Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K GVP UPDATED INVESTOR PRESENTATION DATED NOVEMBER 29, 2017 - GSE SYSTEMS INC | form8-k_gvp-irpres11-2017.htm |

| EX-99.1 - GSE SYSTEMS, INC. TO PARTICIPATE IN UPCOMING INVESTOR CONFERENCES - GSE SYSTEMS INC | exh99-1press_release.htm |

Tech-enabled Engineering AND Training/Consulting Platform For THE GLOBAL NUCLEAR Industry INVESTOR PRESENTATIONNYSE AMERICAN: GVP

FORWARD LOOKING STATEMENTSand non-gaap financial measures This presentation, our remarks, and answers to questions contain statements that are considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. These statements reflect our current expectations concerning future events and results. We use words such as "expect," "intend," "believe," "may," "will," "should," "could," "anticipate," and similar expressions to identify forward-looking statements, but their absence does not mean a statement is not forward-looking. These statements are not guarantees of our future performance and are subject to risks, uncertainties, and other important factors that could cause our actual performance or achievements to be materially different from those we project. For a full discussion of these risks, uncertainties, and factors, we encourage you to read our documents on file with the Securities and Exchange Commission, including those set forth in our periodic reports under the forward-looking statements and risk factors sections. We do not intend to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.This presentation, our remarks, and answers to questions include references to adjusted EBITDA, adjusted net income, and adjusted earnings per share (“adjusted EPS”), which do not adhere to generally accepted accounting principles (“GAAP”). We define adjusted EBITDA as earnings before interest, taxes, depreciation and amortization (“EBITDA”) plus adjustments for consulting support for revenue recognition analysis, stock-based compensation expense, restructuring charges, gain/loss from the changes in fair value of contingent consideration, and write-down of capitalized software development costs. We define adjusted net income as net income plus adjustments for consulting support for revenue recognition analysis, stock-based compensation expense, restructuring charges, gain/loss from the changes in fair value of contingent consideration, and write-down of capitalized software development costs. We define adjusted EPS as adjusted net income divided by fully diluted shares of common stock issued and outstanding. EBITDA, Adjusted EBITDA, adjusted net income, and adjusted EPS are reconciled to net income, the most directly comparable GAAP measure, in the financial tables included in the Appendix to this presentation. We believe that this additional information and the reconciliation we provide may be useful to help evaluate our operations. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results.With respect to Adjusted EBITDA on a forward-looking basis and as a combined company, a reconciliation of the difference between this non-GAAP expectation and the corresponding GAAP measure (expected net income) is not available without unreasonable effort due to potentially high variability, complexity and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains and losses, adjustments to the provision for income taxes, depreciation of fixed assets, amortization of intangibles, costs related to restructuring actions and interest expense, and certain anticipated cost synergies, the impact and timing of potential acquisitions and divestitures, and other structural changes or their probable significance. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results.Unless otherwise indicated, all results of operations and the financial condition of the Company are as of September 30, 2017 and all market data set forth in this presentation is as November 28, 2017. We undertake no duty to update or revise the information in light of new information, future events or otherwise, although we may do so from time to time as management believes is appropriate. Any such updating may be made through the filing of reports or documents with the Securities and Exchange Commission, through press releases or through other public disclosures. 2

Who Is GSE SYSTEMS? 3 We provide high-fidelity engineering and training simulators and technical personnel/consulting services primarily to the nuclear industryWe are one of the market leaders in the global nuclear and fossil power simulation industryWe provide nuclear power plants with specialized technical personnel as well as training servicesOur solutions enhance employee and plant performance, reduce risk, and improve technical engineering and designWe have a track record of 40+ years serving a global, blue chip client base Headquarters Sykesville, MD(Baltimore) Number of employees ~500 IPO date (NYSE American: GVP) 1995 Recent price (11/28/17) $3.30 Shares outstanding ~19M Market cap (11/28/17) ~$63M Total cash (9/30/17) ~$16M Total debt (9/30/17) $0M Enterprise value1 ~$47M Revenue2 (LTM) ~$100M Adjusted EBITDA2 (LTM) ~$8M EV / Revenue1,2 ~0.47x EV / Adjusted EBITDA1,2 ~5.9x 1 The Enterprise Value, EV/Revenue and EV/Adjusted EBITDA figures are estimates based on the Recent Price, Market Cap, Total Cash and Total Debt amounts as of the dates provided herein and do not represent the Enterprise Value, EV/Revenue, or EV/Adjusted EBITDA as of the date of this presentation.2 Pro forma for Absolute Consulting acquisition on September 20, 2017.

4 PROCESS POWER Serving ThE Power & Process Industries NUCLEARWorld leader - significant installed baseAll major reactor typesExpert onsite training and consulting servicesFOSSILCoal; clean coal technologyNatural gas, including IGCC UPSTREAM OIL AND GASComputer-based tutorials and simulation of production and LNG systemsREFINING / PETROCHEMICALComputer-based tutorials and simulation of all major unit operationsSystem and control verificationAdvanced capabilities around concepts, designs and system interactions We help clients reduce risk, increase revenue and lower costs

Pro-Forma Revenue – ~$100M (LTM)1 5 Nuclear Training & Consulting Performance Improvement By Segment By Industry Nuclear Fossil North America Europe By Geography Utilities Energy/Other OEMs By End-User Asia Process EngineeringServices EPCs Government Other 1 Pro forma for the Absolute Consulting acquisition on September 20, 2017

6 Business Model – How we make Money1 ~35%30-40+%Engineering Modeling ServicesFixed price, and time and material contractsPercent complete ~60%12-15%Technical / High-Value StaffingTime and material contractsAs service is performed billing occurs <5%80-90%SoftwareSale of perpetual license with recurring MX, or SaaS annual subscriptionRatable recognition over life of MX agreement Simulation /Engineering Training / Consulting Training/Simulation Software % of Revenue:Gross Margin:Primarily Selling:Business Model:Accounting: 1 Pro forma for the Absolute Consulting acquisition on September 20, 2017

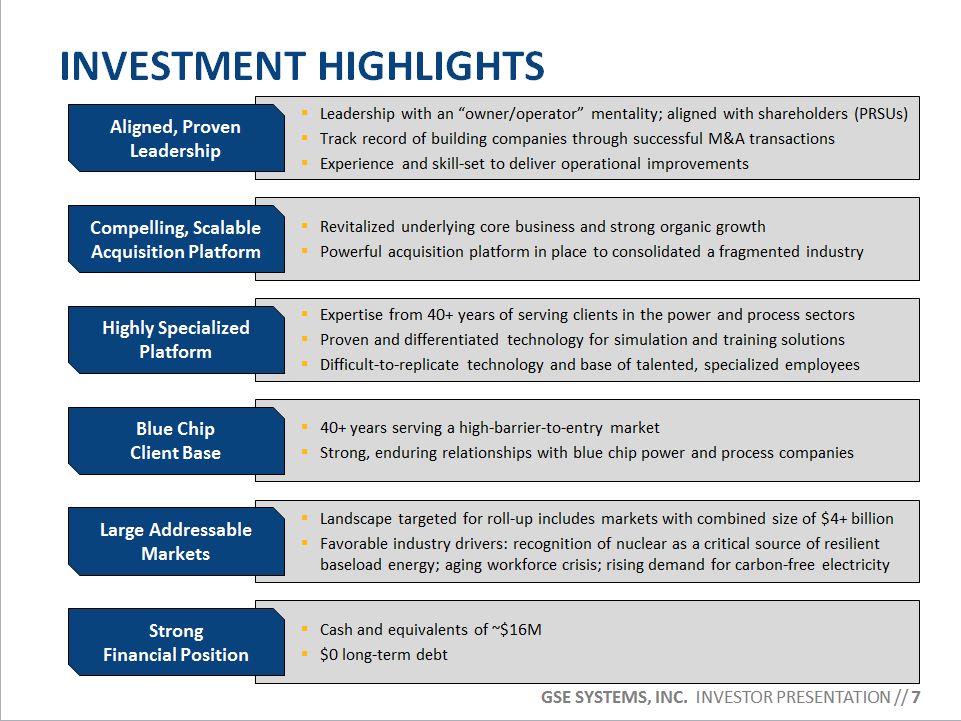

Investment Highlights 7 Revitalized underlying core business and strong organic growth Powerful acquisition platform in place to consolidated a fragmented industry Leadership with an “owner/operator” mentality; aligned with shareholders (PRSUs) Track record of building companies through successful M&A transactionsExperience and skill-set to deliver operational improvements Compelling, Scalable Acquisition Platform Expertise from 40+ years of serving clients in the power and process sectorsProven and differentiated technology for simulation and training solutionsDifficult-to-replicate technology and base of talented, specialized employees Aligned, ProvenLeadership 40+ years serving a high-barrier-to-entry market Strong, enduring relationships with blue chip power and process companies Highly Specialized Platform Blue Chip Client Base Landscape targeted for roll-up includes markets with combined size of $4+ billionFavorable industry drivers: recognition of nuclear as a critical source of resilient baseload energy; aging workforce crisis; rising demand for carbon-free electricity Large Addressable Markets Cash and equivalents of ~$16M $0 long-term debt Strong Financial Position

GSE SENIOR Leadership 8 Kyle Loudermilk – President & CEO20+ years of executive experience at publicly-listed MicroStrategy and AspenTech, and PE-backed Datatel/Ellucian (Thoma Bravo and Hellman & Freidman)Strong track record revitalizing technology companiesBS, MS, Chemical Engineering – Columbia UniversityHarvard University General Management ProgramChris Sorrells – COO20+ years of experience creating growth strategies for companies at the intersection of power/energy/technology12+ years investing experience as private equity professional; highly experienced utilizing M&A to grow platformsSalomon Smith Barney, Banc of America Securities, NGP Energy Technology PartnersBA – Washington & Lee University; M.Acc. – USC; MBA – College of William & MaryEmmett Pepe – CFO, CPA30+ years of experience in finance management across a variety of business sectors Focus on the software and telecommunications industriesExecutive positions at MicroStrategy, BroadSoft, Software AG, and webMethodsBS, Accounting – Penn State UniversityBahram Meyssami – CTO25 years of experience in the software industryFormer positions at Aspen Technology, Datatel, University of MarylandBS, MS, Ph.D Chemical Engineering – University of MarylandPaul Abbott – President, Nuclear Industry Training and Consulting Division 33 years of experience in nuclear training, consulting and operations Principal of Hyperspring since 2007; former senior reactor operator at two different U.S. nuclear facilities Previously served in the U.S. NavyBS, Nuclear Engineering Technology – Excelsior College August 2015 August 2015 July 2016 December 2015 November 2014

Management incentives aligned withShareholders’ interests 9 Executive officers and directors own ~1.0 million shares, or ~5.0% of the Company Majority of equity compensation received by executives and key employees is structured in performance-restricted stock units (“PRSUs”) with the following vesting thresholds: GSE share price - 11/28/2017 % of total PRSUs that vest GSE 30-Day VWAP Threshold1 1VWAP = volume weighted average price of GSE common stock GSE share price - 08/24/2015 = Vested = Unvested

Strategy to utilize GSE as an Acquisition Platform 10 Core focus: understand the nuclear power and process vendor ecosystem – look for asymmetrical risk/reward acquisitions $10-50M30-40%70+Fixed price, and time and material contracts $10-80M12-15% 100+Time and material contracts $5-15M 75-85%30+ Sale of perpetual license with recurring MX, or SaaS annual subscription TechnicalEngineering Staffing & Training Simulation / Software Typical Rev. Range:Gross Margin:# of Opportunities:Business Model: $10-60M30-40% 30+Sale of parts and equipment; time and materials for services Value Added Components / Services

Landscape Targeted for Roll-Up: Markets of SIGNIFICANT Size 11 Global Market1 US Market1,2 1 Source: Company estimates based on various publicly available resources and proprietary research2 Only includes white collar labor Global Market1 Global Market1 TechnicalEngineering Staffing & Training Simulation / Software Value Added Components / Services

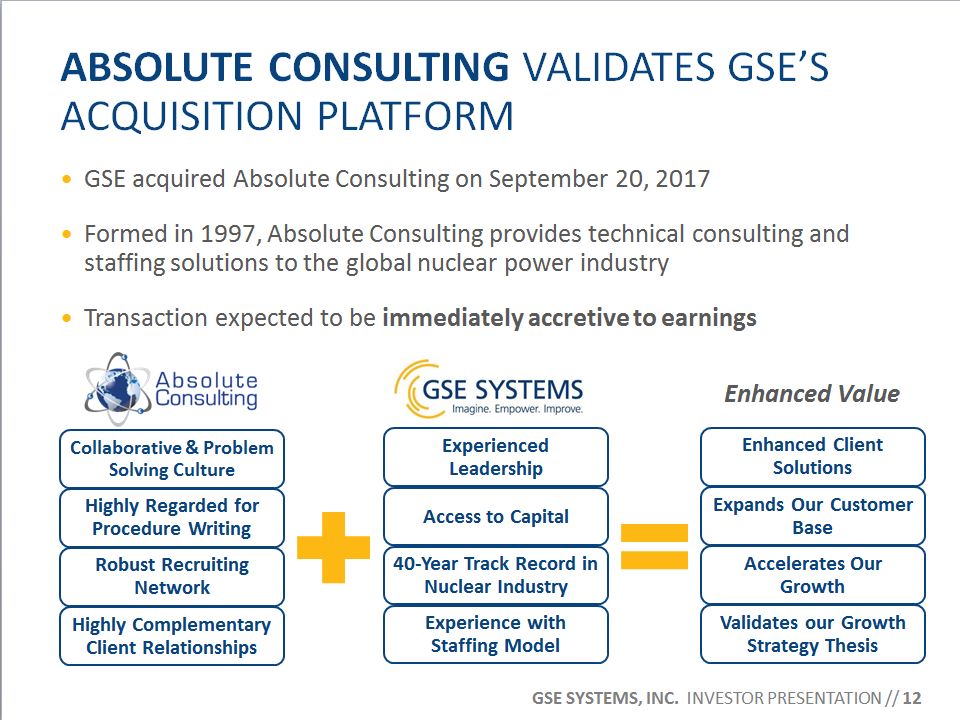

Absolute Consulting Validates GSE’s Acquisition platform 12 GSE acquired Absolute Consulting on September 20, 2017Formed in 1997, Absolute Consulting provides technical consulting and staffing solutions to the global nuclear power industry Transaction expected to be immediately accretive to earnings Enhanced Value

Attractive Deal Metrics 13 Purchase Price Consideration Mix RevenueEV/Revenue Adjusted EBITDAEV/EBITDA Close Date September 20, 2017 $8.75 million1 100% Cash ~$40 million (trailing twelve months)0.2x $2.0+ million (trailing twelve months, including identified synergies)2~4.0x Absolute Consulting, Inc. Transaction Overview: ROIC (est.) 20%+ (assuming utilization of GSE’s NOLs)2 Compelling platform in place to consolidate a fragmented industry 1 Subject to customary pre- and post-closing working capital adjustments2 Non-GAAP disclosure, and defined as: Adjusted EBIT * (1 - 10% Tax) / (Total Purchase Price)

1976 1995 2011 2014 2015 GSE Predecessor, Link Simulation, Founded 2011 Fukushima 1950s First nuclear power plants developed 1979 and 1986 Three Mile Island and Chernobyl drive market growth Today and beyondAging workforce, growing global electricity demand, push for carbon-free energy, nuclear new-build momentum IPONYSE American: GVP Acquired Nuclear Training & Consulting Business - Hyperspring New ManagementLaunches Turnaround and Growth Strategy Acquired Process Software Business - EnVision Systems 40-year history – Founded in 1976, Reinvented in 2015 14 2017 Acquired Nuclear Training & Consulting Business - Absolute

Highly educated, Specializedemployee base (~500)1 15 Technical Training/Consulting Engineering Corporate Nuclear Fossil Software Development Corp./Other Process Employees ByTechnical Focus Employees By Industry/Function 1 Pro forma for the Absolute Consulting acquisition on September 20, 2017

Representative Blue chip customers x 16 The trademarks above are the property of the referenced companies; GSE disclaims ownership of such marks. Inclusion of a representative customer herein is not intended to suggest endorsement or recommendation.

What is driving MARKET demand? Growing awareness of the value and resiliency factor of nuclear power as a source of baseload carbon-free energyWidening skills gap and aging workforce—a significant issue in the US power industryIncreasing demand for carbon-free electricity, such as nuclear powerJapan’s restart of nuclear reactors post-FukushimaInitiatives such as “Delivering the Nuclear Promise” 17 1source: NEI, September 20152source: NEI estimates per Power Engineering magazine, February 2015 “Nuclear energy is America’s top source of carbon-free electricity and avoids more than 1/2 billion tons of carbon emissions each year.”1 “39% of the nuclear workforce will be eligible for retirement by 2018, which means the industry must hire 20,000 new workers over the next four years to replace those retiring workers.”2 X

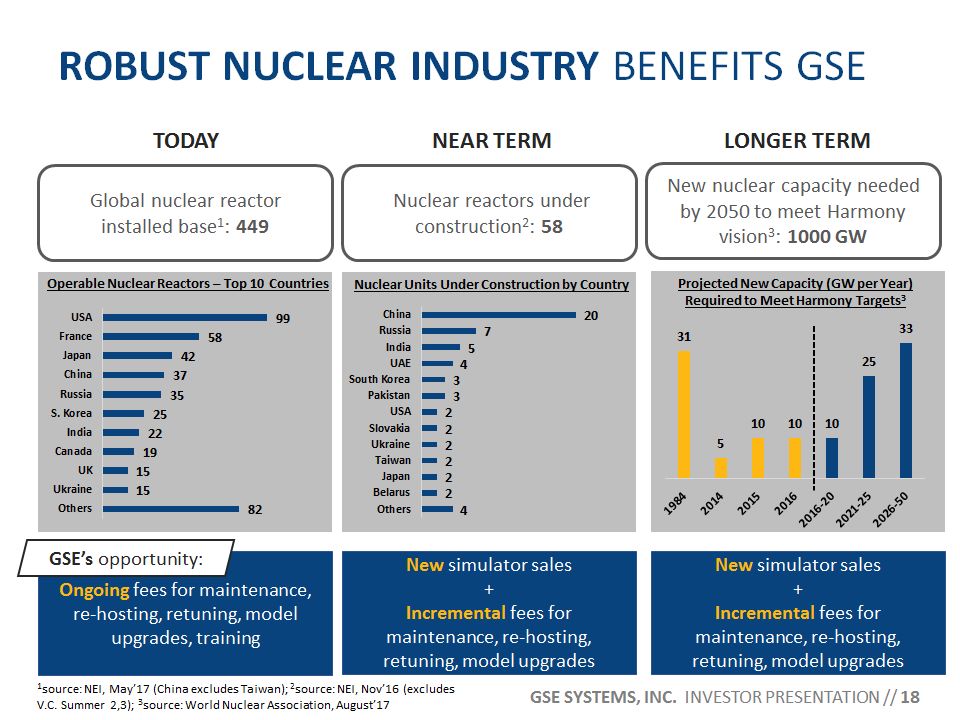

Robust Nuclear INDUSTRY Benefits GSE 18 1source: NEI, May’17 (China excludes Taiwan); 2source: NEI, Nov’16 (excludes V.C. Summer 2,3); 3source: World Nuclear Association, August’17 TODAY NEAR TERM LONGER TERM Global nuclear reactor installed base1: 449 Ongoing fees for maintenance, re-hosting, retuning, model upgrades, training Nuclear reactors under construction2: 58 New nuclear capacity needed by 2050 to meet Harmony vision3: 1000 GW New simulator sales +Incremental fees for maintenance, re-hosting, retuning, model upgrades New simulator sales+Incremental fees for maintenance, re-hosting, retuning, model upgrades Nuclear Units Under Construction by Country Operable Nuclear Reactors – Top 10 Countries Projected New Capacity (GW per Year) Required to Meet Harmony Targets3 GSE’s opportunity:

Financial AND Operating Highlights1,2 19 Revenue (in $M) Gross Profit (in $M) Adjusted EPS (Diluted)1 +23% +16% Adjusted EBITDA (in $M)1 1 Adjusted EBITDA and Adjusted EPS are non-GAAP financial measures; see GAAP to non-GAAP reconciliation in Appendix 2 Absolute Consulting contributed to GSE’s financial results during the last ten days of 9M’17; not included in GSE’s 9M’16 results +44% +50%

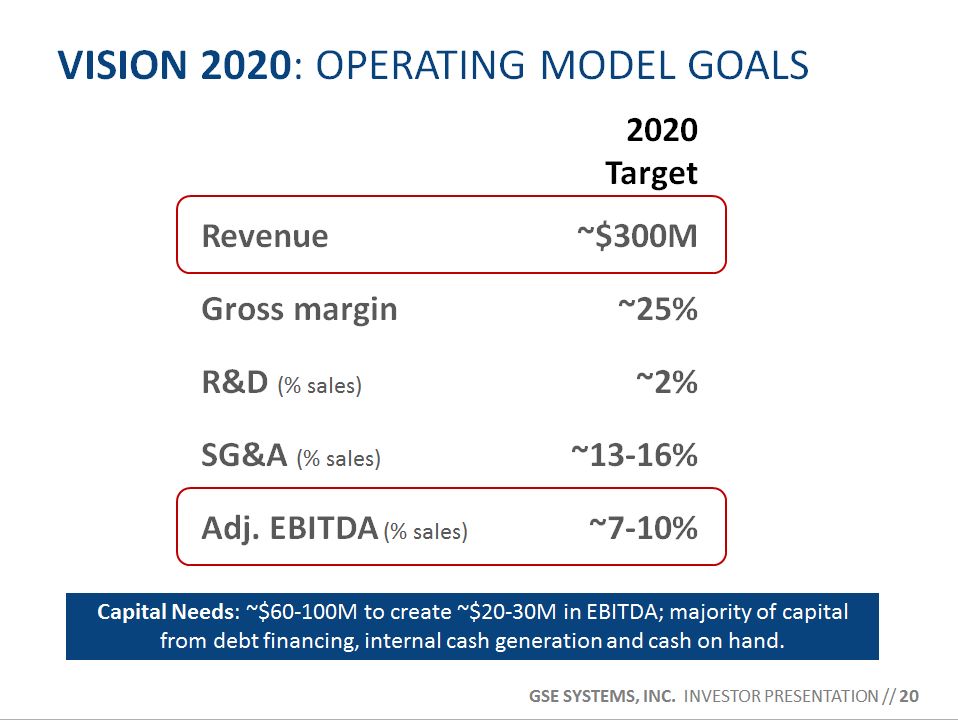

VISION 2020: operating model goals 20 Capital Needs: ~$60-100M to create ~$20-30M in EBITDA; majority of capital from debt financing, internal cash generation and cash on hand. 2020Target Revenue ~$300M Gross margin ~25% R&D (% sales) ~2% SG&A (% sales) ~13-16% Adj. EBITDA (% sales) ~7-10%

Investment CONCLUSIONS 21 GSE is a tech-enabled engineering and training/consulting company focused on the power and process industries Proven simulation and training technology with a highly-specialized employee base Large addressable markets supported by favorable industry drivers Enduring relationships with blue-chip clients developed over 40+ years Strong financial position, including ~$16M cash and $0 long term debt Strong leadership team aligned with shareholders, driving a new growth plan Powerful, scalable acquisition platform in place to enhance growth and build shareholder value

22 Tech-enabled Engineering AND TRAINING/Consulting PlatformFor THE GLOBAL Power and Process Industries Q&A

23 APPENDIX

GSE SYSTEMS Financial History1 24 Financial Summary Fiscal Year Ended 9 Months Ended (in $ millions, except shares amounts) 2013 2014 2015 2016 Sep 30, 2016 Sep 30, 2017 Revenue 47.6 37.5 56.8 53.1 39.8 48.9 Gross Profit 10.4 10.8 12.9 15.2 11.5 13.4 Gross margin 22% 29% 23% 29% 29% 27% Operating (loss) income -10.7 -7.5 -4.1 1.6 0.9 0.1 Operating margin -22% -20% -7% 3% 2% 0% Net (loss) income -10.5 7.3 -4.7 1.4 0.4 -0.0 Diluted EPS ($0.58) ($0.41) ($0.26) $0.08 $0.02 $0.00 Diluted shares 18,150,915 17,887,859 17,892,891 18,512,266 18,287,870 19,204,778 EBITDA -9.7 -6.6 -3.3 2.4 1.5 1.0 Adjusted EBITDA -2.0 -4.4 1.4 4.6 2.8 4.0 Adjusted net (loss) income -2.8 -5.1 0.0 3.6 1.7 2.9 Adjusted EPS – diluted ($0.15) ($0.29) $0.00 $0.20 $0.10 $0.15 Balance Sheet (in $ millions) Sep 30, 2017 Cash and cash equivalents 16.5 Current assets 38.1 Total assets 51.0 Current liabilities 27.0 Long-term debt - Total stockholders' equity 22.5 In prior years, the Company recognized revenue on multiple element arrangements which included sales of its EnVision software product as delivery occurred on each element except post contract support ("PCS"). PCS revenue was recognized ratably over the PCS term. During the fourth quarter of 2015, management determined that that Company had not established vendor specific objective evidence ("VSOE") of the fair value for any of the elements in multiple element transactions including sales of its EnVision software licenses. Accordingly, the consolidated financial statements have been revised to recognize all revenue on multiple element transactions including EnVision software license sales ratably over the PCS terms on these transactions since VSOE did not exist for any of the non-software elements in these multiple element transactions. The revision to revenue resulted in a decrease to revenue and an increase in operating loss of $587,000 for the year ended December 31, 2014. The revision also had the effect of increasing billings in excess by $1.2 million, decreasing unbilled receivables by $62,000, increasing prepaid expenses and other current assets by $291,000 and increasing the accumulated deficit by $415,000 at December 31, 2014 as a result of the cumulative adjustment for prior periods. 1 Excludes Absolute Consulting for all periods presented prior to 2017; Absolute Consulting contributed to GSE’s financial results during the last ten days of the nine months ended September 30, 2017

GSE SYSTEMS ebitda and Adjusted EBITDA reconciliation (in $ Thousands)1 25 EBITDA and Adjusted EBITDA are not measures of financial performance under generally accepted accounting principles ("GAAP"). Management believes EBITDA and Adjusted EBITDA, in addition to GAAP measures, provide meaningful supplemental information regarding our operational performance. Our management uses EBITDA, Adjusted EBITDA, and other non-GAAP measures to evaluate the performance of our business and make certain operating decisions (e.g., budgeting, planning, employee compensation and resource allocation). This information facilitates management's internal comparisons to our historical operating results as well as to the operating results of our competitors. Since management finds these measures to be useful, we believe that our investors can benefit by evaluating both non-GAAP and GAAP results. Investors should recognize that EBITDA and Adjusted EBITDA might not be comparable to similarly-titled measures of other companies. These measures should be considered in addition to, and not as a substitute for or superior to, any measure of performance prepared in accordance with GAAP. A reconciliation of non-GAAP EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure (net income) in accordance with SEC Regulation G follows: 1 Excludes Absolute Consulting for all periods presented prior to 2017; Absolute Consulting contributed to GSE’s financial results during the last ten days of the nine months ended September 30, 2017

Adjusted Net Income and Adjusted EPS reconciliation (In $ Thousands, except share amounts)1 26 Adjusted Net Income and adjusted earnings (loss) per share (“adjusted EPS”) are not measures of financial performance under generally accepted accounting principles (“GAAP”). Management believes adjusted net income and adjusted EPS, in addition to GAAP measures, provide meaningful supplemental information regarding our operational performance. Our management uses Adjusted Net Income and other non-GAAP measures to evaluate the performance of our business and make certain operating decisions (e.g., budgeting, planning, employee compensation and resource allocation). This information facilitates management's internal comparisons to our historical operating results as well as to the operating results of our competitors. Since management finds these measures to be useful, we believe that our investors can benefit by evaluating both non-GAAP and GAAP results. Investors should recognize that Adjusted Net Income and Adjusted EPS might not be comparable to similarly-titled measures of other companies. These measures should be considered in addition to, and not as a substitute for or superior to, any measure of performance prepared in accordance with GAAP. A reconciliation of non-GAAP adjusted net income and adjusted EPS to GAAP net income, the most directly comparable GAAP financial measure, is as follows: 1 Excludes Absolute Consulting for all periods presented prior to 2017; Absolute Consulting contributed to GSE’s financial results during the last ten days of the nine months ended September 30, 2017

EMERGING ADVANCED NUCLEAR REACTOR INDUSTRY 27 source: ThirdWay (http://www.thirdway.org/)

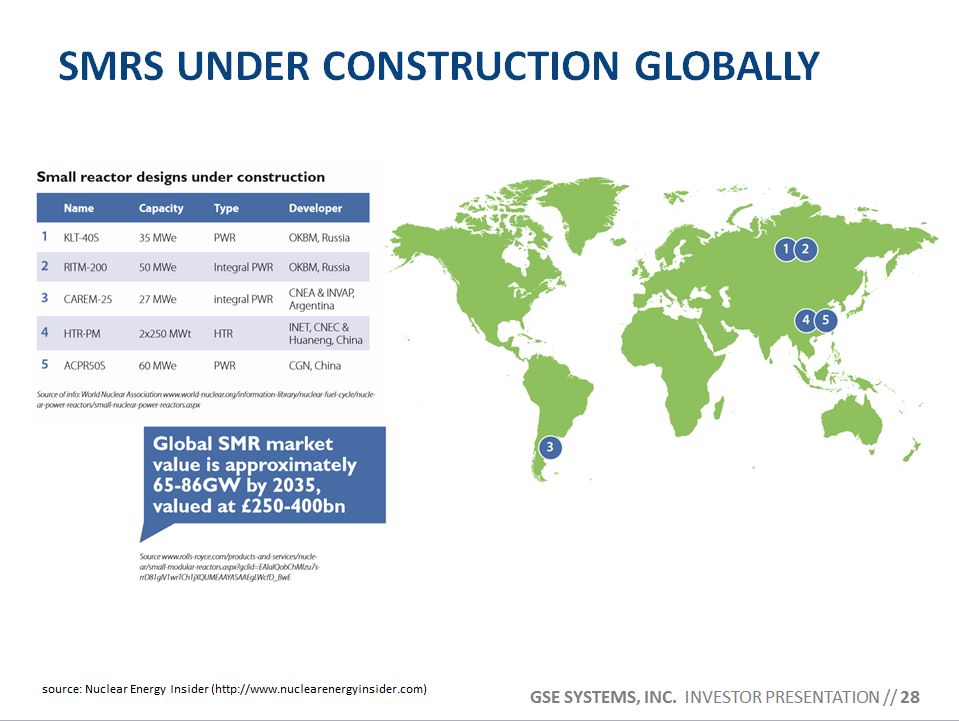

SMRs Under Construction Globally 28 source: Nuclear Energy Insider (http://www.nuclearenergyinsider.com)

SMRs IN ADVANCED DEVELOPMENT 29 source: Nuclear Energy Insider (http://www.nuclearenergyinsider.com)

Proven technology / Services 30 459 Nuclear Fossil Oil & Gas, Petrochemical Full-Scope Simulator Installations1 Computer-Based Tutorials & Operator Training Simulators1 Tutorials Simulators 1,262 1 as of January 2016

Acquisition APPROACH 31 Understand the power and process vendor ecosystem – look for asymmetrical risk/reward acquisitionsAccumulated database of >150 potential targets, in two categories:softwaretechnical engineering, consulting, training and staffingPlan to be very disciplined, adhering to five main acquisition criteria:Immediate or near-term earnings accretion Strong target company fundamentals Good strategic fit, including capacity to leverage our global footprintHigh potential for cost and revenue synergies Ease of integration – business model, management, and culture

contacts 32 Kalle Ahl, CFA (212) 836-9614kahl@equityny.comDevin Sullivan(212) 836-9608dsullivan@equityny.com Kyle Loudermilk, CEO(410) 970-7800kyle.loudermilk@gses.comChris Sorrells, COO(410) 970-7802chris.sorrells@gses.com