Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TELLURIAN INC. /DE/ | d413399dex991.htm |

| 8-K - 8-K - TELLURIAN INC. /DE/ | d413399d8k.htm |

Core Haynesville Acquisition September 2017 Exhibit 99.2

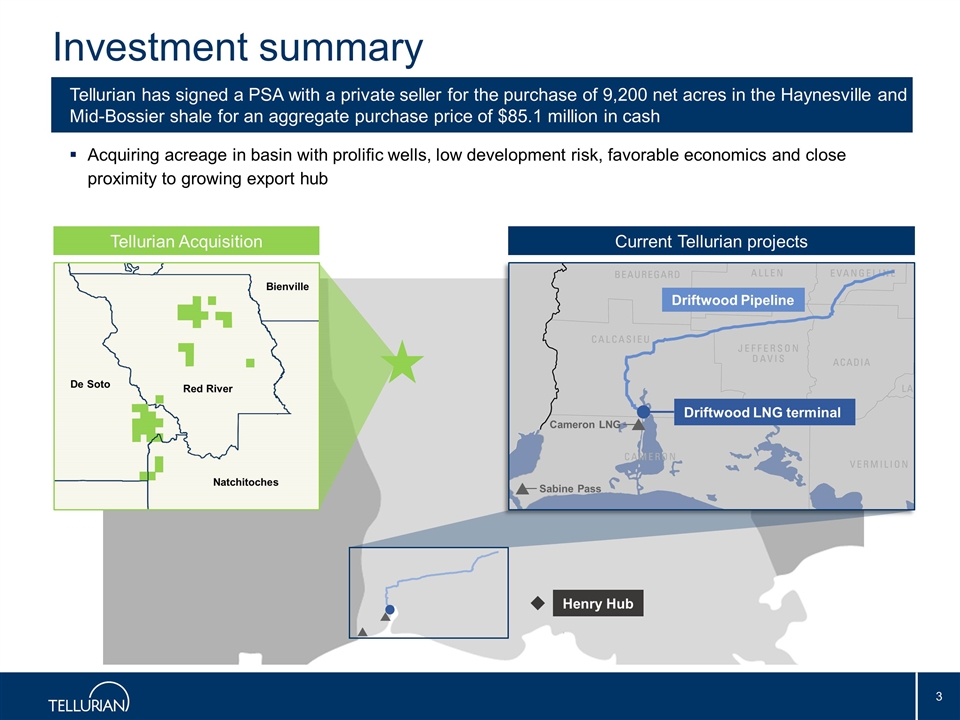

Investment summary Tellurian Acquisition Current Tellurian projects Bienville De Soto Red River Natchitoches Acquiring acreage in basin with prolific wells, low development risk, favorable economics and close proximity to growing export hub Tellurian has signed a PSA with a private seller for the purchase of 9,200 net acres in the Haynesville and Mid-Bossier shale for an aggregate purchase price of $85.1 million in cash Henry Hub Driftwood LNG terminal Driftwood Pipeline Cameron LNG Sabine Pass

Acquisition highlights Asset highlights Strategic overview Acquisition showcases Tellurian’s strategy to become the leading global natural gas company Expected full cycle cost of production and transport to markets of $2.25 per MMBtu, which represents a significant savings to natural gas we will purchase at Henry Hub and other regional liquidity points Leverage Tellurian’s ability to sell U.S. natural gas into global markets Expected closing end of November 2017 9,200 net acres in core of the highly economic Haynesville shale in De Soto and Red River parishes 1.3 Tcf total net resource from up to 138 operated Haynesville and Bossier drilling locations 100% held by production and 92% operated allows for maximum development flexibility Existing midstream assets provide ability to cost effectively gather and deliver to market Financing Interim plan is to fund Haynesville acquisition with cash on hand Driftwood LNG project will require incremental capital to support development Exploring options to minimize dilution while accessing lowest cost funding

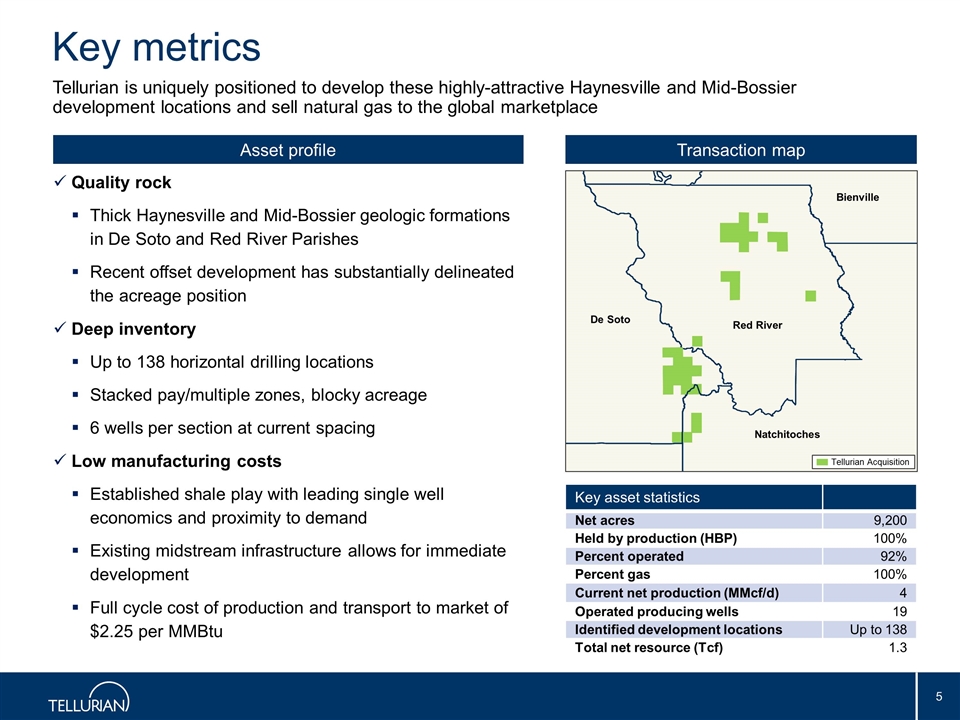

Tellurian is uniquely positioned to develop these highly-attractive Haynesville and Mid-Bossier development locations and sell natural gas to the global marketplace Key metrics Quality rock Thick Haynesville and Mid-Bossier geologic formations in De Soto and Red River Parishes Recent offset development has substantially delineated the acreage position Deep inventory Up to 138 horizontal drilling locations Stacked pay/multiple zones, blocky acreage 6 wells per section at current spacing Low manufacturing costs Established shale play with leading single well economics and proximity to demand Existing midstream infrastructure allows for immediate development Full cycle cost of production and transport to market of $2.25 per MMBtu Asset profile Transaction map Key asset statistics Net acres 9,200 Held by production (HBP) 100% Percent operated 92% Percent gas 100% Current net production (MMcf/d) 4 Operated producing wells 19 Identified development locations Up to 138 Total net resource (Tcf) 1.3 Bienville De Soto Red River Natchitoches Tellurian Acquisition

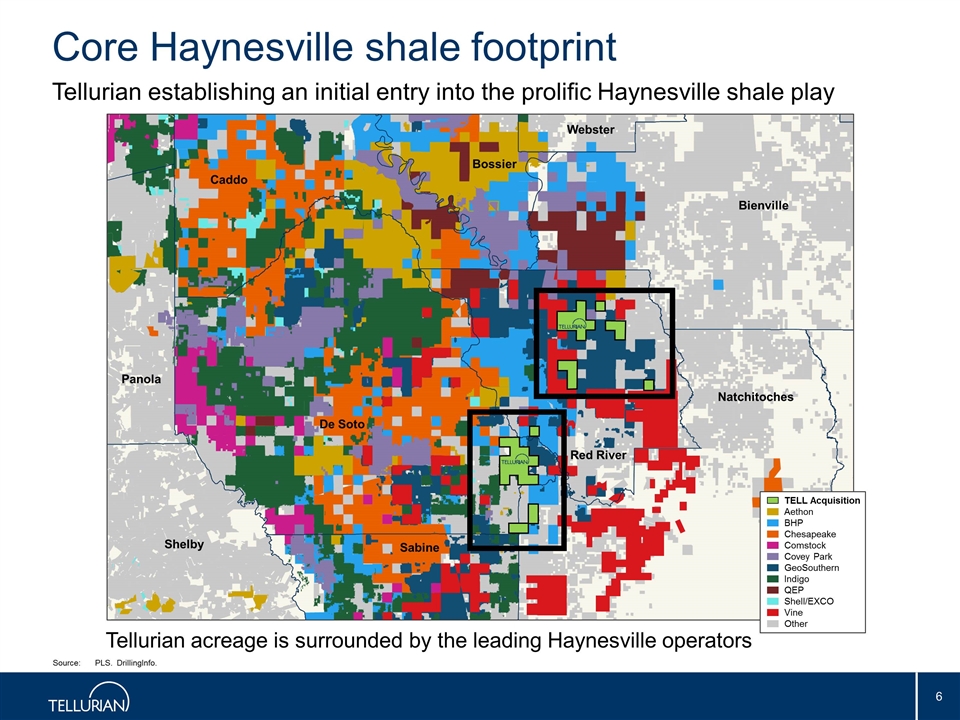

Red River De Soto Shelby Natchitoches Caddo Bienville Panola Sabine Bossier Webster Core Haynesville shale footprint Tellurian establishing an initial entry into the prolific Haynesville shale play Tellurian acreage is surrounded by the leading Haynesville operators TELL Acquisition Aethon BHP Chesapeake Comstock Covey Park GeoSouthern Indigo QEP Shell/EXCO Vine Other Source:PLS. DrillingInfo.

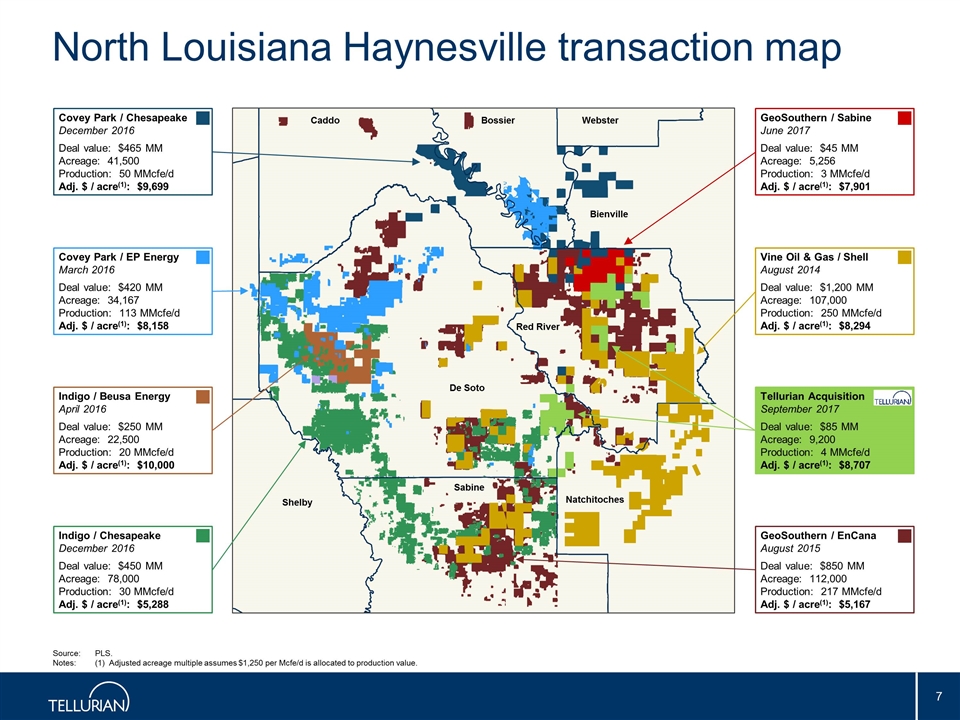

North Louisiana Haynesville transaction map Source:PLS. Notes:(1) Adjusted acreage multiple assumes $1,250 per Mcfe/d is allocated to production value. Covey Park / Chesapeake December 2016 Deal value: $465 MM Acreage: 41,500 Production: 50 MMcfe/d Adj. $ / acre(1): $9,699 Vine Oil & Gas / Shell August 2014 Deal value: $1,200 MM Acreage: 107,000 Production: 250 MMcfe/d Adj. $ / acre(1): $8,294 GeoSouthern / EnCana August 2015 Deal value: $850 MM Acreage: 112,000 Production: 217 MMcfe/d Adj. $ / acre(1): $5,167 GeoSouthern / Sabine June 2017 Deal value: $45 MM Acreage: 5,256 Production: 3 MMcfe/d Adj. $ / acre(1): $7,901 Indigo / Beusa Energy April 2016 Deal value: $250 MM Acreage: 22,500 Production: 20 MMcfe/d Adj. $ / acre(1): $10,000 Indigo / Chesapeake December 2016 Deal value: $450 MM Acreage: 78,000 Production: 30 MMcfe/d Adj. $ / acre(1): $5,288 Covey Park / EP Energy March 2016 Deal value: $420 MM Acreage: 34,167 Production: 113 MMcfe/d Adj. $ / acre(1): $8,158 Tellurian Acquisition September 2017 Deal value: $85 MM Acreage: 9,200 Production: 4 MMcfe/d Adj. $ / acre(1): $8,707 Natchitoches Webster Bossier Caddo Sabine Bienville De Soto Red River Shelby

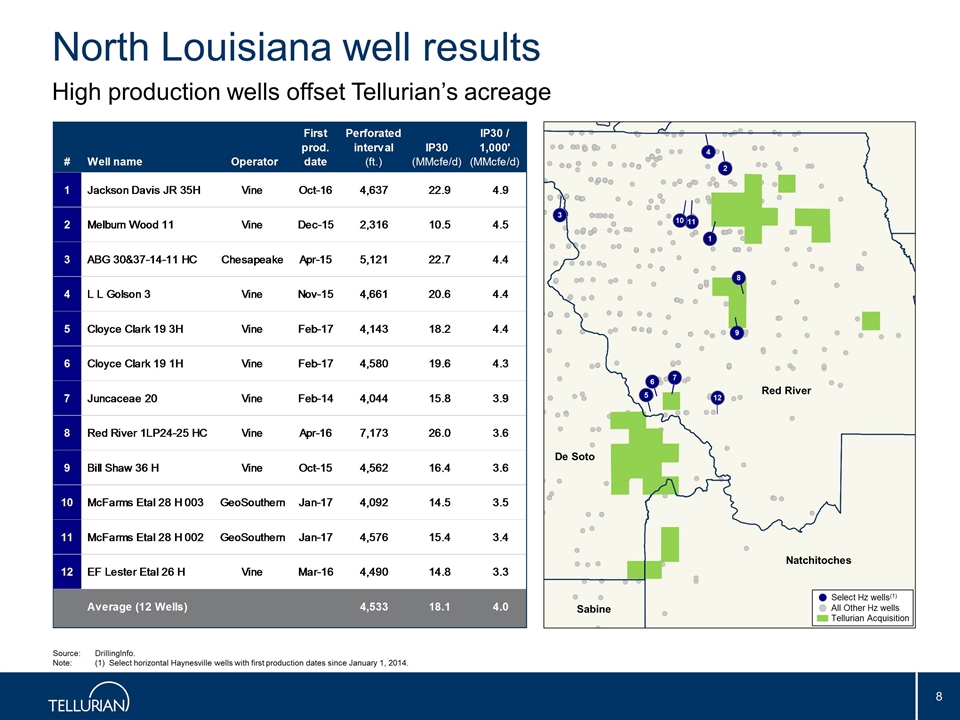

Source:DrillingInfo. Note:(1) Select horizontal Haynesville wells with first production dates since January 1, 2014. North Louisiana well results High production wells offset Tellurian’s acreage ` 5 6 9 8 1 11 10 3 2 4 Select Hz wells(1) All Other Hz wells Tellurian Acquisition 12 De Soto Red River Sabine Natchitoches 7

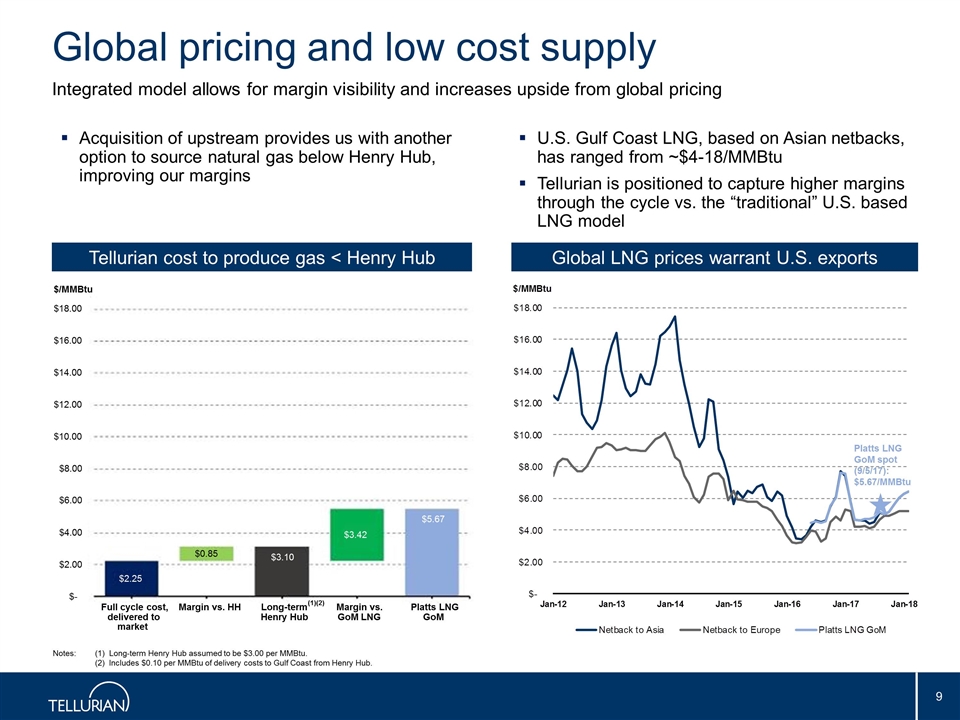

Notes:(1) Long-term Henry Hub assumed to be $3.00 per MMBtu. (2) Includes $0.10 per MMBtu of delivery costs to Gulf Coast from Henry Hub. Global pricing and low cost supply Integrated model allows for margin visibility and increases upside from global pricing Tellurian cost to produce gas < Henry Hub Global LNG prices warrant U.S. exports Acquisition of upstream provides us with another option to source natural gas below Henry Hub, improving our margins Platts LNG GoM spot (9/5/17): $5.67/MMBtu U.S. Gulf Coast LNG, based on Asian netbacks, has ranged from ~$4-18/MMBtu Tellurian is positioned to capture higher margins through the cycle vs. the “traditional” U.S. based LNG model (1)(2) $2.25 $3.10 $5.67 $0.85 $3.42 $- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 Full cycle cost, delivered to market Margin vs. HH Long-term Henry Hub Margin vs. GoM LNG Platts LNG GoM $/MMBtu