Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - NEXEON MEDSYSTEMS INC | ex10_1.htm |

| EX-10.8 - EXHIBIT 10.8 - NEXEON MEDSYSTEMS INC | ex10_8.htm |

| EX-10.7 - EXHIBIT 10.7 - NEXEON MEDSYSTEMS INC | ex10_7.htm |

| EX-10.6 - EXHIBIT 10.6 - NEXEON MEDSYSTEMS INC | ex10_6.htm |

| EX-10.5 - EXHIBIT 10.5 - NEXEON MEDSYSTEMS INC | ex10_5.htm |

| EX-10.4 - EXHIBIT 10.4 - NEXEON MEDSYSTEMS INC | ex10_4.htm |

| EX-10.3 - EXHIBIT 10.3 - NEXEON MEDSYSTEMS INC | ex10_3.htm |

| EX-10.2 - EXHIBIT 10.2 - NEXEON MEDSYSTEMS INC | ex10_2.htm |

| 8-K - NEXEON MEDSYSTEMS INC | p8241728k.htm |

Exhibit 10.9

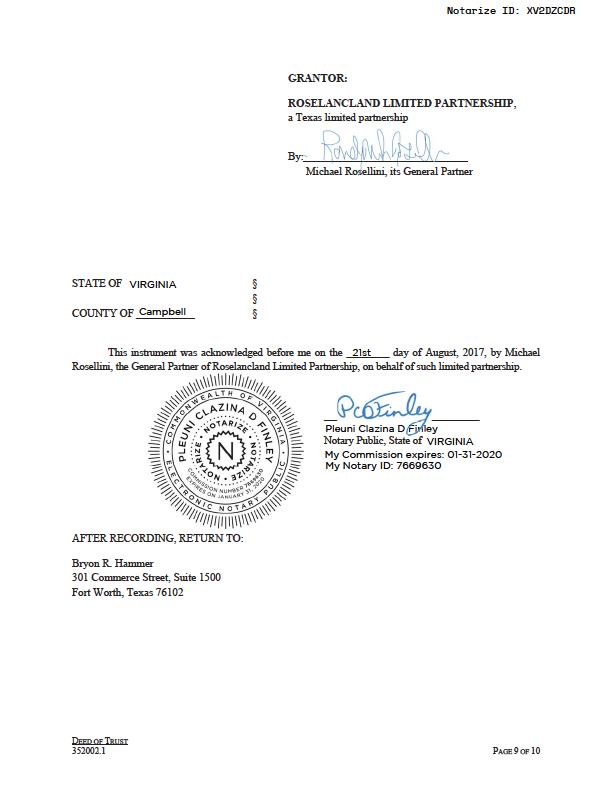

DEED OF TRUST 352002.1 PAGE 1 OF 10 NOTICE OF CONFIDENTIALITY RIGHTS: IF YOU ARE A NATURAL PERSON, YOU MAY REMOVE OR STRIKE ANY OR ALL OF THE FOLLOWING INFORMATION FROM ANY INSTRUMENT THAT TRANSFERS AN INTEREST IN REAL PROPERTY BEFORE IT IS FILED FOR RECORD IN THE PUBLIC RECORDS: YOUR SOCIAL SECURITY NUMBER OR YOUR DRIVER’S LICENSE NUMBER. DEED OF TRUST Terms Date: August ____, 2017 Grantor: Roselancland Limited Partnership Grantor’s Mailing Address: 12147 Lueders Lane Dallas, Texas 75230 Trustee: Bryon R. Hammer Trustee’s Mailing Address: 301 Commerce Street, Suite 1500 Fort Worth, Texas 76102 Lender: Leonite Capital, LLC Lender’s Mailing Address: 1 Hillcrest Center Drive, Suite 232 Spring Valley, New York 10977 Attn: Avi Geller Obligation: Senior Secured Convertible Promissory Note (the “Note”) Date: Of even date herewith. Original principal amount: One Million One Hundred Twenty Thousand and No/100 Dollars ($1,120,000.00) Borrower: Nexeon Medsystems Inc. Attn.: William Rosellini, CEO 1910 Pacific Avenue, Suite 20000 Dallas, Texas 75201 Lender: Leonite Capital, LLC 1 Hillcrest Center Drive, Suite 232 Spring Valley, New York 10977 Attn: Avi Geller Maturity date: Twenty Four (24) months from the Issue Date (as defined in the Note) Notarize ID: XV2DZCDR 21 EXHIBIT 10.9 DEED OF TRUST 352002.1 PAGE 2 OF 10 Other Debt: This conveyance is also made in trust to secure payment of all other present and future debts that Borrower may owe to Lender, its successors or assigns, regardless of how any other such debt is incurred or evidenced. This conveyance is also made to secure payment of any renewal or extension of any present or future debt that Borrower owes to Lender, its successors or assigns, including any loans and advancements from Lender to Borrower under the provisions of this deed of trust. When Borrower repays all debts owed to Lender, its successors or assigns, this deed of trust lien will terminate only if Lender releases this deed of trust at the request of Borrower and at Borrower’s expense. Until Lender, its successors or assigns releases it, this deed of trust will remain fully in effect to secure other present and future advances and debts, regardless of any additional security given for any debt and regardless of any modification. Property (including any improvements): That certain property described on Exhibit A attached hereto and incorporated herein by reference, together with the following personal property: 1. all fixtures, supplies, building materials, and other goods of every nature now or hereafter located, used, or intended to be located or used on the Property; 2. all plans and specifications for development of or construction of improvements on the Property; 3. All accounts, contract rights, instruments, documents, general intangibles, and chattel paper arising from or by virtue of any transactions relating to the Property; 4. All permits, licenses, franchises, certificates, and other rights and privileges obtained in connection with the Property; 5. All proceeds payable or to be payable under each policy of insurance relating to the Property; and 6. All products and proceeds of the foregoing. Notwithstanding any other provision in this deed of trust, the term “Property” does not include personal property that is located, used, or intended to be located or used on the Property, but not owned by Grantor. Prior Lien: None. Other Exceptions to Conveyance and Warranty: Any and all restrictions, covenants, conditions, and easements, if any, relating to the Property, but only to the extent that they are in effect as of the date hereof and shown of record, and all zoning laws, regulations and ordinances of municipal and other governmental authorities, if any, but only to the extent that they are still in effect and relate to the herein described Property. A. Granting Clause For value received, including $100 paid by Borrower to Grantor and the benefit to be derived by Grantor from the Note, and to secure payment of the Note, Grantor conveys the Property to Trustee in trust. Notarize ID: XV2DZCDR DEED OF TRUST 352002.1 PAGE 3 OF 10 Grantor warrants that Grantor has good, indefeasible and insurable title to the Property and has the right to mortgage, give, grant, bargain, sell, convey, pledge, assign and hypothecate the same and that Grantor possesses a fee estate in the Property and that it owns the Property free and clear of all liens, encumbrances and charges whatsoever. Grantor shall forever warrant, defend and preserve such title and the validity and priority of the lien of this deed of trust and shall forever warranty and defend the same to Lender against the claims of all persons whomsoever, subject to the Other Exceptions to Conveyance and Warranty. On payment and satisfaction in full of the Note and all other amounts secured by this deed of trust, this deed of trust will have no further effect, and Lender will release it at Grantor’s expense. B. Grantor’s Obligations B.1. Grantor agrees to maintain, at Grantor’s expense, all property and liability insurance coverages with respect to the Property, revenues generated by the Property, and operations on the Property that Lender reasonably requires (“Required Insurance Coverages”), issued by insurers and written on policy forms acceptable to Lender, and as to property loss, that are payable to Lender under policies containing standard mortgagee clauses, and deliver evidence of the Required Insurance Coverages in a form acceptable to Lender before execution of this deed of trust and again at least ten (10) days before the expiration of the Required Insurance Coverages. B.2. Grantor agrees to— a. keep the Property in good repair and condition; b. pay all taxes, charges, impositions, levies, and assessments on the Property before delinquency, not authorize a taxing entity to transfer its tax lien on the Property to anyone other than Lender, and not request a deferral of the collection of taxes pursuant to section 33.06 of the Texas Tax Code; c. furnish to Lender or other holder of the Note annually, before taxes become delinquent, copies of tax receipts showing that all taxes and assessments on the Property have been paid; d. defend title to the Property subject to the Other Exceptions to Conveyance and Warranty and preserve the lien’s priority as it is established in this deed of trust; e. obey all laws, ordinances, and restrictive covenants applicable to the Property; f. keep any buildings occupied as required by the Required Insurance Coverages; g. if the lien of this deed of trust is not a first lien, pay or cause to be paid all prior lien notes and abide by or cause to be abided by all prior lien instruments; h. notify Lender of any change of address; i. allow Lender or Lender’s agents to enter the Property at reasonable times and inspect it and any personal property in which Lender is granted a security interest by this deed of trust; and Notarize ID: XV2DZCDR DEED OF TRUST 352002.1 PAGE 4 OF 10 j. duly and punctually observe and perform each and every term, provision, condition, and covenant to be observed or performed by Grantor pursuant to the terms of any agreement or recorded instrument affecting or pertaining to the Property, and not suffer or permit any default or event of default to exist under any of the foregoing. C. Lender’s Rights C.1. Lender or its mortgage servicer may appoint in writing one or more substitute trustees, succeeding to all rights and responsibilities of Trustee. C.2. If the proceeds of the Note are used to pay any debt secured by prior liens, Lender is subrogated to all the rights and liens of the holders of any debt so paid. C.3. Lender may apply any proceeds received under the property insurance policies covering the Property either to reduce the Note or to repair or replace damaged or destroyed improvements covered by the policy. If the Property is Grantor’s primary residence and Lender reasonably determines that repairs to the improvements are economically feasible, Lender will make the property insurance proceeds available to Grantor for repairs. C.4. Notwithstanding the terms of the Note to the contrary, and unless applicable law prohibits, all payments received by Lender from Borrower or Grantor with respect to the Note or this deed of trust may, at Lender’s discretion, be applied first to amounts payable under this deed of trust and then to amounts due and payable to Lender with respect to the Note, to be applied to late charges, principal, or interest in the order Lender in its discretion determines. C.5. If Grantor fails to perform any of Grantor’s obligations, Lender may perform those obligations and be reimbursed by Grantor on demand for any amounts so paid, including attorney’s fees, plus interest on those amounts from the dates of payment at the rate stated in the Note for matured, unpaid amounts. The amount to be reimbursed will be secured by this deed of trust. C.6. If a default exists in payment of the Note or performance of Grantor’s obligations and the default continues after any required notice of the default and the time allowed to cure, Lender may— a. declare the unpaid principal balance and earned interest on the Note immediately due; b. exercise Lender’s rights with respect to rent under the Texas Property Code as then in effect; c. direct Trustee to foreclose this lien, in which case Lender or Lender’s agent will cause notice of the foreclosure sale to be given as provided by the Texas Property Code as then in effect; d. purchase the Property at any foreclosure sale by offering the highest bid and then have the bid credited on the Note; and e. exercise any other rights available under law. Notarize ID: XV2DZCDR DEED OF TRUST 352002.1 PAGE 5 OF 10 C.7. Lender may remedy any default without waiving it and may waive any default without waiving any prior or subsequent default. C.8. COLLATERAL PROTECTION INSURANCE NOTICE In accordance with the provisions of section 307.052(a) of the Texas Finance Code, the Lender hereby notifies the Grantor as follows: (a) the Grantor is required to: (i) keep the collateral insured against damage in the amount the Lender specifies; (ii) purchase the insurance from an insurer that is authorized to do business in the state of Texas or an eligible surplus lines insurer; and (iii) name the Lender as the person to be paid under the policy in the event of a loss; (b) the Grantor must, if required by the Lender, deliver to the Lender a copy of the policy and proof of the payment of premiums; and (c) if the Grantor fails to meet any requirement listed in Paragraph (A) or (B), the Lender may obtain collateral protection insurance on behalf of the Grantor at the Grantor’s expense. D. Trustee’s Rights and Duties If directed by Lender to foreclose this lien, Trustee will— D.1. either personally or by agent give notice of the foreclosure sale as required by the Texas Property Code as then in effect; D.2. sell and convey all or part of the Property “AS IS” to the highest bidder for cash with a general warranty binding Grantor, subject to the Prior Lien and to the Other Exceptions to Conveyance and Warranty and without representation or warranty, express or implied, by Trustee; D.3. from the proceeds of the sale, pay, in this order— a. expenses of foreclosure, including a reasonable commission to Trustee; b. to Lender, the full amount of principal, interest, attorney’s fees, and other charges due and unpaid; c. any amounts required by law to be paid before payment to Grantor; and d. to Grantor, any balance. D.4. be indemnified, held harmless, and defended by Lender against all costs, expenses, and liabilities incurred by Trustee for acting in the execution or enforcement of the trust created by this deed of trust, Notarize ID: XV2DZCDR DEED OF TRUST 352002.1 PAGE 6 OF 10 which includes all court and other costs, including attorney’s fees, incurred by Trustee in defense of any action or proceeding taken against Trustee in that capacity. E. General Provisions E.1. If any of the Property is sold under this deed of trust, Grantor must immediately surrender possession to the purchaser. If Grantor does not, Grantor will be a tenant at sufferance of the purchaser, subject to an action for forcible detainer. E.2. Recitals in any trustee’s deed conveying the Property will be presumed to be true. E.3. Proceeding under this deed of trust, filing suit for foreclosure, or pursuing any other remedy will not constitute an election of remedies. E.4. This lien will remain superior to liens later created even if the time of payment of all or part of the Note is extended or part of the Property is released. E.5. If any portion of the Note cannot be lawfully secured by this deed of trust, payments will be applied first to discharge that portion. E.6. Grantor assigns to Lender all amounts payable to or received by Grantor from condemnation of all or part of the Property, from private sale in lieu of condemnation, and from damages caused by public works or construction on or near the Property. After deducting any expenses incurred, including attorney’s fees and court and other costs, Lender will either release any remaining amounts to Grantor or apply such amounts to reduce the Note. Lender will not be liable for failure to collect or to exercise diligence in collecting any such amounts. Grantor will immediately give Lender notice of any actual or threatened proceedings for condemnation of all or part of the Property. E.7. Grantor collaterally assigns to Lender all present and future rent from the Property and its proceeds. Grantor warrants the validity and enforceability of the assignment. Grantor will apply all rent to payment of the Note and performance of this deed of trust, but if the rent exceeds the amount due with respect to the Note and the deed of trust, Grantor may retain the excess. If a default exists in payment of the Note or performance of this deed of trust, Lender may exercise Lender’s rights with respect to rent under the Texas Property Code as then in effect. Lender neither has nor assumes any obligations as lessor or landlord with respect to any occupant of the Property. Lender may exercise Lender’s rights and remedies under this paragraph without taking possession of the Property. Lender will apply all rent collected under this paragraph as required by the Texas Property Code as then in effect. Lender is not required to act under this paragraph, and acting under this paragraph does not waive any of Lender’s other rights and remedies. E.8. Interest on the debt secured by this deed of trust will not exceed the maximum amount of nonusurious interest that may be contracted for, taken, reserved, charged, or received under law. Any interest in excess of that maximum amount will be credited on the principal of the debt or, if that has been paid, refunded. On any acceleration or required or permitted prepayment, any such excess will be canceled automatically as of the acceleration or prepayment or, if already paid, credited on the principal of the debt or, if the principal of the debt has been paid, refunded. This provision overrides any conflicting provisions in this and all other instruments concerning the debt. Notarize ID: XV2DZCDR DEED OF TRUST 352002.1 PAGE 7 OF 10 E.9. In no event may this deed of trust secure payment of any debt that may not lawfully be secured by a lien on real estate or create a lien otherwise prohibited by law. E.10. If all or any party of the Property is sold, transferred, or conveyed without the prior written consent of Lender, Lender may declare the outstanding principal balance of the Note plus accrued interest immediately due and payable. Lender has no obligation to consent to any such sale or conveyance of the Property, and Lender is entitled to condition any consent on a change in the interest rate that will thereafter apply to the Note and any other change in the terms of the Note or this deed of trust that Lender in Lender’s sole discretion deems appropriate. A lease with an option to purchase, or a contract for deed will be deemed to be a sale, transfer, or conveyance of the Property for purposes of this provision. Any deed under threat or order of condemnation, any conveyance solely between makers, and the passage of title by reason of death of a maker or by operation of law will not be construed as a sale or conveyance of the Property. The creation of a subordinate lien without the consent of Lender will be construed as a sale or conveyance of the Property, but any subsequent sale under a subordinate lien to which Lender has consented will not be construed as a sale or conveyance of the Property. E.11. Grantor may not cause or permit any of the following events to occur without the prior written consent of Lender: if Grantor is (a) a corporation, the dissolution of the corporation or the sale, pledge, encumbrance, or assignment of any shares of its stock; (b) a limited liability company, the dissolution of the company or the sale, pledge, encumbrance, or assignment of any of its membership interests; (c) a general partnership or joint venture, the dissolution of the partnership or venture or the sale, pledge, encumbrance, or assignment of any of its partnership or joint venture interests, or the withdrawal from or admission into it of any general partner or joint venturer; or (d) a limited partnership, (i) the dissolution of the partnership, (ii) the sale, pledge, encumbrance, or assignment of any of its general partnership interests, or the withdrawal from or admission into it of any general partner, (iii) the sale, pledge, encumbrance, or assignment of a controlling portion of its limited partnership interests, or (iv) the withdrawal from or admission into it of any controlling limited partner or partners. If granted, consent may be conditioned upon (y) the integrity, reputation, character, creditworthiness, and management ability of the person succeeding to the ownership interest in Grantor (or security interest in such ownership) being satisfactory to Lender; and (z) the execution, before such event, by the person succeeding to the interest of Grantor in the Property or ownership interest in Grantor (or security interest in such ownership) of a written modification or assumption agreement containing such terms as Lender may require, such as a principal pay down on the Note, an increase in the rate of interest payable with respect to the Note, a transfer fee, or any other modification of the Note, this deed of trust, or any other instruments evidencing or securing the Note. E.12. When the context requires, singular nouns and pronouns include the plural. E.13. The term Note includes all extensions, modifications, and renewals of the Note and all amounts secured by this deed of trust. E.14. This deed of trust binds, benefits, and may be enforced by the successors in interest of all parties. Lender may assign its rights and/or obligations under this deed of trust without the prior written consent of Grantor. E.15. If Grantor and Borrower are not the same person, the term Grantor includes Borrower. Notarize ID: XV2DZCDR DEED OF TRUST 352002.1 PAGE 8 OF 10 E.16. Grantor and each surety, endorser, and guarantor of the Note waive, to the extent permitted by law, all (a) demand for payment, (b) presentation for payment, (c) notice of intention to accelerate maturity, (d) notice of acceleration of maturity, (e) protest, and (f) notice of protest. E.17. Grantor agrees to pay reasonable attorney’s fees, trustee’s fees, and court and other costs of enforcing Lender’s rights under this deed of trust if an attorney is retained for its enforcement. E.18. If any provision of this deed of trust is determined to be invalid or unenforceable, the validity or enforceability of any other provision will not be affected. E.19. Grantor agrees to execute, acknowledge, and deliver to Lender any document requested by Lender, at Lender’s request from time to time, to (a) correct any defect, error, omission, or ambiguity in this deed of trust or in any other document executed in connection with the Note or this deed of trust; (b) comply with Grantor’s obligations under this deed of trust and other documents; (c) subject to and perfect the liens and security interests of this deed of trust and other documents any property intended to be covered thereby; and (d) protect, perfect, or preserve the liens and the security interests of this deed of trust and other documents against third persons or make any recordings, file any notices, or obtain any consents requested by lender in connection therewith. Grantor agrees to pay all costs of the foregoing. E.20. In addition to creating a deed-of-trust lien on all the real and other property described above, Grantor also grants to Lender a security interest in all of the above-described personal property pursuant to and to the extent permitted by the Texas Uniform Commercial Code. E.21. In the event of a foreclosure sale under this deed of trust, Grantor agrees that all the Property may be sold as a whole at Lender’s option and that the Lender need not be present at the place of sale. E.22. Grantor represents to Lender that no part of the Property is either the residential or business homestead of Grantor and that Grantor neither resides nor intends to reside in nor conducts nor intends to conduct a business on the Property. Grantor renounces all present and future rights to a homestead exemption for the Property. Grantor acknowledges that Lender relies on the truth of representations in this paragraph in making the loan secured by this deed of trust. E.23. The lien security interest and other security rights of Lender hereunder shall not be impaired by any indulgence, moratorium, or release granted by Lender, including, but not limited to, any renewal, extension, increase, or modification which Lender may grant with respect to the Note or this deed of trust. E.24. Grantor warrants to Lender and agrees that the proceeds of the Note will be used primarily for business or commercial purposes and not primarily for personal, family, or household purposes. [Remainder of the Page Left Intentionally Blank] Notarize ID: XV2DZCDR DEED OF TRUST 352002.1 PAGE 9 OF 10 GRANTOR: ROSELANCLAND LIMITED PARTNERSHIP, a Texas limited partnership By: Michael Rosellini, its General Partner STATE OF TEXAS § § COUNTY OF ___________ § This instrument was acknowledged before me on the ________ day of August, 2017, by Michael Rosellini, the General Partner of Roselancland Limited Partnership, on behalf of such limited partnership. _____________________________ Notary Public, State of Texas AFTER RECORDING, RETURN TO: Bryon R. Hammer 301 Commerce Street, Suite 1500 Fort Worth, Texas 76102 Notarize ID: XV2DZCDR VIRGINIA Campbell 21st : Pa Pleuni Clazina D Finley VIRGINIA __________________ ___ euni Finle My Commission expires: 01-31-2020 My Notary ID: 7669630 DEED OF TRUST 352002.1 PAGE 10 OF 10 EXHIBIT A LEGAL DESCRIPTION OF THE PROPERTY Being a part of the P. KIRKLAND SURVEY, PATENT NO. 352, Volume 10, Abstract No. 746, and described by metes and bounds as follows: BEGINNING at the Northwest corner of 160 acres deeded to H. Bailey by R.P. Henry and wife on December 31, 1901; THENCE South with the West line of said 160 acre tract 1460 feet; THENCE East, passing an iron stake under a fence on the East side of the public road, in all 572 feet to corner, an iron stake; THENCE North 404 feet; THENCE East 1540 feet to an iron stake on the East line of said 160 acre tract; THENCE North 1056 feet to a bois d'arc stake at the N.E. corner of said 160 acre tract; THENCE West 2112 feet to the PLACE OF BEGINNING; EXCEPTING about 3-1/2 acres heretofore set apart and occupied by the right-of-way of the M.K. & T. R.R. and the County Public Road and excepting 3.29 acres of land conveyed by J.N. Lowrance et ux to E.T. Moore, Trustee, by Deed recorded in Volume 529, Page 472, Deed Records of Dallas County, Texas, leaving approximately 47-1/2 acres of land. FURTHER SAVE AND EXCEPT 3.154 acres of land described in Deed recorded in Volume 79173, Page 1603, Real Property Records, Dallas County, Texas. FURTHER SAVE AND EXCEPT 1.00 acre conveyed by Randy Michael Rosellini to Rose Wade Limited Partnership by Deed recorded under Clerk's File No. 20070194882, Real Property Records, Dallas County, Texas. Notarize ID: XV2DZCDR