Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COMMUNITY WEST BANCSHARES / | form8k.htm |

Exhibit 99.1

August 24, 2017

To the Shareholders of Community West Bancshares:

We are happy to report that Community West Bancshares is building on the positive momentum established last year. A number of new Community West Bank offices have opened recently, expanding our reach throughout Ventura, Santa Barbara and San Luis Obispo counties, and our board of directors has been strengthened with the addition of two very experienced new members as we continue to position the bank for long-term growth.

Significant consolidation among community banks continues throughout our marketplace, furthering a trend that started a few years ago. We are seizing the opportunity to fill the void left from acquisitions of home-grown community banks by much larger regional banks. Our full-service branch office in San Luis Obispo opened in November 2016, additionally we relocated our branch in Santa Maria and opened a new Oxnard branch in January 2017. Also, we opened a new Paso Robles loan production office in June 2017, and we have received approval from our primary regulator to establish a full-service branch office in Paso Robles, which will open in 2018. Needless to say, we are on the move to securing our vision of being the leading community bank serving the Central Coast of California.

Dana Boutain and Tom Dobyns joined the Community West Bancshares board of directors in June. Dana is a Managing Director in the Oxnard office of CBIZ, an accountancy, financial services and insurance services firm, with deep connections to the business community throughout Ventura County. Tom has more than 40 years of executive-level bank management experience, including most recently as President and Chief Executive Officer of Mission Community Bank in San Luis Obispo County. Dana and Tom’s expertise is welcome, and their positive influence is already evident as our board of directors develops business plans to maintain our community banking independence in the years ahead.

As we have focused on growing our franchise, we’ve concurrently delivered improved operating results. Please review the attached second quarter investor fact sheet. And we are proud that Community West was awarded a “Super Premier” rating in April 2017, by The Findley Reports, the highest ranking for a community bank. In making their selections, The Findley Reports focuses on four ratios: growth, return on beginning equity, net operating income as a percentage of average assets, and loan losses as a percentage of gross loans. It is an honor for our bank to be recognized by The Findley Reports.

The future is bright for community banks on California’s Central Coast. We appreciate the continued support from you, our shareholders, as we pursue our growth opportunities.

Sincerely,

|

|

|

William R. Peeples

|

Martin E. Plourd

|

|

Chairman of the Board

|

President and Chief Executive Officer

|

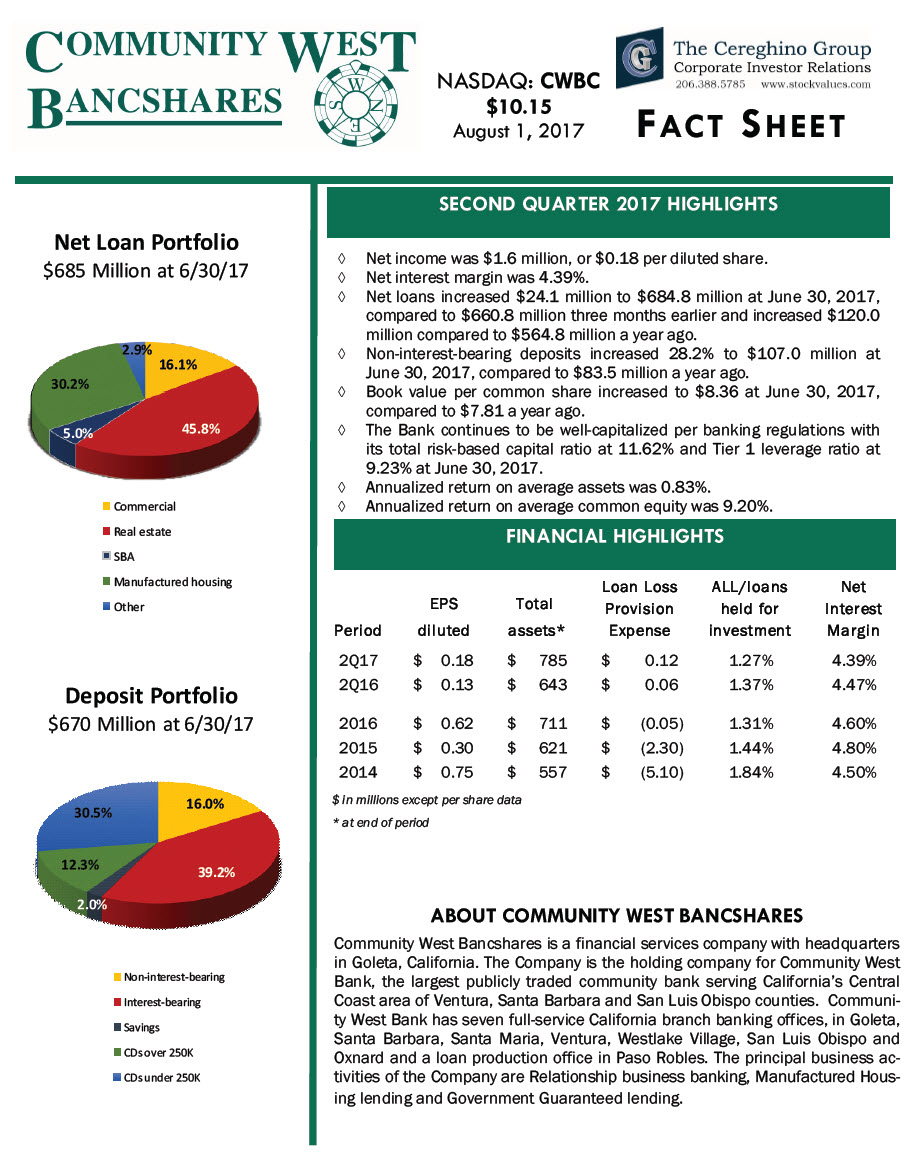

NASDAQ: CWBC $10.15 August 1, 2017 FACT SHEET SECOND QUARTER 2017 HIGHLIGHTS Net Loan Portfolio $685 Million at 6/30/17 2.9% 16.1% 30.2% 5.0% 45.8% CommercialReal estateSBA Manufactured housing Other Deposit Portfolio $670 Million at 6/30/17 16.0% à Net income was $1.6 million, or $0.18 per diluted share.à Net interest margin was 4.39%. à Net loans increased $24.1 million to $684.8 million at June 30, 2017, compared to $660.8 million three months earlier and increased $120.0 million compared to $564.8 million a year ago. à Non-interest-bearing deposits increased 28.2% to $107.0 million at June 30, 2017, compared to $83.5 million a year ago. à Book value per common share increased to $8.36 at June 30, 2017, compared to $7.81 a year ago. à The Bank continues to be well-capitalized per banking regulations with its total risk-based capital ratio at 11.62% and Tier 1 leverage ratio at 9.23% at June 30, 2017. à Annualized return on average assets was 0.83%.à Annualized return on average common equity was 9.20%. FINANCIAL HIGHLIGHTS Loan Loss ALL/loans Net EPS Total Provision held for Interest Period diluted assets* Expense investment Margin 2Q17 $ 0.18 $ 785 $ 0.12 1.27% 4.39% 2Q16 $ 0.13 $ 643 $ 0.06 1.37% 4.47% 2016 $ 0.62 $ 711 $ (0.05) 1.31% 4.60% 2015 $ 0.30 $ 621 $ (2.30) 1.44% 4.80% 2014 $ 0.75 $ 557 $ (5.10) 1.84% 4.50% $ in millions except per share data 30.5% 12.3% 2.0% 39.2% Non-interest-bearingInterest-bearing Savings CDs over 250KCDs under 250K * at end of period ABOUT COMMUNITY WEST BANCSHARES Community West Bancshares is a financial services company with headquartersin Goleta, California. The Company is the holding company for Community WestBank, the largest publicly traded community bank serving California’s CentralCoast area of Ventura, Santa Barbara and San Luis Obispo counties. Communi-ty West Bank has seven full-service California branch banking offices, in Goleta,Santa Barbara, Santa Maria, Ventura, Westlake Village, San Luis Obispo andOxnard and a loan production office in Paso Robles. The principal business ac- tivities of the Company are Relationship business banking, Manufactured Hous- ing lending and Government Guaranteed lending.

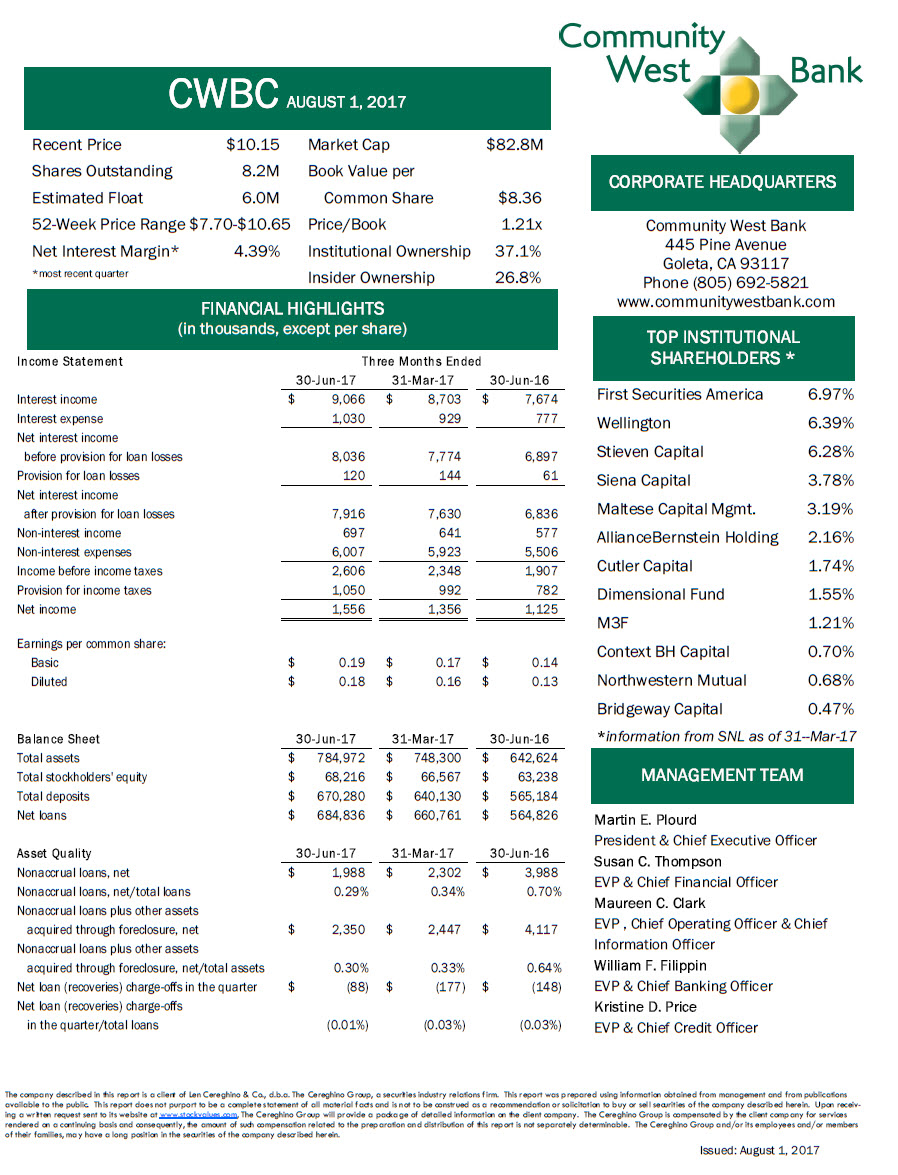

CWBC AUGUST 1, 2017 Recent Price $10.15 Shares Outstanding 8.2M Estimated Float 6.0M52-Week Price Range $7.70-$10.65 Net Interest Margin* 4.39% *most recent quarter Market Cap $82.8MBook Value per Common Share $8.36 Price/Book 1.21x Institutional Ownership 37.1% Insider Ownership 26.8% CORPORATE HEADQUARTERS Community West Bank 445 Pine Avenue Goleta, CA 93117Phone (805) 692-5821 www.communitywestbank.com FINANCIAL HIGHLIGHTS (in thousands, except per share) Income Statement Three Months Ended 30-Jun-17 31-Mar-17 30-Jun-16 Interest income $ 9,066 $ 8,703 $ 7,674 Interest expense 1,030 929 777Net interest income before provision for loan losses 8,036 7,774 6,897 Provision for loan losses 120 144 61Net interest income after provision for loan losses 7,916 7,630 6,836 Non-interest income 697 641 577 Non-interest expenses 6,007 5,923 5,506 Income before income taxes 2,606 2,348 1,907 Provision for income taxes 1,050 992 782 Net income 1,556 1,356 1,125 Earnings per common share: Basic $ 0.19 $ 0.17 $ 0.14 Diluted $ 0.18 $ 0.16 $ 0.13 Balance Sheet 30-Jun-17 31-Mar-17 30-Jun-16 Total assets $ 784,972 $ 748,300 $ 642,624 Total stockholders' equity $ 68,216 $ 66,567 $ 63,238 Total deposits $ 670,280 $ 640,130 $ 565,184 Net loans $ 684,836 $ 660,761 $ 564,826 Asset Quality 30-Jun-17 31-Mar-17 30-Jun-16 Nonaccrual loans, net $ 1,988 $ 2,302 $ 3,988 Nonaccrual loans, net/total loans 0.29% 0.34% 0.70%Nonaccrual loans plus other assets acquired through foreclosure, net $ 2,350 $ 2,447 $ 4,117Nonaccrual loans plus other assets acquired through foreclosure, net/total assets 0.30% 0.33% 0.64% Net loan (recoveries) charge-offs in the quarter $ (88) $ (177) $ (148)Net loan (recoveries) charge-offs in the quarter/total loans (0.01%) (0.03%) (0.03%) TOP INSTITUTIONAL SHAREHOLDERS * First Securities America 6.97% Wellington 6.39% Stieven Capital 6.28% Siena Capital 3.78% Maltese Capital Mgmt. 3.19% AllianceBernstein Holding 2.16% Cutler Capital 1.74% Dimensional Fund 1.55% M3F 1.21% Context BH Capital 0.70% Northwestern Mutual 0.68% Bridgeway Capital 0.47% *information from SNL as of 31--Mar-17 MANAGEMENT TEAM Martin E. Plourd President & Chief Executive OfficerSusan C. Thompson EVP & Chief Financial OfficerMaureen C. Clark EVP , Chief Operating Officer & ChiefInformation Officer William F. Filippin EVP & Chief Banking OfficerKristine D. Price EVP & Chief Credit Officer The company described in this report is a client of Len Cereghino & Co., d.b.a. The Cereghino Group, a securities industry relations firm. This report was prepared using information obtained from management and from publications available to the public. This report does not purport to be a complete statement of all material facts and is not to be construed as a recommendation or solicitation to buy or sell securities of the company described herein. Upon receiv-ing a written request sent to its website at www.stockvalues.com, The Cereghino Group will provide a package of detailed information on the client company. The Cereghino Group is compensated by the client company for servicesrendered on a continuing basis and consequently, the amount of such compensation related to the preparation and distribution of this report is not separately determinable. The Cereghino Group and/or its employees and/or membersof their families, may have a long position in the securities of the company described herein. Issued: August 1, 2017