Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - RE/MAX Holdings, Inc. | rmax-20171231ex321a212a5.htm |

| EX-31.2 - EX-31.2 - RE/MAX Holdings, Inc. | rmax-20171231ex3121c7b59.htm |

| EX-31.1 - EX-31.1 - RE/MAX Holdings, Inc. | rmax-20171231ex311291a35.htm |

| EX-23.1 - EX-23.1 - RE/MAX Holdings, Inc. | rmax-20171231ex23178fc52.htm |

| EX-21.1 - EX-21.1 - RE/MAX Holdings, Inc. | rmax-20171231ex211a5603c.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2017

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-36101

RE/MAX Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

|

80-0937145 |

|

(State or other jurisdiction of incorporation or organization) |

|

|

(I.R.S. Employer Identification Number) |

|

5075 South Syracuse Street Denver, Colorado |

|

|

80237 |

|

(Address of principal executive offices) |

|

|

(Zip code) |

(303) 770-5531

(Registrants’ telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Class A Common Stock, par value $0.0001 per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is well-known seasoned issuers, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, non-accelerated filer, or smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☒ |

|

Accelerated Filer ☐ |

|

Non-Accelerated Filer ☐ |

|

Smaller Reporting Company ☐ |

|

|

|

|

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2017, the last business day of the registrant’s most recently completed second quarter, the aggregate value of the registrant’s common stock held by non-affiliates was approximately $988.5 million, based on the number of shares held by non-affiliates as of June 30, 2017 and the closing price of the registrant’s common stock on the New York Stock Exchange on June 30, 2017. Shares of common stock held by each executive officer and director have been excluded since those persons may under certain circumstances be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of outstanding shares of the registrant’s Class A common stock, par value $0.0001 per share, and Class B common stock, par value $0.0001, as of February 28, 2018 was 17,696,991 and 1, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2017 Annual Meeting of Stockholders are incorporated into Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2017.

RE/MAX HOLDINGS, INC.

2017 ANNUAL REPORT ON FORM 10-K

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements are often identified by the use of words such as “believe,” “intend,” “expect,” “estimate,” “plan,” “outlook,” “project,” “anticipate,” “may,” “will,” “would” and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters. Forward-looking statements include statements related to:

|

· |

our ability to expand our network of franchises in both new and existing but underpenetrated markets; |

|

· |

our growth strategy of increasing our number of closed transaction sides and transaction sides per agent; |

|

· |

our future financial performance; |

|

· |

other plans and objectives for future operations, growth, initiatives, acquisitions or strategies, including investments in our information technology infrastructure; |

|

· |

our intention to repatriate cash generated by our Canadian operations to the U.S. on a regular basis in order to minimize the impact of currency gains and losses; |

|

· |

our ability to effectively implement and account for changes in U.S. tax laws, including the Tax Cuts and Jobs Act. |

|

· |

the implications of the Special Committee investigation and its impact of the findings and recommendations on us and our operations; |

|

· |

our remedial efforts and other measures in response to the outcome, findings and recommendations of the Special Committee investigation; and |

|

· |

our Board of Directors and management structure, including the roles of Adam Contos and the senior management team, the roles of David Liniger and of Richard Covey and the independent members of the Board of Directors. |

3

These and other forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed in “Item 1A.—Risk Factors” and in “Item 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Annual Report on Form 10-K.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law.

4

Overview

We are one of the world’s leading franchisors in the real estate industry, franchising real estate brokerages globally under the RE/MAX brand (“RE/MAX”) and mortgage brokerages within the U.S. under the Motto Mortgage brand (“Motto”). Our business is 100% franchised—we do not own any of the brokerages that operate under our brands. We focus on enabling our franchisees’ success by providing quality education and training, powerful technology, tools and support and valuable marketing to build the strength of the RE/MAX and Motto brands. Because our franchisees fund the cost of developing their brokerages, we maintain a low fixed-cost structure which, combined with our stable, recurring fee-based models, enables us to capitalize on the economic benefits of the franchising model, yielding high margins and significant cash flow.

Our History. RE/MAX was founded in 1973 with an innovative, entrepreneurial culture affording our agents and franchisees the flexibility to operate their businesses with great independence. In the early years of our expansion in the U.S. and Canada, we accelerated the brand’s growth by selling regional franchise rights to independent owners for certain geographic regions, a practice we still employ in countries outside of the U.S. and Canada. RE/MAX has held the number one market share in the U.S. and Canada combined since 1999, as measured by total residential transaction sides completed by our agents. Shares of our Class A common stock began trading on the New York Stock Exchange under the symbol “RMAX” on October 2, 2013. In October 2016, we launched Motto, the first national mortgage brokerage franchise offering in the United States.

Our Brands. RE/MAX. The RE/MAX strategy is to sell franchises to real estate brokers and help those franchisees recruit and retain the best agents. The RE/MAX brand is built on the strength of our global franchise network, which is designed to attract and retain the best-performing and most experienced agents by maximizing their opportunity to retain a larger portion of their commissions. As a result of our unique agent-centric approach, we have established a 45-year track record of helping millions of homebuyers and sellers achieve their goals, creating several competitive advantages in the process:

|

· |

Leading agent productivity. We believe that our agents are substantially more productive than the industry average. In fact, RE/MAX agents at large brokerages on average outsell competing agents more than two-to-one based on two surveys of the largest participating U.S. brokerages (the 2017 REAL Trends 500 and the RISMedia 2017 Power Broker Report). |

|

· |

Leading market share. Nobody in the world sells more real estate than RE/MAX, as measured by residential transaction sides. |

|

· |

Leading brand awareness. The RE/MAX brand has the highest level of unaided brand awareness in real estate in the U.S. and Canada according to a consumer study conducted by MMR Strategy Group, and our iconic red, white and blue RE/MAX hot air balloon is one of the most recognized real estate logos in the world. |

5

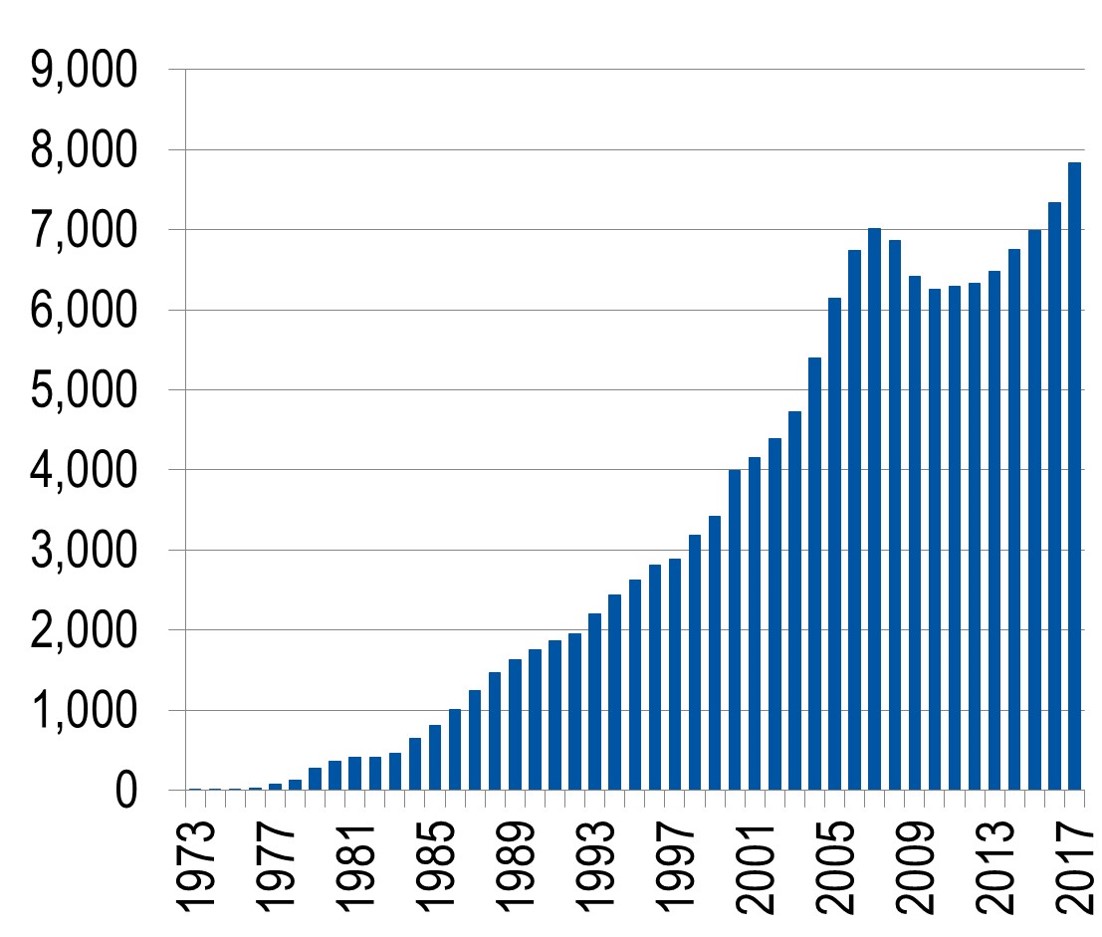

The majority of our revenue—65% in 2017—is derived from fixed, contractual fees and dues paid to us based on the number of agents in our franchise network, so agent count is a key measure of our business performance. Today, the RE/MAX brand has over 115,000 agents operating in over 7,000 offices, and a presence in more than 100 countries and territories—a global footprint bigger than any other real estate brokerage brand in the world.

|

119,041 Agents |

7,841 Offices |

114 Countries and Territories |

As of December 31, 2017.

Motto Mortgage. The Motto concept offers U.S. real estate brokers access to the mortgage brokerage business, which is highly complementary, and a model designed to help Motto franchise owners comply with all relevant mortgage regulations. Motto offers potential homebuyers an opportunity to find both real estate agents and independent Motto loan originators at offices in one location. Further, Motto loan originators provide home-buyers with financing choices by providing access to a variety of quality loan options from multiple leading wholesale lenders. Motto franchisees are mortgage brokers and not mortgage bankers; as a result, Motto franchisees do not fund any loans. Likewise, we franchise the Motto system and are not lenders or brokers.

Motto’s fee model consists of fixed, contractual fees paid monthly on a per-office basis by the broker for being a part of the Motto network and for use of the Motto brand, and from sales of individual franchises. We believe it will generally take 14 to 17 months after the sale of a Motto franchise for a franchisee to ramp up to paying a full set of monthly fees. Consequently, although 31 of the 68 Motto franchises sold from inception to December 31, 2017 were operational as of December 31, 2017, we recognized minimal fee-based revenue from Motto in 2017. We remain focused on enabling the success of these initial franchises, which in turn we believe will serve as concept validators. Motto franchisees should profit by attracting and retaining professional, highly productive loan originators who provide superior client service and value. We will not be compensated based on the volume of loans completed by a franchise; the franchisee retains all upside in the volume of loans completed by a given Motto loan originator or franchise.

Industry Overview and Trends

We are a franchisor of businesses in two facets of the real estate industry—real estate brokerages and mortgage brokerages. With approximately 95% of our revenue and nearly three-quarters of our RE/MAX agent count coming from our franchising operations in the U.S. and Canada, we are significantly affected by the real estate market in the U.S. and Canada.

The U.S. and Canadian Real Estate Industry Are Large Markets. The U.S. residential real estate industry is an approximately $1.83 trillion market based on 2017 sales volume, according to U.S. Census Bureau data and existing home sales information from the National Association of Realtors (“NAR”). Residential real estate represents the largest single asset class in the U.S. with a value of approximately $24.2 trillion, according to the Federal Reserve. Canadian home sales totaled approximately CA$262 billion in 2017, according to the Canadian Real Estate Association (“CREA”).

6

How Brokerages Make Money. Residential real estate brokerages typically realize revenue by charging a commission based on a percentage of the price of the home sold and/or by charging their agents, who are independent contractors, fees for services rendered. The real estate brokerage industry generally benefits in periods of rising home prices and transaction activity (with the number of licensed real estate agents generally increasing during such periods), and is typically adversely impacted in periods of falling prices and home sale transactions (with the number of licensed real estate agents generally decreasing during such periods).

Residential mortgage brokerages typically realize revenue by charging fees for their service, which is based on a percentage of the mortgage loan amount. The mortgage brokerage industry generally benefits from periods of increasing home sales activity, as this generally results in increased purchase-money mortgage originations (loans that arise during the initial sale of a house), and periods when homeowners refinance to take advantage of lower interest rates. The mortgage brokerage industry is usually adversely impacted in periods of decreasing home sales activity, as this results in less purchase-money mortgage originations, and periods of less favorable interest rates making homeowners less likely to refinance.

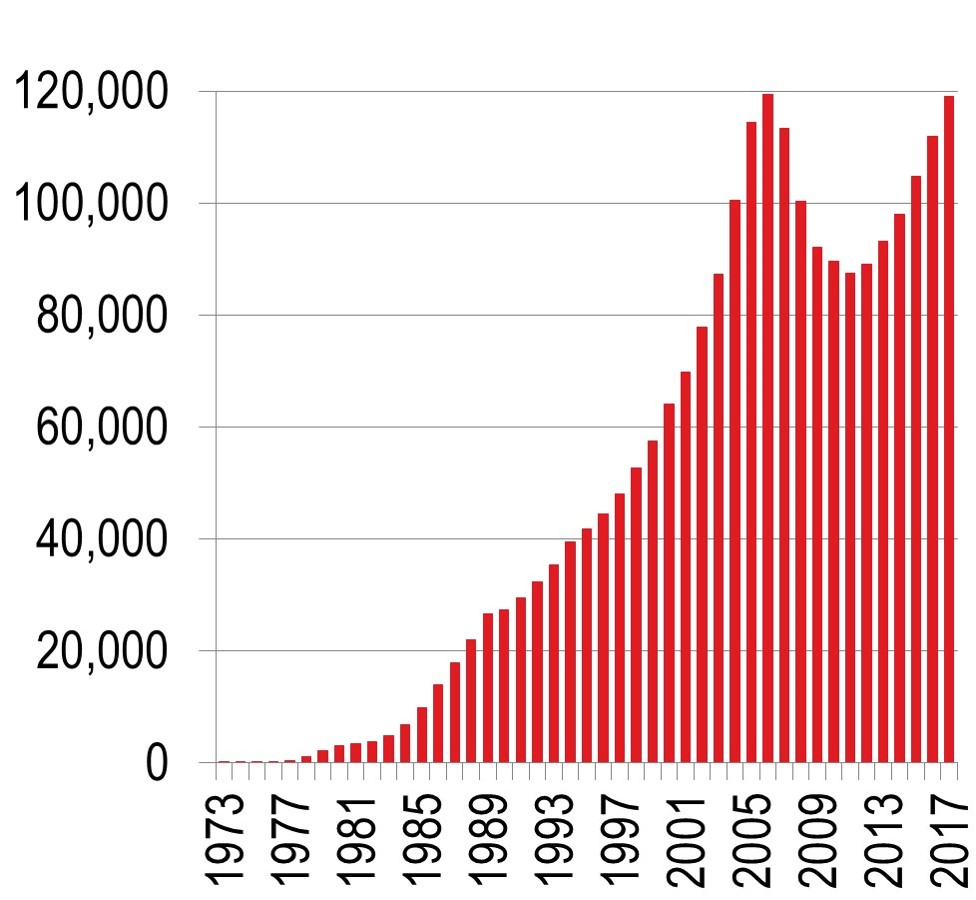

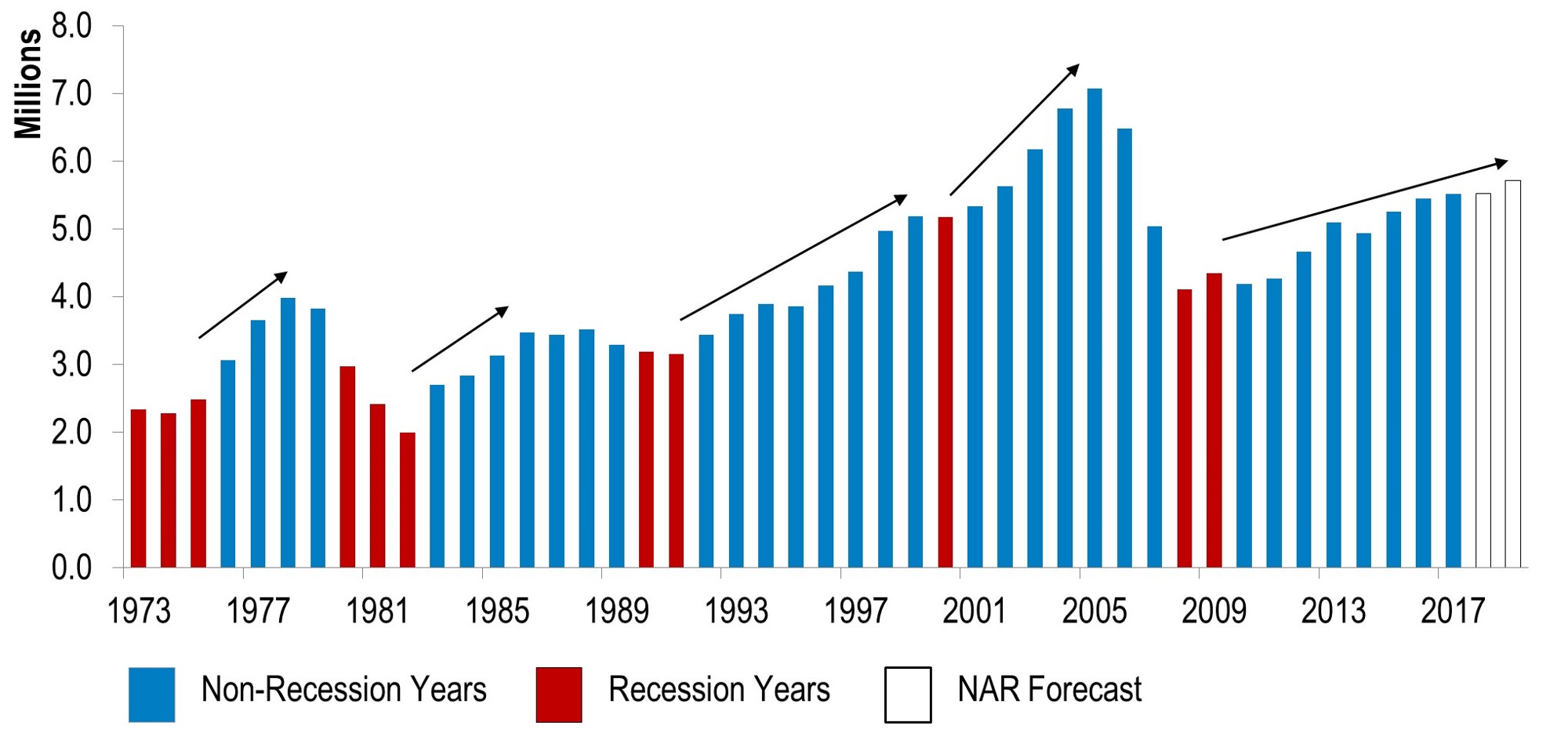

The Residential Real Estate Industry is Cyclical in Nature. The residential real estate industry is cyclical in nature but has shown strong long-term growth. As illustrated below, the number of existing home sales transactions in the U.S. has generally increased during periods of economic growth:

U.S. Existing Home Sales

In Canada, the downturn from 2005 through 2011 was mild by comparison to that of the U.S. for the same period. Canadian home sales were up 5.5% in 2015 and 6.3% in 2016, but declined 4.0% in 2017 and are forecasted to decline 5.3% in 2018, according to CREA.

We believe we remain well-positioned to benefit from the growing U.S. economy and housing sector and the relatively healthy Canadian economy and housing sector.

7

U.S. Housing Trends. According to the 2017 Nation’s Housing Report (the “Report”) compiled by the Joint Center for Housing Studies, the U.S. housing market is finally returning to normal almost a decade after the onset of the Great Recession. The U.S. housing industry has strengthened, but the recovery has been uneven across all markets and pressures remain, particularly in the areas of inventory and affordability. Housing prices have, in many markets, reached or surpassed previous peaks. Homebuilding, while steadily improving over the last several years, has lagged relative to historical levels contributing to an overall deficit in supply. According to the Report, housing completions in the ten-year period ended 2016 totaled 9.0 million units, more than 4.0 million units less than the next-worst 10-year period dating back to the late 1970s. Household formation growth has increased demand for housing, contributing to home sales price gains outstripping wage growth and pressuring overall affordability. Other notable U.S. housing trends include:

|

· |

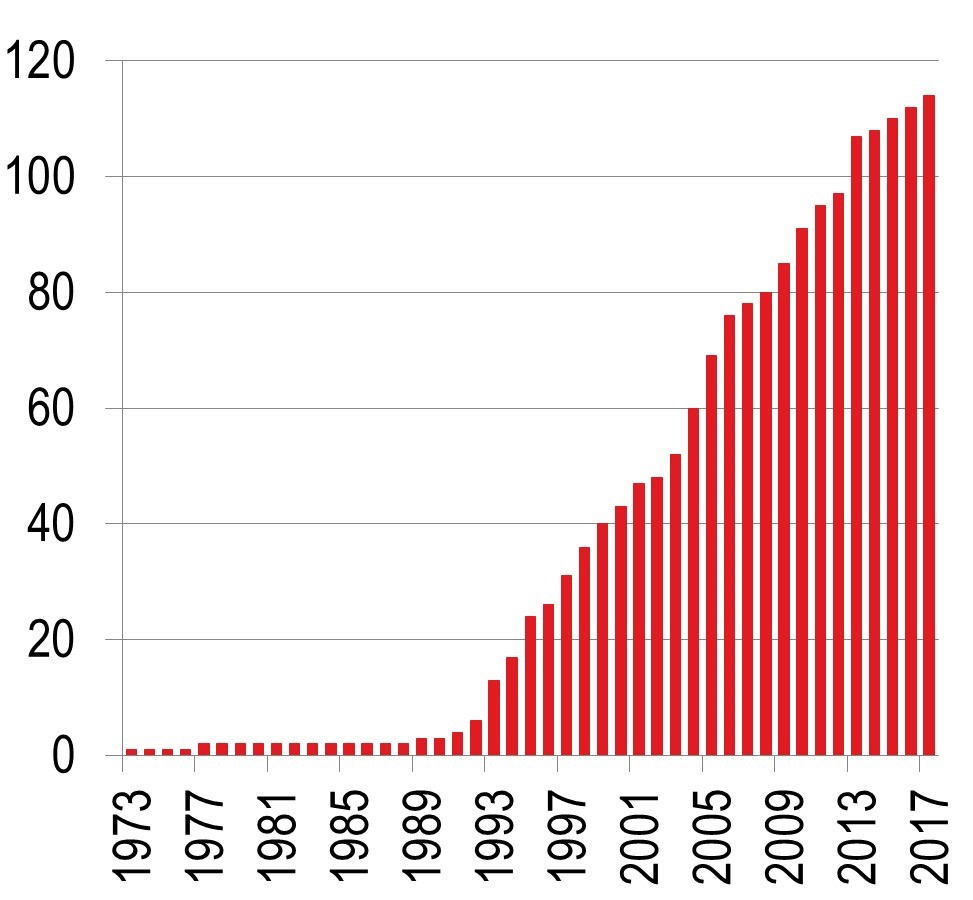

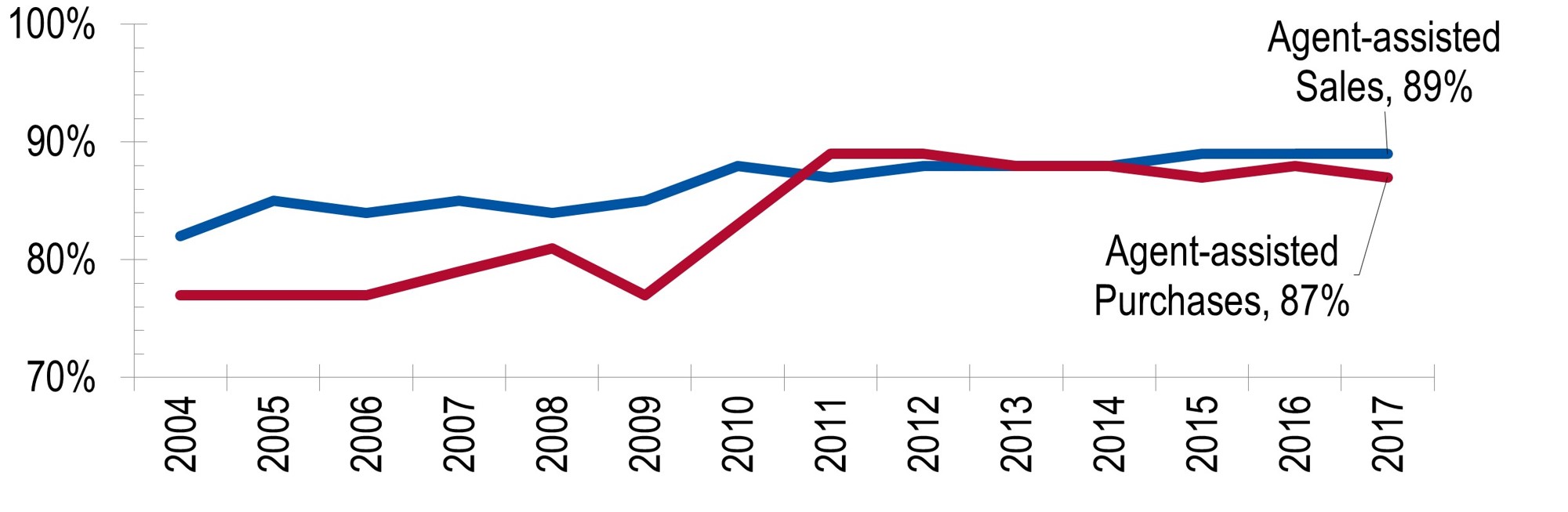

Almost 90% of all U.S. homebuyers and sellers use an agent – About 89% of sellers and 87% of purchasers were represented by a real estate agent in 2017, according to NAR data. These figures have climbed over the last decade and a half—a period of time during which technology has materially changed the typical home-buying or -selling transaction: |

Percentage of Home Buyers and Sellers Using an Agent

Source: NAR Profile of Home Buyers and Sellers

|

· |

The number of agents entering the industry is increasing – At the end of 2017, NAR membership was trending to surpass its all-time record of 1.37 million members established in 2006. Typically, during periods of expansion in the housing cycle, the numbers of agents entering the industry increase as the barriers to entry are relatively low. Many of the recent entrants are new to the profession. In fact, NAR reported in 2017 that 20% of its members had been licensed less than one year, a quadrupling of the percentage from just four years ago. At RE/MAX, our model is not for everyone. We focus our brokers on the importance of attracting and retaining highly productive agents and those who aspire to learn and produce more. Consequently, our agent growth rate in the U.S. can lag that of NAR. For example, our U.S. agent count grew 4.9% in 2015, 3.0% in 2016, and 2.3% in 2017 whereas NAR’s membership grew 6.2% in 2015, 5.7% in 2016 and 6.1% in 2017. |

|

· |

Competition for agents and listings remains fierce – Competition for agents, especially highly productive agents, and listings has always been fierce and today is no different. Franchisors and brokers are continually refining and fine-tuning their economic models in order to craft what they believe to be the most compelling value proposition in order to attract and retain the most productive agents and to capture consumer listings. The year 2017 was even more heated in this regard as the industry witnessed a significant increase in capital invested in relatively newer entrants to our industry, resulting in many well-financed competitors offering a wide variety of business models. See Competition for additional discussion. |

8

|

· |

The importance of technology continues to increase – We believe industry market participants will continue to focus on technology investments as evidenced by increased amounts of capital flowing into the industry. We believe mobile platforms, artificial intelligence and predictive analytics are increasingly becoming a point of focus as the industry looks to use technological advancements to simplify and streamline the oftentimes complicated process of buying and selling a home. In response, many established brokers are starting to favor proprietary technology as opposed to purchasing it from third parties. On February 26, 2018, RE/MAX, LLC acquired certain assets of booj, a real estate technology company, in order to deliver core technology solutions designed for and with RE/MAX affiliates. We expect to continue to invest meaningfully in technology as we seek to enhance our overall value proposition to our brokers, agents and consumers. |

Canadian Housing Trends. The year 2017 saw the single-family detached home and condo markets diverge on distinctly different paths in Canada’s two highest-priced real estate markets, Greater Vancouver and the Greater Toronto Area. The trend is expected to continue into 2018 as a mix of relative affordability for condo units and price appreciation for detached homes in recent years, combined with government policy changes in both markets, has helped push an influx of buyers toward condo ownership. According to a survey conducted by Leger on behalf of RE/MAX, the appetite for home ownership remains strong with roughly half of Canadians (48 percent) considering the purchase of a home in the next five years. In order to find a balance between the home features they’re looking for and affordability, many buyers are continuing to look at real estate markets outside of the country’s largest urban centers. The Royal Bank of Canada projects the average residential sale price for Canada will increase 2.2 percent in 2018, which is indicative of how the desire for home ownership remains strong, particularly among Canadian millennials.

Much of the activity in regional markets across Ontario was fueled by price appreciation in Toronto during the first four months of the year prior to the introduction of the provincial government’s Fair Housing Plan. The 16-point plan introduced a 15 percent non-resident speculation tax, which slowed demand from overseas buyers in the upper-end of the market. The policy changes as a whole curtailed activity significantly for single-family detached homes throughout the Greater Toronto Area in the short-term. New mortgage qualification rules that come into effect on January 1, 2018 also impacted housing market activity toward the end of 2017. It is expected that the new mortgage stress test will slow activity across Canada during the first part of 2018. In November 2017, the Bank of Canada predicted that the new regulations could disqualify up to 10 percent of prospective home buyers who have down payments of 20 percent or more.

Favorable Long-Term Demand. We believe long-term demand for housing in the U.S. is driven by many factors including the economic health of the domestic economy, demographic trends, affordability, interest rates and local factors such as demand relative to supply. We also believe the residential real estate market in the U.S. will benefit from fundamental demographic shifts over the long term, including:

|

· |

An increase in demand from rising household formations, including as a result of immigration, population growth and wealth accumulation and wage growth of minorities. According to the Report, U.S. household formation averaged only 0.5 million to 0.7 million annually in 2007-2012, well below historic levels, but has since recovered and is projected to reach 13.6 million between 2015 and 2025, approximately in line with the increase in the 1990s. Likewise, the U.S. Census Bureau projects that the U.S. will continue to experience long-term population growth and predicts net immigration of 30 million individuals from 2014 to 2050. |

|

· |

An increase in demand from generational shifts. We believe there is pent-up selling demand from generational shifts, such as many retirement age homeowners, from the “baby boom” generation, who are likely to take advantage of improved housing market conditions in order to sell their existing residences and retire in new areas of the country or purchase smaller homes. Similarly, we also believe there is pent-up buying demand among adults in the millennial generation, currently the nation’s largest living generation. The millennial generation is moving into their prime home-buying years as they form households and are supported by strong employment, relatively low interest rates, and rising consumer confidence to purchase a home. |

9

The Long-Term Value Proposition for Real Estate Brokerage Services. We believe the traditional agent-assisted business model compares favorably to alternative channels of the residential brokerage industry, such as discount brokers, “for sale by owner” listings, and lower-fee brokerages catering to consumers who use technology for some of the services traditionally provided by brokers, because full-service brokerages are best suited to address many of the key characteristics of real estate transactions, including:

|

(i) |

the complexity and large monetary value involved in home sale transactions, |

|

(ii) |

the infrequency of home sale transactions, |

|

(iii) |

the high price variability in the home market, |

|

(iv) |

the intimate local knowledge necessary to advise clients on neighborhood characteristics, |

|

(v) |

the unique nature of each particular home, and |

|

(vi) |

the consumer’s need for a high degree of personalized advice and support in light of these factors. |

For these reasons, we believe that consumers will continue to use the agent-assisted model for residential real estate transactions. In addition, although listings are available for viewing on a wide variety of real estate websites, we believe an agent’s local market expertise provides the ability to better understand the inventory of for-sale homes and the interests of potential buyers. This knowledge allows the agent to customize the pool of potential homes they show to a buyer, as well as help sellers to present their home professionally to best attract potential buyers.

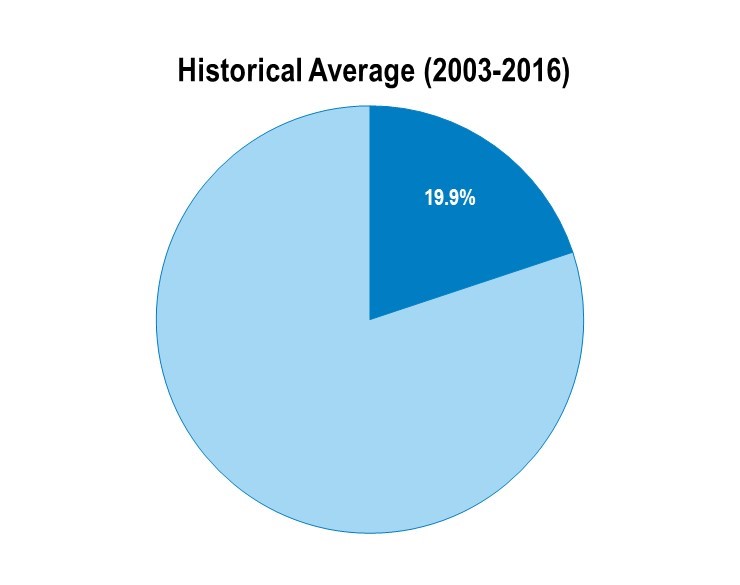

The Long-Term Value Proposition for Mortgage Brokerage Services. Likewise, we believe mortgage brokers provide a valuable “concierge” service for consumers. Mortgage brokers are familiar with the latest loan programs and choices available through various wholesale lenders. A professional mortgage broker can introduce consumers to loan programs from several lenders, providing choice and information consumers may be unlikely to locate on their own. The percentage of mortgage originations handled by mortgage brokerages was, in 2017, substantially below historical levels, which we believe indicates the potential for growth in the mortgage brokerage production channel.

Mortgage Brokerage Share of Mortgage Originations

|

|

|

Source: Inside Mortgage Finance Publications, Inc. © 2017 Used with permission.

10

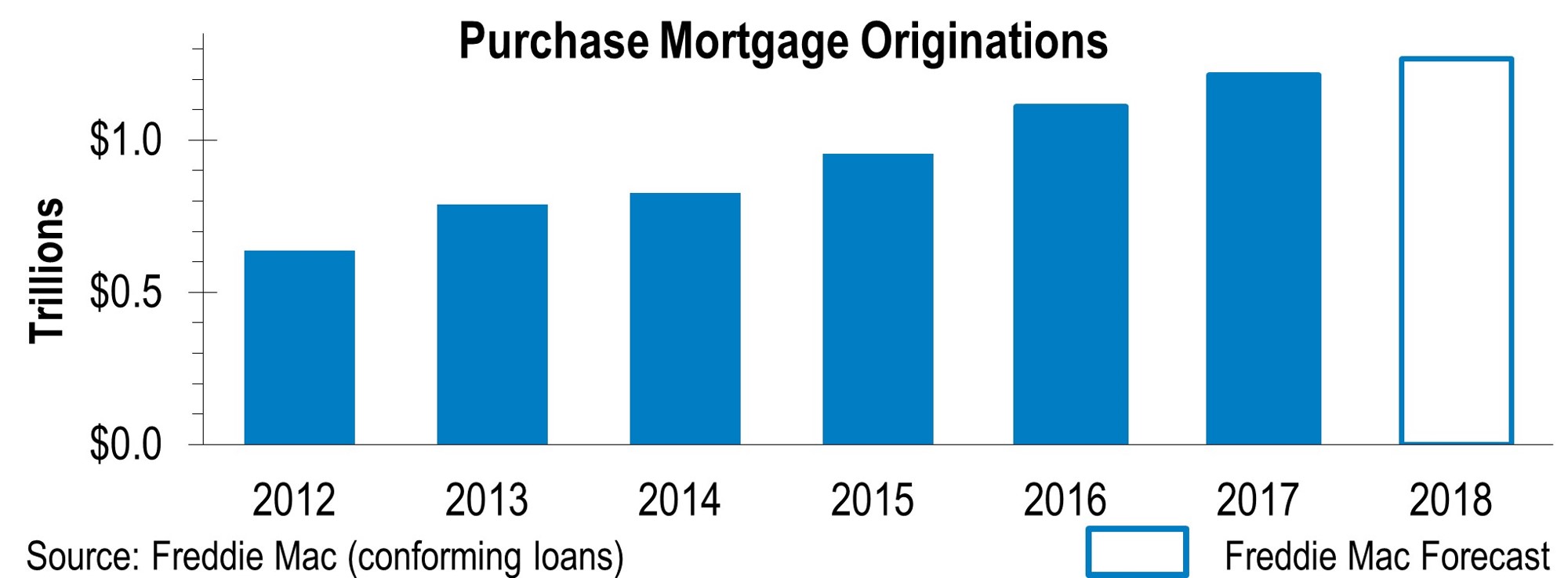

Moreover, according to Federal Home Loan Mortgage Corporation (known as “Freddie Mac”), purchase-money originations are expected to increase gradually in the next few years. Such increases in mortgage originations would provide a growth opportunity for the Motto franchise.

Purchase-money mortgage originations correlate to the overall number of home sales and home prices. Home purchases are driven primarily by the buyer’s personal and professional circumstances, whereas refinances depend mainly upon interest rates, because they primarily occur when homeowners see the opportunity to take advantage of improved interest rates.

Our Franchise Model and Offering

Introduction to Franchising. Franchising is a distributed model for licensing the use of the franchisor’s system and brand. In return, the franchisee retains ownership and sole responsibility for the local business, and therefore the substantial portion of the profits it generates and its risks. The successful franchisor provides its franchisees, i) a unique product or service offering; ii) a distinctive brand name, and as the system gains market share, the favorable consumer recognition that brand comes to symbolize; iii) training, productivity tools and technology to help franchisees operate their business effectively, efficiently, and successfully; and iv) group purchasing power of the franchise system to obtain favorable prices for supplies, advertising, and other tools and services necessary in the operation of the business. Because franchising involves principally the development and licensing of intellectual property, and the costs of retail space and employees are borne by the individual unit owner, it is a low fixed-cost structure typified by high gross margins, allowing the franchisor to focus on innovation, franchisee training and support, and marketing to grow brand reputation.

The REMAX “Agent-Centric” Franchise Offering. We believe that our “agent-centric” approach is a compelling offering in the real estate brokerage industry, and it enables us to attract and retain highly effective agents and motivated franchisees to our network and drive growth in our business and profitability. Our franchise model provides the following combination of benefits to our franchisees and agents:

|

· |

High Agent Commission Fee Split and Low Franchise Fees. The RE/MAX high commission split concept is a cornerstone of our model and, although not unique, differentiates us in the industry. That differentiation is most evident when our brand advantages and services are factored in as part of the concept. We recommend to our franchisees an agent-favorable commission split of 95%/5%, in exchange for the agent paying fixed fees to share the overhead and other costs of the brokerage. This model allows high-producing agents to earn a higher commission compared to traditional brokerages where the broker typically takes 30% to 40% of the agent’s commission. |

|

· |

Affiliation with the Best Brand in Residential Real Estate. With number one market share in the U.S. and Canada combined as measured by total residential transaction sides completed by our agents, and leading unaided brand awareness in the U.S. and Canada, according to a consumer study by MMR Strategy Group, we reinforce brand awareness through marketing and advertising campaigns that are supported by our franchisees’ and agents’ local marketing. |

|

· |

Entrepreneurial, High-Performance Culture. Our brand and the economics of our model generally attract driven, professional, highly productive agents, and we allow them autonomy to run their businesses independently, including, generally, the freedom to set commission rates and oversee local advertising. |

11

|

· |

Sophisticated Technology, including High Traffic Websites Supporting Lead Referral Systems. Remax.com was the most visited real estate franchisor website during 2017, according to Hitwise data. When a prospective buyer inquires about a property displayed on our websites, a RE/MAX agent receives this lead through our lead referral system, LeadStreet®, without a referral fee. LeadStreet® sends approximately one million free leads to our agents a year. We believe that no other national real estate brand provides their agents comparable access to free leads. |

|

· |

RE/MAX University® Training Programs. RE/MAX University® offers on-demand access to industry information and advanced training in areas such as distressed properties, luxury properties, senior clients, buyer agency and many other specialty areas of real estate. |

|

· |

RE/MAX Approved Supplier Program. Using the collective buying power of our franchise network, a network of preferred suppliers provide group discount prices, marketing materials that have been pre-vetted to comply with RE/MAX brand standards and higher quality materials that may not be cost-effective to procure on an individual office basis. These vendors provide us additional revenue in return for marketing access to our network of franchisees and agents. |

We attribute our success to our ability, by providing this unique, agent-centric suite of benefits, to recruit and retain highly productive agents and motivated franchisees. Our goal is to continue a self-reinforcing cycle that we call “Premier Market Presence,” whereby recruiting agents and franchisees helps achieve a network effect to further enhance our brand and market share, expand our franchise network and support offerings, and ultimately grow our revenue, as illustrated below:

RE/MAX Four-Tier Franchise Structure. We are a 100% franchised business, with all of the RE/MAX branded brokerage office locations being operated by franchisees. We franchise directly in the U.S. and Canada, in what we call “Company-owned Regions.” Brokerage offices, in turn, enter into independent contractor relationships with real estate sales associates who represent real estate buyers and sellers. In the early years of our expansion in the U.S. and Canada, we sold regional franchise rights to independent owners for certain geographic regions (“Independent Regions”), pursuant to which those Independent Regions have the exclusive right to sell franchises in those regions. In recent years, we have pursued a strategy to reacquire those regional franchise rights from Independent Regions in the U.S. and Canada.

12

The following depicts our franchise structure and the location of our Company-owned versus Independent Regions:

|

Tier |

|

Description |

|

Services |

|

|

Franchisor RE/MAX, LLC |

|

Owns the right to the RE/MAX brand and sells franchises and franchising rights. |

|

Brand Equity Market Share Advertising Marketing Strategies Corporate Communications |

|

|

|

Independent Regional Franchise Owner

|

|

Owns rights to sell brokerage franchises in a specified region. Typically, 20-year agreement with up to three renewal options. RE/MAX, LLC franchises directly in Company-owned Regions, in the rest of the U.S. and Canada. |

|

Local Services Regional Advertising Franchise Sales In Company-owned Regions, RE/MAX, LLC performs these services. |

|

Franchisee (Broker-Owner) |

|

Operates a RE/MAX-branded brokerage office, lists properties and recruits agents. Typically, 5-year agreement. |

|

Office Infrastructure Sales Tools / Management Broker of Record |

|

|

Agent (Sales Associate) |

|

Branded independent contractors who operate out of local franchise brokerage offices. |

|

Represents real estate buyer or seller Typically sets own commission rate |

|

|

Company-owned Regions |

|||

|

Independent Regions |

In general, the franchisees (or broker-owners) do not receive an exclusive territory except under certain limited circumstances. Prior to opening an office, a franchisee or principal owner is required to attend a four- to five-day training program at our global headquarters. Prospective franchisees, renewing franchisees, and transferees of a franchise are subject to a criminal background check and must meet certain standards, including those related to relevant experience, education, licensing, background, financial capacity, skills, integrity and other qualities of character.

13

RE/MAX Marketing and Promotion. We believe the widespread recognition of the RE/MAX brand and our iconic red, white and blue RE/MAX hot air balloon logo and property signs is a key aspect of our value proposition to agents and franchisees. A variety of advertising, marketing and promotion programs build our brand and generate leads for our agents, including leading websites such as remax.com, advertising campaigns using television, digital marketing, social media, print, billboards and signs, and appearances of the well-known RE/MAX hot-air balloon. In 2017, RE/MAX branding was updated with a fresh, modern design. This “brand refresh” resulted in updates to the iconic RE/MAX Balloon logo, the RE/MAX logotype, and RE/MAX property sign designs. In the company’s 45 year history, this is the first time the RE/MAX logotype has been modernized and the third time the RE/MAX Balloon logo has been updated.

Event-based marketing programs, sponsorships, sporting activities and other similar functions also promote our brand. These include our support, since 1992 for Children's Miracle Network Hospitals in the U.S. and Children's Miracle Network in Canada, to help sick and injured children. Through the Miracle Home program, participating RE/MAX agents donate to Children's Miracle Network Hospitals once a home sale transaction is complete.

Our agents and franchisees fund nearly all of the advertising, marketing and promotion supporting the RE/MAX brand, which, in the U.S. and Canada, occurs primarily on three levels:

|

· |

Local Campaigns. Our franchisees and agents engage in extensive promotional efforts within their local markets to attract customers and drive agent and brand awareness locally. These programs are subject to our brand guidelines and quality standards for use of the RE/MAX brand, but we allow our franchisees and agents substantial flexibility to create advertising, marketing and promotion programs that are tailored to local market conditions. |

|

· |

Regional Advertising Funds. Regional advertising funds primarily support advertising campaigns to build and maintain brand awareness at the regional level. The regional advertising funds in Company-owned Regions are funded by our agents through fees that our brokers collect and pay to the regional advertising funds. These regional advertising funds in Company-owned Regions are corporations owned by our controlling stockholder, and the use of the fund balances is restricted by the terms of our franchise agreements. Therefore, the regional advertising fund entities are excluded from our consolidated financial statements. Franchisee contributions to the regional advertising funds in Company-owned Regions were $67.4 million for their fiscal year ended January 31, 2018. The RE/MAX brand is promoted in Independent Regions by other regional advertising funds. |

|

· |

Pan-Regional Campaigns. The regional advertising funds in Company-owned Regions, together with some or all of the advertising funds in Independent Regions, may contribute to national or pan-regional creative development and media purchases, to promote a consistent brand message and achieve economies of scale in the purchase of advertising. |

The Motto Mortgage Brokerage Model. Through our Motto business, we are a mortgage brokerage franchisor, not a lender or mortgage broker. Our franchisees are brokers, not lenders, and so neither we nor our franchisees fund any loans. As a franchisor, we help our Motto franchisees establish independent mortgage brokerage companies, with a model designed to comply with all relevant regulations. The technology, training, marketing, tools and other services that we provide to Motto franchisees have been designed to enable real estate brokers—both RE/MAX franchisees and other real estate brokers—to overcome the barriers to enter the mortgage business. Pairing a Motto franchise with a real estate brokerage lets homebuyers enjoy an enhanced, coordinated, convenient and simplified experience with a professional real estate agent to find a home and with a Motto loan originator to secure financing from among several quality financing options. Because Motto’s emphasis is on proximity to real estate brokerages and marketing to home-buying customers, we believe our franchisees are well-positioned to benefit from gradually increasing home sales and by extension, a gradually increasing purchase-money mortgage origination market. We believe this convenience should be a differentiator for real estate agents, which we believe will result in enhanced customer satisfaction and customer loyalty, which is essential for a successful, professional, real estate agent. There are not presently any other national mortgage brokerage franchisors in the United States.

Our Motto Mortgage brokerage franchise business, Motto Franchising, LLC offers seven-year agreements with franchisees. Motto sells franchises directly throughout the U.S. as there are no regional franchise rights in the Motto system. Loan Originators at Motto franchises are typically employees of the franchisee and not independent contractors.

14

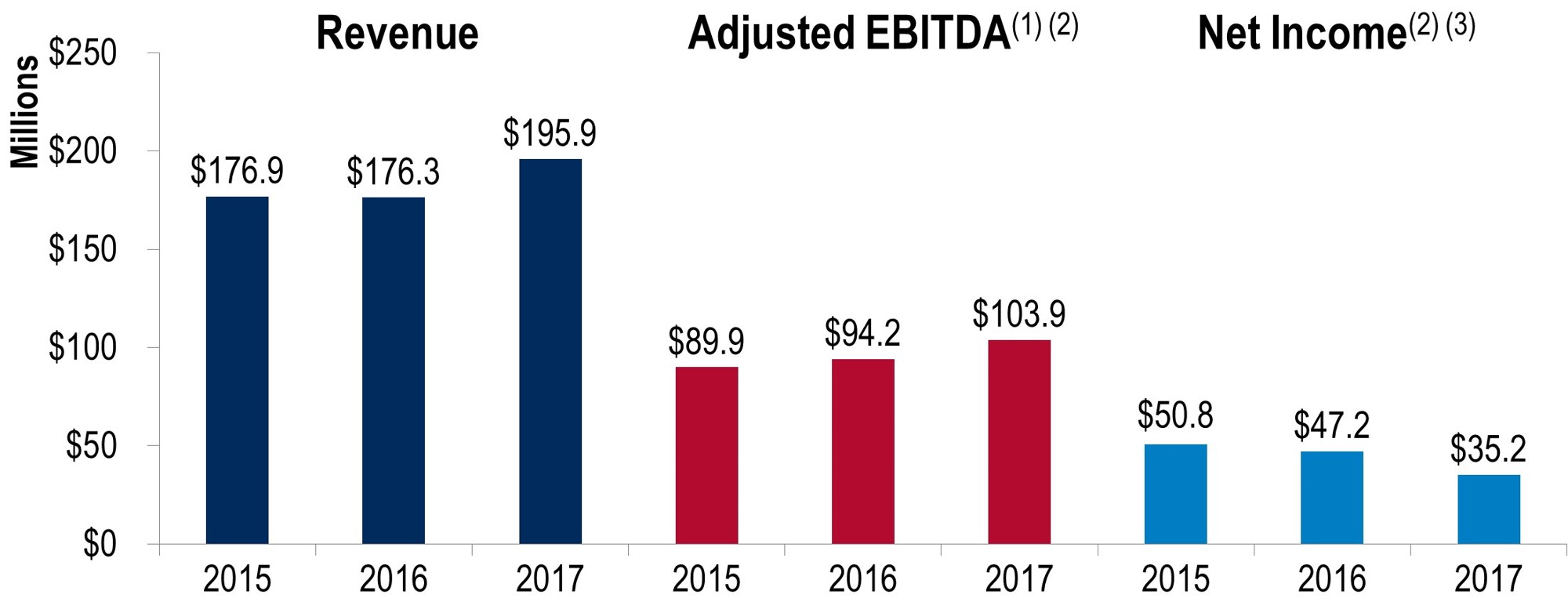

Financial Model

As a franchisor, we maintain a low fixed-cost structure. In addition, our stable, fee-based model derives a majority of our revenue from recurring fees paid by our agents, franchisees and regional franchise owners. This combination helps us drive significant operating leverage through incremental revenue growth, yielding significant cash flow.

|

(1) |

Adjusted EBITDA is a non-GAAP measure of financial performance that differs from U.S. Generally Accepted Accounting Principles. See “Item 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion of Adjusted EBITDA and a reconciliation of the differences between Adjusted EBITDA and net income. |

|

(2) |

Excludes adjustments attributable to the non-controlling interest. See "Corporate Structure and Ownership” below. |

|

(3) |

Prior period amounts reflect an immaterial correction recorded for the years ended December 31, 2016 and 2015. See Note 18, Immaterial Corrections to Prior Period Financial Statements for additional information. |

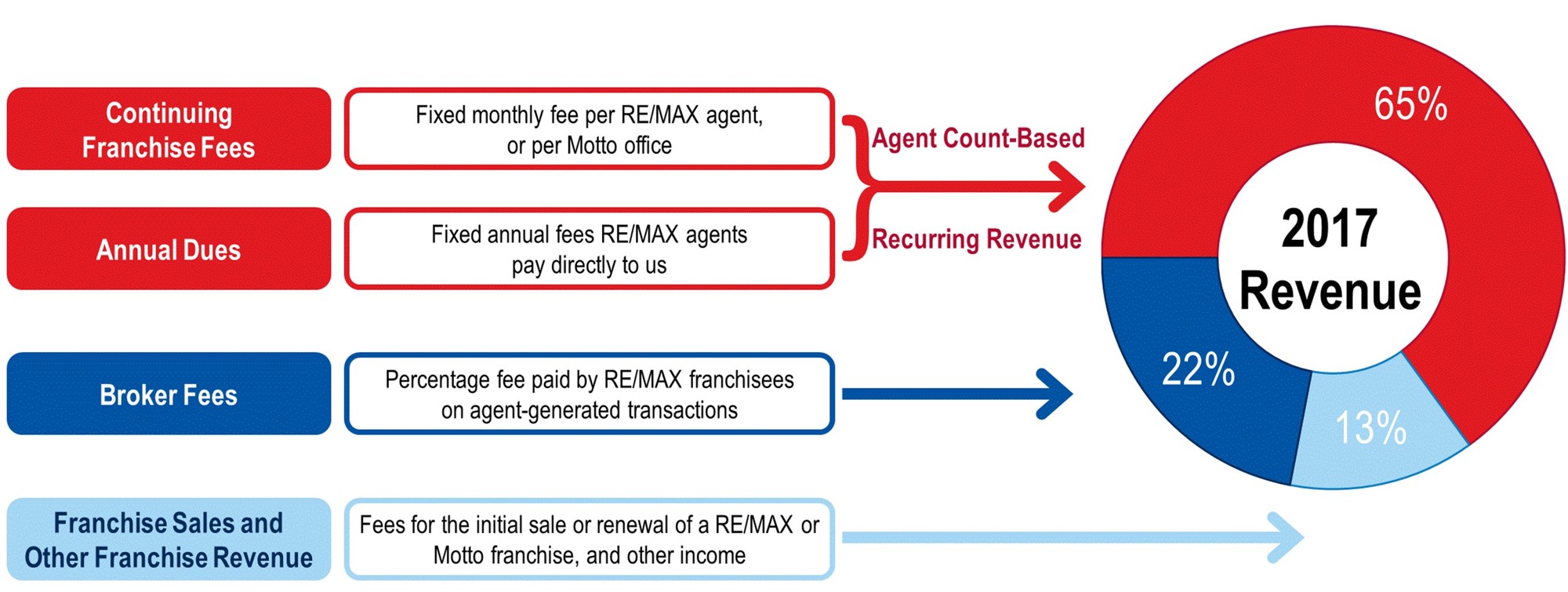

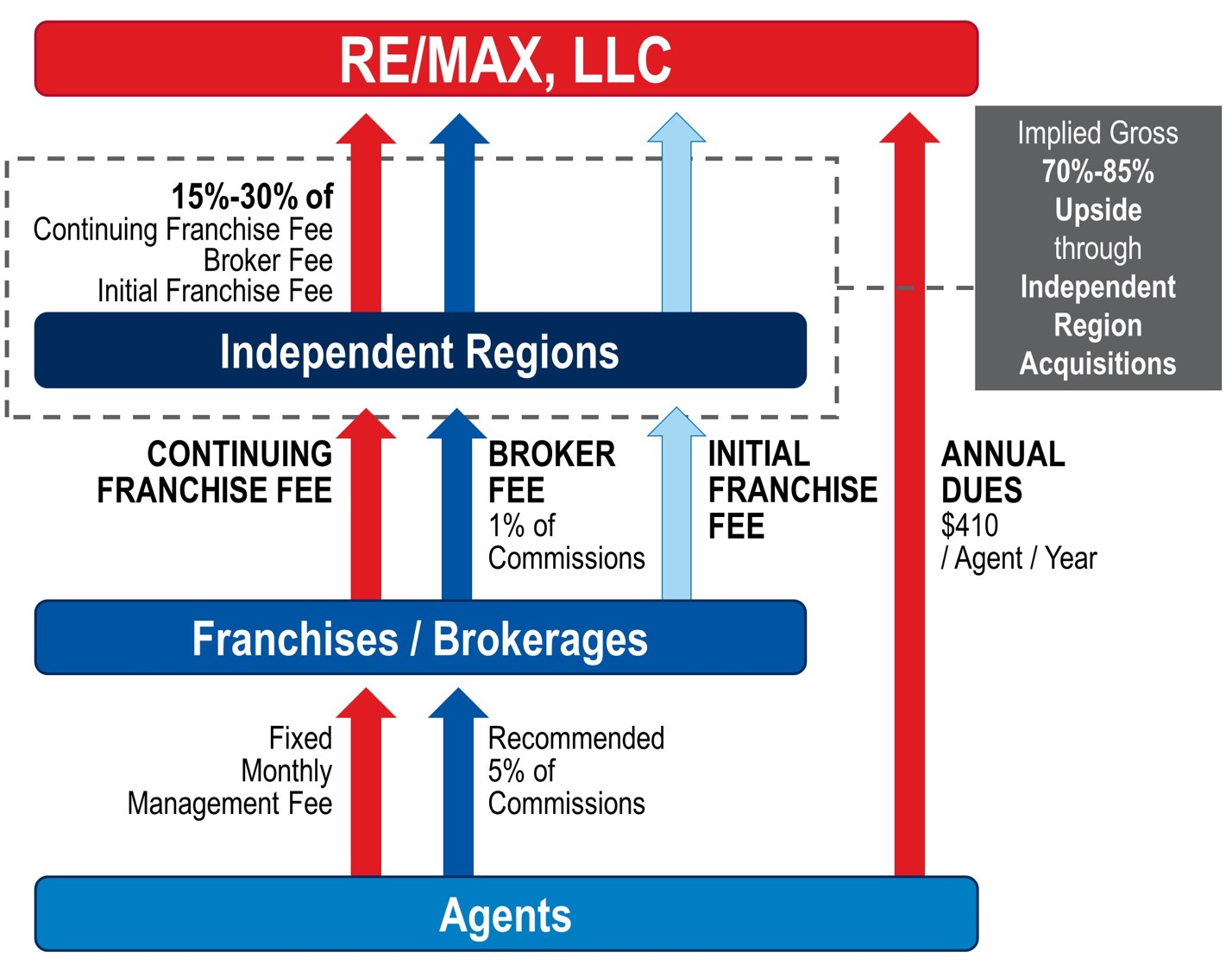

Revenue Streams. The chart below illustrates our revenue streams:

Revenue Streams as Percentage of 2017 Total Revenue

The amount of the various fee types received by RE/MAX will vary significantly depending on whether coming from Company-owned regions, Independent Regions, or global regions, with the greatest amounts in Company-owned regions. See discussion of revenue per agent below.

Continuing Franchise Fees. Continuing franchise fees are fixed contractual fees paid monthly by regional franchise owners in Independent Regions or franchisees in Company-owned Regions to RE/MAX based on their number of agents. Likewise, Motto continuing franchise fees are fixed contractual fees paid monthly by Motto franchisees.

Annual Dues. Annual dues are the membership fees that agents pay directly to us to be a part of the RE/MAX network and use the RE/MAX brand. Annual dues are currently a flat fee per agent paid annually. Motto franchisees do not pay annual dues.

15

Broker Fees. Broker fees are assessed to the RE/MAX broker against real estate commissions paid by customers when an agent sells a home. Generally, the amount paid by broker-owners to the master or regional franchisor, which we refer to as the “broker fee,” is 1% of the total commission on the transaction, although the percentage can vary based on the specific terms of the broker fee agreement. The amount of commission collected by brokers is based primarily on the sales volume of RE/MAX agents, home sale prices in such sales and real estate commissions earned by agents on these transactions. Broker fees, therefore, vary based upon the overall health of the real estate industry and the volume of existing home sales. Additionally, agents in Company-owned Regions existing prior to 2004, the year we began assessing broker fees, are generally “grandfathered” and continue to be exempt from paying a broker fee. As of December 31, 2017 grandfathered agents represented approximately 20% of total agents in U.S. Company-owned regions. Consistent with the trend that we have already noted, we expect that over time, exempt agents will be replaced by new agents who will pay broker fees, which will have a positive impact on our broker fee revenue independent of changes in agent count, sales volume and home sale prices. Motto franchisees do not pay any fees based on the number or dollar value of loans brokered.

Franchise Sales and Other Franchise Revenue. Franchise sales and other franchise revenue primarily consists of:

|

· |

Franchise Sales: Revenue from sales and renewals of individual franchises in RE/MAX Company-owned Regions, Independent Regions, and Motto, as well as RE/MAX regional and country master franchises for Independent Regions in global markets outside of North America (“Global Regions”). We receive only a portion of the revenue from the sales and renewals of individual franchises from Independent and Global Regions. |

|

· |

Other Franchise Revenue: Revenue from preferred marketing arrangements (flat fee) and approved supplier programs with third parties (percentage of revenue from products and services sold to RE/MAX agents), as well as event-based revenue from training and other programs, including our annual convention in the U.S. |

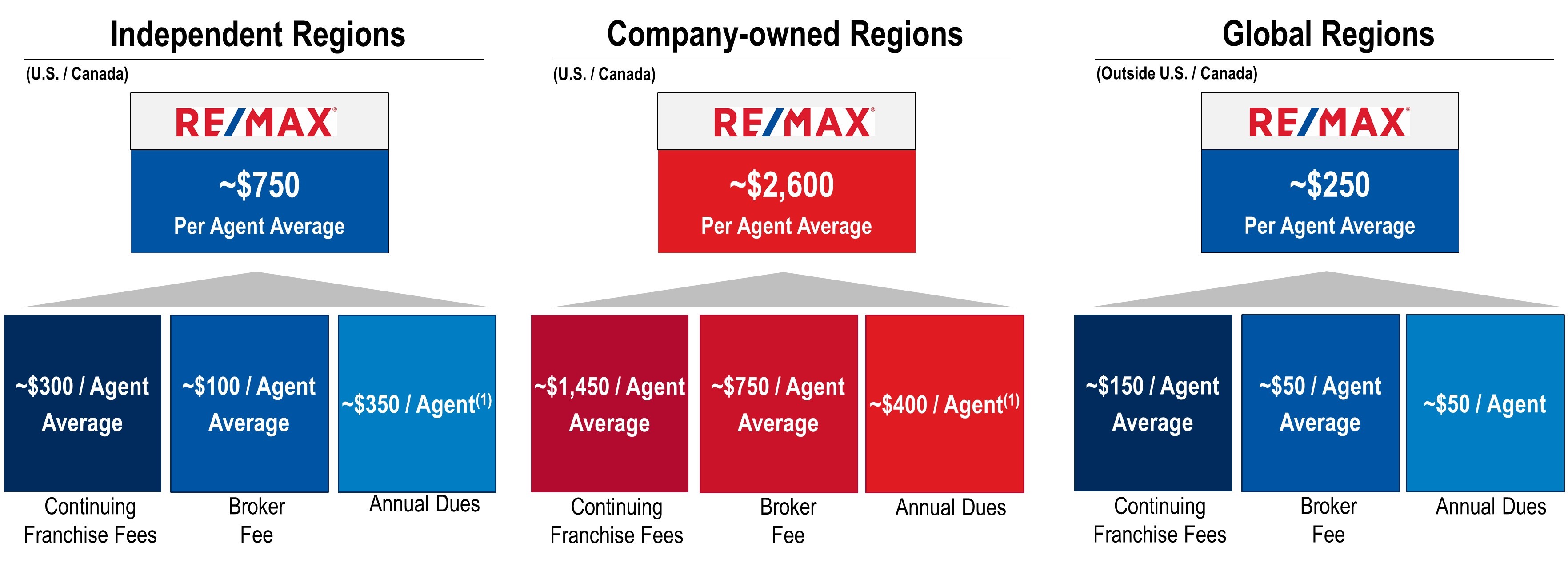

Revenue per Agent in Owned versus Independent RE/MAX Regions. We receive a higher amount of revenue per agent in our Company-owned Regions than in our Independent Regions in the U.S. and Canada, and more in Independent Regions in the U.S. and Canada than in Global Regions. While both Company-owned Regions and Independent Regions in the U.S. and Canada charge relatively similar fees to RE/MAX brokerages and agents, we receive the entire amount of the continuing franchise fee, broker fee and initial franchise and renewal fee in Company-owned Regions, whereas we receive only a portion of these fees in Independent Regions. We generally receive 15%, 20% or 30% of the amount of such fees in Independent Regions, which is a fixed rate in each particular Independent Region established by the terms of the applicable regional franchise agreement. We base our continuing franchise fees, agent dues and broker fees outside the U.S. and Canada on the same structure as our Independent Regions, except that the aggregate level of such fees is substantially lower in these markets. In 2017, the average annual revenue per agent was as follows:

|

(1) |

Annual dues are currently a flat fee of US$410/CA$410 per agent annually for our U.S. and Canadian agents. The average per agent for the year ended December 31, 2017 in both Independent Regions and Company-owned Regions reflects the impact of foreign currency movements related to revenue received from Canadian agents. The ratio of Canadian agents to U.S. agents in Independent Regions has increased as a result of U.S. Independent Region acquisitions. |

16

Value Creation and Growth Strategy

Our favorable margins generate healthy cash flow, which facilitates our value creation and growth strategy. As a leading franchisor in the residential real estate industry in the U.S. and Canada, we create shareholder value by:

|

a) |

growing organically by building on our network of over 7,000 RE/MAX franchisees and 115,000 agents and our network of Motto mortgage brokerage franchises; |

|

b) |

catalyzing growth by reacquiring regional RE/MAX franchise rights and acquiring other complementary businesses; and |

|

c) |

returning capital to shareholders. |

Organic Growth. Our organic growth is expected to come from: a) RE/MAX agent count growth; b) RE/MAX and Motto franchise sales, c) increases in our ability to monetize the value of our RE/MAX and Motto networks; d) the extent to which we increase the fees paid by RE/MAX or Motto franchisees or RE/MAX agents; and e) continued improvement in the housing market, resulting in more home sale transactions or higher home prices.

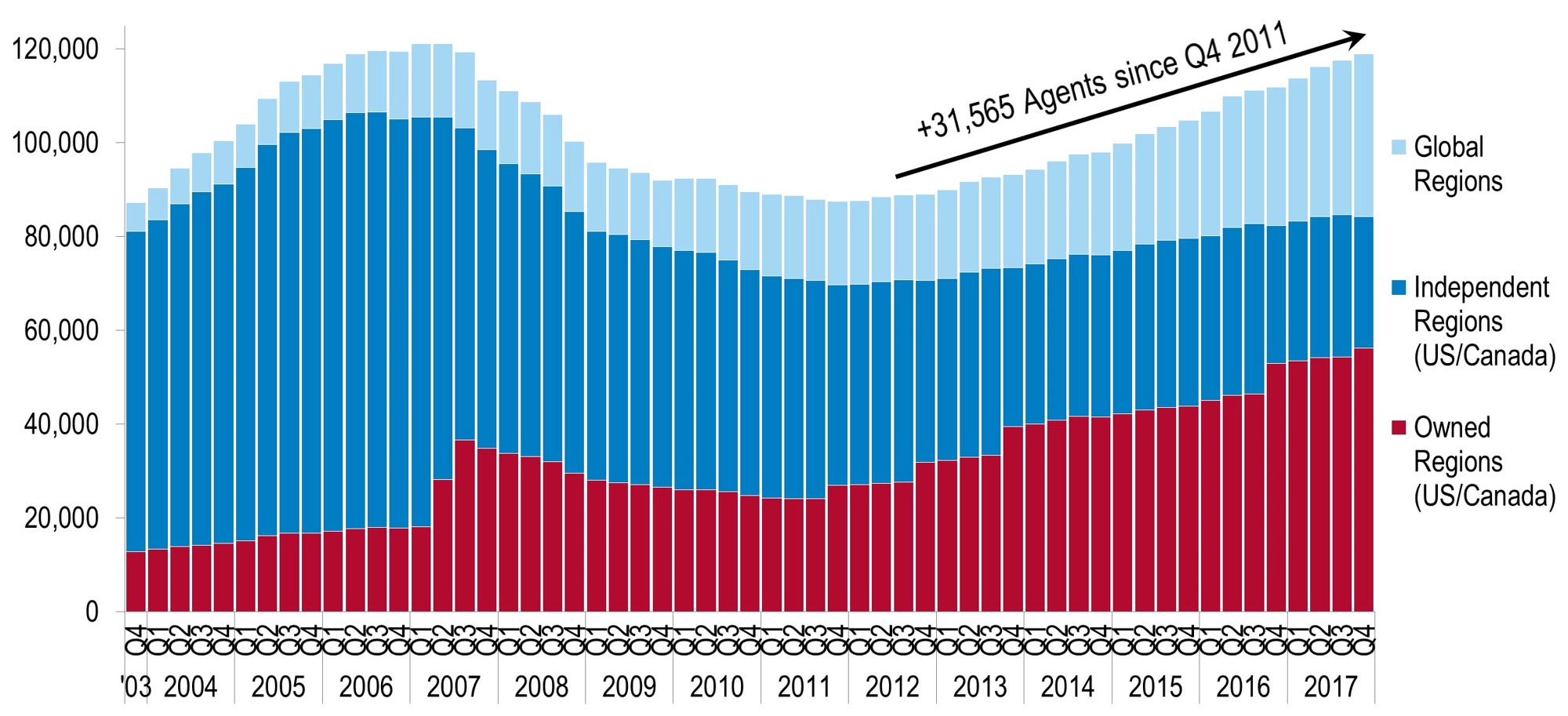

Organic Growth from Agent Count and Franchise Sales. With respect to RE/MAX agent count growth, we experienced agent losses during the downturn, but we returned to a period of net agent growth in 2012 and our year-over-year growth in agent count continued in 2013 through 2017.

RE/MAX Agent Count

Number of Agents at Quarter-End (1)

|

(1) |

Agents that converted from an Independent Region to a Company-owned Region are moved from the Independent Region agent count to the Company-owned Region agent count during the quarter of the acquisition. |

17

RE/MAX intends to continue adding franchises in new and existing markets, and as a result, increase our global market share and brand awareness. Each incremental agent leverages our existing infrastructure, allowing us to drive additional revenue at little incremental cost. We are committed to reinvesting in the business to enhance our value proposition and through a range of new and existing programs and tools.

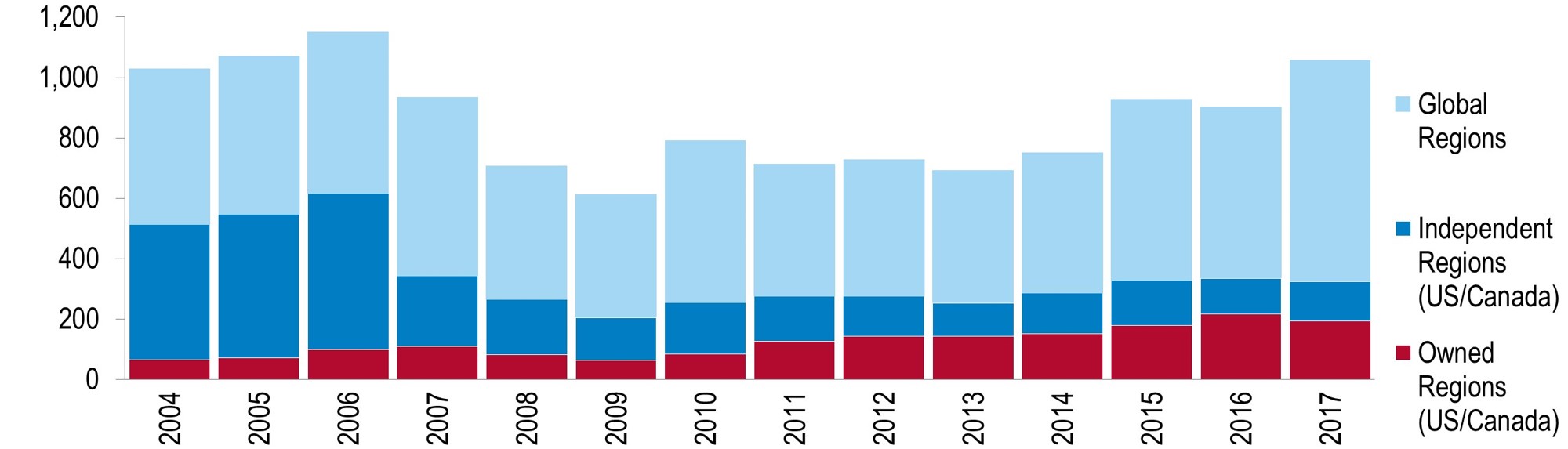

RE/MAX Office Franchise Sales

Motto sold 68 franchises from inception to December 31, 2017. We believe the Motto Mortgage franchise concept extends our core competencies of franchising and real estate industry knowledge to the mortgage brokerage business. We believe the new Motto business, with its recurring fee model, complements the RE/MAX franchise model and adds a new channel for long-term growth. Success of the Motto brokerage model, we believe, will build brand awareness which, in turn, will lead to increased franchise sales and therefore, increased franchise fees.

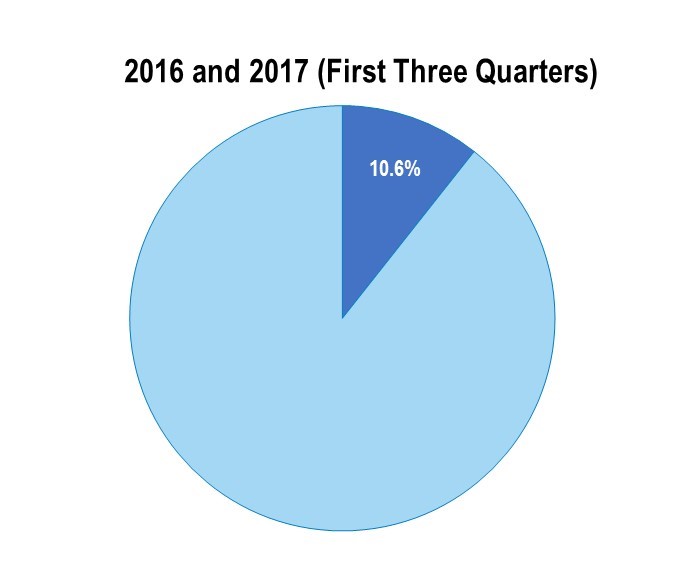

Organic Growth from Global Regions. Over the last two decades, the size of the RE/MAX network outside of the U.S. and Canada has grown to over a quarter of RE/MAX agent count. However, we earn substantially more of our revenue in the U.S. than in other countries as a result of the higher average revenue per agent earned in Company-owned Regions than in Independent Regions, and in the U.S. and Canada as compared to the rest of the world:

|

RE/MAX Agents by Geography As of Year-end 2017 |

|

Revenue by Geography Percent of 2017 Revenue |

Revenue from Global Regions has remained a relatively consistent percentage of our total revenue because, as our agent count in these regions has increased (primarily driven by increasing agent counts in Europe, South America and Southeast Asia), recurring revenue from fees and dues has taken the place of less predictable revenue from master franchise sales.

Our revenue from countries outside of the U.S. is also affected by the strength of the U.S. dollar against other currencies, primarily the Canadian dollar and to a lesser degree, the Euro.

Pricing. Given the low fixed infrastructure cost of our RE/MAX franchise model, modest increases in aggregate fees per agent positively affect our profitability. We may increase our aggregate fees per agent over time in our Company-owned

18

Regions as we enhance the value we offer to our network. We are judicious with respect to the timing and amount of increases in aggregate fees per agent and our strategic focus remains on growing agent count through franchise sales, recruiting programs and retention initiatives. Below are the annualized average price increases for the previous three years, reflected in the year in which the increase was effective.

|

|

|

2015 |

|

2016 |

|

2017 |

|

Continuing Franchise Fees |

|

- |

|

3.9% |

|

- |

|

Company-owned Regions - U.S. |

|

- |

|

1.9% |

|

1.9% |

|

Company-owned Regions - Canada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Dues |

|

|

|

|

|

|

|

Company-owned Regions - U.S. |

|

- |

|

- |

|

2.5% |

|

Company-owned Regions - Canada |

|

- |

|

- |

|

2.5% |

We recently announced an average price increase of 1.9% in continuing franchise fees in our Company-owned regions in the U.S. beginning on July 1, 2018.

Growth Catalysts through Acquisitions. We intend to continue to pursue reacquisitions of the regional RE/MAX franchise rights in a number of Independent Regions in the U.S. and Canada, as well as other acquisitions in related areas that build on or support our core competencies in franchising and real estate.

Independent Region Acquisitions. The reacquisition of a regional franchise substantially increases our revenue per agent and provides an opportunity for us to drive enhanced profitability, as we receive a higher amount of revenue per agent in our Company-owned Regions than in our Independent Regions. While both Company-owned Regions and Independent Regions charge relatively similar fees to their brokerages and agents, we only receive a percentage of the continuing franchise fee, broker fee and initial franchise and renewal fee in Independent Regions. By reacquiring regional franchise rights, we can capture 100% of these fees and substantially increase the average revenue per agent for agents in the reacquired region, which, as a result of our low fixed-cost structure, further increases our overall margins. In addition, we can establish operational efficiencies and improvements in financial performance of a reacquired region by leveraging our existing infrastructure and experience.

Flow through Independent Regions

19

The reacquisition of regional franchise rights over the past five years has changed the agent count attributable to Company-owned Regions versus Independent Regions.

|

Recent History of Reacquiring |

||

| 2012 |

Texas |

|

| 2013 |

Central Atlantic |

|

| 2013 |

Southwest |

|

| 2016 |

New York |

|

| 2016 |

Alaska |

|

| 2016 |

New Jersey |

|

| 2016 |

Georgia |

|

| 2016 |

Kentucky/Tennessee |

|

| 2016 |

Southern Ohio |

|

| 2017 |

Northern Illinois |

|

|

RE/MAX Agents (U.S./Canada) As of Year-end 2012 |

|

RE/MAX Agents (U.S./Canada) As of Year-end 2017 |

Other Acquisitions. We may pursue other acquisitions, either of other brands, or of other businesses that we believe can help enhance the value proposition that we provide to the franchisees in our existing businesses.

20

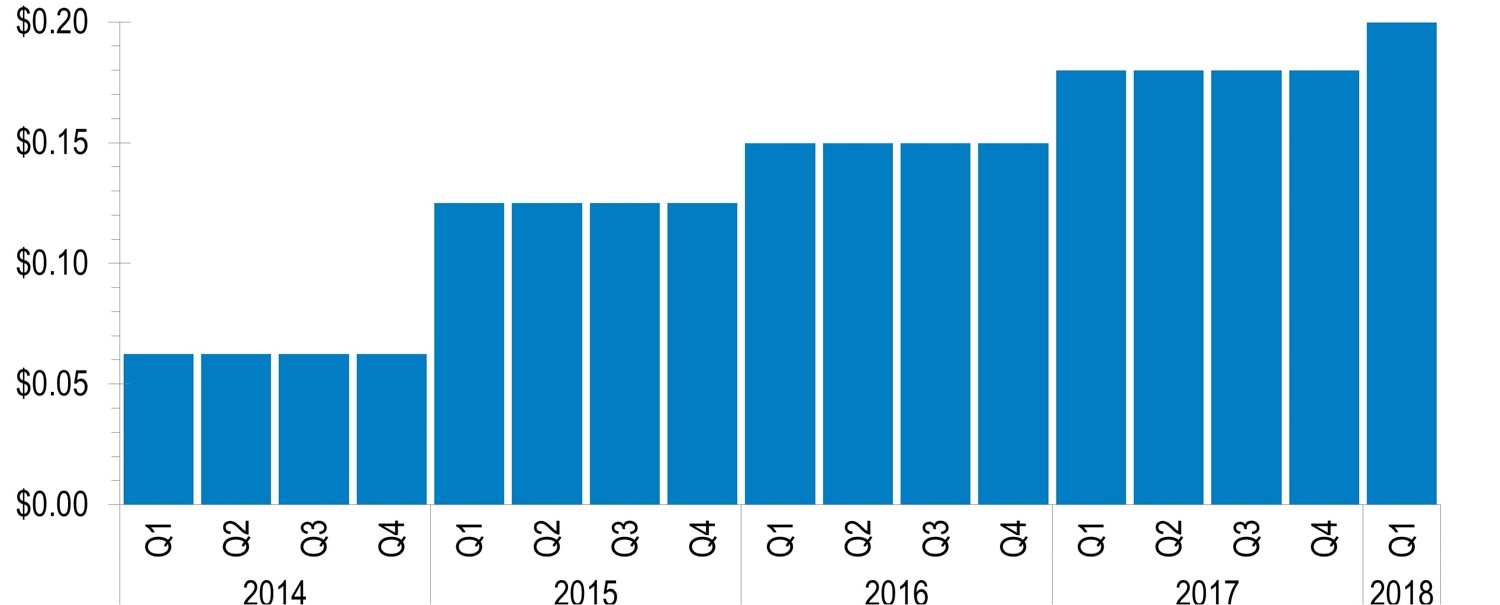

Return of Capital to Shareholders. We are committed to returning capital to shareholders as part of our value creation strategy. We have paid quarterly dividends since April of 2014, the first quarter after our October 7, 2013 initial public offering, when we began paying quarterly dividends of $0.0625 per share, and we have periodically increased our quarterly dividends since then, as we have deemed appropriate. On February 21, 2018, our Board of Directors announced a quarterly dividend of $0.20 per share.

Quarterly Dividends

Our disciplined approach to allocating capital allows us to return capital to shareholders while driving organic growth and catalyzing growth through acquisitions and, as a result, generate shareholder value.

Competition

The real estate brokerage franchise business is fragmented and highly competitive. We primarily compete against other real estate franchisors seeking to grow their franchise system. Our largest national competitors in the U.S. and Canada include the brands operated by Realogy Holdings Corp. (including Century 21, Coldwell Banker, ERA, Sotheby’s and Better Homes and Gardens), Berkshire Hathaway Home Services, Keller Williams Realty, Inc. and Royal LePage. In most markets, we also compete against regional chains, independent, non-franchise brokerages and virtual and hybrid brokers, some of which offer deeply discounted commissions. Our efforts to target consumers and connect them with a RE/MAX agent via our websites also face competition from major real estate portals. Similarly, newer entrants, often referred to as home marketplaces or direct buyers—which along with real estate portals, virtual brokerages and hybrid brokerages—compete with RE/MAX agents for home sales by acting as wholesalers, offering to buy homes directly from homeowners at below-market rates in exchange for speed and convenience, and then resell them shortly thereafter at market prices. Likewise, the support services we provide to RE/MAX franchisees and agents also face competition from various providers of training, back office management, and lead generation services. We believe that competition in the real estate brokerage franchise business is based principally upon the reputational strength of the brand, the quality of the services offered to franchisees, and the amount of franchise-related fees to be paid by franchisees.

The ability of our franchisees to compete with other real estate brokerages, both franchised and unaffiliated, is an important aspect of our growth strategy. A franchisee’s ability to compete may be affected by a variety of factors, including the quality of the franchisee’s independent agents, the location of the franchisee’s offices and the number of competing offices in the area. A franchisee’s success may also be affected by general, regional and local housing conditions, as well as overall economic conditions.

While there are no national mortgage brokerage franchisors in the United States at the present time other than Motto Franchising, the mortgage origination business is characterized by a variety of business models. While real estate brokerage owners are our core market for the purchase of Motto franchises, such owners may form independent, non-franchised mortgage brokerages. They may enter into joint ventures with lenders for mortgage originations, and they may elect not to enter the mortgage origination business themselves, but instead earn revenue from providing marketing and other services to mortgage lenders.

Motto Franchising does not originate loans, and therefore does not compete in the mortgage origination business. The mortgage origination business in which Motto franchisees participate is highly competitive. There are several different marketing channels for mortgage origination services, with some originators, like Motto franchisees, marketing significantly to real estate agents and their customers. Other originators are independent mortgage bankers or

21

correspondent lenders, underwriting and funding mortgage loans and then selling the loans to third parties. Retail lenders, both traditional and online-only companies, and both banks and non-bank lenders, typically market their loan products directly to consumers.

Intellectual Property

We protect the RE/MAX and Motto brands through a combination of trademarks and copyrights. We have registered “RE/MAX” as a trademark in the U.S., Canada, and over 150 other countries and territories, and have registered various versions of the RE/MAX balloon logo and real estate yard sign design in numerous countries and territories as well. We also have filed other trademark applications in the U.S. and certain other jurisdictions, and will pursue additional trademark registrations and other intellectual property protection to the extent we believe it would be beneficial and cost effective. We also are the registered holder of a variety of domain names that include “remax,” “motto,” and similar variations.

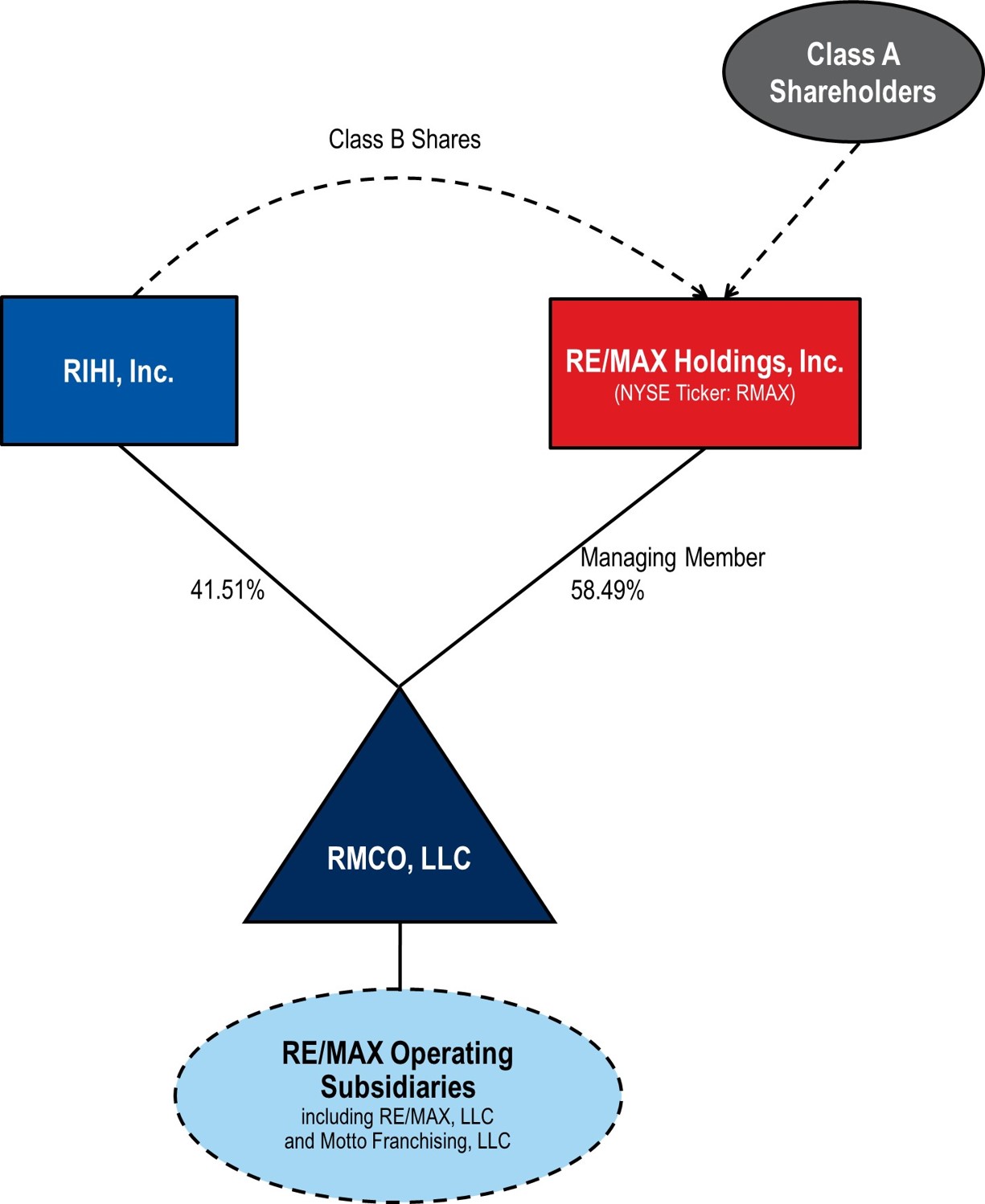

Corporate Structure and Ownership

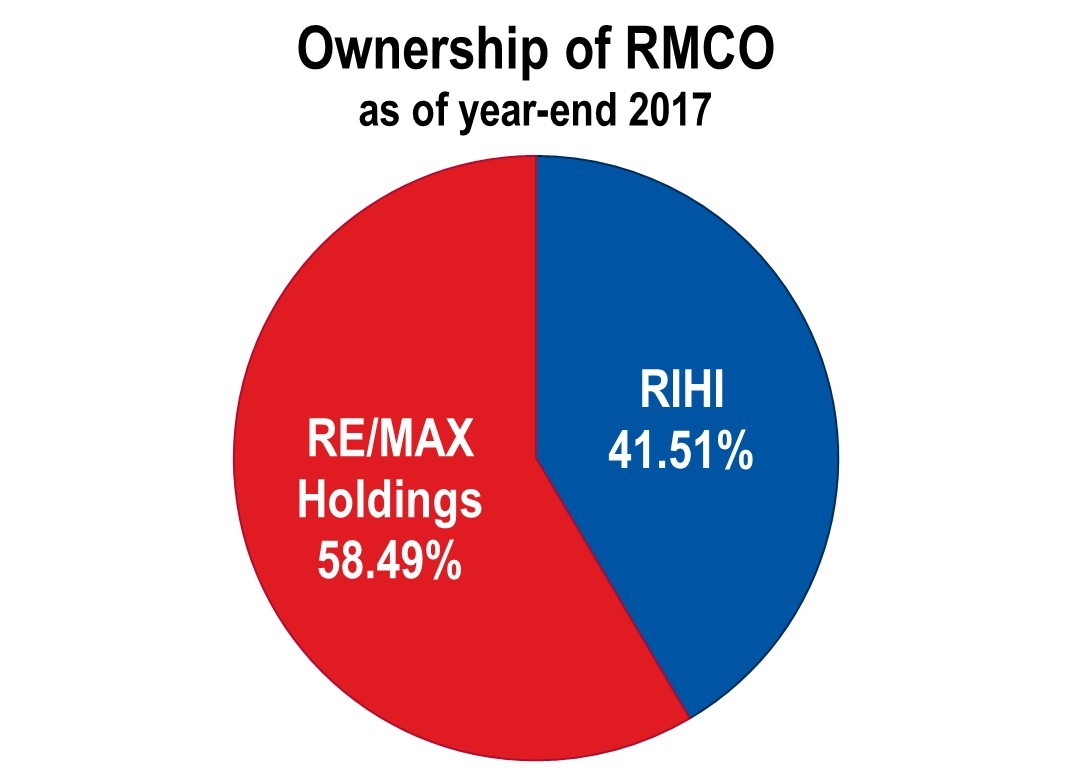

RE/MAX Holdings, Inc. (“RE/MAX Holdings”) is a holding company incorporated in Delaware and its only business is to act as the sole manager of RMCO, LLC, (“RMCO”). In that capacity, RE/MAX Holdings operates and controls all of the business and affairs of RMCO. RMCO is a holding company that is the direct or indirect parent of all of our operating businesses, including RE/MAX, LLC and Motto Franchising, LLC. As of December 31, 2017, RE/MAX Holdings owns 58.49% of the common units in RMCO, while RIHI, Inc. (“RIHI”) owns the remaining 41.51% of common units in RMCO. RIHI, Inc. is majority owned and controlled by David Liniger, our Chairman and Co-Founder, and by Gail Liniger, our Vice Chair and Co-Founder.

The diagram below depicts our organizational structure:

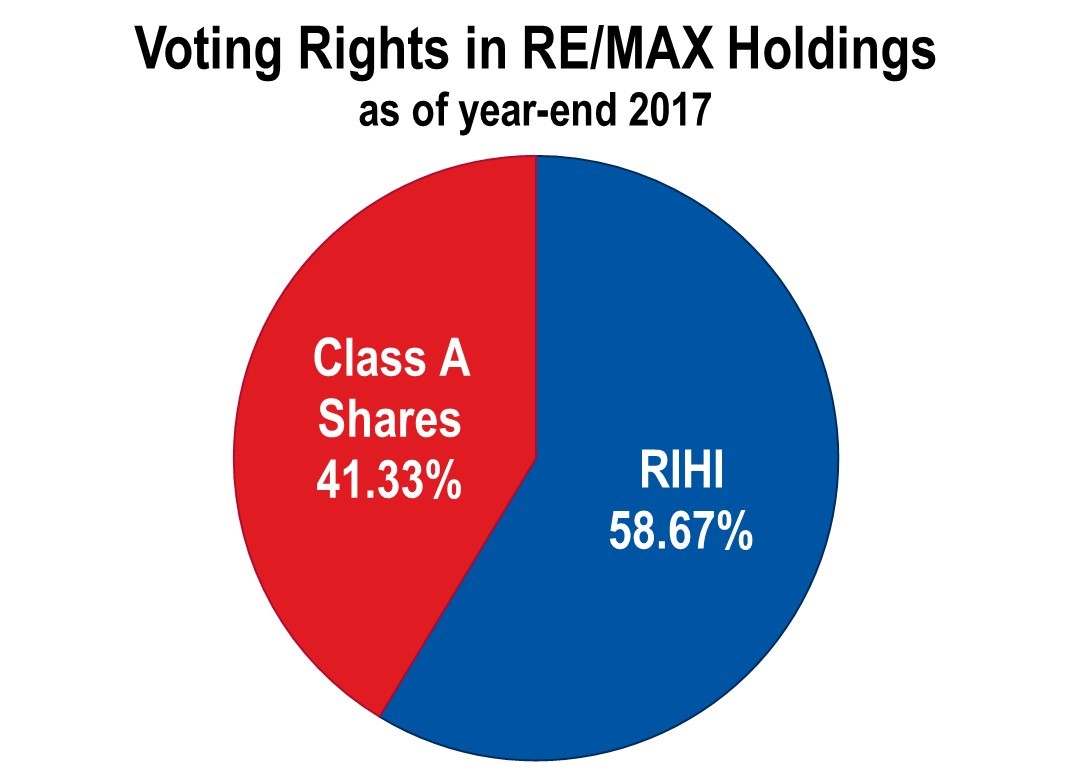

22

The holders of RE/MAX Holdings Class A common stock collectively own 100% of the economic interests in RE/MAX Holdings, while RIHI owns 100% of the outstanding shares of RE/MAX Holdings Class B common stock. The shares of Class B common stock have no economic rights but entitle the holder, without regard to the number of shares of Class B common stock held, to a number of votes on matters presented to stockholders of RE/MAX Holdings that is equal to two times the aggregate number of common units of RMCO held by such holder. As a result of RIHI’s ownership of shares of RE/MAX Holdings Class B common stock, and its ownership of 12,559,600 common units in RMCO, it holds effective control of a majority of the voting power of RE/MAX Holdings outstanding common stock.

RIHI’s voting rights will be reduced to equal the aggregate number of RMCO common units held—and RIHI would therefore be expected to lose its controlling vote of RE/MAX Holdings, Inc.—after any of the following occur: (i) October 7, 2018; (ii) the death of the Company’s Chairman and Co-Founder, David Liniger; or (iii) RIHI’s ownership of RMCO common units falls below 5,320,380 common units.

Due to RIHI’s control of a majority of the voting power of RE/MAX Holdings’ common stock, RE/MAX Holdings constitutes a “controlled company” under the corporate governance standards of the New York Stock Exchange (“NYSE”) and therefore are not required to comply with certain corporate governance requirements. Nonetheless, we do not currently take advantage of any of the exemptions for controlled companies under NYSE listing standards. Due to RIHI’s ownership interest in RMCO, RE/MAX Holdings’ results reflect a significant non-controlling interest and our pre-tax income excludes RIHI’s proportionate share of RMCO’s net income. RE/MAX Holding’s only source of cash flow from operations is in the form of distributions from RMCO and management fees paid by RMCO pursuant to a management services agreement between RE/MAX Holdings and RMCO.

RE/MAX Holdings ownership of RMCO and Tax Receivable Agreements

RE/MAX Holdings has twice acquired significant portions of the ownership in RMCO; first in October 2013 at the time of IPO when RE/MAX Holdings acquired its initial 11.5 million common units of RMCO and, second, in November and December 2015 when it acquired 5.2 million additional common units. RE/MAX Holdings sold Class A common stock, which it exchanged for these common units of RMCO. RIHI then sold the Class A common stock to the market.

When RE/MAX Holdings has acquired common units in RMCO, it received a step-up in tax basis on the underlying assets held by RMCO. The step-up is principally equivalent to the difference between (1) the fair value of the underlying assets on the date of acquisition of the common units and (2) their tax basis in RMCO, multiplied by the percentage of units acquired. The majority of the step-up in basis relates to intangibles assets, primarily franchise agreements and goodwill, and the step-up is often substantial. These assets are amortizable under IRS rules and result in deductions on our tax return for many years and consequently, RE/MAX Holdings receives a future tax benefit. These future benefits are reflected within deferred tax assets of approximately $59.2 million on our consolidated balance sheets as of December 31, 2017.

23

If RE/MAX Holdings acquires additional common units of RMCO from RIHI, the percentage of RE/MAX Holdings’ ownership of RMCO will increase, and additional deferred tax assets will be created as additional tax basis step-ups occur.

In connection with the initial sale of RMCO common units in October 2013, RE/MAX Holdings entered into a tax receivable agreement (“TRA”) which requires that RE/MAX Holdings make annual payments to RIHI and Oberndorf Investments LLC (a successor to the other previous owner of RMCO) equivalent to 85% of any tax benefits realized on each year’s tax return from the additional tax deductions arising from the step-up in tax basis. We believe 85% is common for tax receivable agreements. A TRA liability was established for the future cash obligations expected to be paid under the TRA and is not discounted. As of December 31, 2017, this liability was $53.2 million. Similar to the deferred tax assets, these liabilities would increase if RE/MAX Holdings acquires additional common units of RMCO from RIHI.

Both these deferred tax assets and TRA liability were substantially reduced by the Tax Cuts and Jobs Act enacted in December 2017. The reduction in the corporate tax rate from 35% to 21% resulted in comparable reductions in both the deferred tax asset amounts and the TRA liabilities. See Note 11, Income Taxes for further information on the impact of the Tax Cuts and Jobs Act.

Employees

As of December 31, 2017, we had approximately 350 employees. Our franchisees are independent businesses. Their employees and independent contractor sales associates are therefore not included in our employee count. None of our employees are represented by a union. We believe our relations with our employees are good.

Seasonality

The residential housing market is seasonal, with transactional activity in the U.S. and Canada peaking in the second and third quarter of each year. Our results of operations are somewhat affected by these seasonal trends. Our Adjusted EBITDA margins are often lower in the first and fourth quarters due primarily to the impact of lower broker fees and other revenue as a result of lower overall sales volume, as well as higher selling, operating and administrative expenses in the first quarter for expenses incurred in connection with the RE/MAX annual convention.

Government Regulation

Franchise Regulation. The sale of franchises is regulated by various state laws, as well as by the Federal Trade Commission (“FTC”). The FTC requires that franchisors make extensive disclosures to prospective franchisees but does not require registration. A number of states require registration or disclosure by franchisors in connection with franchise offers and sales. Several states also have “franchise relationship laws” or “business opportunity laws” that limit the ability of the franchisor to terminate franchise agreements or to withhold consent to the renewal or transfer of these agreements. The states with relationship or other statutes governing the termination of franchises include Arkansas, California, Connecticut, Delaware, Hawaii, Illinois, Indiana, Iowa, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, Virginia, Washington and Wisconsin. Some franchise relationship statutes require a mandated notice period for termination; some require a notice and cure period; and some require that the franchisor demonstrate good cause for termination. Although we believe that our franchise agreements comply with these statutory requirements, failure to comply with these laws could result in our company incurring civil liability. In addition, while historically our franchising operations have not been materially adversely affected by such regulation, we cannot predict the effect of any future federal or state legislation or regulation.

Real Estate and Mortgage Regulation. The Real Estate Settlement Procedures Act (“RESPA”) and state real estate brokerage laws and mortgage regulations restrict payments which real estate brokers, mortgage brokers, and other service providers in the real estate industry may receive or pay in connection with the sales of residences and referral of settlement services, such as real estate brokerage, mortgages, homeowners insurance and title insurance. Such laws affect the terms that we may offer in our franchise agreements with Motto franchisees and may to some extent restrict preferred vendor programs, both for Motto and RE/MAX. Federal, state and local laws, regulations and ordinances related to the

24

origination of mortgages, may affect other aspects of the Motto business, including the extent to which we can obtain data on Motto franchisees’ compliance with their franchise agreements. These laws and regulations include (i) the Federal Truth in Lending Act of 1969 (“TILA”), and Regulation Z (“Reg Z”) thereunder; (ii) the Federal Equal Credit Opportunity Act ("ECOA'') and Regulation B thereunder; (iii) the Federal Fair Credit Reporting Act and Regulation V thereunder; (iv) RESPA, and Regulation X thereunder; (v) the Fair Housing Act; (vi) the Home Mortgage Disclosure Act; (vii) the Gramm-Leach-Bliley Act and its implementing regulations; (viii) the Consumer Financial Protection Act and its implementing regulations; (ix) the Fair and Accurate Credit Transactions Act-FACT ACT and its implementing regulations; and (x) the Do Not Call/Do Not Fax Act and other state and federal laws pertaining to the solicitation of consumers.

Available Information

RE/MAX Holdings, Inc. is a Delaware corporation and its principal executive offices are located at 5075 South Syracuse Street, Denver, Colorado 80237, telephone (303) 770-5531. The Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available free of charge through the “Investor Relations” portion of the Company’s website, www.remax.com, as soon as reasonably practical after they are filed with the Securities and Exchange Commission (“SEC”). The content of the Company’s website is not incorporated into this report. The SEC maintains a website, www.sec.gov, which contains reports, proxy and information statements, and other information filed electronically with the SEC by the Company.

RE/MAX Holdings, Inc. and its consolidated subsidiaries (collectively, the “Company,” “we,” “our” or “us”) could be adversely impacted by various risks and uncertainties. An investment in our Class A common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as all of the other information contained in this Annual Report on Form 10-K, including our audited consolidated financial statements and the related notes thereto before making an investment decision. If any of these risks actually occur, our business, financial condition, operating results, cash flow and prospects may be materially and adversely affected. As a result, the trading price of our Class A common stock could decline and you could lose some or all of your investment.

We have grouped our risks according to:

|

· |

Risks Related to Our Business and Industry; |

|

· |

Risks Related to Our Organizational Structure; and |

|

· |

Risks Related to Ownership of Our Class A Common Stock. |

Risks Related to Our Business and Industry

Our results are tied to the residential real estate market and we may be negatively impacted by downturns in this market and general global economic conditions.

The residential real estate market tends to be cyclical and typically is affected by changes in general economic conditions which are beyond our control. These conditions include short-term and long-term interest rates, inflation, fluctuations in debt and equity capital markets, levels of unemployment, consumer confidence and the general condition of the U.S. and the global economy. The residential real estate market also depends upon the strength of financial institutions, which are sensitive to changes in the general macroeconomic and regulatory environment. Lack of available credit or lack of confidence in the financial sector could impact the residential real estate market, which in turn could materially and adversely affect our business, financial condition and results of operations.

For example, the U.S. residential real estate market has steadily improved in recent years after a significant and prolonged downturn, which began in the second half of 2005 and continued through 2011. Based on our experience, we believe gradually improving market conditions in the U.S. will enable us to continue to recruit and retain more agents, increasing our revenue and profitability.

25

We cannot predict whether the market will continue to improve. If the residential real estate market or the economy as a whole does not continue to improve, we may experience adverse effects on our business, financial condition and liquidity, including our ability to access capital and grow our business.

Any of the following could cause a decline in the housing or mortgage markets and have a material adverse effect on our business by causing periods of lower growth or a decline in the number of home sales and/or home prices which, in turn, could adversely affect our revenue and profitability:

|

· |

a decrease in the affordability of homes due to changes in interest rates, home prices, and rates of wage and job growth; |

|

· |

slow economic growth or recessionary conditions; |

|

· |

weak credit markets; |

|

· |

low consumer confidence in the economy and/or the residential real estate market; |

|

· |

instability of financial institutions; |

|

· |

legislative, tax or regulatory changes that would adversely impact the residential real estate or mortgage markets, including but not limited to potential reform relating to Fannie Mae, Freddie Mac and other government sponsored entities (“GSEs”) that provide liquidity to the U.S. housing and mortgage markets; |

|

· |

high levels of foreclosure activity, including but not limited to the release of homes already held for sale by financial institutions; |

|

· |

the inability or unwillingness of homeowners to enter into home sale transactions due to negative equity in their existing homes; |

26

The failure of the U.S. residential real estate market growth to be sustained, or a prolonged decline in the number of home sales and/or home sale prices could adversely affect our revenue and profitability.

The U.S. residential real estate market has gradually improved since 2011. However, not all U.S. markets have participated to the same extent in the improvement. A lack of a continued or widespread growth or a prolonged decline in existing home sales, a decline in home sale prices or a decline in commission rates charged by our franchisees/brokers could adversely affect our results of operations by impacting the number of agents in our network and reducing the recurring fees we receive from our franchisees and our agents.

A lack of financing for homebuyers in the U.S. residential real estate market at favorable rates and on favorable terms could have a material adverse effect on our financial performance and results of operations.

Our business is significantly impacted by the availability of financing at favorable rates or on favorable terms for homebuyers, which may be affected by government regulations and policies. Certain potential reforms such as the U.S. federal government’s conservatorship of Fannie Mae and Freddie Mac, proposals to reform the U.S. housing market, attempts to increase loan modifications for homeowners with negative equity, monetary policy of the U.S. government, increases in interest rates and the Dodd-Frank Act may adversely impact the housing industry, including homebuyers’ ability to finance and purchase homes.

The monetary policy of the U.S. government, and particularly the Federal Reserve Board, which regulates the supply of money and credit in the U.S., significantly affects the availability of financing at favorable rates and on favorable terms, which in turn affects the domestic real estate market. Policies of the Federal Reserve Board can affect interest rates available to potential homebuyers. Further, we are affected by any rising interest rate environment. Changes in the Federal Reserve Board’s policies, the interest rate environment and mortgage market are beyond our control, are difficult to predict, and could restrict the availability of financing on reasonable terms for homebuyers, which could have a material adverse effect on our business, results of operations and financial condition. Since December 2015, the Federal Open Market Committee of the Federal Reserve Board has raised the target range for federal funds five times, including three times in 2017, after leaving the federal funds interest rate near zero since late 2008. The pace of future increases in the federal funds rate is uncertain, although the Federal Open Market Committee has indicated it expects additional increases to occur. Historically, changes in the federal funds rate have led to changes in interest rates for other loans but the extent of the impact on the future availability and price of mortgage financing cannot be predicted with certainty.

In addition, a reduction in government support for home financing, including the possible winding down of GSEs could further reduce the availability of financing for homebuyers in the U.S. residential real estate market. In connection with the U.S. federal government’s conservatorship of Fannie Mae and Freddie Mac, it provided billions of dollars of funding to these entities during the real estate downturn, in the form of preferred stock investments to backstop shortfalls in their capital requirements. No consensus has emerged in Congress concerning potential reforms relating to Fannie Mae and Freddie Mac, so we cannot predict either the short or long term effects of such regulation and its impact on homebuyers’ ability to finance and purchase homes.