Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Cheniere Energy, Inc. | cei20178kseptemberpresenta.htm |

1

CHENIERE ENERGY, INC.

BARCLAYS CEO ENERGY-POWER CONFERENCE | September 2017

NYSE American: LNG

2

Safe Harbor Statements

Forward-Looking Statements

This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements, other than statements of historical or present facts or conditions, included or incorporated by reference herein are “forward-looking statements.” Included among

“forward-looking statements” are, among other things:

• statements regarding the ability of Cheniere Energy Partners, L.P. to pay distributions to its unitholders or Cheniere Energy Partners LP Holdings, LLC or Cheniere Energy, Inc. to pay dividends to its

shareholders or participate in share or unit buybacks;

• statements regarding Cheniere Energy, Inc.’s, Cheniere Energy Partners LP Holdings, LLC’s or Cheniere Energy Partners, L.P.’s expected receipt of cash distributions from their respective subsidiaries;

• statements that Cheniere Energy Partners, L.P. expects to commence or complete construction of its proposed liquefied natural gas (“LNG”) terminals, liquefaction facilities, pipeline facilities or other projects,

or any expansions or portions thereof, by certain dates or at all;

• statements that Cheniere Energy, Inc. expects to commence or complete construction of its proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions then

of, by certain dates or at all;

• statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide,

or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure, or demand for and prices related to natural gas, LNG or other hydrocarbon products;

• statements regarding any financing transactions or arrangements, or ability to enter into such transactions;

• statements relating to the construction of our proposed liquefaction facilities and natural gas liquefaction trains (“Trains”) and the construction of the Corpus Christi Pipeline, including statements concerning the

engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and

anticipated costs related thereto;

• statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding

the amounts of total LNG regasification, natural gas, liquefaction or storage capacities that are, or may become, subject to contracts;

• statements regarding counterparties to our commercial contracts, construction contracts and other contracts;

• statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines;

• statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities;

• statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues, capital expenditures,

maintenance and operating costs, run-rate SG&A estimates, cash flows, EBITDA, Adjusted EBITDA, run-rate EBITDA, distributable cash flow, and distributable cash flow per share and unit, any or all of which

are subject to change;

• statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items;

• statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions;

• statements regarding our anticipated LNG and natural gas marketing activities; and

• any other statements that relate to non-historical or future information.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “goals,” ”guidance,”

“opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” “target,” and similar terms and phrases, or by use of future tense. Although we believe that the expectations reflected in these forward-looking

statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak

only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the

Cheniere Energy, Inc., Cheniere Energy Partners, L.P. and Cheniere Energy Partners LP Holdings, LLC Annual Reports on Form 10-K filed with the SEC on February 24, 2017, which are incorporated by reference into this

presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors.” These forward-looking statements are made as of the date of

this presentation, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information,

future events or otherwise.

Reconciliation to U.S. GAAP Financial Information

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, as amended. Schedules are included in the appendix hereto that reconcile

the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

3

Cheniere Investment Thesis

Full-service LNG offering, including gas procurement, transportation, liquefaction, and shipping

enables flexible solutions tailored to customer needs

Positioned as premier LNG provider, with a proven track record and low-cost advantage through

capacity expansion at existing sites

7 train platform offers excellent visibility for long-term cash flows

• 20-year “take-or-pay” style commercial agreements with investment grade off-takers for approximately 87% of the expected

aggregate nominal production capacity under construction or completed

• Competitive cost of production, with approximately 100 years of natural gas reserves in U.S.(1) and 800 Tcf of North American

natural gas producible below $3.00/MMBtu

Supply/demand fundamentals support continued LNG demand growth worldwide

• Approximately 30% increase in global natural gas demand forecast by 2030

• Global LNG trade grew 7.5% in 2016 to 263.6 mtpa with 39 countries importing LNG in 2016 (4 new market entrants)

• Estimated LNG demand growth of more than 200 mtpa to 475 mtpa in 2030

Opportunities for future cash flow growth at attractive return hurdles

• Uncontracted incremental production available to our integrated marketing function

• Construction of additional LNG trains

• Two trains fully permitted (Corpus Christi T3, Sabine Pass T6), with one partially commercialized (Corpus Christi T3)

• Significant expansion opportunities at both sites leveraging infrastructure and expertise

Investments in additional infrastructure along the LNG value chain

Reiterating our 2017 Consolidated Adjusted EBITDA guidance of $1.6-1.8 billion

Source: Cheniere Research, EIA, Cheniere interpretation of Wood Mackenzie data (Q2 2017), IHS, GIIGNL

(1) Based on EIA’s estimate for 2016 total annual natural gas demand.

4

Santiago, Chile

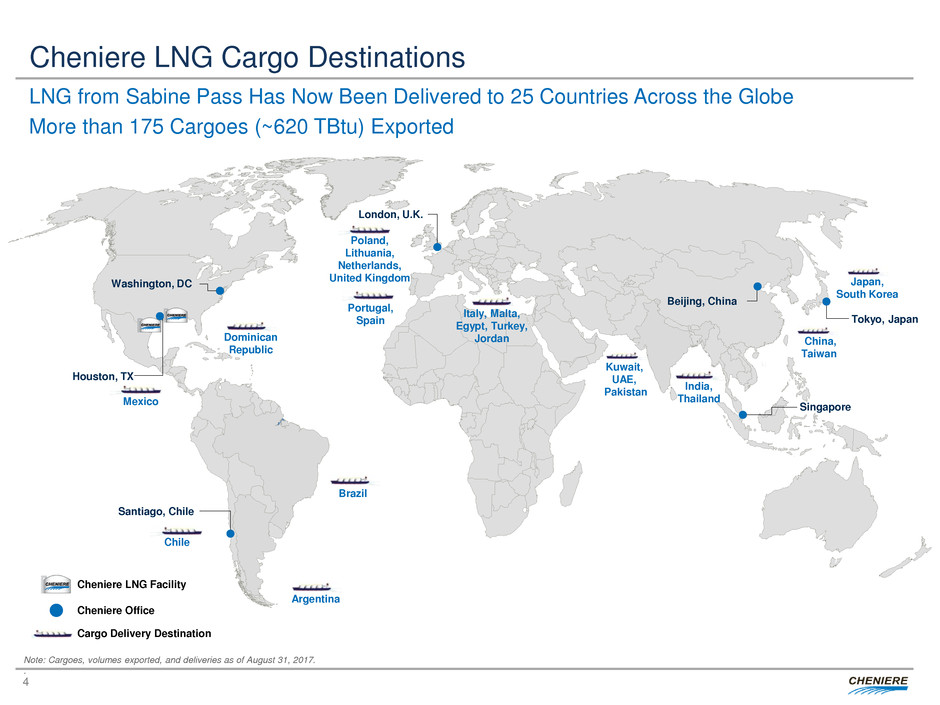

Cheniere LNG Cargo Destinations

Cheniere Office

Cheniere LNG Facility

Portugal,

Spain

Kuwait,

UAE,

Pakistan India,

Thailand

Brazil

Argentina

Houston, TX

Washington, DC

London, U.K.

Singapore

Cargo Delivery Destination

China,

Taiwan

Poland,

Lithuania,

Netherlands,

United Kingdom

Mexico

Dominican

Republic

Italy, Malta,

Egypt, Turkey,

Jordan

Japan,

South Korea

LNG from Sabine Pass Has Now Been Delivered to 25 Countries Across the Globe

More than 175 Cargoes (~620 TBtu) Exported

Chile

Tokyo, Japan

Note: Cargoes, volumes exported, and deliveries as of August 31, 2017.

.

Beijing, China

5

Sabine Pass Liquefaction Construction Progress

Trains 1, 2, and 3 in Operation, Train 4 Expected 2H 2017, Train 5 Expected 2019

Note: Based on Guaranteed Substantial Completion Dates per EPC contract. Construction percentages complete as of July 31, 2017.

DFCD Window Current Completion Schedule Progress Guaranteed Schedule

Oct 2017

S

ab

in

e

P

as

s

2020

Aug 2019

2018 2019 2012 2013 2014 2015 2016 2017

Train 1

Train 2

Train 3

Train 4

Train 5

Stage 1 (Trains 1 & 2) complete with trains operational

• First two trains completed 6 and 12 months ahead of guaranteed schedule, respectively

Stage 2 (Trains 3 & 4) 99.5% overall project completion

• Train 3 completed 3 months ahead of guaranteed schedule

• Train 4 commissioning began in March with first LNG achieved in July

• Engineering and procurement 100% complete, construction 99.6% complete

Stage 3 (Train 5) 71.8% overall project completion

• Soil improvement and piling completed 3 months ahead of schedule

• Engineering 100% complete, procurement 97.7% complete, construction 35.2% complete

Substantial Completion DFCD

6

Corpus Christi Liquefaction Construction Progress

Trains 1 & 2 Expected Completion 2019

Stage 1 (Trains 1 & 2) 69.6% overall project completion

• Engineering 100% complete, procurement 88.7% complete, construction 44.2% complete

• Target substantial completion mid-2019, several months ahead of guaranteed completion dates and

DFCD windows

Stage 2 (Train 3) fully permitted

Note: Based on Guaranteed Substantial Completion Dates per EPC contract. Construction percentages complete as of July 31. 2017.

(1) DFCD first window period varies by SPA.

DFCD Window Opens(1) Current Completion Schedule Progress Guaranteed Schedule

2020

1H 2019

C

or

pu

s

C

hr

is

ti

2H 2019

2018 2019 2012 2013 2014 2015 2016 2017

Train 1

Train 2

7

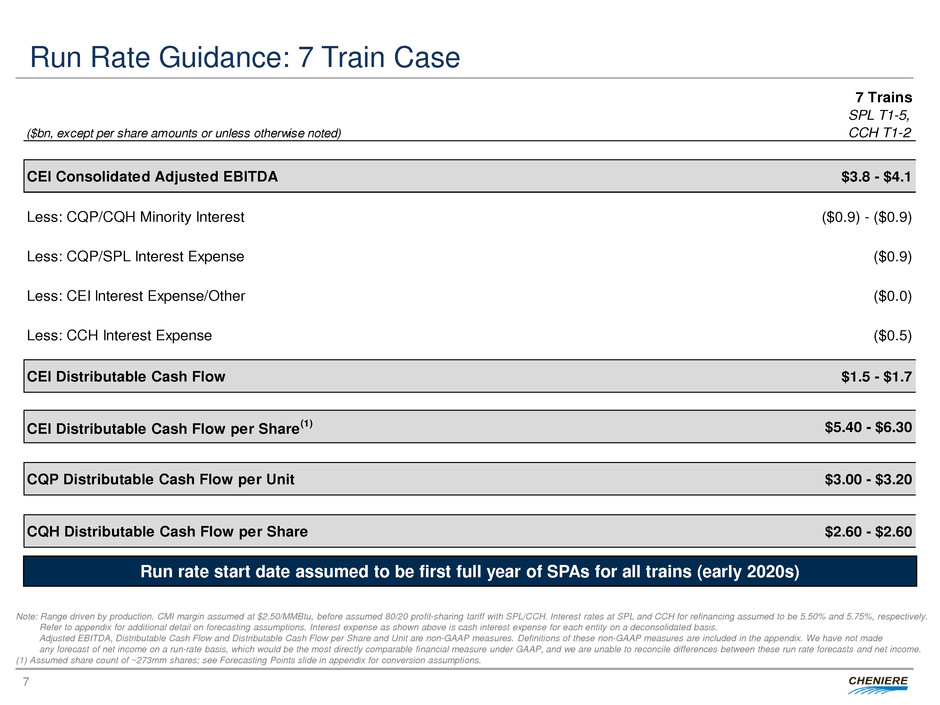

7 Trains

($bn, except per share amounts or unless otherwise noted)

SPL T1-5,

CCH T1-2

CEI Consolidated Adjusted EBITDA $3.8 - $4.1

Less: CQP/CQH Minority Interest ($0.9) - ($0.9)

Less: CQP/SPL Interest Expense ($0.9)

Less: CEI Interest Expense/Other ($0.0)

Less: CCH Interest Expense ($0.5)

CEI Distributable Cash Flow $1.5 - $1.7

CEI Distributable Cash Flow per Share(1) $5.40 - $6.30

CQP Distributable Cash Flow per Unit $3.00 - $3.20

CQH Distributable Cash Flow per Share $2.60 - $2.60

Run Rate Guidance: 7 Train Case

Run rate start date assumed to be first full year of SPAs for all trains (early 2020s)

Note: Range driven by production. CMI margin assumed at $2.50/MMBtu, before assumed 80/20 profit-sharing tariff with SPL/CCH. Interest rates at SPL and CCH for refinancing assumed to be 5.50% and 5.75%, respectively.

Refer to appendix for additional detail on forecasting assumptions. Interest expense as shown above is cash interest expense for each entity on a deconsolidated basis.

Adjusted EBITDA, Distributable Cash Flow and Distributable Cash Flow per Share and Unit are non-GAAP measures. Definitions of these non-GAAP measures are included in the appendix. We have not made

any forecast of net income on a run-rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and net income.

(1) Assumed share count of ~273mm shares; see Forecasting Points slide in appendix for conversion assumptions.

8

$8

.4

–

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

$9.0 CCH - Credit Facilities

$1

.2

5

$1

.5

$1

.5

$4

.6

–

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

$9.0 CCH - Credit Facilities

CCH - Senior Notes

$1

.7

$0.4 $0.4

$4

.6

$5

.0

$2

.0

$1

.0

$1

.5

$2

.0

$2

.0

–

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0 SPLNG - Senior Notes

CTPL - Term Loan

SPL - Credit Facilities

SPL - Senior Notes

$2.8

$2

.0

$1

.0

$1

.5

$2

.0

$2

.0

$1

.5

$1

.5

$1

.3

5

$0

.8

–

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0 CQP - Credit Facilities

SPL - Senior Notes

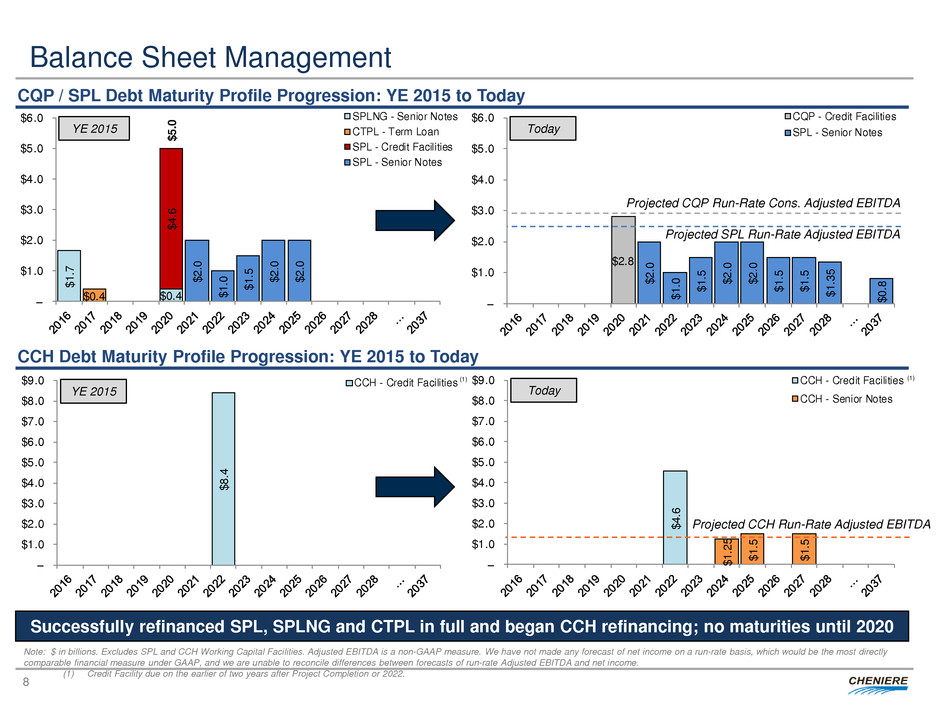

Balance Sheet Management

CQP / SPL Debt Maturity Profile Progression: YE 2015 to Today

Today

Successfully refinanced SPL, SPLNG and CTPL in full and began CCH refinancing; no maturities until 2020

YE 2015

Today

CCH Debt Maturity Profile Progression: YE 2015 to Today

YE 2015

Projected SPL Run-Rate Adjusted EBITDA

Projected CQP Run-Rate Cons. Adjusted EBITDA

Projected CCH Run-Rate Adjusted EBITDA

Note: $ in billions. Excludes SPL and CCH Working Capital Facilities. Adjusted EBITDA is a non-GAAP measure. We have not made any forecast of net income on a run-rate basis, which would be the most directly

comparable financial measure under GAAP, and we are unable to reconcile differences between forecasts of run-rate Adjusted EBITDA and net income.

(1) Credit Facility due on the earlier of two years after Project Completion or 2022.

(1) (1)

9

Note: Cash flows from CQP, SPL and CCH are subject to meeting their applicable distribution requirements. Assumes seven Trains operational at approximately 4.5 mtpa/train production beginning at each Train’s

respective completion date.

(1) Assumes current implied gross margin by CMI through 2019 and $2.50 gross margin thereafter, before 80/20 profit-sharing tariff with SPL/CCH.

$2.3

$0.6

$1.1

$1.2

$0.8

$1.3

$0.9

$0.8

$4.0

–

$2.0

$4.0

$6.0

$8.0

Sources Uses

$bn

CEI Deconsolidated Five Year Sources and Uses

Projected Available Cash Generation: 2017 – 2021

CEI G&A/Other/Interest

Expense

Management Fees

Available Cash

Grow (CCH T3, etc.)

Buy back Stock

Pay Dividend

CCH Distributions

Sources: ~$6.5 billion

CQP GP / IDR Distributions

CMI Cash Flow(1)

CEI Beginning Cash on Hand

CQH Dividends and Tax

Sharing Payments

CCH Equity Contribution

Agreement

Uses: ~$6.5 billion

~$4.0 billion of cash available for distribution over the 5-year planning horizon

10

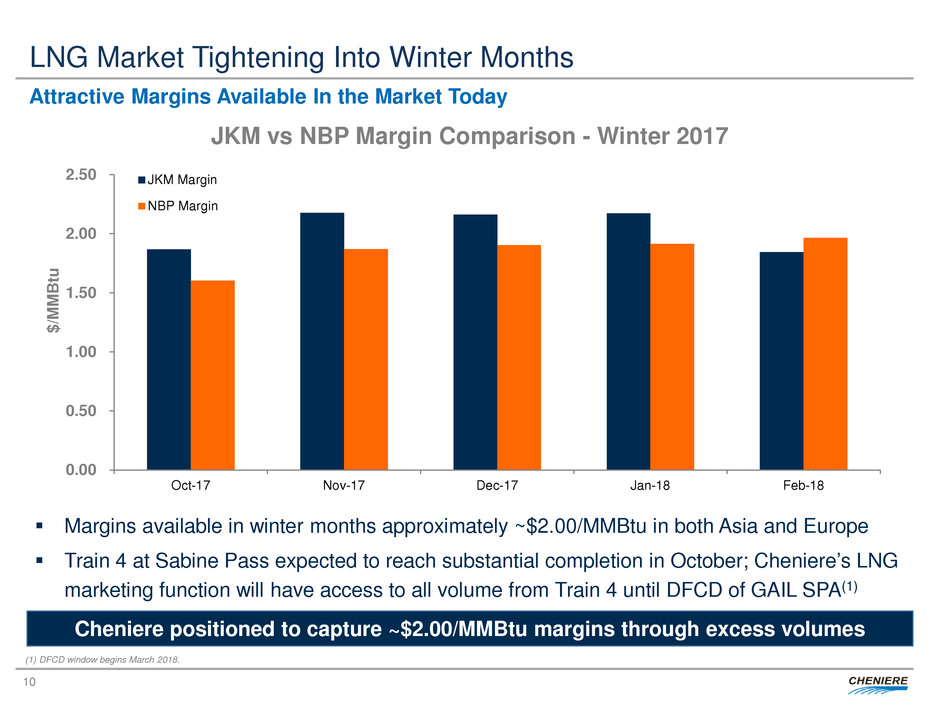

LNG Market Tightening Into Winter Months

Attractive Margins Available In the Market Today

Margins available in winter months approximately ~$2.00/MMBtu in both Asia and Europe

Train 4 at Sabine Pass expected to reach substantial completion in October; Cheniere’s LNG

marketing function will have access to all volume from Train 4 until DFCD of GAIL SPA(1)

Cheniere positioned to capture ~$2.00/MMBtu margins through excess volumes

0.00

0.50

1.00

1.50

2.00

2.50

Oct-17 Nov-17 Dec-17 Jan-18 Feb-18

$/

M

M

B

tu

JKM vs NBP Margin Comparison - Winter 2017

JKM Margin

NBP Margin

(1) DFCD window begins March 2018.

11

Cheniere’s Existing LNG Platform Creates Advantages for Growth

Construction Operations

Significant infrastructure investment at

Corpus Christi and Sabine Pass sites

• Site preparation

• Utilities

• Storage

• Marine

Additional expansion at very competitive

investment: ~$500-600/ton(1)

Positioning both sites for future growth

Ability to scale quickly and effectively

Scale helps reduce operating expense

Operating expense associated with

expansion trains ~30% of initial train

• $60 - $70mm/year of savings moving from T1 to

each incremental train

Leverage existing gas procurement

infrastructure and early mover advantage

Finance Commercial

Expected excess capacity across platform

allows LNG deliveries now through

integrated marketing function

Conditions precedent flexibility – portfolio

sales

Tenor flexibility – short, medium, long term

Counterparty credit flexibility based on

price & payment terms

Lower capitalized financing costs

• Initial Interest during Construction and Financing

Fees are ~$200/ton; not required for initial expansion

• Funding construction from DCF significantly reduces

these costs and reduces leverage metrics

Highly visible and significant cash flows

provide financing flexibility

(1) Includes EPC and owner’s cost.

12

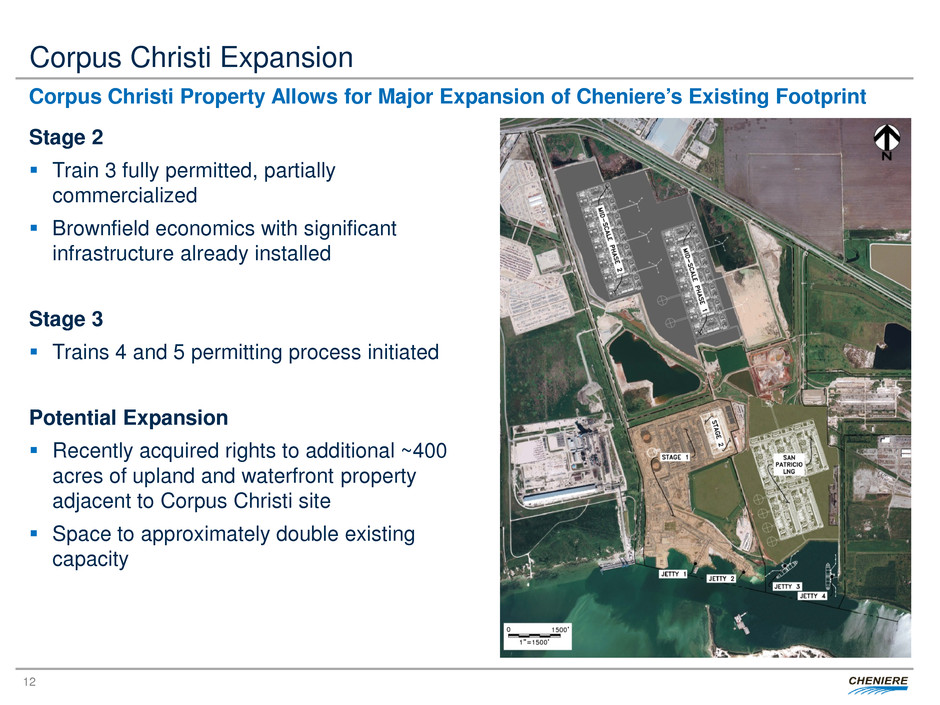

Corpus Christi Expansion

Corpus Christi Property Allows for Major Expansion of Cheniere’s Existing Footprint

Stage 2

Train 3 fully permitted, partially

commercialized

Brownfield economics with significant

infrastructure already installed

Stage 3

Trains 4 and 5 permitting process initiated

Potential Expansion

Recently acquired rights to additional ~400

acres of upland and waterfront property

adjacent to Corpus Christi site

Space to approximately double existing

capacity

13

CHENIERE ENERGY, INC.

BARCLAYS CEO ENERGY-POWER CONFERENCE | September 2017

NYSE American: LNG

14

APPENDIX

15

Sabine Pass Liquefaction Project Execution – 2Q 2017

Trains 1, 2 & 3

Operational

Train 4

Commissioning

Train 5

Under Construction

Train 6

Fully Permitted

16

Corpus Christi Liquefaction Project Execution – 2Q 2017

Stage 1: Trains 1& 2,

Tanks A & C, Marine Berths

Under Construction

Stage 2

Train 3, Tank B

Fully Permitted

17

Existing Capacity

Newly Operational

Under Construction

0

50

100

150

200

250

300

350

400

450

500

2016 2018 2020 2022 2024 2026 2028 2030

LNG Demand vs. Supply (mtpa)

Pacific Basin SPAs

Atlantic Basin SPAs

0

50

100

150

200

250

300

350

400

450

500

2016 2018 2020 2022 2024 2026 2028 2030

Global LNG Demand vs. SPAs (mtpa)

Global LNG Demand Estimate

Market tightening

New Supply

(127 mtpa)

Source: Cheniere Research, Wood Mackenzie

Global LNG market

needs competitive new

supplies to fill the

approaching supply

gap

Expiration of contracts

will result in significant

portfolio gaps

~90 mtpa of

recontracting demand

in addition to underlying

market growth

LNG Fundamentals are Supportive of Long-Term Growth

Projects under construction not sufficient to satisfy growth and ensure stability of prices

Expiring contracts create incremental opportunity, especially in Asia

Total

Uncommitted

Demand

(214 mtpa)

18

-

50

100

150

200

250

300

350

400

450

500

2000 2005 2010 2015 2020 2025 2030

mtpa

Demand Forecast to Grow More than 200 mtpa by 2030 Driven by

Supplemental & Growth Markets

LNG Market Segmentation

Traditional

Flex

Growth

Supplemental

Type Characteristics

Locations

Demand

Growth

(mtpa)

Supplemental

Countries with maturing

indigenous resource

bases require new

sources of gas

Indonesia

Malaysia

Egypt

Pakistan

Thailand

Bahrain

Southeast Europe...

+85

Growth

Growing economies

seeking cleaner and

more diverse fuel mix

China

India +84

Flex

Seasonal / weather

influenced and price

sensitive demand

Northwest Europe

Brazil

Argentina…

+13

Displacement Diversifying energy mix away from oil / coal

Caribbean countries

Kuwait

South Africa

+20

Bunkering

Adopting cleaner ship

fuels due to stricter

emission standards

Singapore

Gibraltar

Tenerife…

+8

Traditional Legacy importers with flat to declining demand

Japan

Korea

Taiwan

+12

Source: Cheniere Research

Note: Projected demand growth between 2015 and 2030.

19

Sabine Pass Liquefaction Project Corpus Christi Liquefaction Project

22.5 9.0

Trains 1 – 3: Operating

Train 4: Commissioning

Train 5: Under Construction (2H 2019)

Trains 1-2: Under Construction (2019)

Creole Trail

NGPL

Transco

Kinder Morgan LA

Corpus Christi Pipeline

Midship Pipeline

Tennessee

NGPL

Transco

KM Tejas

Cheniere Liquefaction Projects at a Glance

Liquefaction Technology

EPC Contractor

Financial Partner

Investment Grade SPA

Counterparties

Maintenance Contract Servicer

Total Nominal Mtpa Under

Construction or Operating

Firm Pipeline Capacity

Project Completion

20

7 Trains utilizing Corporate Debt Capacity CCH T3 Utilizing Corporate Debt Capacity

CCH

Debt Amortization Start at CCH Mid 2020s Late 2020s

Migrated Debt to CEI ($bn) ~$2.0 - $2.5 ~$2.3 - $3.3

Debt at CCH(2) ~$6.5 - $7.5 ~$7.5 - $9.0

Debt at CEI(3) ~$2.6 - $3.1 ~$2.9 - $3.9

7 Trains 8 Trains

($bn, except per share amounts or unless otherwise noted)

SPL T1-5,

CCH T1-2

SPL T-5,

CCH T1-3

CEI Consolidated Adjusted EBITDA $3.8 - $4.1 $0.4 - $0.6 $4.2 - $4.7

Less: CQP/CQH Minority Interest ($0.9) - ($0.9) $0.0 ($0.9) - ($0.9)

Less: CQP/SPL Interest Expense ($0.9) $0.0 ($0.9)

Less: CEI Interest Expense / Other ($0.0) $0.0 ($0.0)

Less: CCH Interest Expense ($0.5) ($0.1) ($0.7)

CEI Distributable Cash Flow $1.5 - $1.7 $0.3 - $0.5 $1.8 - $2.2

CEI Distributable Cash Flow per Share $5.40 - $6.30 $1.00 - $1.70 $6.40 - $8.00

CCH T3 (1)

Run Rate Guidance: Impact of Additional Train at CCH

Additional Run-Rate Distributable Cash Flow

Run rate start date assumed to be first full year of operations for all trains (early 2020s)

Additional Debt Capacity

Note: For CCH T3, range driven by % of train contracted, SPA price and production. CMI margin at $2.50/MMBtu, before 80/20 profit-sharing tariff with CCH. Run rate CEI share count ~273MM shares. Adjusted

EBITDA, Distributable Cash Flow and Distributable Cash Flow per Share are non-GAAP measures. Definitions of these non-GAAP measures are included in the appendix. We have not made any forecast

of net income on a run-rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and net income.

Interest expense as shown above is cash interest expense for each entity on a deconsolidated basis.

(1) Assumes 60/40 debt/equity funding.

(2) Includes projected future bonds to term out remaining CCH credit facility.

(3) Assumes EIG Notes and RRJ Notes are converted into LNG equity during debt migration time period. See Forecasting Points slide in appendix for conversion assumptions.

21

($bn)

7 Trains without utilizing

Corporate Debt Capacity

7 Trains utilizing

Corporate Debt Capacity

SPL

Debt Amortization Start at SPL (1.5x DSCR) Early 2020s Mid-Late 2020s

Migrated Debt to CQP (5.0x debt / EBITDA) – ~$3.0 - $4.0

Debt at SPL (project) $13.7 ~$9.7 - $10.7

Debt at CQP (corporate) $2.8 ~$5.8 - $6.8

CCH

Debt Amortization Start at CCH (1.4x DSCR) Early 2020s Mid 2020s

Migrated Debt to CEI (5.0x debt / EBITDA) – ~$2.0 - $2.5

Debt at CCH(1) (project) ~$9.0 - $9.5 ~$6.5 - $7.5

Debt at CEI(2) (corporate) $0.5 ~$2.6 - $3.1

Summary Projected Amortization Requirements at Project Levels

Debt migration from the projects to corporates provides runway before amortization must commence at

project levels; expansion trains can further defer amortization requirements

Current plan until FID is

reached on expansion trains

Note: Amortization does not include CQP credit facility amortization.

(1) Includes projected future bonds to term out remaining CCH credit facility.

(2) Assumes EIG Notes and RRJ Notes are converted into LNG equity during debt migration time period. See Forecasting Points slide in appendix for conversion assumptions.

22

Forecasting Points

EIG Notes Conversion

CCH Holdco II Notes (EIG Notes) convert into ~20mm LNG shares in 2020 at estimated $94 / share

(ultimate principal balance of ~$1.7B)

• Conversion at a 10% discount to LNG’s share price

• Only 50% of the EIG Notes can be converted at initial conversion and subsequent conversions cannot occur for 90

days after conversion date

RRJ Notes Conversion

CEI Convertible Unsecured Notes (RRJ Notes) convert into ~15mm LNG shares in 2020 at estimated $94 /

share (ultimate principal balance of ~$1.4B)

As of December 31, 2016, CEI’s and CQH’s federal NOL carryforwards are equal to $3.8 billion and $1.7

billion, respectively

CQH tax sharing payments to CEI occur prior to CEI-level taxes

• CQH’s NOL will be exhausted before CEI’s NOL which causes incremental free cash flow to CEI

Class B Conversion

• CQP Class B units owned by Blackstone convert to ~200mm common units in 3Q 2017

• CQP Class B units owned by CEI/CQH convert to ~90mm common units in 3Q 2017

General Assumptions

CEI Cash Tax Payments Begin Late 2020s

CQH Tax Sharing Payments Begin Early 2020s

2020 - 2040 Tax Rate Percentage of Pre-Tax Cash Flow

CEI High Teens

CQH Mid 20%s

23

Insurance Summary

Property and Business Interruption – SPLNG, SPL and CTPL

• Assets Under Construction

• Trains 4 and 5 are insured by Bechtel until transfer of care, custody and control to Sabine

• Assets in Operation

• SPLNG, CTPL and SPL Trains 1-3 are insured under a Cheniere program

• $3.5B limit for combined physical damage and business interruption coverage

• Limit exceeds estimated probable maximum loss for an event at the site

• Covers all perils including terrorism and damage resulting from a cyber event

Property and Business Interruption - Corpus Christi

• Assets Under Construction

• CCL assets insured by Bechtel during construction period

• Construction All Risks (“CAR”) policy insures against physical damage from all perils (subject to sublimits for certain perils)

• Delay in Start-Up (“DSU”) triggered by physical damage

Credit Facility and Indenture Insurance Requirements

• SPL and CCH Facilities require robust insurance programs for each Borrower

• Must insure property in an amount sufficient to cover a probable maximum loss and carry minimum third party liability limits

established by Insurance Consultant to the lenders (at least $100MM)

• Must report to lenders at each renewal and commencement of operations of each train

• Insurance consultant or placing broker must certify that coverage complies with credit facility requirements and is in full

force and effect

• SPL and CCH Indentures require that each insure property with financially sound insurers and in an amount

sufficient to cover a probable maximum loss

• Across all programs (property, CAR, casualty, executive), Cheniere is insured by 65 providers

24

Reconciliation to Non-GAAP Measures

Regulation G Reconciliations

In addition to disclosing financial results in accordance with U.S. GAAP, the accompanying presentation contains non-

GAAP financial measures. Consolidated Adjusted EBITDA, Distributable Cash Flow and Distributable Cash Flow per

Share are non-GAAP financial measures that we use to facilitate comparisons of operating performance across

periods. These non-GAAP measures should be viewed as a supplement to and not a substitute for our U.S. GAAP

measures of performance and the financial results calculated in accordance with U.S. GAAP and reconciliations from

these results should be carefully evaluated.

Consolidated Adjusted EBITDA represents net loss attributable to Cheniere before net income (loss) attributable to the

non-controlling interest, interest, taxes, depreciation and amortization, adjusted for certain non-cash items, other non-

operating income or expense items, and other items not otherwise predictive or indicative of ongoing operating

performance, as detailed in the following reconciliation. Consolidated Adjusted EBITDA is not intended to represent

cash flows from operations or net income (loss) as defined by U.S. GAAP and is not necessarily comparable to

similarly titled measures reported by other companies.

We believe Consolidated Adjusted EBITDA provides relevant and useful information to management, investors and

other users of our financial information in evaluating the effectiveness of our operating performance in a manner that is

consistent with management’s evaluation of business performance. We believe Consolidated Adjusted EBITDA is

widely used by investors to measure a company’s operating performance without regard to items such as interest

expense, taxes, depreciation and amortization which vary substantially from company to company depending on

capital structure, the method by which assets were acquired and depreciation policies. Further, the exclusion of

certain non-cash items, other non-operating income or expense items, and items not otherwise predictive or indicative

of ongoing operating performance enables comparability to prior period performance and trend analysis.

Consolidated Adjusted EBITDA is calculated by taking net loss attributable to common stockholders before net

income (loss) attributable to non-controlling interest, interest expense, net of capitalized interest, changes in the fair

value and settlement of our interest rate derivatives, taxes, depreciation and amortization, and adjusting for the effects

of certain non-cash items, other non-operating income or expense items, and other items not otherwise predictive or

indicative of ongoing operating performance, including the effects of modification or extinguishment of debt,

impairment expense, changes in the fair value of our commodity and foreign currency exchange (“FX”) derivatives and

non-cash compensation expense. We believe the exclusion of these items enables investors and other users of our

financial information to assess our sequential and year-over-year performance and operating trends on a more

comparable basis and is consistent with management’s own evaluation of performance.

Distributable Cash Flow is defined as cash received, or expected to be received, from its ownership and interests in

CQP, CQH and Cheniere Corpus Christi Holdings, LLC, cash received (used) by its integrated marketing function

(other than cash for capital expenditures) less interest, taxes and maintenance capital expenditures associated with

Cheniere and not the underlying entities. Management uses this measure and believes it provides users of our

financial statements a useful measure reflective of our business’s ability to generate cash earnings to supplement the

comparable GAAP measure.

Distributable Cash Flow per Share is calculated by dividing Distributable Cash Flow by the weighted average number

of common shares outstanding.

We believe Distributable Cash Flow is a useful performance measure for management, investors and other users of

our financial information to evaluate our performance and to measure and estimate the ability of our assets to

generate cash earnings after servicing our debt, paying cash taxes and expending sustaining capital, that could be

used for discretionary purposes such as common stock dividends, stock repurchases, retirement of debt, or expansion

capital expenditures. Management uses this measure and believes it provides users of our financial statements a

useful measure reflective of our business’s ability to generate cash earnings to supplement the comparable GAAP

measure.

Distributable Cash Flow is not intended to represent cash flows from operations or net income (loss) as defined by

U.S. GAAP and is not necessarily comparable to similarly titled measures reported by other companies.

Non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or in lieu of an

analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. Note: Totals may not sum due to rounding

Consolidated Adjusted EBITDA

The following table reconciles our Consolidated Adjusted EBITDA to U.S. GAAP results for the three and six months

ended June 30, 2017 and 2016, and the trailing twelve months ended June 30, 2017 (in millions):

Three Months Ended Six Months Ended

Trailing 12

Months

June 30, June 30, June 30,

2017 2016 2017 2016 2017

Net loss attributable to common stockholders $ (285 ) $ (298 ) $ (231 ) $ (619 ) $ (222 )

Net income (loss) attributable to non-controlling

interest 306

(37 ) 424

(65 ) 434

Income tax provision (benefit) 1 (1 ) 1 — 3

Interest expense, net of capitalized interest 188 106 353 182 660

Loss on early extinguishment of debt 33 56 75 57 153

Derivative loss, net 36 91 35 272 (227 )

Other expense (income) (5 ) 7 (7 ) 6 (13 )

Income (loss) from operations $ 274 $ (76 ) $ 650 $ (167 ) $ 788

Adjustments to reconcile income (loss) from

operations to Consolidated Adjusted EBITDA:

Depreciation and amortization expense 90 33 160 57 277

Loss (gain) from changes in fair value of

commodity and FX derivatives, net (5 ) 25

28

26

(35 )

Total non-cash compensation expense 7 14 11 26 20

Impairment expense and loss on sale of assets 5 — 5 10 6

Consolidated Adjusted EBITDA $ 371 $ (4 ) $ 854 $ (48 ) $ 1,056

Distributable Cash Flow

The following table reconciles our forecast Consolidated Adjusted EBITDA and Distributable Cash Flow to forecast

Net loss attributable to common stockholders for 2017 (in billions, except per share data):

2017

Net loss attributable to common stockholders $ (0.6 ) - $ (0.4 )

Net income (loss) attributable to non-controlling interest 0.9 - 0.9

Income tax provision (benefit) (0.0 )

Interest expense, net of capitalized interest 0.8

Loss on early extinguishment of debt 0.1

Derivative loss, net 0.0

Other expense (income) 0.0

Income (loss) from operations $ 1.2 - $ 1.4

Adjustments to reconcile income (loss) from operations to Consolidated Adjusted EBITDA:

Depreciation and amortization expense 0.4

Loss (gain) from changes in fair value of commodity and FX derivatives, net 0.0

Total non-cash compensation expense 0.0

Impairment expense and loss on sale of assets 0.0

Consolidated Adjusted EBITDA $ 1.6 - $ 1.8

CQP/CQH minority interest (0.3 ) - (0.4 )

SPL and CQP cash retained / interest expense / other (0.7 ) - (0.7 )

CQP interest expense (0.1 )

CEI interest expense (0.0 )

CEI Distributable Cash Flow $ 0.5 - $ 0.7

Weighted average number of shares outstanding (in millions) 238

CEI Distributable Cash Flow per Share $ 2.10 $ 2.80

25

CHENIERE ENERGY, INC.

INVESTOR RELATIONS CONTACTS

Randy Bhatia

Vice President, Investor Relations – (713) 375-5479, randy.bhatia@cheniere.com

Megan Light

Manager, Investor Relations – (713) 375-5492, megan.light@cheniere.com