Attached files

| file | filename |

|---|---|

| 8-K - BAR HARBOR BANKSHARES 8-K - BAR HARBOR BANKSHARES | a51717288.htm |

Exhibit 99.1

November 2017 Sandler O’Neill Partners 2017 East Coast Financial Services Conference +

Legal Disclaimer Forward Looking Statements This document contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. There are several factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see the Company’s most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and available on the SEC’s website at www.sec.gov. The Company does not undertake any obligation to update forward-looking statements. Non-GAAP Financial Statements This document contains certain non-GAAP financial measures in addition to results presented in accordance with Generally Accepted Accounting Principles (“GAAP”). These non-GAAP measures provide supplemental perspectives on operating results, performance trends, and financial condition. They are not a substitute for GAAP measures; they should be read and used in conjunction with the Company’s GAAP financial information. A reconciliation of non-GAAP financial measures to GAAP measures is included in the third quarter earnings release and Form 10-Q which can be found at www.bhbt.com. In all cases, it should be understood that non-GAAP per share measures do not depict amounts that accrue directly to the benefit of shareholders. The Company utilizes the non-GAAP measure of core earnings in evaluating operating trends, including components for core revenue and expense. These measures exclude items which the Company does not view as related to its normalized operations. These items include securities gains/losses, merger costs, restructuring costs, and systems conversion costs. Non-core adjustments are presented net of an adjustment for income tax expense. This adjustment is determined as the difference between the GAAP tax rate and the effective tax rate applicable to core income. The efficiency ratio is adjusted for non-core revenue and expense items and for tax preference items. The Company also calculates measures related to tangible equity, which adjust equity (and assets where applicable) to exclude intangible assets due to the importance of these measures to the investment community. Charges related to the acquisition of Lake Sunapee Bank Group consist primarily of severance and retention cost, systems conversion and integration costs, and professional fees. The Company’s disclosure of organic growth of loans in 2017 is also adjusted for the acquisition of Lake Sunapee Bank Group.

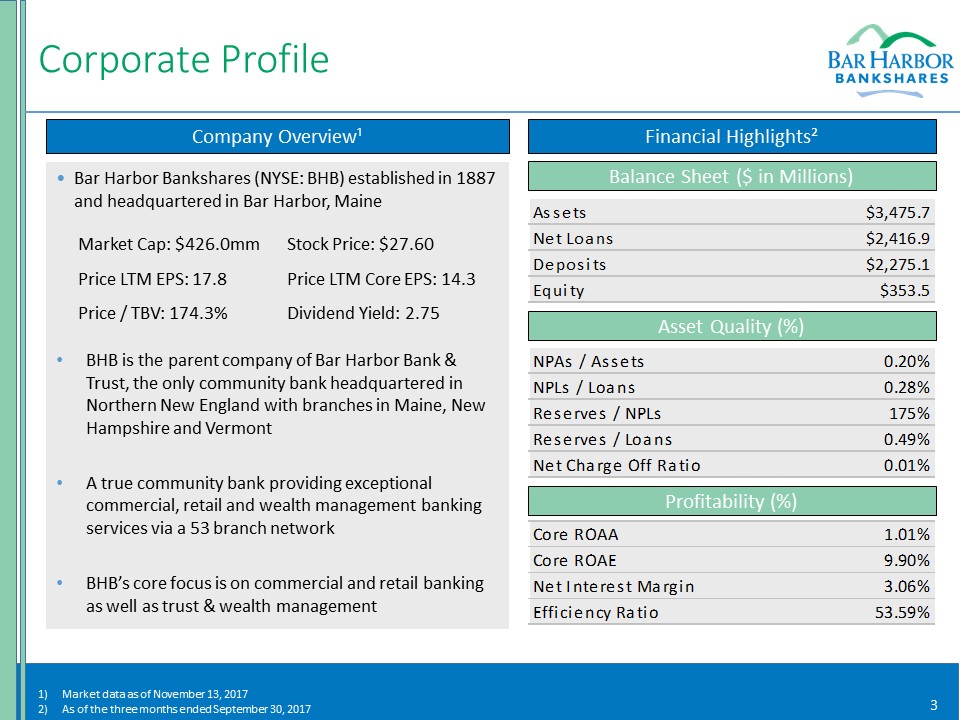

Corporate Profile Market data as of November 13, 2017As of the three months ended September 30, 2017 Balance Sheet ($ in Millions) Asset Quality (%) Profitability (%) Financial Highlights² Company Overview¹ Bar Harbor Bankshares (NYSE: BHB) established in 1887 and headquartered in Bar Harbor, MaineBHB is the parent company of Bar Harbor Bank & Trust, the only community bank headquartered in Northern New England with branches in Maine, New Hampshire and VermontA true community bank providing exceptional commercial, retail and wealth management banking services via a 53 branch networkBHB’s core focus is on commercial and retail banking as well as trust & wealth management Market Cap: $426.0mm Stock Price: $27.60 Price LTM EPS: 17.8 Price LTM Core EPS: 14.3 Price / TBV: 174.3% Dividend Yield: 2.75

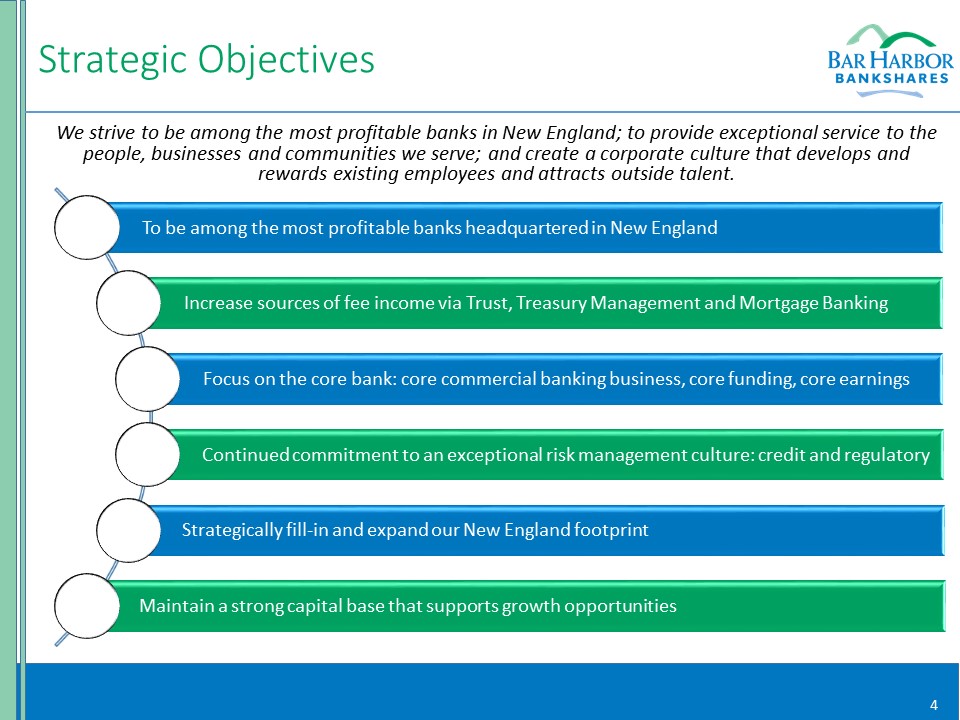

Strategic Objectives We strive to be among the most profitable banks in New England; to provide exceptional service to the people, businesses and communities we serve; and create a corporate culture that develops and rewards existing employees and attracts outside talent.

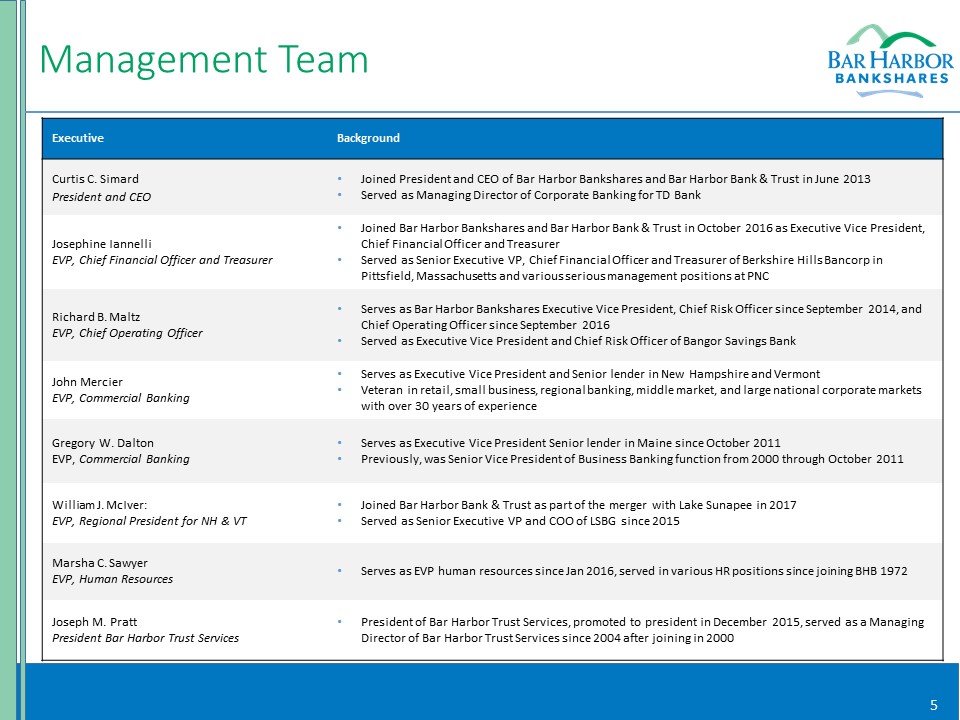

Management Team Executive Background Curtis C. Simard President and CEO Joined President and CEO of Bar Harbor Bankshares and Bar Harbor Bank & Trust in June 2013Served as Managing Director of Corporate Banking for TD Bank Josephine IannelliEVP, Chief Financial Officer and Treasurer Joined Bar Harbor Bankshares and Bar Harbor Bank & Trust in October 2016 as Executive Vice President, Chief Financial Officer and TreasurerServed as Senior Executive VP, Chief Financial Officer and Treasurer of Berkshire Hills Bancorp in Pittsfield, Massachusetts and various serious management positions at PNC Richard B. Maltz EVP, Chief Operating Officer Serves as Bar Harbor Bankshares Executive Vice President, Chief Risk Officer since September 2014, and Chief Operating Officer since September 2016 Served as Executive Vice President and Chief Risk Officer of Bangor Savings Bank John Mercier EVP, Commercial Banking Serves as Executive Vice President and Senior lender in New Hampshire and Vermont Veteran in retail, small business, regional banking, middle market, and large national corporate markets with over 30 years of experience Gregory W. DaltonEVP, Commercial Banking Serves as Executive Vice President Senior lender in Maine since October 2011 Previously, was Senior Vice President of Business Banking function from 2000 through October 2011 William J. McIver: EVP, Regional President for NH & VT Joined Bar Harbor Bank & Trust as part of the merger with Lake Sunapee in 2017Served as Senior Executive VP and COO of LSBG since 2015 Marsha C. Sawyer EVP, Human Resources Serves as EVP human resources since Jan 2016, served in various HR positions since joining BHB 1972 Joseph M. PrattPresident Bar Harbor Trust Services President of Bar Harbor Trust Services, promoted to president in December 2015, served as a Managing Director of Bar Harbor Trust Services since 2004 after joining in 2000

Company Milestones Established in 1887, Bar Harbor Trust has taken significant steps to grow into one of the most profitable banks in New England 1887 Mr. Simard assumed role as President & CEO BHB named to Sandler O’Neill’s All Star List 2013 Transformative acquisition of Lake Sunapee Bank Group expands service market into New Hampshire and VermontHired Ms. Iannelli as Chief Financial Officer given previous acquisition experience 2016 Upgraded core operating systems and invested capital into key businesses 2017 Acquired Border Trust Company 2012 Enhanced management team with the addition of John Mercier at the executive level and other key management level positions 2017 Established Bar Harbor Bankshares as Holding Company 1984 Hired Mr. Maltz as Chief Operating Officer to build out infrastructure in advance of growth strategy 2014

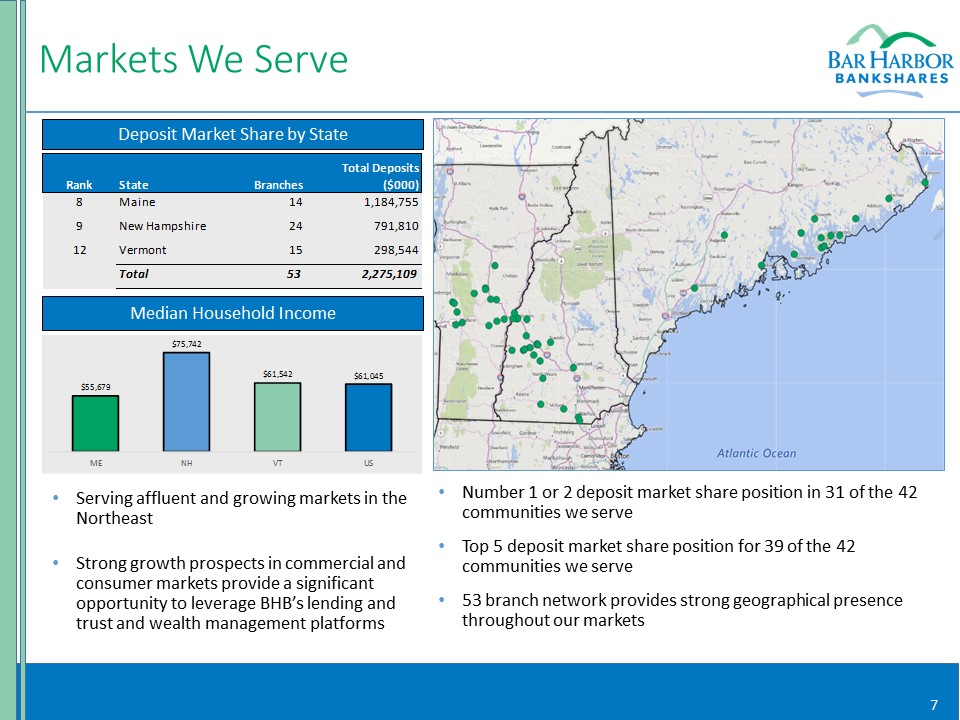

Markets We Serve Serving affluent and growing markets in the NortheastStrong growth prospects in commercial and consumer markets provide a significant opportunity to leverage BHB’s lending and trust and wealth management platforms Deposit Market Share by State Median Household Income Number 1 or 2 deposit market share position in 31 of the 42 communities we serveTop 5 deposit market share position for 39 of the 42 communities we serve53 branch network provides strong geographical presence throughout our markets

Third Quarter 2017 - Highlights & Initiatives 9% total loan growth (annualized)22% commercial loan growth (annualized)11% deposit growth (annualized)1.01% core ROA (non-GAAP)9.90% core ROE (non-GAAP)6% increase in non-interest income53.59% efficiency ratioAnnounced sale of insurance business Announced expansion of treasury management services A record quarter for BHB in terms of revenue and earnings, demonstrating the stability of our business model and our platform for generating even stronger organic growth See appendix for GAAP reconciliation

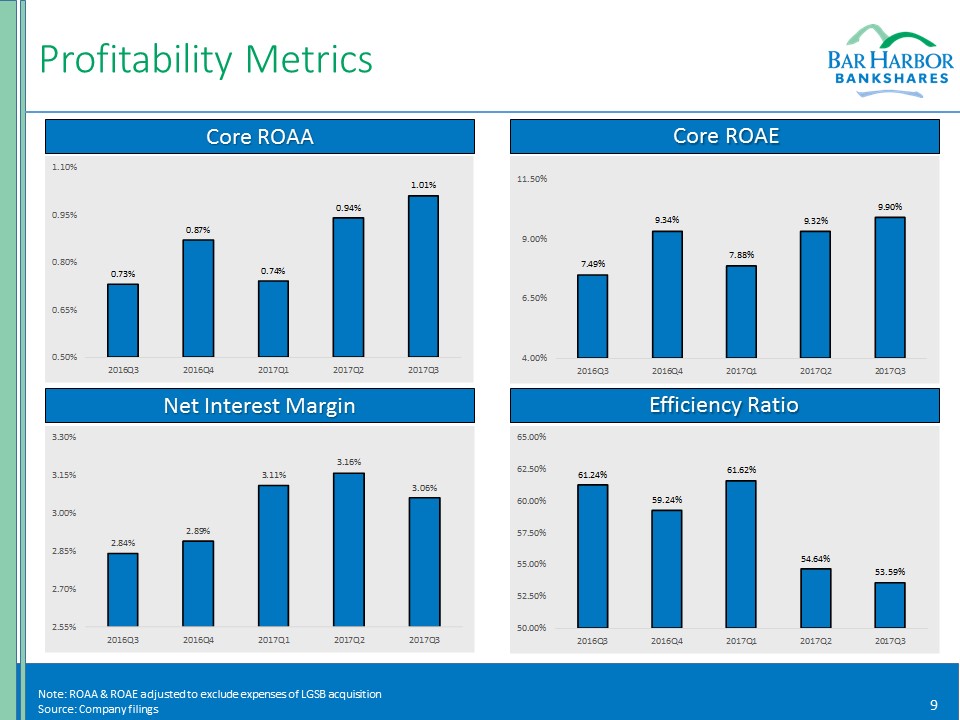

Profitability Metrics Efficiency Ratio Net Interest Margin Core ROAE Core ROAA Note: ROAA & ROAE adjusted to exclude expenses of LGSB acquisitionSource: Company filings

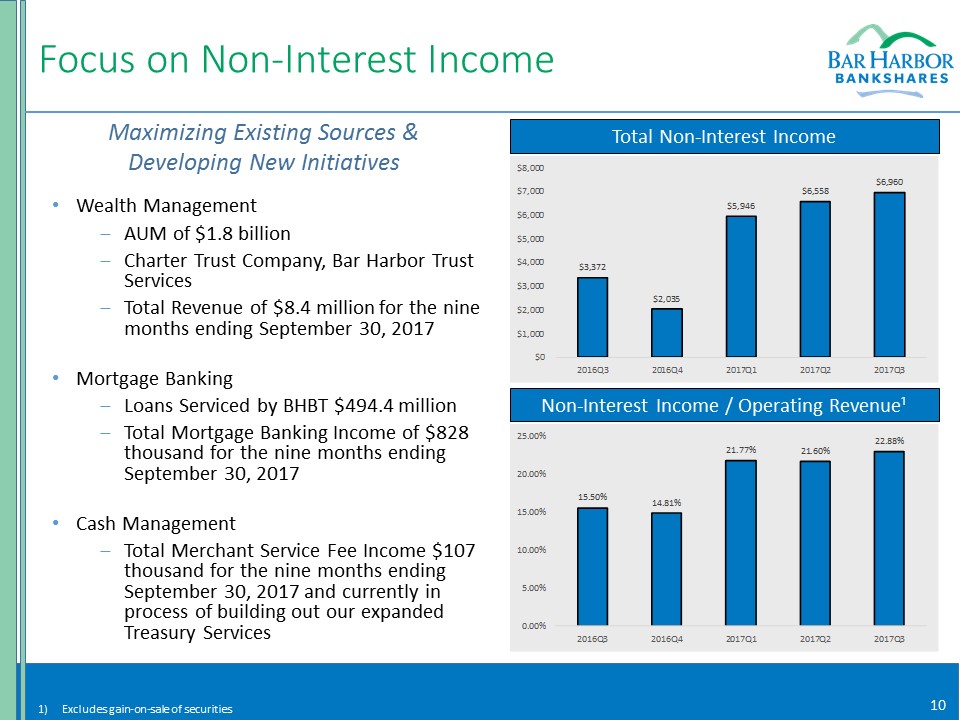

Focus on Non-Interest Income Wealth ManagementAUM of $1.8 billionCharter Trust Company, Bar Harbor Trust ServicesTotal Revenue of $8.4 million for the nine months ending September 30, 2017Mortgage BankingLoans Serviced by BHBT $494.4 millionTotal Mortgage Banking Income of $828 thousand for the nine months ending September 30, 2017Cash Management Total Merchant Service Fee Income $107 thousand for the nine months ending September 30, 2017 and currently in process of building out our expanded Treasury Services Total Non-Interest Income Non-Interest Income / Operating Revenue¹ Maximizing Existing Sources &Developing New Initiatives Excludes gain-on-sale of securities

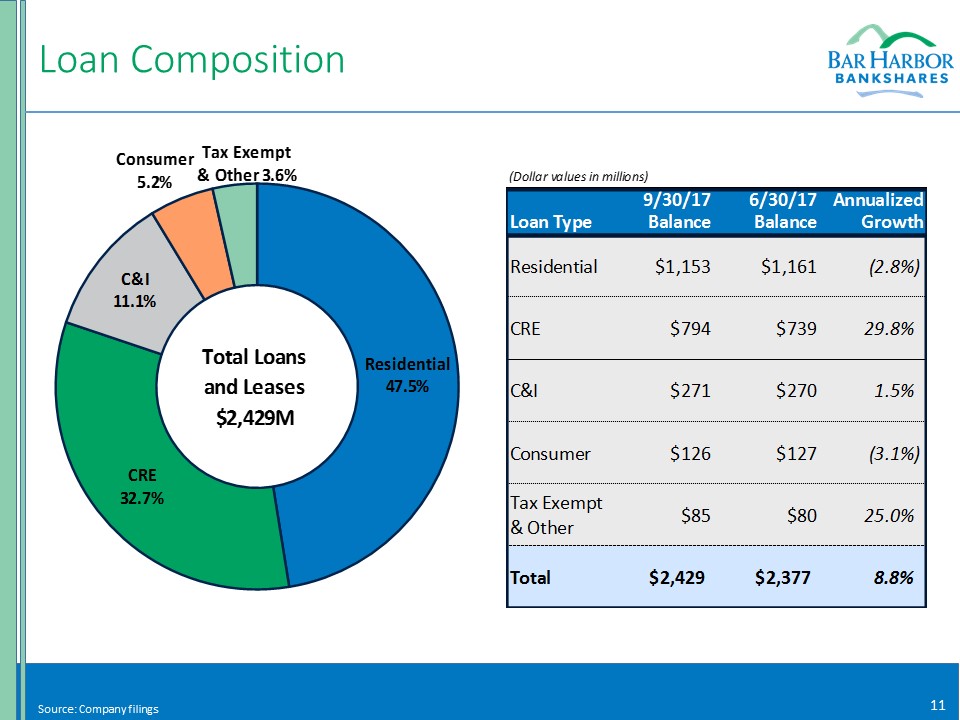

Loan Composition Source: Company filings

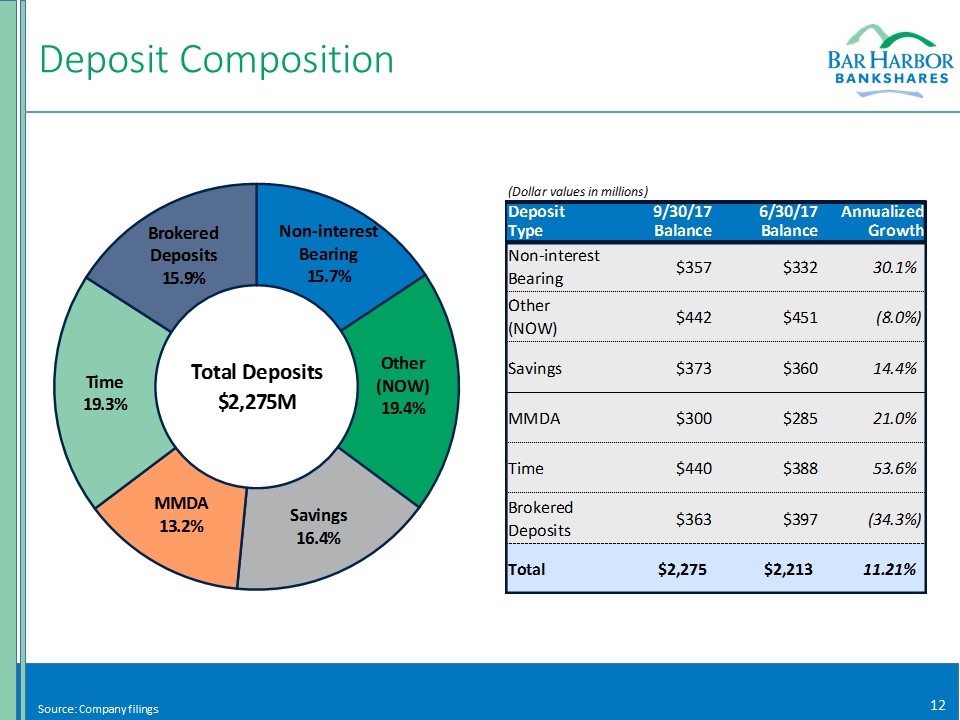

Deposit Composition Source: Company filings

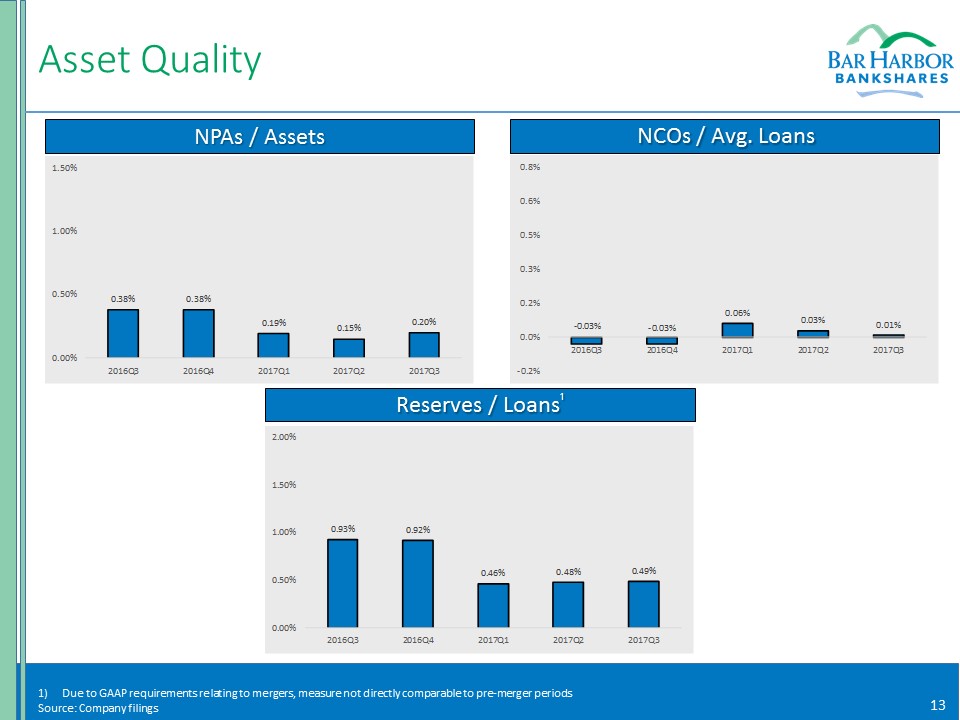

Asset Quality Due to GAAP requirements relating to mergers, measure not directly comparable to pre-merger periodsSource: Company filings Reserves / Loans¹ NCOs / Avg. Loans NPAs / Assets

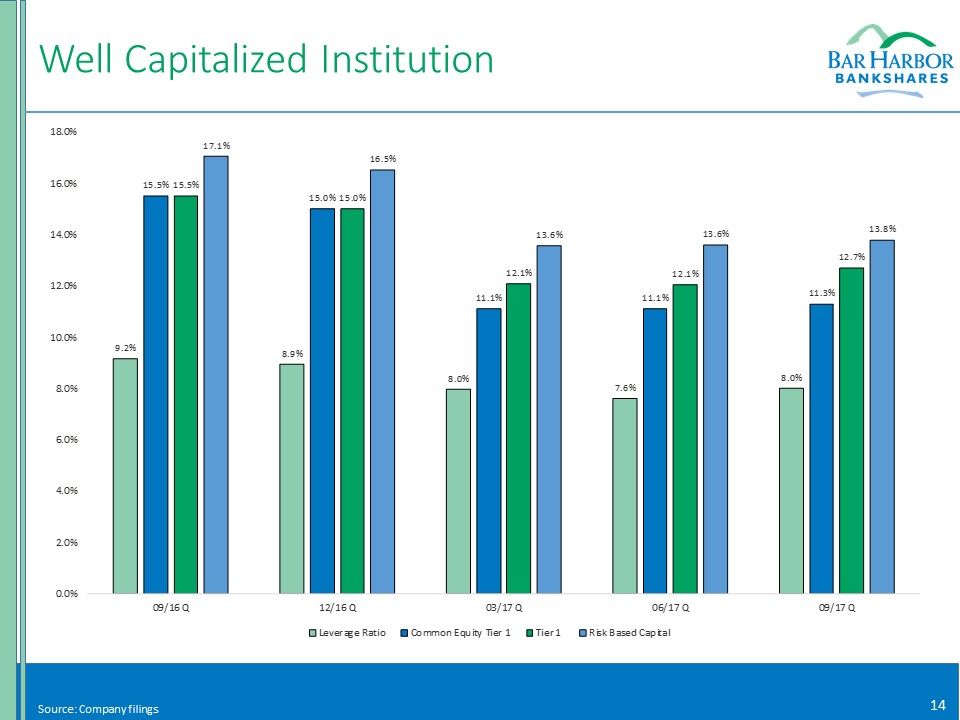

Well Capitalized Institution Source: Company filings

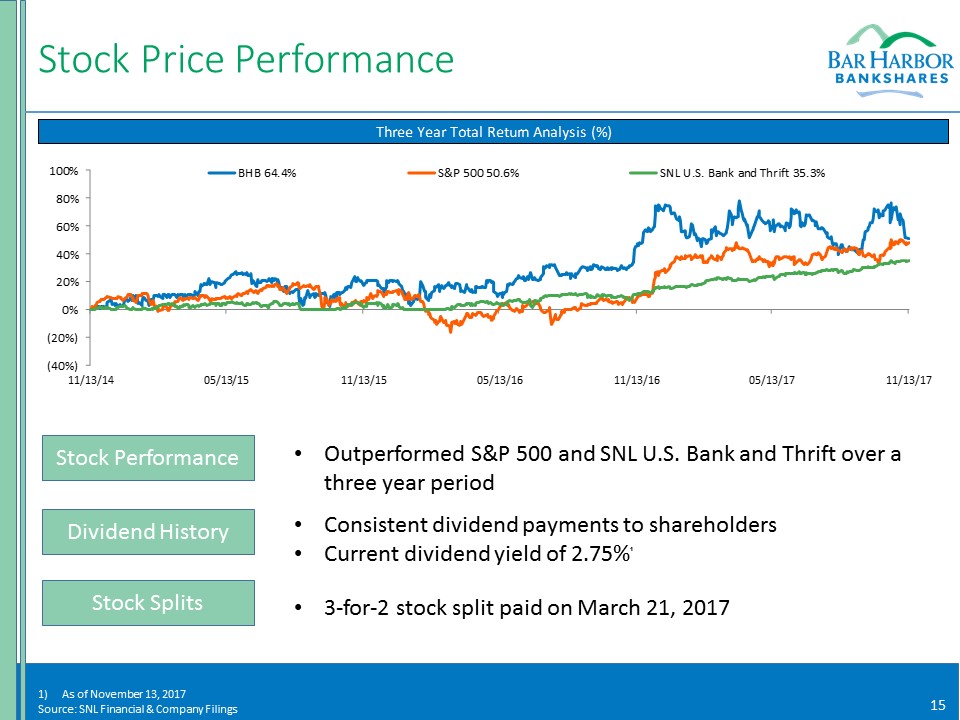

Stock Price Performance Dividend History Stock Splits Consistent dividend payments to shareholdersCurrent dividend yield of 2.75%¹ 3-for-2 stock split paid on March 21, 2017 As of November 13, 2017Source: SNL Financial & Company Filings Stock Performance Outperformed S&P 500 and SNL U.S. Bank and Thrift over a three year period

Investment Considerations Focused on building franchise value Deep and talented management teamProfitable and efficient business model Clear vision to grow core loan/deposit business Development and expansion of non-interest income revenueProven ability to grow organically and via acquisitionsPristine credit quality and culture dedicated to risk managementTeam, platform and strategy in place to generate efficient growth

Appendix

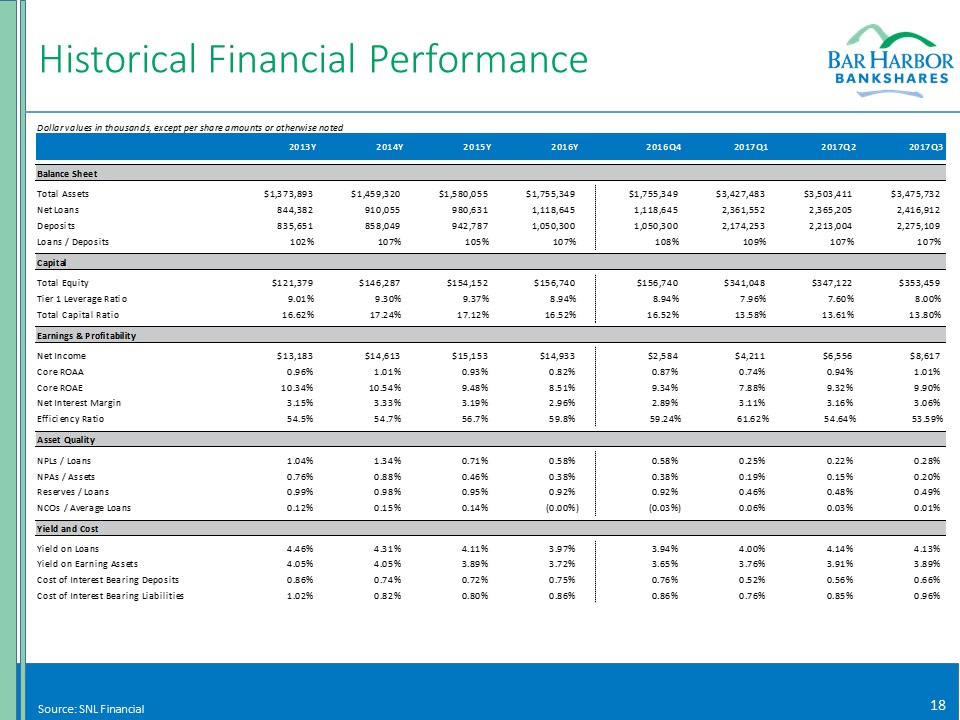

Historical Financial Performance Source: SNL Financial

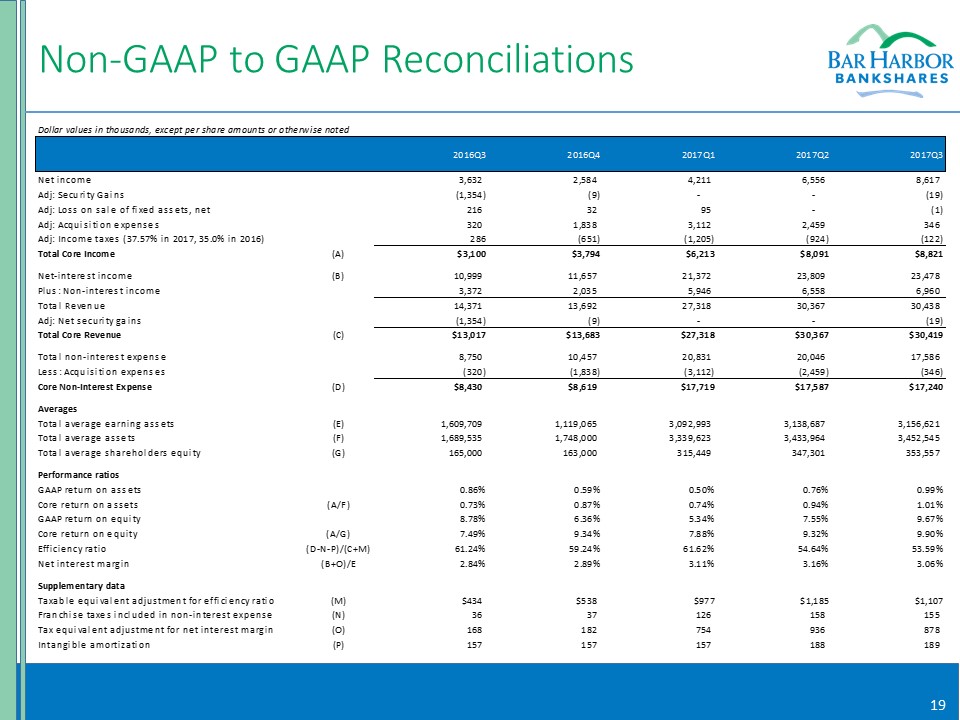

Non-GAAP to GAAP Reconciliations