Attached files

| file | filename |

|---|---|

| 8-K - 8-K - C&J Energy Services, Inc. | d443394d8k.htm |

1 Exhibit 99.1

Important Disclaimer This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “plan,” “estimate,” “project,” “forecast,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “potential,” “would,” “may,” “probable,” “likely,” and similar expressions that convey the uncertainty of future events or outcomes, and the negative thereof, are intended to identify forward-looking statements. Forward-looking statements, which are not generally historical in nature, include those that express a belief, expectation or intention regarding our future activities, plans and goals and our current expectations with respect to, among other things: Our outlook on the market for our services and products; general business and economic conditions; crude oil and natural gas commodity prices; demand for services in our industry; our plans to deploy our fleets; our maintenance backlog, expected recovery and future prices and utilization; our outlook with respect to industry growth and market demand; our business strategy and future activity; pricing pressure and competitive factors; our ability to obtain or renew customer contracts; the market price and availability of materials or equipment; technological developments; financial strategy, liquidity, capital required for our ongoing operations and acquisitions and our ability to raise additional capital; our ability to obtain permits, approvals and authorizations from governmental and third parties, and the effects of governmental regulation; dividends; future financial and operating results; and plans, objectives, expectations and intentions. Forward-looking statements are not assurances of future performance and actual results could differ materially from our historical experience and our present expectations or projections. These forward-looking statements are based on our current expectations and beliefs, forecasts for our existing operations, experience, expectations and perception of historical trends, current conditions, anticipated future developments and their effect on us, and other factors believed to be appropriate. Although we believe the expectations and assumptions reflected in these forward-looking statements are reasonable as and when made, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all). Our forward-looking statements involve significant risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Known material factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, risks associated with the following: a decline in demand for our services, including due to declining commodity prices, overcapacity and other competitive factors affecting our industry; the cyclical nature and volatility of the oil and gas industry, which impacts the level of exploration, production and development activity and spending patterns by exploration and production companies; a decline in, or substantial volatility of, crude oil and gas commodity prices, which generally leads to decreased spending by our customers and negatively impacts drilling, completion and production activity; pressure on pricing for our core services, including due to competition and industry and/or economic conditions, which may impact, among other things, our ability to implement price increases or maintain pricing on our core services; the loss of, or interruption or delay in operations by, one or more significant customers; the failure to pay amounts when due, or at all, by one or more significant customers; changes in customer requirements in markets we serve; costs, delays, regulatory compliance requirements and other difficulties in executing our long-term growth strategy; the effects of future acquisitions on our business, including our ability to successfully integrate our operations and the costs incurred in doing so; business growth outpacing the capabilities of our infrastructure; adverse weather conditions in oil or gas producing regions; the effect of environmental and other governmental regulations on our operations, including the risk that future changes in the regulation of hydraulic fracturing could reduce or eliminate demand for our hydraulic fracturing services; the incurrence of significant costs and liabilities resulting from litigation; the incurrence of significant costs and liabilities resulting from our failure to comply, or our compliance with, new or existing environmental regulations or an accidental release of hazardous substances into the environment; the loss of, or inability to attract, key management personnel; a shortage of qualified workers; the loss of, or interruption or delay in operations by, one or more of our key suppliers; operating hazards inherent in our industry, including the significant possibility of accidents resulting in personal injury or death, property damage or environmental damage; accidental damage to or malfunction of equipment; uncertainty regarding our ability to improve our operating structure, financial results and profitability and to maintain relationships with suppliers, customers, employees and other third parties following emergence from bankruptcy and other risks and uncertainties related to our emergence from bankruptcy; our ability to maintain sufficient liquidity and/or obtain adequate financing to allow us to execute our business plan; and our ability to comply with covenants under our amended credit facility. For additional information regarding known material factors that could affect our operating results and performance, please see our most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, and recent Current Reports on Form 8-K, which are available at the SEC’s website, http://www.sec.gov. Should one or more of these known material risks occur, or should the underlying assumptions change or prove incorrect, our actual results, performance, achievements or plans could differ materially from those expressed or implied in any forward-looking statement. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. All subsequent written or oral forward-looking statements concerning us are expressly qualified in their entirety by the cautionary statements above. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except as required by law. All information in this presentation is as of August 31, 2017 unless otherwise indicated. Non-GAAP Financial Measures: This presentation includes Adjusted EBITDA, a measure not calculated in accordance with generally accepted accounting principles in the U.S. ("U.S. GAAP"). Please see slide 16 for a reconciliation of net income (loss), the nearest measure calculated in accordance with U.S. GAAP, or pro forma net income (loss) prepared and presented in accordance with Article 11 of Regulation S-X, to Adjusted EBITDA. 2

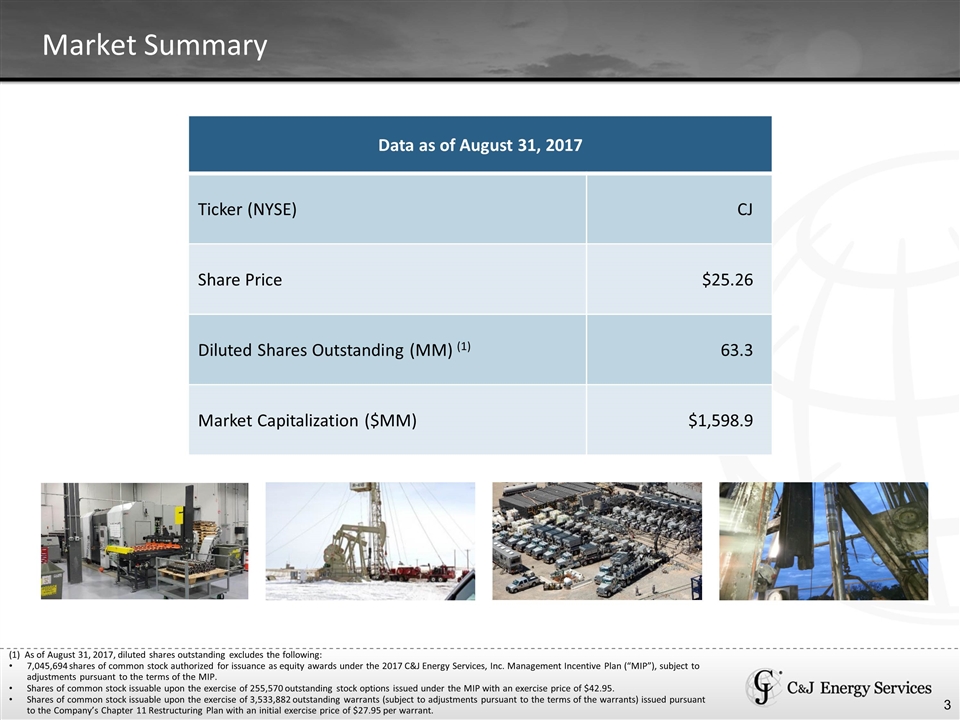

Market Summary 3 Data as of August 31, 2017 Ticker (NYSE) CJ Share Price $25.26 Diluted Shares Outstanding (MM) (1) 63.3 Market Capitalization ($MM) $1,598.9 (1) As of August 31, 2017, diluted shares outstanding excludes the following: 7,045,694 shares of common stock authorized for issuance as equity awards under the 2017 C&J Energy Services, Inc. Management Incentive Plan (“MIP”), subject to adjustments pursuant to the terms of the MIP. Shares of common stock issuable upon the exercise of 255,570 outstanding stock options issued under the MIP with an exercise price of $42.95. Shares of common stock issuable upon the exercise of 3,533,882 outstanding warrants (subject to adjustments pursuant to the terms of the warrants) issued pursuant to the Company’s Chapter 11 Restructuring Plan with an initial exercise price of $27.95 per warrant.

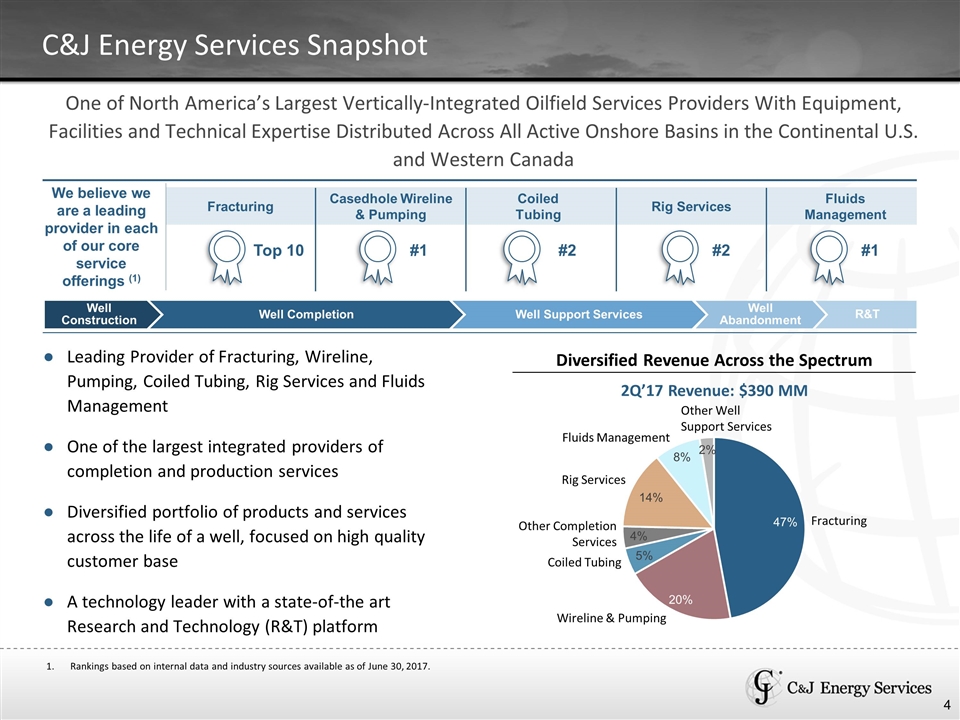

C&J Energy Services Snapshot One of North America’s Largest Vertically-Integrated Oilfield Services Providers With Equipment, Facilities and Technical Expertise Distributed Across All Active Onshore Basins in the Continental U.S. and Western Canada Key Differentiators We believe we are a leading provider in each of our core service offerings (1) Fracturing Casedhole Wireline & Pumping Coiled Tubing Rig Services Fluids Management Top 10 #1 #2 #2 #1 Well Construction Well Completion Well Support Services Well Abandonment Leading Provider of Fracturing, Wireline, Pumping, Coiled Tubing, Rig Services and Fluids Management One of the largest integrated providers of completion and production services Diversified portfolio of products and services across the life of a well, focused on high quality customer base A technology leader with a state-of-the art Research and Technology (R&T) platform Diversified Revenue Across the Spectrum Fracturing Other Well Support Services Coiled Tubing Fluids Management Wireline & Pumping Other Completion Services Rig Services 2Q’17 Revenue: $390 MM Rankings based on internal data and industry sources available as of June 30, 2017. R&T 7

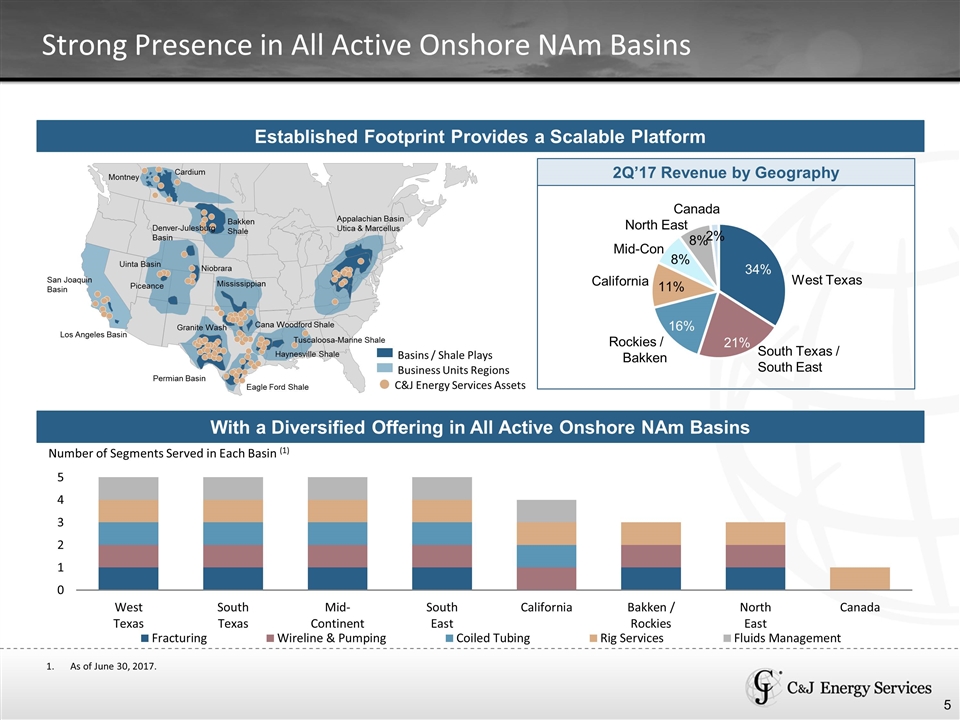

Strong Presence in All Active Onshore NAm Basins Tuscaloosa-Marine Shale Haynesville Shale Eagle Ford Shale Cana Woodford Shale Permian Basin Granite Wash Mississippian Niobrara Los Angeles Basin San Joaquin Basin Piceance Uinta Basin Denver-Julesburg Basin Bakken Shale Cardium Montney Appalachian Basin Utica & Marcellus Basins / Shale Plays Business Units Regions C&J Energy Services Assets West Texas South Texas / South East North East Rockies / Bakken California Mid-Con Canada Number of Segments Served in Each Basin (1) Established Footprint Provides a Scalable Platform With a Diversified Offering in All Active Onshore NAm Basins 2Q’17 Revenue by Geography 8 As of June 30, 2017.

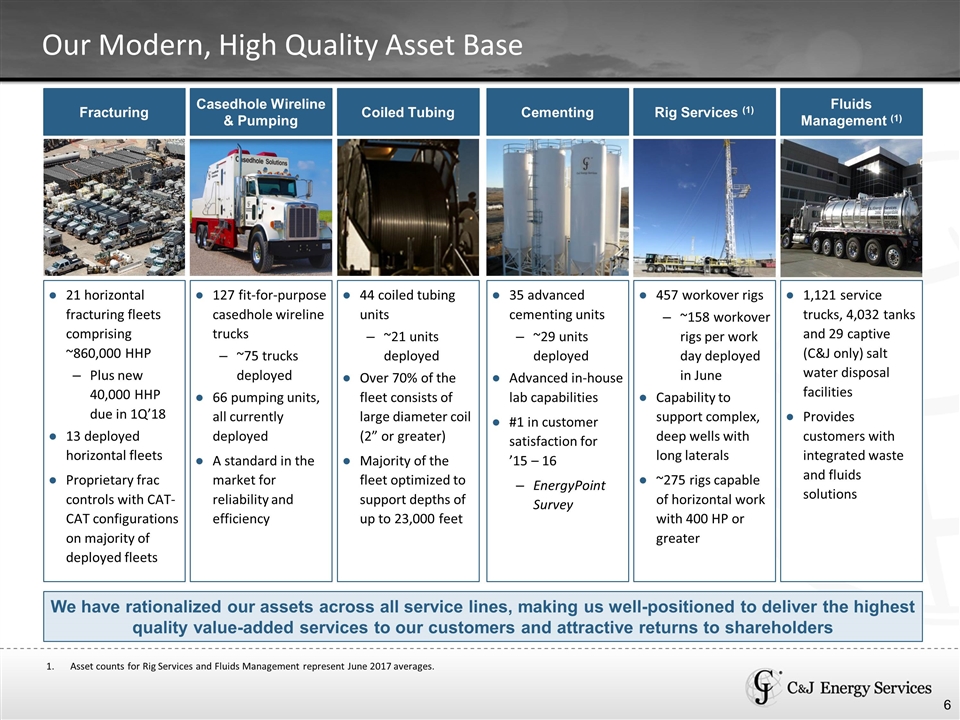

Our Modern, High Quality Asset Base We have rationalized our assets across all service lines, making us well-positioned to deliver the highest quality value-added services to our customers and attractive returns to shareholders Fracturing Casedhole Wireline & Pumping Cementing Rig Services (1) Fluids Management (1) Coiled Tubing 21 horizontal fracturing fleets comprising ~860,000 HHP Plus new 40,000 HHP due in 1Q’18 13 deployed horizontal fleets Proprietary frac controls with CAT-CAT configurations on majority of deployed fleets 127 fit-for-purpose casedhole wireline trucks ~75 trucks deployed 66 pumping units, all currently deployed A standard in the market for reliability and efficiency 35 advanced cementing units ~29 units deployed Advanced in-house lab capabilities #1 in customer satisfaction for ’15 – 16 EnergyPoint Survey 457 workover rigs ~158 workover rigs per work day deployed in June Capability to support complex, deep wells with long laterals ~275 rigs capable of horizontal work with 400 HP or greater 1,121 service trucks, 4,032 tanks and 29 captive (C&J only) salt water disposal facilities Provides customers with integrated waste and fluids solutions 44 coiled tubing units ~21 units deployed Over 70% of the fleet consists of large diameter coil (2” or greater) Majority of the fleet optimized to support depths of up to 23,000 feet 9 Asset counts for Rig Services and Fluids Management represent June 2017 averages.

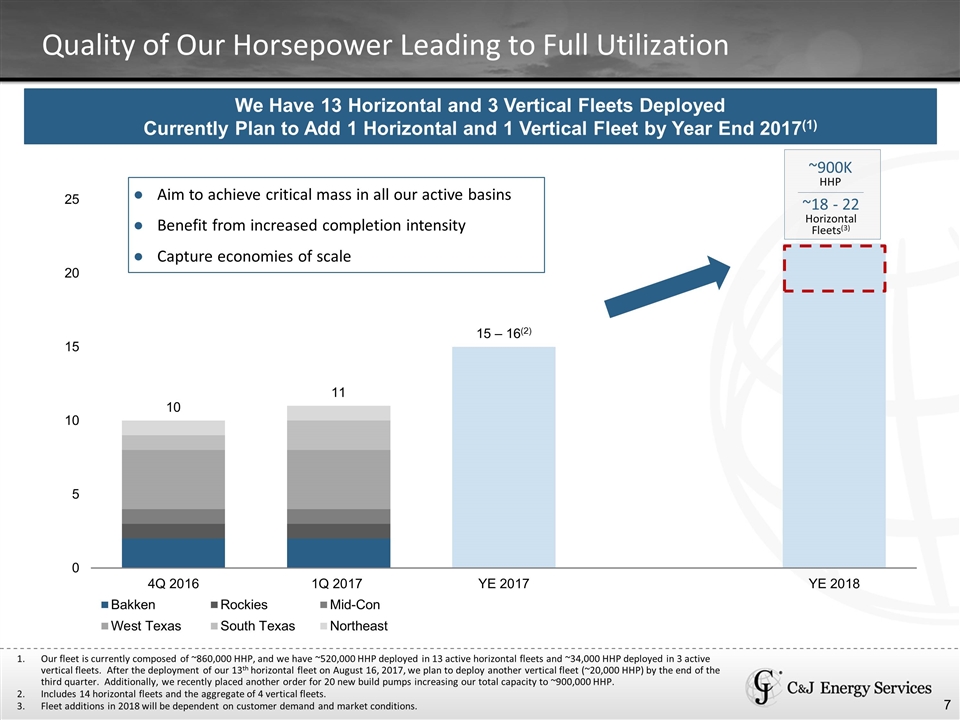

Quality of Our Horsepower Leading to Full Utilization We Have 13 Horizontal and 3 Vertical Fleets Deployed Currently Plan to Add 1 Horizontal and 1 Vertical Fleet by Year End 2017(1) 12 ~900K HHP ~18 - 22 Horizontal Fleets(3) Aim to achieve critical mass in all our active basins Benefit from increased completion intensity Capture economies of scale Our fleet is currently composed of ~860,000 HHP, and we have ~520,000 HHP deployed in 13 active horizontal fleets and ~34,000 HHP deployed in 3 active vertical fleets. After the deployment of our 13th horizontal fleet on August 16, 2017, we plan to deploy another vertical fleet (~20,000 HHP) by the end of the third quarter. Additionally, we recently placed another order for 20 new build pumps increasing our total capacity to ~900,000 HHP. Includes 14 horizontal fleets and the aggregate of 4 vertical fleets. Fleet additions in 2018 will be dependent on customer demand and market conditions.

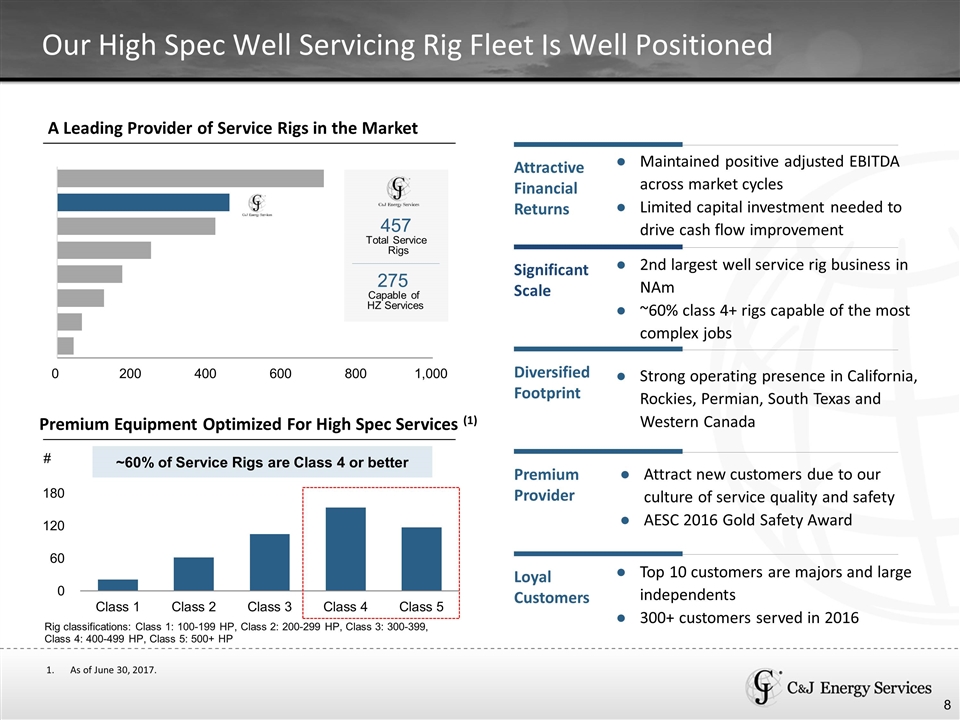

A Leading Provider of Service Rigs in the Market Rig classifications: Class 1: 100-199 HP, Class 2: 200-299 HP, Class 3: 300-399, Class 4: 400-499 HP, Class 5: 500+ HP Our High Spec Well Servicing Rig Fleet Is Well Positioned Premium Equipment Optimized For High Spec Services (1) # ~60% of Service Rigs are Class 4 or better 457 Total Service Rigs 275 Capable of HZ Services 2nd largest well service rig business in NAm ~60% class 4+ rigs capable of the most complex jobs Top 10 customers are majors and large independents 300+ customers served in 2016 Strong operating presence in California, Rockies, Permian, South Texas and Western Canada Attract new customers due to our culture of service quality and safety AESC 2016 Gold Safety Award Significant Scale Diversified Footprint Premium Provider Loyal Customers Maintained positive adjusted EBITDA across market cycles Limited capital investment needed to drive cash flow improvement Attractive Financial Returns 14 As of June 30, 2017.

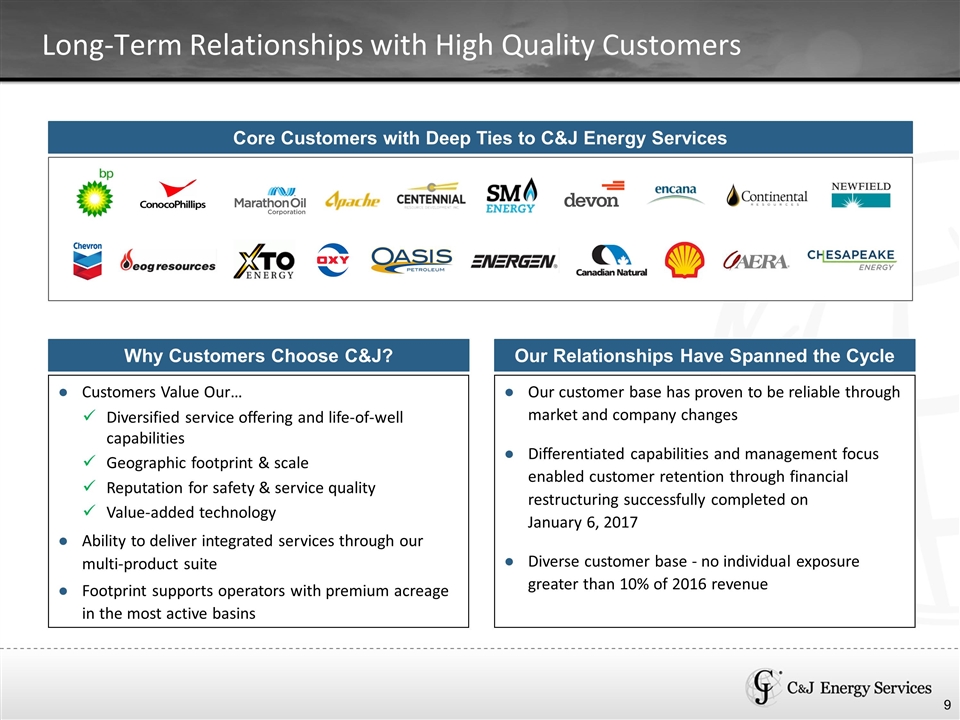

Long-Term Relationships with High Quality Customers Why Customers Choose C&J? Customers Value Our… Ability to deliver integrated services through our multi-product suite Footprint supports operators with premium acreage in the most active basins Our Relationships Have Spanned the Cycle Our customer base has proven to be reliable through market and company changes Differentiated capabilities and management focus enabled customer retention through financial restructuring successfully completed on January 6, 2017 Diverse customer base - no individual exposure greater than 10% of 2016 revenue Logos from next few pages Core Customers with Deep Ties to C&J Energy Services Diversified service offering and life-of-well capabilities Geographic footprint & scale Reputation for safety & service quality Value-added technology 15

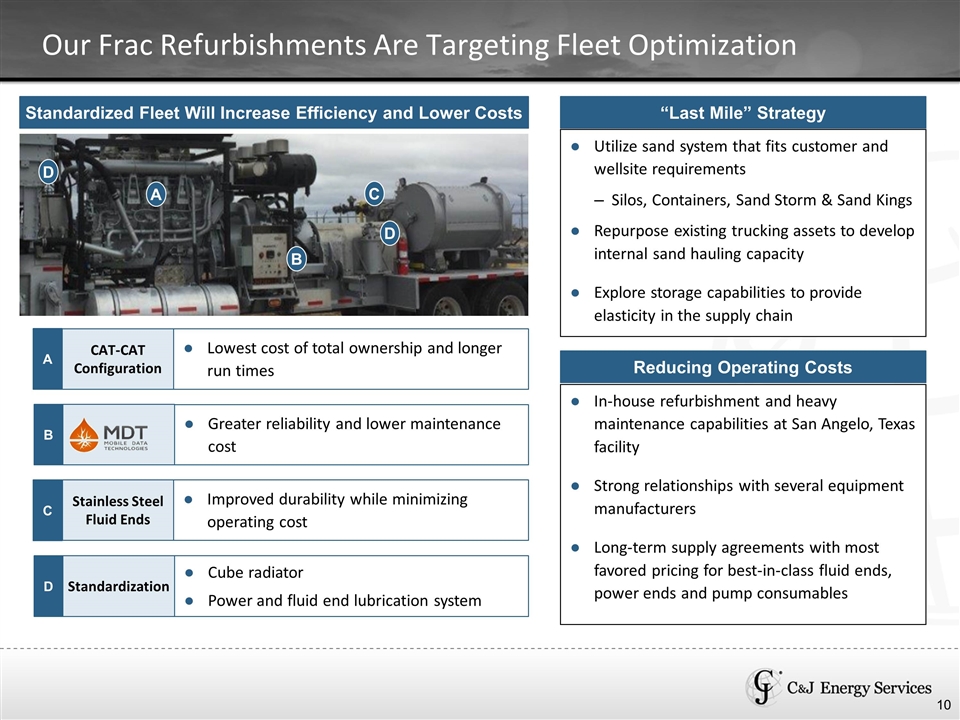

Our Frac Refurbishments Are Targeting Fleet Optimization Standardized Fleet Will Increase Efficiency and Lower Costs B C A D CAT-CAT Configuration A Lowest cost of total ownership and longer run times Standardization D Cube radiator Power and fluid end lubrication system Stainless Steel Fluid Ends C Improved durability while minimizing operating cost B Greater reliability and lower maintenance cost 17 “Last Mile” Strategy Reducing Operating Costs In-house refurbishment and heavy maintenance capabilities at San Angelo, Texas facility Strong relationships with several equipment manufacturers Long-term supply agreements with most favored pricing for best-in-class fluid ends, power ends and pump consumables Utilize sand system that fits customer and wellsite requirements Silos, Containers, Sand Storm & Sand Kings Repurpose existing trucking assets to develop internal sand hauling capacity Explore storage capabilities to provide elasticity in the supply chain D

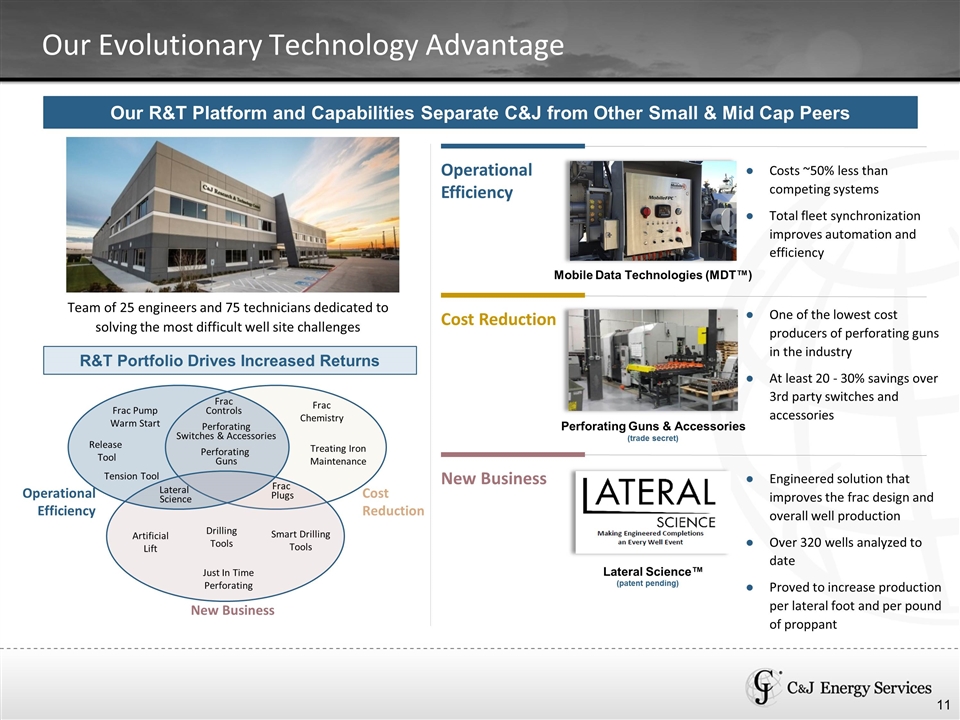

Our Evolutionary Technology Advantage Our R&T Platform and Capabilities Separate C&J from Other Small & Mid Cap Peers Team of 25 engineers and 75 technicians dedicated to solving the most difficult well site challenges R&T Portfolio Drives Increased Returns Perforating Guns Tension Tool Perforating Switches & Accessories Artificial Lift Frac Plugs Frac Controls Frac Chemistry Drilling Tools Just In Time Perforating Smart Drilling Tools Lateral Science Operational Efficiency Cost Reduction New Business Treating Iron Maintenance Frac Pump Warm Start Release Tool Operational Efficiency New Business Perforating Guns & Accessories Mobile Data Technologies (MDT™) Cost Reduction Lateral Science™ One of the lowest cost producers of perforating guns in the industry At least 20 - 30% savings over 3rd party switches and accessories Engineered solution that improves the frac design and overall well production Over 320 wells analyzed to date Proved to increase production per lateral foot and per pound of proppant Costs ~50% less than competing systems Total fleet synchronization improves automation and efficiency (trade secret) (patent pending) 19

Financial Review Section 2: 21

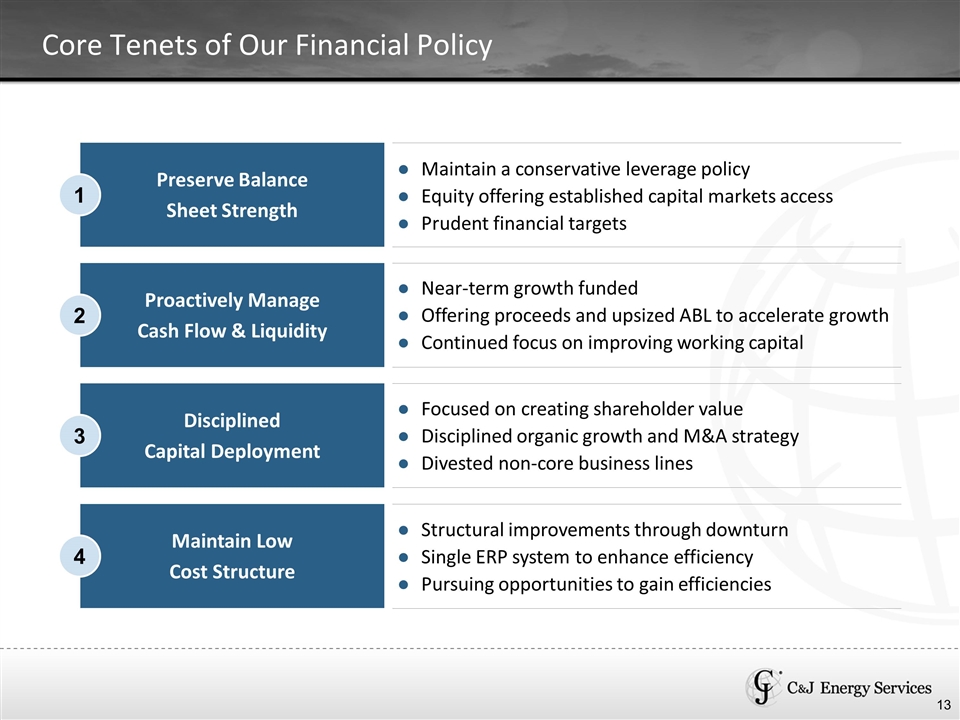

Core Tenets of Our Financial Policy Maintain a conservative leverage policy Equity offering established capital markets access Prudent financial targets Preserve Balance Sheet Strength 1 Near-term growth funded Offering proceeds and upsized ABL to accelerate growth Continued focus on improving working capital Proactively Manage Cash Flow & Liquidity 2 Focused on creating shareholder value Disciplined organic growth and M&A strategy Divested non-core business lines Disciplined Capital Deployment 3 Structural improvements through downturn Single ERP system to enhance efficiency Pursuing opportunities to gain efficiencies Maintain Low Cost Structure 4 22

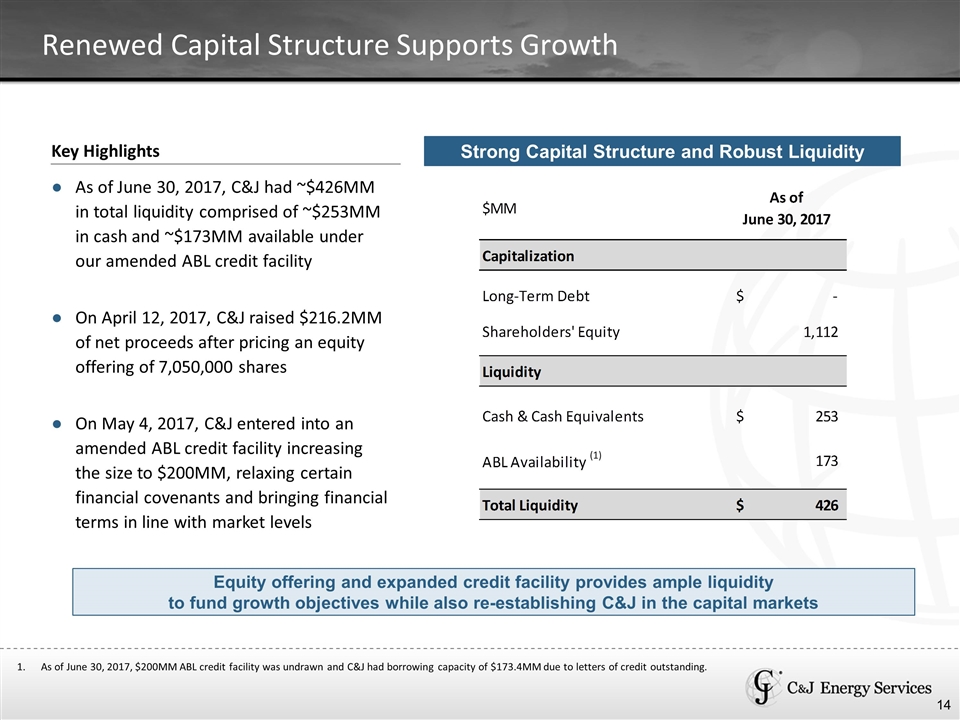

Renewed Capital Structure Supports Growth As of June 30, 2017, $200MM ABL credit facility was undrawn and C&J had borrowing capacity of $173.4MM due to letters of credit outstanding. Key Highlights As of June 30, 2017, C&J had ~$426MM in total liquidity comprised of ~$253MM in cash and ~$173MM available under our amended ABL credit facility On April 12, 2017, C&J raised $216.2MM of net proceeds after pricing an equity offering of 7,050,000 shares On May 4, 2017, C&J entered into an amended ABL credit facility increasing the size to $200MM, relaxing certain financial covenants and bringing financial terms in line with market levels Strong Capital Structure and Robust Liquidity Equity offering and expanded credit facility provides ample liquidity to fund growth objectives while also re-establishing C&J in the capital markets 24 IPO Proceeds 216 $MM As of December 31, 2016 Actual As Adjusted As Further Adjusted Debt Summary Revolving Credit Facility 284.39999999999998 0 0 Five-Year Term Loans 569.25 0 0 Seven-Year Term Loans 480.15 0 0 Debtor-In-Possession Facility 25 0 0 New Credit Facility 0 0 0 Total Debt 1,358 0 0 Liquidity Offering Proceeds 0 0 216 Total Cash 64.582999999999998 175.864 391.86400000000003 ABL Availability (1) 75 65 65 Total Liquidity 139.583 240.864 456.86400000000003 $MM As of March 31, 2017 Actual Adjustments Proforma $MM As of June 30, 2017 Capitalization Capitalization Long-Term Debt $0 $0 $0 Long-Term Debt $0 Shareholders' Equity 905.96 216.2 1,122.1600000000001 Shareholders' Equity 1,112.1289999999999 Liquidity Liquidity Cash & Cash Equivalents $115 $216 $331 Cash & Cash Equivalents $252.755 ABL Availability (1) 63 89.4 152.4 ABL Availability (1) 173.4 Total Liquidity $178 $305.39999999999998 $483.4 Total Liquidity $426.15499999999997

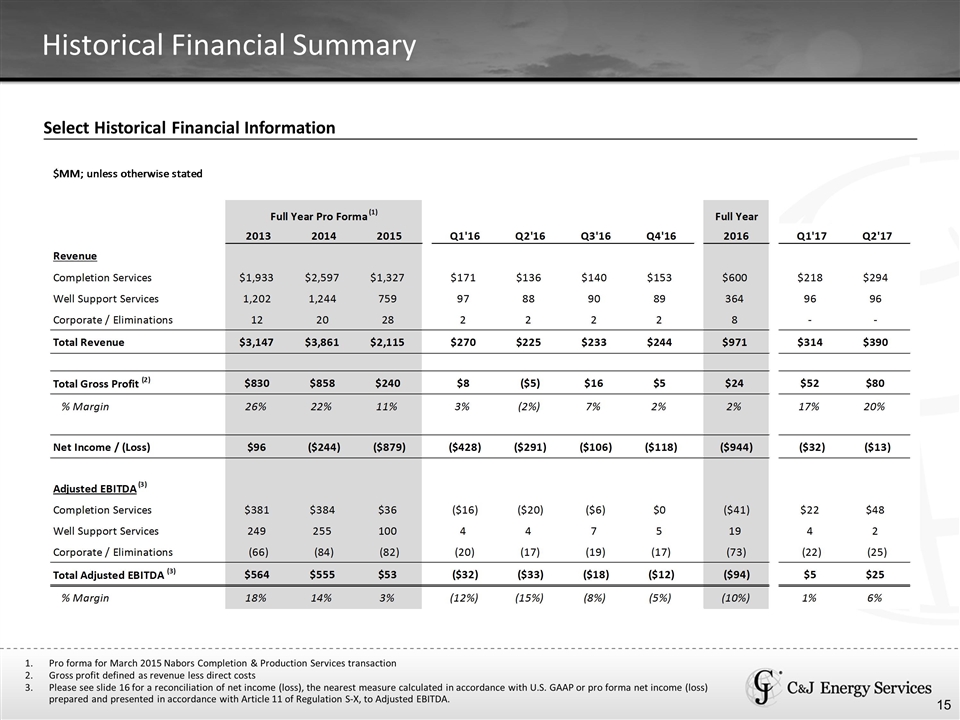

Select Historical Financial Information Historical Financial Summary Pro forma for March 2015 Nabors Completion & Production Services transaction Gross profit defined as revenue less direct costs Please see slide 16 for a reconciliation of net income (loss), the nearest measure calculated in accordance with U.S. GAAP or pro forma net income (loss) prepared and presented in accordance with Article 11 of Regulation S-X, to Adjusted EBITDA. 27 $MM; unless otherwise stated Full Year Pro Forma (1) Full Year 2013 2014 2015 Q1'16 Q2'16 Q3'16 Q4'16 2016 Q1'17 Q2'17 Revenue Completion Services $1,933 $2,597.2102642702171 $1,327.4525147212692 $170.82652248015899 $135.57920742807499 $140.19143702338698 $153.18962048338304 $599.78678741500403 $217.92784690999997 $294.14689596000011 Well Support Services 1,202 1,244.6364575 758.99199700000008 96.952209269999997 87.731653659999992 90.307253650000007 88.77661968000001 363.76773625999999 96.26639385999998 95.996097429999992 Corporate / Eliminations 12 19.555376120000002 28.225684140000002 1.8365355300000012 1.8570875800000002 2.0380250799999997 1.85548409 7.5871322800000014 0 0 Total Revenue $3,147 $3,860.8292861402169 $2,114.6701958612689 $269.61526728015895 $225.16794866807501 $232.536715753387 $243.82172425338305 $971.14165595500401 $314.19424076999996 $390.14299339000013 Total Gross Profit (2) $830 $858 $240.21864848437193 $7.8493657894470381 $-4.6025614340270407 $15.695862630024902 $4.9438364959150203 $23.886503481359917 $52.450665999999998 $79.670700371925236 % Margin 0.26374324753733713 0.22223204819754347 0.1135962709241925 #DIV/0! 2.9113209606526889E-2 -2.044057096603823E-2 6.7498427416816581E-2 2.0276439726828091E-2 2.4596312324663222E-2 0.16693707011133768 0.20420897394480109 Net Income / (Loss) $96.242999999999995 $-,244.18299999999999 $-,879.23099999999999 $-,428.41199999999998 $-,291.11599999999999 $-,106.39 $-,118.371 $-,944.28899999999999 $-32.301000000000002 $-12.720557524603878 Adjusted EBITDA (3) Completion Services $381 $383.91362275465013 $35.87813510048651 $-15.587417381828001 $-19.769047781761014 $-6.0821450211929831 $0.41965746563501621 $-41.018952719146981 $22.479417179886727 $47.719581265396123 Well Support Services 249 254.725123406797 99.771926278551405 3.8384218699999924 4.1522434799999992 6.821339219999996 4.6514792600000012 19.463483829999991 3.8236692900000002 1.9276514699999965 Corporate / Eliminations -66 -83.732395343237002 -82.471886221806997 -20.103776932796013 -17.422541982949959 -18.647053534777999 -16.641065259786981 -72.814437710310955 -21.719420749999983 -24.53702006 Total Adjusted EBITDA (3) $564 $554.90635081821006 $53.17817515723091 $-31.852772444624023 $-33.039346284710973 $-17.907859335970986 $-11.569928534151963 $-94.369906599457948 $4.5836657198867456 $25.110212675396117 % Margin 0.17921830314585319 0.14372724347337462 2.5147266586207476E-2 -0.11814157546028579 -0.14673201261612501 -7.7010889561899859E-2 -4.7452410442837843E-2 -9.7174192890177494E-2 1.4588636980275309E-2 6.4361562557385468E-2 Other Services (BRT, TES, MENA): Reported in Corp/Elims in 2016 Revenue 1.8365355300000012 1.8570875800000002 2.0380250799999997 1.85548376 $7.5871319500000016 Adjusted EBITDA -1.8846303827959996 -1.1995239229499977 -2.1478110447779994 -1.193695349785999 $-6.4256607003099955 Reported in Completion Services in 2017 Revenue 1.384164039999999 0 Adjusted EBITDA -0.83359461429497972 -1.7418201104221362 Other Services -13.05530388 -25.054586980292001 -17.474716728331007 -1.8846303827959996 -1.1995239229499977 -2.1478110447779994 -1.193695349785999 $-6.4256607003099955 Corporate -50.651680559999996 -58.677808362945008 -64.997169493475994 -18.219146550000012 -16.695018059999956 -16.499242489999997 -15.447369910000983 $-66.860777010000959 -63.706984439999999 -83.732395343237016 -82.471886221806997 -20.103776932796013 -17.894541982949953 -18.647053534777996 -16.641065259786981 $-73.286437710310949

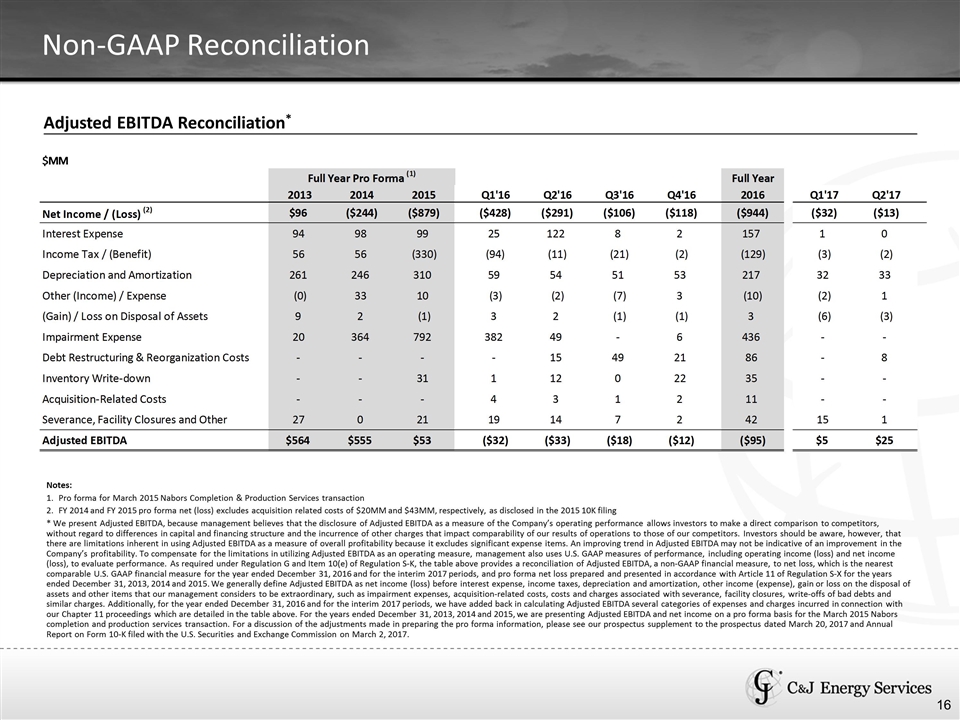

Adjusted EBITDA Reconciliation* Non-GAAP Reconciliation Notes: Pro forma for March 2015 Nabors Completion & Production Services transaction FY 2014 and FY 2015 pro forma net (loss) excludes acquisition related costs of $20MM and $43MM, respectively, as disclosed in the 2015 10K filing * We present Adjusted EBITDA, because management believes that the disclosure of Adjusted EBITDA as a measure of the Company’s operating performance allows investors to make a direct comparison to competitors, without regard to differences in capital and financing structure and the incurrence of other charges that impact comparability of our results of operations to those of our competitors. Investors should be aware, however, that there are limitations inherent in using Adjusted EBITDA as a measure of overall profitability because it excludes significant expense items. An improving trend in Adjusted EBITDA may not be indicative of an improvement in the Company’s profitability. To compensate for the limitations in utilizing Adjusted EBITDA as an operating measure, management also uses U.S. GAAP measures of performance, including operating income (loss) and net income (loss), to evaluate performance. As required under Regulation G and Item 10(e) of Regulation S-K, the table above provides a reconciliation of Adjusted EBITDA, a non-GAAP financial measure, to net loss, which is the nearest comparable U.S. GAAP financial measure for the year ended December 31, 2016 and for the interim 2017 periods, and pro forma net loss prepared and presented in accordance with Article 11 of Regulation S-X for the years ended December 31, 2013, 2014 and 2015. We generally define Adjusted EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization, other income (expense), gain or loss on the disposal of assets and other items that our management considers to be extraordinary, such as impairment expenses, acquisition-related costs, costs and charges associated with severance, facility closures, write-offs of bad debts and similar charges. Additionally, for the year ended December 31, 2016 and for the interim 2017 periods, we have added back in calculating Adjusted EBITDA several categories of expenses and charges incurred in connection with our Chapter 11 proceedings which are detailed in the table above. For the years ended December 31, 2013, 2014 and 2015, we are presenting Adjusted EBITDA and net income on a pro forma basis for the March 2015 Nabors completion and production services transaction. For a discussion of the adjustments made in preparing the pro forma information, please see our prospectus supplement to the prospectus dated March 20, 2017 and Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on March 2, 2017. 28 $MM Full Year Pro Forma (1) Full Year 2013 2014 2015 Q1'16 Q2'16 Q3'16 Q4'16 2016 Q1'17 Q2'17 Net Income / (Loss) (2) $96.242999999999995 $-,244.18299999999999 $-,879.23099999999999 $-,428.41199999999998 $-,291.11599999999999 $-,106.39 $-,118.371 $-,944.28899999999999 $-32.301000000000002 $-12.721 Interest Expense 94.334000000000003 98.49 99.05 25.466999999999999 121.934 8.1579999999999995 1.9059999999999999 157.465 0.69099999999999995 0.41399999999999998 Income Tax / (Benefit) 56.055999999999997 56.045000000000002 -,330.7799999999997 -94.147000000000006 -11.252000000000001 -21.123000000000001 -2.488 -,129.1000000000002 -3.2360000000000002 -2.3929999999999998 Depreciation and Amortization 260.81400000000002 245.80600000000001 310.31299999999999 58.953000000000003 54.283000000000001 51.320999999999998 52.883000000000003 217.44000000000003 31.606000000000002 32.832999999999998 Other (Income) / Expense -5.2999999999999999E-2 32.5 10 -3.319 -2.0030000000000001 -7.0750000000000002 2.8929999999999998 -9.5040000000000013 -1.5620000000000001 1.456 (Gain) / Loss on Disposal of Assets 9.1289999999999996 2.37 -0.5 3.202 1.712 -0.69399999999999995 -1.145 3.0749999999999997 -6.056 -3.1360000000000001 Impairment Expense 20 363.57799999999997 791.80700000000002 381.69400000000002 48.712000000000003 0 5.9889999999999999 436.39499999999998 0 0 Debt Restructuring & Reorganization Costs 0 0 0 0 15.451000000000001 49.137 21.143000000000001 85.730999999999995 0 7.8529999999999998 Inventory Write-down 0 0 31.109000000000002 1.2669999999999999 11.78 0.35199999999999998 21.951000000000001 35.35 0 0 Acquisition-Related Costs 0 0 0 3.6890000000000001 3.379 1.4810000000000001 1.9850000000000001 10.533999999999999 0 0 Severance, Facility Closures and Other 27.157 0.3 20.5 19.469000000000001 13.895999999999999 6.9250000000000007 1.681 41.971000000000004 15.442 0.80400000000000005 Adjusted EBITDA $563.68000000000006 $554.90599999999995 $52.969999999999992 $-32.137000000000008 $-33.22399999999999 $-17.908000000000008 $-11.57299999999999 $-94.841999999999899 $4.5839999999999979 $25.109999999999996

The Differentiated NAm Oilfield Services Company Leading Provider of Products and Services Across the Life of a Well Strong Footprint in All Active Onshore Basins in the Continental U.S. and Western Canada Modern, High-Quality Asset Base and Streamlined Cost Structure Robust Logistics Network Ensures Efficient Operations for Our Customers Long-Term, Established Relationships with Blue-Chip Customer Base Unique Research & Technology Platform Focused on Improving Margins and Assuring Supply Capitalized for Growth – No Leverage and Significant Liquidity Experienced Management Team with Deep Operational Expertise Recognized Leader in Quality, Safety and Reliability Through A Talented Employee Base 1 2 3 4 5 6 7 9 8 30