Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TELEFLEX INC | a9-5x20178xkreprojectnaple.htm |

| EX-99.1 - EXHIBIT 99.1 - TELEFLEX INC | ex991to9-5x20178xkxproject.htm |

1

Teleflex Incorporated

Acquisition of NeoTract, Inc. Conference Call

September 5, 2017

2

This presentation and our discussion contain forward-looking information and statements. These forward

looking statements are subject to risks and uncertainties that may cause actual results to differ materially from

those projected or implied in the forward-looking statements, including, but not limited to, the possibility that the

acquisition does not close; unanticipated costs and length of time required to comply with legal requirements

and regulatory approvals applicable to the transaction; unanticipated difficulties and expenditures in connection

with integration programs; customer and shareholder reaction to the transaction; risks associated with the

financing of the transaction; disruption from the transaction making it more difficult to maintain business and

operational relationships; significant transaction costs; unknown liabilities; the risk of regulatory actions related

to the proposed acquisition; changes in general and international economic conditions, including fluctuations in

foreign currency exchange rates; and other factors described or incorporated in our filings with the Securities

and Exchange Commission (“SEC”), including our Annual Report on Form 10-K for the year ended December 31,

2016.

Forward Looking Statements

3

Agenda

1. Strategic Rationale

2. Transaction Overview

3. NeoTract, Inc. Overview

4. Financial Summary

5. Transaction Summary

4

Strategic Rationale

Highly strategic and complementary acquisition

− Significantly advances Teleflex’s offering of urological solutions

− Single-product company with growth profile better than Vidacare

− Expands Teleflex’s product portfolio into benign prostatic hyperplasia (“BPH”) market estimated

to have a total addressable market size of > $30 billion

Accelerates Teleflex’s sales growth trajectory and provides opportunity to capitalize on

existing sales channel

− NeoTract has experienced significant revenue growth since initiating product commercialization

2015 revenue of approximately $18 million

2016 revenue of approximately $51 million

2017 revenue estimated to be between $115 to $120 million

2018 revenue expected to grow at least 40% over 2017 levels

− Positions Teleflex to expand upon its current presence within the urological call-point

− Ability to capitalize on Teleflex’s existing international infrastructure to drive further O.U.S.

penetration of NeoTract’s UroLift® System

5

Strategic Rationale

Strong clinical data and intellectual property and established reimbursement

− Since receipt of CE Mark in 2010 and de novo 510(k) in 2013, NeoTract’s UroLift® System has been

the subject of a significant number of studies, including:

9 studies, including two randomized studies

23 peer-reviewed publications, including multiple meta-analyses

Over 1,000 patient years published with 5-year follow-up data

− Intellectual property:

62 issued and 30 pending patents

− UroLift® System has broad, sustainable reimbursement in place, including:

Dedicated category 1 CPT codes specific to the UroLift® System procedure prostatic urethral lift

100% covered by Medicare Administrative Contractors, which translates to approximately 174

million covered lives in the United States

Compelling financial profile that substantially improves Teleflex’s revenue growth, margins,

earnings and cash flow generation capabilities

− Expected to be slightly dilutive to adjusted earnings per share1 in 2017, breakeven to adjusted

earnings per share1 in 2018, with significant accretion thereafter including $0.35 to $0.40 of adjusted

earnings per share1 accretion in 2019

1 - Adjusted earnings per share excludes specified items such as amortization of acquired intangibles, inventory step-up, restructuring costs and other costs incurred to execute the

transaction. Adjusted earnings per share is a non-GAAP financial measure and should not be considered a replacement for GAAP results.

6

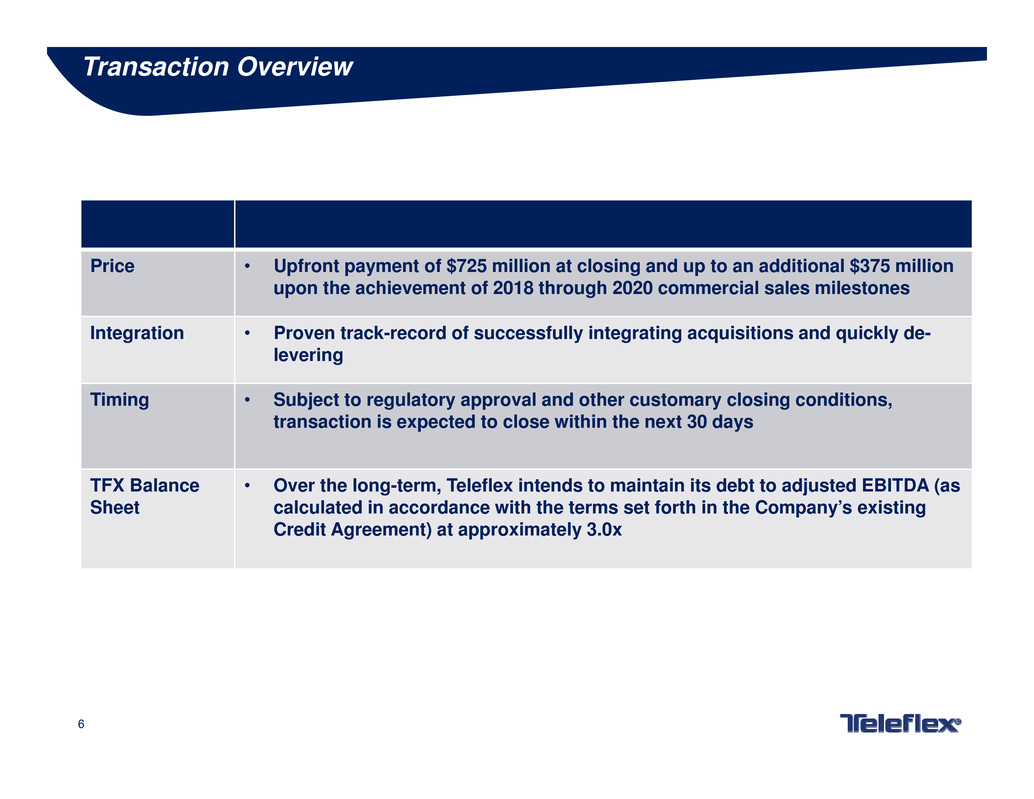

Price • Upfront payment of $725 million at closing and up to an additional $375 million

upon the achievement of 2018 through 2020 commercial sales milestones

Integration • Proven track-record of successfully integrating acquisitions and quickly de-

levering

Timing • Subject to regulatory approval and other customary closing conditions,

transaction is expected to close within the next 30 days

TFX Balance

Sheet

• Over the long-term, Teleflex intends to maintain its debt to adjusted EBITDA (as

calculated in accordance with the terms set forth in the Company’s existing

Credit Agreement) at approximately 3.0x

Transaction Overview

7

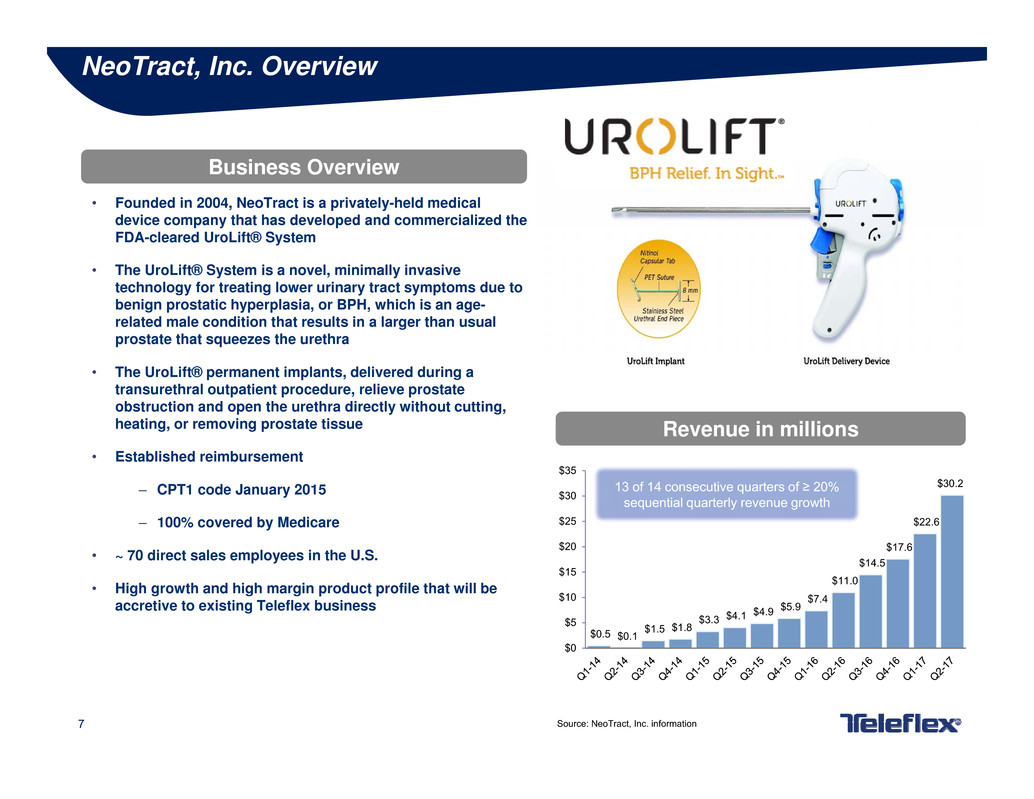

NeoTract, Inc. Overview

• Founded in 2004, NeoTract is a privately-held medical

device company that has developed and commercialized the

FDA-cleared UroLift® System

• The UroLift® System is a novel, minimally invasive

technology for treating lower urinary tract symptoms due to

benign prostatic hyperplasia, or BPH, which is an age-

related male condition that results in a larger than usual

prostate that squeezes the urethra

• The UroLift® permanent implants, delivered during a

transurethral outpatient procedure, relieve prostate

obstruction and open the urethra directly without cutting,

heating, or removing prostate tissue

• Established reimbursement

– CPT1 code January 2015

– 100% covered by Medicare

• ~ 70 direct sales employees in the U.S.

• High growth and high margin product profile that will be

accretive to existing Teleflex business

Business Overview

Revenue in millions

Source: NeoTract, Inc. information

$0.5 $0.1

$1.5 $1.8

$3.3 $4.1

$4.9 $5.9

$7.4

$11.0

$14.5

$17.6

$22.6

$30.2

$0

$5

$10

$15

$20

$25

$30

$35

13 of 14 consecutive quarters of ≥ 20%

sequential quarterly revenue growth

8

9

10 1. Estimates based on IMS data

2. IMS Health NDTI Urology Specialty Profile, July 2012-June 2013

• ~12,000 urologists in the U.S.1

• ~47% of all BPH patients are

in the care of a urologist1

• Initial focus on ~5,400

urologists seeing 80% of BPH

patients in the care of a

urologist1

0 50 100 150 200 250 300 350 400

Specific Exam, Other

Urinary Tract Infection

Abnormal Blood Chemistry

Kidney Stones

Hematuria

Bladder Function Disorder

Annual Visits per Urologist

Surgery Follow Up

Prostate Cancer

Penis Disorder, Other

BPH

Top 10 Reasons for Visits to Urologists2

BPH is the Number One Reason Men Visit a Urologist

11 1. NeoTract internal market estimates for 2017 and IMS Health data

>$30B Market Opportunity for UroLift® in the U.S.

66% UroLift® patients are coming from

the Watchful Waiting, Drug and Drug Drop Out categories

12.0 Million U.S. Men Treated for BPH1

#Men (Millions)

Drugs

Watchful Waiting

Surgery

Drug Drop Out

3.2

1.5

7.0

8.5 Million

Men On Drugs or Drug Drop Out

UroLift® Target Market

0.3

12

The UroLift ® System

Apply Lidocaine

Jelly/Oral Sedative

Insert Delivery System

Gently Push

Tissue Aside

Deploy Customized Implants

(4-6 Avg)

Relieve

Obstruction

Typically Same Day

Discharge

Stainless Steel

Urethral End Piece

Nitinol

Capsular Tab

PET Suture

Simple, Straightforward Procedure

13

Financial Summary

1. Subsequent to issuing Q2’17 financial results and prior to entering into the agreement to acquire

NeoTract, Teleflex used $475 million of cash on the balance sheet to reduce its outstanding borrowings

under its revolving credit facility, reducing Q2’17 LTM pro-forma gross leverage to approximately 2.5x

2. Prudent use of existing balance sheet capacity

− Intend to finance the transaction at closing through borrowing against our revolving credit facility

− Following the consummation of the transaction, Teleflex may seek to opportunistically term-out

revolving credit facility borrowings through a note offering

3. Similar to the acquisitions of Vidacare and Vascular Solutions, NeoTract accelerates Teleflex’s top-line

growth profile with high-margin, differentiated product offering

4. Transaction is expected to be slightly dilutive to adjusted earnings per share1 in 2017, breakeven to

adjusted earnings per share1 in 2018, with significant accretion thereafter including $0.35 to $0.40 of

adjusted earnings per share1 accretion in 2019

5. Acquisition is expected to generate a return on invested capital that meets the Company’s cost of capital

in the third year after closing and exceeds the Company’s cost of capital in the fourth year after closing

1 - Adjusted earnings per share excludes specified items such as amortization of acquired intangibles, inventory step-up, restructuring costs and other costs incurred to execute the

transaction. Adjusted earnings per share is a non-GAAP financial measure and should not be considered a replacement for GAAP results.

14

Transaction Summary

1. Highly strategic, complementary and accretive acquisition

2. Accelerates Teleflex’s sales growth trajectory and provides significant sales channel

opportunity

3. NeoTract’s UroLift® System has strong clinical data and intellectual property, as well

as established reimbursement

4. Compelling financial profile that substantially improves Teleflex’s revenue growth,

margins, earnings and cash flow generation capabilities

5. Leverages Teleflex’s O.U.S. channel capabilities

6. Creates shareholder value for Teleflex shareholders

15

Q&A