Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - TELLURIAN INC. /DE/ | d416042dex322.htm |

| EX-32.1 - EX-32.1 - TELLURIAN INC. /DE/ | d416042dex321.htm |

| EX-31.2 - EX-31.2 - TELLURIAN INC. /DE/ | d416042dex312.htm |

| EX-31.1 - EX-31.1 - TELLURIAN INC. /DE/ | d416042dex311.htm |

| EX-10.6 - EX-10.6 - TELLURIAN INC. /DE/ | d416042dex106.htm |

| EX-10.5 - EX-10.5 - TELLURIAN INC. /DE/ | d416042dex105.htm |

| EX-10.4 - EX-10.4 - TELLURIAN INC. /DE/ | d416042dex104.htm |

| EX-10.3 - EX-10.3 - TELLURIAN INC. /DE/ | d416042dex103.htm |

| EX-10.2 - EX-10.2 - TELLURIAN INC. /DE/ | d416042dex102.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-5507

Tellurian Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 06-0842255 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1201 Louisiana Street, Suite 3100, Houston, TX | 77002 | |

| (Address of principal executive offices) | (Zip Code) | |

(832) 962-4000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer☐ |

Accelerated filer |

☐ | ||||

| Non-accelerated filer ☐ |

Smaller reporting company |

☒ | ||||

| (Do not check if a smaller reporting company) |

Emerging growth company |

☐ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 31, 2017, the issuer had 210,909,739 shares of common stock outstanding.

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

Form 10-Q for the Three and Six Months Ended June 30, 2017

| 1 | ||||||

| 2 | ||||||

| Part I. Financial Information | ||||||

| Item 1. |

3 | |||||

| 3 | ||||||

| 4 | ||||||

| Condensed Consolidated Statements of Changes in Stockholders’ Equity |

5 | |||||

| 6 | ||||||

| 7 | ||||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 | ||||

| Item 3. |

27 | |||||

| Item 4. |

27 | |||||

| Part II. Other Information | ||||||

| Item 1. |

27 | |||||

| Item 1A. |

28 | |||||

| Item 2. |

28 | |||||

| Item 5. |

28 | |||||

| Item 6. |

29 | |||||

| 30 |

i

Table of Contents

As commonly used in the liquefied natural gas industry, to the extent applicable and as used in this quarterly report, the terms listed below have the following meanings:

| Bcf/d |

Billion cubic feet per day | |

| DOE/FE |

U.S. Department of Energy, Office of Fossil Energy | |

| FEED |

Front-End Engineering and Design | |

| FERC |

U.S. Federal Energy Regulatory Commission | |

| FTA countries |

Countries with which the U.S. has a free trade agreement providing for national treatment for trade in natural gas | |

| LNG |

Liquefied natural gas, a product of natural gas consisting primarily of methane (CH4) that is in liquid form at near atmospheric pressure | |

| LSTK |

Lump Sum Turnkey | |

| Mtpa |

Million tonnes per annum | |

| NASDAQ |

NASDAQ Capital Market | |

| NGA |

Natural Gas Act of 1938, as amended | |

| Non-FTA countries |

Countries with which the U.S. does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted | |

| PSD |

Prevention of Significant Deterioration | |

| SEC |

U.S. Securities and Exchange Commission | |

| Train |

An industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG | |

| USACE |

U.S. Army Corps of Engineers | |

| U.S. |

United States | |

| U.S. GAAP |

Generally accepted accounting principles in the U.S. |

1

Table of Contents

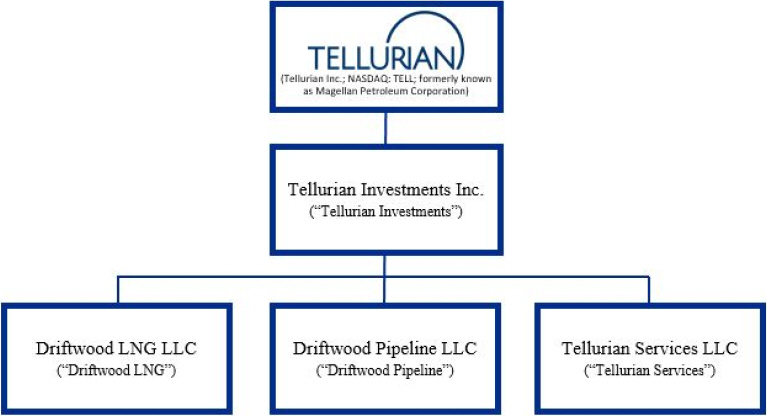

Below is a simplified presentation of Tellurian Inc.’s organizational structure as of June 30, 2017 with references to the names of certain entities discussed in this quarterly report:

2

Table of Contents

PART I. FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

TELLURIAN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

(unaudited)

| June 30, 2017 |

December 31, 2016 | |||

| ASSETS | ||||

| Current assets: |

||||

| Cash and cash equivalents |

$ 160,726 | $ 21,398 | ||

| Restricted cash |

100 | — | ||

| Securities available-for-sale |

1,839 | — | ||

| Accounts receivable |

75 | 48 | ||

| Accounts receivable due from related parties |

2,753 | 1,333 | ||

| Prepaid expenses and other current assets |

2,124 | 1,964 | ||

|

|

| |||

| Total current assets |

167,617 | 24,743 | ||

| Non-current restricted cash |

375 | — | ||

| Property, plant and equipment, net |

25,374 | 10,993 | ||

| Goodwill |

1,190 | 1,190 | ||

| Note receivable due from related party |

251 | 251 | ||

| Other non-current assets |

2,206 | 1,901 | ||

|

|

| |||

| Total assets |

$ 197,013 | $ 39,078 | ||

|

|

| |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||

| Current liabilities: |

||||

| Accounts payable and accrued liabilities |

$ 18,870 | $ 24,403 | ||

| Accounts payable due to related parties |

323 | 323 | ||

|

|

| |||

| Total current liabilities |

19,193 | 24,726 | ||

| Embedded derivative |

— | 8,753 | ||

| Commitments and contingencies (Note 8) |

||||

| Stockholders’ equity: |

||||

| Series A convertible preferred stock: par value $0.001 per share; zero and 5.5 million shares authorized and issued, respectively |

— | 5 | ||

| Common stock: par value $0.01 and $0.001 per share, respectively; 300 million shares and 200 million shares authorized, respectively; 211.5 million shares and 109.6 million shares issued, respectively |

1,933 | 101 | ||

| Treasury stock: 1.2 million and zero shares, respectively, at cost |

(399) | — | ||

| Additional paid-in capital |

445,880 | 102,148 | ||

| Accumulated other comprehensive income |

933 | — | ||

| Accumulated deficit |

(270,527) | (96,655) | ||

|

|

| |||

| Total stockholders’ equity |

177,820 | 5,599 | ||

|

|

| |||

| Total liabilities and stockholders’ equity |

$ 197,013 | $ 39,078 | ||

|

|

|

The Notes to the Condensed Consolidated Financial Statements (unaudited) are an integral part of these financial statements.

3

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

| Successor | Predecessor | |||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | Nine Days Ended April 9, 2016 |

For the period from January 1, 2016 through April 9, 2016 | |||||||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||||||||||||||

| Revenue |

$ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||

| Revenue, related party |

— | — | — | — | — | 31 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Total revenue |

— | — | — | — | — | 31 | ||||||||||||||||||||||

| Costs and expenses: |

||||||||||||||||||||||||||||

| Development expenses |

14,616 | 11,752 | 36,205 | 14,505 | — | 52 | ||||||||||||||||||||||

| General and administrative |

18,283 | 4,764 | 62,823 | 9,204 | 157 | 617 | ||||||||||||||||||||||

| Goodwill impairment |

— | — | 77,592 | — | — | — | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Total costs and expenses |

32,899 | 16,516 | 176,620 | 23,709 | 157 | 669 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Loss from operations |

(32,899 | ) | (16,516 | ) | (176,620 | ) | (23,709 | ) | (157 | ) | (638 | ) | ||||||||||||||||

| Gain on preferred stock exchange feature |

— | — | 2,209 | — | — | — | ||||||||||||||||||||||

| Other income, net |

376 | 69 | 539 | 69 | — | — | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Loss before income taxes |

(32,523 | ) | (16,447 | ) | (173,872 | ) | (23,640 | ) | (157 | ) | (638 | ) | ||||||||||||||||

| Provision for income taxes |

— | 170 | — | 170 | — | — | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Net loss attributable to common stockholders |

$ | (32,523 | ) | $ | (16,277 | ) | $ | (173,872 | ) | $ | (23,470 | ) | $ | (157 | ) | $ | (638 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Net loss per common share: |

||||||||||||||||||||||||||||

| Basic and diluted |

$ | (0.17 | ) | $ | (0.15 | ) | $ | (1.18 | ) | $ | (0.36 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||||||||||

| Basic and diluted |

186,102 | 109,967 | 146,756 | 65,714 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

The Notes to the Condensed Consolidated Financial Statements (unaudited) are an integral part of these financial statements.

4

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in thousands)

(unaudited)

| Common Stock | Treasury Stock | Convertible Preferred Stock |

||||||||||||||||||||||||||||||||||||||

| Shares | Par Value Amount |

Shares | Cost | Shares | Par Value Amount |

Additional Paid-in Capital |

Accum. Other Comp. Income |

Accum. Deficit |

Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Balance, January 1, 2016 (Successor) |

— | $ | — | — | $ | — | — | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||||

| Common stock issued for acquisition |

500 | 1 | — | — | — | — | 999 | — | — | 1,000 | ||||||||||||||||||||||||||||||

| Issuance of common stock |

84,856 | 84 | — | — | — | — | 36,290 | — | — | 36,374 | ||||||||||||||||||||||||||||||

| Restricted stock awards |

1,500 | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Share-based compensation |

1,775 | 2 | — | — | — | — | 5,123 | — | — | 5,125 | ||||||||||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | — | — | (23,470 | ) | (23,470 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Balance, June 30, 2016 (Successor) |

88,631 | $ | 87 | — | $ | — | — | $ | — | $ | 42,412 | $ | — | $ | (23,470 | ) | $ | 19,029 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Balance, January 1, 2017 (Successor) |

109,609 | $ | 101 | — | $ | — | 5,468 | $ | 5 | $ | 102,148 | $ | — | $ | (96,655 | ) | $ | 5,599 | ||||||||||||||||||||||

| Merger adjustments |

51,540 | 1,390 | (1,209 | ) | — | — | — | 86,533 | — | — | 87,923 | |||||||||||||||||||||||||||||

| Share-based compensation |

909 | 9 | — | — | — | — | 15,552 | — | — | 15,561 | ||||||||||||||||||||||||||||||

| Issuance of common stock |

35,838 | 358 | — | — | — | — | 211,619 | — | — | 211,977 | ||||||||||||||||||||||||||||||

| Restricted stock awards |

6,397 | 3 | — | — | — | — | 2,386 | — | — | 2,389 | ||||||||||||||||||||||||||||||

| Share-based payments |

1,700 | 17 | — | — | — | — | 21,148 | — | — | 21,165 | ||||||||||||||||||||||||||||||

| Reclass of embedded derivative |

— | — | — | — | — | — | 6,544 | — | — | 6,544 | ||||||||||||||||||||||||||||||

| Treasury stock |

— | — | (28 | ) | (399 | ) | — | — | — | — | — | (399 | ) | |||||||||||||||||||||||||||

| Exchange from Series A preferred stock |

— | — | — | — | (5,468 | ) | (5 | ) | — | — | — | (5 | ) | |||||||||||||||||||||||||||

| Exchange to Series B preferred stock |

— | — | — | — | 5,468 | 55 | (50 | ) | — | — | 5 | |||||||||||||||||||||||||||||

| Exchange from Series B to common stock |

5,468 | 55 | — | — | (5,468 | ) | (55 | ) | — | — | — | — | ||||||||||||||||||||||||||||

| Other comprehensive income |

— | — | — | — | — | — | — | 933 | — | 933 | ||||||||||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | — | — | (173,872 | ) | (173,872 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Balance, June 30, 2017 (Successor) |

211,461 | $ | 1,933 | (1,237 | ) | $ | (399 | ) | — | $ | — | $ | 445,880 | $ | 933 | $ | (270,527 | ) | $ | 177,820 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

The Notes to the Condensed Consolidated Financial Statements (unaudited) are an integral part of these financial statements.

5

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| Successor | Predecessor | |||||||||||||

| Six Months Ended June 30, | For the period from January 1, 2016 through April 9, 2016 | |||||||||||||

| 2017 | 2016 | |||||||||||||

| Cash flows from operating activities: |

||||||||||||||

| Net loss |

$ | (173,872 | ) | $ | (23,470 | ) | $ | (638 | ) | |||||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||||||||

| Depreciation and amortization expense |

139 | 24 | 8 | |||||||||||

| Goodwill impairment |

77,592 | — | — | |||||||||||

| Loss on disposal of assets |

— | 37 | 3 | |||||||||||

| Provision for income tax benefit |

— | (170 | ) | — | ||||||||||

| Gain on Series A convertible preferred stock exchange feature |

(2,209 | ) | — | — | ||||||||||

| Share-based compensation |

17,951 | 5,125 | — | |||||||||||

| Share-based payments |

19,397 | — | — | |||||||||||

| Changes in operating assets and liabilities: |

||||||||||||||

| Accounts receivable |

(8 | ) | (113 | ) | 1 | |||||||||

| Accounts receivable due from related parties |

(1,819 | ) | (230 | ) | (32 | ) | ||||||||

| Prepaid expenses and other current assets |

(86 | ) | (1,036 | ) | 13 | |||||||||

| Accounts payable and accrued liabilities |

(8,884 | ) | 4,886 | 281 | ||||||||||

| Accounts payable due to related parties |

— | (14 | ) | 253 | ||||||||||

| Other, net |

(292 | ) | (601 | ) | — | |||||||||

|

|

|

|

|

|

|

|

|

| ||||||

| Net cash used in operating activities |

(72,091 | ) | (15,562 | ) | (111 | ) | ||||||||

|

|

|

|

|

|

|

|

|

| ||||||

| Cash flows from investing activities: |

||||||||||||||

| Cash received in acquisition |

56 | 210 | — | |||||||||||

| Purchase of property - land |

— | (8,491 | ) | — | ||||||||||

| Purchase of property and equipment |

(905 | ) | (623 | ) | (268 | ) | ||||||||

| Proceeds from sale of available-for-sale securities |

266 | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

| ||||||

| Net cash used in investing activities |

(583 | ) | (8,904 | ) | (268 | ) | ||||||||

|

|

|

|

|

|

|

|

|

| ||||||

| Cash flows from financing activities: |

||||||||||||||

| Proceeds from the issuance of common stock, net |

212,477 | 36,857 | — | |||||||||||

|

|

|

|

|

|

|

|

|

| ||||||

| Net cash provided by financing activities |

212,477 | 36,857 | — | |||||||||||

|

|

|

|

|

|

|

|

|

| ||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash |

139,803 | 12,391 | (379 | ) | ||||||||||

| Cash, cash equivalents and restricted cash, beginning of period |

21,398 | — | 589 | |||||||||||

|

|

|

|

|

|

|

|

|

| ||||||

| Cash, cash equivalents and restricted cash, end of period |

$ | 161,201 | $ | 12,391 | $ | 210 | ||||||||

|

|

|

|

|

|

|

|

|

| ||||||

The Notes to the Condensed Consolidated Financial Statements (unaudited) are an integral part of these financial statements.

6

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1 — BACKGROUND AND BASIS OF PRESENTATION

Tellurian plans to own, develop and operate natural gas related infrastructure and complementary business lines in the energy industry and to deliver natural gas products and services to customers worldwide. Tellurian is developing an LNG terminal facility (the “Driftwood terminal”) and an associated pipeline (the “Driftwood pipeline”) in Southwest Louisiana (the Driftwood terminal and the Driftwood pipeline collectively, the “Driftwood Project”).

The accompanying unaudited Condensed Consolidated Financial Statements of Tellurian as of and for the period ended June 30, 2017, have been prepared in accordance with U.S. GAAP for interim financial information and with Rule 10-01 of Regulation S-X. Accordingly, the Condensed Consolidated Financial Statements do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In our opinion, all adjustments, consisting only of normal recurring adjustments necessary for a fair presentation, have been included.

The information included herein should be read in conjunction with the consolidated financial statements and the accompanying notes of Tellurian Investments as of and for the fiscal year ended December 31, 2016. Such information was included in Tellurian’s Current Report on Form 8-K/A filed with the SEC on March 15, 2017 following the completion of a merger (the “Merger”) of Tellurian Investments with a subsidiary of Magellan Petroleum Corporation (“Magellan”) on February 10, 2017 (the “Merger Date”). Magellan changed its corporate name to Tellurian Inc. shortly after completing the Merger.

The Merger was accounted for as a “reverse acquisition,” with Tellurian Investments being treated as the accounting acquirer. As such, the historical condensed consolidated comparative information as of and for all periods in 2016 in this report relates to Tellurian Investments and its subsidiaries. Subsequent to the Merger Date, the information relates to the consolidated entities of Tellurian Inc., with Magellan reflected as the accounting acquiree. The Company continues to operate as a single operating segment for financial reporting purposes.

In connection with the Merger, each issued and outstanding share of Tellurian Investments common stock was exchanged for 1.3 shares of Magellan common stock. All share and per share amounts in the Condensed Consolidated Financial Statements and related notes have been retroactively adjusted for all periods presented to give effect to this exchange, including reclassifying an amount equal to the change in par value of common stock from additional paid-in capital.

On April 9, 2016, Tellurian Investments acquired Tellurian Services, formerly known as Parallax Services LLC (“Parallax Services”). Under the financial reporting rules of the SEC, Parallax Services (“Predecessor”) has been deemed to be the predecessor to Tellurian (“Successor”) for financial reporting purposes.

Except where the context indicates otherwise, (i) references to “we,” “us,” “our,” “Tellurian” or the “Company” refer, for periods prior to the completion of the Merger, to Tellurian Investments and its subsidiaries, and for periods following the completion of the Merger, to Tellurian Inc. and its subsidiaries and (ii) references to “Magellan” refer to Tellurian Inc. and its subsidiaries prior to the completion of the Merger.

Results of operations for the three and six months ended June 30, 2017 are not necessarily indicative of the operating results that will be realized for the year ending December 31, 2017.

NOTE 2 — MERGER AND ACQUISITION

The Merger

As discussed in Note 1, Background and Basis of Presentation, Tellurian Investments merged with a subsidiary of Magellan on February 10, 2017. The Merger has been accounted for as a “reverse acquisition,” with Tellurian Investments being treated as the accounting acquirer using the acquisition method.

The total consideration exchanged was as follows (in thousands, except share and per-share amounts):

7

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

| Number of shares of Magellan common stock outstanding (1) |

5,985,042 | |||||||

| Price per share of Magellan common stock (2) |

$ | 14.21 | ||||||

|

|

|

|||||||

| Aggregate value of Tellurian common stock issued |

|

$ | 85,048 | |||||

| Fair value of stock options (3) |

|

2,821 | ||||||

|

|

|

|||||||

| Net purchase consideration to be allocated |

|

$ | 87,869 | |||||

|

|

|

|||||||

|

(1) The number of shares of Magellan common stock issued and outstanding as of February 9, 2017.

(2) The closing price of Magellan common stock on the NASDAQ on February 9, 2017.

(3) The estimated fair value of Magellan stock options for pre-Merger services rendered. |

| |||||||

We utilized estimated fair values at the Merger Date for the allocation of consideration to the net tangible and intangible assets acquired and liabilities assumed. The preliminary purchase price allocation to assets acquired and liabilities assumed in the transaction was as follows (in thousands):

| Fair Value of Assets Acquired: |

||||

| Cash |

$ | 56 | ||

| Securities available-for-sale |

1,111 | |||

| Other current assets |

93 | |||

| Unproved properties |

13,000 | |||

| Wells in progress |

332 | |||

| Land, buildings and equipment, net |

67 | |||

| Other long-term assets |

19 | |||

|

|

|

|||

| Total assets acquired |

14,678 | |||

| Fair Value of Liabilities Assumed: |

||||

| Accounts payable and other liabilities |

4,393 | |||

| Notes payable |

8 | |||

|

|

|

|||

| Total liabilities assumed |

4,401 | |||

|

|

|

|||

| Total net assets acquired |

10,277 | |||

|

|

|

|||

| Goodwill as a result of the Merger |

$ | 77,592 | ||

|

|

|

We valued our interests acquired in unproved oil and gas properties using a market approach based on commercial negotiations and bids received for the interests (see Note 7, Property, Plant and Equipment, for more information about the properties). The fair value of other property, plant and equipment and wells in progress was determined to be the carrying value of Magellan. Securities available-for-sale were valued based on quoted market prices. The carrying values of cash, other current assets, accounts payable and accrued liabilities and other non-current assets and liabilities approximated fair value at the Merger Date. The Company has determined that such fair value measures for the overall allocation are classified as Level 3 in the fair value hierarchy.

Goodwill initially recognized as a result of the Merger totaled $77.6 million, none of which is deductible for income tax purposes. Subsequent to the Merger, the Company determined that there is no evidence that we will recover the value of this goodwill. For purposes of determining the goodwill impairment, we utilized qualitative factors as well as the fair values determined when allocating consideration as of the Merger Date.

Parallax Services Acquisition

On April 9, 2016, Tellurian Investments acquired Parallax Services, which was renamed Tellurian Services, with equity consideration valued at $1 million. The transaction was accounted for using the acquisition method. As of June 30, 2017, goodwill of $1.2 million on our Condensed Consolidated Balance Sheet was entirely related to the acquisition of Parallax Services.

Pro Forma Results

The following table provides unaudited pro forma results for the three and six months ended June 30, 2017 and 2016, as if the Merger occurred and Parallax Services had been acquired as of January 1, 2016 (in thousands, except per-share amounts):

8

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Pro forma net loss |

$ | (32,523) | $ | (15,174) | $ | (177,614) | $ | (34,212) | ||||||||

| Pro forma net loss per basic share |

$ | (0.17) | $ | (0.13) | $ | (1.20) | $ | (0.47) | ||||||||

| Pro forma basic and diluted weighted average common shares outstanding |

186,127 | 116,477 | 148,236 | 72,224 | ||||||||||||

The unaudited pro forma results include adjustments for the historical net loss of Magellan and Parallax Services as well as an increase in compensation expense associated with the addition of three new directors. The pro forma information is provided for informational purposes only and is not necessarily indicative of what Tellurian’s results of operation would have been if the Merger and acquisition of Parallax Services had occurred on January 1, 2016. Following the Merger Date, $0.6 million of net loss related to the acquired activities have been included in our Condensed Consolidated Financial Statements.

NOTE 3 — NON-CURRENT RESTRICTED CASH

Restricted cash represents a long-term certificate of deposit securing a letter of credit issued in the amount of $375 thousand required as part of our Houston, Texas office lease. The letter of credit renews annually unless the issuing bank provides 30 days’ written notice to the beneficiary.

NOTE 4 — PREPAID AND OTHER CURRENT AND NON-CURRENT ASSETS

The components of prepaid expenses and other current assets consist of the following (in thousands):

| June 30, 2017 | December 31, 2016 | |||||||

| Deposits related to marketing activities |

$ | 146 | $ | 968 | ||||

| Insurance |

661 | 67 | ||||||

| Prepaid rent |

631 | 315 | ||||||

| Other |

686 | 614 | ||||||

|

|

|

|

|

|||||

| Total prepaid expenses and current assets |

$ | 2,124 | $ | 1,964 | ||||

|

|

|

|

|

|||||

The components of other non-current assets consist of the following (in thousands):

| June 30, 2017 | December 31, 2016 | |||||||

| Lease and purchase options |

$ | 2,114 | $ | 1,345 | ||||

| Deposits related to marketing activities |

— | 551 | ||||||

| Other |

92 | 5 | ||||||

|

|

|

|

|

|||||

| Total other non-current assets |

$ | 2,206 | $ | 1,901 | ||||

|

|

|

|

|

|||||

9

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

Deposits Related to Marketing Activities

Tellurian has made advances to trade conferences and similar events for networking, marketing and public relations in the ordinary course of its development activities. These deferred costs relate primarily to conference fees, travel accommodations and similar event-specific arrangements, which are required to be paid in advance. General marketing and advertising costs not associated with specific events currently are expensed, and costs that are event-specific are deferred and expensed when the event occurs.

Land Lease and Purchase Options

The Company, through its wholly owned subsidiary Driftwood LNG, holds lease and purchase option agreements (the “Options”) for certain tracts of land and associated river frontage that provide for four or five-year terms. In addition to the Options, the Company holds a ground lease for a port facility adjacent to a tract of land that was acquired in March 2016. The lease provides for a four-year term, subject to a 20-year extension and six five-year renewals and is accounted for as an operating lease, with rental payments accounted for using the straight-line method.

Upon exercise of the Options, the leases are subject to maximum terms of 60 years (inclusive of various renewals) at the option of the Company. Lease and purchase option payments have been capitalized in other non-current assets. Costs of the lease and purchase options will be amortized over the life of the lease once obtained, or capitalized into the land if purchased. If no lease or land is obtained, the Options cost will be expensed.

Office Leases

The Company holds a ten-year lease for its corporate headquarters located in Houston, Texas as well as leases for other offices in the U.S., London and Singapore. The leases are accounted for as operating leases, with rental payments accounted for using the straight-line method. Where payments exceed or are less than the amount of rent expense recognized, prepaid rent or deferred rent payable, respectively, is recognized on the Condensed Consolidated Balance Sheets.

NOTE 5 — CAPITAL DEVELOPMENT ACTIVITIES

Pursuant to the technical services agreement entered into in February 2016, Tellurian engaged Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”) under a request for services (“RFS”) to begin certain detailed engineering services in July 2017, with the anticipated completion of such detailed engineering services upon Bechtel’s receipt of a notice to proceed from the Company on an LSTK contract. The LSTK contract is currently under negotiation; however, amounts incurred under the RFS will be fully credited against the LSTK contract. The RFS may be canceled by either party with 30 days’ written notice.

NOTE 6 — RELATED PARTIES

Accounts Receivable and Payable with Related Parties

Tellurian’s accounts receivable due from related parties primarily consist of indemnities and amounts due from employees who received share-based compensation. The Company will withhold amounts from wages if the tax liability with respect to such share-based compensation is not paid directly by the employees. The accounts payable due to related parties pertains to agreements with entities which are partially owned by Mr. Martin Houston, a major shareholder and Vice Chairman of the Company.

Non-current Note Receivable Due from Related Party

Prior to the acquisition of Tellurian Services, Tellurian Services issued an interest-free $251 thousand note receivable to Mr. Houston. The note was used to provide the collateral required to secure a personal $500 thousand line of credit as part of a covenant related to the lease of our corporate headquarters located in Houston, Texas.

Other

During the three and six months ended June 30, 2017, the Company incurred $116 thousand and $650 thousand, respectively, in legal fees to a law firm for advice associated with the Bonini-Kettlety lawsuit, described in Note 8, Commitments and Contingencies. The suit was settled in April 2017. A member of our board of directors is a partner at such law firm.

10

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

NOTE 7 — PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment is comprised of fixed assets and oil and gas properties, as shown below (in thousands):

|

June 30, 2017 |

December 31, 2016 | |||

| Fixed Assets |

||||

| Land |

$ 9,491 | $ 9,491 | ||

| Buildings |

549 | 549 | ||

| Leasehold improvements |

1,774 | 602 | ||

| Computer, office equipment and fixtures |

436 | 420 | ||

| Accumulated depreciation |

(208) | (69) | ||

|

|

| |||

| Total fixed assets, net |

12,042 | 10,993 | ||

|

|

| |||

| Oil and Gas Properties |

||||

| Unproved |

13,000 | — | ||

| Wells in progress |

332 | — | ||

|

|

| |||

| Total oil and gas properties |

13,332 | — | ||

|

|

| |||

| Total property, plant and equipment, net |

$ 25,374 | $ 10,993 | ||

|

|

|

Property, plant and equipment is depreciated using the straight-line depreciation method. Depreciation expense of $79 thousand and $139 thousand for the three and six months ended June 30, 2017, respectively, and $24 thousand for the three and six months ended June 30, 2016, respectively, is recorded within development expenses on the Condensed Consolidated Statement of Operations.

In February 2017, in connection with the Merger, the Company acquired interests in certain oil and gas properties. Unproved properties consist of oil and gas interests in the Weald Basin, United Kingdom and the Timor Sea, Australia. In the United Kingdom, Tellurian holds non-operating interests in two licenses which expire in June and September 2021. In Australia, Tellurian holds an operating interest in an exploration permit due to expire on November 12, 2017. At this time, the Company is considering applying for an extension of the exploration permit to the appropriate Australian regulatory authorities. There is no production and there are no reserves currently associated with any of our licenses. Accordingly, there is no depletion associated with them for the three and six months ended June 30, 2017.

NOTE 8 — COMMITMENTS AND CONTINGENCIES

In May 2016, Simon Bonini and Paul Kettlety (collectively, the “Plaintiffs”) filed a lawsuit against Tellurian Investments and Tellurian Services, along with each of Messrs. Martin Houston and Christopher Daniels and certain entities in which each of Messrs. Houston and Daniels own membership interests, as applicable (collectively, the “Defendants”), in the District Court of Harris County, Texas, alleging among other things, breach of contract, promissory estoppel, quantum meruit, fraud/fraudulent concealment, negligent misrepresentation, breach of fiduciary duty, usurpation/diversion of corporate opportunity, conversion, civil conspiracy and implied partnership. The Plaintiffs sought damages in excess of $168 million.

In April 2017, the Defendants entered into a Compromise Settlement Agreement and Mutual Release (the “Settlement Agreement”) with the Plaintiffs and the Plaintiffs’ counsel, Schiffer Odom Hicks & Johnson, PLLC, a Texas professional limited liability company (“Schiffer Odom”), in connection with the lawsuit. Pursuant to the Settlement Agreement, among other things, (i) Mr. Houston agreed to transfer a total of 2,000,000 shares of Tellurian common stock owned by Mr. Houston (the “Transferred Shares”) to the Plaintiffs and Schiffer Odom, comprised of 825,000 shares to each of the Plaintiffs and 350,000 shares to Schiffer Odom, (ii) the Company agreed to file a prospectus supplement with respect to the resales of the Transferred Shares by the Plaintiffs and Schiffer Odom and (iii) the Plaintiffs released all claims against the Defendants. Also in April 2017, Mr. Houston transferred the Transferred Shares to the Plaintiffs and Schiffer Odom, and the Company filed a prospectus supplement with respect to the resales of the Transferred Shares by the Plaintiffs and Schiffer Odom.

11

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

NOTE 9 — ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

The components of accounts payable and accrued liabilities consist of the following (in thousands):

| June 30, 2017 | December 31, 2016 | |||||||

| Front-end engineering and design |

$ | 776 | $ | 12,549 | ||||

| Payroll and compensation |

10,507 | 6,311 | ||||||

| Professional services (e.g., legal, audit) |

2,736 | 2,323 | ||||||

| Other |

4,851 | 3,220 | ||||||

|

|

|

|

|

|||||

| Total accounts payable and accrued liabilities |

$ | 18,870 | $ | 24,403 | ||||

|

|

|

|

|

|||||

In February 2016, Tellurian engaged Bechtel to perform a FEED study for the Driftwood terminal, and in June 2016, Tellurian engaged Bechtel to perform a FEED study for the Driftwood pipeline. Accounts payable and accrued liabilities for FEED costs relate primarily to our contracts for FEED services with Bechtel as well as subcontractors working on the project. The FEED studies for the Driftwood pipeline and the Driftwood terminal were completed in March 2017 and June 2017, respectively.

NOTE 10 — SHARE-BASED COMPENSATION

Tellurian has granted fully vested and restricted stock to employees, outside directors, and a consultant under the Amended and Restated Tellurian Investments Inc. 2016 Omnibus Incentive Plan (the “Legacy Plan”) and the Tellurian Inc. 2016 Omnibus Incentive Compensation Plan, as amended (the “Omnibus Plan”). At a special meeting of stockholders on February 9, 2017, Magellan stockholders approved the Omnibus Plan, which replaced the Legacy Plan. No further awards can be made under the Legacy Plan.

The maximum number of shares of Tellurian common stock authorized for issuance under the Omnibus Plan is 40 million shares of common stock. During any calendar year, no employee may be granted more than 10 million shares of Tellurian common stock, or with respect to a grant of cash, an amount equal to the value of 10 million shares of Tellurian common stock at the time of settlement. As of June 30, 2017, 5.5 million shares have been granted under the Omnibus Plan, and 14.9 million shares were granted under the Legacy Plan.

During the three and six months ended June 30, 2017, the Company granted certain awards without vesting conditions, while most awards granted are subject to performance and service-based vesting conditions. Most of the performance-based awards vest based on a final investment decision by the Company’s board of directors, as defined in the award agreements. A portion of the performance awards vest based on the achievement of certain project development activities.

During the three months ended June 30, 2017, the weighted average grant date fair value per share was $11.85 per share, and the total grant date fair value was $19.3 million. For the three and six months ended June 30, 2017, Tellurian recognized $0.4 million and $18 million, respectively, as stock-based compensation expense for employees and directors, $2 million of which was issued in settlement of bonuses accrued at December 31, 2016. For the three and six months ended June 30, 2016, Tellurian recognized $1.6 million and $5.1 million, respectively, as stock-based compensation expense for employees and directors.

NOTE 11 — SHARE-BASED PAYMENTS

For the three and six months ended June 30, 2017, Tellurian recognized $1.6 million and $19.4 million, respectively, as share-based expense for vendors.

In February 2017, the Company issued 409,800 shares of Tellurian common stock, valued at $5.8 million, to a financial adviser in connection with the successful completion of the Merger. This cost has been included in general and administrative expenses in the Condensed Consolidated Statements of Operations. Additionally, on the Merger Date, the Company issued 90,350 shares of Tellurian common stock to settle a liability assumed in the Merger valued at $1.3 million.

12

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

In March 2017, the Company’s board of directors approved the issuance of 1 million shares that were purchased at a discount by a commercial development consultant under the Omnibus Plan. The terms of the share purchase agreement did not contain performance obligations or similar vesting provisions; accordingly, the full amount of $11.4 million, representing the aggregate difference between the purchase price of $0.50 per share and the fair value on the date of issuance of $11.88 per share, was recognized on the date of the share purchase and has been included in general and administrative expenses in the Condensed Consolidated Statements of Operations.

Also in March 2017, the Company issued 200,000 shares under a management consulting arrangement for specified services from March 2017 through May 2017. The services were valued at $11.34 per share on the date of issuance. The total cost of $2.3 million was amortized to general and administrative expenses on a straight-line basis over the three-month service period in the Condensed Consolidated Statements of Operations.

NOTE 12 — INCOME TAXES

As of June 30, 2017, the Company has net operating loss (“NOL”) carryforwards for federal, state and international income tax reporting purposes. The Company has established a full valuation allowance against its NOLs and has not recorded a net liability for federal, state and international income taxes in any of the periods included in the accompanying financial statements. Our Condensed Consolidated Statements of Operations for the three and six months ended June 30, 2017 and December 31, 2016 include no income tax benefits.

Section 382 of the Internal Revenue Code (the “Code”) contains rules that limit the ability of a company that undergoes an ownership change to utilize its NOL carryforwards, tax credits, and certain built-in-losses or deductions existing as of the date of an ownership change. Prior to the Merger, Magellan had NOL carryforwards available to reduce U.S. federal and state taxable income in future tax years. The Company performed a section 382 ownership change analysis for Magellan to determine if there were any Section 382 limitations on the utilization of Magellan’s pre-merger NOLs. Based on this analysis, the Company has determined that the Magellan pre-merger NOL carryforwards are subject to annual Section 382 limitations. Because of these limitations, it is expected that the vast majority of Magellan’s NOL carryforwards generated prior to the Merger will expire unused.

We will continue to monitor activity in the Company’s shares which could cause an ownership change. If the Company experiences a Section 382 ownership change, it could further affect our ability to utilize our existing NOL carryforwards.

The Company remains subject to periodic audits and reviews by taxing authorities; however, we do not expect that these audits will have a material effect on the Company’s tax provision. Magellan’s federal tax returns for the years after June 30, 2013 remain open for examination. Tax authorities may review and adjust NOL carryforwards that were generated prior to these periods if utilized in an open tax year.

NOTE 13 — STOCKHOLDERS’ EQUITY

At-the-Market Program

The Company maintains an at-the-market equity offering program pursuant to which Tellurian may sell shares of its common stock from time to time on the NASDAQ or any other market for the common stock in the U.S., through Credit Suisse Securities (USA) LLC acting as sales agent, for aggregate sales proceeds of up to $200 million. For the three months ended June 30, 2017, the Company issued 0.5 million shares of common stock under this program, for proceeds of $5.1 million, net of $0.1 million in fees and commissions. There were no issuances under this program in the first quarter of 2017.

TOTAL Investment

In January 2017, pursuant to a common stock purchase agreement dated as of December 19, 2016, between Tellurian Investments and TOTAL Delaware, Inc. (“TOTAL”), TOTAL purchased, and Tellurian Investments sold and issued to TOTAL, approximately 35.4 million shares of Tellurian Investments common stock for an aggregate purchase price of $207 million, net of offering costs. In connection with the Merger, the shares purchased by TOTAL were exchanged for 46 million shares of Tellurian common stock.

13

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

In May 2017, Tellurian and TOTAL entered into a pre-emptive rights agreement pursuant to which TOTAL was granted a right to purchase its pro rata portion of any new equity securities that Tellurian may issue to a third party on the same terms and conditions as such equity securities are offered and sold to such party, subject to certain excepted offerings (the “Pre-emptive Rights Agreement”). Pursuant to the common stock purchase agreement dated as of December 19, 2016, between Tellurian Investments and TOTAL, the terms and conditions of the Pre-emptive Rights Agreement are similar to those contained in the pre-emptive rights agreement dated as of January 3, 2017, between Tellurian Investments and TOTAL, but the Pre-emptive Rights Agreement is subject to additional excepted offerings.

Tellurian Preferred Stock

In March 2017, GE Oil & Gas, Inc. (now known as GE Oil & Gas, LLC) (“GE”), as the holder of all 5.5 million outstanding shares of Tellurian Investments Series A convertible preferred stock (the “Tellurian Investments Preferred Shares”), exchanged those shares into an equal number of shares of Tellurian Inc. Series B convertible preferred stock (the “Series B Preferred Stock”) pursuant to the terms of the Tellurian Investments Certificate of Incorporation (the “Preferred Share Exchange”). The terms of the Series B Preferred Stock were substantially similar to those of the Tellurian Investments Preferred Shares. The Series B Preferred Stock were exchangeable at any time into shares of the Company’s common stock on a one-for-one basis, subject to anti-dilution adjustments in certain circumstances. In June 2017, GE, as the holder of all 5.5 million outstanding shares of Series B Preferred Stock exercised its right to convert all such shares of Series B Preferred Stock into 5.5 million shares of Tellurian common stock pursuant to and in accordance with the terms of the Series B Preferred Stock.

Embedded Derivative

The ability of GE to exchange the Tellurian Investments Preferred Shares into shares of Series B Preferred Stock or into shares of Tellurian common stock following the Merger required the fair value of such features to be bifurcated from the contract and recognized as an embedded derivative until the Merger Date.

The fair value of the embedded derivative was determined through the use of a model which utilizes certain observable inputs such as the price of Magellan common stock at various points in time and the volatility of Magellan common stock over an assumed half-year and one-year holding period from February 10, 2017 and December 31, 2016, respectively. At each valuation date, the model also included (i) unobservable inputs related to the weighted probabilities of certain Merger-related scenarios and (ii) a discount for the lack of marketability determined through the use of commonly accepted methods. We have therefore classified the fair value measurements of this embedded derivative as Level 3 inputs. On the Merger Date, the embedded derivative was reclassified to additional paid-in capital in accordance with U.S. GAAP.

The following table summarizes the changes in fair value for the embedded derivative (in thousands):

| February 10, 2017 | December 31, 2016 | |||||||

| Fair value at the beginning of period and initial fair value, respectively | $ | 8,753 | $ | 5,445 | ||||

| (Gain) loss on exchange feature |

(2,209) | 3,308 | ||||||

|

|

|

|

|

|||||

| Fair value at the end of the period and year, respectively |

$ | 6,544 | $ | 8,753 | ||||

|

|

|

|

|

|||||

NOTE 14 — NET LOSS PER SHARE

The following table summarizes the computation of basic and diluted loss per share (in thousands, except per-share amounts):

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Net loss |

$ | (32,523 | ) | $ | (16,277 | ) | $ | (173,872 | ) | $ | (23,470 | ) | ||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Basic weighted average common shares outstanding |

186,102 | 109,967 | 146,756 | 65,714 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Loss per share: |

||||||||||||||||

| Basic and diluted |

$ | (0.17 | ) | $ | (0.15 | ) | $ | (1.18 | ) | $ | (0.36 | ) | ||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

14

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

Basic loss per share is based upon the weighted average number of shares of common stock outstanding during the period. As of June 30, 2017 and 2016, the effect of 18.3 million and 2.0 million, respectively, of unvested restricted stock awards that could potentially dilute basic EPS in the future were not included in the computation of diluted EPS because to do so would have been antidilutive for the periods presented.

NOTE 15 — OTHER COMPREHENSIVE LOSS

The following table is a reconciliation of our net loss to our comprehensive loss for the periods shown (in thousands):

| Successor | Predecessor | |||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | Nine Days Ended April 9, |

Period Ended April 9, |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | 2016 | 2016 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net loss |

$ | (32,523) | $ | (16,277) | $ | (173,872) | $ | (23,470) | $ | (157) | $ | (638) | ||||||||||||||||

| Other comprehensive income items: | ||||||||||||||||||||||||||||

| Unrealized holding gain on securities available-for-sale |

993 | — | 933 | — | — | — | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Comprehensive loss |

$ | (31,530) | $ | (16,277) | $ | (172,939) | $ | (23,470) | $ | (157) | $ | (638) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

NOTE 16 — ADDITIONAL CASH FLOW INFORMATION

The following table provides supplemental disclosure of cash flow information (in thousands):

| As of the Six Months Ended June 30, | ||||||||

| 2017 | 2016 | |||||||

| Property, plant and equipment non-cash accruals |

$ | 217 | $ | 128 | ||||

| Land acquisition non-cash accruals |

— | 1,000 | ||||||

| Equity offering cost accrual |

— | 483 | ||||||

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the Condensed Consolidated Balance Sheets that sum to the total of such amounts shown in the Condensed Consolidated Statements of Cash Flows (in thousands):

| As of the Six Months Ended June 30, | ||||||||

| 2017 | 2016 | |||||||

| Cash and cash equivalents |

$ | 160,726 | $ | 12,391 | ||||

| Restricted cash, current |

100 | — | ||||||

| Non-current restricted cash |

375 | — | ||||||

|

|

|

|

|

|

| |||

| Total cash, cash equivalents, and restricted cash shown in the statement of cash flows | $ | 161,201 | $ | 12,391 | ||||

|

|

|

|

|

|

| |||

NOTE 17 — RECENT ACCOUNTING STANDARDS

The following table provides a description of recent accounting standards that had not been adopted by the Company as of June 30, 2017:

15

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

|

Standard |

Description |

Expected Date of Adoption |

Effect on our Condensed | |||

| ASU 2014-09, Revenue from Contracts with Customers (Topic 606), and subsequent amendments thereto |

This standard amends existing revenue recognition guidance and requires an entity to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. This standard may be early adopted beginning January 1, 2017, and may be adopted either retrospectively to each prior reporting period presented or as a cumulative-effect adjustment as of the date of adoption. |

January 1, 2018 | The implementation of this new standard will not affect the amounts shown in our Condensed Consolidated Financial Statements and related disclosures as the Company has no revenues.

| |||

| ASU 2016-02, Leases (Topic 842) | This standard requires a lessee to recognize leases on its balance sheet by recording a liability representing the obligation to make future lease payments and a right-of-use asset representing the right to use the underlying asset for the lease term. A lessee is permitted to make an election not to recognize lease assets and liabilities for leases with a term of 12 months or less. The standard also modifies the definition of a lease and requires expanded disclosures. This standard may be early adopted and must be adopted using a modified retrospective approach with certain available practical expedients. |

January 1, 2019 | We are currently evaluating the impact of the provisions of this guidance on our Condensed Consolidated Financial Statements and related disclosures. |

Additionally, the following table provides a description of recent accounting standards that were adopted by the Company during the reporting period:

|

Standard |

Description |

Date of Adoption |

Effect on our Condensed | |||

| ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business |

This update clarifies the definition of a business to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses by providing a screen to determine when an integrated set of assets or activities is not a business. |

January 1, 2017 | The adoption of this guidance did not have a material impact on our Condensed Consolidated Financial Statements or disclosures.

| |||

| ASU 2017-04, Intangibles — Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment |

This update eliminated Step 2 from the goodwill impairment test. Step 2 required entities to compute the implied fair value of goodwill if it was determined that the carrying amount of a reporting unit exceed its fair value. The goodwill impairment test now consists of comparing the fair value of a reporting unit with its carrying amount, and a company should recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value.

|

January 1, 2017 | The adoption of this guidance did not have a material impact on our Condensed Consolidated Financial Statements or disclosures. |

16

Table of Contents

TELLURIAN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

(unaudited)

|

Standard |

Description |

Date of Adoption |

Effect on our Condensed | |||

| ASU 2017-09, Compensation — Stock Compensation (Topic 718): Scope of Modification Accounting |

This update clarifies what changes to the terms and conditions of share-based awards require an entity to apply modification accounting. Modification accounting is required only if the fair value, the vesting conditions, or the classification of the award (as equity or liability) changes as a result of the change in terms or conditions.

|

April 1, 2017 | The adoption of this guidance did not have a material impact on our Condensed Consolidated Financial Statements or disclosures.

| |||

| ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash |

This update requires that restricted cash be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. |

April 1, 2017 | The adoption of this guidance did not have a material impact on our Condensed Consolidated Financial Statements or disclosures. |

NOTE 18 — SUBSEQUENT EVENTS

At-the-Market Program

Subsequent to June 30, 2017, the Company issued 0.5 million shares of common stock under its at-the-market equity offering program for proceeds of $5.2 million, net of $0.2 million in fees and commissions.

Seismic Survey

On March 31, 2017, the Company executed an Operations Services Agreement (the “OSA”) with Santos Offshore Pty Ltd (“Santos”). The OSA provides for Santos to perform certain services on behalf of the Company associated with the Company’s exploration permit for our offshore block in Australia. On June 28, 2017, the Company executed a Cost Sharing Agreement (the “CSA”), with Santos and Origin Energy Resources Limited (“Origin”). The CSA provides the basis upon which costs and expenses will be shared among the Company, Santos and Origin for a 3-D seismic survey to be shot over our offshore block.

Pursuant to the OSA and CSA, with the Company’s consent, Santos applied for regulatory approval, designed the seismic survey and engaged a contractor to perform the work. In July 2017, Santos informed the Company that Santos was unable to obtain regulatory approval and canceled the seismic survey. While the Company remains a party to the OSA and CSA, we are not currently committed to make any further expenditures under any agreement, but remain liable for amounts due under the OSA and CSA pertaining to the canceled portion of the survey. We are currently assessing the amounts due, if any, for our portion of the canceled seismic survey. Our estimate is dependent upon information to be gathered between Santos, as the operator, and the seismic contractor.

Litigation

In July 2017, Tellurian Investments, Driftwood LNG, Martin Houston, and three other individuals were named as third-party defendants in a lawsuit filed in state court in Harris County, Texas between Cheniere Energy, Inc. and one of its affiliates, on the one hand (collectively, “Cheniere”), and Parallax Enterprises and certain of its affiliates (not including Parallax Services, n/k/a Tellurian Services) on the other hand (collectively, “Parallax”). Cheniere alleges that it entered into a note and a pledge agreement with Parallax. Cheniere claims that Tellurian Investments and Driftwood LNG tortiously interfered with the note and pledge agreement. We believe that Cheniere’s claims against Tellurian Investments and Driftwood LNG are without merit and do not expect the resolution of the suit to have a material effect on our results of operation or financial condition. As of the date of this filing, neither Tellurian Investments nor Driftwood LNG has been served in this action.

17

Table of Contents

Securities Available-for-sale

Subsequent to June 30, 2017, the Company sold all of the securities available-for-sale, which were acquired in the Merger, for net proceeds of $4.3 million.

Non-current Note Receivable Due from Related Party

On July 28, 2017, the $251 thousand non-current note receivable due from a related party was repaid in full and the demand note evidencing the receivable was canceled.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Information About Forward-Looking Statements

The information in this report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical facts, that address activity, events, or developments with respect to our financial condition, results of operations, or economic performance that we expect, believe or anticipate will or may occur in the future, or that address plans and objectives of management for future operations, are forward-looking statements. The words “anticipate,” “assume,” “believe,” “budget,” “estimate,” “expect,” “forecast,” “initial,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will,” “would” and similar expressions are intended to identify forward-looking statements. These forward-looking statements relate to, among other things:

| • | our businesses and prospects; |

| • | planned or estimated capital expenditures; |

| • | availability of liquidity and capital resources; |

| • | our ability to obtain additional financing as needed; |

| • | revenues, expenses and projected cash burn rates; |

| • | progress in developing Tellurian’s principal project and the timing of that progress; |

| • | future values of that project or other interests or rights that Tellurian holds; and |

| • | government regulations, including our ability to obtain necessary governmental permits and approvals. |

Our forward-looking statements are based on assumptions and analysis made by us in light of our experience, and our perception of historical trends, current conditions, expected future developments and other factors that we believe are appropriate under the circumstances. These statements are subject to a number of known and unknown risks and uncertainties, which may cause our actual results and performance to be materially different from any future results or performance expressed or implied by the forward-looking statements. Factors that could cause actual results and performance to differ materially from any future results or performance expressed or implied by the forward looking statements include, but are not limited to, the following:

| • | the uncertain nature of demand for and price of natural gas; |

| • | risks related to shortages of LNG vessels worldwide; |

| • | technological innovation which may render our anticipated competitive advantage obsolete; |

18

Table of Contents

| • | risks related to a terrorist or military incident involving an LNG carrier; |

| • | changes in legislation and regulations relating to the LNG industry, including environmental laws and regulations that impose significant compliance costs and liabilities; |

| • | uncertainties regarding our ability to maintain sufficient liquidity and capital resources to implement our projects or otherwise continue as a going concern; |

| • | our limited operating history; |

| • | our ability to attract and retain key personnel; |

| • | risks related to doing business in, and having counterparties in, foreign countries; |

| • | our reliance on the skill and expertise of third-party service providers; |

| • | the ability of our vendors to meet their contractual obligations; |

| • | risks and uncertainties inherent in management estimates of future operating results and cash flows; |

| • | development risks, operational hazards and regulatory approvals; and |

| • | risks and uncertainties associated with litigation matters. |

The forward-looking statements in this report speak as of the date hereof. Although we may from time to time voluntarily update our prior forward-looking statements, we disclaim any commitment to do so except as required by securities laws.

Explanatory Note

On February 10, 2017 (the “Merger Date”), Tellurian Inc., which was formerly known as Magellan Petroleum Corporation (“Magellan”), completed the merger (the “Merger”) contemplated by the previously announced Agreement and Plan of Merger, dated as of August 2, 2016, by and among Magellan, Tellurian Investments Inc. (“Tellurian Investments”) and River Merger Sub, Inc. (“Merger Sub”), as amended (the “Merger Agreement”). At the effective time of the Merger, Merger Sub merged with and into Tellurian Investments, with Tellurian Investments continuing as the surviving corporation and a subsidiary of Magellan. Immediately following the completion of the Merger, Magellan amended its certificate of incorporation and bylaws to change its name to “Tellurian Inc.” In connection with the Merger, each outstanding share of common stock of Tellurian Investments was exchanged for 1.300 shares of Magellan common stock. The Merger is accounted for as a “reverse acquisition” under U.S. GAAP. Therefore, Tellurian Investments is treated as the accounting acquirer in the Merger.

Except where the context indicates otherwise, (i) references to “we,” “us,” “our,” “Tellurian” or the “Company” refer, for periods prior to the completion of the Merger, to Tellurian Investments and its subsidiaries, and for periods following the completion of the Merger, to Tellurian Inc. and its subsidiaries and (ii) references to “Magellan” refer to Tellurian Inc. and its subsidiaries prior to the completion of the Merger.

Introduction

The following discussion and analysis presents management’s view of our business, financial condition and overall performance and should be read in conjunction with our Condensed Consolidated Financial Statements and the accompanying notes. This information is intended to provide investors with an understanding of our past development activities, current financial condition and outlook for the future organized as follows:

| • | Our Business |

19

Table of Contents

| • | Overview of Significant Events |

| • | Liquidity and Capital Resources |

| • | Capital Development Activities |

| • | Results of Operations |

| • | Off-Balance Sheet Arrangements |

| • | Summary of Critical Accounting Estimates |

| • | Recent Accounting Standards |

Our Business

Tellurian intends to create value for shareholders by developing low-cost natural gas related infrastructure, profitably delivering natural gas to customers worldwide and pursuing value-enhancing, complementary business lines in the energy industry. Tellurian owns all of the common stock of Tellurian Investments, which indirectly owns a 100% ownership interest in each of Driftwood LNG LLC, a Delaware limited liability company (“Driftwood LNG”), and Driftwood Pipeline LLC, a Delaware limited liability company (“Driftwood Pipeline”), and directly owns a 100% membership interest in Tellurian Services LLC, a Delaware limited liability company (“Tellurian Services”).

Tellurian plans to own, develop and operate natural gas liquefaction facilities, storage facilities and loading terminals and is developing an LNG terminal facility (the “Driftwood terminal”) and an associated pipeline (the “Driftwood pipeline”) in Southwest Louisiana (the Driftwood terminal and the Driftwood pipeline collectively, the “Driftwood Project”). The proposed Driftwood Project will have a liquefaction capacity of approximately 26 mtpa, situated on approximately 1,000 acres in Calcasieu Parish, Louisiana. The proposed terminal facility will include up to 20 liquefaction Trains, three full containment LNG storage tanks and three marine berths. In February 2016, Tellurian engaged Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”) to perform a FEED study for the Driftwood terminal, which was completed in June 2017. Based on such FEED study, Tellurian estimates construction costs for the Driftwood terminal of approximately $500 to $600 per mtpa ($13 to $16 billion) before owners’ costs, financing costs and contingencies.

Tellurian is developing the proposed Driftwood pipeline, a new 96-mile large diameter pipeline which will interconnect with 13 existing interstate pipelines throughout Southwest Louisiana to secure adequate natural gas feedstock for the Driftwood terminal. The Driftwood pipeline will be comprised of 48-inch, 42-inch, 36-inch and 30-inch diameter pipeline segments and three compressor stations totaling approximately 270,000 horsepower, all as necessary to provide approximately 4.0 Bcf/d of average daily gas transportation service. In June 2016, Tellurian engaged Bechtel to perform a FEED study for the Driftwood pipeline, which was completed in March 2017. Based on such FEED study, Tellurian estimates construction costs for the Driftwood pipeline of approximately $1.6 to $2.0 billion before owners’ costs, financing costs and contingencies.

Overview of Significant Events

Significant corporate, developmental and capital events since January 1, 2017 and through the filing date of this Form 10-Q include the following:

TOTAL Investment. In January 2017, pursuant to a common stock purchase agreement (the “TOTAL SPA”) dated as of December 19, 2016, between Tellurian Investments and TOTAL Delaware, Inc. (“TOTAL”), TOTAL purchased, and Tellurian Investments sold and issued to TOTAL, approximately 35.4 million shares of Tellurian Investments common stock (the “TOTAL Shares”) for an aggregate purchase price of $207 million. In connection with the transaction:

| • | Magellan and TOTAL entered into a guaranty and support agreement pursuant to which Magellan guaranteed to TOTAL the performance of all of the obligations of Tellurian Investments in connection with the TOTAL SPA following the completion of the Merger. |

20

Table of Contents

| • | Magellan, TOTAL, Charif Souki, the Souki Family 2016 Trust, and Martin Houston entered into a voting agreement pursuant to which Mr. Souki, the Souki Family 2016 Trust, and Mr. Houston agreed to vote all shares of Tellurian stock they own in favor of the appointment of one board designee of TOTAL to the board of directors of Magellan effective upon the closing of the Merger. |

| • | Tellurian Investments and TOTAL entered into a pre-emptive rights agreement pursuant to which TOTAL was granted a right to purchase its pro rata portion of any new equity securities that Tellurian Investments may issue to a third party on the same terms and conditions as such equity securities are offered and sold to such party, subject to certain excepted offerings. Magellan also agreed that, following the completion of the Merger, Magellan would enter into a similar pre-emptive rights agreement with TOTAL, but subject to additional excepted offerings. On May 10, 2017, Tellurian entered into such a pre-emptive rights agreement with TOTAL. |

Merger-Related Events. Upon or shortly following the completion of the Merger:

| • | The TOTAL Shares were exchanged for 46 million shares of Tellurian common stock. |

| • | Each of the approximately 5.5 million shares of Tellurian Investments Series A convertible preferred stock (the “Tellurian Investments Preferred Shares”) held by GE Oil & Gas, Inc. (now known as GE Oil & Gas, LLC) (“GE”) became convertible or exchangeable into either (i) one share of Tellurian common stock or (ii) one share of Tellurian Series B convertible preferred stock (the “Series B Preferred Stock”). The terms of the Series B Preferred Stock are generally similar to those of the Tellurian Investments Preferred Shares. |

Development and Regulatory Events.

| • | In February 2017, the DOE/FE issued an order authorizing Driftwood LNG to export up to 26 mtpa of LNG to FTA countries, on its own behalf and as agent for others, for a term of 30 years. Driftwood LNG’s application for authority to export LNG to non-FTA countries is currently pending before the DOE/FE and is expected to be decided in the first quarter of 2018. |

| • | In March 2017, Driftwood LNG filed an application with FERC for authorization pursuant to Section 3 of the NGA to site, construct and operate the Driftwood terminal, and Driftwood Pipeline simultaneously sought authorization pursuant to Section 7 of the NGA for authorization to construct and operate interstate natural gas pipeline facilities. Each requested that FERC issue an order approving the facilities by the first quarter of 2018. |

| • | Also in March 2017, the Driftwood Project submitted permit applications to the USACE under regulatory Section 404 of the Clean Water Act, and Sections 10 and 14 of the Rivers and Harbors Act for activities within the waters of the U.S. including dredging and wetland mitigation. Also submitted in March was the Title V and PSD air permit to the Louisiana Department of Environmental Quality under the Clean Air Act for air emissions relating to the Driftwood Project. The regulatory review and approval process for the USACE permit as well as the Title V and PSD permits is expected to be completed in March 2018, concluding the major environmental permitting for the Driftwood Project. |

| • | The FEED studies for the Driftwood pipeline and the Driftwood terminal were completed in March 2017 and June 2017, respectively. |