Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Chaparral Energy, Inc. | d503816d8k.htm |

December, 2017 Cowen Energy & Natural Resources Conference Exhibit 99.1

Statements made in these presentation slides and by representatives of Chaparral Energy (“Chaparral” or the “company”) during the course of this presentation that are not historical facts are “forward-looking statements.” These statements are based on certain assumptions and expectations made by the company, which reflect management’s experience, estimates and perception of historical trends, current conditions and anticipated future developments. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the company, which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to financial performance and results, ability to improve our financial results and profitability following emergence from bankruptcy, availability of sufficient cash flow to execute our business plan, continued low or further declining commodity prices and demand for oil, natural gas and natural gas liquids, ability to hedge future production, ability to replace reserves and efficiently develop current reserves and the regulatory environment and other important factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. These and other important factors could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Please read “risk factors” in the company’s annual reports on form 10-K, quarterly reports on form 10-Q and other public filings. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information or future events. Forward-Looking Statements and Risk Factors Forward-Looking Statements and Risk Factors

General Overview

Transforming into a premier pure-play STACK company Approximately 110,000 net acres Strong pipeline of economic opportunities Solid operating margins and returns, even in a volatile commodity price environment Keys to superior performance Strong assets – focused STACK player Low-cost structure Operational excellence Prioritizing environmental, health and safety Premier operating team Strong foundation capable of excelling in a $40 - $60 per barrel environment Strong Assets, Low Cost Structure and Experienced Leadership with a Vision for Success The New Chaparral

Emerged from restructuring with a strong balance sheet Equitized $1.2 billion in debt and reduced annual interest expense by $110 million Enterprise Value of approximately $1.2 billion Post Emergence Debt/Adjusted LTM EBITDA of approximately 1.4x Recruited new, independent board with extensive industry experience Achieved total net production of 24.5 MBoe/d Q3 2017 55% oil, 17% NGLs and 28% natural gas 34% year-over-year increase in STACK production Total net production of 18.8 MBoe/d without EOR assets Sold EOR assets for $170 million Executed and initiated $100 million DrillCo JV with Bayou City Energy for Canadian and Garfield County Stock trading on the OTCQB market under the symbol CHPE Continued Operational Excellence During Restructuring Recent Achievements

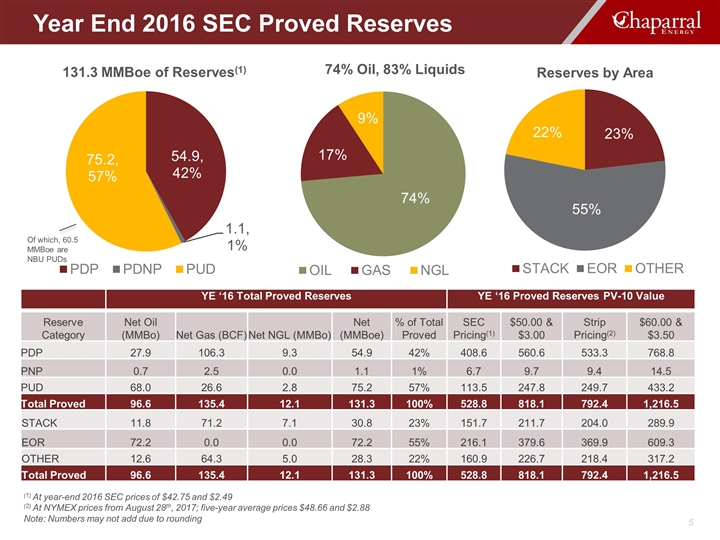

YE ‘16 Total Proved Reserves YE ‘16 Proved Reserves PV-10 Value Reserve Category Net Oil (MMBo) Net Gas (BCF) Net NGL (MMBo) Net (MMBoe) % of Total Proved SEC Pricing(1) $50.00 & $3.00 Strip Pricing(2) $60.00 & $3.50 PDP 27.9 106.3 9.3 54.9 42% 408.6 560.6 533.3 768.8 PNP 0.7 2.5 0.0 1.1 1% 6.7 9.7 9.4 14.5 PUD 68.0 26.6 2.8 75.2 57% 113.5 247.8 249.7 433.2 Total Proved 96.6 135.4 12.1 131.3 100% 528.8 818.1 792.4 1,216.5 STACK 11.8 71.2 7.1 30.8 23% 151.7 211.7 204.0 289.9 EOR 72.2 0.0 0.0 72.2 55% 216.1 379.6 369.9 609.3 OTHER 12.6 64.3 5.0 28.3 22% 160.9 226.7 218.4 317.2 Total Proved 96.6 135.4 12.1 131.3 100% 528.8 818.1 792.4 1,216.5 (1) At year-end 2016 SEC prices of $42.75 and $2.49 (2) At NYMEX prices from August 28th, 2017; five-year average prices $48.66 and $2.88 Note: Numbers may not add due to rounding Of which, 60.5 MMBoe are NBU PUDs Year End 2016 SEC Proved Reserves

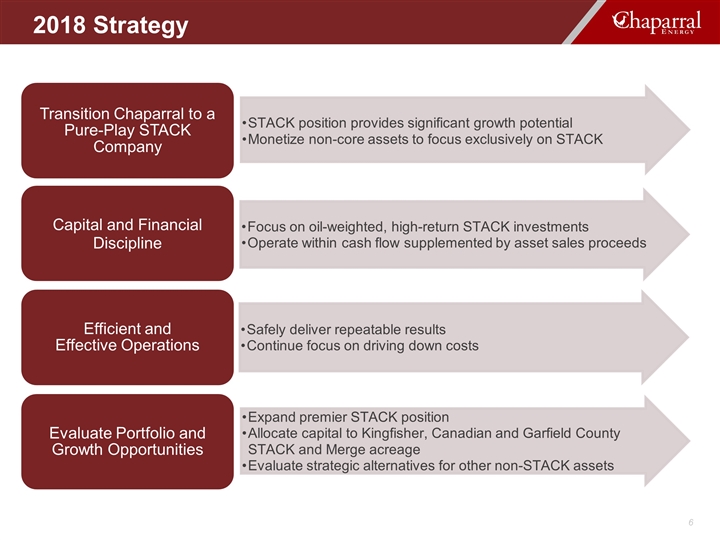

2018 Strategy Transition Chaparral to a Pure-Play STACK Company Efficient and Effective Operations Continue focus on driving down costs Evaluate Portfolio and Growth Opportunities STACK position provides significant growth potential Safely deliver repeatable results Expand premier STACK position Monetize non-core assets to focus exclusively on STACK Capital and Financial Discipline Focus on oil-weighted, high-return STACK investments Operate within cash flow supplemented by asset sales proceeds Evaluate strategic alternatives for other non-STACK assets Allocate capital to Kingfisher, Canadian and Garfield County STACK and Merge acreage

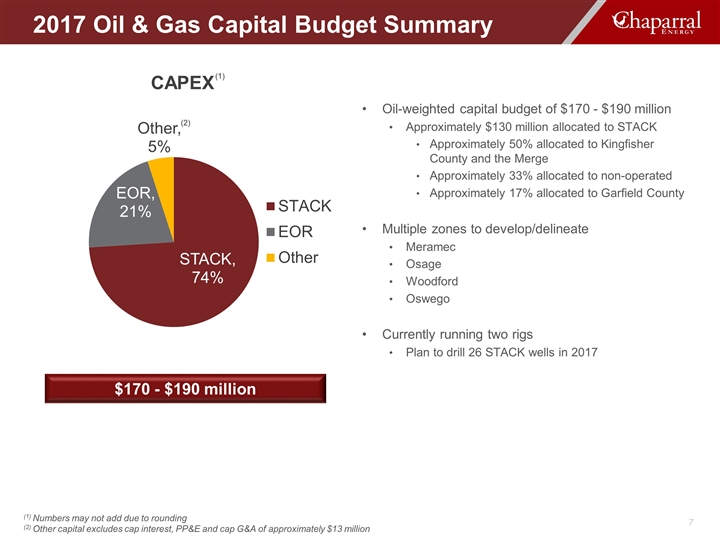

Oil-weighted capital budget of $170 - $190 million Approximately $130 million allocated to STACK Approximately 50% allocated to Kingfisher County and the Merge Approximately 33% allocated to non-operated Approximately 17% allocated to Garfield County Multiple zones to develop/delineate Meramec Osage Woodford Oswego Currently running two rigs Plan to drill 26 STACK wells in 2017 $170 - $190 million 2017 Oil & Gas Capital Budget Summary (1) Numbers may not add due to rounding (2) Other capital excludes cap interest, PP&E and cap G&A of approximately $13 million (1) (2)

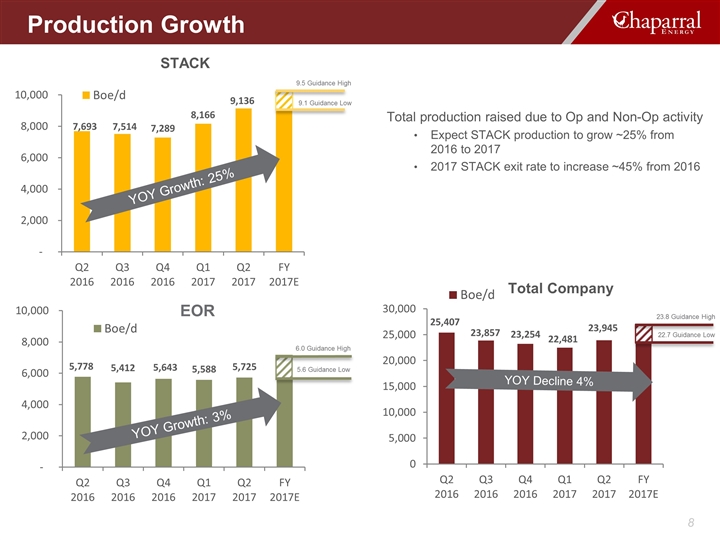

Total production raised due to Op and Non-Op activity Expect STACK production to grow ~25% from 2016 to 2017 2017 STACK exit rate to increase ~45% from 2016 Total Company EOR YOY Decline 4% Production Growth STACK YOY Growth: 25% 9.1 Guidance Low 9.5 Guidance High 22.7 Guidance Low 23.8 Guidance High 5.6 Guidance Low 6.0 Guidance High YOY Growth: 3%

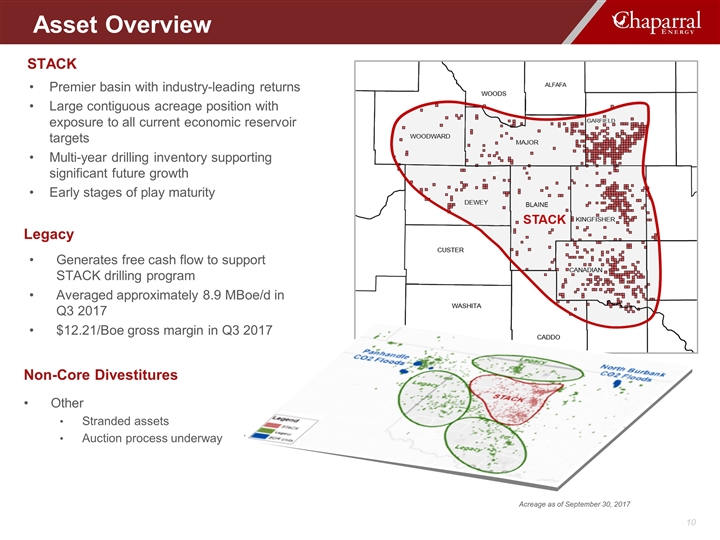

Asset Overview

Other Stranded assets Auction process underway Premier basin with industry-leading returns Large contiguous acreage position with exposure to all current economic reservoir targets Multi-year drilling inventory supporting significant future growth Early stages of play maturity STACK Generates free cash flow to support STACK drilling program Averaged approximately 8.9 MBoe/d in Q3 2017 $12.21/Boe gross margin in Q3 2017 Legacy Non-Core Divestitures Acreage as of September 30, 2017 Asset Overview

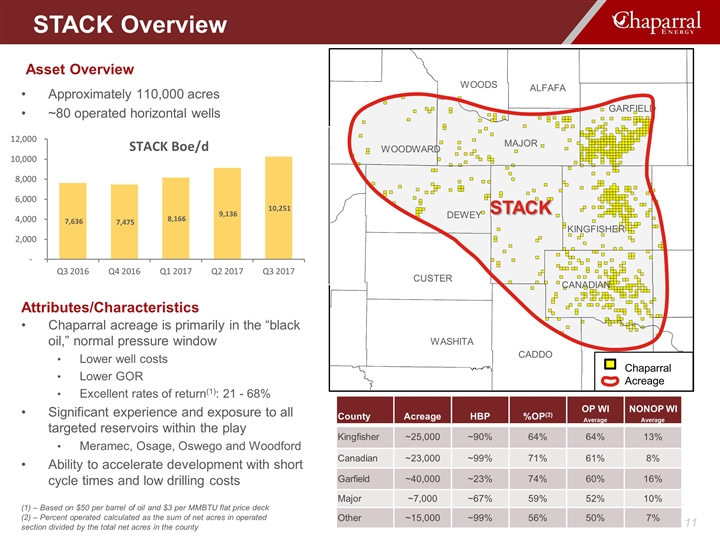

Asset Overview County Acreage HBP %OP(2) OP WI Average NONOP WI Average Kingfisher ~25,000 ~90% 64% 64% 13% Canadian ~23,000 ~99% 71% 61% 8% Garfield ~40,000 ~23% 74% 60% 16% Major ~7,000 ~67% 59% 52% 10% Other ~15,000 ~99% 56% 50% 7% Chaparral acreage is primarily in the “black oil,” normal pressure window Lower well costs Lower GOR Excellent rates of return(1): 21 - 68% Significant experience and exposure to all targeted reservoirs within the play Meramec, Osage, Oswego and Woodford Ability to accelerate development with short cycle times and low drilling costs Attributes/Characteristics STACK Overview (1) – Based on $50 per barrel of oil and $3 per MMBTU flat price deck (2) – Percent operated calculated as the sum of net acres in operated section divided by the total net acres in the county STACK WOODWARD ALFAFA WOODS KINGFISHER MAJOR DEWEY CANADIAN CUSTER WASHITA CADDO GARFIELD Chaparral Acreage Approximately 110,000 acres ~80 operated horizontal wells

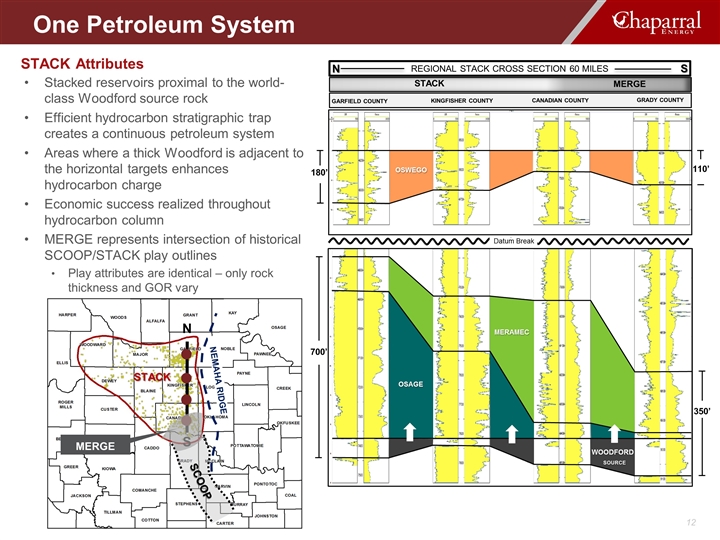

Stacked reservoirs proximal to the world-class Woodford source rock Efficient hydrocarbon stratigraphic trap creates a continuous petroleum system Areas where a thick Woodford is adjacent to the horizontal targets enhances hydrocarbon charge Economic success realized throughout hydrocarbon column MERGE represents intersection of historical SCOOP/STACK play outlines Play attributes are identical – only rock thickness and GOR vary STACK Attributes GARFIELD COUNTY KINGFISHER COUNTY CANADIAN COUNTY REGIONAL STACK CROSS SECTION 60 MILES N S STACK MERGE OSWEGO MERAMEC OSAGE WOODFORD SOURCE GRADY COUNTY 110’ 180’ 350’ 700’ Datum Break One Petroleum System STACK N SCOOP S NEMAHA RIDGE MERGE

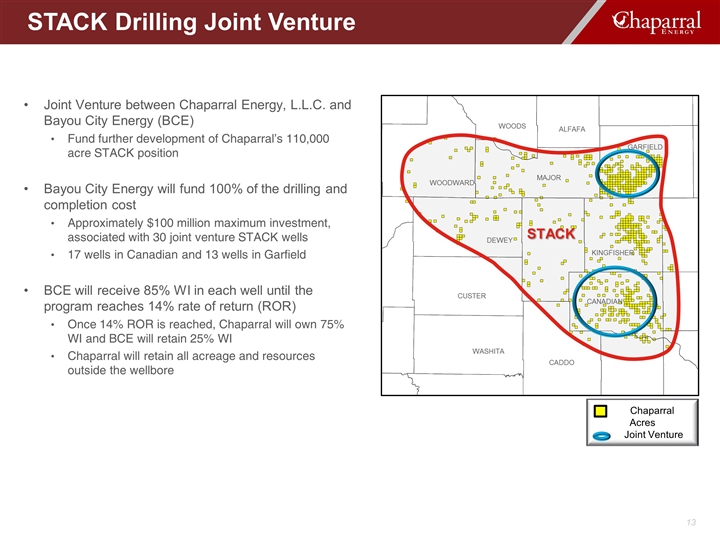

STACK Drilling Joint Venture Joint Venture between Chaparral Energy, L.L.C. and Bayou City Energy (BCE) Fund further development of Chaparral’s 110,000 acre STACK position Bayou City Energy will fund 100% of the drilling and completion cost Approximately $100 million maximum investment, associated with 30 joint venture STACK wells 17 wells in Canadian and 13 wells in Garfield BCE will receive 85% WI in each well until the program reaches 14% rate of return (ROR) Once 14% ROR is reached, Chaparral will own 75% WI and BCE will retain 25% WI Chaparral will retain all acreage and resources outside the wellbore STACK WOODWARD ALFAFA WOODS KINGFISHER MAJOR DEWEY CANADIAN CUSTER WASHITA CADDO GARFIELD Chaparral Acres Joint Venture

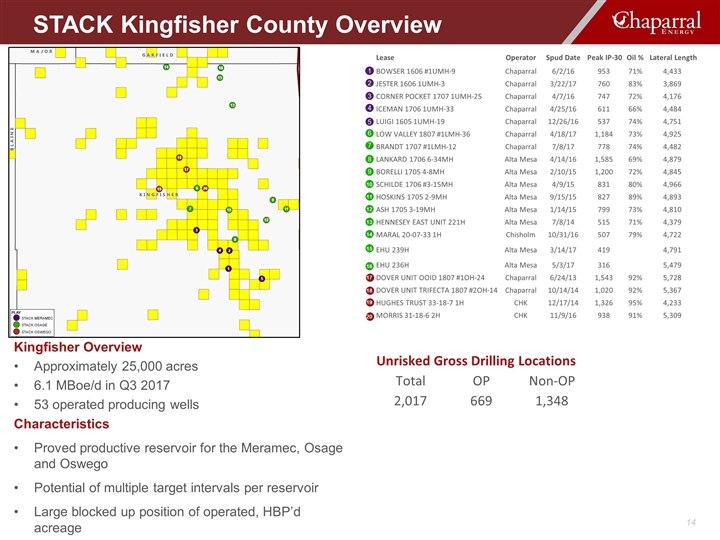

STACK Kingfisher County Overview Kingfisher Overview Approximately 25,000 acres 6.1 MBoe/d in Q3 2017 53 operated producing wells Characteristics Proved productive reservoir for the Meramec, Osage and Oswego Potential of multiple target intervals per reservoir Large blocked up position of operated, HBP’d acreage Unrisked Gross Drilling Locations Total OP Non-OP 2,017 669 1,348 17 1 2 3 4 5 6 7 8 9 10 11 12 16 13 14 15 18 19 20 Lease Operator Spud Date Peak IP-30 Oil % Lateral Length BOWSER 1606 #1UMH-9 Chaparral 6/2/16 953 71% 4,433 JESTER 1606 1UMH-3 Chaparral 3/22/17 760 83% 3,869 CORNER POCKET 1707 1UMH-25 Chaparral 4/7/16 747 72% 4,176 ICEMAN 1706 1UMH-33 Chaparral 4/25/16 611 66% 4,484 LUIGI 1605 1UMH-19 Chaparral 12/26/16 537 74% 4,751 LOW VALLEY 1807 #1LMH-36 Chaparral 4/18/17 1,184 73% 4,925 BRANDT 1707 #1LMH-12 Chaparral 7/8/17 778 74% 4,482 LANKARD 1706 6-34MH Alta Mesa 4/14/16 1,585 69% 4,879 BORELLI 1705 4-8MH Alta Mesa 2/10/15 1,200 72% 4,845 SCHILDE 1706 #3-15MH Alta Mesa 4/9/15 831 80% 4,966 HOSKINS 1705 2-9MH Alta Mesa 9/15/15 827 89% 4,893 ASH 1705 3-19MH Alta Mesa 1/14/15 799 73% 4,810 HENNESEY EAST UNIT 221H Alta Mesa 7/8/14 515 71% 4,379 MARAL 20-07-33 1H Chisholm 10/31/16 507 79% 4,722 EHU 239H Alta Mesa 3/14/17 419 4,791 EHU 236H Alta Mesa 5/3/17 316 5,479 DOVER UNIT OOID 1807 #1OH-24 Chaparral 6/24/13 1,543 92% 5,728 DOVER UNIT TRIFECTA 1807 #2OH-14 Chaparral 10/14/14 1,020 92% 5,367 HUGHES TRUST 33-18-7 1H CHK 12/17/14 1,326 95% 4,233 MORRIS 31-18-6 2H CHK 11/9/16 938 91% 5,309

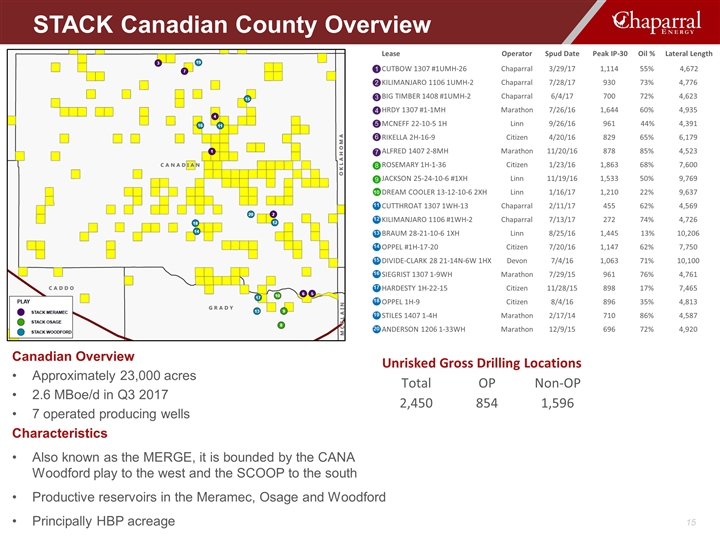

Canadian Overview Approximately 23,000 acres 2.6 MBoe/d in Q3 2017 7 operated producing wells Characteristics Also known as the MERGE, it is bounded by the CANA Woodford play to the west and the SCOOP to the south Productive reservoirs in the Meramec, Osage and Woodford Principally HBP acreage STACK Canadian County Overview Unrisked Gross Drilling Locations Total OP Non-OP 2,450 854 1,596 1 2 3 4 5 6 7 8 9 10 20 19 18 17 16 15 14 13 12 11 Lease Operator Spud Date Peak IP-30 Oil % Lateral Length CUTBOW 1307 #1UMH-26 Chaparral 3/29/17 1,114 55% 4,672 KILIMANJARO 1106 1UMH-2 Chaparral 7/28/17 930 73% 4,776 BIG TIMBER 1408 #1UMH-2 Chaparral 6/4/17 700 72% 4,623 HRDY 1307 #1-1MH Marathon 7/26/16 1,644 60% 4,935 MCNEFF 22-10-5 1H Linn 9/26/16 961 44% 4,391 RIKELLA 2H-16-9 Citizen 4/20/16 829 65% 6,179 ALFRED 1407 2-8MH Marathon 11/20/16 878 85% 4,523 ROSEMARY 1H-1-36 Citizen 1/23/16 1,863 68% 7,600 JACKSON 25-24-10-6 #1XH Linn 11/19/16 1,533 50% 9,769 DREAM COOLER 13-12-10-6 2XH Linn 1/16/17 1,210 22% 9,637 CUTTHROAT 1307 1WH-13 Chaparral 2/11/17 455 62% 4,569 KILIMANJARO 1106 #1WH-2 Chaparral 7/13/17 272 74% 4,726 BRAUM 28-21-10-6 1XH Linn 8/25/16 1,445 13% 10,206 OPPEL #1H-17-20 Citizen 7/20/16 1,147 62% 7,750 DIVIDE-CLARK 28 21-14N-6W 1HX Devon 7/4/16 1,063 71% 10,100 SIEGRIST 1307 1-9WH Marathon 7/29/15 961 76% 4,761 HARDESTY 1H-22-15 Citizen 11/28/15 898 17% 7,465 OPPEL 1H-9 Citizen 8/4/16 896 35% 4,813 STILES 1407 1-4H Marathon 2/17/14 710 86% 4,587 ANDERSON 1206 1-33WH Marathon 12/9/15 696 72% 4,920

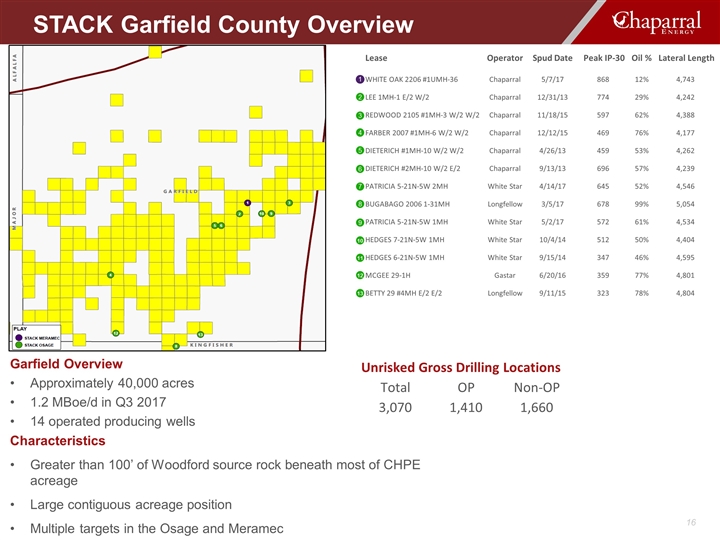

Garfield Overview Approximately 40,000 acres 1.2 MBoe/d in Q3 2017 14 operated producing wells Characteristics Greater than 100’ of Woodford source rock beneath most of CHPE acreage Large contiguous acreage position Multiple targets in the Osage and Meramec STACK Garfield County Overview Unrisked Gross Drilling Locations Total OP Non-OP 3,070 1,410 1,660 1 2 3 4 5 6 7 8 9 10 11 12 13 Lease Operator Spud Date Peak IP-30 Oil % Lateral Length WHITE OAK 2206 #1UMH-36 Chaparral 5/7/17 868 12% 4,743 LEE 1MH-1 E/2 W/2 Chaparral 12/31/13 774 29% 4,242 REDWOOD 2105 #1MH-3 W/2 W/2 Chaparral 11/18/15 597 62% 4,388 FARBER 2007 #1MH-6 W/2 W/2 Chaparral 12/12/15 469 76% 4,177 DIETERICH #1MH-10 W/2 W/2 Chaparral 4/26/13 459 53% 4,262 DIETERICH #2MH-10 W/2 E/2 Chaparral 9/13/13 696 57% 4,239 PATRICIA 5-21N-5W 2MH White Star 4/14/17 645 52% 4,546 BUGABAGO 2006 1-31MH Longfellow 3/5/17 678 99% 5,054 PATRICIA 5-21N-5W 1MH White Star 5/2/17 572 61% 4,534 HEDGES 7-21N-5W 1MH White Star 10/4/14 512 50% 4,404 HEDGES 6-21N-5W 1MH White Star 9/15/14 347 46% 4,595 MCGEE 29-1H Gastar 6/20/16 359 77% 4,801 BETTY 29 #4MH E/2 E/2 Longfellow 9/11/15 323 78% 4,804

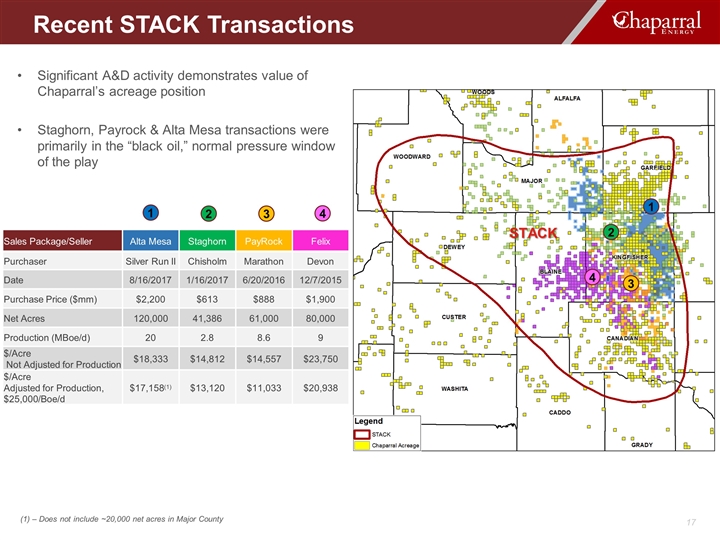

Significant A&D activity demonstrates value of Chaparral’s acreage position Staghorn, Payrock & Alta Mesa transactions were primarily in the “black oil,” normal pressure window of the play 2 3 4 4 3 2 Recent STACK Transactions 1 1 (1) – Does not include ~20,000 net acres in Major County Sales Package/Seller Alta Mesa Staghorn PayRock Felix Purchaser Silver Run II Chisholm Marathon Devon Date 8/16/2017 1/16/2017 6/20/2016 12/7/2015 Purchase Price ($mm) $2,200 $613 $888 $1,900 Net Acres 120,000 41,386 61,000 80,000 Production (MBoe/d) 20 2.8 8.6 9 $/Acre Not Adjusted for Production $18,333 $14,812 $14,557 $23,750 $/Acre Adjusted for Production, $25,000/Boe/d $17,158(1) $13,120 $11,033 $20,938 STACK

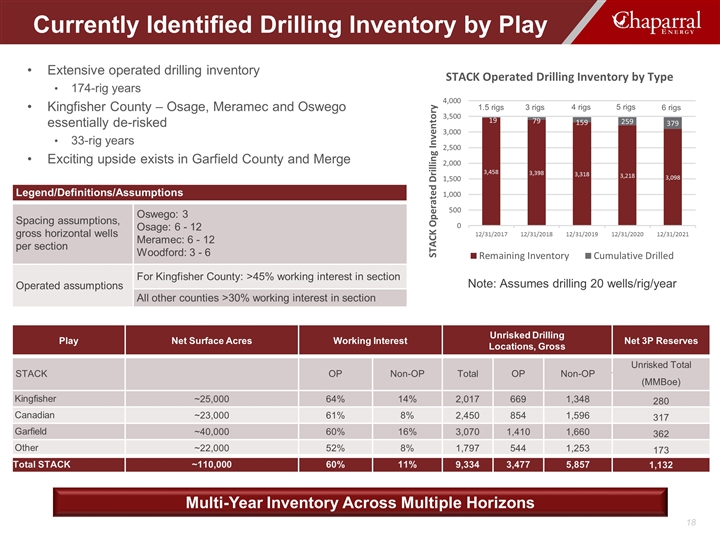

Extensive operated drilling inventory 174-rig years Kingfisher County – Osage, Meramec and Oswego essentially de-risked 33-rig years Exciting upside exists in Garfield County and Merge Legend/Definitions/Assumptions Spacing assumptions, gross horizontal wells per section Oswego: 3 Osage: 6 - 12 Meramec: 6 - 12 Woodford: 3 - 6 Operated assumptions For Kingfisher County: >45% working interest in section All other counties >30% working interest in section Play Net Surface Acres Working Interest Unrisked Drilling Locations, Gross Net 3P Reserves STACK OP Non-OP Total OP Non-OP Unrisked Total (MMBoe) Kingfisher ~25,000 64% 14% 2,017 669 1,348 280 Canadian ~23,000 61% 8% 2,450 854 1,596 317 Garfield ~40,000 60% 16% 3,070 1,410 1,660 362 Other ~22,000 52% 8% 1,797 544 1,253 173 Total STACK ~110,000 60% 11% 9,334 3,477 5,857 1,132 1.5 rigs 3 rigs 4 rigs 5 rigs 6 rigs Multi-Year Inventory Across Multiple Horizons Note: Assumes drilling 20 wells/rig/year Currently Identified Drilling Inventory by Play

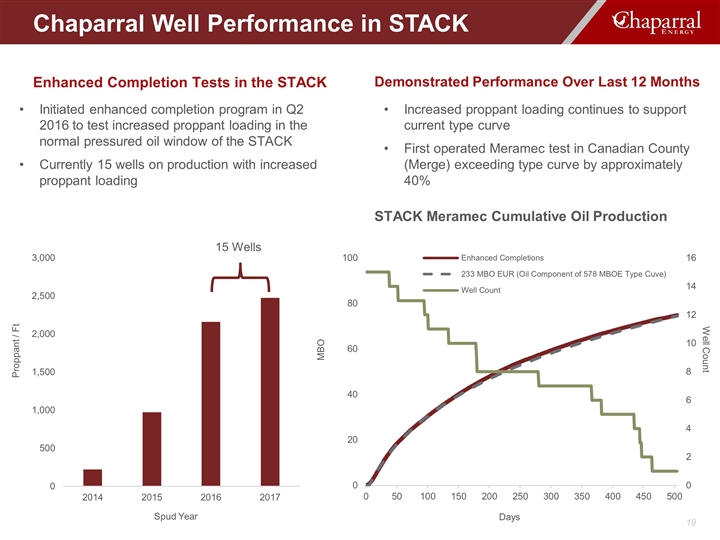

Chaparral Well Performance in STACK Enhanced Completion Tests in the STACK Initiated enhanced completion program in Q2 2016 to test increased proppant loading in the normal pressured oil window of the STACK Currently 15 wells on production with increased proppant loading MBO Demonstrated Performance Over Last 12 Months Increased proppant loading continues to support current type curve First operated Meramec test in Canadian County (Merge) exceeding type curve by approximately 40% STACK Meramec Cumulative Oil Production Well Count Days Spud Year 15 Wells

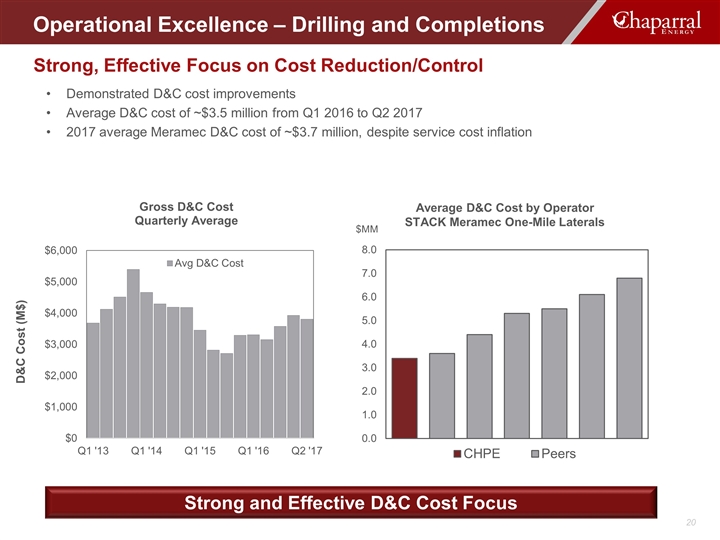

Operational Excellence – Drilling and Completions Strong, Effective Focus on Cost Reduction/Control Demonstrated D&C cost improvements Average D&C cost of ~$3.5 million from Q1 2016 to Q2 2017 2017 average Meramec D&C cost of ~$3.7 million, despite service cost inflation Average D&C Cost by Operator STACK Meramec One-Mile Laterals $MM Strong and Effective D&C Cost Focus

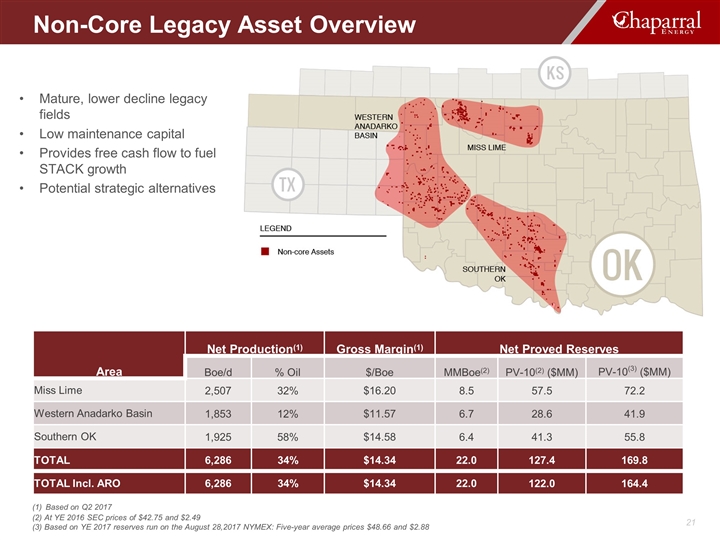

Mature, lower decline legacy fields Low maintenance capital Provides free cash flow to fuel STACK growth Potential strategic alternatives Area Net Production(1) Gross Margin(1) Net Proved Reserves Boe/d % Oil $/Boe MMBoe(2) PV-10(2) ($MM) PV-10(3) ($MM) Miss Lime 2,507 32% $16.20 8.5 57.5 72.2 Western Anadarko Basin 1,853 12% $11.57 6.7 28.6 41.9 Southern OK 1,925 58% $14.58 6.4 41.3 55.8 TOTAL 6,286 34% $14.34 22.0 127.4 169.8 TOTAL Incl. ARO 6,286 34% $14.34 22.0 122.0 164.4 (1) Based on Q2 2017 (2) At YE 2016 SEC prices of $42.75 and $2.49 (3) Based on YE 2017 reserves run on the August 28,2017 NYMEX: Five-year average prices $48.66 and $2.88 Non-Core Legacy Asset Overview

Financial Overview

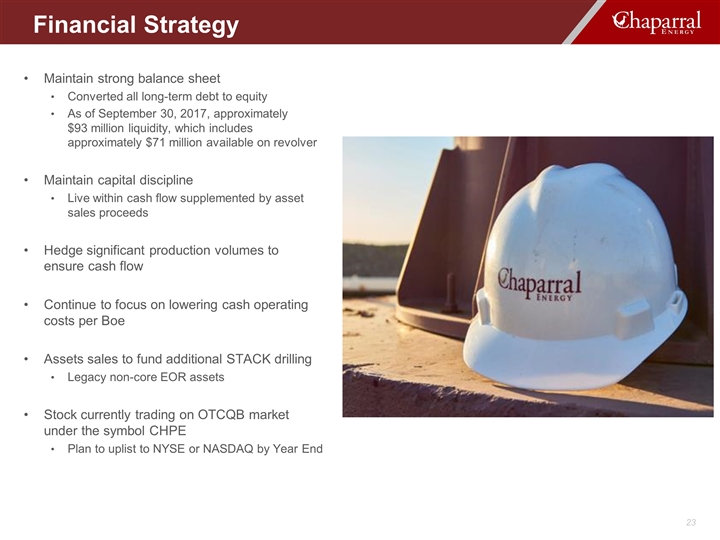

Maintain strong balance sheet Converted all long-term debt to equity As of September 30, 2017, approximately $93 million liquidity, which includes approximately $71 million available on revolver Maintain capital discipline Live within cash flow supplemented by asset sales proceeds Hedge significant production volumes to ensure cash flow Continue to focus on lowering cash operating costs per Boe Assets sales to fund additional STACK drilling Legacy non-core EOR assets Stock currently trading on OTCQB market under the symbol CHPE Plan to uplist to NYSE or NASDAQ by Year End Financial Strategy

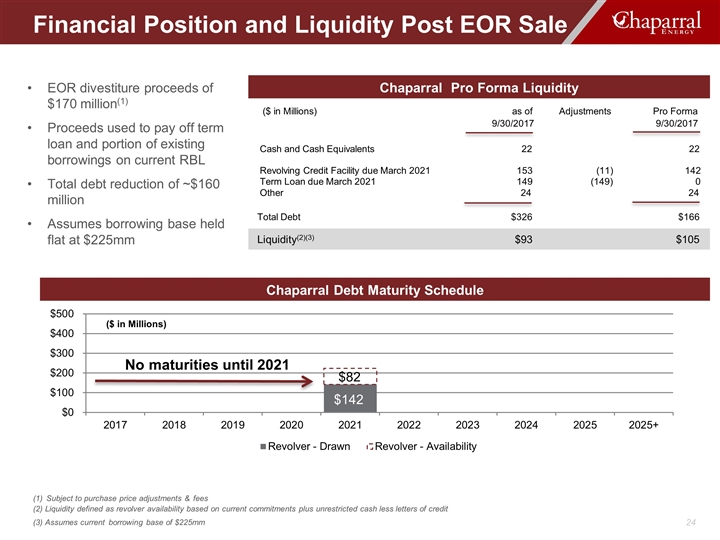

Financial Position and Liquidity Post EOR Sale EOR divestiture proceeds of $170 million(1) Proceeds used to pay off term loan and portion of existing borrowings on current RBL Total debt reduction of ~$160 million Assumes borrowing base held flat at $225mm Chaparral Pro Forma Liquidity ($ in Millions) as of Adjustments Pro Forma 9/30/2017 9/30/2017 Cash and Cash Equivalents 22 22 Revolving Credit Facility due March 2021 153 (11) 142 Term Loan due March 2021 149 (149) 0 Other 24 24 Total Debt $326 $166 Liquidity(2)(3) $93 $105 Chaparral Debt Maturity Schedule (1) Subject to purchase price adjustments & fees (2) Liquidity defined as revolver availability based on current commitments plus unrestricted cash less letters of credit (3) Assumes current borrowing base of $225mm

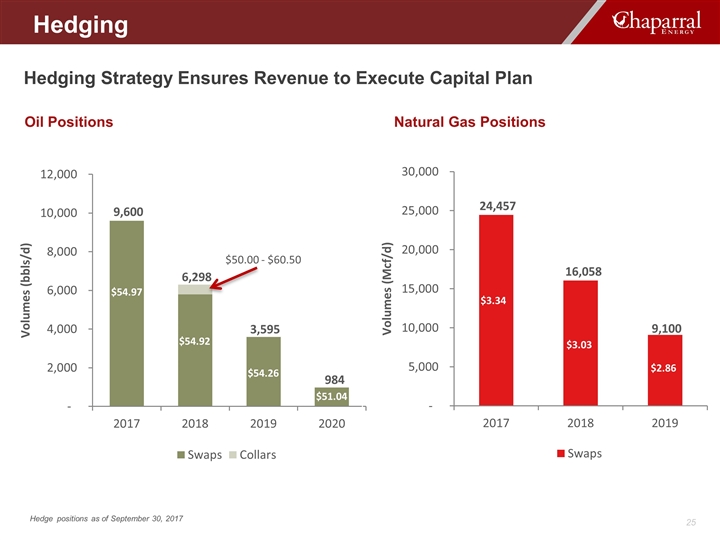

Hedging Strategy Ensures Revenue to Execute Capital Plan Oil Positions Natural Gas Positions Hedge positions as of September 30, 2017 Hedging $54.92 $50.00 - $60.50 $54.97 $54.26 $51.04

Why Chaparral? Why Chaparral? Peer Leading Balance Sheet Execution-focused STACK Player Deep Inventory of High-return Drilling Prospects Strong Management Team with Excellent Track Record

Appendix

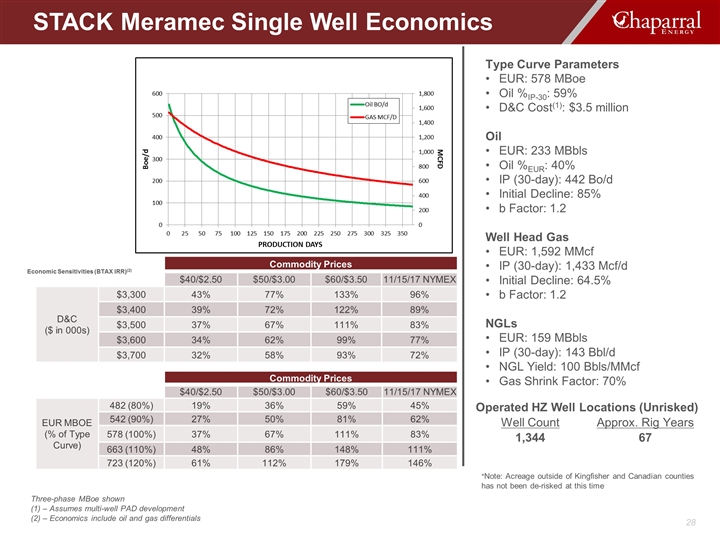

Type Curve Parameters EUR: 578 MBoe Oil %IP-30: 59% D&C Cost(1): $3.5 million Oil EUR: 233 MBbls Oil %EUR: 40% IP (30-day): 442 Bo/d Initial Decline: 85% b Factor: 1.2 Well Head Gas EUR: 1,592 MMcf IP (30-day): 1,433 Mcf/d Initial Decline: 64.5% b Factor: 1.2 NGLs EUR: 159 MBbls IP (30-day): 143 Bbl/d NGL Yield: 100 Bbls/MMcf Gas Shrink Factor: 70% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX D&C ($ in 000s) $3,300 43% 77% 133% 96% $3,400 39% 72% 122% 89% $3,500 37% 67% 111% 83% $3,600 34% 62% 99% 77% $3,700 32% 58% 93% 72% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX EUR MBOE (% of Type Curve) 482 (80%) 19% 36% 59% 45% 542 (90%) 27% 50% 81% 62% 578 (100%) 37% 67% 111% 83% 663 (110%) 48% 86% 148% 111% 723 (120%) 61% 112% 179% 146% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 1,344 67 STACK Meramec Single Well Economics *Note: Acreage outside of Kingfisher and Canadian counties has not been de-risked at this time

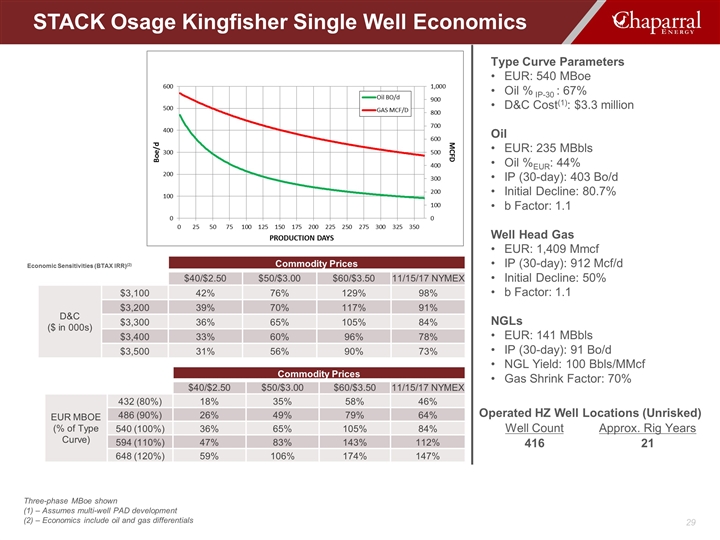

Type Curve Parameters EUR: 540 MBoe Oil % IP-30 : 67% D&C Cost(1): $3.3 million Oil EUR: 235 MBbls Oil %EUR: 44% IP (30-day): 403 Bo/d Initial Decline: 80.7% b Factor: 1.1 Well Head Gas EUR: 1,409 Mmcf IP (30-day): 912 Mcf/d Initial Decline: 50% b Factor: 1.1 NGLs EUR: 141 MBbls IP (30-day): 91 Bo/d NGL Yield: 100 Bbls/MMcf Gas Shrink Factor: 70% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX D&C ($ in 000s) $3,100 42% 76% 129% 98% $3,200 39% 70% 117% 91% $3,300 36% 65% 105% 84% $3,400 33% 60% 96% 78% $3,500 31% 56% 90% 73% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX EUR MBOE (% of Type Curve) 432 (80%) 18% 35% 58% 46% 486 (90%) 26% 49% 79% 64% 540 (100%) 36% 65% 105% 84% 594 (110%) 47% 83% 143% 112% 648 (120%) 59% 106% 174% 147% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 416 21 STACK Osage Kingfisher Single Well Economics

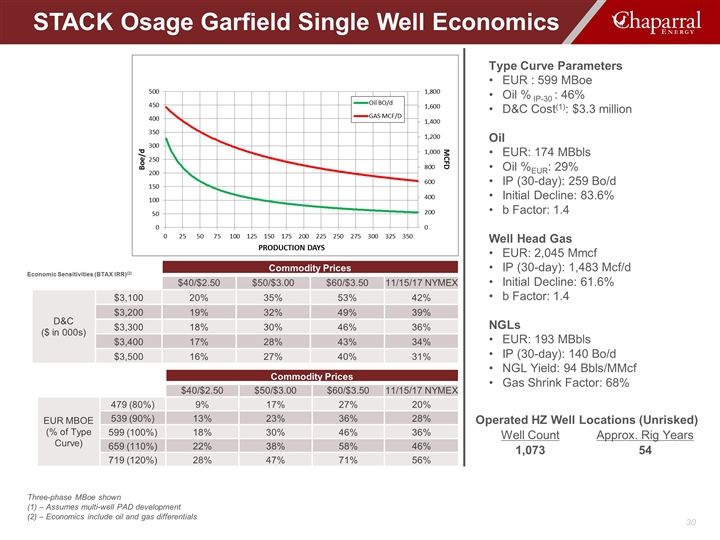

Type Curve Parameters EUR : 599 MBoe Oil % IP-30 : 46% D&C Cost(1): $3.3 million Oil EUR: 174 MBbls Oil %EUR: 29% IP (30-day): 259 Bo/d Initial Decline: 83.6% b Factor: 1.4 Well Head Gas EUR: 2,045 Mmcf IP (30-day): 1,483 Mcf/d Initial Decline: 61.6% b Factor: 1.4 NGLs EUR: 193 MBbls IP (30-day): 140 Bo/d NGL Yield: 94 Bbls/MMcf Gas Shrink Factor: 68% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX D&C ($ in 000s) $3,100 20% 35% 53% 42% $3,200 19% 32% 49% 39% $3,300 18% 30% 46% 36% $3,400 17% 28% 43% 34% $3,500 16% 27% 40% 31% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX EUR MBOE (% of Type Curve) 479 (80%) 9% 17% 27% 20% 539 (90%) 13% 23% 36% 28% 599 (100%) 18% 30% 46% 36% 659 (110%) 22% 38% 58% 46% 719 (120%) 28% 47% 71% 56% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 1,073 54 STACK Osage Garfield Single Well Economics

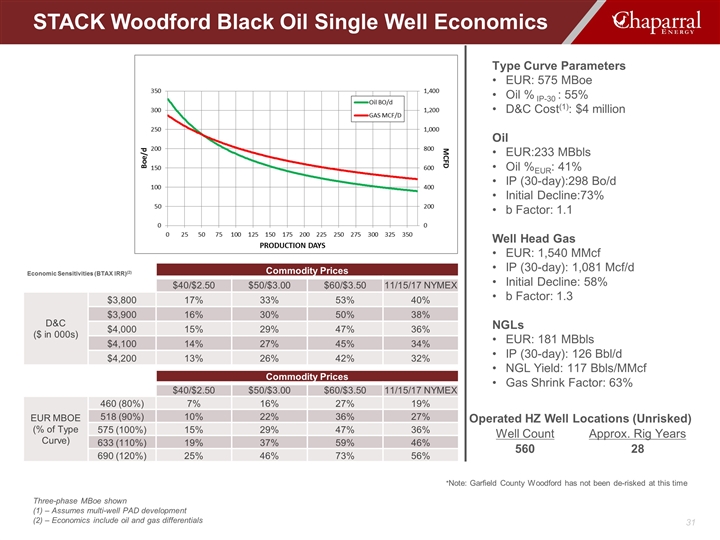

Type Curve Parameters EUR: 575 MBoe Oil % IP-30 : 55% D&C Cost(1): $4 million Oil EUR:233 MBbls Oil %EUR: 41% IP (30-day):298 Bo/d Initial Decline:73% b Factor: 1.1 Well Head Gas EUR: 1,540 MMcf IP (30-day): 1,081 Mcf/d Initial Decline: 58% b Factor: 1.3 NGLs EUR: 181 MBbls IP (30-day): 126 Bbl/d NGL Yield: 117 Bbls/MMcf Gas Shrink Factor: 63% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX D&C ($ in 000s) $3,800 17% 33% 53% 40% $3,900 16% 30% 50% 38% $4,000 15% 29% 47% 36% $4,100 14% 27% 45% 34% $4,200 13% 26% 42% 32% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX EUR MBOE (% of Type Curve) 460 (80%) 7% 16% 27% 19% 518 (90%) 10% 22% 36% 27% 575 (100%) 15% 29% 47% 36% 633 (110%) 19% 37% 59% 46% 690 (120%) 25% 46% 73% 56% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 560 28 STACK Woodford Black Oil Single Well Economics *Note: Garfield County Woodford has not been de-risked at this time

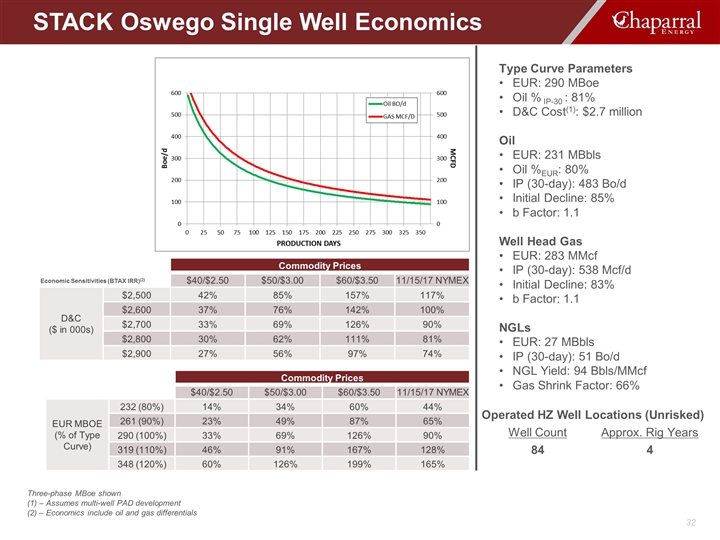

Type Curve Parameters EUR: 290 MBoe Oil % IP-30 : 81% D&C Cost(1): $2.7 million Oil EUR: 231 MBbls Oil %EUR: 80% IP (30-day): 483 Bo/d Initial Decline: 85% b Factor: 1.1 Well Head Gas EUR: 283 MMcf IP (30-day): 538 Mcf/d Initial Decline: 83% b Factor: 1.1 NGLs EUR: 27 MBbls IP (30-day): 51 Bo/d NGL Yield: 94 Bbls/MMcf Gas Shrink Factor: 66% Three-phase MBoe shown (1) – Assumes multi-well PAD development (2) – Economics include oil and gas differentials Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX D&C ($ in 000s) $2,500 42% 85% 157% 117% $2,600 37% 76% 142% 100% $2,700 33% 69% 126% 90% $2,800 30% 62% 111% 81% $2,900 27% 56% 97% 74% Commodity Prices $40/$2.50 $50/$3.00 $60/$3.50 11/15/17 NYMEX EUR MBOE (% of Type Curve) 232 (80%) 14% 34% 60% 44% 261 (90%) 23% 49% 87% 65% 290 (100%) 33% 69% 126% 90% 319 (110%) 46% 91% 167% 128% 348 (120%) 60% 126% 199% 165% Economic Sensitivities (BTAX IRR)(2) Operated HZ Well Locations (Unrisked) Well Count Approx. Rig Years 84 4 STACK Oswego Single Well Economics

Company production: 8.3 - 8.7 MMBoe Capital expenditures: $185 - $200 million Lease operating expense(LOE): $10.50 - $11.00 per Boe General and administrative(G&A)(1): $3.40 - $4.20 per Boe Chaparral will review guidance after conclusion of strategic alternatives for EOR assets 2017 Guidance (1) – Normalized to exclude approximately $27 million of professional fees associated with the Chapter 11 bankruptcy process, as well as approximately $4.5 million for 2016 employee performance bonus that was expensed in 2017 due to bankruptcy accounting rules. 2017 Guidance

Investors Joe Evans Chief Financial Officer joe.evans@chaparralenergy.com 405-426-4590 Media Brandi Wessel Manager – Communications brandi.wessel@chaparralenergy.com 405-426-6657 Contact Information Contact Information Chaparral Energy, Inc. 701 Cedar Lake Boulevard Oklahoma City, OK 73114

James M. Miller, Sr. Vice President - Operations Mr. Miller joined Chaparral in 1996 as an operations engineer and has since been promoted to positions of increasing responsibility ,including his current role as senior vice president of operations. Prior to joining the company, Mr. Miller worked as a petroleum engineer for KEPCO Operating Inc. and Robert A Mason, where he was named vice president of production. Joseph O. Evans, Chief Financial Officer and Executive Vice President Mr. Evans joined Chaparral in 2005 as chief financial officer and executive vice president. Prior to joining Chaparral, he worked as a consultant and practiced public accounting with Evans Gaither & Assoc., served as senior vice president and financial advisor for First National Bank of Commerce and Deloitte & Touche, where he became an audit partner. K. Earl Reynolds, Chief Executive Officer and Director Mr. Reynolds joined Chaparral in 2011 as an executive vice president and chief operating officer before being named president in 2014 and chief executive officer in 2017. Prior to which, he served as the senior vice president of strategic development for Devon Energy, where he led the International Business Unit and was actively involved in strategic planning, as well as holding key leadership roles in domestic and international operations with Burlington Resources and Mobil Oil. Mr. Reynolds currently sits on the board for the Oklahoma City YMCA and the Oklahoma Independent Petroleum Association, where he serves as the Chairman of its Legislative Committee. Executive Team

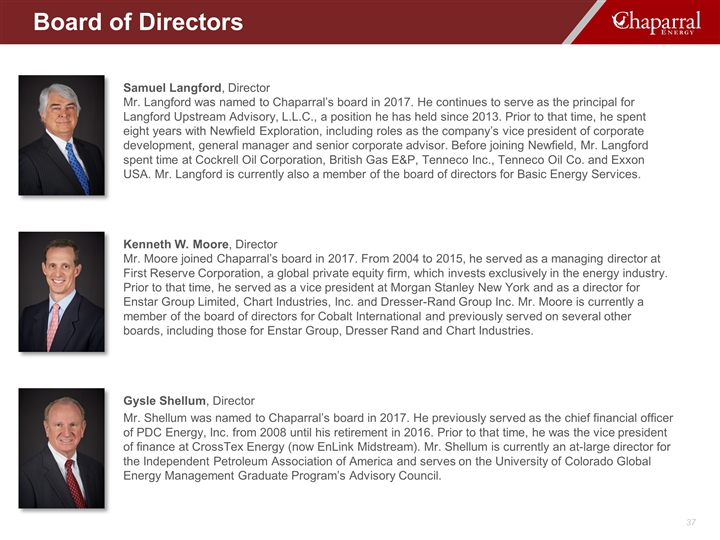

Matthew D. Cabell, Director Mr. Cabell was named to Chaparral’s board in 2017. During his career, Mr. Cabell served as the president of Seneca Resources, as an executive vice president and general manager at Marubeni Oil & Gas, USA, and held various roles in the exploration and production segments of Texaco and Amerada Hess Corporation. Mr. Cabell currently serves as an advisor to KKR and previously served as a member of the board for the American Exploration and Production Council and America’s Natural Gas Alliance. Douglas E. Brooks, Director Mr. Brooks joined Chaparral’s board in 2017. Prior to joining the board, Mr. Brooks served as the president and CEO for Yates Petroleum, CEO of Aurora Oil & Gas Limited and a senior vice president at Forest Oil Corporation. In addition, he spent 24 years with Marathon. Mr. Brooks has also built two private equity-sponsored firms and served as a board member for Aurora Oil & Gas Limited, Magdalena Energy Company, Yates Petroleum and the Houston Producers’ Forum. He is currently CEO of Energy XXI Gulf Coast and an advisor for Hart Energy’s A&D Watch, a global energy research publication. Robert F. Heinemann, Chairman Mr. Heinemann was named to the board in 2017. During his career, Mr. Heinemann worked for Berry Petroleum Company, as a director and as its president and chief executive officer, as well as for Halliburton Company, Mobil Exploration and Producing and various other Mobil entities. He currently serves on the board for Crescent Point Energy, Crestone Peak Resources and Great Western Oil and Gas where he was the chairman from 2014 to 2016. He also previously served on the board for Yates Petroleum until its merger in late 2016 and as chairman of the board for C12 Energy. Board of Directors

Gysle Shellum, Director Mr. Shellum was named to Chaparral’s board in 2017. He previously served as the chief financial officer of PDC Energy, Inc. from 2008 until his retirement in 2016. Prior to that time, he was the vice president of finance at CrossTex Energy (now EnLink Midstream). Mr. Shellum is currently an at-large director for the Independent Petroleum Association of America and serves on the University of Colorado Global Energy Management Graduate Program’s Advisory Council. Kenneth W. Moore, Director Mr. Moore joined Chaparral’s board in 2017. From 2004 to 2015, he served as a managing director at First Reserve Corporation, a global private equity firm, which invests exclusively in the energy industry. Prior to that time, he served as a vice president at Morgan Stanley New York and as a director for Enstar Group Limited, Chart Industries, Inc. and Dresser-Rand Group Inc. Mr. Moore is currently a member of the board of directors for Cobalt International and previously served on several other boards, including those for Enstar Group, Dresser Rand and Chart Industries. Samuel Langford, Director Mr. Langford was named to Chaparral’s board in 2017. He continues to serve as the principal for Langford Upstream Advisory, L.L.C., a position he has held since 2013. Prior to that time, he spent eight years with Newfield Exploration, including roles as the company’s vice president of corporate development, general manager and senior corporate advisor. Before joining Newfield, Mr. Langford spent time at Cockrell Oil Corporation, British Gas E&P, Tenneco Inc., Tenneco Oil Co. and Exxon USA. Mr. Langford is currently also a member of the board of directors for Basic Energy Services. Board of Directors

Reserve Estimates The SEC permits oil and natural gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms. The company may use terms in this presentation that the SEC’s guidelines strictly prohibit in SEC filings, such as estimated ultimate recovery or EUR, resources, net resources, total resource potential and similar terms to estimate oil and natural gas that may ultimately be recovered. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves as used in SEC filings and, accordingly, are subject to substantially greater uncertainty of being actually realized. These estimates have not been fully risked by management. Actual quantities that may be ultimately recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery include the scope of the company’s actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual drilling results and recoveries of oil and natural gas in place and other factors. These estimates may change significantly as the development of properties provides additional data. PV-10 PV-10 value is a non-GAAP measure that differs from the standardized measure of discounted future net cash flows in that PV-10 value is a pre-tax number, while the standardized measure of discounted future net cash flows is an after-tax number. We believe that the presentation of the PV-10 value is relevant and useful to investors because it presents the discounted future net cash flows attributable to our proved reserves prior to taking into account future corporate income taxes, and it is a useful measure of evaluating the relative monetary significance of our oil and natural gas properties. Further, investors may utilize the measure as a basis for comparison of the relative size and value of our reserves to other companies. We use this measure when assessing the potential return on investment related to our oil and natural gas properties. However, PV-10 value is not a substitute for the standardized measure of discounted future net cash flows. Our PV-10 value measure and the standardized measure of discounted future net cash flows do not purport to present the fair value of our oil and natural gas reserves. Reserve and Non-GAAP Information Statement

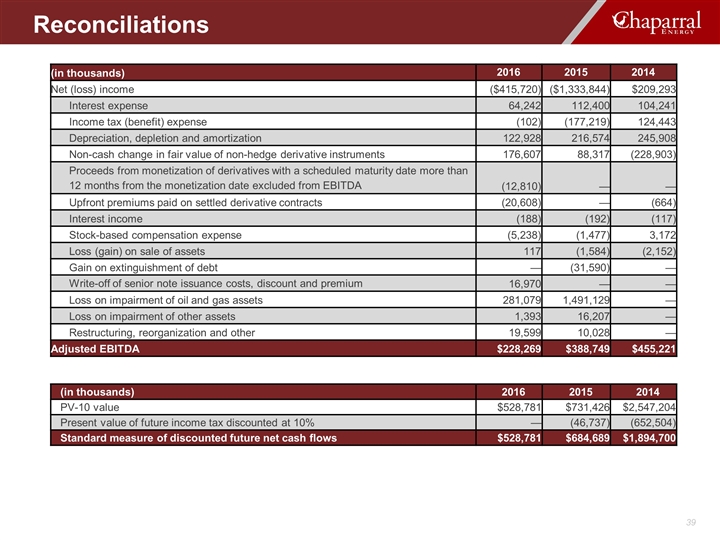

Reconciliations (in thousands) 2016 2015 2014 Net (loss) income ($415,720) ($1,333,844) $209,293 Interest expense 64,242 112,400 104,241 Income tax (benefit) expense (102) (177,219) 124,443 Depreciation, depletion and amortization 122,928 216,574 245,908 Non-cash change in fair value of non-hedge derivative instruments 176,607 88,317 (228,903) Proceeds from monetization of derivatives with a scheduled maturity date more than 12 months from the monetization date excluded from EBITDA (12,810) — — Upfront premiums paid on settled derivative contracts (20,608) — (664) Interest income (188) (192) (117) Stock-based compensation expense (5,238) (1,477) 3,172 Loss (gain) on sale of assets 117 (1,584) (2,152) Gain on extinguishment of debt — (31,590) — Write-off of senior note issuance costs, discount and premium 16,970 — — Loss on impairment of oil and gas assets 281,079 1,491,129 — Loss on impairment of other assets 1,393 16,207 — Restructuring, reorganization and other 19,599 10,028 — Adjusted EBITDA $228,269 $388,749 $455,221 (in thousands) 2016 2015 2014 PV-10 value $528,781 $731,426 $2,547,204 Present value of future income tax discounted at 10% — (46,737) (652,504) Standard measure of discounted future net cash flows $528,781 $684,689 $1,894,700 Reconciliations

ENERGIZING America’s Heartland