Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - CHASE CORP | ccf-20170831ex322d90466.htm |

| EX-32.1 - EX-32.1 - CHASE CORP | ccf-20170831ex321e9a85e.htm |

| EX-31.2 - EX-31.2 - CHASE CORP | ccf-20170831ex3120fb53f.htm |

| EX-31.1 - EX-31.1 - CHASE CORP | ccf-20170831ex311e5b00d.htm |

| EX-23.1 - EX-23.1 - CHASE CORP | ccf-20170831ex2310e7385.htm |

| EX-21 - EX-21 - CHASE CORP | ccf-20170831ex21f0f261a.htm |

| EX-10.10.8 - EX-10.10.8 - CHASE CORP | ccf-20170831ex10108b2b2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2017

Commission File Number: 1‑9852

CHASE CORPORATION

(Exact name of registrant as specified in its charter)

|

Massachusetts |

11‑1797126 |

|

(State or other jurisdiction of incorporation of organization) |

(I.R.S. Employer Identification No.) |

295 University Avenue, Westwood, Massachusetts 02090

(Address of Principal Executive Offices, Including Zip Code)

(781) 332-0700

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to section 12(b) of the Act:

|

Title of Each Class: |

Name of Each Exchange on Which Registered |

|

Common Stock |

NYSE American |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well‑known seasoned issuer (as defined in Rule 405 of the Securities Act). YES ☐ NO ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☒

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☒ |

||||

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ☐ |

||||

|

Emerging growth company ☐ |

|

||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the common stock held by non‑affiliates of the registrant, as of February 28, 2017 (the last business day of the registrant’s second quarter of fiscal 2017), was approximately $653,152,000.

As of October 31, 2017, the Company had outstanding 9,364,936 shares of common stock, $0.10 par value, which is its only class of common stock.

Documents Incorporated By Reference:

Portions of the registrant’s definitive proxy statement for the Annual Meeting of Shareholders, which is expected to be filed within 120 days after the registrant’s fiscal year ended August 31, 2017, are incorporated by reference into Part III hereof.

CHASE CORPORATION

INDEX TO ANNUAL REPORT ON FORM 10-K

For the Year Ended August 31, 2017

|

|

|

|

Page No. |

|

Cautionary Note Concerning Forward-Looking Statements |

|

2 | |

|

|

|

|

|

|

|

|

|

|

|

|

3 | ||

|

|

9 | ||

|

|

11 | ||

|

|

12 | ||

|

|

13 | ||

|

|

13 | ||

|

|

13 | ||

|

|

|

|

|

|

|

|

|

|

|

|

14 | ||

|

|

16 | ||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

17 | |

|

|

32 | ||

|

|

33 | ||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

86 | |

|

|

86 | ||

|

|

86 | ||

|

|

|

|

|

|

|

|

|

|

|

|

87 | ||

|

|

87 | ||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

87 | |

|

Certain Relationships and Related Transactions, and Director Independence |

|

87 | |

|

|

87 | ||

|

|

|

|

|

|

|

|

|

|

|

|

88 | ||

|

|

91 | ||

|

|

|

|

|

|

|

92 | ||

1

Cautionary Note Concerning Forward-Looking Statements

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements made by Chase Corporation (the “Company,” “Chase,” “we,” or “us”), including without limitation forward-looking statements made under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” involve risks and uncertainties. Any statements contained in this Annual Report that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements include, without limitation, statements as to our future operating results; seasonality expectations; plans for the development, utilization or disposal of manufacturing facilities; future economic conditions; our expectations as to legal proceedings; the effect of our market and product development efforts; and expectations or plans relating to the implementation or realization of our strategic goals and future growth, including through potential future acquisitions. Forward-looking statements may include, among other things, statements relating to future sales, earnings, cash flow, results of operations, use of cash and other measures of financial performance, as well as statements relating to future dividend payments. Other forward-looking statements may be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “predicts,” “targets,” “forecasts,” “strategy,” and other words of similar meaning in connection with the discussion of future operating or financial performance. These statements are based on current expectations, estimates and projections about the industries in which we operate, and the beliefs and assumptions made by management. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Accordingly, the Company’s actual results may differ materially from those contemplated by the forward-looking statements. Investors, therefore, are cautioned against relying on any of these forward-looking statements, which speak only as of the date the statement was made. They are neither statements of historical fact nor guarantees or assurances of future performance. Readers should refer to the discussions under Item 1A “Risk Factors” of this Annual Report on Form 10-K.

2

Primary Operating Divisions and Facilities and Industry Segments

Chase Corporation, founded in 1946, is a leading manufacturer of protective materials for high-reliability applications. Our strategy is to maximize the performance of our core businesses and brands while seeking future opportunities through strategic acquisitions. We are organized into two operating segments, an Industrial Materials segment and a Construction Materials segment. The segments are distinguished by the nature of the products we manufacture and how they are delivered to their respective markets. The Industrial Materials segment includes specified products that are used in, or integrated into, another company’s product, with demand typically dependent upon general economic conditions. The Construction Materials segment is principally composed of project-oriented product offerings that are primarily sold and used as "Chase" branded products. Our manufacturing facilities are distinct to their respective segments with the exception of our O’Hara Township, PA and Blawnox, PA facilities, which produce products related to both operating segments. A summary of our operating structure as of August 31, 2017 is as follows:

|

INDUSTRIAL MATERIALS SEGMENT |

|

|

|

|

|

|

|

Primary |

|

|

|

|

|

Manufacturing |

|

|

|

Key Products |

|

Locations |

|

Background/History |

|

Specialty tapes and related products for the electronic and telecommunications industries using the brand name Chase & Sons®.

|

|

Oxford, MA |

|

In August 2011, we relocated our manufacturing processes that had been previously conducted at our Webster, MA facility to this location. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Advanced adhesives, sealants, and coatings for automotive and industrial applications that require specialized bonding, encapsulating, environmental protection, or thermal management functionality.

|

|

Woburn, MA Newark, CA

|

|

In September 2016, we acquired certain assets and the operations of Resin Designs, LLC, and entered leases in their existing manufacturing facilities in Massachusetts and California.

|

|

Laminated film foils for the electronics and cable industries and cover tapes essential to delivering semiconductor components via tape and reel packaging. |

|

Pawtucket, RI |

|

In June 2012, we acquired all of the capital stock of NEPTCO Incorporated, which operated facilities in Rhode Island, North Carolina and China. |

3

|

|

|

|

|

|

|

Key Products & Services |

|

Primary |

|

Background/History |

|

Protective conformal coatings under the brand name HumiSeal®, moisture protective electronic coatings sold to the electronics industry including circuitry used in automobiles and home appliances. |

|

Winnersh, Wokingham, England |

|

In October 2005, we acquired all of the capital stock of Concoat Holdings Ltd. and its subsidiaries. In 2006 Concoat was renamed HumiSeal Europe. |

|

|

|

|

|

|

4

|

CONSTRUCTION MATERIALS SEGMENT |

|

|

|

|

|

|

|

Primary |

|

|

|

|

|

Manufacturing |

|

|

|

Key Products |

|

Locations |

|

Background/History |

|

Protective pipe coating tapes and other protectants for valves, regulators, casings, joints, metals, concrete, and wood which are sold under the brand name Royston®, to oil companies, gas utilities and pipeline companies.

Rosphalt50® is a polymer additive that provides long-term cost-effective solutions in many applications such as waterproofing of approaches and bridges, ramps, race tracks, airports and specialty road applications.

|

|

Blawnox, PA |

|

The Royston business was acquired in the early 1970's. |

|

|

|

|

|

|

|

Technologically advanced products, including the brand Tapecoat®, for demanding anti-corrosion applications in the gas, oil and marine pipeline market segments, as well as tapes and membranes for roofing and other construction-related applications.

|

|

|

|

|

|

|

|

|

|

|

|

Specialized high-performance coating and lining systems used worldwide in liquid storage and containment applications. |

|

Houston, TX |

|

In September 2009, we acquired all of the outstanding capital stock of C.I.M. Industries Inc. (“CIM”). |

|

|

|

|

|

|

|

Waterproofing and corrosion protection systems for oil, gas and water pipelines, and a supplier to Europe, the Middle East and Southeast Asia. This facility joins Chase's North American-based Tapecoat® and Royston® brands to broaden the protective pipeline coatings product line and better address global demand.

The ServiWrap® product offering complements the portfolio of our pipeline protection tapes, coatings and accessories to extend our global customer base.

|

|

Rye, East Sussex, England |

|

In September 2007, we purchased certain product lines and a related manufacturing facility in Rye, East Sussex, England through our wholly-owned subsidiary, Chase Protective Coatings Ltd.

In December 2009, we acquired the full range of ServiWrap® pipeline protection products (“ServiWrap”) from Grace Construction Products Limited, a UK-based unit of W.R. Grace & Co. |

Other Business Developments

On April 3, 2017, Chase executed an agreement with an unrelated party to sell all inventory, machinery and equipment and intangible assets of the Company’s fiber optic cable components product line for proceeds of $3,858,000 net of transaction costs and following certain working capital adjustments. The resulting pre-tax gain on sale of $2,013,000 was recognized in the third quarter of fiscal 2017 as gain on sale of businesses within the consolidated statement of operations. Further, the purchaser entered a multiyear lease for a portion of the manufacturing space at the Company’s Granite Falls, NC facility. Chase will provide ongoing manufacturing and administrative support to the purchaser for which the Company will receive additional consideration upon the performance of services. The Company’s fiber optic cable components product line was formerly a part of the Company’s Industrial Materials operating segment.

On September 30, 2016, the Company acquired certain assets of Resin Designs, LLC (“Resin Designs”), an advanced adhesives and sealants manufacturer, with locations in Woburn, MA and Newark, CA. The business was acquired for a purchase price of $30,270,000 after final working capital adjustments and excluding acquisition-related costs. As part of this transaction, Chase acquired all working capital and fixed assets of the business, and entered multiyear leases at both locations. The Company expensed $584,000 of acquisition-related costs during the first quarter of fiscal 2017 associated with this acquisition. The purchase was funded entirely with available cash on hand. Resin Designs is a formulator of customized adhesive and sealant systems used in high-reliability electronic applications. The acquisition broadens the Company’s adhesives and sealants product offering and manufacturing capabilities, and expands its market reach. Since

5

the effective date of the acquisition, the financial results of Resin Designs’ operations have been included in the Company’s financial statements within the electronic and industrial coatings product line, contained within the Industrial Materials operating segment.

On June 23, 2016 (the fourth quarter of fiscal 2016), the Company acquired all the capital stock of Spray Products (India) Private Limited for $1,161,000, net of cash acquired. This acquired business works closely with our HumiSeal® coating manufacturing operation in Winnersh, Wokingham, England. The acquisition in India enhances the Company’s ability to provide technical, sales, manufacturing, chemical handling, and packaging services in the region. Since the effective date for this acquisition, the financial results of the business have been included in the Company's financial statements within the Company’s Industrial Materials operating segment in the electronic and industrial coatings product line. Effective December 2016, Spray Products (India) Private Limited was renamed HumiSeal India Private Limited.

In November 2015 (the first quarter of fiscal 2016), the Company sold its RodPack® wind energy business, contained within its structural composites product line, to an otherwise unrelated party for proceeds of $2,186,000. The Company’s structural composites product line is a part of the Company’s Industrial Materials operating segment. The Company will provide ongoing development support to the Buyer for which it will receive additional consideration upon the completion of services.

Products and Markets

Our principal products are specialty tapes, laminates, adhesives, sealants, coatings and chemical intermediates which are sold by our salespeople, manufacturers' representatives and distributors. In our Industrial Materials segment, these products consist of:

|

(i) |

insulating and conducting materials for the manufacture of electrical and telephone wire and cable, electrical splicing, and terminating and repair tapes, which are marketed to wire and cable manufacturers; |

|

(ii) |

laminated film foils, including EMI/RFI shielding tapes used in communication and local area network (LAN) cables; |

|

(iii) |

moisture protective coatings, which are sold to the electronics industry for circuitry manufacturing, including circuitry used in automobiles and home appliances; |

|

(iv) |

laminated durable papers, including laminated paper with an inner security barrier used in personal and mail-stream privacy protection, which are sold primarily to the envelope converting and commercial printing industries; |

|

(v) |

pulling and detection tapes used in the installation, measurement and location of fiber optic cables, water and natural gas lines, and power, data, and video cables for commercial buildings; |

|

(vi) |

cover tapes with reliable adhesive and anti-static properties essential to delivering semiconductor components via tape and reel packaging; |

|

(vii) |

advanced adhesives, sealants, and coatings for automotive and industrial applications that require specialized bonding, encapsulating, environmental protection, or thermal management functionality; |

|

(viii) |

polymeric microspheres utilized by various industries to allow for weight and density reduction and sound dampening; |

|

(ix) |

water-based polyurethane dispersions utilized for various coating products; and |

|

(x) |

composite strength elements utilized in wind energy generation. |

6

In our Construction Materials segment, these products consist of:

|

(i) |

protective pipe coating tapes and other protectants for valves, regulators, casings, joints, metals, concrete and wood, which are sold to oil companies, gas utilities, and pipeline companies for utilization in both the construction and maintenance of oil and gas, water and wastewater pipelines; |

|

(ii) |

waterproofing membranes for highway bridge deck metal-supported surfaces, which are sold to municipal transportation authorities, and high-performance polymeric asphalt additives; |

|

(iii) |

fluid-applied coating and lining systems for use in the water and wastewater industry; and |

|

(iv) |

expansion and control joint systems designed for roads, bridges, stadiums and airport runways. |

There is some seasonality in selling products into the construction market. Higher demand is often experienced when temperatures are warmer in most of North America (April through October), with lower demand occurring when temperatures are colder (typically our second fiscal quarter). Other than the acquisition of the operations of Resin Designs, we did not introduce any new products requiring an investment of a material amount of our assets during fiscal year 2017.

Employees

As of October 31, 2017, we employed approximately 695 people (including union employees). We consider our employee relations to be good. In the U.S., we offer our employees a wide array of company-paid benefits, which we believe are competitive relative to others in our industry. In our operations outside the U.S., we offer benefits that may vary from those offered to our U.S. employees due to customary local practices and statutory requirements.

Backlog, Customers and Competition

As of October 31, 2017, the backlog of customer orders believed to be firm was approximately $19,719,000. This compared with a backlog of $17,583,000 as of October 31, 2016. The increase in backlog from the prior year amount is primarily due to current period increases in specialty chemical intermediates, pulling and detection and cable materials products. During fiscal 2017, 2016 and 2015, no customer accounted for more than 10% of sales. No material portion of our business is subject to renegotiation or termination of profits or contracts at the election of the United States Federal Government.

There are other companies that manufacture or sell products and services similar to those made and sold by us. Many of those companies are larger and have greater financial resources than we have. We compete principally on the basis of technical performance, service reliability, quality and price.

Raw Materials

We obtain raw materials from a wide variety of suppliers, with alternative sources of most essential materials available within reasonable lead times.

Patents, Trademarks, Licenses, Franchises and Concessions

We own the following trademarks that we believe are of material importance to our business: Chase Corporation®, C-Spray (Logo), a trademark used in conjunction with most of the Company’s business segment and product line marketing material and communications; HumiSeal®, a trademark for moisture protective coatings sold to the electronics industry; Chase & Sons®, a trademark for barrier and insulating tapes sold to the wire and cable industry; Chase BLH2OCK®, a trademark for a water-blocking compound sold to the wire and cable industry; Rosphalt50®, a trademark for an asphalt additive used predominantly on bridge decks for waterproofing protection; PaperTyger®, a trademark for laminated durable papers sold to the envelope converting and commercial printing industries; DuraDocument®, a trademark for durable, laminated papers sold to the digital print industry; Defender® a trademarked and patent-pending

7

RFID protective material sold to the personal accessories and paper industries; Tapecoat®, a trademark for corrosion preventive surface coatings and primers; Maflowrap®, a trademark for anti-corrosive tapes incorporating self-adhesive mastic or rubber-backed strips, made of plastic materials; Royston®, a trademark for a corrosion-inhibiting coating composition for use on pipes; Ceva®, a trademark for epoxy pastes/gels/mortars and elastomeric concrete used in the construction industry; CIM® trademarks for fluid-applied coating and lining systems used in the water and wastewater industry; ServiWrap® trademarks for pipeline protection tapes, coatings and accessories; NEPTCO®, a trademark used in conjunction with most of NEPTCO’s business and product line marketing material and communications; NEPTAPE®, a trademark for coated shielding and insulation materials used in the wire and cable industry; Muletape®, a trademark for pulling and installation tapes sold to the telecommunications industry; Trace-Safe®, a trademark for detection tapes sold to the water and gas industies; Dualite®, a trademark for polymeric microspheres utilized for density and weight reduction and sound dampening by various industries; 4EvaSeal®, a trademark for adhesive-backed tape utilized in various industries; Resin Designs®, a trademark for adhesives and sealants sold into the microelectronics and semiconductor industries; SlickTape®, a trademark for a lubricated shielding tape sold to the wire and cable industry; and HighDraw®, a trademark for a highly extensible shielding tape sold to the wire and cable industry. We do not have any other material trademarks, licenses, franchises, or concessions. While we do hold various patents, as well as other trademarks, we do not believe that they are material to the success of our business.

Working Capital

We fund our business operations through a combination of available cash and cash equivalents, short-term investments and cash flows generated from operations. In addition, our revolving credit facility is available for additional working capital needs or investment opportunities. We have historically funded acquisitions through both available cash on hand and additional borrowings and financing agreements with our bank lenders.

Research and Development

Approximately $3,696,000, $2,792,000 and $2,690,000 was expensed for Company-sponsored research and development during fiscal 2017, 2016 and 2015, respectively, and recorded within selling, general and administrative expenses. Research and development increased by $904,000 in fiscal 2017 due to continued focused development work on strategic product lines, and eleven months of operations related to the established research and development department of Resin Designs, acquired in the first quarter of fiscal 2017.

Available Information

Chase maintains a website at http://www.chasecorp.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports filed or furnished pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as section 16 reports on Form 3, 4, or 5, are available free of charge on this site as soon as is reasonably practicable after they are filed or furnished with the SEC. Our Code of Conduct and Ethics and the charters for the Audit Committee, the Nominating and Governance Committee and the Compensation and Management Development Committee of our Board of Directors are also available on our internet website. The Code of Conduct and Ethics and charters are also available in print to any shareholder upon request. Requests for such documents should be directed to Paula Myers, Shareholder and Investor Relations Department, at 295 University Avenue, Westwood, Massachusetts 02090. Our internet website and the information contained on it or connected to it are not part of nor incorporated by reference into this Form 10-K. Our filings with the SEC are also available on the SEC’s website at http://www.sec.gov and at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operations of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Financial Information regarding Segment and Geographic Areas

Please see Notes 11 and 12 to the Company’s Consolidated Financial Statements for financial information about the Company’s operating segments and domestic and foreign operations for each of the last three fiscal years.

8

The following risk factors should be read carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. We feel that any of the following risks could materially adversely affect our business, operations, industry, financial position or our future financial performance. While we believe that we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our business, operations, industry, financial position and financial performance in the future.

We currently operate in mature markets where increases or decreases in market share could be significant.

Our sales and net income are largely dependent on sales from a consistent and well-established customer base. Organic growth opportunities are minimal; however, we have used and will continue to use strategic acquisitions as a means to build and grow the business. In this business environment, increases or decreases in market share could have a material effect on our business condition or results of operation. We face intense competition from a diverse range of competitors, including operating divisions of companies much larger and with far greater resources than we have. If we are unable to maintain our market share, our business could suffer.

Our business strategy includes the pursuit of strategic acquisitions, which may not be successful if they happen at all.

From time to time, we engage in discussions with potential target companies concerning potential acquisitions. In executing our acquisition strategy, we may be unable to identify suitable acquisition candidates. In addition, we may face competition from other companies for acquisition candidates, making it more difficult to acquire suitable companies on favorable terms.

Even if we do identify a suitable acquisition target and are able to negotiate and close a transaction, the integration of an acquired business into our operations involves numerous risks, including potential difficulties in integrating an acquired company’s product line with ours; the diversion of our resources and management’s attention from other business concerns; the potential loss of key employees; limitations imposed by antitrust or merger control laws in the United States or other jurisdictions; risks associated with entering a new geographical or product market; and the day-to-day management of a larger and more diverse combined company.

We may not realize the synergies, operating efficiencies, market position or revenue growth we anticipate from acquisitions, and our failure to effectively manage the above risks could have a material adverse effect on our business, growth prospects and financial performance.

Our results of operations could be adversely affected by uncertain economic and political conditions and the effects of these conditions on our customers’ businesses and levels of business activity.

Global economic and political conditions can affect the businesses of our customers and the markets they serve. A severe or prolonged economic downturn or a negative or uncertain political climate could adversely affect, among others, the automotive, housing, construction, pipeline, energy, transportation infrastructure and electronics industries. This may reduce demand for our products or depress pricing of those products, either of which may have a material adverse effect on our results of operations. Changes in global economic conditions or foreign and domestic trade policy could also shift demand to products for which we do not have competitive advantages, and this could negatively affect the amount of business that we are able to obtain. In addition, if we are unable to successfully anticipate changing economic and political conditions, we may be unable to effectively plan for and respond to those changes and our business could be negatively affected.

9

General economic factors, domestically and internationally, may also adversely affect our financial performance through increased raw material costs or other expenses and by making access to capital more difficult.

The cumulative effect of higher interest rates, energy costs, inflation, levels of unemployment, healthcare costs, unsettled financial markets, and other economic factors (including changes in foreign currency exchange rates) could adversely affect our financial condition by increasing our manufacturing costs and other expenses at the same time that our customers may be scaling back demand for our products. Prices of certain commodity products, including oil and petroleum-based products, are historically volatile and are subject to fluctuations arising from changes in domestic and international supply and demand, labor costs, competition, weather events, market speculation, government regulations and periodic delays in delivery. Rapid and significant changes in commodity prices may affect our sales and profit margins. These factors can increase our cost of products and services sold and/or selling, general and administrative expenses, and otherwise adversely affect our operating results. Disruptions in the credit markets may limit our ability to access debt capital for use in acquisitions or other purposes on advantageous terms or at all. If we are unable to manage our expenses in response to general economic conditions and margin pressures, or if we are unable to obtain capital for strategic acquisitions or other needs, then our results of operations would be negatively affected.

Fluctuations in the supply and prices of raw materials may negatively impact our financial results.

We obtain raw materials needed to manufacture our products from a number of suppliers. Many of these raw materials are petroleum-based derivatives. Under normal market conditions, these materials are generally available on the open market and from a variety of producers. From time to time, however, the prices and availability of these raw materials fluctuate, which could impair our ability to procure necessary materials, or increase the cost of manufacturing our products. If the prices of raw materials increase, and we are unable to pass these increases on to our customers, we could experience reduced profit margins.

If our products fail to perform as expected, or if we experience product recalls, we could incur significant and unexpected costs and lose existing and future business.

Our products are complex and could have defects or errors presently unknown to us, which may give rise to claims against us, diminish our brands or divert our resources from other purposes. Despite testing, new and existing products could contain defects and errors and may in the future contain manufacturing or design defects, errors or performance problems when first introduced, or even after these products have been used by our customers for a period of time. These problems could result in expensive and time-consuming design modifications or warranty charges, changes to our manufacturing processes, product recalls, significant increases in our maintenance costs, or exposure to liability for damages, any of which may result in substantial and unexpected expenditures, require significant management attention, damage our reputation and customer relationships, and adversely affect our business, our operating results and our cash flow.

We are dependent on key personnel.

We depend significantly on our executive officers including our President and Chief Executive Officer, Adam P. Chase, and our Executive Chairman, Peter R. Chase, and on other key employees. The loss of the services of any of these key employees could have a material impact on our business and results of operations. In addition, our acquisition strategy will require that we attract, motivate and retain additional skilled and experienced personnel. The inability to satisfy such requirements could have a negative impact on our ability to remain competitive in the future.

If we cannot successfully manage the unique challenges presented by international markets, we may not be successful in expanding our international operations.

Our strategy includes expansion of our operations in existing and new international markets by selective acquisitions and strategic alliances. Our ability to successfully execute our strategy in international markets is affected by many of the same operational risks we face in expanding our U.S. operations. In addition, our international expansion may be adversely affected by our ability to identify and gain access to local suppliers as well as by local laws and customs, legal and regulatory constraints, political and economic conditions and currency regulations of the countries or regions in

10

which we currently operate or intend to operate in the future. Risks inherent in our international operations also include, among others, the costs and difficulties of managing international operations, adverse tax consequences and greater difficulty in enforcing intellectual property rights. Additionally, foreign currency exchange rates and fluctuations (such as those experienced following the June 23, 2016 “Brexit” referendum vote in the United Kingdom) may have an impact on future costs or on future cash flows from our international operations.

We may experience difficulties in the redesign and consolidation of our manufacturing facilities which could impact shipments to customers, product quality, and our ability to realize cost savings.

We currently have several ongoing projects to streamline our manufacturing operations, which include the redesign and consolidation of certain manufacturing facilities. We anticipate a reduction of overhead costs as a result of these projects, to the extent that we can effectively leverage assets, personnel, and business processes in the transition of production among manufacturing facilities. However, uncertainty is inherent within the facility redesign and consolidation process, and unforeseen circumstances could offset the anticipated benefits, disrupt service to customers, and impact product quality.

Financial market performance may have a material adverse effect on our pension plan assets and require additional funding requirements.

Significant and sustained declines in the financial markets may have a material adverse effect on the fair market value of the assets of our pension plans. While these pension plan assets are considered non-financial assets since they are not carried on our balance sheet, the fair market valuation of these assets could impact our funding requirements, funded status or net periodic pension cost. Any significant and sustained declines in the fair market value of these pension assets could require us to increase our funding requirements, which would have an impact on our cash flow, and could also lead to additional pension expense.

Failure or compromise of security with respect to an operating or information system or portable electronic device could adversely affect our results of operations and financial condition or the effectiveness of our internal controls over operations and financial reporting.

We are highly dependent on automated systems to record and process our daily transactions and certain other components of our financial statements. We could experience a failure of one or more of these systems, or a compromise of our security due to technical system flaws, data input or record keeping errors, or tampering or manipulation of our systems by employees or unauthorized third parties. Information security risks also exist with respect to the use of portable electronic devices, such as laptops and smartphones, which are particularly vulnerable to loss and theft. We may also be subject to disruptions of any of these systems arising from events that are wholly or partially beyond our control (for example, natural disasters, acts of terrorism, epidemics, computer viruses, cyber-attacks and electrical/telecommunications outages). All of these risks are also applicable wherever we rely on outside vendors to provide services. Operating system failures, disruptions, or the compromise of security with respect to operating systems or portable electronic devices could subject us to liability claims, harm our reputation, interrupt our operations, or adversely affect our business, results from operations, financial condition, cash flow or internal control over financial reporting.

Item 1B – Unresolved Staff Comments

Not applicable.

11

We own and lease office and manufacturing properties as outlined in the table below.

|

|

|

Square |

|

Owned / |

|

|

|

Location |

|

Feet |

|

Leased |

|

Principal Use |

|

Westwood, MA |

|

20,200 |

|

Leased |

|

Corporate headquarters, executive office and global operations center, including research and development, sales and administrative services |

|

Oxford, MA |

|

73,600 |

|

Owned |

|

Manufacture of tape and related products for the electronic and telecommunications industries, as well as laminated durable papers |

|

Blawnox, PA |

|

44,000 |

|

Owned |

|

Manufacture and sale of protective coatings and tape products |

|

O’Hara Township, PA |

|

109,000 |

|

Owned |

|

Manufacture and sale of protective electronic coatings, expansion joints and accessories |

|

Evanston, IL |

|

100,000 |

|

Owned |

|

Manufacture and sale of protective coatings and tape products |

|

Houston, TX |

|

45,000 |

|

Owned |

|

Manufacture of coating and lining systems for use in liquid storage and containment applications |

|

Pawtucket, RI |

|

70,400 |

|

Owned |

|

Manufacture and sale of laminated film foils for the electronics and cable industries, and offices for sales and administrative services |

|

Granite Falls, NC |

|

108,000 |

|

Owned |

|

Manufacture and sale of pulling and detection tapes and fiber optic strength elements, as well as research and development services |

|

Lenoir, NC |

|

110,000 |

|

Owned |

|

Manufacture and sale of laminated film foils and cover tapes |

|

Woburn, MA |

|

34,000 |

|

Leased |

|

Manufacture and sale of adhesive systems, as well as research and development |

|

Newark, CA |

|

32,500 |

|

Leased |

|

Manufacture and sale of sealant systems |

|

Greenville, SC |

|

34,600 |

|

Leased |

|

Manufacture and sale of polymeric microspheres, as well as research and development |

|

Winnersh, Wokingham, England |

|

18,800 |

|

Leased |

|

Manufacture and sale of protective electronic coatings, as well as research and development |

|

Rye, East Sussex, England |

|

36,600 |

|

Owned |

|

Manufacture and sale of protective coatings and tape products |

|

Paris, France |

|

1,900 |

|

Leased |

|

Sales/technical service office and warehouse allowing direct sales and service to the French market |

|

Mississauga, Canada |

|

2,500 |

|

Leased |

|

Distribution center |

|

Rotterdam, Netherlands |

|

2,500 |

|

Leased |

|

Distribution center |

|

Suzhou, China |

|

48,000 |

|

Leased |

|

Manufacture of packaging tape products for the electronics industries |

|

Pune, India |

|

4,650 |

|

Owned |

|

Packaging and sale of protective electronic coatings |

|

Randolph, MA |

|

- |

|

Owned |

|

Ceased manufacturing products at this location in 2012. During fiscal 2016, we demolished the building and classified the property as an asset held for sale |

The above facilities vary in age, are in good condition and, in the opinion of management, adequate and suitable for present operations. We also own equipment and machinery that is in good repair and, in the opinion of management, adequate and suitable for present operations. We believe that we could significantly add to our capacity by increasing shift operations. Availability of machine hours through additional shifts would provide expansion of current production volume without significant additional capital investment.

12

The Company is involved from time to time in litigation incidental to the conduct of its business. Although the Company does not expect that the outcome in any of these matters, individually or collectively, will have a material adverse effect on its financial condition, results of operations or cash flows, litigation is inherently unpredictable. Therefore, judgments could be rendered or settlements agreed to that could adversely affect the Company’s operating results or cash flows in a particular period. The Company routinely assesses all its litigation and threatened litigation as to the probability of ultimately incurring a liability, and records its best estimate of the ultimate loss in situations where we assess the likelihood of loss as probable.

item 4 – mine safety disclosures

Not applicable.

Item 4a – Executive Officers of the Registrant

The following table sets forth information concerning our Executive Officers as of October 31, 2017. Each of our Executive Officers is selected by our Board of Directors and holds office until his successor is elected and qualified.

|

Name |

|

Age |

|

Offices Held and Business Experience during the Past Five Years |

|

Adam P. Chase |

|

45 |

|

President of the Company since January 2008, Chief Executive Officer of the Company since February 2015. Adam Chase was the Chief Operating Officer of the Company from February 2007 to February 2015. |

|

Peter R. Chase |

|

69 |

|

Chairman of the Board of the Company since February 2007, and Executive Chairman of the Company since February 2015. Peter Chase was the Chief Executive Officer of the Company from September 1993 to February 2015. Peter Chase is the father of Adam Chase. |

|

Kenneth J. Feroldi |

|

62 |

|

Chief Financial Officer and Treasurer of the Company since September 2014. Previously Director of Finance for the Company, prior to which he served as Vice President – Finance, Chief Financial Officer and Treasurer of NEPTCO, Inc. from 1992 until 2012, when NEPTCO was acquired by the Company. |

13

Item 5 – Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the NYSE American under the symbol CCF. As of October 31, 2017, there were 327 shareholders of record of our Common Stock and we believe there were approximately 5,010 beneficial shareholders who held shares in nominee name. On that date, the closing price of our common stock was $118.75 per share as reported by the NYSE American.

The following table sets forth the high and low daily sales prices for our common stock as reported by the NYSE American (formerly the NYSE MKT) for each quarter in the fiscal years ended August 31, 2017 and 2016:

|

|

|

Fiscal 2017 |

|

Fiscal 2016 |

|

||||||||

|

|

|

High |

|

Low |

|

High |

|

Low |

|

||||

|

First Quarter |

|

$ |

82.10 |

|

$ |

61.75 |

|

$ |

44.61 |

|

$ |

36.83 |

|

|

Second Quarter |

|

|

93.75 |

|

|

76.55 |

|

|

50.87 |

|

|

37.20 |

|

|

Third Quarter |

|

|

108.35 |

|

|

90.40 |

|

|

58.79 |

|

|

45.07 |

|

|

Fourth Quarter |

|

|

116.15 |

|

|

83.35 |

|

|

65.19 |

|

|

55.54 |

|

Single annual cash dividend payments were declared and scheduled to be paid subsequent to year end in the amounts of $0.80, $0.70, and $0.65 per common share, for the years ended August 31, 2017, 2016 and 2015, respectively. Certain of our borrowing facilities contain financial covenants which may have the effect of limiting the amount of dividends that we can pay.

14

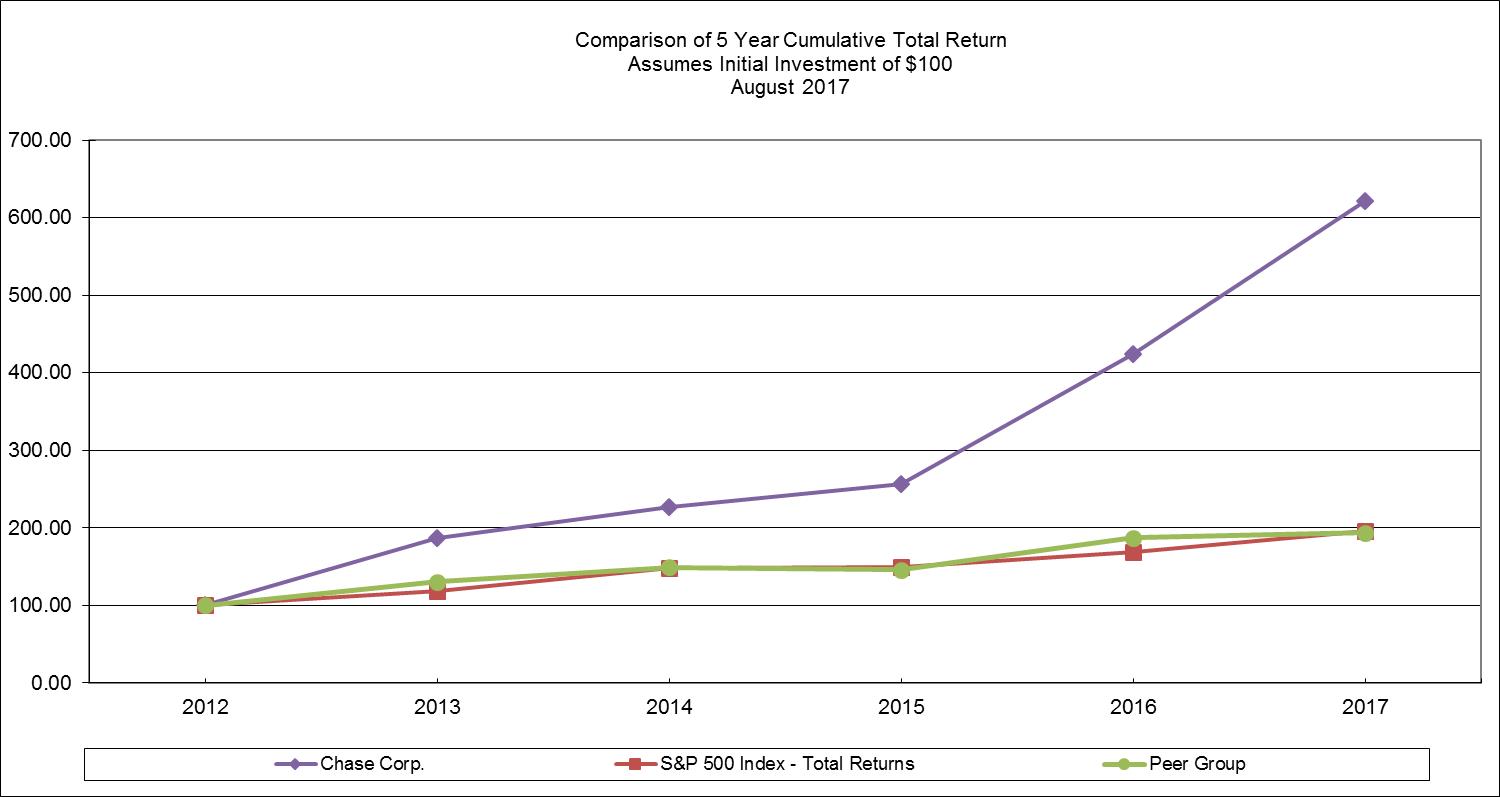

Comparative Stock Performance

The following line graph compares the yearly percentage change in our cumulative total shareholder return on the Common Stock for the last five fiscal years with the cumulative total return on the Standard & Poor's 500 Stock Index (the “S&P 500 Index”), and a composite peer index that is weighted by market equity capitalization (the “Peer Group Index”). The companies included in the Peer Group Index are Henkel AG & Co KGaA, H.B. Fuller Company, Intertape Polymer Group, Rogers Corporation and RPM International, Inc. Cumulative total returns are calculated assuming that $100 was invested on August 31, 2012 in each of the Common Stock, the S&P 500 Index and the Peer Group Index, and that all dividends were reinvested.

|

|

|

2012 |

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

||||||

|

Chase Corp |

|

$ |

100 |

|

$ |

187 |

|

$ |

226 |

|

$ |

256 |

|

$ |

424 |

|

$ |

622 |

|

|

S&P 500 Index |

|

$ |

100 |

|

$ |

119 |

|

$ |

149 |

|

$ |

149 |

|

$ |

168 |

|

$ |

195 |

|

|

Peer Group Index |

|

$ |

100 |

|

$ |

131 |

|

$ |

149 |

|

$ |

146 |

|

$ |

187 |

|

$ |

194 |

|

The information under the caption “Comparative Stock Performance” above is not deemed to be “filed” as part of this Annual Report, and is not subject to the liability provisions of Section 18 of the Securities Exchange Act of 1934. Such information will not be deemed to be incorporated by reference into any filing we make under the Securities Act of 1933 unless we explicitly incorporate it into such a filing at the time.

15

Item 6 – Selected Financial Data

the following selected financial data should be read in conjunction with “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 8 – Financial Statements and Supplementary Data.”

|

|

|

Fiscal Years Ended August 31, |

|

|||||||||||||

|

|

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

|||||

|

|

|

(In thousands, except per share amounts) |

|

|||||||||||||

|

Statement of Operations Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from continuing operations |

|

$ |

252,560 |

|

$ |

238,094 |

|

$ |

238,046 |

|

$ |

224,006 |

|

$ |

216,062 |

|

|

Net income |

|

$ |

42,014 |

|

$ |

32,807 |

|

$ |

26,413 |

|

$ |

26,523 |

|

$ |

16,740 |

|

|

Add: net (gain) loss attributable to noncontrolling interest |

|

|

— |

|

|

— |

|

|

(95) |

|

|

108 |

|

|

474 |

|

|

Net income attributable to Chase Corporation |

|

$ |

42,014 |

|

$ |

32,807 |

|

$ |

26,318 |

|

$ |

26,631 |

|

$ |

17,214 |

|

|

Net income available to common shareholders, per common and common equivalent share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common and common equivalent share |

|

$ |

4.49 |

|

$ |

3.55 |

|

$ |

2.87 |

|

$ |

2.92 |

|

$ |

1.90 |

|

|

Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common and common equivalent share |

|

$ |

4.44 |

|

$ |

3.50 |

|

$ |

2.82 |

|

$ |

2.86 |

|

$ |

1.87 |

|

|

Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

254,738 |

|

$ |

262,819 |

|

$ |

255,642 |

|

$ |

245,545 |

|

$ |

224,360 |

|

|

Long-term debt, including current portion |

|

|

— |

|

|

43,400 |

|

|

51,800 |

|

|

58,800 |

|

|

64,400 |

|

|

Total stockholders' equity |

|

|

210,929 |

|

|

174,089 |

|

|

154,342 |

|

|

137,490 |

|

|

113,860 |

|

|

Cash dividends paid per common and common equivalent share |

|

$ |

0.70 |

|

$ |

0.65 |

|

$ |

0.60 |

|

$ |

0.45 |

|

$ |

0.40 |

|

16

Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion provides an analysis of our financial condition and results of operations and should be read in conjunction with the Consolidated Financial Statements and notes thereto included in Item 8 of this Annual Report on Form 10-K.

Selected Relationships within the Consolidated Statements of Operations

|

|

|

Years Ended August 31, |

|

|||||||

|

|

|

2017 |

|

2016 |

|

2015 |

|

|||

|

|

|

(Dollars in thousands) |

|

|||||||

|

Revenue |

|

$ |

252,560 |

|

$ |

238,094 |

|

$ |

238,046 |

|

|

Net income |

|

$ |

42,014 |

|

$ |

32,807 |

|

$ |

26,413 |

|

|

Add: net (gain) loss attributable to noncontrolling interest |

|

|

— |

|

|

— |

|

|

(95) |

|

|

Net income attributable to Chase Corporation |

|

$ |

42,014 |

|

$ |

32,807 |

|

$ |

26,318 |

|

|

Increase in revenue from prior year |

|

|

|

|

|

|

|

|

|

|

|

Amount |

|

$ |

14,466 |

|

$ |

48 |

|

$ |

14,040 |

|

|

Percentage |

|

|

6 |

% |

|

* |

% |

|

6 |

% |

|

Increase/(Decrease) in net income from prior year |

|

|

|

|

|

|

|

|

|

|

|

Amount |

|

$ |

9,207 |

|

$ |

6,394 |

|

$ |

(110) |

|

|

Percentage |

|

|

28 |

% |

|

24 |

% |

|

(*) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of revenue: |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

100 |

% |

|

100 |

% |

|

100 |

% |

|

Cost of products and services sold |

|

|

58 |

|

|

61 |

|

|

63 |

|

|

Selling, general and administrative expenses |

|

|

19 |

|

|

19 |

|

|

19 |

|

|

Acquisition-related costs |

|

|

* |

(a) |

|

— |

|

|

* |

(d) |

|

Other (income) expense, net |

|

|

(1) |

(b) |

|

(*) |

(c) |

|

* |

|

|

Income before income taxes |

|

|

24 |

% |

|

21 |

% |

|

17 |

% |

|

Income taxes |

|

|

7 |

|

|

7 |

|

|

6 |

|

|

Net income |

|

|

17 |

% |

|

14 |

% |

|

11 |

% |

|

(a) |

Represents $584 in expenses related to the acquisition of the operations and certain assets of Resin Designs |

|

(b) |

Includes effects of $2,013 gain on sale of fiber optic cable components product line and a $860 gain related to the sale of real estate |

|

(c) |

Includes effects of $1,031 gain on sale of RodPack business |

|

(d) |

Represents $584 in expenses related to the acquisition of the specialty chemical intermediates product line |

* Denotes less than one percent

Overview

Continued strong demand for many of our product offerings, a significant acquisition and a favorable sales mix all contributed to increased revenue, operating income and net income over the prior year results. Our strategic diversification remained one of our core strengths, as several product lines in both of our segments exceeded prior year revenue, offsetting shortfalls from others.

In September 2016, we completed the acquisition of certain assets and the operations of Resin Designs, a formulator of customized adhesive and sealant systems used in high-reliability electronic applications. In November 2016 and December 2016, respectively, we sold our Paterson, NJ location and our former corporate headquarters in Bridgewater, MA. In April 2017, the Company divested its fiber optic cable components product line, after determining the low-margin business to not be part of Chase’s long-term strategy.

17

Revenue from the Industrial Materials segment increased over the prior year on greater demand for our electronic and industrial coatings, specialty products, structural composites, pulling and detection, electronic materials, cable materials and specialty chemical intermediates product lines. The segment’s organic increases in these legacy product lines were complemented by the September 2016 acquisition of the operations of Resin Designs, which is now included within the electronic and industrial coatings product line. The segment’s overall revenue increase was negatively impacted by the April 2017 sale of our fiber optic cable components product line.

Revenue from the Construction Materials segment fell short of the prior year primarily due to the decreased demand for our UK-produced pipeline coatings products, as well as our building envelope products. The overall decrease in sales experienced by the segment was lessened by increased sales of our bridge and highway, domestically-produced pipeline coatings and coating and lining systems products.

Through our active M&A program, our management of real estate and our marketing and product development efforts, the Company remains focused on its core strategies for sustainable growth. At August 31, 2017, the Company’s cash on hand was $47,354,000 and there was no outstanding balance under the Company’s $150,000,000 revolving debt facility.

The Company has two reportable segments summarized below:

|

Segment |

|

Product Lines |

|

Manufacturing Focus and Products |

|

Industrial Materials |

|

Cable Materials |

|

Protective coatings and tape products, including insulating and conducting materials for wire and cable manufacturers; moisture protective coatings and customized sealant and adhesive systems for electronics; laminated durable papers, packaging and industrial laminate products and custom manufacturing services; pulling and detection tapes used in the installation, measurement and location of fiber optic cables and water and natural gas lines; cover tapes essential to delivering semiconductor components via tape and reel packaging; composite materials elements; glass-based strength elements designed to allow fiber optic cables to withstand mechanical and environmental strain and stress; polyurethane dispersions and polymeric microspheres. |

|

|

|

|

|

|

|

Construction Materials |

|

Coating and Lining Systems |

|

Protective coatings and tape products, including coating and lining systems for use in liquid storage and containment applications; protective coatings for pipeline and general construction applications; adhesives and sealants used in architectural and building envelope waterproofing applications; high-performance polymeric asphalt additives and expansion and control joint systems for use in the transportation and architectural markets. |

|

(1) |

50% owned joint venture until October 31, 2014, when we purchased the remaining 50% noncontrolling interest. Results of product line included for period prior to its April 3, 2017 sale by the Company. |

18

Results of Operations

Revenue and Operating Profit by Segment are as follows:

|

|

|

|

|

|

Income Before |

|

% of |

|

|

|

|

|

Revenue |

|

Income Taxes |

|

Revenue |

|

||

|

|

|

(Dollars in thousands) |

|

|

|

||||

|

Fiscal 2017 |

|

|

|

|

|

|

|

|

|

|

Industrial Materials |

|

$ |

202,956 |

|

$ |

67,561 |

(a) |

33 |

% |

|

Construction Materials |

|

|

49,604 |

|

|

18,205 |

|

37 |

% |

|

|

|

$ |

252,560 |

|

|

85,766 |

|

34 |

% |

|

Less corporate and common costs |

|

|

|

|

|

(24,874) |

(b) |

|

|

|

Income before income taxes |

|

|

|

|

$ |

60,892 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2016 |

|

|

|

|

|

|

|

|

|

|

Industrial Materials |

|

$ |

181,728 |

|

$ |

53,530 |

(c) |

29 |

% |

|

Construction Materials |

|

|

56,366 |

|

|

19,967 |

|

35 |

% |

|

|

|

$ |

238,094 |

|

|

73,497 |

|

31 |

% |

|

Less corporate and common costs |

|

|

|

|

|

(23,387) |

(d) |

|

|

|

Income before income taxes |

|

|

|

|

$ |

50,110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2015 |

|

|

|

|

|

|

|

|

|

|

Industrial Materials |

|

$ |

176,547 |

|

$ |

46,388 |

(e) |

26 |

% |

|

Construction Materials |

|

|

61,499 |

|

|

17,272 |

|

28 |

% |

|

|

|

$ |

238,046 |

|

|

63,660 |

|

27 |

% |

|

Less corporate and common costs |

|

|

|

|

|

(22,434) |

(f) |

|

|

|

Income before income taxes |

|

|

|

|

$ |

41,226 |

|

|

|

|

(a) |

Includes a $2,013 gain on sale of our fiber optic cable components business and $190 of expenses related to inventory step-up in fair value attributable to the September 2016 acquisition of certain assets of Resin Designs |

|

(b) |

Includes $584 in acquisition-related expenses attributable to the September 2016 acquisition of certain assets of Resin Designs, facility exit and demolition costs of $70 related to the Company’s Randolph, MA location, a $792 gain related to the November 2016 sale of the Company’s Paterson, NJ location, a $68 gain related to the December 2016 sale of the Company’s former corporate headquarters in Bridgewater, MA and $14 of pension-related settlement costs due to the timing of lump sum distributions |

|

(c) |

Includes a $1,031 gain on sale of our RodPack wind energy business contained within our structural composites product line and a $365 write-down on certain other structural composites assets based on usage constraints following the sale, both recognized in November 2015 |

|

(d) |

Includes $935 in Randolph, MA facility exit and demolition costs, a $877 gain on the write-down of an annuity and $13 of pension-related settlement costs due to the timing of lump sum distributions |

|

(e) |

Includes $65 of expense related to inventory step-up in fair value related to the January 2015 acquisition of the specialty chemical intermediates product line |

|

(f) |

Includes $584 in expenses related to the January 2015 acquisition of the specialty chemical intermediates product line and $188 of pension-related settlement costs due to the timing of lump sum distributions |

Total Revenue

Total revenue in fiscal 2017 increased $14,466,000 or 6% to $252,560,000 from $238,094,000 in the prior year.

Revenue in our Industrial Materials segment increased $21,228,000 or 12% to $202,956,000 for the year ended August 31, 2017 compared to $181,728,000 in fiscal 2016. The increase in revenue from our Industrial Materials segment in fiscal 2017 was primarily due to: (a) revenue from our electronic and industrial coatings product line, which included sales of $14,868,000 related to the acquired Resin Designs operations, had total increases in revenue of $20,108,000,

19

reflecting increased sales volume from the automotive and appliance manufacturing industries, along with an increased royalty received from our licensed manufacturer in Asia; (b) sales volume increase of $2,674,000 for our specialty products, which, subsequent to the sale of our fiber optic cable components business on April 3, 2017, includes revenue from the manufacturing services provided by the Company to the purchaser of the fiber optic cable components product line (totaling $740,000 for fiscal 2017); (c) sales volume increase of $2,072,000 from our structural composite products, on sales into the wind energy market; (d) sales volume increase of $1,056,000 from our pulling and detection products, as we continue to meet the utility and telecommunication industries’ high demand for our products; (e) a sales volume increase of $450,000 for our electronic materials; (f) sales growth of $321,000 for our cable materials products on strong demand from manufacturers of communication and server cables in the third and fourth quarters of fiscal 2017; and (g) our specialty chemical intermediates product line, which had $24,000 in increased sales volume. These increases were partially offset by decreased sales of $5,477,000 from our fiber optic cable components product line, which the Company sold in April. No revenue was recorded within the fiber optic cable components product line following its divestiture early in the third quarter.

Revenue from our Construction Materials segment decreased $6,762,000 or 12% to $49,604,000 for the year ended August 31, 2017 compared to $56,366,000 for fiscal 2016. The decreased sales from our Construction Materials segment in fiscal 2017 was primarily due to a net decrease in sales volume of $7,409,000 in pipeline coatings products. Delayed project work and general weakness in the region has continued to affect Middle East water infrastructure project demand for pipeline coatings products produced at our Rye, U.K. facility. Conversely, sales for our domestically produced pipeline products, which sell predominantly into the North American oil and gas markets, increased compared to the prior year. Our building envelope products saw a year-over-year sales volume decrease of $382,000. Partially offsetting the overall decrease in sales for the segment, were: (a) a $974,00 increase in our bridge and highway products sales volume, resulting from increased bridge work in the New York metro region; and (b) coating and lining systems products, whose sales volume increased by $55,000 over the prior year.

Royalties and commissions in the Industrial Materials segment were $4,683,000, $3,644,000 and $3,156,000 for the years ended August 31, 2017, 2016 and 2015, respectively. The increase in royalties and commissions in fiscal 2017 over both fiscal 2016 and 2015 was primarily due to increased sales of electronic and industrial coatings products by our licensed manufacturer in Asia.

Export sales from domestic operations to unaffiliated third parties were $36,719,000, $28,826,000 and $27,955,000 for the years ended August 31, 2017, 2016 and 2015, respectively. The increase in export sales in fiscal 2017 against both fiscal 2016 and 2015 resulted from increased export sales into China, and certain European countries.

In fiscal 2016, total revenue increased $48,000 or less than one percent to $238,094,000 from $238,046,000 in the prior year. Revenue in our Industrial Materials segment increased $5,181,000 or 3% to $181,728,000 for the year ended August 31, 2016 compared to $176,547,000 in fiscal 2015. The increase in revenue from our Industrial Materials segment in fiscal 2016 was primarily due to: (a) increased sales volume of specialty chemical intermediates products totaling $7,755,000, aided by a full year of operations in fiscal 2016; (b) increased sales volume of $3,356,000 from our pulling and detection products, which continued to experience increased demand in product volume by the utility and telecom industries; and (c) $574,000 in increased sales volume from our electronic and industrial coatings product line, primarily due to a higher rate of acceptance and use in the automotive and appliance industries. These increases were partially offset by decreased sales of $4,077,000 from our cable materials products, reflecting a decrease in demand for products with exposure to energy-related markets (inclusive of the oil exploration and mining markets), as well as lower sales volume of $1,744,000 from our fiber optic cable components product line. Revenue from our Construction Materials segment decreased $5,133,000 or 8% to $56,366,000 for the year ended August 31, 2016 compared to $61,499,000 for fiscal 2015. The decreased sales from our Construction Materials segment in fiscal 2016 was primarily due to a decrease in sales volume of $7,708,000 in pipeline coatings products. The anticipated slowdown in Middle East water infrastructure project demand, for products produced at our Rye, UK facility, drove the majority of this decrease, while domestic pipeline coatings sales, which have a largely repair and maintenance focus, had a more tempered year-over-year decease. Partially offsetting the overall decrease in sales for the segment, were: (a) a $1,793,000 year-over-year increase in our coating and lining systems products sales volume, resulting from increased market acceptance and project demand; and (b) bridge and highway products, which capitalized on the weather-lengthened road construction seasons to obtain a $1,193,000 year-over-year sales volume increase.

20

Cost of Products and Services Sold

Cost of products and services sold increased $1,598,000 or 1% to $146,036,000 for the fiscal year ended August 31, 2017 compared to $144,438,000 in fiscal 2016. As a percentage of revenue, cost of products and services sold decreased to 58% in fiscal 2017 compared to 61% for fiscal 2016.

The following table summarizes the relative percentages of cost of products and services sold to revenue for both of our operating segments:

|

|

|

|

|

|

|

Fiscal Years Ended August 31, |

|

||||

|

Cost of products and services sold |

|

|

|

|

|

2017 |

|

2016 |

|

2015 |

|

|

Industrial Materials |

|

|

|

|

|

59 |

% |

61 |

% |

63 |

% |

|

Construction Materials |

|

|

|

|

|

54 |

% |

59 |

% |

63 |

% |

|

Total |

|

|

|

|

|

58 |

% |

61 |

% |

63 |

% |

Cost of products and services sold in our Industrial Materials segment was $119,109,000 for the fiscal year ended August 31, 2017 compared to $111,424,000 in fiscal 2016. As a percentage of revenue, cost of products and services sold in this segment decreased to 59% for fiscal 2017 compared to 61% in fiscal 2016. Cost of products and services sold in our Construction Materials segment was $26,927,000 for the fiscal year ended August 31, 2017 compared to $33,014,000 in fiscal 2016. As a percentage of revenue, cost of products and services sold in this segment decreased to 54% in fiscal 2017 compared to 59% for fiscal 2016. As a percentage of revenue, cost of products and services sold in both segments decreased primarily due to product mix, as our lower margin products constituted a comparatively lower portion of total sales in the current year. We purchase a wide variety of commodity items, including petroleum-based solvents, films, yarns, and nonwovens, along with base metals (aluminum and copper), as well as many other substrates. To facilitate continued improvement in margins, we closely monitor the pricing of our commodities-based raw materials across all product lines, as their price volatility can have short and long-term effects on both our customers’ demand for our products and the margins at which we are able to sell them.

In fiscal 2016, cost of products and services sold in our Industrial Materials segment was $111,424,000 compared to $110,729,000 in fiscal 2015. As a percentage of revenue, cost of products and services sold in this segment decreased to 61% for fiscal 2016 compared to 63% in fiscal 2015. Cost of products and services sold in our Construction Materials segment was $33,014,000 for the fiscal year ended August 31, 2016 compared to $38,473,000 in fiscal 2015. As a percentage of revenue, cost of products and services sold in this segment decreased to 59% in fiscal 2016 compared to 63% for fiscal 2015. As a percentage of revenue, cost of products and services sold in both segments decreased primarily due to product mix as we had decreased sales volume from our lower margin products within the segments.

Selling, General and Administrative Expenses