Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Veritex Holdings, Inc. | a8-kstephensbankceoforumin.htm |

V E R I T E X

Stephens Bank CEO Forum

September 20, 2017

2

Safe Harbor Statement

ABOUT VERITEX HOLDINGS, INC.

Headquartered in Dallas, Texas, Veritex Holdings, Inc. (“VBTX”, “Veritex” or the “Company”) is a bank holding company that conducts banking activities

through its wholly-owned subsidiary, Veritex Community Bank, with locations throughout the Dallas Fort Worth metroplex and in the Houston and

Austin metropolitan area. Veritex Community Bank is a Texas state chartered bank regulated by the Texas Department of Banking and the Board of

Governors of the Federal Reserve System. For more information, visit www.veritexbank.com.

NO OFFER OR SOLICITATION

This communication does not constitute an offer to sell, a solicitation of an offer to sell, the solicitation or an offer to buy any securities or a solicitation

of any vote or approval. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirement of Section 10 of the Securities Act of 1933, as amended.

ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT

In connection with the proposed merger of Veritex and Liberty Bancshares, Inc. (“Liberty”), Veritex will file with the Securities and Exchange Commission

(the “SEC”) a registration statement on Form S-4 that will include a proxy statement of Liberty and a prospectus of Veritex, as well as other relevant

documents concerning the proposed merger. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4

AND THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THESE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VERITEX, SOVEREIGN AND THE MERGER. Investors and security holders will be able to

obtain free copies of the registration statement on Form S-4 and the related proxy statement/prospectus, when filed, as well as other documents filed

with the SEC by Veritex through the web site maintained by the SEC at www.sec.gov. Documents filed with the SEC by Veritex will also be available free

of charge by directing a written request to Veritex Holdings, Inc., 8214 Westchester Drive, Suite 400, Dallas, Texas 75225 Attn: Investor Relations.

Veritex’s telephone number is (972) 349-6200.

NON-GAAP FINANCIAL MEASURES

Veritex reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that

certain non-GAAP performance measures used in managing the business may provide meaningful information about underlying trends in its business.

Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Veritex’s reported results prepared in accordance with

GAAP. Please see Reconciliation of Non-GAAP Measures at the end of this presentation for a reconciliation to the nearest GAAP financial measure.

PARTICIPANTS IN THE TRANSACTION

Veritex, Liberty and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the

shareholders of Liberty in connection with the proposed merger. Certain information regarding the interests of these participants and a description of

their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus regarding the proposed

transaction when it becomes available. Additional information about Veritex and its directors and officers may be found in the definitive proxy statement

of Veritex relating to its 2017 Annual Meeting of Stockholders filed with the SEC on April 10, 2017. The definitive proxy statement can be obtained free

of charge from the sources described above.

3

Forward Looking Statements

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This presentation may contain certain forward-looking statements

within the meaning of the securities laws that are based on various facts and derived utilizing important assumptions, current expectations, estimates

and projections about the Company and its subsidiaries. Forward-looking statements include information regarding the Company’s future financial

performance, business and growth strategy, projected plans and objectives, and related transactions, integration of the acquired businesses, ability to

recognize anticipated operational efficiencies, and other projections based on macroeconomic and industry trends, which are inherently unreliable due

to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise

include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs

such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking

statements include the foregoing. Further, certain factors that could affect our future results and cause actual results to differ materially from those

expressed in the forward-looking statements include, but are not limited to whether the Company can: successfully implement its growth strategy,

including identifying acquisition targets and consummating suitable acquisitions; continue to sustain internal growth rate; provide competitive products

and services that appeal to its customers and target market; continue to have access to debt and equity capital markets; and achieve its performance

goals. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Speical Cautionary Note

Regarding Forward-Looking Statements” and “Risk Factors” in Veritex’s Annual Report on Form 10-K filed with the SEC on March 10, 2017 and any

updates to those risk factors set forth in Veritex’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events

related to these or other risks or uncertainties materialize, or if Veritex’s underlying assumptions prove to be incorrect, actual results may differ

materially from what Veritex anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking

statement speaks only as of the date on which it is made, and Veritex does not undertake any obligation to publicly update or review any forward-

looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it

is not possible for us to predict those events or how they may affect us. In addition, Veritex cannot assess the impact of each factor on Veritex’s business

or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this

cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking

statements that Veritex or persons acting on Veritex’s behalf may issue. Annualized, pro forma, projected and estimated numbers are used for

illustrative purpose only, are not forecasts and may not reflect actual results.

4

Headquartered in Dallas, Texas

Established in 2010

21 locations within several of the fastest

growing metropolitan markets in the U.S.

Strong core deposit mix and commercial

lending focus

Significant organic growth profile

complemented by disciplined M&A

Sovereign acquisition closed and system

conversion completed in third quarter 2017

Franchise FootprintOverview

Veritex – “Truth in Texas Banking”

6/30/17 Financial Highlights

Source: SNL Financial and Company documents; financial data as of 6/30/17.

(1) Pro forma represents Veritex and Sovereign figures as of 6/30/17 as adjusted for purchase accounting.

(2) Total loans excludes loans held for sale.

(Dollars in Millions)

D/FW Metroplex

As Reported Pro Forma

Total Assets 1,509$ 2,572$

Tota l Loans (2) 1,122 1,890

Tota l Depos its 1,211 2,024

NPAs / Assets 0.13% 0.46%

(1)

Veritex Community Bank: Goals, Objectives & Strategies

5

Our goal is to be Texas’ premier community bank generating superior returns for our

shareholders while delivering unparalleled customer service through personal

relationships maintained by a highly motivated and satisfied workforce.

Equip our bankers

with quality

support, analytic

resources, and

product solutions

tailored to meet our

customers’ needs.

Monitor banker

pipeline, sales and

closings.

Support the generation

of quality leads and

referrals resulting in

new business.

Implement programs

that focus on cross

selling.

Maintain a sharp

focus on capital

growth through

consistent increase in

earnings and tangible

book value.

Closely manage cost

and income

opportunities.

Identify unprofitable

relationships and

manage them

accordingly.

Link profitability to

executive and lender

compensation.

Manage production

teams and

operations to

ensure compliance

with policies,

procedures and

regulations.

Invest time, resources,

and capital in technology,

compliance, audit and risk

management.

Maintain sound policies

and procedures, obtain

buy-in from staff.

Maintain high quality

credit culture, continue to

monitor and analyze the

loan portfolio.

Build a banking

team and corporate

structure that

consistently

outperforms our

peer group.

Continue to build teams that

provide excellent customer

service and support all areas

of the bank.

Improve and foster

Veritex culture and

brand.

Hire and retain best in

class employees.

G

o

al

Obje

cti

ve

s

St

ra

tegi

es

~40% annualized loan growth for the quarter

Record loan production exceeding $100 million

Pipelines are building with the addition of experienced lending

executives to our already strong team

Loan Growth

6

Recently Announced Q2 Highlights

0.13% NPAs to Total Assets

No material net charge offs in the quarter

Continued strong credit trends

Pristine Credit

3.53% NIM representing a 32bps increase from Q1

55.0% efficiency ratio

Diluted EPS of $0.23 vs. $0.20 in Q1

Earnings Trends

Source: VBTX earnings release. Figures represent Veritex standalone for the periods noted.

7

Announced Acquisition of Liberty Bancshares

Source: SNL Financial and Company documents. Weighted deposit market share rank based upon SNL Branch Analytics.

(1) Data as of and for the second quarter ended 6/30/17.

(2) Pro forma represents combined Veritex, Sovereign and Liberty figures as of 6/30/17, excluding purchase accounting adjustments.

Company Overview

Financial Summary(1)

Fort Worth-based bank founded in 1985

with 5 branches in Tarrant County

Largest remaining independent bank with

significant assets in Fort Worth and Tarrant

County

Experienced lending team with intimate

knowledge of Tarrant County market

Strong asset quality

Pro Forma Metroplex Footprint

VBTX (12)

Sovereign (6)

Liberty (5)

Strong pro forma(2) Tarrant County deposit

franchise:

̶ Ranked 11th in deposits in Tarrant County

̶ Ranked 4th among Texas-based banks

Consolidated Balance Sheet Data ($ in 000s)

Total Assets 459,287$

Total Loans 330,206

Total Deposits 389,440

Loans / Deposits 84.8%

Tangible Common Equity 35,207$

T E / TA 7.9%

Bank Level Profitability Data (MRQ 6/30/17)

ROAA 0.91%

Net Interest Margin 3.94%

Efficiency Ratio 62.2%

Asset Quality

NPAs / Assets 0.36%

Significant Expansion in Attractive Fort Worth Market

Source: SNL Financial & United States Census Bureau Estimates.

(1) Pro forma represents combined Veritex, Sovereign and Liberty figures as of 6/30/17, excluding purchase accounting adjustments.

(2) Weighted deposit market share rank based upon SNL Branch Analytics.

8

Projected 5-Year Population GrowthMarket Highlights

Tarrant County is the 5th fastest growing

county in the U.S.

Fort Worth is the 16th largest city in the

U.S. ranked by population

Headquarters for several major U.S.

corporations plus significant ongoing

corporate relocations and expansions

Veritex’s pro forma(1) Tarrant County

franchise will include:

̶ 8 branch offices

̶ $501 million in loans

̶ $515 million in deposits

Pro Forma Deposit Market Share

8.5%

8.1%

7.5%

3.8%

Fort Worth DFW Texas National

Tarrant County

Overall

Rank

TX HQ

Rank

Bank City State

Weighted

Deposits (2)

1 JPMorgan Chase & Co. New York NY 7,280,813$

2 Wells Fargo & Co. San Francisco CA 6,075,447

3 Bank of America Corp. Charlotte NC 4,874,500

4 1 Cullen/Frost Bankers Inc. San Antonio TX 4,353,891

5 Banco Bilbao Vizcaya Argentaria SA Bilbao - 2,752,698

6 Simmons First National Corp. Pine Bluff AR 1,258,807

7 BOK Financial Corp. Tulsa OK 813,080

8 Pinnacle Bancorp Inc. Omaha NE 720,439

9 2 Southside Bancshares Inc. Tyler TX 701,935

10 3 Hilltop Holdings Inc. Dallas TX 521,462

11 4 Veritex Holdings Inc. Dallas TX 507,843

12 5 Comerica Inc. Dallas TX 409,537

13 Capital One Financial Corp. McLean VA 404,159

14 6 Colonial Holding Co. Fort Worth TX 361,919

15 7 First Command Financial Services Inc. Fort Worth TX 328,602

(Dollars in Thousands)

9

Accretive Transaction Combined with Growth Capital

Note: Estimated pro forma for completion of the Sovereign transaction (including purchase accounting adjustments) and assumes Liberty transaction closes on 12/31/17. Assumes ~$50

million equity raise plus 15% option based on an offering price per share of $26.53, the closing price as of 7/28/17. EPS accretion estimates represent figures before any deployment of

growth capital.

Transaction

Impact

Growth

Capital

TCE / TA 8.8% 10.5%

Total RBC 11.2% 13.2%

100% CL&D Guideline ~125% ~100%

300% CRE Guideline ~360% ~300%

2018 EPS Accretion ~8% ~0.5%

2019 EPS Accretion ~9% ~1%

TBVPS Accretion / (Dilution) ~(4%) ~5%

Pro Forma

Liberty

Pro Forma

Equity Raise

Expect net undeployed proceeds of ~$45 million after payment of cash

consideration in Sovereign and Liberty transactions

Represents unique opportunity to provide growth capital and meaningful

TBVPS accretion without EPS dilution

̶ The merger and offering combined is slightly accretive to 2018 EPS

before assuming any deployment or leveraging of growth capital

Positions Veritex to take full advantage of significant growth opportunities

̶ Robust loan and M&A pipelines are expected to continue

̶ Emphasis on maintaining credit quality and M&A disciplines

̶ Proven history and relentless focus on stewardship of capital

$1,408,507

$181,800

$220,100

$121,417

$197,949

$437,820

$524,127

$664,971

$802,286

$1,039,551

$1,508,589

$2,572,394

$3,031,681

2010 2011 2012 2013 2014 2015 2016 6/30/17 Pro Forma

6/30/17

Pro Forma

6/30/17

Total Assets at Year End Assets Acquired During the Year

Successful Organic Growth and M&A Strategy

Source: SNL Financial and Company documents.

(1) Pro forma represents combined assets for Veritex and Sovereign as of 6/30/17, including purchase accounting adjustments.

(2) Pro forma represents combined assets for Veritex, Sovereign and Liberty as of 6/30/17, including purchase accounting adjustments for Sovereign, but not Liberty.

10

Founded Veritex

Holdings &

acquired $182

million asset

Professional Bank

Acquired $166

million asset

Fidelity Bank and

$54 million asset

Bank of Las

Colinas

Grew $86

million

organically

and hit $500

million in

total assets

Grew $141

million

organically

Completed $40

million Initial

Public Offering

and grew $137

million

organically

Acquired

$121 million

asset IBT

Bancorp, Inc.

Grew $369

million or 35.5%

organically

in 2016

(Dollars in Thousands)

Record Q2

loan growth

of $100

million

(1) (2)

Commitment to Delivering Shareholder Value

Sources: SNL Financial, Company documents as filed for the period ending 6/30/17 and Factset as of 9/12/17. Figures represent Veritex standalone for the periods noted.

(1) Excludes loans held for sale.

(2) Efficiency ratio calculated as net interest income excluding provision for loan loss plus noninterest income divided by total noninterest expense.

Total Deposits

11

Efficiency Ratio (2)

(Dollars in Millions)

92.2%

78.0%

69.8%

66.5%

60.8%

55.6% 55.0%

2011 2012 2013 2014 2015 2016 2Q17

Performance Since IPO

(Dollars in Millions)

Total Loans (1)

$298

$398

$495

$603

$821

$992

$1,122

2011 2012 2013 2014 2015 2016 2Q17

$365

$448

$574

$639

$868

$1,120

$1,211

2011 2012 2013 2014 2015 2016 2Q17

Veritex

96.2%

NASDAQ Bank

49.6%

S&P 500

29.5%

Total Houston loan exposure $209.7 million

Loan Mix $149.8 million Commercial real estate

$ 59.8 million Non-real estate

Loan Exposure

12

Houston Market Update

Expect minimal impact to loan loss reserve

Continue to evaluate the impact of Hurricane Harvey on our Houston

business

Credit Impact

Employees are safe, our offices did not incur any significant damage,

and most borrowers did not experience any significant downtime

Options offered to customers include:

➢ Moratorium on principal payments for up to 90 days

➢ Short term working capital/assistance loans

➢ Waiving overdraft, NSF and late payment fees

Hurricane Harvey Impact

13

Acquisition and Integration Update

Third

Quarter

2017

Fourth

Quarter

2017

First

Quarter

2018

Second

Quarter

2018

Closed Sovereign on

August 1, completed

integration and system

conversion on

September 11

Liberty shareholder

meeting to approve

transaction

Anticipated close of the

Liberty transaction

Liberty integration and

conversion

Announced definitive

agreement for Liberty on

August 1

Expected significant

recognition of Sovereign

cost savings

Focus on Liberty

integration and system

conversion

Expected full realization

of Sovereign cost

savings. Continue Liberty

transition and cost

savings

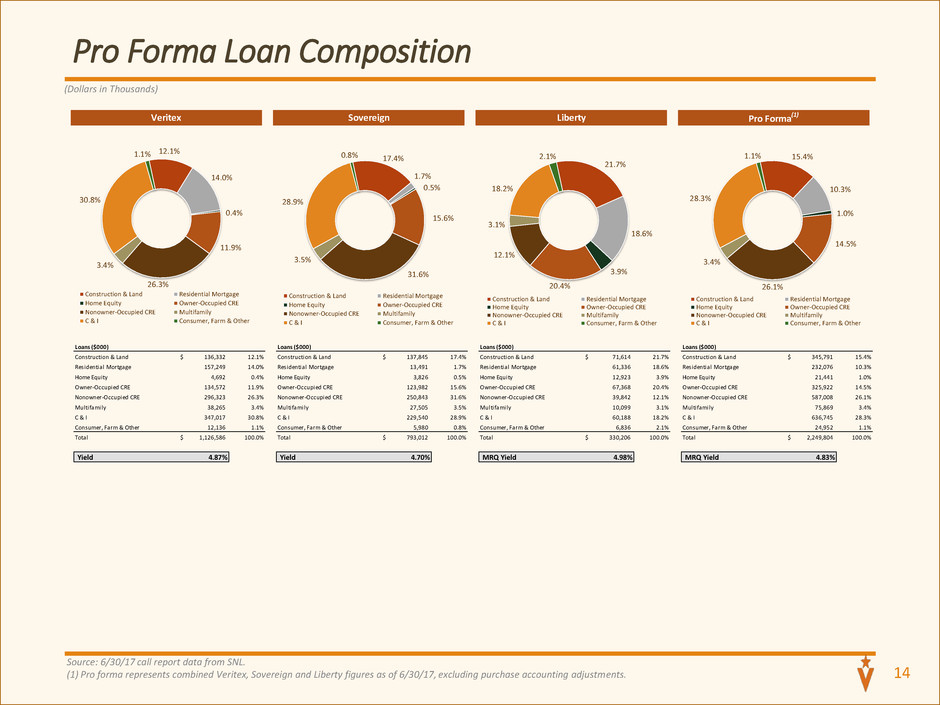

Pro Forma Loan Composition

Source: 6/30/17 call report data from SNL.

(1) Pro forma represents combined Veritex, Sovereign and Liberty figures as of 6/30/17, excluding purchase accounting adjustments. 14

Loans ($000) Loans ($000) Loans ($000) Loans ($000)

Construction & Land 136,332$ 12.1% Construction & Land 137,845$ 17.4% Construction & Land 71,614$ 21.7% Construction & Land 345,791$ 15.4%

Residential Mortgage 157,249 14.0% Residential Mortgage 13,491 1.7% Residential Mortgage 61,336 18.6% Residential Mortgage 232,076 10.3%

Home Equity 4,692 0.4% Home Equity 3,826 0.5% Home Equity 12,923 3.9% Home Equity 21,441 1.0%

Owner-Occupied CRE 134,572 11.9% Owner-Occupied CRE 123,982 15.6% Owner-Occupied CRE 67,368 20.4% Owner-Occupied CRE 325,922 14.5%

Nonowner-Occupied CRE 296,323 26.3% Nonowner-Occupied CRE 250,843 31.6% Nonowner-Occupied CRE 39,842 12.1% Nonowner-Occupied CRE 587,008 26.1%

Multifamily 38,265 3.4% Multifamily 27,505 3.5% Multifamily 10,099 3.1% Multifamily 75,869 3.4%

C & I 347,017 30.8% C & I 229,540 28.9% C & I 60,188 18.2% C & I 636,745 28.3%

Consumer, Farm & Other 12,136 1.1% Consumer, Farm & Other 5,980 0.8% Consumer, Farm & Other 6,836 2.1% Consumer, Farm & Other 24,952 1.1%

Total 1,126,586$ 100.0% Total 793,012$ 100.0% Total 330,206$ 100.0% Total 2,249,804$ 100.0%

Yield 4.87% Yield 4.70% MRQ Yield 4.98% MRQ Yield 4.83%

12.1%

14.0%

0.4%

11.9%

26.3%

3.4%

30.8%

1.1%

Construction & Land Residential Mortgage

Home Equity Owner-Occupied CRE

Nonowner-Occupied CRE Multifamily

C & I Consumer, Farm & Other

17.4%

1.7%

0.5%

15.6%

31.6%

3.5%

28.9%

0.8%

Construction & Land Residential Mortgage

Home Equity Owner-Occupied CRE

Nonowner-Occupied CRE Multifamily

C & I Consumer, Farm & Other

21.7%

18.6%

3.9%

20.4%

12.1%

3.1%

18.2%

2.1%

Construction & Land Residential Mortgage

Home Equity Owner-Occupied CRE

Nonowner-Occupied CRE Multifamily

C & I Consumer, Farm & Other

15.4%

10.3%

1.0%

14.5%

26.1%

3.4%

28.3%

1.1%

Construction & Land Residential Mortgage

Home Equity Owner-Occupied CRE

Nonowner-Occupied CRE Multifamily

C & I Consumer, Farm & Other

(Dollars in Thousands)

Pro Forma(1)Veritex Sovereign Liberty

Pro Forma Deposit Composition

Source: 6/30/17 call report data from SNL.

(1) Pro forma represents combined Veritex, Sovereign and Liberty figures as of 6/30/17, excluding purchase accounting adjustments.

(2) Excludes holding company cash deposited at the bank.

15

27.8%

62.7%

1.3%

8.2%

Noninterest-bearing Deposits

IB Demand, Savings & MMDA

Retail Time Deposits

Jumbo Time Deposits

20.6%

30.1%

5.2%

44.1%

Noninterest-bearing Deposits

IB Demand, Savings & MMDA

Retail Time Deposits

Jumbo Time Deposits

33.6%

30.3%4.4%

31.7%

Noninterest-bearing Deposits

IB Demand, Savings & MMDA

Retail Time Deposits

Jumbo Time Deposits

26.3%

46.5%

3.1%

24.1%

Noninterest-bearing Deposits

IB Demand, Savings & MMDA

Retail Time Deposits

Jumbo Time Deposits

(Dollars in Thousands)

Deposit ($000) Deposits ($000) Deposits ($000) Deposits ($000)

Noninterest-bearing Deposits (2) 337,057$ 27.8% Noninterest-bearing Deposits 167,843$ 20.6% Noninterest-bearing Deposits 130,988$ 33.6% Noninterest-bearing Deposits 635,888$ 26.3%

IB De and, Savings & MMDA 758,9 1 62.7 IB Demand, Savings & MMDA 244, 1 3 .1 IB Demand, Savings & MMDA 18,224 0.3 IB Demand, Savings & MMDA 1,122,016 4 .5

Retail Ti e Deposits 15,858 1.3% Retail Time Deposits 2,668 5.2% Retail Time Deposits 7,075 4.4% Retail Time Deposits 75,601 3.1%

Jumbo Time Deposits 99,241 8.2 Jumbo Ti e Deposits 358,555 44.1 Jumbo Ti e Deposits 123,489 31.7 Jumbo Ti e Deposits 581,285 24.

Total 1,211,107$ 100.0% Total 813,907$ 100.0% Total 389,776$ 100.0% Total 2,414,790$ 100.0%

MRQ Cost(2) 0.58% MRQ Cost 0.68% MRQ Cost 0.44% MRQ Cost 0.59%

Pro Forma(1)Veritex Sovereign Liberty

Experienced Leadership

16

Executive Management

C. Malcolm Holland, III

Chairman of the Board,

Chief Executive Officer

35 years of banking experience in Texas

Former CEO of Texas region for Colonial Bank, which grew from $625 million to

$1.6 billion

Former President of First Mercantile Bank

William C. Murphy

Vice Chairman

45 years of banking experience

Former Chairman or CEO of several Dallas community banks

Has led 25 financial institution transactions

Noreen E. Skelly

Chief Financial Officer

30 years of banking experience

Former CFO of Highlands Bancshares, Inc.

Former SVP and Retail line of business chief finance officer for Comerica and

LaSalle Banks

Jeff Kesler

Chief Lending Officer

16 years of banking experience

Former president of Dallas and Austin markets for Colonial Bank

Clay Riebe

Chief Credit Officer

30 years of banking experience

Former Chief Lending Officer of American Momentum Bank

Former market president of Citibank’s Bryan/College Station markets

LaVonda Renfro

Chief Retail Officer

32 years of banking experience

Former Retail Executive of Colonial Bank/BB&T

Former Senior Vice President, District Manager for Bank of America’s Austin and

San Antonio markets

Angela Harper

Chief Risk Officer

25 years of banking experience

Former Senior Vice President, Credit Administration Officer and Risk Management

Officer for the Texas Region of Colonial Bank

17

Reconciliation of Non-GAAP Measures

The Company’s management uses certain non-GAAP financial measures to evaluate its performance including tangible book

value per common share and tangible common equity to tangible assets. The Company has included in this presentation

information related to these non-GAAP financial measures for the applicable periods presented. Reconciliation of these non-

GAAP financial measures to the most directly comparable GAAP financial measures are presented in the table below.

(Dollars in Thousands, Except Per Share)

As of December 31, As of

2011 2012 2013 2014 2015 2016 6/30/17

Total Stockholders' Equity 58,676$ 61,860$ 66,239$ 113,312$ 132,046$ 239,088$ 247,602$

Preferred Stock (8,000) (8,000) (8,000) (8,000) - - -

Common Equity 50,676 53,860 58,239 105,312 132,046 239,088 247,602

Goodwill (19,148) (19,148) (19,148) (19,148) (26,865) (26,865) (26,865)

Intangible Assets (2,183) (1,875) (1,567) (1,261) (2,410) (2,181) (2,171)

Tangible Common Equity 29,345 32,837 37,524 84,903 102,771 210,042 218,566

Common Shares Outstanding 5,554 5,694 5,805 9,471 10,712 15,195 15,233

Tangible Book Value per Share 5.28$ 5.77$ 6.46$ 8.96$ 9.59$ 13.82$ 14.35$

To al ss ts 437,820$ 524,127$ 664,946$ 802,231$ 1,039,551$ 1,408,507$ 1,508,589$

Go will (19,148) (19,148) (19,148) (19,148) (26,865) (26,865) (26,865)

Intangible Assets (2,183) (1,875) (1,567) (1,261) (2,410) (2,181) (2,171)

Tangible Assets 416,489 503,104 644,231 781,822 1,010,276 1,379,461 1,479,553

Tangible Common Equity 29,345 32,837 37,524 84,903 102,771 210,042 218,566

TCE / TA 7.0% 6.5% 5.8% 10.9% 10.2% 15.2% 14.8%

Source: Company documents.

18