Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BrightSphere Investment Group plc | omam-2017930xpressreleasee.htm |

| 8-K - 8-K - BrightSphere Investment Group plc | omam-q3x20178xkearningsrel.htm |

1

Q3 2017 EARNINGS

PRESENTATION

November 2, 2017

Exhibit 99.2

2

Disclaimer

Forward Looking Statements

This presentation may contain forward looking statements for the purposes of the safe harbor

provision under the Private Securities Litigation Reform Act of 1995. Forward-looking statements

are identified by words such as “expect,” “anticipate,” “may,” “intends,” “believes,” “estimate,”

“project,” and other similar expressions.

Such statements involve a number of risks, uncertainties and other factors that could cause actual

results to differ materially from these forward looking statements. These factors include, but are

not limited to, the factors described in OMAM’s filings made with the Securities and Exchange

Commission, including our most recent Annual Report on Form 10-K, filed with the SEC on

February 22, 2017, under the heading “Risk Factors,” our Current Report on Form 8-K, filed with

the SEC on May 15, 2017 and our Quarterly Report on Form 10-Q, filed with the SEC on August 10,

2017.

Any forward-looking statements in this presentation are based on assumptions as of today and we

undertake no obligation to update these statements as a result of new information or future

events. We urge you not to place undue reliance on any forward-looking statements.

Non-GAAP Financial Measures

This presentation contains non-GAAP financial measures. Reconciliations of GAAP to non-GAAP

measures are included in the appendix to this presentation.

3

Overview and Highlights(1)

• Q3'17 U.S. GAAP EPS of $0.17 down (39.3)% from Q3'16

• Q3'17 ENI per share of $0.43 up 34.4% from Q3'16 ENI per share of $0.32, primarily driven

by increases in management fee revenue and stock buybacks

• Net Client Cash Flows of $0.5 billion for Q3'17 with an annualized revenue impact of $12.2

million

◦ Q3'17 inflows of $7.3 billion at approximately 54 bps and outflows and disposals of

$(6.8) billion at approximately 40 bps

• AUM of $235.9 billion (reflecting removal of $32 billion of Heitman AUM in Q3’17) down

(8.8)% from Q2'17 and up 0.7% from Q3'16 primarily driven by strong market performance

offset by the removal of Heitman

• Investment performance remained strong in the third quarter

◦ Strategies representing 69%, 67% and 81% of revenue outperformed benchmarks on a

1-, 3- and 5-year basis at September 30, 2017

• Continued progress with Old Mutual’s managed separation process and sale of Heitman

• OMAM CEO succession process proceeding on track

___________________________________________________________

(1) OMAM has executed a non-binding term sheet to sell its stake in Heitman LLC to Heitman’s management; therefore, AUM and flow data removes Heitman beginning in the third quarter

of 2017. Under U.S. GAAP and ENI, financial results will continue to include Heitman until the transaction closes at year-end 2017 or early 2018.

Please see definitions and additional notes.

4

Growth Strategy

OMAM’s multi-boutique model is well positioned for growth, with four key

areas of focus...

Multi-Boutique Value Proposition Drives

Incremental Growth Opportunities

Four Key

Growth Areas New

Partnerships

Global

Distribution

Collaborative Organic Growth

(Growth and Seed / Co-Investment Capital)

Core Affiliate Growth

(Investment Performance and Net Client Cash Flows)

OMAM’s Aligned Partnership Model

- Operating autonomy - Affiliate-level employee ownership

- Long-term perspective - Talent management

- Profit-sharing model - Strategic business support

Unique Partnership Approach

Provides Stability and the

Foundation for Growth

___________________________________________________________

Please see definitions and additional notes.

5

AUM

AUM by Affiliate(1) $B %Total

$ 92.8 39%

92.4 39%

5.2 2%

6.0 3%

2.0 1%

13.4 6%

24.1 10%

Total $ 235.9 100%

$240

$220

$200

$180

$160

$140

Q3'16 Q3'17

$234.2

$(32.4)

$(0.8)

$34.9

$235.9

OMAM AUM Progression and Mix

AUM Progression (Last 12 Months) AUM Mix (9/30/17)

AUM

AUM by Asset Class $B %Total

US Equity - large cap value $ 57.0 24%

US Equity - all other 23.5 10%

International Equity 54.6 23%

Global Equity 38.7 16%

Emerging Markets Equity 28.0 12%

Alternatives(1) 20.7 9%

Fixed Income 13.4 6%

Total $ 235.9 100%

AUM Progression (3rd Quarter)

$280

$260

$240

$220

$200

$180

$160

Q2'17 Q3'17

$258.8

$(32.4) $0.5

$9.0

$235.9

AUM at Period End As % of BoP AUM

Removal of

Heitman

Net flows Market and

other

% Change: 0.7%

% Change: (8.8)%

3.5% 0.2%

(0.4)% 14.9%

_________________________________________________

(1) Heitman AUM has been removed from this data.

Please see definitions and additional notes.

$B

$B

(13.8)%

Removal of

Heitman

Net flows Market and

other

(12.5)%

6

Derived

Average

Weighted

NCCF ($b)(2)

Net Client Cash Flows and Revenue Impact

AUM Net Client Cash Flows (“NCCF”) Revenue Impact of NCCF(1)

$24

$20

$16

$12

$8

$4

$0

-$4

-$8

$(3.0)

$18.4$19.1

$20.0

$11.3

$13.5

$0.7

$(6.6)

$7.3

$(3.4)

$(7.5)

$14.6

$0.8

$13.1

$12.2

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3(3)

40 43 46 44 47 46 46 45 38 46 42 44 43 53 54

38 36 38 38 30 31 32 37 40 32 38 35 32 35 40

2014 2015 2016 2017

$54.5 $18.9 $11.0 $26.1

Bps inflows

Bps outflows

___________________________________________________________

(1) Annualized revenue impact of net flows represents the difference between annualized management fees expected to be earned on new accounts and net assets contributed to existing accounts, less the annualized management fees lost on

terminated accounts or net assets withdrawn from existing accounts, including equity-accounted Affiliates. Annualized revenue is calculated by multiplying the annual gross fee rate for the relevant account by the net assets gained in the account in

the event of a positive flow or the net assets lost in the account in the event of an outflow.

(2) Derived Average Weighted NCCF reflects the implied NCCF if annualized revenue impact of net flows represents asset flows at the weighted fee rate for OMAM (i.e. 38.6 bps in Q3'17). For example, NCCF annualized revenue impact of $12.2 million

divided by average weighted fee rate of OMAM’s AUM of 38.6 bps equals the derived average weighted NCCF of $3.2 billion.

(3) Heitman AUM and flows have been removed from this data.

$4

$2

$0

-$2

-$4

$(1.0)

$3.6

$3.1

$3.8

$(0.2)

$0.8

$(2.5)

$(3.2)

$2.4

$(2.9)

$(2.6)

$1.5

$(2.5)

$(0.3)

$0.5

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3(3)

$(0.9) $5.5 $5.8 $6.1 $3.3 $3.9 $0.2 $(1.9) $ 2.1 $(1.0) $(2.1) $ 4.0 $0.2 $3.4 $3.2

2014 2015 2016 2017

$9.5 $(5.1) $(1.6) $(2.3)

$B $M

7

Hard asset disposals

$24

$20

$16

$12

$8

$4

$0

-$4

-$8

-$12

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

$(5.9)

$(3.8)

$(5.5)

$(7.3)

$(4.9)

$(0.1)

$8.1

$(1.2)

$5.9 $6.7

$(0.5)

$0.2

$(1.6) $(0.5)

$(0.2)

$(4.2)

$(2.6)

$3.2

$12.7

$9.4

$15.6 $13.1

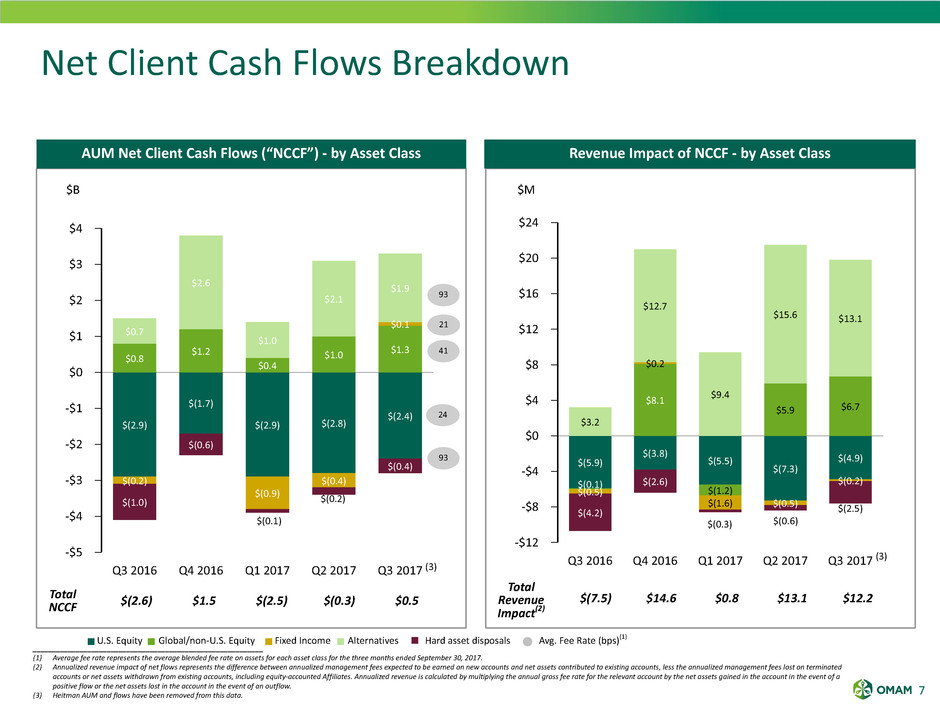

Net Client Cash Flows Breakdown

AUM Net Client Cash Flows (“NCCF”) - by Asset Class Revenue Impact of NCCF - by Asset Class

Total

Revenue

Impact(2)

$(7.5) $14.6 $0.8 $13.1 $12.2

___________________________________________________________

(1) Average fee rate represents the average blended fee rate on assets for each asset class for the three months ended September 30, 2017.

(2) Annualized revenue impact of net flows represents the difference between annualized management fees expected to be earned on new accounts and net assets contributed to existing accounts, less the annualized management fees lost on terminated

accounts or net assets withdrawn from existing accounts, including equity-accounted Affiliates. Annualized revenue is calculated by multiplying the annual gross fee rate for the relevant account by the net assets gained in the account in the event of a

positive flow or the net assets lost in the account in the event of an outflow.

(3) Heitman AUM and flows have been removed from this data.

U.S. Equity Global/non-U.S. Equity Fixed Income Alternatives Avg. Fee Rate (bps)(1)

Total

NCCF $(2.6) $1.5 $(2.5) $(0.3) $0.5

21

24

41

93

$M$B

93

$(0.6)

$(2.5)

$(0.2)

$(0.1) $(0.3)

(3)

(3)

$4

$3

$2

$1

$0

-$1

-$2

-$3

-$4

-$5

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

$(2.9)

$(1.7)

$(2.9) $(2.8)

$(2.4)

$0.8

$1.2

$0.4

$1.0 $1.3

$(0.2)

$(0.9)

$(0.4)

$0.1

$(1.0)

$(0.6)

$(0.4)

$0.7

$2.6

$1.0

$2.1

$1.9

8

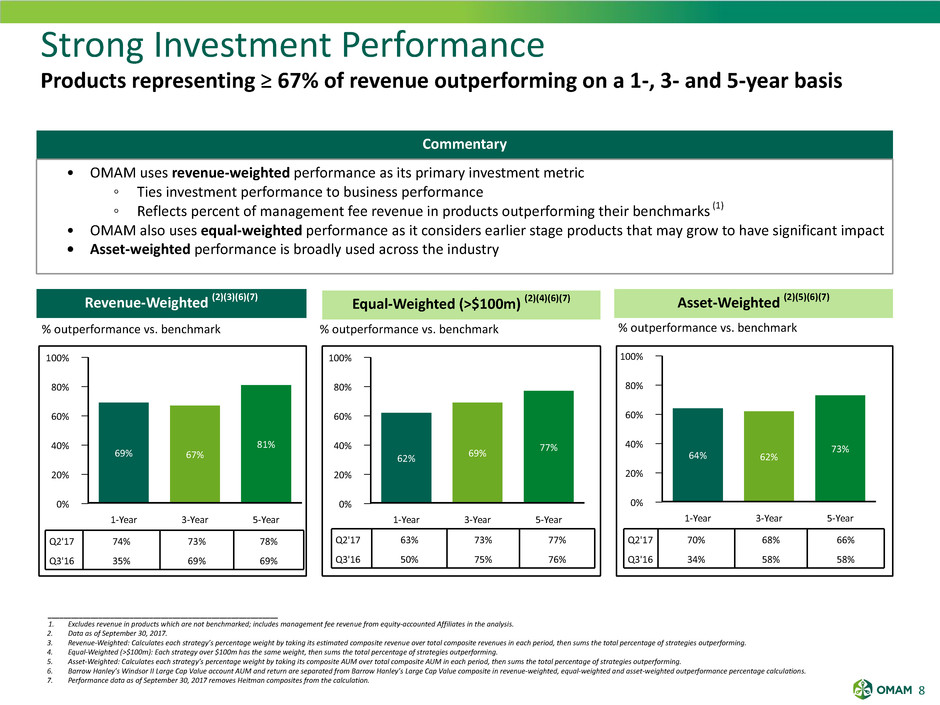

Strong Investment Performance

Products representing ≥ 67% of revenue outperforming on a 1-, 3- and 5-year basis

Commentary

• OMAM uses revenue-weighted performance as its primary investment metric

◦ Ties investment performance to business performance

◦ Reflects percent of management fee revenue in products outperforming their benchmarks (1)

• OMAM also uses equal-weighted performance as it considers earlier stage products that may grow to have significant impact

• Asset-weighted performance is broadly used across the industry

___________________________________________________________

1. Excludes revenue in products which are not benchmarked; includes management fee revenue from equity-accounted Affiliates in the analysis.

2. Data as of September 30, 2017.

3. Revenue-Weighted: Calculates each strategy’s percentage weight by taking its estimated composite revenue over total composite revenues in each period, then sums the total percentage of strategies outperforming.

4. Equal-Weighted (>$100m): Each strategy over $100m has the same weight, then sums the total percentage of strategies outperforming.

5. Asset-Weighted: Calculates each strategy’s percentage weight by taking its composite AUM over total composite AUM in each period, then sums the total percentage of strategies outperforming.

6. Barrow Hanley’s Windsor II Large Cap Value account AUM and return are separated from Barrow Hanley’s Large Cap Value composite in revenue-weighted, equal-weighted and asset-weighted outperformance percentage calculations.

7. Performance data as of September 30, 2017 removes Heitman composites from the calculation.

100%

80%

60%

40%

20%

0%

1-Year 3-Year 5-Year

64% 62%

73%

100%

80%

60%

40%

20%

0%

1-Year 3-Year 5-Year

62% 69%

77%

100%

80%

60%

40%

20%

0%

1-Year 3-Year 5-Year

69% 67%

81%

Revenue-Weighted (2)(3)(6)(7) Equal-Weighted (>$100m) (2)(4)(6)(7) Asset-Weighted (2)(5)(6)(7)

% outperformance vs. benchmark % outperformance vs. benchmark % outperformance vs. benchmark

Q2'17 74% 73% 78%

Q3'16 35% 69% 69%

Q2'17 63% 73% 77%

Q3'16 50% 75% 76%

Q2'17 70% 68% 66%

Q3'16 34% 58% 58%

9

Financial Highlights – Q3 2017 v. Q3 2016

• Q3'17 economic net income up 22.9% to $46.7 million ($0.43 per share) from $38.0 million ($0.32 per share) in

Q3'16

◦ EPS growth of 34.4% benefited from buyback of 6.0 million shares in December 2016 and 5.0 million shares

in May 2017

• ENI revenue increase of $52.4 million, or 29.8%, to $228.2 million in Q3'17

◦ Management fees increased 29.0% to $221.7 million, reflecting a 17.0% increase in consolidated Affiliate

average AUM along with a 3.5 bps increase in average yield to 38.4 bps

◦ Performance fees increased to $0.7 million in Q3'17 from $(1.1) million in Q3'16

◦ Landmark increases Q3 yield by approximately 3 bps

• Operating expenses up 18.4% from year-ago quarter to $78.0 million, but the operating expense ratio(1) decreased

from 38.4% to 35.2%

• ENI operating margin of 38.9% improved 235 bps over operating margin of 36.5% in year-ago quarter

• Adjusted EBITDA of $72.0 million, a 30.0% increase from $55.4 million in Q3'16

• Third party debt of $392.6 million at September 30, 2017 represents 1.5x trailing twelve months Adjusted EBITDA

• U.S. and U.K. tax legislation being closely monitored; proposed U.K. legislation expected to increase taxes by

approximately $3 million in Q4’17 and $10 million annually thereafter

• Planning for moderated EPS growth in 2018 due to impact of U.K. taxes and Heitman divestiture (until proceeds

are reinvested)

___________________________________________________________

Please see definitions and additional notes.

(1) The ENI operating expense ratio reflects total ENI operating expenses as a percent of management fees.

10

Average AUM(1)

$300

$250

$200

$150

$100

$50

$0

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

$196 $203 $212 $221

$229

ENI Per Share(5)

Pre-tax ENI

$70

$60

$50

$40

$30

$20

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

$50 $48 $52

$58 $63

$0.50

$0.40

$0.30

$0.20

$0.10

$0.00

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

$0.32 $0.32 $0.34

$0.39 $0.42

ENI Revenue(2)

$250

$210

$170

$130

$90

$50

$10

-$30

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

$177 $185 $199

$210 $228

$228

___________________________________________________________

Please see definitions and additional notes.

1. Operational information (AUM and flows) excludes Heitman beginning in the third quarter of 2017.

2. ENI Revenue consists of management fees, performance fees, and other income, which primarily consists of earnings of our equity-accounted Affiliates.

3. Represents fee rate for consolidated Affiliates; excludes fees for equity-accounted Affiliates.

4. ENI Operating Margin represents ENI operating margin before Affiliate key employee distributions. This is a non-GAAP efficiency measure, calculated based on ENI operating earnings divided by ENI Revenue.

5. ENI per share is calculated as Economic Net Income divided by weighted average diluted shares outstanding.

Improving Markets and Fee Mix Benefit Q3'17

Results

$200

$150

$100

$50

Q2’15 Q3’15 Q4’15 Q1’16 Q2’16

$167 $163 $161 $153

$229

Fee Rate (Basis Points)(3) ENI Operating Margin(4)

40.0

35.0

30.0

25.0

20.0

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

34.9 35.6

37.4 37.5 38.4 $0.42

$0.32 $0.33

% Change Q3'16 to Q3'17: 1.3% % Change Q3'16 to Q3'17: 29.8%

% Change Q3'16 to Q3'17: 34.4%

$221

$176

Performance

Fees

$190

$0.34

Performance

Fees

$228

% Change ex. perf. fees: 28.6%

$63

$49 $51

$64

Performance

Fees

% Change Q3'16 to Q3'17: 30.0%

45%

38%

31%

24%

17%

10%

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

37.0% 34.9% 36.3% 37.9%

38.7%

38.9%

36.5% 35.8% 36.4%

Performance Fees

$0.43

% Change ex. perf. fees: 25.9%

$m$b $m

$199

$52

38.1%

$(1)

(9.3)%

8.2%

8.6%

7.7%

% Change ex perf. fees: 31.3%

1.9%

2.4%

3.1%

Equity-accounted

Affiliates

$228

$255 $235 $246 $231

3.8%

% Change, consolidated Affiliates: 17.0%

11

Management Fee Growth Driven By Increased Average

Assets at Consolidated Affiliates and Landmark

______________________________________________________________________________________________________________

(1) Figures in parenthesis represent the percent of the total respective bar.

(2) Excludes equity-accounted Affiliates.

$240

$210

$180

$150

$120

$90

$60

$30

$0

Q3 2016 Q3 2017

$195.8

$229.1

ENI Management Fee Revenue by Asset Class(1)(2)Consolidated Affiliates Average AUM and Fee Rate by Asset Class(1)(2)

U.S. Equity Global/non-U.S. Equity Fixed Income Alternatives Avg. Fee Rate (bps)

$B

Avg. AUM

% Change

78%

(7)%

27%

1% 24

% Chan

ge: 17.0%

42

21

73

24

41

21

93 $220

$180

$140

$100

$60

$20

Q3 2016 Q3 2017

$171.8

$221.7

$M % Change

129%

(8)%

26%

(1)%

% Chan

ge: 29.0%

$77.4 (39%)

$93.1 (48%)

$14.3 (7%)

$11.0 (6%)

$19.6 (9%)

$13.3 (6%)

$117.8 (51%)

$78.4 (34%)

$47.6 (28%)

$96.6 (56%)

$20.1 (12%)

$7.5 (4%)

$ 47.2 (21%)

$121.5 (55%)

$ 46.1 (21%)

$6.9 (3%)

34.9

38.4

12

Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 Q-O-Q 2017 2016 P-O-P

$M $M % of MFs(1) $M % of MFs(1)

2017 vs.

2016 $M % of MFs(1) $M % of MFs(1)

2017 vs.

2016

Fixed compensation and benefits $ 42.8 19.3% $ 36.3 21.1% 18% $ 126.6 20.3% $ 105.7 22.1% 20%

G&A expenses (excl. sales based

compensation) 27.4 12.4% 22.8 13.3% 20% 80.7 12.9% 65.6 13.7% 23%

Depreciation and amortization 3.2 1.4% 2.5 1.5% 28% 8.5 1.4% 6.9 1.4% 23%

Core operating expense subtotal $ 73.4 33.1% $ 61.6 35.9% 19% $ 215.8 34.6% $ 178.2 37.2% 21%

Sales based compensation 4.6 2.1% 4.3 2.5% 7% 13.5 2.2% 13.5 2.8% —%

Total ENI operating expenses $ 78.0 35.2% $ 65.9 38.4% 18% $ 229.3 36.7% $ 191.7 40.1% 20%

Note: Management fees $ 221.7 $ 171.8 29% $ 624.1 $ 478.5 30%

• Total ENI operating expenses reflect Affiliate operating expenses, Center expenses and key initiatives, including Global Distribution

(excluding variable compensation)

• Q3'17 ENI Operating Expense Ratio(2) decreased to 35.2% for the period, reflecting cost efficiencies at the existing Affiliates and

incremental scale following the Landmark transaction

• Expense increase reflects higher fixed compensation and benefits and general and administrative expenses, partly as a result of the

Landmark transaction, unusual seasonality and one-off items, and normal growth of the business

◦ Excluding Landmark, operating expenses increased approximately 12% compared to the year-ago quarter

• Full-year ENI Operating Expense Ratio(2) expected to be in the range of 36-37%

__________________________________________________________

(1) Represents management fee revenue.

(2) The ENI Operating Expense Ratio reflects total ENI operating expenses as a percent of management fees.

OMAM Benefited From Scale Efficiencies

Commentary

Total ENI Operating Expenses

13

Three Months Ended September 30, Q-O-Q Nine Months Ended September 30, P-O-P

$M

2017 2016

Q3'17 vs.

Q3'16 2017 2016

2017 vs.

2016

Cash Variable Compensation $ 56.8 $ 39.4 44% $ 157.1 $ 105.0 50%

Add: Non-cash equity-based award amortization 4.7 6.3 (25)% 16.7 19.1 (13)%

Variable compensation 61.5 45.7 35% 173.8 124.1 40%

Earnings before variable compensation(1) $ 150.2 $ 109.9 37% $ 419.1 $ 297.0 41%

Variable Compensation Ratio (VC as % of earnings before

variable comp.) 40.9% 41.6% (64) bps 41.5% 41.8% (32) bps

Variable Compensation

• Variable compensation typically awarded based on contractual percentage (e.g., ~25 – 35%) of each Affiliate’s ENI earnings before

variable compensation, plus Center bonuses; also includes contractual split of certain performance fees

◦ Affiliate variable compensation includes cash and equity provided through recycling

◦ Center variable compensation includes cash and OMAM equity

• Variable Compensation Ratio decreased to 40.9% from 41.6% in the year-ago quarter; ratio decreased due to higher growth in

earnings before variable compensation

◦ Increase in absolute level of variable compensation related to Landmark acquisition, variable compensation break-points,

new initiatives and growth of earnings before variable compensation

• Full-year Variable Compensation Ratio expected to be in the range of 40-41% or just above

___________________________________________________________

Please see definitions and additional notes.

(1) Earnings before variable compensation represents ENI revenue less ENI operating expense.

Variable Compensation In Line With Business

Profitability

Commentary

14

Affiliate Key Employee Distributions

Three Months Ended

September 30, Q-O-Q

Nine Months Ended

September 30, P-O-P

$M

2017 2016

Q3'17 vs.

Q3'16 2017 2016 2017 vs. 2016

Earnings after variable compensation (ENI operating earnings) $ 88.7 $ 64.2 38% $ 245.3 $ 172.9 42%

Less: Affiliate key employee distributions (19.9) (11.3) 76% (51.3) (28.8) 78%

Earnings after Affiliate key employee distributions $ 68.8 $ 52.9 30% $ 194.0 $ 144.1 35%

Affiliate Key Employee Distribution Ratio ( / ) 22.4% 17.6% 483 bps 20.9% 16.7% 426 bps

• Represents employees’ share of profit from their respective Affiliates, in some cases following an initial preference to OMAM(1)

• Q3'17 Key Employee Distributions increased due to higher ENI operating earnings, leveraged employee equity structure and the

impact of the Landmark transaction

• Q3'17 Distribution Ratio of 22.4% higher than Q3'16 primarily due to impact of Landmark employees’ continued ownership of 40%

of their business and growth in the Landmark business

• Full-year Key Employee Distribution Ratio expected to be approximately 20-21% or just above

__________________________________________________________

(1) For consolidated Affiliates.

Distribution Ratio Increased Due to Landmark

Acquisition and Leveraged Employee Equity Structure

Commentary

A

B A

B

15

Balance Sheet

$M September 30,

2017

December 31,

2016

Assets

Cash and cash equivalents $ 126.4 $ 101.9

Investment advisory fees receivable 194.6 163.7

Investments 255.3 233.3

Other assets 795.8 759.1

Assets of consolidated Funds 67.6 36.3

Total assets $ 1,439.7 $ 1,294.3

Liabilities and shareholders’ equity

Accounts payable and accrued expenses $ 212.6 $ 178.1

Due to related parties 111.9 156.3

Non-recourse borrowings 33.5 —

Third party borrowings 392.6 392.3

Other liabilities 534.6 391.3

Liabilities of consolidated Funds 8.1 5.8

Total liabilities 1,293.3 1,123.8

Total equity 146.4 170.5

Total liabilities and equity $ 1,439.7 $ 1,294.3

Shares outstanding in the quarter ended:

Basic 109.0 120.0

Diluted 109.7 120.6

Leverage ratio 1.5x 1.9x

Balance Sheet Management Provides Ongoing

Opportunities to Increase Shareholder Value

• $0.09 per share interim dividend approved, reflecting

~21% payout rate

◦ Payable December 29 to shareholders of record

as of December 15

• Financial capacity remains for potential cash acquisition

◦ Net proceeds from Heitman transaction of

approximately $73 million in addition to cash

generation and borrowing ability

◦ Full capacity available on $350 million RCF

• September 30 leverage ratio (Debt / LTM Adjusted

EBITDA) of 1.5x, below target range of 1.75x - 2.25x

• Cash of $126.4 million includes $108.0 million at the

Affiliates and $18.4 million at the Center

• At 6/30/17, paid first DTA installment of $45.5 million

due to OM plc with remaining $97.1 million to be paid in

two installments on 12/31/17 and 6/30/18

• In July 2017, purchased remaining $63.4 million of seed

capital from OM plc (included in both Investments and

Assets of consolidated Funds), partially financed with

non-recourse debt

Capital

Dividend & Investment

16

Appendix

17

i. Exclude non-cash expenses representing

changes in the value of Affiliate equity and

profit interests held by Affiliate key

employees

ii. Exclude non-cash amortization or impairment

expenses related to acquired goodwill and

other intangibles, as well as the amortization

of acquisition-related contingent

consideration and the value of employee

equity owned prior to acquisitions. Please

note that the revaluations related to these

acquisition-related items are included in (1)

above

iii. Exclude capital transaction costs including the

costs of raising debt or equity, gains or losses

realized as a result of redeeming debt or

equity and direct incremental costs associated

with acquisitions of businesses or assets

iv. Exclude gains/losses on seed capital and co-

investments, as well as related financing costs

v. Include cash tax benefits related to tax

amortization of acquired intangibles

vi. Exclude results of discontinued operations as

they are not part of the ongoing business, and

restructuring costs incurred in continuing

operations which represent an exit from a

distinct product or line of business

vii. Exclude one-off tax benefits or costs

unrelated to current operations

Reconciliation: GAAP to ENI and Adjusted EBITDA

ENI AdjustmentsThree Months Ended

September 30,

Nine Months Ended

September 30,

$m 2017 2016 2017 2016

U.S. GAAP net income attributable to controlling interests $ 18.7 $ 34.0 $ 53.0 $ 101.1

Adjustments to reflect the economic earnings of the Company:

Non-cash key employee-owned equity and profit interest

revaluations(1) 35.8 (6.4) 71.0 (8.8)

Amortization of acquired intangible assets, acquisition-related

consideration and pre-acquisition employee equity(1) 19.2 9.7 57.8 9.8

Capital transaction costs(1) — 4.4 — 6.1

Seed/Co-investment (gains) losses and financings(1) (4.7) 0.2 (13.4) (0.5)

Tax benefit of goodwill and acquired intangible deductions 2.2 1.7 6.7 3.0

Discontinued operations and restructuring(2) 0.3 0.4 9.7 (1.2)

Total adjustment to reflect earnings of the Company $ 52.8 $ 10.0 $ 131.8 $ 8.4

Tax effect of above adjustments(1) (20.3) (3.1) (50.3) (2.6)

ENI tax normalization (4.5) (2.9) (2.3) (0.7)

Economic net income $ 46.7 $ 38.0 $ 132.2 $ 106.2

Net interest expense to third parties 4.6 3.5 14.4 3.9

Depreciation and amortization 3.2 2.5 8.5 6.9

Tax on Economic Net Income 17.5 11.4 47.4 34.0

Adjusted EBITDA $ 72.0 $ 55.4 $ 202.5 $ 151.0

___________________________________________________________

(1) Tax-affected items for which adjustments are included in “Tax effect of above adjustments” line; includes restructuring component of discontinued operations and restructuring line

taxed at 40.2% U.S. statutory rate (including state tax).

(2) Included in restructuring for the three months ended September 30, 2017 is $0.2 million for CEO transition costs. Included in restructuring for the nine months ended September 30,

2017 is $9.5 million related to CEO transition costs, comprised of $0.5 million of fixed compensation and benefits, $8.8 million of variable compensation and $0.2 million of CEO

recruiting costs.

1

3

2

4

5

1

2

3

4

5

6

7

7

6

18

Reconciliation: GAAP to ENI and Components of ENI

Components of ENI revenue

($ in millions) Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 2017 2016

Management fees(1) $ 221.7 $ 171.8 $ 624.1 $ 478.5

Performance fees 0.7 (1.1) 12.1 (1.9)

Other income, including equity-accounted Affiliates(2) 5.8 5.1 12.2 12.1

ENI revenue $ 228.2 $ 175.8 $ 648.4 $ 488.7

U.S. GAAP revenue to ENI revenue

($ in millions) Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 2017 2016

U.S. GAAP revenue $ 223.2 $ 170.8 $ 638.2 $ 476.9

Include investment return on equity-accounted

Affiliates(2) 5.7 5.0 11.2 11.8

Exclude revenue from consolidated Funds (0.7) — (1.4) —

Other — — 0.4 —

ENI revenue $ 228.2 $ 175.8 $ 648.4 $ 488.7

Components of ENI operating expense

($ in millions) Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 2017 2016

Fixed compensation & benefits $ 42.8 $ 36.3 $ 126.6 $ 105.7

General and administrative expenses 32.0 27.1 94.2 79.1

Depreciation and amortization 3.2 2.5 8.5 6.9

ENI operating expense $ 78.0 $ 65.9 $ 229.3 $ 191.7

___________________________________________________________

(1) ENI management fees correspond to U.S. GAAP management fees.

(2) ENI other income is comprised of other revenue under U.S. GAAP, plus our earnings from equity-accounted Affiliates of $5.7 million and $11.2 million for the three and nine

months ended September 30, 2017, respectively, and $5.0 million and $11.8 million for the three and nine months ended September 30, 2016, respectively. Of the Other

income, Heitman represents $5.0 million and $9.3 million for the three and nine months ended September 30, 2017, respectively, and $4.1 million and $9.9 million for the three

and nine months ended September 30, 2016, respectively.

19

U.S. GAAP operating expense to ENI operating expense

($ in millions) Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 2017 2016

U.S. GAAP operating expense $ 214.9 $ 130.6 $ 593.5 $ 351.7

Less: items excluded from economic net income

Acquisition-related consideration and pre-acquisition employee equity(1) (17.6) (8.8) (52.9) (8.8)

Non-cash key employee-owned equity and profit interest revaluations (35.8) 6.4 (71.0) 8.8

Amortization of acquired intangible assets (1.6) (0.9) (4.9) (1.0)

Capital transaction costs — (4.4) — (6.1)

Restructuring costs(2) (0.2) — (9.5) —

Funds’ operating expense (0.3) — (0.8) —

Less: items segregated out of U.S. GAAP operating expense

Variable compensation (61.5) (45.7) (173.8) (124.1)

Affiliate key employee distributions (19.9) (11.3) (51.3) (28.8)

ENI operating expense $ 78.0 $ 65.9 $ 229.3 $ 191.7

U.S. GAAP compensation expense to ENI fixed compensation and benefits expense

($ in millions) Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 2017 2016

Total U.S. GAAP compensation expense $ 182.2 $ 100.0 $ 498.4 $ 272.1

Acquisition-related consideration and pre-acquisition employee equity(1) (17.6) (8.8) (52.9) (8.8)

Non-cash key employee-owned equity and profit interest revaluations

excluded from ENI (35.8) 6.4 (71.0) 8.8

Sales-based compensation reclassified to ENI general & administrative

expenses (4.6) (4.3) (13.5) (13.5)

Affiliate key employee distributions (19.9) (11.3) (51.3) (28.8)

Compensation related to restructuring expenses(2) — — (9.3) —

Variable compensation (61.5) (45.7) (173.8) (124.1)

ENI fixed compensation and benefits $ 42.8 $ 36.3 $ 126.6 $ 105.7

Reconciliation: GAAP to ENI

__________________________________________________________

(1) Reflects amortization of contingent purchase price and equity owned by employees, both with a service requirement, associated with the Landmark acquisition.

(2) Included in restructuring for the three months ended September 30, 2017 is $0.2 million for CEO transition costs (general and administrative expense). Included in restructuring for the nine months ended

September 30, 2017 is $9.5 million related to CEO transition costs, comprised of $0.5 million of fixed compensation and benefits, $8.8 million of variable compensation and $0.2 million of CEO recruiting costs

(general and administrative expense).

20

Reconciliation: GAAP to ENI

U.S. GAAP general and administrative expense to ENI general and administrative expense

($ in millions) Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 2017 2016

U.S. GAAP general and administrative expense $ 27.6 $ 27.2 $ 80.9 $ 71.7

Sales-based compensation 4.6 4.3 13.5 13.5

Capital transaction costs — (4.4) — (6.1)

Restructuring costs(1) (0.2) — (0.2) —

ENI general and administrative expense $ 32.0 $ 27.1 $ 94.2 $ 79.1

U.S. GAAP operating income to ENI operating earnings and ENI earnings after Affiliate key employee distributions

($ in millions) Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 2017 2016

U.S. GAAP operating income $ 8.3 $ 40.2 $ 44.7 $ 125.2

Include investment return on equity-accounted Affiliates 5.7 5.0 11.2 11.8

Exclude the impact of:

Non-cash key employee-owned equity and profit interest revaluations 35.8 (6.4) 71.0 (8.8)

Amortization of acquired intangible assets, acquisition-related consideration

and pre-acquisition employee equity 19.2 9.7 57.8 9.8

Capital transaction costs — 4.4 — 6.1

Restructuring costs(1) 0.2 — 9.5 —

Other — — 0.4 —

Affiliate key employee distributions 19.9 11.3 51.3 28.8

Variable compensation 61.5 45.7 173.8 124.1

Funds’ operating (income) loss (0.4) — (0.6) —

ENI earnings before variable compensation 150.2 109.9 419.1 297.0

Less: ENI variable compensation (61.5) (45.7) (173.8) (124.1)

ENI operating earnings 88.7 64.2 245.3 172.9

Less: ENI Affiliate key employee distributions (19.9) (11.3) (51.3) (28.8)

ENI earnings after Affiliate key employee distributions $ 68.8 $ 52.9 $ 194.0 $ 144.1

__________________________________________________________

(1) Included in restructuring for the three months ended September 30, 2017 is $0.2 million for CEO transition costs (general and administrative expense). Included in restructuring for the

nine months ended September 30, 2017 is $9.5 million related to CEO transition costs, comprised of $0.5 million of fixed compensation and benefits, $8.8 million of variable

compensation and $0.2 million of CEO recruiting costs (general and administrative expense).

21

Calculation of ENI Effective Tax Rate

($ in millions) Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 2017 2016

Pre-tax economic net income(1) $ 64.2 $ 49.4 $ 179.6 $ 140.2

Intercompany interest expense deductible for U.S. tax purposes (19.7) (18.9) (58.6) (54.3)

Taxable economic net income 44.5 30.5 121.0 85.9

Taxes at the U.S. federal and state statutory rates(2) (17.8) (12.2) (48.6) (34.5)

Other reconciling tax adjustments 0.3 0.8 1.2 0.5

Tax on economic net income (17.5) (11.4) (47.4) (34.0)

Add back intercompany interest expense previously excluded 19.7 18.9 58.6 54.3

Economic net income $ 46.7 $ 38.0 $ 132.2 $ 106.2

Economic net income effective tax rate(3) 27.3% 23.1% 26.4% 24.3%

_______________________________________________________

(1) Pre-tax economic net income is shown before intercompany interest and tax expense.

(2) Taxed at U.S. Federal and State statutory rate of 40.2%.

(3) The economic net income effective tax rate is calculated by dividing the tax on economic net income by pre-tax economic net income.

Calculation of ENI Effective Tax Rate

22

Definitions and Additional Notes

References to “OMAM” or the “Company” refer to OM Asset Management plc; references to “OM plc” refer to Old Mutual plc, the Company’s former parent; references to the

“Center” refer to the holding company excluding the Affiliates; references to "Landmark" refer to Landmark Partners, LLC, acquired by the Company in August 2016. OMAM

operates its business through eight boutique asset management firms (the “Affiliates”). OMAM’s distribution activities are conducted in various jurisdictions through affiliated

companies in accordance with local regulatory requirements.

The Company uses a non-GAAP performance measure referred to as economic net income (“ENI”) to represent its view of the underlying economic earnings of the business. ENI

is used to make resource allocation decisions, determine appropriate levels of investment or dividend payout, manage balance sheet leverage, determine Affiliate variable

compensation and equity distributions, and incentivize management. The Company’s ENI adjustments to U.S. GAAP include both reclassifications of U.S. GAAP revenue and

expense items, as well as adjustments to U.S. GAAP results, primarily to exclude non-cash, non-economic expenses, or to reflect cash benefits not recognized under U.S. GAAP.

The Company re-categorizes certain line items on the income statement to:

• exclude the effect of Funds consolidation by removing the portion of Fund revenues, expenses and investment return which were not attributable to our

shareholders.

• include within management fee revenue any fees paid to Affiliates by consolidated Funds, which are viewed as investment income under U.S. GAAP.

• include the Company’s share of earnings from equity-accounted Affiliates within other income, rather than investment income;

• treat sales-based compensation as a general and administrative expense, rather than part of fixed compensation and benefits;

• identify separately from operating expenses, variable compensation and Affiliate key employee distributions, which represent Affiliate earnings shared with Affiliate

key employees.

The Company also makes the following adjustments to U.S. GAAP results to more closely reflect its economic results by:

i. excluding non-cash expenses representing changes in the value of Affiliate equity and profit interests held by Affiliate key employees. These ownerships interests may

in certain circumstances be repurchased by OMAM at a value based on a pre-determined fixed multiple of trailing earnings and as such this value is carried on the

Company’s balance sheet as a liability. Non-cash movements in the value of this liability are treated as compensation expense under U.S. GAAP. However, any equity

or profit interests repurchased by OMAM can be used to fund a portion of future variable compensation awards, resulting in savings in cash variable compensation

that offset the negative cash effect of repurchasing the equity.

ii. excluding non-cash amortization or impairment expenses related to acquired goodwill and other intangibles as these are non-cash charges that do not result in an

outflow of tangible economic benefits from the business. It also excludes the amortization of acquisition-related contingent consideration, as well as the value of

employee equity owned pre-acquisition, as occurred as a result of the Landmark transaction, where such items have been included in compensation expense as a

result of ongoing service requirements for certain employees. Please note that the revaluations related to these acquisition-related items are included in (i) above.

iii. excluding capital transaction costs, including the costs of raising debt or equity, gains or losses realized as a result of redeeming debt or equity and direct incremental

costs associated with acquisitions of businesses or assets.

iv. excluding seed capital and co-investment gains, losses and related financing costs. The net returns on these investments are considered and presented separately

from ENI because ENI is primarily a measure of the Company’s earnings from managing client assets, which therefore differs from earnings generated by its

investments in Affiliate products, which can be variable from period to period.

v. including cash tax benefits associated with deductions allowed for acquired intangibles and goodwill that may not be recognized or have timing differences compared

to U.S. GAAP.

vi. excluding the results of discontinued operations attributable to controlling interests since they are not part of the Company’s ongoing business, and restructuring

costs incurred in continuing operations which represent an exit from a distinct product or line of business.

vii. excluding deferred tax resulting from changes in tax law and expiration of statutes, adjustments for uncertain tax positions, deferred tax attributable to intangible

assets and other unusual items not related to current operating results to reflect ENI tax normalization.

23

The Company adjusts its income tax expense to reflect any tax impact of its ENI adjustments. Please see Slide 17 for a reconciliation of U.S. GAAP net income attributable to

controlling interests to economic net income.

Adjusted EBITDA

Adjusted EBITDA is defined as economic net income before interest, income taxes, depreciation and amortization. The Company notes that its calculation of Adjusted EBITDA may not

be consistent with Adjusted EBITDA as calculated by other companies. The Company believes Adjusted EBITDA is a useful liquidity metric because it indicates the Company’s ability to

make further investments in its business, service debt and meet working capital requirements. Please see Slide 17 for a reconciliation of U.S. GAAP net income attributable to

controlling interests to ENI and Adjusted EBITDA.

Methodologies for calculating investment performance(1):

Revenue-weighted investment performance measures the percentage of management fee revenue generated by Affiliate strategies which are beating benchmarks. It

calculates each strategy’s percentage weight by taking its estimated composite revenue over total composite revenues in each period, then sums the total percentage of

revenue for strategies outperforming.

Equal-weighted investment performance measures the percentage of Affiliates’ scale strategies (defined as strategies with greater than $100 million of AUM) beating

benchmarks. Each outperforming strategy over $100 million has the same weight; the calculation sums the number of strategies outperforming relative to the total number

of composites over $100 million.

Asset-weighted investment performance measures the percentage of AUM in strategies beating benchmarks. It calculates each strategy’s percentage weight by taking its

composite AUM over total composite AUM in each period, then sums the total percentage of AUM for strategies outperforming.

ENI operating earnings

ENI operating earnings represents ENI earnings before Affiliate key employee distributions and is calculated as ENI revenue, less ENI operating expense, less ENI variable

compensation. It differs from economic net income because it does not include the effects of Affiliate key employee distributions, net interest expense or income tax expense.

ENI operating margin

The ENI operating margin, which is calculated before Affiliate key employee distributions, is used by management and is useful to investors to evaluate the overall operating margin of

the business without regard to our various ownership levels at each of the Affiliates. ENI operating margin is a non-GAAP efficiency measure, calculated based on ENI operating

earnings divided by ENI revenue. The ENI operating margin is most comparable to our U.S. GAAP operating margin.

ENI management fee revenue

ENI Management fee revenue corresponds to U.S. GAAP management fee revenue.

ENI operating expense ratio

The ENI operating expense ratio is used by management and is useful to investors to evaluate the level of operating expense as measured against our recurring management fee

revenue. We have provided this ratio since many operating expenses, including fixed compensation & benefits and general and administrative expense, are generally linked to the

overall size of the business. We track this ratio as a key measure of scale economies at OMAM because in our profit sharing economic model, scale benefits both the Affiliate

employees and OMAM shareholders.

Definitions and Additional Notes

___________________________________________________________

(1) Barrow Hanley’s Windsor II Large Cap Value account AUM and return are separated from Barrow Hanley’s Large Cap Value composite in revenue-weighted, equal-weighted and asset-weighted

outperformance percentage calculations.

24

Definitions and Additional Notes

ENI earnings before variable compensation

ENI earnings before variable compensation is calculated as ENI revenue, less ENI operating expense.

ENI variable compensation ratio

The ENI variable compensation ratio is calculated as variable compensation divided by ENI earnings before variable compensation. It is used by management and is useful to

investors to evaluate consolidated variable compensation as measured against our ENI earnings before variable compensation. Variable compensation is usually awarded based on

a contractual percentage of each Affiliate’s ENI earnings before variable compensation and may be paid in the form of cash or non-cash Affiliate equity or profit interests. Center

variable compensation includes cash and OMAM equity. Non-cash variable compensation awards typically vest over several years and are recognized as compensation expense

over that service period. The variable compensation ratio at each Affiliate will typically be between 25% and 35%.

ENI Affiliate key employee distribution ratio

The Affiliate key employee distribution ratio is calculated as Affiliate key employee distributions divided by ENI operating earnings. The ENI Affiliate key employee distribution ratio

is used by management and is useful to investors to evaluate Affiliate key employee distributions as measured against our ENI operating earnings. Affiliate key employee

distributions represent the share of Affiliate profits after variable compensation that is attributable to Affiliate key employee equity and profit interests holders, according to their

ownership interests. At certain Affiliates, OMUS is entitled to an initial preference over profits after variable compensation, structured such that before a preference threshold is

reached, there would be no required key employee distributions, whereas for profits above the threshold the key employee distribution amount would be calculated based on the

key employee economic percentages, which range from approximately 20% to 40% at our consolidated Affiliates.

U.S. GAAP operating margin

U.S. GAAP operating margin equals operating income from continuing operations divided by total revenue.

Consolidated Funds

Financial information presented in accordance with U.S. GAAP may include the results of consolidated pooled investment vehicles, or Funds, managed by our Affiliates, where it

has been determined that these entities are controlled by the Company. Financial results which are “attributable to controlling interests” exclude the impact of Funds to the extent

it is not attributable to our shareholders.

Annualized revenue impact of net flows (“NCCF”)

Annualized revenue impact of net flows represents the difference between annualized management fees expected to be earned on new accounts and net assets contributed to

existing accounts, less the annualized management fees lost on terminated accounts or net assets withdrawn from existing accounts, including equity-accounted Affiliates.

Annualized revenue is calculated by multiplying the annual gross fee rate for the relevant account by the net assets gained in the account in the event of a positive flow or the net

assets lost in the account in the event of an outflow and is designed to provide investors with a better indication of the potential financial impact of net client cash flows.

Hard asset disposals

Net flows include hard asset disposals and fund distributions made by OMAM’s Affiliates. This category is made up of investment-driven asset dispositions by Landmark, investing

in real estate funds and secondary private equity; Heitman, a real estate manager; or Campbell, a timber manager.

Derived average weighted NCCF

Derived average weighted NCCF reflects the implied NCCF if annualized revenue impact of net flows represents asset flows at the weighted fee rate for OMAM (i.e. 38.6 bps in

Q3'17). For example, NCCF annualized revenue impact of $12.2 million divided by the average weighted fee rate of OMAM’s AUM of 38.6 bps equals the derived average weighted

NCCF of $3.2 billion.

n/m

“Not meaningful.”