Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMERIGAS PARTNERS LP | ex991sept17.htm |

| 8-K - 8-K - AMERIGAS PARTNERS LP | apusept2017er.htm |

1

FY 2017 Results

and

FY 2018 Outlook

Jerry E. Sheridan

President & CEO

2

About This Presentation

AmeriGas Partners | Fiscal 2017 Results

This presentation contains certain forward-looking statements that management believes to be

reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties

that are difficult to predict and many of which are beyond management’s control. You should read

AmeriGas’s Annual Report on Form 10-K for a more extensive list of factors that could affect results.

Among them are adverse weather conditions, cost volatility and availability of propane, increased

customer conservation measures, the impact of pending and future legal proceedings, liability for

uninsured claims and for claims in excess of insurance coverage, political, regulatory and economic

conditions in the United States and in foreign countries, the availability, timing and success of our

acquisitions, commercial initiatives and investments to grow our business, our ability to successfully

integrate acquired businesses and achieve anticipated synergies, and the interruption, disruption, failure,

malfunction, or breach of our information technology systems, including due to cyber-attack. AmeriGas

undertakes no obligation to release revisions to its forward-looking statements to reflect events or

circumstances occurring after today. In addition, this presentation uses certain non-GAAP financial

measures. Please see the appendix for reconciliations of these measures to the most comparable GAAP

financial measure.

3

A

me

riGa

s

Jerry Sheridan

President & CEO,

AmeriGas

AmeriGas

FY 2017

Recap

Jerry E. Sheridan

President & CEO, AmeriGas

4

• FY17 was 13.5% warmer than normal, 1.3%

colder than prior year

• FY 17 was 3rd warmest year on record, FY 16

was 2nd warmest

• In 2017, temperatures in the critical heating

season of January and February were 9%

warmer than prior year

• Unit margins up ~$0.02 despite 18%

increased propane costs

• Operating expenses down $21 million,

excluding a $7.5 million environmental

reserve

Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation.

AmeriGas FY17 Earnings Recap

$551.2

FY 2016 FY 2017

Adjusted EBITDA

($ in millions)

$543.0

$551.3

AmeriGas Partners | Fiscal 2017 Results

5

Growth Drivers and 2018 Outlook

National Accounts

• Delivered record operating results

• Currently serving over 43,000 customer

locations

Cylinder Exchange

• Generated record operating results

• Volume up over 8% compared to prior year

• Over 50,000 distribution points

Acquisitions

• Completed 5 acquisitions ~ 6 million gallons

annually

• More than 50% of funding for acquisitions

generated by sale of excess/underutilized assets

Growth Initiatives FY 2018 Adjusted EBITDA Guidance

• Expect Adjusted EBITDA of $650 - $690 million

• Based on normal weather over 15-year period,

which is ~3% warmer than previous 30-year

period

AmeriGas Partners | Fiscal 2017 Results

6

Standby Equity Commitment Agreement

• AmeriGas has entered into a standby equity commitment agreement with UGI Corporation

• Provides AmeriGas with ability to issue Class B common units to UGI in exchange for cash

o $50 million minimum draws

o Up to $225 million in total

o Draws available through July 1, 2019

• Class B units pay distribution based on a stated yield

o 130 basis points over common yield

o Payable in cash or Class B units

• Class B units are excluded from the IDR waterfall

• Provides AmeriGas with balance sheet flexibility to continue with strategic growth investments

should it experience another significantly warmer-than-normal winter

• AmeriGas does not currently have plans to draw on this commitment

AmeriGas Partners | Fiscal 2017 Results

7

APPENDIX

8

• Because we are unable to predict certain potentially material items affecting net income on a GAAP basis, principally mark-to-market

gains and losses on commodity derivative instruments, we cannot reconcile 2018 Adjusted EBITDA, a non-GAAP measure, to net income

attribute to AmeriGas Partners, L.P., the most directly comparable GAAP measure, in reliance on the “unreasonable efforts” exception set

forth in SEC rules. Adjustments that management can reasonably estimate are provided in the appendix.

• The enclosed supplemental information contains a reconciliation of earnings before interest expense, income taxes, depreciation and

amortization ("EBITDA") and Adjusted EBITDA to Net Income.

• EBITDA and Adjusted EBITDA are not measures of performance or financial condition under accounting principles generally accepted in

the United States ("GAAP"). Management believes EBITDA and Adjusted EBITDA are meaningful non-GAAP financial measures used by

investors to compare the Partnership's operating performance with that of other companies within the propane industry. The

Partnership's definitions of EBITDA and Adjusted EBITDA may be different from those used by other companies.

• EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) attributable to AmeriGas Partners, L.P.

Management uses EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to

compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing

methods, capital structure, income taxes or historical cost basis. Management uses Adjusted EBITDA to exclude from AmeriGas

Partners’ EBITDA gains and losses that competitors do not necessarily have to provide additional insight into the comparison of year-

over-year profitability to that of other master limited partnerships. In view of the omission of interest, income taxes, depreciation and

amortization, gains and losses on commodity derivative instruments not associated with current-period transactions, and other gains

and losses that competitors do not necessarily have from Adjusted EBITDA, management also assesses the profitability of the business

by comparing net income attributable to AmeriGas Partners, L.P. for the relevant periods. Management also uses Adjusted EBITDA to

assess the Partnership's profitability because its parent, UGI Corporation, uses the Partnership's Adjusted EBITDA to assess the

profitability of the Partnership, which is one of UGI Corporation’s business segments. UGI Corporation discloses the Partnership's

Adjusted EBITDA as the profitability measure for its domestic propane segment.

AmeriGas Supplemental Footnotes

AmeriGas Partners | Fiscal 2017 Results

9

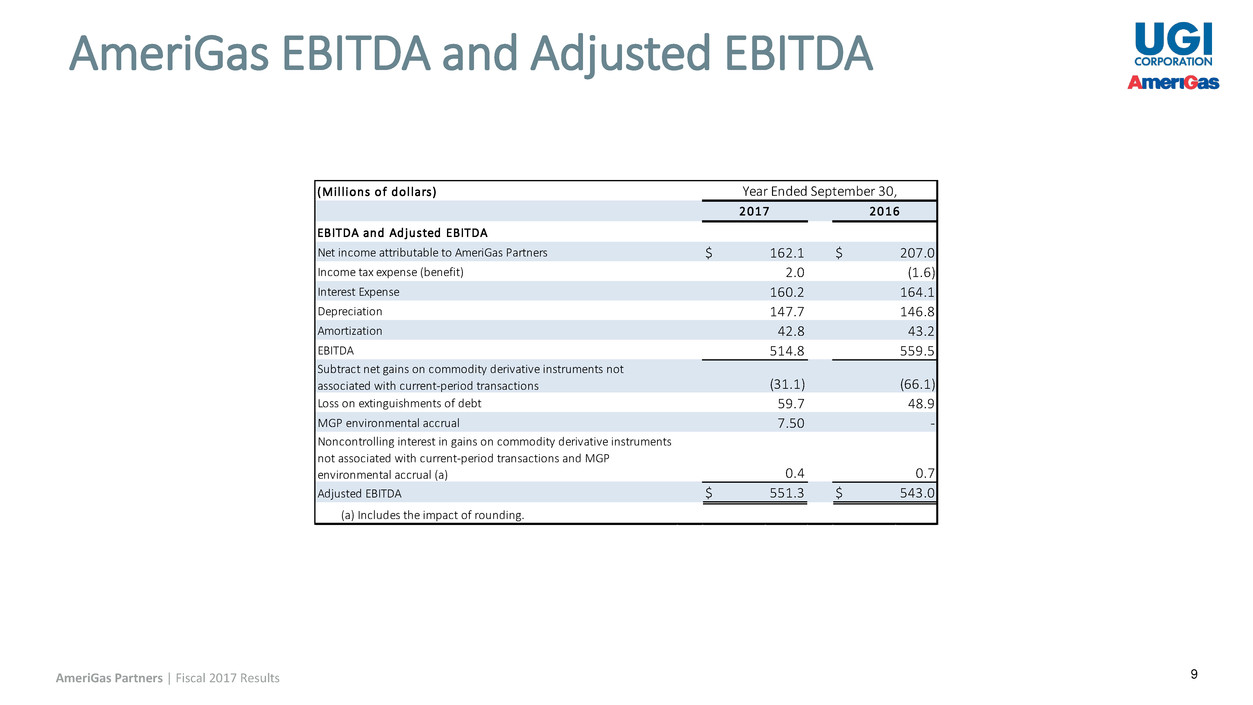

AmeriGas EBITDA and Adjusted EBITDA

(Mil l ions of dol lars)

EBITDA and Adjusted EBITDA

Net income attributable to AmeriGas Partners $ 162.1 $ 207.0

Income tax expense (benefit)

Interest Expense

Depreciation

Amortization

EBITDA 514.8 559.5

Subtract net gains on commodity derivative instruments not

associated with current-period transactions

Loss on extinguishments of debt 59.7 48.9

MGP environmental accrual

Noncontrolling interest in gains on commodity derivative instruments

not associated with current-period transactions and MGP

environmental accrual (a)

Adjusted EBITDA $ 551.3 $ 543.0

(a) Includes the impact of rounding.

Year Ended September 30,

42.8 43.2

(31.1) (66.1)

2017 2016

2.0 (1.6)

7.50 -

0.4 0.7

160.2 164.1

147.7 146.8

AmeriGas Partners | Fiscal 2017 Results

10

Investor Relations:

Will Ruthrauff

610-456-6571

ruthrauffw@ugicorp.com