Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Rapid7, Inc. | d465233dex991.htm |

| 8-K - 8-K - Rapid7, Inc. | d465233d8k.htm |

EXHIBIT 10.1

HUB ON CAUSEWAY

120 CAUSEWAY STREET

BOSTON, MASSACHUSETTS

Lease Dated November 16, 2017 (the “Execution Date”)

THIS INSTRUMENT IS AN INDENTURE OF LEASE in which the Landlord and the Tenant are the parties hereinafter named, and which relates to space in the building to be known as 120 Causeway Street, Boston, Massachusetts 02114.

The parties to this instrument hereby agree with each other as follows:

ARTICLE I

Reference Data

| 1.1 | Subjects Referred To |

Each reference in this Lease to any of the following subjects shall be construed to incorporate the data stated for that subject in this Article:

| Landlord: | PODIUM DEVELOPER LLC, a Delaware limited liability company | |

| Present Mailing Address of Landlord: | c/o Boston Properties Limited Partnership Prudential Center 800 Boylston Street, Suite 1900 Boston, Massachusetts 02199-8103 | |

| Landlord’s Construction Representative: | Noah Luskin | |

| Tenant: | Rapid7, Inc., a Delaware corporation | |

| Present Mailing Address of Tenant: | 100 Summer Street, Boston, Massachusetts 02110 | |

| Tenant’s Email Address for Information Regarding Billings and Statements: | peter_kaes@rapid7.com | |

| Tenant’s Construction Representative: | Jeff Kalowski | |

1

| Tenant Preliminary Plans Date: | December 22, 2017 | |

| Tenant Plans Date: | May 18, 2018 | |

| Authorization to Proceed Date: | Thirty (30) days after Landlord’s delivery to Tenant of the initial Total Costs Notice as provided in Section 1.1(A)(4) of Exhibit B-1. | |

| Long Lead Item Release Date: | July 16, 2018 | |

| Estimated Commencement Date: | June 1, 2019 | |

| Fourth Floor Rent Commencement Date: | The date that is six (6) months after the Commencement Date. | |

| Outside Completion Date: | December 1, 2019 | |

| Expiration Date: | The last day of the 126th full calendar month following the Commencement Date. | |

| Original Lease Term: | The period commencing on the Commencement Date and ending on the Expiration Date, as such period may be sooner terminated as provided in this Lease. | |

| Term or Lease Term: | The period commencing on the Commencement Date and ending on the Expiration Date, as such period may be extended or sooner terminated as provided in this Lease. | |

| Extension Options: | Two (2) periods of five (5) years each, as provided in and on the terms set forth in Section 3.2 hereof. | |

| Lease Year: | A period of twelve (12) consecutive calendar months, commencing on the first day of January in each year, except that the first Lease Year of the Lease Term hereof shall be the period commencing on the Commencement Date and ending on the succeeding December 31, and the last Lease Year of the Lease Term hereof shall be the period commencing on January 1 of the calendar year in which the Lease Term ends, and ending with the date on which the Lease Term ends. | |

2

| Rent Year: | Any twelve (12) month period during the Term of the Lease commencing as of the Commencement Date, or as of any anniversary of the Commencement Date, except that if the Commencement Date does not occur on the first day of a calendar month, then (i) the first Rent Year shall further include the partial calendar month in which the first anniversary of the Commencement Date occurs, and (ii) the remaining Rent Years shall be the successive twelve-(12)-month periods following the end of such first Rent Year. | |

| Commencement Date: | As defined in Section 3.1 of this Lease and in Exhibit B-1. | |

3

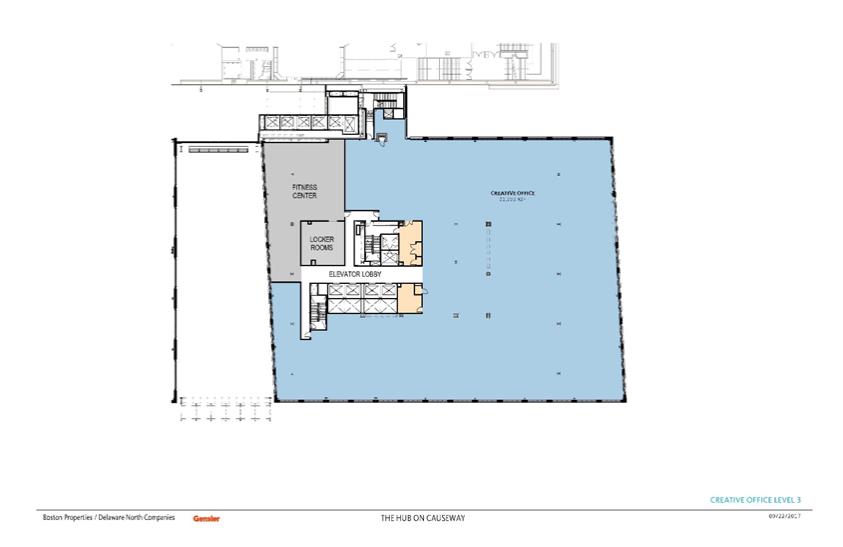

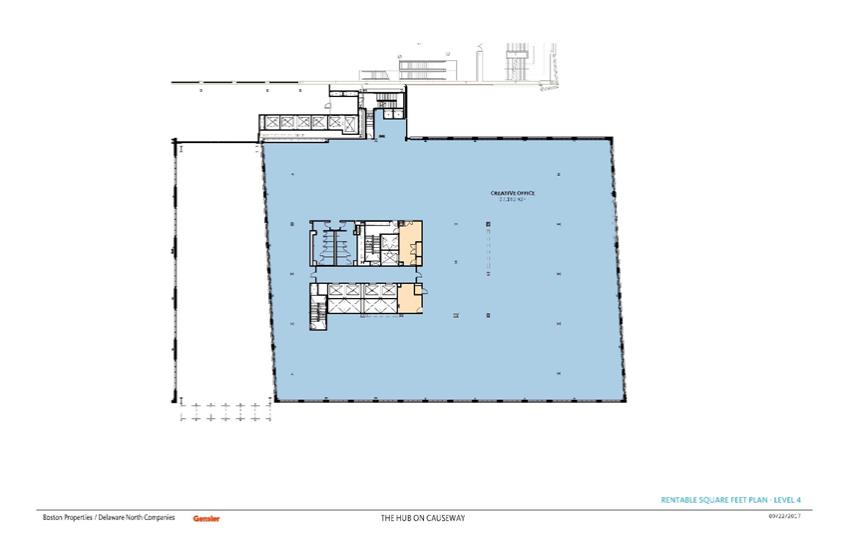

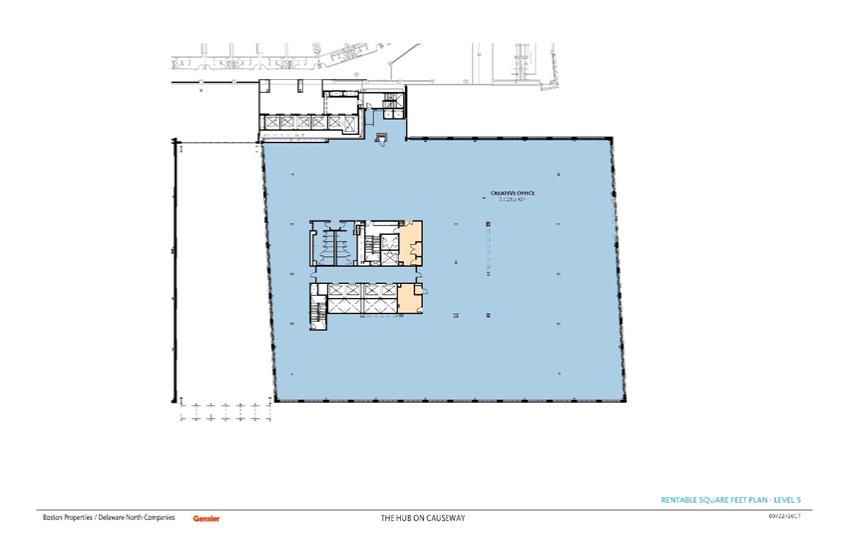

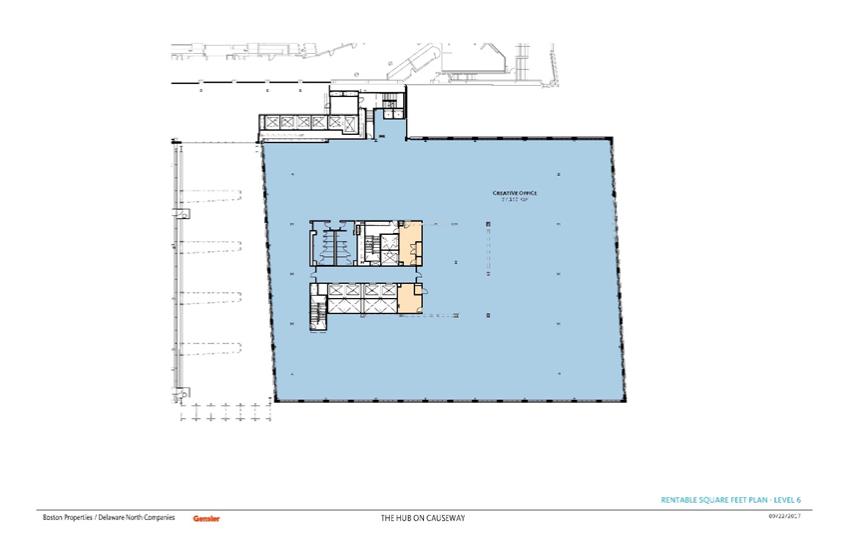

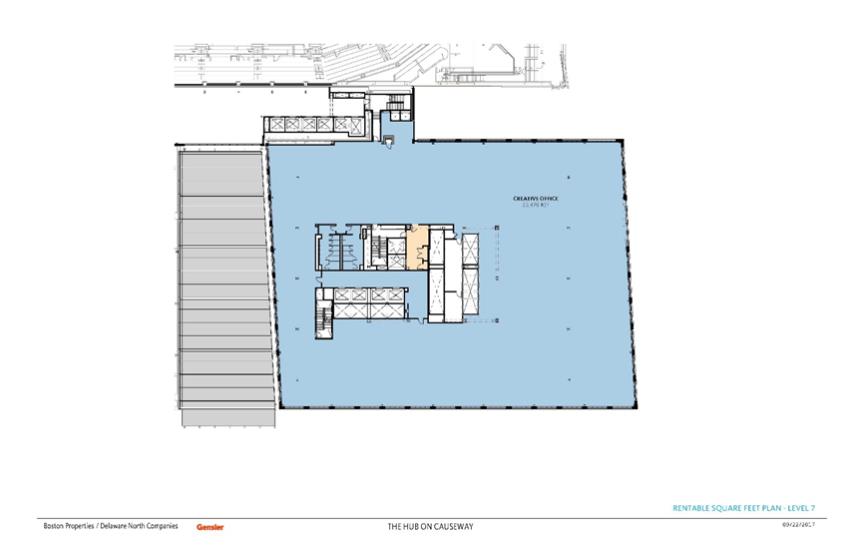

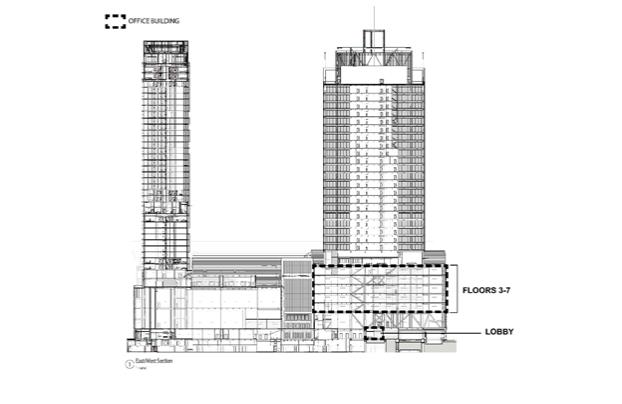

| Premises: | The entire fourth (4th), fifth (5th), sixth (6th) and seventh (7th) floors of the Office Building, which Office Building is part of the Hub Complex (as hereinafter defined), in accordance with the floor plan annexed hereto as Exhibit A-1 and incorporated herein by reference, as further defined and limited in Section 2.1 hereof. Set forth below is the conclusively agreed-upon Rentable Floor Area of each floor of the Premises

Fourth (4th) Floor: 37,163 square feet Fifth (5th) Floor: 37,265 square feet Sixth (6th) Floor: 37,163 square feet Seventh (7th) Floor 35,470 square feet

Tenant shall have the right to add to the Premises pursuant to Section 3.3 hereof the entirety of the third (3rd) floor of the Office Building and/or the entirety or a portion of the third (3rd) floor of the Office Building pursuant to Section 3.4 hereof. The conclusively agreed upon Rentable Floor Area of the third (3rd) floor is 33,993 square feet. If Tenant timely exercises its rights under Sections 3.3 and/or 3.4, then the entirety of the third (3rd) floor or portion thereof, as applicable, shall be added to the Premises on all of the same terms of this Lease that are applicable to the other floors in the Premises, except as otherwise expressly provided in this Lease. | |

| Rentable Floor Area of the Premises: | 147,061 square feet, subject to expansion pursuant to Tenant’s Expansion Option as set forth in Section 3.3, and Tenant’s Right of First Offer as set forth in Section 3.4. | |

4

| Annual Fixed Rent: | (a) During the Original Term of this Lease, Annual Fixed Rent shall be payable by Tenant as follows: |

| Rent Year |

Rate per Square Foot of Rentable Floor Area |

Annual Rate | ||||||

| 1 |

$ | 49.00 | $ | 7,205,989.00 | * | |||

| 2 |

$ | 50.00 | $ | 7,353,050.00 | ||||

| 3 |

$ | 51.00 | $ | 7,500,111.00 | ||||

| 4 |

$ | 52.00 | $ | 7,647,172.00 | ||||

| 5 |

$ | 53.00 | $ | 7,794,233.00 | ||||

| 6 |

$ | 54.00 | $ | 7,941,294.00 | ||||

| 7 |

$ | 55.00 | $ | 8,088,355.00 | ||||

| 8 |

$ | 56.00 | $ | 8,235,416.00 | ||||

| 9 |

$ | 57.00 | $ | 8,382,477.00 | ||||

| 10 |

$ | 58.00 | $ | 8,529,538.00 | ||||

| 11 |

$ | 59.00 | $ | 8,676,599.00 | ||||

*During the portion of Rent Year 1 after the Commencement Date but prior to the Fourth Floor Rent Commencement Date (“Rent Abatement Period”), the Annual Fixed Rent shall be Five Million Three Hundred Eighty Five Thousand Two and 00/100 Dollars ($5,385,002.00) (representing the Annual Fixed Rent for the fifth (5th), sixth (6th), and seventh (7th) floors of the Premises). In addition to Annual Fixed Rent with respect to the fourth (4th) floor of the Premises, the following amounts with respect to the fourth (4th) floor of the Premises shall be abated during the Rent Abatement Period: (i) Additional Rent in respect of Landlord’s Tax Expenses Allocable to the Premises, and (ii) Additional Rent in respect of Operating Expenses Allocable to the Premises.

(b) During the extension option period (if exercised), as determined pursuant to Section 3.2.

| Tenant Electricity: | See Section 5.2. |

| Additional Rent: | All charges and other sums payable by Tenant as set forth in this Lease, in addition to Annual Fixed Rent. |

| Permitted Use: | General office purposes and uses ancillary thereto. |

5

| Total Rentable Floor Area of the Office Building: | 181,054 square feet as of the Execution Date provided, however, the Total Rentable Floor Area of the Office Building, but not the Premises, may change from time to time in accordance with physical additions or subtractions and improvements to and changes in use of the Office Building (it being understood and agreed, however, the Total Rentable Floor Area of the Office Building shall not change merely by a remeasurement of the Office Building). | |

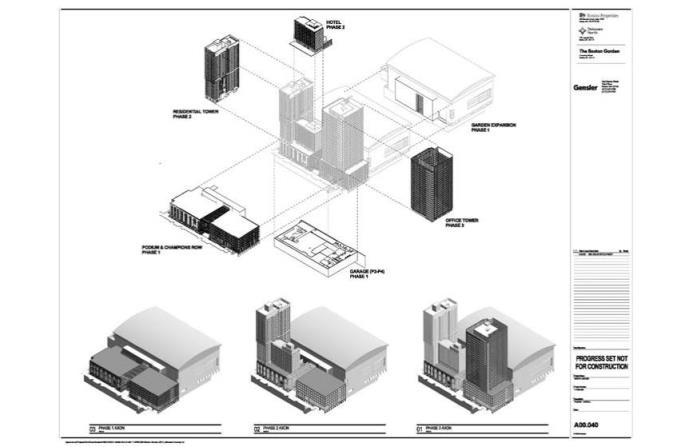

| Office Building: | For the purposes of this Lease, the Office Building shall mean the portion of the Podium Building that is designated as the “Office Building” on Exhibit A-2. Nothing in Exhibit A-2 shall be treated as a representation that any or all of the buildings for which provision is made thereon shall be constructed, or that such buildings will be located, precisely within the areas shown on Exhibit A-2, or that such buildings will be of the dimensions or shapes shown, it being the intention of Exhibit A-2 only generally to show diagrammatically, rather than precisely, the possible development of the Hub Complex as presently contemplated. Any stores which are or may be identified on Exhibit A-2 shall not be relied on by Tenant that there are or will be tenants occupying the spaces as noted on said exhibit during all or any portion of the Term of this Lease. In addition, it is acknowledged and agreed that Landlord and the other Owners of the Hub Complex may elect to construct the Hub Complex as a phased project, and that construction of certain phases may occur after the Commencement Date. | |

| Garage: | The North Station Garage, as it may be altered from time to time. | |

| Office Tower Parcel: | The parcel identified as the “Office Tower Parcel” and as described on Exhibit A-4. | |

| Office Tower: | Any building located on or within the Office Tower Parcel. | |

| Office Tower Owner | The entity that is the owner of the Office Tower. | |

6

| Hub Complex: | The center commonly referred to as the Hub on Causeway, located in the city of Boston, County of Suffolk, Commonwealth of Massachusetts, the initial boundaries of which are described on Exhibit A-3, as the same may be altered, expanded, reduced or otherwise changed from time to time. | |

| HubOwner: | Each owner of record or tenant under a ground lease, from time to time, of all or any portion of the Hub Complex. | |

| Hub Complex Mortgagee: | Each holder of a mortgage, from time to time, affecting all or any portion of the Office Building, the Podium Building, the Garage, the Office Tower Parcel, or any other portion of the Hub Complex. | |

| Declaration: | The Amended and Restated Declaration of Covenants, Easements and Restriction for The Hub on Causeway (formerly known as Boston Garden) made as of November 28, 2016 by Boston Garden Development Corp. and agreed to by Podium Owner, LP, Garage Expansion Owner, LP and Garden Improvements Owner, LP, a Delaware limited partnership. Landlord shall not agree to any amendment or modification of the Declaration that would cause a material adverse effect on Tenant’s use or occupancy of the Premises. | |

| Legal Requirements: | All applicable laws, ordinances, rules, regulations, statutes, by-laws, court decisions, and orders and requirements of all public authorities. | |

| Broker: | T3 Realty Advisors, LLC. | |

| Market Area: | CBD Boston | |

| Security Deposit: | $4,816,248.000 in the form of a letter of credit in accordance with Section 16.26, subject to reduction in accordance with Section 16.26. | |

7

| Consumer Price Index: | The Consumer Price Index (“CPI”) shall be defined as the Consumer Price Index for All Urban Consumers (CPI-U) (Revised), Boston, Massachusetts All Items – Series A (1982-84=100) as published by the United states Bureau of Labor Statistics. If the compilation or publication of such Index shall be discontinued or transferred to any other governmental department or bureau or agency, then the parties shall mutually agree upon another index that similarly reflects changes in purchasing power of money. |

1.2 Table of Articles and Sections

| ARTICLE I Reference Data |

1 | |||||

| 1.1 |

Subjects Referred To | 1 | ||||

| 1.2 |

Table of Articles and Sections | 8 | ||||

| 1.3 |

Exhibits | 11 | ||||

| ARTICLE II Premises |

12 | |||||

| 2.1 |

Demise and Lease of Premises | 12 | ||||

| 2.2 |

Appurtenant Rights and Reservations | 13 | ||||

| 2.3 |

Tenant’s Access | 15 | ||||

| ARTICLE III Lease Term and Extension Options |

15 | |||||

| 3.1 |

Term | 15 | ||||

| 3.2 |

Extension Option | 16 | ||||

| 3.3 |

Expansion Option | 18 | ||||

| 3.4 |

Right of First Offer – Third Floor of Office Building | 20 | ||||

| 3.5 |

Tenant’s Right to Renovate the Lobby of the Office Building | 24 | ||||

| 3.6 |

Right of First Offer – Space in New Office Tower | 25 | ||||

| ARTICLE IV Condition of Premises |

28 | |||||

| 4.1 |

Preparation of Premises | 28 | ||||

| ARTICLE V Annual Fixed Rent and Electricity |

29 | |||||

| 5.1 |

Fixed Rent | 29 | ||||

| 5.2 |

Electricity | 30 | ||||

| 5.3 |

Central HVAC System | 31 | ||||

| ARTICLE VI Taxes |

31 | |||||

| 6.1 |

Definitions | 31 | ||||

| 6.2 |

Tenant’s Share of Real Estate Taxes | 32 | ||||

| 6.3 |

Chapter 121A Payments | 33 | ||||

| 6.4 |

I-Cubed | 34 | ||||

| ARTICLE VII Landlord’s Repairs and Services and Tenant’s Operating Expense Payments |

35 | |||||

8

| 7.1 |

Structural Repairs | 35 | ||||

| 7.2 |

Other Repairs to be Made by Landlord | 35 | ||||

| 7.3 |

Services to be Provided by Landlord | 36 | ||||

| 7.4 |

Operating Costs Defined | 36 | ||||

| 7.5 |

Tenant’s Operation Expenses Payments | 42 | ||||

| 7.6 |

No Damage | 44 | ||||

| 7.7 |

Environmental Performance Objective | 46 | ||||

| ARTICLE VIII Tenant’s Repairs |

47 | |||||

| 8.1 |

Tenant’s Repairs and Maintenance | 47 | ||||

| ARTICLE IX Alterations |

48 | |||||

| 9.1 |

Landlord’s Approval | 48 | ||||

| 9.2 |

Conformity of Work | 50 | ||||

| 9.3 |

Performance of Work, Governmental Permits and Insurance | 50 | ||||

| 9.4 |

Liens | 51 | ||||

| 9.5 |

Nature of Alterations | 51 | ||||

| 9.6 |

Increases in Taxes | 52 | ||||

| 9.7 |

Alterations Permitted Without Landlord’s Consent | 52 | ||||

| 9.8 |

TD Garden Alterations | 53 | ||||

| ARTICLE X Parking |

54 | |||||

| 10.1 |

Parking Privileges | 54 | ||||

| 10.2 |

Parking Charges | 55 | ||||

| 10.3 |

Garage Operation | 55 | ||||

| 10.4 |

Limitations | 56 | ||||

| ARTICLE XI Certain Tenant Covenants |

56 | |||||

| ARTICLE XII Assignment and Subletting |

61 | |||||

| 12.1 |

Restrictions on Transfer | 61 | ||||

| 12.2 |

Exceptions | 62 | ||||

| 12.3 |

Landlord’s Recapture Right | 63 | ||||

| 12.4 |

Consent of Landlord | 64 | ||||

| 12.5 |

Tenant’s Notice | 66 | ||||

| 12.6 |

Profit on Subleasing or Assignment | 67 | ||||

| 12.7 |

Additional Conditions | 68 | ||||

| ARTICLE XIII Indemnity and Insurance |

69 | |||||

| 13.1 |

Tenant’s Indemnity | 69 | ||||

| 13.2 |

Landlord’s Indemnity | 71 | ||||

| 13.3 |

Tenant’s Risk | 71 | ||||

| 13.4 |

Tenant’s Commercial General Liability Insurance | 72 | ||||

| 13.5 |

Tenant’s Property Insurance | 73 | ||||

| 13.6 |

Tenant’s Other Insurance | 74 | ||||

| 13.7 |

Requirements for Tenant’s Insurance | 74 | ||||

| 13.8 |

Additional Insureds | 75 | ||||

9

| 13.9 |

Certificates of Insurance | 75 | ||||

| 13.10 |

Subtenants and Other Occupants | 75 | ||||

| 13.11 |

No Violation of Building Policies | 76 | ||||

| 13.12 |

Tenant to Pay Premium Increases | 76 | ||||

| 13.13 |

Landlord’s Insurance | 76 | ||||

| 13.14 |

Waiver of Subrogation | 77 | ||||

| 13.15 |

Tenant’s Work | 78 | ||||

| ARTICLE XIV Fire, Casualty and Taking |

78 | |||||

| 14.1 |

Damage Resulting from Casualty | 78 | ||||

| 14.2 |

Rights of Termination for Uninsured Casualty | 80 | ||||

| 14.3 |

Rights of Termination for Taking | 81 | ||||

| 14.4 |

Award | 82 | ||||

| ARTICLE XV Default |

83 | |||||

| 15.1 |

Tenant’s Default | 83 | ||||

| 15.2 |

Termination; Re-Entry | 84 | ||||

| 15.3 |

Continued Liability; Re-Letting | 84 | ||||

| 15.4 |

Waiver of Redemption | 86 | ||||

| 15.5 |

Landlord’s Default | 86 | ||||

| ARTICLE XVI Miscellaneous Provisions |

87 | |||||

| 16.1 |

Waiver | 87 | ||||

| 16.2 |

Cumulative Remedies | 87 | ||||

| 16.3 |

Quiet Enjoyment | 87 | ||||

| 16.4 |

Surrender | 88 | ||||

| 16.5 |

Brokerage | 88 | ||||

| 16.6 |

Invalidity of Particular Provisions | 89 | ||||

| 16.7 |

Provisions Binding, Etc | 89 | ||||

| 16.8 |

Recording; Confidentiality | 89 | ||||

| 16.9 |

Notices and Time for Action | 90 | ||||

| 16.10 |

When Lease Becomes Binding and Authority | 91 | ||||

| 16.11 |

Paragraph Headings | 91 | ||||

| 16.12 |

Rights of Mortgagee | 91 | ||||

| 16.13 |

Rights of Ground Lessor | 92 | ||||

| 16.14 |

Notice to Mortgagee and Ground Lessor | 93 | ||||

| 16.15 |

Assignment of Rents | 93 | ||||

| 16.16 |

Status Report and Financial Statements | 94 | ||||

| 16.17 |

Self-Help | 95 | ||||

| 16.18 |

Holding Over | 96 | ||||

| 16.19 |

Entry by Landlord | 97 | ||||

| 16.20 |

Tenant’s Payments | 98 | ||||

| 16.21 |

Late Payment | 98 | ||||

| 16.22 |

Counterparts | 99 | ||||

| 16.23 |

Entire Agreement | 99 | ||||

| 16.24 |

Landlord Liability | 99 | ||||

| 16.25 |

No Partnership | 100 | ||||

10

| 16.26 |

Security Deposit | 100 | ||||

| 16.27 |

Governing Law | 102 | ||||

| 16.28 |

Waiver of Trial by Jury | 103 | ||||

| 16.29 |

Electronic Signatures | 103 | ||||

| 16.30 |

Fitness Center | 103 | ||||

| 16.31 |

Retail Delivery | 103 | ||||

| 16.32 |

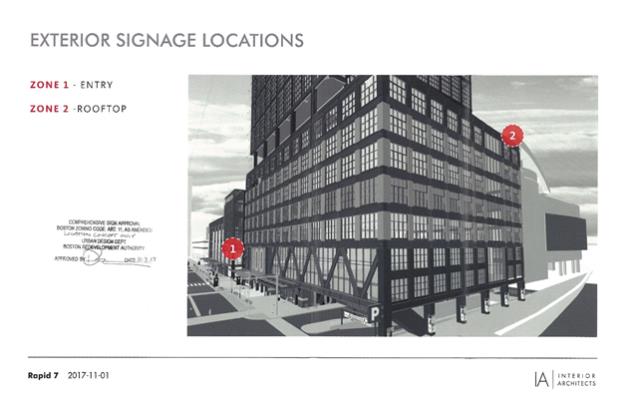

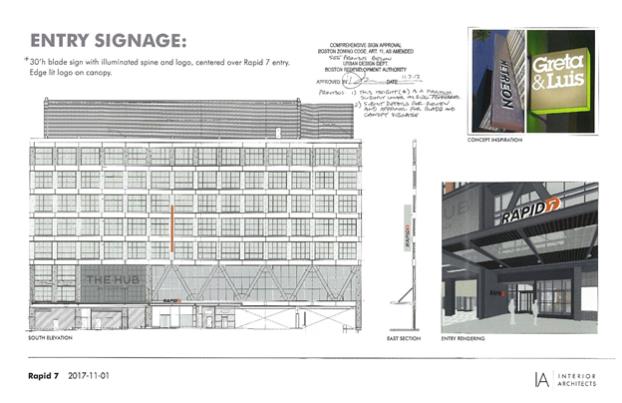

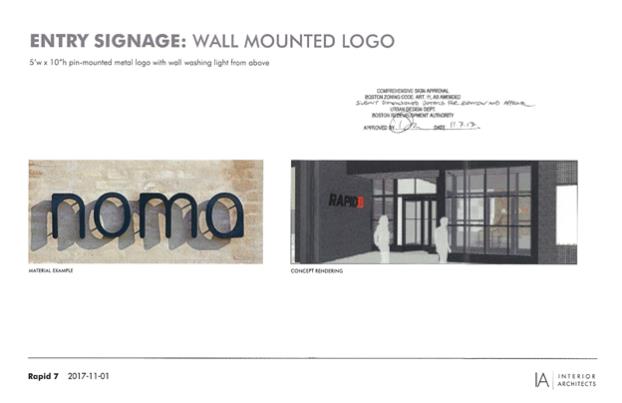

Building Signage | 105 | ||||

| 16.33 |

Arbitration | 106 | ||||

| 16.34 |

Pets | 107 | ||||

| 16.35 |

Competitor Restrictions | 109 | ||||

| 16.36 |

Roof Deck | 109 |

| 1.3 | Exhibits |

The following Exhibits attached hereto are a part of this Lease, are incorporated herein by reference, and are to be treated as a part of this Lease for all purposes. Undertakings contained in such Exhibits are agreements on the part of Landlord and Tenant, as the case may be, to perform the obligations stated therein to be performed by Landlord and Tenant, as and where stipulated therein.

| Exhibit A-1 | — | Premises | ||

| Exhibit A-2 | — | Office Building | ||

| Exhibit A-3 | — | Legal Description | ||

| Exhibit A-4 | — | Office Tower Parcel Legal Description | ||

| Exhibit B-1 | — | Work Agreement | ||

| Exhibit B-2 | — | Base Building Specifications | ||

| Exhibit B-3 | — | Tenant Plan and Working Drawing Requirements | ||

| Exhibit C | — | Landlord’s Services | ||

| Exhibit D | — | Central HVAC System | ||

| Exhibit E | — | Form of Declaration Affixing the Commencement Date of Lease | ||

| Exhibit F | — | Signage | ||

| Exhibit G | — | Intentionally Omitted | ||

| Exhibit H | — | Appraiser Determination of Prevailing Market Rent | ||

| Exhibit I | — | List of Mortgages | ||

11

| Exhibit J | — | Form of Letter of Credit | ||

| Exhibit K | — | Form of Certificate of Insurance | ||

| Exhibit L | — | Tenant Manual | ||

| Exhibit M | — | Transportation Demand Management Program | ||

| Exhibit N | — | Plan of Proposed Hub Complex Improvements | ||

| Exhibit O | — | Legal Description of Podium Parcel | ||

ARTICLE II

Premises

| 2.1 | Demise and Lease of Premises |

(A) Landlord hereby demises and leases to Tenant, and Tenant hereby hires and accepts from Landlord, the Premises in the Office Building, excluding exterior faces of exterior walls, the common stairways and stairwells, elevators and elevator walls, mechanical rooms, electric and telephone closets, janitor closets, and pipes, ducts, shafts, conduits, wires and appurtenant fixtures serving exclusively or in common other parts of the Office Building, and if the Premises includes less than the entire rentable area of any floor, excluding the common corridors, elevator lobbies and toilets located on such floor.

(B) Tenant acknowledges that the Hub Complex is a mixed use project to consist of retail areas, office buildings, apartment buildings, hotels and other commercial and residential uses and may be altered, expanded, reduced or otherwise changed from time to time and that Landlord and any other HubOwner reserve the right to modify the Hub Complex, to change the uses thereof, and to designate areas of the Hub Complex as common areas or as areas for the exclusive use of one or more occupants or one or more uses, provided that, subject to Section 4.2, no such alteration, expansion, reduction, change or modification has a material adverse effect on Tenant’s use of, or access to, the Premises for the Permitted Use. It is understood that the Office Building does not and will not include any portion of the other office, hotel or residential towers in the Hub Complex (or the lobbies for any of the foregoing) or any portion of the garage facilities located beneath the Office Building.

(C) No rights to any view or to light or air over any property, whether belonging to Landlord or any other person, are granted to Tenant by this Lease. If at any time any windows of the Premises are temporarily darkened or the light therefrom is obstructed by reason of any repairs, improvements, maintenance or cleaning in or about the Property, provided that Landlord shall use diligent efforts to complete such repairs, improvements, maintenance or cleaning as expeditiously as possible, the same shall be without liability to Landlord and without any reduction or diminution of Tenant’s obligations under this Lease.

12

| 2.2 | Appurtenant Rights and Reservations. |

(A) Subject to Landlord’s or any other HubOwner’s right to change or alter any of the following in its discretion as herein provided, Tenant shall have, as appurtenant to the Premises, the non-exclusive right to use in common with others, but not in a manner or extent that would materially interfere with the normal operation and use of the Office Building as a multi-tenant office building and subject to reasonable rules of general applicability to tenants of the Office Building (which shall be non-discriminatory with respect to tenants in similar circumstances) from time to time made by Landlord or any other HubOwner of which Tenant is given written notice: (a) the common lobbies, corridors, stairways, and elevators of the Office Building, and the pipes, ducts, shafts, conduits, wires and appurtenant meters and equipment serving the Premises in common with others, (b) the loading areas serving the Office Building and the common walkways and driveways necessary for access to the Office Building, (c) if the Premises include less than the entire rentable floor area of any floor, the common toilets, corridors and elevator lobby of such floor and (d) such other common areas of the Hub Complex as Landlord or any other HubOwner, as the case may be, makes the same available from time to time; and no other appurtenant rights and easements.

(B) Landlord reserves for its benefit and the benefit of any HubOwner the right from time to time, without material interference with Tenant’s use: (a) to install, use, maintain, repair, replace and relocate for service to the Premises and other parts of the Office Building, or either, pipes, ducts, conduits, wires and appurtenant fixtures, wherever located in the Premises or the Office Building, and (b) to alter or relocate any other common facility, provided that substitutions are substantially equivalent or better. Installations, replacements and relocations referred to in clause (a) above shall be located so far as practicable in the central core area of the Office Building, above ceiling surfaces, below floor surfaces or within perimeter walls of the Premises or, if not so practicable, then in an unobtrusive location within the Premises, in which event the Rentable Floor Area of the Premises shall be reduced to the extent that such installations, replacements and relocations reduce the physical floor space available to Tenant within the Premises. Except in the case of emergencies or for normal cleaning or maintenance operations, Landlord agrees to use all reasonable efforts to give, or cause such HubOwner to give, Tenant reasonable advance notice of any of the foregoing activities which require work in the Premises. Notwithstanding anything to the contrary contained in this Lease, in making any entry into the Premises, and in performing any work in the Premises or the Office Building, Landlord shall use diligent efforts to minimize interference with the conduct of Tenant’s business in the Premises, consistent with the nature of the reason for such entry.

(C) Notwithstanding anything to the contrary contained in this Lease, Tenant shall have the right to select its own telecommunications provider from those providers that serve the Office Building, subject to Landlord’s reasonable approval (“Tenant’s Telecom Provider”), and, so long as the Premises are the only premises in the Office Building

13

served by Tenant’s Telecom Provider, Landlord agrees that it shall not charge any fees to Tenant’s Telecom Provider. However, if Tenant’s Telecom Provider serves any other premises in the Office Building, Landlord shall have the right to charge fees to Tenant’s Telecom Provider in connection with the services being performed by Tenant’s Telecom Provider at the reasonable, prevailing rates, from time to time, then being charged by Landlord to other telecommunication service providers in the Office Building providing the same or similar services to other office tenants in the Office Building. Landlord agrees not to discriminate against Tenant or to act arbitrarily in assessing such fees to Tenant’s Telecom Provider. Subject to: (i) the foregoing, and (ii) Tenant’s Telecom Provider entering into reasonable access agreement consistent with this Section 2.2, Landlord shall permit Tenant’s Telecom Provider to install cabling to Tenant’s floors and to have access to the Office Building and the Premises to install telecommunications equipment, using a portion of available Office Building shafts, conduits, and related telecommunications rooms (on floors on which the Premises is located and in the Office Building shafts proportionate to the portion of the Office Building leased by Tenant). All such installations and replacements from time to time shall be made by Tenant or the applicable service provider in accordance with Article IX.

(D) Landlord reserves and excepts for its benefit and the benefit of any HubOwner all rights of ownership and use in all respects outside the Premises, including without limitation, the Office Building and all other structures and improvements and plazas and common areas in the Hub Complex, provided that at all times during the Term of this Lease, Tenant shall have a reasonable means of access from a public street to the Premises. Without limitation of the foregoing reservation of rights by Landlord, it is understood that in its sole discretion, Landlord or any HubOwner (as the case may be) shall have the right to change and rearrange the plazas and other common areas, to change, relocate and eliminate facilities therein, to erect new buildings thereon, to permit the use of or lease all or part thereof for exhibitions and displays and to sell, lease or dedicate all or part thereof to public use; and further that Landlord or any HubOwner, as the case may be, shall have the right to make changes in, additions to and eliminations from the Office Building and other structures and improvements in the Hub Complex, the Premises excepted; provided however that Tenant, its employees, agents, clients, customers, and invitees shall at all times have reasonable access to the Premises. Landlord is not under any obligation to permit individuals without proper building identification or proper registration on a visitor list to enter the Office Building during the hours outside of 8:00 AM to 6:00 PM.

(E) Landlord (on behalf of itself and all Landlord Affiliates) shall have the right at any time and from time to time, in its sole discretion, to submit all or any portion of the Hub Complex to one or more condominiums pursuant to Massachusetts General Laws, Chapter 183 A (the “Condominiums”) and/or to create different fee or leasehold parcels (including air rights parcels) for the different components of the Hub Complex (the Condominiums and any such fee or leasehold parcels being hereinafter referred to, singly and collectively, as the “Ownership Parcels”). Subject to the terms and conditions set forth in this paragraph Tenant covenants and agrees for itself and for the holders of any mortgages or other security interests in Tenant’s leasehold (“Leasehold Security Holders”), (i) that the consent or approval of Tenant (and any such Leasehold Security

14

Holders) shall not be necessary or required in order to create any of the Ownership Parcels, and (ii) that this Lease shall be subject and subordinate to all of the documents creating such Ownership Parcels and pursuant to which such Ownership Parcels are governed (collectively the “Ownership Documents”) with the same force and effect as if this Lease (and any Notice of Lease) were executed, acknowledged, delivered and recorded subsequent to the execution, acknowledgment, delivery and recording of the Ownership Documents. Such subordination shall be upon the condition (i) that in no event shall the creation of any one or more Ownership Parcels (A) adversely modify, or expressly permit adverse modification of, the operation and maintenance requirements set forth in this Lease; and (B) unreasonably interfere with or materially, adversely affect Tenant’s use of, or access to, the Premises or to the common areas in the Hub Complex and/or any of Tenant’s rights or benefits under the terms of this Lease, and (ii) that the creation of any Ownership Parcels shall not affect Landlord’s obligations under this Lease, including, without limitation, Landlord’s obligations to provide maintenance, repairs and services as required pursuant to this Lease. Landlord shall give Tenant thirty (30) days’ prior notice accompanied by proposed condominium documents before submitting any portion of the Office Building to a condominium.

| 2.3 | Tenant’s Access |

During the Term of this Lease, Tenant shall have the right to access the Premises and its appurtenances and the common areas of the HubComplex on a 24-hours-per-day, 7-days-per-week basis, subject to Landlord’s reasonable security requirements and in accordance with the provisions of this Lease, including, without limitation, Legal Requirements, Insurance Requirements (as hereinafter defined), and Force Majeure (as hereinafter defined).

ARTICLE III

Lease Term and Extension Options

| 3.1 | Term |

The Term of this Lease shall be the period specified in Section 1.1 hereof as the “Lease Term.” The Lease Term hereof shall commence on, and the “Commencement Date” shall be, the first to occur of:

| (a) | The later to occur of: (i) the day on which the Premises (including the Shell Work and Landlord’s Work (as each such term is defined in Exhibit B-1)) are delivered by Landlord to Tenant “substantially complete” (as defined in Exhibit B-1) and (ii) the day on which Garage Owner’s expansion of the Garage is sufficiently complete to legally allow Tenant to exercise and Garage Owner to provide all of the parking rights to which Tenant is entitled pursuant to Section 10.1; and |

15

| (b) | The date upon which Tenant commences beneficial use of the Premises.Tenant shall be treated as having commenced beneficial use of the Premises when it first commences to use the Premises for the Permitted Use. As soon as may be convenient after the Commencement Date has been determined, Landlord and Tenant agree to join with each other in the execution, in the form of Exhibit E hereto, of a written Declaration Affixing the Commencement Date of Lease in which the Commencement Date and specified Lease Term of this Lease shall be stated. |

| 3.2 | Extension Option |

(A) Provided that Tenant satisfies all of the Extension Option Conditions, as hereinafter defined (any of which Extension Option Conditions Landlord may waive by written notice to Tenant), Tenant shall have the right to extend the Lease Term for up to two (2) periods of five (5) years each upon all the same terms, conditions, covenants and agreements herein contained, except (i) the Annual Fixed Rent shall be adjusted during the option period as hereinbelow set forth, (ii) there shall be no further option to extend the Term of this Lease after the second (2nd) Extended Term, and (iii) Tenant shall not receive any free rent or abatement with respect to the Premises for the Extended Term. Each option period is sometimes herein referred to as the “Extended Term.” Notwithstanding any implication to the contrary Landlord has no obligation to make any additional payment to Tenant in respect of any construction allowance or the like or to perform any work to the Premises as a result of the exercise by Tenant of any such option.

Tenant shall be deemed to have satisfied the “Extension Option Conditions” if: (1) at the time of exercise of the herein described option to extend there exists no continuing monetary or material non-monetary Event of Default, and this Lease is then in full force and effect, (2) as of the commencement of the Extended Term, there exists no continuing Event of Default pursuant to subsections (f) through (k) of Section 15.1, and this Lease is then in full force and effect, and (3) at the time of exercise of the herein described option to extend, Tenant is not then subletting more than fifty percent (50%) of the Rentable Floor Area of the then-current Premises, except for a Permitted Transfer permitted in accordance with Section 12.2 hereof (“Extension Option Occupancy Test”); Landlord hereby agreeing, however, that if Tenant fails to satisfy the Extension Option Occupancy Test as of the time of option exercise, Tenant will be deemed to have satisfied the Extension Option Occupancy Test, if the Extension Option Occupancy Test is satisfied in all respects as of the commencement of the Extended Term.

(B) Exercise Procedures. If Tenant desires to exercise an option to extend the Term, then Tenant shall give notice (“Extension Exercise Notice”) to Landlord, no earlier than twenty-four (24) months and no later than eighteen (18) months prior to the expiration of the then Term of this Lease (as it may have been previously extended) exercising such option to extend. If Tenant shall not have timely given Tenant’s Extension Exercise Notice on or before the date eighteen (18) months prior to the expiration of the then Term of this Lease (as it may have been previously extended), then such option shall be void and of no further force and effect. If Tenant timely gives an Extension Exercise Notice, then, subject to the conditions to Tenant’s exercise of its right to extend the Term, as set forth in this Section 3.2, the Term of this Lease shall be extended for the Extended Term

16

in question, without the need for further act or deed of either party, and without the necessity for the execution of any additional documents, except that Landlord and Tenant agree to enter into an instrument in writing setting forth the Annual Fixed Rent for the applicable Extended Term as determined in the relevant manner set forth in this Section 3.2; and in such event all references herein to the Lease Term or the Term of this Lease shall be construed as referring to the Lease Term, as so extended, unless the context clearly otherwise requires, and except that there shall be no further option to extend the Lease Term.

(C) Determination of Annual Fixed Rent. Within thirty (30) days after Landlord’s receipt of the Extension Exercise Notice, Landlord shall provide Landlord’s quotation to Tenant of a proposed fair market rental rate for the Annual Fixed Rent for the applicable Extended Term (“Landlord’s Rent Quotation”). If at the expiration of thirty (30) days after Tenant’s receipt of Landlord’s Rent Quotation (or, if earlier, sixty (60) days after Landlord’s receipt of the Extension Exercise Notice) (the “Extension Term Negotiation Period”), Landlord and Tenant have not reached agreement on a determination of the fair market rental rate for the Annual Fixed Rent for such Extended Term and executed a written instrument extending the Term of this Lease pursuant to such agreement, then Tenant shall have the right, for thirty (30) days following the expiration of the Extension Term Negotiation Period, to make a request to Landlord for an appraiser determination (the “Appraiser Determination”) of the Prevailing Market Rent (as defined in Exhibit H) for such Extended Term, which Appraiser Determination shall be made in the manner set forth in Exhibit H. If Tenant timely shall have requested the Appraiser Determination, then the Annual Fixed Rent for such Extended Term shall be an amount equal to the Prevailing Market Rent as determined by the Appraiser Determination. If Tenant does not timely request the Appraiser Determination and the parties have not timely signed an agreement regarding the Annual Fixed Rent that is payable by Tenant during the Extended Term, then Tenant shall be deemed to have elected to withdraw its Extension Exercise Notice, in which event Tenant option to extend shall be deemed null and void and of no further force or effect. In addition, if the Appraiser Determination results in a determination of Prevailing Market Rent that is more than ten percent (10%) higher than the determination of Prevailing Market Rent submitted by Tenant’s Appraiser (as defined in Exhibit H attached hereto), then Tenant shall have the right, by notice (“Extension Rescission Notice”) delivered to Landlord within ten (10) days after the date Tenant was advised in writing of the final Appraiser Determination, to rescind its Extension Exercise Notice, in which event (i) Tenant’s option to extend shall be deemed null and void and of no force or effect and (ii) either of Landlord or Tenant may, by notice to the other given within ten (10) days after delivery of Tenant’s Extension Rescission Notice, extend the Term until the later of (a) six (6) months after the then-scheduled expiration date and (b) twenty (20) months after the date of Tenant’s Extension Rescission Notice, with the Annual Fixed Rent during such extended period being at the rate determined pursuant to the Appraiser Determination, and with no obligation on the part of Landlord to provide any tenant improvement allowance or perform any construction in the Premises, and no obligation to pay any fee to Tenant’s Appraiser. If Tenant delivers an Extension Rescission Notice, then, notwithstanding anything to the contrary herein contained, Tenant shall reimburse Landlord, within thirty (30) days after demand therefor, for all of Landlord’s actual third-party expenses in connection with the Appraiser Determination,

17

and Tenant shall indemnify Landlord against any commission due to a broker representing Tenant in connection with the foregoing extension. Upon the first to occur of: (1) the written agreement by Landlord and Tenant during the Extension Term Negotiation Period on an Annual Fixed Rent for the Extended Term, and (2) the timely request by Tenant for an Appraiser Determination in accordance with the provisions of this subsection (C) above, then this Lease and the Lease Term hereof shall automatically be deemed extended, for the Extended Term, without the necessity for the execution of any additional documents. Notwithstanding the foregoing, at the request of either party, the parties agree to enter into an instrument in writing setting forth the Annual Fixed Rent for the Extended Term as determined in the relevant manner set forth in this Section 3.2, provided however, that the execution of such instrument shall not be a condition to the effectiveness of Tenant’s exercise of its extension option under this Section 3.2. In the event that this Lease is extended, as aforesaid, all references herein to the Lease Term or the Term of this Lease shall be construed as referring to the Lease Term, as so extended, unless the context clearly otherwise requires, and except that there shall be no further option to extend the Lease Term. Notwithstanding anything contained herein to the contrary, in no event shall Tenant have the right to exercise more than one extension option at a time and, further, Tenant shall not have the right to exercise its second extension option unless it has duly exercised the first extension option and in no event shall the Lease Term hereof be extended for more than ten (10) years after the expiration of the Original Lease Term hereof.

| 3.3 | Expansion Option |

(A) Subject to the terms and conditions of this Section 3.3, Tenant shall have the right to add the entirety of the third (3rd) floor of the Office Building (the “Third Floor”), which Landlord and Tenant conclusively agree contains 33,993 square feet of Rentable Floor Area (the “Third Floor Option Space”) to the Premises (the “Expansion Option”). If, prior to exercise of the Expansion Option, Tenant has leased any portion of the Third Floor pursuant to the Right of First Offer set forth in Section 3.4, then the Expansion Option shall apply to, and the Third Floor Option Space shall mean, the entirety of the Third Floor other than the portion leased by Tenant pursuant to the Right of First Offer. To exercise the Expansion Option, Tenant must provide written notice of its exercise to Landlord on or before the fourth (4th) anniversary of the Commencement Date.

(B) Tenant may not exercise the Expansion Option unless each of the following conditions (the “Expansion Conditions”) is satisfied or waived by Landlord in writing (i) at the time of Tenant’s exercise of its option, there exists no continuing monetary or material non-monetary Event of Default (as hereinafter defined), (ii) at the time the Term commences with respect to the expansion space, there exists no continuing Event of Default pursuant to subsections (f) through (k) of Section 15.1, (iii) at the time of Tenant’s exercise its option, this Lease is in full force and effect, and (iv) at the time of Tenant’s exercise of its option, Tenant has not assigned this Lease or sublet more than twenty five percent (25%) of the Rentable Floor Area of the Premises (except for subleases pursuant to Permitted Transfers under Section 12.2 hereof). If Tenant validly exercises the Expansion Option and each of the Expansion Conditions is satisfied, then promptly after the fifth (5th) anniversary of the Fourth Floor Rent Commencement Date

18

(the “Third Floor Commencement Date”), Landlord and Tenant shall execute and deliver an instrument to confirm Tenant’s exercise of the Expansion Option, but the failure of Tenant or Landlord to execute and deliver such instrument shall not affect the validity of Tenant’s exercise of the Expansion Option.

(C) If Tenant validly exercises the Expansion Option, then Landlord shall deliver the Third Floor Option Space to Tenant in its “as-is” condition as of the Third Floor Commencement Date. Effective as of the Third Floor Commencement Date, the Rentable Floor Area of the Premises shall be increased to include the Rentable Floor Area of the Third Floor Option Space, the Annual Fixed Rent shall be increased proportionately to account for the addition of the square footage of the Third Floor Option Space to the Premises (such increase shall be equal to the product of the Rate per Square Foot of Rentable Floor Area applicable to the Premises from time to time, multiplied by the number of square feet of Rentable Floor Area in the Third Floor Option Space), and the Third Floor Option Space shall be added to the Premises on all of the same terms and conditions of this Lease, except that (i) the Term of this Lease with respect to the Third Floor Option Space shall commence on the Third Floor Commencement Date, and (ii) the tenant improvement allowance with respect to the Third Floor shall be equal to the product of Forty One and 90/100 Dollars ($41.90) and the Rentable Floor Area of the Third Floor Option Space. Such tenant improvement allowance shall be applied solely to the hard and soft costs of improvements made to the Third Floor Option Space to ready it for Tenant’s occupancy thereof, and Tenant may not use more than fifteen percent (15%) of such tenant improvement allowance for, in the aggregate, fees for construction management, architectural and engineering services, other consultants providing services directly related to the design or construction of Landlord’s Work, and/or any other Soft Costs (as defined in Exhibit B-1). The disbursement of such tenant improvement allowance will be subject to reasonable terms and conditions required by Landlord.

(D) If Tenant validly exercises its Expansion Option and thereafter, the then occupant of the Third Floor Option Space wrongfully fails to deliver possession of such premises at the time when its tenancy is scheduled to expire, then Landlord shall use reasonable efforts and due diligence to evict such occupant from the Third Floor Option Space and to recover from such occupant any Third Floor Option Space Hold-Over Premium. In such event, the commencement of the term of Tenant’s occupancy and lease of the applicable Third Floor Option Space shall be deferred until possession of the Third Floor Option Space is delivered to Tenant. The failure of the then occupant of such premises to so vacate shall not constitute a default or breach by Landlord and shall not give Tenant any right to revoke or cancel its exercise of the Expansion Option other than as expressly set forth in this Section 3.3(D), to terminate this Lease or to deduct from, offset against or withhold Annual Fixed Rent or Additional Rent (or any portions thereof); provided, however, that Tenant shall have the right to require Landlord to pay to Tenant one hundred percent (100%) of the net amount (i.e. net of the costs and expenses, including, attorneys’ fees, incurred by Landlord in obtaining possession of the Third Floor Option Space and the Third Floor Option Space Hold-Over Premium) of any Third Floor Option Space Hold-Over Premium received by Landlord from such hold-over occupant, when and if Landlord receives any such payment. For the purposes hereof, the term “Third

19

Floor Option Space Hold-Over Premium” shall be defined as the amount (if any) that a hold-over occupant of any portion of the Third-Floor Option Space is required to pay to Landlord in respect of its hold-over in the premises (whether characterized as rent, damages, or use and occupation) in excess of the amount of fixed rent and other charges that the tenant under whom such occupant claims would have been required to pay to Landlord had the term of such tenant’s lease been extended throughout the period of such hold-over at the same rental rate as such tenant was required to pay during the last month of its tenancy. In the event that such holding over continues for twelve (12) months, Tenant shall have the right, at any time thereafter and prior to delivery of the Third Floor Option Space to Tenant, to rescind Tenant’s exercise of its Expansion Option, whereupon Tenant’s lease of the Third Floor Option Space shall be null and void.

(E) Time is of the essence with respect to the respective rights and obligations of Landlord and Tenant pursuant to this Section 3.3.

| 3.4 | Right of First Offer – Third Floor of Office Building. |

(A) Prior to leasing any space on the Third Floor (the “First Offer Space”) that Landlord has determined is “available for lease” (as hereinafter defined) to a third party other than pursuant to the Prior Rights (as hereinafter defined), Landlord will first offer to lease the First Offer Space to Tenant on and subject to the terms of this Section 3.4 (the “Right of First Offer”), but only if, at the time that Landlord would otherwise be required to give Landlord’s ROFO Notice (as hereinafter defined) to Tenant, each of the following conditions is satisfied or waived by Landlord in writing: (i) each of the Expansion Conditions is satisfied, and (ii) the First Offer Space shall not be part of any portion of the Premises previously surrendered by Tenant to Landlord. For purposes of this Lease, it is agreed that the term “Prior Rights” means: (A) extension or renewal rights granted by Landlord at any time, whether prior to or subsequent to the date hereof, to existing tenants of any space that would otherwise have been First Offer Space (i.e., regardless of whether the existing or future leases for such space expressly provide the existing tenants thereunder with any such right to renew or extend), and (B) any rights (including, without limitation, rights of first offer, first refusal or expansion rights, but excluding extension or renewal rights, which are addressed in clause (A) above) that encumber what would otherwise have been First Offer Space and that were granted by Landlord to any one or more tenants after Tenant has rejected (or is deemed to have rejected) the exercise of its Right of First Offer with respect to such First Offer Space and Landlord subsequently leases such First Offer Space to a third party.

(B) If Landlord determines that any First Offer Space has become available for lease, then Landlord shall give notice (a “ROFO Notice”) to Tenant of the availability of such space, which notice shall include: (i) the location of the First Offer Space, (ii) Landlord’s quotation of a proposed Annual Fixed Rent for the First Offer Space (which, if the Lease Term with respect to the First Offer Space is to commence during Rent Years 1 through 5, shall be equal to the product of the applicable Rate per Square Foot of Rentable Floor Area applicable to the Premises from time to time, multiplied by the number of square feet of Rentable Floor Area in the applicable First Offer Space), (iii) the date on which it is estimated that the First Offer Space will be available for actual delivery to Tenant (the

20

“Estimated ROFO Space Delivery Date”), (iv) the number of parking spaces in the Garage for use in connection with such First Offer Space, which spaces shall be subject to the terms of Article 11, and (v) all other material terms and conditions that will apply to Landlord’s proposed lease of the First Offer Space. First Offer Space shall be deemed “available for lease” after it has initially been leased to a third party and Landlord, in its sole judgment, determines that the then-current tenant of the applicable First Offer Space will vacate the First Offer Space at the expiration or earlier termination of such tenant’s lease and any applicable Prior Rights have lapsed or been irrevocably waived (or, if the First Offer Space has not been initially leased to a third party by the second (2nd) anniversary of the Execution Date, the First Offer Space shall be deemed to be “available for lease” for purposes of this Section 3.4). Landlord may not give a ROFO Notice with respect to any First Offer Space prior to the date that is fifteen (15) months before the date on which it is estimated that such First Offer Space will be available for actual delivery to Tenant, except that such time period shall not apply to First Offer Space that is or will be available by means of a termination of lease prior to its expiration date by reason of default, recapture or otherwise.

(C) If Tenant wishes to exercise its Right of First Offer with respect to First Offer Space, Tenant shall do so, if at all, by giving Landlord written notice (a “ROFO Acceptance Notice”) within fifteen (15) business days after Tenant’s receipt of Landlord’s ROFO Notice stating Tenant’s election to lease all (and not less than all) the applicable First Offer Space on the terms set forth in Landlord’s ROFO Notice, except that if the Lease Term with respect to the First Offer Space will commence after the expiration of Rent Year 5 and Tenant believes that the Annual Fixed Rent quoted by Landlord in the ROFO Notice is not the Prevailing Market Rent for the First Offer Space, then Tenant may require an Appraiser Determination of the Prevailing Market Rent for the First Offer Space in the manner set forth in Section 3.2 and Exhibit H, but only if Tenant states its election to require an Appraiser Determination in its ROFO Acceptance Notice. If Tenant elects to require an Appraiser Determination in its ROFO Acceptance Notice, and the Prevailing Market Rent for the First Offer Space has not been determined by the date on which the Lease Term with respect to the First Offer Space is to commence, then Tenant shall be required to pay the Annual Fixed Rent quoted by Landlord in the ROFO Notice until the Prevailing Market Rent has been determined pursuant to the Appraiser Determination, whereupon the Annual Fixed Rent for the First Offer Space shall be retroactively adjusted, if necessary.

(D) If Tenant validly exercises the Right of First Offer with respect to any First Offer Space, then Tenant shall be bound to lease the First Offer Space on and subject to all of the terms of this Lease, except that: (i) if the Lease Term with respect to any First Offer Space is to commence after Rent Year 5, then, pursuant to Section 3.4(C), above, the Annual Fixed Rent for the balance of the Original Lease Term shall be either the Annual Fixed Rent for such First Offer Space proposed by Landlord in Landlord’s ROFO Notice or, if Tenant elects to require an Appraiser Determination in accordance with Section 3.4(C), the Prevailing Market Rent for such First Offer Space, (ii) Tenant shall take such First Offer Space “as-is” in its then (i.e., as of the date of delivery) state of construction, finish, and decoration, without any obligation on the part of Landlord to improve, construct or prepare any such First Offer Space for Tenant’s occupancy, (iii) if the Lease

21

Term with respect to any First Offer Space is to commence during Rent Years 1 through 5, then the tenant improvement allowance with respect to such space shall be an amount equal to (1) the product of Eighty Eight and 00/100 Dollars ($88.00) multiplied by a fraction, the numerator of which is the number of full months remaining in the Original Lease Term from the commencement of the Lease Term with respect to the First Offer Space and the denominator of which is 126, multiplied by (2) the number of square feet of Rentable Floor Area in the First Offer Space, (iv) if the Lease Term with respect to any First Offer Space is to commence after Rent Year 5 then, the tenant improvement allowance with respect to such space shall be equal to a fair market tenant improvement allowance amount (if any) for the First Offer Space at the time of Landlord’s ROFO Notice, which shall be the amount of a tenant improvement allowance (if any) specified in Landlord’s ROFO Notice, subject to adjustment if Tenant elects to require an Appraiser Determination in accordance with Section 3.4(C), (v) if Landlord provides any tenant improvement allowance in connection with the First Offer Space, then Landlord shall have the right, if and to the extent consistent with its leasing practices at the time based on the amount of the tenant improvement allowance and Tenant’s credit worthiness, to require that Tenant provide an additional security deposit in a reasonable amount, (vi) those provisions of the Lease that are inconsistent with the additional terms contained in Landlord’s ROFO Notice shall be modified accordingly with respect to the First Offer Space, and (vii) the Lease Term in respect of such First Offer Space shall commence on the later of: (1) the commencement date in respect of such First Offer Space specified forth in Landlord’s ROFO Notice, and (2) the date that Landlord delivers such First Offer Space to Tenant. With respect to the tenant improvement allowance referenced in this Section 3.4(D), such tenant improvement allowance (if any, if the Lease Term with respect to the applicable First Offer Space is to commence after Rent Year 5) shall be applied solely to the hard and soft costs of improvements made to the applicable First Offer Space to ready it for Tenant’s occupancy thereof, and Tenant may not use more than fifteen percent (15%) of such tenant improvement allowance for, in the aggregate, fees for construction management, architectural and engineering services, other consultants providing services directly related to the design or construction of Landlord’s Work, and/or any other Soft Costs (as defined in Exhibit B-1). The disbursement of such tenant improvement allowance will be subject to reasonable terms and conditions required by Landlord.

(E) If Tenant does not timely exercise its Right of First Offer with respect to any First Offer Space, then Tenant shall have no further right to lease such space under this Section 3.4 unless and until such space again becomes available for lease after being leased to other parties, and Landlord shall be free to enter into a lease or leases of such space with another prospective tenant or tenants upon such terms and conditions as Landlord shall determine, which terms may include rights for options to extend the term or to expand the size of the premises under such lease or leases.

(F) If any First Offer Space shall be available for delivery to Tenant at any time during the last thirty-six (36) months of the then existing Lease Term, then:

22

(i) If Tenant then has a remaining option to extend the Lease Term that has not either lapsed unexercised or been irrevocably waived, then Tenant may give an Extension Exercise Notice in accordance with this subsection (i) (notwithstanding any limitation as to the time of exercise set forth in Section 3.2 that would have precluded the exercise of the extension option on the basis that the notice would be given earlier than as otherwise permitted), in which event the term as to the First Offer Space shall be coterminous with the last day of the Term as so extended. As a condition to exercising its right to lease a First Offer Space which becomes available for lease during the last thirty-six (36) months of the then existing Lease Term, Tenant must give an unconditional and irrevocable Extension Exercise Notice at the time that Tenant gives its notice exercising its right of first offer to such First Offer Space, except that if Tenant rejects Landlord’s offer with respect to any First Offer Space that becomes available for lease during the last thirty-six (36) months, then, as a condition to requesting an Appraiser Determination, Tenant must give an Extension Exercise Notice together with such request. Notwithstanding Tenant’s exercise of its extension option in accordance with this subsection (i), the Annual Fixed Rent for the original Premises (as it may have been previously expanded) for such Extended Term shall be determined at the same time and in the same manner such Annual Fixed Rent would have been determined if Tenant had exercised the extension option within the time periods for such exercise set forth in this Lease.

(ii) If Tenant has no further remaining option to extend the Term (i.e., because Tenant’s right to extend the Term of this Lease pursuant to Section 3.2 has been irrevocably waived by Tenant or has lapsed unexercised or Tenant has no further right to extend this Lease), then Tenant shall have no right to lease such First Offer Space under this Section 3.4.

(G) If Tenant validly exercises its Right of First Offer with respect to any First Offer Space and thereafter, the then occupant of the applicable First Offer Space wrongfully fails to deliver possession of such premises at the time when its tenancy is scheduled to expire, then Landlord shall use reasonable efforts and due diligence to evict such occupant from the First Offer Space and to recover from such occupant any ROFO Hold-Over Premium (as hereinafter defined) payable by such occupant. In such event, the commencement of the term of Tenant’s occupancy and lease of the applicable First Offer Space shall be deferred until possession of the First Offer Space is delivered to Tenant. The failure of the then occupant of such premises to so vacate shall not constitute a default or breach by Landlord and shall not give Tenant any right to revoke or cancel its exercise of the Right of First Offer other than as expressly set forth in this Section 3.4(G), to terminate this Lease or to deduct from, offset against or withhold Annual Fixed Rent or Additional Rent (or any portions thereof); provided, however, that Tenant shall have the right to require Landlord to pay to Tenant one hundred percent (100%) of the net amount (i.e. net of the costs and expenses, including, attorneys’ fees, incurred by Landlord in obtaining possession of the First Offer Space and the ROFO Hold-Over Premium) amount of any ROFO Hold-Over Premium received by Landlord from such hold-over occupant, when and if Landlord receives any such payment. For the purposes hereof, the term “ROFO Hold-Over Premium” shall be defined as the amount (if any) that a hold-over occupant of any portion of the First Offer Space is required to pay to Landlord in respect of its hold-over in the premises (whether characterized as rent, damages, or use

23

and occupation) in excess of the amount of fixed rent and other charges that the tenant under whom such occupant claims would have been required to pay to Landlord had the term of such tenant’s lease been extended throughout the period of such hold-over at the same rental rate as such tenant was required to pay during the last month of its tenancy. In the event that such holding over continues for twelve (12) months, Tenant shall have the right, at any time thereafter and prior to delivery of the First Offer Space to Tenant, to rescind Tenant’s ROFO Acceptance Notice, whereupon Tenant’s lease of the First Offer Space shall be null and void.

(H) Time is of the essence with respect to the respective rights and obligations of Landlord and Tenant pursuant to this Section 3.4.

| 3.5 | Tenant’s Right to Renovate the Lobby of the Office Building. |

Tenant shall at any time during which the Premises contain the entire rentable floor area of the Office Building have the right to perform at its sole cost and expense any alterations, additions or improvements (“Lobby Alterations”) to the lobby of the Office Building (the “Lobby”), provided that such Lobby Alterations are (a) consistent with the image of the Office Building as a first-class creative office space and (b) performed by Tenant in accordance with plans and specifications approved by Landlord, which approval shall not be unreasonably withheld, delayed or conditioned. Landlord shall respond (i.e., by giving Tenant written notice which either grants Landlord’s consent to the final proposed plans and specifications, or withholds such consent and sets forth, with reasonable specificity, the basis of such withholding), on or before the Lobby Plan Approval Response Date (as hereinafter defined). Any item as to which Landlord does not disapprove in its response shall be deemed approved. The “Lobby Plan Approval Response Date” with respect to Tenant’s final plans shall be defined as the date thirty (30) business days after Landlord receives Tenant’s written request for Landlord’s consent to such proposed plans and specifications (or ten (10) days in the case of revised plans which are resubmitted in response to Landlord’s review, so long as the changes between the resubmitted plans and the prior versions of the plans are readily identified, by bubbles or otherwise), unless Landlord: (i) has a reasonable basis for requesting additional time to review such request, and (ii) within five (5) business days after Landlord receives such request, Landlord gives Tenant written notice specifying a later Lobby Plan Approval Response Date.

Tenant’s right to perform Lobby Alterations pursuant to this Section shall be subject to the last paragraph of Section 9.1, and Sections 9.2 through 9.7; provided, however, that for the purposes of this Section only (i) all references to “Section 9.1” in Sections 9.5 and 9.7 shall be deemed to refer to the first paragraph of this Section and (ii) all references to the “Premises” in the last paragraph of Section 9.1, and in Sections 9.2 through 9.7 shall be deemed to refer to the Lobby. Without limiting the terms of this Section 3.5, at the end of the Lease Term, Tenant shall remove from the Lobby all Tenant specific signage and alterations of a branding nature relating specifically to Tenant and shall comply with the other removal and restoration requirements set forth in Section 9.5.

24

| 3.6 | Right of First Offer – Space in New Office Tower. |

If, and only if, affiliates of Boston Garden Development Corp. (an affiliate of Delaware North Companies) and Boston Properties Limited Partnership together develop, through a joint venture ownership structure, the Office Tower as a multi-tenant office building, then Tenant shall have a right of first offer to lease the Tower Offer Space on and subject to the terms and conditions set forth in this Section 3.6 (the “Tower Right of First Offer”). The “Tower Offer Space” shall mean two (2) contiguous floors in the Office Tower that are to be identified by Landlord.

(A) Prior to leasing all or any portion of the Tower Offer Space to a third party, the Office Tower Owner will first offer to lease such space to Tenant on and subject to the terms of this Section 3.6, but only if, at the time that the Office Tower Owner would otherwise be required to give a Tower ROFO Notice (as hereinafter defined) to Tenant, each of the Expansion Conditions is satisfied.

(B) Subject to the terms of this Section 3.6, when the Office Tower Owner determines that the Tower Offer Space has become “available for lease” (as hereinafter defined), the Office Tower Owner shall give notice (a “Tower ROFO Notice”) to Tenant of the availability of such space, which notice shall include: (i) the location of the Tower Offer Space, (ii) the Office Tower Owner’s quotation of a proposed Annual Fixed Rent for the Tower Offer Space, (iii) the date on which it is estimated that the Tower Offer Space will be available for actual delivery to Tenant (the “Estimated Tower ROFO Space Delivery Date”), (iv) the number of parking spaces (if any) in the Garage for use in connection with the Tower Offer Space, and (v) all other material terms and conditions that will apply to the Office Tower Owner’s proposed lease of the Tower Offer Space. The Office Tower Owner may not give a Tower ROFO Notice with respect to the Tower Offer Space prior to the date construction of the Office Tower Commences. The Tower Offer Space shall be deemed “available for lease” after the Officer Tower Owner, in its sole judgement, determines that construction of the Office Tower has commenced.

(C) If Tenant wishes to exercise its Tower Right of First Offer with respect to the Tower Offer Space, then Tenant shall do so, if at all, by giving the Office Tower Owner written notice (a “Tower ROFO Acceptance Notice”) within fifteen (15) business days after Tenant’s receipt of a Tower ROFO Notice stating Tenant’s election to lease the Tower Offer Space. Tenant must elect to exercise its Tower Right of First Offer, if at all, with respect to all or none of the space on each floor of the Tower Offer Space set forth in the Tower ROFO Notice. If Tenant exercises its Tower Right of First Offer with respect to all of one or both floors of the Tower Offer Space (the “Selected Offer Space”), then Tenant’s lease of such space shall be on the terms set forth in such Tower ROFO Notice and in this Section 3.6, except that if Tenant believes that the Annual Fixed Rent quoted by Office Tower Owner in the Tower ROFO Notice is not the Prevailing Market Rent for the Selected Offer Space, then Tenant may require an Appraiser Determination of the Prevailing Market Rent for the Selected Offer Space in the manner set forth in Section 3.2 and Exhibit H, but only if Tenant states its election to require an Appraiser Determination in its Tower ROFO Acceptance Notice. If Tenant elects to

25

require an Appraiser Determination in its Tower ROFO Acceptance Notice, and the Prevailing Market Rent for the Selected Offer Space has not been determined by the date on which the lease term with respect to the Selected Offer Space is to commence, then Tenant shall be required to pay the Annual Fixed Rent quoted by the Office Tower Owner in the Tower ROFO Notice until the Prevailing Market Rent has been determined, whereupon the Annual Fixed Rent for the Selected Offer Space shall be retroactively adjusted, if necessary.

(D) If Tenant validly exercises the Tower Right of First Offer with respect to the Tower Offer Space, then Tenant and Office Tower Owner shall be bound to enter into a lease (the “Office Tower Lease”) for the Selected Offer Space in form and substance substantially similar to this Lease, except for those certain provisions and terms that are premises and building specific, including, but not limited to the following provisions and terms: (i) Annual Fixed Rent, (ii) the delivery condition, the parties agreeing that under the Office Tower Lease Tenant shall take the Selected Offer Space “as-is” in its then (i.e., as of the date of delivery) state of construction, finish, and decoration, without any obligation on the part of Office Tower Owner to improve, construct or prepare any such Selected Offer Space for Tenant’s occupancy, (iii) the tenant improvement allowance, the parties agreeing that under the Office Tower Lease the tenant improvement allowance for the Selected Offer Space shall be equal to a fair market tenant improvement allowance amount (if any) for the Selected Offer Space at the time of the applicable Tower ROFO Notice, which shall be the amount of a tenant improvement allowance (if any) specified in such Tower ROFO Notice, subject to adjustment if Tenant elects to require an Appraiser Determination in accordance with Section 3.6(C), (iv) the security deposit, the parties agreeing that under the Office Tower Lease, the Office Tower Owner may require that Tenant provide a security deposit, in a reasonable amount, with respect to the Selected Offer Space, (v) those provisions of this Lease that are inconsistent with the additional terms contained in the Tower ROFO Notice shall be modified accordingly with respect to the Selected Offer Space, and (vi) Real estate taxes, Operating Expenses Allocable to the Premises, and the Central HVAC System, and Exhibits A-1 through Exhibit D, Exhibit F, Exhibit I, and Exhibit L, which provisions and exhibits shall be consistent with the applicable provisions and exhibits that are used for other leases in the Office Tower (subject to any modifications set forth in the Tower ROFO Notice). Unless otherwise agreed to by the Office Tower Owner and Tenant, Sections 3.2, 3.3, 3.4, 3.5, 3.6, 9.7, 16.30, 16.31, 16.32 and Article 10, shall not be included in the Office Tower Lease. The Office Tower Lease shall include a provision whereby a default of Tenant under this Lease will constitute a default of Tenant under the Office Tower Lease The lease term with respect of the Selected Offer Space shall commence on the later of: (1) the commencement date in respect of the Tower Offer Space specified in the applicable Tower ROFO Notice, and (2) the date that the Office Tower Owner delivers the Selected Offer Space to Tenant, and shall terminate on the Expiration Date of this Lease unless otherwise agreed to by Tenant and the Office Tower Owner. With respect to the tenant improvement allowance referenced in this Section 3.6(D), such tenant improvement allowance (if any) shall be applied solely to the cost of improvements made to the Selected Offer Space to ready it for Tenant’s occupancy and Tenant may not use more than fifteen percent (15%) of such tenant improvement allowance for, in the aggregate, fees for construction management, architectural and engineering services, other

26

consultants providing services directly related to the design or construction of the Selected Offer Space work and any other Soft Costs (as defined in Exhibit B-1). The disbursement of such tenant improvement allowance will be subject to reasonable terms and conditions required by the Office Tower Owner.

(E) If Tenant does not timely exercise its Tower Right of First Offer with respect to the Tower Offer Space, then the Office Tower Owner shall be free to enter into a lease or leases of such space with another prospective tenant or tenants upon such terms and conditions as the Office Tower Owner shall determine, and Tenant shall have no further right to lease such space under this Section 3.6.

(F) If the Estimated Tower ROFO Space Delivery Date shall be a date during the last thirty-six (36) months of the then existing Lease Term, then:

(i) If Tenant then has a remaining option to extend the Lease Term that has not either lapsed unexercised or been irrevocably waived, then Tenant may give an Extension Exercise Notice in accordance with this subsection (i) (notwithstanding any limitation as to the time of exercise set forth in Section 3.2 that would have precluded the exercise of the extension option on the basis that the notice would be given earlier than as otherwise permitted), in which event the term as to the Selected Offer Space shall be coterminous with the last day of the Term as so extended. As a condition to exercising its right to lease Selected Offer Space for which the Estimated Tower ROFO Space Delivery Date occurs during the last thirty-six (36) months of the then existing Lease Term, Tenant must give an unconditional and irrevocable Extension Exercise Notice to Landlord at the time that Tenant gives its notice exercising its Tower Right of First Offer with respect to such Selected Offer Space, except that if Tenant rejects the Annual Fixed Rent quoted by Office Tower Owner in the Tower ROFO Notice with respect to Selected Offer Space for which the Estimated Tower ROFO Space Delivery Date occurs during the last thirty-six (36) months of the then existing Lease Term, then, as a condition to requesting an Appraiser Determination, Tenant must give an Extension Exercise Notice to Landlord simultaneously with making such Appraiser Determination request to the Office Tower Owner. Notwithstanding Tenant’s exercise of its extension option in accordance with this subsection (i), the Annual Fixed Rent for the original Premises (as it may have been previously expanded) for such Extended Term shall be determined at the same time and in the same manner such Annual Fixed Rent would have been determined if Tenant had exercised the extension option within the time periods for such exercise set forth in this Lease.

(ii) If Tenant has no further remaining option to extend the Term (i.e., because Tenant’s right to extend the Term of this Lease pursuant to Section 3.2 has been irrevocably waived by Tenant or has lapsed unexercised or Tenant has no further right to extend this Lease), then Tenant shall have no right to lease the Tower Offer Space under this Section 3.6.

27

(G) Time is of the essence with respect to the respective rights and obligations of the Office Tower Owner and Tenant pursuant to this Section 3.6.

(H) If the Office Tower Parcel is acquired by a joint venture between affiliates of Boston Garden Development Corp. and Boston Properties Limited Partnership, then Landlord shall notify Tenant thereof and Tenant shall have the right to record a notice of Tenant’s rights under this Section 3.6 with the applicable land records for the Office Tower Parcel, which notice shall be in form and substance reasonably satisfactory to such joint venture and Tenant.

ARTICLE IV

Condition of Premises

| 4.1 | Preparation of Premises |

The condition of the Premises upon Landlord’s delivery along with any work to be performed by either Landlord or Tenant shall be as set forth in the Work Agreement attached hereto as Exhibit B-1 and made a part hereof.