Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - CatchMark Timber Trust, Inc. | d475761dex992.htm |

| 8-K - 8-K - CatchMark Timber Trust, Inc. | d475761d8k.htm |

Exhibit 99.1

Coastal Acquisition & Follow -On Equity Offering October 2017

FORWARD—LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. Forward looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward looking information. Such statements include that given the flat pricing outlook, we are well positioned and will continue to concentrate on disciplined execution of our operating plan while strategically expanding our timberlands holdings and capital relationships, that we are on target for executing our business plan, that we remain focused on providing a superior and sustainable rate of return to stockholders and that we believe that our new growth opportunities, operational execution, and capital allocation strategy are building long-term value. Factors that could cause or contribute to such differences include, but are not limited to: (i) we may not generate the harvest volumes from our timberlands that we currently anticipate; (ii) the demand for our timber may not increase at the rate we currently anticipate or at all due to changes in general economic and business conditions in the geographic regions where our timberlands are located; (iii) the cyclical nature of the real estate market generally, including fluctuations in demand and valuations, may adversely impact our ability to generate income and cash flow from sales of higher-and-better use properties; (iv) timber prices may not increase at the rate we currently anticipate or could decline, which would negatively impact our revenues; (v) the supply of timberlands available for acquisition that meet our investment criteria may be less than we currently anticipate; (vi) we may be unsuccessful in winning bids for timberland that are sold through an auction process; (vii) we may not be able to access external sources of capital at attractive rates or at all; (viii) potential increases in interest rates could have a negative impact on our business; (ix) our share repurchase program may not be successful in improving stockholder value over the long-term; (x) our joint venture strategy may not enable us to access non-dilutive capital and enhance our ability to make acquisitions; and (xi) the factors described in Item 1A. Risk Factors of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, our quarterly report on Form 10-Q for the quarter ended June 30, 2017, and our other filings with Securities and Exchange Commission. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to update our forward-looking statements, except as required by law. 2

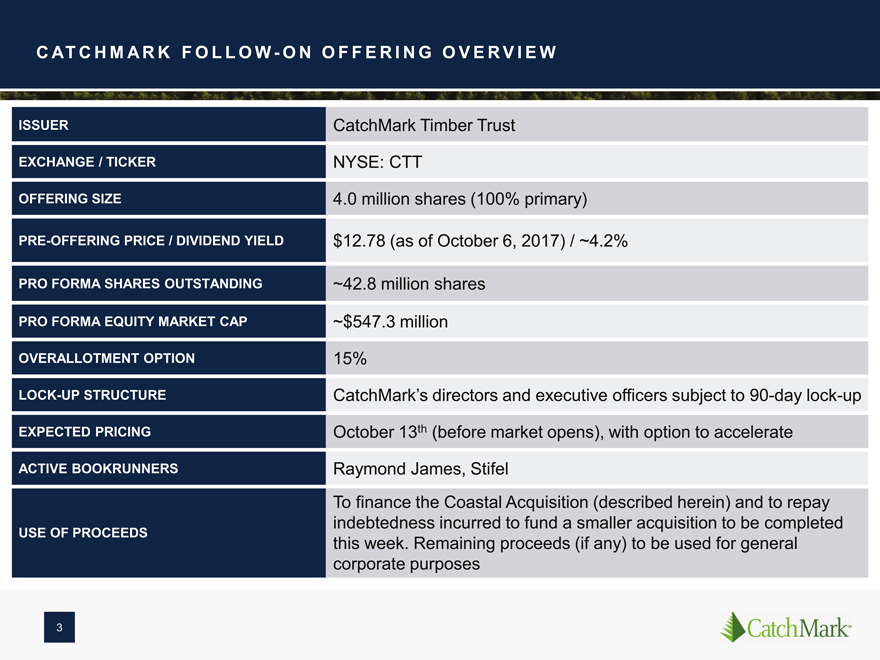

CATCHMARK FOLLOW—ON OFFERING OVERVIEW ISSUER CatchMark Timber Trust EXCHANGE / TICKER NYSE: CTT OFFERING SIZE 4.0 million shares (100% primary) PRE-OFFERING PRICE / DIVIDEND YIELD $12.78 (as of October 6, 2017) / ~4.2% PRO FORMA SHARES OUTSTANDING ~42.8 million shares PRO FORMA EQUITY MARKET CAP ~$547.3 million OVERALLOTMENT OPTION 15% LOCK-UP STRUCTURE CatchMark?s directors and executive officers subject to 90-day lock-up EXPECTED PRICING October 13th (before market opens), with option to accelerate ACTIVE BOOKRUNNERS Raymond James, Stifel To finance the Coastal Acquisition (described herein) and to repay indebtedness incurred to fund a smaller acquisition to be completed USE OF PROCEEDS this week. Remaining proceeds (if any) to be used for general corporate purposes 3

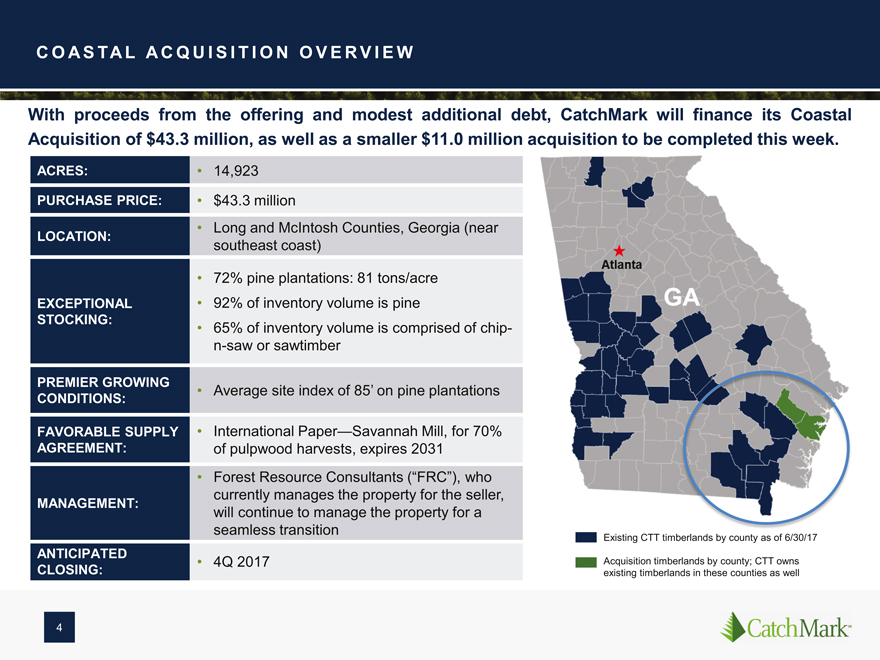

COASTAL ACQUISITION OVERVIEW With proceeds from the offering and modest additional debt, CatchMark will finance its Coastal Acquisition of $43.3 million, as well as a smaller $11.0 million acquisition to be completed this week. ACRES: 14,923 PURCHASE PRICE: $43.3 million Long and McIntosh Counties, Georgia (near LOCATION: southeast coast) 72% pine plantations: 81 tons/acre EXCEPTIONAL 92% of inventory volume is pine STOCKING: 65% of inventory volume is comprised of chip-n-saw or sawtimber PREMIER GROWING Average site index of 85? on pine plantations CONDITIONS: FAVORABLE SUPPLY International Paper?Savannah Mill, for 70% AGREEMENT: of pulpwood harvests, expires 2031 Forest Resource Consultants (?FRC?), who currently manages the property for the seller, MANAGEMENT: will continue to manage the property for a seamless transition Existing CTT timberlands by county as of 6/30/17 ANTICIPATED 4Q 2017 Acquisition timberlands by county; CTT owns CLOSING: existing timberlands in these counties as well 4

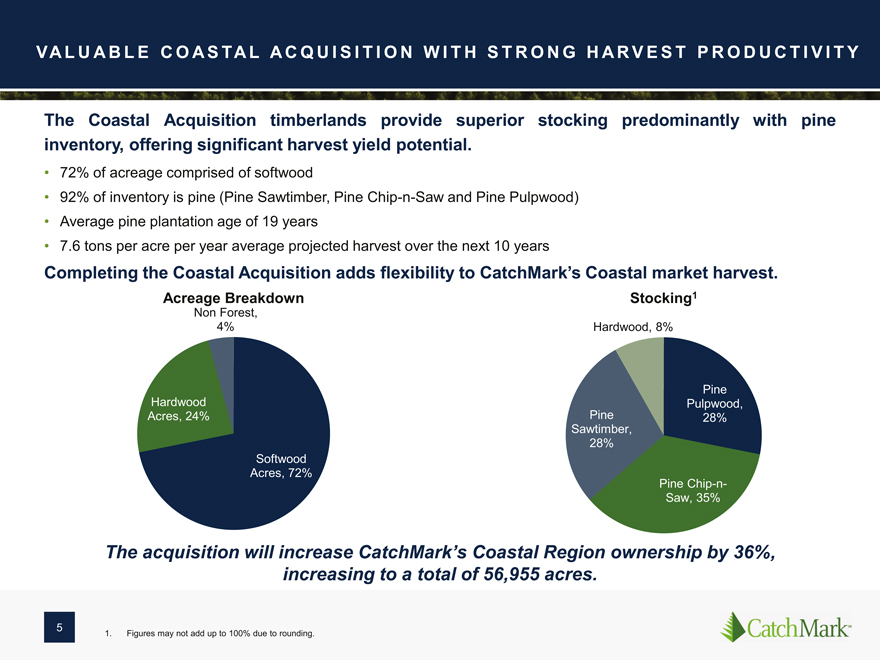

VALUABLE COASTAL ACQUISITION WITH STRONG HARVEST PRODUCTIVITY The Coastal Acquisition timberlands provide superior stocking predominantly with pine inventory, offering significant harvest yield potential. 72% of acreage comprised of softwood 92% of inventory is pine (Pine Sawtimber, Pine Chip-n-Saw and Pine Pulpwood) Average pine plantation age of 19 years 7.6 tons per acre per year average projected harvest over the next 10 years Completing the Coastal Acquisition adds flexibility to CatchMark?s Coastal market harvest. Acreage Breakdown Stocking1 Non Forest, 4% Hardwood, 8% Hardwood Pine Pulpwood, Acres, 24% Pine 28% Sawtimber, 28% Softwood Acres, 72% Pine Chip-n-Saw, 35% The acquisition will increase CatchMark?s Coastal Region ownership by 36%, increasing to a total of 56,955 acres. 5 1. Figures may not add up to 100% due to rounding.

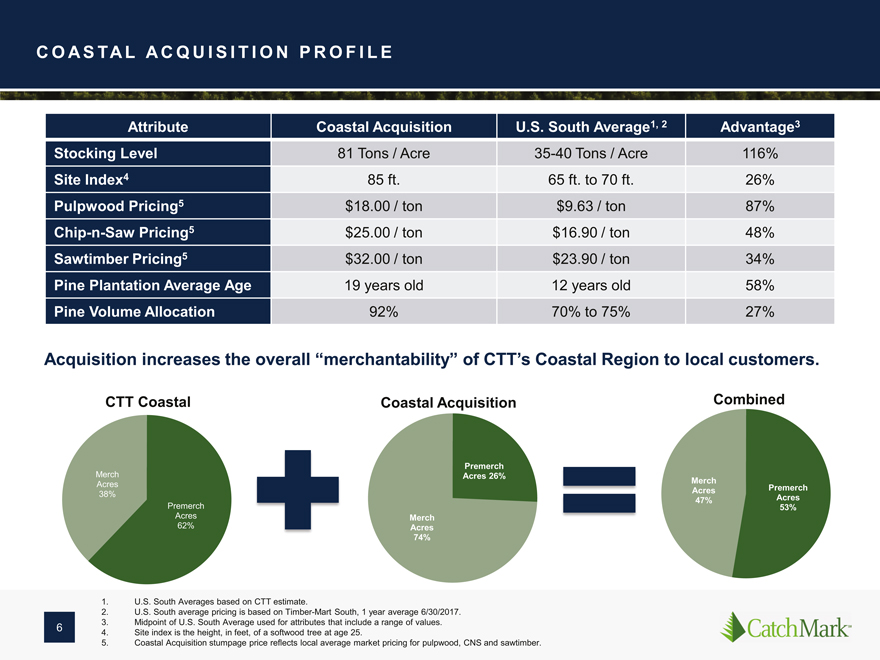

COASTAL ACQUISITION PROFILE Attribute Coastal Acquisition U.S. South Average1, 2 Advantage3 Stocking Level 81 Tons / Acre 35-40 Tons / Acre 116% Site Index4 85 ft. 65 ft. to 70 ft. 26% Pulpwood Pricing5 $18.00 / ton $9.63 / ton 87% Chip-n-Saw Pricing5 $25.00 / ton $16.90 / ton 48% Sawtimber Pricing5 $32.00 / ton $23.90 / ton 34% Pine Plantation Average Age 19 years old 12 years old 58% Pine Volume Allocation 92% 70% to 75% 27% Acquisition increases the overall ?merchantability? of CTT?s Coastal Region to local customers. CTT Coastal Coastal Acquisition Combined Merch Premerch Acres 26% Acres Merch Acres Premerch 38% Acres 47% Premerch 53% Acres Merch 62% Acres 74% 1. U.S. South Averages based on CTT estimate. 2. U.S. South average pricing is based on Timber-Mart South, 1 year average 6/30/2017. 6 3. Midpoint of U.S. South Average used for attributes that include a range of values. 4. Site index is the height, in feet, of a softwood tree at age 25. 5. Coastal Acquisition stumpage price reflects local average market pricing for pulpwood, CNS and sawtimber.

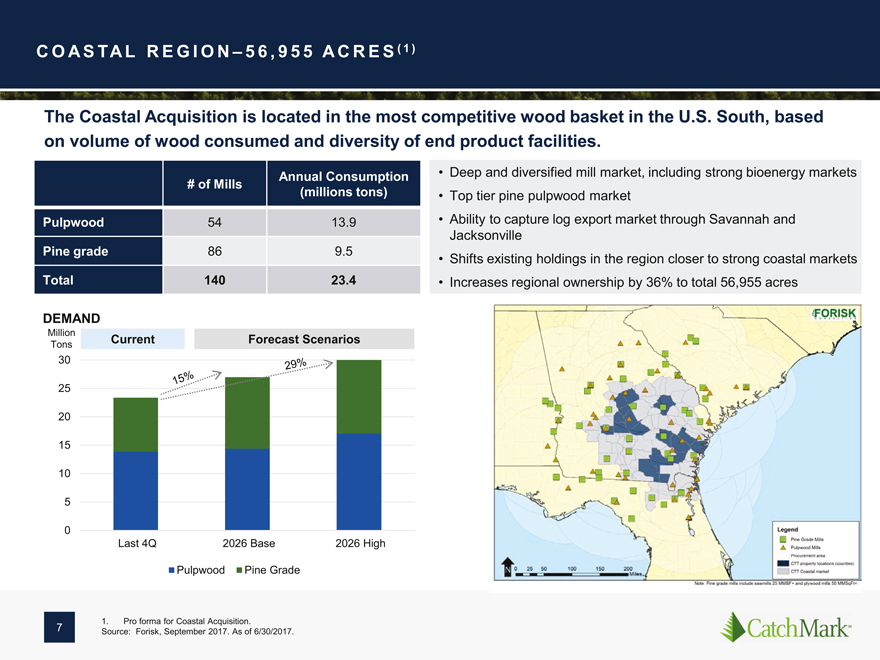

COASTAL REGION– 5 6 , 9 5 5 A C R E S (1 ) The Coastal Acquisition is located in the most competitive wood basket in the U.S. South, based on volume of wood consumed and diversity of end product facilities. NC Annual Consumption Deep and diversified mill market, including strong bioenergy markets # of Mills (millions tons) Top tier pine pulpwood market Pulpwood 54 13.9 Ability to capture log export market through Savannah and Jacksonville Pine grade 86 9.5 Shifts existing holdings in the region closer to strong coastal markets Total 140 23.4 Increases regional ownership by 36% to total 56,955 acres DEMAND Million Current Forecast Scenarios Tons 30 25 20 15 10 5 0 Last 4Q 2026 Base 2026 High Pulpwood Pine Grade 1. Pro forma for Coastal Acquisition. 7 Source: Forisk, September 2017. As of 6/30/2017.

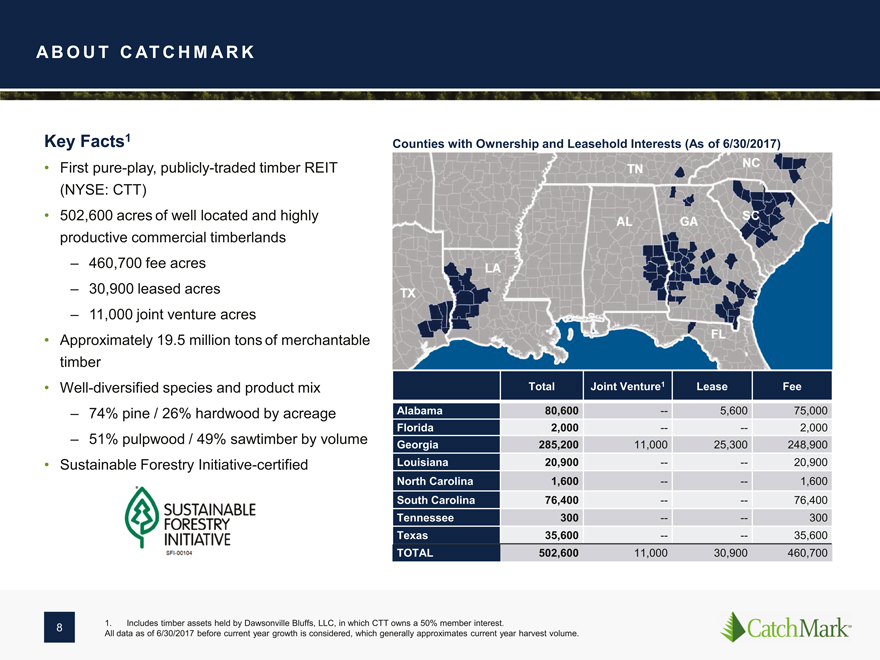

ABOUT CATCHMARK Key Facts1 Counties with Ownership and Leasehold Interests (As of 6/30/2017) First pure-play, publicly-traded timber REIT (NYSE: CTT) 502,600 acres of well located and highly productive commercial timberlands ? 460,700 fee acres ? 30,900 leased acres ? 11,000 joint venture acres Approximately 19.5 million tons of merchantable timber Well-diversified species and product mix Total Joint Venture1 Lease Fee ? 74% pine / 26% hardwood by acreage Alabama 80,600 — 5,600 75,000 Florida 2,000 — — 2,000 ? 51% pulpwood / 49% sawtimber by volume Georgia 285,200 11,000 25,300 248,900 Sustainable Forestry Initiative-certified Louisiana 20,900 — — 20,900 North Carolina 1,600 — — 1,600 South Carolina 76,400 — — 76,400 Tennessee 300 — — 300 Texas 35,600 — — 35,600 TOTAL 502,600 11,000 30,900 460,700 8 1. Includes timber assets held by Dawsonville Bluffs, LLC, in which CTT owns a 50% member interest. All data as of 6/30/2017 before current year growth is considered, which generally approximates current year harvest volume.

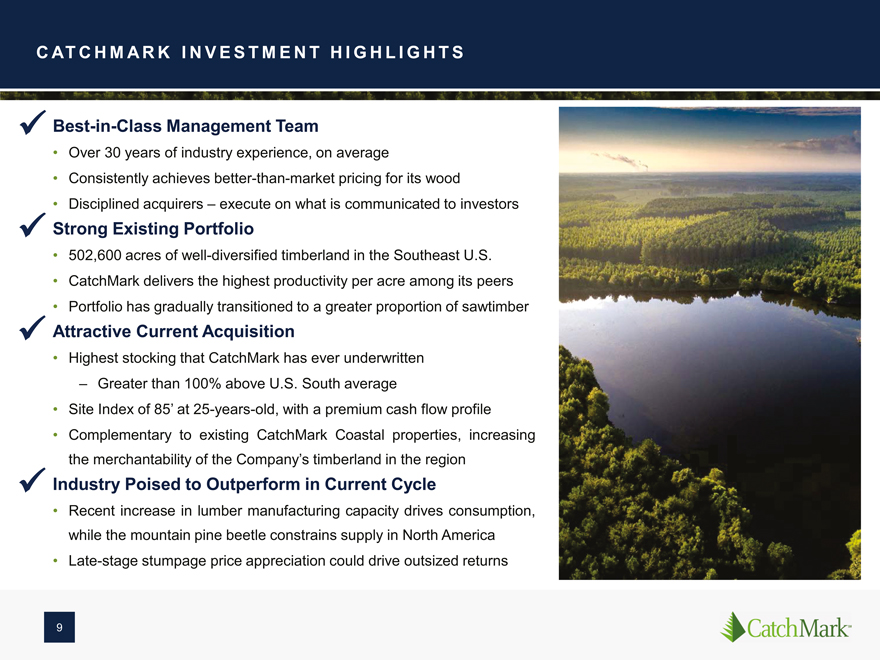

CATCHMARK INVESTMENT HIGHLIGHTS ? Best-in-Class Management Team Over 30 years of industry experience, on average Consistently achieves better-than-market pricing for its wood Disciplined acquirers ? execute on what is communicated to investors ? Strong Existing Portfolio 502,600 acres of well-diversified timberland in the Southeast U.S. CatchMark delivers the highest productivity per acre among its peers Portfolio has gradually transitioned to a greater proportion of sawtimber ? Attractive Current Acquisition Highest stocking that CatchMark has ever underwritten ? Greater than 100% above U.S. South average Site Index of 85? at 25-years-old, with a premium cash flow profile Complementary to existing CatchMark Coastal properties, increasing the merchantability of the Company?s timberland in the region ? Industry Poised to Outperform in Current Cycle Recent increase in lumber manufacturing capacity drives consumption, while the mountain pine beetle constrains supply in North America Late-stage stumpage price appreciation could drive outsized returns 9

EXPERIENCED MANAGEMENT TEAM CatchMark?s seasoned leadership provides significant industry experience and capability to help realize company objectives and growth plan. Jerry Barag, President and CEO (31 years of industry experience) Managing Director and Founder TimberStar Advisors and TimberStar Chief Investment Officer at Lend Lease Real Estate Investments Executive Vice President, Equitable Real Estate John Rasor, Chief Operating Officer (46 years) Managing Director and Founder TimberStar Advisors and TimberStar Executive Vice President of Georgia Pacific, responsible for timber and timberlands, building product businesses, and wood and fiber procurement for wood products, pulp and paper Brian Davis, Chief Financial Officer (26 years) Senior Vice President and Chief Financial Officer of Wells Timberland Various executive finance roles with SunTrust Bank and CoBank, delivering capital market solutions ? advisory, capital raising, and financial risk management to public and private companies. Todd Reitz, Senior Vice President, Forestry Operations (23 years) Atlantic South Regional Marketing Manager for Weyerhaeuser with operational oversite for all log and pulpwood production from East Alabama to Virginia Previous roles with Weyerhaeuser, Plum Creek and Stone Container Corporation ? extensive marketing, harvesting, silviculture and business development experience across the U.S. South from East Texas to Virginia. 10

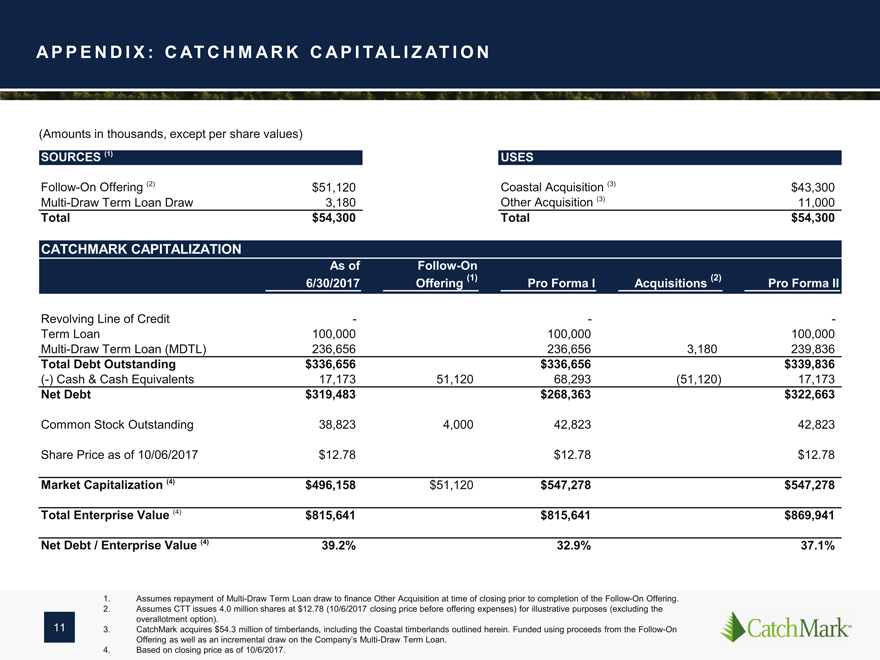

APPENDIX: CATCHMARK CAPITALIZATION (Amounts in thousands, except per share values) SOURCES (1) USES Follow-On Offering (2) $51,120 Coastal Acquisition (3) $43,300 Multi-Draw Term Loan Draw 3,180 Other Acquisition (3) 11,000 Total $54,300 Total $54,300 CATCHMARK CAPITALIZATION As of Follow-On 6/30/2017 Offering (1) Pro Forma I Acquisitions (2) Pro Forma II Revolving Line of Credit———Term Loan 100,000 100,000 100,000 Multi-Draw Term Loan (MDTL) 236,656 236,656 3,180 239,836 Total Debt Outstanding $336,656 $336,656 $339,836 (-) Cash & Cash Equivalents 17,173 51,120 68,293 (51,120) 17,173 Net Debt $319,483 $268,363 $322,663 Common Stock Outstanding 38,823 4,000 42,823 42,823 Share Price as of 10/06/2017 $12.78 $12.78 $12.78 Market Capitalization (4) $496,158 $51,120 $547,278 $547,278 Total Enterprise Value (4) $815,641 $815,641 $869,941 Net Debt / Enterprise Value (4) 39.2% 32.9% 37.1% 1. Assumes repayment of Multi-Draw Term Loan draw to finance Other Acquisition at time of closing prior to completion of the Follow-On Offering. 2. Assumes CTT issues 4.0 million shares at $12.78 (10/6/2017 closing price before offering expenses) for illustrative purposes (excluding the overallotment option). 11 3. CatchMark acquires $54.3 million of timberlands, including the Coastal timberlands outlined herein. Funded using proceeds from the Follow-On Offering as well as an incremental draw on the Company?s Multi-Draw Term Loan. 4. Based on closing price as of 10/6/2017.

12 catchmark