Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - CNX Resources Corp | d500008dex993.htm |

| EX-99.2 - EX-99.2 - CNX Resources Corp | d500008dex992.htm |

| EX-10.4 - EX-10.4 - CNX Resources Corp | d500008dex104.htm |

| EX-10.3 - EX-10.3 - CNX Resources Corp | d500008dex103.htm |

| EX-10.2 - EX-10.2 - CNX Resources Corp | d500008dex102.htm |

| EX-10.1 - EX-10.1 - CNX Resources Corp | d500008dex101.htm |

| EX-3.3 - EX-3.3 - CNX Resources Corp | d500008dex33.htm |

| EX-3.2 - EX-3.2 - CNX Resources Corp | d500008dex32.htm |

| EX-3.1 - EX-3.1 - CNX Resources Corp | d500008dex31.htm |

| EX-2.4 - EX-2.4 - CNX Resources Corp | d500008dex24.htm |

| EX-2.3 - EX-2.3 - CNX Resources Corp | d500008dex23.htm |

| EX-2.2 - EX-2.2 - CNX Resources Corp | d500008dex22.htm |

| EX-2.1 - EX-2.1 - CNX Resources Corp | d500008dex21.htm |

| 8-K - 8-K - CNX Resources Corp | d500008d8k.htm |

Table of Contents

Exhibit 99.1

| CONSOL Energy Inc. 1000 CONSOL Energy Drive, Canonsburg, PA 15317-6506 T (724) 485-4000 www.consolenergy.com |

|

Dear CONSOL Stockholders:

In December 2016, we announced our intention to separate CONSOL Energy Inc. (ParentCo) into two independent, publicly traded companies: a coal company and a natural gas exploration and production (E&P) company. This separation provides current stockholders ownership in two leading and focused companies, each positioned to capitalize on distinct opportunities for growth and profitability, and has been approved by our Board of Directors. The coal company will include our Pennsylvania Mining Complex (PAMC), our ownership interest in CNX Coal Resources LP (CNXC), our marine terminal at the Baltimore Port, our undeveloped coal reserves located in the Northern Appalachian, Central Appalachian and Illinois basins and certain related coal assets and liabilities (collectively, the Coal Business). The Coal Business is held by CONSOL Mining Corporation (CoalCo), which is currently a wholly owned subsidiary of ParentCo. The E&P company will include developed and undeveloped oil and gas properties, both leased and owned in fee, located primarily in Appalachia (Pennsylvania, West Virginia, Ohio and Virginia), with a primary focus in the continued development of Marcellus Shale acreage and the delineation and development of Utica Shale acreage, along with certain water services and land resource management services (collectively, the Gas Business). The Gas Business is held through subsidiaries of ParentCo separate from CoalCo.

Management believes that the separation and spin-off of the Coal Business will:

| - | improve business and operational decision-making and strategic and management focus for each respective business; |

| - | improve each company’s ability to attract, retain and incentivize employees; |

| - | improve the Gas Business’s access to capital, while eliminating competition for capital among the two businesses; and |

| - | by creating an independent equity structure for each business, improve the understanding of each business in the capital and investor markets, lead to a stronger, more focused investor base for each business, allow each company to use its stock as consideration for acquisitions and enhance the value of its equity-based compensation programs, thereby enabling each business to more fully realize its value. |

To implement the separation, ParentCo currently plans to distribute all of the outstanding shares of CoalCo common stock on a pro rata basis to ParentCo stockholders. Each ParentCo stockholder will receive one share of CoalCo common stock for every eight shares of ParentCo common stock held by such stockholder of record as of the close of business on November 15, 2017, the record date, in a distribution that is intended to qualify as generally tax-free to the ParentCo stockholders for U.S. federal income tax purposes, except with respect to any cash received in lieu of fractional shares. No fractional shares of CoalCo common stock will be issued. If you would otherwise have been entitled to receive a fractional share of common stock in the distribution, you will receive the net cash proceeds of the sale of such fractional share instead.

In conjunction with the separation, CoalCo will apply for authorization to list its common stock on the New York Stock Exchange under the symbol “CEIX.” Upon completion of the separation, each ParentCo stockholder as of the record date will continue to own shares of ParentCo and will own a pro rata share of the outstanding shares of common stock of CoalCo. The CoalCo common stock will be issued in book-entry form only, which means that no physical share certificates will be issued. No vote of ParentCo stockholders is required for the distribution.

You do not need to take any action to receive shares of CoalCo common stock to which you are entitled as a ParentCo stockholder, and you do not need to pay any consideration or surrender or exchange your ParentCo common stock. I invite you to read the enclosed information statement, which describes the spin-off in detail and provides other important business and financial information about CoalCo.

We believe the separation provides tremendous opportunities for our businesses and our stockholders, as we work to continue to build long-term shareholder value. Thank you for your continued support of CONSOL Energy and your future support of CoalCo.

Very truly yours,

Nicholas J. DeIuliis

President and Chief Executive Officer

Table of Contents

| CONSOL Mining Corporation 1000 CONSOL Energy Drive, Canonsburg, PA 15317-6506 T (724) 485-4000 |

Dear Future CONSOL Mining Corporation Stockholder:

I am excited to welcome you as a future stockholder of CONSOL Mining Corporation (CoalCo), a U.S.-based coal company focused on safely and compliantly producing and selling high-quality bituminous coal from the Northern Appalachian Basin. Our company and its predecessors have been successfully mining coal, primarily in Northern Appalachia, since 1864. We have established ourselves as a leading coal producer in the eastern United States due to our demonstrated ability to efficiently produce and deliver large volumes of high-quality coal with a low cost structure, the strategic location of our mines, our unique marketing strategy, and the industry experience of our management team.

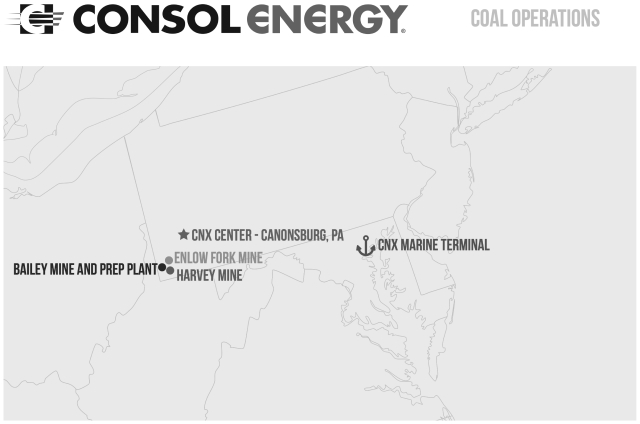

CoalCo will own and operate the Pennsylvania Mining Complex (PAMC), which consists of three underground mines - Bailey, Enlow Fork, and Harvey - and related infrastructure. The PAMC has an annual production capacity of 28.5 million tons, and it controls approximately 767 million tons of proven and probable reserves (as of December 31, 2016). Coal from the PAMC can be sold domestically or abroad, as either high-Btu thermal coal or high-volatile crossover metallurgical coal. The complex includes five longwalls and 15-17 continuous miner sections, which allow us to mine large quantities of coal while maintaining a very competitive cost structure. In addition, CoalCo will own and operate the CNX Marine Terminal, which is located on 200 acres in the Port of Baltimore and gives us access to the seaborne markets for exporting thermal and metallurgical coal. The terminal has a throughput capacity of 15 million tons per year, and it is the only coal marine terminal on the East Coast to be served by two rail lines – Norfolk Southern and CSX Transportation. Our management team has decades of experience in developing, operating, and expanding large-scale coal mining operations using the latest technology. Over the last several years, we have created a diversified portfolio of top-performing, environmentally-controlled, rail-served power plant customers in our core market areas in the eastern United States, while also opportunistically participating in the export and crossover metallurgical markets and employing a flexible operating strategy focused on delivering strong cash flows.

The assets of CoalCo, and the team that operates them, have consistently generated significant amounts of free cash flow and have withstood the recent volatility in the coal markets. The separation of CoalCo from ParentCo provides a new opportunity in that CoalCo will now be able to capitalize on its own free cash flow generation and strategic vision to build value for the CoalCo shareholders. Management intends to accomplish this by judiciously selecting from several options, including capitalizing on organic growth opportunities that exist within PAMC and the 1.6 billion tons of additional greenfield reserves that we control, pursuing acquisitions or other business arrangements that complement our operations and expertise, returning capital to our shareholders through dividends or share repurchases, or repaying any outstanding indebtedness. The separation from the combined E&P and coal entity will enable the CoalCo management team to foster its strategic goals and enhance value per share.

In connection with the separation, CoalCo will be renamed CONSOL Energy Inc., and we intend to list CoalCo’s common stock on the New York Stock Exchange under the symbol “CEIX.”

As we prepare to become a standalone company, we look to build upon our rich heritage, ready to seize the future and excel.

Sincerely,

James Brock

Chief Executive Officer

Table of Contents

INFORMATION STATEMENT

CONSOL Mining Corporation

This information statement is being furnished to the holders of common stock of CONSOL Energy Inc. (ParentCo) in connection with the distribution by ParentCo to its stockholders of all of the outstanding shares of common stock of CONSOL Mining Corporation (CoalCo or We). CoalCo is a wholly owned subsidiary of ParentCo that was formed to hold and operate ParentCo’s Pennsylvania Mining Operations (PAMC) and certain related coal assets, including ParentCo’s ownership interest in CNX Coal Resources LP (CNXC), which owns a 25% stake in PAMC, ParentCo’s terminal operations at the Port of Baltimore (the CNX Marine Terminal), undeveloped coal reserves and certain related coal assets and liabilities (collectively, the Coal Business). The Coal Business focuses primarily on the extraction, preparation and sale of coal in the Appalachian Basin. To implement the separation, ParentCo currently plans to distribute all of the outstanding shares of CoalCo common stock on a pro rata basis to ParentCo stockholders in a distribution that is intended to qualify as generally tax-free to the ParentCo stockholders for United States (U.S.) federal income tax purposes, except with respect to any cash received in lieu of fractional shares. We refer to the pro rata distribution of our common stock as the “distribution.”

The distribution is subject to certain conditions, as described in this information statement. You should consult your own tax advisor as to the particular consequences of the distribution to you, including the applicability and effect of any U.S. federal, state and local and non-U.S. tax laws.

For every eight shares of common stock of ParentCo held of record by you as of the close of business on November 15, 2017, the record date for the distribution, you will receive one share of CoalCo common stock. You will receive cash in lieu of any fractional shares of CoalCo common stock that you would have received after application of the above ratio. We expect the shares of CoalCo common stock to be distributed by ParentCo to you on November 28, 2017. We refer to the date of the distribution of CoalCo common stock as the “distribution date.” Until the separation occurs, CoalCo will be a wholly owned subsidiary of ParentCo and consequently, ParentCo will have the sole and absolute discretion to determine and change the terms of the separation, including the establishment of the record date for the distribution and the distribution date.

No vote of ParentCo stockholders is required to effect the distribution. Therefore, you are not being asked for a proxy, and you are requested not to send ParentCo a proxy, in connection with the distribution. You do not need to pay any consideration, exchange or surrender your existing shares of ParentCo common stock or take any other action to receive your shares of CoalCo common stock.

CoalCo was organized as a Delaware corporation on June 21, 2017. ParentCo currently owns all of the outstanding equity of CoalCo. Accordingly, there is no current trading market for CoalCo common stock, although we expect that a limited market, commonly known as a “when-issued” trading market, will develop on or shortly before the record date for the distribution. We expect “regular-way” trading of CoalCo common stock to begin on the first trading day following the distribution date. As discussed under “The Separation and Distribution—Trading Between the Record Date and the Distribution Date,” if you sell your ParentCo common stock in the “regular-way” market after the record date and before the distribution date, you also will be selling your right to receive shares of CoalCo common stock in connection with the separation and distribution. CoalCo will change its name to CONSOL Energy Inc., and intends to have its common stock authorized for listing on the New York Stock Exchange (the NYSE) under the symbol “CEIX.” ParentCo will be renamed “CNX Resources Corporation” and will retain its current stock symbol “CNX” in connection with the separation.

In reviewing this information statement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 1.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

References in this information statement to specific codes, legislation or other statutory enactments are to be deemed as references to those codes, legislation or other statutory enactments, as amended from time to time.

The date of this information statement is November 3, 2017.

This information statement was first made available to ParentCo stockholders on or about November 6, 2017.

Table of Contents

| iii | ||||

| x | ||||

| SUMMARY HISTORICAL AND UNAUDITED PRO FORMA COMBINED FINANCIAL DATA |

xxvii | |||

| 1 | ||||

| 29 | ||||

| 32 | ||||

| 40 | ||||

| 40 | ||||

| 42 | ||||

| 42 | ||||

| 50 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

73 | |||

| 103 | ||||

| 104 | ||||

| 112 | ||||

| 113 | ||||

| 126 | ||||

| 152 | ||||

| 156 | ||||

| 166 | ||||

| 170 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

172 | |||

| 175 | ||||

| 179 | ||||

| A-1 | ||||

| F-1 | ||||

Table of Contents

Presentation of Information

Unless the context otherwise requires:

| • | The information included in this information statement about CoalCo, including the Combined Financial Statements of CoalCo, which primarily comprise the assets and liabilities of ParentCo’s Pennsylvania Mining Complex (PAMC) and certain related coal assets, including ParentCo’s ownership interest in CNX Coal Resources LP (CNXC), which owns a 25% stake in PAMC, ParentCo’s terminal operations at the Port of Baltimore (the CNX Marine Terminal), undeveloped coal reserves and certain other coal-related assets and liabilities (collectively, the Coal Business), assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution. |

| • | References in this information statement to the “Pennsylvania Mining Complex” or “PAMC” refers to coal mines, coal reserves and related assets and operations, located primarily in southwestern Pennsylvania and owned 75% by ParentCo and 25% by CNXC. |

| • | References in this information statement to “CoalCo,” “we,” “our,” “us,” “our company” and “the company” refer to CONSOL Mining Corporation, a Delaware corporation and its subsidiaries, after giving effect to the separation and distribution. |

| • | References in this information statement to “ParentCo” refer to CONSOL Energy Inc., a Delaware corporation, and its consolidated subsidiaries, including CoalCo and the Coal Business prior to completion of the separation. |

| • | References in this information statement to “GasCo” refer to ParentCo after the completion of the separation and the distribution, in connection with which ParentCo will change its name to CNX Resources Corporation, and at which time its business will comprise the oil and natural gas exploration and production (E&P) business, focused on Appalachian area natural gas and liquids activity, including production, gathering, processing and acquisition of natural gas properties in the Appalachian Basin (collectively the Gas Business). |

| • | References in this information statement to the “separation” refer to the separation of the Coal Business from ParentCo’s other businesses and the creation, as a result of the distribution, of an independent, publicly traded company, CoalCo, to hold the assets and liabilities associated with the Coal Business after the distribution. |

| • | References in this information statement to the “distribution” refer to the distribution of CoalCo’s issued and outstanding shares of common stock to ParentCo stockholders as of the close of business on the record date for the distribution. |

| • | References in this information statement to CoalCo’s per share data assume a distribution ratio of one share of CoalCo common stock for every eight shares of ParentCo common stock. |

| • | References in this information statement to CoalCo’s historical assets, liabilities, products, businesses or activities generally refer to the historical assets, liabilities, products, businesses or activities of the Coal Business as the business was conducted as part of ParentCo prior to the completion of the separation. |

i

Table of Contents

Industry Information

Unless indicated otherwise, the information concerning our industry contained in this information statement is based on CoalCo’s general knowledge of and expectations concerning the industry. CoalCo’s market position, market share and industry market size are based on estimates using CoalCo’s internal data and estimates, based on data from various industry analyses, our internal research and adjustments and assumptions. Industry publications and surveys generally state that the information contained therein has been obtained from sources that are believed to be reliable. While we have not been able to independently verify data from industry analyses, we believe based on management’s knowledge that such information is sufficient and reliable for purposes of its inclusion within this information statement. Further, CoalCo’s estimates and assumptions involve risks and uncertainties and are subject to change based on various factors, including those discussed in the “Risk Factors” section. These and other factors could cause results to differ materially from those expressed in the estimates and assumptions.

ii

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

| What is CoalCo and why is ParentCo separating CoalCo’s business and distributing CoalCo stock? | CoalCo, currently a wholly owned subsidiary of ParentCo, was formed on June 21, 2017 to own and operate ParentCo’s Coal Business. The separation of CoalCo from ParentCo and the distribution of CoalCo common stock are intended, among other things, to (1) result in improved business and operational decision-making and greater strategic and management focus for each respective business; (2) improve each company’s ability to attract, retain and incentivize employees; (3) improve access to capital for each business while eliminating competition for capital; and (4) create an independent equity structure for each business, resulting in an improved understanding of each business in the capital and investor markets, and a stronger, more focused investor base for each business. We believe that the separation will allow each business to more fully realize its value, and each company to use its stock as consideration for acquisitions and enhance the value of its equity-based compensation programs. ParentCo expects that the separation will result in enhanced long-term performance of each business for the reasons discussed in the sections entitled “The Separation and Distribution—Reasons for the Separation.” | |

| Why am I receiving this document? | ParentCo is delivering this document to you because you hold shares of ParentCo common stock. If you are a holder of shares of ParentCo common stock as of the close of business on November 15, 2017, the record date of the distribution, you will be entitled to receive one share of CoalCo common stock for every eight shares of ParentCo common stock that you hold at the close of business on such date, resulting in a distribution of all of the outstanding shares of CoalCo common stock (without accounting for cash to be issued in lieu of fractional shares). This document will help you understand how the separation and distribution will affect your post-separation ownership in GasCo and CoalCo. | |

| How will the separation of CoalCo from ParentCo work? | As part of the separation, and prior to the distribution, ParentCo and its subsidiaries expect to complete an internal restructuring in order to transfer to CoalCo the assets and liabilities associated with the Coal Business that CoalCo will own following the separation. To accomplish the separation, ParentCo will, following the internal restructuring, distribute to its stockholders all of our common stock. Following the separation, the number of shares of ParentCo common stock you own will not change as a result of the separation. | |

| What is the record date for the distribution? | The record date for the distribution will be November 15, 2017. | |

| When will the distribution occur? | We expect that the shares of CoalCo common stock will be distributed by ParentCo at 11:59 p.m., Eastern Time, on November 28, 2017, to holders of record of shares of ParentCo common stock at the close of business on November 15, 2017, the record date for the distribution. | |

iii

Table of Contents

| What do stockholders need to do to participate in the distribution? | Stockholders of ParentCo as of the record date for the distribution will not be required to take any action to receive CoalCo common stock in the distribution, but you are urged to read this entire information statement carefully. No stockholder approval of the distribution is required. You are not being asked for a proxy. You do not need to pay any consideration, exchange or surrender your existing shares of ParentCo common stock, or take any other action to receive your shares of CoalCo common stock. Please do not send in your ParentCo stock certificates. The distribution will not affect the number of outstanding shares of ParentCo common stock or any rights of ParentCo stockholders, although it will affect the market value of each outstanding share of ParentCo common stock. | |

| How will shares of CoalCo common stock be issued? | You will receive shares of CoalCo common stock through the same channels that you currently use to hold or trade shares of ParentCo common stock, whether through a brokerage account, 401(k) plan or other channel. Receipt of CoalCo shares will be documented for you in the same manner that you typically receive stockholder updates, such as monthly broker statements and 401(k) statements. | |

| If you own shares of ParentCo common stock as of the close of business on the record date for the distribution, including shares owned in certificate form, ParentCo, with the assistance of Computershare Trust Company, N.A. (Computershare), the distribution agent, will electronically distribute shares of CoalCo common stock to you or to your brokerage firm on your behalf in book-entry form. Computershare will mail you a book-entry account statement that reflects your shares of CoalCo common stock, or your bank or brokerage firm will credit your account for the shares. | ||

| How many shares of CoalCo common stock will I receive in the distribution? | ParentCo will distribute to you one share of CoalCo common stock for every eight shares of ParentCo common stock held by you as of close of business on the record date for the distribution. Based on approximately 224.4 million shares of ParentCo common stock outstanding as of October 31, 2017, and applying the distribution ratio (without accounting for cash to be issued in lieu of fractional shares), a total of approximately 28.0 million shares of CoalCo common stock will be distributed to ParentCo’s stockholders. For additional information on the distribution, see “The Separation and Distribution.” | |

| Will CoalCo issue fractional shares of its common stock in the distribution? | No. CoalCo will not issue fractional shares of its common stock in the distribution. Fractional shares that ParentCo stockholders would otherwise have been entitled to receive will be aggregated and sold in the public market by Computershare. The net cash proceeds of these sales will be distributed pro rata (based on the fractional share such holder would otherwise be entitled to receive) to those stockholders who would otherwise have been entitled to receive fractional shares. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payment made in lieu of fractional shares. | |

iv

Table of Contents

| What are the conditions to the distribution? | The distribution is subject to the satisfaction (or waiver by ParentCo in its sole discretion) of the following conditions, among others:

• the U.S. Securities and Exchange Commission (the SEC) declaring effective the registration statement of which this information statement forms a part; there being no order suspending the effectiveness of the registration statement in effect; and no proceedings for such purposes having been instituted or threatened by the SEC;

• the mailing of this information statement or a notice of Internet availability of this information statement to ParentCo stockholders;

• the receipt by ParentCo of a private letter ruling from the Internal Revenue Service (the IRS), which was received on October 16, 2017, and one or more opinions of its tax advisors, in each case satisfactory to the ParentCo Board of Directors, regarding certain U.S. federal income tax matters relating to the separation and distribution, including, with respect to the opinion of Wachtell, Lipton, Rosen & Katz, to the effect that the distribution will be a transaction described in Section 355(a) of the Internal Revenue Code (the Code);

• the internal reorganization having been completed and the transfer of assets and liabilities of the Coal Business from ParentCo to CoalCo, and the transfer of certain assets and liabilities of the Gas Business from CoalCo to ParentCo, having been completed in accordance with the separation and distribution agreement;

• the receipt of one or more opinions from an independent appraisal firm to the ParentCo Board of Directors as to the solvency of ParentCo and CoalCo after the completion of the distribution, in each case in a form and substance acceptable to the ParentCo Board of Directors in its sole and absolute discretion; | |

| • all actions necessary or appropriate under applicable U.S. federal, state or other securities or blue sky laws and the rule and regulations thereunder having been taken or made and, where applicable, having become effective or been accepted;

• the execution of certain agreements contemplated by the separation and distribution agreement;

• no order, injunction or decree issued by any government authority of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the separation, the distribution or any of the related transactions being in effect;

| ||

v

Table of Contents

| • the shares of CoalCo common stock to be distributed having been accepted for listing on the NYSE, subject to official notice of distribution;

• CoalCo having entered into the financing arrangements described under “Description of Material Indebtedness” and ParentCo being satisfied in its sole and absolute discretion that, as of the effective time of the distribution, it will have no further liability under such arrangements; | ||

|

• ParentCo having received $425 million in cash from CoalCo; and

• no other event or development existing or having occurred that, in the judgment of ParentCo’s Board of Directors, in its sole and absolute discretion, makes it inadvisable to effect the separation, the distribution and the other related transactions.

ParentCo and CoalCo cannot assure you that any or all of these conditions will be met, or that the separation will be consummated even if all of the conditions are met. ParentCo can decline at any time to go forward with the separation. In addition, ParentCo may waive any of the conditions to the distribution. For a complete discussion of all of the conditions to the distribution, see “The Separation and Distribution—Conditions to the Distribution.” | ||

| What is the expected date of completion of the separation? | The completion and timing of the separation are dependent upon a number of conditions. We expect that the shares of CoalCo common stock will be distributed by ParentCo at 11:59 p.m., Eastern Time, on November 28, 2017, to the holders of record of shares of ParentCo common stock at the close of business on November 15, 2017, the record date for the distribution. However, no assurance can be provided as to the timing of the separation or that all conditions to the distribution will be met, by November 28, 2017 or at all. | |

| Will CoalCo and ParentCo be renamed in conjunction with the Separation? | Yes. In connection with the separation, CoalCo will change its name to CONSOL Energy Inc. and will apply for authorization to list its common stock on the NYSE under the symbol “CEIX.” ParentCo will change its name to CNX Resources Corporation and will retain its current stock symbol “CNX” on the NYSE. | |

| Can ParentCo decide to cancel the distribution of CoalCo common stock even if all the conditions have been met? | Yes. Until the distribution has occurred, ParentCo has the right to terminate the distribution, even if all of the conditions are satisfied. | |

| What if I want to sell my ParentCo common stock or my CoalCo common stock? | You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. | |

vi

Table of Contents

| What is “regular-way” and “ex-distribution” trading of ParentCo common stock? | Beginning on or shortly before the record date for the distribution and continuing up to and through the distribution date, we expect that there will be two markets in ParentCo common stock: a “regular-way” market and an “ex-distribution” market. ParentCo common stock that trades in the “regular-way” market will trade with an entitlement to shares of CoalCo common stock distributed pursuant to the distribution. Shares that trade in the “ex-distribution” market will trade without an entitlement to CoalCo common stock distributed pursuant to the distribution. If you decide to sell any shares of ParentCo common stock before the distribution date, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your ParentCo common stock with or without your entitlement to CoalCo common stock pursuant to the distribution. | |

| Where will I be able to trade shares of CoalCo common stock? | CoalCo intends to apply for authorization to list its common stock on the NYSE under the symbol “CEIX.” CoalCo anticipates that trading in shares of its common stock will begin on a “when-issued” basis on or shortly before the record date for the distribution and will continue up to and through the distribution date, and that “regular-way” trading in CoalCo common stock will begin on the first trading day following the completion of the distribution. If trading begins on a “when-issued” basis, you may purchase or sell CoalCo common stock up to and through the distribution date, but your transaction will not settle until after the distribution date. CoalCo cannot predict the trading prices for its common stock before, on or after the distribution date. | |

| What will happen to the listing of ParentCo common stock? | ParentCo common stock will continue to trade on the NYSE after the distribution under its current stock symbol “CNX.” ParentCo will be renamed CNX Resources Corporation upon completion of the separation and distribution. | |

| Will the number of shares of ParentCo common stock that I own change as a result of the distribution? | No. The number of shares of ParentCo common stock that you own will not change as a result of the distribution. | |

| Will the distribution affect the market price of my ParentCo common stock? | Yes. As a result of the distribution, ParentCo expects the trading price of shares of GasCo common stock immediately following the distribution to be different from the “regular-way” trading price of ParentCo shares immediately prior to the distribution because the trading price will no longer reflect the value of the Coal Business. There can be no assurance whether the aggregate market value of the GasCo common stock and the CoalCo common stock following the separation will be higher or lower than the market value of ParentCo common stock if the separation did not occur. This means, for example, that the combined trading prices of eight shares of GasCo common stock and one share of CoalCo common stock after the distribution may be equal to, greater than or less than the trading price of eight shares of ParentCo common stock before the distribution. | |

| What are the material U.S. federal income tax consequences of the separation and the distribution? | It is a condition to the distribution that ParentCo receive a private letter ruling from the IRS, which was received October 16, 2017, and one or more opinions of its tax advisors, in each case | |

vii

Table of Contents

| satisfactory to the ParentCo Board of Directors, regarding certain U.S. federal income tax matters relating to the separation and distribution, including, with respect to the opinion of Wachtell, Lipton, Rosen & Katz, to the effect that the distribution will be a transaction described in Section 355(a) of the Code. Accordingly, it is expected that you generally will not recognize any gain or loss, and no amount will be included in your income, upon your receipt of CoalCo common stock pursuant to the distribution. You will, however, recognize gain or loss for U.S. federal income tax purposes with respect to cash received in lieu of a fractional share of CoalCo common stock. | ||

| You should consult your own tax advisor as to the particular consequences of the distribution to you, including the applicability and effect of any U.S. federal, state and local tax laws, as well as any foreign tax laws. For more information regarding the material U.S. federal income tax consequences of the distribution, see the section entitled “Material U.S. Federal Income Tax Consequences.” | ||

| What will CoalCo’s relationship be with GasCo following the separation? | Following the distribution, ParentCo stockholders will own all of the outstanding shares of CoalCo common stock, and CoalCo will be a separate company from ParentCo. CoalCo will enter into a separation and distribution agreement with ParentCo to effect the separation and to provide a framework for CoalCo’s relationship with GasCo after the separation, and will enter into certain other agreements, including but not limited to a transition services agreement, a tax matters agreement, an employee matters agreement, an intellectual property matters agreement and other agreements related to operations of CoalCo post-separation. These agreements will provide for the allocation between CoalCo and GasCo of the assets, employees, liabilities and obligations (including investments, property and employee benefits and tax-related assets and liabilities) of ParentCo and its subsidiaries attributable to periods prior to, at and after CoalCo’s separation from ParentCo and will govern the relationship between CoalCo and GasCo subsequent to the completion of the separation. For additional information regarding the separation and distribution agreement and other transaction agreements, see the sections entitled “Risk Factors—Risks Related to the Separation” and “Certain Relationships and Related Party Transactions.” | |

| Who will manage CoalCo after the separation? | Led by James Brock, CoalCo’s management team will possess deep knowledge of, and extensive experience in, the coal industry generally. For more information regarding CoalCo’s directors and management, see “Management” and “Board of Directors Following the Separation.” | |

| Are there risks associated with owning CoalCo common stock? | Yes. Ownership of CoalCo common stock is subject to both general and specific risks relating to CoalCo’s business, the coal industry in which it operates, its ongoing contractual relationships with GasCo and its status as a separate, publicly traded company. Ownership of CoalCo common stock is also subject to risks relating to the separation. Certain of these risks are described in the “Risk Factors” section of this information statement, beginning on page 1. We encourage you to read that section carefully. | |

viii

Table of Contents

| Does CoalCo plan to pay dividends? | The declaration and payment of any dividends in the future by CoalCo with respect to the common stock will be subject to the sole discretion of our Board of Directors and will depend upon many factors. See “Dividend Policy.” | |

| How will equity-based and other long-term incentive compensation awards held by ParentCo employees be affected as a result of the separation? | The currently anticipated treatment of equity-based and other long-term incentive compensation awards that may be held by our named executives as of the time of separation is discussed under the section entitled, “The Separation and Distribution— Treatment of Equity-Based Compensation.” Additional information regarding the treatment of such awards is included in the Employee Matters Agreement, the form of which is filed as Exhibit 2.3. | |

| Will CoalCo incur any indebtedness prior to or at the time of the distribution? | Subject to market conditions and other factors, prior to or concurrent with the separation, CoalCo intends to secure new borrowings from third-party financing sources, a portion of which is anticipated to be distributed to GasCo. See “Description of Material Indebtedness” and “Risk Factors—Risks Related to Our Business.” | |

| Who will be the distribution agent for the distribution and transfer agent and registrar for CoalCo common stock? | The distribution agent, transfer agent and registrar for the CoalCo common stock will be Computershare Trust Company, N.A. For questions relating to the transfer or mechanics of the stock distribution, you should contact Computershare toll free at 1-800-622-6757 or non-toll free at 1-781-575-2879. | |

| Where can I find more information about ParentCo and CoalCo? | Before the distribution, if you have any questions relating to ParentCo’s business performance, you should contact:

CONSOL Energy Inc. 1000 CONSOL Energy Drive Canonsburg, PA 15317-6506 Attention: Investor Relations

After the distribution, CoalCo stockholders who have any questions relating to CoalCo’s business performance should contact CoalCo at:

CONSOL Energy Inc. 1000 CONSOL Energy Drive Canonsburg, PA 15317-6506 Attention: Investor Relations

The CoalCo investor website (www.consolenergy.com) will be operational on or around November 29, 2017. The CoalCo website and the information contained therein or connected thereto are not incorporated into this information statement or the registration statement of which this information statement forms a part, or in any other filings with, or any information furnished or submitted to, the SEC. | |

ix

Table of Contents

The following is a summary of material information discussed in this information statement. This summary may not contain all the details concerning the separation or other information that may be important to you. To better understand the separation and distribution and CoalCo’s business and financial position, you should carefully review this entire information statement. Unless the context otherwise requires, the information included in this information statement about CoalCo, including the Combined Financial Statements of CoalCo, assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution. Unless the context otherwise requires, references in this information statement to “CoalCo,” “we,” “us,” “our,” “our company” and “the company” refer to CONSOL Mining Corporation, a Delaware corporation, and its subsidiaries. Unless the context otherwise requires, references in this information statement to “ParentCo” refer to CONSOL Energy Inc., a Delaware corporation, and its consolidated subsidiaries, including the Coal Business prior to completion of the separation and GasCo refers to the ParentCo entity and operations following the separation.

Unless the context otherwise requires, references in this information statement to our historical assets, liabilities, products, businesses or activities of our businesses are generally intended to refer to the historical assets, liabilities, products, businesses or activities of ParentCo’s Pennsylvania Mining Operations (PAMC), ParentCo’s ownership interest in CNX Coal Resources LP (CNXC) which owns a 25% stake in PAMC, the CNX Marine Terminal, and the undeveloped coal reserves located in the Northern Appalachian, Central Appalachian and Illinois basins (the Greenfield Reserves), as such operations were conducted as part of ParentCo prior to completion of the separation.

Our Company

We are a leading, low-cost producer of high-quality bituminous coal from the Northern Appalachian Basin (NAPP) with excellent access to major U.S. and international coal markets and a highly experienced management team. Our company and its predecessors have been mining coal, primarily in NAPP, since 1864. We are a leading producer of high-Btu thermal coal in the NAPP and the eastern United States due to our ability to efficiently produce and deliver large volumes of high-quality coal at competitive prices, the strategic location of our mines, and the industry experience of our management team.

We have the capacity to produce up to 28.5 million tons per year of thermal and crossover metallurgical coal from our PAMC, which consists of three highly productive, well-capitalized underground mines in the Pittsburgh No. 8 coal seam and the largest coal preparation plant in the United States. Coal from the PAMC is valued because of its high energy content (as measured in British thermal units, or Btu, per pound), relatively low levels of sulfur and other impurities, and strong thermoplastic properties that enable it to be used in metallurgical as well as thermal applications. We take advantage of these desirable quality characteristics and our extensive logistical network, which is directly served by both the Norfolk Southern and CSX railroads, to aggressively market our product to a broad base of strategically-selected, top-performing power plant customers in the eastern United States.

We also capitalize on the operational synergies afforded by our wholly-owned CNX Marine Terminal in the Port of Baltimore to export our coal to thermal and metallurgical end-users in Europe, Asia, South America, and Canada. Our operations, including the PAMC and the CNX Marine Terminal, have consistently generated strong free cash flows. The PAMC controls 766.7 million tons of high-quality Pittsburgh seam reserves (as of December 31, 2016), enough to allow for approximately 27 years of full-capacity production. In addition, we own or control approximately 1.6 billion tons of Greenfield Reserves in the eastern United States that could provide us with a solid growth platform in the future. Our vision is to maximize cash flow generation through the safe, compliant, and efficient operation of this world-class core asset base, while strategically reducing debt, returning capital through share buybacks or dividends, and when prudent, allocating capital toward compelling growth opportunities.

x

Table of Contents

Our major assets include:

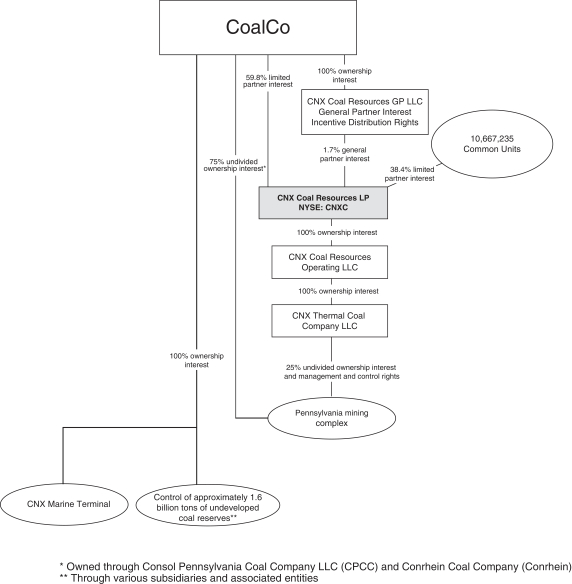

| • | ~90% economic ownership and full operational control of the PAMC, consisting of: |

| o | 75% undivided interest in the PAMC; |

| o | ~60% limited partner interest, a 1.7% general partner interest (reflecting 100% of the general partner units) and incentive distribution rights in CNX Coal Resources LP (referred to herein as CNXC), a growth-oriented master limited partnership formed in 2015 to manage and further develop our active coal operations in Pennsylvania, and which owns the remaining 25% stake in PAMC; |

| • | the CNX Marine Terminal; and |

| • | 1.6 billion tons of Greenfield Reserves in NAPP, the Central Appalachian Basin (CAPP), and the Illinois Basin (ILB). |

These assets and the diverse markets they serve provide robust flexibility for generating cash across a wide variety of demand and pricing scenarios. This flexibility begins with the low-cost structure and optionality afforded by our PAMC. The three mines at the PAMC, which include the Bailey, Enlow Fork, and Harvey mines, produce coal from the Pittsburgh No. 8 Coal Seam using longwall mining, a highly automated underground mining technique that produces large volumes of coal at lower costs compared to alternative mining methods. These three mines collectively operate five longwalls, and the production from all three mines is processed at a single, centralized preparation plant, which is connected via conveyor belts to each mine. The Bailey Central Preparation Plant, which can clean and process up to 8,200 raw tons of coal per hour, provides economies of scale while also maintaining the ability to segregate and blend coals based on quality. This infrastructure enables us to tailor our production levels and quality specifications to meet market demands. It also results in a highly productive, low-cost operation as compared to other NAPP coal mines. The PAMC was the most productive longwall operation in NAPP during 2015-2016, producing 6.77 tons of coal per employee hour, compared with an average of 4.94 tons per employee hour for all other currently-operating NAPP longwalls. As of June 30, 2017, productivity further increased from year-end 2016 results to 7.43 tons of coal per employee hour, compared with an average of 5.24 tons per employee hour for all other currently-operating NAPP longwalls. Our high productivity helps drive a low cost structure, which according to Wood Mackenzie was in the first quartile

xi

Table of Contents

among NAPP coal mines in 2016. Our efficiency strengthens our margins throughout the commodity cycle, and has allowed us to continue to generate positive margins even in challenging pricing environments.

Coal from the PAMC is versatile in that it can be sold either domestically or abroad, in the thermal coal market or as a crossover product in the high-volatile metallurgical coal market. Domestically, we have a well-established and diverse blue chip customer base, the majority of which is comprised of domestic utility companies located across the eastern United States. In 2016, we shipped coal to 38 plants located in 18 eastern U.S. states. As of June 30, 2017, the PAMC is fully contracted for 2017. For 2018 and 2019, our contracted position as of October 9, 2017 is at 80% and 41%, respectively, assuming a 27 million ton coal sales volume. These committed and contracted sales positions represent the volumes that we currently expect our customers will take under our existing contracts in each of 2017 and 2018, given current market conditions. Certain of our sales contracts include provisions that allow our customers to nominate additional volumes at their option, to carry a portion of their committed tonnage over from

xii

Table of Contents

one calendar year into a future year, or to increase or decrease their volume commitment for a given time period (e.g., year or quarter) within a specified tonnage range. Each of these provisions could have an impact within each contract, either positively or negatively, on the volume of coal that we are required to deliver under said contracts.

We also sell coal under both short-term and multi-year contracts (as well as in the spot market) that may contain base prices that are subject to pre-established price adjustments that reflect (i) variances in the quality characteristics of coal delivered to the customer beyond threshold quality characteristics specified in the applicable sales contract, (ii) the actual calorific value of coal delivered to the customer, and/or (iii) changes in electric power prices in the markets in which CoalCo’s customers operate, as adjusted for any factors set forth in the applicable contract. Such price adjustments, as well as “price reopener” or similar provisions in our multi-year coal sales contracts discussed above, may reduce the protection from coal price volatility traditionally provided by coal supply contracts. We believe our committed and contracted position is well-balanced in hedging against market downside risk while allowing us to continue to build out the customer portfolio strategically and opportunistically as the market evolves.

Going forward, we plan to continue to execute our sales strategy of targeting top-performing, environmentally-controlled, rail-served power plants in our core market areas in the eastern United States. Our top 15 domestic power plant customers in 2016, which accounted for 82% of our domestic power plant shipments that year, operated at a 15% higher capacity factor than other NAPP rail-served plants in 2016, and have consistently consumed more than 50 million tons of coal per year over the past five years. We have grown our share at these plants from 12% in 2011 to 32% in 2016, and we believe that we can continue to grow this share. Our customer plants consume coal from all four primary coal producing basins in the United States. However, we believe that we are favorably positioned to compete with producers from these basins primarily because of: (i) our significant transportation cost advantage compared to producers in the ILB and the Powder River Basin (PRB), which incur higher rail transportation rates to deliver coal to many of our core market areas in the eastern United States, (ii) our favorable operating environment compared to producers in CAPP, where production has been declining and is expected to continue to decline primarily due to the basin’s high cost production profile, reserve degradation and difficult permitting environment, and (iii) the attractive quality characteristics of our coal, which enable us to compete for demand from a broader range of coal-fired power plants as compared to (x) mining operations in basins that typically produce coal with a comparatively lower heat content, such as the ILB and PRB, (y) mining operations in basins that typically produce coal with a comparatively higher sulfur content, such as the ILB and most areas in NAPP, and (z) mining operations in basins that typically produce coal with a comparatively higher chlorine content, such as certain areas in the ILB.

The PAMC and our 100%-owned CNX Marine Terminal allow us to participate in the international thermal and metallurgical coal markets. The CNX Marine Terminal provides coal transshipments directly from rail cars to ocean-going vessels for both PAMC and third-party shippers, and is the only coal marine terminal on the East Coast served by two rail lines (Norfolk Southern and CSX). Located on 200 acres, the terminal has a throughput capacity of 15 million tons per year, as well as extensive blending capabilities and significant ground storage capacity of 1.1 million tons. In 2016, approximately 8.1 million tons of coal were shipped through the CNX Marine Terminal, with approximately 57% of that amount having been produced at our PAMC. The ability to serve both domestic and international markets with premium thermal and crossover metallurgical coal provides us with significant diversification and optionality, allowing us to pursue upside while helping to minimize both pricing and volume risk. Since 2014, our domestic thermal shipments from the PAMC have ranged from 17.3 to 22.8 million tons per year, our export thermal shipments have ranged from 2.1 to 4.4 million tons per year, and our export metallurgical shipments have ranged from 1.2 to 2.0 million tons per year. After accounting for PAMC tons, the CNX Marine Terminal still has significant surplus capacity that may be used to generate additional revenue by providing services to third parties.

Finally, the 1.6 billion tons of Greenfield Reserves that we control in NAPP, CAPP, and ILB, which are in addition to the substantial reserve base associated with PAMC, feature both thermal and metallurgical reserves.

xiii

Table of Contents

Included among these are approximately 591 million tons and 377 million tons of contiguous greenfield reserves associated with the River Mine and Mason Dixon Mine projects, respectively, which are among the last remaining greenfield Pittsburgh No. 8 coal seam projects in the Northern Appalachian region. Also included are 26 million tons of low-volatile metallurgical coal reserves associated with our Itmann property, 40 million tons of high-volatile metallurgical coal reserves associated with our Martinka property, and 117 million tons of reserves associated with our Birch and Canfield properties that are classified as thermal but that have strong potential as a high-vol or crossover metallurgical product. Our Greenfield Reserves provide additional optionality for organic growth or monetization as market conditions allow.

Industry Overview and Market Outlook

Coal is an abundant and relatively inexpensive natural resource that continues to play a critical role in the electric power generation and steelmaking industries, both in the United States and globally. Coal quality largely depends upon rank (which correlates with heat content, with anthracite, bituminous, sub-bituminous and lignite coal representing the highest to lowest ranking, respectively), level of impurities (such as ash, sulfur, chlorine, and other non-hydrocarbon constituents), and the presence or absence of coking properties. Thermal coal, which is sometimes referred to as “steam” coal, is primarily used by electric utilities and independent power producers to generate electricity, while metallurgical coal, which is sometimes referred to as “coking” coal, is primarily used by steel companies to produce metallurgical coke for use in the steel making process. Coal is also used in certain other industrial processes, such as cement kilns, blast furnaces, and electric arc furnaces, as a source of energy or carbon.

Thermal coal consumption patterns are influenced by many factors, including the demand for electricity, power generation infrastructure, transportation costs, governmental and environmental regulations, and technological developments, as well as the location, availability and cost of other sources of energy such as natural gas, nuclear power, and renewable sources of electricity generation such as hydroelectric, wind, and solar power. Demand for metallurgical coal, on the other hand, is influenced primarily by the worldwide demand for steel. Thermal coal produced in NAPP, where the PAMC is located, is marketed primarily to electric utilities in the eastern United States, as they tend to prefer to source coal with higher heat content at the lowest all-in cost.

Coal accounts for approximately 89% of U.S. fossil energy reserves on a Btu basis, according to the National Mining Association. According to the 2017 BP Statistical Review published in June 2017 (the BP Statistical Review), worldwide proven coal reserves totaled approximately 1,139 billion metric tons at 2016 year end. The United States has the largest proven reserve base in the world with approximately 252 billion metric tons, or 22.1% of total world proven coal reserves. According to the BP Statistical Review, U.S. coal reserves represent over 380 years of domestic supply based on 2016 production rates.

Coal is a major contributor to the world’s energy supply. According to the BP Statistical Review, coal represented approximately 28% of the world’s primary energy consumption in 2016, including approximately 16% and 49% of the regional energy consumption of the United States and the Asia Pacific Region, respectively.

In the United States, in particular, thermal coal continues to be an abundant, low-cost resource. A substantial portion of the power generation infrastructure in the United States remains coal-fired. Although recent environmental regulations together with low-cost natural gas and the subsidized buildout of renewable energy sources have eroded coal’s predominant market share, thermal coal is expected to remain a core fuel for electricity generation. Coal’s share of the U.S. electric power generation mix fell from 39% in 2014 to 30% in 2016, largely as a result of the aforementioned factors and abnormally mild winter weather in 2015-2016, which put additional downward pressure on gas and power prices. However, the U.S. Energy Information Administration (EIA) projects in its 2017 Annual Energy Outlook that coal’s share of the generation mix will rebound from 30% to 32% in 2021, while gas’s share declines from 35% to 28%, driven largely by rising gas prices and the prospects of a more favorable policy stance under the current U.S. presidential administration. The expectation of rising gas prices is supported by EIA’s prediction that annual U.S. net exports of natural gas will grow by 4.6 Tcf from 2016-2021, and industrial demand for natural gas will grow by 0.8 Tcf, while production grows by just 4.4 Tcf.

xiv

Table of Contents

Globally, thermal coal demand from new generating capacity is expected to remain robust, particularly in the seaborne market. According to AME’s Q2 2017 Export Thermal Coal Strategic Market Study (AME Q2 2017 Thermal Coal Study), global seaborne thermal coal demand is forecast to grow at a CAGR of 2.6% between 2016 and 2030, slowing from the 4.4% CAGR witnessed between 2007 and 2016. Although China’s government has communicated an intention to reduce its economy’s carbon intensity through greater energy efficiency and a more diversified energy mix, this is offset by India’s seaborne thermal coal demand, which is forecasted to grow at a CAGR of 4.5% between 2016 and 2030 due to robust infrastructure development and industrialization. AME expects India to be the largest source of demand for seaborne thermal coal by 2030 at approximately 20% of total global demand, as compared to approximately 15% in 2016. Moreover, electrification in other rapidly growing Southeast Asian countries is expected to serve as an additional strong source of future thermal coal demand due to coal’s cost-competitiveness relative to other fuels. As a result, according to the AME Q2 2017 Thermal Coal Study, thermal coal’s share of total primary energy demand globally is expected to remain relatively constant through 2030 at approximately 29%. As the long-term global demand for thermal coal in the Asia Pacific region continues to rise, however, use of low-quality thermal coal in those markets is expected to become increasingly less desirable as consumers continue to push for higher efficiencies and lower emissions. This interplay is expected to benefit U.S. coal exports, and we believe that it will especially benefit exports of coal from NAPP because of its high Btu content and its favorable access to export infrastructure.

In the seaborne metallurgical coal markets, on the other hand, persistent oversupply in recent years began to subside in 2016 due to a number of international developments impacting both demand and supply. Most importantly, in China, the combination of a stimulus package released by the Chinese government in early 2016 and supply side reforms restricting domestic coal mines to 276 days of operations (down from 330 days) resulted in a sharp increase in Chinese imports of metallurgical coal. According to AME’s Q2 2017 Export Metallurgical Coal Strategic Market Study (AME Q2 2017 Met Coal Study), Chinese imports of metallurgical coal increased 25% in 2016 compared to 2015 to reach 60.0 million metric tons. Coupled with weather-related production issues in Australia, hard coking coal prices reached the highest levels since 2011.

Coking coal prices have receded somewhat since their recent spike as supply has begun to return to the market from China and Australia. Nevertheless, the market is expected to remain well supported on the back of an expected growth in global demand for seaborne metallurgical coal from 2016 to 2030 at a CAGR of approximately 3.2%, according to AME’s Q2 2017 Met Coal Study. This trend is underpinned by the robust growth expected out of India, at a CAGR of approximately 7.8% from 2016-2030 according to AME, making the country the largest importer of metallurgical coal by 2023. Due to the strategic location and quality of its coal reserves, we believe NAPP coal is among the best-suited in the U.S. to take advantage of this expected uptick in global seaborne metallurgical coal demand.

Our Core Strengths

We believe we are well-positioned to successfully execute our business strategies because of the following competitive strengths:

Focus on free cash flow generation supported by industry-leading margins and optimized production levels

We intend to continue our focus on maintaining high margins by optimizing production from our high-quality reserves and leveraging our extensive logistics infrastructure and broad market reach. The PAMC’s low-cost structure, high-quality product, favorable access to rail and port infrastructure, and diverse base of end-use customers allow it to move large volumes of coal at positive cash margins throughout a variety of market conditions. For example, despite challenging domestic market conditions in 2016, which caused total U.S. coal production to fall by 19% year-on-year, PAMC managed to grow production by 8%. For the year ended December 31, 2016, the PAMC generated an average cash margin per ton of $15.22 compared to the median cash margin per ton of $9.97 generated by other coal companies for domestic bituminous thermal coal operations,

xv

Table of Contents

based on management review of publicly available data for the year ended December 31, 2016. Through our recent capital investment program, we have optimized our mining operations and logistics infrastructure to sustainably drive down our cash operating costs. Furthermore, our significant portfolio of multi-year, committed and priced contracts with our longstanding customer base will enhance our ability to sustain high margins in varied commodity price environments. We believe that these factors will help enable us to maintain higher margins per ton on average than our competitors and better position us to maintain profitability throughout commodity price cycles.

Extensive, High-Quality Reserve Base

The PAMC has extensive high-quality reserves of bituminous coal. We mine our reserves from the Pittsburgh No. 8 Coal Seam, which is a large contiguous formation of uniform, high-Btu coal that is ideal for high productivity, low-cost longwall operations. As of December 31, 2016, the PAMC included 766.7 million tons of proven and probable coal reserves that are sufficient to support at least 27 years of full-capacity production. The advantageous qualities of our coal enable us to compete for demand from a broader range of coal-fired power plants compared to mining operations in basins that typically produce coal with a comparatively lower heat content (ILB and PRB), higher sulfur content (ILB and most areas in NAPP) and higher chlorine content (certain areas of ILB). Our remaining reserves have an average as-received gross heat content of 12,970 Btu/lb (on an as-received basis), while production from the PRB, ILB, CAPP, and the rest of NAPP averages approximately 8,700 Btu/lb, 11,400 Btu/lb, 12,300 Btu/lb, and 12,400 Btu/lb, respectively (based on the average quality reported by EIA for U.S. power plant deliveries for the three years ended June 30, 2017). Moreover, our remaining reserves have an average sulfur content of 2.38% (on an as-received basis), while production from the Illinois Basin averages ~2.9% sulfur and production from the rest of NAPP averages ~3.3% sulfur (again based on EIA power plant delivery data for the three years ended June 30, 2017). With our high Btu content and low-cost structure, our 2016 total costs averaged $1.32 per mmBtu, which is lower than any monthly average Louisiana Henry Hub natural gas spot price during the past 20+ years, and provides a strong foundation for competing against natural gas even after accounting for differences in delivered costs and power plant efficiencies. In addition to the substantial reserve base associated with the PAMC, our 1.6 billion tons of Greenfield Reserves in NAPP, CAPP, and ILB feature both thermal and metallurgical reserves and provide additional optionality for organic growth or monetization as market conditions allow.

World-Class, Well-Capitalized, Low-Cost Longwall Mining Complex

Since 2006, we have invested over $2.0 billion at the PAMC ($1.4 billion of which has been invested in the past five years) to develop technologically advanced, large-scale longwall mining operations and related production and logistics infrastructure. We also have permanently sealed off 85 square miles of already-mined area, reducing the active areas of the mine to just 24.4 square miles and significantly limiting the area that we must ventilate and maintain. As a result, the PAMC is the most productive and efficient coal mining complex in NAPP, averaging 6.77 tons of coal production per employee hour in 2015-2016, compared to 4.94 tons of coal production per employee hour for other currently-operating NAPP longwall mines. As of June 30, 2017, productivity further increased from year-end 2016 results to 7.43 tons of coal per employee hour, compared with an average of 5.24 tons per employee hour for all other currently-operating NAPP longwalls. We believe our substantial capital investment in the PAMC will enable us to maintain high production volumes, low operating costs and a strong safety and environmental compliance record, which we believe are key to supporting stable financial performance and cash flows throughout business and commodity price cycles. As a result, we expect to be able to mine the remaining 27+ years of reserves at the PAMC with only maintenance-of-production levels of capital expenditure.

xvi

Table of Contents

Strategically Located Mining Operations with Advanced Distribution Capabilities and Excellent Access to Key Logistics Infrastructure

Our logistics infrastructure and proximity to coal-fired power plants in the eastern United States provide us with operational and marketing flexibility, reduce the cost to deliver coal to our core markets, and allow us to realize higher netback prices. We believe that we have a significant transportation cost advantage compared to many of our competitors, particularly producers in the ILB and PRB, for deliveries to customers in our core markets and to East Coast ports for international shipping. For example, based on publicly available data and internal estimates, we believe that the transportation cost advantage from our mines compared to ILB mines (not accounting for Btu differences) is approximately $3 to $8 per ton for coal delivered to foreign consumers in Europe and India, $4 to $8 per ton for coal delivered to domestic customers in the Carolinas, and an even more pronounced cost advantage for coal delivered to domestic customers in the mid-Atlantic states. Our ability to accommodate multiple unit trains at the Bailey Central Preparation Plant, which includes a dual-batch loadout facility capable of loading up to 9,000 tons of clean coal per hour and 19.3 miles of track with three sidings, allows for the seamless transition of locomotives from empty inbound trains to fully loaded outbound trains at our facility. Furthermore, the PAMC has among the best access to export infrastructure in the United States. Through our 100%-owned CNX Marine Terminal, served by both the Norfolk Southern and CSX railroads, we are able to participate in the world’s seaborne coal markets with premium thermal and crossover metallurgical coal, providing tremendous optionality.

Strong, Well-Established Customer Base Supporting Contractual Volumes

We have a well-established and diverse blue chip customer base, comprised primarily of domestic electric-power-producing companies located in the eastern United States. We have had success entering into multi-year coal sales agreements with our customers due to our longstanding relationships, reliability of production and delivery, competitive pricing and high coal quality. About 90% of our sales in 2016 were to customers that were in our 2015 portfolio, and each of our top 15 domestic power plant customers in 2016 have been in our portfolio for at least three consecutive years. In addition, to mitigate our exposure with respect to coal-fired power plant retirements, we have strategically developed our customer base to include power plants that are economically positioned to continue operating for the foreseeable future and that are equipped with state-of-the-art environmental controls. In 2016, approximately 4% of our total sales were to domestic power plant customers that have announced plans to retire between 2017 and 2023. Moreover, none of our top 15 customer plants, which accounted for 82% of our domestic power plant shipments in 2016, have announced plans to retire. These top 15 plants operated at a 15% higher capacity factor than other NAPP rail-served plants in 2016, highlighting their economic competitiveness even in a challenging power market. In addition to our robust domestic customer base, we also have favorable access to seaborne coal markets through a long-standing commercial and contractual relationship with a leading coal trading and brokering company, Xcoal Energy & Resources, that maintains a broad market presence with foreign coal consumers. We have consistently exported 3.4 to 5.6 million tons of PAMC coal to the seaborne thermal and crossover metallurgical markets in each of the past 5+ years, which represents approximately 20% of annual sales volume.

Highly Experienced Management Team and Operating Team

Our management and operating teams have (i) significant expertise owning, developing and managing complex thermal and metallurgical coal mining operations, (ii) valuable relationships with customers, railroads and other participants across the coal industry, (iii) technical wherewithal and demonstrated success in developing new applications and customers for our coal products, in both the thermal and metallurgical markets, and (iv) a proven track record of successfully building, enhancing and managing coal assets in a reliable and cost-effective manner throughout all parts of the commodity cycle. We intend to leverage these qualities to continue to successfully develop our coal mining assets while efficiently and flexibly managing our operations to maximize operating cash flow.

xvii

Table of Contents

Our Strategy

Our strategy is to safely and compliantly operate our assets to increase shareholder value through the execution of our strategic objectives:

Selectively pursue growth opportunities that maximize shareholder value by capitalizing on synergies with our assets and expertise

We plan to judiciously direct the cash generated by our operations toward those opportunities that present the greatest potential for value creation to our shareholders, particularly those that take advantage of synergies with our asset base and/or with the expertise of our management team. To effectuate this, we plan to regularly and rigorously evaluate opportunities both for organic growth and for acquisitions, joint ventures, and other business arrangements in the coal industry and related industries that complement our core operations. In addition, our ownership interest in CNXC provides us with a unique vehicle for generating cash and raising capital, through the potential future drop down of assets into CNXC, which if utilized will allow us to generate cash to assist in the execution of our growth strategy. Both the PAMC and our Greenfield Reserves present the potential for organic growth projects if long-term market conditions are favorable. For example, we are currently evaluating a project to improve the recovery and processing of fine coal from the Bailey Central Preparation Plant, which has the potential to add up to 1.5 million tons per year of additional clean coal production without additional mining of raw tons. Moreover, the Harvey Mine’s existing infrastructure, including its bottom development, slope belt, and material handling system, is able to support an additional permanent longwall mining system with moderate additional capital investment in mining equipment. Such an investment would further increase the annual production capacity of the PAMC by 5 million tons. Our Greenfield Reserves associated with the Mason Dixon and River Mine projects present additional organic growth opportunities in NAPP, and our Greenfield Reserves associated with the Itmann Mine, Martinka Mine, and Birch Mine provide actionable organic growth opportunities in the metallurgical coal space, should market conditions warrant. Our management team is well-qualified to evaluate organic and external growth opportunities. We intend to prudently use our interest in CNXC to benefit our growth strategy, and plan to carefully weigh any capital investment decisions against alternate uses of the cash to help ensure we are delivering the most value to our shareholders.

Continue to grow our share at top-performing rail-served power plants in our core market areas, while opportunistically pursuing export and crossover metallurgical opportunities

We plan to seek to minimize our market risk and maximize realizations by continuing to focus on selling coal to strategically-selected, top-performing, rail-served power plants located in our core market areas in the eastern United States. Our top 15 power plant customers in 2016 have consistently consumed more than 50 million tons of coal per year in each of the past five years, have operated at a greater capacity factor than other NAPP rail-served plants, and have not announced plans to retire. We have grown our share at these plants from 12% in 2011 to 32% in 2016, and we believe we can continue to grow this share by displacing less competitive supply from NAPP, CAPP, and other basins. We also plan to continue to work on identifying and penetrating new customer plants that we believe are aligned with our strategic objectives and would be a good fit for our coal. To this end, we tested PAMC coal at five new customer plants in 2016. While the majority of our production is directed toward our established base of domestic power plant customers, many of which are secured through annual or multi-year contracts, we also plan to continue to flexibly and opportunistically place a smaller portion of our production in shorter-term opportunities in the export and crossover metallurgical markets. These markets provide us with pricing upside when markets are strong and with volume stability when markets are weak. As of June 30, 2017, the PAMC is fully contracted for 2017. For 2018 and 2019, our contracted position as of October 9, 2017 is at 80% and 41%, respectively, assuming a 27 million ton coal sales volume. We believe our committed and contracted position is well-balanced in hedging against market downside risk while allowing us to continue to build out our portfolio strategically and opportunistically as the market evolves.

xviii

Table of Contents

Drive operational excellence through safety, compliance, and continuous improvement

We intend to continue focusing on our core values of safety, compliance and continuous improvement. We operate some of the most productive, lowest-cost underground mines in the coal industry, while simultaneously setting some of the industry’s highest standards for safety and compliance. From 2013 through 2016, our Mine Safety and Health Administration (MSHA) reportable incident rate was approximately 42% lower than the national average underground bituminous coal mine incident rate. Furthermore, our MSHA significant and substantial (S&S) citation rate per 100 inspection hours was approximately 23.5% lower than the industry’s average MSHA S&S citation rate over the twelve-month period ended June 30, 2017. We believe that our focus on safety and compliance promotes greater reliability in our operations, which fosters long-term customer relationships and lower operating costs that support higher margins. Consistent with our core value of continuous improvement, we have improved our productivity from 5.69 tons per employee hour in 2014 to 7.52 tons per employee hour in 2016, and have reduced our cash costs of coal sold per ton by 22.6% over this same period. We intend to continue to grow the economic competiveness of our operations by proactively identifying, pursuing, and implementing efficiency improvements and new technologies that can drive down unit costs without compromising safety or compliance.

Ability to Grow Cash Flow through Drop-Downs into CNXC