Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Homes 4 Rent | a1113178kdoc-novnareitpres.htm |

Investor HighlightsInvestor Highlights

November 2017

2

Forward-Looking Statements

Various statements contained in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of

historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning the timing and success

of our strategies, plans or intentions. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,”

“expect,” “intend,” “anticipate,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes. We have based these

forward-looking statements on our current expectations and assumptions about future events. These assumptions include, among others, our projections

and expectations regarding: market trends in the single-family home rental industry and in the local markets where we operate, our ability to institutionalize

a historically fragmented business model, our business strengths, our ideal tenant profile, the quality and location of our properties in attractive

neighborhoods, the scale advantage of our national platform and the superiority of our operational infrastructure, the effectiveness of our investment

philosophy and diversified acquisition strategy, our ability to grow our portfolio and to create a cash flow opportunity with attractive current yields and

upside from increasing rents and cost efficiencies and our understanding of our competition and general economic, demographic and real estate conditions

that may impact our business. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business,

economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our

control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward-

looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation,

November 13, 2017. We undertake no obligation to update any forward-looking statements to conform to actual results or changes in our expectations,

unless required by applicable law. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in

these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s

Annual Report for the year ended December 31, 2016, the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2017, and the

Company’s subsequent filings with the Securities and Exchange Commission.

Non-GAAP Financial Measures

This presentation includes certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (GAAP)

because we believe they help investors understand our performance. Any non-GAAP financial measures presented are not, and should not be viewed as,

substitutes for financial measures required by U.S. GAAP and may not be comparable to the calculation of similar measures of other companies.

Legal Disclosures

3

AMH At A Glance ……………………………………………………….................. 4

AMH Strategy …………………………………………………………..................... 5

Single-family Rental Sector: Compelling Macro Landscape …... 6

Growth Strategy - How & Where We Invest ……………...................

• Foreclosure Auction/MLS

• Built for Rental Program

• Bulk/Portfolio Opportunities

• Where We Invest

7-10

AMH Operating Approach …………………………………………………....... 11

Financial Results …………………………......................................................... 12-15

Defined Terms ……………………………………………………………………....... 16

Atlanta, GA

Table of Contents

4

AMH At A Glance

50,015 high-quality

properties in 22

states (1)

Only Investment

Grade Rated

balance sheet in

SFR sector

95.3% Same-Home

October 2017

ending leased

percentage (3)

8.3% TTM avg.

Same Home NOI

after Capex

growth (2)

~ $220 million of

expected annual

retained cash flow

(1) As of or for the quarter ended September 30, 2017.

(2) Year-over-year percentage growth comparisons based on quarterly same-home populations presented in the Company’s supplemental for the respective period.

(3) Reflects a 0.1% increase over September 2017 as a result of a 13.3% increase in monthly signed lease activity compared to prior year. Ending October 2017 Same-Home

occupancy was 94.3%.

Average property

age of 14 years

Phoenix, AZ

Boise, ID

~ 1,000 employees,

of which over 700

are field based or

delivering customer

service

Best-in-class call

center and

proprietary

technology Net debt to TTM

Adjusted EBITDA of

4.2x (1)

$10.8 billion total

market

capitalization (1)

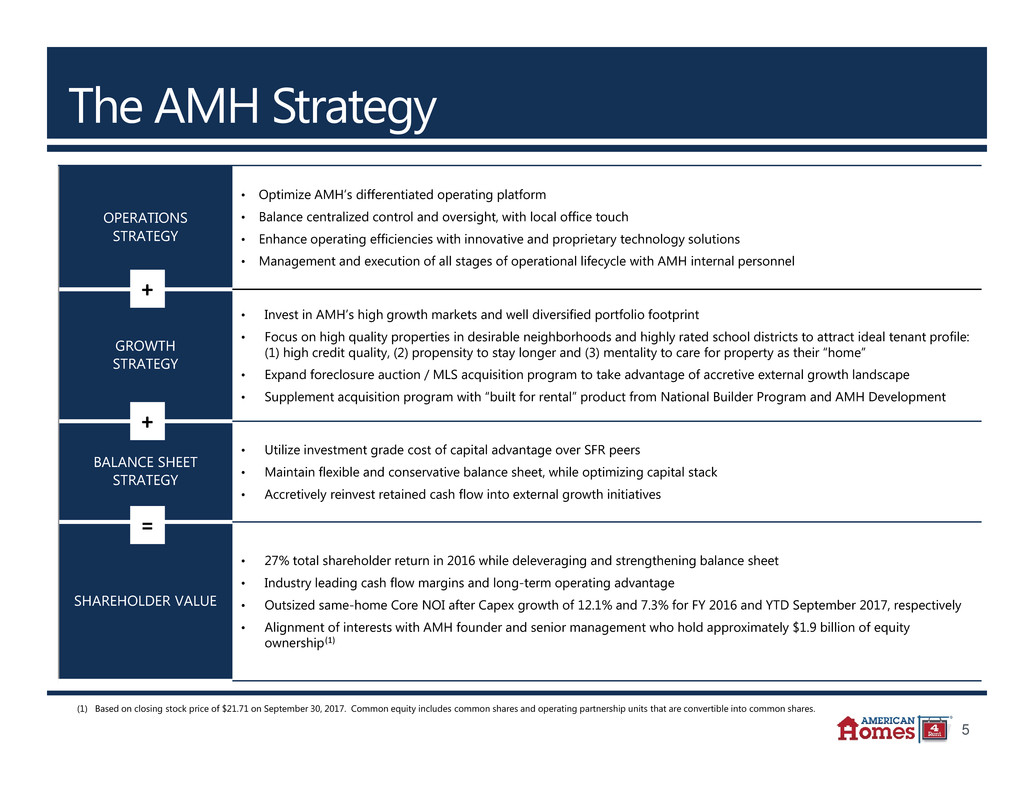

5

The AMH Strategy

OPERATIONS

STRATEGY

• Optimize AMH’s differentiated operating platform

• Balance centralized control and oversight, with local office touch

• Enhance operating efficiencies with innovative and proprietary technology solutions

• Management and execution of all stages of operational lifecycle with AMH internal personnel

GROWTH

STRATEGY

• Invest in AMH’s high growth markets and well diversified portfolio footprint

• Focus on high quality properties in desirable neighborhoods and highly rated school districts to attract ideal tenant profile:

(1) high credit quality, (2) propensity to stay longer and (3) mentality to care for property as their “home”

• Expand foreclosure auction / MLS acquisition program to take advantage of accretive external growth landscape

• Supplement acquisition program with “built for rental” product from National Builder Program and AMH Development

BALANCE SHEET

STRATEGY

• Utilize investment grade cost of capital advantage over SFR peers

• Maintain flexible and conservative balance sheet, while optimizing capital stack

• Accretively reinvest retained cash flow into external growth initiatives

SHAREHOLDER VALUE

• 27% total shareholder return in 2016 while deleveraging and strengthening balance sheet

• Industry leading cash flow margins and long-term operating advantage

• Outsized same-home Core NOI after Capex growth of 12.1% and 7.3% for FY 2016 and YTD September 2017, respectively

• Alignment of interests with AMH founder and senior management who hold approximately $1.9 billion of equity

ownership

+

+

=

(1)

(1) Based on closing stock price of $21.71 on September 30, 2017. Common equity includes common shares and operating partnership units that are convertible into common shares.

6

Owner Occupied

55% / ~ 75.7M units

Apartments & Other Rentals

31% / ~ 43.1M units

Total Housing Stock (2)

Substantial Growth In Renter Household Demand (2)Household Formations Outpace Housing Supply (1)

36%

59%

69%

75%

79%

30%

40%

50%

60%

70%

80%

90%

2000 2002 2004 2006 2008 2010 2012 2014 2016

Under 35 35 - 44 45 - 54 55 - 64 65+

0.0

0.5

1.0

1.5

2.0

1980 1985 1990 1995 2000 2005 2010 2015

Multi Family Starts Single Family Starts Long Term Average Household Formation Rate

(

I

n

m

i

l

l

i

o

n

s

)

Non-Institutional

Single-Family Rentals

13% / ~ 15.0M units

(1) Federal Reserve Bank of St. Louis Economic Data and U.S. Census Bureau.

(2) U.S. Census Bureau 3Q17.

R

e

n

t

e

r

H

o

u

s

e

h

o

l

d

s

(

i

n

m

i

l

l

i

o

n

s

)

Homeownership Decline Supports Rental Demand (2)

30.0

32.0

34.0

36.0

38.0

40.0

42.0

44.0

2000 2005 2010 2015

Accelerating demand for single-family rental housing supported by fundamental shifts in demographics and consumer preferences

Compelling Macro Landscape

Institutional

Single-Family Rentals

1% / ~ 1.0M units

7

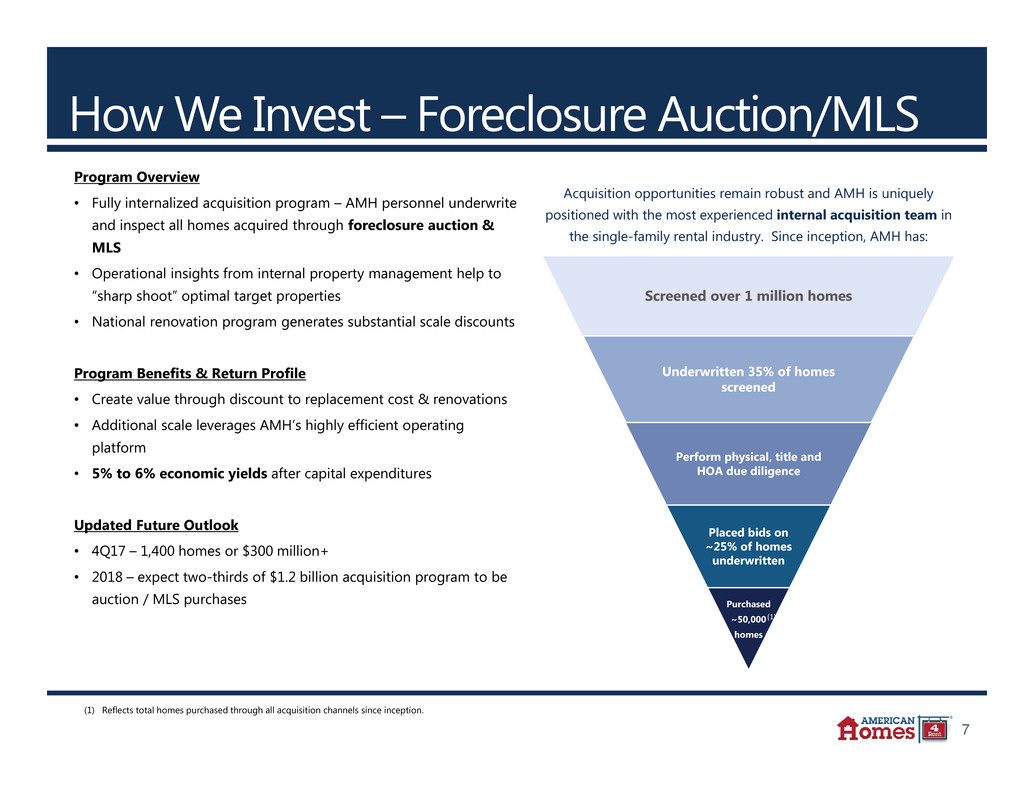

Program Overview

• Fully internalized acquisition program – AMH personnel underwrite

and inspect all homes acquired through foreclosure auction &

MLS

• Operational insights from internal property management help to

“sharp shoot” optimal target properties

• National renovation program generates substantial scale discounts

Program Benefits & Return Profile

• Create value through discount to replacement cost & renovations

• Additional scale leverages AMH’s highly efficient operating

platform

• 5% to 6% economic yields after capital expenditures

Updated Future Outlook

• 4Q17 – 1,400 homes or $300 million+

• 2018 – expect two-thirds of $1.2 billion acquisition program to be

auction / MLS purchases

Screened over 1 million homes

Underwritten 35% of homes

screened

Perform physical, title and

HOA due diligence

Placed bids on

~25% of homes

underwritten

Purchased

~50,000

homes

Acquisition opportunities remain robust and AMH is uniquely

positioned with the most experienced internal acquisition team in

the single-family rental industry. Since inception, AMH has:

(1) Reflects total homes purchased through all acquisition channels since inception.

How We Invest – Foreclosure Auction/MLS

(1)

8

Program Overview

• National Builder Program

• Acquiring newly constructed “built for rental” homes from

growing national network of 3rd party homebuilders

• AMH typically acquiring 10-20% of homes in newly

constructed for-sale communities

• AMH Development

• Recently launched internal development program

• AMH personnel sourcing land acquisitions and overseeing

construction

Program Benefits

• Strong new construction demand achieving premium rents

• Superior “built for rental” quality homes expected to have lower

expenditure levels

• New development benefit, with minimal development risk:

• No capital at risk with National Builder Program until

construction completion

• Minimal lease-up risk – Predictable delivery schedule and

standardized home models enable pre-marketing and

accelerated leasing of homes

Return Profile

• National Builder Program: 50 bps yield premium

• AMH Development: 100+ bps yield premium

Future Outlook

• 4Q17 – continue ramping up homebuilder relationships and AMH

Development program

• 2018 – expect one-third of $1.2 billion acquisition program to be

new construction

How We Invest – Built for Rental Program

Charlotte, NC

9

1 Property

55%

> 250

Properties

2%

51 - 250

Properties

2%

11 – 50

Properties

7%

2 – 10

Properties

34%

Program Overview

• Robust consolidation opportunity provided by fragmented asset class

• Over 30,000 owners of 11-50 property portfolios

• Over 2,000 owners of 51-250 property portfolios

Program Benefits & Return Profile

• Further leverage AMH’s scalable operating platform

• Accretive cost synergy opportunities

• Integration risk mitigated by AMH’s successful track record of

portfolio acquisitions

Future Outlook

• Bullish view on consolidation opportunities, but timing will be lumpy

and unpredictable

• “Special Forces” AMH acquisition team dedicated to sourcing and

executing bulk portfolio transactions

Single-Family Rental Market Ownership

“Ripe for Consolidation”

Approximately 1 million

owners of 2+ property

portfolios

Sources: Rent range, aggregated by John Burns Real Estate Consulting, LLC (“JBREC”) (Data 2015)

How We Invest – Bulk/Portfolio Opportunities

10

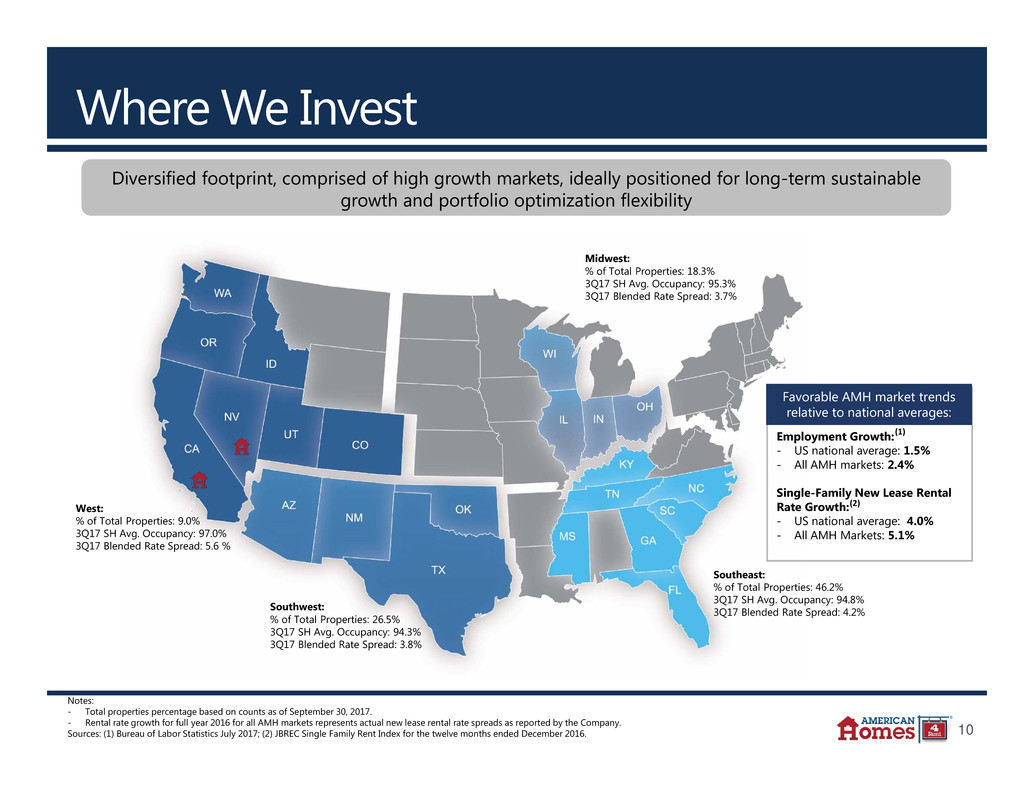

Where We Invest

Notes:

- Total properties percentage based on counts as of September 30, 2017.

- Rental rate growth for full year 2016 for all AMH markets represents actual new lease rental rate spreads as reported by the Company.

Sources: (1) Bureau of Labor Statistics July 2017; (2) JBREC Single Family Rent Index for the twelve months ended December 2016.

Diversified footprint, comprised of high growth markets, ideally positioned for long-term sustainable

growth and portfolio optimization flexibility

Southwest:

% of Total Properties: 26.5%

3Q17 SH Avg. Occupancy: 94.3%

3Q17 Blended Rate Spread: 3.8%

Southeast:

% of Total Properties: 46.2%

3Q17 SH Avg. Occupancy: 94.8%

3Q17 Blended Rate Spread: 4.2%

Midwest:

% of Total Properties: 18.3%

3Q17 SH Avg. Occupancy: 95.3%

3Q17 Blended Rate Spread: 3.7%

West:

% of Total Properties: 9.0%

3Q17 SH Avg. Occupancy: 97.0%

3Q17 Blended Rate Spread: 5.6 %

Employment Growth:

- US national average: 1.5%

- All AMH markets: 2.4%

Single-Family New Lease Rental

Rate Growth:

- US national average: 4.0%

- All AMH Markets: 5.1%

Favorable AMH market trends

relative to national averages:

(1)

(2)

11

The AMH Operating Approach

Centralized Support

• Call centers

• Tenant U/W

• Lease execution

• Rental pricing

• Maintenance

oversight

Boots on

The Ground

• Leasing agents

• Property managers

• Maintenance

technicians

Field

Management

• Local district office

• Regional & district

managers

Centralized approach differentiates AMH operating efficiency

Enhanced efficiency

Superior control

Ability to make nimble

enhancements

Standardized processes

Efficient management of

multiple satellite markets

Local customer service

delivery

Exceptional customer service

Accelerated leasing process

Asset preservation

Efficient maintenance delivery

12

Strong Financial Results

Same-Home: Revenue Growth & Expense Controls (1)

Best-In-Class Platform Efficiency

M

o

r

e

e

f

f

i

c

i

e

n

t

$2,084

$2,034

$1,967 $1,977 $1,967

$150

$155

$160

$165

3Q16 4Q16 1Q17 2Q17 3Q17

Total Core Revenues Annual Maintenance Expenditures per property (1)

12.3% 11.4% 9.0% 7.4% 5.5%

Y-o-Y growth in quarterly NOI after capex (2):

($000’s)

Same-Home: Core NOI Margin Trend (2)

Leverage Metrics

(1) Reflects core revenues in all periods for the 36,682 same-home property pool. Annual maintenance expenditures per property represent average R&M and turnover costs, net plus

capital expenditures for the trailing twelve month period for the related same-home pool for the given quarter.

(2) As presented for the related same-home pool for the given quarter.

58.7%

61.4%

62.2% 62.2%

61.0%

64.4%

65.4%

64.3%

63.3%

57.0%

59.0%

61.0%

63.0%

65.0%

67.0%

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

13.1%

12.7% 12.7% 12.6%

12.2%

11.0%

11.5%

12.0%

12.5%

13.0%

13.5%

14.0%

3Q16 4Q16 1Q17 2Q17 3Q17

6.6 x

6.1 x

5.1 x 4.8 x

4.2 x

9.4 x

8.7 x 8.3 x

7.4 x 7.3 x

0.0 x

2.0 x

4.0 x

6.0 x

8.0 x

10.0 x

12.0 x

14.0 x

3Q16 4Q16 1Q17 2Q17 3Q17

Net Debt to Adj EBITDA Debt and preferreds to Adj EBITDA

13

Capital Structure Debt Maturity Schedule (2)

(Figures in millions, except per share amounts)

12/31/2016

(In thousands, except share and per share amounts)

Note: Refer to Defined Terms and Non-GAAP Reconciliations in the Appendix, as well as the 3Q17 Supplemental Information Package, for definitions of metrics and reconciliations to GAAP.

(1) Pro Forma for the October 2017 Series A and B participating preferred share conversion, Debt and preferred shares to Adjusted EBITDA was 6.8x.

(2) As of September 30, 2017, reflects maturity of entire principal balance at the fully extended maturity date inclusive of regularly scheduled amortization.

(3) As of September 30, 2017, liquidity represents the sum of $244 million cash on the balance sheet, and $800 million undrawn capacity under our revolving credit facility.

(In millions)

(3)

Investment Grade Balance Sheet

Fixed Rate Debt

20.2%

Floating Rate

Debt

1.9%

Preferred

Shares

11.7%

Common Shares

& OP Units

66.2%

Balance Sheet Philosophy

Maintain flexible investment grade

balance sheet with diverse access to

capital

Continue optimizing capital stack

and utilize investment grade rating

to reduce cost of capital

Expand sources of available capital

as the Company and the SFR sector

evolves and matures

Prudent retention of operating cash

flow

Credit Ratings & Ratios

Moody’s Investor Service

S&P Global Ratings

Baa3 / (Stable)

BBB- / (Stable)

Net debt to Adjusted EBITDA

Debt and preferred shares to Adjusted EBITDA

Fixed charge coverage

Unencumbered Core NOI percentage

4.2x

7.3x

2.9x

62.5%

(1)

$1,044

$1,011 $1,008

$49

$115

Liquidity 2017 2018 2019 2020 2021 2022 2023 2024 Thereafter

Liquidity Asset-backed Securitizations

Secured Note Payable Exchangeable Senior Notes

Revolving Credit and Term Loan Facilities

$200

14

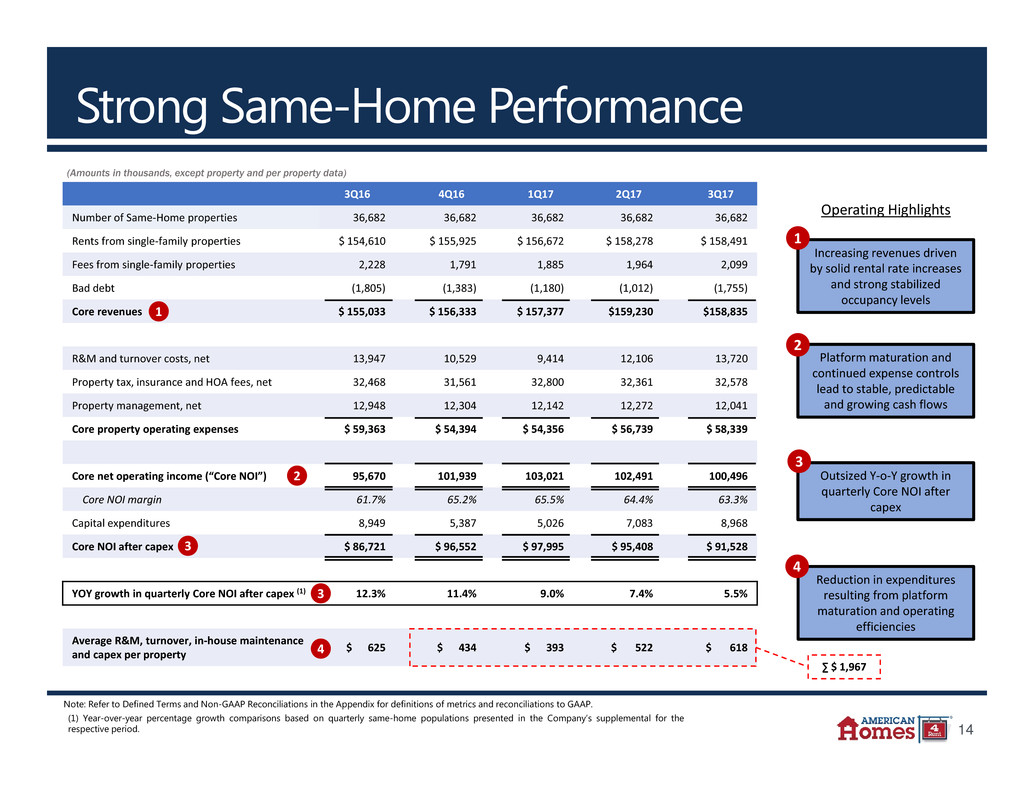

Strong Same-Home Performance

Operating Highlights

3Q16 4Q16 1Q17 2Q17 3Q17

Number of Same‐Home properties 36,682 36,682 36,682 36,682 36,682

Rents from single‐family properties $ 154,610 $ 155,925 $ 156,672 $ 158,278 $ 158,491

Fees from single‐family properties 2,228 1,791 1,885 1,964 2,099

Bad debt (1,805) (1,383) (1,180) (1,012) (1,755)

Core revenues $ 155,033 $ 156,333 $ 157,377 $159,230 $158,835

R&M and turnover costs, net 13,947 10,529 9,414 12,106 13,720

Property tax, insurance and HOA fees, net 32,468 31,561 32,800 32,361 32,578

Property management, net 12,948 12,304 12,142 12,272 12,041

Core property operating expenses $ 59,363 $ 54,394 $ 54,356 $ 56,739 $ 58,339

Core net operating income (“Core NOI”) 95,670 101,939 103,021 102,491 100,496

Core NOI margin 61.7% 65.2% 65.5% 64.4% 63.3%

Capital expenditures 8,949 5,387 5,026 7,083 8,968

Core NOI after capex $ 86,721 $ 96,552 $ 97,995 $ 95,408 $ 91,528

YOY growth in quarterly Core NOI after capex (1) 12.3% 11.4% 9.0% 7.4% 5.5%

Average R&M, turnover, in‐house maintenance

and capex per property

$ 625 $ 434 $ 393 $ 522 $ 618

(Amounts in thousands, except property and per property data)

Increasing revenues driven

by solid rental rate increases

and strong stabilized

occupancy levels

1

Platform maturation and

continued expense controls

lead to stable, predictable

and growing cash flows

2

Outsized Y‐o‐Y growth in

quarterly Core NOI after

capex

3

Reduction in expenditures

resulting from platform

maturation and operating

efficiencies

4

1

2

3

4

3

∑ $ 1,967

Note: Refer to Defined Terms and Non-GAAP Reconciliations in the Appendix for definitions of metrics and reconciliations to GAAP.

(1) Year-over-year percentage growth comparisons based on quarterly same-home populations presented in the Company’s supplemental for the

respective period.

15

Industry Leading Efficiency Metrics

(Dollars in thousands) 3Q16 4Q16 1Q17 2Q17 3Q17

Adjusted EBITDA Margins

Total revenues, excluding tenant charge‐backs $ 205,249 $ 204,382 $ 205,381 $ 209,626 $ 210,742

Property operating expenses, net ( 63,116) ( 56,562) ( 56,393) ( 59,715) (63,110)

Property management expenses, net ( 16,488) ( 15,737) ( 15,600) ( 15,875) ( 15,770)

General & administrative expenses, net ( 7,563) ( 8,026) ( 8,774) ( 8,229) ( 7,826)

Other expenses, net ( 2,575) ( 1,993) ( 629) 199 14

Adjusted EBITDA $ 115,507 $ 122,064 $ 123,985 $ 126,006 $ 124,050

Margin 56.3 % 59.7 % 60.4 % 60.1 % 58.9 %

Maintenance capex ( 10,411) ( 6,353) ( 6,444) ( 9,096) ( 11,600)

Leasing costs ( 2,119) ( 1,806) ( 1,482) ( 1,919) ( 1,960)

Adjusted EBITDA after capex & leasing costs $ 102,977 $ 113,905 $ 116,059 $ 114,991 $ 110,490

Margin 50.2 % 55.7 % 56.5 % 54.9 % 52.4%

Platform Efficiency Percentage

Rents & fees from single‐family properties $ 200,035 $ 201,395 $ 203,711 $ 207,338 $ 210,333

Property management expenses, net $ 16,488 $ 15,737 $ 15,600 $ 15,875 $ 15,770

General & administrative expenses, net 7,563 8,026 8,774 8,229 7,826

Leasing costs 2,119 1,806 1,482 1,919 1,960

Total platform costs $ 26,170 $ 25,569 $ 25,856 $ 26,023 $ 25,556

Platform Efficiency Percentage 13.1 % 12.7 % 12.7 % 12.6 % 12.2 %

Note: Refer to Defined Terms and Non-GAAP Reconciliations in the Appendix for definitions of metrics and reconciliations to GAAP.

16

Highligh

ts

(1

)

Defined Terms and Non-GAAP Reconciliations

Core Net Operating Income ("Core NOI") and Same-Home Core NOI After Capital Expenditures

Core NOI, which we also present separately for our Same-Home portfolio, is a supplemental non-GAAP financial measure that we define as core revenues,

which is calculated as rents and fees from single-family properties, net of bad debt expense, less core property operating expenses, which is calculated as

property operating and property management expenses, excluding noncash share-based compensation expense, expenses reimbursed by tenant charge-

backs and bad debt expense. A property is classified as Same-Home if it has been stabilized longer than 90 days prior to the beginning of the earliest period

presented under comparison and if it has not been classified as held for sale or taken out of service as a result of a casualty loss.

Core NOI also excludes (1) noncash fair value adjustments associated with remeasuring our participating preferred shares derivative liability to fair value, (2)

noncash gain or loss on conversion of convertible units, (3) gain or loss on early extinguishment of debt, (4) hurricane-related charges, net, (5) gain or loss

on sales of single-family properties and other, (6) depreciation and amortization, (7) acquisition fees and costs expensed incurred with recent business

combinations and the acquisition of individual properties, (8) noncash share-based compensation expense, (9) interest expense, (10) general and

administrative expense, (11) other expenses and (12) other revenues. We consider Core NOI to be a meaningful financial measure because we believe it is

helpful to investors in understanding the operating performance of our single-family properties without the impact of certain operating expenses that are

reimbursed through tenant charge-backs. We further adjust Core NOI for our Same-Home portfolio by subtracting capital expenditures to calculate Same-

Home Core NOI After Capital Expenditures, which we believe is a meaningful supplemental non-GAAP financial measure because it more fully reflects our

operating performance after the impact of all property-level expenditures, regardless of whether they are capitalized or expensed.

Core NOI and Same-Home Core NOI After Capital Expenditures should be considered only as supplements to net income or loss as a measure of our

performance and should not be used as measures of our liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to

pay dividends or make distributions. Additionally, these metrics should not be used as substitutes for net income (loss) or net cash flows from operating

activities (as computed in accordance with GAAP).

17

(1

)

The following are reconciliations of core revenues, core property operating expenses, Core NOI, Same-Home Core NOI and Same-Home Core NOI After

Capital Expenditures to their respective GAAP metrics for the trailing five quarters (amounts in thousands):

Sep 30,

2016

Dec 31,

2016

Mar 31,

2017

Jun 30,

2017

Sep 30,

2017

Core revenues

Total revenues 236,057$ 227,559$ 233,754$ 237,008$ 246,836$

Tenant charge‐backs (30,808) (23,177) (28,373) (27,382) (36,094)

Bad debt expense (2,609) (1,877) (1,510) (1,333) (2,299)

Other revenues (5,214) (2,987) (1,670) (2,288) (409)

Core revenues 197,426 199,518 202,201 206,005 208,034

Less: Non‐Same‐Home core revenues 42,393 43,185 44,824 46,775 49,199

Same‐Home core revenues 155,033$ 156,333$ 157,377$ 159,230$ 158,835$

For the Three Months Ended

Sep 30,

2016

Dec 31,

2016

Mar 31,

2017

Jun 30,

2017

Sep 30,

2017

Core property operating expenses

Property operating expenses 92,488$ 78,323$ 83,305$ 85,954$ 97,944$

Property management expenses 18,335 17,547 17,478 17,442 17,447

Noncash share‐based compensation ‐ property management (411) (394) (417) (424) (417)

Expenses reimbursed by tenant charge‐backs (30,808) (23,177) (28,373) (27,382) (36,094)

Bad debt expense (2,609) (1,877) (1,510) (1,333) (2,299)

Core property operating expenses 76,995 70,422 70,483 74,257 76,581

Less: Non‐Same‐Home core property operating expenses 17,632 16,028 16,127 17,518 18,242

Same‐Home core property operating expenses 59,363$ 54,394$ 54,356$ 56,739$ 58,339$

For the Three Months Ended

Defined Terms and Non-GAAP Reconciliations

18

Highligh

ts

(1

)

Sep 30,

2016

Dec 31,

2016

Mar 31,

2017

Jun 30,

2017

Sep 30,

2017

Net (loss) income (167)$ 9,338$ 11,796$ 15,066$ 19,097$

Remeasurement of participating preferred shares 2,490 4,080 5,410 1,640 (8,391)

Loss on early extinguishment of debt 13,408 ‐ ‐ 6,555 ‐

Hurricane‐related charges, net ‐ ‐ ‐ ‐ 10,136

Gain on sale of single‐family properties and other, net (11,682) (1,995) (2,026) (2,454) (1,895)

Depreciation and amortization 75,392 74,164 73,953 72,716 74,790

Acquisition fees and costs expensed 1,757 544 1,096 1,412 1,306

Noncash share‐based compensation expense ‐ property management 411 394 417 424 417

Interest expense 32,851 31,538 31,889 28,392 26,592

General and administrative expense 8,043 8,524 9,295 8,926 8,525

Other expenses 3,142 5,496 1,558 1,359 1,285

Other revenues (5,214) (2,987) (1,670) (2,288) (409)

Tenant charge‐backs 30,808 23,177 28,373 27,382 36,094

Expenses reimbursed by tenant charge‐backs (30,808) (23,177) (28,373) (27,382) (36,094)

Bad debt expense excluded from operating expenses 2,609 1,877 1,510 1,333 2,299

Bad debt expense included in revenues (2,609) (1,877) (1,510) (1,333) (2,299)

Core NOI 120,431 129,096 131,718 131,748 131,453

Less: Non‐Same‐Home Core NOI 24,761 27,157 28,697 29,257 30,957

Same‐Home Core NOI 95,670 101,939 103,021 102,491 100,496

Same‐Home capital expenditures 8,949 5,387 5,026 7,083 8,968

Same‐Home Core NOI After Capital Expenditures 86,721$ 96,552$ 97,995$ 95,408$ 91,528$

For the Three Months Ended

Defined Terms and Non-GAAP Reconciliations

19

EBITDA / Adjusted EBITDA / Adjusted EBITDA after Capex and Leasing Costs / Adjusted EBITDA Margin / Adjusted EBITDA after Capex and

Leasing Costs Margin

EBITDA is defined as earnings before interest, taxes, depreciation and amortization. EBITDA is a non-GAAP financial measure and is used by us and

others as a supplemental measure of performance. Adjusted EBITDA is a supplemental non-GAAP financial measure calculated by adjusting EBITDA for

(1) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of individual properties, (2) net gain or loss on

sales / impairment of single-family properties and other, (3) noncash share-based compensation expense, (4) hurricane-related charges, net, (5) gain or

loss on early extinguishment of debt, (6) gain or loss on conversion of convertible units and (7) noncash fair value adjustments associated with

remeasuring our participating preferred shares derivative liability to fair value. Adjusted EBITDA after Capex and Leasing Costs is a supplemental non-

GAAP financial measure calculated by adjusting Adjusted EBITDA for (1) recurring capital expenditures and (2) leasing costs. Adjusted EBITDA Margin is

a supplemental non-GAAP financial measure calculated as Adjusted EBITDA divided by total revenues, net of tenant charge-backs. Adjusted EBITDA

after Capex and Leasing Costs Margin is a supplemental non-GAAP financial measure calculated as Adjusted EBITDA after Capex and Leasing costs

divided by total revenues, net of tenant charge-backs. We consider these metrics to be meaningful financial measures of operating performance

because they exclude the impact of various income and expense items that are not indicative of operating performance.

Defined Terms and Non-GAAP Reconciliations

20

Sep 30,

2016

Dec 31,

2016

Mar 31,

2017

Jun 30,

2017

Sep 30,

2017

Net (loss) income (167)$ 9,338$ 11,796$ 15,066$ 19,097$

Interest expense 32,851 31,538 31,889 28,392 26,592

Depreciation and amortization 75,392 74,164 73,953 72,716 74,790

EBITDA 108,076 115,040 117,638 116,174 120,479

Noncash share‐based compensation ‐ general and administrative 480 498 521 697 699

Noncash share‐based compensation ‐ property management 411 394 417 424 417

Acquisition fees and costs expensed 1,757 544 1,096 1,412 1,306

Net (gain) loss on sale / impairment of single‐family properties and other (11,115) 1,508 (1,097) (896) (596)

Hurricane‐related charges, net ‐ ‐ ‐ ‐ 10,136

Loss on early extinguishment of debt 13,408 ‐ ‐ 6,555 ‐

Remeasurement of participating preferred shares 2,490 4,080 5,410 1,640 (8,391)

Adjusted EBITDA 115,507$ 122,064$ 123,985$ 126,006$ 124,050$

Recurring capital expenditures (10,411) (6,353) (6,444) (9,096) (11,600)

Leasing costs (2,119) (1,806) (1,482) (1,919) (1,960)

Adjusted EBITDA after Capex and Leasing Costs 102,977$ 113,905$ 116,059$ 114,991$ 110,490$

Total revenues 236,057$ 227,559$ 233,754$ 237,008$ 246,836$

Less: tenant charge‐backs (30,808) (23,177) (28,373) (27,382) (36,094)

Total revenues, net of tenant charge‐backs 205,249$ 204,382$ 205,381$ 209,626$ 210,742$

Adjusted EBITDA Margin 56.3% 59.7% 60.4% 60.1% 58.9%

Adjusted EBITDA after Capex and Leasing Costs Margin 50.2% 55.7% 56.5% 54.9% 52.4%

For the Three Months Ended

The following is a reconciliation of net income or loss, determined in accordance with GAAP, to EBITDA, Adjusted EBITDA, Adjusted EBITDA after Capex

and Leasing Costs, Adjusted EBITDA Margin and Adjusted EBITDA after Capex and Leasing Costs Margin for the trailing five quarters (amounts in

thousands):

Defined Terms and Non-GAAP Reconciliations

21

Platform Efficiency Percentage

Management costs, including (1) property management expenses, net of tenant charge-backs and excluding noncash share-based compensation

expense, (2) general and administrative expense, excluding noncash share-based compensation expense and (3) leasing costs, as a percentage of total

portfolio rents and fees.

Sep 30,

2016

Dec 31,

2016

Mar 31,

2017

Jun 30,

2017

Sep 30,

2017

Property management expenses 18,335$ 17,547$ 17,478$ 17,442$ 17,447$

Less: tenant charge‐backs (1,436) (1,416) (1,461) (1,143) (1,260)

Less: noncash share‐based compensation ‐ property management (411) (394) (417) (424) (417)

Property management expenses, net 16,488 15,737 15,600 15,875 15,770

General and administrative expense 8,043 8,524 9,295 8,926 8,525

Less: noncash share‐based compensation ‐ general and administrative (480) (498) (521) (697) (699)

General and administrative expense, net 7,563 8,026 8,774 8,229 7,826

Leasing costs 2,119 1,806 1,482 1,919 1,960

Platform costs 26,170$ 25,569$ 25,856$ 26,023$ 25,556$

Rents from single‐family properties 197,137$ 198,980$ 201,107$ 204,648$ 207,490$

Fees from single‐family properties 2,898 2,415 2,604 2,690 2,843

Total portfolio rents and fees 200,035$ 201,395$ 203,711$ 207,338$ 210,333$

Platform Efficiency Percentage 13.1% 12.7% 12.7% 12.6% 12.2%

For the Three Months Ended

(In Thousands)

Defined Terms and Non-GAAP Reconciliations

22

Credit Metrics

We present the following selected metrics because we believe they are helpful as supplemental measures in assessing the Company’s ability to service

its financing obligations and in evaluating balance sheet leverage against that of other real estate companies. The tables below reconcile these metrics,

which are calculated in part based on several non-GAAP financial measures (amounts in thousands).

Sep 30,

2017

Total Debt 2,382,871$

Preferred shares at l iquidation value 1,259,477

Total Debt and preferred shares 3,642,348

Adjusted EBITDA ‐ TTM 496,105$

Debt and Preferred Shares to Adjusted EBITDA 7.3 x

For the Trailing

Twelve Months

Ended

Sep 30, 2017

Interest expense per income statement 118,411$

Less: noncash interest expense related to acquired debt (3,489)

Less: amortization of deferred financing costs (8,925)

Add: capitalized interest 3,884

Cash interest 109,881

Dividends on preferred shares 59,709

Fixed charges 169,590

Adjusted EBITDA 496,105$

Fixed Charge Coverage 2.9 x

Debt and Preferred Shares to Adjusted EBITDA

Fixed Charge Coverage

Defined Terms and Non-GAAP Reconciliations

23

Sep 30,

2017

Total Debt 2,382,871$

Less: cash and cash equivalents (243,547)

Less: asset‐backed securitization certificates (25,666)

Less: restricted cash related to securitizations (46,166)

Net debt 2,067,492$

Adjusted EBITDA TTM 496,105

Net Debt to TTM Adjusted EBITDA 4.2 x

For the Three

Months Ended

Sep 30, 2017

Unencumbered Core NOI 82,186$

Core NOI 131,453$

Unencumbered Core NOI Percentage 62.5%

Unencumbered Core NOI Percentage

Net Debt to Adjusted EBITDA

Defined Terms and Non-GAAP Reconciliations