Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Santander Consumer USA Holdings Inc. | d482508d8k.htm |

Exhibit 99.1

|

Exhibit 99.1

SANTANDER CONSUMER USA HOLDINGS INC. Retail Auto Leasing Portfolio Overview October 2017

|

IMPORTANT INFORMATION 2 Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimates,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends,” and similar words or phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties which are subject to change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled “Risk Factors” and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed by us with the SEC. Among the factors that could cause our financial performance to differ materially from that suggested by the forward-looking statements are: (a) we operate in a highly regulated industry and continually changing federal, state, and local laws and regulations could materially adversely affect our business; (b) our ability to remediate any material weaknesses in internal controls over financial reporting completely and in a timely manner could impact our ability to timely and accurately report our financial results; (c) adverse economic conditions in the United States and worldwide may negatively impact our results; (d) our business could suffer if our access to funding is reduced; (e) we face significant risks implementing our growth strategy, some of which are outside our control; (f) we may incur unexpected costs and delays in connection with exiting our personal lending portfolio; (g) our agreement with FCA US LLC may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; (h) our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (i) our financial condition, liquidity, and results of operations depend on the credit performance of our loans; (j) loss of our key management or other personnel, or an inability to attract such management and personnel, could negatively impact our business; (k) we are subject to certain regulations, including oversight by the Office of the Comptroller of the Currency, the CFPB, the European Central Bank, and the Federal Reserve, which oversight and regulation may limit certain of our activities, including the timing and amount of dividends and other limitations on our business; and (l) future changes in our relationship with Santander could adversely affect our operations. If one or more of the factors affecting our forward-looking information and statements proves incorrect, our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution not to place undue reliance on any forward-looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. New factors emerge from time to time, and management cannot assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements only speak as of the date of this document, and we undertake no obligation to update any forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

|

LEASE OVERVIEW

|

FCA US LLC (FCA) RELATIONSHIP 4 10-year contract to serve as FCA’s preferred finance provider 1 Brand Name Marketing » SC’s FCA relationship operates under the Chrysler Capital brand name » Chrysler Capital originates prime and near-prime loans, leases, dealer loans and commercial receivables » FCA branded products for FCA branded dealerships 2 SC Credit Policies » SC maintains control of credit policy and underwriting » SC is evaluated based on: Minimum approval rates Market benchmarks for customer APRs Loan and lease penetration rates 3 Subvention » FCA is required to provide a minimum 85% of subvented unit volume through Chrysler Capital » Per the agreement, FCA should treat SC in a manner consistent with comparable OEMs’ treatment of their captive finance providers » Integrated systems provide daily data feeds on national and regional campaigns SC’s technology-driven platform can assist dealers in optimizing the right incentives for the right car while managing regulatory risk

|

PRODUCT OVERVIEW 5 » The Chrysler Capital lease product is offered for Chrysler, Jeep, Ram, Dodge, Fiat and Alfa Romeo makes in all 50 states. The lease product is presented and sold by the FCA network of dealers and is typically sold as an incentivized support rate from FCA » A significant portion of our lease portfolio is comprised of SUV, CUV and trucks which include vehicles such as Grand Cherokee, Durango, Journey, Cherokee, Wrangler, and Ram 1500 » Leases are generally offered in terms ranging from 24-48 months. The term mix is dependent upon FCA incentive offers Most leases are offered in terms ranging from 36-39 month » Chrysler Capital uses Automotive Lease Guide (ALG) as a benchmark in establishing residuals for all makes and models The baseline of residual setting is ALG at Inception(1) Analysis of residual performance is conducted monthly to determine accuracy of ALG estimates » Chrysler Capital provides gap coverage to lessees at no additional cost » Support rates provided to FCA are utilized to structure market competitive payments on all models and trim levels Chrysler Capital does not participate in establishing the market payments for lease offers (1) ALG at Inception is the expected value of the related vehicle at lease maturity, established by Automotive Lease Guide at the time of origination, assuming that the vehicle is in “average” (rather than “clean”) condition

|

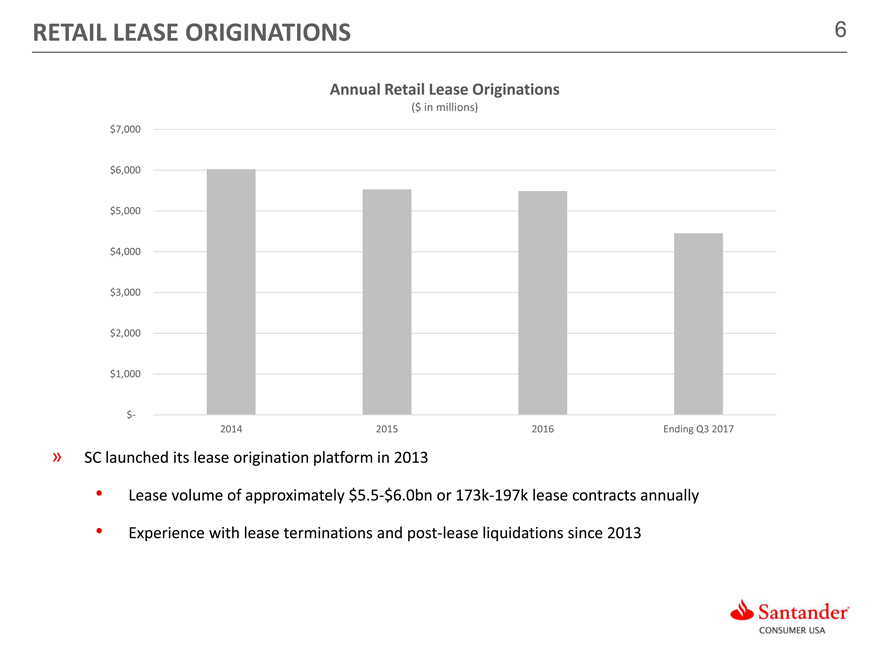

RETAIL LEASE ORIGINATIONS 6 Annual Retail Lease Originations ($ in millions) $7,000 $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $- 2014 2015 2016 Ending Q3 2017 » SC launched its lease origination platform in 2013 • Lease volume of approximately $5.5-$6.0bn or 173k-197k lease contracts annually • Experience with lease terminations and post-lease liquidations since 2013

|

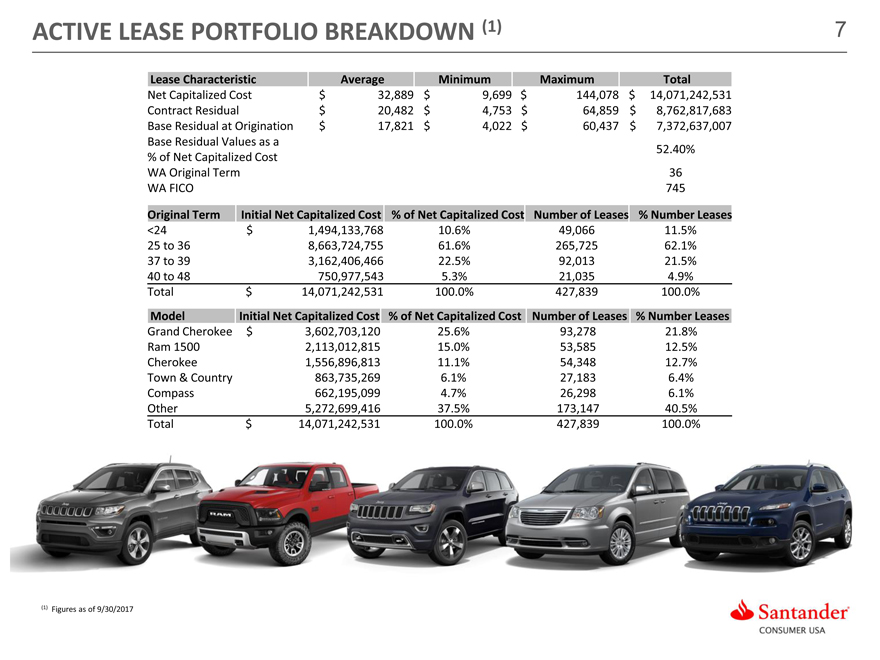

ACTIVE LEASE PORTFOLIO BREAKDOWN (1) 7 Lease Characteristic Average Minimum Maximum Total Net Capitalized Cost $ 32,889 $ 9,699 $ 144,078 $ 14,071,242,531 Contract Residual $ 20,482 $ 4,753 $ 64,859 $ 8,762,817,683 Base Residual at Origination $ 17,821 $ 4,022 $ 60,437 $ 7,372,637,007 Base Residual Values as a 52.40% % of Net Capitalized Cost WA Original Term 36 WA FICO 745 Original Term Initial Net Capitalized Cost % of Net Capitalized Cost Number of Leases % Number Leases <24 $ 1,494,133,768 10.6% 49,066 11.5% 25 to 36 8,663,724,755 61.6% 265,725 62.1% 37 to 39 3,162,406,466 22.5% 92,013 21.5% 40 to 48 750,977,543 5.3% 21,035 4.9% Total $ 14,071,242,531 100.0% 427,839 100.0% Model Initial Net Capitalized Cost % of Net Capitalized Cost Number of Leases % Number Leases Grand Cherokee $ 3,602,703,120 25.6% 93,278 21.8% Ram 1500 2,113,012,815 15.0% 53,585 12.5% Cherokee 1,556,896,813 11.1% 54,348 12.7% Town & Country 863,735,269 6.1% 27,183 6.4% Compass 662,195,099 4.7% 26,298 6.1% Other 5,272,699,416 37.5% 173,147 40.5% Total $ 14,071,242,531 100.0% 427,839 100.0% (1) Figures as of 9/30/2017

|

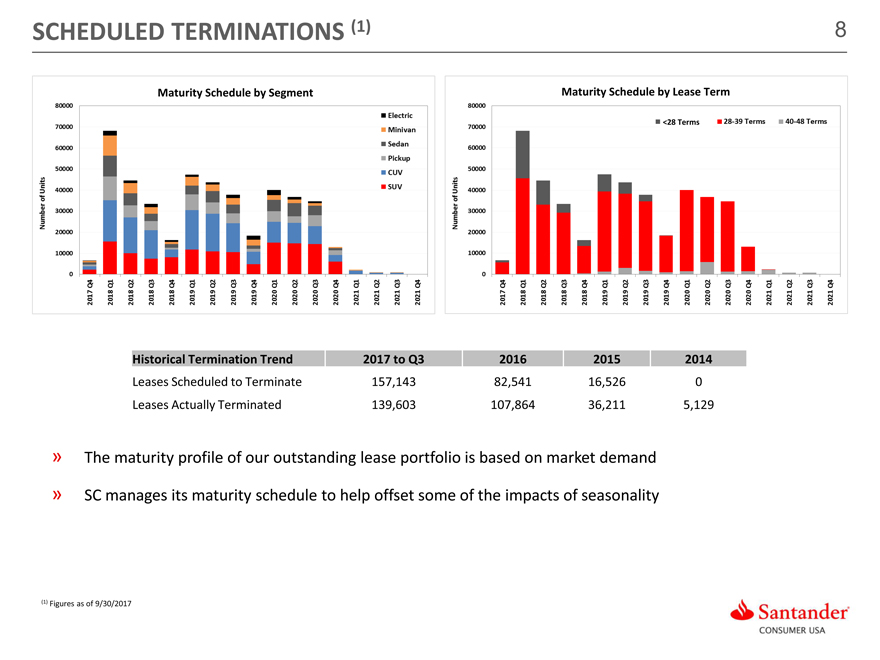

SCHEDULED TERMINATIONS (1) 8 Maturity Schedule by Segment Maturity Schedule by Lease Term <28 Terms Historical Termination Trend 2017 to Q3 2016 2015 2014 Leases Scheduled to Terminate 157,143 82,541 16,526 0 Leases Actually Terminated 139,603 107,864 36,211 5,129 » The maturity profile of our outstanding lease portfolio is based on market demand » SC manages its maturity schedule to help offset some of the impacts of seasonality (1) Figures as of 9/30/2017

|

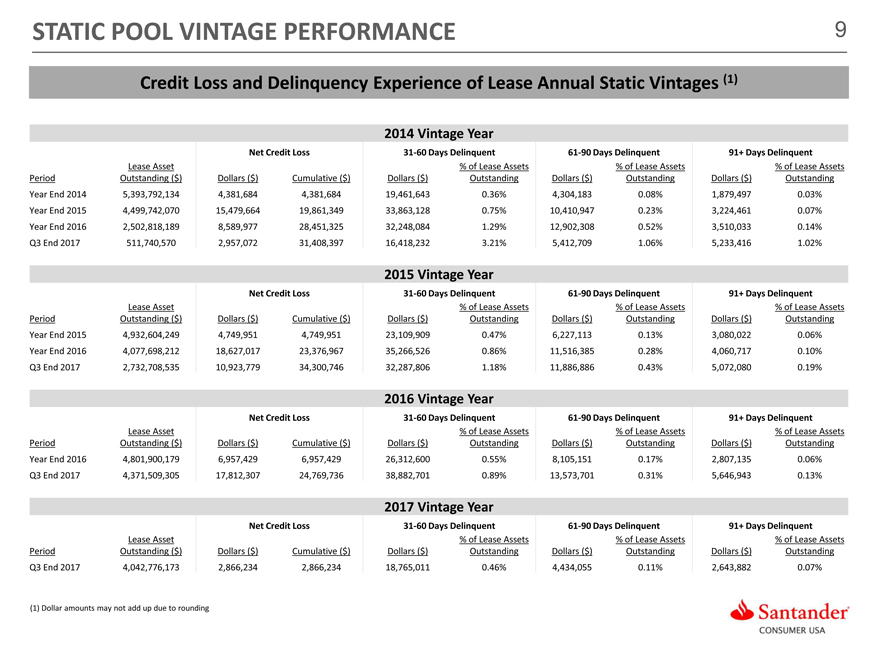

STATIC POOL VINTAGE PERFORMANCE 9 Credit Loss and Delinquency Experience of Lease Annual Static Vintages (1) 2014 Vintage Year Net Credit Loss 31-60 Days Delinquent 61-90 Days Delinquent 91+ Days Delinquent Lease Asset % of Lease Assets % of Lease Assets % of Lease Assets Period Outstanding ($) Dollars ($) Cumulative ($) Dollars ($) Outstanding Dollars ($) Outstanding Dollars ($) Outstanding Year End 2014 5,393,792,134 4,381,684 4,381,684 19,461,643 0.36% 4,304,183 0.08% 1,879,497 0.03% Year End 2015 4,499,742,070 15,479,664 19,861,349 33,863,128 0.75% 10,410,947 0.23% 3,224,461 0.07% Year End 2016 2,502,818,189 8,589,977 28,451,325 32,248,084 1.29% 12,902,308 0.52% 3,510,033 0.14% Q3 End 2017 511,740,570 2,957,072 31,408,397 16,418,232 3.21% 5,412,709 1.06% 5,233,416 1.02% 2015 Vintage Year Net Credit Loss 31-60 Days Delinquent 61-90 Days Delinquent 91+ Days Delinquent Lease Asset % of Lease Assets % of Lease Assets % of Lease Assets Period Outstanding ($) Dollars ($) Cumulative ($) Dollars ($) Outstanding Dollars ($) Outstanding Dollars ($) Outstanding Year End 2015 4,932,604,249 4,749,951 4,749,951 23,109,909 0.47% 6,227,113 0.13% 3,080,022 0.06% Year End 2016 4,077,698,212 18,627,017 23,376,967 35,266,526 0.86% 11,516,385 0.28% 4,060,717 0.10% Q3 End 2017 2,732,708,535 10,923,779 34,300,746 32,287,806 1.18% 11,886,886 0.43% 5,072,080 0.19% 2016 Vintage Year Net Credit Loss 31-60 Days Delinquent 61-90 Days Delinquent 91+ Days Delinquent Lease Asset % of Lease Assets % of Lease Assets % of Lease Assets Period Outstanding ($) Dollars ($) Cumulative ($) Dollars ($) Outstanding Dollars ($) Outstanding Dollars ($) Outstanding Year End 2016 4,801,900,179 6,957,429 6,957,429 26,312,600 0.55% 8,105,151 0.17% 2,807,135 0.06% Q3 End 2017 4,371,509,305 17,812,307 24,769,736 38,882,701 0.89% 13,573,701 0.31% 5,646,943 0.13% 2017 Vintage Year Net Credit Loss 31-60 Days Delinquent 61-90 Days Delinquent 91+ Days Delinquent Lease Asset % of Lease Assets % of Lease Assets % of Lease Assets Period Outstanding ($) Dollars ($) Cumulative ($) Dollars ($) Outstanding Dollars ($) Outstanding Dollars ($) Outstanding Q3 End 2017 4,042,776,173 2,866,234 2,866,234 18,765,011 0.46% 4,434,055 0.11% 2,643,882 0.07% (1) Dollar amounts may not add up due to rounding

|

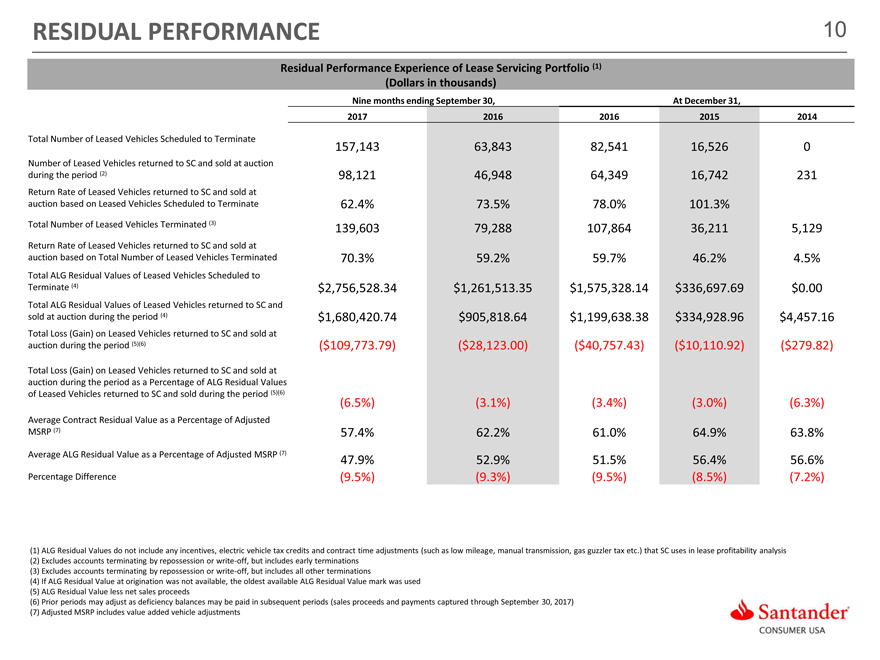

RESIDUAL PERFORMANCE 10 Residual Performance Experience of Lease Servicing Portfolio (1) (Dollars in thousands) Nine months ending September 30, At December 31, 2017 2016 2016 2015 2014 Total Number of Leased Vehicles Scheduled to Terminate 157,143 63,843 82,541 16,526 0 Number of Leased Vehicles returned to SC and sold at auction during the period (2) 98,121 46,948 64,349 16,742 231 Return Rate of Leased Vehicles returned to SC and sold at auction based on Leased Vehicles Scheduled to Terminate 62.4% 73.5% 78.0% 101.3% Total Number of Leased Vehicles Terminated (3) 139,603 79,288 107,864 36,211 5,129 Return Rate of Leased Vehicles returned to SC and sold at auction based on Total Number of Leased Vehicles Terminated 70.3% 59.2% 59.7% 46.2% 4.5% Total ALG Residual Values of Leased Vehicles Scheduled to Terminate (4) $2,756,528.34 $1,261,513.35 $1,575,328.14 $336,697.69 $0.00 Total ALG Residual Values of Leased Vehicles returned to SC and sold at auction during the period (4) $1,680,420.74 $905,818.64 $1,199,638.38 $334,928.96 $4,457.16 Total Loss (Gain) on Leased Vehicles returned to SC and sold at auction during the period (5)(6) ($109,773.79) ($28,123.00) ($40,757.43) ($10,110.92) ($279.82) Total Loss (Gain) on Leased Vehicles returned to SC and sold at auction during the period as a Percentage of ALG Residual Values of Leased Vehicles returned to SC and sold during the period (5)(6) (6.5%) (3.1%) (3.4%) (3.0%) (6.3%) Average Contract Residual Value as a Percentage of Adjusted MSRP (7) 57.4% 62.2% 61.0% 64.9% 63.8% Average ALG Residual Value as a Percentage of Adjusted MSRP (7) 47.9% 52.9% 51.5% 56.4% 56.6% Percentage Difference (9.5%) (9.3%) (9.5%) (8.5%) (7.2%) (1) ALG Residual Values do not include any incentives, electric vehicle tax credits and contract time adjustments (such as low mileage, manual transmission, gas guzzler tax etc.) that SC uses in lease profitability analysis (2) Excludes accounts terminating by repossession or write-off, but includes early terminations (3) Excludes accounts terminating by repossession or write-off, but includes all other terminations (4) If ALG Residual Value at origination was not available, the oldest available ALG Residual Value mark was used (5) ALG Residual Value less net sales proceeds (6) Prior periods may adjust as deficiency balances may be paid in subsequent periods (sales proceeds and payments captured through September 30, 2017) (7) Adjusted MSRP includes value added vehicle adjustments

|

LEASE ORIGINATIONS PROCESS OVERVIEW 11 Step 1 SC receives a credit application from the dealer Step 2 Systemic underwriting and pricing is performed Step 3 A credit decision is rendered for the application Step 4 Lease terms are transmitted to dealer and customer Step 5 Dealer and customer review lease terms and submit contract package if accepted Step 6 Lease contract will be funded after passing the standard documents review and any necessary external verifications Credit Risk Management and Underwriting » SC’s overall underwriting policy for its auto finance portfolio is based on a tiered, risk-based system. » Each underwritten lease is assigned a pricing tier based on the credit risk tier that is reflected in the lease and vehicle characteristics » SC sets pricing at levels that allow the organization to generate an acceptable risk-adjusted rate of return and meet its overall profit objectives

|

LEASE SERVICING OVERVIEW 12 We service our loan and lease assets using the same platform Servicing Operations » Covering more than 3 time zones, operating through multiple locations in U.S., including Puerto Rico and other off-shore locations » More than 3,000 full-time servicing employees Identical Servicing Platform » Shaw & My Supervisor: Same industry leading servicing systems » Advanced data mining and analytics » Robust systemic controls ensuring compliance and superior customer experience » System integration with repo and remarketing Consistent Collection Strategies » Addresses multiple stages of collection as well as collateral recovery » Includes traditional cash payments and ACH

|

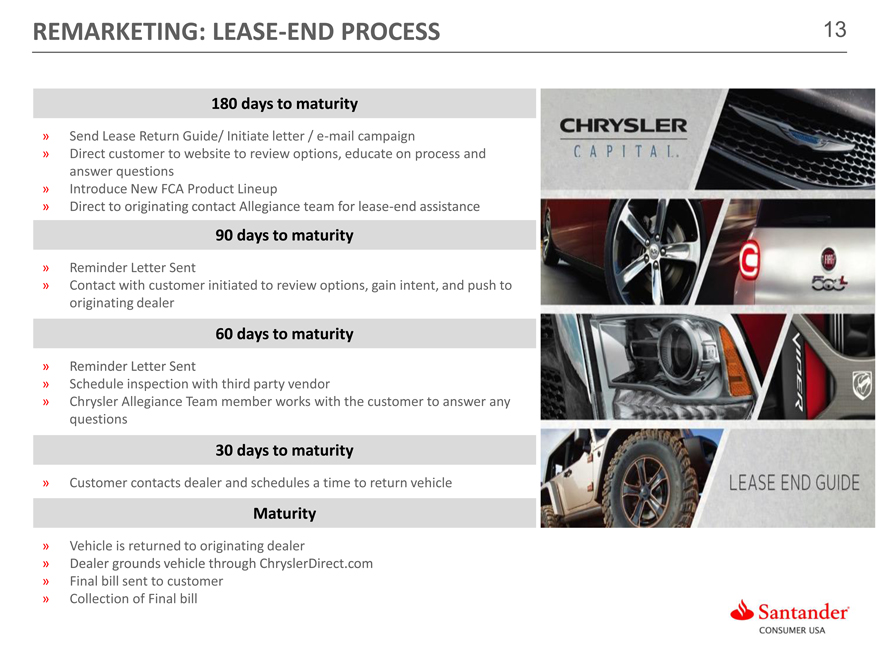

REMARKETING: LEASE-END PROCESS 13 180 days to maturity » Send Lease Return Guide/ Initiate letter / e-mail campaign » Direct customer to website to review options, educate on process and answer questions » Introduce New FCA Product Lineup » Direct to originating contact Allegiance team for lease-end assistance 90 days to maturity » Reminder Letter Sent » Contact with customer initiated to review options, gain intent, and push to originating dealer 60 days to maturity » Reminder Letter Sent » Schedule inspection with third party vendor » Chrysler Allegiance Team member works with the customer to answer any questions 30 days to maturity » Customer contacts dealer and schedules a time to return vehicle Maturity » Vehicle is returned to originating dealer » Dealer grounds vehicle through ChryslerDirect.com » Final bill sent to customer » Collection of Final bill

|

REMARKETING: RISK MITIGATION WITH CHRYSLER DIRECT 14 Chrysler Direct Impact to Leases in the Marketplace » Reduce volumes going through auctions – maintains residual values » FCA product remains at FCA dealers » Selling on Chrysler Direct gets proceeds to SC quicker (Days to Sale) Dealer Benefits for Off-Lease Purchase on Chrysler Direct » Great opportunities to buy one-owner, quality pre-owned vehicles » Dealers do not have to wait for the weekly auction; Chrysler Direct is available 24 hours a day, seven days a week » Dealer personnel do not have to spend time at the auction and can stay in the dealership » Off-lease are typically well-equipped and prime candidates for Certified PreOwned Vehicles (CPOV)

|

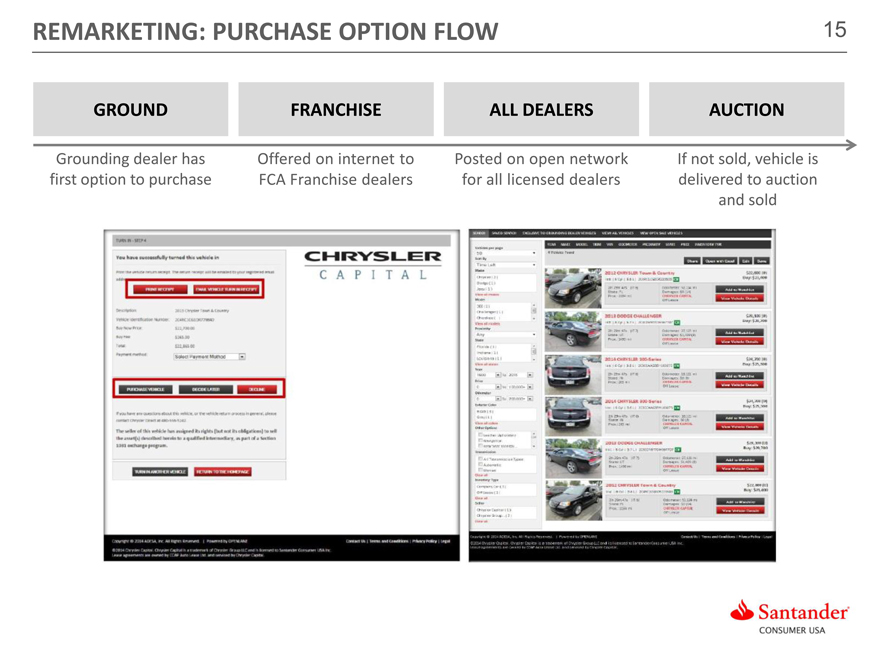

REMARKETING: PURCHASE OPTION FLOW 15 GROUND FRANCHISE ALL DEALERS AUCTION Grounding dealer has Offered on internet to Posted on open network If not sold, vehicle is first option to purchase FCA Franchise dealers for all licensed dealers delivered to auction and sold

|

EARLY TERMINATION MARKETING PROGRAM – DEALER EARLY LEASE BUYOUT 16 » In Dealer Early Lease Buyout: • The Dealer agrees to make remaining scheduled payments owed by the Lessee • The Lessee steps into another FCA vehicle • From a residual value perspective, the Lessee does not have any remaining residual liability after payments have been made • Vehicle is returned to Chrysler Capital and is either sold through the dealer network or sold at open auction » Dealer Early Lease Buyout is similar to many other OEM dealer programs where the dealer makes the remaining payments and the lessee enters into another vehicle contract

|

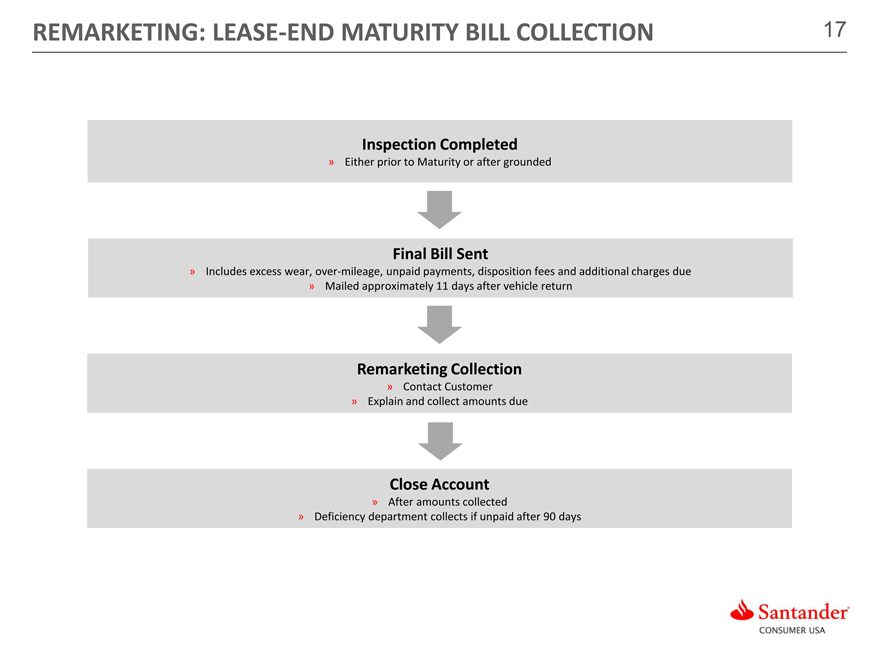

REMARKETING: LEASE-END MATURITY BILL COLLECTION 17 Inspection Completed » Either prior to Maturity or after grounded Final Bill Sent » Includes excess wear, over-mileage, unpaid payments, disposition fees and additional charges due » Mailed approximately 11 days after vehicle return Remarketing Collection » Contact Customer » Explain and collect amounts due Close Account » After amounts collected » Deficiency department collects if unpaid after 90 days