Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TELEFLEX INC | exhibit991to11-2x20178xkre.htm |

| 8-K - 8-K - TELEFLEX INC | a11-2x20178xkreq3earningsr.htm |

1

Teleflex Incorporated

Third Quarter 2017

Earnings Conference Call

2

Conference Call Logistics

The release, accompanying slides, and replay webcast are available online at

www.teleflex.com (click on “Investors”)

Telephone replay available by dialing 855-859-2056 or for international calls, 404-

537-3406, pass code number 3479079

3

Introductions

Benson Smith

Chairman and CEO

Liam Kelly

President and COO

Thomas Powell

Executive Vice President and CFO

Jake Elguicze

Treasurer and Vice President of Investor Relations

4

Note on Forward-Looking Statements

This presentation and our discussion contain forward-looking information and statements including, but not limited

to, forecasted 2017 GAAP and constant currency revenue growth, GAAP and adjusted gross and operating margins

and GAAP and adjusted earnings per share and the items that are expected to impact each of those forecasted

results; our estimates with respect to NeoTract Inc.’s (“NeoTract”) revenue for 2017 and revenue growth for 2018;

our expectation that NeoTract’s financial profile will substantially improve our future financial results; our

expectations with respect to the impact NeoTract will have on our adjusted earnings per share results for 2017,

2018 and 2019; estimated pre-tax charges we expect to incur and annualized pre-tax savings we expect to realize

in connection with our restructuring programs; our expectations with respect to when we will begin to realize savings

from our restructuring programs and when those programs will be substantially completed; our expectation with

respect to estimated annual increases in our revenue related to improved pricing with respect to certain of our kits;

and other matters which inherently involve risks and uncertainties which could cause actual results to differ from

those projected or implied in the forward–looking statements. These risks and uncertainties are addressed in our

SEC filings, including our most recent Form 10-K.

Note on Non-GAAP Financial Measures

This presentation refers to certain non-GAAP financial measures, including, but not limited to, constant currency

revenue growth, adjusted diluted earnings per share, adjusted gross and operating margins and adjusted tax rate.

These non-GAAP financial measures should not be considered replacements for, and should be read together with,

the most comparable GAAP financial measures. Tables reconciling these non-GAAP financial measures to the most

comparable GAAP financial measures are contained within the appendices to this presentation.

Additional Notes

Unless otherwise noted, the following slides reflect continuing operations.

5

Executive Summary

Third quarter 2017 revenue of $534.7 million

• Up 17.4% vs. prior year period on an as-reported basis

• Up 15.4% vs. prior year period on a constant currency basis

Third quarter 2017 Earnings Per Share

• GAAP EPS of $1.70, up 21.4% vs. prior year period

• Adjusted EPS of $2.12, up 17.8% vs. prior year period

2017 Full Year Financial Guidance

• Raised GAAP revenue growth range from 11.5% - 13.0% to 15.0% - 15.5%

• Raised constant currency revenue growth range from 12.5% - 14.0% to 14.25% - 14.75%

• Lowered GAAP EPS range from $5.91 - $5.98 to $5.61 - $5.66

• Raised adjusted EPS range from $8.20 - $8.35 to $8.30 to $8.40

Note: See appendices for reconciliations of non-GAAP information

6

Third Quarter Highlights

Note: See appendices for reconciliations of non-GAAP information

Q3 2017

Constant Currency

Revenue Growth

Volume 2.4%

New product introductions 2.1%

Price 0.5%

M&A excluding Vascular Solutions 0.9%

Vascular Solutions 9.5%

Constant currency revenue growth 15.4%

7

Segment Revenue Review

Q3’17 Q3’16

Constant Currency Revenue Commentary

Vascular N.A.: $91.0 million, up 6.7% Anesthesia N.A.: $50.8 million, up 4.3%

Surgical N.A.: $40.8 million, down 2.7% EMEA: $131.5 million, up 3.3%

Asia: $72.4 million, up 11.7% OEM: $48.6 million, up 16.1%

All Other: $99.6 million, up 86.5%

Note: Increases and decreases in revenue referred to above are as compared to results for the third quarter of 2016. See

appendices for reconciliations of non-GAAP information.

17%

8%

9%

25%

13%

9%

19%

Vascular North America Surgical North America

Anesthesia North America EMEA

Asia OEM

All Other

19%

9%

11%

26%

14%

9%

12%

Vascular North America Surgical North America

Anesthesia North America EMEA

Asia OEM

All Other

8

Acquisition Update

Completed Acquisition of NeoTract on October 2, 2017

Highly strategic and complementary acquisition that significantly advances Teleflex’s offering of urological solutions

− Single-product company with growth profile better than Vidacare

− Expands Teleflex’s product portfolio into benign prostatic hyperplasia (“BPH”) market estimated to have a total

addressable market size of > $30 billion

Accelerates Teleflex’s sales growth trajectory and provides opportunity to capitalize on existing sales channel

− NeoTract has experienced significant revenue growth since initiating product commercialization

2015 revenue of approximately $18 million

2016 revenue of approximately $51 million

2017 revenue estimated to be between $115 to $120 million

2018 revenue expected to grow at least 40% over 2017 levels

− Opportunity to capitalize on Teleflex’s existing international infrastructure to drive further O.U.S. penetration of

NeoTract’s UroLift® System

Strong clinical data and intellectual property and established reimbursement

Financial profile expected to substantially improve Teleflex’s revenue growth, margins, earnings and cash flow

generation capabilities

− Expected to be slightly dilutive to adjusted earnings per share1 in 2017, breakeven to adjusted earnings per share1

in 2018, with significant accretion thereafter including $0.35 to $0.40 of adjusted earnings per share1 accretion in

2019

1 - Adjusted earnings per share excludes specified items such as amortization of acquired intangibles, inventory step-up, restructuring costs and other costs incurred to execute the

transaction. Adjusted earnings per share is a non-GAAP financial measure and should not be considered a replacement for GAAP results.

9

Acquisition Update

Transaction completed in September 2017

Acquired certain assets from Tianjin Medis Medical Co. LTD, a contract manufacturer

based in Tianjin, China

Consists of substantially all of the assets used by Tianjin to manufacture a line of the

Teleflex’s laryngeal masks

10

Restructuring Update

With respect to our restructuring plans and programs, the table below summarizes (1) the estimated total cost and estimated

annual pre-tax savings and synergies once the programs are completed; (2) the costs incurred and estimated pre-tax savings

realized through December 31, 2016; and (3) the costs expected to be incurred and estimated incremental pre-tax savings and

synergies estimated to be realized for these programs from January 1, 2017 through the anticipated completion dates.

During the quarter ended October 1, 2017, we increased the range of estimated aggregate annual pre-tax savings we expect to

realize from these programs from $60 million to $71 million to $67 million to $75 million to reflect incremental savings identified

across several of our restructuring programs.

Dollars

in Millions

Estimated

Total

Through

December 31, 2016

Estimated remaining from

January 1, 2017 through

December 31, 2021 2

Restructuring charges $52 to $60 $33 $19 to $27

Restructuring related charges 1 $53 to $65 $30 $23 to $35

Total charges $105 to $125 $63 $42 to $62

Pre-tax savings 3 $67 to $75 $31 $36 to $44

Vascular Solutions and Pyng integration

programs – synergies 4

$21 to $27 ̶ $21 to $27

1. Restructuring related charges principally constitute accelerated depreciation and other costs primarily related to the transfer of manufacturing operations to new locations and are expected to be recognized

primarily in cost of goods sold.

2. We expect to incur substantially all of the costs prior to the end of 2018, and to have realized substantially all of the estimated annual pre-tax savings and synergies by the year ended December 31, 2019.

3. Approximately 65% of the savings is expected to result in reductions to cost of goods sold. During 2016, in connection with our execution of the 2014 footprint realignment plan, we implemented changes to

medication delivery devices included in certain of our kits, which are expected to result in increased product costs (and therefore reduce the annual savings that were estimated at the inception of the

program). However, we also expect to achieve improved pricing on these kits to offset the cost, which is expected to result in estimated annual increased revenues of $5 million to $6 million. We expect to begin

realizing the benefits of this incremental pricing in 2017. Savings generated from restructuring programs are difficult to estimate, given the nature and timing of the restructuring activities and the possibility that

unanticipated expenditures may be required as the programs progress. Moreover, predictions of revenues related to increased pricing are particularly uncertain and can be affected by a number of factors,

including customer resistance to price increases and competition.

4. While pre-tax savings address anticipated cost savings to be realized with respect to our historical expense items, synergies reflect anticipated efficiencies to be realized with respect to increased costs that

otherwise would have resulted from our acquisition of Vascular Solutions and Pyng Medical Corp. ("Pyng," which we acquired in April 2017). In this regard, the synergies are expected to result from the

elimination of redundancies between our operations and Vascular Solutions’ and Pyng's operations, principally through the elimination of personnel redundancies.

11

Third Quarter Financial Review

Revenue of $534.7 million

• Up 17.4% vs. prior year period on an as-reported basis

• Up 15.4% vs. prior year period on a constant currency basis

Gross Margin

• GAAP gross margin of 55.2%, up 220 bps vs. prior year period

• Adjusted gross margin of 55.7%, up 170 bps vs. prior year period

Operating Margin

• GAAP operating margin of 20.6%, up 160 bps vs. prior year period

• Adjusted operating margin of 26.3%, up 260 bps vs. prior year period

Tax Rate

• GAAP tax rate of 11.2%, up 100 bps vs. prior year period

• Adjusted tax rate of 18.1%, up 390 bps vs. prior year period

Earnings Per Share

• GAAP EPS of $1.70, up 21.4% vs. prior year period

• Adjusted EPS of $2.12, up 17.8% vs. prior year period

Note: See appendices for reconciliations of non-GAAP information

12

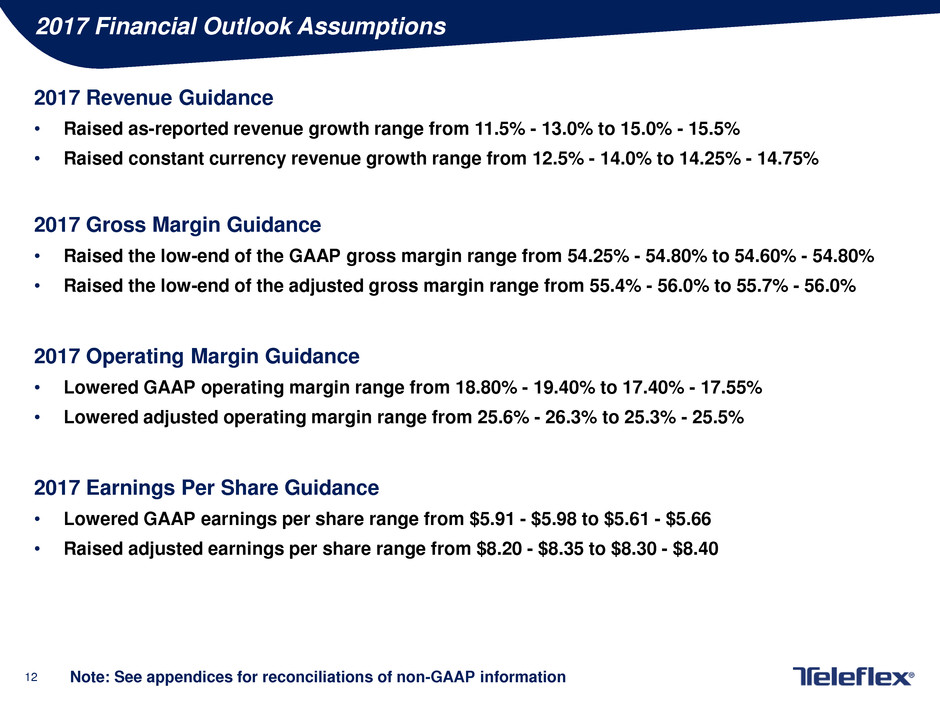

2017 Financial Outlook Assumptions

2017 Revenue Guidance

• Raised as-reported revenue growth range from 11.5% - 13.0% to 15.0% - 15.5%

• Raised constant currency revenue growth range from 12.5% - 14.0% to 14.25% - 14.75%

2017 Gross Margin Guidance

• Raised the low-end of the GAAP gross margin range from 54.25% - 54.80% to 54.60% - 54.80%

• Raised the low-end of the adjusted gross margin range from 55.4% - 56.0% to 55.7% - 56.0%

2017 Operating Margin Guidance

• Lowered GAAP operating margin range from 18.80% - 19.40% to 17.40% - 17.55%

• Lowered adjusted operating margin range from 25.6% - 26.3% to 25.3% - 25.5%

2017 Earnings Per Share Guidance

• Lowered GAAP earnings per share range from $5.91 - $5.98 to $5.61 - $5.66

• Raised adjusted earnings per share range from $8.20 - $8.35 to $8.30 - $8.40

Note: See appendices for reconciliations of non-GAAP information

13

Any Questions?

14

Thank You

15

Appendices

16

Non-GAAP Financial Measures

The following appendices include, among other things, tables reconciling the following non-GAAP financial measures

to the most comparable GAAP financial measure:

• Constant currency revenue growth. This measure excludes the impact of translating the results of international

subsidiaries at different currency exchange rates from period to period.

• Adjusted diluted earnings per share. This measure excludes, depending on the period presented the impact of (i)

restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items;

(iii) other items identified in note (C) to the reconciliation tables appearing in Appendices E and F; (iv) amortization

of the debt discount on the Company’s convertible notes; (v) intangible amortization expense; (vi) loss on

extinguishment of debt; and (vii) tax adjustments identified in note (G) to the reconciliation tables appearing in

Appendices E and F. In addition, the calculation of diluted shares within adjusted earnings per share gives effect

to the anti-dilutive impact of the Company’s previously outstanding convertible note hedge agreements, which

reduced the potential economic dilution that otherwise would have occurred upon conversion of the Company’s

senior subordinated convertible notes (under GAAP, the anti-dilutive impact of the convertible note hedge

agreements is not reflected in diluted shares).

• Adjusted gross margin. This measure excludes, depending on the period presented, the impact of restructuring,

restructuring related and impairment items.

• Adjusted operating margin. This measure excludes, depending on the period presented, (i) the impact of

restructuring, restructuring related and impairment charges and reversals; (ii) acquisitions, integration and

divestiture related items; (iii) other items identified in note (C) to the reconciliation table appearing in Appendix D;

and (iv) intangible amortization expense.

• Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing

operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from

continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated

with (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related

items; (iii) other items identified in note (A) to the reconciliation table appearing in Appendix G; (iv) amortization of

the debt discount on the Company’s convertible notes; (v) intangible amortization expense; and (v) tax adjustments

identified in note (B) to the reconciliation tables appearing in Appendix G.

17

APPENDIX A –

RECONCILIATION OF CONSTANT CURRENCY REVENUE GROWTH

DOLLARS IN MILLIONS

October 1, 2017 September 25, 2016 Constant Currency Currency Total

Vascular North America 91.0$ 85.1$ 6.7% 0.2% 6.9%

Anesthesia North America 50.8 48.7 4.3% 0.1% 4.4%

Surgical North America 40.8 41.9 (2.7%) 0.3% (2.4%)

EMEA 131.5 121.4 3.3% 5.0% 8.3%

Asia 72.4 64.0 11.7% 1.3% 13.0%

OEM 48.6 41.4 16.1% 1.2% 17.3%

All Other 99.6 53.1 86.5% 1.0% 87.5%

Net Revenues 534.7$ 455.6$ 15.4% 2.0% 17.4%

Three Months Ended % Increase / (Decrease)

18

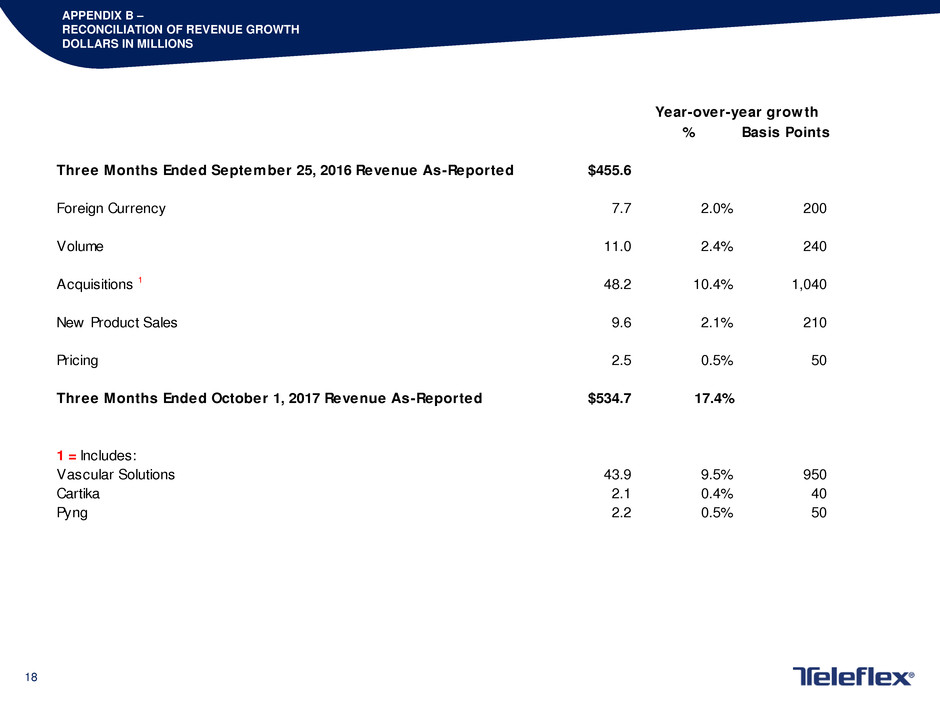

APPENDIX B –

RECONCILIATION OF REVENUE GROWTH

DOLLARS IN MILLIONS

% Basis Points

Three Months Ended September 25, 2016 Revenue As-Reported $455.6

Foreign Currency 7.7 2.0% 200

Volume 11.0 2.4% 240

Acquisitions 1 48.2 10.4% 1,040

New Product Sales 9.6 2.1% 210

Pricing 2.5 0.5% 50

Three Months Ended October 1, 2017 Revenue As-Reported $534.7 17.4%

1 = Includes:

Vascular Solutions 43.9 9.5% 950

Cartika 2.1 0.4% 40

Pyng 2.2 0.5% 50

Year-over-year growth

19

APPENDIX C –

RECONCILIATION OF ADJUSTED GROSS PROFIT AND MARGIN

DOLLARS IN THOUSANDS

October 1, 2017 September 25, 2016

Teleflex gross profit as-reported 295,227$ 241,602$

Teleflex gross margin as-reported 55.2% 53.0%

Restructuring, restructuring related and

impairment items (A) 2,768 4,247

Adjusted Teleflex gross profit 297,995$ 245,849$

Adjusted Teleflex gross margin 55.7% 54.0%

Teleflex revenue as-reported 534,703$ 455,648$

Three Months Ended

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, improve operating

efficiencies and integrate acquired businesses. Our restructuring charges consist of termination benefits, contract termination costs, facility closure costs and other exit costs

associated with a specific restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including

accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an

incentive for them to remain with our company after completion of the restructuring program.

20

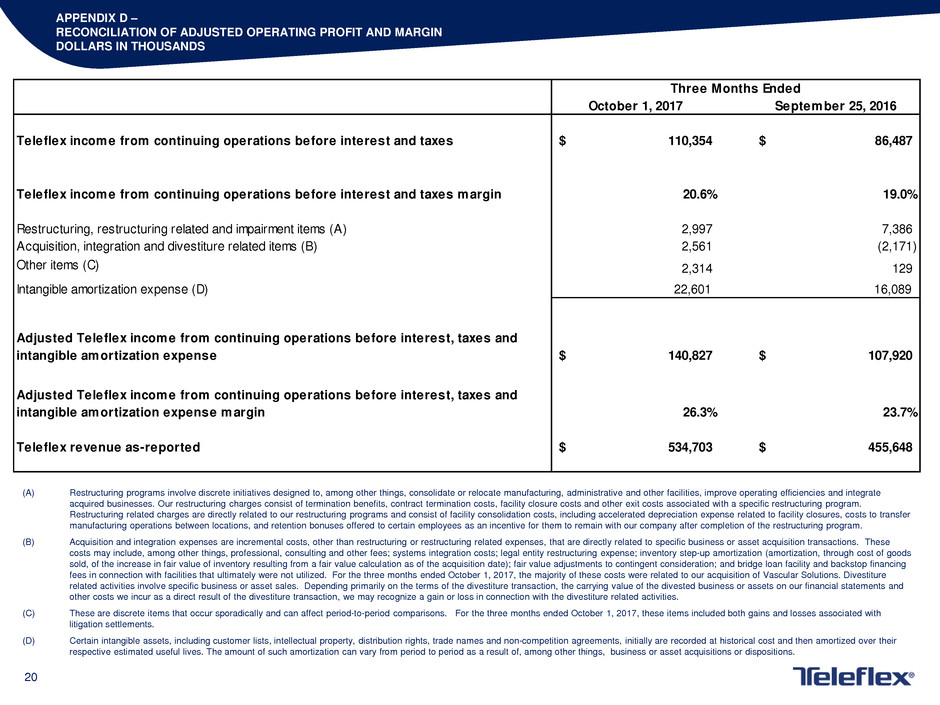

APPENDIX D –

RECONCILIATION OF ADJUSTED OPERATING PROFIT AND MARGIN

DOLLARS IN THOUSANDS

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, improve operating efficiencies and integrate

acquired businesses. Our restructuring charges consist of termination benefits, contract termination costs, facility closure costs and other exit costs associated with a specific restructuring program.

Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer

manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program.

(B) Acquisition and integration expenses are incremental costs, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These

costs may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods

sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration; and bridge loan facility and backstop financing

fees in connection with facilities that ultimately were not utilized. For the three months ended October 1, 2017, the majority of these costs were related to our acquisition of Vascular Solutions. Divestiture

related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and

other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities.

(C) These are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended October 1, 2017, these items included both gains and losses associated with

litigation settlements.

(D) Certain intangible assets, including customer lists, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their

respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions.

October 1, 2017 September 25, 2016

Teleflex income from continuing operations before interest and taxes 110,354$ 86,487$

Teleflex income from continuing operations before interest and taxes margin 20.6% 19.0%

Restructuring, restructuring related and impairment items (A) 2,997 7,386

Acquisition, integration and divestiture related items (B) 2,561 (2,171)

Other items (C) 2,314 129

Intangible amortization expense (D) 22,601 16,089

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense 140,827$ 107,920$

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense margin 26.3% 23.7%

Teleflex revenue as-reported 534,703$ 455,648$

Three Months Ended

21

APPENDIX E –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

QUARTER ENDED – OCTOBER 1, 2017

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

(Gain) loss on

sale of business

and assets

Interest

expense, net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

Diluted earnings

per share available

to common

shareholders

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $239.5 $163.8 $21.2 ($0.1) — $21.0 $10.0 $79.4 $1.70 46,587

Adjustments

Restructuring,

restructuring related and

impairment items (A)

2.8 0.1 0.2 (0.1) — — 1.1 1.9 $0.04 —

Acquisition, integration

and divestiture related

items (B)

— 2.6 — — — — (0.3) 2.8 $0.06 —

Other items (C) — 2.3 — — — — 0.6 1.7 $0.04 —

Amortization of debt

discount on convertible

notes (D)

— — — — — 0.1 0.0 0.1 $0.00 —

Intangible amortization

expense (E)

— 22.5 0.1 — — — 6.0 16.6 $0.36 —

Loss on extinguishment

of debt (F)

— — — — — — — — — —

Tax adjustments (G) — — — — — — 4.1 (4.1) ($0.09) —

Shares due to Teleflex

under note hedge (H)

— — — — — — — — $0.01 (141)

Adjusted basis $236.7 $136.3 $20.9 — — $20.9 $21.7 $98.3 $2.12 46,446

22

APPENDIX F –

RECONCILIATION OF ADJUSTED EPS FROM CONTINUING OPERATIONS

QUARTER ENDED – SEPTEMBER 25, 2016

DOLLARS IN MILLIONS, EXCEPT PER SHARE DATA

Cost of

goods

sold

Selling, general

and administrative

expenses

Research and

development

expenses

Restructuring and

other impairment

charges

(Gain) loss on sale

of business and

assets

Interest

expense, net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

Diluted earnings

per share available

to common

shareholders

Shares used in

calculation of GAAP

and adjusted

earnings per share

GAAP Basis $214.0 $139.8 $15.1 $3.0 ($2.8) $12.8 $7.5 $66.2 $1.40 47,446

Adjustments

Restructuring,

restructuring related and

impairment items (A)

4.2 0.1 0.0 3.0 — — 2.5 4.9 $0.10 —

Acquisition, integration

and divestiture related

items (B)

— 0.6 — — (2.8) — (0.8) (1.4) ($0.03) —

Other items (C) — 0.1 — — — — 0.0 0.1 $0.00 —

Amortization of debt

discount on convertible

notes (D)

— — — — — 1.1 0.4 0.7 $0.02 —

Intangible amortization

expense (E)

— 16.0 0.1 — — — 3.7 12.4 $0.26 —

Loss on extinguishment

of debt (F)

— — — — — — 0.0 0.0 $0.00 —

Tax adjustments (G) — — — — — — 0.3 (0.3) ($0.01) —

Shares due to Teleflex

under note hedge (H)

— — — — — — — — $0.06 (1,463)

Adjusted basis $209.8 $123.0 $14.9 — — $11.7 $13.7 $82.6 $1.80 45,983

23

APPENDICES E AND F –

TICKMARKS

(A) Restructuring, restructuring related and impairment items - Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate

manufacturing, administrative and other facilities, improve operating efficiencies and integrate acquired businesses. Our restructuring charges consist of termination benefits, contract

termination costs, facility closure costs and other exit costs associated with a specific restructuring program. Restructuring related charges are directly related to our restructuring

programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations,

and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. For the three months ended

October 1, 2017 and September 25, 2016, pre-tax restructuring related charges were $3.1 million and $4.4 million, respectively.

(B) Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental costs, other than restructuring or restructuring related expenses, that are

directly related to specific business or asset acquisition transactions. These costs may include, among other things, professional, consulting and other fees; systems integration costs;

legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation

as of the acquisition date); fair value adjustments to contingent consideration; and bridge loan facility and backstop financing fees in connection with facilities that ultimately were not

utilized. For the three months ended October 1, 2017, the majority of these costs were related to our acquisition of Vascular Solutions. Divestiture related activities involve specific

business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other

costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities.

(C) Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended October 1, 2017, these items included both

gains and losses associated with litigation settlements.

(D) Amortization of debt discount on convertible notes - When we sold $400 million principal amount of our 3.875% convertible notes (the “convertible notes”) in 2010, we allocated the

proceeds between the liability and equity components of the debt, in accordance with GAAP. As a result, the $83.7 million difference between the proceeds of the sale of the convertible

notes and the liability component of the debt constituted a debt discount that was to be amortized to interest expense over the approximately seven year term of the convertible notes,

which significantly increased the amount we recorded as interest expense attributable to the convertible notes. The amount of the amortization of the debt discount was reduced as a

result of our repurchases of convertible notes in 2016 and 2017 and redemptions of the convertible notes by holders of the notes, although we continued to amortize the remaining

portion of the debt discount to interest expense until August 2017, when all remaining convertible notes were either converted or matured.

(E) Intangible amortization expense - Certain intangible assets, including customer lists, intellectual property, distribution rights, trade names and non-competition agreements, initially

are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among

other things, business or asset acquisitions or dispositions.

(F) Loss on extinguishment of debt - In connection with debt refinancings, debt repayments, repurchases of convertible notes and redemptions of convertible notes, outstanding

indebtedness is extinguished. These events, which have occurred from time to time on an irregular basis, have resulted in losses reflecting, among other things, unamortized debt

issuance costs, as well as debt prepayment fees and premiums (including conversion premiums resulting from conversion of convertible securities).

(G) Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended

returns with respect to prior tax years and/or tax law changes affecting our deferred tax liability.

(H) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s previously outstanding convertible note hedge agreements, which reduced the

potential economic dilution that otherwise would have occurred upon conversion of the Company's convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge

agreements is not reflected in the weighted average number of diluted shares.

24

APPENDIX G –

RECONCILIATION OF ADJUSTED TAX RATE

DOLLARS IN THOUSANDS

Three Months Ended October 1, 2017

Income from

continuing

operations

before taxes

Taxes on

income from

continuing

operations Tax rate

GAAP basis $89,376 $9,978 11.2%

Restructuring, restructuring related and impairment items 2,997 1,146

Acquisition integration and divestiture related items 2,561 (269)

Other items (A) 2,314 613

Amortization of debt discount on convertible notes 125 46

Intangible amortization expense 22,601 6,049

Tax adjustments (B) 0 4,127

Adjusted basis $119,974 $21,690 18.1%

Three Months Ended September 25, 2016

GAAP basis $73,714 $7,514 10.2%

Restructuring, restructuring related and impairment items 7,386 2,509

Acquisition integration and divestiture related items (2,171) (799)

Other items (A) 129 49

Amortization of debt discount on convertible notes 1,122 410

Intangible amortization expense 16,089 3,713

Tax adjustments (B) 0 291

Adjusted basis $96,269 $13,686 14.2%

(A) Other items - these are discrete items that occur sporadically and can affect period-to-period

comparisons. For the three months ended October 1, 2017, these items included both gains and losses

associated w ith litigation settlements.

(B) Tax adjustments - these adjustments represent the impact of the expiration of applicable statutes of

limitations for prior year returns, the resolution of audits, the f iling of amended returns w ith respect to

prior tax years and/or tax law changes affecting our deferred tax liability.

25

APPENDIX H –

RECONCILIATION OF 2017 CONSTANT CURRENCY REVENUE GROWTH GUIDANCE

Low High

Forecasted GAAP Revenue Growth 15.00% 15.50%

Estimated Impact of Foreign Currency Exchange Rate Fluctuations -0.75% -0.75%

Forecasted Constant Currency Revenue Growth 14.25% 14.75%

26

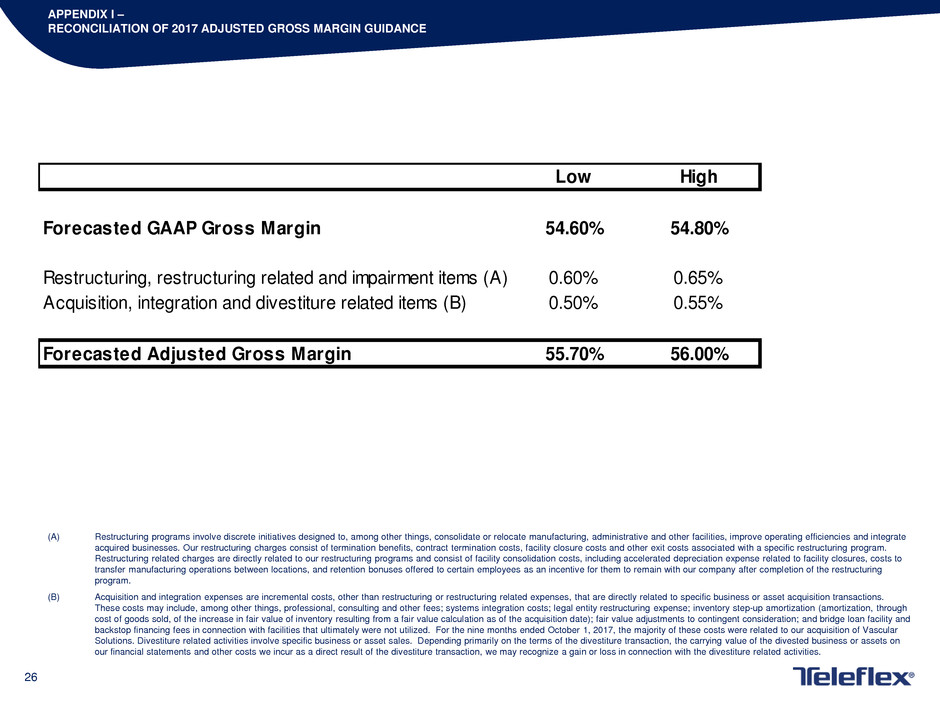

APPENDIX I –

RECONCILIATION OF 2017 ADJUSTED GROSS MARGIN GUIDANCE

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, improve operating efficiencies and integrate

acquired businesses. Our restructuring charges consist of termination benefits, contract termination costs, facility closure costs and other exit costs associated with a specific restructuring program.

Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to

transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring

program.

(B) Acquisition and integration expenses are incremental costs, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions.

These costs may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through

cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration; and bridge loan facility and

backstop financing fees in connection with facilities that ultimately were not utilized. For the nine months ended October 1, 2017, the majority of these costs were related to our acquisition of Vascular

Solutions. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on

our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities.

Low High

Forecasted GAAP Gross Margin 54.60% 54.80%

Restructuring, restructuring related and impairment items (A) 0.60% 0.65%

Acquisition, integration and divestiture related items (B) 0.50% 0.55%

Forecasted Adjusted Gross Margin 55.70% 56.00%

27

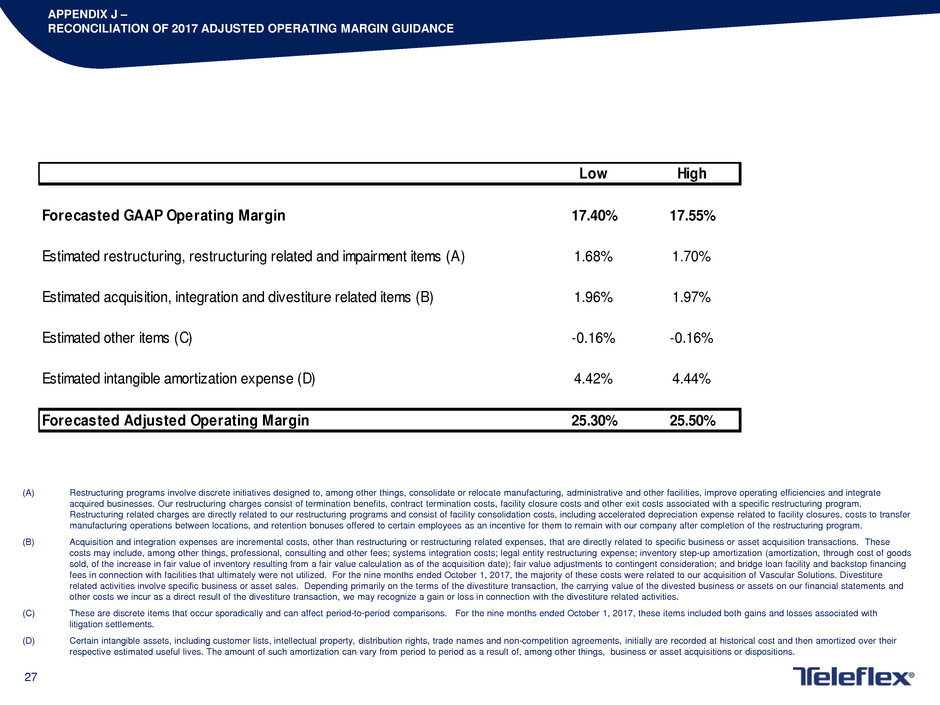

APPENDIX J –

RECONCILIATION OF 2017 ADJUSTED OPERATING MARGIN GUIDANCE

Low High

Forecasted GAAP Operating Margin 17.40% 17.55%

Estimated restructuring, restructuring related and impairment items (A) 1.68% 1.70%

Estimated acquisition, integration and divestiture related items (B) 1.96% 1.97%

Estimated other items (C) -0.16% -0.16%

Estimated intangible amortization expense (D) 4.42% 4.44%

Forecasted Adjusted Operating Margin 25.30% 25.50%

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, improve operating efficiencies and integrate

acquired businesses. Our restructuring charges consist of termination benefits, contract termination costs, facility closure costs and other exit costs associated with a specific restructuring program.

Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer

manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program.

(B) Acquisition and integration expenses are incremental costs, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These

costs may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods

sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration; and bridge loan facility and backstop financing

fees in connection with facilities that ultimately were not utilized. For the nine months ended October 1, 2017, the majority of these costs were related to our acquisition of Vascular Solutions. Divestiture

related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and

other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities.

(C) These are discrete items that occur sporadically and can affect period-to-period comparisons. For the nine months ended October 1, 2017, these items included both gains and losses associated with

litigation settlements.

(D) Certain intangible assets, including customer lists, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their

respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions.

28

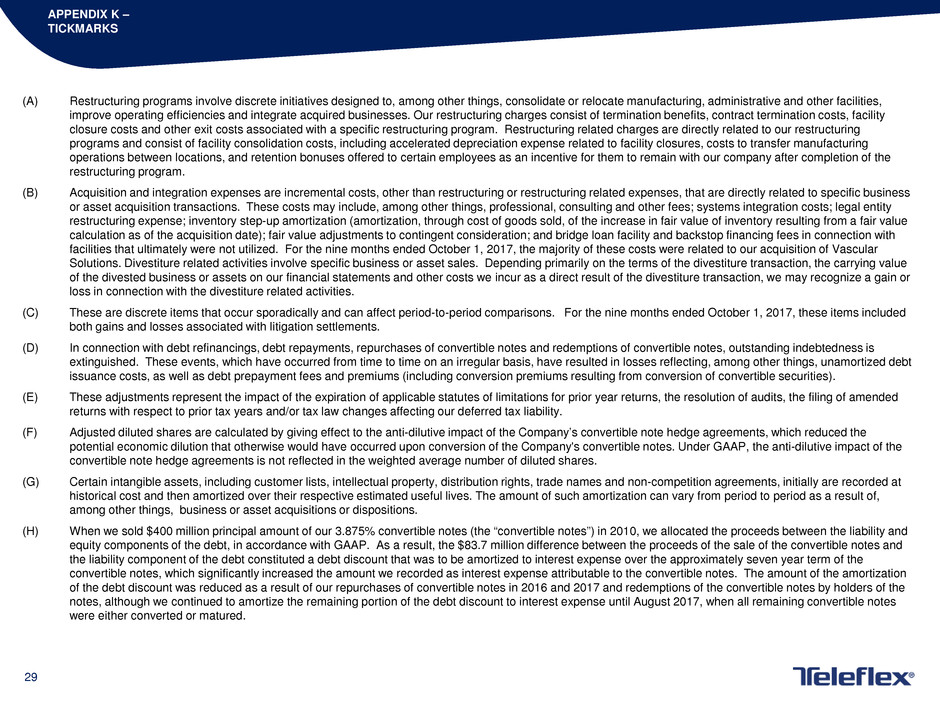

APPENDIX K –

RECONCILIATION OF 2017 ADJUSTED EARNINGS PER SHARE GUIDANCE

Low High

Forecasted diluted earnings per share attributable to common shareholders $5.61 $5.66

Restructuring, restructuring related and impairment items, net of tax (A) $0.50 $0.52

Acquisition, integration and divestiture items, net of tax (B) $0.72 $0.74

Other items, net of tax (C) ($0.04) ($0.04)

Loss on extinguishment of debt, net of tax (D) $0.08 $0.08

Tax adjustments (E) ($0.10) ($0.10)

Shares due to Teleflex under note hedge (F) $0.05 $0.05

Intangible amortization expense, net of tax (G) $1.47 $1.48

Amortization of debt discount on convertible notes, net of tax (H) $0.01 $0.01

Forecasted adjusted diluted earnings per share $8.30 $8.40

29

APPENDIX K –

TICKMARKS

(A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities,

improve operating efficiencies and integrate acquired businesses. Our restructuring charges consist of termination benefits, contract termination costs, facility

closure costs and other exit costs associated with a specific restructuring program. Restructuring related charges are directly related to our restructuring

programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing

operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the

restructuring program.

(B) Acquisition and integration expenses are incremental costs, other than restructuring or restructuring related expenses, that are directly related to specific business

or asset acquisition transactions. These costs may include, among other things, professional, consulting and other fees; systems integration costs; legal entity

restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value

calculation as of the acquisition date); fair value adjustments to contingent consideration; and bridge loan facility and backstop financing fees in connection with

facilities that ultimately were not utilized. For the nine months ended October 1, 2017, the majority of these costs were related to our acquisition of Vascular

Solutions. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value

of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or

loss in connection with the divestiture related activities.

(C) These are discrete items that occur sporadically and can affect period-to-period comparisons. For the nine months ended October 1, 2017, these items included

both gains and losses associated with litigation settlements.

(D) In connection with debt refinancings, debt repayments, repurchases of convertible notes and redemptions of convertible notes, outstanding indebtedness is

extinguished. These events, which have occurred from time to time on an irregular basis, have resulted in losses reflecting, among other things, unamortized debt

issuance costs, as well as debt prepayment fees and premiums (including conversion premiums resulting from conversion of convertible securities).

(E) These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended

returns with respect to prior tax years and/or tax law changes affecting our deferred tax liability.

(F) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduced the

potential economic dilution that otherwise would have occurred upon conversion of the Company's convertible notes. Under GAAP, the anti-dilutive impact of the

convertible note hedge agreements is not reflected in the weighted average number of diluted shares.

(G) Certain intangible assets, including customer lists, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at

historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of,

among other things, business or asset acquisitions or dispositions.

(H) When we sold $400 million principal amount of our 3.875% convertible notes (the “convertible notes”) in 2010, we allocated the proceeds between the liability and

equity components of the debt, in accordance with GAAP. As a result, the $83.7 million difference between the proceeds of the sale of the convertible notes and

the liability component of the debt constituted a debt discount that was to be amortized to interest expense over the approximately seven year term of the

convertible notes, which significantly increased the amount we recorded as interest expense attributable to the convertible notes. The amount of the amortization

of the debt discount was reduced as a result of our repurchases of convertible notes in 2016 and 2017 and redemptions of the convertible notes by holders of the

notes, although we continued to amortize the remaining portion of the debt discount to interest expense until August 2017, when all remaining convertible notes

were either converted or matured.

30

Track record of expansion of contractual agreements continues in Q3’17

Group Purchasing Organization Update

• 5 renewed agreements

IDN Update

• 11 renewed agreements

• 1 existing agreements not renewed

APPENDIX L –

GROUP PURCHASING ORGANIZATION AND IDN REVIEW