Attached files

| file | filename |

|---|---|

| EX-99.4 - EXHIBIT 99.4 - ABERCROMBIE & FITCH CO /DE/ | q32017earningscalltransc.htm |

| EX-99.2 - EXHIBIT 99.2 - ABERCROMBIE & FITCH CO /DE/ | q32017quarterlyhistory.htm |

| EX-99.1 - EXHIBIT 99.1 - ABERCROMBIE & FITCH CO /DE/ | q32017earningsrelease.htm |

| 8-K - 8-K - ABERCROMBIE & FITCH CO /DE/ | q32017form8-kearningsrelea.htm |

INVESTOR PRESENTATION

2017 THIRD QUARTER

2

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

A&F cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this

presentation or made by management or spokespeople of A&F involve risks and uncertainties and are subject to change based on various important factors,

many of which may be beyond the company's control. Words such as "estimate," "project," "plan," "believe," "expect," "anticipate," "intend," and similar

expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise

our forward-looking statements. The factors disclosed in "ITEM 1A. RISK FACTORS" of A&F's Annual Report on Form 10-K for the fiscal year ended January

28, 2017 and in A&F's subsequently filed quarterly reports on Form 10-Q, in some cases have affected, and in the future could affect, the company's

financial performance and could cause actual results for the 2017 fiscal year and beyond to differ materially from those expressed or implied in any of the

forward-looking statements included in this presentation or otherwise made by management.

OTHER INFORMATION

The following presentation includes certain adjusted non-GAAP financial measures. Additional details about non-GAAP financial measures and a

reconciliation of GAAP financial measures to non-GAAP financial measures is included in the news release issued by the company on November 17, 2017,

which is available in the "Investors" section of the company's website, located at www.abercrombie.com. As used in the presentation, "GAAP" refers to

accounting principles generally accepted in the United States of America.

All dollar and share amounts are in 000’s unless otherwise stated. Sub-totals and totals may not foot due to rounding.

Net income and net income per share financial measures included herein are attributable to Abercrombie & Fitch Co., excluding net income attributable

to noncontrolling interests.

3

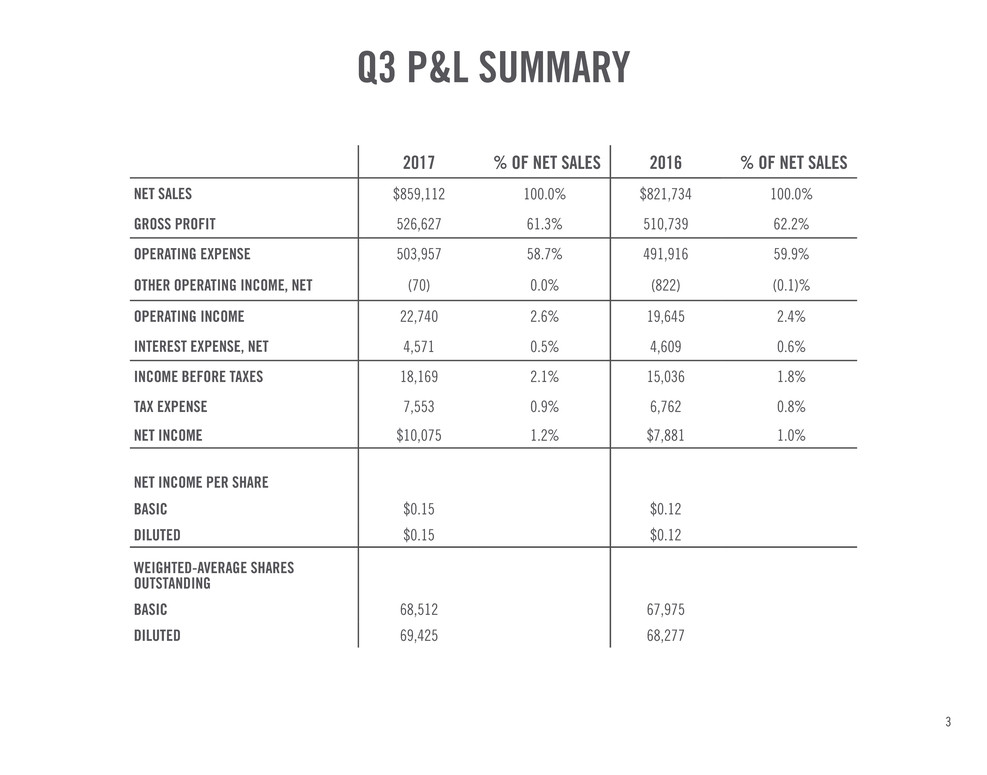

Q3 P&L SUMMARY

2017 % OF NET SALES 2016 % OF NET SALES

NET SALES $859,112 100.0% $821,734 100.0%

GROSS PROFIT 526,627 61.3% 510,739 62.2%

OPERATING EXPENSE 503,957 58.7% 491,916 59.9%

OTHER OPERATING INCOME, NET (70) 0.0% (822) (0.1)%

OPERATING INCOME 22,740 2.6% 19,645 2.4%

INTEREST EXPENSE, NET 4,571 0.5% 4,609 0.6%

INCOME BEFORE TAXES 18,169 2.1% 15,036 1.8%

TAX EXPENSE 7,553 0.9% 6,762 0.8%

NET INCOME $10,075 1.2% $7,881 1.0%

NET INCOME PER SHARE

BASIC $0.15 $0.12

DILUTED $0.15 $0.12

WEIGHTED-AVERAGE SHARES

OUTSTANDING

BASIC 68,512 67,975

DILUTED 69,425 68,277

4

Q3 ADJUSTED P&L SUMMARY*

* The Q3 Adjusted P&L Summary for the current and prior periods are presented on an adjusted non-GAAP basis, and excludes the effect of certain items set out on page 5.

2017 % OF NET SALES 2016 % OF NET SALES

NET SALES $859,112 100.0% $821,734 100.0%

GROSS PROFIT 526,627 61.3% 510,739 62.2%

OPERATING EXPENSE 489,407 57.0% 497,916 60.6%

OTHER OPERATING INCOME, NET (70) 0.0% (822) (0.1)%

OPERATING INCOME 37,290 4.3% 13,645 1.7%

INTEREST EXPENSE, NET 4,571 0.5% 4,609 0.6%

INCOME BEFORE TAXES 32,719 3.8% 9,036 1.1%

TAX EXPENSE 11,670 1.4% 7,241 0.9%

NET INCOME $20,508 2.4% $1,402 0.2%

NET INCOME PER SHARE

BASIC $0.30 $0.02

DILUTED $0.30 $0.02

WEIGHTED-AVERAGE SHARES

OUTSTANDING

BASIC 68,512 67,975

DILUTED 69,425 68,277

5

EXCLUDED ITEMS (PRE-TAX)

2017 Q1 Q2 Q3 YEAR TO DATE

LEGAL CHARGES $— $— $11,070 $11,070

ASSET IMPAIRMENT — 6,135 3,480 9,615

TOTAL $— $6,135 $14,550 $20,685

2016 Q1 Q2 Q3 YEAR TO DATE

CLAIMS SETTLEMENT BENEFITS $— $(12,282) $— $(12,282)

ASSET IMPAIRMENT — 6,356 — 6,356

INDEMNIFICATION RECOVERY — — (6,000) (6,000)

TOTAL $— $(5,926) $(6,000) $(11,926)

6

* Comparable sales are calculated on a constant currency basis. Sales include store and DTC sales.

(1) Abercrombie includes the company's Abercrombie & Fitch and abercrombie kids brands.

Q3 2017 COMPARABLE SALES*

Q1 Q2 Q3 YTD

TOTAL COMPANY (3)% (1)% 4% 0%

BRAND:

HOLLISTER 3% 5% 8% 6%

ABERCROMBIE (1) (10)% (7)% (2)% (6)%

GEOGRAPHY:

UNITED STATES (3)% 0% 6% 1%

INTERNATIONAL (2)% (1)% 0% (1)%

7

* Comparable sales are calculated on a constant currency basis. Sales include store and DTC sales.

(1) Abercrombie includes the company's Abercrombie & Fitch and abercrombie kids brands.

COMPARABLE SALES TREND BY BRAND*

HOLLISTER ABERCROMBIE TOTAL COMPANY

Q3 16 Q4 16 Q1 17 Q2 17 Q3 17

0%

1%

3%

5%

8%

(14)%

(13)%

(10)%

(7)%

(2)%

(6)%

(5)%

(3)%

(1)%

4%

2%

(4)%

(6)%

(2)%

0%

(12)%

(14)%

(10)%

(8)%

4%

(1)

6%

8%

10%

8

* Abercrombie includes the company's Abercrombie & Fitch and abercrombie kids brands.

Q3 2017 SALES MIX*

INTERNATIONAL

35.4%

UNITED STATES

64.6%

INTERNATIONAL

37.6%

UNITED STATES

62.4%

HOLLISTER

59.1%

ABERCROMBIE

40.9% HOLLISTER

57.8%

ABERCROMBIE

42.2%

Q3 YTD

BRAN

D

GEOGRAPH

Y

9

Q3 ADJUSTED OPERATING EXPENSE*

* Q3 Adjusted Operating Expense for the current and prior periods are presented on an adjusted non-GAAP basis, and excludes the effect of certain items set out of page 5.

(1) Includes rent, other landlord charges, utilities, depreciation and other occupancy expense.

(2) Includes selling payroll, store management and support, other store expense, direct-to-consumer expense, and distribution center costs.

(3) Rounded based on reported percentages.

2017 % OF NET SALES 2016 % OF NET SALES Δ bps (3)

STORE OCCUPANCY (1) $165,911 19.3% $172,982 21.1% (180)

ALL OTHER (2) 210,033 24.4% 213,627 26.0% (160)

STORES AND DISTRIBUTION 375,944 43.8% 386,609 47.0% (320)

MARKETING, GENERAL &

ADMINISTRATIVE 113,463 13.2% 111,307 13.5% (30)

OTHER OPERATING INCOME, NET (70) 0.0% (822) (0.1)% 10

TOTAL $489,337 57.0% $497,094 60.5% (350)

10

Q3 STORE OPENINGS

BRAND CENTER CITY DATE

DOMESTI

C

A&F Westfield Century City Los Angeles, CA 8/25/2017

OUTLE

T

A&F Florentia Village Tianjin, China 9/22/2017

11

Q3 STORE COUNT ACTIVITY

(1) Excludes five international franchise stores as of October 28, 2017 and July 29, 2017.

(2) Abercrombie includes the company's Abercrombie & Fitch and abercrombie kids brands. Locations with abercrombie kids carveouts within Abercrombie &

Fitch stores are represented as a single store count. Excludes four international franchise stores as of October 28, 2017 and three international franchise

stores as of July 29, 2017.

(3) Includes 46 stores in Asia and 8 stores in the Middle East.

ALL BRANDS TOTAL U.S. CANADA EUROPE

REST OF

WORLD (3)

START OF Q3 2017 891 703 18 117 53

OPENINGS 2 1 — — 1

CLOSINGS (4) (4) — — —

END OF Q3 2017 889 700 18 117 54

HOLLISTER (1)

START OF Q3 2017 542 397 11 100 34

OPENINGS — — — — —

CLOSINGS (1) (1) — — —

END OF Q3 2017 541 396 11 100 34

ABERCROMBIE (2)

START OF Q3 2017 349 306 7 17 19

OPENINGS 2 1 — — 1

CLOSINGS (3) (3) — — —

END OF Q3 2017 348 304 7 17 20

12

OUTLOOK

FOR THE FOURTH QUARTER OF FISCAL 2017, THE COMPANY EXPECTS:

• COMPARABLE SALES TO BE UP LOW-SINGLE DIGITS, AND NET SALES TO BE UP MID- TO HIGH-SINGLE DIGITS,

INCLUDING BENEFITS FROM THE 53RD WEEK AND CHANGES IN FOREIGN CURRENCY EXCHANGE RATES

• THE 53RD WEEK TO BENEFIT NET SALES BY APPROXIMATELY $38 MILLION AND OPERATING INCOME BY

APPROXIMATELY $2 MILLION

• CHANGES IN FOREIGN CURRENCY EXCHANGE RATES TO BENEFIT NET SALES BY APPROXIMATELY $20

MILLION AND OPERATING INCOME BY APPROXIMATELY $5 MILLION, NET OF HEDGING

• A GROSS PROFIT RATE DOWN APPROXIMATELY 100 BASIS POINTS TO LAST YEAR'S RATE OF 59.3%, IN LINE

WITH THE THIRD QUARTER YEAR-OVER-YEAR DECLINE

• OPERATING EXPENSE, INCLUDING OTHER OPERATING INCOME, TO BE DOWN APPROXIMATELY 1% FROM

$553.7 MILLION LAST YEAR, WITH EXPENSE REDUCTIONS PARTIALLY OFFSET BY INCREASES IN VOLUME-

RELATED EXPENSES FROM HIGHER SALES AND THE ADVERSE EFFECT FROM CHANGES IN FOREIGN

CURRENCY EXCHANGE RATES

• THE EFFECTIVE TAX RATE TO BE IN THE MID 30S

• A WEIGHTED AVERAGE DILUTED SHARE COUNT OF APPROXIMATELY 70 MILLION SHARES, EXCLUDING THE

EFFECT OF POTENTIAL SHARE BUYBACKS

THE COMPANY NOW EXPECTS FULL YEAR CAPITAL EXPENDITURES TO BE APPROXIMATELY $110 MILLION