Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - APX Group Holdings, Inc. | d468856dex991.htm |

| 8-K - FORM 8-K - APX Group Holdings, Inc. | d468856d8k.htm |

Exhibit 99.2

APX Group Holdings, Inc. - Third Quarter 2017 Earnings Call and Webcast, November 14, 2017

CORPORATE PARTICIPANTS

Dale R. Gerard, Senior Vice President, Finance & Treasurer

Todd R. Pedersen, Chairman, Chief Executive Officer & Co-Founder

Mark J. Davies, Chief Financial Officer

Alexander J. Dunn, President & Director

CONFERENCE CALL PARTICIPANTS

Jeffrey Kessler, Imperial Capital

Geoffrey McKinney, Deutsche Bank AG

PRESENTATION

Operator:

Good afternoon. My name is Chantal, and I will be your conference Operator today. At this time, I would like to welcome everyone to Vivint’s Third Quarter 2017 Earnings Call and Webcast. All lines have been placed on mute to prevent any background noise. After the speakers’ remarks, there will be a question-and-answer session. If you would like to ask a question during this time, simply press star, then the number one on your telephone keypad. If you would like to withdraw your question, press the pound key. Thank you.

Dale Gerard, Senior Vice President of Finance and Treasurer, you may begin your conference.

Dale R. Gerard:

Thanks, Chantal. Good afternoon, everyone. Thanks for joining us this afternoon to discuss our results for the three-month period ended September 30, 2017. Joining me on the conference call this afternoon are Todd Pedersen, APX Chief Executive Officer; Alex Dunn, APX Group’s President; and Mark Davies, APX Group’s Chief Financial Officer.

I would like to begin by reminding everyone that today’s discussion may contain forward—certain forward-looking statements, including with regard to the Company’s future performance and prospects. Forward-looking statements are inherently subject to risks, uncertainties and assumptions and are not guarantees of performance. You should not put undue reliance on these statements. You should understand that a number of important factors, including the items discussed under the Risk Factors in our most recent annual report on Form 10-K, such as factors—such factors may be updated from time to time in our filings with the SEC, which are available on the Investor Relations section of our website, could cause actual

1

APX Group Holdings, Inc. - Third Quarter 2017 Earnings Call and Webcast, November 14, 2017

results to differ materially from those expressed or implied in our forward-looking statements. The Company undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

In today’s remarks, we will also refer to certain non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most comparable measures calculated and presented in accordance with GAAP are available on the earnings release and the accompanying presentation or in the Financial Information page of the Investor Relations portion of our website.

Now I’ll turn the call over to Todd.

Todd R. Pedersen:

Thanks, Dale. As always, we’ve had a very busy year. Q3 is no different. We’ve got projects that we started to implement during the year, some investments that we’ve been making, new products, new sales processes. Obviously, we released a new financing structure for our customers. Some of these, I’ve got a little bit better view on them in Q3, so I will go through some of those. We’ve continued to make investment in service, employees, process and IT. Those are going to continue and we hope drive consumer satisfaction, NPS scores, easier onboarding for the consumer. With some of the new channels that we’ve launched this year, there are some definite changes to IT, and the processes that need to come along with those. Those are coming along nicely, and we’re going to see results to that over time.

Sales is obviously something that we’ve focused on with the Flex Pay coming about this year. Obviously, there was change to how we executed the sale. The fact that we’re now two contracts, one with us, one with Citizens with a consumer, that did change how customers were sold, the whole process. We have had to focus on sales to try to get that back to par, and we’ve done that. It did take some time. I think we had mentioned we felt there was going to be some pullback in productivity, which we did see. But we’ve come back full force and are very happy that we made this step because it’s been phenomenal.

Then, obviously, with product, we’ve been making incremental changes. No major releases of product but incremental changes to reliability and usability of the products that we have in the consumer’s home where we think that’s going to drive customer satisfaction, lower service costs, higher NPS scores also, so those are necessary changes. We think we’ll see quite a bit of impact from that investment, although, I guess, investments, because there’s quite a few things we’re working on over the next few quarters and especially the next couple of years.

Again, we’ve talked about Flex Pay quite a bit. But we think this is the single biggest decision that we’ve made in the Company as far as positive impact to help—well, one, to help the consumer. It’s a great product for the consumer, but it’s also great from the Company from a balance sheet perspective. Sixty-nine percent of our customers this quarter, this past quarter, Q3, utilized Flex Pay, either Flex Pay or paid-in-full. We’re kind of right at what we hoped for from a percentage of people utilizing that product. Eighty-eight million dollars of cash was collected at the point of sale during the quarter, which is, for us, phenomenal, astounding. We’re happy with that.

We’ve talked some about the Best Buy partnership and our general retail focus. This is a very new part to our business. We think it’s—as you do anything that’s new that hasn’t been done by the Company before, it takes a lot of effort and focus. At the end of Q3, we had 350 chain stores open. We now have 450 Best Buy stores fully opened up, and we have some test stores with another retail partner that are open also in full test mode right now. We’re very bullish on this part of the business, but as I said, it’s new. It’s different than what we’ve done before. We are integrated inside of the store, someone else’s store, not ours, not controlled by us. But we see that there is very big potential for the Company from a sales perspective but also branding. There’s—millions of people are coming to these stores on a daily basis, and so we see a

2

APX Group Holdings, Inc. - Third Quarter 2017 Earnings Call and Webcast, November 14, 2017

lot of upside from different areas in having this partnership, and we’re very focused on it. I will say, and you’ll probably ask anyway, that it’s going to take time for us to get to the point that we stabilize that part of the business. We have a lot of sales people that are brand new to Vivint, brand new to selling a Smart Home that have never worked inside of a Best Buy structure that are being up and trained right now. But we feel confident that we’re going to get that accomplished. It’s just going to take some time and some focus.

During the holiday season, which, if you follow Best Buy at all or any retail generally, that will be a very important season for us. We’re supplementing our local Best Buy salespeople and Management with our sales leadership and experienced sales people from Vivint for about a six-week period. One, there’s quite a bit of increased foot traffic in the stores. We did not want to scale up and then scale back and essentially fire people post-holiday season. We really wanted to take advantage of the knowledge and skill set of our direct-to-home sales force in going out in the market and working side by side with our retail agents and helping them understand how to present the product and the service, represent Vivint, pricing and really walk the customer through the process A to Z. This is a major advantage that Vivint has compared to any other organization. We’d want to try to do something like roll out full nationwide retail operations, so we’re very bullish on it. But again, it’s going to take some time to get that stabilized but see a lot of future in that.

With that, I’m going to turn it over to Mark.

Mark J. Davies:

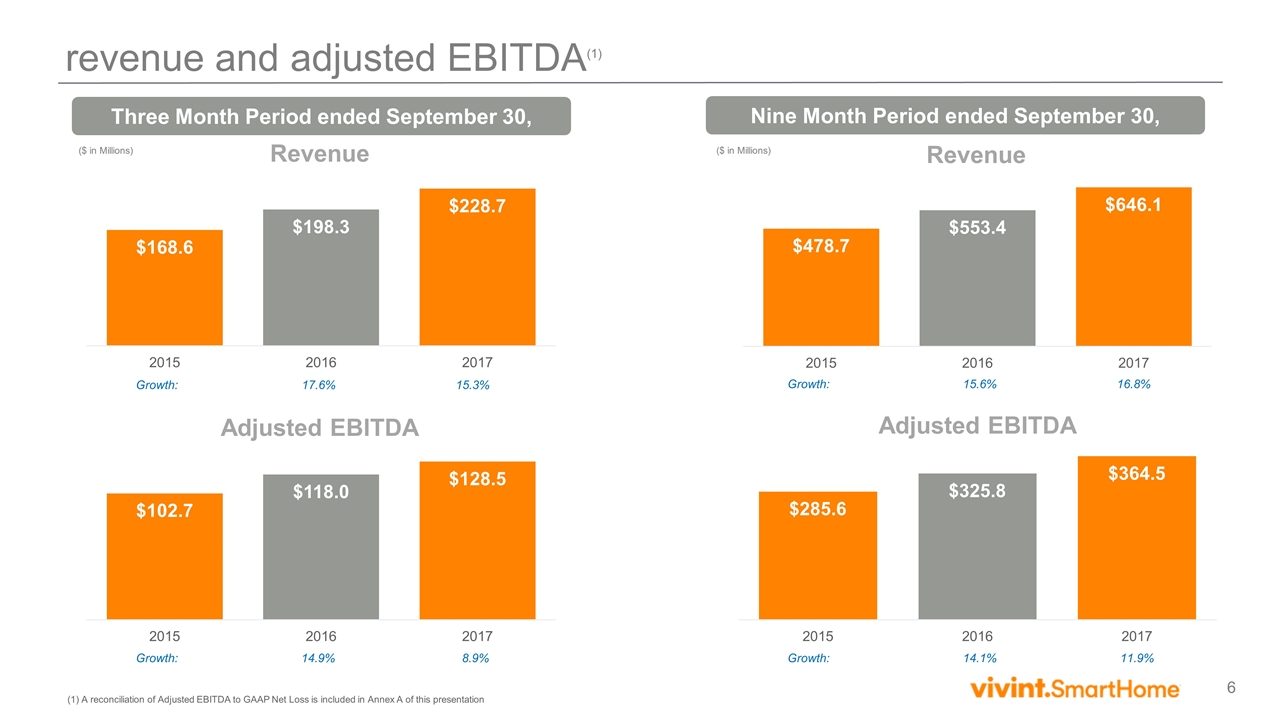

Okay. Let’s go through some of the financials here. There’s a deck that you might want to follow along with. We’re on Page six. On the left-hand side, we’ll just walk through the quarterly results. Revenue was up $30 million to $228 million. Twenty-one million dollars of that increase came up from subs, incremental subscribers during the year-over-year period, and about $10 million of that is growth in the hardware sales from the Flex Pay program that we’ll continue to see come on as revenue over the—as we evolve and sell more through the Flex Pay program.

The Adjusted EBITDA, that rose $10 million to $128 million. That’s up 9% for the year-over-year period. I would point out that there was about $7 million of Best Buy startup costs in that, which we signaled earlier this year that there would be expenses to bring up these 350 stores that we exited Q3 with, about $4 million in G&A and about $3 million in service and operations cost around G&A. If you normalize for that, then we would have had a pretty normal scaling quarter, would have been about a 15% rise in EBITDA, Adjusted EBITDA.

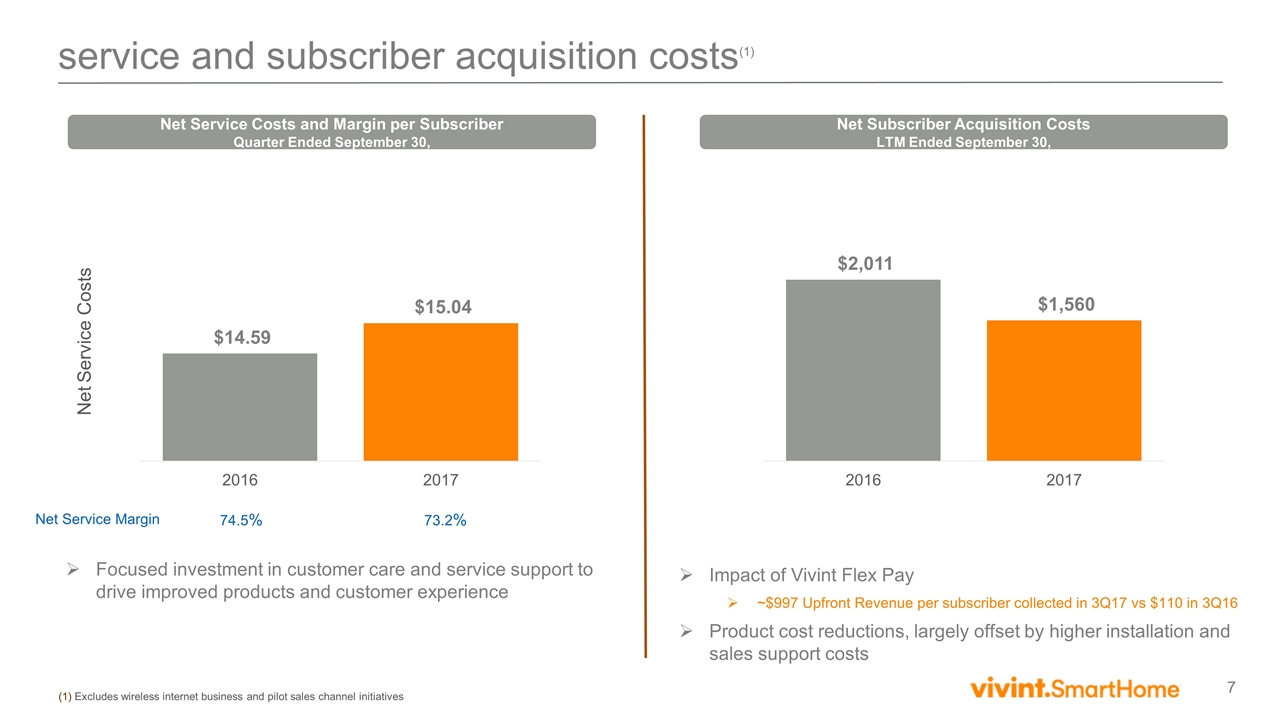

If you look at the next page on service and subscriber costs, on the left-hand side, it shows that, year-over-year, our service cost are up about $0.45 from $14.59 to $15.04, really two drivers for that. One is we chose to invest a bit more in our call center staffing, which really drives down wait times, hold times on calls coming into our centers. We’ve actually seen a pretty close correlation between hold times and NPS, transactional NPS, and so we’ve invested some there. About 1/3 of the raise year-over-year is due to payment processing. With the Flex Pay, we’ve had an increase in credit card payments versus ACH or debits to checking accounts. That has a higher cost of—as everyone knows—to process a credit card. That’s something that is a by-product, the negative by-product of consumer financing. I should point out also that, while it’s up year-over-year on service costs, it’s actually down quarter-over-quarter. It’s actually down $0.41 from $15.45 in Q2, and that’s really volume scaling on the fixed cost portion of the service cost center.

On the right-hand side of the page, talk a little bit about subscriber acquisition costs, pretty significant move year-over-year. Last year, we had a net subscriber cost, which is total net cost of putting on a subscriber less cash that we receive at point of sale. Last year, we received about $110 at point of sale.

3

APX Group Holdings, Inc. - Third Quarter 2017 Earnings Call and Webcast, November 14, 2017

This year, we’re receiving about $997 on average across all of the payment programs, which has brought our last 12-month creation cost down by about $451 to $1,560. You can see that there’s really only about a quarter’s worth of Flex Pay run rate in this metric since its trailing 12 months. I think you’ll see that kind of flatline or come into a run rate of about $1,200 when we get a full four quarters in that metric.

I kind of—I guess I would also say that the average—and this is like Todd was saying, we think this is really pretty favorable from a customer perspective. We didn’t expect this, but we’re actually selling more hardware per sale than we did last year. We’re now up to about $1,500 average through all of the channels, so that’s kind have been a positive impact to us. We’re driving, on aggregate, about a 50% margin on that hardware sale. That’s a bit of color around how Flex Pay has impacted acquisition costs.

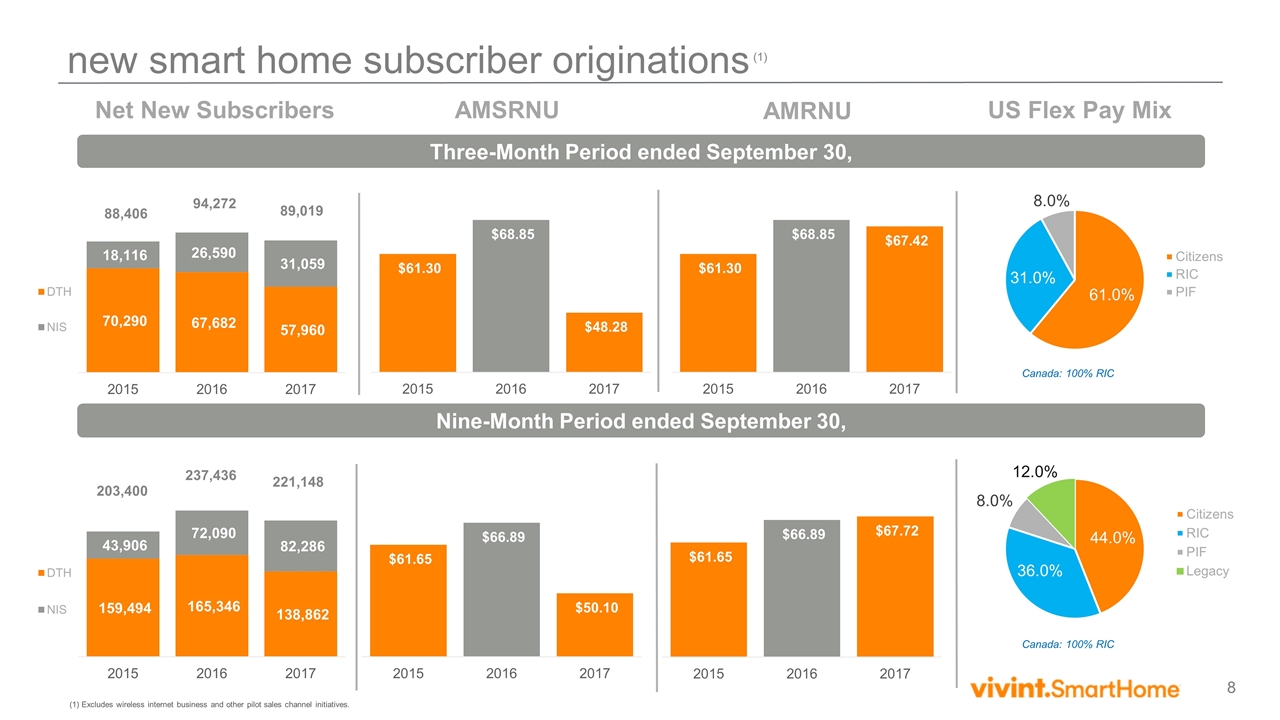

Also, there’s a few changes on our per-user metric. If you look at Slide 8, from the left-hand side, we’ll start with sales. We put on 89,000 new subs during the quarter. That’s down about 5,000 year-over-year. The decline is really per-rep average productivity, sales productivity, which we believe is primarily related to the new program of Flex Pay versus the old model where we gave hardware away for free, basically. We saw that the per-rep average started coming back towards the end of Q3, and we’re fairly confident that we will quickly come back to the pre-Flex Pay run rate on sales per sales rep.

In our inside sales, we actually had good growth year-over-year, quarter-over-quarter, so it’s easier and quicker to roll out the new product offering of Flex Pay through our inside sales. It’s a smaller sales force. They’re all held in one physical location. It’s easier to come up to speed on that.

In terms of ARPUs, or average revenue per user, there’s a change with this new offering. We have both hardware revenue and service revenue. You see on this $48.28, we call it average service revenue per new user, which is this RNU metric. We’re averaging about 85% of our sales across all of our channels are the Smart Home with video. If you recall, we have two packages, $49.99 with Smart Home and cameras or $39.99 if you don’t take cameras. About 85% are taking cameras. Therefore, 15% are at $39.99, and that averages about $48.28. Mix is a bit different by channel.

Then if you walk over to the next set of columns, you’ll take—you’ll see the $67.42, and that includes the hardware amortization. There’s a $48.28 and about $19 of hardware revenue, which is coming off the balance sheet. All of our hardware revenue is capitalized and put on as deferred revenue, and then it comes off over a 15-year period according to GAAP. You see a slight decrease in average total revenue, even though we’re selling more hardware than last year, because of the way the amortization periods work. But that’s kind of how you can track year-over-year metrics with hardware and service.

Then on the far right, this is a bit of a mix indication. Of the 100% of sales in the U.S., about 8% of our sales paid cash at point of sale. They use their own credit cards, their own checks to pay that $1,500 upfront. About 61% during Q3 paid using the Citizens program, and about 31% paid on installment contracts that we funded.

You’ll see right below that for the mix by—over the entire nine-month period. You’ll see that, that 44% had moved up to 61% for the amount of Citizens funding. We didn’t have this fully turned on in Q1 or Q2, so there’s kind of a ramp. I think you’ll see, roughly, we’ll stabilize at the Citizens mix around 70% or so, high 60% to 70%. A lot of cash flow. That’s what generated that $88 million in the quarter that Todd mentioned through either paid-in-full or Citizens.

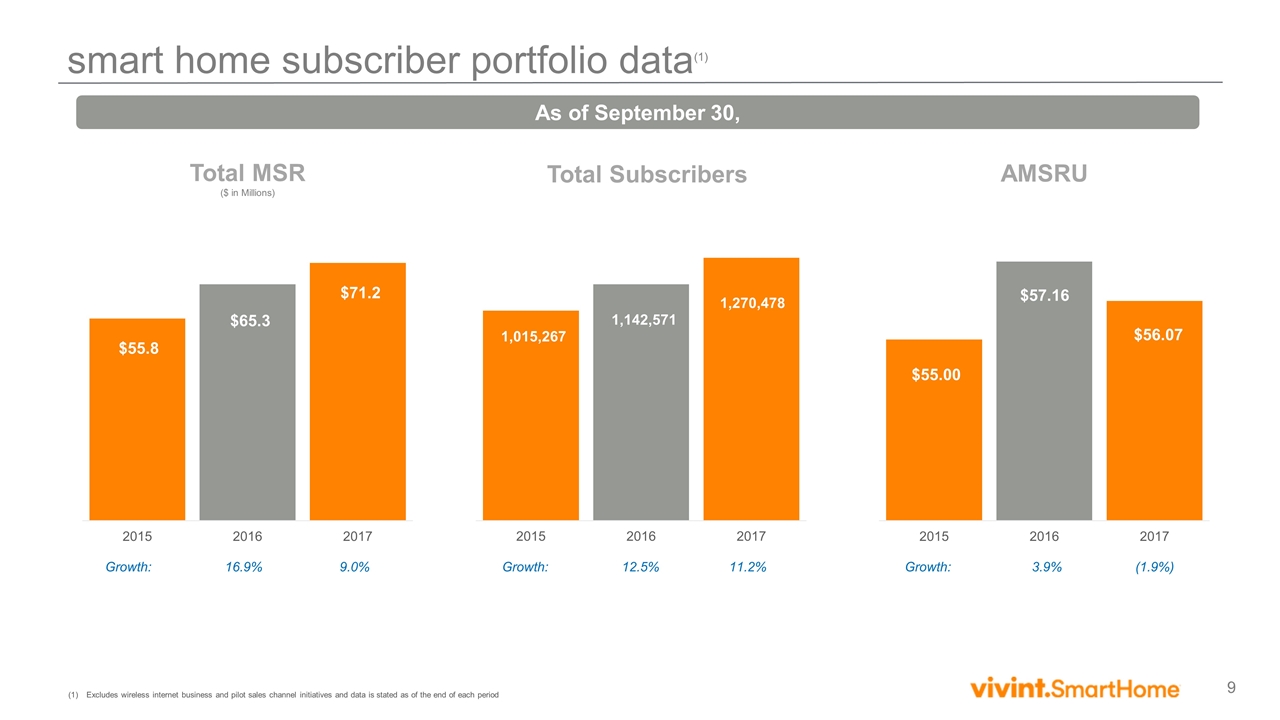

Kind of standard metrics that we show you on this next page. Our total recurring revenue at the end of Q3, which is the contracted, high-margin, long-term revenue was $71 million. Then there’s about a $3 million hardware amortization that’s coming off over time that’s on top of that. That $71 million is a service. Total subscribers moved up to 1.27 million. As we talked about, the service revenue here on a portfolio basis came down slightly to $56.07 and that’s really because we split the hardware and the

4

APX Group Holdings, Inc. - Third Quarter 2017 Earnings Call and Webcast, November 14, 2017

software. You’ll see, we’ll kind of asymptotically get to about $49 on the service revenue, probably a little less meaningful going forward because we have these two packages now and the differentiation in packages coming in through hardware. That’s how we’ll see that metric going forward.

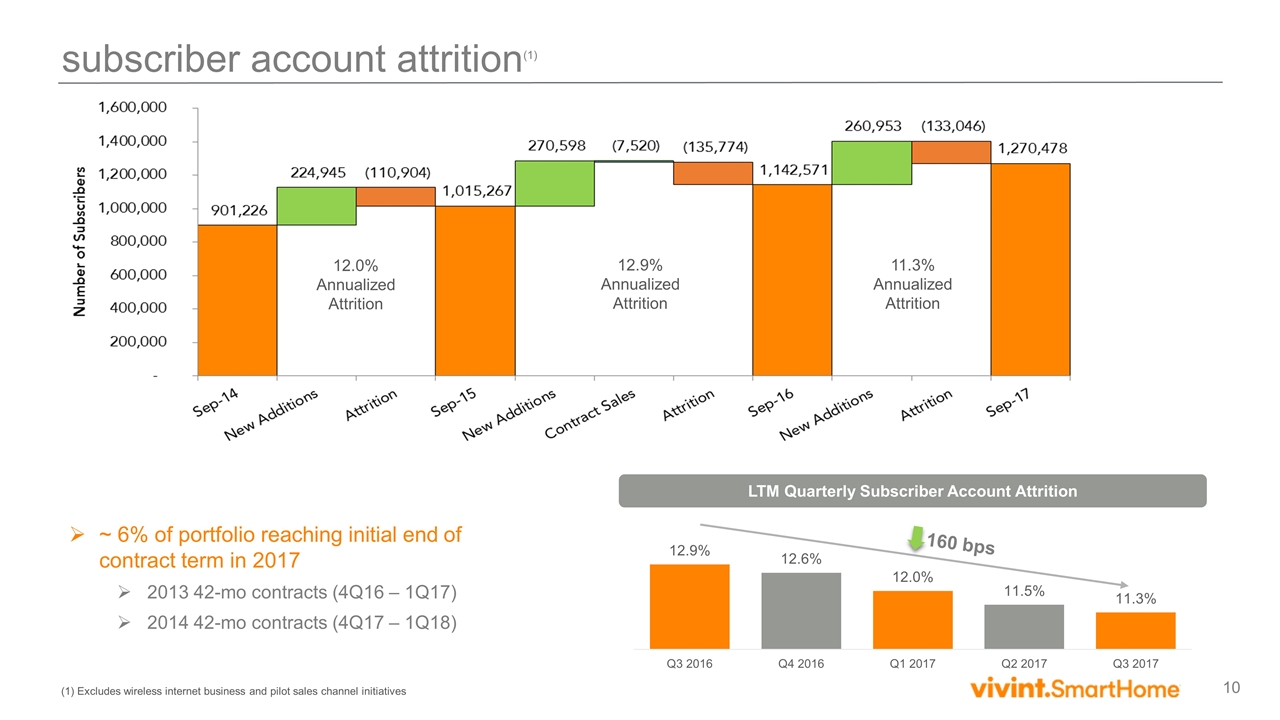

Finally, standard chart that we show on attrition. Attrition was pretty good for the quarter. The trailing 12 months was 11.3%. That was down from 12.9 % a year ago and even down from last quarter, which was 11.5%. We feel pretty good about customer retention and churn. We put on about 261,000 customers over the last year and lost about 133 on that 11.3% attrition.

I think that’s a pretty good summary of where we are on our financials as it relates to where the Company has—how the Company has moved through Q3. I guess I’ll turn this back over to Todd to give a summary of where we are in the year and then to maybe open up for Q&A.

Todd R. Pedersen:

Yes. Just some things, and kind of repeating a little bit of what I said to start with. Some of the priorities for ‘17 are things that I’ve stated already: continued focus on IT implementation to improve processes and current business and some of the new initiatives with small and big box retail. They’re super important. Obviously, interacting with sales people and customers, you want to make things as seamless as possible. We’re working towards that, and we think we’re making the right investments in those areas.

Customer experience, which includes investment in product and reliability and connectivity of product. Some of the investments we’ve made are somewhat for the future with some of those same things in mind, and again, always focused on delivering great service to the customer, which we think will drive NPS scores and satisfaction to our consumers.

Sales activity is another area of focus. We are intending to start to expand our direct-to-home program for—coming to this next year. We’ve opened up some—a few new recruiting offices. We think we’ll see some impact in the 2018 season on number of overall sales reps. Best Buy is a huge initiative for us. The holiday season, there’s a lot of traffic and a lot of people coming through, a great opportunity for us to present our product and services to those consumers. We’re excited with the fact that we have our support of our experienced direct-to-home sales force in talking to those customers but then also doing a large amount of training for our new hires in that portion of the business.

Then one other thing I would say, just from a market positioning perspective, I think more than ever, we are confident. We’ve always been confident but just kind of seeing the competitive landscape out there. The single-point solution products are not Smart Home. They’re a Smart Home product. They’re a single-point solution, but they’re not solving to what we’re trying to solve to, which is making sure that people’s lives are easier and you can live in a home that’s more self-driving or autonomous, like when they speak about a car, the autonomous car. We’re trying to build the autonomous home, so that it’s seamless. It knows the consumer. It knows what’s happening in a real-time basis.

With that, that requires everything that we do. We’ve got the technology platform. We’ve got to own it. We’ve got to control it. We have to have people involved in the process that do the sales, do the installation. When they do the installation, they’ve got to install the right equipment, the right products, the right sensors and peripherals in the right area. We collect real data, the correct data to deliver on the self-driving or autonomous home. We already have—believe we’re ahead of anyone else in that area. We think we’ve got an incredible game plan towards that. It’s going to require a lot of work for us to get to where we feel consumers are going to demand that we are from a service perspective and use case perspective in the upcoming years, but we think there’s a massive market opportunity. There are definite other business opportunities and partnerships that will be available if we pull this off properly, and we think we’re on track to do that. We’ve got a lot of excitement over what we’re doing currently, what we’re working on for the future. Of course, as always, we appreciate your support being on the call, just being part of this over the years and letting us do what we do.

5

APX Group Holdings, Inc. - Third Quarter 2017 Earnings Call and Webcast, November 14, 2017

With that, we’ll probably turn it over to Q&A.

Mark J. Davies:

All right. Chantal, we’re ready to start taking questions.

Operator:

At this time, I would like to remind everyone, in order to ask a question, press star, then number one on your telephone keypad. We will pause for just a moment to compile the Q&A roster.

Your first question comes from Jeff Kessler with Imperial Capital. Your line is open.

Jeffrey Kessler:

Thanks. Hi, guys. How are you doing?

Todd R. Pedersen:

Great.

Jeffrey Kessler:

Quick—a couple of quick questions. One, you mentioned that the hardware component of the sale, the percentage going into hardware, has gone up as you’ve begun to feel out what the sales component will be at Best Buy. Can you talk a little bit about this? Are there any ramifications about—with regard to payback period, with regard to the type of customer who’s taking this? I mean, what is this indicating to you?

Todd R. Pedersen:

Yes. Just so you know, Jeff, this is across all channels, core hardware across all channels. I think if you’ve taken a look at our pricing model previously, we had packages, predetermined packages for the consumer. There was some flexibility in it. They could add things. But the interesting part about this, this year is this is consumer choice. They’re going through and picking the hardware they want with our direct-to-home sales force or the person in retail or the person over the phone, but they’re choosing—we’re not—we didn’t build a bigger package. The consumers are building a bigger package for themselves, and we think this is going to be a trend that we could see continue. Again, a lot of it is based on consumer awareness and demand and understanding of what’s possible in the Smart Home. But it’s been a great—what’s that?

Mark J. Davies:

Jeff, this significantly reduces the time to breakeven. On the Flex Pay cash program, we’ve seen our IRR go up significantly. We’ve seen our time to breakeven go down by 2/3, so it’s a much better financial model for us.

6

APX Group Holdings, Inc. - Third Quarter 2017 Earnings Call and Webcast, November 14, 2017

Jeffrey Kessler:

Had you modeled 30% that you would—30% of the Flex that you would be financing? Or is that something—you mentioned that you expect that the Citizens percentage is going to go up and stabilize at a higher level.

Mark J. Davies:

We modeled about 30%. I mean, we—Dale Gerard’s team did a pretty good job of working with the Heros and Citizens team to work through the underwriting algorithms, and we knew we would have about this take rate. I guess the one thing that’s kind of a pleasant surprise that we didn’t expect, we did not expect 8% of our customers to just pay in full. That’s certainly the most efficient way to do this from our perspective, and we haven’t, at this point, incented any sort of either sales commission or a customer incentive to pay in full. But that’s something that we could look at in the future.

Todd R. Pedersen:

No. I mean, last year, we had tens of customers paid in full. This year, 8%, that’s pretty phenomenal. We’re pretty excited about that.

Jeffrey Kessler:

Okay. Just one final question. The Best Buy experience, if you have—obviously, when you walk into a Best Buy, you are not the only game in town when you walk into Best Buy. There’s different games, I should say, different ways of buying into either point products or a fully integrated product like yours. Can you describe how you intend to—how you’re positioning yourself? What the consumer, walking into Best Buy, sees when they go into that big department, that Best Buy, depending on to keep that in business?

Alexander J. Dunn:

Yes. This is Alex, Jeff. There’s actually a picture in the presentation of what that looks like, and so we’re positioned right there in the Smart Home section. It’s a Best Buy Smart Home powered by Vivint. I think the strategy too is, is that we’re on—on our platform, we’re connected to many of the other third-party devices that are being sold in the store. We don’t actually think it—in most cases, have to be mutually exclusive one or the other, but that we can really help improve the experience of many products that are sold in that section. We’re right—the picture is in the presentation, and that’s kind of how we’re positioned.

Todd R. Pedersen:

Yes. I think, Jeff, we’ll see in the future, there’ll probably be more product integrations on our platform, and now it’s hitting on the head. Those other products that are inside of the Best Buy store, they help us and we help them. It’s not necessarily competitive. It’s beneficial. Now, someone may want just a single-point solution initially, and that’s fine. But we—most of the product or the segment winners, I guess, high-selling product segments, we’re integrated with those folks so we think it’s kind of a helpful partnership more than a competitive situation.

Jeffrey Kessler:

Thank you very much.

Operator:

Again, if you would like to ask a question, press star, then the number one on your telephone keypad.

7

APX Group Holdings, Inc. - Third Quarter 2017 Earnings Call and Webcast, November 14, 2017

Your next question comes from Geoffrey McKinney with Deutsche Bank. Your line is open.

Geoffrey McKinney:

Hi. Thanks for the question. I guess just one question on the revolving credit facility. You increased the amount in the—during the quarter. In the context of the Flex Pay working to bring down capital intensity, can you kind of walk through the reasoning behind that increase? What drove that? What’s the incremental amount and what potentially the proceeds for that could be utilized for?

Mark J. Davies:

It was just a strategy to improve the liquidity of the business going forward. We obviously believe that our growth trajectory in terms of cash usage with Flex Pay and Citizens financing is significantly less per sub than we’ve had in the past. We do think that we will see an accelerated growth going forward with all of this channel expansion and that we may have needs for growth or investments going forward. But there is no specific use of proceeds right now for that incremental. It wasn’t—it went from $289 million to $324 million roughly.

Todd R. Pedersen:

Yes. Which then, again, one of those institutions was dropping out. As of right now, I think we’re back to roughly about $300 million in that revolving credit facility.

Geoffrey McKinney:

Okay. That helped. I guess in kind of understanding the comments around that the expectation for Flex Pay, understand the benefits of capital upfront for you guys. But you’re potentially looking to utilize some of that benefit to accelerate customer acquisition or subscriber growth. Is that the right way to think about this? Maybe we see the business grow at a greater rate than previously and kind of maintain a similar cash flow usage dynamic.

Mark J. Davies:

Yes. I think so. For example, I think what you will continue to see is the same economics for the same unit of one dynamics (phon) that we see today. I don’t think we plan on putting on less profitable or less secure customers. I think what you will see is us increase the aperture around sales, so direct-to-home sales people. We’ve been relatively stable at about 2,500 sales reps making sales during the season. We’re actually investing in recruiting right now, recruiting centers throughout the U.S., to add more sales people. I think you’ll see our direct to channel—direct-to-home channel increase. But that’s probably the best use of funds that I—If I were modeling this, it would be to either use less debt or put on more customers.

Geoffrey McKinney:

Okay. I guess, if you had a choice between the two, which would you pick?

Mark J. Davies:

We would pick more customers at this point, the breakeven, the return, the NVD IRR, with as much cash as we’re collecting upfront and the margins that we enjoy on that $48-plus service margin or service revenue is a great investment. We can’t think of a better investment, and I don’t think we would look to be paying down. We certainly aren’t thinking about a dividend. This is to give us a bigger footprint and a larger space in the market.

8

APX Group Holdings, Inc. - Third Quarter 2017 Earnings Call and Webcast, November 14, 2017

Geoffrey McKinney:

Okay. That’s helpful. Thank you, guys.

Todd R. Pedersen:

Thank you.

Operator:

Again, if you would like to ask a question, press star, then the number one on your telephone keypad.

There are no further questions at this time. I will now turn the call back over to the presenter.

Todd R. Pedersen:

Again, we appreciate everyone getting on the call. Thanks for those two questions, thought we were going to get at least three. But anyway, we look forward to having a great quarter, and we’ll get back to everyone in about three months. But again, thank you.

Mark J. Davies:

Thanks.

Operator:

This concludes this conference call. You may now disconnect.

9

APX Group Holdings, Inc. 3rd Quarter 2017 Results November 14, 2017

APX Group Holdings, Inc. (the ”Company”, “Vivint”, “we”, “our”, or “us”) obtained the industry, market and competitive position data included in this presentation from its estimates and research as well as from industry publications, surveys and studies conducted by third parties. Industry publications studies and surveys generally state that the information contained therein has been obtained from sources believed to be reliable but there can be no assurance as to the accuracy or completeness of such information. While APX Group Holdings, Inc. believes that each of the publications, studies and surveys is reliable, we have not independently verified industry, market and competitive position data from third-party sources. While we believe our internal business research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent sources. Accordingly, you should not place undue weight on the industry and market share data in this presentation. This presentation includes forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995, including but not limited to, statements related to the performance of our business, our financial results, our liquidity and capital resources, our plans, strategies and prospects, both business and financial and other non-historical statements. Forward-looking statements convey the Company’s current expectations or forecasts of future events. All statements contained in this presentation other than statements of historical fact are forward-looking statements. These statements are based on the beliefs and assumptions of our management. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or similar expressions. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of this date hereof. You should understand that the following important factors, in addition to those discussed in “Risk Factors” in our most recent annual report on Form 10K, and other reports filed with the Securities Exchange Commission (“SEC”) including our quarterly report on Form 10-Q for the quarterly period ended September 30,2017, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements: (1) risks of the smart home industry and security, including risks of and publicity surrounding the sales, subscriber origination and retention process; (2) the highly competitive nature of the smart home and security industry and product introductions and promotional activity by our competitors; (3) litigation, complaints or adverse publicity; (4) the impact of changes in consumer spending patterns, consumer preferences, local, regional, and national economic conditions, crime, weather, demographic trends and employee availability; (5) adverse publicity and product liability claims; (6) increases and/or decreases in utility and other energy costs, increased costs related to utility or governmental requirements; (7) cost increases or shortages in smart home and security technology products or components; and (8) the introduction of unsuccessful new products and services; (9) privacy and data protection laws, privacy or data breaches, or the loss of data; and (10) the impact to our business, results of operations, financial condition, regulatory compliance and customer experience of the Vivint Flex Pay plan and the Best Buy Smart Home powered by Vivint Program. In addition, the origination and retention of new subscribers will depend on various factors, including, but not limited to, market availability, subscriber interest, the availability of suitable components, the negotiation of acceptable contract terms with subscribers, local permitting, licensing and regulatory compliance, and our ability to manage anticipated expansion and to hire, train and retain personnel, the financial viability of subscribers and general economic conditions. These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this presentation are more fully described in the “Risk Factors” section of our most recent annual report on Form 10-K, as such factors may be updated from time to time in our periodic filings with the SEC. These risk factors should not be construed as exhaustive. We disclaim any obligations to and do not intend to update the above list or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. We undertake no obligations to update or revise publicly any forward-looking statements, whether a result of new information, future events, or otherwise. forward-looking statements

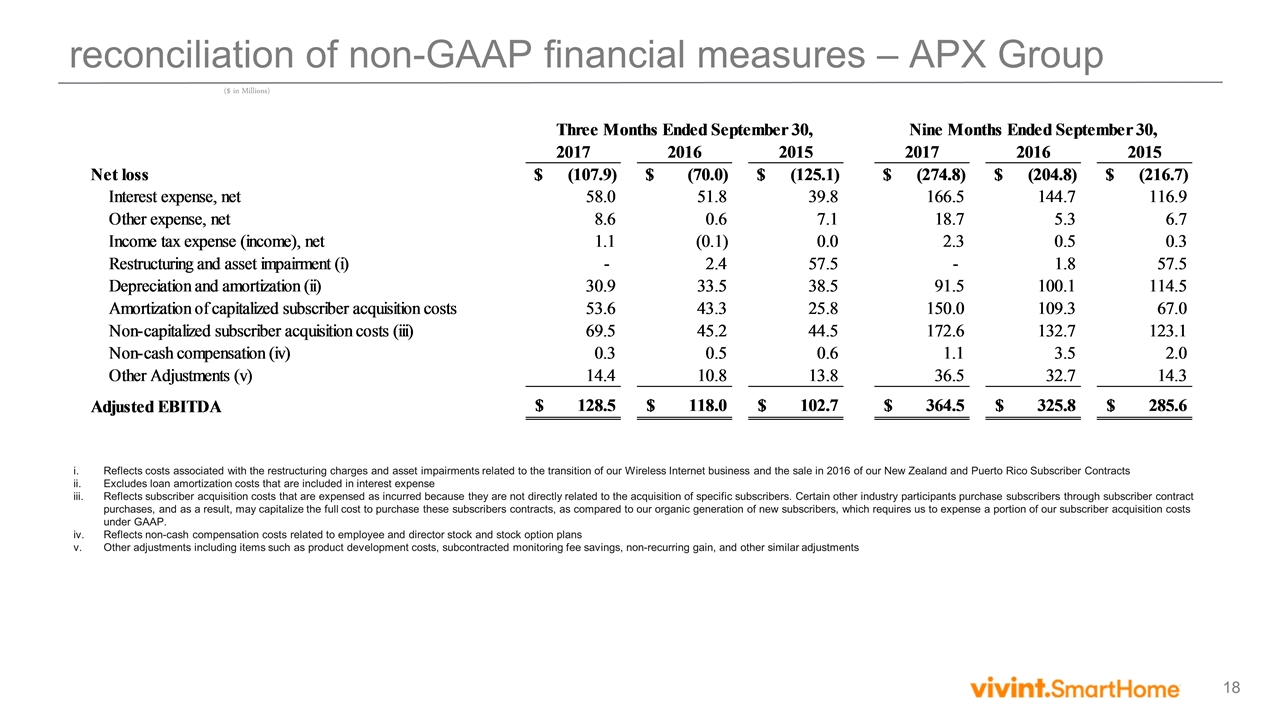

non-GAAP financial measures This presentation includes Adjusted EBITDA which is a supplemental measure that is not required by, or presented in accordance with, accounting principles generally accepted in the United States (“GAAP”). Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income or any other measure derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity. We believe the presentation of Adjusted EBITDA is appropriate to provide useful information about the flexibility we have under our covenants to investors, lenders, financial analysts and rating agencies since these groups have historically used EBITDA-related measures in our industry, along with other measures, to estimate the value of a company, to make informed investment decisions, and to evaluate a company’s ability to meet its debt service requirements. Adjusted EBITDA eliminates the effect of non-cash depreciation of tangible assets and amortization of intangible assets, much of which results from acquisitions accounted for under the purchase method of accounting. Adjusted EBITDA also eliminates the effects of interest rates and changes in capitalization which management believes may not necessarily be indicative of a company’s underlying operating performance. Adjusted EBITDA is also used by us to measure covenant compliance under the indenture governing our senior secured notes, the indenture governing our senior unsecured notes and the credit agreement governing our revolving credit facility. We caution investors that amounts presented in accordance with our definition of Adjusted EBITDA may not be comparable to similar measures disclosed by other issuers, because not all issuers and analysts calculate Adjusted EBITDA in the same manner. See Annex A of this presentation for a reconciliation of Adjusted EBITDA to net loss for the Company, which we believe is the most closely comparable financial measure calculated in accordance with GAAP. Adjusted EBITDA should be considered in addition to and not as a substitute for, or superior to, financial measures presented in accordance with GAAP.

participants Todd Pedersen Chief Executive Officer Alex Dunn President Mark Davies Chief Financial Officer Dale R. Gerard SVP, Finance & Treasurer

third quarter 2017 update Vivint Flex Pay Positive customer adoption… ~69% of new subscribers paid for the purchase of products and installation through consumer finance and paid-in-full options ~$88 million of cash collected at point of sale during the quarter Best Buy Partnership 353 stores at Q3 exit… currently fully deployed at 450 stores Supplementing holiday selling season with direct to home sales reps and installation techs Operational investments are ramping and taking shape Service: Employees, process, and IT to drive customer service and improving NPS Sales: Working through the sales productivity impact from the transition to Vivint Flex Pay in direct to home and inside sales channels Product: Deploying incremental resources to both quality and targeted technology development… system reliability, AI, video and connectivity

revenue and adjusted EBITDA(1) (1) A reconciliation of Adjusted EBITDA to GAAP Net Loss is included in Annex A of this presentation Adjusted EBITDA Three Month Period ended September 30, Revenue ($ in Millions) Growth: 17.6% 15.3% Growth: 14.9% 8.9% Revenue Adjusted EBITDA Nine Month Period ended September 30, ($ in Millions) Growth: 15.6% 16.8% Growth: 14.1% 11.9%

service and subscriber acquisition costs(1) Net Subscriber Acquisition Costs LTM Ended September 30, Net Service Costs and Margin per Subscriber Quarter Ended September 30, (1) Excludes wireless internet business and pilot sales channel initiatives Net Service Costs Net Service Margin 74.5% 73.2% Focused investment in customer care and service support to drive improved products and customer experience Impact of Vivint Flex Pay ~$997 Upfront Revenue per subscriber collected in 3Q17 vs $110 in 3Q16 Product cost reductions, largely offset by higher installation and sales support costs

Three-Month Period ended September 30, new smart home subscriber originations (1) Net New Subscribers 88,406 94,272 89,019 US Flex Pay Mix Nine-Month Period ended September 30, 203,400 237,436 221,148 AMRNU AMSRNU (1) Excludes wireless internet business and other pilot sales channel initiatives. Canada: 100% RIC Canada: 100% RIC

smart home subscriber portfolio data(1) Excludes wireless internet business and pilot sales channel initiatives and data is stated as of the end of each period As of September 30, Total Subscribers Growth: 16.9% 9.0% ($ in Millions) Total MSR Growth: 12.5% 11.2% AMSRU Growth: 3.9% (1.9%)

11.3% Annualized Attrition 12.0% Annualized Attrition 12.9% Annualized Attrition subscriber account attrition(1) ~ 6% of portfolio reaching initial end of contract term in 2017 2013 42-mo contracts (4Q16 – 1Q17) 2014 42-mo contracts (4Q17 – 1Q18) (1) Excludes wireless internet business and pilot sales channel initiatives LTM Quarterly Subscriber Account Attrition 160 bps

Management’s focus… building toward the future Priorities for the remainder of 2017 Execute on changes and improvements made in 2017… flex pay, large-format retail Vivint customer experience… technology, reliability and service System and process improvements… people, process, systems Q4 Sales activities Best Buy holiday selling season Recruiting and retention of DTH, including opening of recruiting centers Expansion of small retail format pilots Vivint’s market positioning Continue to believe that technology combined with service is the winning model in smart home Point products and voice interfaces do not overcome the barriers to smart home adoption Vision of a self-driving, diffentiated smart home experience is predicated on an integrated platform, physical presence in the home, and large number of strategically placed sensors and devices

Q&A

APX Group Holdings, Inc. Quarters Ended September 30, 2017 and 2016 Consolidated Financial Statements

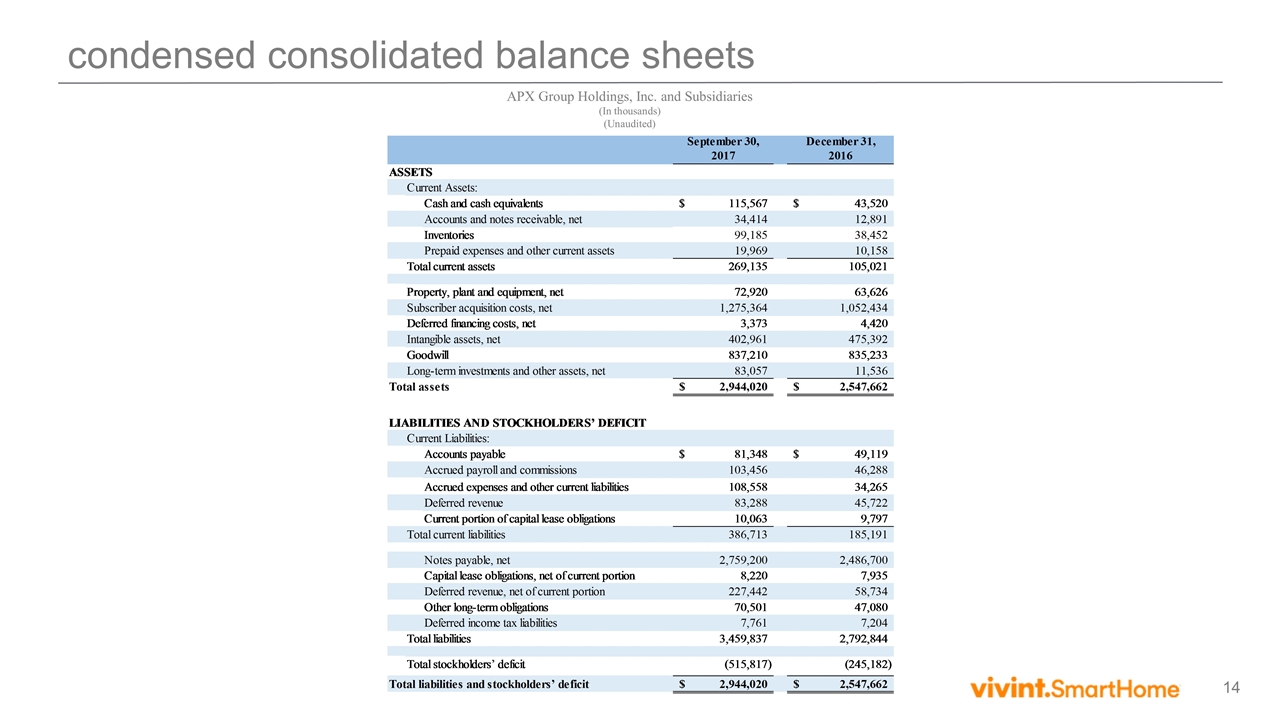

condensed consolidated balance sheets APX Group Holdings, Inc. and Subsidiaries (In thousands) (Unaudited)

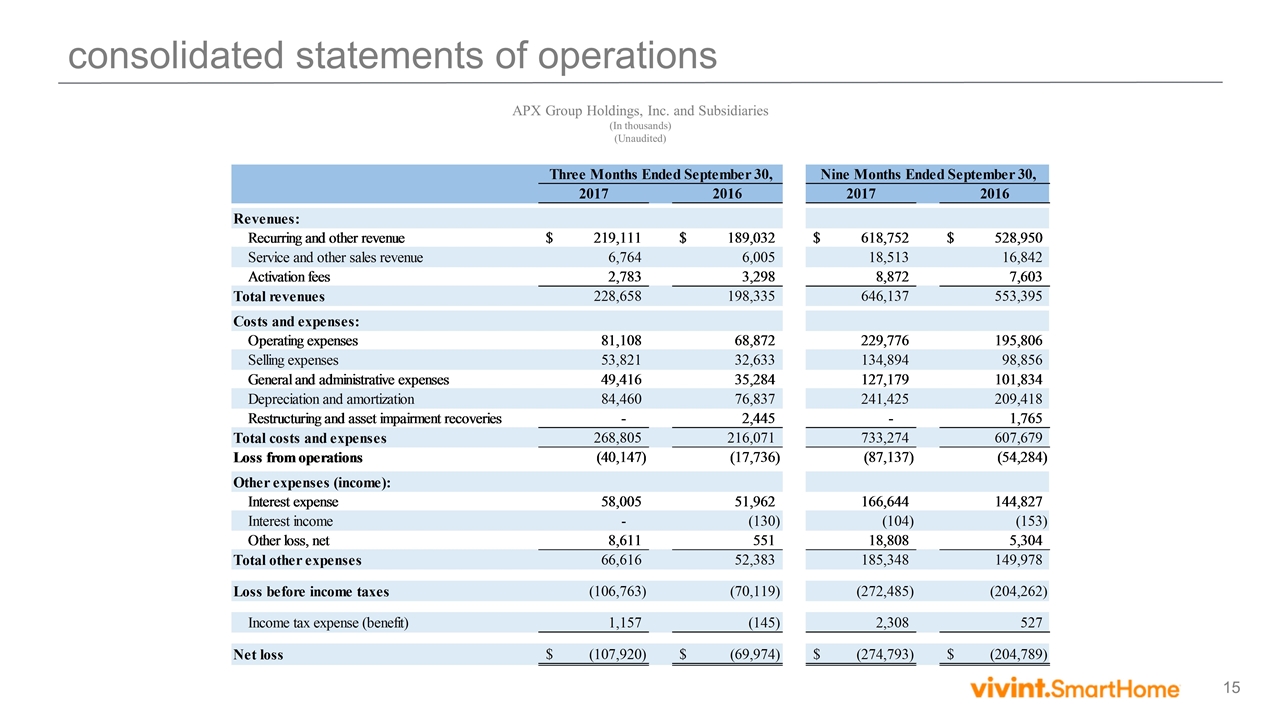

consolidated statements of operations APX Group Holdings, Inc. and Subsidiaries (In thousands) (Unaudited)

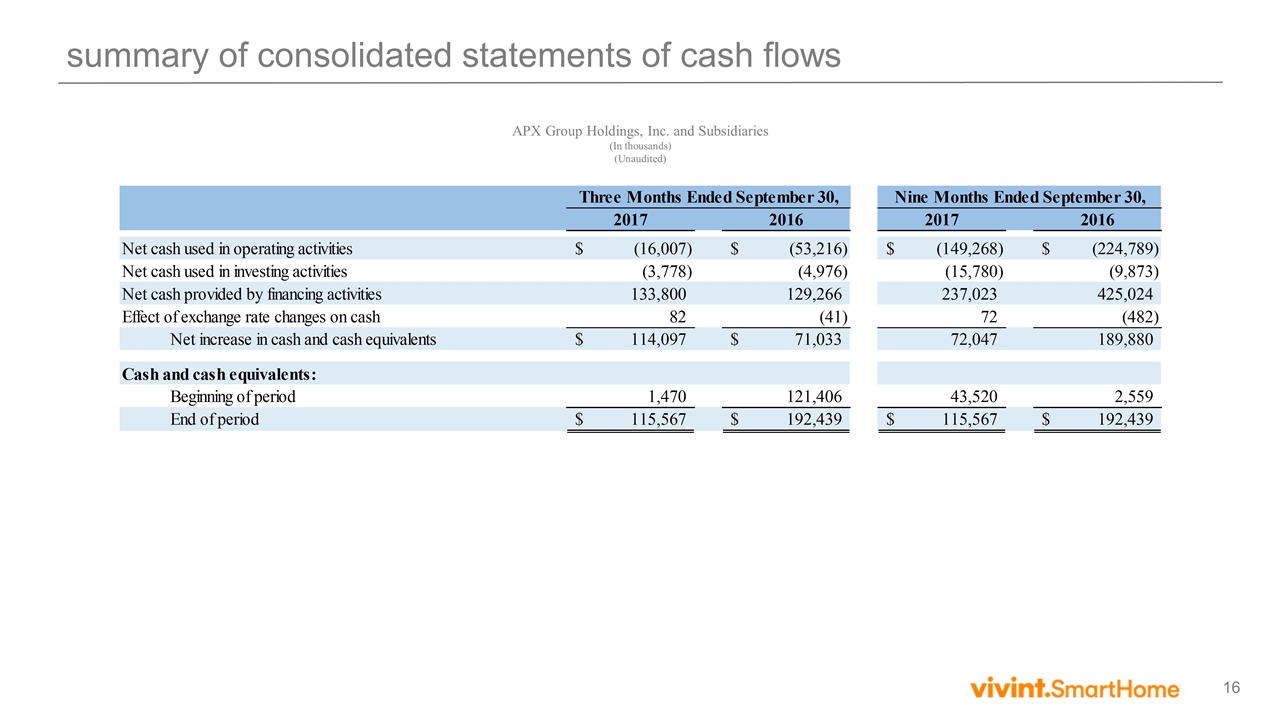

summary of consolidated statements of cash flows APX Group Holdings, Inc. and Subsidiaries (In thousands) (Unaudited)

APX Group Holdings, Inc. Annex A

reconciliation of non-GAAP financial measures – APX Group ($ in Millions) Reflects costs associated with the restructuring charges and asset impairments related to the transition of our Wireless Internet business and the sale in 2016 of our New Zealand and Puerto Rico Subscriber Contracts Excludes loan amortization costs that are included in interest expense Reflects subscriber acquisition costs that are expensed as incurred because they are not directly related to the acquisition of specific subscribers. Certain other industry participants purchase subscribers through subscriber contract purchases, and as a result, may capitalize the full cost to purchase these subscribers contracts, as compared to our organic generation of new subscribers, which requires us to expense a portion of our subscriber acquisition costs under GAAP. Reflects non-cash compensation costs related to employee and director stock and stock option plans Other adjustments including items such as product development costs, subcontracted monitoring fee savings, non-recurring gain, and other similar adjustments

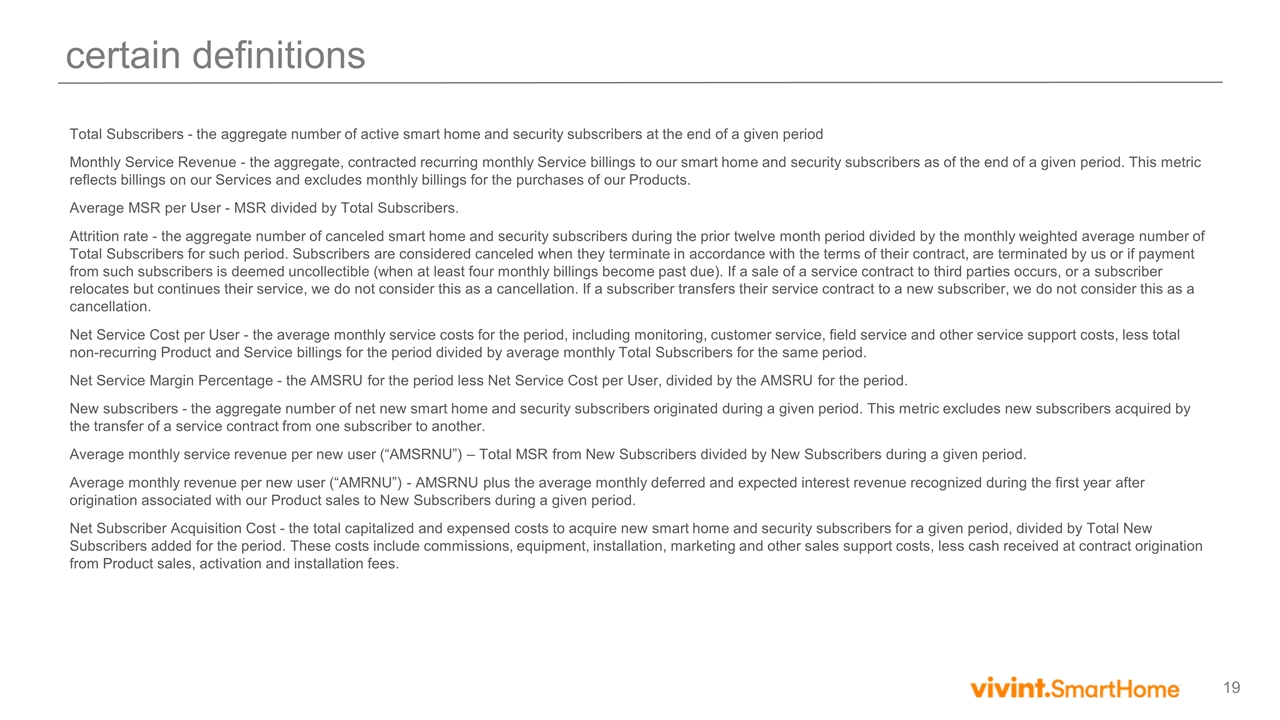

certain definitions Total Subscribers - the aggregate number of active smart home and security subscribers at the end of a given period Monthly Service Revenue - the aggregate, contracted recurring monthly Service billings to our smart home and security subscribers as of the end of a given period. This metric reflects billings on our Services and excludes monthly billings for the purchases of our Products. Average MSR per User - MSR divided by Total Subscribers. Attrition rate - the aggregate number of canceled smart home and security subscribers during the prior twelve month period divided by the monthly weighted average number of Total Subscribers for such period. Subscribers are considered canceled when they terminate in accordance with the terms of their contract, are terminated by us or if payment from such subscribers is deemed uncollectible (when at least four monthly billings become past due). If a sale of a service contract to third parties occurs, or a subscriber relocates but continues their service, we do not consider this as a cancellation. If a subscriber transfers their service contract to a new subscriber, we do not consider this as a cancellation. Net Service Cost per User - the average monthly service costs for the period, including monitoring, customer service, field service and other service support costs, less total non-recurring Product and Service billings for the period divided by average monthly Total Subscribers for the same period. Net Service Margin Percentage - the AMSRU for the period less Net Service Cost per User, divided by the AMSRU for the period. New subscribers - the aggregate number of net new smart home and security subscribers originated during a given period. This metric excludes new subscribers acquired by the transfer of a service contract from one subscriber to another. Average monthly service revenue per new user (“AMSRNU”) – Total MSR from New Subscribers divided by New Subscribers during a given period. Average monthly revenue per new user (“AMRNU”) - AMSRNU plus the average monthly deferred and expected interest revenue recognized during the first year after origination associated with our Product sales to New Subscribers during a given period. Net Subscriber Acquisition Cost - the total capitalized and expensed costs to acquire new smart home and security subscribers for a given period, divided by Total New Subscribers added for the period. These costs include commissions, equipment, installation, marketing and other sales support costs, less cash received at contract origination from Product sales, activation and installation fees.