Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Atkore Inc. | atkr4q17exhibit991.htm |

| 8-K - 8-K - Atkore Inc. | atkr4q17form8-k.htm |

PRINTING INSTRUCTIONS

CHECK TOC BEFORE PRINTING

Color/grayscale: Color (regardless of printing in b/w)

Scale to fit paper: OFF

Print hidden slides: OFF

POWERPOINT OPTIONS > ADVANCED > PRINT

Print in background: OFF

Fourth Quarter and FY 2017 Earnings Presentation

November 29, 2017

Cautionary statements

This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical

fact included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our intentions, beliefs,

assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or expectations; customer retention; the outcome (by

judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or any other litigation; and the impact of

prevailing economic conditions. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “believes,”

“expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking

statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and

the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of

operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or

developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Annual Report on Form 10-K for the fiscal year ended September 30, 2017, filed with the U.S.

Securities and Exchange Commission on November 29, 2017 (File No. 001-37793), could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements.

Because of these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict

those events or how they may affect us. Further, any forward-looking statement speaks only as of the date on which it is made. We undertake no obligation to revise the forward-looking statements in this

presentation after the date of this presentation.

Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent

available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third party sources. All of the market data

and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, and you are cautioned not to give undue weight to such estimates.

Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the

estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and

beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of

uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the

estimates prepared by independent parties.

We present Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, Adjusted earnings per share, Net debt (total debt less cash and cash equivalents), and Leverage ratio (net debt or total debt less

cash and cash equivalents, over Adjusted EBITDA on trailing twelve month basis) to help us describe our operating and financial performance. Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net

income, Adjusted earnings per share, and Leverage ratio are non-GAAP financial measures commonly used in our industry and have certain limitations and should not be construed as alternatives to net

income, net sales and other income data measures (as determined in accordance with generally accepted accounting principles in the United States, or GAAP), or as better indicators of operating performance.

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, Adjusted earnings per share, Net debt (total debt less cash and cash equivalents), and Leverage ratio (net debt or total debt less cash and

cash equivalents over Adjusted EBITDA on a trailing twelve month basis), as defined by us may not be comparable to similar non-GAAP measures presented by other issuers. Our presentation of such

measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. See the appendix to this presentation for a reconciliation of Adjusted EBITDA to

net income, Adjusted net income to adjusted net income per share, and net debt over Adjusted EBITDA.

Fiscal Periods - The Company has a fiscal year that ends on September 30th. It is the Company's practice to establish quarterly closings using a 4-5-4 calendar. The Company's fiscal quarters end on the last

Friday in December, March and June.

2

[VALUE]M $99

$1 $5

[VALUE]M

$87

2016 Volume Price / Mix M&A FX 2017

[VALUE]M

[VALUE]

$0

[VALUE]M

$18 $1

2016 Volume Price vs.

Cost

Productivity

/ Other

M&A / FX 2017

Working

Days

($29M)

Direct

Solar

($33M)

Working

Days

($6M)

Direct

Solar

($14M)

FY 2017 Highlights

Year ended September 30

Passed through $87M raw material inflation

Over-delivered M&A capital allocation goal

Delivered $14M productivity savings

Expanded capabilities to bring innovations

to market

Improved ease of doing business with

Atkore (Agent Portal / Order to Cash System)

2017

Acquisitions

+$7M

Fence &

Sprinkler ($8M)

Net Income of $84.6M and Earnings per

share of $1.27 were up 44% and 35% year

over year, respectively

FY 2017 Net Sales Bridge

FY 2017 Adjusted EBITDA(1) Bridge

(1) See non-GAAP reconciliation in appendix

3

Q4 2017 Financial Summary

($’s in millions)

Q4

2017

Q4

2016

Y/Y

Change

Net Sales $395.8 $416.2 (4.9%)

Net Income $20.9 $15.6 40.0%

Adjusted EBITDA(1) $59.6 $61.4 (2.9%)

Net Income Margin 5.3% 3.7% +160 bps

Adjusted EBITDA

Margin(1)

15.0% 14.7% +30 bps

Net Income per

Share

$0.31 $0.24 29.2%

Adjusted Net Income

per Share(1)

$0.35 $0.34 2.9%

(1) See non-GAAP reconciliation

Net Sales Growth

Organic Growth +0.8%

Fewer Working Days (7.0%)

Acquisitions +1.2%

FX +0.1%

Total (4.9%)

Net Sales on a per day basis,

earnings and margins up

year over year

4

[VALUE]M [VALUE]

[VALUE]

[VALUE]M

[VALUE]

$1

2016 Volume Price vs.

Cost

Productivity

/ Other

M&A / FX 2017

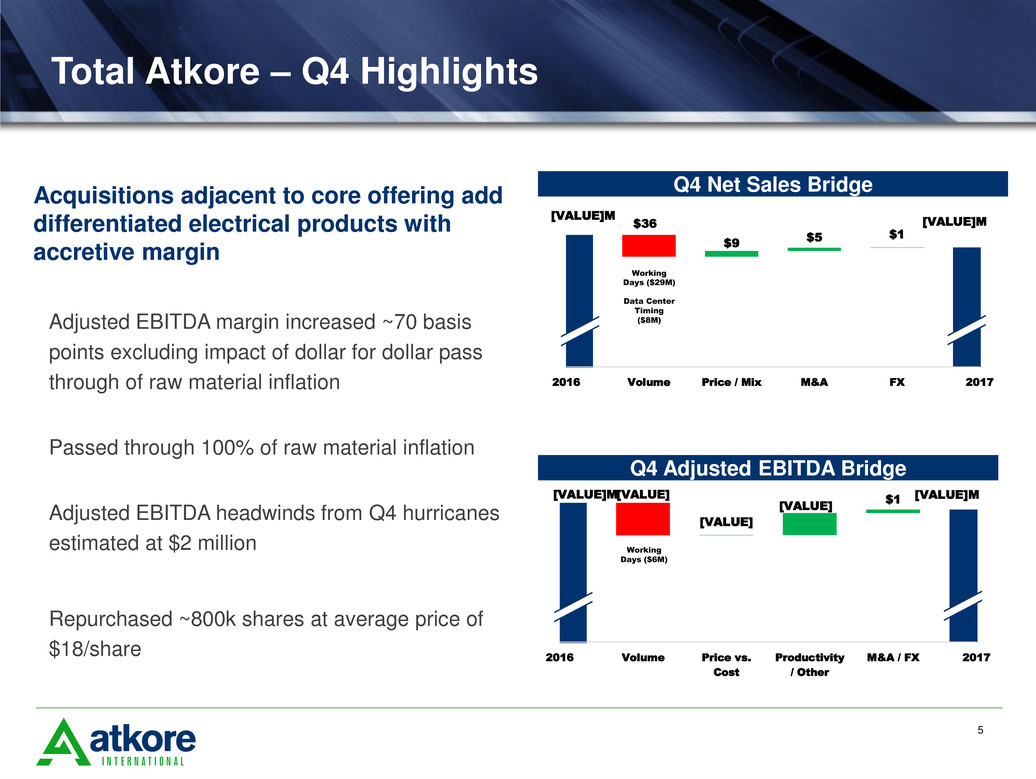

[VALUE]M $36

[VALUE]M

$9

$5 $1

2016 Volume Price / Mix M&A FX 2017

Working

Days ($6M)

Acquisitions adjacent to core offering add

differentiated electrical products with

accretive margin

Adjusted EBITDA margin increased ~70 basis

points excluding impact of dollar for dollar pass

through of raw material inflation

Passed through 100% of raw material inflation

Adjusted EBITDA headwinds from Q4 hurricanes

estimated at $2 million

Repurchased ~800k shares at average price of

$18/share

Total Atkore – Q4 Highlights

Q4 Net Sales Bridge

Q4 Adjusted EBITDA Bridge

Working

Days ($29M)

Data Center

Timing

($8M)

5

Electrical Raceway – Q4 Highlights

US volume strengthened in key categories

Average selling prices up 4 percent from

pass through of raw material inflation

Adjusted EBITDA margin up 170 basis

points adjusted for dollar for dollar pass

through of raw material inflation

[VALUE]M $22 [VALUE]M

$11 $5

$1

2016 Volume Price / Mix M&A FX 2017

Q4 Net Sales Bridge

Working

Days

($20M)

Improved margin by 110 basis points and

passed through raw material inflation in

a tough volume environment

($’s in millions)

Q4

2017

Q4

2016

Y/Y

Change

Net Sales $293.1 $299.1 (2.0%)

Adjusted EBITDA $50.9 $48.7 4.4%

Adjusted EBITDA

Margin

17.4% 16.3% +110 bps

6

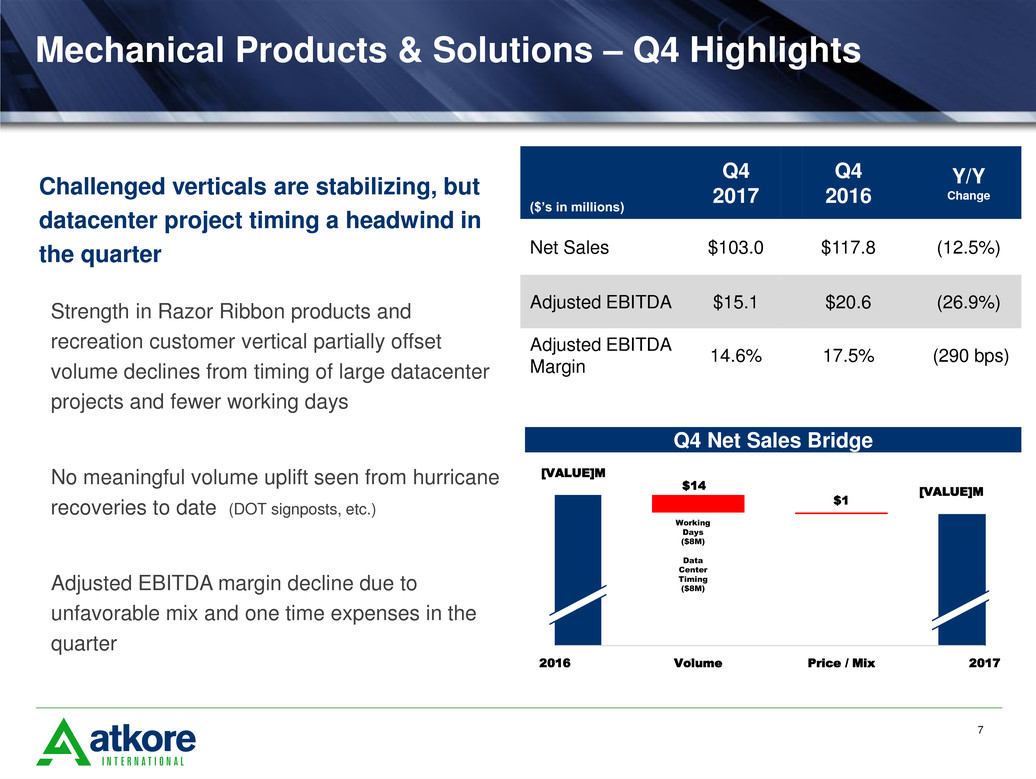

Mechanical Products & Solutions – Q4 Highlights

Strength in Razor Ribbon products and

recreation customer vertical partially offset

volume declines from timing of large datacenter

projects and fewer working days

No meaningful volume uplift seen from hurricane

recoveries to date (DOT signposts, etc.)

Adjusted EBITDA margin decline due to

unfavorable mix and one time expenses in the

quarter

Challenged verticals are stabilizing, but

datacenter project timing a headwind in

the quarter

[VALUE]M

$14

$1

[VALUE]M

2016 Volume Price / Mix 2017

Working

Days

($8M)

Data

Center

Timing

($8M)

($’s in millions)

Q4

2017

Q4

2016

Y/Y

Change

Net Sales $103.0 $117.8 (12.5%)

Adjusted EBITDA $15.1 $20.6 (26.9%)

Adjusted EBITDA

Margin

14.6% 17.5% (290 bps)

Q4 Net Sales Bridge

7

Key Balance Sheet and Cash Flow Metrics

($mm)

9/30/2017

Cash and cash equivalents $45.7

Total Debt $576.1

CapEx $25.1

Net cash from operating activities $121.7

Adjusted EBITDA $227.6

Leverage Ratio (1)

Total debt / Adjusted EBITDA(1)

2.5x

Net debt / Adjusted EBITDA(1) 2.3x

Metrics Leverage Ratio(1)

1. Leverage ratio is defined as net debt (total debt less cash and cash equivalents) divided by the fiscal year Adjusted EBITDA. Total debt was

$692.9mm, $652.2mm, and $630.3mm, as of September 26, 2014, September 25, 2015, and September 30, 2016, respectively. Cash and cash

equivalents were $33.4mm, $80.6mm, and $200.3mm as of September 26, 2014, September 25, 2015, and September 30, 2016, respectively.

Leverage ratio for all periods above is reconciled in the appendix.

5.2x

3.5x

1.8x

2.3x

FY 2014 FY 2015 FY 2016 FY 2017

Strong Cash Flow and Leverage Ratio Continue

to Support M&A Capital Allocation Strategy

8

Non - Residential

Construction

Industrial

Residential

Construction

What We Expect from the Market

flat to +3%

+2 to 3%

Key Market Influences by Segment Market Growth

Modest Volume Growth Expected in 2018

Electrical Raceway

Mechanical Products

& Solutions

2018 Expectations

flat to +3%

9

2018 Financial Outlook Summary

Electrical Raceway

Segment

Consolidated Atkore

Mechanical Products &

Solutions Segment

Q1 2018 FY 2018

Volume Flat to +3%

Adjusted EBITDA* $50 - $55M $215 - $225M

Volume Flat to +2%

Adjusted EBITDA* $12 - $15M $60 - $65M

Adjusted EBITDA* $55 - $60M $245 - $260M

Adjusted EPS* $0.30 - $0.35 $1.45 - $1.60***

Capital Expenditures $6M $30M

Interest Expense $7M $27M

Tax Rate 35% 35%

Diluted Shares**

66 66

* Reconciliation of the forward-looking full-year 2018 outlook for Adjusted EBITDA and Adjusted EPS is not being provided as the Company does not currently have sufficient data to accurately

estimate the variables and individual adjustments for such reconciliation.

** Represents weighted-average shares outstanding in millions used in calculation of Adjusted EPS guidance.

***Estimated Full Year EPS Impact of Purchase Accounting (-$0.10/share) included for Acquisitions

10

Appendix

2017 Financial Summary

Year ended September 30

($’s in millions)

2017 2016 Y/Y

Change

Net Sales $1,503.9 $1,523.4 (1.3%)

Adjusted Net Sales(1) $1,503.9 $1,515.6 (0.8%)

Net Income $84.6 $58.8 43.9%

Adjusted EBITDA(1) $227.6 $235.0 (3.1%)

Net Income Margin 5.6% 3.9% +170 bps

Adjusted EBITDA

Margin(1)

15.1% 15.5% (40 bps)

Net Income per

Share

$1.27 $0.94 35.1%

Adjusted Net Income

per Share(1)

$1.42 $1.31 8.4%

(1) See non-GAAP reconciliation

Sales Growth

Organic Growth +1.2%

Fewer Working Days (2.0%)

Acquisitions +0.4%

Divestures (0.5%)

FX (0.4%)

Total (1.3%)

Adjusted Net Sales reconciliation

A

B

C

D

E

F

G

H

Three Months Ended Fiscal year ended

($ in thousands)

September

30, 2017

September

30, 2016 Change

%

Change

September 30,

2017

September 30,

2016 Change

%

Change

Net sales $ 395,807 $ 416,239 $ (20,432 ) (4.9 )% $ 1,503,934 $ 1,523,384 $ (19,450 ) (1.3 )%

Impact of Fence and

Sprinkler exit —

—

—

* —

(7,816 ) 7,816

(100.0 )%

Adjusted net sales $ 395,807 $ 416,239 $ (20,432 ) (4.9 )% $ 1,503,934 $ 1,515,568 $ (11,634 ) (0.8 )%

Adjusted EBITDA $ 59,562 $ 61,364 $ (1,802 ) (2.9 )% $ 227,608 $ 235,002 $ (7,394 ) (3.1 )%

Adjusted EBITDA Margin 15.0 % 14.7 % 15.1 % 15.5 %

* Not meaningful

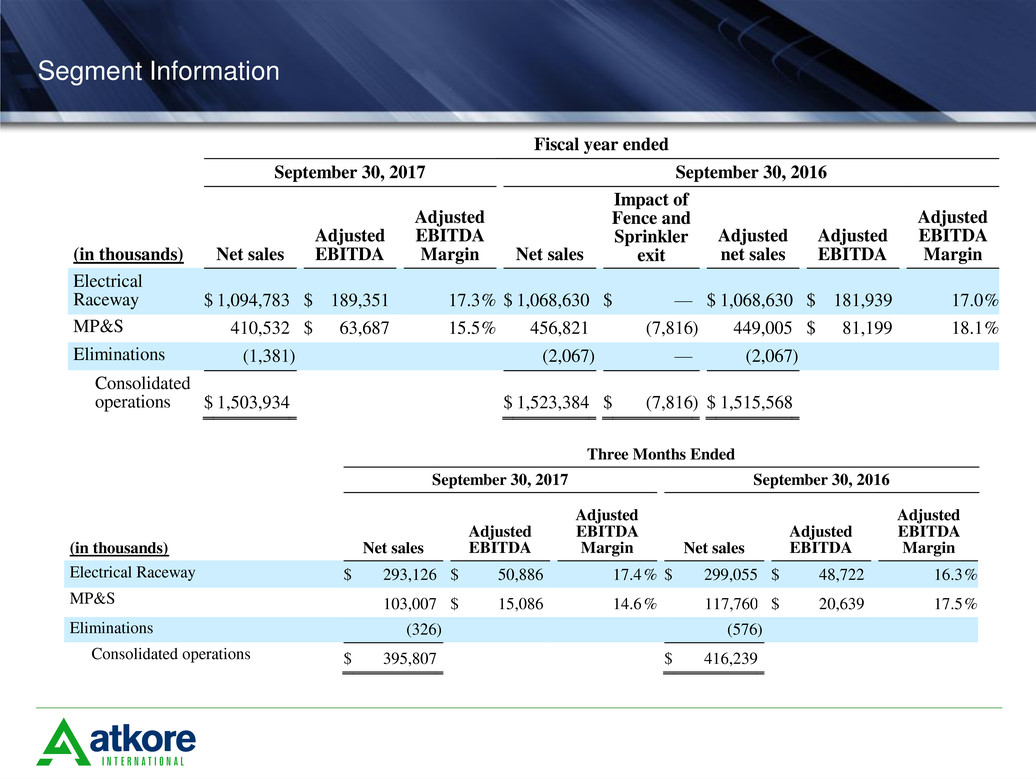

Segment Information

A

B

C

D

E

F

G

H

Fiscal year ended

September 30, 2017 September 30, 2016

(in thousands) Net sales

Adjusted

EBITDA

Adjusted

EBITDA

Margin Net sales

Impact of

Fence and

Sprinkler

exit

Adjusted

net sales

Adjusted

EBITDA

Adjusted

EBITDA

Margin

Electrical

Raceway $ 1,094,783

$ 189,351

17.3 % $ 1,068,630

$ —

$ 1,068,630

$ 181,939

17.0 %

MP&S 410,532 $ 63,687 15.5 % 456,821 (7,816 ) 449,005 $ 81,199 18.1 %

Eliminations (1,381 ) (2,067 ) — (2,067 )

Consolidated

operations $ 1,503,934

$ 1,523,384

$ (7,816 ) $ 1,515,568

Three Months Ended

September 30, 2017 September 30, 2016

(in thousands) Net sales

Adjusted

EBITDA

Adjusted

EBITDA

Margin Net sales

Adjusted

EBITDA

Adjusted

EBITDA

Margin

Electrical Raceway $ 293,126 $ 50,886 17.4 % $ 299,055 $ 48,722 16.3 %

MP&S 103,007

$ 15,086

14.6 % 117,760

$ 20,639

17.5 %

Eliminations (326 ) (576 )

Consolidated operations $ 395,807

$ 416,239

Adjusted earnings per share reconciliation

A

B

C

D

E

F

G

H

Consolidated Atkore International Group Inc.

Three Months Ended Fiscal Year Ended

(in thousands, except per share data)

September

30, 2017

September

30, 2016

September

30, 2017

September

30, 2016

Net income $ 20,857 $ 15,572 $ 84,639 $ 58,796

Stock-based compensation 3,420 4,230 12,788 21,127

Consulting fee — — — 15,425

Loss (gain) on extinguishment of debt — — 9,805 (1,661 )

Gain on sale of joint venture — — (5,774 ) —

Legal matters — 82 7,551 1,382

Other (a) 60 6,947 (10,247 ) 1,103

Impact of Fence and Sprinkler exit — — — 811

Pre-tax adjustments to net income 3,480 11,259 14,123 38,187

Tax effect (1,246 ) (5,087 ) (4,434 ) (14,511 )

Adjusted net income $ 23,091 $ 21,744 $ 94,328 $ 82,472

Weighted-Average Common Shares Outstanding

Basic 63,954 62,492 63,420 62,486

Diluted 66,503 64,269 66,585 62,820

Net income (loss) per share

Basic $ 0.33 $ 0.25 $ 1.33 $ 0.94

Diluted $ 0.31 $ 0.24 $ 1.27 $ 0.94

Adjusted Net income (loss) per share

Basic $ 0.36 $ 0.35 $ 1.49 $ 1.32

Diluted $ 0.35 $ 0.34 $ 1.42 $ 1.31

(a) Represents other items, such as inventory reserves and adjustments, release of indemnified uncertain tax positions and the impact of foreign exchange

gains or losses.

Net Income to Adjusted EBITDA reconciliation

A

B

C

D

E

F

G

H

Consolidated Atkore International Group Inc.

Three Months Ended Fiscal Year Ended

(in thousands) September 30, 2017 September 30, 2016 September 30, 2017 September 30, 2016

Net income $ 20,857

$ 15,572

$ 84,639

$ 58,796

Income tax expense 12,173

3,892

41,486

27,985

Depreciation and amortization 14,485

14,953

54,727

55,017

Interest expense, net 5,726

11,181

26,598

41,798

Loss (gain) on extinguishment of debt —

—

9,805

(1,661 )

Restructuring & impairments 556

1,701

1,256

4,096

Net periodic pension benefit cost —

110

—

441

Stock-based compensation 3,420

4,230

12,788

21,127

ABF product liability impact —

212

—

850

Gain on sale of joint venture —

—

(5,774 ) —

Consulting fees —

—

—

15,425

Legal matters 50

82

7,551

1,382

Transaction costs 2,235

2,484

4,779

7,832

Other (a) 60

6,947

(10,247 ) 1,103

Impact of Fence and Sprinkler exit —

—

—

811

Adjusted EBITDA $ 59,562

$ 61,364

$ 227,608

$ 235,002

(a) Represents other items, such as inventory reserves and adjustments, release of indemnified uncertain tax positions and the impact of foreign exchange gains or losses.

Net debt / Adjusted EBITDA reconciliation

A

B

C

D

E

F

G

H

Consolidated Atkore International Group Inc.

($ in thousands)

September

30, 2017

September

30, 2016

September

25, 2015

Short-term debt and current maturities of long-term debt $ 4,215 $ 1,267 $ 42,887

Long-term debt 571,863 629,046 649,980

Total Debt 576,078 630,313 692,867

Less cash and cash equivalents 45,718 200,279 33,360

Net Debt $ 530,360 $ 430,034 $ 659,507

Adjusted EBITDA $ 227,608 $ 235,002 $ 163,950

Total debt/Adjusted EBITDA 2.5 x 2.7 x 4.2 x

Net debt/Adjusted EBITDA 2.3 x 1.8 x 4.0 x