Attached files

| file | filename |

|---|---|

| EX-31.1 - VBI Vaccines Inc/BC | ex31-1.htm |

| EX-32.2 - VBI Vaccines Inc/BC | ex32-2.htm |

| EX-32.1 - VBI Vaccines Inc/BC | ex32-1.htm |

| EX-31.2 - VBI Vaccines Inc/BC | ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017

OR

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-37769

VBI VACCINES INC.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | N/A | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

222 Third Street, Suite 2241 Cambridge, Massachusetts |

02142 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 617-830-3031

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Common Shares, no par value per share | 63,804,781 |

| (Class) | Outstanding at November [9], 2017 |

VBI VACCINES INC.

FORM 10-Q FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2017

TABLE OF CONTENTS

| 2 |

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION

CONTAINED IN THIS REPORT

This quarterly report on Form 10-Q (this “Form 10-Q”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by looking for words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “would,” “should,” “could,” “may,” or other similar expressions in this Form 10-Q. In particular, these include statements relating to future actions; prospective products, applications, customers and technologies; future performance or results of anticipated products; anticipated expenses; and projected financial results. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections described under the sections in this Quarterly Report on Form 10-Q entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2016 annual report on the Form 10-K filed with the Securities and Exchange Commission on March 20, 2017. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| ● | the timing of, and our ability to, obtain and maintain regulatory approvals for our clinical trials, products and product candidates; | |

| ● | the timing and results of our ongoing and planned clinical trials for products and product candidates; | |

| ● | the amount of funds we require for our immuno-oncology and infectious disease vaccine candidate pipeline; | |

| ● | the potential benefits of strategic partnership agreements and our ability to enter into strategic partnership arrangements; | |

| ● | our ability to effectively execute and deliver our plans related to commercialization, marketing and manufacturing capabilities and strategy; | |

| ● | our ability to license our intellectual property; | |

| ● | our ability to maintain a good relationship with our employees; | |

| ● | the suitability and adequacy of our office, manufacturing and research facilities and our ability to secure term extensions or expansions of leased space; | |

| ● | our ability to manufacture, or to have manufactured, any products we develop to the standards and requirements of regulatory agencies; | |

| ● | the ability of our vendors to manufacture and deliver materials that meet regulatory agency and our standards and requirements in order to meet planned timelines and milestones; |

| 3 |

| ● | our compliance with all laws, rules and regulations applicable to our business and products; | |

| ● | our ability to continue as a going concern; | |

| ● | our history of losses; | |

| ● | our ability to generate revenues and achieve profitability; | |

| ● | emerging competition and rapidly advancing technology in our industry that may outpace our technology; | |

| ● | customer demand for our products and product candidates; | |

| ● | the impact of competitive or alternative products, technologies and pricing; | |

| ● | general economic conditions and events and the impact they may have on us and our potential customers; | |

| ● | our ability to obtain adequate financing in the future on reasonable terms, as and when we need it; | |

| ● | our ability to implement network systems and controls that are effective at preventing cyber-attacks, malware intrusions, malicious viruses and ransomware threats; | |

| ● | our ability to secure and maintain protection over our intellectual property; | |

| ● | our ability to maintain our existing licenses for intellectual property; and | |

| ● | our success at managing the risks involved in the foregoing items. |

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for us to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Unless otherwise stated or the context otherwise requires, the terms “VBI,” “we,” “us,” “our” and the “Company” refer to VBI Vaccines Inc. and its subsidiaries.

Unless indicated otherwise, all references to the U.S. Dollar, Dollar or $ are to the United States Dollar, the legal currency of the United States of America and all references to € mean Euros, the legal currency of the European Union. We may also refer to NIS, which is the New Israeli Shekel, the legal currency of Israel, and the Canadian Dollar or CAD, which is the legal currency of Canada.

Except for per share amounts or as otherwise specified to be in millions, amounts presented are stated in thousands.

| 4 |

| Item 1. | Condensed Consolidated Financial Statements |

VBI Vaccines Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands, except number of shares)

| September 30, 2017 | December 31, 2016 | |||||||

| (Unaudited) | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 10,054 | $ | 32,282 | ||||

| Accounts receivable, net | 203 | 10 | ||||||

| Inventory, net | 701 | 830 | ||||||

| Other current assets | 1,993 | 1,236 | ||||||

| Total current assets | 12,951 | 34,358 | ||||||

| NON-CURRENT ASSETS | ||||||||

| Long-term deposits | 172 | 167 | ||||||

| Other long term assets | 514 | 487 | ||||||

| Property and equipment, net | 2,153 | 1,850 | ||||||

| Intangible assets, net | 63,669 | 59,507 | ||||||

| Goodwill | 9,021 | 8,385 | ||||||

| Total non-current assets | 75,529 | 70,396 | ||||||

| TOTAL ASSETS | $ | 88,480 | $ | 104,754 | ||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 3,446 | $ | 2,018 | ||||

| Other current liabilities | 8,138 | 5,562 | ||||||

| Deferred revenues | - | 34 | ||||||

| Current portion of long-term debt | 1,000 | - | ||||||

| Total current liabilities | 12,584 | 7,614 | ||||||

| NON-CURRENT LIABILITIES | ||||||||

| Long-term debt, net of debt discount of $2,460 and $3,344, as of September 30, 2017 and December 31, 2016, respectively and current portion | 11,840 | 11,956 | ||||||

| Long-term deferred tax liability | - | 428 | ||||||

| Liabilities for severance pay | 414 | 356 | ||||||

| Deferred revenues, net of current portion | 669 | 669 | ||||||

| Total non-current liabilities | 12,923 | 13,409 | ||||||

| COMMITMENTS AND CONTINGENCIES (NOTE 10) | - | - | ||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Common shares (unlimited authorized; no par value) (40,229,371 and 40,018,495 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively) | 134,046 | 133,312 | ||||||

| Additional paid-in capital | 59,721 | 58,595 | ||||||

| Accumulated other comprehensive income (loss) | 1,638 | (3,196 | ) | |||||

| Accumulated deficit | (132,432 | ) | (104,980 | ) | ||||

| Total stockholders’ equity | 62,973 | 83,731 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 88,480 | $ | 104,754 | ||||

See accompanying Notes to Condensed Consolidated Financial Statements

| 5 |

VBI Vaccines Inc. and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(in thousands, except per share data)

| Three

months ended September 30 | Nine

months ended September 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenues | $ | 193 | $ | 281 | $ | 664 | $ | 411 | ||||||||

| Operating expenses: | ||||||||||||||||

| Cost of revenue | 1,334 | 1,501 | 3,966 | 2,581 | ||||||||||||

| Research and development | 5,205 | 3,371 | 14,387 | 5,748 | ||||||||||||

| General and administration | 2,795 | 3,149 | 8,611 | 8,267 | ||||||||||||

| Total operating expenses | (9,334 | ) | (8,021 | ) | (26,964 | ) | (16,596 | ) | ||||||||

| Loss from operations | (9,141 | ) | (7,740 | ) | (26,300 | ) | (16,185 | ) | ||||||||

| Interest expense, net | 742 | 62 | 2,188 | 90 | ||||||||||||

| Foreign exchange gain | (81 | ) | (503 | ) | (605 | ) | (1,481 | ) | ||||||||

| Loss before incomes taxes | (9,802 | ) | (7,299 | ) | (27,883 | ) | (14,794 | ) | ||||||||

| Income tax benefit | - | - | 431 | - | ||||||||||||

| NET LOSS | $ | (9,802 | ) | $ | (7,299 | ) | $ | (27,452 | ) | $ | (14,794 | ) | ||||

| Net loss per share of common shares, basic and diluted | $ | (0.24 | ) | $ | (0.20 | ) | $ | (0.68 | ) | $ | (0.54 | ) | ||||

| Weighted-average number of common shares outstanding, basic and diluted | 40,229,371 | 36,150,936 | 40,115,689 | 27,592,940 | ||||||||||||

| Other comprehensive income (loss): | ||||||||||||||||

| Foreign currency translation adjustments | 2,818 | (506 | ) | 4,834 | (816 | ) | ||||||||||

| COMPREHENSIVE LOSS | $ | (6,984 | ) | $ | (7,805 | ) | $ | (22,618 | ) | $ | (15,610 | ) | ||||

See accompanying Notes to Condensed Consolidated Financial Statements

| 6 |

VBI Vaccines Inc. and Subsidiaries

Condensed Consolidated Statement of Stockholders’ Equity

(Unaudited)

(in thousands, except number of shares)

| Number of Common Shares | Share Capital | Additional Paid-in Capital | Accumulated Other Comprehensive Income (Loss) - Foreign Currency Translation Adjustments | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||

| BALANCE AS OF DECEMBER 31, 2016 | 40,018,495 | $ | 133,312 | $ | 58,595 | $ | (3,196 | ) | $ | (104,980 | ) | $ | 83,731 | |||||||||||

| Stock-based compensation | 179,499 | 633 | 1,126 | 1,759 | ||||||||||||||||||||

| Common shares issued for services | 25,000 | 85 | 85 | |||||||||||||||||||||

| Common shares issued on exercise of stock options | 6,377 | 16 | 16 | |||||||||||||||||||||

| Net loss | (27,452 | ) | (27,452 | ) | ||||||||||||||||||||

| Foreign currency translation adjustments | 4,834 | 4,834 | ||||||||||||||||||||||

| BALANCE AS OF SEPTEMBER 30, 2017 | 40,229,371 | $ | 134,046 | $ | 59,721 | $ | 1,638 | $ | (132,432 | ) | $ | 62,973 | ||||||||||||

See accompanying Notes to Condensed Consolidated Financial Statements

| 7 |

VBI Vaccines Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

| For

the Nine months Ended September 30 |

||||||||

| 2017 | 2016 | |||||||

| CASH FLOWS FROM: | ||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (27,452 | ) | $ | (14,794 | ) | ||

| Adjustments to reconcile net loss to cash used in operating activities: | ||||||||

| Depreciation and amortization | 539 | 440 | ||||||

| Deferred taxes | (431 | ) | - | |||||

| Stock-based compensation | 1,844 | 1,808 | ||||||

| Amortization of debt discount | 884 | 9 | ||||||

| Impairment charge of intangible assets | 300 | - | ||||||

| Net change in operating working capital items, net of business acquisitions: | ||||||||

| (Increase) in accounts receivable | (187 | ) | (35 | ) | ||||

| Decrease in inventory | 198 | 272 | ||||||

| (Increase) decrease in other current assets | (686 | ) | 639 | |||||

| Decrease in other long-term assets | 26 | 15 | ||||||

| Increase in trade account payable and other current liabilities | 3,169 | 1,835 | ||||||

| (Decrease) in deferred revenues | (94 | ) | (758 | ) | ||||

| Net cash flows used in operating activities | (21,890 | ) | (10,569 | ) | ||||

| INVESTING ACTIVITIES | ||||||||

| Cash acquired in business combination | - | 2,126 | ||||||

| Changes in long-term deposits | - | (215 | ) | |||||

| Purchase of property and equipment | (526 | ) | (311 | ) | ||||

| Net cash flows (used in)/provided by investing activities | (526 | ) | 1,600 | |||||

| FINANCING ACTIVITIES | ||||||||

| Proceeds from issuance of common shares for cash | - | 13,610 | ||||||

| Proceeds from exercise of stock options | 16 | - | ||||||

| Repayment of long-term debt | - | (375 | ) | |||||

| Net cash flows provided by financing activities | 16 | 13,235 | ||||||

| Effect of exchange rates on cash | 172 | (27 | ) | |||||

| CHANGE IN CASH FOR THE PERIOD | (22,228 | ) | 4,266 | |||||

| CASH, BEGINNING OF PERIOD | 32,282 | 12,476 | ||||||

| CASH, END OF PERIOD | $ | 10,054 | $ | 16,715 | ||||

| Supplementary disclosure of cash flow information: | ||||||||

| Cash paid during the period for interest | $ | 1,375 | $ | 111 | ||||

| Non-cash investing and financing activities: | ||||||||

| Common shares, options and warrants issued on acquisition of VBI | - | 67,494 | ||||||

| Capital expenditures included in other current liabilities | 145 | 31 | ||||||

See accompanying Notes to Condensed Consolidated Financial Statements

| 8 |

VBI Vaccines Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

(in thousands, except share and per share amounts)

| 1. | NATURE OF BUSINESS AND CONTINUATION OF BUSINESS |

Corporate Overview

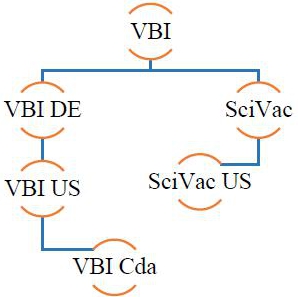

VBI Vaccines Inc. (formerly SciVac Therapeutics, Inc.) was incorporated under the laws of British Columbia, Canada on April 9, 1965 and has the following wholly-owned subsidiaries: VBI Vaccines (Delaware) Inc., a Delaware corporation (“VBI DE”); VBI DE’s wholly-owned subsidiary, Variation Biotechnologies (US), Inc., a Delaware corporation (“VBI US”); Variation Biotechnologies, Inc. a Canadian company (“VBI Cda”) and the wholly-owned subsidiary of VBI US; SciVac Ltd. an Israeli company (“SciVac”); and SciVac USA, LLC, a Florida limited liability company (“SciVac US”) and the wholly owned subsidiary of SciVac. VBI Vaccines Inc. and its subsidiaries are collectively referred to as the “Company,” “we,” “us,” “our” or “VBI”.

The Company’s principal office is located at 222 Third Street, Suite 2241, Cambridge, Massachusetts 02142. In addition, the Company has manufacturing facilities located in Rehovot, Israel and research facilities located in Ottawa, Ontario, Canada.

The Company operates in one segment and therefore segment information is not presented.

Principal Operations

We are a commercial stage biopharmaceutical company developing next generation vaccines to address unmet needs in infectious disease and immuno-oncology. VBI’s first marketed product is Sci-B-Vac®, a hepatitis B (“HBV”) vaccine that mimics all three viral surface antigens of the hepatitis B virus. Sci-B-Vac is approved for use in Israel and 14 other countries. Our wholly-owned subsidiary, SciVac Ltd., manufactures Sci-B-Vac in Rehovot, Israel. VBI is also planning to continue advancing Sci-B-Vac®, in a Phase III clinical study to be conducted in the United States, Europe and Canada.

Following our merger with VBI DE on May 6, 2016 (the “VBI-SciVac Merger”), we are also advancing our two platform technologies – our Enveloped Virus-Like Particle (“eVLP”) platform technology and our Lipid Particle Vaccine (“LPV”) technology. We are advancing a pipeline of eVLP vaccines, with lead programs in both infectious disease, with our congenital cytomegalovirus (“CMV”) vaccine, and in immuno-oncology, with our therapeutic glioblastoma multiforme (“GBM” or “glioblastoma”) vaccine candidate.

| 9 |

Liquidity and Going Concern

The Company has a limited operating history and faces a number of risks, including but not limited to, uncertainties regarding the success of its development activities, demand and market acceptance of the Company’s products and reliance on major customers. The Company anticipates that it will continue to incur significant operating costs and losses in connection with the development of its products.

The Company has an accumulated deficit of $132,432 as of September 30, 2017, and cash outflows from operating activities of $21,890 for the nine months ended September 30, 2017.

The Company will require significant additional funds to conduct clinical and non-clinical studies, achieve regulatory approvals, and, subject to such approvals, commercially launch its products. The Company plans to finance future operations with a combination of existing cash reserves, proceeds from the issuance of equity securities, the issuance of additional debt, and revenues from potential collaborations, if any. There is no assurance the Company will manage to obtain these sources of financing. The above conditions raise substantial doubt about the Company’s ability to continue as a going concern. The report of our independent registered public accounting firm on our consolidated financial statements for the year ended December 31, 2016 contains an explanatory paragraph regarding our ability to continue as a going concern. The condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

On May 15, 2017, the Company entered into an equity distribution agreement (the “Distribution Agreement”) with a registered broker-dealer, as sales agent (the “Sales Agent”), pursuant to which the Company may offer and sell, from time to time, through the Sales Agent its common shares having an aggregate offering price of up to $30 million. The Company is not obligated to sell any common shares under the Distribution Agreement. Subject to the terms and conditions of the Distribution Agreement, the Sales Agent will use commercially reasonable efforts consistent with its normal trading and sales practices, applicable state and federal law, rules and regulations, and the rules of the NASDAQ Capital Market to sell shares from time to time based upon the Company’s instructions, including any price, time or size limits specified by the Company. The Company will pay the Sales Agent a commission of 3.0% of the aggregate gross proceeds from each sale of common shares occurring pursuant to the Distribution Agreement, if any. The Distribution Agreement may be terminated by the Sales Agent or the Company at any time upon ten days’ notice to the other party, or by the Sales Agent at any time in certain circumstances. To-date no amounts have been raised under this Distribution Agreement.

See Note 13, Subsequent Events, for a description of financings completed in October 2017.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation and Consolidation

The Company’s fiscal year ends on December 31 of each calendar year. The accompanying unaudited condensed consolidated financial statements have been prepared in U.S. dollars (“USD”) and pursuant to the rules and regulations of the United States Securities and Exchange Commission (“SEC”), for interim reporting. Accordingly, certain information and footnote disclosures normally included in the financial statements prepared in accordance with United States of America generally accepted accounting principles (“U.S. GAAP”), have been condensed or omitted pursuant to such rules and regulations. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from these estimates and are not necessarily indicative of the results to be expected for any future period or the entire fiscal year. The December 31, 2016 consolidated balance sheet in this document was derived from the audited consolidated financial statements and does not include all of the disclosures required by U.S. GAAP. The condensed consolidated financial statements and notes included in this quarterly report on Form 10-Q (this “Form 10-Q”) should be read in conjunction with the financial statements and notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 (the “2016 10-K”), as filed with the SEC on March 20, 2017.

| 10 |

The condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries: SciVac, SciVac USA, and from May 6, 2016 the accounts of VBI DE, VBI US and VBI Cda. Intercompany balances and transactions between the Company and its subsidiaries are eliminated in the condensed consolidated financial statements.

In the opinion of management, these condensed consolidated financial statements include all adjustments and accruals of a normal and recurring nature necessary to fairly state the financial statements for the dates and the periods presented. The results for the periods presented are not necessarily indicative of results to be expected for the full year or for any future periods.

Significant Accounting Policies

The significant accounting policies used in the preparation of these condensed consolidated financial statements are disclosed in the 2016 10-K, and there have been no changes to the Company’s significant accounting policies during the nine months ended September 30, 2017.

Foreign currency

The functional and reporting currency of the Company is the USD. Each of the Company’s subsidiaries determines its own respective functional currency, and this currency is used to separately measure each entity’s financial position and operating results.

Assets and liabilities of foreign operations with a different functional currency from that of the Company are translated at the closing rate at the end of each reporting period. Profit or loss items are translated at average exchange rates for all the relevant periods. All resulting translation differences are recognized as a component of accumulated other comprehensive income (loss).

Foreign exchange gains and losses arising from transactions denominated in a currency other than the functional currency of the entity involved, are included in the condensed consolidated statements of operations.

Use of Estimates

Preparation of the condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual amounts could differ from the estimates made and changes in estimates may occur. We continually evaluate estimates used in the preparation of the condensed consolidated financial statements for reasonableness. Appropriate adjustments, if any, to the estimates used are made prospectively based upon such periodic evaluation. The significant areas of estimation include determining the deferred tax valuation allowance, the estimated lives of property and equipment and intangible assets, the inputs in determining the fair value of equity based awards and warrants issued as well as the values ascribed to assets acquired and liabilities assumed in a business combination. Actual results may differ from those estimates.

| 11 |

Goodwill and In-Process Research and Development

The Company’s intangibles including in-process research and development (“IPR&D”) and goodwill, are tested for impairment annually, or more frequently if events or circumstances indicate that the assets might be impaired.

Goodwill represents the excess of the purchase price over the fair value of the net tangible and identifiable intangible assets acquired in a business combination. Goodwill can become impaired in certain circumstances, including but not limited to: (1) a significant adverse change in legal factors or in business climate, (2) unanticipated competition, or (3) an adverse action or assessment by a regulator. When evaluating goodwill for impairment, we may first perform an assessment qualitatively whether it is more likely than not that a reporting unit’s carrying amount exceeds its fair value, referred to as a “step zero” approach. The Company adopted Accounting Standards Update (“ASU”) 2017-04, “Intangibles – Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment” effective August 31, 2017 which has eliminated Step 2 from the goodwill impairment test. Under this update, an entity should perform its goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount. The Company has established August 31st as the date for its annual impairment test of goodwill. There was no goodwill impairment determined as a result of the Company’s annual testing on August 31, 2017.

The costs of rights to IPR&D projects acquired in an asset acquisition are expensed in the consolidated statements of operations unless the project has an alternative future use. These costs include initial payments incurred prior to regulatory approval in connection with research and development agreements that provide rights to develop, manufacture, market and/or sell pharmaceutical products.

IPR&D acquired in a business combination is capitalized as an intangible asset and tested for impairment at least annually until commercialization, after which time the IPR&D is amortized over its estimated useful life. The impairment test compares the carrying amount of the IPR&D asset to its fair value. If the carrying amount exceeds the fair value of the asset, such excess is recorded as an impairment loss. The Company performed its annual impairment test on its IPR&D assets on August 31, 2017 and recorded an impairment of $300 related to certain IPR&D assets. The fair value of the IRR&D assets included in the impairment test on August 31, 2017 was determined using the income approach method.

Fair value measurements of financial instruments

Accounting guidance defines fair value as the price that would be received to sell an asset or paid to transfer a liability (the exit price) in an orderly transaction between market participants at the measurement date. The accounting guidance outlines a valuation framework and creates a fair value hierarchy in order to increase the consistency and comparability of fair value measurements and the related disclosures. In determining fair value, the Company uses quoted prices and observable inputs. Observable inputs are inputs that market participants would use in pricing the asset or liability based on market data obtained from independent sources.

The fair value hierarchy is broken down into three levels based on the source of inputs as follows:

Level 1 — Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 — Valuations based on observable inputs and quoted prices in active markets for similar assets and liabilities.

Level 3 — Valuations based on inputs that are unobservable and models that are significant to the overall fair value measurement.

Financial instruments recognized in the condensed consolidated balance sheet consist of cash, accounts receivable and other current assets, accounts payable and other current liabilities. The Company believes that the carrying value of the aforementioned financial instruments approximates their fair values due to the short-term nature of these instruments. The Company does not hold any derivative financial instruments.

The carrying amounts of the Company’s deposits and other long-term assets approximate their respective fair values.

At September 30, 2017 and December 31, 2016, the fair value of the Company’s outstanding debt is estimated to be approximately $15,512 and $15,012, respectively.

| 12 |

In determining the fair value of the long-term debt as of September 30, 2017 and December 31, 2016 the Company used the following assumptions:

| September 30, 2017 | December 31, 2016 | |||||||

| Long-term debt: | ||||||||

| Interest rate | 12.2 | % | 12.0 | % | ||||

| Discount rate | 11.0 | % | 13.5 | % | ||||

| Expected time to payment in months | 26 | 35 | ||||||

| 3. | NEW ACCOUNTING PRONOUNCEMENTS |

Recently Adopted Accounting Pronouncements

Stock Compensation

In March 2016, the Financial Accounting Standards Board (the “FASB”) issued ASU No. 2016-09, “Compensation - Stock Compensation (Topic 718),” which simplifies several aspects of the accounting for share-based payment award transactions, including the income tax consequences, classification of awards as either equity or liabilities, classification on the statement of cash flows and accounting for forfeitures. ASU No. 2016-09 is effective for fiscal years beginning after December 15, 2016, including periods within those fiscal years. Our adoption of this ASU in the first quarter of 2017 did not have a material impact on our condensed consolidated financial statements.

Cash Flow Classification

The FASB issued ASU 2016-15, an accounting standard that affects the classification of certain cash receipts and cash payments on the statement of cash flows. The standard provides guidance on eight issues: debt prepayment or extinguishment costs, settlement of zero-coupon bonds or bonds issued at a discount with insignificant cash coupon, contingent consideration payments made after a business combination, proceeds from the settlement of insurance claims, proceeds from the settlement of corporate-owned life insurance policies, distributions received from equity method investees, beneficial interests in securitization transactions, separately identifiable cash flows and applying the predominance principle. The standard is effective for public business entities for fiscal years beginning after December 15, 2017 including periods within those fiscal years.

The FASB issued ASU 2016-18, an accounting standard that requires companies to include cash and cash equivalents that have restrictions on withdrawal or use in total cash and cash equivalents on the statement of cash flows. The standard does not define restricted cash or restricted cash equivalents, but companies will need to disclose the nature of the restrictions. The standard is effective for public business entities for fiscal years beginning after December 15, 2017 including interim periods within those fiscal years.

Our adoption of these ASUs in the first quarter of 2017 did not have an impact on our condensed consolidated financial statements.

Recently Issued Accounting Standards, not yet Adopted

Revenue from Contracts with Customers

In May 2014, the FASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”). ASU 2014-09 outlines a single comprehensive model to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. ASU 2014-09 also requires entities to disclose sufficient information, both quantitative and qualitative, to enable users of financial statements to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. An entity should apply the amendments in this ASU using one of the following two methods: (1) retrospectively to each prior reporting period presented with a possibility to elect certain practical expedients, or, (2) on a modified retrospective basis with the cumulative effect of initially applying ASU 2014-09 recognized at the date of initial application. If an entity elects the latter transition method, it also should provide certain additional disclosures. For a public entity, the ASU as amended is effective for annual periods beginning after December 15, 2017, including interim reporting periods within that reporting period. Given the Company’s current level of revenue, we do not expect a significant impact from the adoption of this new accounting guidance on our financial statements and footnote disclosures.

| 13 |

Leases

In February 2016 the FASB issued ASU 2016-02: Leases. The ASU introduces a lessee model that results in most leases impacting the balance sheet by requiring reporting entities to recognize lease assets and lease liabilities for substantially all lease arrangements. The update is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The Company is currently evaluating the impact this new guidance will have on its financial statements and related disclosures.

Accounting for Income Taxes on Intercompany Transfers

The FASB recently issued ASU 2016-16, an accounting standard that requires the seller and buyer to recognize at the transaction date the current and deferred income tax consequences of intercompany asset transfers. The FASB expects the new standard to cause volatility in companies’ effective tax rates, particularly for those that transfer intangible assets to subsidiaries. The standard is effective for public business entities for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. While the Company continues to assess the potential impact of this standard, the adoption of this standard is not expected to have a material impact on our financial statements.

Recognition and Measurement of Financial Assets and Financial Liabilities

In January 2016, the FASB issued ASU 2016-01, “Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities”. This update will change the income statement impact of equity investments held by an entity; disclosures related to fair value of financial instruments and presentation of financial assets and liabilities. ASU 2016-01 is effective for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. Entities must apply the standard using a cumulative-effect adjustment to the balance sheet as of the beginning of the fiscal year of adoption. Except for certain early application guidance, early adoption is not permitted. The Company is currently assessing the impact that adopting this new ASU will have on our financial statements and footnote disclosures.

Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets

In February 2017, The FASB issued ASU 2017-05, “Other Income – Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-12): Clarifying the Scope of Assets Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets”. This amendment in this update clarifies the guidance on accounting for derecognition of a nonfinancial asset and an in-substance nonfinancial asset and applies only when the asset (or asset group) does not meet the definition of a business; defines in-substance nonfinancial assets; and provides guidance for partial sales of nonfinancial assets. ASU 2017-05 is effective for annual reporting periods beginning after December 15, 2017, including interim periods within those fiscal years. While the Company continues to assess the potential impact of this standard, the adoption of this standard is not expected to have a material impact on its financial statements.

| 14 |

| 4. | INTANGIBLES |

| September 30, 2017 | ||||||||||||||||||||

| Gross

Carrying amount | Accumulated

Amortization | Impairment Charge | Cumulative Currency Translation | Net

Book Value | ||||||||||||||||

| Patents | $ | 669 | $ | (381 | ) | $ | - | $ | 27 | $ | 315 | |||||||||

| IPR&D assets | 61,500 | - | (300 | ) | 2,154 | 63,354 | ||||||||||||||

| $ | 62,169 | $ | (381 | ) | $ | (300 | ) | $ | 2,181 | $ | 63,669 | |||||||||

| December 31, 2016 | ||||||||||||||||

| Gross

Carrying amount | Accumulated

Amortization | Cumulative Currency Translation | Net

Book Value | |||||||||||||

| Patents | $ | 669 | $ | (334 | ) | $ | (4 | ) | $ | 331 | ||||||

| IPR&D assets | 61,500 | - | (2,324 | ) | 59,176 | |||||||||||

| $ | 62,169 | $ | (334 | ) | $ | (2,328 | ) | $ | 59,507 | |||||||

The Company amortizes intangible assets with finite lives on a straight-line basis over their estimated useful lives. The amortization expense for the three and nine months ended September 30, 2017 was $16 and $46, respectively compared to the three and nine months ended in 2016 of $15 and $46, respectively.

The IPR&D assets relate to the May 6, 2016 VBI-SciVac Merger and will not begin amortizing until the Company commercializes its products. Future costs incurred to extend the life of the patents will be expensed. At August 31, 2017, the Company prepared its annual impairment test. As a result of that test, there was an impairment charge of $300 related to certain IPR&D assets. Such amount is included in research and development expenses in the accompanying condensed consolidated statements of operations and comprehensive loss.

| 5. | LOSS PER SHARE OF COMMON SHARES |

Basic loss per share is computed by dividing net loss applicable to common stockholders by the weighted average number of common shares outstanding during each period. Diluted loss per share includes the effect, if any, from the potential exercise or conversion of securities, such as warrants, and stock options, which would result in the issuance of incremental common shares unless such effect is anti-dilutive. In computing the basic and diluted net loss per share applicable to common stockholders, the weighted average number of shares remains the same for both calculations due to the fact that when a net loss exists, dilutive shares are not included in the calculation as their effect would be anti-dilutive. These potentially dilutive securities are more fully described in Note 8, Stockholders’ Equity and Additional Paid-in Capital.

The following potentially dilutive securities outstanding at September 30, 2017 and 2016 have been excluded from the computation of diluted weighted average shares outstanding, as they would be antidilutive:

| As at September 30, | ||||||||

| 2017 | 2016 | |||||||

| Warrants | 2,069 | 364 | ||||||

| Stock options and equity awards | 2,871 | 2,766 | ||||||

| 4,940 | 3,130 | |||||||

| 15 |

| 6. | LONG-TERM DEBT |

As at September 30, 2017 and the December 31, 2016, the outstanding debt is as follows:

| September 30, 2017 | December 31, 2016 | |||||||

| Long-term debt, net of deferred financing costs and unamortized debt discount based on an imputed interest rate of 20.5% of $ 2,460 and $3,344 at September 30, 2017 and December 31, 2016, respectively | $ | 12,840 | $ | 11,956 | ||||

| Less: current portion | 1,000 | - | ||||||

| $ | 11,840 | $ | 11,956 | |||||

As a result of the VBI-SciVac Merger, the Company through VBI DE assumed a term loan facility with Perceptive Credit Holdings, LP (the “Lender”) in the amount of $6,000 (the “Facility”), with an initial advance of $3,000 drawn down on prior to the VBI-SciVac Merger. As of the date of the VBI-SciVac Merger, the Company assumed an amount of $2,361 in the Facility. On December 6, 2016, the Company amended the Facility (the “Amended Facility”) and raised an additional $13,200 which was combined with the remaining balance from the Facility of $1,800. The total principal outstanding at September 30, 2017, including the $300 exit fee discussed below, is $15,300 before the net deferred financing costs and unamortized debt discount of $2,460. The principal on the Amended Facility accrues interest at an annual rate equal to the greater of (a) one-month LIBOR (subject to a 5.00% cap) or (b) 1.00%, plus the applicable margin. The applicable margin will be 11.00%. The first eighteen months are interest only. The interest rate as of September 30, 2017 was 12.25%. Upon the occurrence of an event of default, and during the continuance, of an event of default, the applicable margin will be increased by 4.00% per annum. The Company begins monthly principal repayments of $200 in May 2018 for 19 months upon which the remaining balance is due on maturity. The Amended Facility matures December 6, 2019 and includes both financial and non-financial covenants, including a minimum cash balance requirement of $2,500. The Company was in compliance with these covenants as of September 30, 2017. Pursuant to the Amended Facility, the Company agreed to appoint a representative of the Lender to the Board who is also a portfolio manager of the Company’s largest shareholder.

The Company’s obligations under the Amended Facility are secured on a senior basis by a lien on substantially all of the assets of the Company, including the Company’s interest in its subsidiaries, and its U.S. and Canadian subsidiaries and guaranteed by the Company and its subsidiaries. The Amended Facility also contains customary events of default.

In connection with the Amended Facility, on December 6, 2016, the Company issued to the Lender two tranches of warrants. The first tranche was a warrant to purchase 363,771 common shares at an exercise price of $4.13 per share and the second tranche was a warrant to purchase 1,341,282 common shares at an exercise price of $3.355 per share. The total proceeds from the Amended Facility attributed to the warrants was $2,793, based on the relative fair value of the warrants as compared to the sum of the fair values of the warrants and debt. This attribution resulted in the debt being issued at a discount. The Company incurred $360 of debt issuance costs and is required to pay an exit fee of $300 upon full repayment of the debt resulting in additional debt discount. The total debt discount of $3,453 is being charged to interest expense using the effective interest method over the term of the debt. As of September 30, 2017, the unamortized debt discount is $2,460. The Company recorded $884 of interest expense related to the amortization of the debt discount during the nine months ended September 30, 2017.

The following table summarizes the future principal payments that the Company expects to make for long-term debt:

| Period

ending September 30, | Principal

payments on Amended Facility and exit fee | |||

| 2017 | $ | - | ||

| 2018 | 1,000 | |||

| 2019 | 14,300 | |||

| $ | 15,300 | |||

| 16 |

| 7. | DEFERRED REVENUE AND RELATED PARTY TRANSACTIONS |

Prior to the VBI-SciVac Merger, one of the Company’s directors was also the chairman of the board of Kevelt AS (“Kevelt”), a wholly owned subsidiary of OAO Pharmsynthez (“Pharmsynthez”), a shareholder of the Company and was also the chairman of the board of Pharmsynthez. Following the VBI-SciVac Merger, in accordance with the merger agreement, this director resigned.

On April 26, 2013, SciVac entered into a Development and Manufacturing Agreement (“DMA”) with Kevelt, pursuant to which SciVac agreed to develop the manufacturing process for the production of clinical and commercial quantities of certain materials in drug substance form. On July 30, 2016, the Company received a letter of termination from Kevelt, in part containing a request for refund of $2.5 million it had previously transferred to the Company. Such amount is included in other current liabilities in the accompanying condensed consolidated financial statements. See Note 13, Subsequent Events for a description on the Kevelt settlement agreement.

SciVac entered into a services agreement with OPKO Biologics Ltd. (“OPKO Bio”), a wholly-owned subsidiary of OPKO Health, Inc., a related party shareholder of the Company, dated as of March 15, 2015, as amended on January 25, 2016, pursuant to which SciVac agreed to provide certain aseptic process filling services to OPKO Bio. The terms of the services agreement are based on market rates and comparable to other non-related party service agreements.

See Note 6, Long-term Debt, for the Facility from a lender that is also affiliated with the Company’s largest shareholder.

Nine months ended September 30 | ||||||||

| 2017 | 2016 | |||||||

| Services revenues from related parties: | ||||||||

| OPKO Bio | $ | 4 | $ | 12 | ||||

Subsequent to the VBI-SciVac Merger on May 6, 2016, Kevelt and Pharmsynthez are no longer considered related parties due to the common shareholder no longer having significant influence.

| 8. | STOCKHOLDERS’ EQUITY AND ADDITIONAL PAID-IN CAPITAL |

Stock option plans

The Company’s stock option plans are approved by and administered by the Company’s board of directors (the “Board”) and its Compensation Committee. The Board designates, in connection with recommendations from the Compensation Committee, eligible participants to be included under the plan, and designates the number of options, exercise price and vesting period of the new options.

2006 VBI US Stock Option Plan

No further options will be issued under the 2006 VBI US Stock Option Plan (the “2006 Plan”). As at September 30, 2017, there were 1,290,153 options outstanding under the 2006 Plan.

2013 Stock Incentive Plan

No further options will be issued under the 2013 Equity Incentive Plan (the “2013 Plan”). As at September 30, 2017, there were 4,613 options outstanding under the 2013 Plan.

2014 Equity Incentive Plan

No further options will be issued under the 2014 Equity Incentive Plan (the “2014 Plan”). As at September 30, 2017, there were 713,716 options outstanding under the 2014 Plan.

| 17 |

2016 VBI Equity Incentive Plan

The 2016 VBI Equity Incentive Plan (the “2016 Plan”) is a rolling incentive plan that sets the number of common shares issuable under the 2016 Plan, together with any other security-based compensation arrangement of the Company, at a maximum of 10% of the aggregate common shares issued and outstanding on a non-diluted basis at the time of any grant under the 2016 Plan. The 10% maximum is inclusive of options granted under all equity incentive plans. The 2016 Plan is an omnibus equity incentive plan pursuant to which the Company may grant equity and equity-linked awards to eligible participants in order to promote the success of the Company following the VBI-SciVac Merger by providing a means to offer incentives and to attract, motivate, retain and reward persons eligible to participate in the 2016 Plan. Grants under the 2016 Plan include a grant or right consisting of one or more options, stock appreciation rights (“SARs”), restricted share units (“RSUs”), performance share units (“PSUs”), shares of restricted stock or other such award as may be permitted under the 2016 Plan. As at September 30, 2017, there were 412,250 options and 450,250 stock awards outstanding under the 2016 Plan.

The aggregate number of common shares remaining available for issuance for awards under this plan was 648,702 at September 30, 2017.

Activity related to stock options is as follows (in thousands, except for weighted average exercise price):

| Number of Stock Options | Weighted

Average Exercise Price | |||||||

| Balance outstanding at December 31, 2016 | 2,168 | $ | 4.45 | |||||

| Granted | 304 | $ | 3.60 | |||||

| Exercised | (6 | ) | $ | 2.50 | ||||

| Forfeited | (45 | ) | $ | 4.41 | ||||

| Balance outstanding at September 30, 2017 | 2,421 | $ | 4.43 | |||||

| Exercisable at September 30, 2017 | 1,634 | $ | 4.47 | |||||

Information relating to restricted stock units is as follow (in thousands, except for weighted average fair value at grant date):

| Number of Stock Awards | Weighted Average Fair Value at Grant Date |

|||||||

| Unvested shares outstanding at December 31, 2016 | 639 | $ | 3.88 | |||||

| Granted | 57 | $ | 4.72 | |||||

| Vested | (212) | $ | 4.23 | |||||

| Forfeited | (33) | $ | 3.90 | |||||

| Unvested shares outstanding at September 30, 2017 | 451 | $ | 3.96 | |||||

| 18 |

The fair value of the options and restricted stock units will be recognized as an expense on a straight-line basis over the vesting period. The total stock-based compensation expense recorded in the three and nine months ended September 30, 2017 and 2016 was as follows:

| Three

months ended September 30 |

Nine

months ended September 30 |

|||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Research and development | $ | 166 | $ | 334 | $ | 553 | $ | 616 | ||||||||

| General and administrative | 410 | 368 | 1,241 | 1,128 | ||||||||||||

| Cost of revenues | 17 | - | 50 | - | ||||||||||||

| Total stock based compensation | $ | 593 | $ | 702 | $ | 1,844 | $ | 1,744 | ||||||||

| 9. | INCOME TAXES |

The Company operates in U.S., Israel and Canadian tax jurisdictions. Its income is subject to varying rates of tax, and losses incurred in one jurisdiction cannot be used to offset income taxes payable in another.

The Company’s effective tax rate on loss before tax for the three and nine months ended September 30, 2017 of 0% and 1.5%, respectively (0% - 2016) differs from the Canadian statutory rate of 26% primarily due to the recognition of a valuation allowance on the Canadian deferred tax assets as well as on the other deferred tax assets in all other jurisdictions.

The Company maintains a valuation allowance on its net deferred tax assets. A valuation allowance is required when, based upon an assessment of various factors, including recent operating loss history, anticipated future earnings, and prudent and reasonable tax planning strategies, it is more likely than not that some portion of the deferred tax assets will not be realized.

| 10. | COMMITMENTS AND CONTINGENCIES |

Licensing

| (a) | The Company’s manufactured and marketed product, Sci-B-Vac™, is a recombinant third generation hepatitis B vaccine whose sales and territories are governed by the Ferring License Agreement (“License Agreement”). Under the License Agreement, the Company is committed to pay Ferring royalties equal to 7% of net sales (as defined therein). Royalty payments have been de minimis for the three and nine months ended September 30, 2017 and 2016, respectively. |

| (b) | Under an Assignment and Assumption Agreement, the Company is required to pay royalties to SciGen Singapore equal to 5% of net sales of Sci-B-Vac. Royalty payments have been de minimis for the three and nine months ended September 30, 2017 and 2016. |

Legal Proceedings

From time to time, the Company may be involved in certain claims and litigation arising out of the ordinary course of business. Management assesses such claims and, if it considers that it is probable that an asset had been impaired or a liability had been incurred and the amount of loss can be reasonably estimated, provisions for loss are made based on management’s assessment of the most likely outcome. The Company believes that it maintains adequate insurance coverage for any such litigation matters arising in the normal course of business.

| 19 |

Operating Leases

The Company has entered into various non-cancelable lease agreements for its office, lab and manufacturing facilities. These arrangements expire at various times through 2022. Rent expense for the three months ended September 30, 2017 and 2016 was $233 and $184, respectively and for the nine months ended September 30, 2017 and 2016 was $689 and $401, respectively.

The future annual minimum payments under these leases is as follows:

| Year ending December 31 | ||||

| Remaining 2017 | $ | 228 | ||

| 2018 | 738 | |||

| 2019 | 685 | |||

| 2020 | 448 | |||

| 2021 | 448 | |||

| Thereafter | 37 | |||

| Total | $ | 2,584 | ||

| 11. | REVENUE BY GEOGRAPHIC REGION |

| Three

months ended September 30 | Nine

months ended September 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Israel | $ | 153 | $ | 116 | $ | 400 | $ | 206 | ||||||||

| Asia | 40 | - | 101 | 4 | ||||||||||||

| North America | - | - | 150 | - | ||||||||||||

| South America | - | - | 2 | - | ||||||||||||

| Europe | - | 165 | 11 | 201 | ||||||||||||

| Total | $ | 193 | $ | 281 | $ | 664 | $ | 411 | ||||||||

| 12. | PROPERTY AND EQUIPMENT, NET BY GEOGRAPHIC REGION |

| September 30, 2017 | December 31, 2016 | |||||||

| Property and equipment in Israel | $ | 2,015 | $ | 1,850 | ||||

| Property and equipment in North America | 138 | - | ||||||

| Total | $ | 2,153 | $ | 1,850 | ||||

| 13. | SUBSEQUENT EVENTS |

On October 30, 2017, the Company closed an underwritten public offering and a concurrent registered direct offering of an aggregate of 23,575,410 common shares at a price of $3.05 per share. In addition, in connection with the registered direct offering, the Company issued four-year warrants to purchase 550,000 common shares at an exercise price of $3.34 per share. The aggregate estimate net proceeds from the offerings to the Company were approximately $67.4 million.

On November 8, 2017, SciVac Ltd.entered into a settlement agreement with Kevelt, whereby SciVac Ltd. agreed to pay Kevelt $1,000,000 in cash by November 10, 2017, and issue 274,000 common shares of the Company by no later than December 18, 2017, to settle certain ongoing disputes arising out of SciVac Ltd.’s development and manufacturing agreement with Kevelt. As part of the settlement, the development and manufacturing agreement was terminated and Kevelt and SciVac Ltd. entered into mutual release agreements, whereby each of them released the other from all claims and liabilities arising under the development and manufacturing agreement.

| 20 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion of our financial condition and results of operations in conjunction with the condensed consolidated financial statements and the related notes included elsewhere in this Form 10-Q and with our audited consolidated financial statements included in our annual report on Form 10-K for the year ended December 31, 2016, as filed with the U.S. Securities and Exchange Commission (the “SEC”).

Overview

VBI- SciVac Merger

On May 6, 2016, the Company completed its acquisition of VBI DE, pursuant to which Seniccav Acquisition Corporation, a Delaware corporation and a wholly owned subsidiary of the Company, merged with and into VBI DE, with VBI DE continuing as the surviving corporation and as a wholly-owned subsidiary of the Company (the “VBI-SciVac Merger”). Upon completion of the VBI-SciVac Merger, the Company changed its name to “VBI Vaccines Inc.” and its common shares commenced trading on The NASDAQ Capital Market. The common shares began trading on The NASDAQ Capital Market under the ticker symbol “VBIV.” Prior to the VBI-SciVac Merger, the Company’s common shares were only listed on the Toronto Stock Exchange (the “TSX”) under the symbol “VAC.” Following the effective time of the VBI-SciVac Merger, the common shares began to trade on the TSX under the new symbol “VBV.”

Principal Operations

We are a commercial stage biopharmaceutical company developing next generation vaccines to address unmet needs in infectious disease and immuno-oncology. Our first marketed product is Sci-B-Vac®, a hepatitis B virus (“HBV”) vaccine that mimics all three viral surface antigens of the hepatitis B virus. Sci-B-Vac is approved for use in Israel and 14 other countries. Our wholly-owned subsidiary, SciVac Ltd., manufactures Sci-B-Vac in Rehovot, Israel.

We are also advancing our two platform technologies – our “enveloped” virus-like particle (“eVLP”) platform technology and our thermostable lipid particle vaccine (“LPV”) technology.

| - | Our eVLP platform technology enables the development of enveloped virus-like particle vaccines that closely mimic the target virus to elicit a potent immune response. We are advancing a pipeline of eVLP vaccines, with lead programs in both infectious disease, with our congenital cytomegalovirus (“CMV”) vaccine, and in immuno-oncology, with our therapeutic glioblastoma multiforme (“GBM”) vaccine candidate. | |

| - | Our LPV thermostability technology is a proprietary formulation of lipids and process that allows vaccines and biologics to preserve stability, potency, and safety at temperatures outside of the most common cold chain storage requirements of 2oC to 8 oC. |

Sci-B-Vac Clinical Program

On November 14, 2016, we announced results from an interim analysis of a post-marketing Phase IV clinical study in Israel for Sci-B-Vac to confirm a new in-house reference standard for regulatory and quality control purposes. Sci-B-Vac has not yet been approved by the U.S. Food and Drug Administration (the “FDA”), the European Medicines Agency (the “EMA”) or Health Canada (“HC”). The post-marketing Phase IV clinical study was completed in June 2017. On July 11, 2017, we announced plans for a global Phase III clinical program for Sci-B-Vac following discussions with the FDA, the EMA, and HC. The Phase III program is expected to be a global 15-month program, consisting of two concurrent Phase III studies – a safety and immunogenicity study (“PROTECT”) and a lot-to-lot consistency study (“CONSTANT”), enrolling approximately 4,800 subjects. The Phase III program is expected to be conducted at approximately 40 sites across the U.S., Europe, and Canada.

| 21 |

PROTECT – Safety and Immunogenicity Study

| ● | PROTECT will be a double-blind, two-arm, randomized, controlled study. Approximately 1,600 adult subjects, age 18 years and older, will be randomized in a 1:1 ratio to receive either a three-dose course of Sci-B-Vac 10μg or a three-dose course of the control vaccine, Engerix-B® 20μg. Enrollment will be stratified by age group. |

The co-primary objectives of the study will be:

| ● | To demonstrate non-inferiority of the seroprotection rate induced by Sci-B-Vac as compared to Engerix-B four weeks after the third vaccination in adults age 18 and older. | |

| ● | To demonstrate superiority of the seroprotection rate induced by Sci-B-Vac as compared to Engerix-B four weeks after the third vaccination in adults older than 45 years of age. |

The study will also include multiple secondary objectives to evaluate the speed to seroprotection and the overall safety and tolerability of Sci-B-Vac as compared to Engerix-B.

CONSTANT – Lot-to-Lot Consistency Study

| ● | CONSTANT will be a double-blind, four-arm, randomized, controlled study. Approximately 3,200 adult subjects, age 18-45 years, will be randomized in a 1:1:1:1 ratio to receive one of four three-dose courses: Lot A of Sci-B-Vac 10μg, Lot B of Sci-B-Vac 10μg, Lot C of Sci-B-Vac 10μg, or the control vaccine Engerix-B® 20μg. |

The primary objective of this study will be to demonstrate lot-to-lot consistency for immune response as measured by geometric mean concentration (GMC) of antibodies across three independent, consecutive lots of Sci-B-Vac four weeks after the third vaccination.

The secondary objective will be to evaluate safety and efficacy of Sci-B-Vac as compared to Engerix-B.

On August 25, 2017, the FDA accepted our investigational new drug application (“IND”) for the Sci-B-Vac Phase III clinical program. Previously, on June 14, 2017, HC provided us with a No Objection Letter for both Sci-B-Vac Phase III clinical studies, which authorized us to proceed with the Sci-B-Vac Phase III clinical studies as described in our clinical trial application. Acceptance of the IND and the receipt of the No Objection Letter enable us to initiate the the Sci-B-Vac Phase III clinical study in both the United States and Canada.

Congenital CMV Vaccine Candidate (eVLP)

Our second lead program is a vaccine for congenital CMV, a leading cause of birth defects, that is in Phase I development. Our congenital CMV vaccine candidate uses our eVLP platform and is adjuvanted with aluminum phosphate (alum), an adjuvant used in FDA-approved products.

In July 2017, we announced interim data read-out of safety data through day 84 of the study and initial immunogenicity signals in participant samples collected one month after the second of three planned vaccine doses as follows:

| ● | Safety: The vaccine was well tolerated at all doses, with no safety signals. | |

| ● | Immunogenicity: |

| ● | The vaccine induced antibody responses against the CMV glycoprotein B (gB) antigen with clear evidence of dose-dependent boosting after the second vaccination. | |

| ● | Immunization with the highest dose of the vaccine induced seroconversion in 100% of subjects after just two vaccinations. | |

| ● | After two of the three planned vaccinations, neutralizing antibodies against epithelial cell infection were demonstrated in 17% of subjects who received the highest dose of VBI-1501A. | |

| ● | The highest dose of VBI-1501A (2.0μg of gB-G content with alum) has approximately 10-fold less antigen content than that used in several other VLP-based vaccines or in past CMV vaccine candidates. | |

| ● | Formulation of the vaccine with alum enhanced antibody titers. |

| 22 |

The final data read-out of safety and immunogenicity, following a third vaccination is expected in the first half of 2018.

Therapeutic GBM Vaccine (eVLP)

We also have a therapeutic glioblastoma brain cancer (GBM) vaccine program, VBI-1901, with respect to which an IND was accepted by the FDA on August 11, 2017. We expect to initiate enrollment in a multi-center Phase I/IIA clinical study evaluating VBI-1901 in patients with recurrent GBM in the fourth quarter of 2017. We expect results from an ongoing biomarker analysis in the first half of 2018, and initial efficacy indications in the second half of 2018. On October 3, 2017, the U.S. Patent and Trademark Office granted a patent on VBI-1901.

At present, our operations are focused on:

| ● | manufacturing in Rehovot, Israel and sale of Sci-B-Vac in territories where it is currently registered; | |

| ● | preparing for the Sci-B-Vac Phase III clinical program to support various marketing authorization applications in the U.S., Europe, Canada; | |

| ● | completing the Phase I clinical study with our CMV vaccine candidate, VBI-1501; | |

| ● | preparing for the planned Phase I/IIA clinical study of our GBM vaccine candidate, VBI-1901; | |

| ● | scaling-up Sci-B-Vac manufacturing capabilities to further commercialize this product in additional markets where we may obtain regulatory approval; | |

| ● | continuing the research and development of our product candidates, including the exploration and development of new product candidates; | |

| ● | adding operational, financial and management information systems and human resources support, including additional personnel to support our vaccine development and commercialization activities; and | |

| ● | maintaining, expanding and protecting our intellectual property portfolio. |

R&D Services

Pursuant to an agreement with the Office of the Chief Scientist in Israel, we are required to make services available for the biotechnology industry in Israel. These services include relevant activities for development and manufacturing of therapeutic proteins according to international standards and cGMP quality level suitable for toxicological studies in animals and clinical studies (Phase I & II) in humans. Service activities include analytics/bio analytics methods for development and process development of therapeutic proteins starting with a lead candidate clone through the upstream, purification, formulation and filling processes and manufacturing for Phase I & II clinical studies.

These R&D services are primarily marketed to the Israeli research community in academia and Israeli biotechnology companies in the life sciences lacking the infrastructure or experience in the development and production of therapeutic proteins and the standards and quality required for clinical studies for human use. In 2016 and 2015, we provided services to more than 10 biotech companies including analytical development, upstream development process, protein purification and formulation and filling for Phase I clinical studies.

| 23 |

VBI Cda also provides R&D services pursuant to a research agreement and certain governmental research and development grants.

Financial Overview

Overall Performance

We had net losses of approximately $9,802 and $7,299 for the three months ended September 30, 2017 and 2016, respectively and $27,452 and $14,794 for the nine months ended September 30, 2017 and 2016, respectively. At September 30, 2017, we had an accumulated deficit of $132,432, cash on hand of $10,054 and net working capital of approximately $367.

R&D Expenses

R&D expenses consist primarily of costs incurred for the development of our CMV, GBM and Sci-B-Vac vaccines, which include:

| ● | the cost of acquiring, developing and manufacturing clinical study materials and other consumables and lab supplies used in our pre-clinical studies; | |

| ● | expenses incurred under agreements with contractors or contract manufacturing organizations to advance the vaccines into clinical studies; and | |

| ● | employee-related expenses, including salaries, benefits, travel and stock-based compensation expense. |

We expense R&D costs when we incur them.

General and Administrative Expenses

General and administrative expenses consist principally of salaries and related costs for executive and other administrative personnel and consultants, including stock-based compensation and travel expenses. Other general and administrative expenses include professional fees for legal, patent protection, consulting and accounting services, travel and conference fees, including board and scientific advisory board meeting costs, rent, maintenance of facilities, depreciation, office supplies and expenses, insurance and other general expenses.

We expect that our general and administrative expenses will increase in the future as a result of adding employees and scaling our operations commensurate with advancing clinical candidates and continuing to support a public company infrastructure. These increases will likely include increased costs for insurance, hiring of additional personnel, board committees, outside consultants, investor relations, lawyers and accountants, among other expenses.

Interest Income

Interest income consists principally of interest income earned on cash balances and on R&D tax refunds.

Interest Expense

Interest expense is associated with our previously outstanding convertible notes and the credit facility entered into on July 25, 2014 and subsequently amended on December 6, 2016.

| 24 |

Results of Operations

Three and Nine months Ended September 30, 2017 Compared to the Three and Nine months Ended September 30, 2016

All amounts stated below are in thousands, unless otherwise indicated.

Revenues

Revenue by Geographic Region

| Three

months ended September 30, 2017 | Three

months ended September 30, 2016 | $ Change | % Change | |||||||||||||

| Revenue in Israel | $ | 153 | $ | 116 | $ | 37 | 32 | % | ||||||||

| Revenue in Asia | 40 | - | 40 | N/A | % | |||||||||||

| Revenue in Europe | - | 165 | (165 | ) | N/A | % | ||||||||||

| Total Revenue | $ | 193 | $ | 281 | $ | (88 | ) | (32 | )% | |||||||

| Nine

months ended September 30, 2017 | Nine

months ended September 30, 2016 | $ Change | % Change | |||||||||||||

| Revenue in Israel | $ | 400 | $ | 206 | $ | 194 | 94 | % | ||||||||

| Revenue in Asia | 101 | 4 | 97 | 2,425 | % | |||||||||||

| Revenue in North America | 150 | - | 150 | N/A | % | |||||||||||

| Revenue in South America | 2 | - | 2 | N/A | % | |||||||||||

| Revenue in Europe | 11 | 201 | (190 | ) | (95 | )% | ||||||||||

| Total Revenue | $ | 664 | $ | 411 | $ | 253 | 62 | % | ||||||||

Revenue earned in Israel for the three months ended September 30, 2017 was $153 as compared to $116 for the three months ended September 30, 2016. The revenue earned in Israel increased by $37, or 32%, primarily as a result of completion of a fee for service project during the third quarter of 2017 compared to 2016. In Asia, we completed a contract with one customer in the three and nine month periods ended September 30, 2017 compared to negligible sales in 2016 in that region. For the nine month period ended September 30, 2017, the revenue earned in Israel increased by 94% due to several new contracts in 2017 while there was a factory shutdown in 2016.

Revenue earned in North America for the nine months ended September 30, 2017 was a result of a services agreement that was completed, whereas there were no similar agreements in North America in the comparative period in 2016 that generated revenue.

Cost of Revenues

Cost of revenues for the three months ended September 30, 2017 was $1,334 as compared to $1,501 for the three months ended September 30, 2016. The decrease in the cost of revenues of $167, or 11%, was a result of lower sales for the three months ended September 30, 2017 compared to the three months ended September 30, 2016.

Cost of revenues for the nine months ended September 30, 2017 was $3,966 as compared to $2,581 for the nine months ended September 30, 2016. The increase in the cost of revenues of $1,385, or 54%, was a result of a returning to regular vaccine manufacturing production, as noted above.

| 25 |

Research and Development

Research and Development (“R&D”) expenses for the three months ended September 30, 2017 were $5,205, as compared to $3,371 for the three months ended September 30, 2016. The increase of $1,834 was mainly a result of the costs associated with various research projects that are going on in Q3 2017 and us having a lower level of activity in the three months ended September 30, 2016. In addition, in the three months ended September 30, 2017, the Company recorded a $300 impairment related to certain IPR&D assets.

R&D expenses for the nine months ended September 30, 2017 were $14,387, as compared to $5,748 for the nine months ended September 30, 2016. The increase of $8,639 was mainly a result of a full nine months of expenses in 2017 compared to five months post acquisition expenses for the nine months ended September 30, 2016, as well as a higher level of activity associated with research projects and trials during the nine months ended September 30, 2017.

General and Administrative

General and administrative (“G&A”) expenses for the three months ended September 30, 2017 were $2,795 compared to the three months ended September 30, 2016 of $3,149. The decrease of $354 was due to additional costs associated with post merger activities incurred during the three month ended September 30, 2016 compared to the period ended September 30, 2017.

G&A expenses for the nine months ended September 30, 2017 were $8,611 compared to the nine months ended September 30, 2016 of $8,267. G&A expenses for the nine months ended September 30, 2017 were $8,611 compared to the nine months ended September 30, 2016 of $8,267. G&A costs for the nine months ended September 30, 2016 included G&A costs for five months of activity incurred for the combined Company following the VBI-SciVac Merger as compared to G&A costs for nine months of activity incurred for the combined Company during the nine months in the period ended September 30, 2017. Additionally, during the nine months ended September 30, 2016, the Company incurred certain acquisition costs that were not incurred in the nine months ended September 30, 2017.

Loss from Operations

Losses from operations were $9,141 and $26,300 for the three and nine months ended September 30, 2017, compared to $7,740 and $16,185 for the three and nine months ended September 30, 2016. The losses for all periods presented are a result of the items noted above.

Interest expense, net

Interest expense, net is $742 and $2,188 for the three and nine months ended September 30, 2017. This includes the interest on our outstanding long term-debt plus the amortization of the debt discount. In 2016, these amounts were minimal as a majority of the long term debt was drawn in December 2016.

Foreign exchange gain

The foreign exchange gains of $81 and $605 for the three and nine months ended September 30, 2017 and the foreign exchange gains of $503 and $1,481 for the three and nine month periods ended September 30, 2016 are a result of the change in the foreign currencies in which the foreign currency transactions were denominated for each of those periods.

Income tax benefit

The income tax benefit for the nine month period ended September 30, 2017 was a result of the losses incurred by VBI Cda up to the amount of deferred tax asset that is more likely than not to be realized.

Net loss

Losses of $9,802 and $27,452 for the three and nine months ended September 30, 2017 compared to $7,299 and $14,794 for the three and nine months ended September 30, 2016 are a result of the items discussed above.

| 26 |

Liquidity and Capital Resources

| September 30, 2017 | December 31, 2016 | $ Change | % Change | |||||||||||||

| Cash | $ | 10,054 | $ | 32,282 | $ | (22,228 | ) | (69 | )% | |||||||

| Current Assets | 12,951 | 34,358 | (21,507 | ) | (63 | )% | ||||||||||

| Current Liabilities | 12,584 | 7,614 | 4,870 | 64 | % | |||||||||||

| Working Capital | 367 | 26,744 | (26,377 | ) | (99 | )% | ||||||||||