Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ZAGG Inc | a8k-november132017.htm |

0

Investor Presentation

November 2017

1

Safe harbor statement

Forward-Looking Statements

Statements in this presentation relating to ZAGG Inc’s (“ZAGG”) future plans, expectations, beliefs, intentions and prospects are “forward-looking statements” and are subject to material risks and

uncertainties. Many factors could affect our current expectations and our actual results could differ materially from those expectations. We presently consider the following to be among the important

factors that could cause actual results to differ materially from expectations: (a) the ability to design, produce, and distribute the creative product solutions required to retain existing customers and to

attract new customers; (b) building and maintaining marketing and distribution functions sufficient to gain meaningful international market share for ZAGG's products; (c) the ability to respond quickly

with appropriate products after the adoption and introduction of new mobile devices by major manufacturers like Apple, Samsung, and Google; (d) changes or delays in announced launch schedules

for (or recalls or withdrawals of) new mobile devices by major manufacturers like Apple, Samsung, and Google; (e) the ability to successfully integrate new operations or acquisitions, specifically including

mophie inc., (f) the impact of inconsistent quality or reliability of new product offerings; (g) the impact of lower profit margins in certain new and existing product categories, including certain mophie

products; (h) the impacts of changes in economic conditions, including on customer demand; (i) managing inventory in light of constantly shifting consumer demand; (j) the failure of information systems

or technology solutions or the failure to secure information system data, failure to comply with privacy laws, security breaches, or the effect on the company from cyber-attacks, terrorist incidents, or the

threat of terrorist incidents; and (k) adoption of or changes in accounting policies, principles, or estimates. A detailed discussion of these factors and other risks that affect our business is contained in our

filings with the Securities and Exchange Commission, including our most recent reports on Form 10-K and Form 10-Q, particularly under the heading “Risk Factors.” Any forward-looking statement speaks

only as of the date on which such statement is made. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such

factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. All information set forth in

this presentation is current as of November 13, 2017. ZAGG undertakes no duty to update any statement in light of new information or future events.

This presentation also contains estimates and other statistical data made by independent parties and by ZAGG relating to market share, growth and other industry data. This data involves a number of

assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent

parties and contained in this presentation and, accordingly, cannot guarantee their accuracy or completeness. In addition, projections, assumptions and estimates of our future performance and the

future performance of the markets in which we compete are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results or

outcomes to differ materially from those expressed in the estimates made by the independent parties and by ZAGG.

Non-GAAP Financial Measures

This presentation also includes certain non-GAAP financial measures. These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures,

and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. There are a number of limitations related to the use of these non-GAAP financial

measures versus their nearest GAAP equivalents. We have provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available in the appendix.

The Company is unable to provide guidance for net income (loss), and reconciliation of Adjusted EBITDA to net income (loss), as the closest corresponding U.S. GAAP measure is not available without

unreasonable efforts on a forward-looking basis due to the variability and complexity with respect to charges excluded from this non-GAAP measure. In particular, these complexities include the

measures and effects of stock based compensation expense that are directly impacted by unpredictable fluctuations in our share price, and our tax expense that is directly impacted by our taxable

income. We expect the variability of these charges could have a significant, and potentially unpredictable, impact on our future U.S. GAAP results

2

Corporate objectives & values

3

$-

$100

$200

$300

$400

$500

$600

A history of continuous innovation

Key ZAGG

milestones

Industry

products

released

2013 2016200920082007 2014 20152010 2011 2012 2017E

Key ZAGG

products

introduced

Year

InvisibleShield

was first

released

ZAGG releases

first tablet

keyboard

First iPad

released by

Apple

InvisibleShield

introduced curved

glass solution

iFROGZ wireless

earbuds released

Apple announces

new wireless

charging platform

Screen Protection

Power

Audio

Keyboards, Cases, & Other

First Apple

iPhone is

released

Randy Hales

appointed CEO

Company

reaches

$100mm in

revenue

ZAGG

acquires

iFrogz

ZAGG launches

InvisibleShield On

Demand and

InvisibleShield

Glass

mophie launches

wireless charging

platform

Release of

Samsung

Galaxy S4

ZAGG acquires

mophie

Samsung

announces

Galaxy S8 with

curved glass

display

4

Product portfolio aligns with consumer needs

46%

42%

6% 5%

Power

Audio

Cases

Screen

protection

Tablet

keyboards

1%

2017E

$520MM

net sales

Mobile audio lifestyle

Connectivity

& productivity

Investment protection

Extended power

Handset costs are on the rise

Protecting trade-in device value

Brittleness vs. scratch resistance screens

1.5 billion units sold in 2016

Mobile traffic outpacing desktop traffic

Increasing frequency of working remotely

Tablets being used for more than just consumption –

content creation

Larger screens and thinner devices are gaining popularity

Apps and increased phone usage drain battery at an

alarming rate

“Our One Wish? Longer Battery Life” – Wall Street Journal

People are consuming increasing amounts of content

Wireless options allow for more flexibility

Mobile music listening has driven weekly headphone

usage from an average 3 hours in 1980 to over 20 hours

in 2016

5

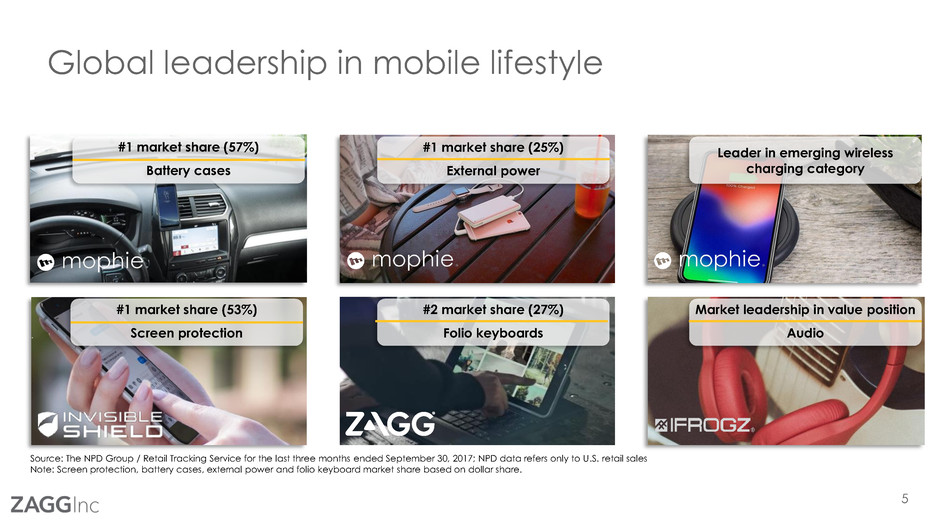

Global leadership in mobile lifestyle

#1 market share (53%)

Screen protection

#1 market share (57%)

Battery cases

#2 market share (27%)

Folio keyboards

Source: The NPD Group / Retail Tracking Service for the last three months ended September 30, 2017; NPD data refers only to U.S. retail sales

Note: Screen protection, battery cases, external power and folio keyboard market share based on dollar share.

Leader in emerging wireless

charging category

Market leadership in value position

Audio

#1 market share (25%)

External power

6

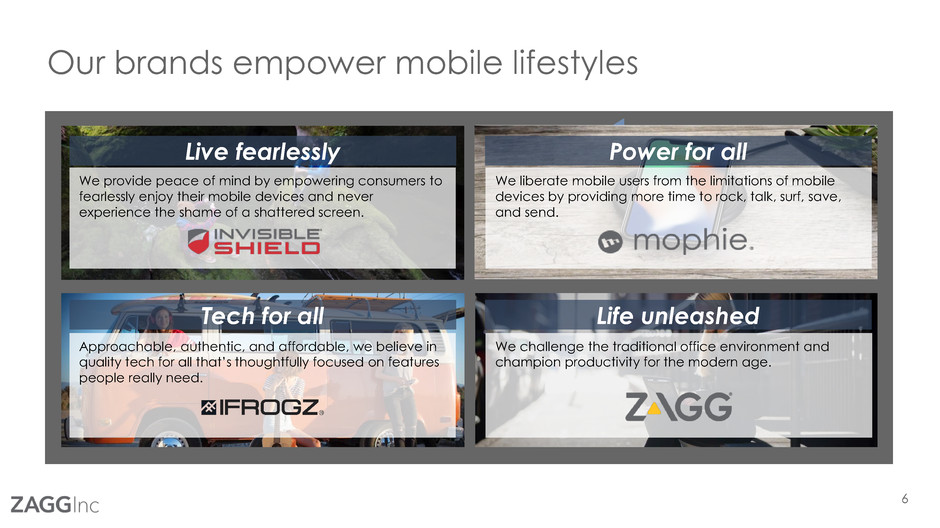

Our brands empower mobile lifestyles

We challenge the traditional office environment and

champion productivity for the modern age.

We liberate mobile users from the limitations of mobile

devices by providing more time to rock, talk, surf, save,

and send.

Approachable, authentic, and affordable, we believe in

quality tech for all that’s thoughtfully focused on features

people really need.

Power for allLive fearlessly

We provide peace of mind by empowering consumers to

fearlessly enjoy their mobile devices and never

experience the shame of a shattered screen.

Tech for all Life unleashed

7

Preferred partner across channels

Wireless

carriers

45%

Major retail 42%

E-

commerce

9%

Strategic

retail

4%

Category management expertise

Speed to market

Operational execution

Strong retail sell-through

High margin categories

World class customer service

Deep strategic partnerships✓

✓

✓

✓

✓

Channel Select customers % of sales1

ZAGG International

customers

✓

✓

= ~12% of sales1

1 % of sales figures from expected 2017 year-end results

Why our partners love us

8

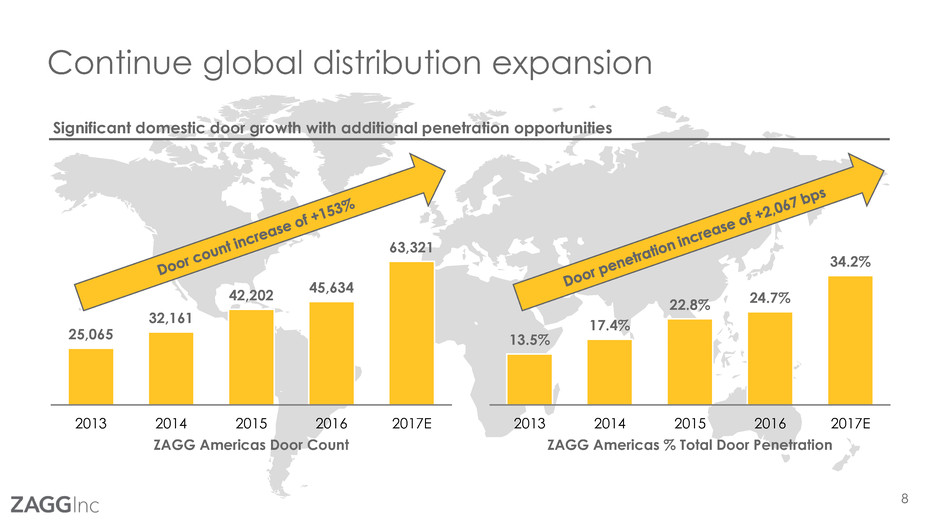

Continue global distribution expansion

Significant domestic door growth with additional penetration opportunities

25,065

32,161

42,202

45,634

63,321

2013 2014 2015 2016 2017E

ZAGG Americas Door Count

13.5%

17.4%

22.8% 24.7%

34.2%

2013 2014 2015 2016 2017E

ZAGG Americas % Total Door Penetration

9

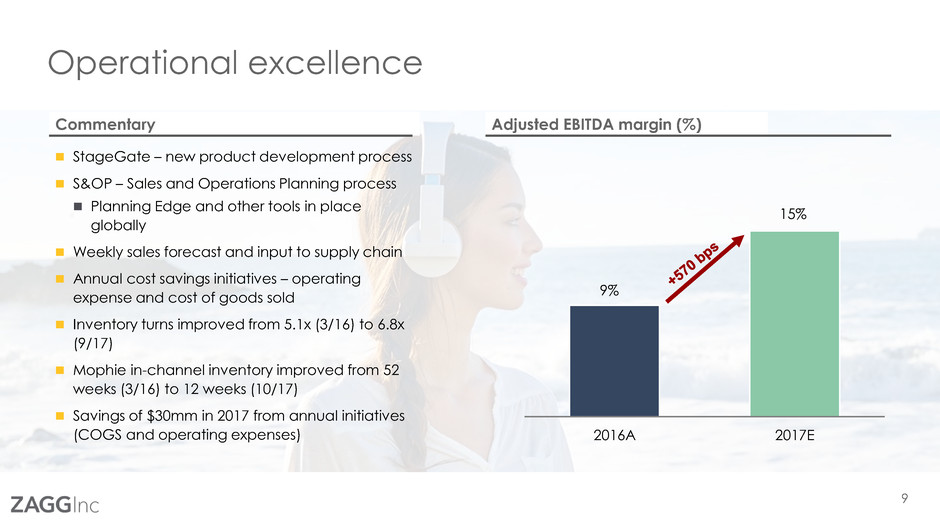

Operational excellence

9%

15%

2016A 2017E

Adjusted EBITDA margin (%)

StageGate – new product development process

S&OP – Sales and Operations Planning process

Planning Edge and other tools in place

globally

Weekly sales forecast and input to supply chain

Annual cost savings initiatives – operating

expense and cost of goods sold

Inventory turns improved from 5.1x (3/16) to 6.8x

(9/17)

Mophie in-channel inventory improved from 52

weeks (3/16) to 12 weeks (10/17)

Savings of $30mm in 2017 from annual initiatives

(COGS and operating expenses)

Commentary

10

Strong relationship with key OEMs

During the Apple iPhone 8 / iPhone X unveil, Apple

announced mophie wireless charging collaboration

During the Google Pixel 2 launch event, Google

announced InvisibleShield screen protection collaboration

Close partnerships with key OEMsProducts designed for all the top mobile devices1

1 Logos shown are not inclusive of all brands

✓ Longstanding partnership with

diverse set of key OEMS

✓ Nimble across form factors

✓ Ability to adapt to rapidly

changing technology landscape

11

34%

42%

51%

53%

20%

30%

40%

50%

60%

2014 2015 2016 2017 YTD

Dollar Market Share

Strategy case study: screen protection

InvisibleShield ~19 points of market share gains driven by:

✓ Product innovation and higher ASPs ✓ Expanded distribution at wireless retailers

✓ Increased brand awareness ✓ Desirable, high-margin product for retailers

✓ Increased attach rates with further growth expected as cost of devices increase, changing phone contract dynamics

Source: ZAGG management; The NPD Group, Inc., U.S. Retail Tracking Service, Cell Phone Screen Protection, January 2014 – September 2017, dollars

GG4 11/14 GG5 08/16

Timing of Gorilla Glass launches (originally launched in 2010)

12

Successfully executing on mophie turnaround strategy

Appointed ZAGG executive to oversee turnaround efforts, right-size cost structure to drive

margin expansion, and further improve S&OP process

✓

Products designed for improved gross margin by utilizing standard and modular components,

stage gate, and improved sales and operations planning (Supply chain process)

Consolidated mophie and ZAGG sales teams to maximize cross-selling opportunities

Realized economies of scale at existing retailer relationships to drive expanded market

penetration, improve mophie contractual terms, and B2B opportunities with broader

complimentary products

Management implemented initiatives have led to mophie

operational improvements

Implemented S&OP process and tools

✓ Reduced sales returns

✓ In-channel inventory reduced from 52 weeks (03/16) to 12 weeks (10/17)

✓

✓

✓

✓

✓

Consolidated synergies of $16mm+ in first 24 months

Financial overview

14

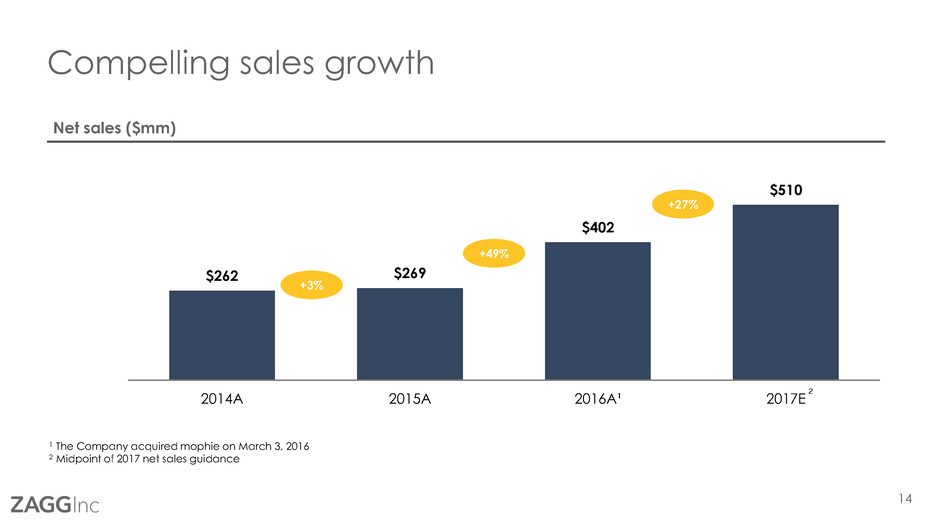

Compelling sales growth

Net sales ($mm)

$262 $269

$402

$510

2014A 2015A 2016A¹ 2017E

+3%

+27%

+49%

1 The Company acquired mophie on March 3, 2016

2 Midpoint of 2017 net sales guidance

2

15

Strong profitability

Adjusted EBITDA1 ($mm)

$32

$42

$37

$77

2014A 2015A 2016A 2017E

EBITDA

margin %

12.3% 15.7% 15.0%9.3%

1 Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, amortization, stock-based compensation expense, other income (expense), mophie transaction costs, mophie fair value

inventory write-up related to acquisition, mophie restructuring charges, mophie employee retention bonus, and the loss on disputed mophie purchase price

2 mophie Adjusted EBITDA of ($16mm); ZAGG Adjusted EBITDA of $53mm

3 Midpoint of 2017 Adjusted EBITDA guidance

+105%

+31% (12%)

2 3

16

Adjusted EBITDA bridge – 2016A-2017E

Bridge to 2017E Adjusted EBITDA ($mm)

$37

$20

$12

$8 $77

2016A Adj. EBITDA Screen protection,

audio and keyboards

Power management Synergies 2017E Adj. EBITDA

Summary of 2017E Adjusted EBITDA adjustments

Screen protection, audio and keyboard category growth

Power management and wireless category expansion, including improved margins

Synergies – cost synergies related to mophie acquisition

1

2

3

2 31

17

Long-term growth

Long-term growth engine

▪ Continued international expansion

▪ Organically grow existing product categories in the

domestic market

▪ Digital channel expansion (zagg.com

mophie.com, and Amazon)

▪ M&A activity in existing or new product categories

Historical acquisition success

$350+1

$300+1

$300+1

Purchase price / acquisition date

Net sales

(cumulative, $mm)

Keyboard IP

acquisition

$2.5mm (2011)

$100mm (2011)

$100mm (2016)

1 Expected cumulative sales for the year-ended December 31, 2017

18

Appendix

19

Non-GAAP reconciliation

Three months ended Nine months ended Year Ended

September 31,

2017

September 31,

2016

September 31,

2017

September 31,

2016

December 31,

2016

Net income in accordance with GAAP $ 9,776 $ (7,105) $ 7,041 $ (11,442) $ (15,587)

Adjustments:

a. Stock based compensation expense 899 1,386 2,535 3,679 3,830

b. Depreciation and amortization 5,486 4,989 16,505 16,484 22,270

c. Other (income) expense 399 656 1,460 1,639 2,199

d. Impairment of intangible asset - - 1,959 - -

e. mophie transaction costs 96 145 611 2,467 2,591

f. mophie fair value of inventory write-up - (739) - 2,586 2,586

g. mophie restructuring charges - 138 437 1,201 2,160

h. mophie employee retention bonus - 300 346 500 841

i. Loss on disputed mophie purchase price - 24,317 - 24,317 24,317

j. Income tax benefit 5,760 (6,261) 6,281 (7,963) (7,972)

Adjusted EBITDA $ 22,416 $ 17,826 $ 37,175 $ 33,468 $ 37,235

20

The NPD Group, Inc. references

References to the market shares information on slide #5 from The NPD Group Retail Tracking Services cited below:

1. The NPD Group Inc., U.S. Retail Tracking Service, Cell Phone Screen Protection, Based on dollar sales, July 2017 – September 2017.

2. The NPD Group Inc., U.S. Retail Tracking Service, Cell Phone Device Protection, Charging Case, Based on dollar sales, July 2017 – September 2017.

3. The NPD Group Inc., U.S. Retail Tracking Service, Mobile Power, Charge Type: Portable Power Packs, Based on dollar sales, July 2017 – September 2017.

4. The NPD Group Inc., U.S. Retail Tracking Service, Tablet and e-readers – Cases, Keyboard Included, Based on dollar sales, July 2017 – September 2017.

21

Investor Presentation

November 2017