Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMERIGAS PARTNERS LP | apu_exhibit9912014.htm |

| EX-31.2 - EXHIBIT 31.2 - AMERIGAS PARTNERS LP | apu201410kex312.htm |

| EX-31.1 - EXHIBIT 31.1 - AMERIGAS PARTNERS LP | apu201410kex311.htm |

| EX-32 - EXHIBIT 32 - AMERIGAS PARTNERS LP | apu201410kex32.htm |

| EX-10.34 - EXHIBIT 10.34 - AMERIGAS PARTNERS LP | apu201410kex1034.htm |

| EX-21 - EXHIBIT 21 - AMERIGAS PARTNERS LP | apuexhibit212014.htm |

| EX-23 - EXHIBIT 23 - AMERIGAS PARTNERS LP | apu_10kex232014.htm |

| EXCEL - IDEA: XBRL DOCUMENT - AMERIGAS PARTNERS LP | Financial_Report.xls |

| EX-10.33 - EXHIBIT 10.33 - AMERIGAS PARTNERS LP | apu201410kex1033.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2014

Commission file number 1-13692

AMERIGAS PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 23-2787918 (I.R.S. Employer Identification No.) | |

460 North Gulph Road, King of Prussia, PA 19406

(Address of Principal Executive Offices) (Zip Code)

(610) 337-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of each Exchange on Which Registered | |

Common Units representing limited partner interests | New York Stock Exchange, Inc. | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of AmeriGas Partners, L.P. Common Units held by non-affiliates of AmeriGas Partners, L.P. on March 31, 2014 was approximately $2,915,242,944. At November 18, 2014, there were outstanding 92,869,863 Common Units representing limited partner interests.

TABLE OF CONTENTS

Page | |

2

FORWARD-LOOKING INFORMATION

Information contained in this Annual Report on Form 10-K may contain forward-looking statements. Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. However, we caution you that actual results almost always vary from assumed facts or bases, and the differences between actual results and assumed facts or bases can be material, depending on the circumstances. When considering forward-looking statements, you should keep in mind the following important factors which could affect our future results and could cause those results to differ materially from those expressed in our forward-looking statements: (1) adverse weather conditions resulting in reduced demand; (2) cost volatility and availability of propane, and the capacity to transport propane to our customers; (3) the availability of, and our ability to consummate, acquisition or combination opportunities; (4) successful integration and future performance of acquired assets or businesses and achievement of anticipated synergies; (5) changes in laws and regulations, including safety, tax, consumer protection and accounting matters; (6) competitive pressures from the same and alternative energy sources; (7) failure to acquire new customers and retain current customers thereby reducing or limiting any increase in revenues; (8) liability for environmental claims; (9) increased customer conservation measures due to high energy prices and improvements in energy efficiency and technology resulting in reduced demand; (10) adverse labor relations; (11) large customer, counterparty or supplier defaults; (12) liability in excess of insurance coverage for personal injury and property damage arising from explosions and other catastrophic events, including acts of terrorism, resulting from operating hazards and risks incidental to transporting, storing and distributing propane, butane and ammonia; (13) political, regulatory and economic conditions in the United States and foreign countries; (14) capital market conditions, including reduced access to capital markets and interest rate fluctuations; (15) changes in commodity market prices resulting in significantly higher cash collateral requirements; (16) the impact of pending and future legal proceedings; and (17) the timing and success of our acquisitions and investments to grow our business.

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. We undertake no obligation to update publicly any forward-looking statement whether as a result of new information or future events except as required by the federal securities laws.

PART I:

ITEM 1. | BUSINESS |

General

AmeriGas Partners, L.P. is a publicly traded limited partnership formed under Delaware law on November 2, 1994. We are the largest retail propane distributor in the United States based on the volume of propane gallons distributed annually. The Partnership serves approximately 2 million residential, commercial, industrial, agricultural, wholesale and motor fuel customers in all 50 states from over 2,000 propane distribution locations.

We are a holding company and we conduct our business principally through our subsidiary, AmeriGas Propane, L.P. (“AmeriGas OLP”), a Delaware limited partnership. AmeriGas OLP is referred to herein as “the Operating Partnership.” Our common units (“Common Units”), which represent limited partner interests, are traded on the New York Stock Exchange under the symbol “APU.” Our executive offices are located at 460 North Gulph Road, King of Prussia, Pennsylvania 19406, and our telephone number is (610) 337-7000. In this Report, the terms “Partnership” and “AmeriGas Partners,” as well as the terms “our,” “we,” and “its,” are used sometimes as abbreviated references to AmeriGas Partners, L.P. itself or collectively, AmeriGas Partners, L.P. and its consolidated subsidiaries, including the Operating Partnership. The terms “Fiscal 2014” and “Fiscal 2013” refer to the fiscal years ended September 30, 2014 and September 30, 2013, respectively.

AmeriGas Propane, Inc. is our general partner (the “General Partner”) and is responsible for managing our operations. The General Partner is a wholly owned subsidiary of UGI Corporation (“UGI”), a publicly traded company listed on the New York Stock Exchange. The General Partner has an approximate 26% effective ownership interest in the Partnership.

Business Strategy

Our strategy is to grow by (i) pursuing opportunistic acquisitions, (ii) developing internal sales and marketing programs, (iii) leveraging our scale and driving productivity, and (iv) achieving world class safety performance. We regularly consider and evaluate opportunities for growth through the acquisition of local, regional, and national propane distributors. We compete for

3

acquisitions with others engaged in the propane distribution business. During Fiscal 2014, we completed the acquisition of seven propane distribution businesses. We expect that internal growth will be provided in part from the continued expansion of our AmeriGas Propane Exchange (“Propane Exchange”) program, through which consumers can purchase propane cylinders or exchange empty propane cylinders at various retail locations, and our National Accounts program, through which we encourage multi-location propane users to enter into a supply agreement with us rather than with many suppliers.

General Partner Information

The Partnership’s website can be found at www.amerigas.com. Information on our website is not intended to be incorporated into this Report. The Partnership makes available free of charge at this website (under the tab “Investor Relations,” caption “SEC Filings”) copies of its reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, including its Annual Reports on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K. The General Partner’s Principles of Corporate Governance, Code of Ethics for the Chief Executive Officer and Senior Financial Officers, Code of Business Conduct and Ethics for Directors, Officers and Employees, and charters of the Corporate Governance, Audit and Compensation/Pension Committees of the Board of Directors of the General Partner are also available on the Partnership’s website (under the tab “Investor Relations,” caption “Corporate Governance”). All of these documents are also available free of charge by writing to Daniel J. Platt, Treasurer, AmeriGas Propane, Inc., P.O. Box 965, Valley Forge, PA 19482.

Products, Services and Marketing

The Partnership serves approximately 2 million customers in all 50 states from over 2,000 propane distribution locations. In addition to distributing propane, the Partnership also sells, installs and services propane appliances, including heating systems. Typically, we are located in suburban and rural areas where natural gas is not readily available. Our district offices generally consist of a business office and propane storage. As part of its overall transportation and distribution infrastructure, the Partnership operates as an interstate carrier in all states throughout the continental United States.

The Partnership sells propane primarily to residential, commercial/industrial, motor fuel, agricultural and wholesale customers. The Partnership distributed nearly 1.4 billion gallons of propane in Fiscal 2014. Approximately 93% of the Partnership’s Fiscal 2014 sales (based on gallons sold) were to retail accounts and approximately 7% were to wholesale and supply customers. Sales to residential customers in Fiscal 2014 represented approximately 41% of retail gallons sold; commercial/industrial customers 36%; motor fuel customers 13%; and agricultural customers 6%. Transport gallons, which are large-scale deliveries to retail customers other than residential, accounted for 4% of Fiscal 2014 retail gallons. No single customer represents, or is anticipated to represent, more than 5% of the Partnership’s consolidated revenues.

The Partnership continues to expand its Propane Exchange program. At September 30, 2014, Propane Exchange cylinders were available at nearly 49,000 retail locations throughout the United States. Sales of our Propane Exchange cylinders to retailers are included in commercial/industrial sales. The Propane Exchange program enables consumers to purchase or exchange propane cylinders at various retail locations such as home centers, gas stations, mass merchandisers and grocery and convenience stores. We also supply retailers with large propane tanks to enable retailers to replenish customers’ propane cylinders directly at the retailer’s location.

Residential and commercial customers use propane primarily for home heating, water heating and cooking purposes. Commercial users include hotels, restaurants, churches, warehouses, and retail stores. Industrial customers use propane to fire furnaces, as a cutting gas and in other process applications. Other industrial customers are large-scale heating accounts and local gas utility customers who use propane as a supplemental fuel to meet peak load deliverability requirements. As a motor fuel, propane is burned in internal combustion engines that power over-the-road vehicles, forklifts, commercial lawn mowers, and stationary engines. Agricultural uses include tobacco curing, chicken brooding and crop drying. In its wholesale operations, the Partnership principally sells propane to large industrial end-users and other propane distributors.

Retail deliveries of propane are usually made to customers by means of bobtail and rack trucks. Propane is pumped from the bobtail truck, which generally holds 2,400 to 3,000 gallons of propane, into a stationary storage tank on the customer’s premises. The Partnership owns most of these storage tanks and leases them to its customers. The capacity of these tanks ranges from approximately 120 gallons to approximately 1,200 gallons. The Partnership also delivers propane in portable cylinders, including Propane Exchange cylinders. Some of these deliveries are made to the customer’s location, where cylinders are either picked up or replenished in place.

4

Propane Supply and Storage

The United States propane market has over 250 domestic and international sources of supply, including the spot market. Supplies of propane from the Partnership’s sources historically have been readily available. During Fiscal 2014, over 90% of the Partnership’s propane supply was purchased under supply agreements with terms of 1 to 3 years. The availability of propane supply is dependent upon, among other things, the severity of winter weather, the price and availability of competing fuels such as natural gas and crude oil, and the amount and availability of imported and exported supply. During the winter heating season of Fiscal 2014, there were wholesale supply challenges in certain regions of the United States due to industry-wide storage and transportation issues. These issues were exacerbated by prolonged periods of unusually cold winter weather, record volumes during the fall crop drying season that depleted propane storage inventories for the winter heating season, and an increase in demand for domestic propane overseas from the United States’ propane export market. The Partnership responded to these issues by instituting supply allocation measures, procuring propane from alternative supply sources, using its extensive transportation network to transport existing propane supplies to areas of the country that were most affected by the winter weather, and deploying employees from areas of the country that were less affected by the weather to those areas in need. Although no assurance can be given that supplies of propane will be readily available in the future, management currently expects to be able to secure adequate supplies during the fiscal year ending September 30, 2015 (“Fiscal 2015”). If supply from major sources were interrupted, however, the cost of procuring replacement supplies and transporting those supplies from alternative locations might be materially higher and, at least on a short-term basis, margins could be adversely affected. Enterprise Products Partners, L.P., Plains Marketing, L.P., and Targa Liquids Marketing & Trade LLC supplied approximately 46% of the Partnership’s Fiscal 2014 propane supply. No other single supplier provided more than 10% of the Partnership’s total propane supply in Fiscal 2014. In certain geographical areas, however, a single supplier provides more than 50% of the Partnership’s requirements. Disruptions in supply in these areas could also have an adverse impact on the Partnership’s margins.

The Partnership’s supply contracts typically provide for pricing based upon (i) index formulas using the current prices established at a major storage point such as Mont Belvieu, Texas, or Conway, Kansas, or (ii) posted prices at the time of delivery. In addition, some agreements provide maximum and minimum seasonal purchase volume guidelines. The percentage of contract purchases, and the amount of supply contracted for at fixed prices, will vary from year to year as determined by the General Partner. The Partnership uses a number of interstate pipelines, as well as railroad tank cars, delivery trucks, and barges, to transport propane from suppliers to storage and distribution facilities. The Partnership stores propane at various storage facilities and terminals located in strategic areas across the United States.

Because the Partnership’s profitability is sensitive to changes in wholesale propane costs, the Partnership generally seeks to pass on increases in the cost of propane to customers. There is no assurance, however, that the Partnership will always be able to pass on product cost increases fully, or keep pace with such increases, particularly when product costs rise rapidly. Product cost increases can be triggered by periods of severe cold weather, supply interruptions, increases in the prices of base commodities such as crude oil and natural gas, or other unforeseen events. The General Partner has adopted supply acquisition and product cost risk management practices to reduce the effect of volatility on selling prices. These practices currently include the use of summer storage, forward purchases and derivative commodity instruments, such as options and propane price swaps. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Risk Disclosures.”

5

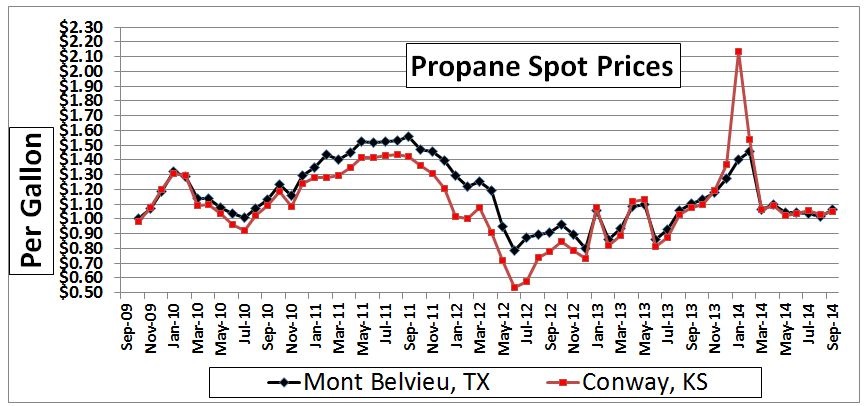

The following graph shows the average prices of propane on the propane spot market during the last five fiscal years at Mont Belvieu, Texas and Conway, Kansas, both major storage areas.

Average Propane Spot Market Prices

General Industry Information

Propane is separated from crude oil during the refining process and also extracted from natural gas or oil wellhead gas at processing plants. Propane is normally transported and stored in a liquid state under moderate pressure or refrigeration for economy and ease of handling in shipping and distribution. When the pressure is released or the temperature is increased, it is usable as a flammable gas. Propane is colorless and odorless; an odorant is added to allow for its detection. Propane is considered a clean alternative fuel under the Clean Air Act Amendments of 1990, producing negligible amounts of pollutants when properly consumed.

Competition

Propane competes with other sources of energy, some of which are less costly for equivalent energy value. Propane distributors compete for customers with suppliers of electricity, fuel oil and natural gas, principally on the basis of price, service, availability and portability. Electricity is generally more expensive than propane on a British thermal unit (“Btu”) equivalent basis, but the convenience and efficiency of electricity makes it an attractive energy source for consumers and developers of new homes. Fuel oil is also a major competitor of propane and, although a less environmentally attractive energy source, is currently less expensive than propane. Furnaces and appliances that burn propane will not operate on fuel oil, and vice versa, and, therefore, a conversion from one fuel to the other requires the installation of new equipment. Propane serves as an alternative to natural gas in rural and suburban areas where natural gas is unavailable or portability of product is required. Natural gas is generally a significantly less expensive source of energy than propane, although in areas where natural gas is available, propane is used for certain industrial and commercial applications and as a standby fuel during interruptions in natural gas service. The gradual expansion of the nation’s natural gas distribution systems has resulted in the availability of natural gas in some areas that previously depended upon propane. However, natural gas pipelines are not present in many areas of the country where propane is sold for heating and cooking purposes.

For motor fuel customers, propane competes with gasoline, diesel fuel, electric batteries, fuel cells, and, in certain applications, liquefied natural gas and compressed natural gas. Wholesale propane distribution is a highly competitive, low margin business. Propane sales to other retail distributors and large-volume, direct-shipment industrial end-users are price sensitive and frequently involve a competitive bidding process.

Retail propane industry volumes have been declining for several years and no or modest growth in total demand is foreseen in the next several years. Therefore, the Partnership’s ability to grow within the industry is dependent on its ability to acquire other retail distributors and to achieve internal growth, which includes expansion of the Propane Exchange program and the National Accounts program, as well as the success of its sales and marketing programs designed to attract and retain customers. The failure of the

6

Partnership to retain and grow its customer base would have an adverse effect on its long-term results.

The domestic propane retail distribution business is highly competitive. The Partnership competes in this business with other large propane marketers, including other full-service marketers, and thousands of small independent operators. Some farm cooperatives, rural electric cooperatives, and fuel oil distributors include propane distribution in their businesses and the Partnership competes with them as well. The ability to compete effectively depends on providing high quality customer service, maintaining competitive retail prices and controlling operating expenses. The Partnership also offers customers various payment and service options, including guaranteed price programs, fixed price arrangements and pricing arrangements based on published propane prices at specified terminals.

In Fiscal 2014, the Partnership’s retail propane sales totaled nearly 1.3 billion gallons. Based on the most recent annual survey by the American Petroleum Institute, 2012 domestic retail propane sales (annual sales for other than chemical uses) in the United States totaled approximately 7.7 billion gallons. Based on LP-GAS magazine rankings, 2012 sales volume of the ten largest propane companies (including AmeriGas Partners) represented approximately 40% of domestic retail sales.

Trade Names, Trade and Service Marks

The Partnership markets propane principally under the “AmeriGas®”, “America’s Propane Company®”, Heritage Propane®” and “Relationships Matter®” trade names and related service marks. UGI owns, directly or indirectly, all the right, title and interest in the “AmeriGas” name and related trade and service marks. The Partnership also markets propane under various other trade names throughout the United States. The General Partner owns all right, title and interest in the “America’s Propane Company” trade name and related service marks. The Partnership has an exclusive (except for use by UGI, AmeriGas, Inc., AmeriGas Polska Sp. z.o.o. and the General Partner), royalty-free license to use these trade names and related service marks. UGI and the General Partner each have the option to terminate its respective license agreement (on 12 months prior notice in the case of UGI), without penalty, if the General Partner is removed as general partner of the Partnership other than for cause. If the General Partner ceases to serve as the general partner of the Partnership for cause, the General Partner has the option to terminate its license agreement upon payment of a fee to UGI equal to the fair market value of the licensed trade names. UGI has a similar termination option; however, UGI must provide 12 months prior notice in addition to paying the fee to the General Partner.

Seasonality

Because many customers use propane for heating purposes, the Partnership’s retail sales volume is seasonal. During Fiscal 2014, approximately 67% of the Partnership’s retail sales volume occurred, and substantially all of the Partnership’s operating income was earned, during the peak heating season from October through March. As a result of this seasonality, sales are typically higher in the Partnership’s first and second fiscal quarters (October 1 through March 31). Cash receipts are generally greatest during the second and third fiscal quarters when customers pay for propane purchased during the winter heating season.

Sales volume for the Partnership traditionally fluctuates from year-to-year in response to variations in weather, prices, competition, customer mix and other factors, such as conservation efforts and general economic conditions. For information on national weather statistics, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Government Regulation

The Partnership is subject to various federal, state and local environmental, health, safety and transportation laws and regulations governing the storage, distribution and transportation of propane and the operation of bulk storage propane terminals. Generally, these laws impose limitations on the discharge of pollutants, establish standards for the handling of solid and hazardous substances, and require the investigation and cleanup of environmental contamination. These laws include, among others, the federal Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), the Clean Air Act, the Occupational Safety and Health Act, the Homeland Security Act of 2002, the Emergency Planning and Community Right-to-Know Act, the Clean Water Act, and comparable state statutes. The Partnership incurs expenses associated with compliance with its obligations under federal and state environmental laws and regulations, and we believe that the Partnership is in material compliance with all of its obligations. The Partnership maintains various permits that are necessary to operate its facilities, some of which may be material to its operations. The Partnership continually monitors its operations with respect to potential environmental issues, including changes in legal requirements.

Hazardous Substances and Wastes

The Partnership is investigating and remediating contamination at a number of present and former operating sites in the United States, including former sites where it or its former subsidiaries operated manufactured gas plants. CERCLA and similar state

7

laws impose joint and several liability on certain classes of persons considered to have contributed to the release or threatened release of a “hazardous substance” into the environment without regard to fault or the legality of the original conduct. Propane is not a hazardous substance within the meaning of federal and most state environmental laws.

Health and Safety

The Partnership is subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”) and comparable state laws that regulate the protection of the health and safety of its workers. These laws require the Partnership, among other things, to maintain information about materials, some of which may be hazardous or toxic, that are used, released, or produced in the course of its operations. Certain portions of this information must be provided to employees, state and local governmental authorities and responders, and local citizens in accordance with applicable federal and state Emergency Planning and Community Right-to-Know Act requirements. The Partnership’s operations are also subject to the safety hazard communication requirements and reporting obligations set forth in federal workplace standards.

All states in which the Partnership operates have adopted fire safety codes that regulate the storage and distribution of propane. In some states, these laws are administered by state agencies, and in others they are administered on a municipal level. The Partnership conducts training programs to help ensure that its operations are in compliance with applicable governmental regulations. With respect to general operations, National Fire Protection Association (“NFPA”) Pamphlets No. 54 and No. 58 and/or one or more of various international codes (including international fire, building and fuel gas codes) establish rules and procedures governing the safe handling of propane, or comparable regulations, which have been adopted by all states in which the Partnership operates. Management believes that the policies and procedures currently in effect at all of its facilities for the handling, storage and distribution of propane are consistent with industry standards and are in compliance in all material respects with applicable environmental, health and safety laws.

With respect to the transportation of propane by truck, the Partnership is subject to regulations promulgated under federal legislation, including the Federal Motor Carrier Safety Act and the Homeland Security Act of 2002. Regulations under these statutes cover the security and transportation of hazardous materials and are administered by the United States Department of Transportation (“DOT”), Pipeline and Hazardous Materials Safety Administration. The Natural Gas Safety Act of 1968 required the DOT to develop and enforce minimum safety regulations for the transportation of gases by pipeline. The DOT's pipeline safety regulations apply to, among other things, a propane gas system which supplies 10 or more residential customers or two or more commercial customers from a single source and to a propane gas system any portion of which is located in a public place. The DOT’s pipeline safety regulations require operators of all gas systems to provide operator qualification standards and training and written instructions for employees and third party contractors working on covered pipelines and facilities, establish written procedures to minimize the hazards resulting from gas pipeline emergencies, and conduct and keep records of inspections and testing. Operators are subject to the Pipeline Safety Improvement Act of 2002. Management believes that the procedures currently in effect at all of the Partnership’s facilities for the handling, storage, transportation and distribution of propane are consistent with industry standards and are in compliance, in all material respects, with applicable laws and regulations.

Climate Change

There continues to be concern, both nationally and internationally, about climate change and the contribution of greenhouse gas (“GHG”) emissions, most notably carbon dioxide, to global warming. Because propane is considered a clean alternative fuel under the federal Clean Air Act Amendments of 1990, the Partnership anticipates that this will provide it with a competitive advantage over other sources of energy, such as fuel oil and coal, to the extent new climate change regulations become effective. At the same time, increased regulation of GHG emissions, especially in the transportation sector, could impose significant additional costs on the Partnership, its suppliers and its customers. The impact of new legislation and regulations will depend on a number of factors, including (i) which industry sectors would be impacted, (ii) the timing of required compliance, (iii) the overall GHG emissions cap level, (iv) the allocation of emission allowances to specific sources, and (v) the costs and opportunities associated with compliance.

Employees

The Partnership does not directly employ any persons responsible for managing or operating the Partnership. The General Partner provides these services and is reimbursed for its direct and indirect costs and expenses, including all compensation and benefit costs. At September 30, 2014, the General Partner had nearly 8,400 employees, including nearly 400 part-time, seasonal and temporary employees, working on behalf of the Partnership. UGI also performs certain financial and administrative services for the General Partner on behalf of the Partnership and is reimbursed by the Partnership.

8

ITEM 1A. RISK FACTORS

There are many factors that may affect our business and results of operations. Additional discussion regarding factors that may affect our businesses and operating results is included elsewhere in this Report.

Risks Related to Our Business

Decreases in the demand for propane because of warmer-than-normal heating season weather or unfavorable weather may adversely affect our results of operations.

Because many of our customers rely on propane as a heating fuel, our results of operations are adversely affected by warmer-than-normal heating season weather. Weather conditions have a significant impact on the demand for propane for both heating and agricultural purposes. Accordingly, the volume of propane sold is at its highest during the peak heating season of October through March and is directly affected by the severity of the winter weather. For example, historically approximately 60% to 70% of our annual retail propane volumes are sold during these months. There can be no assurance that normal winter weather in our service territories will occur in the future.

The agricultural demand for propane is also affected by weather, as dry or warm weather during the harvest season may reduce the demand for propane. Our Propane Exchange operations experience higher volumes in the spring and summer, mainly due to the grilling season. Sustained periods of unfavorable weather conditions can negatively affect our Propane Exchange revenues. Unfavorable weather conditions may also cause a reduction in the purchase and use of grills and other propane appliances which could reduce the demand for our Propane Exchange cylinders.

Our profitability is subject to propane pricing and inventory risk.

The retail propane business is a “margin-based” business in which gross profits are dependent upon the excess of the sales price over the propane supply costs. Propane is a commodity, and, as such, its unit price is subject to volatile fluctuations in response to changes in supply or other market conditions. We have no control over these market conditions. Consequently, the unit price of the propane that we and other marketers purchase can change rapidly over a short period of time. Most of our propane product supply contracts permit suppliers to charge posted prices at the time of delivery or the current prices established at major storage points such as Mont Belvieu, Texas or Conway, Kansas. Because our profitability is sensitive to changes in wholesale propane supply costs, it will be adversely affected if we cannot pass on increases in the cost of propane to our customers. Due to competitive pricing in the industry, we may not fully be able to pass on product cost increases to our customers when product costs rise, or when our competitors do not raise their product prices in a timely manner. Finally, market volatility may cause us to sell inventory at less than the price we purchased it, which would adversely affect our operating results.

High propane prices can lead to customer conservation and attrition, resulting in reduced demand for our product.

Prices for propane are subject to volatile fluctuations in response to changes in supply and other market conditions. During periods of high propane costs our prices generally increase. High prices can lead to customer conservation and attrition, resulting in reduced demand for our product.

Supplier defaults may have a negative effect on our operating results.

When we enter into fixed-price sales contracts with customers, we typically enter into fixed-price purchase contracts with suppliers. Depending on changes in the market prices of propane compared to the prices secured in our contracts with suppliers of propane, a default of one or more of our suppliers under such contracts could cause us to purchase propane at higher prices which would have a negative impact on our operating results.

We are dependent on our principal propane suppliers, which increases the risks from an interruption in supply and transportation.

During Fiscal 2014, AmeriGas Propane purchased over 90% of its propane needs from twenty suppliers. If supplies from these sources were interrupted, the cost of procuring replacement supplies and transporting those supplies from alternative locations might be materially higher and, at least on a short-term basis, our earnings could be affected. Additionally, in certain geographical areas, a single supplier may provide more than 50% of our propane requirements. Disruptions in supply in these areas could also have an adverse impact on our earnings.

9

Changes in commodity market prices may have a negative effect on our liquidity.

Depending on the terms of our contracts with suppliers as well as our use of financial instruments to reduce volatility in the cost of propane, changes in the market price of propane can create margin payment obligations for us and expose us to an increased liquidity risk. In addition, increased demand for domestically produced propane overseas may, depending on production volumes in the United States, result in higher domestic propane prices and expose us to additional liquidity risks.

Our operations may be adversely affected by competition from other energy sources.

Propane competes with other sources of energy, some of which are less costly on an equivalent energy basis. In addition, we cannot predict the effect that the development of alternative energy sources might have on our operations. We compete for customers against suppliers of electricity, fuel oil and natural gas.

Electricity is a major competitor of propane and is generally more expensive than propane on a Btu equivalent basis for space heating, water heating, and cooking. The convenience and efficiency of electricity makes it an attractive energy source for consumers and developers of new homes. Fuel oil is also a major competitor of propane and, although a less environmentally attractive energy source, is currently less expensive than propane. Furnaces and appliances that burn propane will not operate on fuel oil and vice versa, and, therefore, a conversion from one fuel to the other requires the installation of new equipment. Our customers generally have an incentive to switch to fuel oil only if fuel oil becomes significantly less expensive than propane. Except for certain industrial and commercial applications, propane is generally not competitive with natural gas in areas where natural gas pipelines already exist because natural gas is generally a significantly less expensive source of energy than propane. As long as natural gas remains a less expensive energy source than propane, our business will lose customers in each region into which natural gas distribution systems are expanded. The gradual expansion of the nation’s natural gas distribution systems has resulted, and may continue to result, in the availability of natural gas in some areas that previously depended upon propane.

Our ability to increase revenues is adversely affected by the decline of the retail propane industry.

The retail propane industry has been declining over the past several years, with no or modest growth in total demand foreseen in the next several years. Accordingly, we expect that year-to-year industry volumes will be principally affected by weather patterns. Therefore, our ability to grow within the industry is dependent on our ability to acquire other retail distributors and to achieve internal growth, which includes expansion of our Propane Exchange and National Accounts programs, as well as the success of our sales and marketing programs designed to attract and retain customers. Any failure to retain and grow our customer base would have an adverse effect on our results.

Volatility in credit and capital markets may restrict our ability to grow, increase the likelihood of defaults by our customers and counterparties and adversely affect our operating results.

The volatility in credit and capital markets may create additional risks to our business in the future. We are exposed to financial market risk (including refinancing risk) resulting from, among other things, changes in interest rates and conditions in the credit and capital markets. Developments in the credit markets during the past few years increase our possible exposure to the liquidity, default and credit risks of our suppliers, counterparties associated with derivative financial instruments and our customers. Although we believe that current financial market conditions, if they were to continue for the foreseeable future, will not have a significant impact on our ability to fund our existing operations, such market conditions could restrict our ability to grow through acquisitions, could limit the scope of major capital projects if access to credit and capital markets is limited or could adversely affect our operating results.

Our ability to grow will be adversely affected if we are not successful in making acquisitions or integrating the acquisitions we have made.

We have historically expanded our propane business through acquisitions. We regularly consider and evaluate opportunities for growth through the acquisition of local, regional and national propane distributors. We may choose to finance future acquisitions with debt, equity, cash or a combination of the three. We can give no assurances that we will find attractive acquisition candidates in the future, that we will be able to acquire such candidates on economically acceptable terms, that we will be able to finance acquisitions on economically acceptable terms, that any acquisitions will not be dilutive to earnings and distributions or that any additional debt incurred to finance an acquisition will not affect our ability to make distributions.

To the extent we are successful in making acquisitions, such acquisitions involve a number of risks, including, but not limited to, the assumption of material liabilities, the diversion of management’s attention from the management of daily operations to the integration of operations, difficulties in the assimilation and retention of employees and difficulties in the assimilation of different cultures and practices and internal controls, as well as in the assimilation of broad and geographically dispersed personnel and

10

operations. The failure to successfully integrate acquisitions could have an adverse effect on our business, financial condition and results of operations.

We are subject to operating and litigation risks that may not be covered by insurance.

Our operations are subject to all of the operating hazards and risks normally incidental to handling, storing, transporting and otherwise providing combustible liquids such as propane for use by consumers. These risks could result in substantial losses due to personal injury and/or loss of life, and severe damage to and destruction of property and equipment arising from explosions and other catastrophic events, including acts of terrorism. As a result, we are often a defendant in legal proceedings and litigation arising in the ordinary course of business. There can be no assurance that our insurance will be adequate to protect us from all material expenses related to pending and future claims or that such levels of insurance will be available in the future at economical prices.

Our net income and earnings will decrease if we are required to incur additional costs to comply with new governmental safety, health, transportation, tax and environmental regulations.

We are subject to various federal, state and local safety, health, transportation, tax and environmental laws and regulations governing the storage, distribution and transportation of propane. We have implemented safety and environmental programs and policies designed to avoid potential liability and costs under applicable laws. It is possible, however, that we will incur increased costs as a result of complying with new safety, health, transportation and environmental regulations and such costs will reduce our net income. It is also possible that material environmental liabilities will be incurred, including those relating to claims for damages to property and persons.

Our operations, capital expenditures and financial results may be affected by regulatory changes and/or market responses to global climate change.

There continues to be concern, both nationally and internationally, about climate change and the contribution of GHG emissions, most notably carbon dioxide, to global warming. Because propane is considered a clean alternative fuel under the federal Clean Air Act Amendments of 1990, we anticipate that this will provide us with a competitive advantage over other sources of energy, such as fuel oil and coal, as new climate change regulations become effective. At the same time, increased regulation of GHG emissions, especially in the transportation sector, could impose significant additional costs on us, our suppliers and our customers. While some states have adopted laws and regulations regulating the emission of GHGs for some industry sectors, there is currently no federal or regional legislation mandating the reduction of GHG emissions in the United States. Although Congress has not enacted federal climate change legislation, the EPA has begun adopting and implementing regulations to restrict emissions of GHGs from motor vehicles and certain large stationary sources, and to require reporting of GHG emissions by certain regulated facilities on an annual basis. The Partnership’s facilities are not currently subject to these regulations, but the potential increased costs of regulatory compliance and mandatory reporting by our customers and suppliers could have an effect on our operations or financial condition.

The adoption of additional federal or state climate change legislation or regulatory programs to reduce emissions of GHGs could also require the Partnership or its suppliers to incur increased capital and operating costs, with resulting impact on product price and demand. The impact of new legislation and regulations will depend on a number of factors, including (i) which industry sectors would be impacted, (ii) the timing of required compliance, (iii) the overall GHG emissions cap level, (iv) the allocation of emission allowances to specific sources, and (v) the costs and opportunities associated with compliance. At this time, we cannot predict the effect that climate change regulation may have on our business, financial condition or operations in the future.

If we are unable to protect our information technology systems against service interruption, misappropriation of data, or breaches of security resulting from cyber security attacks or other events, or we encounter other unforeseen difficulties in the operation of our information technology systems, our operations could be disrupted, our business and reputation may suffer, and our internal controls could be adversely affected.

In the ordinary course of business, we rely on information technology systems, including the Internet and third-party hosted services, to support a variety of business processes and activities and to store sensitive data, including (i) intellectual property, (ii) our proprietary business information and that of our suppliers and business partners, (iii) personally identifiable information of our customers and employees, and (iv) data with respect to invoicing and the collection of payments, accounting, procurement, and supply chain activities. In addition, we rely on our information technology systems to process financial information and results of operations for internal reporting purposes and to comply with financial reporting, legal, and tax requirements. Despite our security measures, our information technology systems may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, sabotage, or other disruptions. A loss of our information technology systems, or temporary interruptions in

11

the operation of our information technology systems, misappropriation of data, and breaches of security could have a material adverse effect on our business, financial condition, results of operations, and reputation.

Moreover, the efficient execution of our business is dependent upon the proper functioning of our internal systems, including an information technology system that supports our Order-to-Cash business processes. Any significant failure or malfunction of this information technology system may result in disruptions of our operations. Our results of operations could be adversely affected if we encounter unforeseen problems with respect to the operation of this system.

Risks Inherent in an Investment in Our Common Units

Cash distributions are not guaranteed and may fluctuate with our performance.

Although we distribute all of our available cash each quarter, the amount of cash that we generate each quarter fluctuates. As a result, we cannot guarantee that we will pay the current regular quarterly distribution each quarter. Available cash generally means, with respect to any fiscal quarter, all cash on hand at the end of each quarter, plus all additional cash on hand as of the date of the determination of available cash resulting from borrowings after the end of the quarter, less the amount of reserves established to provide for the proper conduct of our business, to comply with applicable law or agreements, or to provide funds for future distributions to partners. The actual amount of cash that is available to be distributed each quarter will depend upon numerous factors, including:

• | our cash flow generated by operations; |

• | the weather in our areas of operation; |

• | our borrowing capacity under our bank credit facilities; |

• | required principal and interest payments on our debt; |

• | fluctuations in our working capital; |

• | our cost of acquisitions (including related debt service payments); |

• | restrictions contained in our debt instruments; |

• | our capital expenditures; |

• | our issuances of debt and equity securities; |

• | reserves made by our General Partner in its discretion; |

• | prevailing economic and industry conditions; and |

• | financial, business and other factors, a number of which are beyond our control. |

As is the case for most master limited partnerships, our Fourth Amended and Restated Agreement of Limited Partnership dated as of July 27, 2009, as amended as of March 13, 2012 (the “Partnership Agreement”) requires that distributions to our partners upon our liquidation (or to a partner upon certain redemptions) be made in accordance with positive capital account balances in order to comply with Treasury regulation (“Treasury Regulations”) promulgated under the Internal Revenue Code of 1986, as amended (the “Code”), as to our allocations of tax items. Although our Partnership Agreement grants our General Partner broad discretion to use special allocations, capital account adjustments, and other corrective measures to prevent this capital account liquidation requirement from causing economic distortions, it is not possible to confirm in all instances that such economic distortions will not result from this capital account liquidation requirement.

Our General Partner has broad discretion to determine the amount of “available cash” for distribution to holders of our equity securities through the establishment and maintenance of cash reserves, thereby potentially lessening and limiting the amount of “available cash” eligible for distribution.

Our General Partner determines the timing and amount of our distributions and has broad discretion in determining the amount of funds that will be recognized as “available cash.” Part of this discretion comes from the ability of our General Partner to establish reserves. Decisions as to amounts to be reserved have a direct impact on the amount of available cash for distributions because reserves are taken into account in computing available cash. Each fiscal quarter, our General Partner may, in its reasonable discretion, determine the amounts to be reserved, subject to restrictions on the purposes of the reserves. Reserves may be made, increased or decreased for any proper purpose, including, but not limited to, reserves:

• | to comply with terms of any of our agreements or obligations, including the establishment of reserves to fund the future payment of interest and principal on our debt securities; |

• | to provide for level distributions of cash notwithstanding the seasonality of our business; and |

• | to provide for future capital expenditures and other payments deemed by our General Partner to be necessary or advisable. |

The decision by our General Partner to establish reserves may limit the amount of cash available for distribution to holders of our

12

equity securities. Holders of our equity securities will not receive payments unless we are able to first satisfy our own obligations and the establishment of any reserves.

We are a holding company and have no material operations or assets. Accordingly, unitholders will receive distributions only if we receive distributions from our Operating Partnership after it meets its own financial obligations.

We are a holding company for our subsidiaries, with no material operations and only limited assets. We are dependent on cash distributions from the Operating Partnership to make cash distributions to our unitholders.

Unitholders will not receive cash distributions unless the Operating Partnership is able to make distributions to us after it first satisfies its obligations under the terms of its own borrowing arrangements and reserves any necessary amounts to meet its own financial obligations. The Operating Partnership is required to distribute all of its available cash each quarter, less the amounts of cash reserves that our General Partner determines are necessary or appropriate in its reasonable discretion to provide for the proper conduct of our Operating Partnership’s business, to enable it to make distributions to us so that we can make timely distributions to our limited partners and the General Partner under our Partnership Agreement during the next four quarters, or to comply with applicable law or any of our Operating Partnership’s debt or other agreements.

The agreements governing certain of the Operating Partnership’s debt obligations require the Operating Partnership to include in its cash reserves amounts for future required payments. This limits the amount of available cash the Operating Partnership may distribute to us each quarter.

Holders of Common Units may experience dilution of their interests.

We may issue an unlimited number of additional limited partner interests and other equity securities, including senior equity securities, for such consideration and on such terms and conditions as shall be established by our General Partner in its sole discretion, without the approval of any unitholders. We also may issue an unlimited number of partnership interests junior to the Common Units without a unitholder vote. When we issue additional equity securities, a unitholder’s proportionate partnership interest will decrease and the amount of cash distributed on each unit and the market price of the Common Units could decrease. Issuance of additional Common Units will also diminish the relative limited voting power of each previously outstanding unit. Please read “Holders of Common Units have limited voting rights, management and control of us” below. The ultimate effect of any such issuance may be to dilute the interests of holders of units in AmeriGas Partners and to make it more difficult for a person or group to remove our General Partner or otherwise change our management.

The market price of the Common Units may be adversely affected by various change of management provisions.

Our Partnership Agreement contains certain provisions that are intended to discourage a person or group from attempting to remove our General Partner as general partner or otherwise change the management of AmeriGas Partners. If any person or group other than the General Partner or its affiliates acquires beneficial ownership of 20% or more of the Common Units, such person or group will lose its voting rights with respect to all of its Common Units. The effect of these provisions and the change of control provisions in our debt instruments may be to diminish the price at which the Common Units will trade under certain circumstances.

Restrictive covenants in the agreements governing our indebtedness and other financial obligations may reduce our operating flexibility.

The various agreements governing our and the Operating Partnership’s indebtedness and other financing transactions restrict quarterly distributions. These agreements contain various negative and affirmative covenants applicable to us and the Operating Partnership and some of these agreements require us and the Operating Partnership to maintain specified financial ratios. If we or the Operating Partnership violate any of these covenants or requirements, a default may result and distributions would be limited. These covenants limit our and the Operating Partnership’s ability to, among other things:

• | incur additional indebtedness; |

• | engage in transactions with affiliates; |

• | create or incur liens; |

• | sell assets; |

• | make restricted payments, loans and investments; |

• | enter into business combinations and asset sale transactions; and |

• | engage in other lines of business. |

13

Holders of Common Units have limited voting rights, management and control of us.

Our General Partner manages and operates AmeriGas Partners. Unlike the holders of common stock in a corporation, holders of outstanding Common Units have only limited voting rights on matters affecting our business. Holders of Common Units have no right to elect the general partner or its directors, and our General Partner generally may not be removed except pursuant to the vote of the holders of not less than two-thirds of the outstanding units. In addition, removal of the general partner may result in a default under our debt instruments and loan agreements. As a result, holders of Common Units have limited say in matters affecting our operations and others may find it difficult to attempt to gain control or influence our activities.

Holders of Common Units may be required to sell their Common Units against their will.

If at any time our General Partner and its affiliates hold 80% or more of the issued and outstanding Common Units, our General Partner will have the right (but not the obligation) to purchase all, but not less than all, of the remaining Common Units held by nonaffiliates at certain specified prices pursuant to the Partnership Agreement. Accordingly, under certain circumstances holders of Common Units may be required to sell their Common Units against their will and the price that they receive for those securities may be less than they would like to receive. They may also incur a tax liability upon a sale of their Common Units.

Holders of Common Units may not have limited liability in certain circumstances and may be liable for the return of distributions that cause our liabilities to exceed our assets.

The limitations on the liability of holders of Common Units for the obligations of a limited partnership have not been clearly established in some states. If it were determined that AmeriGas Partners had been conducting business in any state without compliance with the applicable limited partnership statute, or that the right or the exercise of the right by the holders of Common Units as a group to remove or replace our General Partner, to make certain amendments to our Partnership Agreement or to take other action pursuant to that Partnership Agreement constituted participation in the “control” of the business of AmeriGas Partners, then a holder of Common Units could be held liable under certain circumstances for our obligations to the same extent as our General Partner. We are not obligated to inform holders of Common Units about whether we are in compliance with the limited partnership statutes of any states.

Holders of Common Units may also have to repay AmeriGas Partners amounts wrongfully returned or distributed to them. Under Delaware law, we may not make a distribution to holders of Common Units if the distribution causes our liabilities to exceed the fair value of our assets. Liabilities to partners on account of their partnership interests and nonrecourse liabilities are not counted for purposes of determining whether a distribution is permitted. Delaware law provides that a limited partner who receives such a distribution and knew at the time of the distribution that the distribution violated Delaware law will be liable to the limited partnership for the distribution amount for three years from the distribution date.

Our General Partner has conflicts of interest and limited fiduciary responsibilities, which may permit our General Partner to favor its own interest to the detriment of holders of Common Units.

Conflicts of interest can arise as a result of the relationships between AmeriGas Partners, on the one hand, and the General Partner and its affiliates, on the other. The directors and officers of the General Partner have fiduciary duties to manage the General Partner in a manner beneficial to the General Partner’s sole shareholder, AmeriGas, Inc., a wholly owned subsidiary of UGI Corporation. At the same time, the General Partner has fiduciary duties to manage AmeriGas Partners in a manner beneficial to both it and the unitholders. The duties of our General Partner to AmeriGas Partners and the unitholders, therefore, may come into conflict with the duties of the directors and officers of our General Partner to its sole shareholder, AmeriGas, Inc.

Such conflicts of interest might arise in the following situations, among others:

• | Decisions of our General Partner with respect to the amount and timing of cash expenditures, borrowings, issuances of additional units and reserves in any quarter affect whether and the extent to which there is sufficient available cash from operating surplus to make quarterly distributions in a given quarter. In addition, actions by our General Partner may have the effect of enabling the General Partner to receive distributions that exceed 2% of total distributions. |

• | AmeriGas Partners does not have any employees and relies solely on employees of the General Partner and its affiliates. |

• | Under the terms of the Partnership Agreement, we reimburse our General Partner and its affiliates for costs incurred in managing and operating AmeriGas Partners, including costs incurred in rendering corporate staff and support services to us. |

• | Any agreements between us and our General Partner and its affiliates do not grant to the holders of Common Units, |

14

separate and apart from AmeriGas Partners, the right to enforce the obligations of our General Partner and such affiliates in our favor. Therefore, the General Partner, in its capacity as the general partner of AmeriGas Partners, is primarily responsible for enforcing such obligations.

• | Under the terms of the Partnership Agreement, our General Partner is not restricted from causing us to pay the General Partner or its affiliates for any services rendered on terms that are fair and reasonable to us or entering into additional contractual arrangements with any of such entities on behalf of AmeriGas Partners. Neither the Partnership Agreement nor any of the other agreements, contracts and arrangements between us, on the one hand, and the General Partner and its affiliates, on the other, are or will be the result of arm’s-length negotiations. |

• | Our General Partner may exercise its right to call for and purchase units as provided in the Partnership Agreement or assign such right to one of its affiliates or to us. |

Our Partnership Agreement expressly permits our General Partner to resolve conflicts of interest between itself or its affiliates, on the one hand, and us or the unitholders, on the other, and to consider, in resolving such conflicts of interest, the interests of other parties in addition to the interests of the unitholders. In addition, the Partnership Agreement provides that a purchaser of Common Units is deemed to have consented to certain conflicts of interest and actions of our General Partner and its affiliates that might otherwise be prohibited and to have agreed that such conflicts of interest and actions do not constitute a breach by the General Partner of any duty stated or implied by law or equity. The General Partner is not in breach of its obligations under the Partnership Agreement or its duties to us or the unitholders if the resolution of such conflict is fair and reasonable to us. The latitude given in the Partnership Agreement to the General Partner in resolving conflicts of interest may significantly limit the ability of a unitholder to challenge what might otherwise be a breach of fiduciary duty.

Our Partnership Agreement expressly limits the liability of our General Partner by providing that the General Partner, its affiliates and its officers and directors are not liable for monetary damages to us, the limited partners or assignees for errors of judgment or for any actual omissions if the General Partner and other persons acted in good faith. In addition, we are required to indemnify our General Partner, its affiliates and their respective officers, directors, employees and agents to the fullest extent permitted by law, against liabilities, costs and expenses incurred by our General Partner or such other persons, if the General Partner or such persons acted in good faith and in a manner they reasonably believed to be in, or not opposed to, our best interests and, with respect to any criminal proceedings, had no reasonable cause to believe the conduct was unlawful.

Our General Partner may voluntarily withdraw or sell its general partner interest.

Our General Partner may withdraw as the general partner of AmeriGas Partners and the Operating Partnership without the approval of our unitholders. Our General Partner may also sell its general partner interest in AmeriGas Partners and the Operating Partnership without the approval of our unitholders. Any such withdrawal or sale could have a material adverse effect on us and could substantially change the management and resolutions of conflicts of interest, as described above.

Our substantial debt could impair our financial condition and our ability to make distributions to holders of Common Units and operate our business.

Our substantial debt and our ability to incur significant additional indebtedness, subject to the restrictions under AmeriGas OLP’s bank credit agreement, the outstanding HOLP note agreements and the indentures governing our outstanding notes could adversely affect our ability to make distributions to holders of our Common Units and could limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate and place us at a competitive disadvantage compared to our competitors that have proportionately less debt. If we are unable to meet our debt service obligations, we could be forced to restructure or refinance our indebtedness, seek additional equity capital or sell assets. We may be unable to obtain financing or sell assets on satisfactory terms, or at all.

Our agreement with Energy Transfer Partners, L.P. (“ETP”) may delay or prevent a change of control, which could adversely affect the price of our Common Units.

Various provisions in the Contingent Residual Support Agreement (“CRSA”) that we entered into on January 12, 2012 with ETP and UGI Corporation may delay or prevent a change in control of AmeriGas Partners, which could adversely affect the price of our Common Units. These provisions may also make it more difficult for our unitholders to benefit from transactions, including an actual or threatened change in control of us, even though such a transaction may offer our unitholders the opportunity to sell their Common Units at a price above the prevailing market price. The CRSA provides that, during the five-year period following the effectiveness of the CRSA, UGI Corporation may not cease to control the General Partner without the consent of ETP (such consent not to be unreasonably withheld). Thereafter, until termination of the CRSA, which will occur on the earlier of (a) payment in full of the Supported Debt Principal Amount as defined in the CRSA and (b) payment by ETP of the maximum amount due by

15

ETP under the CRSA, ETP will not have any consent right with respect to a change of control of the General Partner unless such change of control would result in a downgrade of the credit rating of the senior notes issued in connection with the Heritage Propane acquisition. Such provisions may prevent unitholders from realizing potential increases in the price of our Common Units from an actual or threatened change in control.

Our partnership agreement limits our General Partner’s fiduciary duties of care to unitholders and restricts remedies available to unitholders for actions taken by our General Partner that might otherwise constitute breaches of fiduciary duties.

Our partnership agreement contains provisions that reduce the standards of care to which our General Partner would otherwise be held by state fiduciary duty law. For example, our partnership agreement waives or limits, to the extent permitted by law, any standard of care and duty imposed under state law to act in accordance with the provisions of our partnership agreement so long as such action is reasonably believed by our General Partner to be in, or not inconsistent with, our best interest. Accordingly, you may not be entitled to the benefits of certain fiduciary duties imposed by statute or otherwise that would ordinarily apply to directors and senior officers of publicly traded corporations.

Tax Risks

Our tax treatment depends on our status as a partnership for federal income tax purposes. If the IRS were to treat us as a corporation, then our cash available for distribution to holders of Common Units would be substantially reduced.

The availability to a common unitholder of the federal income tax benefits of an investment in the Common Units depends, in large part, on our classification as a partnership for federal income tax purposes. No ruling from the IRS as to this status has been or is expected to be requested.

If we were classified as a corporation for federal income tax purposes (including, but not limited to, due to a change in our business or a change in current law), we would be required to pay tax on our income at corporate tax rates (currently a maximum 35% federal rate, in addition to state and local income taxes at varying rates), and distributions received by the Common Unitholders would generally be taxed a second time as corporate distributions. Because a tax would be imposed upon us as an entity, the cash available for distribution to the Common Unitholders would be substantially reduced. Treatment of us as a corporation would cause a material reduction in the anticipated cash flow and after-tax return to the Common Unitholders, likely causing a substantial reduction in the value of the Common Units.

Our Partnership Agreement provides that if a law is enacted or existing law is modified or interpreted in a manner that subjects us to taxation as a corporation or otherwise subjects us to entity-level taxation for federal, state, or local income tax purposes, our Partnership distribution levels will change. These changes would include a decrease in the current regular quarterly distribution and the target distribution levels to reflect the impact of this law on us. Any such reductions could increase our General Partner’s percentage of cash distributions and decrease our limited partners’ percentage of cash distributions.

If federal or state tax treatment of partnerships changes to impose entity-level taxation, the amount of cash available to us for distributions may be lower and distribution levels may have to be decreased.

Current law may change, causing us to be treated as a corporation for federal income tax purposes or otherwise subjecting us to entity-level taxation. For example, the Obama Administration and members of Congress have recently considered substantive changes to the existing federal income tax laws that would have affected certain publicly traded partnerships. Specifically, federal income tax legislation has been considered that would have eliminated partnership tax treatment for certain publicly traded partnerships and recharacterized certain types of income received from partnerships. Similarly, several states currently impose entity-level taxes on partnerships, including us. If any additional states were to impose a tax upon us as an entity, our cash available for distribution would be reduced. We are unable to predict whether any such changes in state entity-level taxes will ultimately be enacted. Any such changes could negatively impact the value of an investment in our Common Units.

Holders of Common Units will likely be subject to state, local and other taxes in states where holders of Common Units live or as a result of an investment in the Common Units.

In addition to United States federal income taxes, unitholders will likely be subject to other taxes, such as state and local taxes, unincorporated business taxes and estate, inheritance or intangible taxes that are imposed by the various jurisdictions in which the unitholder resides or in which we do business or own property. A unitholder will likely be required to file state and local income tax returns and pay state and local income taxes in some or all of the various jurisdictions in which we do business or own property and may be subject to penalties for failure to comply with those requirements. It is the responsibility of each unitholder to file all applicable United States federal, state and local tax returns.

16

A successful IRS contest of the federal income tax positions that we take may adversely affect the market for Common Units and the costs of any contest will be borne directly or indirectly by the unitholders and our General Partner.

We have not requested a ruling from the IRS with respect to our classification as a partnership for federal income tax purposes, the classification of any of the revenue from our propane operations as “qualifying income” under Section 7704 of the Internal Revenue Code, or any other matter affecting us. Accordingly, the IRS may adopt positions that differ from the conclusions expressed herein or the positions taken by us. It may be necessary to resort to administrative or court proceedings in an effort to sustain some or all of such conclusions or the positions taken by us. A court may not concur with some or all of our positions. Any contest with the IRS may materially and adversely impact the market for the Common Units and the prices at which they trade. In addition, the costs of any contest with the IRS will be borne directly or indirectly by the unitholders and our General Partner.

Holders of Common Units may be required to pay taxes on their allocable share of our taxable income even if they do not receive any cash distributions.

A unitholder will be required to pay federal income taxes and, in some cases, state and local income taxes on the unitholder’s allocable share of our taxable income, even if the unitholder receives no cash distributions from us. We cannot guarantee that a unitholder will receive cash distributions equal to the unitholder’s allocable share of our taxable income or even the tax liability to the unitholder resulting from that income.

Ownership of Common Units may have adverse tax consequences for tax-exempt organizations and certain other investors.

Investment in Common Units by certain tax-exempt entities, regulated investment companies and foreign persons raises issues unique to them. For example, virtually all of our taxable income allocated to organizations exempt from federal income tax, including individual retirement accounts and other retirement plans, will be unrelated business taxable income and thus will be taxable to the unitholder. Distributions to foreign persons will be reduced by withholding taxes at the highest applicable effective tax rate, and foreign persons will be required to file U.S. federal income tax returns and pay tax on their share of our taxable income. Prospective unitholders who are tax-exempt organizations or foreign persons should consult their tax advisors before investing in Common Units.

There are limits on the deductibility of losses that may adversely affect holders of Common Units.