Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - CB Financial Services, Inc. | exh_992.htm |

| EX-2.1 - EXHIBIT 2.1 - CB Financial Services, Inc. | exh_21.htm |

| 8-K - FORM 8-K - CB Financial Services, Inc. | f8k_111617.htm |

Exhibit 99.1

0 Expanding Into The Ohio Valley CB Financial Services, Inc. Acquiring First West Virginia Bancorp, Inc. November 16, 2017

1 This investor presentation contains "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act, relating to present or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of CB Financial Services, Inc . (“CBFV”) and First West Virginia Bancorp, Inc . (“FWVB”) . Forward - looking statements may be identified by words such as " believe," " plan," " expect," " anticipate," " intend," " outlook," " estimate," " forecast," " will," " should," " project," " goal," and other similar words and expressions . These forward - looking statements involve certain risks and uncertainties . In addition to factors previously disclosed in CBFV’s reports filed with the Securities and Exchange Commission (“the SEC”) and those identified elsewhere in this investor presentation or the related press release, the following factors among others, could cause actual results to differ materially from forward - looking statements or historical performance : ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by CBFV and FWVB’s stockholders, on the expected terms and schedule ; delay in closing the merger ; difficulties and delays in integrating the respective businesses of CBFV and FWVB or fully realizing cost savings and other benefits ; business disruption following the merger ; changes in asset quality and credit risk ; the inability to sustain revenue and earnings growth ; changes in interest rates and capital markets ; inflation ; customer acceptance of CBFV products and services ; customer borrowing, repayment, investment and deposit practices ; customer disintermediation ; the introduction, withdrawal, success and timing of business initiatives ; competitive conditions ; economic conditions ; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms . CBFV and FWVB undertake no obligation to revise these forward - looking statements or to reflect events or circumstances after the date of this investor presentation . Accordingly, you should not place undue reliance on such statements . Important Additional Information and Where to Find It This communication is being made pursuant to and in compliance with Rules 165 and 425 of the Securities Act of 1933 and does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities . In connection with the proposed transaction, CBFV and FWVB will prepare a proxy statement/prospectus as part of a registration statement on Form S - 4 that CBFV will file with the SEC regarding the proposed transaction . Investors and security holders are urged to read the proxy statement/prospectus because it will contain important information about CBFV and FWVB and the proposed transaction . The final proxy statement/prospectus will be mailed to shareholders of CBFV and FWVB . Investors and security holders may obtain a free copy of the definitive proxy statement/prospectus and other documents when filed with the SEC at the SEC’s website at www . sec . gov . Participants in Solicitation CBFV, FWVB and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of CBFV and FWVB in connection with the proposed merger . Information about the directors and executive officers of CBFV is set forth in the proxy statement for the CBFV 2017 annual meeting of stockholders, as filed with the SEC on Schedule 14 A on April 12 , 2017 . Information about the directors and executive officers of FWVB will be included in the joint proxy statement/prospectus when it becomes available . Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the joint proxy statement/prospectus and other relevant documents regarding the proposed merger to be filed with the SEC when they become available . This investor presentation does not constitute an offer of any securities for sale . The shares of common stock of CBFV are not savings or deposit accounts and are not insured by the Federal Deposit Insurance Corporation or any other government agency . General Information and Limitations

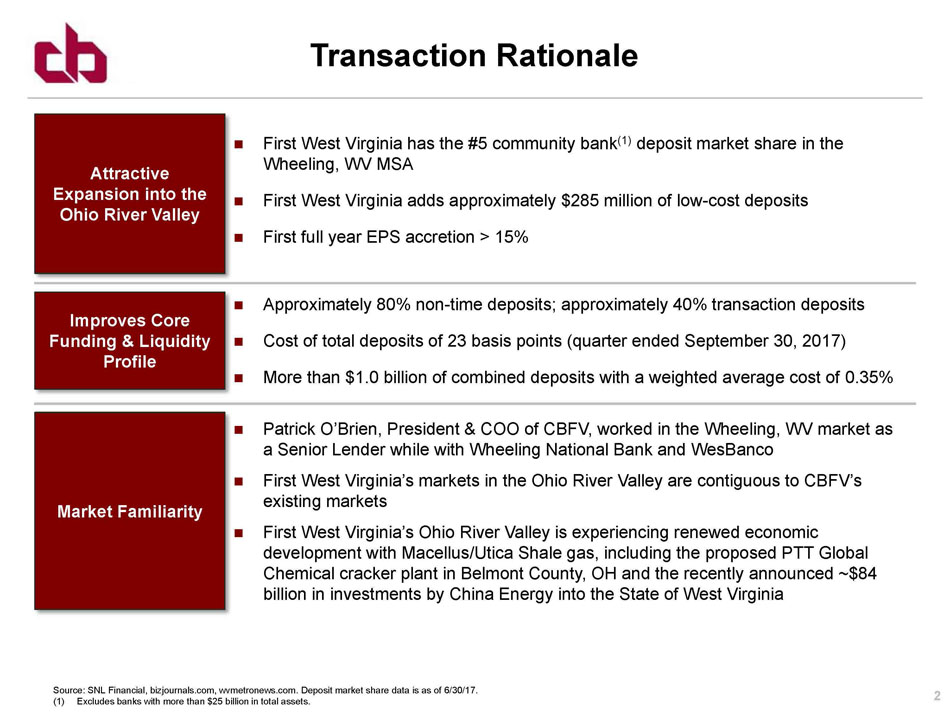

2 Attractive Expansion into the Ohio River Valley Improves Core Funding & Liquidity Profile Market Familiarity First West Virginia has the #5 community bank (1) deposit market share in the Wheeling, WV MSA First West Virginia adds approximately $285 million of low - cost deposits First full year EPS accretion > 15% Approximately 80% non - time deposits; approximately 40 % transaction deposits Cost of total deposits of 23 basis points (quarter ended September 30, 2017 ) More than $1.0 billion of combined deposits with a weighted average cost of 0.35% Patrick O’Brien, President & COO of CBFV, worked in the Wheeling, WV market as a Senior Lender while with Wheeling National Bank and WesBanco First West Virginia’s markets in the Ohio River Valley are contiguous to CBFV’s existing markets First West Virginia’s Ohio River Valley is experiencing renewed economic development with Macellus /Utica Shale gas, including the proposed PTT Global Chemical cracker plant in Belmont County, OH and the recently announced ~$84 billion in investments by China Energy into the State of West Virginia Transaction Rationale Source: SNL Financial , bizjournals.com, wvmetronews.com . Deposit market share data is as of 6/30/17. (1) Excludes banks with more than $25 billion in total assets.

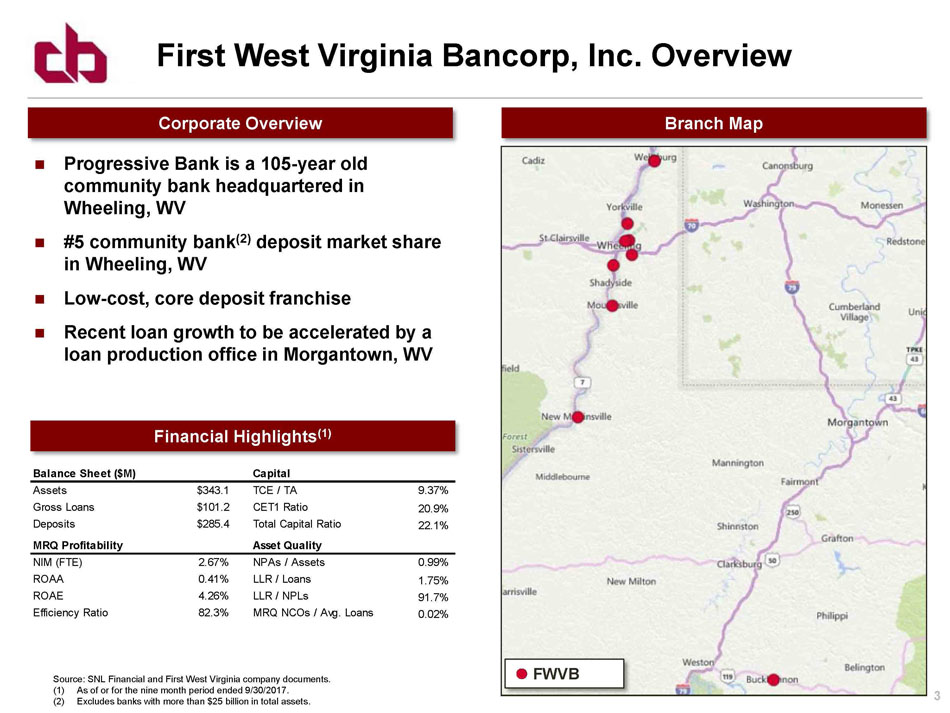

3 Source: SNL Financial. Financial data as of 6/30/17. (1) Alpine is an S - Corporation. ROAA and ROAE tax - effected at an effective rate of 30%. (2) NPLs include nonaccrual loans and TDRs. NPAs include NPLs, OREO and loans 90+ days past due and still accruing interest. 3 Progressive Bank is a 105 - year old community bank headquartered in Wheeling, WV #5 community bank (2) deposit market share in Wheeling, WV Low - cost, core deposit franchise Recent loan growth to be accelerated by a loan production office in Morgantown, WV First West Virginia Bancorp, Inc. Overview Branch Map Corporate Overview Financial Highlights (1) Source: SNL Financial and First West Virginia company documents. (1) As of or for the nine month period ended 9/30/2017. (2) Excludes banks with more than $25 billion in total assets . FWVB Balance Sheet ($M) Capital Assets $343.1 TCE / TA 9.37% Gross Loans $101.2 CET1 Ratio 20.9% Deposits $285.4 Total Capital Ratio 22.1% MRQ Profitability Asset Quality NIM (FTE) 2.67% NPAs / Assets 0.99% ROAA 0.41% LLR / Loans 1.75% ROAE 4.26% LLR / NPLs 91.7% Efficiency Ratio 82.3% MRQ NCOs / Avg. Loans 0.02%

4 Regional Economic Developments Deposit Market Share – Wheeling, WV (1) Pro Forma Franchise Expanding into the Ohio Valley Region Source: SNL Financial, bizjournals.com, wvmetronews.com. (1) Excludes banks with more than $25 billion in total assets . (2) Purchase announced in June 2017. (3) http://wvmetronews.com/2017/11/09/china - natural - gas - deal - begins - with - new - power - plants - in - harrison - and - brooke - counties/ FWVB CBFV Proposed Cracker Plant Community Bank Rank Institution (ST) Deposits in Market ($mm) Market Share (%) 1 WesBanco Inc. (WV) 1,363 47.3 2 United Bankshares Inc. (WV) 418 14.5 3 Belmont SB (OH) 309 10.7 4 Main Street Finl Services Corp (WV) 304 10.5 5 204 7.1 6 United Bancorp Inc. (OH) 192 6.7 7 Powhatan Point Cmnty Bcshs Inc (OH) 47 1.6 8 United Community Finl Corp. (OH) 27 0.9 9 CNB Bancorp Inc. (OH) 15 0.5 10 Woodforest Financial Grp Inc. (TX) 3 0.1 Total 2,882 100.0 PTT Global Chemical has purchased 168 acres in Belmont County, OH as the potential future home of a proposed $5 billion ethane cracker plant (2) On 11/9/17 the WV Department of Commerce announced an agreement with China Energy to invest nearly $84 billion in projects throughout the state over the next 20 years » The first phase of the project is slated to being in 6 to 8 months and include a proposed natural gas power plant in Brooke County (Wellsburg, WV) (3)

5 Cost of Funds vs. Peers (1) Stable, low - cost deposit sources provide ready liquidity source to fund continued loan growth 7 branch locations in the Ohio River Valley and 1 in Buckhannon, WV Deposit portfolio details (as of 9/30/2017) • $285 million of total deposits • $49.5 million of noninterest bearing deposits • Approximately 40% of deposits are low - cost transaction accounts • Approximately 80% of deposits are non - time • Cost of funds of 29 basis points for the quarter ended 9/30/17 Deposit Portfolio Overview First West Virginia – Excellent Core Funding Source: SNL Financial and First West Virginia company documents. (1) Peers include all publicly traded banks and thrifts headquartered in West Virginia, Ohio, or Pennsylvania with most recent quarter - end total assets between $100 million and $750 million. 0.46% 0.39% 0.32% 0.30% 0.29% 0.50% 0.50% 0.49% 0.53% 0.58% 2015 2016 3/31/2017 6/30/2017 9/30/2017 FWVB Peer Median

6 Loan Portfolio Deposit Mix Total loans: $704 million Average yield: 4.31% CBFV Total deposits: $762 million Cost of Deposits = 0.39% Loan/deposit ratio of 92% CBFV Total loans: $101 million Average yield: 4.51% FWVB Total deposits: $285 million Cost of Deposits = 0.23% Loan/deposit ratio of 36% Total loans: $805 million Pro Forma Total deposits: $1,048 million Cost of Deposits = 0.35% Loan/deposit ratio of 77% Pro Forma FWVB Loan and Deposit Portfolios Source: SNL Financial and First West Virginia company documents . Historical data per regulatory filings as of 9/30/2017. Construction 4.1% Residential R.E. 36.0% Commercial R.E. 28.9% Commercial & Industrial 10.3% Consumer & Other 20.7% Construction 0.3% Residential R.E. 25.9% Commercial R.E. 45.5% Commercial & Industrial 13.3% Consumer & Other 14.9% Construction 3.6% Residential R.E. 34.8% Commercial R.E. 31.0% Commercial & Industrial 10.7% Consumer & Other 20.0% Demand Deposits 24.6% NOW & Other Trans. Accts 4.0% MMDA & Other Savings 50.1% Retail Time Deposits 9.9% Jumbo Time Deposits 11.4% Demand Deposits 17.4% NOW & Other Trans. Accts 21.8% MMDA & Other Savings 42.1% Retail Time Deposits 12.0% Jumbo Time Deposits 6.8% Demand Deposits 22.6% NOW & Other Trans. Accts 8.9% MMDA & Other Savings 47.9% Retail Time Deposits 10.5% Jumbo Time Deposits 10.1%

7 Each outstanding share of First West Virginia will be exchanged for 0.9583 shares of CBFV common stock or $28.50 of cash at the election of First West Virginia shareholders Consideration Mix: 80% stock / 20% cash Implied Price per Share: $28.50 (1) Transaction Value: $49.0 million (1) Price / Tangible Book Value: 1.53x (2) First West Virginia shareholders to own approximately 24% of the combined entity Three current First West Virginia board members to be appointed to the board of CBFV CBFV will establish a Wheeling, WV advisory board First West Virginia and CBFV shareholder approvals Customary regulatory approvals Transaction Summary Board Seats Required Approvals Summary of Terms Source: SNL Financial. (1) Based upon a 10 - day average closing price for CBFV’s common stock of $29.74 as of 11/15/17 . (2) Based upon the cash deal value per share of $28.50 and First West Virginia’s 9/30/17 tangible book value per share of $18.62.

8 Identified cost savings of approximately $3.0 million (37 % of noninterest expense) when fully phased - in • 65% phased - in during 2018 and 100% thereafter Assumes ~$155.6 million of incremental loan growth from CBFV and FWVB is funded through a redeployment of FWVB’s existing liquidity over the next three years Cumulative estimated interest rate marks of approximately $4.0 million (1) primarily related to First West Virginia’s securities portfolio After - tax deal - related charges of $3.8 million Credit due diligence: • Gross credit mark of ~2.5% of First West Virginia’s loan portfolio ($2.5 million) • Reviewed 67% of the outstanding commercial portfolio and 57% of the total portfolio Estimated close in the 2 nd quarter of 2018 2018 EPS : ~0.5% accretive (2) 2019 EPS: > 15% accretive (2 ) TBV Impact : ~12.0% dilutive (3) TBV Earnback: ~4.5 years (4) IRR: >25% (including loan leverage) >15% (excluding loan leverage) TCE / TA: Approximately 8.1% All regulatory capital ratios estimated to remain well in excess of well capitalized levels Assumptions & Due Diligence Transaction Impacts (1) Includes the cumulative interest rate marks on securities, loans and deposits . Securities portfolio interest rate mark assumed to accrete over 4.9 years, the portfolio’s weighted average maturity. (2) Estimated based on consensus earnings estimates for CB Financial Services, Inc. plus assumed transaction adjustments. CB Financial Services, Inc. does not endorse consensus earnings estimates or publish financial guidance. Actual results may differ from consensus earnings estimates. (3) Estimated tangible book value per share impact and capital ratios assume a 5/31/18 closing date for example purposes. (4) Using the crossover method. Summary of Assumptions and Impact

9 2019 Estimated ROAA (%) (1) Source: SNL Financial and company documents. Pricing data as of 11/15/17. Peers include exchange traded banks headquartered in the Mid - Atlantic and Midwest with assets between $1.0 billion and $1.75 bil lion and at least one 2019 return on average assets or earnings per share estimate. Excludes announced merger targets and Marlin Business Services Corp. (1) Estimated return on average assets and earnings per share per consensus research estimates. Valuation Discount Relative to Pro Forma Peers Projected profitability in line with peer estimated profitability Pro forma 2019 estimated earnings multiple is approximately 0 .8x lower than peer Valuation supported by strong dividend yield of 3.2% vs. peer median of 1.8% Price / Tangible Book Value Price / 2019 Estimated EPS (1) 13.4x 14.2x 11.0x 13.0x 15.0x CBFV Exchange Traded Peers 1.62x 1.62x 0.00x 1.00x 2.00x CBFV Exchange Traded Peers 0.93% 0.99% CBFV Exchange Traded Peers

10 Logical expansion into contiguous Ohio River Valley markets Stable, low - cost pro forma core funding base comprised of approximately 80% non - time deposits at a weighted rate of 35 basis points Attractive funding source for CBFV’s loan growth $1.25 billion combined franchise positioned for continued growth with the increased scale provided by the transaction Significantly accretive to earnings per share with a manageable tangible book value earnback period Pro forma market capitalization of approximately $160 million (1) Increases capacity to serve customers throughout the Marcellus and Utica Shale Regions Morgantown, WV market provides an identified expansion opportunity Transaction Summary Source: SNL Financial . (1) Market data as of 11/15/17.