Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - N1 Liquidating Trust | d497806d8k.htm |

| EX-2.1 - EX-2.1 - N1 Liquidating Trust | d497806dex21.htm |

Colony NorthStar Credit Real Estate, Inc. Creating a Leading Commercial Real Estate Credit REIT Supplemental Retail Information Regarding Proposed Combination Transaction EXHIBIT 99.1

Forward-Looking Statements Cautionary Statement Regarding Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology, such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond our control, and may cause actual results to differ significantly from those expressed in any forward-looking statement. Among others, the following uncertainties and other factors could cause actual results to differ from those set forth in the forward-looking statements: the failure to receive, on a timely basis or otherwise, the required approvals by NorthStar Real Estate Income Trust, Inc. and NorthStar Real Estate Income II, Inc. stockholders, government or regulatory agencies and third parties; the risk that a condition to closing of the combination may not be satisfied; each company’s ability to consummate the combination; operating costs and business disruption may be greater than expected; the ability of each company to retain it senior executives and maintain relationships with business partners pending consummation of the combination; the ability to realize substantial efficiencies and synergies as well as anticipated strategic and financial benefits and the impact of legislative, regulatory and competitive changes and other risk factors relating to the industries in which each company operates, as detailed from time to time in each company’s reports filed with Securities and Exchange Commission (“SEC”). There can be no assurance that the combination will in fact be consummated. Neither of NorthStar Real Estate Income Trust, Inc. or NorthStar Real Estate Income II, Inc. or any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements speak only as of the date of this presentation. Neither of NorthStar Real Estate Income Trust, Inc. or NorthStar Real Estate Income II, Inc. are under any duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectation, and neither of NorthStar Real Estate Income Trust, Inc. or NorthStar Real Estate Income II, Inc. intends to do so. Additional Information and Where to Find It In connection with the proposed transaction, Colony NorthStar, Inc., NorthStar Real Estate Income Trust, Inc. and NorthStar Real Estate Income II, Inc. have caused Colony NorthStar Credit Real Estate, Inc., the surviving company of the combination, to file with the SEC a registration statement on Form S-4 that includes a joint proxy statement of NorthStar Real Estate Income Trust, Inc. and NorthStar Real Estate Income II, Inc. and that also constitutes a prospectus of Colony NorthStar Credit Real Estate, Inc.. Each of Colony NorthStar, Inc., NorthStar Real Estate Income Trust, Inc. and NorthStar Real Estate Income II, Inc. may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document which Colony NorthStar, Inc., NorthStar Real Estate Income Trust, Inc. or NorthStar Real Estate Income II, Inc. may file with the SEC. INVESTORS AND SECURITY HOLDERS OF COLONY NORTHSTAR, INC., NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND NORTHSTAR REAL ESTATE INCOME II, INC. ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, THE CURRENT REPORT ON FORM 8-K FILED BY EACH OF COLONY NORTHSTAR, INC., NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND NORTHSTAR REAL ESTATE INCOME II, INC. ON AUGUST 28, 2017 IN CONNECTION WITH THE ANNOUNCEMENT OF THE ENTRY INTO THE COMBINATION AGREEMENT, THE CURRENT REPORT ON FORM 8-K TO BE FILED BY EACH OF COLONY NORTHSTAR, INC., NORTHSTAR REAL ESTATE INCOME TRUST, INC. AND NORTHSTAR REAL ESTATE INCOME II, INC. REGARDING THE AMENDMENT OF THE AGREEMENT GOVERNING THE COMBINATION AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Colony NorthStar, Inc., NorthStar Real Estate Income Trust, Inc. and NorthStar Real Estate Income II, Inc. through the website maintained by the SEC at www.sec.gov or by contacting the investor relations department of Colony NorthStar, Inc., NorthStar Real Estate Income Trust, Inc. or NorthStar Real Estate Income II, Inc. at the following: Contacts: NorthStar Real Estate Income Trust, Inc. NorthStar Real Estate Income II, Inc. Investor RelationsInvestor Relations 877-940-8777877-940-8777 Participants in the Solicitation Each of NorthStar Real Estate Income Trust, Inc. and NorthStar Real Estate Income II, Inc. and their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from their respective stockholders in connection with the proposed transaction. Information regarding NorthStar Real Estate Income Trust, Inc.’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in NorthStar Real Estate Income Trust, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2016, its annual proxy statement filed with the SEC on April 28, 2017 and in its annual proxy statement filed with the SEC on April 28, 2017. Information regarding NorthStar Real Estate Income II, Inc.’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in NorthStar Real Estate Income II, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2016 and in its annual proxy statement filed with the SEC on April 28, 2017. A more complete description will be available in the registration statement on Form S-4 filed by Colony NorthStar Credit Real Estate, Inc. and the joint proxy statement/prospectus. You may obtain free copies of these documents as described in the preceding paragraph. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Rounded figures may not foot.

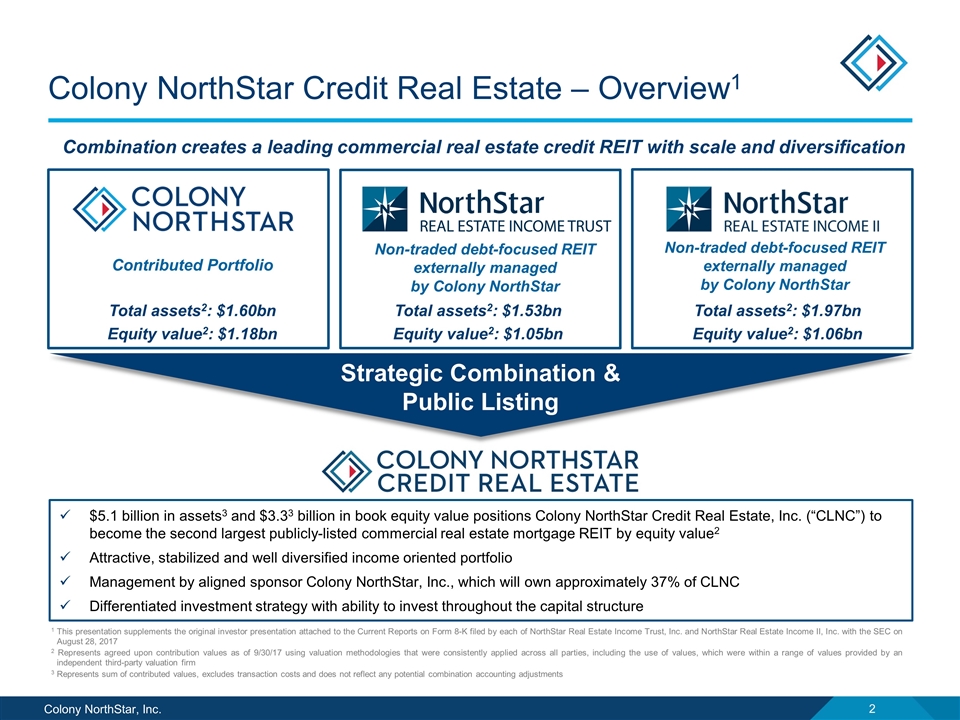

Colony NorthStar Credit Real Estate – Overview1 $5.1 billion in assets3 and $3.33 billion in book equity value positions Colony NorthStar Credit Real Estate, Inc. (“CLNC”) to become the second largest publicly-listed commercial real estate mortgage REIT by equity value2 Attractive, stabilized and well diversified income oriented portfolio Management by aligned sponsor Colony NorthStar, Inc., which will own approximately 37% of CLNC Differentiated investment strategy with ability to invest throughout the capital structure ü Propels Colony NorthStar’ objective of becoming an equity REIT… ü Attractive market backdrop and opportunity for growth ü Compelling value proposition to NorthStar I and NorthStar II shareholders through liquidity event and more efficient overhead ü Strong sponsorship in Colony NorthStar as a manager and successful track record across multiple Commercial Mortgage REITs ü Strategic Combination & Public Listing Contributed Portfolio Total assets2: $1.60bn Equity value2: $1.18bn Total assets2: $1.97bn Equity value2: $1.06bn 1 This presentation supplements the original investor presentation attached to the Current Reports on Form 8-K filed by each of NorthStar Real Estate Income Trust, Inc. and NorthStar Real Estate Income II, Inc. with the SEC on August 28, 2017 2 Represents agreed upon contribution values as of 9/30/17 using valuation methodologies that were consistently applied across all parties, including the use of values, which were within a range of values provided by an independent third-party valuation firm 3 Represents sum of contributed values, excludes transaction costs and does not reflect any potential combination accounting adjustments Total assets2: $1.53bn Equity value2: $1.05bn Combination creates a leading commercial real estate credit REIT with scale and diversification Non-traded debt-focused REIT externally managed by Colony NorthStar Non-traded debt-focused REIT externally managed by Colony NorthStar

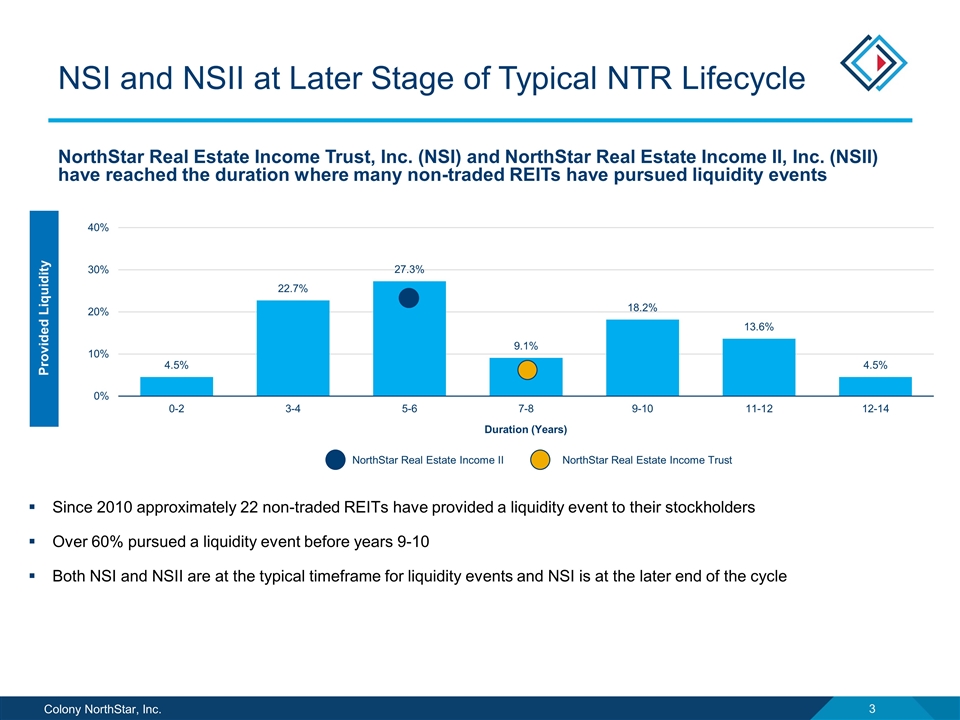

NSI and NSII at Later Stage of Typical NTR Lifecycle NorthStar Real Estate Income Trust, Inc. (NSI) and NorthStar Real Estate Income II, Inc. (NSII) have reached the duration where many non-traded REITs have pursued liquidity events Source: Company filings for comparable set of non-traded REITs; data set does not include all non-traded REITs Duration (Years) Provided Liquidity NorthStar Real Estate Income Trust NorthStar Real Estate Income II Since 2010 approximately 22 non-traded REITs have provided a liquidity event to their stockholders Over 60% pursued a liquidity event before years 9-10 Both NSI and NSII are at the typical timeframe for liquidity events and NSI is at the later end of the cycle

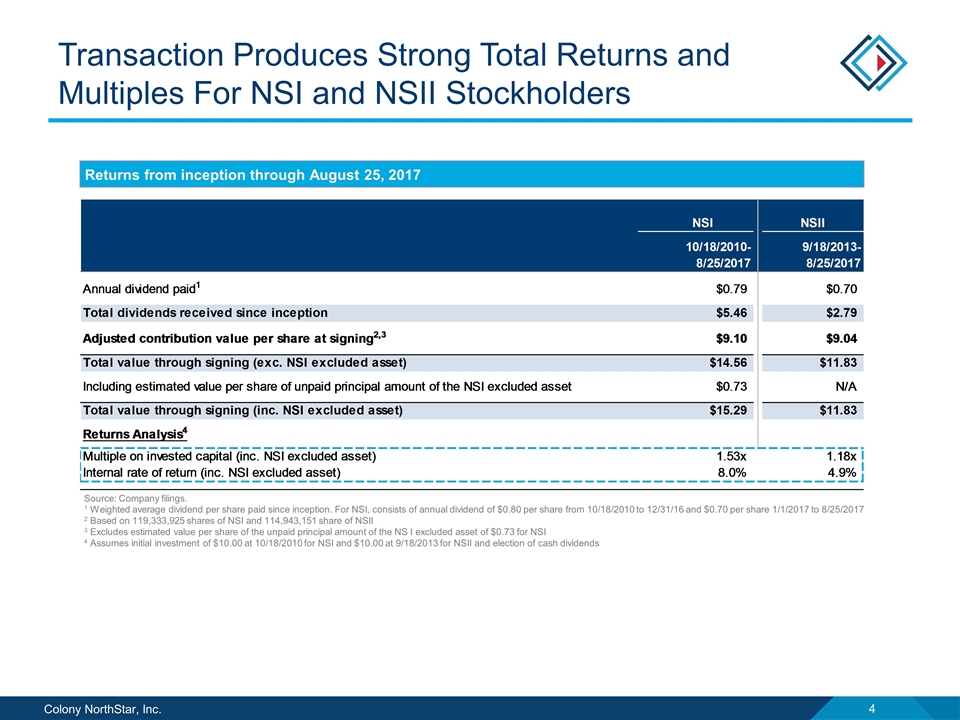

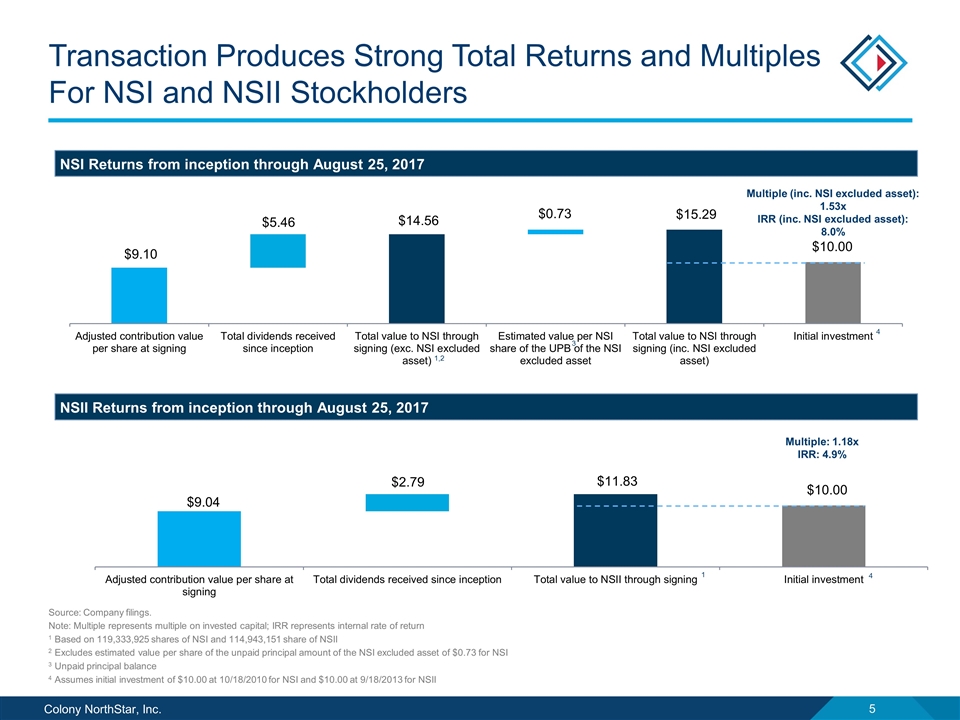

Transaction Produces Strong Total Returns and Multiples For NSI and NSII Stockholders Source: Company filings. 1 Weighted average dividend per share paid since inception. For NSI, consists of annual dividend of $0.80 per share from 10/18/2010 to 12/31/16 and $0.70 per share 1/1/2017 to 8/25/2017 2 Based on 119,333,925 shares of NSI and 114,943,151 share of NSII 3 Excludes estimated value per share of the unpaid principal amount of the NS I excluded asset of $0.73 for NSI 4 Assumes initial investment of $10.00 at 10/18/2010 for NSI and $10.00 at 9/18/2013 for NSII and election of cash dividends Returns from inception through August 25, 2017

Transaction Produces Strong Total Returns and Multiples For NSI and NSII Stockholders Source: Company filings. Note: Multiple represents multiple on invested capital; IRR represents internal rate of return 1 Based on 119,333,925 shares of NSI and 114,943,151 share of NSII 2 Excludes estimated value per share of the unpaid principal amount of the NSI excluded asset of $0.73 for NSI 3 Unpaid principal balance 4 Assumes initial investment of $10.00 at 10/18/2010 for NSI and $10.00 at 9/18/2013 for NSII NSI Returns from inception through August 25, 2017 Multiple (inc. NSI excluded asset): 1.53x IRR (inc. NSI excluded asset): 8.0% Multiple: 1.18x IRR: 4.9% NSII Returns from inception through August 25, 2017 1 1,2 4 4 3

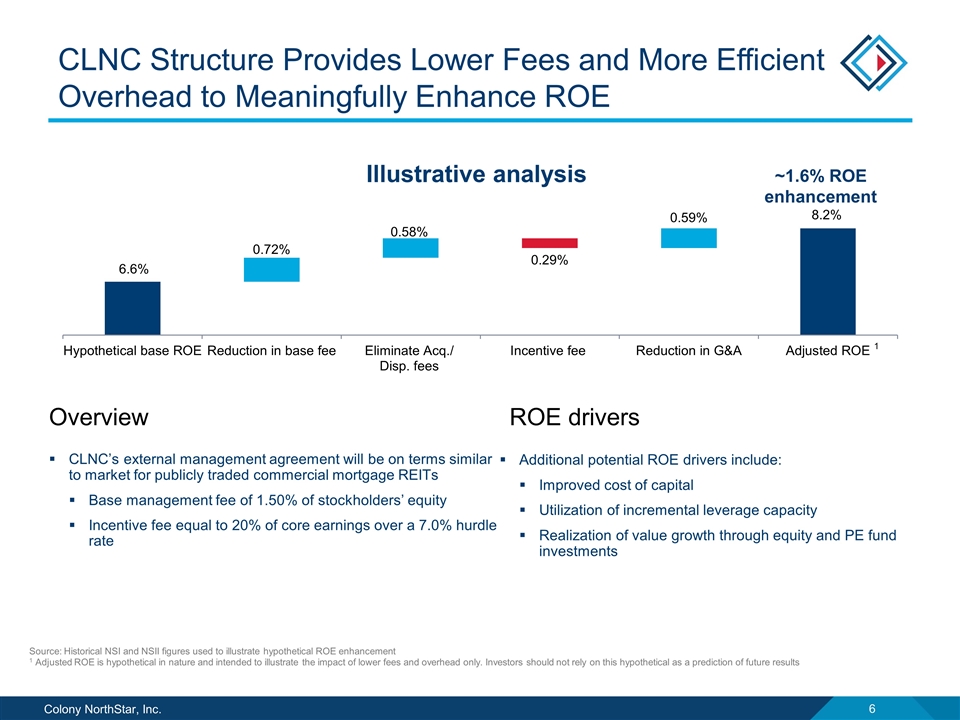

CLNC Structure Provides Lower Fees and More Efficient Overhead to Meaningfully Enhance ROE Source: Historical NSI and NSII figures used to illustrate hypothetical ROE enhancement 1 Adjusted ROE is hypothetical in nature and intended to illustrate the impact of lower fees and overhead only. Investors should not rely on this hypothetical as a prediction of future results Illustrative analysis ~1.6% ROE enhancement Overview CLNC’s external management agreement will be on terms similar to market for publicly traded commercial mortgage REITs Base management fee of 1.50% of stockholders’ equity Incentive fee equal to 20% of core earnings over a 7.0% hurdle rate ROE drivers Additional potential ROE drivers include: Improved cost of capital Utilization of incremental leverage capacity Realization of value growth through equity and PE fund investments 1

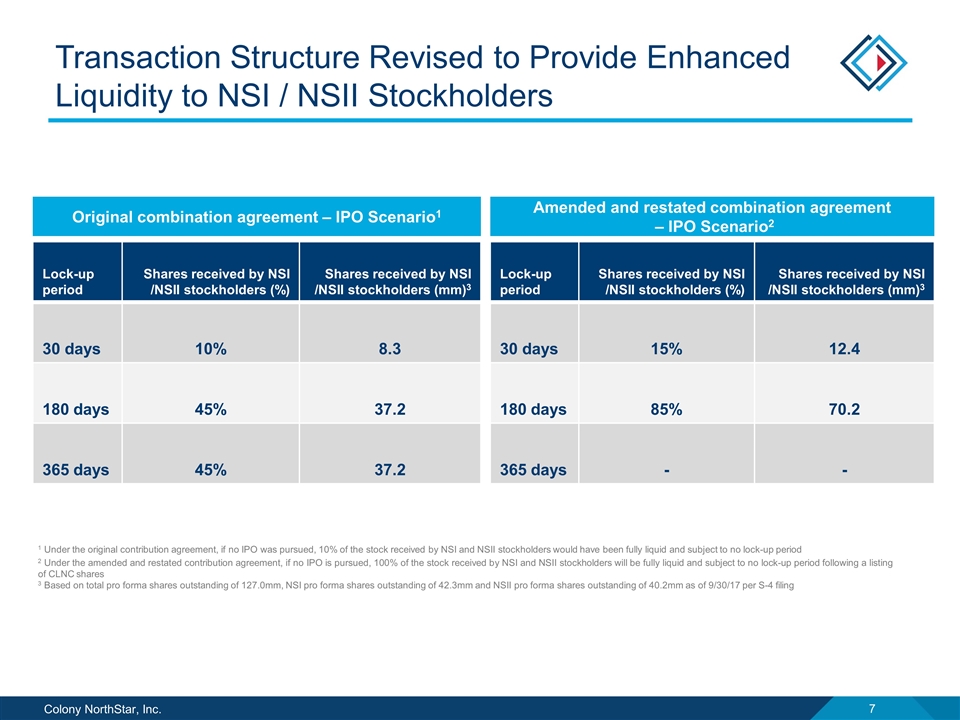

Transaction Structure Revised to Provide Enhanced Liquidity to NSI / NSII Stockholders Lock-up period Shares received by NSI /NSII stockholders (%) Shares received by NSI /NSII stockholders (mm)3 30 days 10% 8.3 180 days 45% 37.2 365 days 45% 37.2 Original combination agreement – IPO Scenario1 Amended and restated combination agreement – IPO Scenario2 Lock-up period Shares received by NSI /NSII stockholders (%) Shares received by NSI /NSII stockholders (mm)3 30 days 15% 12.4 180 days 85% 70.2 365 days - - 1 Under the original contribution agreement, if no IPO was pursued, 10% of the stock received by NSI and NSII stockholders would have been fully liquid and subject to no lock-up period 2 Under the amended and restated contribution agreement, if no IPO is pursued, 100% of the stock received by NSI and NSII stockholders will be fully liquid and subject to no lock-up period following a listing of CLNC shares 3 Based on total pro forma shares outstanding of 127.0mm, NSI pro forma shares outstanding of 42.3mm and NSII pro forma shares outstanding of 40.2mm as of 9/30/17 per S-4 filing