Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - LUMINEX CORP | form8-ka102017.htm |

October 21, 2017

Luminex Corporate

Update

© Copyright 2017 Luminex Corporation 2

Safe Harbor Statement

Certain statements made during the course of this presentation may not be purely historical and consequently may be forward looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to statements made regarding: our Licensed Technologies Group model

and the ability of our licensees and installed base to drive future growth; the ability of our technology to enhance productivity and efficiency; our financial position

and long-term revenue growth; our ability to integrate our recent acquisition of Nanosphere Inc.; our molecular diagnostic business model, the markets we are

targeting, market segmentation, expected growth of such markets, and the ability of our products to address those markets; sales of our products, their technical

capabilities, and the anticipated market size and acceptance, demand and regulatory environment and approvals therefor; our direct sales efforts; our system

placements; our system and assay product pipeline and anticipated timelines for regulatory approvals and market releases, including for ARIES® and VERIGENE®

instrumentation and assays; market opportunity for ARIES® and VERIGENE ®; functionality and benefits of ARIES® and VERIGENE ® and competitive position;

reimbursement trends; our ability to drive growth through investment in R&D and next generation systems and focus on operating leverage and managing

operating costs; our long term financial targets; our key steps and strategies for growth; our strategic outlook and growth plan for our business for 2017 and

beyond; operational trends, including those related to sales of systems, assays, consumables, and royalty revenues; competitive threats and products offered by

other companies; 2017 revenue guidance; our business outlook, financial targets and projections about revenues, cash flow, system shipments, expenses and

market conditions, and their anticipated impact on Luminex for 2017 and beyond; and, any statements of the plans, strategies and objectives of management for

future operations.

These forward looking statements speak only as of the date hereof and are based on our current beliefs and expectations and are subject to known or unknown

risks and uncertainties some of which are beyond our control that could cause actual results or plans to differ materially and adversely from those anticipated in the

forward looking statements. Factors that could cause or contribute to such differences are detailed in our annual, quarterly, or other filings with the Securities and

Exchange Commission. We undertake no obligation to update these forward looking statements.

Also, certain non-GAAP financial measures as defined by SEC Regulation G, may be covered in this presentation. To the extent that any non-GAAP financial

measures are covered, a presentation of and reconciliation to the most directly comparable GAAP financial measures will be included in this presentation may be

available on our website at www.luminexcorp.com in accordance with Regulation G.

© Copyright 2017 Luminex Corporation 3

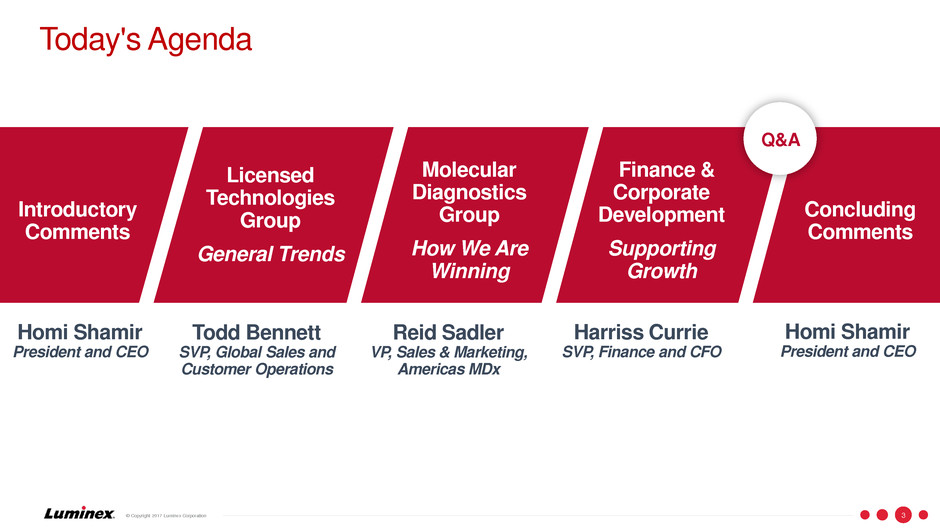

Today's Agenda

Introductory

Comments

Licensed

Technologies

Group

General Trends

Molecular

Diagnostics

Group

How We Are

Winning

Finance &

Corporate

Development

Supporting

Growth

Q&A

Concluding

Comments

Homi Shamir

President and CEO

Todd Bennett

SVP, Global Sales and

Customer Operations

Reid Sadler

VP, Sales & Marketing,

Americas MDx

Harriss Currie

SVP, Finance and CFO

Homi Shamir

President and CEO

Homi Shamir

President and CEO

Introductory Comments

© Copyright 2017 Luminex Corporation 5

A Track Record of Success

2014 2015 2016

Total Annual Revenue Growth Accelerating

+13%

$227M

$238M

$271M

$300M - $310M

2017E

Consistency:

11 Straight Quarters

Meeting or Exceeding Street

Revenue Expectations

© Copyright 2017 Luminex Corporation 6

Executive Summary

STRATEGIC GOALS

• Continue to drive double digit total revenue growth, excluding LabCorp

• Continued focus on profitable activities (high ROI) in both LTG and MDx

• Leverage strong balance sheet to pursue expansion opportunities

GROWTH DRIVERS

• Licensed Technologies Group: stable, mid-single digit revenue growth with high GM

• MDx infectious disease testing: double-digit revenue growth driven by high growth

S2A molecular testing platforms

• MDx well positioned for future growth with broad breadth of testing solutions and

pricing strategies (e.g. Flex) as well as VERIGENE® II and menu

LICENSED

TECHNOLOGIES

GROUP

MOLECULAR

DIAGNOSTICS

GROUP

Todd Bennett

SVP, Global Sales and Customer Operations

Licensed Technologies Group (LTG)

General Trends

© Copyright 2017 Luminex Corporation 8

Licensed Technologies Group: Summary

1H17 LTG-Related Revenue, by Product:

+5%

in

1H17

~40%

Total:

$74.5M Other

12%

% of Total 1H17 LTG-Related Revenue, by Market:

Royalty

System

Consumable

LTG:

~50%

of our

business

~40%

~20%

Transplant

Diagnostics

Immuno-dx

Protein

Research

…Luminex

bead-based

platforms are an

open technology

and the applications

are extremely broad.

There are uses in all

fields from

academia to the

clinic…”

– Director,

Academic Core Facility

37%

29%

22%

LMNX IP Portfolio*:

568

Granted

Patents

160

Patents

Pending

* Worldwide

© Copyright 2017 Luminex Corporation 9

LTG: Multiplexing Systems Overview

0

5,000

10,000

15,000

2008 2010 2012 2014 2016

0

500

1,000

1,500

2,000

2,500

'01 / '02 '03 / '04 '05 / '06 '07 / '08 '09 / '10 '11 / '12 '13 / '14 '15 / '16

Total Cumulative Systems Shipped to Date

Multiplexing System Shipments (2-Year Totals)

© Copyright 2017 Luminex Corporation 10

LTG: High Margin Revenue Trends

End-User Sales (Partner Reported)*

$0

$50

$100

$150

$200

$250

$300

'01/'02 '03/'04 '05/'06 '07/'08 '09/'10 '11/'12 '13/'14 '15/'16

LMNX LTG Revenue: Total*

$0

$200

$400

$600

$800

$1,000

$1,200

'01/'02 '03/'04 '05/'06 '07/'08 '09/'10 '11/'12 '13/'14 '15/'16

$0

$20

$40

$60

$80

$100

'01/'02 '03/'04 '05/'06 '07/'08 '09/'10 '11/'12 '13/'14 '15/'16

* $ in Millions, 2-Year Totals

$0

$20

$40

$60

$80

$100

$120

'01/'02 '03/'04 '05/'06 '07/'08 '09/'10 '11/'12 '13/'14 '15/'16

LMNX LTG Revenue: Consumables* LMNX LTG Revenue: Royalties*

© Copyright 2017 Luminex Corporation 11

LTG: Success Story

Large European Blood Bank and Testing Network

The Customer Why Luminex? The Result

• Network of 15 centers

• Focus on collection,

testing, preparation and

distribution of blood

products to some 1,900

health care facilities

• Dependability of the xMAP®

platform

• Unique approach to kit

supply utilizing two of our

Partners

• 15 LX200™ sold

• 9 Luminex service

contracts

• Valued at ~$2.5M in total

revenue over 5 year term

© Copyright 2017 Luminex Corporation 12

LTG: Growth Opportunities

• 70+ partners investing in our technology; long-term

contractual partnerships; addressing large markets

•Stable growth; highly profitable

• Large and growing system base (14,500+)

•New system (improved sensitivity and automation)

7

Reid Sadler

VP, Sales & Marketing Americas MDx

Molecular Diagnostics Group

How We are Winning

© Copyright 2017 Luminex Corporation 14

Molecular Diagnostics (MDx): Summary

Molecular

Diagnostics:

~50%

of our

business

1H17 MDx Assay Revenue, by Category:

Genetic

19%

Infectious

Disease

81%

Total:

$74M

100+

Highly Experienced

MDx Sales &

Support Professionals

+42%

in

1H17

© Copyright 2017 Luminex Corporation 15

MDx: The Right Solution for Customers Needs

SYSTEM THROUGHPUT

M

U

L

T

IP

L

E

X

IN

G

C

A

P

A

B

IL

IT

IE

S

MAGPIX®

Launched 2010

Luminex® 200™

Launched 2005

ARIES®

Launched 2015

VERIGENE®

Acquired 2016

Automated Sample to Answer

Non-Automated

VERIGENE® II

Coming Soon

© Copyright 2017 Luminex Corporation 16

MDx: Targeted & Syndromic Testing Solutions

HSV 1&2 Flu/RSV GBS C. Difficile Norovirus GAS MRSA Respiratory Panel GI Panel BCID Panel

Targeted Syndromic

Luminex is the only manufacturer providing Targeted & Syndromic solutions

© Copyright 2017 Luminex Corporation 17

MDx: Key Recent Wins

Sizeable agreements closed over the past 6 months

Large Hospital (BF) BC,EP,RP $1M

Large Hospital (BF) EP $500K

IDN Hospital Grp (BF) BC, EP $500K

IDN Hospital Grp EP $500K

Large Hospital (BF) BC,RP $400K

Large Hospital (Cult.) BC, EP RP $400K

Large Hospital (Cult.) EP $275K

Reference Lab (BF) Bordetella $500K

IDN Hospital Grp (MB) HSV, ASRs $400K

Pathology Lab GBS $250K

Reference Lab (LDT) Bordetella $200K

Large Hospital (CPD) GBS, HSV $200K

Large Hospital (DS) FLU $200K

Pathology Lab WH ASRs $150K

Reference Lab (BF) RPP $700K

IDN Core Lab (BD) NxTAG® WH $600K

Reference Lab (BF) RPP,GPP $500K

VA Hospital (BF) RPP $400K

Large Hospital

(GMK)

RPP $400K

IDN Core Lab (GMK) RPP,CF $350K

VERIGENE® ARIES® NxTAG® & xTAG®

Closed Deal Competitive Takeaway

* Dollar amounts per year

© Copyright 2017 Luminex Corporation 18

MDx: 2017 Success Story

Commercial Lab in California

The Lab The Deal The Result

Offering confidential lab-

based drug tests as well

as:

• Upper Respiratory

Testing

• GI Pathogen Testing

• UDT Testing

• Oral Fluid Testing

• Multi-year agreement

including:

‒ xTAG® GPP

‒ NxTAG® RPP

‒ ARIES® Bordetella

‒ ARIES® Group A Strep

• Valued at $4M (over term)

• 3 ARIES® & 1 MAGPIX®

• Displacing BioFire

• Great example of Total

Portfolio Selling

(syndromic panel and

targeted testing)

© Copyright 2017 Luminex Corporation 19

MDx: Customer Sales and Support

Selling Sample to

Answer and Non-

Automated MDx Portfolio

Jan

45+ 60

100+

Highly Experienced

MDx Sales &

Support Professionals

Sales Force Sales Support

MDx

Sales Force

Integrated &

Trained

Focused on Microbiology

& Molecular Clinical

Laboratories

Targeting Hospital &

Reference Lab Market

Prefer this slide (or consolidated slide earlier) –

confirm 75 FTEs vs. 100+ in previously public slide

© Copyright 2017 Luminex Corporation 20

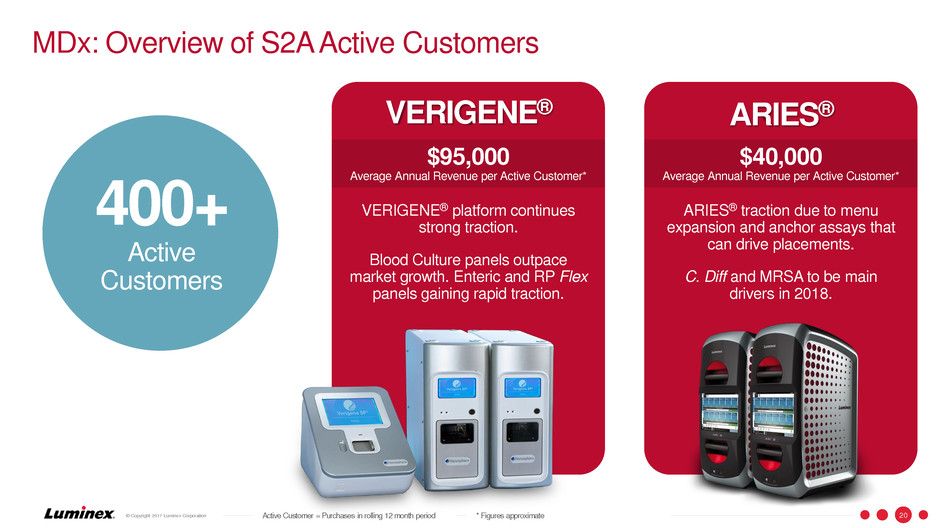

MDx: Overview of S2A Active Customers

VERIGENE® platform continues

strong traction.

Blood Culture panels outpace

market growth. Enteric and RP Flex

panels gaining rapid traction.

ARIES® traction due to menu

expansion and anchor assays that

can drive placements.

C. Diff and MRSA to be main

drivers in 2018.

$95,000

Average Annual Revenue per Active Customer*

VERIGENE® ARIES®

$40,000

Average Annual Revenue per Active Customer*

Active Customer = Purchases in rolling 12 month period

400+

Active

Customers

* Figures approximate

© Copyright 2017 Luminex Corporation 21

MDx: The Importance of Our Flex Testing Strategy

Single Center Experience with RP Flex*

Annual Cost Savings of MDx Respiratory Testing

Targets

Competitor’s

Full MDx Panel

Luminex

RP Flex

Overall Cost

Savings

Flu A/B + RSV $215,760 $129,920 $85,840

Respiratory Virus

Panel

$181,350 $171,600 $9,750

Total $397,110 $301,520

RP Flex

Generated

Annual

Savings of:

>$95K

Source: Dr. Yvette McCarter, College of Medicine – Jacksonville, University of Florida, Department of Pathology and Laboratory Medicine

NOTE: Single center experiences may vary

How does Flex testing work?

• Each Flex cartridge contains a

broad panel of viral, bacterial

and/or parasitic targets.

• Any combination of tiered

targets can be selected for an

individual sample at the time of

test ordering.

• Additional results not initially

reported after test completion

can be reflexed instantly at an

extra cost without running an

additional test.

© Copyright 2017 Luminex Corporation 22

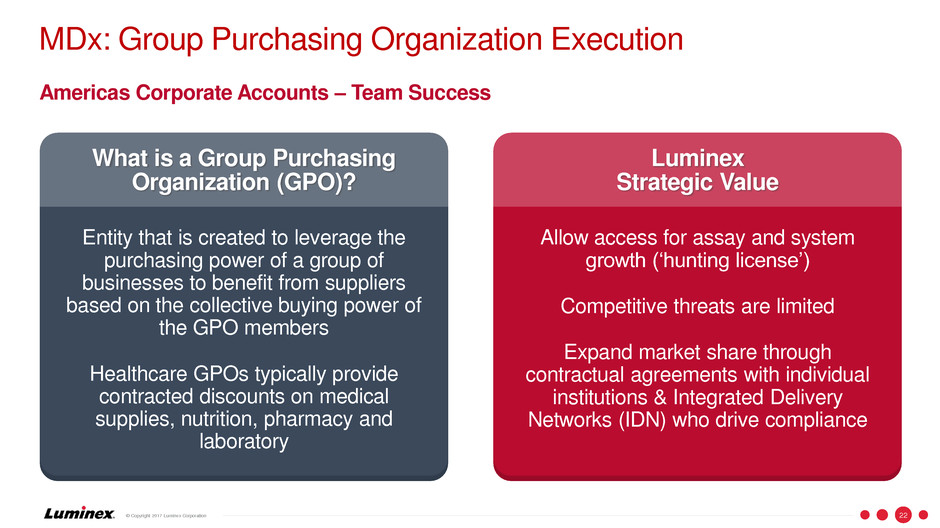

Americas Corporate Accounts – Team Success

MDx: Group Purchasing Organization Execution

What is a Group Purchasing

Organization (GPO)?

Entity that is created to leverage the

purchasing power of a group of

businesses to benefit from suppliers

based on the collective buying power of

the GPO members

Healthcare GPOs typically provide

contracted discounts on medical

supplies, nutrition, pharmacy and

laboratory

Luminex

Strategic Value

Allow access for assay and system

growth (‘hunting license’)

Competitive threats are limited

Expand market share through

contractual agreements with individual

institutions & Integrated Delivery

Networks (IDN) who drive compliance

© Copyright 2017 Luminex Corporation 23

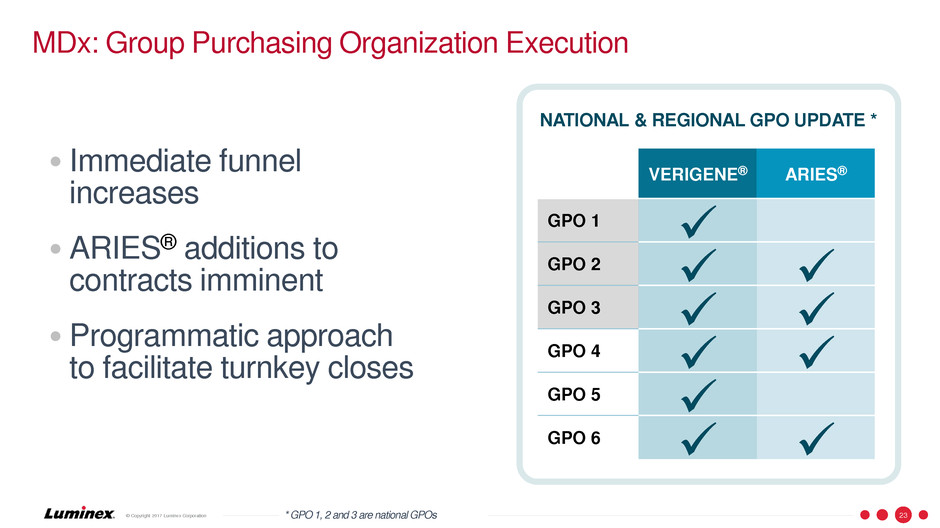

MDx: Group Purchasing Organization Execution

• Immediate funnel

increases

•ARIES® additions to

contracts imminent

•Programmatic approach

to facilitate turnkey closes

VERIGENE® ARIES®

GPO 1

GPO 2

GPO 3

GPO 4

GPO 5

GPO 6

NATIONAL & REGIONAL GPO UPDATE *

* GPO 1, 2 and 3 are national GPOs

© Copyright 2017 Luminex Corporation 24

MDx: Growth Opportunities

• Total S2A revenue – accelerated growth from over $45M in

2017E and approaching ~$100M by end of 2019E, driven by;

– Continued strong adoption of VERIGENE® I

– Expanded menu on ARIES®

– Recent expansion of GPO coverage of S2A platforms

– Initial launch of VERIGENE® II with multiple assays

• In uncertain reimbursement landscape,

Luminex is well positioned with a broad

product offering and differentiated

pricing strategies

© Copyright 2017 Luminex Corporation 25

MDx: Update on VERIGENE® II

Progress Report

• VERIGENE® II system now robust and ready

for clinical trials. Failure rates consistently

below 5%.

• Plan on commencing multiple clinical trials

with system in 2018 (enteric, respiratory,

blood culture ID) for launch in 2019

• With on-going success of VERIGENE® I,

commercialization strategy for VERIGENE® II

favors launching with multiple assays.

• Monitoring reimbursement landscape – well

positioned with Flex pricing strategy

Financial and Corporate Development

Supporting Growth

Harriss Currie

SVP, Finance and CFO

© Copyright 2017 Luminex Corporation 27

2H16 1Q17

MDx Revenue,

Automated *

2H16 1Q17

Financial Overview: Well Positioned for Future Growth

• Nanosphere deal accretive in 2Q17 -

ahead of target

• VERIGENE® gram-positive blood

culture (BC-GP) and gram-negative

blood culture (BC-GN) molecular

assays are First to Market in Japan

• Automated Sample to Answer

revenue to be more than $45M in

2017 and approaching $100M by

end of 2019

• LTG-related revenue to grow 3 - 5%

in 2017

1H17 revenue grew

5% over 1H16,

reaching $74 million;

High Margin Items

accounted for 78% of

1H17 revenue

MDx Revenue,

Non-Automated

Financial Strength LTG - Related Revenue

* Pro-forma

$57M

+6%

$22M

+55%

$103M

2Q17 Cash and

Investments

$20M

1H17 Cash

Flow from

Operations

1H17 1H17 2H16 2H16

Thank You