Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RE/MAX Holdings, Inc. | tv478793_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - RE/MAX Holdings, Inc. | tv478793_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - RE/MAX Holdings, Inc. | tv478793_ex2-1.htm |

Exhibit 99.2

November 7, 2017 Northern Illinois Supplementary Information

2 Forward - Looking Statements This presentation includes "forward - looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as "believe," "intend," "expect," "estimate," "plan," "outlook," "project" and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters . These forward - looking statements include statements regarding the Company’s expectation for the timing of the closing of the purchase of the master franchise for the RE/MAX Northern Illinois Region, statements regarding the expected incremental revenue and Adjusted EBITDA contributions from the acquisition, statements regarding the expected benefits to the Company of such acquisition, as well as statements regarding the management team that is expected to oversee such region . Forward - looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved . Forward - looking statements are based on information available at the time those statements are made and/or management's good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward - looking statements . Such risks and uncertainties include, without limitation, ( 1 ) the possibility that the proposed transaction does not close when expected or at all, such as because conditions to closing are not received or satisfied on a timely basis or at all or for other reasons ; ( 2 ) changes in business and economic activity in general, ( 3 ) changes in the real estate market, including changes due to interest rates and availability of financing, ( 4 ) the Company's ability to attract and retain quality franchisees, ( 5 ) the Company's franchisees' ability to recruit and retain real estate agents, ( 6 ) changes in laws and regulations that may affect the business or the real estate market, ( 7 ) failure to maintain, protect and enhance the RE/MAX brand, as well as those risks and uncertainties described in the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the most recent Annual Report on Form 10 - K filed with the Securities and Exchange Commission ("SEC") and similar disclosures in subsequent periodic and current reports filed with the SEC, which are available on the investor relations page of the Company's website at www . remax . com and on the SEC website at www . sec . gov . Readers are cautioned not to place undue reliance on forward - looking statements, which speak only as of the date on which they are made . Except as required by law, the Company does not intend, and undertakes no duty, to update this information to reflect future events or circumstances .

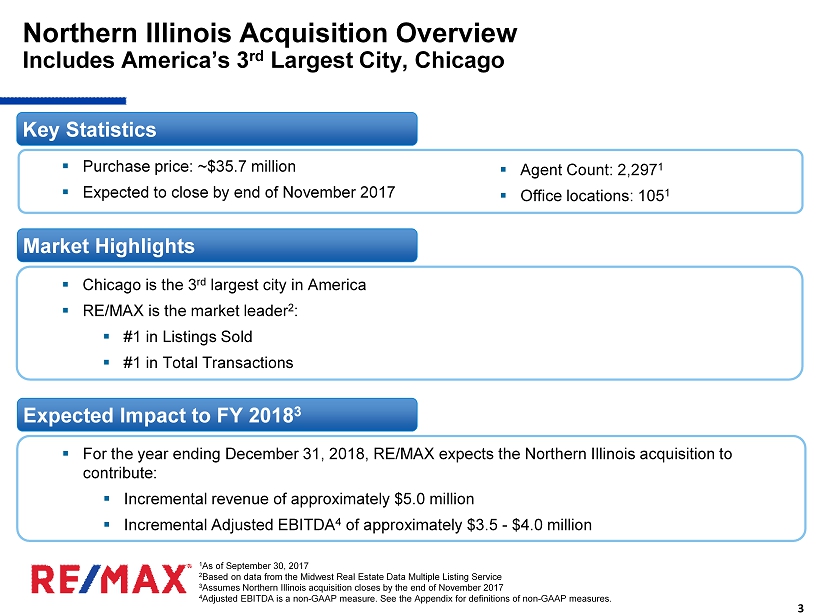

3 Northern Illinois Acquisition Overview Includes America’s 3 rd Largest City, Chicago ▪ Purchase price: ~$35.7 million ▪ Expected to close by end of November 2017 Key Statistics 1 As of September 30, 2017 2 Based on data from the Midwest Real Estate Data Multiple Listing Service 3 Assumes Northern Illinois acquisition closes by the end of November 2017 4 Adjusted EBITDA is a non - GAAP measure. See the Appendix for definitions of non - GAAP measures. ▪ For the year ending December 31, 2018, RE/MAX expects the Northern Illinois acquisition to contribute: ▪ Incremental revenue of approximately $5.0 million ▪ Incremental Adjusted EBITDA 4 of approximately $3.5 - $4.0 million Expected Impact to FY 2018 3 ▪ Chicago is the 3 rd largest city in America ▪ RE/MAX is the market leader 2 : ▪ #1 in Listings Sold ▪ #1 in Total Transactions Market Highlights ▪ Agent Count: 2,297 1 ▪ Office locations: 105 1

4 Upon Closing, Northern Illinois Will Be the 7 th Independent Region Acquired in Two Years Region Agents 1 ▪ RE/MAX captures 100% of fee revenue earned by Company - owned regions. In Independent regions, RE/MAX captures all fee revenue from Annual Dues and between 15 - 30% of other fee revenue earned. Offices 1 1 As of acquisition date with the exception of Northern Illinois which is as of 9/30/2017 2 Northern Illinois acquisition is expected to close by end of November 2017 Date Acquired 2 New York 869 60 Feb-16 Alaska 245 9 Apr-16 New Jersey 3,008 168 Dec-16 Kentucky/Tennessee 1,929 120 Dec-16 Georgia 1,488 94 Dec-16 Southern Ohio 546 42 Dec-16 Northern Illinois 2,297 105 Nov-17 Total 10,382 598

As measured by residential transaction sides. Each Office Independently Owned and Operated. 17_ 191524

6 Appendix

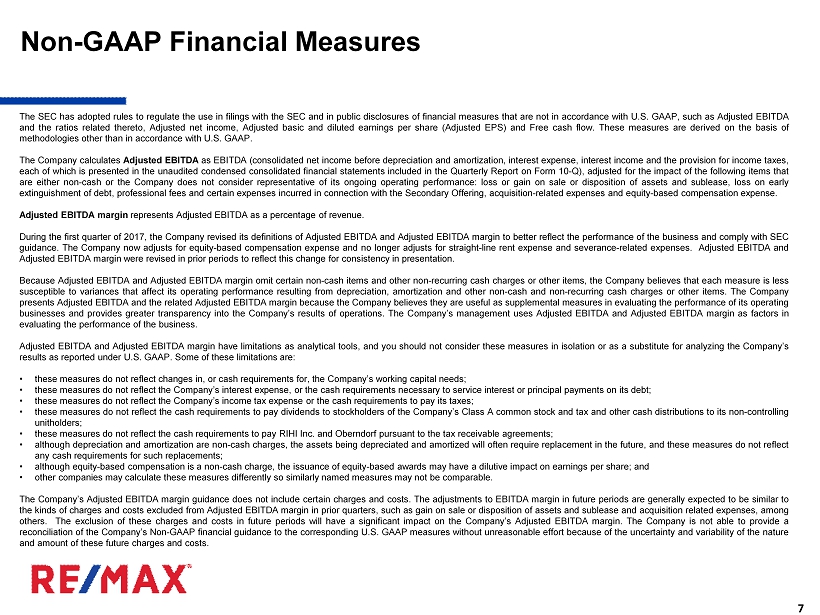

7 The SEC has adopted rules to regulate the use in filings with the SEC and in public disclosures of financial measures that are not in accordance with U . S . GAAP, such as Adjusted EBITDA and the ratios related thereto, Adjusted net income, Adjusted basic and diluted earnings per share (Adjusted EPS) and Free cash flow . These measures are derived on the basis of methodologies other than in accordance with U . S . GAAP . The Company calculates Adjusted EBITDA as EBITDA (consolidated net income before depreciation and amortization, interest expense, interest income and the provision for income taxes, each of which is presented in the unaudited condensed consolidated financial statements included in the Quarterly Report on Form 10 - Q), adjusted for the impact of the following items that are either non - cash or the Company does not consider representative of its ongoing operating performance : loss or gain on sale or disposition of assets and sublease, loss on early extinguishment of debt, professional fees and certain expenses incurred in connection with the Secondary Offering, acquisition - related expenses and equity - based compensation expense . Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenue . During the first quarter of 2017 , the Company revised its definitions of Adjusted EBITDA and Adjusted EBITDA margin to better reflect the performance of the business and comply with SEC guidance . The Company now adjusts for equity - based compensation expense and no longer adjusts for straight - line rent expense and severance - related expenses . Adjusted EBITDA and Adjusted EBITDA margin were revised in prior periods to reflect this change for consistency in presentation . Because Adjusted EBITDA and Adjusted EBITDA margin omit certain non - cash items and other non - recurring cash charges or other items, the Company believes that each measure is less susceptible to variances that affect its operating performance resulting from depreciation, amortization and other non - cash and non - recurring cash charges or other items . The Company presents Adjusted EBITDA and the related Adjusted EBITDA margin because the Company believes they are useful as supplemental measures in evaluating the performance of its operating businesses and provides greater transparency into the Company’s results of operations . The Company’s management uses Adjusted EBITDA and Adjusted EBITDA margin as factors in evaluating the performance of the business . Adjusted EBITDA and Adjusted EBITDA margin have limitations as analytical tools, and you should not consider these measures in isolation or as a substitute for analyzing the Company’s results as reported under U . S . GAAP . Some of these limitations are : • these measures do not reflect changes in, or cash requirements for, the Company’s working capital needs ; • these measures do not reflect the Company’s interest expense, or the cash requirements necessary to service interest or principal payments on its debt ; • these measures do not reflect the Company’s income tax expense or the cash requirements to pay its taxes ; • these measures do not reflect the cash requirements to pay dividends to stockholders of the Company’s Class A common stock and tax and other cash distributions to its non - controlling unitholders ; • these measures do not reflect the cash requirements to pay RIHI Inc . and Oberndorf pursuant to the tax receivable agreements ; • although depreciation and amortization are non - cash charges, the assets being depreciated and amortized will often require replacement in the future, and these measures do not reflect any cash requirements for such replacements ; • although equity - based compensation is a non - cash charge, the issuance of equity - based awards may have a dilutive impact on earnings per share ; and • other companies may calculate these measures differently so similarly named measures may not be comparable . The Company’s Adjusted EBITDA margin guidance does not include certain charges and costs . The adjustments to EBITDA margin in future periods are generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA margin in prior quarters, such as gain on sale or disposition of assets and sublease and acquisition related expenses, among others . The exclusion of these charges and costs in future periods will have a significant impact on the Company’s Adjusted EBITDA margin . The Company is not able to provide a reconciliation of the Company’s Non - GAAP financial guidance to the corresponding U . S . GAAP measures without unreasonable effort because of the uncertainty and variability of the nature and amount of these future charges and costs . Non - GAAP Financial Measures

8 Adjusted net income is calculated as Net income attributable to RE/MAX Holdings, assuming the full exchange of all outstanding non - controlling interests for shares of Class A common stock as of the beginning of the period (and the related increase to the provision for income taxes after such exchange), plus primarily non - cash items and other items that management does not consider to be useful in assessing the Company’s operating performance (e . g . , amortization of acquired intangible assets, gain on sale or disposition of assets and sub - lease, loss on early debt extinguishment, public - offering related expenses, acquisition - related expenses and equity - based compensation expense) . Adjusted basic and diluted earnings per share (Adjusted EPS) are calculated as Adjusted net income (as defined above) divided by pro forma (assuming the full exchange of all outstanding non - controlling interests) basic and diluted weighted average shares, as applicable . When used in conjunction with GAAP financial measures, Adjusted net income and Adjusted EPS are supplemental measures of operating performance that management believes are useful measures to evaluate the Company’s performance relative to the performance of its competitors as well as performance period over period . By assuming the full exchange of all outstanding non - controlling interests, management believes these measures : • facilitate comparisons with other companies that do not have a low effective tax rate driven by a non - controlling interest on a pass - through entity ; • facilitate period over period comparisons because they eliminate the effect of changes in Net income attributable to RE/MAX Holdings, Inc . driven by increases in its ownership of RMCO, LLC, which are unrelated to the Company’s operating performance ; and • eliminate primarily non - cash and other items that management does not consider to be useful in assessing the Company’s operating performance . Free cash flow is calculated as cash flows from operations less capital expenditures, both as reported under GAAP, and quantifies how much cash a company has to pursue opportunities that enhance shareholder value . The Company believes free cash flow is useful to investors as a supplemental measure as it calculates the cash flow available for working capital needs, re - investment opportunities, potential independent region and strategic acquisitions, dividend payments or other strategic uses of cash . Free cash flow after tax and non - dividend distributions to RIHI is calculated as free cash flow less tax and other non - dividend distributions paid to RIHI (the non - controlling interest holder) to enable RIHI to satisfy its income tax obligations . Similar payments would be made by the Company directly to federal and state taxing authorities as a component of the Company’s consolidated provision for income taxes if a full exchange of non - controlling interests occurred in the future . As a result and given the significance of the Company’s ongoing tax and non - dividend distribution obligations to its non - controlling interest, free cash flow after tax and non - dividend distributions, when used in conjunction with GAAP financial measures, provides a meaningful view of cash flow available to the Company to pursue opportunities that enhance shareholder value . Unencumbered cash generated is calculated as free cash flow after tax and non - dividend distributions to RIHI less quarterly debt principal payments less annual excess cash flow payment on debt, as applicable . Given the significance of the Company’s excess cash flow payment on debt, when applicable, unencumbered cash generated, when used in conjunction with GAAP financial measures, provides a meaningful view of the cash flow available to the Company to pursue opportunities that enhance shareholder value after considering its debt service obligations . Non - GAAP Financial Measures (continued)