Several states have adopted regulations requiring operators to identify the chemicals used in fracturing operations, others have adopted moratoriums on the use of fracturing, and the State of New York has banned the practice altogether. The EPA is studying the potential impact of hydraulic fracturing on drinking water including impacts from the disposal of waste fluid by underground injection. Although we do not provide hydraulic fracturing services and our drilling fluids products are not used in such services, regulations which have the effect of limiting the use or significantly increasing the costs of hydraulic fracturing, could have a significant negative impact on the drilling activity levels of our customers, and, therefore, the demand for our products and services.

Risks Related to the Inherent Limitations of Insurance Coverage

While we maintain liability insurance, this insurance is subject to coverage limitations. Specific risks and limitations of our insurance coverage include the following:

▪ | self-insured retention limits on each claim, which are our responsibility; |

▪ | exclusions for certain types of liabilities and limitations on coverage for damages resulting from pollution; |

▪ | coverage limits of the policies, and the risk that claims will exceed policy limits; and |

▪ | the financial strength and ability of our insurance carriers to meet their obligations under the policies. |

In addition, our ability to continue to obtain insurance coverage on commercially reasonable terms is dependent upon a variety of factors impacting the insurance industry in general, which are outside our control. Any of the issues noted above, including insurance cost increases, uninsured or underinsured claims, or the inability of an insurance carrier to meet their financial obligations could have a material adverse effect on our profitability.

Risks Related to Potential Impairments of Long-lived Intangible Assets

As of December 31, 2016, our consolidated balance sheet includes $20.0 million in goodwill and $6.1 million of intangible assets, net. Goodwill and indefinite-lived intangible assets are tested for impairment annually, or more frequently as the circumstances require, using a combination of market multiple and discounted cash flow approaches. During the fourth quarter of 2015, we determined that our drilling fluids reporting unit had a fair value below its net carrying value, and we recognized a goodwill impairment of $70.7 million. During the second quarter of 2016, we recognized a $3.1 million charge to fully impair the customer related intangible assets for the Asia Pacific region.

In 2016, oil and natural gas prices and U.S. drilling activity remained significantly below the levels of recent years. Although activity levels have improved in the second half of 2016 and early 2017, continued weakness or volatility in market conditions may further deteriorate the financial performance or future projections for our operating segments from current levels, which may result in an impairment of goodwill or indefinite-lived intangible assets and negatively impact our financial results in the period of impairment.

Risks Related to Technological Developments in our Industry

The market for our products and services is characterized by continual technological developments that generate substantial improvements in product functions and performance. If we are not successful in continuing to develop product enhancements or new products that are accepted in the marketplace or that comply with industry standards, we could lose market share to competitors, which would negatively impact our results of operations and financial condition.

We hold U.S. and foreign patents for certain of our drilling fluids components and our mat systems. However, these patents are not a guarantee that we will have a meaningful advantage over our competitors, and there is a risk that others may develop systems that are substantially equivalent to those covered by our patents. If that were to happen, we would face increased competition from both a service and a pricing standpoint. In addition, costly and time-consuming litigation could be necessary to enforce and determine the scope of our patents and proprietary rights. It is possible that future innovation could change the way companies drill for oil and gas, or utilize matting systems, which could reduce the competitive advantages we may derive from our patents and other proprietary technology.

Risks Related to Severe Weather, Particularly in the U.S. Gulf Coast

We have significant operations located in market areas in the U.S. Gulf of Mexico and related near-shore areas which are susceptible to hurricanes and other adverse weather events. In these market areas, we generated approximately 14% of our consolidated revenue in 2016 and had approximately $200 million of inventory and property, plant and equipment as of December 31, 2016. Such adverse weather events can disrupt our operations and result in damage to our properties, as well as negatively impact the activity and financial condition of our customers. Our business may be adversely affected by these and other negative effects of future hurricanes or other adverse weather events in regions in which we operate.

10

Risks Related to Cybersecurity Breaches or Business System Disruptions

We utilize various management information systems and information technology infrastructure to manage or support a variety of our business operations, and to maintain various records, which may include confidential business or proprietary information as well as information regarding our customers, business partners, employees or other third parties. Failures of or interference with access to these systems, such as communication disruptions, could have an adverse effect on our ability to conduct operations or directly impact consolidated financial reporting. Security breaches pose a risk to confidential data and intellectual property which could result in damages to our competitiveness and reputation. We have policies and procedures in place, including system monitoring and data back-up processes, to prevent or mitigate the effects of these potential disruptions or breaches, however there can be no assurance that existing or emerging threats will not have an adverse impact on our systems or communications networks. These risks could harm our reputation and our relationships with our customers, business partners, employees or other third parties, and may result in claims against us. In addition, these risks could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Risks Related to Fluctuations in the Market Value of our Common Stock

The market price of our common stock may fluctuate due to a number of factors, including the general economy, stock market conditions, general trends in the E&P industry, announcements made by us or our competitors, and variations in our operating results. Investors may not be able to predict the timing or extent of these fluctuations.

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

We lease office space to support our operating segments as well as our corporate offices. All material domestic owned properties are subject to liens and security interests under our ABL Facility.

Fluids Systems. We own a facility containing approximately 103,000 square feet of office space on approximately 11 acres of land in Katy, Texas, which houses the divisional headquarters and technology center for this segment. We also own a distribution warehouse and fluids blending facility containing approximately 65,000 square feet of office and industrial space on approximately 21 acres of land in Conroe, Texas. Additionally, we own six warehouse facilities and have 15 leased warehouses and 10 contract warehouses to support our customers and operations in the U.S. We own two warehouse facilities and have 19 contract warehouses in Canada to support our Canadian operations. Additionally, we lease 19 warehouses and own one warehouse in the EMEA region, lease five warehouses in the Latin America region, and own one warehouse and lease five warehouses in the Asia Pacific region to support our international operations. This leased space is located in several cities primarily in the United States, Canada, Italy, Eastern Europe, North Africa, Kuwait, Brazil, and Australia. We also own buildings providing office space in Oklahoma and office/warehouse space in Henderson, Australia. Some of the warehouses listed also include blending facilities.

We operate four specialty product grinding facilities in the U.S. These facilities are located in Houston, Texas on approximately 18 acres of owned land, in New Iberia, Louisiana on 15.7 acres of leased land, in Corpus Christi, Texas on 6 acres of leased land, and in Dyersburg, Tennessee on 13.2 acres of owned land.

Mats and Integrated Services. We own a facility containing approximately 93,000 square feet of office and industrial space on approximately 34 acres of land in Carencro, Louisiana, which houses our manufacturing facilities, the divisional headquarters, and technology center for this segment. We also lease eight sites throughout Texas, Pennsylvania, Colorado, Illinois and Wisconsin which serve as bases for our well site service activities. Additionally, we own two facilities which are located in Louisiana and Texas and lease two facilities in the United Kingdom to support field operations.

ITEM 3. Legal Proceedings

Wage and Hour Litigation

Davida v. Newpark Drilling Fluids LLC. On June 18, 2014, Jesse Davida, a former employee of Newpark Drilling Fluids LLC, filed a class action lawsuit in the U.S. District Court for the Western District of Texas, San Antonio Division, alleging violations of the Fair Labor Standards Act (“FLSA”). The plaintiff sought damages and penalties for our alleged failure to properly classify our field service employees as “non-exempt” under the FLSA and pay them on an hourly basis (including overtime). On January 6, 2015, the Court granted the plaintiff’s motion to “conditionally” certify the class of fluid service technicians that have worked for Newpark Drilling Fluids over the past three years.

11

Christiansen v. Newpark Drilling Fluids LLC. On November 11, 2014, Josh Christiansen (represented by the same counsel as Davida) filed a purported class action lawsuit in the U.S. District Court for the Southern District of Texas, Houston Division, alleging violations of the FLSA. The plaintiff sought damages and penalties for our alleged failure to properly classify him as an employee rather than an independent contractor; properly classify our field service employees as “non-exempt” under the FLSA; and, pay them on an hourly basis (including overtime) and sought damages and penalties for our alleged failure to pay him and the others in the proposed class on an hourly basis (including overtime). Following the filing of this lawsuit, five additional plaintiffs joined the proceedings. In March of 2015, the Court denied the plaintiffs’ motion for conditional class certification. Counsel for the plaintiffs did not appeal that ruling and subsequently filed individual cases for each of the original opt-in plaintiffs plus two new plaintiffs, leaving a total of eight separate independent contractor cases.

Additional Individual FLSA cases. In the fourth quarter of 2015, the same counsel representing the plaintiffs in the Davida and Christiansen-related cases filed two additional individual FLSA cases on behalf of former fluid service technician employees. These cases are similar in nature to the Davida case discussed above.

Resolution of Wage and Hour Litigation. Beginning in November 2015, we engaged in settlement discussions with counsel for the plaintiffs in the pending wage and hour litigation cases described above. As a result of the then ongoing settlement negotiations, we recognized a $5.0 million charge in the fourth quarter of 2015 related to the resolution of these wage and hour litigation claims. Following mediation in January 2016, the parties executed a settlement agreement in April 2016 to resolve all of the pending matters, subject to a number of conditions, including approval by the Court in the Davida case, and the dismissal of the other FLSA cases (Christiansen-related lawsuits and individual FLSA cases). The settlement agreement was approved by the Davida Court on August 19, 2016. Approximately 569 current and former fluid service technician employees eligible for the settlement were notified of the pending resolution beginning on August 26, 2016 and given an opportunity to participate in the settlement. The amount paid to any eligible individual varied based on a formula that takes into account the number of workweeks and salary for the individual during the time period covered by the settlement. Any eligible individual that elected to participate in the settlement released all wage and hour claims against us.

The deadline for submitting claims or opting out was October 25, 2016 with 379 individuals filing claims and no individuals opting out. The percentage of current or former fluid service technicians that elected to participate in the settlement represented approximately 67% of the individuals receiving notice. Individuals that did not participate in the settlement may retain the right to file an individual lawsuit against us, subject to any defenses we may assert. As a result of the settlement agreement, we funded the $4.5 million settlement amount into the settlement fund in the second half of 2016. The settlement fund was administered by a third party who made payments to eligible individuals that elected to participate in accordance with a formula incorporated into the settlement agreement. In addition, under the terms of settlement agreement, settlement funds that remained after all payments were made to eligible individuals that elected to participate in the settlement were shared by the participating individuals and us. In the fourth quarter of 2016, we recognized a $0.7 million gain associated with the change in final settlement amount of these wage and hour litigation claims.

Escrow Claims Related to the Sale of the Environmental Services Business

Newpark Resources, Inc. v. Ecoserv, LLC. On July 13, 2015, we filed a declaratory action in the District Court in Harris County, Texas (80th Judicial District) seeking release of $8.0 million of funds placed in escrow by Ecoserv in connection with its purchase of our Environmental Services business. Ecoserv has filed a counterclaim asserting that we breached certain representations and warranties contained in the purchase/sale agreement including, among other things, the condition of certain assets. In addition, Ecoserv has alleged that Newpark committed fraud in connection with the sale transaction.

Under the terms of the March 2014 sale of the Environmental Services business to Ecoserv, $8.0 million of the sales price was withheld and placed in an escrow account to satisfy claims for possible breaches of representations and warranties contained in the sale agreement. For the amount withheld in escrow, $4.0 million was scheduled for release to Newpark at each of the nine-month and 18-month anniversary of the closing. In December 2014, we received a letter from counsel for Ecoserv asserting that we had breached certain representations and warranties contained in the sale agreement including failing to disclose service work performed on injection/disposal wells and increased barge rental costs. The letter indicated that Ecoserv expected the costs associated with these claims to exceed the escrow amount. Following a further exchange of letters, in July of 2015, we filed the declaratory judgment action against Ecoserv referenced above. We believe there is no basis in the agreement or on the facts to support the claims asserted by Ecoserv and intend to vigorously defend our position while pursuing release of the entire $8.0 million escrow. The litigation remains in the discovery process with mediation currently scheduled in March of 2017.

ITEM 4. Mine Safety Disclosures

The information concerning mine safety violations and other regulatory matters required by section 1503 (a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K is included in Exhibit 95.1 of this Annual Report on Form 10-K, which is incorporated by reference.

12

PART II

ITEM 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange under the symbol “NR.”

The following table sets forth the range of the high and low sales prices for our common stock for the periods indicated:

Period | High | Low | ||||||

2016 | ||||||||

Fourth Quarter | $ | 8.20 | $ | 5.80 | ||||

Third Quarter | $ | 7.72 | $ | 5.48 | ||||

Second Quarter | $ | 5.89 | $ | 3.74 | ||||

First Quarter | $ | 5.47 | $ | 3.35 | ||||

2015 | ||||||||

Fourth Quarter | $ | 6.60 | $ | 4.83 | ||||

Third Quarter | $ | 8.03 | $ | 5.09 | ||||

Second Quarter | $ | 10.61 | $ | 7.43 | ||||

First Quarter | $ | 9.85 | $ | 8.34 | ||||

As of February 1, 2017, we had 1,390 stockholders of record as determined by our transfer agent.

The following table details our repurchases of shares of our common stock for the three months ended December 31, 2016:

Period | Total Number of Shares Purchased (1) | Average Price per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Approximate Dollar Value of Shares and Convertible Notes due 2017 that May Yet be Purchased Under Plans or Programs | ||||||||||

October 2016 | 303 | $ | 7.30 | — | $ | 33.5 | ||||||||

November 2016 | — | $ | — | — | $ | 33.5 | ||||||||

December 2016 | — | — | — | $ | 33.5 | |||||||||

Total | 303 | $ | 7.30 | — | ||||||||||

(1) | During the three months ended December 31, 2016, we purchased an aggregate of 303 shares surrendered in lieu of taxes under vesting of restricted stock awards. |

Our Board of Directors has approved a repurchase program that authorizes us to purchase up to $100.0 million of our outstanding shares of common stock or outstanding Convertible Notes due 2017. The repurchase program has no specific term. We may repurchase shares or Convertible Notes due 2017 in the open market or as otherwise determined by management, subject to certain limitations under the ABL Facility and other factors. Repurchases are expected to be funded from operating cash flows and available cash on-hand. As part of the share repurchase program, our management has been authorized to establish trading plans under Rule 10b5-1 of the Securities Exchange Act of 1934.

There were no share repurchases under the program during 2016. In February 2016, we repurchased $11.2 million of our Convertible Notes due 2017 in the open market for $9.2 million. This repurchase was made under our existing Board authorized repurchase program discussed above. At December 31, 2016, there was $33.5 million of authorization remaining under the program. In addition, the Board separately authorized the repurchase of $78.1 million of Convertible Notes due 2017 in connection with the December 2016 issuance of $100.0 million of Convertible Notes due 2021. During 2016, we repurchased 234,901 of shares surrendered in lieu of taxes under vesting of restricted stock awards. All of the shares repurchased are held as treasury stock.

We have not paid any dividends during the three most recent fiscal years or any subsequent interim period, and we do not intend to pay any cash dividends in the foreseeable future. In addition, our ABL Facility contains covenants which limit the payment of dividends on our common stock. See “Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources - Asset Based Loan Facility.”

13

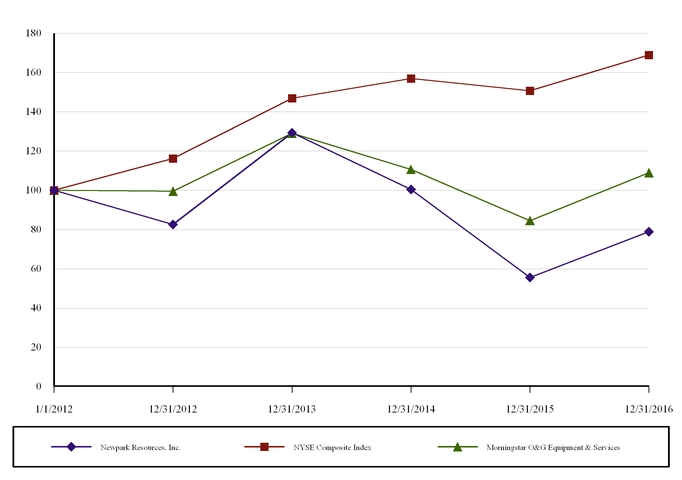

Performance Graph

The following graph reflects a comparison of the cumulative total stockholder return of our common stock from January 1, 2012 through December 31, 2016, with the New York Stock Exchange Market Value Index, a broad equity market index, and the Morningstar Oil & Gas Equipment & Services Index, an industry group index. The graph assumes the investment of $100 on January 1, 2012 in our common stock and each index and the reinvestment of all dividends, if any. This information shall be deemed furnished not filed, in this Form 10-K, and shall not be deemed incorporated by reference into any filing under the Securities Exchange Act of 1933, or the Securities Act of 1934, except to the extent we specifically incorporate it by reference.

14

ITEM 6. Selected Financial Data

The selected consolidated historical financial data presented below for the five years ended December 31, 2016 is derived from our consolidated financial statements. The following data should be read in conjunction with the consolidated financial statements and notes thereto and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Items 7 and 8 below.

As of and for the Year Ended December 31, | |||||||||||||||||||

(In thousands, except share data) | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

Consolidated Statements of Operations Data: | |||||||||||||||||||

Revenues | $ | 471,496 | $ | 676,865 | $ | 1,118,416 | $ | 1,042,356 | $ | 983,953 | |||||||||

Operating income (loss) | (57,213 | ) | (99,099 | ) | 130,596 | 94,445 | 92,275 | ||||||||||||

Interest expense, net | 9,866 | 9,111 | 10,431 | 11,279 | 9,727 | ||||||||||||||

Income (loss) from continuing operations | (40,712 | ) | (90,828 | ) | 79,009 | 52,622 | 50,453 | ||||||||||||

Income from discontinued operations, net of tax | — | — | 1,152 | 12,701 | 9,579 | ||||||||||||||

Gain from disposal of discontinued operations, net of tax | — | — | 22,117 | — | — | ||||||||||||||

Net income (loss) | (40,712 | ) | (90,828 | ) | 102,278 | 65,323 | 60,032 | ||||||||||||

Basic income (loss) per share from continuing operations | $ | (0.49 | ) | $ | (1.10 | ) | $ | 0.95 | $ | 0.62 | $ | 0.58 | |||||||

Basic net income (loss) per share | $ | (0.49 | ) | $ | (1.10 | ) | $ | 1.23 | $ | 0.77 | $ | 0.69 | |||||||

Diluted income (loss) per share from continuing operations | $ | (0.49 | ) | $ | (1.10 | ) | $ | 0.84 | $ | 0.56 | $ | 0.53 | |||||||

Diluted net income (loss) per share | $ | (0.49 | ) | $ | (1.10 | ) | $ | 1.07 | $ | 0.69 | $ | 0.62 | |||||||

Consolidated Balance Sheet Data: | |||||||||||||||||||

Working capital | $ | 283,139 | $ | 380,950 | $ | 440,098 | $ | 395,159 | $ | 433,728 | |||||||||

Total assets | 798,183 | 848,893 | 1,007,672 | 954,918 | 979,750 | ||||||||||||||

Foreign bank lines of credit | — | 7,371 | 11,395 | 12,809 | 2,546 | ||||||||||||||

Other current debt | 83,368 | 11 | 253 | 58 | 53 | ||||||||||||||

Long-term debt, less current portion | 72,900 | 171,211 | 170,462 | 170,009 | 253,315 | ||||||||||||||

Stockholders' equity | 500,543 | 520,259 | 625,458 | 581,054 | 513,578 | ||||||||||||||

Consolidated Cash Flow Data: | |||||||||||||||||||

Net cash provided by operations | $ | 11,095 | $ | 121,517 | $ | 89,173 | $ | 151,903 | $ | 110,245 | |||||||||

Net cash used in investing activities | (28,260 | ) | (84,366 | ) | (14,002 | ) | (60,063 | ) | (96,167 | ) | |||||||||

Net cash provided by (used in) financing activities | (650 | ) | (6,730 | ) | (49,158 | ) | (72,528 | ) | 5,853 | ||||||||||

During 2016 and 2015, operating loss includes charges totaling $14.8 million and $80.5 million, respectively, resulting from the reduction in value of certain assets, the wind-down of our operations in Uruguay and the resolution of certain wage and hour litigation claims. Charges in 2016 include $6.9 million of non-cash impairments in the Asia Pacific region, $4.1 million of charges for the reduction in carrying values of certain inventory, $4.5 million of charges in the Latin America region associated with the wind-down of our operations in Uruguay, partially offset by a $0.7 million gain in 2016 associated with the change in final settlement amount of certain wage and hour litigation claims. Charges in 2015 include a $70.7 million non-cash impairment of goodwill, a $2.6 million non-cash impairment of assets, a $2.2 million charge to reduce the carrying value of inventory and a $5.0 million charge for the resolution of certain wage and hour litigation claims and related costs.

15

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition, results of operations, liquidity and capital resources should be read together with our Consolidated Financial Statements and Notes to Consolidated Financial Statements included in Item 8 of this Annual Report.

Overview

We are a geographically diversified supplier providing products and services primarily to the oil and gas exploration and production (“E&P”) industry. We operate our business through two reportable segments: Fluids Systems and Mats and Integrated Services.

Our Fluids Systems segment, which generated 84% of consolidated revenues in 2016, provides customized drilling fluids solutions to E&P customers globally, operating through four geographic regions: North America, Europe, the Middle East and Africa (“EMEA”), Latin America, and Asia Pacific.

International expansion is a key element of our corporate strategy. In recent years, we have been awarded multiple international contracts to provide drilling fluids and related services, primarily within the EMEA region, which have expanded our international presence, despite the continuing decline in global E&P drilling activity. Significant international contracts include:

• | A contract to provide drilling fluids and related services for a series of wells in the deepwater Black Sea. Work under this contract began in 2014 and was completed in early 2016. |

• | A five year contract with Kuwait Oil Company (“Kuwait”) to provide drilling fluids and related services for land operations. Work under this contract began in the second half of 2014. |

• | Lot 1 and Lot 3 of a restricted tender with Sonatrach to provide drilling fluids and related services, which expanded our market share with Sonatrach in Algeria. Work under this three-year contract began in the second quarter of 2015, with activity levels ramping up during the second half of 2015 and early 2016. In 2016, revenues under this contract represented approximately 14% of our consolidated revenues. |

• | A contract with ENI S.p.A. for onshore and offshore drilling in the Republic of Congo. The initial term of this contract is three years and includes an extension option for up to an additional two years. Work under this contract began in the fourth quarter of 2015. |

• | A contract with Total S.A. to provide drilling fluids and related services for an exploratory ultra-deepwater well in Block 14 of offshore Uruguay. This project began in March 2016 and was completed in the second quarter of 2016, contributing $12.3 million of revenue in 2016. |

• | A two-year contract with Shell Oil in Albania to provide drilling fluids and related services for onshore drilling activity. Work under this contract started late in the second quarter of 2016. |

• | A five-year contract with ENAP in Chile to provide drilling fluids and related services for onshore drilling activity. Work under this contract started late in the fourth quarter of 2016. |

Total revenue generated under these contracts, including our prior contract with Sonatrach, was approximately $127.3 million in 2016, $98.4 million in 2015 and $64.1 million in 2014 despite being unfavorably impacted by foreign currency exchange attributable to the strengthening of the U.S. dollar.

Also, in 2014 we announced two capital investment projects within the U.S operations of our Fluids Systems segment. We have since completed the investment of approximately $24 million in our new fluids blending facility and distribution center located in Conroe, Texas, which will support the manufacturing of our proprietary fluid technologies, including our Evolution®, KronosTM, and FusionTM systems. In addition, we are investing approximately $38 million to significantly expand existing capacity and upgrade the drilling fluids blending, storage, and transfer capabilities in Fourchon, Louisiana, providing us with the required capacity and capabilities to serve customers in the Gulf of Mexico deepwater market. This project is part of our Fluids Systems strategy to penetrate the Gulf of Mexico deepwater market and is expected to be completed in the first half of 2017. Capital expenditures related to these projects totaled $25.6 million, $26.1 million and $3.9 million in 2016, 2015 and 2014, respectively.

Our Mats and Integrated Services segment, which generated 16% of consolidated revenues in 2016, provides composite mat rentals, well site construction and related site services to oil and gas customers. In addition, mat rental and services activity is expanding in other markets, including electrical transmission & distribution, pipeline, solar, petrochemical and construction industries across the U.S., Canada and United Kingdom. Revenues from customers in markets other than oil and gas exploration represented approximately 60% of our rental and services revenues in 2016 compared to approximately one-third in 2015. We also sell composite mats to customers outside of the U.S. and to domestic customers outside of the oil and gas exploration market. Mat sales have been negatively impacted in recent years by lower demand from international oil and gas customers in the weak commodity price environment.

16

In March 2014, we completed the sale of our Environmental Services business, which was historically reported as a third operating segment, for $100 million in cash. The proceeds were used for general corporate purposes, including investments in our core drilling fluids and mats segments, along with share purchases under our share repurchase program. See “Note 14 - Discontinued Operations” in our Consolidated Financial Statements for additional information.

Our operating results depend, to a large extent, on oil and gas drilling activity levels in the markets we serve, and particularly for the Fluids Systems segment, the nature of the drilling operations (including the depth and whether the wells are drilled vertically or horizontally), which governs the revenue potential of each well. Drilling activity, in turn, depends on oil and gas commodity pricing, inventory levels, product demand and regulatory restrictions. Oil and gas prices and activity are cyclical and volatile. This market volatility has a significant impact on our operating results.

Beginning in the fourth quarter of 2014 and continuing throughout 2015 and into early 2016, the price of oil declined dramatically from the price levels in recent years. As a result, E&P drilling activity significantly declined in North America and many global markets over this period. While oil prices have improved from the lows reached in the first quarter of 2016, price levels remain lower than in recent years. Rig count data is the most widely accepted indicator of drilling activity. Average North American rig count data for the last three years ended December 31 is as follows:

Year Ended December 31, | 2016 vs 2015 | 2015 vs 2014 | |||||||||||||||||||

2016 | 2015 | 2014 | Count | % | Count | % | |||||||||||||||

U.S. Rig Count | 509 | 978 | 1,862 | (469 | ) | (48 | %) | (884 | ) | (47 | %) | ||||||||||

Canadian Rig Count | 130 | 192 | 379 | (62 | ) | (32 | %) | (187 | ) | (49 | %) | ||||||||||

Total | 639 | 1,170 | 2,241 | (531 | ) | (45 | %) | (1,071 | ) | (48 | %) | ||||||||||

________________

Source: Baker Hughes Incorporated

The North America rig count continually declined in 2015 and early 2016, reaching a low point of 447 in May 2016, and has since recovered to 1,082 rigs as of February 17, 2017, including 751 rigs in the U.S. and 331 rigs in Canada. The Canadian rig count reflects the normal seasonality for this market with the highest rig count levels generally observed in the first quarter of the year prior to spring break up. With the improvement in rig counts from the lows reached in May 2016, average activity levels are expected to improve in 2017 compared to 2016 but remain below 2015 levels.