Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ROSETTA STONE INC | draftform8-kxregulationfdd.htm |

Rosetta Stone

Reach, Relevancy and Recurring Revenue

BMO Back to School Education Conference

September 14, 2017

2

Caution on Forward-Looking Statements

This presentation contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by non-historical

statements and often include words such as “outlook,” “potential,”

"believes," "expects," "anticipates," "estimates," "intends," "plans,"

"seeks" or words of similar meaning, or future-looking or conditional

verbs, such as "will," "should," "could," "may," "might, " "aims,"

"intends," or "projects.” These statements may include, but are not

limited to, statements relating to: our business strategy; guidance or

projections related to revenue, Adjusted EBITDA, bookings, and other

measures of future economic performance; the contributions and

performance of our businesses including acquired businesses and

international operations; projections for future capital expenditures;

and other guidance, projections, plans, objectives, and related

estimates and assumptions. A forward-looking statement is neither a

prediction nor a guarantee of future events or circumstances. In

addition, forward-looking statements are based on the Company’s

current assumptions, expectations and beliefs and are subject to

certain risks and uncertainties that could cause actual results to differ

materially from our present expectations or projections. Some

important factors that could cause actual results, performance or

achievement to differ materially from those expressed or implied by

these forward-looking statements include, but are not limited to: the

risk that we are unable to execute our business strategy; declining

demand for our language learning solutions; the risk that we are not

able to manage and grow our business; the impact of any revisions to

our pricing strategy; the risk that we might not succeed in introducing

and producing new products and services; the impact of foreign

exchange fluctuations; the adequacy of internally generated funds

and existing sources of liquidity, such as bank financing, as well as

our ability to raise additional funds; the risk that we cannot effectively

adapt to and manage complex and numerous technologies; the risk

that businesses acquired by us might not perform as expected; and

the risk that we are not able to successfully expand internationally.

We expressly disclaim any obligation to update or revise any forward-

looking statements, whether as a result of new information, future

developments or otherwise, except as required by law. These factors

should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements, risks and

uncertainties that are more fully described in the Company's filings

with the U.S. Securities and Exchange Commission (SEC), including

those described under the section entitled “Risk Factors” in the

Company’s most recent quarterly Form 10-Q filings and Annual

Report on Form 10-K, as such factors may be updated from time

to time.

Immaterial rounding differences may be present in this data in order

to conform to reported totals.

Non-GAAP Financial Measures

Today’s presentation and discussion also contain references to non-

GAAP financial measures. The full definition, GAAP comparisons, and

reconciliation of those measures are available in this presentation or

in our press release which is posted on our website at

www.rosettastone.com. Our non-GAAP measures may not be

comparable to those used by other companies, and we encourage

you to review and understand all our financial reporting before making

any investment decision.

68%

10%

18%

4%

3

Rosetta Stone 2014

% Total Revenues in 2014

Consumer Lexia Education Enterprise

Non-Recurring Consumer

Dominated Business …

… Doing Too Many Things in

Too Many Places

§ Four acquisitions in eight

months

§ 15 offices, 8 outside the U.S.

§ Product investment spread

broadly

4

Singular Objective

Build a Profitable and Growing

Recurring Revenue Business

5

Step 1: Expenses Reduced 33%1

2014 $MM

1 Amounts are before restructuring and severance related charges of $4.2MM and $5.2MM in 2014 and 2016, respectively

Results:

§ R&D1 down 23%

§ COGS1 down 36%

§ S&M1 down 34%

§ G&A1 down 30%

§ Restructured Consumer

§ Sold Korean operations

§ Restructured E&E

§ Closed/shrank every office but Lexia

§ Licensed Japanese marketplace

56 39

171

112

52

34

33

25

G&A S&M COGS R&D

2016

6

Step 2: While Investing in Lexia

930

476

Language and G&A 49%

2014

2016

Lexia Headcount1

536

Language and G&A

Headcount1

Lexia 151%

2017 YTD

June

1 Full-time headcount.

84

181

211

2014

2016

2017 YTD

June

Lexia – From 8% to 30% of Full-Time HC in 30 Months

7

Why Invest in Lexia?

§ 2/3 of U.S. students in grades 4 and 8 are non-proficient

readers

§ Struggling readers account for 60% of students who

drop out or fail to graduate on time

Sources: U.S. Department of Education, 2015 National Assessment of Educational Progress and Anne E. Casey

Foundation, 2012 “Double Jeopardy: How Third Grade Reading Skills and Poverty Influence High School Graduation”;

Lexia actively served 16K schools/school districts at March 31, 2017.

Huge TAM

Great Need

21K Schools

Grades 9-12

70K Schools

Grades K-8

100,000

U.S. Public Schools

16K

Notes: 2017 National analysis of 712,000 students using Lexia Reading in a geographically and ethnically representative sample.

8

§ Students reading below grade

level declined from 53% to

11% in one school year

§ Most 3rd party published

studies of any program

Start Level

53%

19%

34%

End Level

11%

7%

1 Grade Below

2+ Grades Below

Why Invest in Lexia?

Demonstrated Efficacy

9

2014 2016

23.1

38.4

66% Growth in Sales

Land

Investment in Direct Sales

and Support

§ Own the Relationship

$MM

Lexia Growth Strategy

10

Lexia Growth Strategy

$38.4MM

Retention1 Above 90%

1 Retention rate is on TMM basis.

89% 95%

1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

Investment in

Implementation Services

§ Own the Relationship

§ Own Success

Service

11

Lexia Growth Strategy

Unlimited School Licenses

~3,300

2014 2016

Expand

~2,300

~2,900

August

2017

Moving Classrooms to

Schools, Schools to

Districts

2015

~1,300

12

$MM1

3Q15 2Q17 4Q15 1Q16 1Q17 2Q16 4Q16 3Q16

Growing Annualized Recurring Revenue

1See Appendix for definitions and reconciliation of GAAP to non-GAAP Financial Measures. Prior period ARR has been

updated to reflect current period presentation.

25

27

29

31

33

35

37

39

41

43

45

3Q '15 4Q '15 1Q '16 2Q '16 3Q '16 4Q '16 1Q '17 2Q '17

39

26

Lexia Growth Strategy

13

Lexia Growth Strategy

~40% of Sales People < 1 Year

Sales Rep Tenure1 % of Total % of 2-Years+

2 Years+ 33% 100%

1 Year – 2 Years 26% 80%

Less than 1 Year 22% 33%

New 17% NM

1 At July 31, 2017

1

Accelerate - Improve Sales Productivity

14

INSTRUCTION

6-12

K-5

Accelerate (Pre-2016 / 17)

Lexia Growth Strategy

ASSESSMENT

15

INSTRUCTION

Lexia Growth Strategy

Accelerate – Portfolio Sale (2016 / 17)

6-12

K-5

ASSESSMENT

16

ASSESSMENT INSTRUCTION

6-12

K-5

Lexia Growth Strategy

Adolescent

Literacy

Program

Accelerate – Portfolio Sale (2018 and Beyond)

§ Significant TAM – 100K U.S. public schools

§ Great Need – 2/3 of kids reading below grade level

§ Demonstrated Efficacy – Significant improvement in reading

levels; 90%+ retention and renewal rates

§ Broad Reach – 16K schools1, ~3 million kids

§ Productivity Increase – Increasing sales experience lowers CAC

§ Growing LTV – Soon-to-be-completed Literacy portfolio

§ Emerging Profitability – Profit emerges as investments levered

17

Lexia Learning Opportunity

1Lexia actively served 16K schools/school districts at March 31, 2017.

18

Lexia 2020

Revenue

COGS

S&M

R&D

Segment

Contribution

2016 Expected Growth 2020E

$34.1

4.8

21.7

4.1

1.5

$85 to $90

~$20

~27% CAGR

G&A 2.1

Target ~ 20% FCF1 Contribution Margins With Growth

$MM

Segment FCF1 $0.5 ~$18

~91% CAGR

~145% CAGR

1 See Appendix for definitions and reconciliation of GAAP to non-GAAP Financial Measures.

19

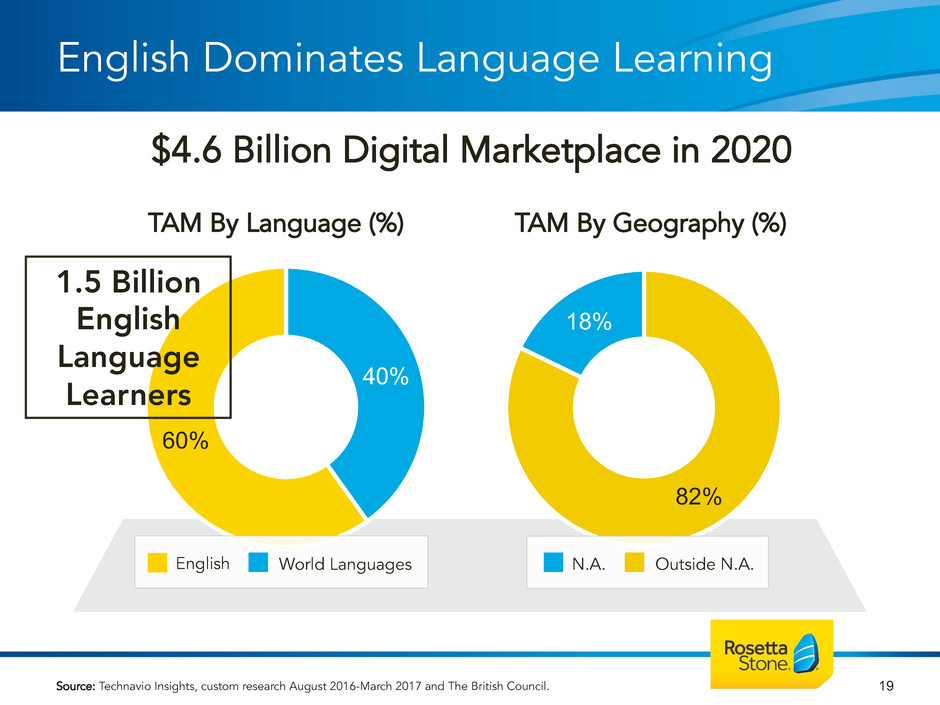

English Dominates Language Learning

$4.6 Billion Digital Marketplace in 2020

Source: Technavio Insights, custom research August 2016-March 2017 and The British Council.

40%

60%

82%

18%

N.A. Outside N.A. English World Languages

TAM By Geography (%) TAM By Language (%)

1.5 Billion

English

Language

Learners

20

Investment Focused on English Language

Enterprise

Catalyst Opens English

Consumer

Focused on Mobile &

Subscription Sales and Partners

21

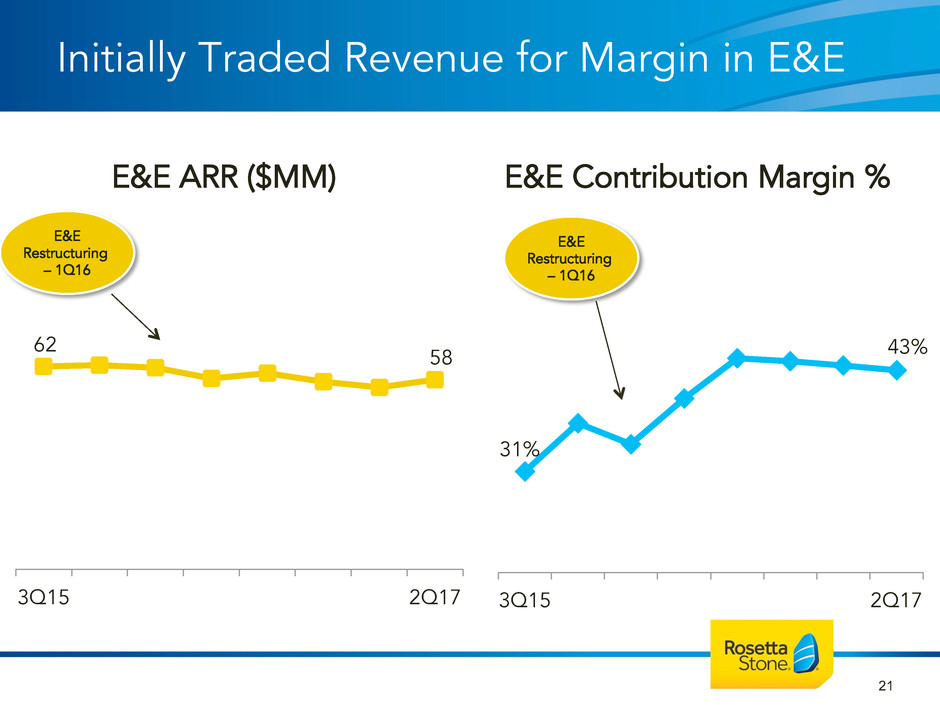

Initially Traded Revenue for Margin in E&E

62 58

3Q15 2Q17

E&E Contribution Margin % E&E ARR ($MM)

31%

43%

3Q15 2Q17

E&E

Restructuring

– 1Q16

E&E

Restructuring

– 1Q16

22

Building a Sustainable Consumer Business…

8% 5% 5% 6%

26% 11% 15% 16%

17%

15%

18%

28%

22%

69% 62%

50%

35%

CD

Digital Download

Long-term Subscription1

Short-Term Subscription2

Type of Unit Sold

2014 2016 2015 2013

2017 YTD

June

CDs from 79% to 35% ⎯ Soon to Approach 0

1 More than one year subscription term.

2 One year or less subscription term.

Mostly Retail

79%

13%

2Q16 2Q17

23

…With a Renewable Portfolio

Increased Unit Mix of “Renewable” Sales in 1H 2017

1 Excludes renewal subscription unit sales.

2 North America DTC; CAC includes all Sales and Marketing expenses, both Media and non-Media.

LTV-to-CAC Multiple2

1.8x

1.5x

0%

20%

40%

60%

80%

100%

2016 YTD June 2017 YTD June

Term >1 Year Term <1 Year CDs & Downloads

57%

82%

17%

17% 1%

26%

Overall Unit Sales up 4% Y/Y

24

Focused on English Language Opportunity

Sources: U.S. Census; RS Analysis

24MM

English proficient

16MM

Not yet English proficient

40MM

U.S. Spanish Speakers

Univision Strategic Partnership

Establish Scale in the U.S. Hispanic Segment

§ Significant TAM – Huge and growing English Language

Learning need; 1.5 billion English learners worldwide1

§ Iconic Brand – Iconic brand in U.S. with worldwide reach

§ Serious Outcomes – Serving genuine needs with expertise

§ Recurring Revenue – Approaching 100%-SaaS business;

More predictable, sustainable model

§ Growth Opportunities – Partnerships (e.g., Univision),

Global ESL/EFL (English as a Second or Foreign Language)

and K12 ELL (English Language Learning)

25

Rosetta Stone Language Opportunity

1The British Council estimate.

26

Language Businesses 2020

$MM

Revenue

COGS

S&M

R&D

Segment

Contribution

2016 Expected Growth 2020E

$160.0

23.9

86.9

18.9

29.8

$150 to $155

~45

Roughly Flat

G&A 0.5

Segment FCF1 $18.0 ~$38

Target ~25% FCF1 Contribution Margin

~11% CAGR

~21% CAGR

1 See Appendix for definitions and reconciliation of GAAP to non-GAAP Financial Measures.

68%

18%

40%

23%

16%

21%

27

Rosetta Stone Today

Education Becoming our Largest Segment in a

More Balanced Business

TODAY: Q2 2017 Revenue Mix

K-12: 39%

Consumer Lexia Education Enterprise

2014 Revenue Mix

K-12:

14%

28

Rosetta Stone Today – 2017 Guidance

Amounts in $MM FY16A FY17E

GAAP Revenue $194.1 Approx. $182 – $185

GAAP Net Loss $(27.6) Approx. $(13 – 15)

Adjusted EBITDA1 $4.4 Approx. $8 - 10

Capital Expenditures $12.5 Approx. $14

Year-End Cash Balance $36.2 Approx. $44

2H Cash Increase +$6.5 Approx. +$17.6

1 See Appendix for definitions and reconciliation of GAAP to non-GAAP Financial Measures.

Restructuring Language and G&A

§ Transition to Consumer SaaS-sales creating temporary drag

§ Cost base lowered, but not fully levered

Reinvesting in Lexia

§ Q2 cash R&D 35% of revenue as we invest in growth

§ Investing in direct sales force to build future productivity

§ Result – Lexia Contribution1 19% vs. Language 25% in Q2

29

Why Not Highly Profitable Yet?

Restructuring and Reinvesting Simultaneously

1. Contribution as a percentage of pro forma revenue

30

Rosetta Stone Consolidated 2020 Outlook

$MM 2017E2 Expected Growth 2020E

Revenue $183.5 ~$235~9% CAGR

Targeting 2020 15% Adj. EBITDA and 10+% FCF1 Margins

Adj. EBITDA1 $9 ~$35~57% CAGR

FCF1 $(5)3 ~$30~$36MM

1 See Appendix for definitions and reconciliation of GAAP to non-GAAP Financial Measures

2 Based on current company 2017 full year or year end guidance. Midpoint where appropriate.

3 Before cash received from SOURCENEXT transaction but after certain restructuring and one-time items..

Year-End Cash $44 ~$56MM ~$100

RST

RST today

Opportunity

31

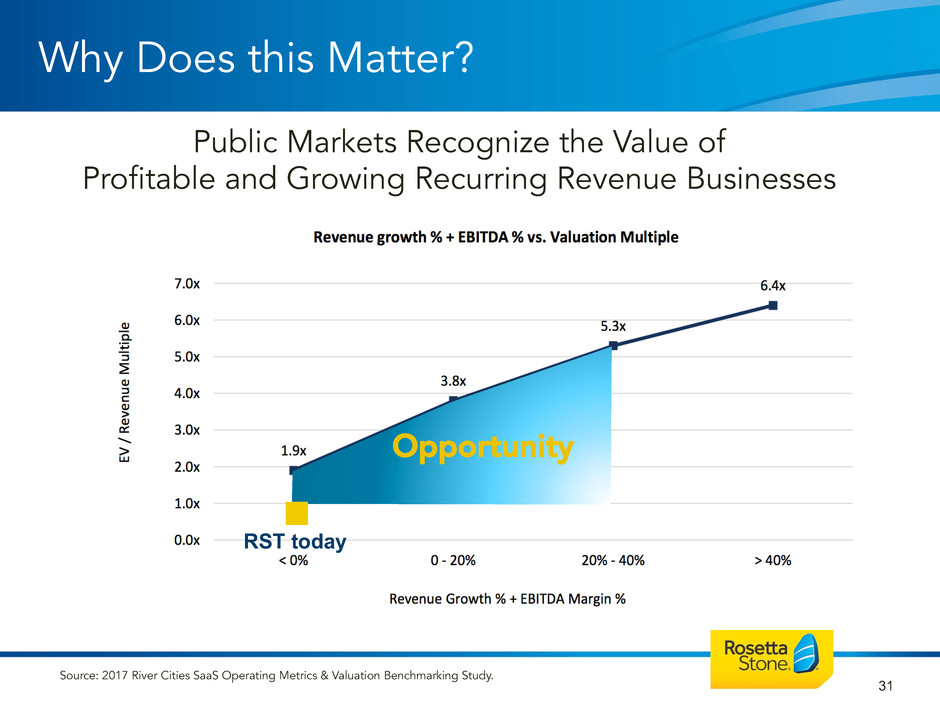

Why Does this Matter?

Source: 2017 River Cities SaaS Operating Metrics & Valuation Benchmarking Study.

Public Markets Recognize the Value of

Profitable and Growing Recurring Revenue Businesses

§ Large addressable marketplaces; growing digital

share

§ Iconic Brand and Expertise in Language and

Demonstrated Efficacy in Literacy

§ Nearing 100%-SaaS, Recurring Revenue business

§ Multiple opportunities for growth

§ Growth expected to bring profitability and cash

generation

32

Changing Lives through Language and Literacy

Our Mission

Change Lives Through Language

and Literacy Education

Thank You

Appendix

§ Annualized recurring revenue (or “ARR”) is computed using the annualized value of active

subscription arrangements at the end of the period. ARR is a performance metric used to

assess the health and trajectory of our E&E Language and Literacy segments, which we

believe aids investors in understanding our segment results. We present ARR as a statistical

measure rather than a non-GAAP financial measure. ARR should be viewed independently

of revenue and deferred revenue, as ARR is a performance metric and is not intended to be

combined with either of these items.

35

Definitions of Statistical Measures

§ Bookings represent executed sales contracts received by the Company that are either recorded

immediately as revenue or as deferred revenue.

§ Adjusted EBITDA is GAAP net income/loss plus interest income and expense, other income/expense,

income tax benefit/expense, impairment, lease abandonment and termination, depreciation,

amortization, stock-based compensation, restructuring, and strategy and cost-reduction related

consulting expenses. In addition, Adjusted EBITDA excludes "Other" items related to non-restructuring

wind down and severance costs, and transaction and other costs associated with mergers and

acquisitions, as well as all adjustments related to recording the non-cash tax valuation allowance for

deferred tax assets. Adjusted EBITDA for prior periods has been revised to conform to current definition.

§ Free cash flow is cash flow from operating activities minus cash used in purchases of property and

equipment.

§ Segment contribution is calculated as segment revenue less expenses directly incurred by or allocated to

the segment. Direct segment expenses include costs and expenses that are directly incurred by or

allocated to the segment and include materials costs, service costs, customer care and coaching costs,

sales and marketing expenses, and bad debt expense. In addition to the previously referenced expenses,

the Literacy segment includes direct research and development expenses and Combined Language

includes shared research and development expenses, costs of revenue, sales and marketing, and general

and administrative expenses applicable to the Consumer Language and Enterprise & Education

Language segments.

§ Segment free cash flow is Adjusted EBITDA plus the change in deferred revenue, less the change in

deferred commissions, less capital expenditures.

36

Definitions of Non-GAAP Financial Measures

37

Adjusted EBITDA and Free Cash Flow1

1 See Appendix for definitions and reconciliation of GAAP to non-GAAP Financial Measures.

Amounts ($000)

Quarterly Quarterly

1Q16 2Q16 3Q16 4Q16 FY16 1Q17 2Q17

GAAP net income (loss) $ (7,507) $ (8,978) $ (5,452) $ (5,613) $ (27,550) $ 454 $ (1,135)

Total non-operating (income) expense, net (1,129) (816) (524) 596 (1,873) (209) (312)

Income tax (benefit) expense 449 (992) 1,793 1,253 2,503 700 782

Impairment 0 2,902 1,028 0 3,930 0 0

Depreciation and amortization 3,408 3,178 3,226 3,510 13,322 3,075 2,987

Stock-based compensation 421 1,397 1,639 1,449 4,906 147 1,359

Restructuring expenses 2,509 2,512 162 10 5,193 780 205

Lease abandonment and termination 0 30 0 1,614 1,644 0 0

Strategy consulting expense 402 519 458 577 1,956 169 0

Other EBITDA adjustments (117) 304 85 56 328 39 16

Adjusted EBITDA $ (1,564) $ 56 $ 2,415 $ 3,452 $ 4,359 $ 5,155 $ 3,902

Amounts ($000)

Quarterly Quarterly

1Q16 2Q16 3Q16 4Q16 FY16 1Q17 2Q17

Net cash provided by/(used in) operating activities $ (2,546) $ (9,879) $ 6,479 $ 7,186 $ 1,240 $ 5,769 $ (10,397)

Purchases of property and equipment (2,586) (3,348) (3,694) (2,886) (12,514) (2,313) (3,080)

Free Cash Flow $ (5,132) $ (13,227) $ 2,785 $ 4,300 $ (11,274) $ 3,456 $ (13,477)

38

Revenue and Bookings1

1 See Appendix for definitions and reconciliation of GAAP to non-GAAP Financial Measures.

Amounts ($000)

Quarterly Quarterly

1Q16 2Q16 3Q16 4Q16 FY16 1Q17 2Q17

Revenue

Literacy $ 7,577 $ 7,950 $ 8,786 $ 9,810 $ 34,123 $ 10,170 $ 10,370

Enterprise & Education ("E&E") Language

Enterprise 11,044 10,479 11,041 10,554 43,118 9,408 9,914

North America K-12 7,287 7,011 7,295 7,372 28,965 7,092 7,346

Total E&E Language 18,331 17,490 18,336 17,926 72,083 16,500 17,260

Consumer 22,094 20,276 21,571 23,942 87,883 21,023 18,275

Total Revenue $ 48,002 $ 45,716 $ 48,693 $ 51,678 $ 194,089 $ 47,693 $ 45,905

Bookings

Literacy $ 3,817 $ 9,433 $ 17,923 $ 7,221 $ 38,394 $ 5,300 $ 8,628

Enterprise & Education ("E&E") Language

Enterprise 7,906 8,972 12,553 11,071 40,502 6,034 10,203

North America K-12 2,877 9,184 11,643 5,438 29,142 2,890 8,354

Total E&E Language 10,783 18,156 24,196 16,509 69,644 8,924 18,557

Consumer 22,911 18,234 19,203 24,413 84,761 18,495 27,299

Total Bookings $ 37,511 $ 45,823 $ 61,322 $ 48,143 $ 192,799 $ 32,719 $ 54,484

39

Reconciliation of Revenue and Bookings1

1 See Appendix for definitions and reconciliation of GAAP to non-GAAP Financial Measures.

Amounts ($000)

Quarterly Quarterly

1Q16 2Q16 3Q16 4Q16 FY16 1Q17 2Q17

Reconciliation of Revenue to Bookings

Literacy

Segment revenue $ 7,577 $ 7,950 $ 8,786 $ 9,810 $ 34,123 $ 10,170 $ 10,370

Segment change in deferred revenue (3,760) 1,483 9,137 (2,589) 4,271 (4,870) (1,742)

Bookings $ 3,817 $ 9,433 $ 17,923 $ 7,221 $ 38,394 $ 5,300 $ 8,628

Enterprise & Education ("E&E") Language

Segment revenue $ 18,331 $ 17,490 $ 18,336 $ 17,926 $ 72,083 $ 16,500 $ 17,260

Segment change in deferred revenue (7,548) 666 5,860 (1,417) (2,439) (7,576) 1,297

Bookings $ 10,783 $ 18,156 $ 24,196 $ 16,509 $ 69,644 $ 8,924 $ 18,557

Consumer

Segment revenue $ 22,094 $ 20,276 $ 21,571 $ 23,942 $ 87,883 $ 21,023 $ 18,275

Segment change in deferred revenue 817 (2,042) (2,368) 471 (3,122) (2,528) 9,024

Bookings $ 22,911 $ 18,234 $ 19,203 $ 24,413 $ 84,761 $ 18,495 $ 27,299

Total revenue $ 48,002 $ 45,716 $ 48,693 $ 51,678 $ 194,089 $ 47,693 $ 45,905

Change in deferred revenue (10,491) 107 12,629 (3,535) (1,290) (14,974) 8,579

Total bookings $ 37,511 $ 45,823 $ 61,322 $ 48,143 $ 192,799 $ 32,719 $ 54,484

40

Segment Contribution1

1 Please see the Appendix for definitions of non-GAAP financial measures. The Literacy segment was previously a component of the

"Enterprise & Education" segment and is comprised solely of the Lexia business. Prior periods have been reclassified to reflect our

current segment presentation and definition of segment contribution.

Segment Contribution

Amounts ($000)

Quarterly Quarterly

1Q16 2Q16 3Q16 4Q16 FY16 1Q17 2Q17

Revenue:

Literacy segment $ 7,577 $ 7,950 $ 8,786 $ 9,810 $ 34,123 $ 10,170 $ 10,370

Enterprise & Education ("E&E") Language segment 18,331 17,490 18,336 17,926 72,083 16,500 17,260

Consumer segment 22,094 20,276 21,571 23,942 87,883 21,023 18,275

Shared services 0 0 0 0 0 0 0

Combined Language 40,425 37,766 39,907 41,868 159,966 37,523 35,535

Total revenue $ 48,002 $ 45,716 $ 48,693 $ 51,678 $ 194,089 $ 47,693 $ 45,905

Segment contribution:

Literacy segment $ 57 $ 439 $ (364) $ 1,400 $ 1,532 $ 961 $ 1,591

E&E Language segment 6,297 6,903 8,064 7,818 29,082 7,119 7,357

Consumer segment 5,040 3,934 6,233 6,295 21,502 8,357 6,060

Shared services (5,457) (4,982) (4,758) (5,562) (20,759) (4,990) (4,672)

Combined Language 5,880 5,855 9,539 8,551 29,825 10,486 8,745

Total segment contribution $ 5,937 $ 6,294 $ 9,175 $ 9,951 $ 31,357 $ 11,447 $ 10,336

Segment contribution margin percentage:

Literacy segment 1% 6% -4% 14% 4% 9% 15%

E&E Language segment 34% 39% 44% 44% 40% 43% 43%

Consumer segment 23% 19% 29% 26% 24% 40% 33%

Rosetta Stone

Reach, Relevancy and Recurring Revenue

BMO Back to School Education Conference

September 14, 2017