Attached files

| file | filename |

|---|---|

| 10-Q - FORM 10-Q - JanOne Inc. | arca_10q-070117.htm |

| EX-10.3 - PLEDGE AGREEMENT - JanOne Inc. | arca_ex1003.htm |

| EX-10.5 - EQUITY PURCHASE AGREEMENT - JanOne Inc. | arca_ex1005.htm |

| EX-10.4 - LETTER AGREEMENT - JanOne Inc. | arca_ex1004.htm |

| EX-31.1 - CERTIFICATION - JanOne Inc. | arca_10q-ex3101.htm |

| EX-10.8 - PATENT LICENSE AGREEMENT - JanOne Inc. | arca_ex1008.htm |

| EX-32.1 - CERTIFICATION - JanOne Inc. | arca_10q-ex3201.htm |

| EX-32.2 - CERTIFICATION - JanOne Inc. | arca_10q-ex3202.htm |

| EX-10.2 - REVOLVING LOAN NOTE - JanOne Inc. | arca_ex1002.htm |

| EX-31.2 - CERTIFICATION - JanOne Inc. | arca_10q-ex3102.htm |

| EX-10.7 - AGREEMENT BETWEEN RECLEIM AND THE COMPANY - JanOne Inc. | arca_ex1007.htm |

| EX-10.9 - AGREEMENT AND PLAN OF MERGER - JanOne Inc. | arca_ex1009.htm |

| EX-10.1 - CREDIT AND SECURITY AGREEMENT DATED MAY 10, 2017, AMONG THE COMPANY, APPLIANCESM - JanOne Inc. | arca_ex1001.htm |

| EX-3.1 - CERTIFICATE OF DESIGNATION - JanOne Inc. | arca_10q-ex0301.htm |

Exhibit 10.6

ASSET PURCHASE AGREEMENT

between

RECLEIM PA, LLC

and

ARCA ADVANCED PROCESSING, LLC

dated as of

August 15, 2017

| ARTICLE I Defined Terms | 1 | |

| Section 1.01 | Defined Terms | 1 |

| Section 1.02 | Construction | 4 |

| ARTICLE II Purchase and Sale | 5 | |

| Section 2.01 | Purchase and Sale of Assets | 5 |

| Section 2.02 | Excluded Assets | 5 |

| Section 2.03 | Assumption of Liabilities | 5 |

| Section 2.04 | Specifically Excluded Liabilities | 6 |

| ARTICLE III Purchase Price; Closing | 6 | |

| Section 3.01 | Purchase Price | 6 |

| Section 3.02 | Payment of Initial Purchase Price and Aggregate Payoff Amount | 6 |

| Section 3.03 | Closing | 7 |

| Section 3.04 | Closing Deliverables | 7 |

| Section 3.05 | Allocation of Purchase Price | 8 |

| Section 3.06 | Method of Payment | 8 |

| Section 3.07 | Withholding Tax | 8 |

| ARTICLE IV Representations and Warranties of Seller | 8 | |

| Section 4.01 | Organization and Authority of Seller; Enforceability | 8 |

| Section 4.02 | No Conflicts; Consents | 9 |

| Section 4.03 | Title to and Sufficiency of Purchased Assets | 9 |

| Section 4.04 | Financial Statements | 9 |

| Section 4.05 | Operations since Interim Balance Sheet Date | 10 |

| Section 4.06 | Condition of Assets | 10 |

| Section 4.07 | Inventory | 10 |

| Section 4.08 | Intellectual Property | 10 |

| Section 4.09 | Assigned Contracts | 10 |

| Section 4.10 | Permits | 11 |

| Section 4.11 | Environmental Matters. | 11 |

| Section 4.12 | Non-foreign Status | 11 |

| Section 4.13 | Compliance With Laws | 11 |

| Section 4.14 | Legal Proceedings | 11 |

| Section 4.15 | Real Property | 11 |

| i |

TABLE OF CONTENTS

(continued)

| Section 4.16 | Employees and Employment Matters | 12 |

| Section 4.17 | Brokers | 13 |

| ARTICLE V Representations and Warranties of Buyer | 13 | |

| Section 5.01 | Organization and Authority of Buyer; Enforceability | 13 |

| Section 5.02 | No Conflicts; Consents | 13 |

| Section 5.03 | Legal Proceedings | 13 |

| Section 5.04 | Brokers | 13 |

| ARTICLE VI Covenants | 13 | |

| Section 6.01 | Public Announcements | 13 |

| Section 6.02 | Employee Matters | 14 |

| Section 6.03 | Covenant Not to Compete and Confidentiality | 14 |

| Section 6.04 | Bulk Sales Laws | 14 |

| Section 6.05 | Transfer Taxes | 15 |

| Section 6.06 | Further Assurances. | 15 |

| Section 6.07 | Consents | 15 |

| ARTICLE VII Indemnification | 15 | |

| Section 7.01 | Survival | 15 |

| Section 7.02 | Indemnification By the Seller Parties | 16 |

| Section 7.03 | Indemnification By Buyer. | 16 |

| Section 7.04 | Indemnification Procedures | 16 |

| Section 7.05 | Tax Treatment of Indemnification Payments | 17 |

| Section 7.06 | Effect of Investigation. | 17 |

| Section 7.07 | Exclusive Remedy | 17 |

| ARTICLE VIII Miscellaneous | 17 | |

| Section 8.01 | Expenses | 17 |

| Section 8.02 | Notices | 17 |

| Section 8.03 | Headings | 18 |

| Section 8.04 | Severability | 18 |

| Section 8.05 | Entire Agreement | 18 |

| Section 8.06 | Successors and Assigns | 18 |

| Section 8.07 | No Third-party Beneficiaries | 18 |

| Section 8.08 | Amendment and Modification | 19 |

| Section 8.09 | Waiver | 19 |

| ii |

TABLE OF CONTENTS

(continued)

| Section 8.10 | Governing Law | 19 |

| Section 8.11 | Submission to Jurisdiction | 19 |

| Section 8.12 | Waiver of Jury Trial | 19 |

| Section 8.13 | Specific Performance | 19 |

| Section 8.14 | Counterparts | 19 |

| Exhibits | ||

| Exhibit 2.01 | Tangible Assets | |

| Exhibit 2.02(e) | Excluded Assets | |

| Exhibit 2.03(b)(iii) | Assumed Liabilities | |

| Exhibit 3.01(b) | Indebtedness to be Paid Off at the Closing | |

| Exhibit 3.05 | Purchase Price Allocation | |

| Exhibit 4.15 | Assigned Leases |

| iii |

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (this “Agreement”), dated as of August 15, 2017, is entered into among ARCA Advanced Processing, LLC, a Minnesota limited liability company (“Seller”), 4301 Operations, LLC, a Delaware limited liability company (“4301”), Brian Conners (“Conners”), James Ford (“Ford”) and Recleim PA, LLC, a Delaware limited liability company (“Buyer”). Seller, Conners, Ford and 4301 are collectively referred to herein as the “Seller Parties” and each as a “Seller Party.”

RECITALS

A. Immediately prior to the execution of this Agreement, 4301 and Appliance Recycling Centers of America, Inc. a Minnesota corporation, entered into an Equity Purchase Agreement, pursuant to which 4301 became the owner of 100% of the issued and outstanding equity interests of Seller.

B. Conners and Ford own 100% of the issued and outstanding equity interests of 4301.

C. Seller is engaged in the business of appliance recycling and bulk appliance and appliance part sales (the “Business”).

D. Seller wishes to sell and assign to Buyer, and Buyer wishes to purchase and assume from Seller, the rights and obligations of Seller to the Purchased Assets and the Assumed Liabilities, subject to the terms and conditions set forth herein.

E. Concurrently with the execution of this Agreement, Buyer has entered into an employment agreement with each of Brian Conners, Michael Safford and Mary Volpe (the “Key Employee Agreements”).

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

DEFINED TERMS

Section 1.01 Defined Terms. As used herein, the following terms have the meanings set forth below:

“4301” has the meaning set forth in the preamble.

“Action” has the meaning set forth in Section 4.14.

“Affiliate” means, with respect to any Person, any other Person which, at the time of determination, directly or indirectly through one or more intermediaries controls, is controlled by or is under common control with such Person. For purposes of this Agreement, “control”, “controlled by”, “under common control with” and “controlling” means, as to any Person, the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise.

| 1 |

“Aggregate Payoff Amount” has the meaning set forth in Section 3.01(b).

“Agreement” has the meaning set forth in the preamble.

“Assigned Contracts” has the meaning set forth in Section 4.09.

“Assigned Leases” has the meaning set forth in Section 4.15.

“Assumed Liabilities” has the meaning set forth in Section 2.03(b).

“Bill of Sale and Assumption Agreement” has the meaning set forth in Section 3.04(a)(i).

“Business” has the meaning set forth in the recitals.

“Business Employee” means an employee of Seller.

“Buyer” has the meaning set forth in the preamble.

“Buyer Business” means the Business, as conducted by Buyer following the Closing.

“Closing” has the meaning set forth in Section 3.03.

“Closing Date” has the meaning set forth in Section 3.03.

“Code” means the Internal Revenue Code of 1986, as amended, and the treasury regulations promulgated thereunder.

“Competing Business” has the meaning set forth in Section 6.03(a).

“Confidential Information” means any data or information concerning Seller (including trade secrets), without regard to form, regarding (for example and including) (i) business process models, (ii) proprietary software, (iii) research, development, products, services, marketing, selling, business plans, budgets, unpublished financial statements, licenses, prices, costs, contracts, suppliers, customers, and customer lists, (iv) the identity, skills and compensation of employees, contractors, and consultants, (v) specialized training or (vi) discoveries, developments, trade secrets, processes, formulas, data, lists, and all other works of authorship, mask works, ideas, concepts, know-how, designs, and techniques, whether or not any of the foregoing is or are patentable, copyrightable, or registrable under any Intellectual Property laws in the United States or elsewhere. Notwithstanding the foregoing, no data or information constitutes “Confidential Information” if such data or information is publicly known and in the public domain through means that do not involve a breach by Seller of any covenant or obligation set forth in this Agreement.

“Conners” has the meaning set forth in the preamble.

“Disclosure Schedules” has the meaning set forth in Article IV.

“Encumbrance” means any mortgage, pledge, lien, charge, security interest, claim or other encumbrance.

“Environmental Law” means all laws concerning the environment, human health and safety or Hazardous Substances.

| 2 |

“Environmental Permits” means any permits, licenses or authorizations required by or pursuant to any Environmental Laws.

“ERISA” means the Employee Retirement Income Security Act of 1974.

“Excluded Assets” has the meaning set forth in Section 2.02.

“Excluded Liabilities” has the meaning set forth in Section 2.03(a).

“Ford” has the meaning set forth in the preamble.

“GAAP” means United States generally accepted accounting principles as in effect from time to time.

“Governmental Authority” means any (i) government or any governmental, regulatory or administrative body thereof, or political subdivision thereof, whether federal, state, provincial, municipal, local or foreign, (ii) governmental agency, instrumentality, commission, department, board, bureau or any authority thereof, (iii) multinational or supra national entity, body or authority, or (iv) court or tribunal.

“Hazardous Substances” means (i) any petroleum, petroleum by-product or break-down product, radiation or radioactive material, asbestos or asbestos-containing material, mold and polychlorinated biphenyl, and (ii) any material, substance, mixture or solution that is defined, identified or regulated as a pollutant, contaminant or waste, or as hazardous, toxic, radioactive or words of similar effect, by or pursuant to any Environmental Law.

“Indemnified Party” has the meaning set forth in Section 7.04.

“Indemnifying Party” has the meaning set forth in Section 7.04.

“Independent Accountant” has the meaning set forth in Section 3.05(b)(ii).

“Initial Purchase Price” has the meaning set forth in Section 3.01(a).

“Intellectual Property” means any and all of the following in any jurisdiction throughout the world: (i) trademarks and service marks, including all applications and registrations and the goodwill connected with the use of and symbolized by the foregoing; (ii) copyrights, including all applications and registrations related to the foregoing; (iii) trade secrets and confidential know-how; (iv) patents and patent applications; (v) websites and internet domain name registrations; and (vi) other intellectual property and related proprietary rights, interests and protections (including all rights to sue and recover and retain damages, costs and attorneys’ fees for past, present and future infringement and any other rights relating to any of the foregoing).

“Interim Balance Sheet” means the balance sheet of Seller as of the Interim Balance Sheet Date.

“Interim Balance Sheet Date” means June 30, 2017.

“Key Employee Agreements” has the meaning set forth in the recitals.

| 3 |

“Non-Assignable Contract” means any contract included in the Purchased Assets that requires the consent of any third party, which consent has not been obtained by Seller prior to or as of the Closing.

“Person” means any individual, corporation, partnership, joint venture, limited liability company, association, joint-stock company, trust, unincorporated organization, or Governmental Authority.

“Purchase Price” has the meaning set forth in Section 3.01.

“Purchased Assets” has the meaning set forth in Section 2.01.

“Purchased IP” has the meaning set forth in Section 4.08(a).

“Restricted Period” has the meaning set forth in Section 6.03(a).

“Seller” has the meaning set forth in the preamble.

“Seller Parties” has the meaning set forth in the preamble.

“Seller Plans” means (i) all employee benefit plans (within the meaning of Section 3(3) of ERISA) and all retirement, welfare benefit, bonus, stock option, stock purchase, restricted stock, incentive, equity or equity-based compensation, deferred compensation, retiree health or life insurance, supplemental retirement, severance, change in control, Code Section 125 flexible benefit, vacation or other benefit plans, programs or arrangements, whether written or oral, that are maintained, contributed to or sponsored by Seller or its respective Affiliates for the benefit of any current or former employee, director or individual consultant of the Business, other than governmental plans or arrangements, and (ii) all individual employment, retention, termination, severance, Tax gross up, collective bargaining, consulting, employee non-competition, employee non-solicitation or other similar contracts pursuant to which Seller or its respective Affiliates currently has any obligation with respect to any current or former employee, director or individual consultant of the Business.

“Transferred Permits” has the meaning set forth in Section 4.10.

Section 1.02 Construction.

(a) Unless the context of this Agreement otherwise requires, (i) words of any gender include the other gender; (ii) words using the singular or plural number also include the plural or singular number, respectively; (iii) the terms “hereunder,” “hereof,” “herein,” “hereby,” “hereto” and derivative or similar words refer to this entire Agreement, including the Schedules and Exhibits hereto; (iv) the terms “Article,” “Section,” “paragraph,” “clause” and “Exhibit” refer to the specified Article, Section, paragraph, clause or Exhibit of this Agreement; and (v) the words “include” and “including” and variations thereof mean without limitation.

(b) References to agreements and other documents (including this Agreement) include (i) all subsequent amendments and other modifications thereto and (ii) all addenda, exhibits and schedules thereto.

(c) References to statutes include all regulations promulgated thereunder and references to statutes or regulations will be construed as including all statutory and regulatory provisions consolidating, amending or replacing the statute or regulation.

| 4 |

(d) Whenever this Agreement refers to a number of days, such number refers to calendar days unless Business Days are specified.

(e) All accounting terms used herein and not expressly defined herein have the meanings given to them under GAAP.

(f) References to “$” or “dollars” means United States dollars.

(g) A reference to any Person includes such Person’s successors and permitted assigns.

(h) When calculating the period of time before which, within which or following which any act is to be done or step taken pursuant to this Agreement, the date that is the reference date in calculating such period will be excluded, and if the last day of such period is not a Business Day, the period will end on the next succeeding Business Day.

(i) This Agreement was negotiated by the parties with the benefit of legal representation and any rule of construction or interpretation otherwise requiring this Agreement to be construed or interpreted against any party will not apply to any construction or interpretation hereof.

ARTICLE II

PURCHASE AND SALE

Section 2.01 Purchase and Sale of Assets. Subject to the terms and conditions set forth herein, Seller will sell, assign, transfer, convey and deliver to Buyer, and Buyer will purchase from Seller, all of Seller’s assets, properties, rights and interests, of any kind and description (whether real or personal, tangible or intangible, fixed, contingent or otherwise), wherever located and by whomever possessed, including the assets set forth on Exhibit 2.01, other than the Excluded Assets (collectively, the “Purchased Assets”), free and clear of any Encumbrance.

Section 2.02 Excluded Assets. Notwithstanding the provisions of Section 2.01, the Purchased Assets will not include the following assets (collectively, the “Excluded Assets”):

(a) all cash, cash equivalents and bank accounts of Seller;

(b) all accounts and notes receivable due to Seller from any member or Affiliate of Seller or any of their respective Affiliates;

(c) all corporate minute books, stock transfer books, the corporate seal, if any, all accounting records, and all books and records of Seller not related to the Purchased Assets;

(d) all Seller Plans;

(e) all assets set forth on Exhibit 2.02(e); and

(f) any rights of Seller created under this Agreement. Section

2.03 Assumption of Liabilities.

| 5 |

(a) Except as provided in Section 2.03(b), Buyer will not assume, in connection with the transactions contemplated hereby, any liability or obligation of Seller whatsoever, whether known or unknown, disclosed or undisclosed, accrued or hereafter arising, absolute or contingent, and Seller will retain responsibility for, and will timely discharge and satisfy, all such liabilities and obligations (collectively, and including the liabilities set forth in Section 2.04, the “Excluded Liabilities”).

(b) Effective as of the Closing, Buyer will assume and be responsible for the following liabilities and obligations of Seller (collectively, the “Assumed Liabilities”):

(i) the obligations of Seller under each Assigned Contract and Assigned Lease, except to the extent such obligations are required to be performed on or prior to the Closing Date, or accrue and relate to the operation of the Business prior to the Closing Date;

(ii) the accounts payable and other current liabilities of Seller of the type reflected or reserved against on the Interim Balance Sheet; and

(iii) the liabilities listed on Exhibit 2.03(b)(iii).

Section 2.04 Specifically Excluded Liabilities. Specifically, and without in any way limiting the generality of Section 2.03, the Assumed Liabilities do not include, and in no event will Buyer assume, agree to pay, discharge or satisfy any liability or obligation of Seller:

(a) for any taxes of Seller for any period;

(b) owed to any member or Affiliate of Seller or any of their respective Affiliates (other than accrued salary, wages, commissions or bonuses for the then-current payroll period);

(c) that is being paid off by Buyer at the Closing pursuant to Article III; or

(d) in respect of any Excluded Asset.

ARTICLE III

PURCHASE PRICE; CLOSING

Section 3.01 Purchase Price. The aggregate consideration for the Purchased Assets (the “Purchase Price”) is:

(a) the payment by Buyer at the Closing of an amount equal to $1.00 (the “Initial Purchase Price”); plus

(b) the payment by Buyer at the Closing of the aggregate amount of the indebtedness listed on Exhibit 3.01(b) (the “Aggregate Payoff Amount”); plus

(c) the assumption by Buyer of the Assumed Liabilities.

Section 3.02 Payment of Initial Purchase Price and Aggregate Payoff Amount. At the Closing, Buyer will pay (i) to Seller, the Initial Purchase Price and (ii) to each lender listed on Exhibit 3.01(b), the portion of the Aggregate Payoff Amount listed opposite such lender’s name on Exhibit 3.01(b).

| 6 |

Section 3.03 Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) will take place simultaneously with the execution of this Agreement on the date of this Agreement (the “Closing Date”) at the offices of Jones Day, 1420 Peachtree St. N.E., Atlanta, GA 30309, or remotely via electronic exchange of documents. The consummation of the transactions contemplated by this Agreement will be deemed to occur at 12:01 a.m. on the Closing Date.

Section 3.04 Closing Deliverables.

(a) At or prior to the Closing (or, in those cases where a specified period of time before the Closing is indicated in this Agreement, by no later than such time), Seller will deliver to Buyer the following:

(i) a bill of sale and assumption agreement in form and substance satisfactory to Buyer and Seller (the “Bill of Sale and Assumption Agreement”) and duly executed by Seller, transferring the Purchased Assets to Buyer and effecting the assignment to and assumption by Buyer of the the Assumed Liabilities;

(ii) copies of all consents, approvals, waivers and authorizations set forth in Section 4.02 of the Disclosure Schedules;

(iii) a certificate pursuant to Treasury Regulations Section 1.1445-2(b) that Seller is not a foreign person within the meaning of Section 1445 of the Code, duly executed by Seller;

(iv) a certificate of the Secretary or Assistant Secretary (or equivalent officer) of Seller certifying as to the resolutions of the board of directors of Seller, duly adopted and in effect, which authorize the execution, delivery and performance of this Agreement and the transactions contemplated hereby;

(v) the Key Employee Agreements, duly executed by Brian Conners, Michael Safford and Mary Volpe;

(vi) a payoff letter from each lender listed on Exhibit 3.01(b), evidencing the amount of Seller’s indebtedness to such lender as of the Closing Date and providing that, if such aggregate amount so identified is paid to such lender on the Closing Date, such indebtedness will be repaid in full and that all Encumbrances affecting any real or personal property of Seller will be released;

(vii) a transition services agreement (the “Transition Services Agreement”), in form and substance satisfactory to Buyer and Seller and duly executed by Seller; and

(viii) such other customary instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to Buyer, as may be required to give effect to this Agreement.

(b) At the Closing, Buyer will deliver the following:

(i) to Seller, the Initial Purchase Price;

(ii) to each lender listed on Exhibit 3.01(b), the portion of the Aggregate Payoff Amount listed opposite such lender’s name thereon;

| 7 |

(iii) to Seller, the Bill of Sale and Assumption Agreement duly executed by Buyer;

(iv) to Seller, the Transition Services Agreement, duly executed by Buyer;

(v) to Brian Conners, Michael Safford and Mary Volpe, the Key Employment Agreements, duly executed by Buyer;

(vi) to Seller, a certificate of the Secretary or Assistant Secretary (or equivalent officer) of Buyer certifying as to the resolutions of the members, managers or board of directors, as applicable, of Buyer, duly adopted and in effect, which authorize the execution, delivery and performance of this Agreement and the transactions contemplated hereby; and

(vii) to Seller, such other customary instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to Seller, as may be required to give effect to this Agreement.

Section 3.05 Allocation of Purchase Price. Seller and Buyer agree to allocate the Purchase Price among the Purchased Assets for all purposes (including tax and financial accounting) in accordance with Exhibit 3.05. Buyer and Seller will file all tax returns (including amended returns and claims for refund) and information reports in a manner consistent with such allocation.

Section 3.06 Method of Payment. All payments required under this Article III or any other provision of this Agreement will be made in cash by wire transfer of immediately available federal funds to a bank account designated in writing by the party entitled to receive such payment.

Section 3.07 Withholding Tax. Buyer will be entitled to deduct and withhold from the Purchase Price all taxes that Buyer may be required to deduct and withhold under any applicable tax law, which have been identified and agreed to by Seller prior to the Closing. All such withheld amounts will be treated as delivered to Seller hereunder; provided, however, that such amount withheld pursuant to applicable tax laws are actually remitted to the appropriate Governmental Authority as and when required by law.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF SELLER

For purposes of this Article IV, “Seller Parties’ knowledge,” “knowledge of the Seller Seller Parties” and any similar phrases will mean the actual knowledge of Conners and Ford, after due and careful inquiry. Except as set forth in the disclosure schedules delivered by Seller in connection with this Agreement (the “Disclosure Schedules”), the Seller Parties, jointly and severally, represent and warrant to Buyer as follows:

Section 4.01 Organization and Authority of Seller; Enforceability. Seller is a limited liability company duly organized, validly existing and in good standing under the laws of the state of Minnesota. Seller has full limited liability company power and authority to enter into this Agreement and the documents to be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. The execution, delivery and performance by Seller of this Agreement and the documents to be delivered hereunder and the consummation of the transactions contemplated hereby have been duly authorized by all requisite action on the part of Seller. This Agreement and the documents to be delivered hereunder have been duly executed and delivered by Seller, and (assuming due authorization, execution and delivery by Buyer) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of Seller, enforceable against Seller in accordance with their respective terms.

| 8 |

Section 4.02 No Conflicts; Consents. The execution, delivery and performance by Seller of this Agreement and the documents to be delivered hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (a) violate or conflict with the organizational documents of Seller; (b) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule or regulation applicable to Seller or the Purchased Assets; (c) conflict with, or result in (with or without notice or lapse of time or both) any violation of, or default under, or give rise to a right of termination, acceleration or modification of any obligation or loss of any benefit under any contract or other instrument to which Seller is a party or to which any of the Purchased Assets are subject; or (d) result in the creation or imposition of any Encumbrance on the Purchased Assets. Except as set forth in Section 4.02 of the Disclosure Schedules, no consent, approval, waiver or authorization is required to be obtained by Seller from any Person (including any Governmental Authority) in connection with the execution, delivery and performance by Seller of this Agreement and the consummation of the transactions contemplated hereby.

Section 4.03 Title to and Sufficiency of Purchased Assets. Seller owns and has good title to the Purchased Assets, free and clear of Encumbrances. The Purchased Assets constitute all of the assets used in the Business and reasonably necessary to operate the Business as currently conducted, and are sufficient for the continued conduct of the Business immediately after the Closing in substantially the manner conducted prior to the Closing. Section 4.03 of the Disclosure Schedules sets forth a description of all material services received by the Business provided by individuals who are not Business Employees or provided using assets that are not included in the Purchased Assets, including any such services provided by a member of Seller or any Affiliate of such member (other than Seller) who is not a Business Employee.

Section 4.04 Financial Statements. Section 4.04(a) of the Disclosure Schedules contains (i) the Interim Balance Sheet and related statements of income and cash flows of Seller as of and for the six-month period ended on the Interim Balance Sheet Date and (ii) the audited balance sheets and related statements of income and cash flows of Seller as of and for the years 2015 and 2016, respectively. All such balance sheets and statements of income and cash flows have been prepared in conformity with GAAP consistently applied and present fairly in all material respects the financial position, results of operations and cash flows of Seller as of their respective dates and for the respective periods covered thereby. Except as set forth in Section 4.04(b) of the Disclosure Schedules, Seller is not, with respect to the Business, subject to any known or asserted liability which is not shown or which is in excess of amounts shown or reserved for in the Interim Balance Sheet, other than liabilities of the same nature as those set forth in the Interim Balance Sheet and incurred in the ordinary course of business after the Interim Balance Sheet Date.

| 9 |

Section 4.05 Operations since Interim Balance Sheet Date. Except as set forth in Section 4.05 of the Disclosure Schedules, and except for the transactions contemplated by this Agreement, since the Interim Balance Sheet Date (a) there has been no material adverse change in the Purchased Assets, the Business or the operations, liabilities, profits or condition (financial or otherwise) of Seller, and, to the knowledge of the Seller Parties, no fact or condition exists or is contemplated or threatened which would reasonably be expected to cause such a change in the future, and (b) Seller has conducted the Business only in the ordinary course and in conformity with past practice.

Section 4.06 Condition of Assets. The tangible personal property included in the Purchased Assets is in good condition (normal wear and tear excepted) and is adequate for the uses to which it is being put, and none of such tangible personal property is in need of maintenance or repairs except for ordinary, routine maintenance and repairs that are not material in nature or cost.

Section 4.07 Inventory. All inventory, finished goods, raw materials, work in progress, packaging, supplies, parts and other inventories included in the Purchased Assets consist of a quality and quantity usable and salable in the ordinary course of business.

Section 4.08 Intellectual Property.

(a) Seller owns or has adequate, valid and enforceable rights to use all Intellectual Property included in the Purchased Assets (“Purchased IP”), free and clear of all Encumbrances. Seller is not bound by any outstanding judgment, injunction, order or decree restricting the use of the Purchased IP, or restricting the licensing thereof to any Person. With respect to the registered Intellectual Property included in the Purchased IP, (i) all such Intellectual Property is valid, subsisting and in full force and effect and (ii) Seller has paid all maintenance fees and made all filings required to maintain Seller’s ownership thereof.

(b) Seller’s prior and current use of the Purchased IP has not and does not infringe, violate, dilute or misappropriate the Intellectual Property of any Person and there are no claims pending or, to the knowledge of the Seller Parties, threatened by any Person with respect to the ownership, validity, enforceability, effectiveness or use of the Purchased IP. No Person is infringing, misappropriating, diluting or otherwise violating any of the Purchased IP, and neither Seller nor any Affiliate of Seller has made or asserted any claim, demand or notice against any Person alleging any such infringement, misappropriation, dilution or other violation.

Section 4.09 Assigned Contracts. Each contract included in the Purchased Assets and being assigned to and assumed by Buyer (the “Assigned Contracts”) is valid and binding on Seller in accordance with its terms and is in full force and effect, or is a month-to month contract under which goods or services are being provided after the expiration of its original term. None of Seller or, to the knowledge of the Seller Parties, any other party thereto is in breach of or default under (or is alleged to be in breach of or default under), or has provided or received any notice of any intention to terminate, any Assigned Contract. No event or circumstance has occurred that, with or without notice or lapse of time or both, would constitute an event of default under any Assigned Contract or result in a termination thereof or would cause or permit the acceleration or other changes of any right or obligation or the loss of benefit thereunder. Complete and correct copies of each Assigned Contract have been made available to Buyer. There are no disputes pending or threatened under any Assigned Contract.

| 10 |

Section 4.10 Permits. All permits, licenses, franchises, approvals, authorizations, registrations, certificates, variances and similar rights obtained from Governmental Authorities included in the Purchased Assets (the “Transferred Permits”) are valid and in full force and effect. All fees and charges with respect to such Transferred Permits as of the date hereof have been paid in full. To Seller’s knowledge, no event has occurred that, with or without notice or lapse of time or both, would reasonably be expected to result in the revocation, suspension, lapse or limitation of any Transferred Permit.

Section 4.11 Environmental Matters. Except as set forth in Section 4.11 of the Disclosure Schedules: (i) Seller complies, and for the last five years has complied, in all material respects with all applicable Environmental Laws; (ii) Seller has obtained all Environmental Permits necessary for the operation of the Business, all such Environmental Permits are in good standing, and Seller is, and has for the past five years been, in compliance in all material respects with all of the terms and conditions thereof, and the transactions contemplated by this Agreement will not result in or trigger the termination, revocation, or right of termination or cancellation, of any such Environmental Permits; (iii) there are not now, nor in the last five years has there been, any lawsuits, claims, proceedings or investigations concerning Environmental Laws pending or, to the knowledge of the Seller Parties, threatened against or affecting Seller or the Purchased Assets nor, to the knowledge of the Seller Parties, is there currently any reasonable basis for any of the same; and (iv) Seller has not received any notice that it is or may be subject to any liability with respect any actual or alleged presence of, or exposure to, Hazardous Substances or violation of Environmental Law at any location.

Section 4.12 Non-foreign Status. Seller is not a “foreign person” as that term is used in Treasury Regulations Section 1.1445-2.

Section 4.13 Compliance With Laws. Seller has complied, and is now complying, with all applicable federal, state and local laws and regulations applicable to ownership and use of the Purchased Assets.

Section 4.14 Legal Proceedings. There is no claim, action, suit, proceeding or governmental investigation (“Action”) of any nature pending or, to the knowledge of the Seller Parties, threatened against or by Seller (a) relating to or affecting the Purchased Assets or the Assumed Liabilities; or (b) that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. To Seller’s knowledge, no event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

Section 4.15 Real Property. Seller does not now own any real property or hold any option to acquire any real property. Exhibit 4.15 sets forth (i) a list of each lease or similar agreement under which Seller is lessee of, or holds or operates, any real property owned by any third Person and that is being assigned to Buyer in connection with the transactions contemplated by this Agreement (“Assigned Leases”). Each Assigned Lease is valid and binding on Seller in accordance with its terms and is in full force and effect. None of Seller or, to the knowledge of the Seller Parties, any other party thereto is in breach of or default under (or is alleged to be in breach of or default under), or has provided or received any notice of any intention to terminate, any Assigned Lease. No event or circumstance has occurred that, with or without notice or lapse of time or both, would constitute an event of default under any Assigned Lease or result in a termination thereof or would cause or permit the acceleration or other changes of any right or obligation or the loss of benefit thereunder. Complete and correct copies of each Assigned Lease have been made available to Buyer. There are no disputes pending or, to Seller’s knowledge, threatened under any Assigned Lease.

| 11 |

Section 4.16 Employees and Employment Matters.

(a) Section 4.16(a)(i) of the Disclosure Schedules sets forth a list of each Business Employee and the name, title, date of birth, and date of hire of each such person. Section 4.16(a)(ii) of the Disclosure Schedules sets forth a list of each material Seller Plan. Seller is, and has been, in compliance in all material respects with all applicable laws in respect of the Business Employees and the Seller Plans, including under ERISA and the Code. Seller is not party to any collective bargaining agreement and is not, and has not previously been, the subject of any collective bargaining or union organizing activity. Except as set forth in Section 4.16(a)(iii) of the Disclosure Schedules, Seller is not a party to any employment agreement, or any other agreement, providing for any payment or consideration payable to any Business Employee upon a change of control or a sale of all or any portion of the Business.

(b) Each Seller Plan that is intended to be qualified under Section 401(a) of the Code has received a favorable determination letter from the IRS that it is so qualified, and each related trust that is intended to be exempt from federal income tax pursuant to Section 501(a) of the Code has received a determination letter from the IRS that it is so exempt, and no fact or event has occurred or is expected to occur since the date of such determination letter that could reasonably be expected to adversely affect such qualification or exemption, as the case may be.

(c) Seller has not incurred any liability, contingent or otherwise, under or arising out of Title IV of ERISA that has not been satisfied in full and no fact or event exists that has or could reasonably be expected to result in such a liability. None of the Purchased Assets is the subject of any Encumbrance arising with respect to any Seller Plan under applicable law (including ERISA and the Code).

(d) Seller is in compliance in all material respects with all laws relating to the employment of the Business Employees, and has paid in full all wages, salaries, commissions, and other compensation and benefits, as well as all contributions due to them or to third parties on their behalf (including taxes, social security taxes, workers compensation contributions and employment insurance payments). No material claim, charge or litigation with respect to such compliance or payment obligations has been asserted, is now pending, or to the knowledge the Seller Parties, has been threatened with respect to current or former Business Employees. There are no outstanding, unsatisfied obligations to comply with any recommendations or declarations of any Governmental Authority in respect of claims by current or former Business Employees.

Section 4.17 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Seller.

| 12 |

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF BUYER

For purposes of this Article V, “Buyer’s knowledge,” “knowledge of Buyer” and any similar phrases will mean the actual or constructive knowledge of any member, manager, director or officer of Buyer, after due inquiry. Buyer represents and warrants to Seller as follows:

Section 5.01 Organization and Authority of Buyer; Enforceability. Buyer is a limited liability company duly organized, validly existing and in good standing under the laws of the state of Delaware. Buyer has full limited liability company power and authority to enter into this Agreement and the documents to be delivered hereunder, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. The execution, delivery and performance by Buyer of this Agreement and the documents to be delivered hereunder and the consummation of the transactions contemplated hereby have been duly authorized by all requisite action on the part of Buyer. This Agreement and the documents to be delivered hereunder have been duly executed and delivered by Buyer, and (assuming due authorization, execution and delivery by the Seller Parties) this Agreement and the documents to be delivered hereunder constitute legal, valid and binding obligations of Buyer enforceable against Buyer in accordance with their respective terms.

Section 5.02 No Conflicts; Consents. The execution, delivery and performance by Buyer of this Agreement and the documents to be delivered hereunder, and the consummation of the transactions contemplated hereby, do not and will not: (a) violate or conflict with the organizational documents of Buyer; or (b) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule or regulation applicable to Buyer. No consent, approval, waiver or authorization is required to be obtained by Buyer from any Person (including any Governmental Authority) in connection with the execution, delivery and performance by Buyer of this Agreement and the consummation of the transactions contemplated hereby.

Section 5.03 Legal Proceedings. There is no Action of any nature pending or, to Buyer’s knowledge, threatened against or by Buyer that challenges or seeks to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

Section 5.04 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Buyer.

ARTICLE VI

COVENANTS

Section 6.01 Public Announcements. Unless otherwise required by applicable law, no party will make any public announcements regarding this Agreement or the transactions contemplated hereby without the prior written consent of the other parties (which consent will not be unreasonably withheld or delayed).

| 13 |

Section 6.02 Employee Matters. Buyer may, in its sole and absolute discretion, make an offer of employment to any Business Employee. Seller hereby waives any contractual or other obligation or provision that would restrict any Business Employee from accepting employment with Buyer or would otherwise restrict the activities of any Business Employee hired by Buyer, including any non-competition or non-solicitation covenant contained in an agreement between Seller and any Business Employee. Seller will use commercially reasonable efforts to cause each Business Employee to whom Buyer makes an offer of employment to accept such offer in a timely manner.

Section 6.03 Covenant Not to Compete and Confidentiality.

(a) In furtherance of the sale of the Business and the Purchased Assets and to more effectively protect the value and goodwill thereof, Seller covenants and agrees for a period ending on the five-year anniversary of the Closing Date (the “Restricted Period”), that it will not, directly or indirectly (whether as principal, agent, independent contractor, employee, partner or otherwise), own, manage, operate, control, participate in, perform services for, or otherwise carry on, a business competitive with the Business (a “Competing Business”) anywhere in the United States (it being understood by the parties hereto that the Business is not limited to any particular region of the United States and that such Business may be engaged in effectively from any location in the United States).

(b) Seller will hold in confidence at all times following the Closing all Confidential Information and will not disclose, publish or make use of Confidential Information at any time following the date hereof without the prior written consent of Buyer.

(c) It is the intent and understanding of each party hereto that if, in any action before any Governmental Authority legally empowered to enforce this Section 6.03, any term, restriction, covenant or promise in this Section 6.03 is found to be unreasonable and for that reason unenforceable, then such term, restriction, covenant or promise will be deemed modified to the extent necessary to make it enforceable by such Governmental Authority.

(d) In the event that Seller violates any obligation under this Section 6.03, Buyer may proceed against Seller in law or in equity. Seller acknowledges that a violation of this Section 6.3 would cause Buyer irreparable harm which cannot be adequately compensated for by money damages. Seller expressly acknowledges that the remedy at law for any breach of this Section 6.03 will be inadequate, and that upon any such breach or threatened breach Buyer will be entitled as a matter of right to injunctive relief in any court or other tribunal of competent jurisdiction, in equity or otherwise, and to enforce the specific performance of the obligations under these provisions without the necessity of proving actual damages or the inadequacy of a legal remedy or posting a bond or other security. If Buyer prevails in any action commenced under this Section 6.03, it will also be entitled to recover its expenses in connection therewith.

Section 6.04 Bulk Sales Laws. The parties hereby waive compliance with the provisions of any bulk sales, bulk transfer or similar laws of any jurisdiction that may otherwise be applicable with respect to the sale of any or all of the Purchased Assets to Buyer.

Section 6.05 Transfer Taxes. All transfer, documentary, sales, use, stamp, registration, value added and other such taxes and fees (including any penalties and interest) incurred in connection with this Agreement and the documents to be delivered hereunder will be borne and paid by Seller when due. Seller will timely pay such taxes and fees and timely file and any tax return or other document with respect to such taxes or fees.

| 14 |

Section 6.06 Further Assurances. Following the Closing, each of the parties hereto will execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement and the documents to be delivered hereunder.

Section 6.07 Consents. Until such time as each Non-Assignable Contract can be assigned to Buyer, and then during the remaining term of each Non-Assignable Contract, Seller will make the benefit of such Non-Assignable Contract available to Buyer so long as Buyer fully cooperates with Seller and reimburses Seller for all payments made by Seller in connection therewith. In addition, during the remaining term of each Non-Assignable Contract, Seller will use commercially reasonable efforts to (a) obtain the consent of the third parties required thereunder, and (b) enforce, at the request of Buyer and for the account of Buyer, any right of Seller arising from such Non-Assignable Contract against the other party or parties thereto (including the right to elect or terminate any such Non- Assignable Contract in accordance with the terms thereof). Seller will not take any action or suffer any omission that would reasonably be expected to limit, restrict or terminate in any material respect the benefits to Buyer of such Non-Assignable Contract unless, in good faith and after consultation with and prior written notice to Buyer, Seller is (i) ordered to do so by a Governmental Authority of competent jurisdiction or (ii) otherwise required to do so by law; provided, however, that if any such order is appealable and Buyer so requests, Seller will take such reasonable actions as are requested by Buyer to file and pursue such appeal and to obtain a stay of such order, and the Seller will reimburse Buyer for the costs incurred by Buyer related to the appeal of such an order. Nothing in this Agreement or the Bill of Sale and Assumption Agreement constitutes a sale, assignment, transfer or conveyance to, or assumption by, Buyer of the Non-Assignable Contracts. With respect to any such Non-Assignable Contract as to which the necessary approval or consent for the assignment or transfer to Buyer is obtained following the Closing, Seller will transfer such Non-Assignable Contract to Buyer by execution and delivery of an instrument of conveyance reasonably satisfactory to Buyer within five business days following receipt of such approval or consent.

ARTICLE VII

INDEMNIFICATION

Section 7.01 Survival. All representations, warranties, covenants and agreements contained herein and all related rights to indemnification will survive the Closing and continue in full force and effect for four years thereafter, except (i) the representations and warranties set forth in Sections 4.11 and 4.16, which will survive the Closing and continue in full force and effect until the applicable statute of limitations expires (or for 15 years if there is no applicable statute of limitations) and (ii) the representations and warranties set forth in Section 4.01 and 5.01, which will survive the Closing and will continue in full force and effect forever.

Section 7.02 Indemnification By the Seller Parties. Subject to the other terms and conditions of this Article VII, the Seller Parties will, jointly and severally, defend, indemnify and hold harmless Buyer, its Affiliates and their respective members, managers, directors, officers and employees from and against all claims, judgments, damages, liabilities, settlements, losses, costs and expenses, including reasonable attorneys’ fees and disbursements, but excluding punitive or incidental damages, arising from or relating to:

| 15 |

(a) any inaccuracy in or breach of any of the representations or warranties of the Seller Parties contained in this Agreement or any document to be delivered hereunder;

(b) any breach or non-fulfillment of any covenant, agreement or obligation to be performed by any Seller Party pursuant to this Agreement or any document to be delivered hereunder;

(c) the operation and ownership of, or conditions first occurring with respect to, the Purchased Assets prior to the Closing (other than the Assumed Liabilities relating thereto); or

(d) any Excluded Asset or Excluded Liability.

Section 7.03 Indemnification By Buyer. Subject to the other terms and conditions of this Article VII, Buyer will defend, indemnify and hold harmless Seller, its Affiliates and their respective stockholders or other equity holders, directors, officers and employees from and against all claims, judgments, damages, liabilities, settlements, losses, costs and expenses, including reasonable attorneys’ fees and disbursements, but excluding punitive or incidental damages, arising from or relating to:

(a) any inaccuracy in or breach of any of the representations or warranties of Buyer contained in this Agreement or any document to be delivered hereunder;

(b) any breach or non-fulfillment of any covenant, agreement or obligation to be performed by Buyer pursuant to this Agreement or any document to be delivered hereunder;

(c) the operation and ownership of, or conditions first occurring with respect to, the Purchased Assets from and after the Closing (other than the Excluded Liabilities relating thereto); or

(d) any Assumed Liability.

Section 7.04 Indemnification Procedures. Whenever any claim will arise for indemnification hereunder, the party entitled to indemnification (the “Indemnified Party”) will promptly provide written notice of such claim to the other party (the “Indemnifying Party”). In connection with any claim giving rise to indemnity hereunder resulting from or arising out of any Action by a Person who is not a party to this Agreement, the Indemnifying Party, at its sole cost and expense and upon written notice to the Indemnified Party, may assume the defense of any such Action with counsel reasonably satisfactory to the Indemnified Party. The Indemnified Party will be entitled to participate in the defense of any such Action, with its counsel and at its own cost and expense. If the Indemnifying Party does not assume the defense of any such Action, the Indemnified Party may, but will not be obligated to, defend against such Action in such manner as it may deem appropriate, including, but not limited to, settling such Action, after giving notice of it to the Indemnifying Party, on such terms as the Indemnified Party may deem appropriate and no action taken by the Indemnified Party in accordance with such defense and settlement will relieve the Indemnifying Party of its indemnification obligations herein provided with respect to any damages resulting therefrom. The Indemnifying Party will not settle any Action without the Indemnified Party’s prior written consent (which consent will not be unreasonably withheld or delayed).

| 16 |

Section 7.05 Tax Treatment of Indemnification Payments. All indemnification payments made by Seller under this Agreement will be treated by the parties as an adjustment to the Purchase Price for tax purposes, unless otherwise required by law.

Section 7.06 Effect of Investigation. Buyer’s right to indemnification or other remedy based on the representations, warranties, covenants and agreements of the Seller Parties contained herein will not be affected by any investigation conducted by Buyer with respect to, or any knowledge acquired by Buyer at any time, with respect to the accuracy or inaccuracy of or compliance with, any such representation, warranty, covenant or agreement.

Section 7.07 Exclusive Remedy. The rights and remedies provided in this Article VII are the exclusive remedies of Buyer and Seller arising out of or in connection with this Agreement and shall be in lieu of any rights under contract, tort or otherwise (other than claims based on actual fraud of this Agreement, intentional misrepresentation or deliberate or willful breach). Notwithstanding the foregoing, nothing in this Section 7.07 will impair the parties’ rights to specific performance pursuant to Section 8.13.

ARTICLE VIII

MISCELLANEOUS

Section 8.01 Expenses. All costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby will be paid by the party incurring such costs and expenses.

Section 8.02 Notices. All notices, requests, consents, claims, demands, waivers and other communications hereunder will be in writing and will be deemed to have been given (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee if sent by a nationally recognized overnight courier (receipt requested); (c) on the date sent by e-mail of a PDF document (with confirmation of transmission) if sent during normal business hours of the recipient, and on the next business day if sent after normal business hours of the recipient; or (d) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid. Such communications must be sent to the respective parties at the following addresses (or at such other address for a party as specified in a notice given in accordance with this Section 8.02):

| If to Seller: | ARCA Advanced Processing, LLC |

| 4301 N. Delaware Ave. Bldg. C | |

| Philadelphia, PA 19137 | |

| If to 4301, Conners or Ford: | 4301 Operations, LLC |

| 4301 N. Delaware Ave. Bldg. C | |

| Philadelphia, PA 19137 |

| 17 |

| If to Buyer: | Recleim PA, LLC |

| c/o Peachtree Investment Solutions, LLC | |

| 34 Old Ivy road, Suite 200 | |

| Atlanta, GA 30342 | |

| Attention: Pete Davis | |

| E-mail: pete@peachtreeinv.com | |

| with a copy to: | Jones Day |

| 1420 Peachtree St., N.E., Suite 800 | |

| Atlanta, GA 30309 | |

| Attention: Ken Boehner | |

| E-mail: kboehner@jonesday.com |

Section 8.03 Headings. The headings in this Agreement are for reference only and will not affect the interpretation of this Agreement.

Section 8.04 Severability. If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction.

Section 8.05 Entire Agreement. This Agreement and the documents to be delivered hereunder constitute the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein, and supersede all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. In the event of any inconsistency between the statements in the body of this Agreement and the documents to be delivered hereunder, the Exhibits and Disclosure Schedules (other than an exception expressly set forth as such in the Disclosure Schedules), the statements in the body of this Agreement will control.

Section 8.06 Successors and Assigns. This Agreement will be binding upon and will inure to the benefit of the parties hereto and their respective successors and permitted assigns. No party may assign its rights or obligations hereunder without the prior written consent of the other parties, which consent will not be unreasonably withheld or delayed. Notwithstanding the foregoing, Buyer may assign this Agreement to an Affiliate of Buyer without the prior consent of Seller. No assignment will relieve the assigning party of any of its obligations hereunder.

Section 8.07 No Third-party Beneficiaries. Except as provided in Article VII, this Agreement is for the sole benefit of the parties hereto and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or will confer upon any other Person any legal or equitable right, benefit or remedy of any nature whatsoever under or by reason of this Agreement.

Section 8.08 Amendment and Modification. This Agreement may only be amended, modified or supplemented by an agreement in writing signed by each party hereto.

Section 8.09 Waiver. No waiver by any party of any of the provisions hereof will be effective unless explicitly set forth in writing and signed by the party so waiving. No waiver by any party will operate or be construed as a waiver in respect of any failure, breach or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver. No failure to exercise, or delay in exercising, any right, remedy, power or privilege arising from this Agreement will operate or be construed as a waiver thereof; nor will any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

| 18 |

Section 8.10 Governing Law. This Agreement will be governed by and construed in accordance with the internal laws of the State of Delaware without giving effect to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction).

Section 8.11 Submission to Jurisdiction. Any legal suit, action or proceeding arising out of or based upon this Agreement or the transactions contemplated hereby may be instituted in the federal courts of the United States of America or the courts of the State of Delaware in each case located in the city of Wilmington and county of New Castle, and each party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action or proceeding.

Section 8.12 Waiver of Jury Trial. Each party acknowledges and agrees that any controversy which may arise under this Agreement is likely to involve complicated and difficult issues and, therefore, each such party irrevocably and unconditionally waives any right it may have to a trial by jury in respect of any legal action arising out of or relating to this Agreement or the transactions contemplated hereby.

Section 8.13 Specific Performance. The parties agree that irreparable damage would occur if any provision of this Agreement were not performed in accordance with the terms hereof and that the parties will be entitled to specific performance of the terms hereof, in addition to any other remedy to which they are entitled at law or in equity.

Section 8.14 Counterparts. This Agreement may be executed in counterparts, each of which will be deemed an original, but all of which together will be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic transmission will be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

[Signature Page Follows]

| 19 |

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above.

| BUYER | |

| RECLEIM PA, LLC | |

| By: /s/ J. Steve Bush | |

| Name: J. Steve Bush | |

| Title: Manager | |

| SELLER PARTIES | |

| ARCA ADVANCED PROCESSING, LLC | |

| By: /s/ Brian Conners | |

| Name: Brian Conners | |

| Title: COO | |

| 4301 OPERATIONS, LLC | |

| By: /s/ Brian Conners | |

| Name: Brian Conners | |

| Title: President | |

| /s/ Brian Conners | |

| Brian Conners | |

| /s/ James Ford | |

| James Ford |

[SIGNATURE PAGE TO ASSET PURCHASE AGREEMENT]

| 20 |

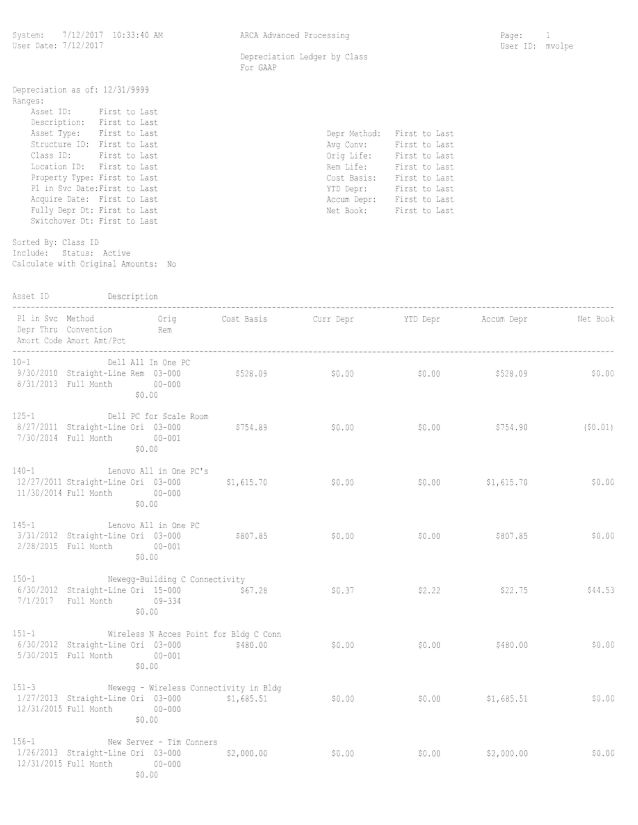

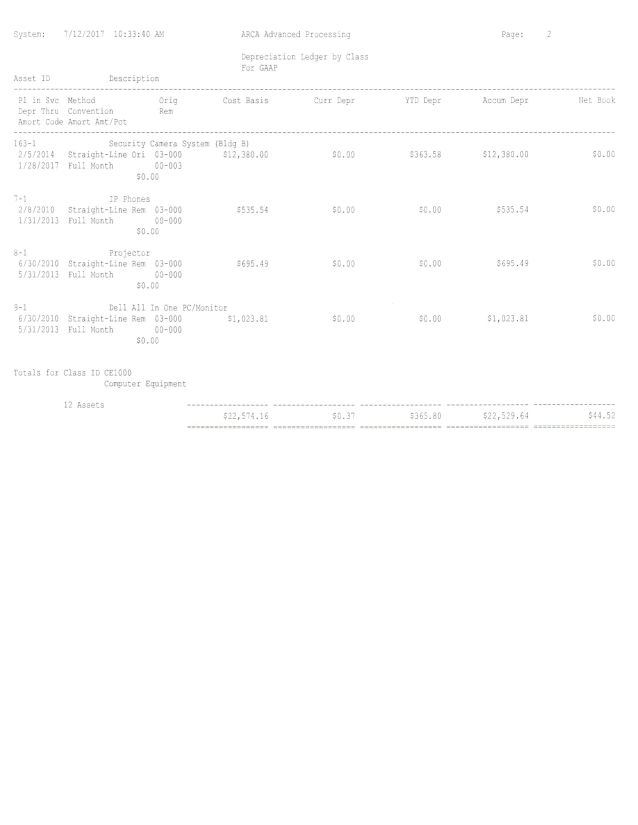

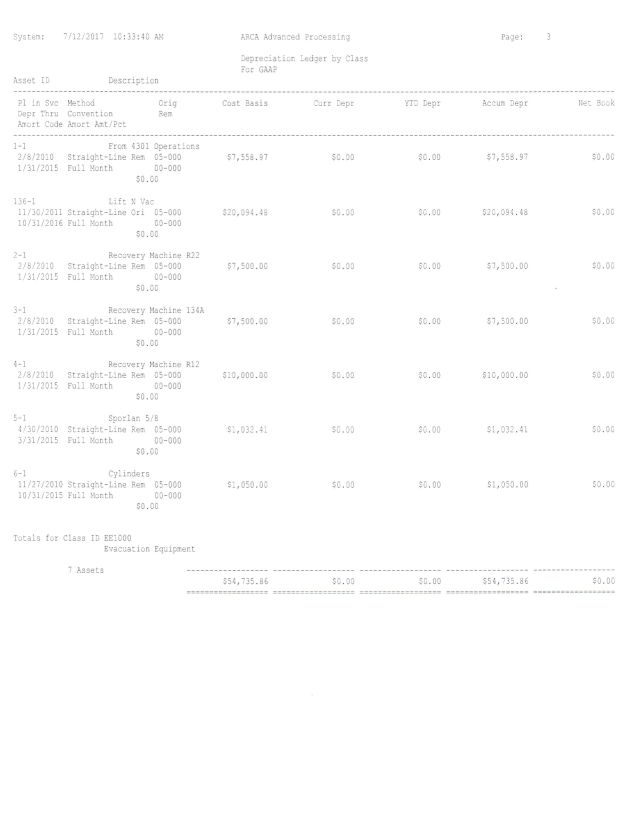

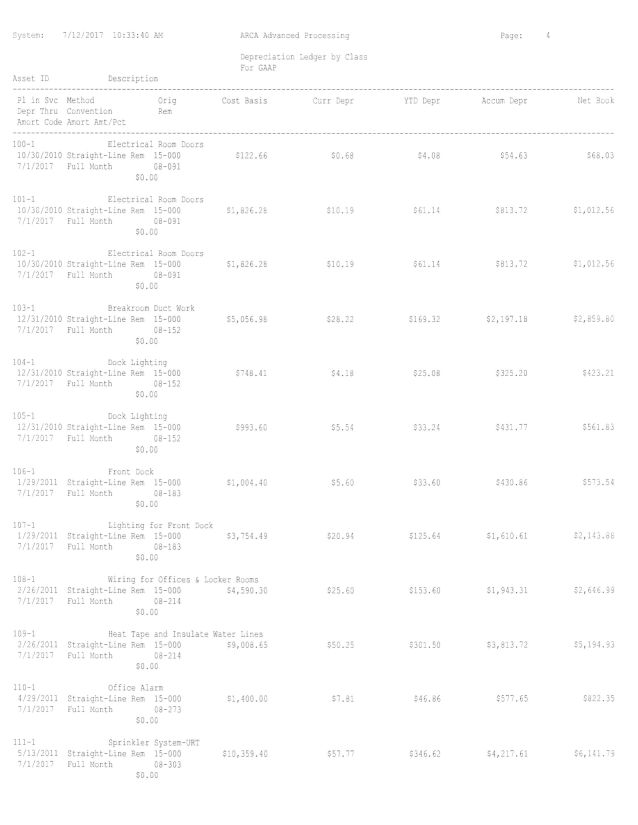

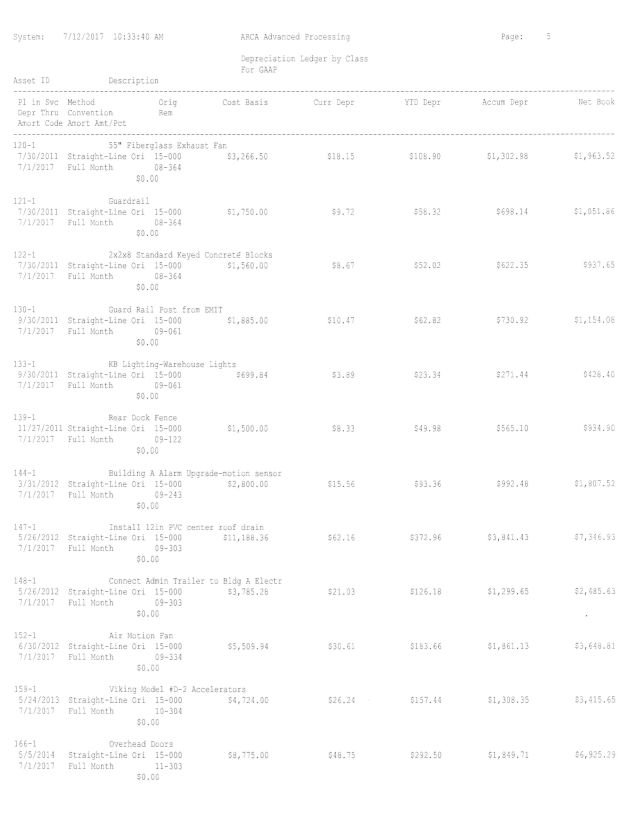

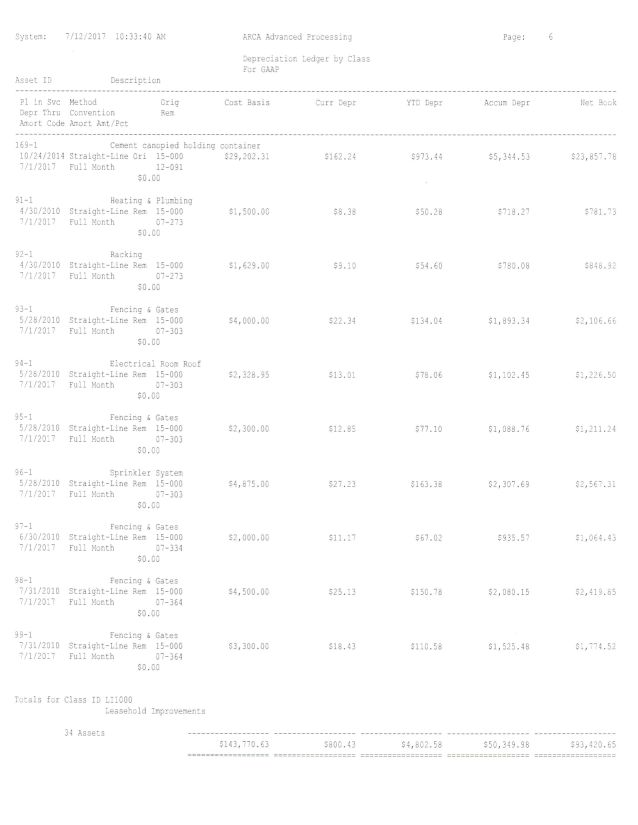

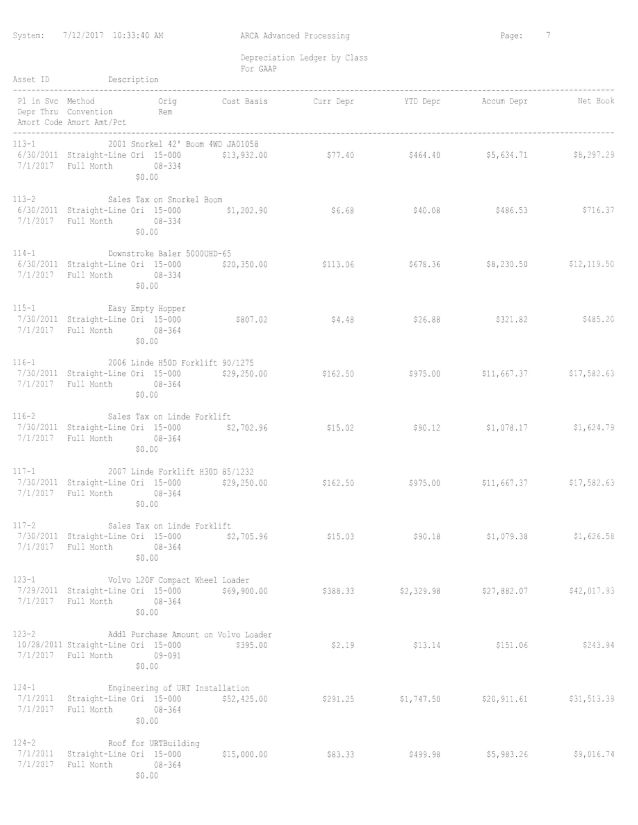

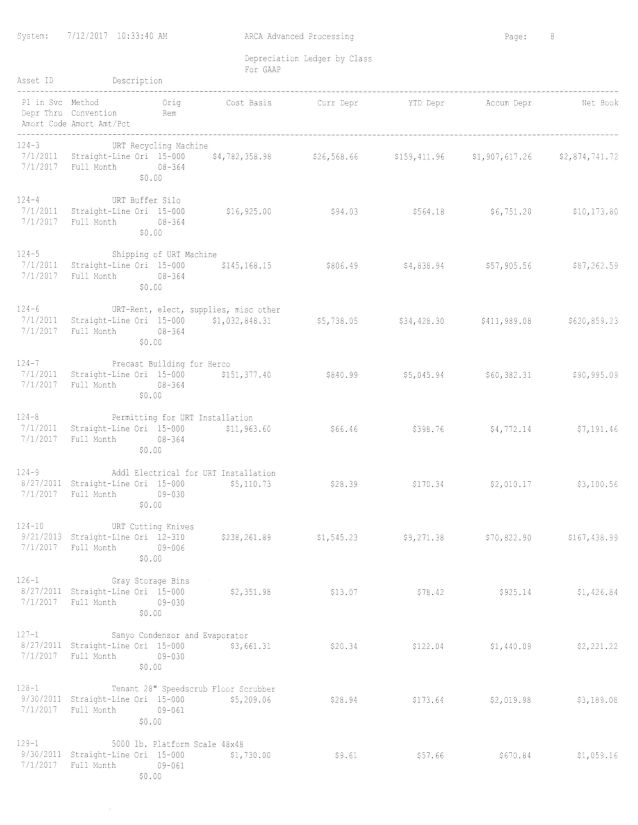

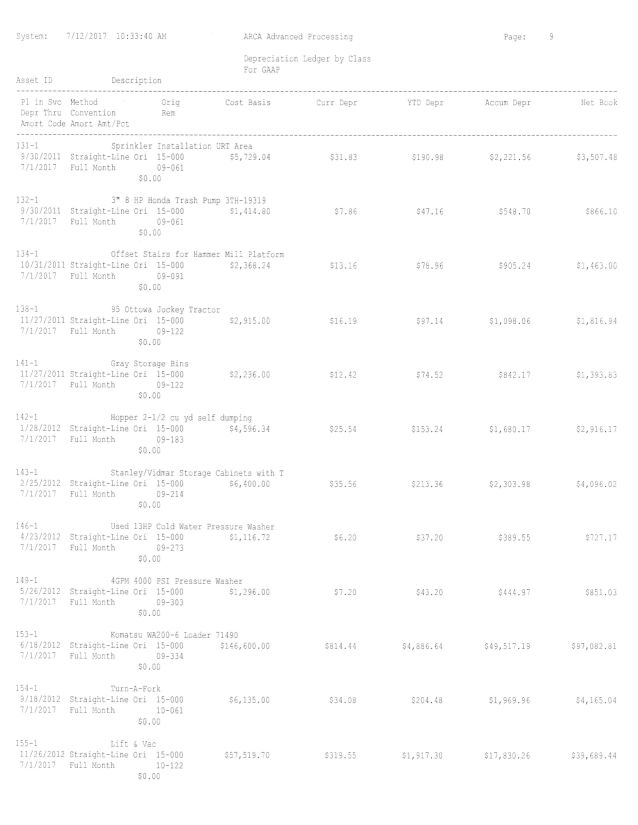

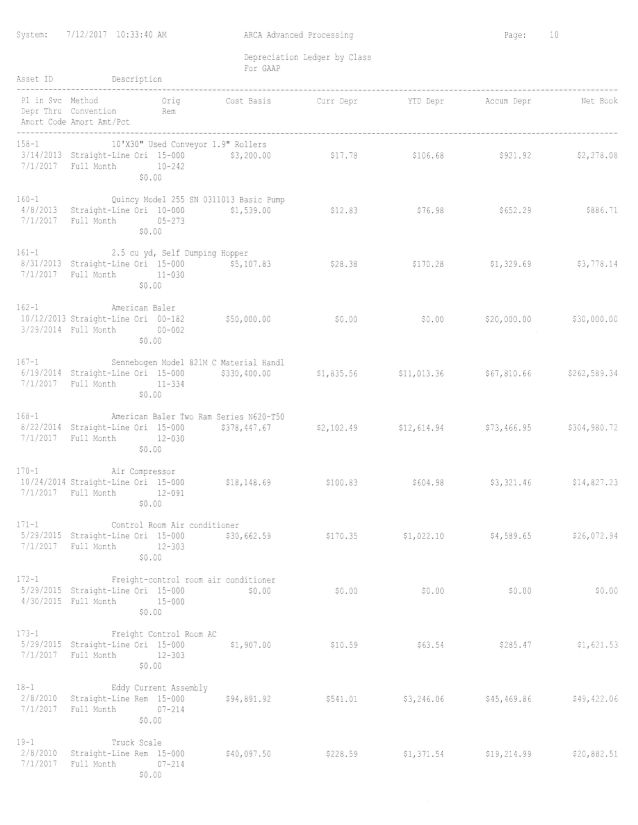

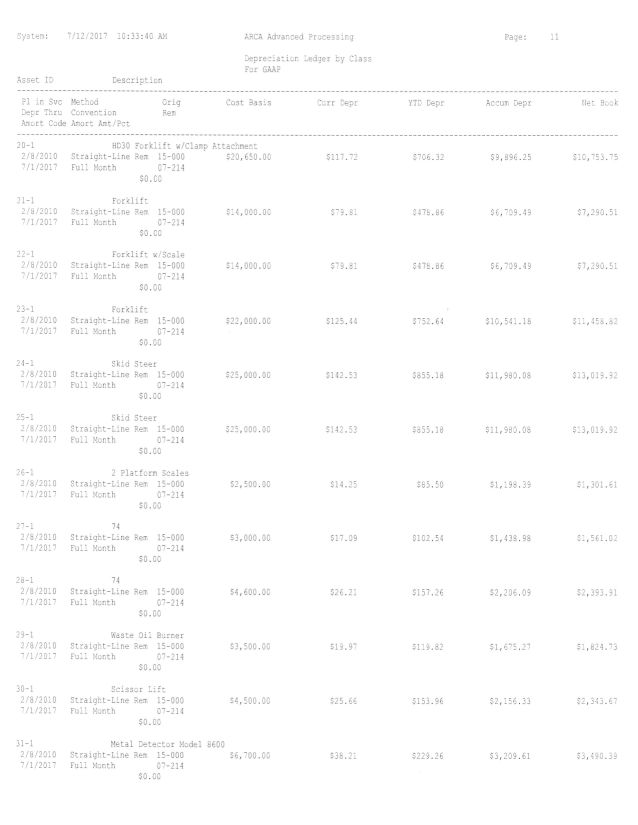

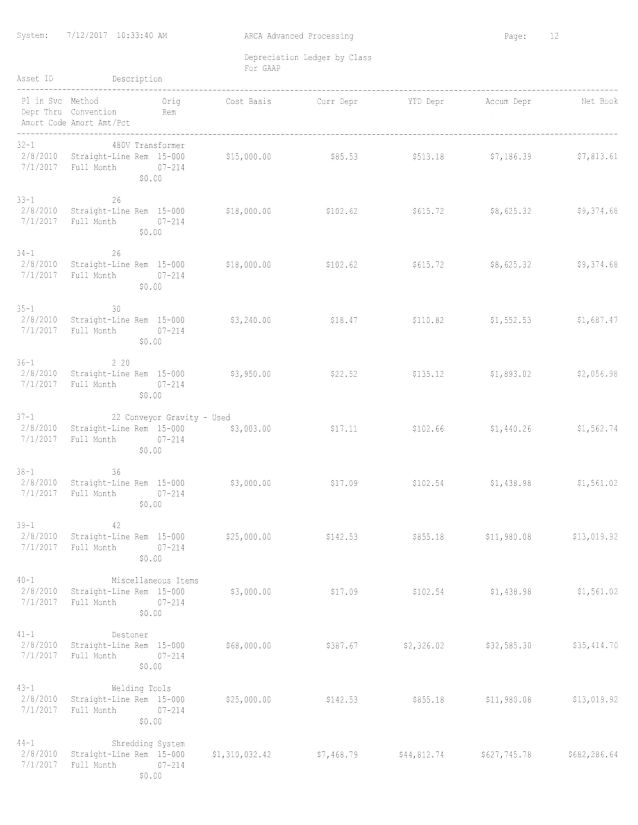

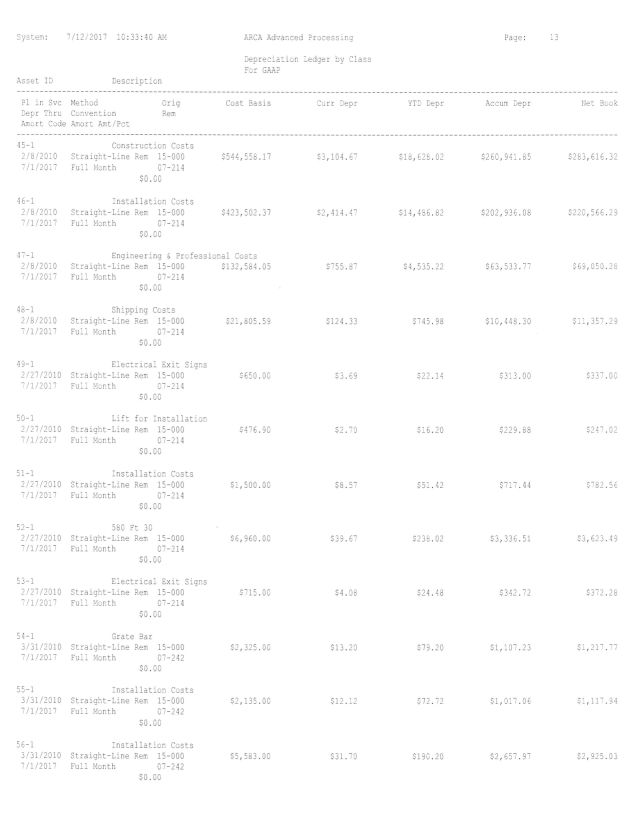

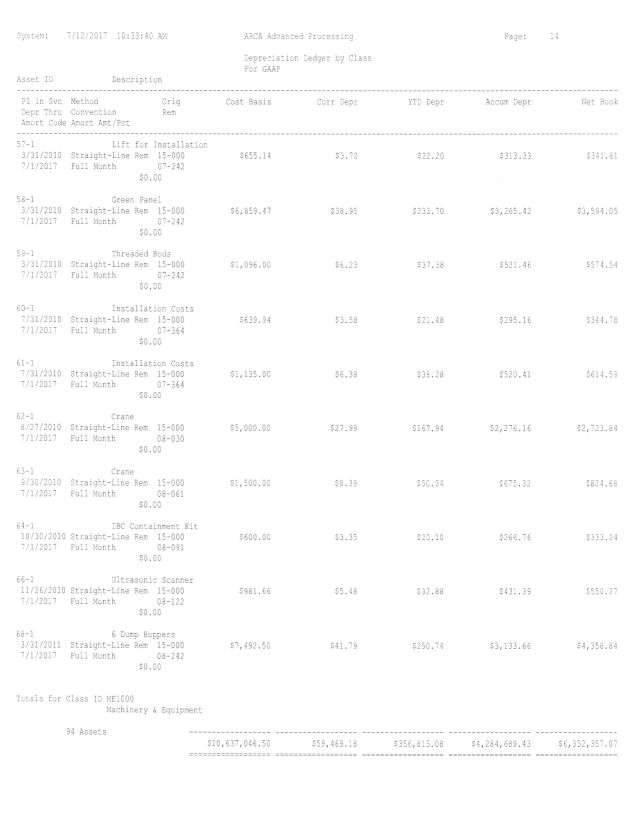

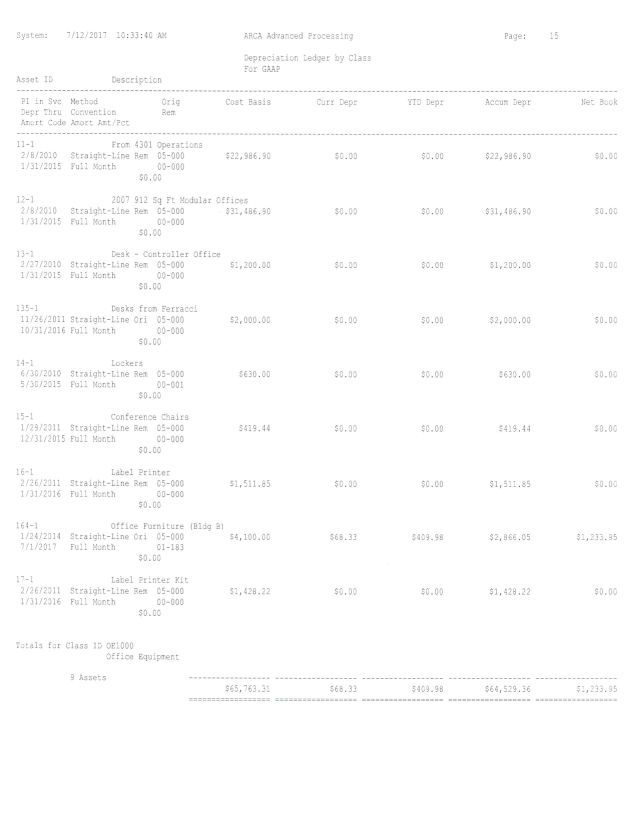

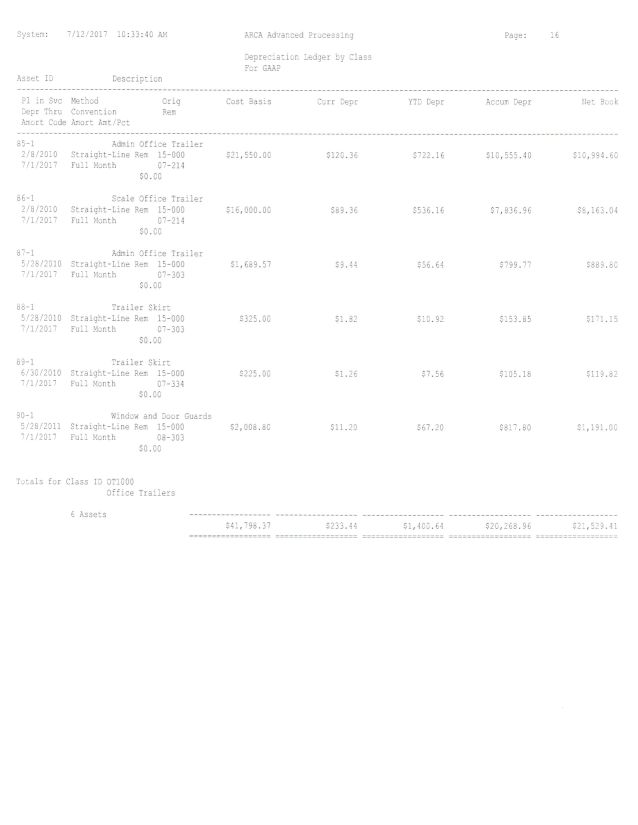

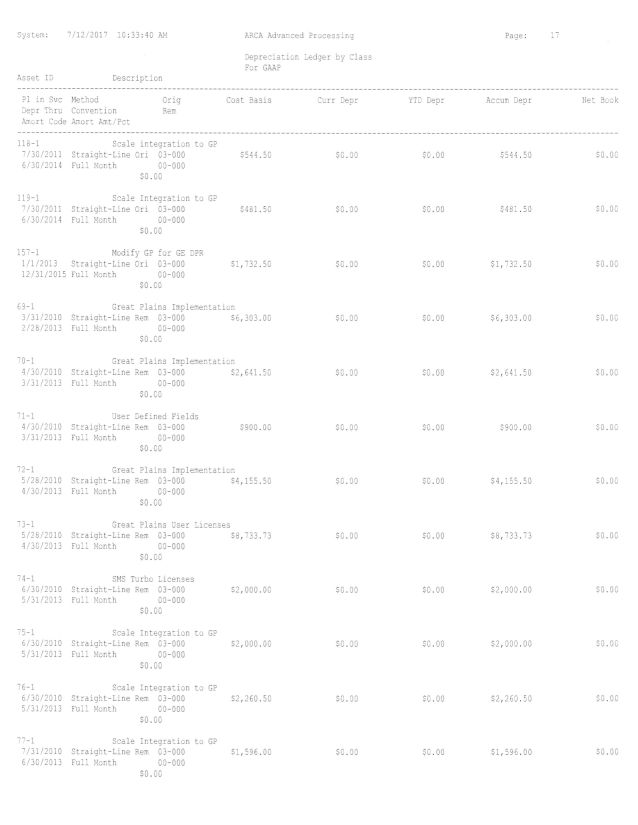

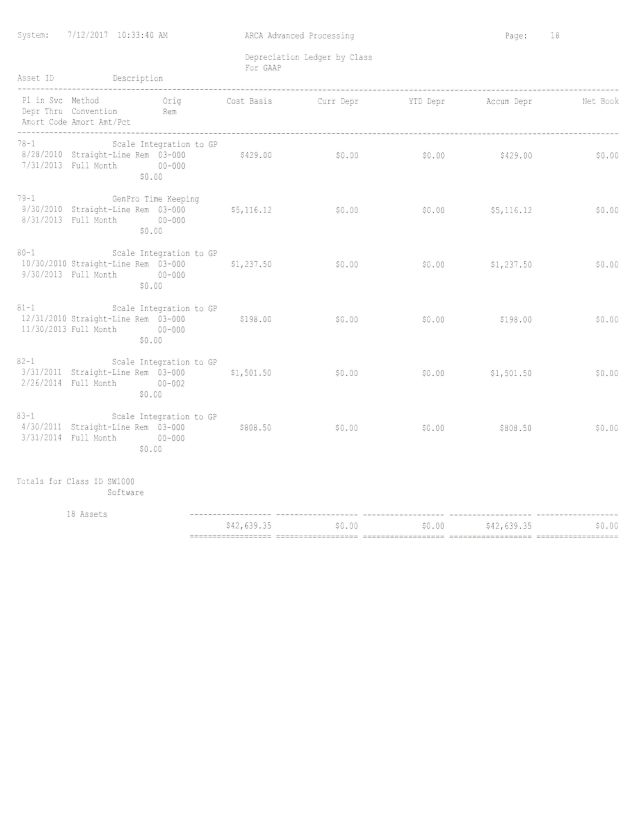

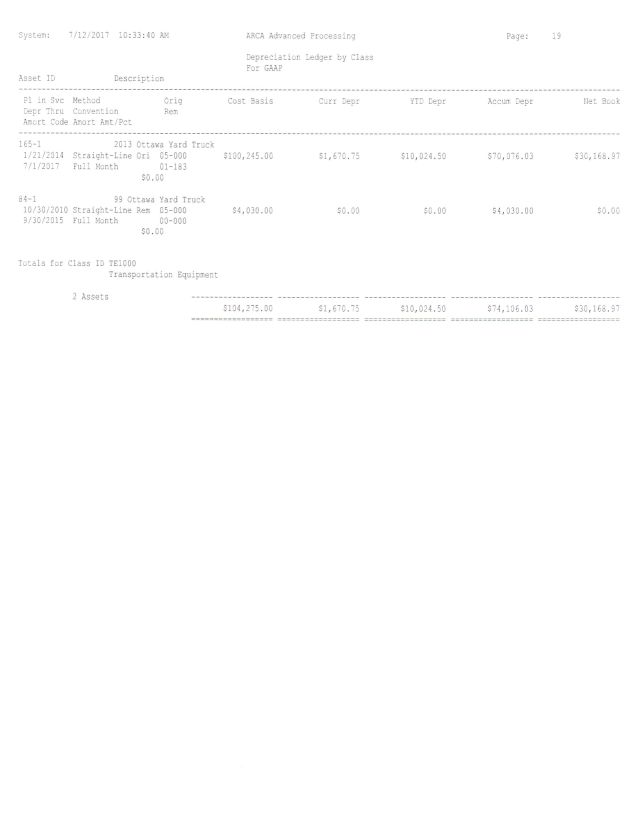

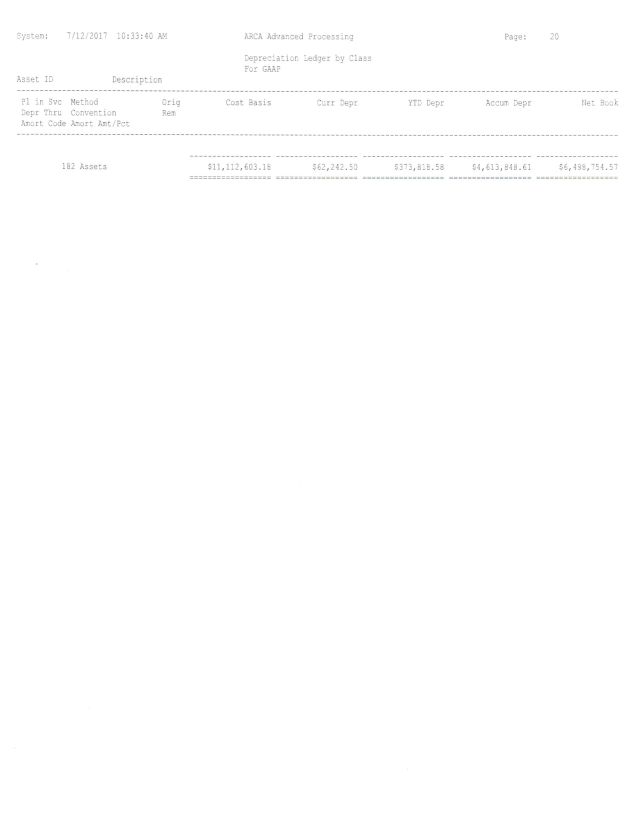

Exhibit 2.01

Tangible Assets

See attached.

| 21 |

| 22 |

| 23 |

| 24 |

| 25 |

| 26 |

| 27 |

| 28 |

| 29 |

| 30 |

| 31 |

| 32 |

| 33 |

| 34 |

| 35 |

| 36 |

| 37 |

| 38 |

| 39 |

| 40 |

| 41 |

Exhibit 2.02(e)

Excluded Assets

None.

| 42 |

Exhibit 2.03(b)(iii)

Assumed Liabilities

See attached.

| 43 |

| ABCA Recycling | $ | 1,950.00 | |

| AERC.COM | $ | 6,237.40 | |

| Aeroteck | $ | 209,573.70 | |

| AirGas | |||

| All Staffing Warehouse | |||

| American Pulverizer | |||

| American Metal Markets | |||

| AMSCO | |||

| Anthem Propane | $ | 1,049.46 | |

| Appliance Warehouse | $ | 751.54 | |

| Atomic Extinguishers | |||

| Belgrade | $ | 58.64 | |

| Beverly Brown-Petty cash | $ | 524.54 | |

| Bermuda International Shipping | |||

| Beverage & Diamond | $ | 3,068.83 | |

| Bowman | $ | 10,673.40 | |

| Brian Finn Scale | $ | 1,801.00 | |

| BSE Holdings | $ | 19,840.00 | |

| Celayix | $ | 1,600.00 | |

| CJB Packaging | 4 | 875.83 | |

| Cleaning MDs | 1,180.98 | ||

| Commonwealth Computer Recycling | 1,822.80 | ||

| Concentra | $ | 156.50 | |

| Corestaff | $ | 12,268.03 | |

| The Ministry of Public Works | $ | 29,532.96 | |

| DB Schenker | $ | 369.90 | |

| Delaware Ave LLC | $ | 21,222.88 | |

| de lage landen | $ | 4,318.66 | |

| Delware Valley Remediation | $ | 1,252.30 | |

| ECOvanta | $ | 8,912.40 | |

| Eforce | $ | 3,006.57 | |

| Elemental | |||

| Environmed | |||

| Equipment Depot | $ | 12,212.60 | |

| E-Waste Experts | |||

| Fidelity Alarm | $ | 810.00 | |

| First Star Logistics | $ | 2,781.00 | |

| Frank Callahan | $ | 1,846.31 | |

| Franc Environmental | $ | 2,095.00 | |

| George Leck | |||

| Grainger | $ | 29.59 | |

| Guardian Life | |||

| Harleysville Ins | |||

| Hustler Conveyor | $ | 7,097.14 | |

| Incorp | $ | 99.00 | |

| IBX | $ | 10,046.85 |

| 44 |

| Industrial Tire | |||

| JJ Keller | |||

| Jag Expansion | $ | 11,630.00 | |

| Jim Fesmire | $ | 4,175.00 | |

| Joseph Fazzio | $ | 256.29 | |

| JQ Staffing | $ | 36,260.88 | |

| Komatsu | $ | 4,985.95 | |

| Law Offices of Dimitri Karapelou | |||

| Leshkowitz & Co | $ | 201.35 | |

| Linde | 23818.94 | ||

| Lorco | |||

| Martin's Appliance | 3981.05 | ||

| Masterman's | |||

| Mazzucco & Co | $ | 2,630.00 | |

| McMaster Carr | $ | 2,173.50 | |

| Metal Stock | |||

| Midatlantic Machinery | $ | 2,173.80 | |

| MidAtlantic Fire | $ | 2,350.00 | |

| Nationwide Insurance | |||

| Mobile Mini Inc | $ | 1,194.91 | |

| Nova | $ | 4,281.00 | |

| Payroll, taxes, 401k and support payments | |||

| Parade Wire | |||

| PBP Fasteners | $ | 2,177.50 | |

| Peco | |||

| Penn Jersey | $ | 795.75 | |

| Perry Johnson Registars | $ | 2,000.00 | |

| Petro Choice | $ | 971.84 | |

| PIDC | $ | 16,965.55 | |

| Port packaging | |||

| Praxair | $ | 4,251.39 | |

| Premium Assignment | $ | 7,661.86 | |

| Recycling Equipment | $ | 10,277.84 | |

| Revolution Recovery | $ | 771.30 | |

| Wells Fargo | $ | 15,798.45 | |

| River Drive | |||

| Royal | $ | 919.83 | |

| Ryder | $ | 5,463.84 | |

| Safe Disposal | 8485.97 | ||

| Safety Kleen | 91.56 | ||

| SDS Service | $ | 1,142.68 | |

| Separator Disc | |||

| Shingle & Gibb | $ | 3,347.89 | |

| Spichers | $ | 9,529.70 | |

| Stauffer Glove | |||

| 45 |

| Sullivan Scrap | 765.9 | ||

| Susquehanna Credit card | $ | 22,991.33 | |

| Trailer Tech Parts | $ | 718.99 | |

| Unum insurance | |||

| Van Hydraulics | |||

| Vintage Tech | $ | 6,555.92 | |

| Waste Management | $ | 9,822.60 | |

| Water Revenue Bureau | 524.42 | ||

| William C. Miller, Trustee | $ | 4,322.50 | |

| Wright Express | |||

| Yard Specialists | |||

| Zwicky | $ | 1,849.47 | |

| River Drive | |||

| Safety Kleen | |||

| Service Caster Corp | $ | 309.20 | |

| SLC Nationwide | |||

| Stauffer Glove | |||

| STS Trucking | |||

| Volvo | |||

| Vintage Tech | |||

| Water Revenue Bureau | |||

| Wells Fargo debit from BBT account | |||

| Delaware Avenue, LLC (April-July) | $ | 150,208.40 | |

| Total | $ | 767,900.16 |

| 46 |

Exhibit 3.01(b)

Indebtedness to be Paid off at the Closing

BB&T - $3,454,068.37

| 47 |

Exhibit 3.05

Purchase Price Allocation

The Purchase Price (as adjusted under federal income tax principles) will be allocated among the Purchased Assets for federal income tax purposes based on the Purchase Price Allocation Methodology set forth below, which follows the principles of Section 1060 of the Code and the regulations under Section 338 of the Code. Capitalized terms have the meanings set forth in the Agreement.

| Cash | The net tax basis at Closing. |

| (Class I assets) | |

| Marketable securities and certificates of deposit | The net tax basis at Closing. |

| (Class II assets) | |

| Accounts receivable and other like rights to payments | The net tax basis at Closing. |

| (Class III assets) | |

| Inventory | The net tax basis at Closing. |

| (Class IV assets) | |

| All other assets (i.e., other than those included in Classes I, II, III, IV, VI, and VII) | The net tax basis at Closing. |

| (Class V assets) | |

| Intangibles other than goodwill and going concern value | The fair market value at Closing. |

| (Class VI assets) | |

| Goodwill and going concern value | Any ).residual amount of the |

| Purchase Price (as adjusted under | |

| (Class VII assets) | federal income tax principles |

| 48 |

Exhibit 4.15

Assigned Leases

| 1. | 4301 N. Delaware Avenue, Philadelphia, PA, Bldg. A, Parking Yard C: Industrial Lease, dated November 26, 2008, between Delaware Avenue, LLC and Safe Disposal Systems, Inc., as amended by the Addendum to Industrial Lease, dated February 9, 2010, as assigned to ARCA Advanced Processing, LLC pursuant to the Assignment of Lease, dated June 15, 2010, as further amended by the Amendment to Lease Agreement, dated November 24, 2010, as further amended by the Addendum to Industrial Lease, dated November 30, 2013, as further amended by the Fourth Amendment to Lease, dated January 1, 2015 |

| 2. | 4301 N. Delaware Avenue, Philadelphia, PA, Bldg. B: Industrial Lease, dated October 1, 2013, between Delaware Avenue, LLC and ARCA Advanced Processing, LLC |

| 49 |