Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Tronox Holdings plc | s001852x3_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Tronox Holdings plc | s001852x3_ex99-1.htm |

| 8-K - FORM 8-K - Tronox Holdings plc | s001852x3_8k.htm |

Exhibit 99.3

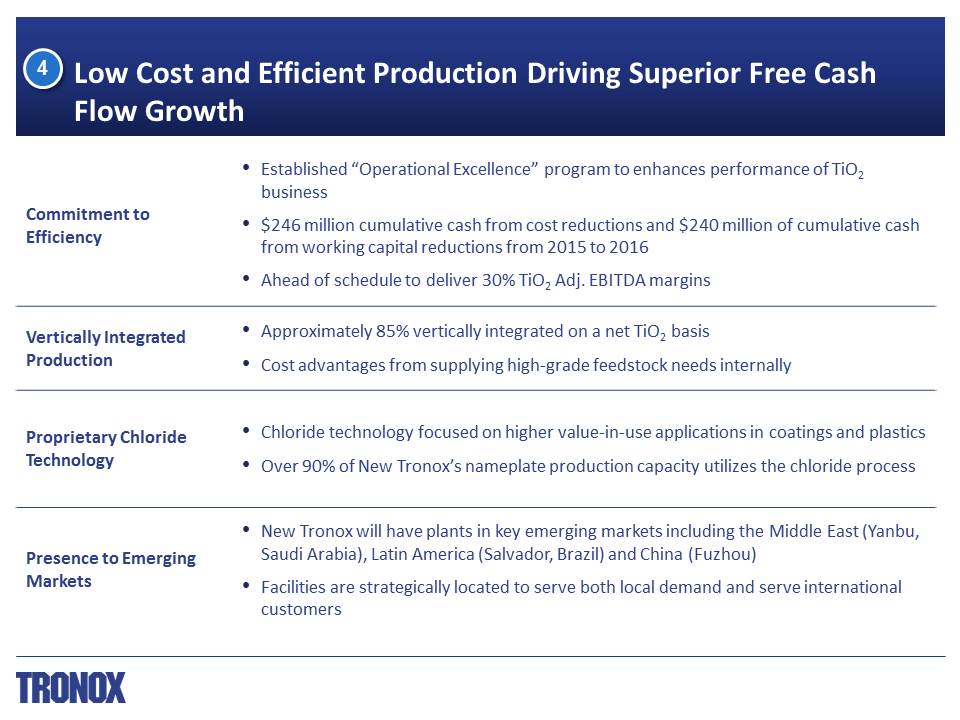

Low Cost and Efficient Production Driving Superior Free Cash Flow Growth 4 45-63-136 42-109-186 103-146-171 134-184-0 112-48-160 Commitment to Efficiency Established “Operational Excellence” program to enhances performance of TiO2 business$246 million cumulative cash from cost reductions and $240 million of cumulative cash from working capital reductions from 2015 to 2016Ahead of schedule to deliver 30% TiO2 Adj. EBITDA margins Vertically Integrated Production Approximately 85% vertically integrated on a net TiO2 basis Cost advantages from supplying high-grade feedstock needs internally Proprietary Chloride Technology Chloride technology focused on higher value-in-use applications in coatings and plasticsOver 90% of New Tronox’s nameplate production capacity utilizes the chloride process Presence to Emerging Markets New Tronox will have plants in key emerging markets including the Middle East (Yanbu, Saudi Arabia), Latin America (Salvador, Brazil) and China (Fuzhou)Facilities are strategically located to serve both local demand and serve international customers