Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - PAPERWEIGHT DEVELOPMENT CORP | d497693dex992.htm |

| 8-K - 8-K - PAPERWEIGHT DEVELOPMENT CORP | d497693d8k.htm |

2017 / 2018 Forecast Update November 2017 – Highly Confidential – – For Professional Eyes Only – Exhibit 99.1

Forward-Looking Statements In this presentation, all statements that are not purely historical facts (including statements which address the Company’s strategy, future operations, future financial position, estimated revenues, projected costs, prospects, plans and objectives) are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements often include words such as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecasts” or similar expressions. These statements are not guarantees of results, and actual results could differ materially from those expressed in the forward-looking statements due to a variety of important factors, both positive and negative, that could cause material impacts on the Company’s historical or anticipated financial results. Although the Company believes that in making any such forward-looking statement its expectations are based on reasonable assumptions, any such forward-looking statement involves uncertainties and is qualified in its entirety by reference to the discussion of risk factors under “Risk Factors” and the discussion under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q filed by the Company and the following important factors, among others, that could cause actual results to differ materially from those projected in such forward-looking statements: • the Debtors’ ability to obtain the approval of the Bankruptcy Court with respect to motions filed in the Chapter 11 Cases and the outcomes of Bankruptcy Court rulings and the Chapter 11 Cases in general; • the effectiveness of the overall restructuring activities pursuant to the Chapter 11 Filings and any additional strategies that the Debtors may employ to address their liquidity and capital resources; • the actions and decisions of creditors, regulators and other third parties that have an interest in the Chapter 11 Cases; • the actions and decisions of the Company’s material vendors, suppliers and customers in response to the Chapter 11 Cases; and • restrictions on the Debtors due to the terms of the Debtor’s Superpriority Senior Debtor-in-Possession Credit Agreement that the Debtors have entered into in connection with the Chapter 11 Cases and restrictions imposed by the Bankruptcy Court. Many of these factors are beyond the Company’s ability to control or predict. Given these uncertainties, you should not place undue reliance on the forward-looking statements. All such statements speak only as of the date made, and the Company (and its advisors, including Guggenheim Securities) expressly disclaims any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

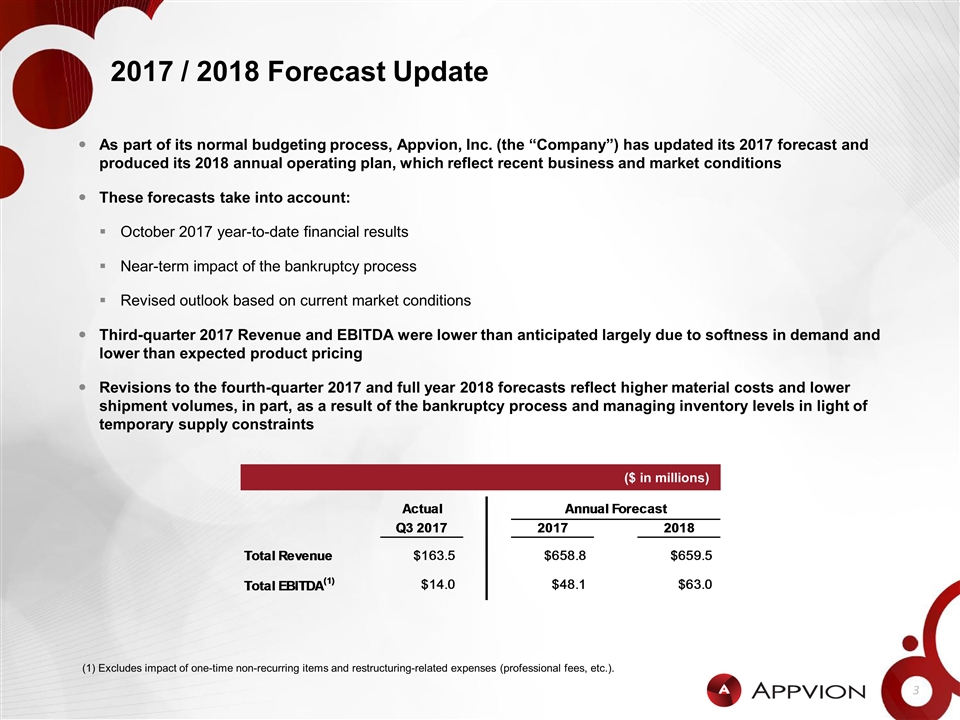

2017 / 2018 Forecast Update As part of its normal budgeting process, Appvion, Inc. (the “Company”) has updated its 2017 forecast and produced its 2018 annual operating plan, which reflect recent business and market conditions These forecasts take into account: October 2017 year-to-date financial results Near-term impact of the bankruptcy process Revised outlook based on current market conditions Third-quarter 2017 Revenue and EBITDA were lower than anticipated largely due to softness in demand and lower than expected product pricing Revisions to the fourth-quarter 2017 and full year 2018 forecasts reflect higher material costs and lower shipment volumes, in part, as a result of the bankruptcy process and managing inventory levels in light of temporary supply constraints (1) Excludes impact of one-time non-recurring items and restructuring-related expenses (professional fees, etc.). ($ in millions)