Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Sucampo Pharmaceuticals, Inc. | exh_991.htm |

| 8-K - FORM 8-K - Sucampo Pharmaceuticals, Inc. | f8k_110117.htm |

EXHIBIT 99.2

November 1, 2017 Third Quarter 2017 Corporate Update and Financial Results 1

Introductions and Forward - Looking Statements Silvia Taylor, SVP Investor Relations & Corporate Affairs 2

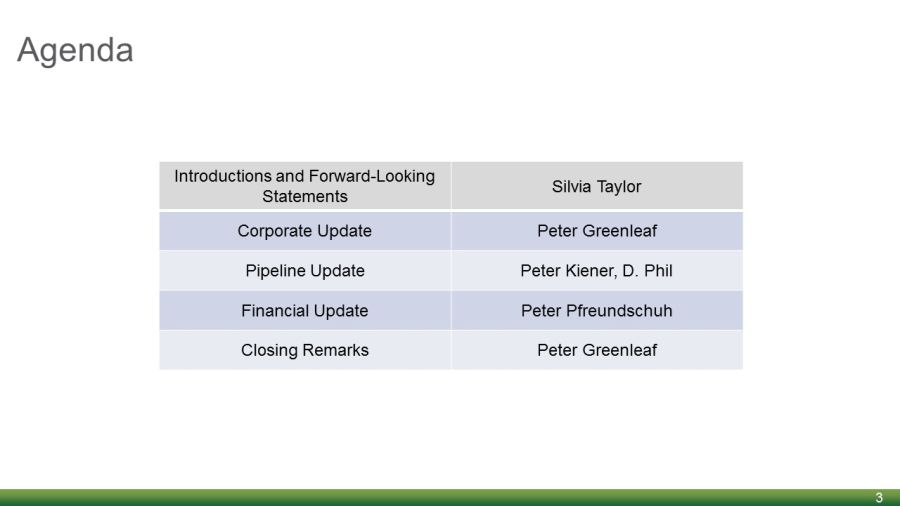

Agenda Introductions and Forward - Looking Statements Silvia Taylor Corporate Update Peter Greenleaf Pipeline Update Peter Kiener, D. Phil Financial Update Peter Pfreundschuh Closing Remarks Peter Greenleaf 3

Forward Looking Statement This presentation contains "forward - looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and involve risks and uncertainties, which may cause results to dif fer materially from those set forth in the statements. The forward - looking statements may include statements regarding product development, and othe r statements that are not historical facts. The following factors, among others, could cause actual results to differ from those set forth in t he forward - looking statements: the impact of pharmaceutical industry regulation and health care legislation; Sucampo's ability to accurately predict future mar ket conditions; Sucampo’s ability to successfully integrate the operations of acquired businesses; dependence on the effectiveness of Sucampo 's patents and other protections for innovative products; the effects of competitive products on Sucampo’s products; and the exposure to litigatio n a nd/or regulatory actions. No forward - looking statement can be guaranteed and actual results may differ materially from those projected. Sucampo undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events, or otherwise. Forward - look ing statements in this presentation should be evaluated together with the many uncertainties that affect Sucampo's business, particularly those ment ion ed in the risk factors and cautionary statements in Sucampo's most recent Form 10 - K as filed with the Securities and Exchange Commission on March 8, 20 17, as well as its filings with the Securities and Exchange Commission on Forms 8 - K and 10 - Q since the filing of the Form 10 - K, all of which Su campo incorporates by reference. 4

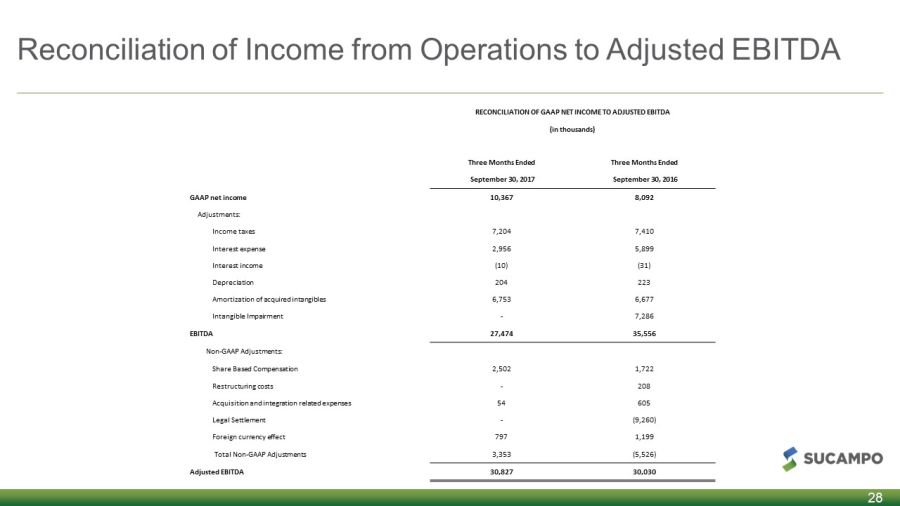

Non - GAAP Metrics This presentation contains four financial metrics (Adjusted Net Income, EBITDA, Adjusted EBITDA and Free Cash Flow) that are con sidered “non - GAAP” financial metrics under applicable Securities and Exchange Commission rules and regulations. These non - GAAP financial metr ics should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted acco unt ing principles. The company’s definition of these non - GAAP metrics may differ from similarly titled metrics used by others. Adjusted Net Income adju sts for specified items that can be highly variable or difficult to predict, and various non - cash items, which includes amortization of acquired i ntangibles, intangible impairment, legal settlement, restructuring costs, acquisition and integration related expenses, amortization of debt financi ng costs, foreign currency effect and the tax impact of these adjustments. EBITDA reflects net income excluding the impact of provision for income taxes , i nterest expense, interest income, depreciation, amortization of acquired intangibles and intangible impairment. Adjusted EBITDA reflects EBITD A a nd adjusts for specified items that can be highly variable or difficult to predict, and various non - cash items, which includes share based comp ensation expense, restructuring costs, acquisition and integration related expenses, legal settlement and foreign currency effect. Free cash f low reflects net cash provided by operating activities less expenditures made for property and equipment. The company views these non - GAAP financial m etrics as a means to facilitate management’s financial and operational decision - making, including evaluation of the company’s historical ope rating results and comparison to competitors’ operating results. These non - GAAP financial metrics reflect an additional way of viewing aspects of t he company’s operations that, when viewed with GAAP results may provide a more complete understanding of factors and trends affecting the com pany’s business. The determination of the amounts that are excluded from these non - GAAP financial metrics is a matter of management judgment and depends upon, among other factors, the nature of the underlying expense or income amounts. Because non - GAAP financial metrics exclude the effe ct of items that will increase or decrease the company’s reported results of operations, management strongly encourages investors to review th e c ompany’s consolidated financial statements and publicly - filed reports in their entirety. 5

Q3 2017 Corporate Update Peter Greenleaf, Chairman and CEO 6

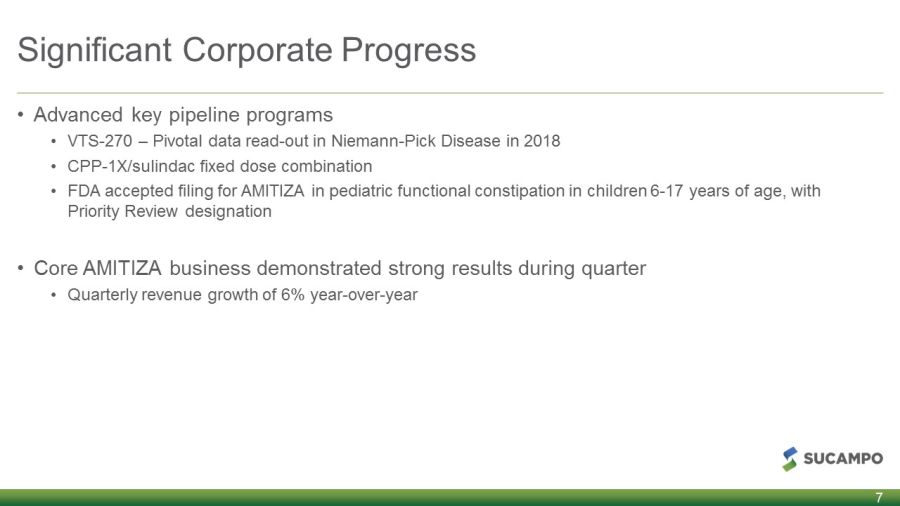

Significant Corporate Progress • Advanced key pipeline programs • VTS - 270 – Pivotal data read - out in Niemann - Pick Disease in 2018 • CPP - 1X/sulindac fixed dose combination • FDA accepted filing for AMITIZA in pediatric functional constipation in children 6 - 17 years of age, with Priority Review designation • Core AMITIZA business demonstrated strong results during quarter • Quarterly revenue growth of 6% year - over - year 7

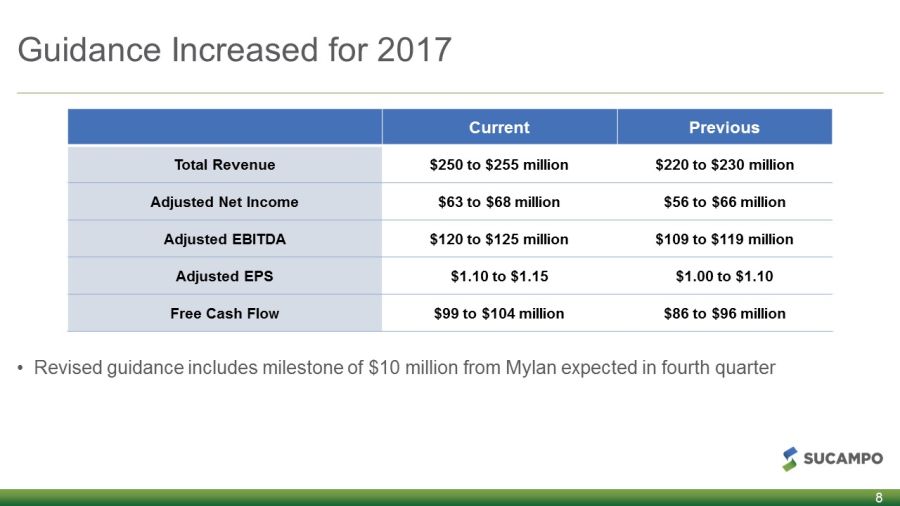

Guidance Increased for 2017 • Revised guidance includes milestone of $10 million from Mylan expected in fourth quarter 8 Current Previous Total Revenue $250 to $255 million $220 to $230 million Adjusted Net Income $63 to $68 million $56 to $66 million Adjusted EBITDA $120 to $125 million $109 to $119 million Adjusted EPS $1.10 to $1.15 $1.00 to $1.10 Free Cash Flow $99 to $104 million $86 to $96 million

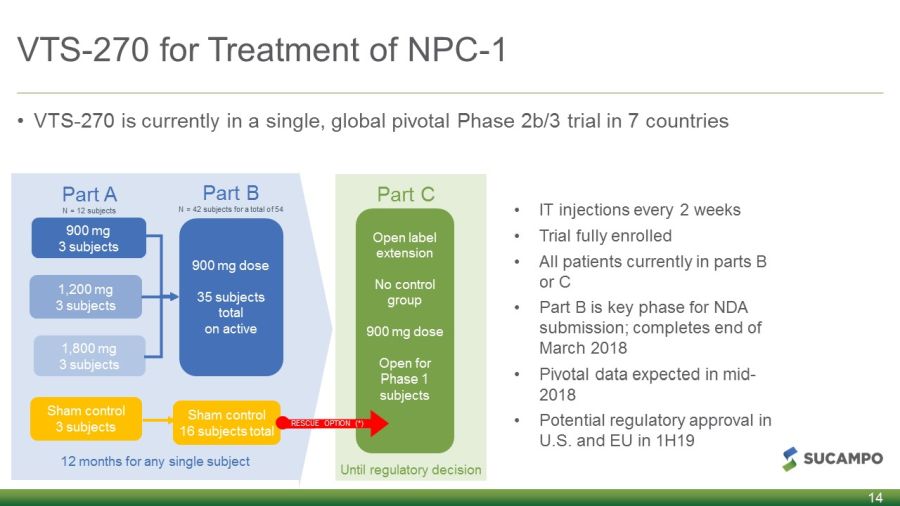

VTS - 270 Program Update • VTS - 270 for the treatment of Niemann - Pick Disease (NPC - 1) in global pivotal registration program • Ultra - rare disorder with devastating and ultimately fatal outcome • Orphan drug designation in both U.S. and Europe and breakthrough therapy designation in U.S. • Phase 1/2a trial data Published in The Lancet • Open - label, dose - escalation trial studying safety, tolerability, biomarker changes, and clinical efficacy of VTS - 270 intrathecal administration • Results showed reduction in signs and symptoms of disease progression • Phase 3 program ongoing • Pivotal data results in mid - 2018 • Commercialization expected in 2019 9

CPP - 1X/sulindac Phase 3 Program Update • In Phase 3 program for the treatment of Familial Adenomatous Polyposis (FAP) • Rare disease that leads to cancer of GI tract in 100% of patients • Partnership with Cancer Prevention Pharmaceuticals • Fast - Track status granted by FDA • If relevant criteria met, makes product eligible for Accelerated Approval and Priority Review • Previously, orphan drug status granted in U.S. 10

Strong Q3 2017 U.S. AMITIZA Performance • Takeda’s AMITIZA net sales for royalty calculation purposes • Q3 grew 6% YoY to $115.2M • Driven by increased volume and price • Royalty revenue grew 11% YoY to $23.0M • U.S. AMITIZA product sales to Takeda of $13.1M • Total U.S. revenue of $36.2M • AMITIZA TRx • Q3 IMS: ~375,000 TRx, increase of approximately 1% YoY • Strong performance attributed to competitive profile • Strong commercial and Part D managed coverage care status with CVS Caremark and Express Scripts 11

Strong Japan AMITIZA Performance • Sucampo Q3 revenue: $20.5M, growth of 18% YoY • Growth driven by volume • Increased 35% YoY • Patient demand for AMITIZA remains strong in an increasingly competitive market • Expect AMITIZA to continue to hold solid position with prescribers and benefit from increased disease education and awareness 12

Pipeline Update Peter Kiener, D. Phil, CSO 13 13

VTS - 270 for Treatment of NPC - 1 14 Until regulatory decision • IT injections every 2 weeks • Trial fully enrolled • All patients currently in parts B or C • Part B is key phase for NDA submission; completes end of March 2018 • Pivotal data expected in mid - 2018 • Potential regulatory approval in U.S. and EU in 1H19 12 months for any single subject Part A N = 12 subjects Part B N = 42 subjects for a total of 54 Part C Sham control 3 subjects 1,800 mg 3 subjects 1,200 mg 3 subjects 900 mg 3 subjects 900 mg dose 35 subjects total on active Sham control 16 subjects total Open label extension No control group 900 mg dose Open for Phase 1 subjects RESCUE OPTION (*) • VTS - 270 is currently in a single, global pivotal Phase 2b/3 trial in 7 countries

CPP - 1X/sulindac for Treatment of FAP • CPP - 1X/sulindac is being developed to treat Familial Adenomatous Polyposis (FAP), a predominately genetic disease • If left untreated, FAP eventually develops into colon cancer in 100% of patients • Orphan disease in U.S. and Europe • Ongoing Phase 3 study is a 150 patient, three - arm, double - blind, randomized trial • Granted Fast Track Status by FDA • Product recently passed a pre - specified interim futility analysis • Recommendation to not discontinue trial was made by an Independent Data Monitoring Committee (IDMC) • Approval anticipated in 2019 • Sucampo has exclusive option for North America 15

AMITIZA for Treatment of Pediatric Functional Constipation • FDA accepted sNDA filing for life cycle management program for AMITIZA in children age 6 - 17 with pediatric functional constipation • Priority Review designation • PDUFA date Jan 28, 2018 • Ongoing commitment to pediatric functional constipation 16

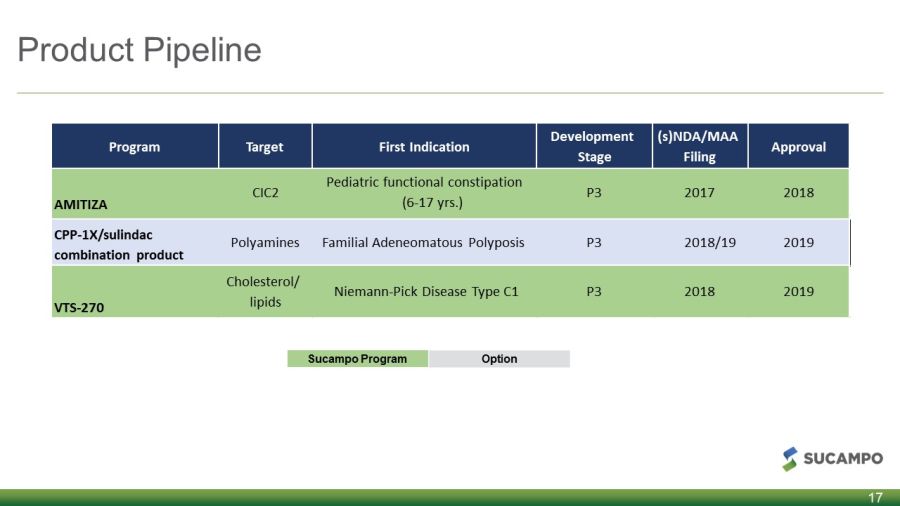

Product Pipeline 17 Sucampo Program Option Program Target First Indication Development Stage (s)NDA/MAA Filing Approval AMITIZA CIC2 Pediatric functional constipation (6 - 17 yrs.) P3 2017 2018 CPP - 1X/sulindac combination product Polyamines Familial Adeneomatous Polyposis P3 2018/19 2019 VTS - 270 Cholesterol/ lipids Niemann - Pick Disease Type C1 P3 2018 2019

Financial Update Peter Pfreundschuh, CFO 18 18

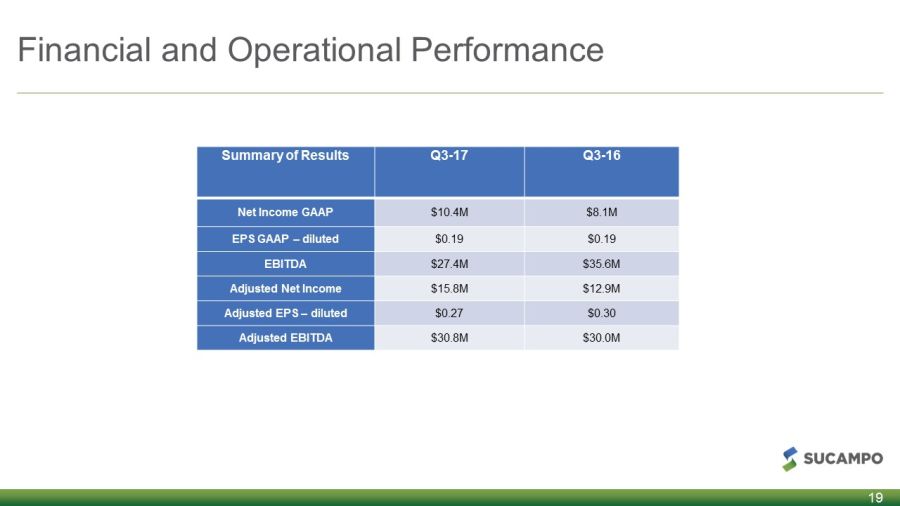

Financial and Operational Performance Summary of Results Q3 - 17 Q3 - 16 Net Income GAAP $10.4M $8.1M EPS GAAP – diluted $0.19 $0.19 EBITDA $27.4M $35.6M Adjusted Net Income $15.8M $12.9M Adjusted EPS – diluted $0.27 $0.30 Adjusted EBITDA $30.8M $30.0M 19

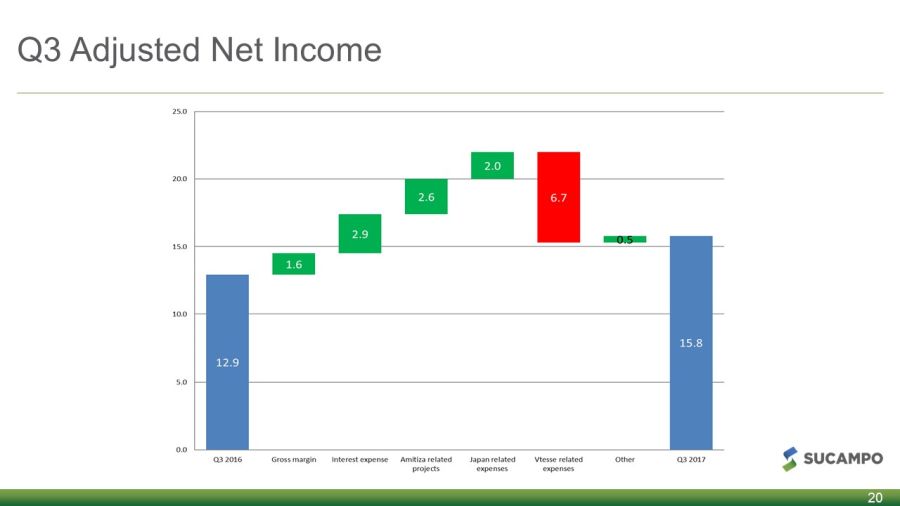

Q3 Adjusted Net Income 20

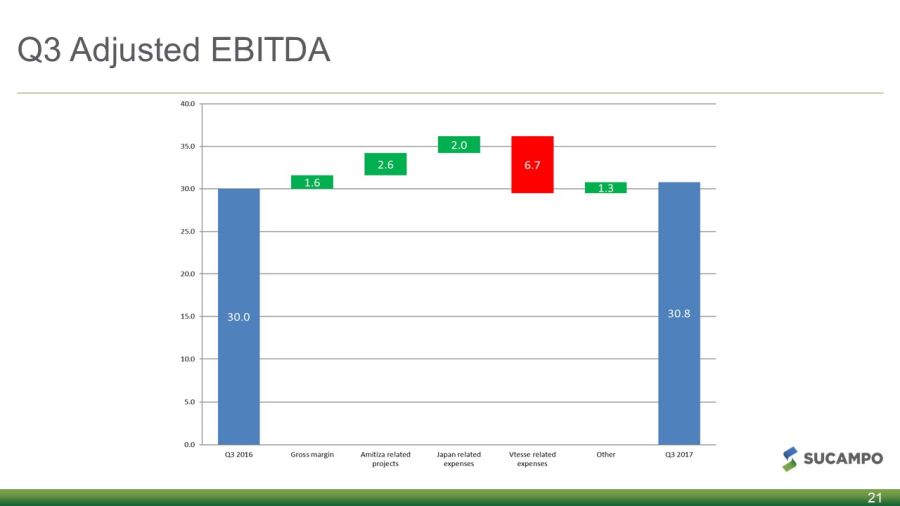

Q3 Adjusted EBITDA 21

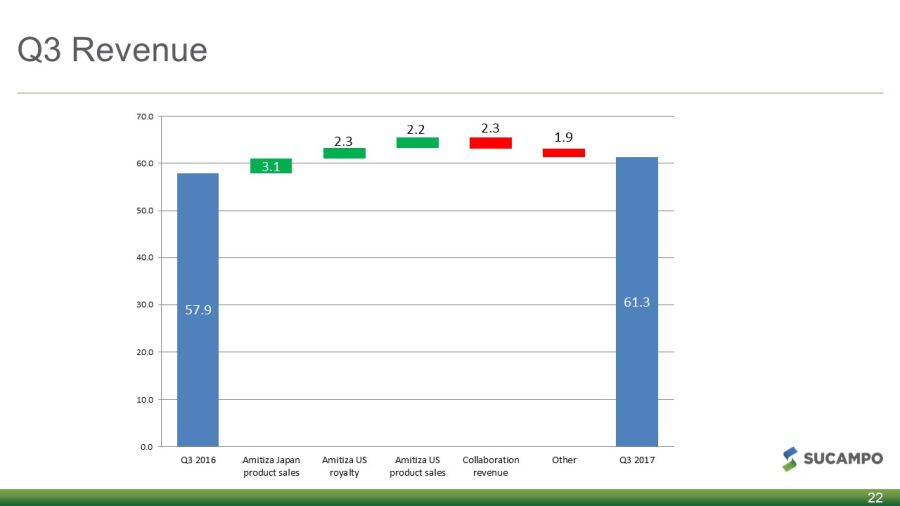

Q3 Revenue 22 61.3 3.1 2.3 2.2 2.3 1.9 57.9 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 Q3 2016 Amitiza Japan product sales Amitiza US royalty Amitiza US product sales Collaboration revenue Other Q3 2017

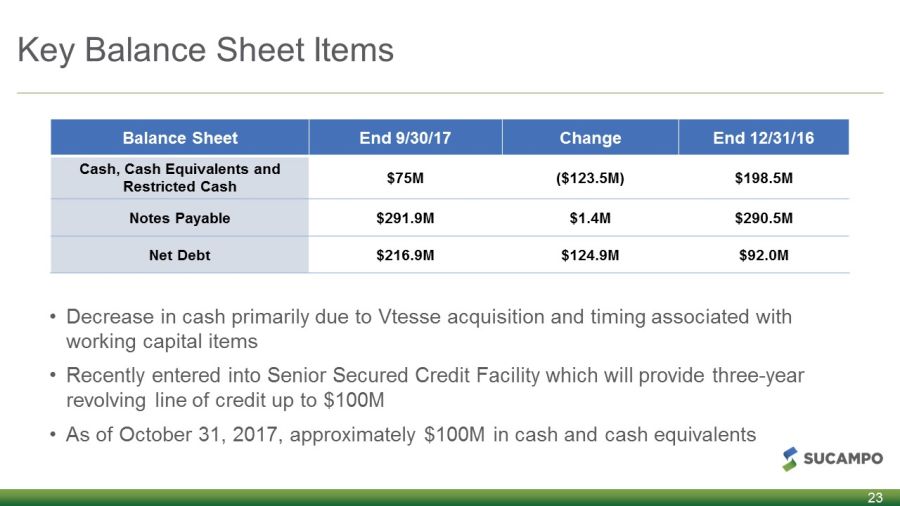

Key Balance Sheet Items 23 Balance Sheet End 9/30/17 Change End 12/31/16 Cash, Cash Equivalents and Restricted Cash $75M ($123.5M) $198.5M Notes Payable $291.9M $1.4M $290.5M Net Debt $216.9M $124.9M $92.0M • Decrease in cash primarily due to Vtesse acquisition and timing associated with working capital items • Recently entered into Senior Secured Credit Facility which will provide three - year revolving line of credit up to $100M • As of October 31, 2017, approximately $100M in cash and cash equivalents

Closing Remarks Peter Greenleaf, Chairman and CEO 24 24

2017 Areas of Focus 1. Deliver strong financial performance 2. Accelerate priority clinical programs 3. Evaluate and execute on additional opportunities for growth 25

Q&A Session 26

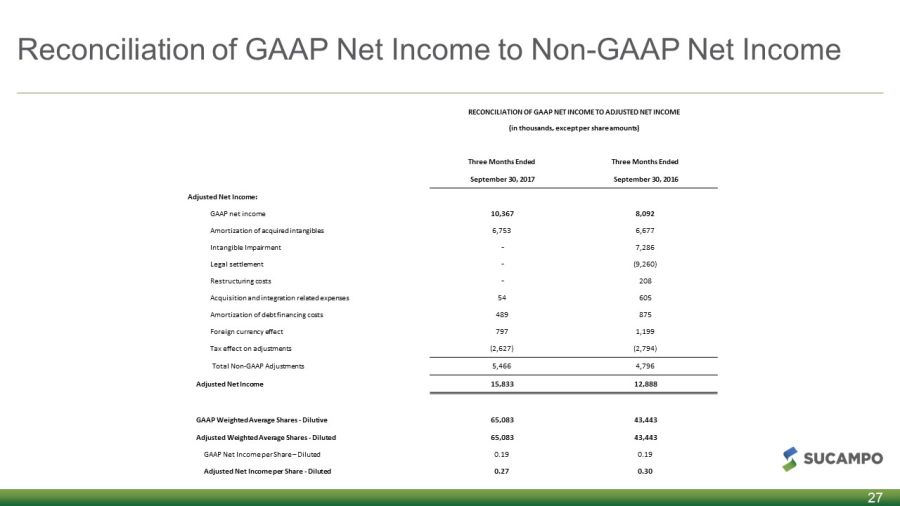

Reconciliation of GAAP Net Income to Non - GAAP Net Income 27 RECONCILIATION OF GAAP NET INCOME TO ADJUSTED NET INCOME (in thousands, except per share amounts) Three Months Ended Three Months Ended September 30, 2017 September 30, 2016 Adjusted Net Income: GAAP net income 10,367 8,092 Amortization of acquired intangibles 6,753 6,677 Intangible Impairment - 7,286 Legal settlement - (9,260) Restructuring costs - 208 Acquisition and integration related expenses 54 605 Amortization of debt financing costs 489 875 Foreign currency effect 797 1,199 Tax effect on adjustments (2,627) (2,794) Total Non - GAAP Adjustments 5,466 4,796 Adjusted Net Income 15,833 12,888 GAAP Weighted Average Shares - Dilutive 65,083 43,443 Adjusted Weighted Average Shares - Diluted 65,083 43,443 GAAP Net Income per Share – Diluted 0.19 0.19 Adjusted Net Income per Share - Diluted 0.27 0.30

Reconciliation of Income from Operations to Adjusted EBITDA 28 RECONCILIATION OF GAAP NET INCOME TO ADJUSTED EBITDA (in thousands) Three Months Ended Three Months Ended September 30, 2017 September 30, 2016 GAAP net income 10,367 8,092 Adjustments: Income taxes 7,204 7,410 Interest expense 2,956 5,899 Interest income (10) (31) Depreciation 204 223 Amortization of acquired intangibles 6,753 6,677 Intangible Impairment - 7,286 EBITDA 27,474 35,556 Non - GAAP Adjustments: Share Based Compensation 2,502 1,722 Restructuring costs - 208 Acquisition and integration related expenses 54 605 Legal Settlement - (9,260) Foreign currency effect 797 1,199 Total Non - GAAP Adjustments 3,353 (5,526) Adjusted EBITDA 30,827 30,030