Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - POTLATCHDELTIC CORP | d477074dex993.htm |

| EX-99.1 - EX-99.1 - POTLATCHDELTIC CORP | d477074dex991.htm |

| 8-K - 8-K - POTLATCHDELTIC CORP | d477074d8k.htm |

Q3 2017 Earnings Release Michael J. Covey Chairman and Chief Executive Officer Eric J. Cremers President and Chief Operating Officer Jerald W. Richards Vice President and Chief Financial Officer October 23, 2017 Exhibit 99.2

Q3 2017 Earnings Release – October 23, 2017 Additional Information This communication is being made in respect of the proposed merger transaction involving Potlatch Corporation (“Potlatch”) and Deltic Timber Corporation (“Deltic”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. In connection with the proposed merger, Potlatch and Deltic will file relevant materials with the Securities and Exchange Commission (“SEC”), including a Potlatch registration statement on Form S-4 that will include a joint proxy statement of Potlatch and Deltic and also constitutes a prospectus of Potlatch. Potlatch and Deltic also plan to file other documents with the SEC regarding the proposed merger transaction and a definitive joint proxy statement/prospectus will be mailed to stockholders of Potlatch and Deltic. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SECURITY HOLDERS OF POTLATCH AND DELTIC ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The joint proxy statement/prospectus, as well as other filings containing information about Potlatch and Deltic will be available without charge, at the SEC’s Internet site (http://www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, when available, without charge, from Potlatch’s website at http://www.Potlatchcorp.com under the Investor Resources tab (in the case of documents filed by Potlatch) and on Deltic’s website at https://www.Deltic.com under the Investor Relations tab (in the case of documents filed by Deltic). Potlatch and Deltic, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Deltic and Potlatch in respect of the proposed merger transaction. Certain information about the directors and executive officers of Potlatch is set forth in its Annual Report on Form 10-K for the year ended December 31, 2016, which was filed with the SEC on February 17, 2017, its proxy statement for its 2017 annual meeting of stockholders, which was filed with the SEC on April 3, 2017 and its Current Report on Form 8-K, which was filed on May 1, 2017. Certain Information about the directors and executive officers of Deltic is set forth in its Annual Report on Form 10-K for the year ended December 31, 2016, which was filed with the SEC on March 7, 2017, its proxy statement for its 2017 annual meeting of stockholders, which was filed with the SEC on March 20, 2017, its supplement to the proxy statement for its 2017 annual meeting of the stockholders, which was filed with the SEC on March 30, 2017 and its Current Reports on Form 8-K, which were filed with the SEC on September 1, 2017, May 2, 2017, March 8, 2017 and February 27, 2017. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus and other relevant documents filed with the SEC when they become available. Additional Information, Forward-Looking Statements & Non-GAAP Measures

FORWARD-LOOKING STATEMENTS This presentation contains certain forward-looking statements within the meaning of the Private Litigation Reform Act of 1995 as amended, including without limitation, statements about our expectations regarding U.S. housing starts; strong repair and remodel markets; lumber/demand; the company’s financial performance in the fourth quarter of 2017 and for the full year; our outlook for future operating conditions, pricing, earnings and EBITTDA in our Resource, Wood Products and Real Estate segments in the fourth quarter of 2017 and for the full year; robust cedar sawlog market resulting in an increase in EBITDDA compared to 2016; mix and pricing for sawlogs, pulpwood, and hardwood in the North and South regions in the fourth quarter of 2017; expected demand and pricing for cedar logs; expected lumber prices and lumber shipments in the fourth quarter of 2017 and for the full year; expected fourth quarter and full year 2017 harvest volumes in the North and South; expected pulpwood/sawlog mix in the North and South in the fourth quarter of 2017; expected real estate sales in the fourth quarter of 2017 and for the full year, expected mix of real estate sales in 2017, and expected pricing and land basis; expected corporate and interest expense in the fourth quarter of 2017; expected earnings in the fourth quarter of 2017; the company’s balance sheet; expected closing of the sale of Avery Landing in the fourth quarter of 2017; expected capital expenditures for the full year 2017; liquidity, cash flows and dividend levels; debt maturities; expected consolidated tax rate in the fourth quarter of 2017 and the full year; the terms and closing of the proposed transaction between Potlatch and Deltic, the proposed impact of the merger on Potlatch’s financial results, and the integration of Deltic’s operations; and related matters. These forward-looking statements are based on current expectations, estimates, assumptions and projections that are subject to change, and actual results may differ materially from the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, changes in timberland values; changes in timber harvest levels on our lands; changes in timber prices; changes in lumber and plywood prices; changes in policy regarding governmental timber sales; availability of logging contractors; changes in the United States and international economies; currency fluctuations; changes in the level of construction, repair and remodel activity; changes in tariffs, quotas and trade agreements involving wood products; changes in demand for forest products; changes in production and production capacity in the forest products industry; competitive pricing pressures for our products; unanticipated manufacturing disruptions; changes in general and industry-specific environmental laws and regulations; unforeseen environmental liabilities or expenditures; weather conditions; an inability to reach a settlement of the Avery Landing environmental claim; fire and fire-related restrictions on harvesting; pest infestation; changes in raw material, diesel, other fuel and other costs; the ability to satisfy complex rules in order to remain qualified as a REIT; changes in tax laws that could reduce the benefits associated with REIT status; changes in the bond markets; fluctuations in the company’s share price; the parties’ ability to consummate the transaction or satisfy the conditions to the completion of the transaction, including the receipt of stockholder approvals, the receipt of regulatory approvals required for the transaction on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction; the possibility that any of the anticipated benefits of the proposed merger will not be realized or will not be realized within the expected time period; the risk that integration of Deltic’s operations with those of Potlatch will be materially delayed or will be more costly or difficult than expected; the failure of the proposed merger to close for any other reason; the effect of the announcement of the merger on customer relationships and operating results (including, without limitation, difficulties in maintaining relationships with employees or customers); dilution caused by Potlatch’s issuance of additional shares of its common stock in connection with the merger; the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the diversion of management time on transaction related issues and other risks and uncertainties described from time to time in our public filings with the Securities and Exchange Commission. These forward-looking statements are made as of the date of this presentation and we do not undertake to update any forward-looking statements. NON-GAAP MEASURES This presentation includes non-GAAP financial information. A reconciliation of those numbers to U.S. GAAP is included in this presentation, which is available on the company’s website at www.potlatchcorp.com. Q3 2017 Earnings Release – October 23, 2017 Additional Information, Forward-Looking Statements & Non-GAAP Measures

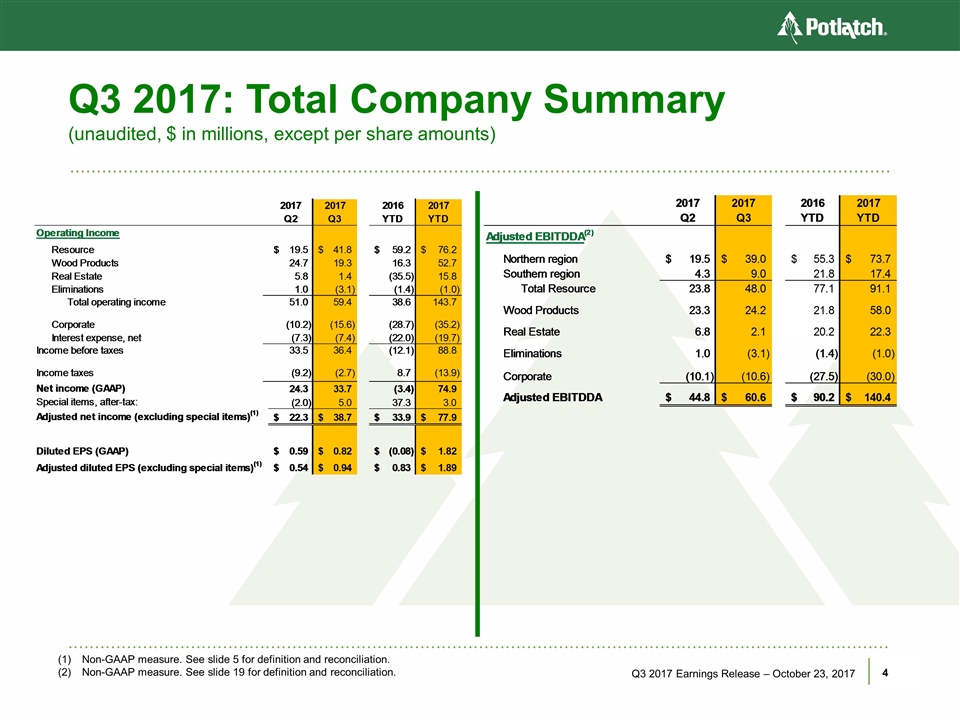

Q3 2017: Total Company Summary (unaudited, $ in millions, except per share amounts) Q3 2017 Earnings Release – October 23, 2017 Non-GAAP measure. See slide 5 for definition and reconciliation. Non-GAAP measure. See slide 19 for definition and reconciliation.

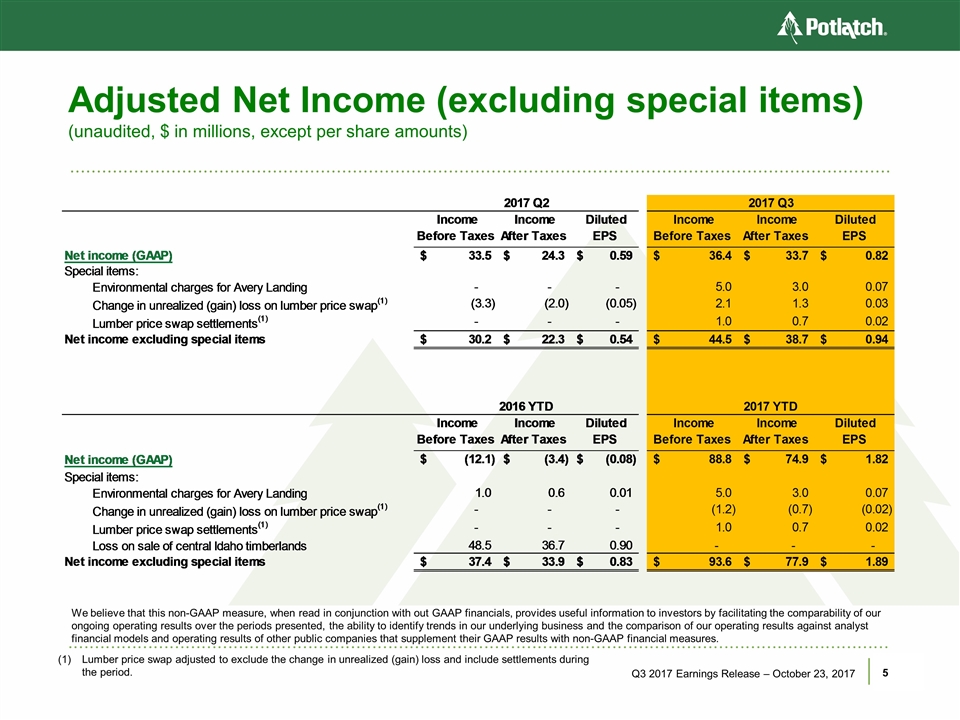

Adjusted Net Income (excluding special items) (unaudited, $ in millions, except per share amounts) Q3 2017 Earnings Release – October 23, 2017 Lumber price swap adjusted to exclude the change in unrealized (gain) loss and include settlements during the period. We believe that this non-GAAP measure, when read in conjunction with out GAAP financials, provides useful information to investors by facilitating the comparability of our ongoing operating results over the periods presented, the ability to identify trends in our underlying business and the comparison of our operating results against analyst financial models and operating results of other public companies that supplement their GAAP results with non-GAAP financial measures.

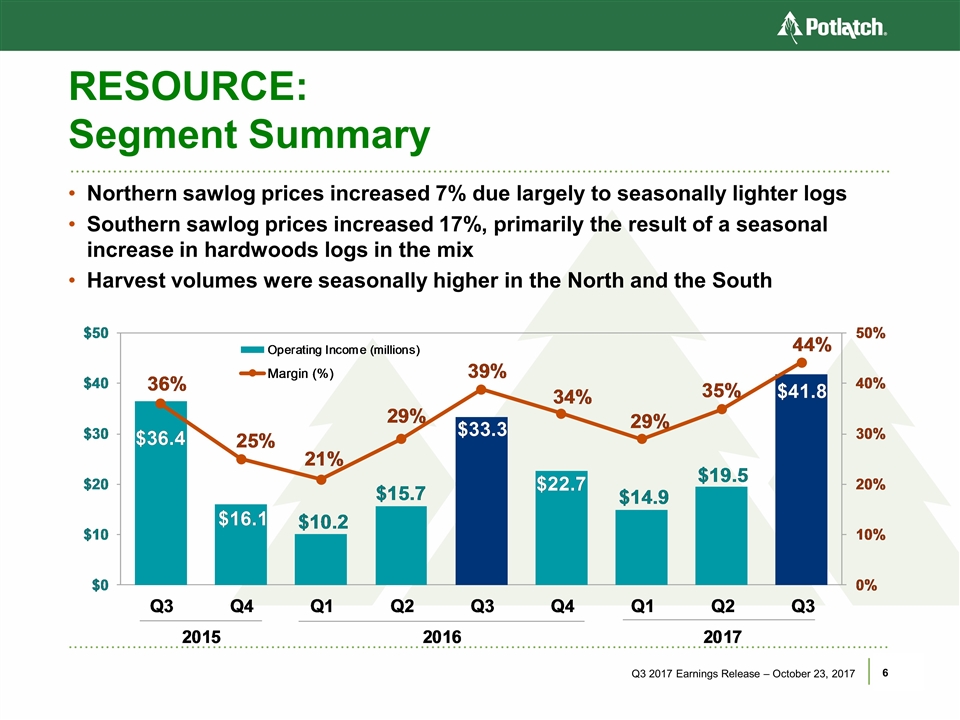

RESOURCE: Segment Summary Northern sawlog prices increased 7% due largely to seasonally lighter logs Southern sawlog prices increased 17%, primarily the result of a seasonal increase in hardwoods logs in the mix Harvest volumes were seasonally higher in the North and the South Q3 2017 Earnings Release – October 23, 2017

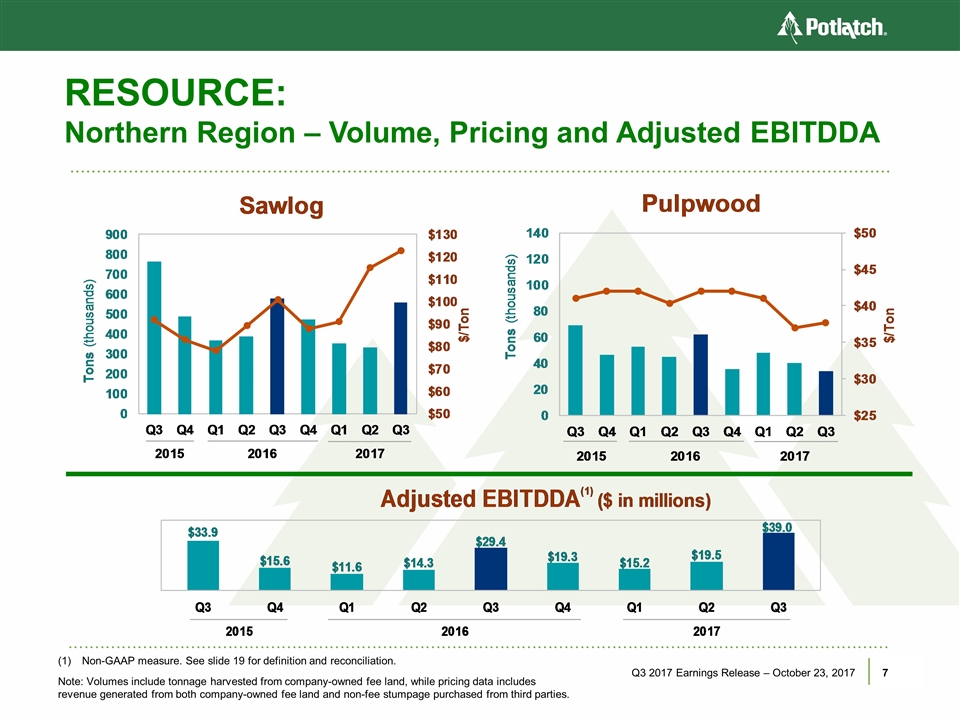

RESOURCE: Northern Region – Volume, Pricing and Adjusted EBITDDA Q3 2017 Earnings Release – October 23, 2017 Non-GAAP measure. See slide 19 for definition and reconciliation. Note: Volumes include tonnage harvested from company-owned fee land, while pricing data includes revenue generated from both company-owned fee land and non-fee stumpage purchased from third parties.

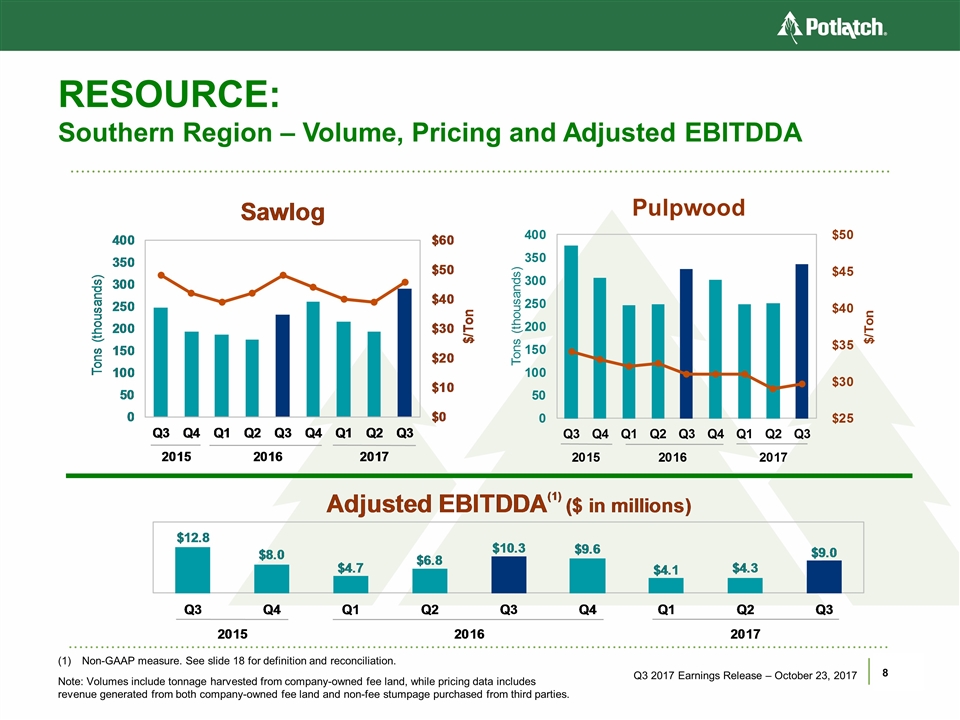

RESOURCE: Southern Region – Volume, Pricing and Adjusted EBITDDA Q3 2017 Earnings Release – October 23, 2017 Non-GAAP measure. See slide 18 for definition and reconciliation. Note: Volumes include tonnage harvested from company-owned fee land, while pricing data includes revenue generated from both company-owned fee land and non-fee stumpage purchased from third parties.

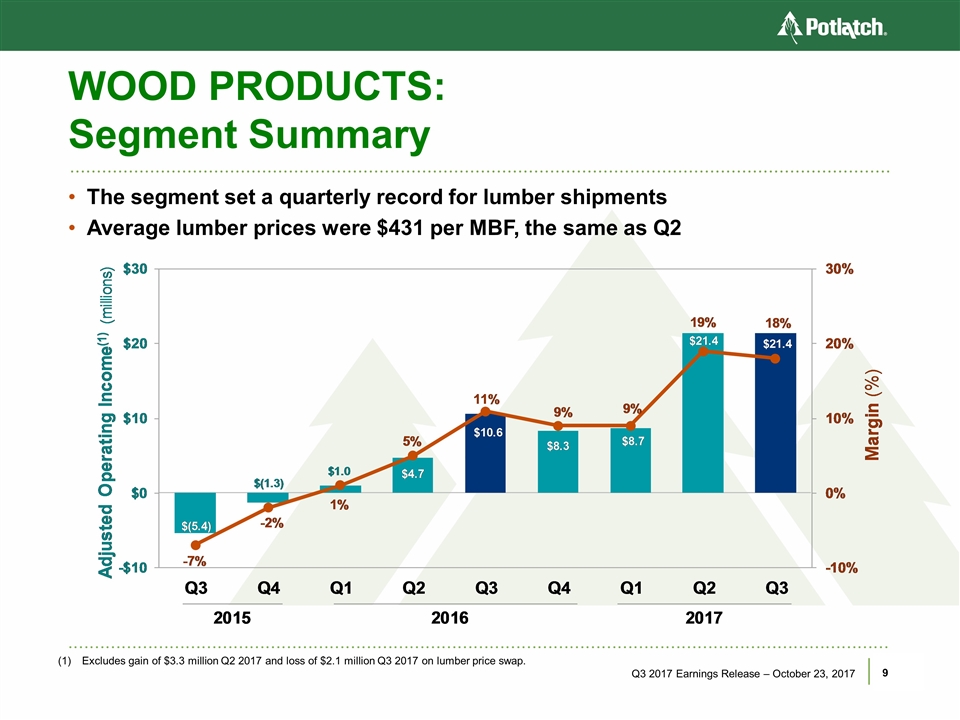

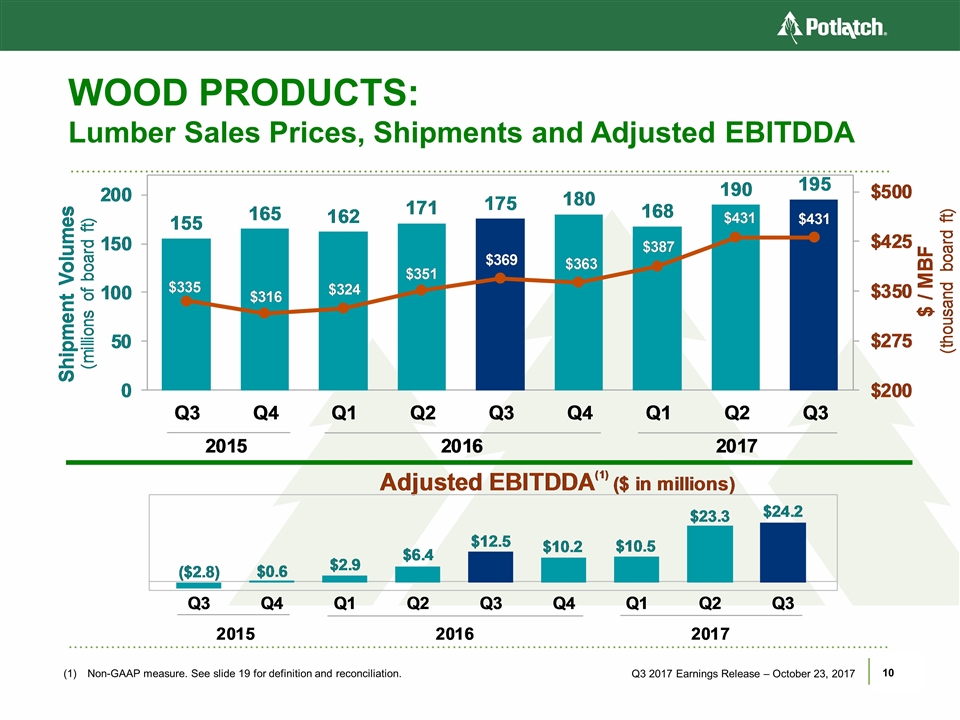

WOOD PRODUCTS: Segment Summary The segment set a quarterly record for lumber shipments Average lumber prices were $431 per MBF, the same as Q2 Q3 2017 Earnings Release – October 23, 2017 Excludes gain of $3.3 million Q2 2017 and loss of $2.1 million Q3 2017 on lumber price swap.

WOOD PRODUCTS: Lumber Sales Prices, Shipments and Adjusted EBITDDA Q3 2017 Earnings Release – October 23, 2017 Non-GAAP measure. See slide 19 for definition and reconciliation.

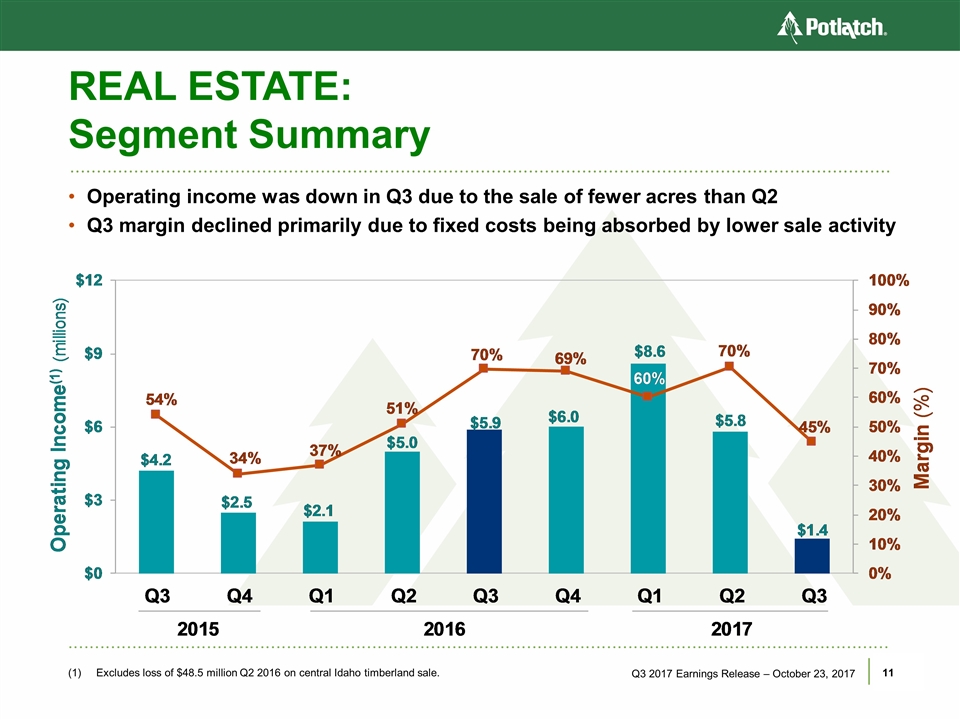

REAL ESTATE: Segment Summary Operating income was down in Q3 due to the sale of fewer acres than Q2 Q3 margin declined primarily due to fixed costs being absorbed by lower sale activity Q3 2017 Earnings Release – October 23, 2017 (1) Excludes loss of $48.5 million Q2 2016 on central Idaho timberland sale.

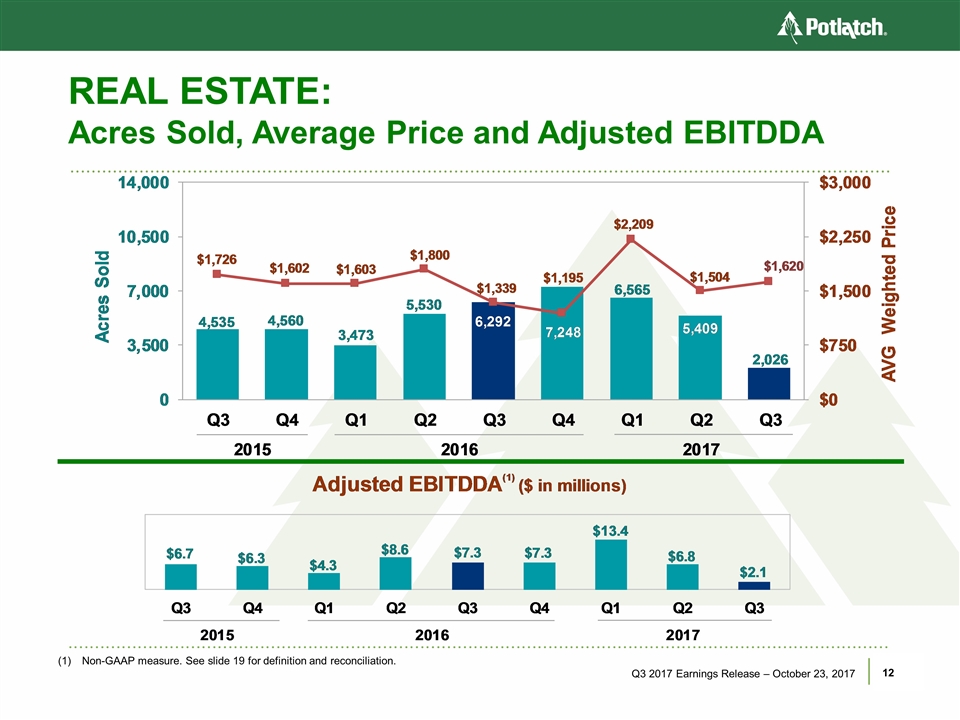

REAL ESTATE: Acres Sold, Average Price and Adjusted EBITDDA Q3 2017 Earnings Release – October 23, 2017 Non-GAAP measure. See slide 19 for definition and reconciliation.

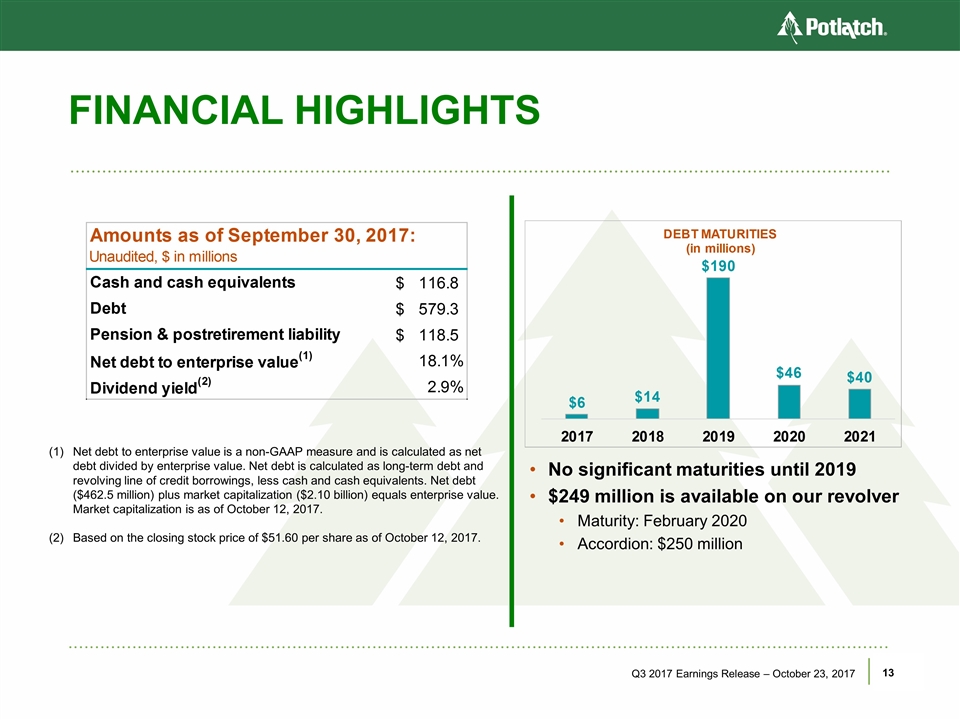

FINANCIAL HIGHLIGHTS Q3 2017 Earnings Release – October 23, 2017 Net debt to enterprise value is a non-GAAP measure and is calculated as net debt divided by enterprise value. Net debt is calculated as long-term debt and revolving line of credit borrowings, less cash and cash equivalents. Net debt ($462.5 million) plus market capitalization ($2.10 billion) equals enterprise value. Market capitalization is as of October 12, 2017. Based on the closing stock price of $51.60 per share as of October 12, 2017. No significant maturities until 2019 $249 million is available on our revolver Maturity: February 2020 Accordion: $250 million

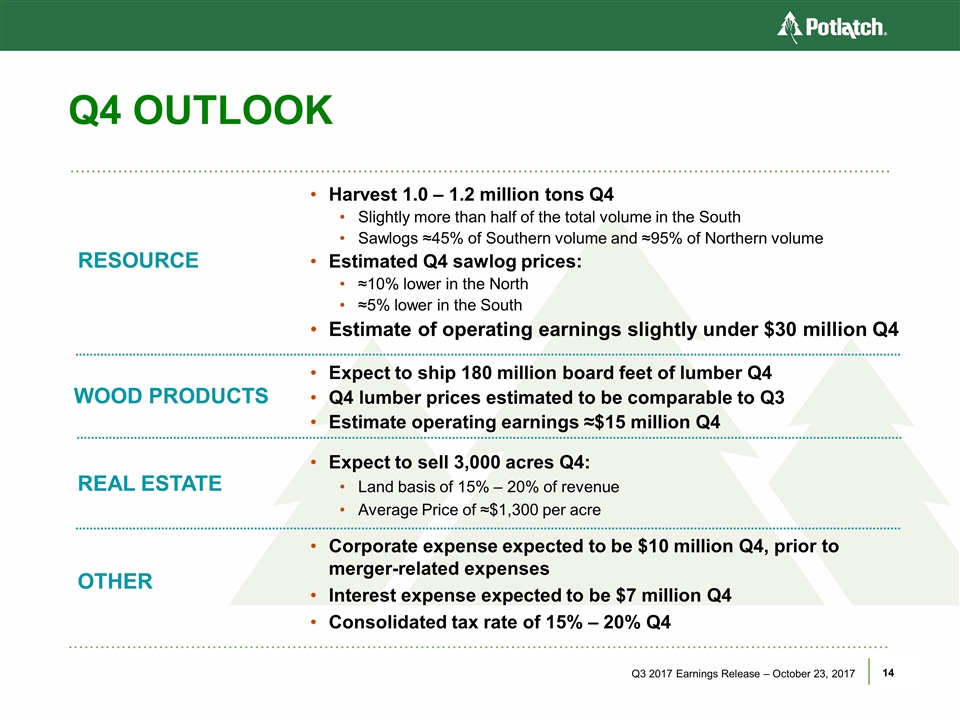

Q4 OUTLOOK Harvest 1.0 – 1.2 million tons Q4 Slightly more than half of the total volume in the South Sawlogs ≈45% of Southern volume and ≈95% of Northern volume Estimated Q4 sawlog prices: ≈10% lower in the North ≈5% lower in the South Estimate of operating earnings slightly under $30 million Q4 Q3 2017 Earnings Release – October 23, 2017 Expect to ship 180 million board feet of lumber Q4 Q4 lumber prices estimated to be comparable to Q3 Estimate operating earnings ≈$15 million Q4 Expect to sell 3,000 acres Q4: Land basis of 15% – 20% of revenue Average Price of ≈$1,300 per acre Corporate expense expected to be $10 million Q4, prior to merger-related expenses Interest expense expected to be $7 million Q4 Consolidated tax rate of 15% – 20% Q4 RESOURCE WOOD PRODUCTS REAL ESTATE OTHER

Appendix

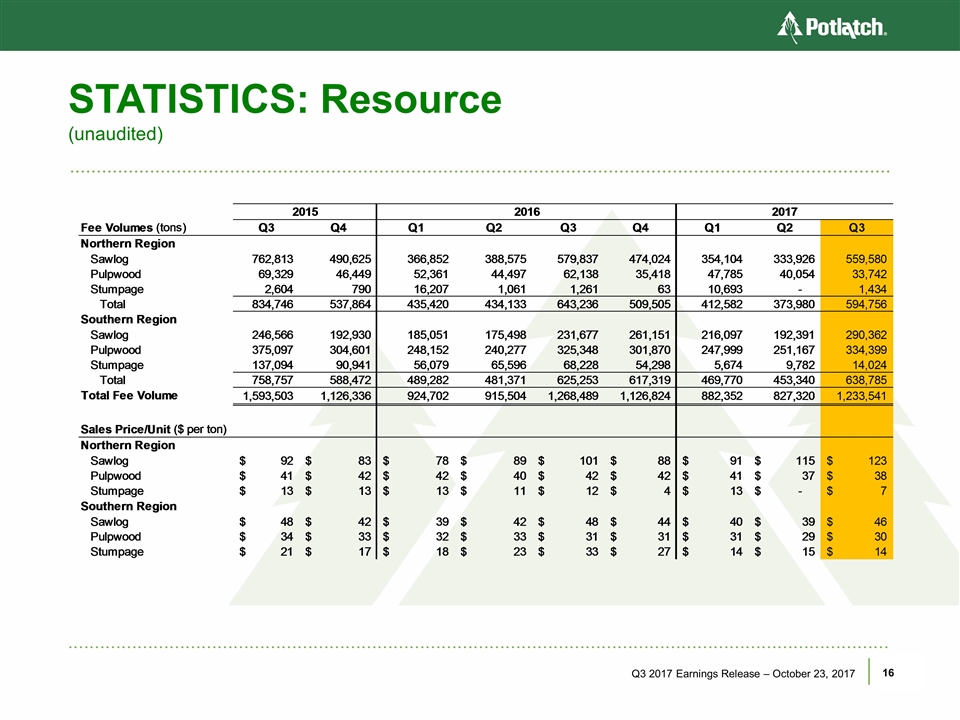

STATISTICS: Resource (unaudited) Q3 2017 Earnings Release – October 23, 2017

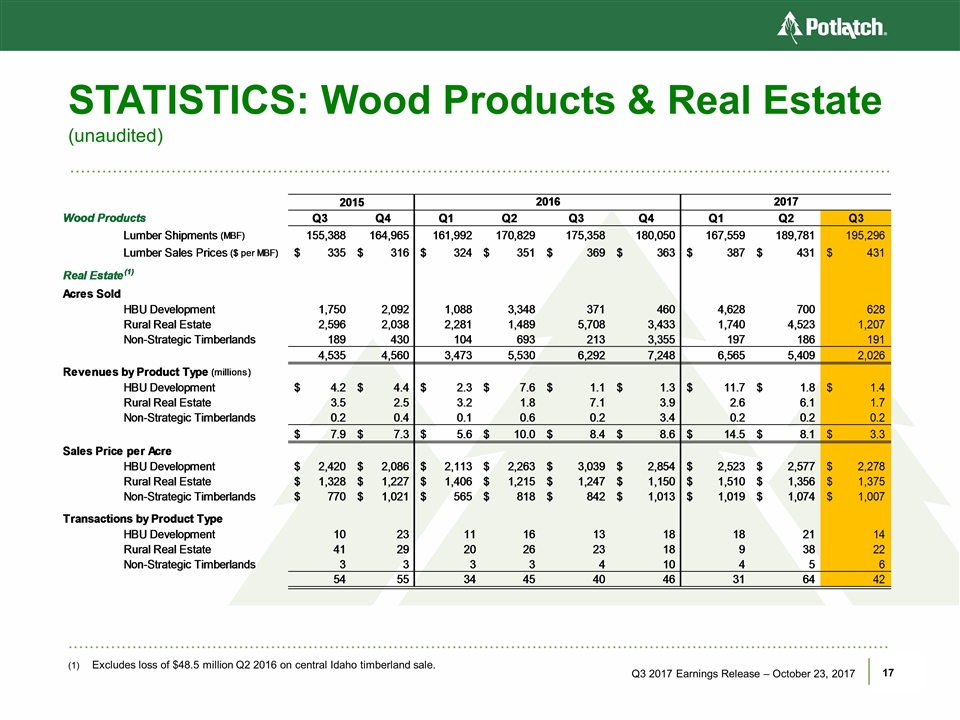

STATISTICS: Wood Products & Real Estate (unaudited) Q3 2017 Earnings Release – October 23, 2017 Excludes loss of $48.5 million Q2 2016 on central Idaho timberland sale.

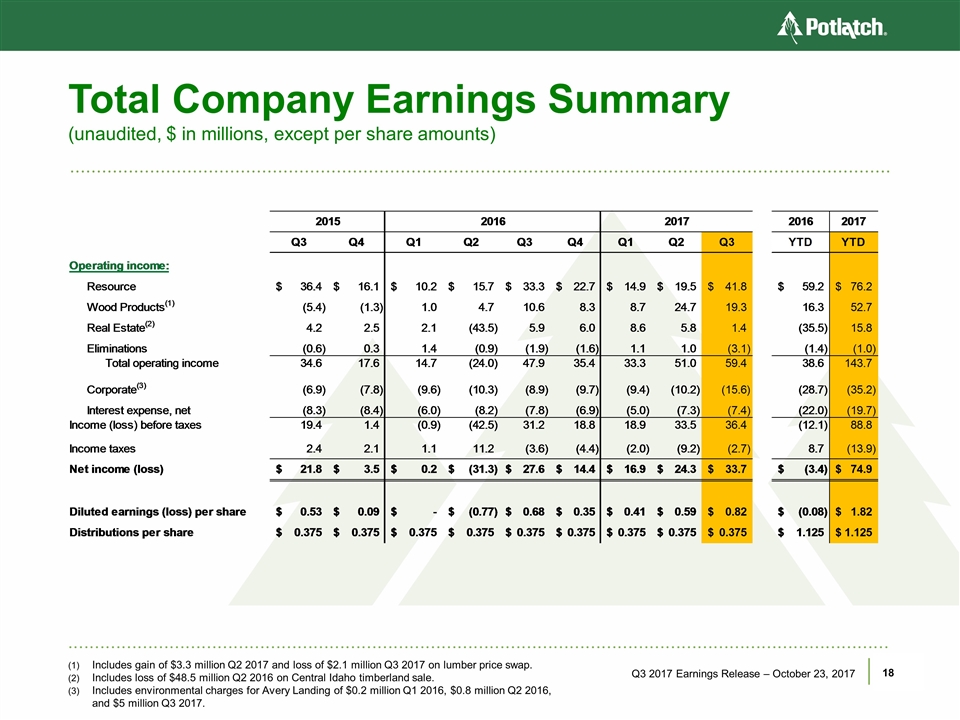

Total Company Earnings Summary (unaudited, $ in millions, except per share amounts) Q3 2017 Earnings Release – October 23, 2017 Includes gain of $3.3 million Q2 2017 and loss of $2.1 million Q3 2017 on lumber price swap. Includes loss of $48.5 million Q2 2016 on Central Idaho timberland sale. Includes environmental charges for Avery Landing of $0.2 million Q1 2016, $0.8 million Q2 2016, and $5 million Q3 2017.

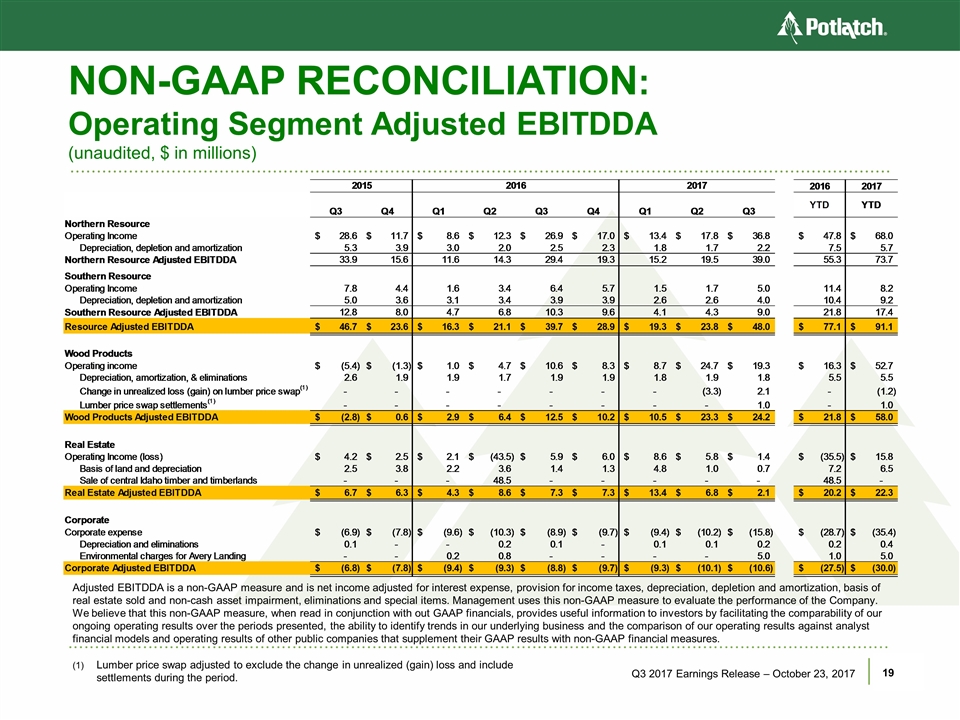

NON-GAAP RECONCILIATION: Operating Segment Adjusted EBITDDA (unaudited, $ in millions) Q3 2017 Earnings Release – October 23, 2017 Lumber price swap adjusted to exclude the change in unrealized (gain) loss and include settlements during the period. Adjusted EBITDDA is a non-GAAP measure and is net income adjusted for interest expense, provision for income taxes, depreciation, depletion and amortization, basis of real estate sold and non-cash asset impairment, eliminations and special items. Management uses this non-GAAP measure to evaluate the performance of the Company. We believe that this non-GAAP measure, when read in conjunction with out GAAP financials, provides useful information to investors by facilitating the comparability of our ongoing operating results over the periods presented, the ability to identify trends in our underlying business and the comparison of our operating results against analyst financial models and operating results of other public companies that supplement their GAAP results with non-GAAP financial measures.